MEMBERS ONLY

Mish's Daily: The Battle Against Inflation May Have Only Just Begun

The Federal Reserve hiked interest rates by 50 basis points, as the market was expecting. Major U.S. indices turned red on the news with a modest day of losses. The SPDR Dow Jones Industrial Average ETF (DIA) closed in negative territory, but stayed above its 50- and 200-day moving...

READ MORE

MEMBERS ONLY

Mish's Daily: Grandpa Russell Might Be Running Into Trouble

While we follow the Fed announcement tomorrow, we'll closely watch Grandpa Russell's (IWM) reaction.

As the patriarch in charge of Mish's Modern Family, it's a good idea to meticulously monitor Grandpa Russell's pricing daily and weekly. IWM is also the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stealth Sector Rotation for XLY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I present a thorough review of the current state of sector rotation in the US market. Materials and Industrials are showing strong tails on the Relative Rotation Graph, but the most interesting -- Under The Hood Rotation -- is showing...

READ MORE

MEMBERS ONLY

The Business Cycle Is Poised for a Stage 1 Signal

by Martin Pring,

President, Pring Research

One of my favorite chart lists is one called Interasset Ratios. As the name implies, it contains a library of charts that plot various long-term relationships between asset classes, such as the stock/bond ratio, bond/commodity relationship, and so forth. It's not something you want to focus...

READ MORE

MEMBERS ONLY

Mish's Daily: How to Trade a Golden Cross in a Bear Market

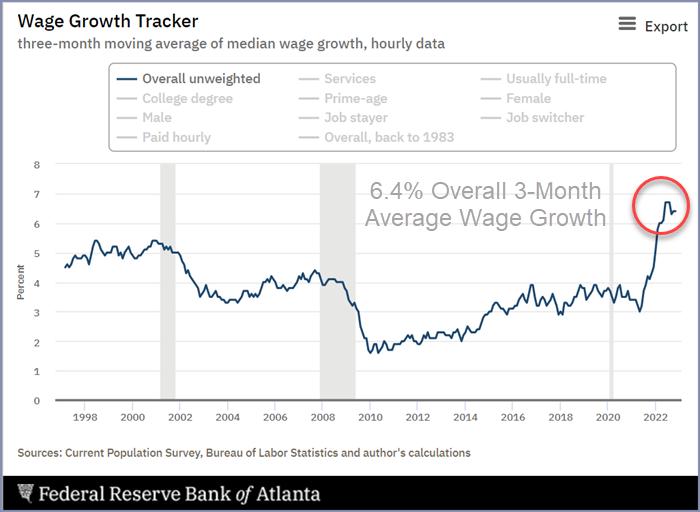

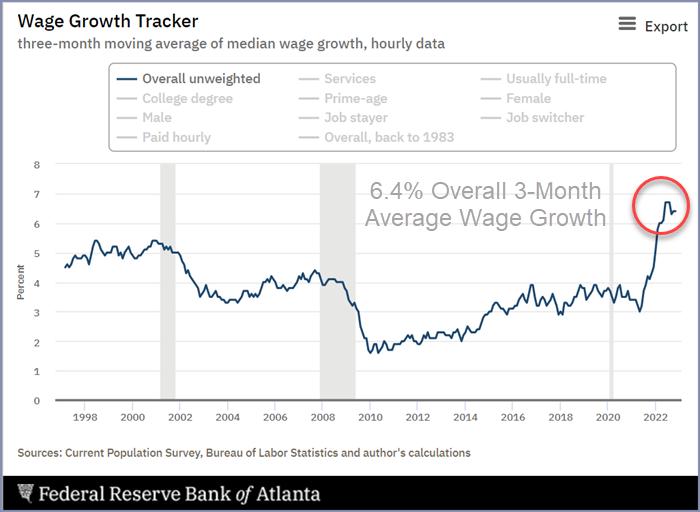

Investors will watch closely tomorrow, as the Consumer Price Index (CPI) print is released, and Wednesday, when the Fed announces its latest rate hike. The expectation is for CPI to be lower and for the Fed to raise interest rates a half-percentage point.

The Dow Jones Industrial Average (represented above...

READ MORE

MEMBERS ONLY

Two Index ETFs with Rising Momentum

by Erin Swenlin,

Vice President, DecisionPoint.com

We were somewhat surprised today when we reviewed the index ETFs. Two ETFs actually show rising momentum. Don't get too excited, there are problems on both of their charts. For comparison, SP500 (SPY), Dow (DIA), Nasdaq 100 (QQQ), SP100 (OEX) and Nasdaq (COMPQ) all have negative momentum and...

READ MORE

MEMBERS ONLY

DP Trading Room: Watershed Events in Gold & Crypto

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl answers the question: "How do we find overbought/oversold levels on the PMO?". Both he and Erin discuss rounded tops found throughout the market. Additionally, they talk the importance of knowing the trend and condition of...

READ MORE

MEMBERS ONLY

The Halftime Show: Trend Changes and Buy Zones

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Right now, the markets are green across the screen, but on this week's edition of StockCharts TV'sHalftime (presented by Chaikin Analytics), Pete urges caution due to the CPI coming out tomorrow. Pete takes a look at trends today, including the oil market looking at a pullback...

READ MORE

MEMBERS ONLY

Keeping 2022 In Perspective Will Help You in 2023

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At our MarketVision 2022 event on Saturday, January 8, 2022, I said stock market bulls would need patience—a lot of it—because it was going to take some time for sentiment, which was ridiculously bullish, to reset. I also said at the time that we should expect a minimum...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Needs to Move Past This Point; Continue Focusing on These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that it would be crucial to see if NIFTY could keep its head above 18600 levels to extend and confirm the breakout that it has attempted. However, despite a strong relative outperformance from the NIFTY Bank Index, the NIFTY has delayed...

READ MORE

MEMBERS ONLY

Grayson's Top 5 Most Valuable New Features & a Sneak Peek for Next Release!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shares his top 5 favorite new features and gives a quick sneak peek of what's coming in the next product release.

This video was originally broadcast on December 9, 2022. Click on the above...

READ MORE

MEMBERS ONLY

Weekend Daily: Mish's Modern Economic Family -- A Blueprint for Trading like a Pro

Looking at Modern Economic Family member charts and connecting the different members shows a unique market vantage point.

The Modern Family has continued to serve as a reliable indicator for market direction through the years. The Family gives you an overall gauge of how aggressive or conservative you can be...

READ MORE

MEMBERS ONLY

And That's Why We Wait for the Close

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've now been hosting our closing bell show, The Final Bar, for over three years. It's been such a fascinating experience to use my daily show as a way to focus my own analytical process, and I truly believe that hosting a show like this has...

READ MORE

MEMBERS ONLY

MEM TV: Growth Falters, But These Areas Shine

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews key price action ahead of next week's pivotal period of key economic data and Fed Chair comments. She also highlights pockets of strength and why these areas will remain strong into next year.

This video...

READ MORE

MEMBERS ONLY

Chop Going Into CPI and FOMC

by TG Watkins,

Director of Stocks, Simpler Trading

The market has been flagging at its highs as it seems to be awaiting more economic data from CPI and direction from the Fed at FOMC. In this week's edition of Moxie Indicator Minutes, TG explains how he can see the case for both bullish and bearish outcomes,...

READ MORE

MEMBERS ONLY

STOCK INDEXES STRUGGLE BELOW RESISTANCE LEVELS --YEAREND RALLY IS RUNNING OUT OF TIME -- WHY FALLING COMMODITIES ARE A BAD SIGN

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES CONTINUE TO STRUGGLE WITH OVERHEAD RESISTANCE... The expected yearend rally has taken major stock indexes up against some formidable overhead resistance barriers. So far, the rally hasn't been enough to reverse the market's major downtrend. While seasonal trends are usually favorable during the fourth...

READ MORE

MEMBERS ONLY

GNG TV: Markets Try to Rally Into End of Week

by Alex Cole,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, following a heavy day earlier in the week, Alex looks at how the U.S. Equity markets seem to have found support. He walks through charts over multiple timeframes of several macro factors that impact risk assets such as...

READ MORE

MEMBERS ONLY

Using ADX to Trend Trade

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use ADX to identify the best periods to play trend trades. This can be used for swing trades or position trades. By using ADX, we can avoid the noisy periods and improve our chances...

READ MORE

MEMBERS ONLY

Stock Market View: Look Beyond The Length of Your Nose!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

EUR/USD Under Pressure From Long-Term Resistance

The EUR/USD ($EURUSD) relationship has been under pressure since late 2021, when a peak was set at 1.2350. In a steady downtrend, EUR/USD declined to a recent low of 0.9540. During this decline, a significant support level around 1....

READ MORE

MEMBERS ONLY

Top 5 Reasons You Need to Use the Stock Trader's Almanac

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

As 2022 comes to a close, it's time to start thinking about next year's investment and trading roadmap.

It happens every year, and this year is no different. The end of the year, among other things, is a time for reflection and thinking about the following...

READ MORE

MEMBERS ONLY

Mish's Daily: Small Caps vs. Large Caps -- Who Is Leading?

Clearly, large-cap stocks have been leading, with the Dow Jones Industrial Average ($INDU) down the least year-to-date. Yet, even though the selling pressure has been constant, trading volume has been anemic.

The iShares Russell 200 ETF (IWM) normally trades approximately 27 million shares on average daily and traded approximately 17...

READ MORE

MEMBERS ONLY

Is Your Trading Stuck in "The Maze"?

by Dave Landry,

Founder, Sentive Trading, LLC

Traders often get stuck in "the maze," trading in lackluster markets or pick mediocre setups. They might also trade for excitement, not honor their stops, micromanage themselves soon-to-be great setups, and a host of other bad behaviors. In this week's edition of Trading Simplified, Dave begins...

READ MORE

MEMBERS ONLY

Mish's Daily: Real Motion Trading -- Forecasting Reversal Patterns

The S&P 500, Dow Jones Industrial Average, and Nasdaq all traded lower on Tuesday. Despite the intense two days of selling, we have yet to see any technical criteria suggesting a crash is imminent. Our Real Motion Trading Indicator above displays downward moderated momentum and forecasted a stalled...

READ MORE

MEMBERS ONLY

Why Some Make Stock Market Forecasts

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Why are there entire businesses set up to make stock market forecasts? The answer is quite simple; forecasting exists because there is a giant market for it. Investors/traders thirst for forecasts. Here is the real question; why do investors want to hear/read forecasts?

Those who have knowledge don&...

READ MORE

MEMBERS ONLY

Sector Spotlight: USD Index Resting on Major Support

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, on this first Tuesday of the month, I address the trends for asset classes and sectors on the monthly charts. There is no clear trend for "the market" -- only one sector is in an uptrend, while five...

READ MORE

MEMBERS ONLY

Is Gold a Buy or a Sell?

by Martin Pring,

President, Pring Research

The price of gold has been on a tear recently, bouncing sharply from its October low. It could be a good time to see whether this is the start of a new bull market or just a flash in the pan. Let's begin with the big picture and...

READ MORE

MEMBERS ONLY

Mish's Daily: This Commodity Will Sweeten Your Returns

If you're looking to invest in a commodity with high trading potential, sugar has seen significant price fluctuations in recent years.

Sugar prices have been rising due to increased demand in countries like China and India, which is likely to continue. Many factors affect the global sugar market,...

READ MORE

MEMBERS ONLY

DP Trading Room: Overbought/Oversold Momentum

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl answers the question: "How do we find overbought/oversold levels on the PMO?". Both he and Erin discuss rounded tops found throughout the market. Additionally, they talk the importance of knowing the trend and condition of...

READ MORE

MEMBERS ONLY

The Halftime Show: It's a Mixed Bag of Performers

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, presented by Chaikin Analytics, Pete notes that it's a bit of an ugly market today. The Dow is down over 400 points, the Nasdaq is down about 1.5%, and the Russell is down 2.4%. It...

READ MORE

MEMBERS ONLY

December Historical Tendencies Tell Us This Could Be a Stock Picker's Month

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's a great debate as to whether we've seen the market bottom. I'm firmly in the camp of "YES, we've seen it." I called a bottom in mid-June and, if it weren't for FedSpeak from Jackson Hole in...

READ MORE

MEMBERS ONLY

Week Ahead: These Factors Stay a Cause of Concern While Markets Try to Stage a Breakout; Stay Selective

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by saw the markets trading very much on the analyzed lines. It was mentioned that if the NIFTY can keep its head above 18300–18400 levels, there were chances of it testing its lifetime high point of 18604 and attempting a breakout. While moving on the...

READ MORE

MEMBERS ONLY

Weekend Daily: Is Now a Good Time to Buy Silver or Gold?

While investor sentiment continues to be tugged and pulled, precious metals continue climbing.

The iShares Silver Trust (SLV) is forecast to lead gold prices higher. We like both the yellow metal and white metal. We are long in both and have taken profits along the way.

Silver ended the week...

READ MORE

MEMBERS ONLY

S&P 500 Index Crosses above 200-day SMA: Not So Fast there Cowboy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 Index ($SPX) crossed its 200-day simple moving average (SMA) for the 173rd time since 2000 and the performance for this "signal" is not that great. Buying and selling the 200-day SMA cross produced a lower return than buy and hold. This cross, however,...

READ MORE

MEMBERS ONLY

These Stocks Have Been the Stars of Q3 Earnings Season—Many Are Poised to Trade Much Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

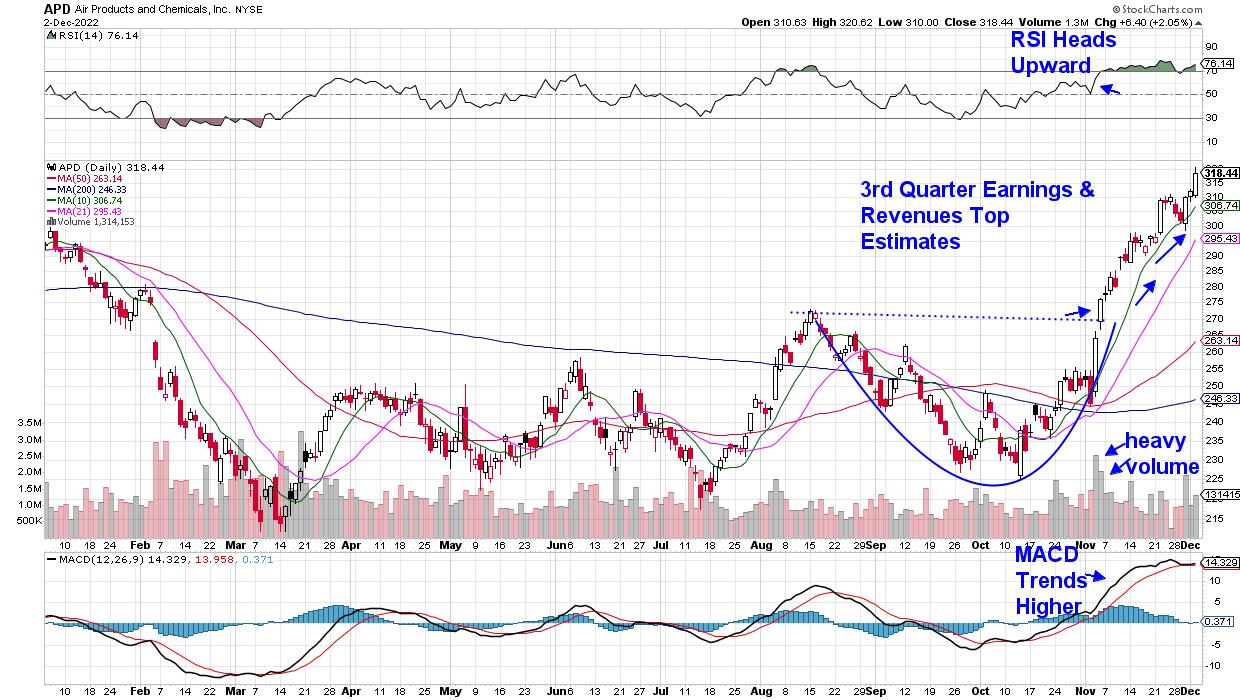

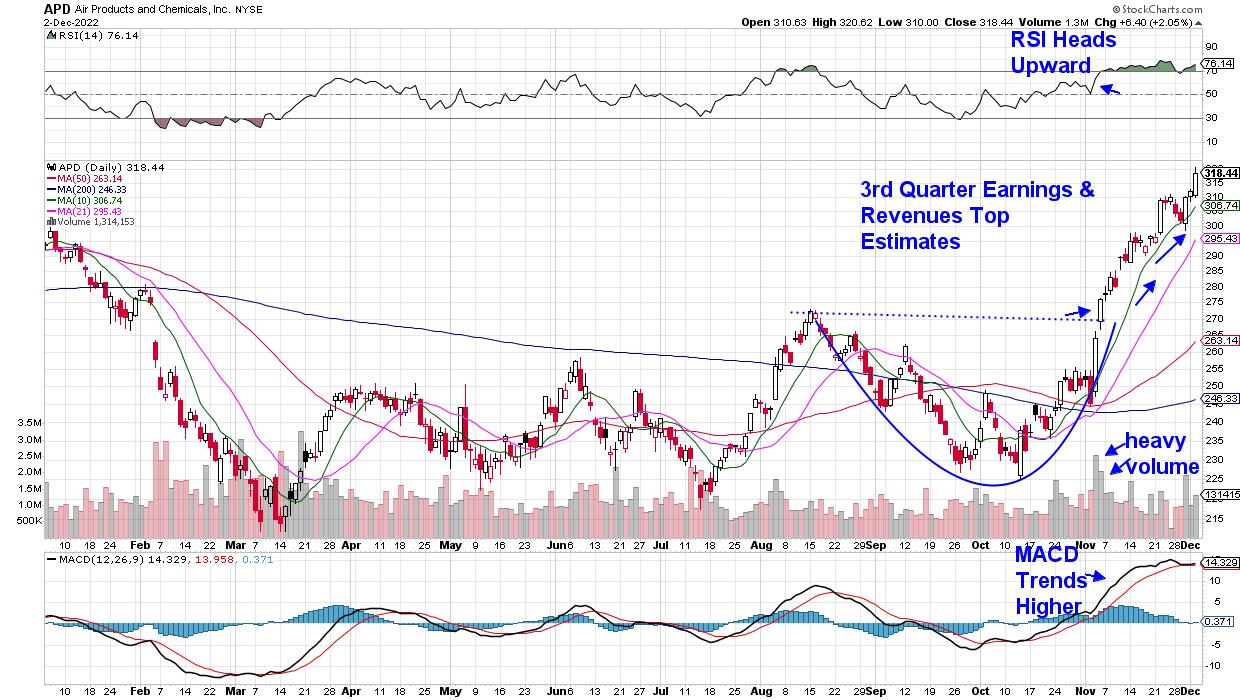

Most stocks in the S&P 500 Index have reported Q3 results and, while a lower-than-average number reported above estimates, many that had positive results have gone on to trade higher in moves that still have further upside during the current bear market rally.

The biggest winners among these...

READ MORE

MEMBERS ONLY

Three Trendlines I'm Watching Next Week

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In early October, market trends appeared to make sense—at least, as much as could be expected in 2022. The S&P 500 Index ($SPX) had just made a new 52-week low, the U.S. dollar had just achieved a new 52-week high, and the 10-Year Treasury yield had...

READ MORE

MEMBERS ONLY

MEM TV: Stealth Moves Into These New Areas

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews high yielding stocks that are on the move higher after reporting strong earnings reports. These dividend aristocrat stocks can buffer against current volatility.

This video was originally broadcast on December 2, 2022. Click on the above image...

READ MORE

MEMBERS ONLY

How to Create Your Own Custom Multi-Timeframe Chart Dashboards

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to create and customize your own multi-timeframe charting views in both SharpCharts and ACP using "GalleryView". Learn how to pull up the same symbol in multiple timeframes to simultaneously scroll through...

READ MORE

MEMBERS ONLY

Will the QQQ Swing into Gear?

by Bruce Fraser,

Industry-leading "Wyckoffian"

Mega-Cap Growth stocks have led the stock market weakness on the way down in 2022. They have also lagged during the 4th quarter rally. This weakness has been a drag on major stock indexes such as the S&P 500 and the NASDAQ Composite. With the recent rally phase...

READ MORE

MEMBERS ONLY

Fed Fallout: Why a Perfect UVXY Setup Failed to Perform

by TG Watkins,

Director of Stocks, Simpler Trading

Setups are only as valid as the most recent data, and often times that data is greatly influenced by market news. This week was no exception when Jerome Powell rocked the market upon announcing the possible reduction of interest rate hikes. In this week's edition of Moxie Indicator...

READ MORE

MEMBERS ONLY

GNG TV: US Equity Go Trend Reaches Downtrend Resistance

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Tyler shares perspective on global markets from a trend perspective, examining a "Go" trend in US equities that is bumping up against a familiar downtrend resistance line. Looking across macro forces like the "NoGo" in...

READ MORE