MEMBERS ONLY

Today Marks The Beginning Of An Overwhelmingly Bullish Period

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While current technical conditions are "iffy" at best, I want to point out that we have just entered THE most bullish historical period of the year. The S&P 500 and NASDAQ can be broken down into 3 lengthy historical periods, in my view - the good,...

READ MORE

MEMBERS ONLY

Junk Science; Junk Analysis!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I don't think I have offended anyone in quite a while and feel I'm not doing my job if I don't try to periodically; so here goes!

Often a simple mathematical series of numbers can sometimes get misinterpreted (promoted) to be something magical. My...

READ MORE

MEMBERS ONLY

Mish's Daily: Granddad Russell 2000 Leads This Stock Market Rally

This week, it is crucial for traders to maintain the overall macro firmly in their vision.

We are keeping an eye on the indices, currency movements, the PCE print, and the GDP statistics. We also closely follow the small caps this week, the Russell 2000 (IWM), and the patriarch of...

READ MORE

MEMBERS ONLY

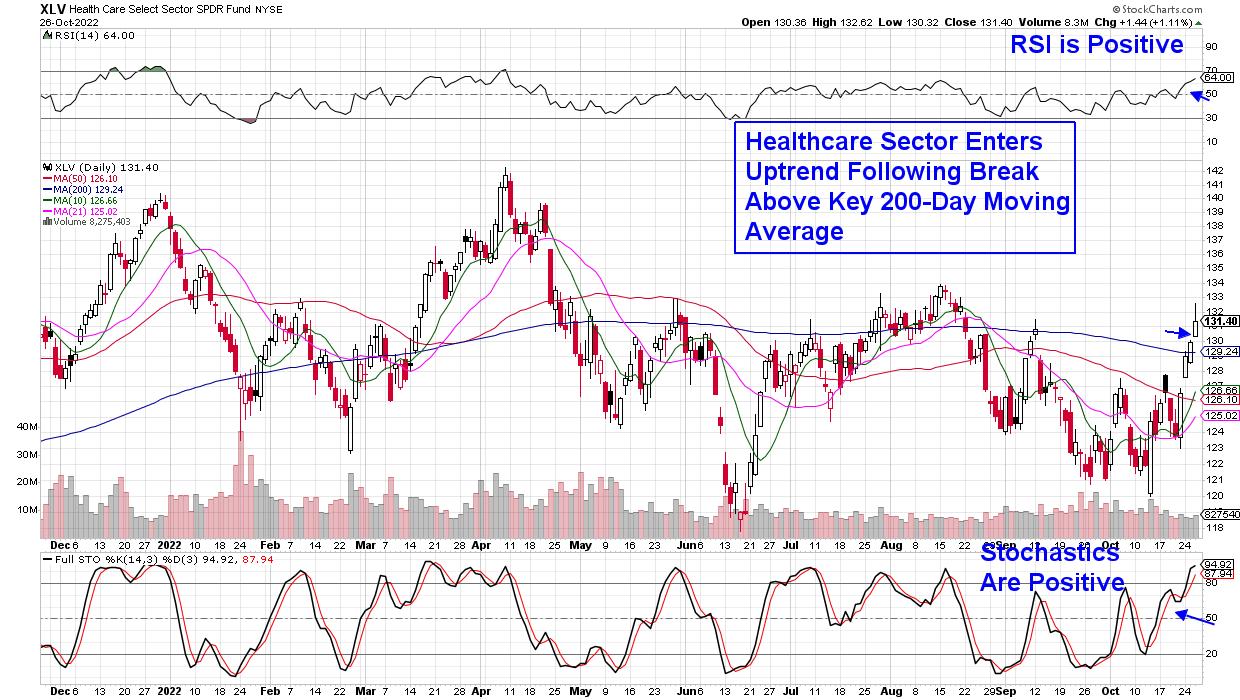

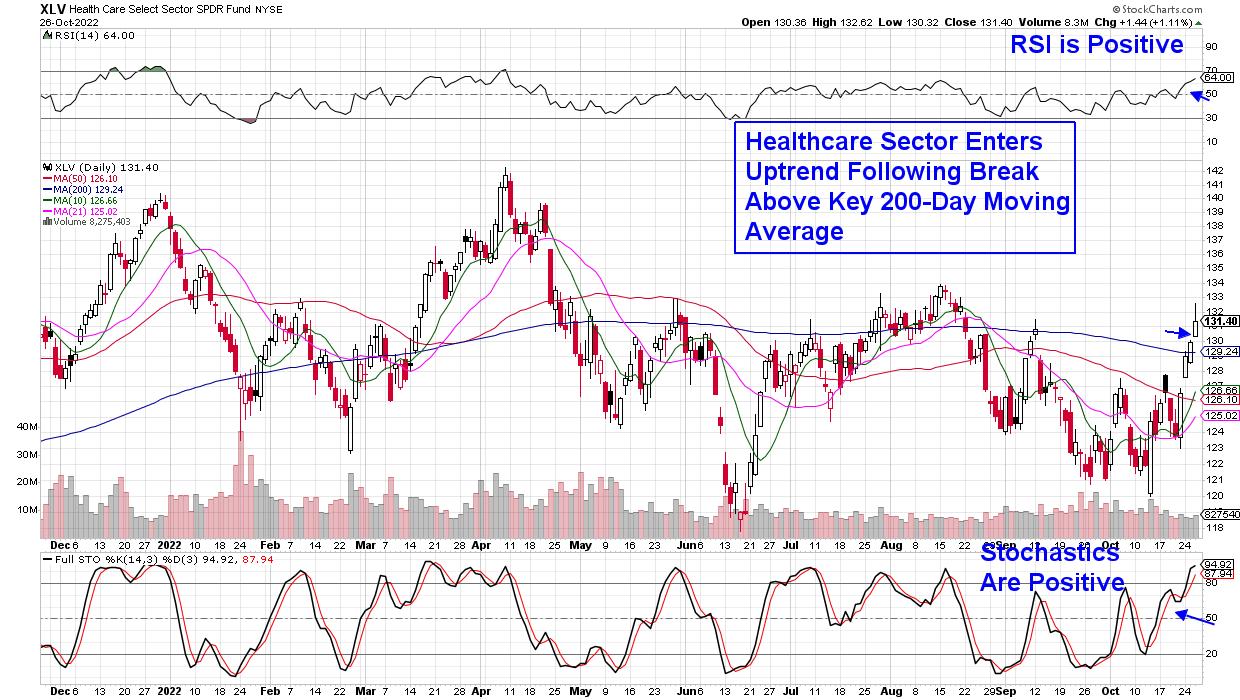

Breadth in the Markets Is Expanding: Can the Markets Withstand the Drop In Big Tech Names?

by Mary Ellen McGonagle,

President, MEM Investment Research

Today, we saw a large decline in mega-cap names Microsoft (MSFT) and Alphabet (GOOGL) after both companies reported earnings and sales that were well below estimates. Citing a strong dollar and high inflation, among other factors, both companies warned of slower growth going forward amid a tough environment.

Adding to...

READ MORE

MEMBERS ONLY

Which Country ETFs Can Lead Us Out of the Bear Market and Which Ones Could Drag Us Deeper In?

by Martin Pring,

President, Pring Research

When I am looking at a downtrend of a specific market that has been in existence for a while, I often ask myself which components might be on the verge of an upside breakout and could therefore lead it higher. Conversely, I have to ask if there are any downside...

READ MORE

MEMBERS ONLY

Will Regional Banks Finally Begin to Shine?

This week is a big week for earnings.

Furthermore, PCE and GDP prints will also be closely watched.

This week will be important in determining the tone leading to the Fed meeting next week and the midterm elections on November 8.

As many investors will be watching tech earnings, many...

READ MORE

MEMBERS ONLY

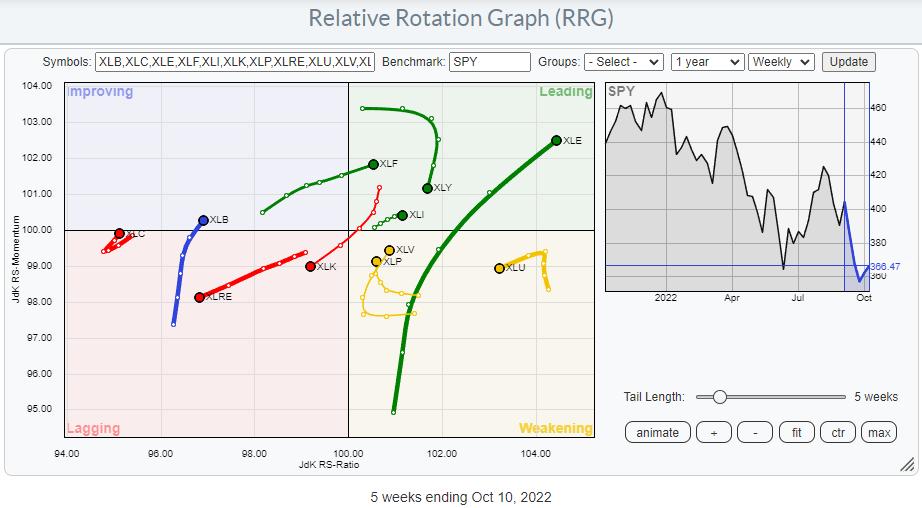

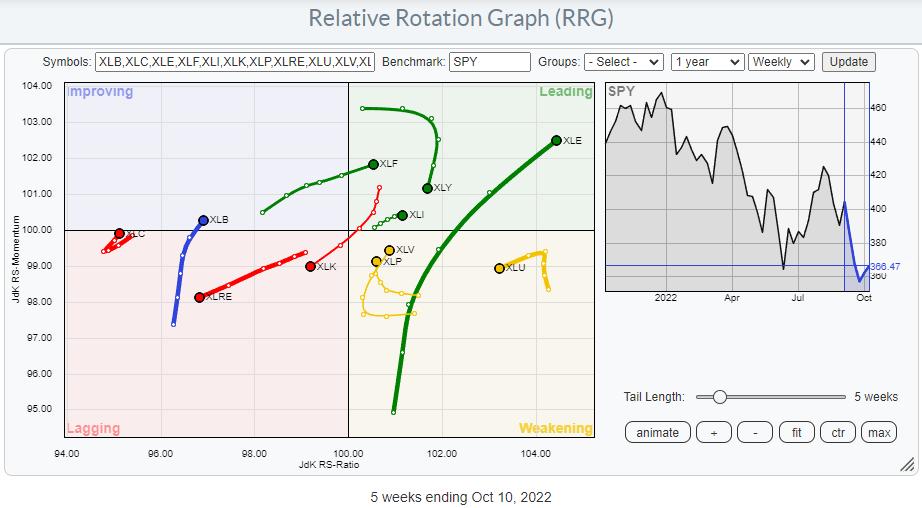

SPY Rally While Technology and Discretionary Remain On Negative RRG-Heading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I don't like it when parts of a puzzle don't match. You just don't get a clear picture.

As participants in the markets, we are trying to solve the puzzle of the markets every day/week/month, and at the start of every new...

READ MORE

MEMBERS ONLY

My Sustainability Ratios Remain Fairly Strong And Suggest We Be LONG, Not Short

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I made a bold bottoming call on June 16th, just prior to a massive 700-point rally in the S&P 500. I didn't see the recent drop and double-bottom coming, however. Now that we've seen it, has anything changed? Are my signals still bullish? For...

READ MORE

MEMBERS ONLY

Week Ahead: Festive & Truncated Week May See Markets in a Range; NIFTY Largely to Defend to Stay Stable

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After taking support near the key levels on the charts, the NIFTY finally resumed its up move, ending the week on a decently positive note. The last three weeks had seen the index taking support at its 20-Week MA; now, the NIFTY is above all the key moving averages. The...

READ MORE

MEMBERS ONLY

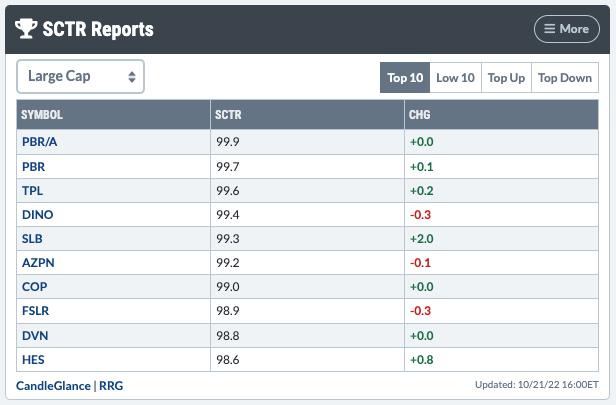

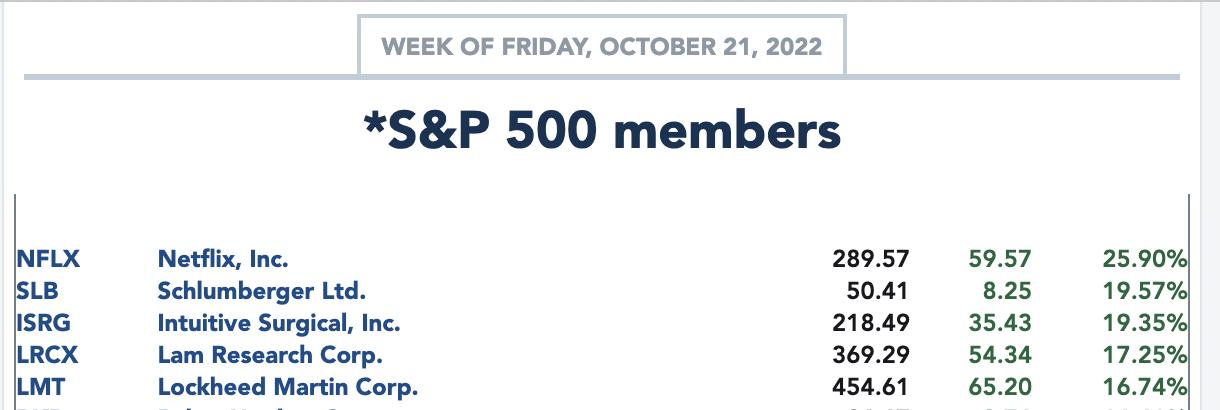

Top Ten Stocks in Accumulation Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When someone sends me a ticker to review, the first thing I do is bring up my standard two-year daily chart on StockCharts. And the very first question I ask myself is always the same: is this chart in an accumulation phase or a distribution phase?

Now that is a...

READ MORE

MEMBERS ONLY

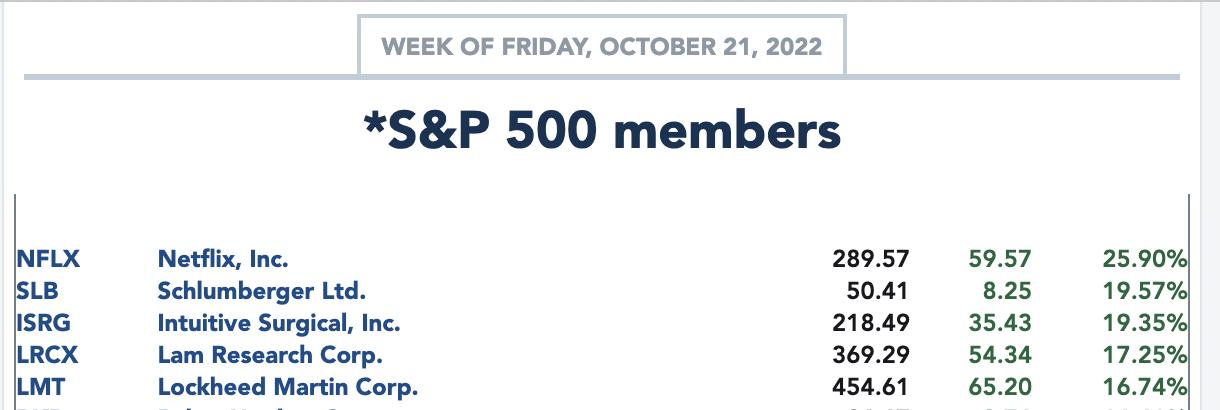

Three Reasons We're Headed Higher From Here

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets posted an impressive rally this past week as a lack of inflation-related economic data had investors focused instead on quarterly earnings reports. While not all companies posted strong results -- think Tesla (TSLA) -- a majority came in with positive earnings surprises that were greeted with heavy buying...

READ MORE

MEMBERS ONLY

Scans, Markets, SCTRs & More: My 5 Favorite ACP Sidebar Tools

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson loves using StockCharts ACP overall, but to be honest, his favorite part of ACP can be found on the right side of the screen - the sidebar views! Today, he's going to show you...

READ MORE

MEMBERS ONLY

MEM TV: Markets in Rally Mode

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's driving the markets higher and what to be on the lookout for next week. She also shared Group and Sector rotation taking shape.

This video was originally broadcast on October 21, 2022. Click on...

READ MORE

MEMBERS ONLY

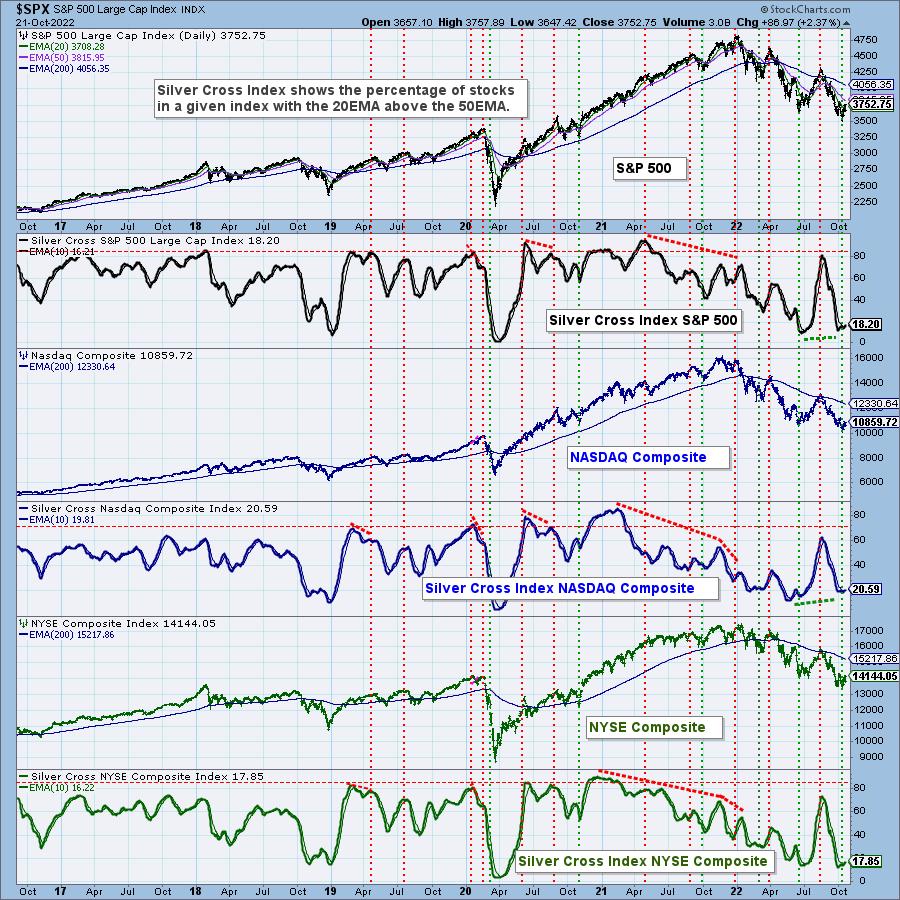

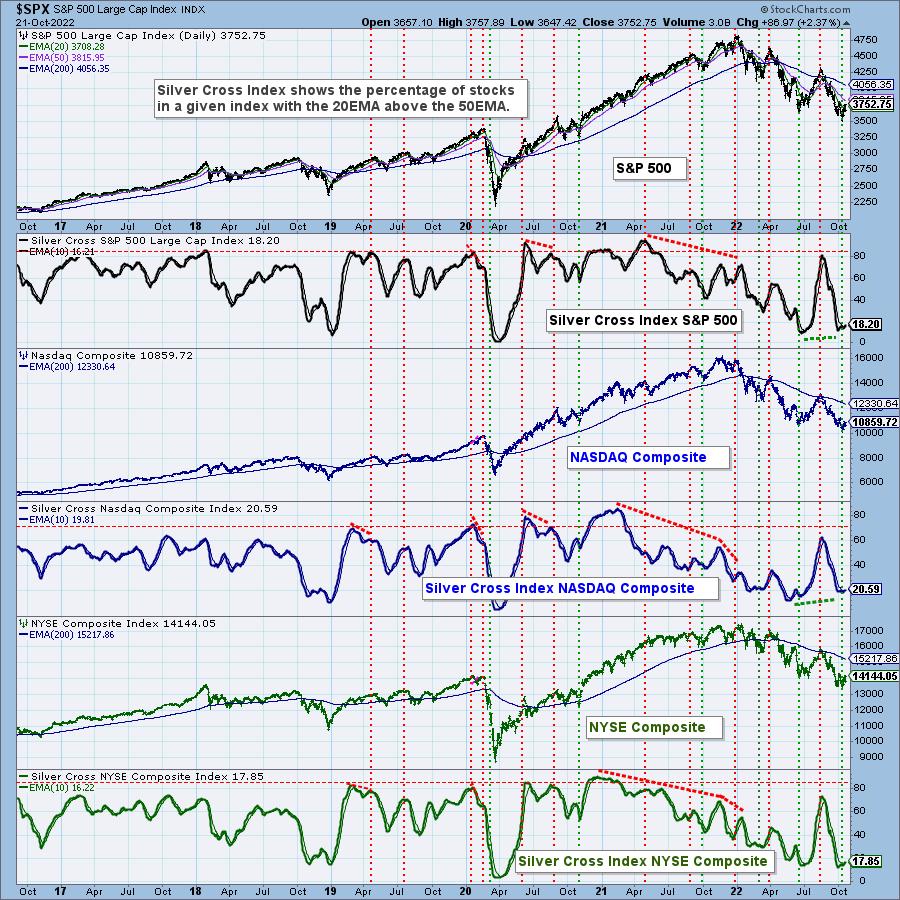

Broad Market Rallies Confirmed by Silver Cross Index

by Erin Swenlin,

Vice President, DecisionPoint.com

With the market on the cusp of a rally, we thought it time to walk through our Silver Cross Index (SCI) and Golden Cross Index on the broad markets (SPX, NASDAQ and NYSE). Before we look at each chart, let's review what Golden and Silver Crosses are.

Most...

READ MORE

MEMBERS ONLY

Weekend Daily: The Perfect Storm - U.S. Dollar, Inflation and Precious Metals

According to recent PPI and CPI prints, inflation has plateaued. Some analysts will argue that inflation has hit its zenith. However, what if one of the next catalysts to even higher inflation is spurred by the potential and recent peak in the U.S. dollar?

Looking at the price chart...

READ MORE

MEMBERS ONLY

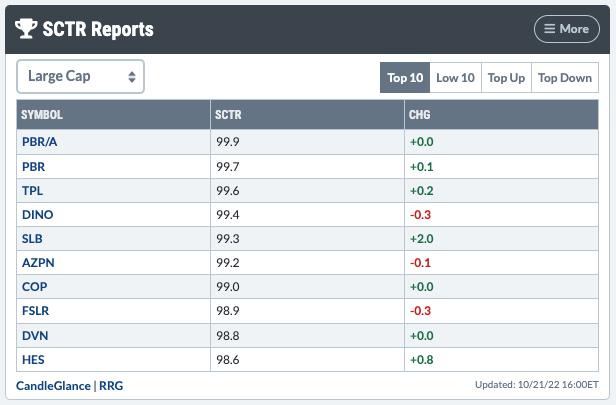

SHORT-TERM STOCK REBOUND CONTINUES -- ENERGY SECTOR ACHIEVES UPSIDE BREAKOUTS -- EXXON AND SCHLUMBERGER.HIT 52-WEEK HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM REBOUND CONTINUES... Stocks are ending the week on a positive note and continue to show signs of having formed a short-term bottom. The daily bars in Chart 1 show the S&P 500 building on the gains that started the previous week. Sbort-term momentum indicators like the RSI...

READ MORE

MEMBERS ONLY

Market Trying to Hammer Out a Bottom

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG shares that there are indications that the market is trying to hammer out a near-term bottom in order to meet up with the Daily 50-SMA. He is unsure of how that path will unfold, other than price and D50...

READ MORE

MEMBERS ONLY

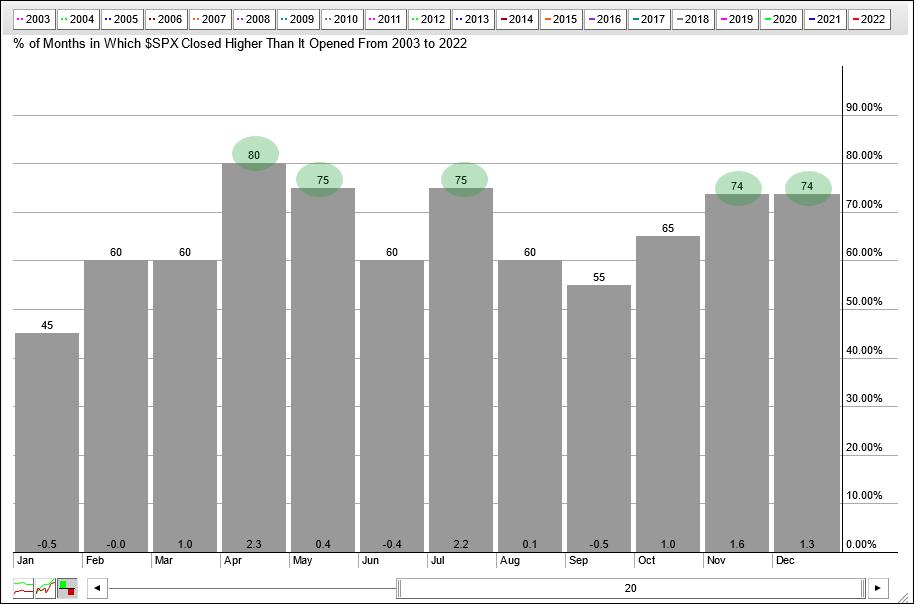

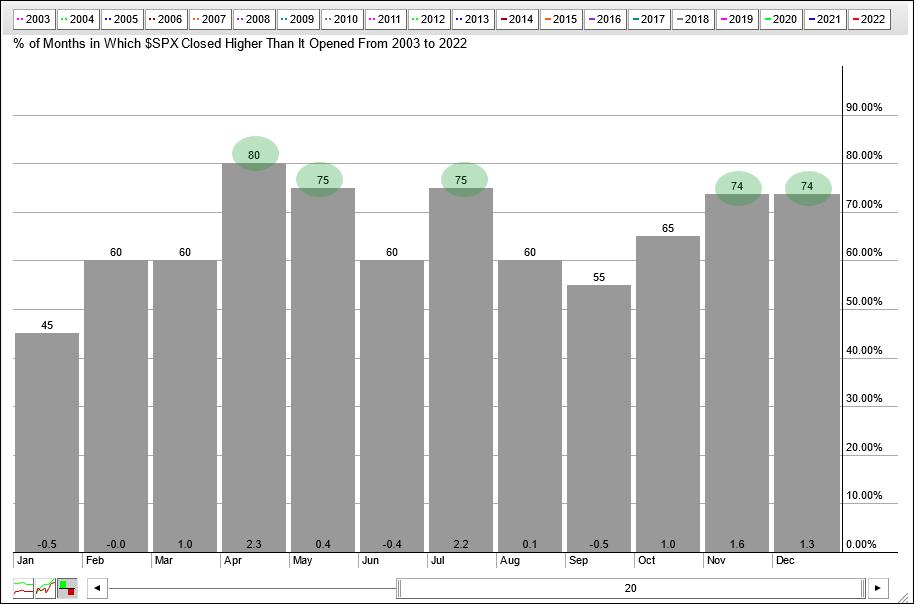

Tape and Fed Outweigh Seasonality

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The seasonal patterns for October and yearend are quite positive, but seasonality is just one aspect of broad market analysis and the weight of the evidence remains bearish.

The histogram below shows the seasonal patterns for the S&P 500 over the last twenty years. Five of the twelve...

READ MORE

MEMBERS ONLY

Do We Have A BIG Drop Ahead?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have a feeling that most of you would say "Yes, there's no way we've reached bottom."

Let me start by saying that calling tops and bottoms is GREAT if you get it right. For me, it's not about calling every stock...

READ MORE

MEMBERS ONLY

GNG TV: Earnings Do Not Equal Trends

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler take a look at some stocks that had big moves around earnings this week, including AT&T and IBM. Alex also runs through an example (Netflix) of using information from traditional technical analysis (in this...

READ MORE

MEMBERS ONLY

Simple Tools to Improve Timing

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how he uses 2 simple MA lines to tell when we should be thinking BUY and when we should be thinking SELL. Employing this technique can dramatically improve your timing on entry and exits. He then...

READ MORE

MEMBERS ONLY

Sectors to Avoid if the Market Declines and Worth Consideration if it Rallies

by Martin Pring,

President, Pring Research

Last week, I suggested that some unusually bullish outside bars, in conjunction with positive short-term momentum and a favorable seasonal going into year-end, could trigger a worthwhile rally. That does not make me wildly bullish, because I still think we are in a bear market. When my long-term indicators turn,...

READ MORE

MEMBERS ONLY

Mish's Daily: Russell 2000 -- How Money is Made and Lost in Small Caps

The Grandaddy Russell 2000 rallied close to its 200-week moving average (topic of our previous article) yesterday. On Wednesday, with rising yields once again, Gramps retreated.

In a bullish scenario, IWM continues to consolidate and rally in the coming days and weeks, eventually breaking through the 200-week moving average and...

READ MORE

MEMBERS ONLY

Market Timing - Where are We Now?

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave discusses where we are based on market timing and shorter-term signals to watch for--signals that that would suggest the beginning of a bottom. He also presents his methodology in action by revealing a mystery chart and showing a new one....

READ MORE

MEMBERS ONLY

Power Charting TV: Stocks on the Edge

by Bruce Fraser,

Industry-leading "Wyckoffian"

On rare occasions stock indexes become delicately balanced between two profoundly differing scenarios. This currently seems to be one of those junctures. The most recent Power Charting TV episode explores this existential moment.

Stock indexes have been in a mega-bullish upward stride since 2009. The pace of this advance has...

READ MORE

MEMBERS ONLY

Mish's Daily: The Four Indices -- Where Each Are in a 4-Year Cycle

The 200-week moving average (about 4 years), represented on the charts as a green line, is starting to look like one of the more important and pivotal chart points.

There is very little written about the 200-WMA. But only once, in 2007, did the SPY break its 200-WMA, for a...

READ MORE

MEMBERS ONLY

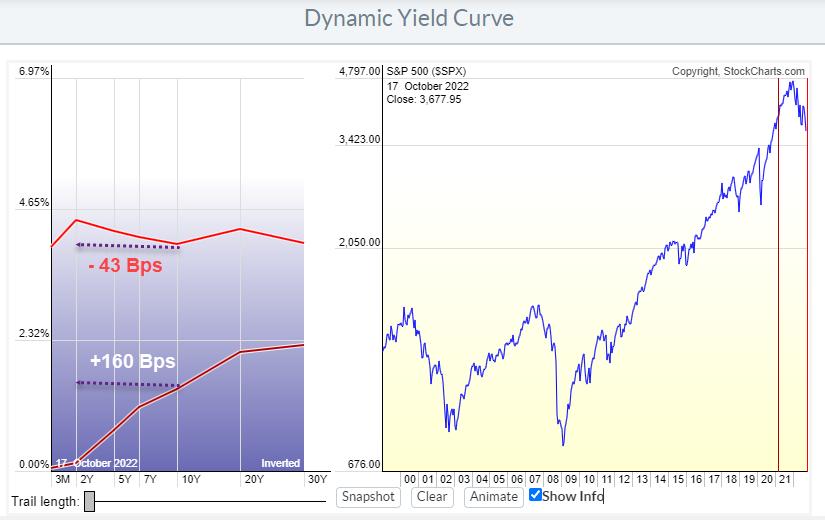

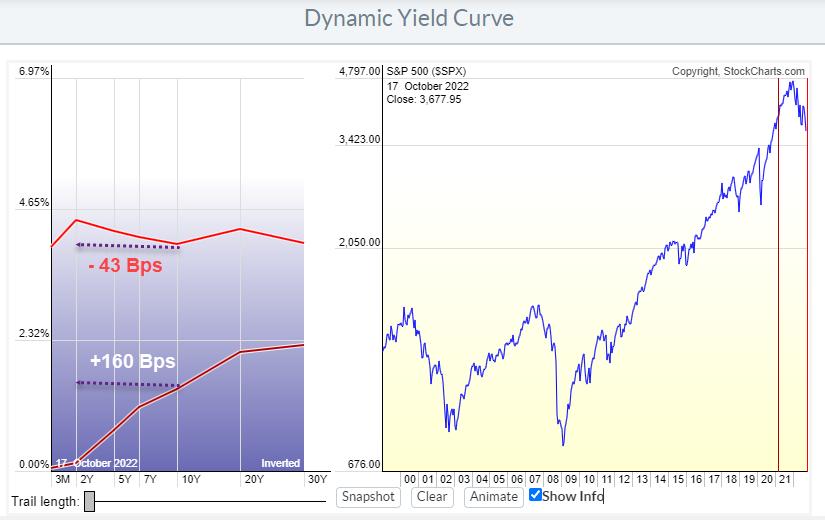

Sector Spotlight: Inverted Yield Curve Looms Over Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After one week of hiatus, I'm back with a new episode of StockCharts TV's Sector Spotlight. I'll be catching up with a refresher on asset class rotation, as well as sector rotation. In the AC segment, I point to the still-inverted yield curve and...

READ MORE

MEMBERS ONLY

About That Yield Curve Inversion

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In March 2021, lending money to the US Government for ten years would give you a return of around 1.7%/ann over the next 10 years. Lending money to the government for 2 years at the same time would give you roughly 0.1%/ann for the next 2...

READ MORE

MEMBERS ONLY

Mish's Daily: 4 Indicators and The "Bear Market" Rally

The 200-week moving average or about 4-years, represented on the charts as a green line, is starting to look like one of the more important and pivotal chart points.

Although there is very little written about the 200-WMA, only in 2007 did the SPY break its 200-WMA for a period...

READ MORE

MEMBERS ONLY

DP Trading Room: Walk Through the Dow

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, after looking closely at the market and new positive divergences on DecisionPoint indicators, Carl opens a CandleGlance of the Dow 30 and discusses which stocks look the most encouraging. Erin dives into four sectors and their industry groups to...

READ MORE

MEMBERS ONLY

Net Put Premium And Options Expiration Week Suggest A Huge Rally Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love trading during options expiration week. It's the one time when I have a pretty good idea of which market direction would likely benefit market makers. It doesn't provide us a guarantee, but, in my opinion, does tilt the odds heavily in our favor. I...

READ MORE

MEMBERS ONLY

It's Homework Time: Improving Stocks In Improving Industry Groups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

By all accounts, it's been a very difficult year. There were plenty of stock market warning shots fired in December 2021 and we're now paying seeing the carnage. While the current environment is dangerous, it's no time to rest on our laurels. There'...

READ MORE

MEMBERS ONLY

Week Ahead: Stability In Global Equity Markets A Must For A Technical Pullback; NIFTY Continues To Defend Key Support Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Despite the scale of volatility represented by gaps over the previous days, the NIFTY has by and large maintained its crucial support levels on the weekly charts. The previous technical note mentioned how the Index has created and maintained its crucial support; it managed to keep its head above these...

READ MORE

MEMBERS ONLY

Weekend Daily: Precarious Action in the Bonds and Stock Market

It was a wild ride on Wall Street this week, with stocks swinging wildly in both directions before closing overall a little lower for the week. The CPI data indicates inflation is entrenched in the economy, squeezing household real income, and is a significant concern for businesses.

This year also...

READ MORE

MEMBERS ONLY

What a Difference a Day Makes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

On Thursday, the S&P 500 index opened around 3500, which is a fairly significant level. That price point represents a 50% retracement of the 2020-2022 bull market phase.

Was I surprised to see a bounce off the 50% retracement level? Absolutely not. As Katie Stockton shared on The...

READ MORE

MEMBERS ONLY

MEM TV: How Much Lower Can the Markets Go?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares the next area of possible support for the markets. She also reviews what's driving these markets lower and what we'll need to see to stem the losses. Lastly, she highlights areas of strength...

READ MORE

MEMBERS ONLY

STOCKS ENDING WEEK ON THE DOWNSIDE -- 10-YEAR TREASURY YIELD TRADES ABOVE 4% -- THAT'S HURTING HOMEBUILDERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NO UPSIDE FOLLOW-THROUGH...Stocks are being sold again on Friday following Thursday's impressive upside reversal. The daily bars in Chart 1 show the S&P 500 reversing upward on Thursday after falling to another bear market low. And it did so on heavy volume. The fact that...

READ MORE

MEMBERS ONLY

Sell the Rumor, Buy the News

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG explains that, while the market did gap down on the hot CPI number, that gap sparked a strong short squeeze all day on 10/13/22. That's all well and good, but can it sustain? Was it...

READ MORE

MEMBERS ONLY

Strong Sector Rotation To Financials, But Will It Be Enough to Turn the Market Back Up?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph, the tail for XLF has just crossed over into the leading quadrant while keeping up its rising relative momentum. This makes the financials sector one of the leading sectors in the market at the moment.

In the past week, XLF picked up 2.62%...

READ MORE

MEMBERS ONLY

Giant Outside Days Spook the Bears

by Martin Pring,

President, Pring Research

Thursday's price action began bearishly with the probing of recent bear market lows. By the end of the session, the DJIA, along with several other markets, totally encompassed Tuesday's trading range and then some, in a one-day pattern known as an "outside day". To...

READ MORE