MEMBERS ONLY

GNG TV: Rally Provides No Relief as "NoGo" Returns

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In a highly volatile morning, markets reacted to an upside surprise in both PPI and CPI inflation data. Annualized inflation remains at 8.2% in the US and the S&P 500 gapped lower at the open. Despite a magnificent rally back into positive territory by midday, the trend...

READ MORE

MEMBERS ONLY

How to Learn Indicators

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, explains how he learned the indicators he employs. He discusses how the indicators should be learned independent of one another and how they can then form a weight of the evidence. He then covers the stock requests that...

READ MORE

MEMBERS ONLY

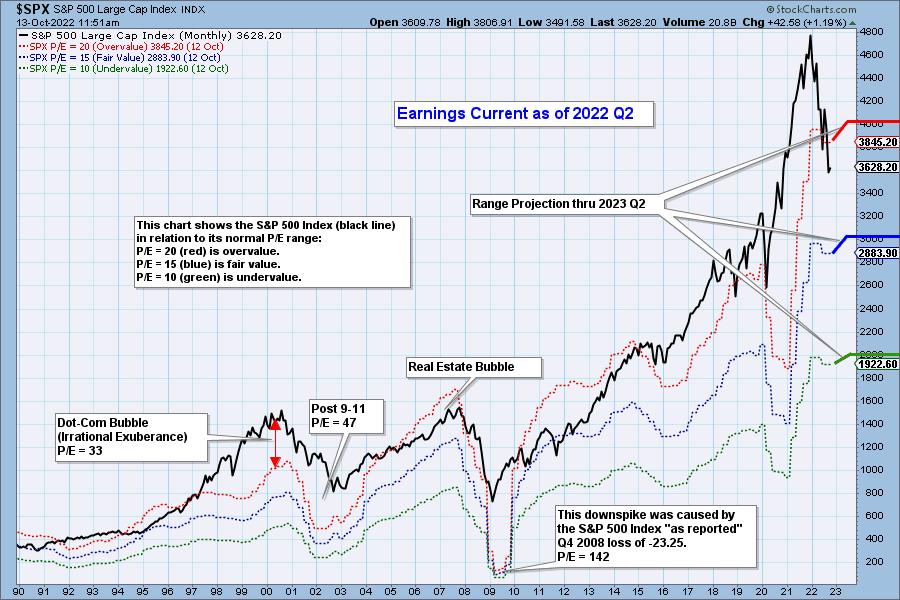

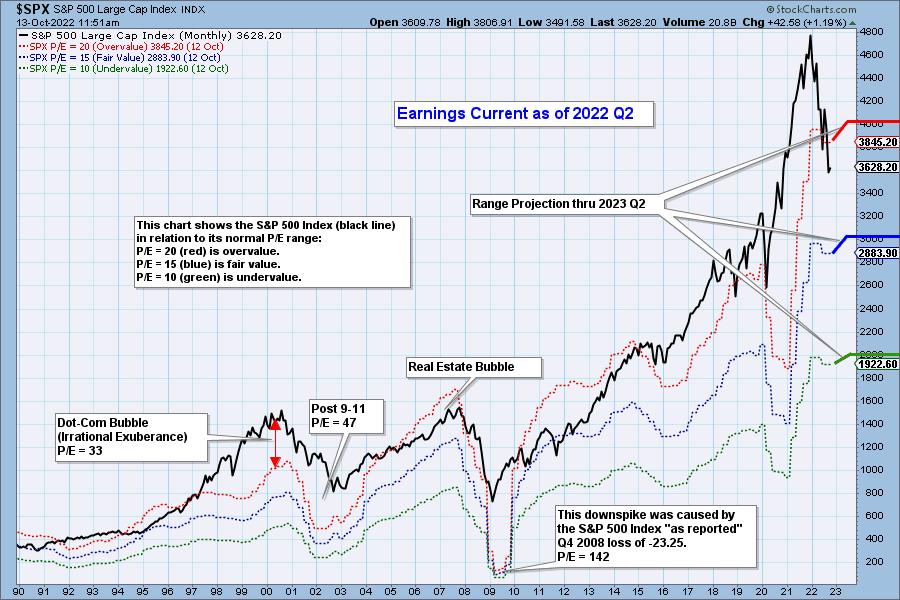

2022 Q2 Final: Earnings Have Peaked

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an...

READ MORE

MEMBERS ONLY

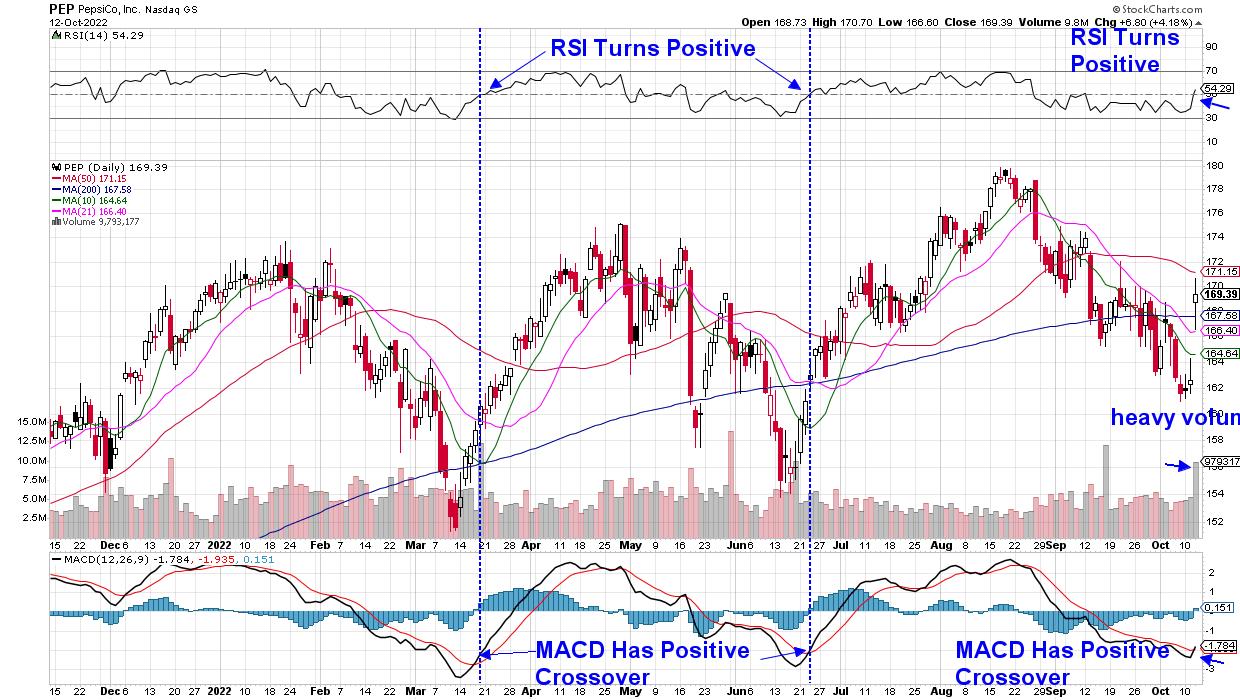

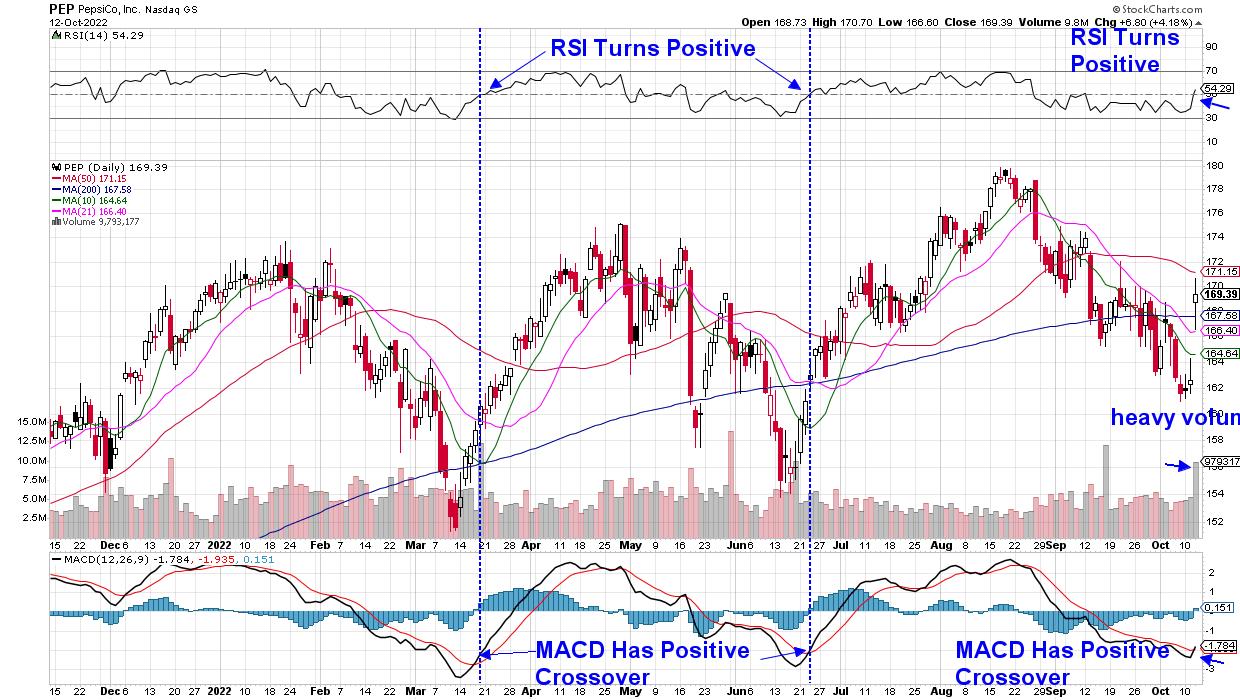

PepsiCo Inc. (PEP) Starts Earnings Season With a Bang

by Mary Ellen McGonagle,

President, MEM Investment Research

Earnings season for the 3rd quarter has begun, with PepsiCo (PEP) reporting earnings and sales results today that were above estimates, despite recognizing a $1.4B charge related to its withdrawal from Russian markets.

Even more important for investors is the fact that management raised their guidance for organic revenue...

READ MORE

MEMBERS ONLY

Mish's Daily: Taking the Temperature of the Economic Modern Family

One of the most important first steps towards trading success is to tilt your trading towards trending sectors that display strength and avoid market weakness. A very helpful tool for understanding the underlying forces driving trends is Mish's Modern Economic Family, a simplified economic market model. The Family...

READ MORE

MEMBERS ONLY

Up, Up & Away!

by Larry Williams,

Veteran Investor and Author

In this exclusive StockCharts TV special, Larry talks about how inflation has been the driving force in the markets. Where are we now, and what is about to happen? Larry uses the Cycle Theory, Crude Oil, P/E, the Presidential Cycle and more to determine where the markets are likely...

READ MORE

MEMBERS ONLY

Better Manage Your Expectations

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave continues to show his methodology in action with a new mystery chart. In his "Mind the Trade" segment, Dave discusses why you must manage your expectations when trading. He then continued his discussion on "your mind on...

READ MORE

MEMBERS ONLY

Past Performance is no Guarantee of Future Results

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There is no doubt that investors are attracted by positive performance. Unfortunately, most investors stop there and never accomplish the due diligence to confirm that the returns are meaningful. In most cases they usually place entirely too much emphasis on performance without putting it into the context of the market...

READ MORE

MEMBERS ONLY

Mish's Daily: Analyzing Two Stocks in the Grocery Space

With the potential of a full recession looming in the coming quarters, investors are looking for defensive plays, such as dividend-paying stocks and businesses more resilient in economic downturns.

Looking at Tuesday's market close, XRT, a.k.a. Granny Retail, was up 1.1%, along with Costco (1....

READ MORE

MEMBERS ONLY

Mish's Daily: The Convergence of Market Headwinds and Mid-Term Elections

The S&P 500, represented by the SPY, has generally stayed above the 200-week moving average long-term. It is a good line in the sand to use as a guide for potential market crashes. Bear market declines are primarily responsible for the few occasions when the SPY dipped to...

READ MORE

MEMBERS ONLY

DP Trading Room: What is a Market Climax?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl goes into detail on how DecisionPoint Climax Analysis works. Climax identification can give you clues into market behavior for the next few days, but it is more than that. Meanwhile, Erin covers sectors and dives into industry groups...

READ MORE

MEMBERS ONLY

Weekend Daily: Don't Be Afraid of the Fed; The Modern Family Will Guide You

Wall Street sold off dramatically on Friday after the jobs report. While the economy is stagnating, many investors are concerned that the Fed will raise rates too quickly, pushing the U.S. economy into a deep recession.

It is good to stay current on the unemployment rate and Fed policy....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Eyes This Level as the Immediate Target; Staying Above These Two WMAs Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, we mentioned how the Indian equities stayed in a defined range, as they traded within the defined corners while respecting basic technical levels. In the week that has gone by, the NIFTY once again made measured moves, continuing to strongly inherit buoyancy from the US...

READ MORE

MEMBERS ONLY

The Pickings are Slim, but one Metal Stands Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The pickings are extremely thin in the markets because the vast majority of groups are in downtrends. TrendInvestorPro tracks trend signals in 274 ETFs. This list include 170 stock-based ETFs, 18 fixed income ETFs, 17 commodity ETFs, 9 currency ETFs and 60 non-US ETFs. Only 14 (5.1%) of the...

READ MORE

MEMBERS ONLY

STOCKS SELL OFF ON JOBS REPORT -- RISING RATES AND OIL ARE ALSO WEIGHING ON STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAP LOWER... Stocks are selling off sharply following this morning's September job report which came in a bit stronger than expected. That may be a case of good economic news being bad for stocks because it keeps the Fed on its path of higher interest rates....

READ MORE

MEMBERS ONLY

The Oil Price Gets Resuscitated: Is it Enough to Keep the Bull Market Alive?

by Martin Pring,

President, Pring Research

Just when it seemed that oil was peaking, OPEC breathed new life into the commodity this week by threatening a sizeable production cut. That does not change the overextended nature of the longer-term indicators. Nevertheless, it does hint that oil prices and their related stocks may be on the verge...

READ MORE

MEMBERS ONLY

GNG TV: It's Just a Lower High Until it Isn't!

by Alex Cole,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex Cole runs through the markets, discussing the major asset trends and macro drivers that affect equity prices, such as Treasury rates, Oil prices and the dollar. Alex looks at the S&P 500 in some detail to...

READ MORE

MEMBERS ONLY

Mish's Daily: The Battle of Supply and Demand, Oil, Gold and the Market

As predicted, and as we wrote about yesterday, oil prices continued to climb in anticipation of an OPEC+ production cut. Reports confirmed today that OPEC+ will cut production by 2 million barrels a day.

The Strategic Petroleum Reserve (SPR), which the Biden administration has tapped to ease gas prices, has...

READ MORE

MEMBERS ONLY

MEM TV Special: Characteristics of a New Bull Cycle

by Mary Ellen McGonagle,

President, MEM Investment Research

In this special presentation from StockCharts TV'sThe MEM Edge, Mary Ellen highlights the unique characteristics of a new bull market, along with the precise signals that alert you to when it's safe to invest for the long term. She also reviews ways to capitalize on bear...

READ MORE

MEMBERS ONLY

Mish's Daily: Gasoline Prices Matter to the Stock Market

It's no secret that gas prices significantly impact the economy, discretionary spending and stock market prices. Gas prices were at record highs following an incredible run-up over the summer and have declined steadily until recently, as represented by the United States Gasoline Fund (UGA). Treasury yields have fallen,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks and Bonds Both Breaking Major Support Levels

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, for the first show of October, I address long-term trends using monthly charts. In line with the longer-term perspective of this show, I start both the asset class and the sector rotation segments with a side-by-side comparison...

READ MORE

MEMBERS ONLY

Mish's Daily: 3 Technical Lessons on Whether or Not Semiconductors Bottomed

We currently have high inflation, a rising US dollar, and massive global interest rate hikes that have hammered stocks. Investors have lost approximately $24 trillion in value destruction for 2022 already.

The good news today is that it appears a short-term bottom has been reached, and a potential rally is...

READ MORE

MEMBERS ONLY

DP Trading Room: Bear Market Rally Ahead

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl discusses the implications of short-term vs. intermediate-term indicators' reactions to last week's rally and what they will likely look like after today's rally. Good stuff on the charts right now! Erin dives into...

READ MORE

MEMBERS ONLY

Week Ahead: Markets May Stay Volatile and In a Range; These Sectors May Start Doing Better

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that was volatile for the Indian markets, the NIFTY50 index oscillated in a 448-point range before ending with a net loss. In the previous week, the NIFTY had closed above the 50-Week MA, which is presently placed at 17100; the index slipped below this point and bounced...

READ MORE

MEMBERS ONLY

Exploring All the Excitement You Can Expect at ChartCon 2022!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson gives you a quick preview of ChartCon 2022 and what to expect in this two-day event, running October 7-8. He summarizes the highlights, walks you through the agenda, and shows how you can save your seat...

READ MORE

MEMBERS ONLY

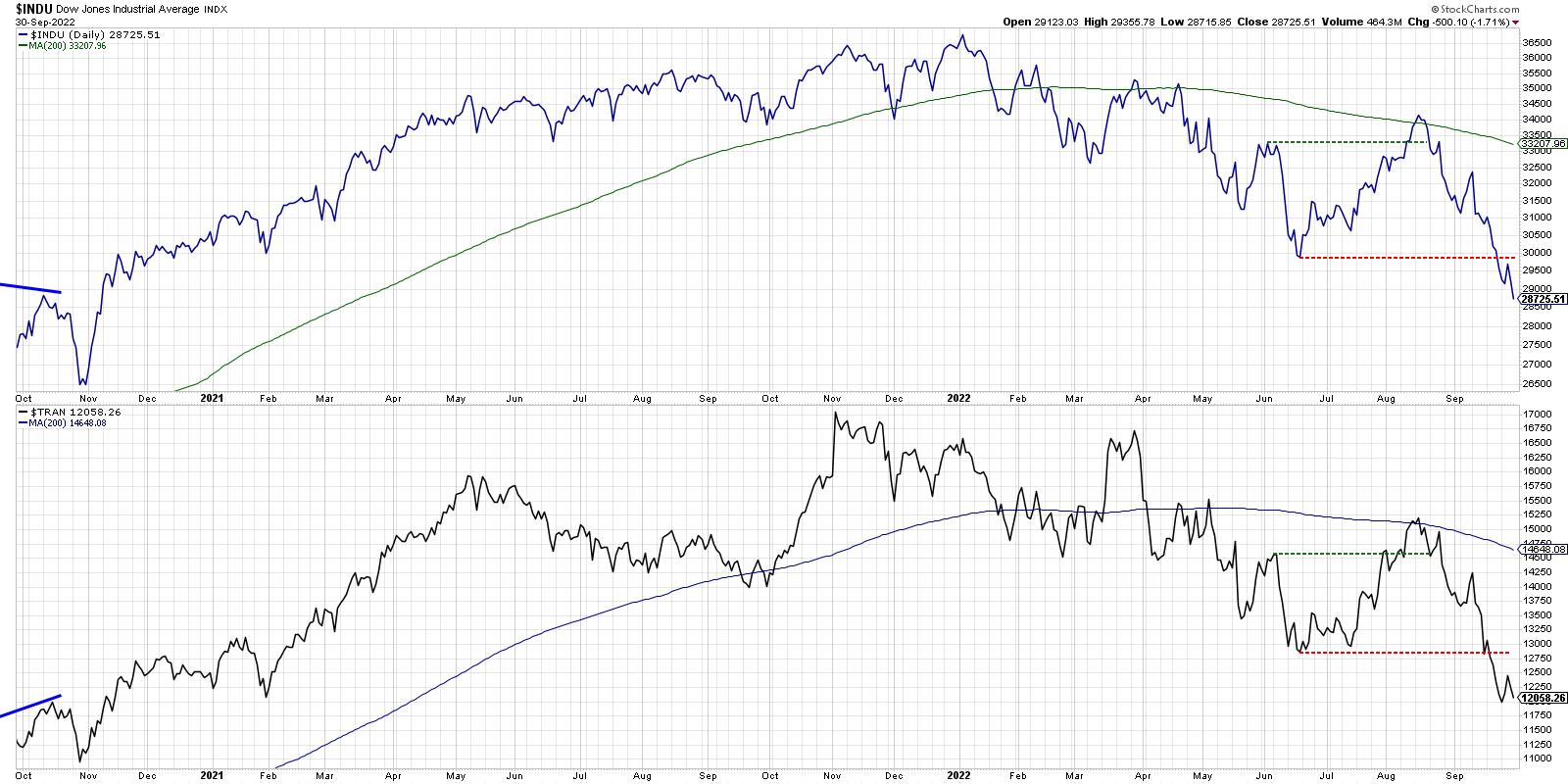

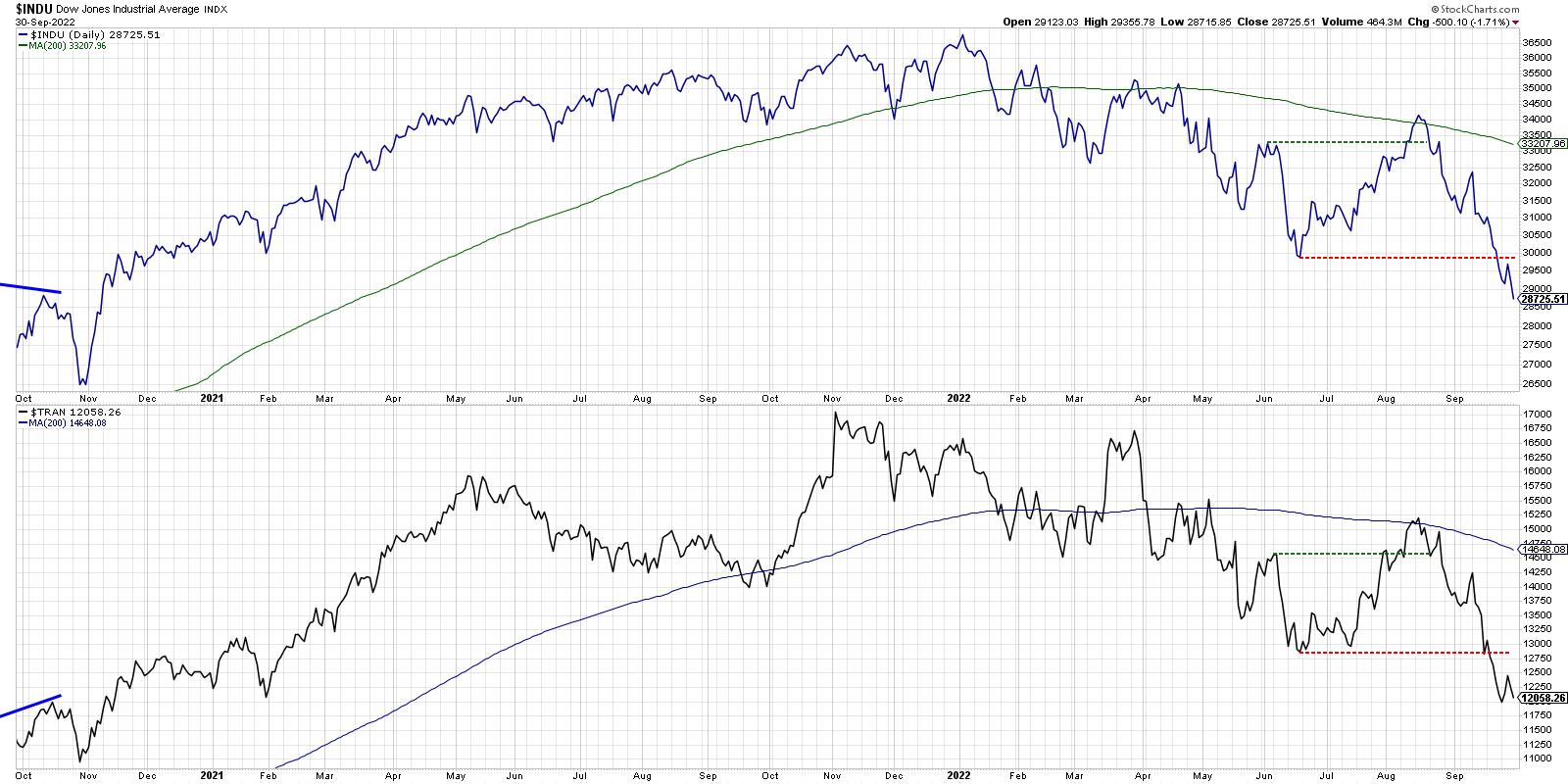

New Dow Theory Confirmed Sell Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

OK, so we know the market is going down. And, save for a mid-summer bear market rally, the S&P 500 and Nasdaq have been in fairly consistent downtrends.

Last week, I highlighted the extreme bearish readings in the AAII Survey(it's worth noting that this weekNAAIM...

READ MORE

MEMBERS ONLY

Anticipating More Inflation

It is crucial to prepare for adjustments in Fed policy and the credit markets, and adjust your trading accordingly, given the persistence of high inflation.

As seen above, The Fed-preferred inflation gauge (core PCE) remained elevated at 4.9% in August, as data released Friday remains far above the Fed&...

READ MORE

MEMBERS ONLY

Understanding Bear Markets and Setting Expectations

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Technical analysts often scoff at the notion that a 20% decline marks a bear market. However, a look back shows that further losses are certainly possible after a 20% decline. Over the last 25 years, the last two bear markets started with declines in excess of 20% and the S&...

READ MORE

MEMBERS ONLY

Five Decades Of Personal Stock Market Passages, Tools, Lessons And Stories: Part 3

by Gatis Roze,

Author, "Tensile Trading"

When I began investing full-time, my methodology's foundation was based on William O'Neil's CANSLIM® approach. It's a deeply researched and proven strategy. The AAII's own ongoing trading models validate that fact.

For the next three decades, my efforts were focused...

READ MORE

MEMBERS ONLY

Pop or Implode?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG discusses how the market is at a very difficult spot to interpret right now. On one side, things are stretched and there is enough bearish kindling to set off a short squeeze. On the other, what reason do people...

READ MORE

MEMBERS ONLY

FOREIGN STOCKS ARE LEADING U.S. LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING FOREIGN CURRENCIES... Last week's message showed the U.S. Dollar Index rising to the highest level in twenty years. That's due largely to the fact that the Fed has been hiking rates faster and higher than most foreign bankers. What's good for the...

READ MORE

MEMBERS ONLY

GNG TV: Risk-Off Environment Despite Key Support

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler review Wednesday's upside move in the context of a persistent "NoGo" trend in US Equities, Commodities, and bond prices. The continued "NoGo" trend conditions on the daily and weekly charts...

READ MORE

MEMBERS ONLY

ADX Simplified

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the ADX indicator, discussing how it gives us insight into 2 different groups of investors and how to interpret them. He also shows how this indicator can help to determine when the climate is better for...

READ MORE

MEMBERS ONLY

NYSE and SPX New Lows Confirm Price Bottom

by Erin Swenlin,

Vice President, DecisionPoint.com

As we saw a positive divergence materialize on the $SPX with New Lows, we thought it a good time to bring out the NYSE New Highs/New Lows chart, which has also seen a positive divergence between shrinking New Lows and price bottoms that were moving lower. This indicator has...

READ MORE

MEMBERS ONLY

Mish's Daily: Mid-September Column Highlights

As we prepare to move into October, I wanted to take a moment to highlight some of my recent daily columns from September.

On September 13, I wrote a Daily titled "Why Higher Inflation Matters and Transportation is Key". In it, I highlighted that the transportation sector and...

READ MORE

MEMBERS ONLY

You Better Know Your Nuances

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, given the nature of the markets, Dave thought it would be a good time to dive deeper into the topic of methodology. You must know the nuances of your methodology and more importantly, be willing to live with them. Using his...

READ MORE

MEMBERS ONLY

Inflation is All the Rage, but Many Market Signals are Pointing in a Different Direction

by Martin Pring,

President, Pring Research

Polls show that the number one issue with voters is inflation, but some intermarket relationships are signaling otherwise. I am not saying that inflation is about to be wrestled to the ground, but it goes in waves, as you can see from Chart 1. Also, once prices go up, they...

READ MORE

MEMBERS ONLY

Mish's Daily: The Retail Market as a Stock and Economic Indicator

As the selloff continues, our Big View serviceRisk Gauge has been bearish for weeks, signaling risk off.Most of our portfolio strategies hold more than 50% cash, some are short, and my discretionary service is looking to deploy capital soon.

Today, we'll focus on what the retail sector,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Back in Line

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I review the current rotations for asset classes, where we find continuing strength for the US dollar and fixed-income-related asset classes, while stocks are rotating back to the lagging quadrant. As it is the last Tuesday of...

READ MORE

MEMBERS ONLY

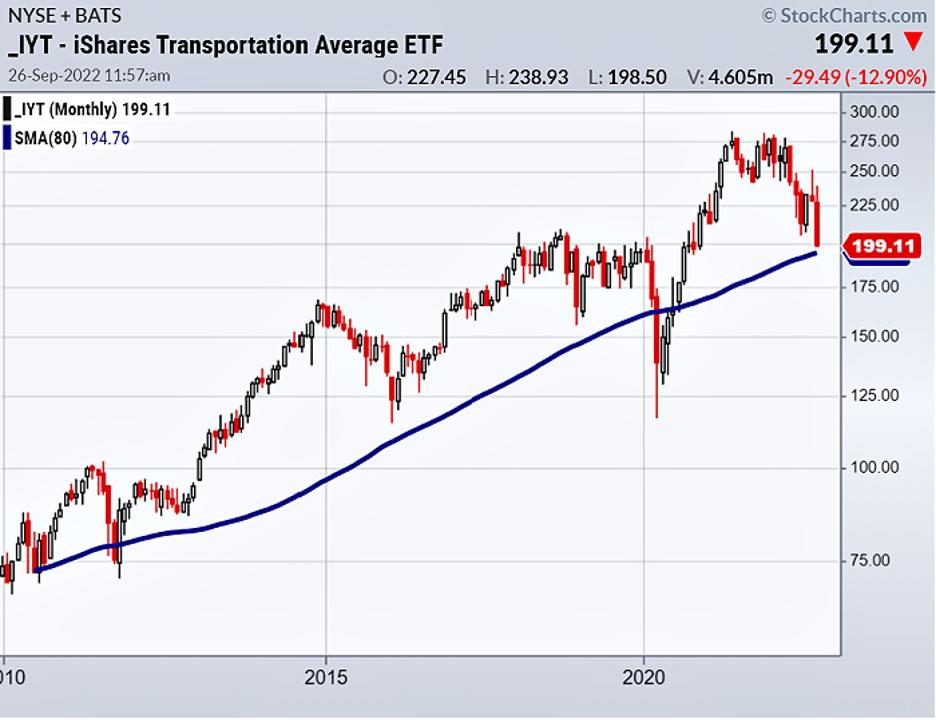

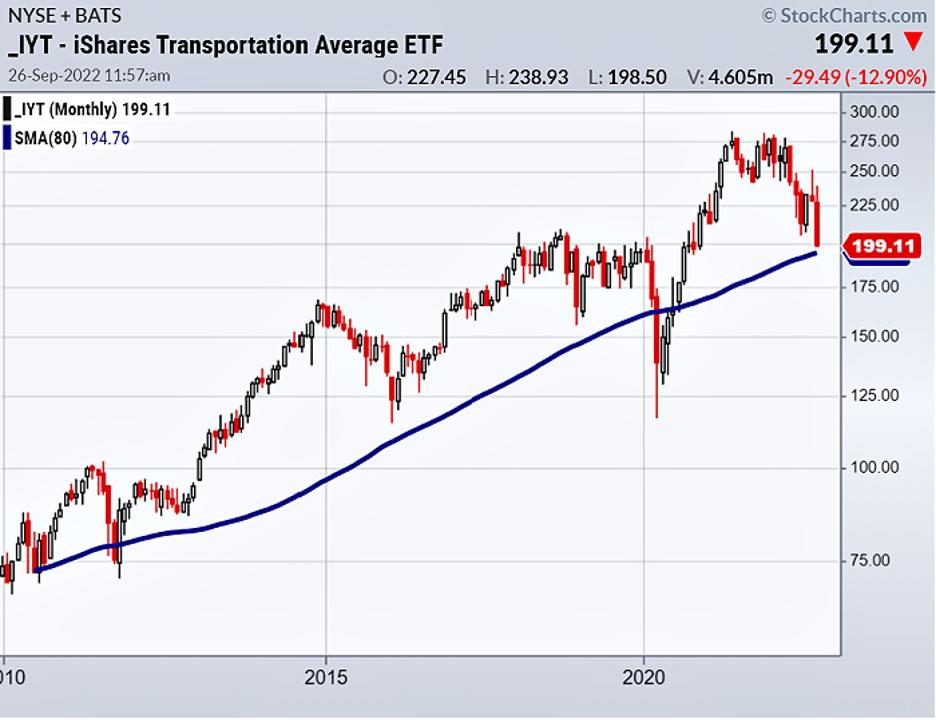

Mish's Daily: Step Back to the Monthly Chart on Transportation

Last Friday, I spoke on Women of Wall Street Twitter Spaces and Fox Business's Making Money with Charles Payne to talk about a key monthly moving average.

What makes this moving average so important right now is that three of the Economic Modern Family members are testing it....

READ MORE