MEMBERS ONLY

StockCharts Insider: Don’t Miss One of the Most Powerful Tools in the Nav Bar

by Karl Montevirgen,

The StockCharts Insider

Before You Click Around…

Let’s be honest: most nav bars are just toolboxes. StockCharts’ new nav bar? It’s sleeker, smarter, and if you look closely, it’s also sneakier. Why? Hidden inside one of those tabs is a full-blown market analysis workflow. It’s a comprehensive top-down routine...

READ MORE

MEMBERS ONLY

10 Stocks Set to Soar in October 2025

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 500 has broken above 6700! Tom recaps another week of all-time highs and sector strength, with healthcare leading the surge; he spotlights 10 top stocks, including Tesla, Johnson & Johnson, and more that are showing fresh upside momentum.

This video premiered on October 2, 2025. Click...

READ MORE

MEMBERS ONLY

S&P 500 Earnings for 2025 Q2: Is This the Most Overvalued Market Ever?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Discover why the S&P 500 is at its most overvalued level in history. See earnings trends, valuation ranges, and what rising P/E ratios mean for investors heading into 2026....

READ MORE

MEMBERS ONLY

Confidence Ratios are Breaking Out in One Direction

by Martin Pring,

President, Pring Research

Martin Pring analyzes the relationship between sectors and various asset classes to confirm trend continuations....

READ MORE

MEMBERS ONLY

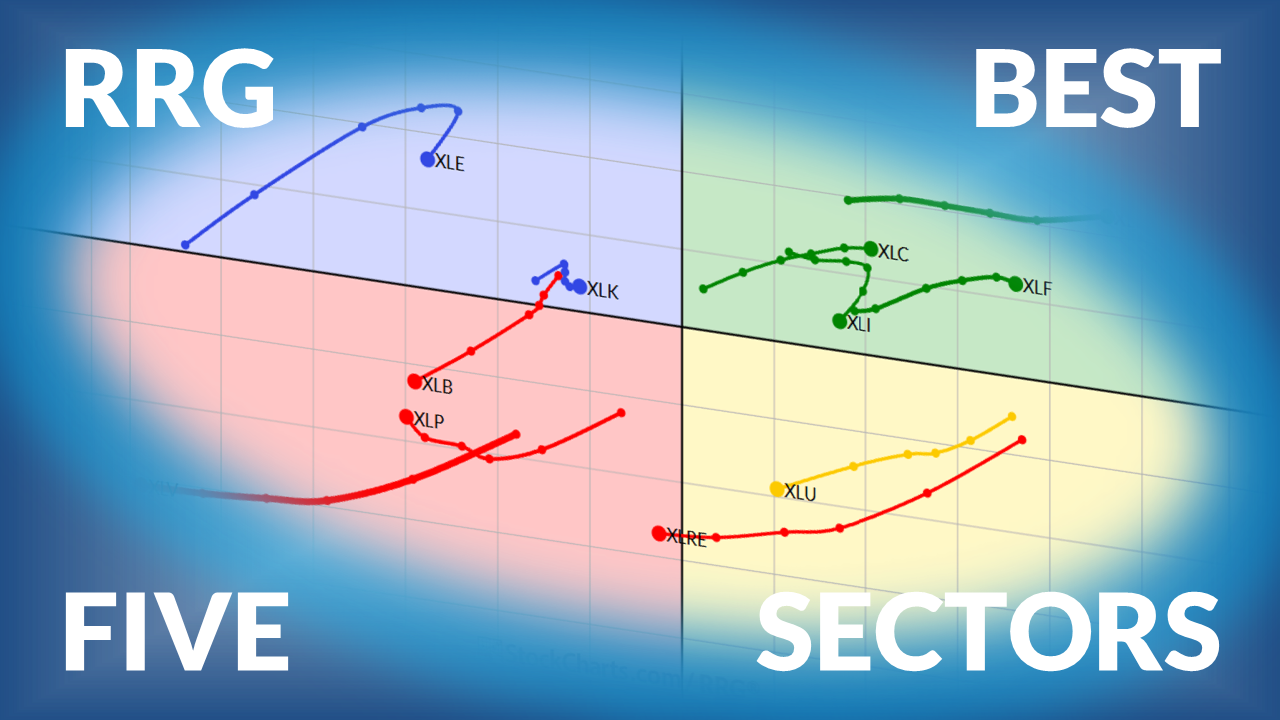

It’s All Relative: What the RRG View Tells Us About Q4

Soft jobs data raises Fed cut odds as stocks enter Q4 strong. Discover which sectors lead on RRG, Health Care's rebound, and Energy's outlook....

READ MORE

MEMBERS ONLY

10 Must-See Charts for October 2025

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Grayson and Dave as they reveal their top 10 stock charts to watch this October....

READ MORE

MEMBERS ONLY

18-MA Trading Strategy: How to Spot Trends & Signals

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil of Rabil Stock Research shows how to use the 18-MA to identify trend, momentum, and support/resistance, before then reviewing the latest S&P market conditions. He also covers the IWM and stock requests such as ACT, EQNR, FLNG, SAP, FCX, OSK, and VNT, pointing out setups...

READ MORE

MEMBERS ONLY

The Squeeze Is On: Using the TTM to Catch Big Moves

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Learn how the TTM Squeeze indicator spots stocks ready to break out of a consolidation and see how you can apply it to stocks that have long-term investing potential....

READ MORE

MEMBERS ONLY

Intermarket Crosscurrents: What Quarter-End Trends Signal for Q4

Stocks rally as Q3 ends, yields creep higher, metals shine, and the dollar moves sideways. Explore key trends in equities, bonds, commodities, and currencies....

READ MORE

MEMBERS ONLY

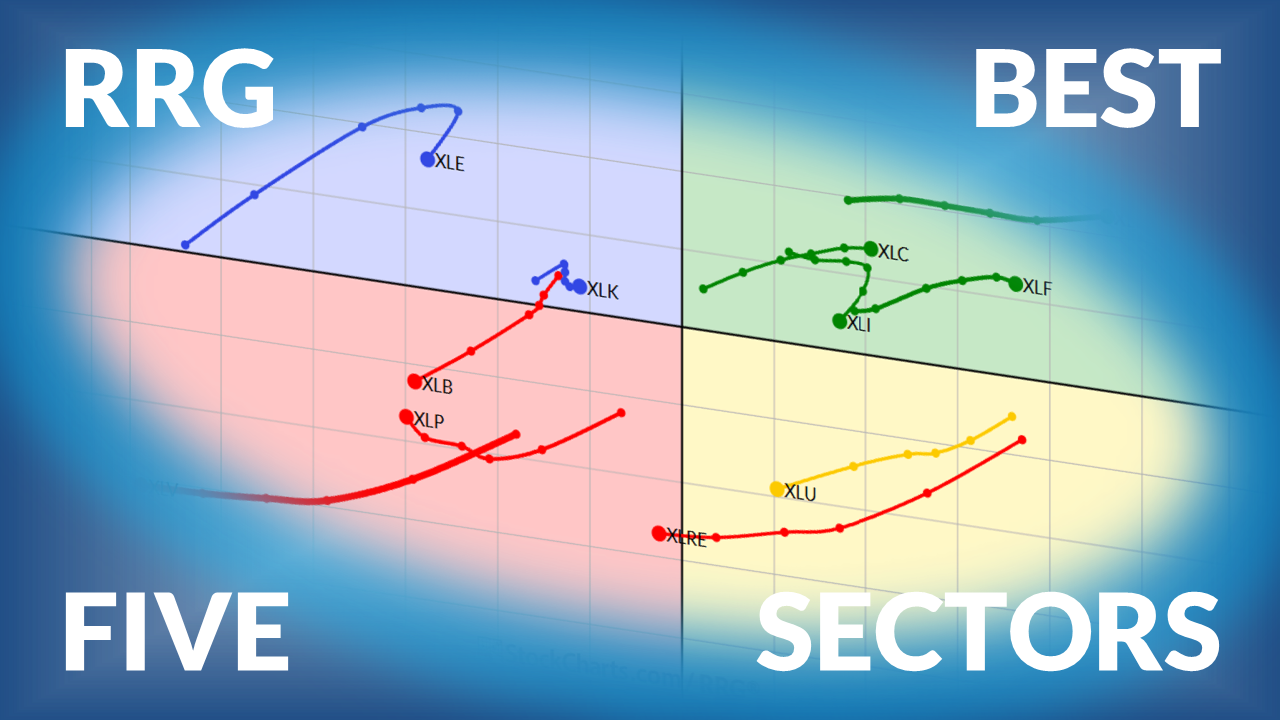

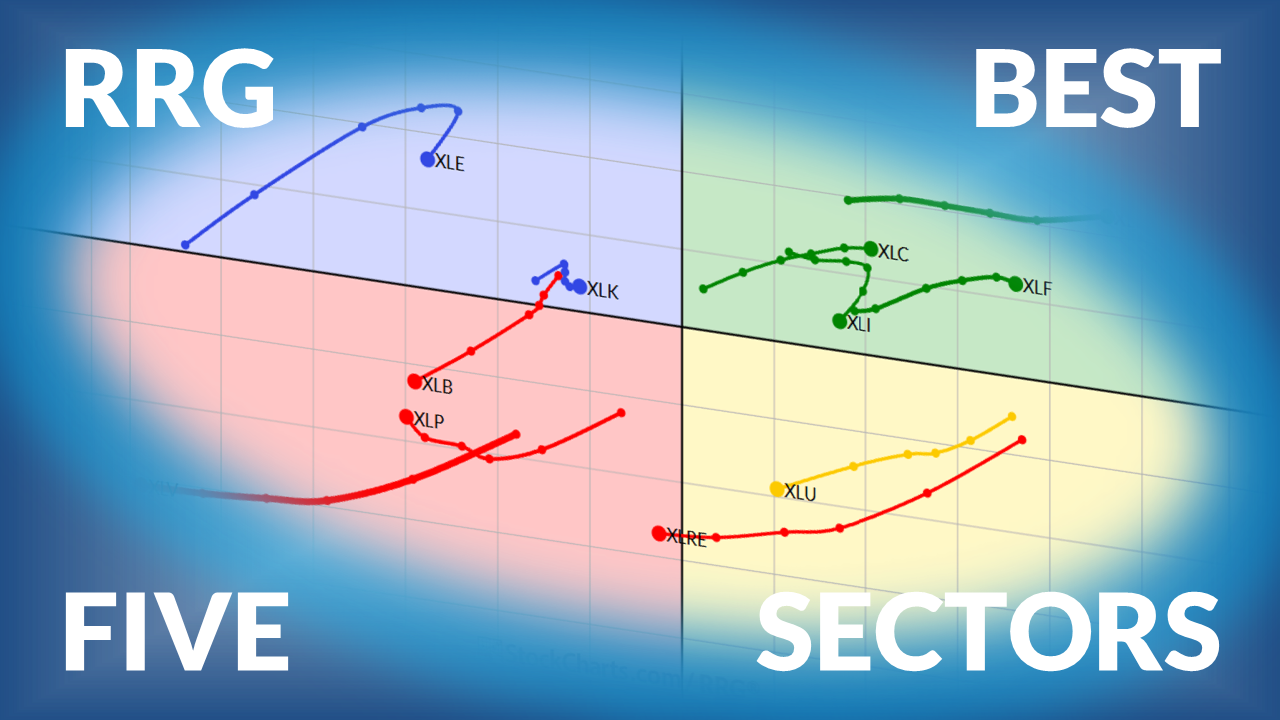

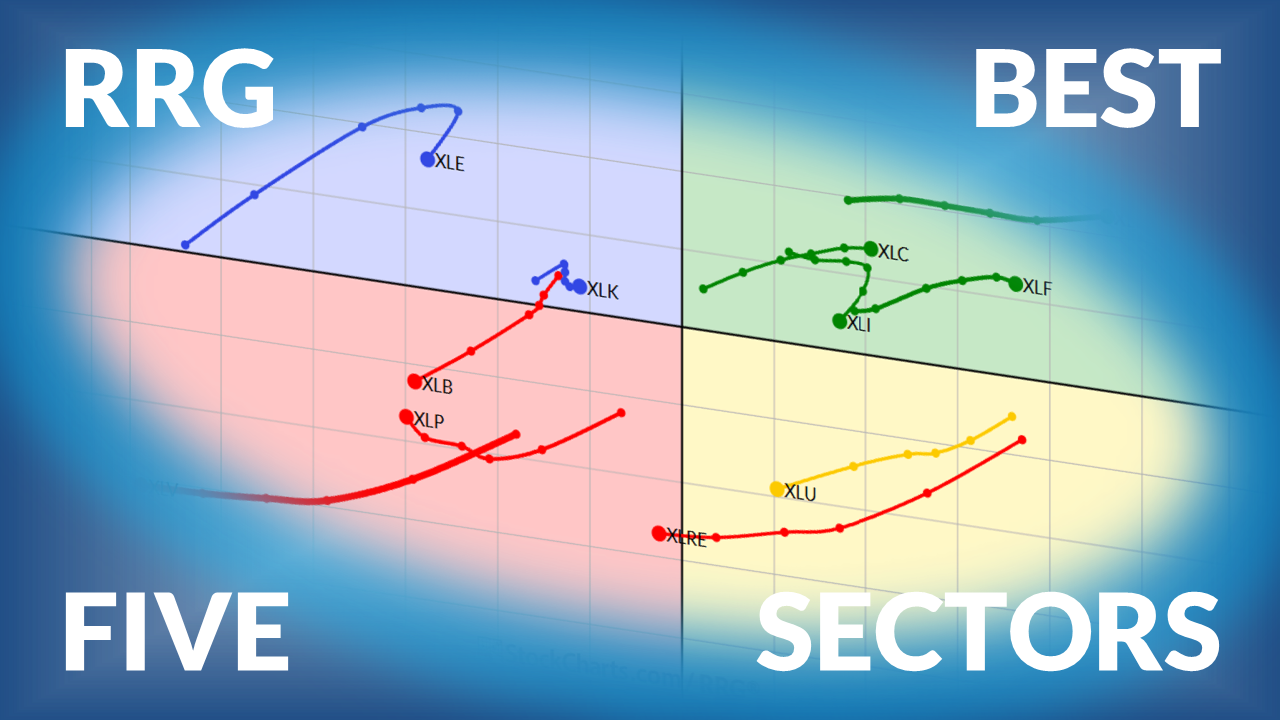

The Best Five Sectors This Week, #38

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector ranking based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Sits at Important Supports; Scarcity of Leadership Remains a Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The NIFTY is facing consistent resistance, failing to break out of a trading range; where does it go from here? Meanwhile, sectors are facing a lack of leadership....

READ MORE

MEMBERS ONLY

StockCharts Insider: Your Chart Might Be Lying to You — Here’s How to Fix It

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

If you’ve never checked whether your chart is set to log scale or arithmetic scale, you might be looking at a distorted picture without even knowing it. Not a great way to start your analysis. One small setting, one HUGE impact. Let’s make sure...

READ MORE

MEMBERS ONLY

The Next Step in AI Is Here: Powered by Quantum Computing

by Mary Ellen McGonagle,

President, MEM Investment Research

Spot the next innovative cycle and uncover potential stock market winners....

READ MORE

MEMBERS ONLY

Don’t Get Squeezed: Using TTM to Stay Head of Wall Street

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

If you follow the stock market, you know that September is supposed to be a soft month. Well, not this year. So far, all three major indexes are up and, with just two trading days left, it’s looking like the month could finish on solid footing.

Here’s how...

READ MORE

MEMBERS ONLY

New Market Leaders Are Emerging – Don’t Miss This Rotation!

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen breaks down where strength is emerging beneath the surface of the markets, highlighting leadership in energy stocks, utilities, and industrials. She then shares setups in coal, natural gas, and electricity names, along with constructive moves in DOW components like INTC, IBM, AAPL, and CAT. In addition, she takes...

READ MORE

MEMBERS ONLY

Sentiment Issues Short-Term Warning For U.S. Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Discover why September often brings stock market weakness, how sentiment indicators like CPCE & VIX signal caution, and what investors should watch next....

READ MORE

MEMBERS ONLY

102 Days Above 50-Day; New Lows Expand; Tech Power; Commodity Bull Market; Oil Gets Interesting

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The SPY has traded above its 50-day simple moving average for 102 days, commodities are in a bull market, and crude oil is starting to turn up. Explore what Arthur Hill's analysis uncovers some of the activity taking place below the surface....

READ MORE

MEMBERS ONLY

Old Dogs, New Tricks: Bitcoin & Gold and What's Next

by Larry Williams,

Veteran Investor and Author

Larry compares Bitcoin and gold, looking at their shared appeal; he notes caution signals for Bitcoin and similar risks for gold. He also revisits past forecasts and updates his market outlook....

READ MORE

MEMBERS ONLY

Energy Stocks Ready to Break Out? Key Setups to Watch

by Joe Rabil,

President, Rabil Stock Research

Joe highlights key setups in the energy sector, reviewing stocks such as XOM, CVX, VLO, and SU while explaining patterns like reverse divergence, zero line reversals, and low ADX conditions. He then analyzes the S&P market conditions, covering sentiment, volatility, trend, and momentum across multiple time frames, noting...

READ MORE

MEMBERS ONLY

Are the Mag 7 Rolling Over? Key Signals from Apple to Amazon

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom recaps the week, then turns his attention to the Mag 7 stocks after short-term sentiment warnings appeared in the market. He reviews key charts showing bearish engulfing patterns, resistance tests, and potential pullbacks in AAPL, MSFT, NVDA, META, GOOGL, TSLA, and AMZN, noting that six of the seven may...

READ MORE

MEMBERS ONLY

China Tech Breakout: Alibaba Sparks a FXI Rally Despite Powell's Warning

BABA stock is rebounding with AI-driven momentum. Learn how the stock price of Alibaba impacts FXI and what the technicals signal for traders in 2025....

READ MORE

MEMBERS ONLY

Turn Your Stock Watchlist Into Winners With This Chart Tool

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Learn how the StockCharts Technical Rank (SCTR) score can help you spot stocks gaining momentum....

READ MORE

MEMBERS ONLY

Dave's September 2025 Stock Picks: 3 Charts That Worked… and 2 That Didn’t

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dave revisits five stocks from the September Top Ten Charts episode to see how they’ve evolved. He reviews NVDA, AXP, MSI, MRK, and the SIL, explaining which setups worked, which failed, and the lessons to carry forward. From short ideas that didn’t pan out to breakout patterns and...

READ MORE

MEMBERS ONLY

Taking Stock of the Small-Cap Record High: Here's How High IWM Could Go

The Russell 2000 ETF (IWM) logged a record weekly close, triggering a bullish breakout target of $322. Explore why small-caps may thrive with Fed rate cuts, supportive seasonality, and strong relative strength versus large caps....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #37

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector rotation ranking based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Faces Resistance at These Levels; RRG Indicates Weakening Outpacing Shifts Within Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The price action in the Nifty reflects a potential breakout buildup. But will it be able to break out of the resistance? Here's what you need to look for in the charts....

READ MORE

MEMBERS ONLY

Dow Theory Bearish, But Some Transports Are Thriving

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dow Theory has flashed a bearish non-confirmation signal. Dave breaks down the implications of this ominous pattern and analyzes some of the key transportation stocks that have caused this macro divergence....

READ MORE

MEMBERS ONLY

Tech & Small Caps Surge After Rate Cut – Who Leads Next?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this week’s show, Mary Ellen highlights the stocks and groups showing the most promise following the Fed’s rate cut. She spotlights leadership in technology, software, and semiconductors, while also pointing out opportunities in small-cap AI names, robotics, crypto, and biotechs. Mary Ellen shares how industrials, uranium, and...

READ MORE

MEMBERS ONLY

Special Offer: 2 Months FREE for New StockCharts Members

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Another week, another record-setting close in the major indexes. With the S&P 500 ($SPX) up over 13% so far this year, investors are seeing gains far beyond what CDs or money markets can deliver.

The stock market may seem to be a complex and risky beast, but here’...

READ MORE

MEMBERS ONLY

StockCharts Insider: The SCTR Fast Track to Buy-the-Dips & Breakouts

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

How do you turn a quick morning scan into a market edge? With SCTR Reports. In this article, we’ll cover how SCTRs rank stocks, how to scan them fast, and how to spot leaders, laggards, and turnarounds in minutes. This is your quick-start guide to...

READ MORE

MEMBERS ONLY

Sector Rotation Points to Large-Cap Growth Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius takes a look at the current sector rotation, in combination with growth-value and size rotation. Combining these Relative Rotation Graphs shows strength concentrating in large-cap growth and the Tech, Discretionary, and Communication Services sectors. From this vantage point, we can see continued strength for the S&P 500...

READ MORE

MEMBERS ONLY

Fed Day Signals: Noise or the Start of Something Bigger?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The Fed delivered a rate cut and markets wobbled. Discover how stocks, bonds, and the dollar reacted and what investors should watch next. ...

READ MORE

MEMBERS ONLY

Wednesday May Have Been Turnaround Day for Some Markets

by Martin Pring,

President, Pring Research

Following the Fed's rate cut, the price action in several markets indicated a short-term reversal. Martin suggests monitoring these charts and their technical signals in the coming weeks....

READ MORE

MEMBERS ONLY

10 Stocks Poised To Run After Fed Cuts Rates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom Bowley, EarningsBeats.com's Chief Market Strategist, as he recaps last week's action, especially Wednesday's action after the Federal Reserve finally decided to continues its 2024 rate-cutting campaign. Tom dives into what areas of the stock market were working after the decision to...

READ MORE

MEMBERS ONLY

Simple Yet Powerful RSI Pullback Signal

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe shows viewers how to use a deep pullback in RSI as a buying opportunity. He uses two different settings for RSI in order to identify when a stock is a getting a great setup during an uptrend, and presents several examples on weekly and daily charts....

READ MORE

MEMBERS ONLY

Offense Still Crushing Defense

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While technology stocks have stalled out over the last six weeks, other growth sectors have stepped into a leadership role. Here are the charts Dave uses regularly to track leadership themes, and identify when new sectors are improving in relative strength terms....

READ MORE