MEMBERS ONLY

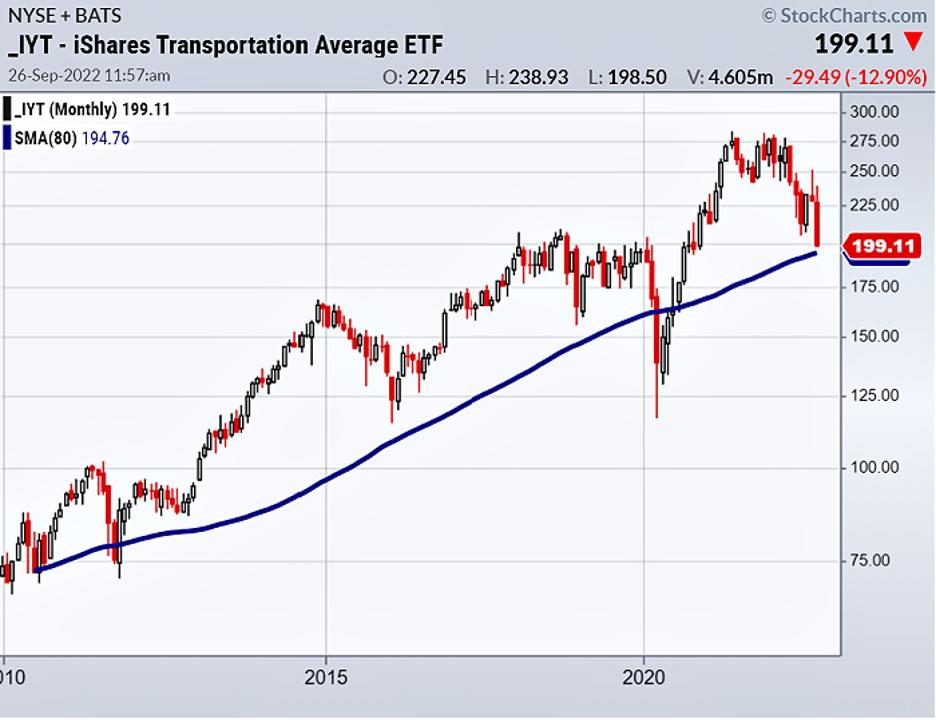

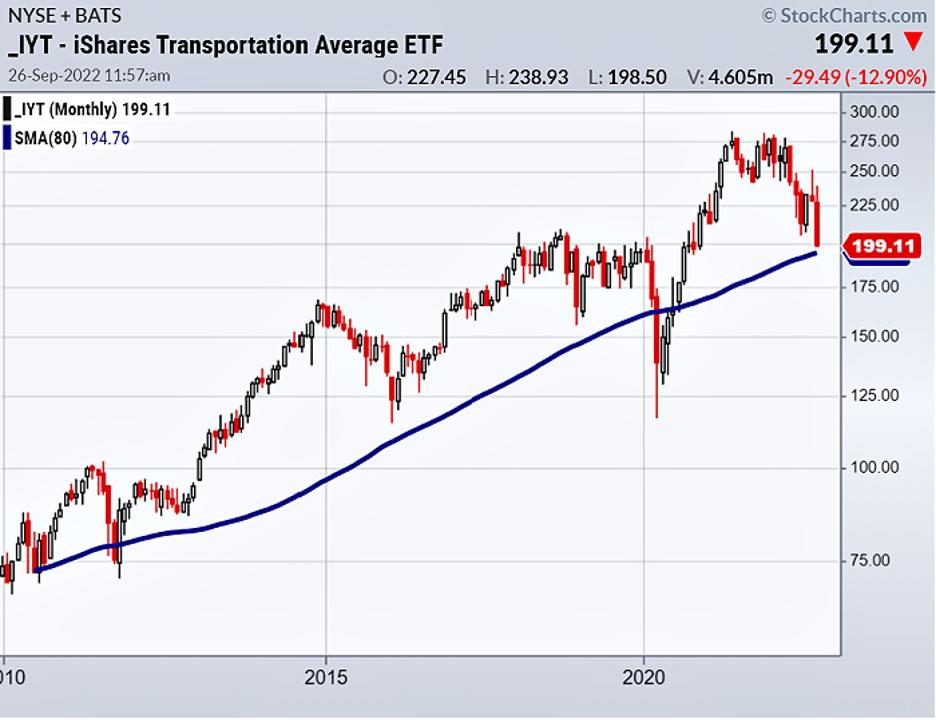

Mish's Daily: Step Back to the Monthly Chart on Transportation

Last Friday, I spoke on Women of Wall Street Twitter Spaces and Fox Business's Making Money with Charles Payne to talk about a key monthly moving average.

What makes this moving average so important right now is that three of the Economic Modern Family members are testing it....

READ MORE

MEMBERS ONLY

DP Trading Room: Carl Explains the VIX!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl reacts to a viewer question about why he thinks the market will likely retrace 55% or more from the bull market high. He focuses on earnings, which he goes through in detail. We also got a bonus discussion...

READ MORE

MEMBERS ONLY

Risk is More than a Four Letter Word

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Dictionary.com says: The exposure to the chance of injury or loss; a hazard or dangerous chance. American Heritage Dictionary says: The possibility of suffering harm or loss; danger. These are just two of the many entries and these were just for the noun. Risk in the world of investments...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Approaches This Key Support on Higher Timeframe Charts; Keep Positions at Modest Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by remained rather contradictory in nature; however, let's consider if this statement holds if we look at it from different perspectives and different timeframes. The markets certainly remained highly volatile, as they reacted, in turn, to the global market reactions to the 75 bps...

READ MORE

MEMBERS ONLY

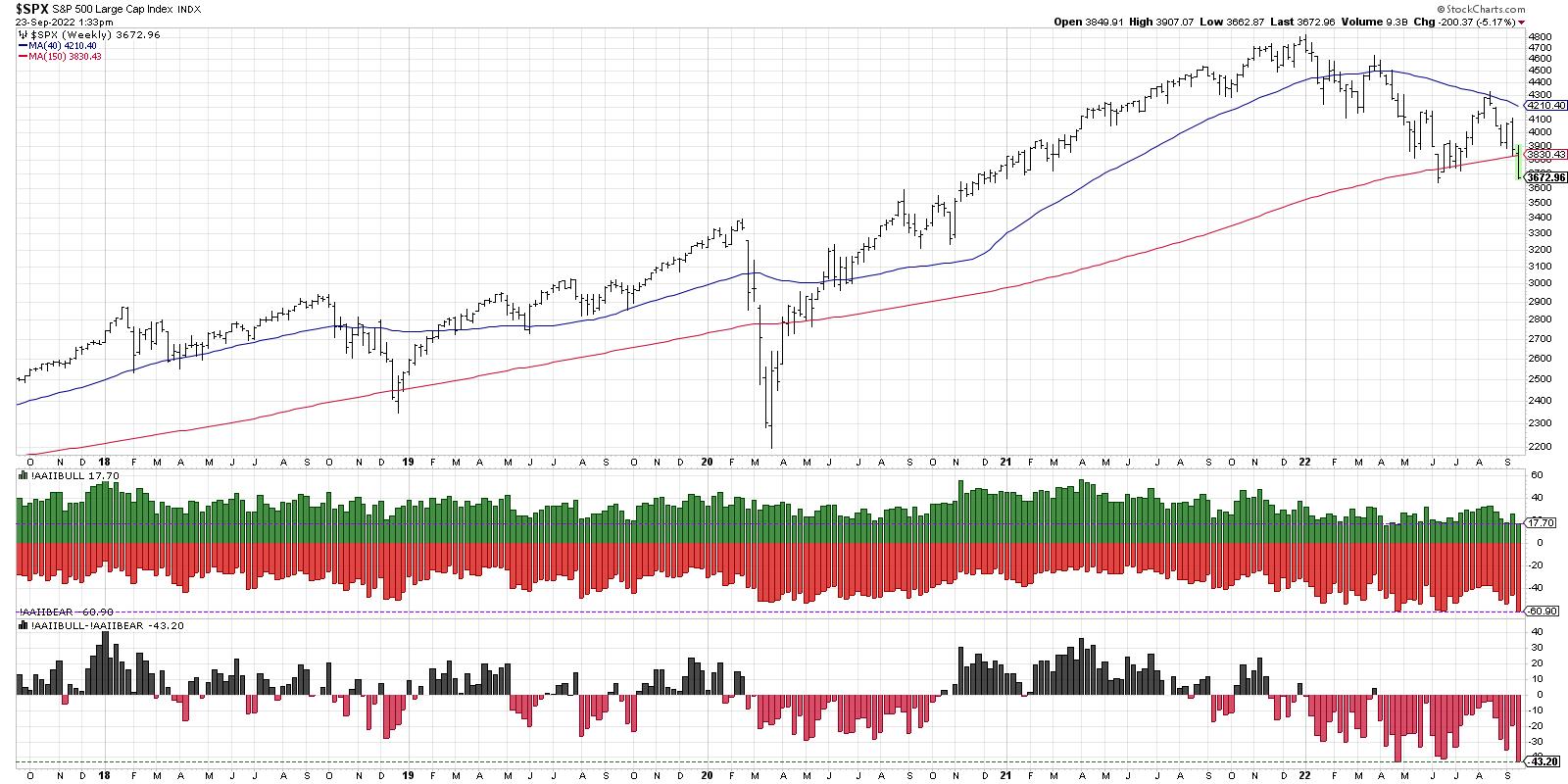

Will The Markets Stage a Countertrend Bounce Next Week?

by Mary Ellen McGonagle,

President, MEM Investment Research

It was another tough period for the markets, with the S&P 500 posting its 2nd consecutive week of a 4.7% decline. Both weeks posted above-average volume as investors fled stocks amid signs that the Fed will continue to quickly raise rates, despite the real possibility of leading...

READ MORE

MEMBERS ONLY

Weekend Daily: The Biotech Sector Should Come Back First

The market has turned for the worst in recent weeks and continues to fall in a bear market fashion.

Most of our portfolio strategies are holding more than 50% cash, some are utilizing inverse ETFs, and in my discretionary trading service, we are largely in cash. We are looking for...

READ MORE

MEMBERS ONLY

The Perfect Starter to Build Your Daily Market Review Routine

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson discusses the importance of a daily market review routine and demonstrates how two specific ChartLists from his own account fuel his personal process. You'll learn how to create and organize market review lists of...

READ MORE

MEMBERS ONLY

MEM TV: Is There Anywhere to Hide?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this week's edition of StockCharts TV'sThe MEM Edge, Mary Ellen reviews areas that are withstanding the downtrend in the markets, as well as what's driving price action elsewhere. She also shares why the poorest performers this week may have further downside.

This video...

READ MORE

MEMBERS ONLY

Stocks Sinking Faster Than Dollar Can Rise -- Time to Broaden Your Horizon

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When markets across the world and all asset classes are dropping, it's time to put things into (international) perspective and see if any alternatives to US stocks are available.

I always keep an eye on this Relative Rotation Graph, which holds a group of international stock market indexes...

READ MORE

MEMBERS ONLY

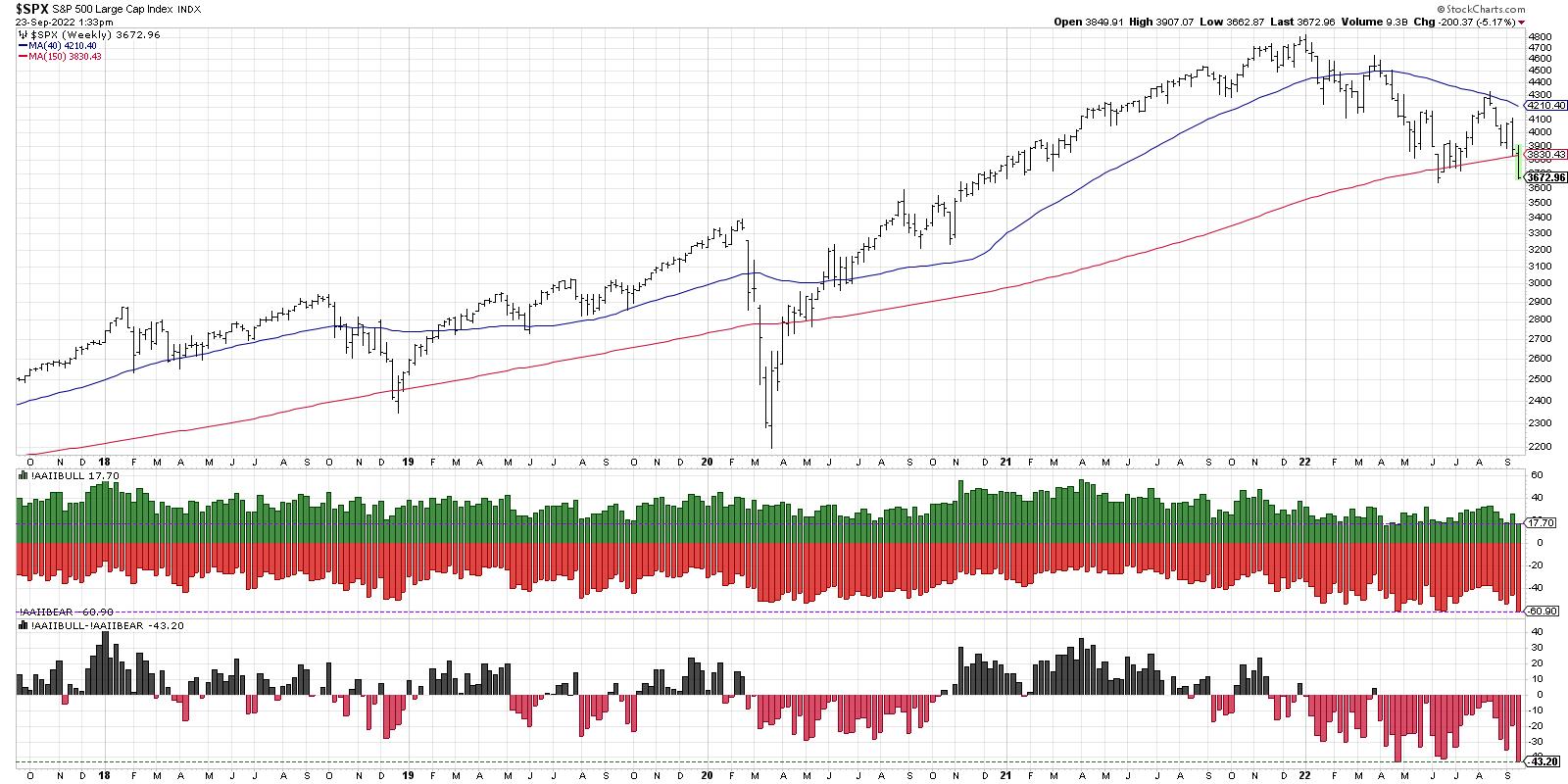

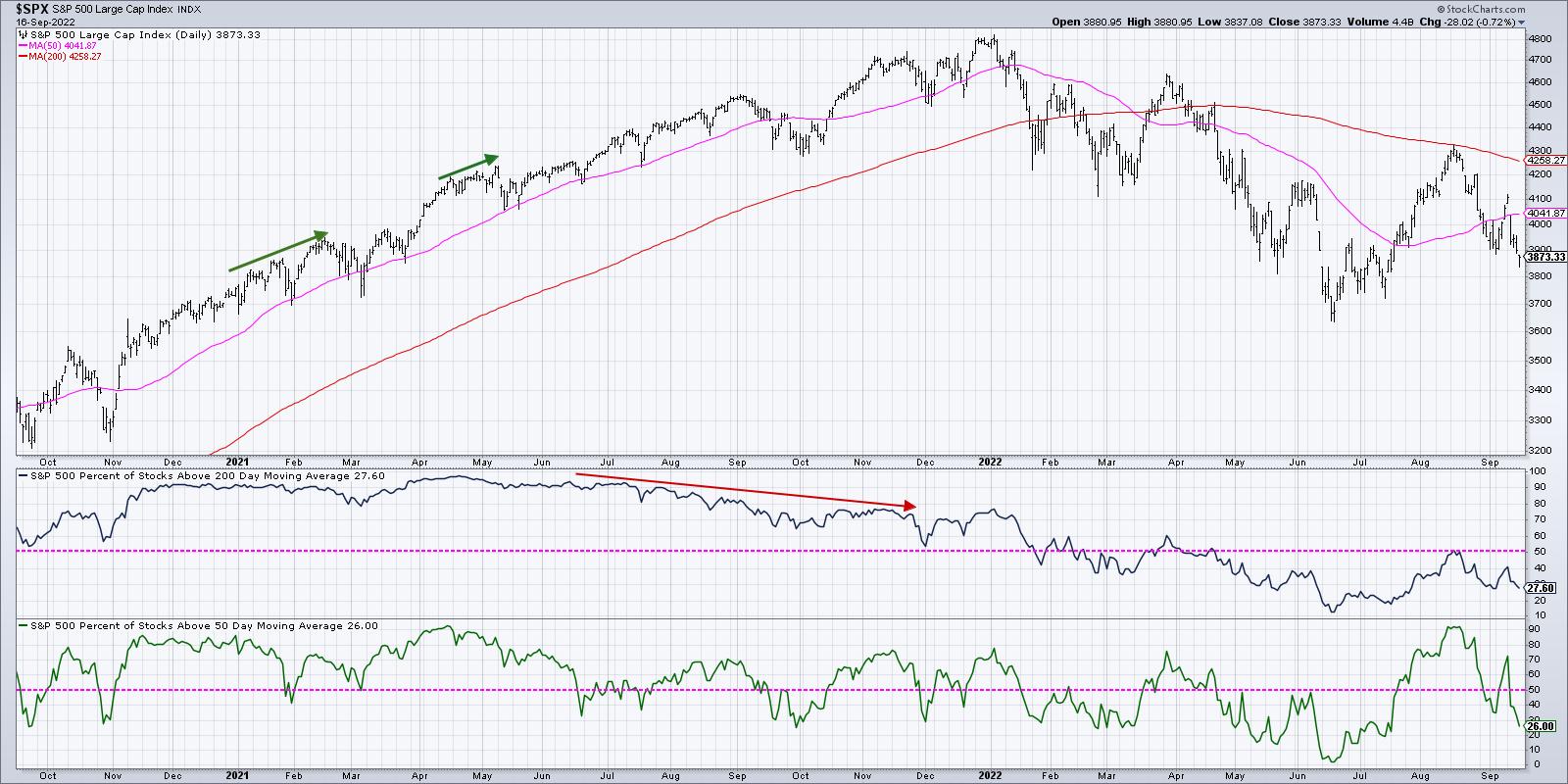

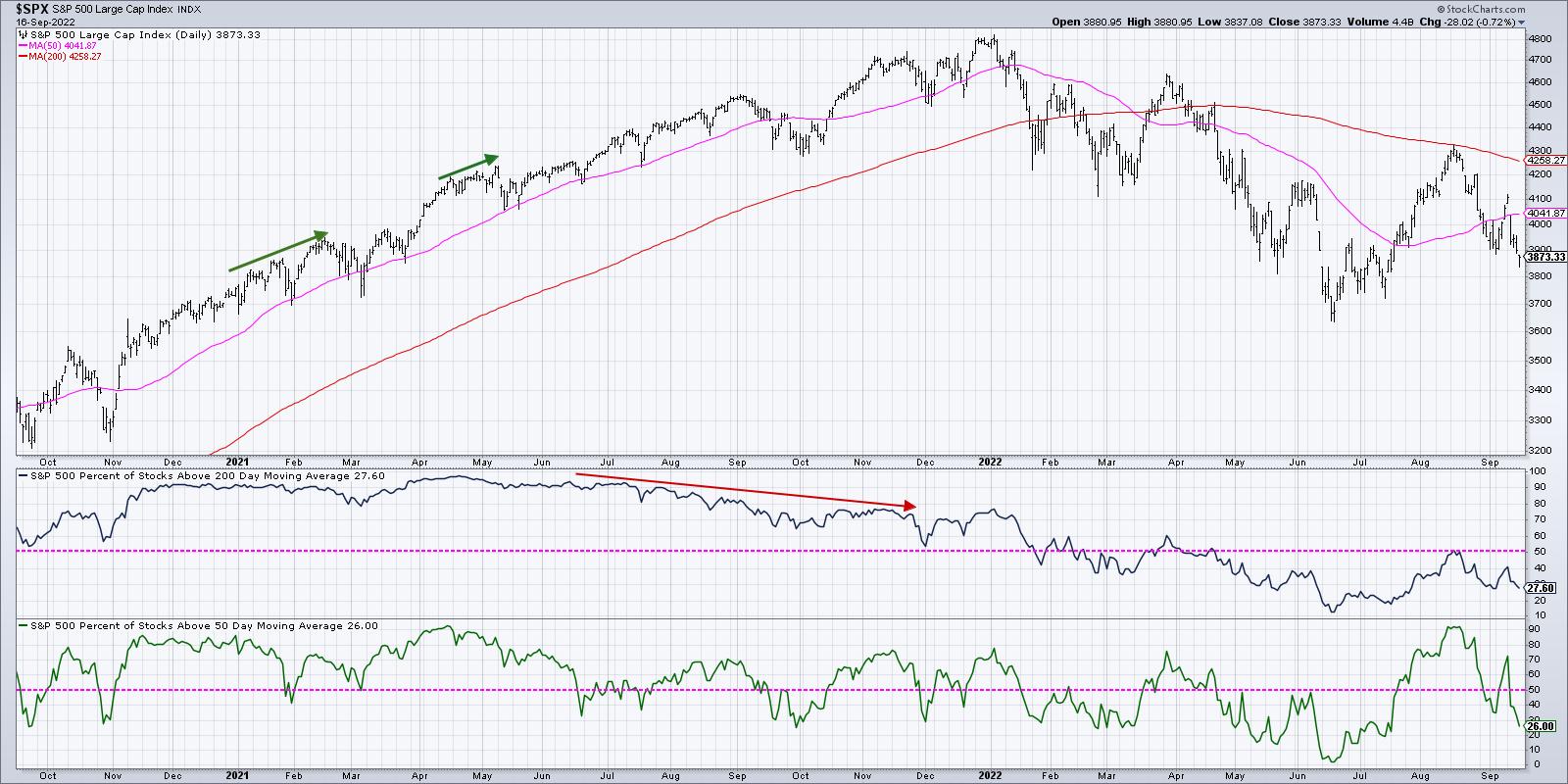

Exceptionally Bearish Breadth

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I have very fond memories of time spent in the Fidelity Chart Room, from discussing the merits of contrary opinion with teams of financial advisors to teaching student investment clubs about the value of technical analysis. But one of my favorite "behind the scenes" moments came in 2009....

READ MORE

MEMBERS ONLY

INTERMARKET VIEW REMAINS BEARISH -- YIELDS SURGE WITH DOLLAR AS COMMODITIES FALL -- STOCKS PRESSURE JUNE LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELDS SOAR... An intermarket view across the various financial markets continues to present an overall bearish picture. And it starts with this year's surge in interest rates. Chart 1 shows the yield on 2-Year and 10-Year Treasury yields surging to the highest levels in more than a...

READ MORE

MEMBERS ONLY

Market Responds Bearish to the FOMC

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG shares that the FOMC was wild as expected, and, with another 75 BPS rate raise, the market responded in a bearish way. For now, the downside has been the correct direction, but there are indications that fuel for a...

READ MORE

MEMBERS ONLY

How Interest Rates are Squeezing Home Buyers

by Carl Swenlin,

President and Founder, DecisionPoint.com

I knew well ahead of the 2006-2007 real estate crash that problems were coming, but I didn't really understand the cause. I thought that the price of houses was going to deter buyers, but buyers didn't care about the price of a home, they only cared...

READ MORE

MEMBERS ONLY

Correlations Rise as Bear Extends its Grip

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite the bear market environment, a handful of stock-based ETFs were showing leadership with bullish Trend Composite signals. Representatives from dirty energy (XLE), clean energy (TAN) and utilities (XLU) were covered over the last few weeks and this article is a follow-up. These ETFs remain with bullish Trend Composite signals,...

READ MORE

MEMBERS ONLY

GNG TV: Relative Strength in Renewables

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler assess the acceleration of the "NoGo" for US equities ($SPY) in the wake of the latest rate hike ($TNX). Go trends for US Dollar and Government Yields are uninterrupted, but the energy space is...

READ MORE

MEMBERS ONLY

Rule-Based Discretionary Trading

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses specific rules or guidelines that can be incorporated into a trading , which can help to add discipline to your trading. By adding these rules, your trading will become more consistent. He also explains how to add...

READ MORE

MEMBERS ONLY

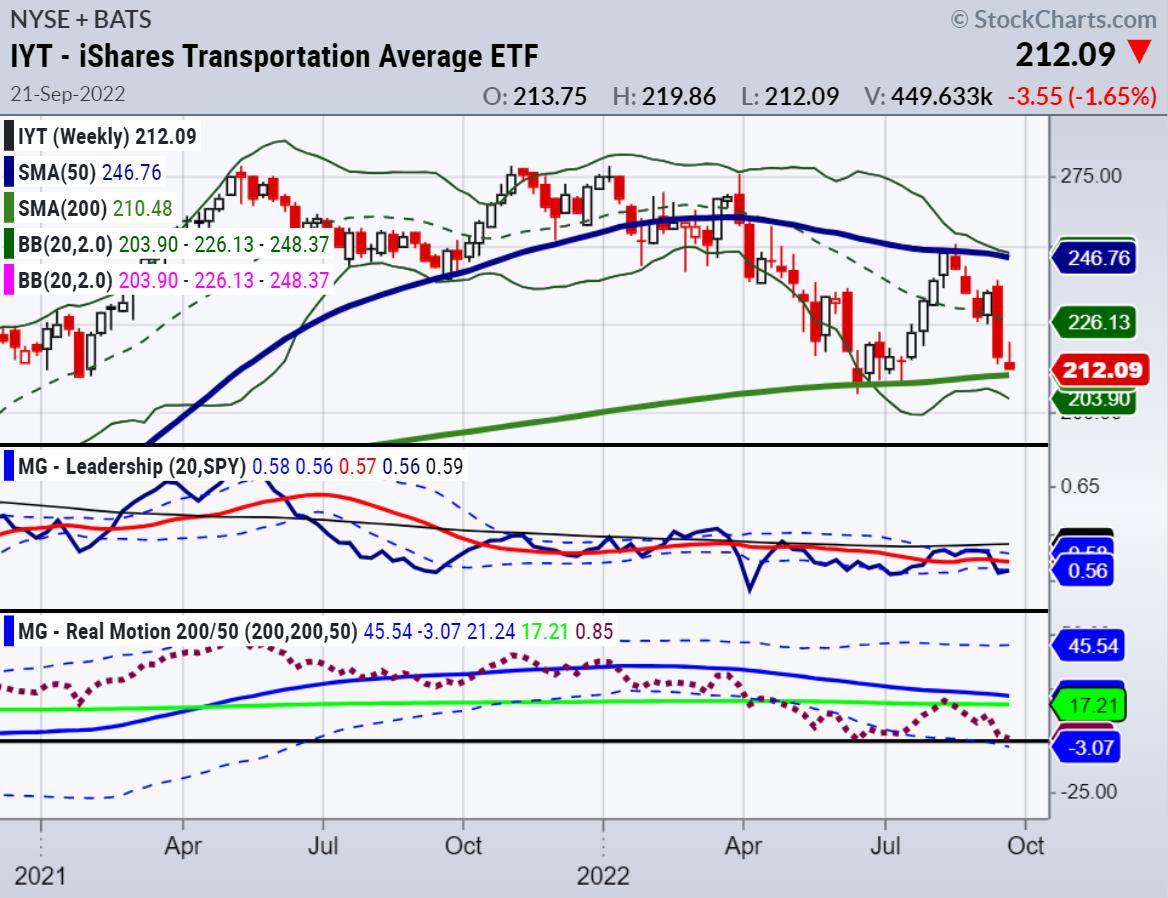

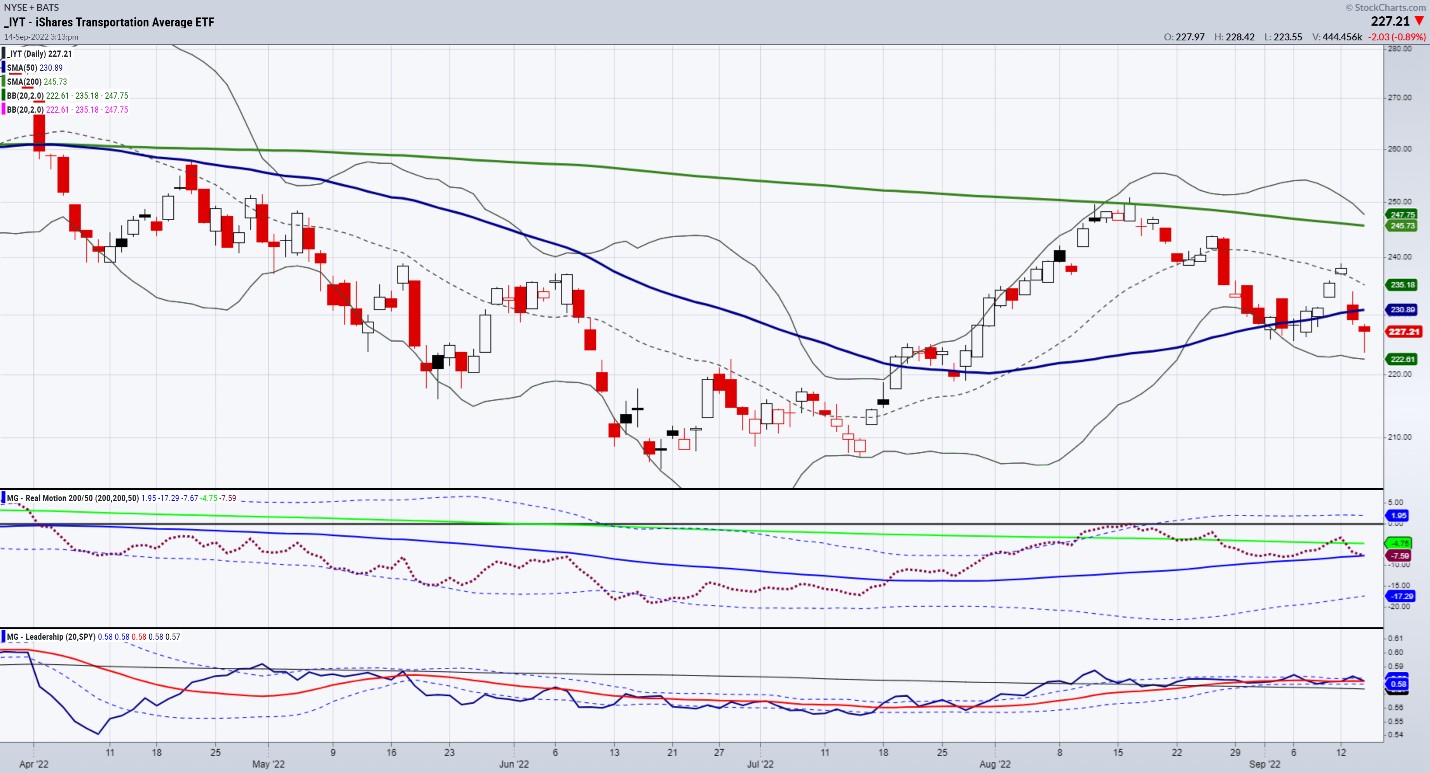

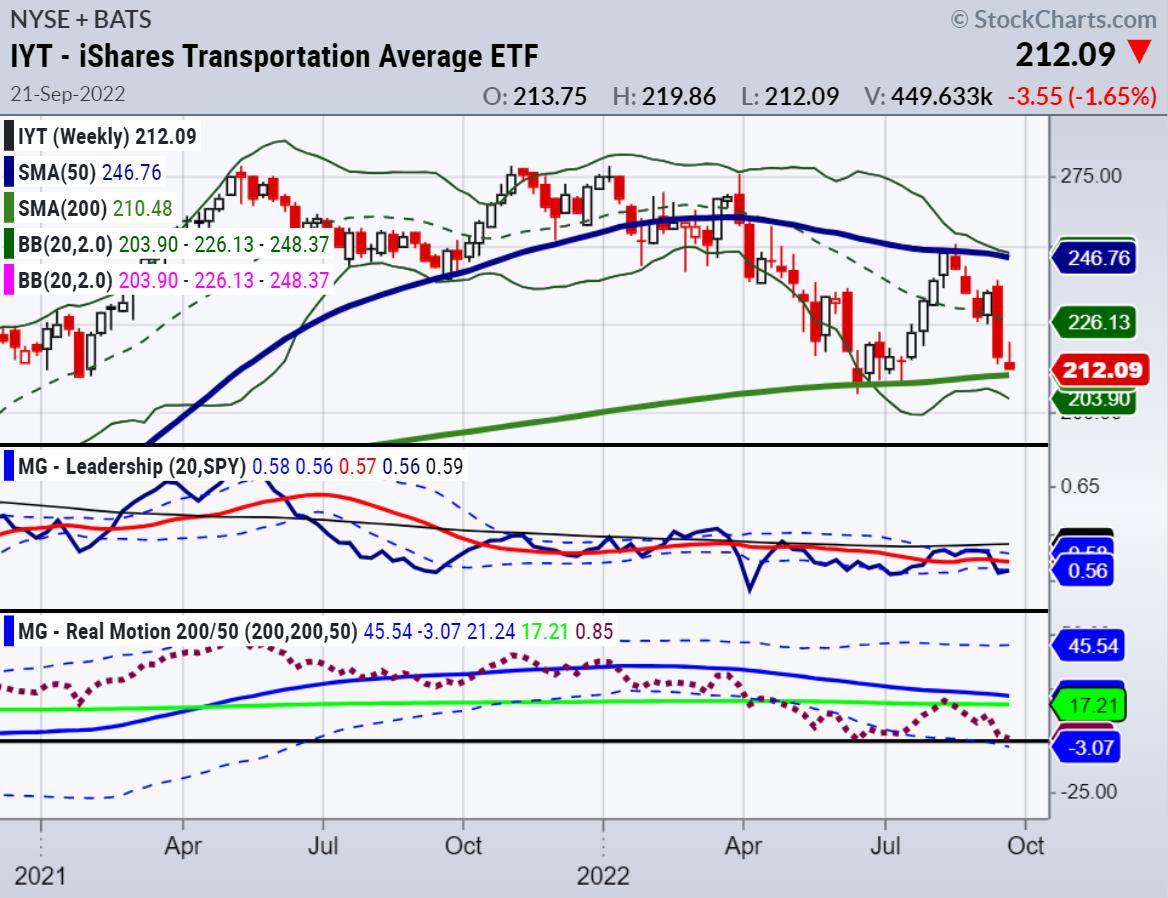

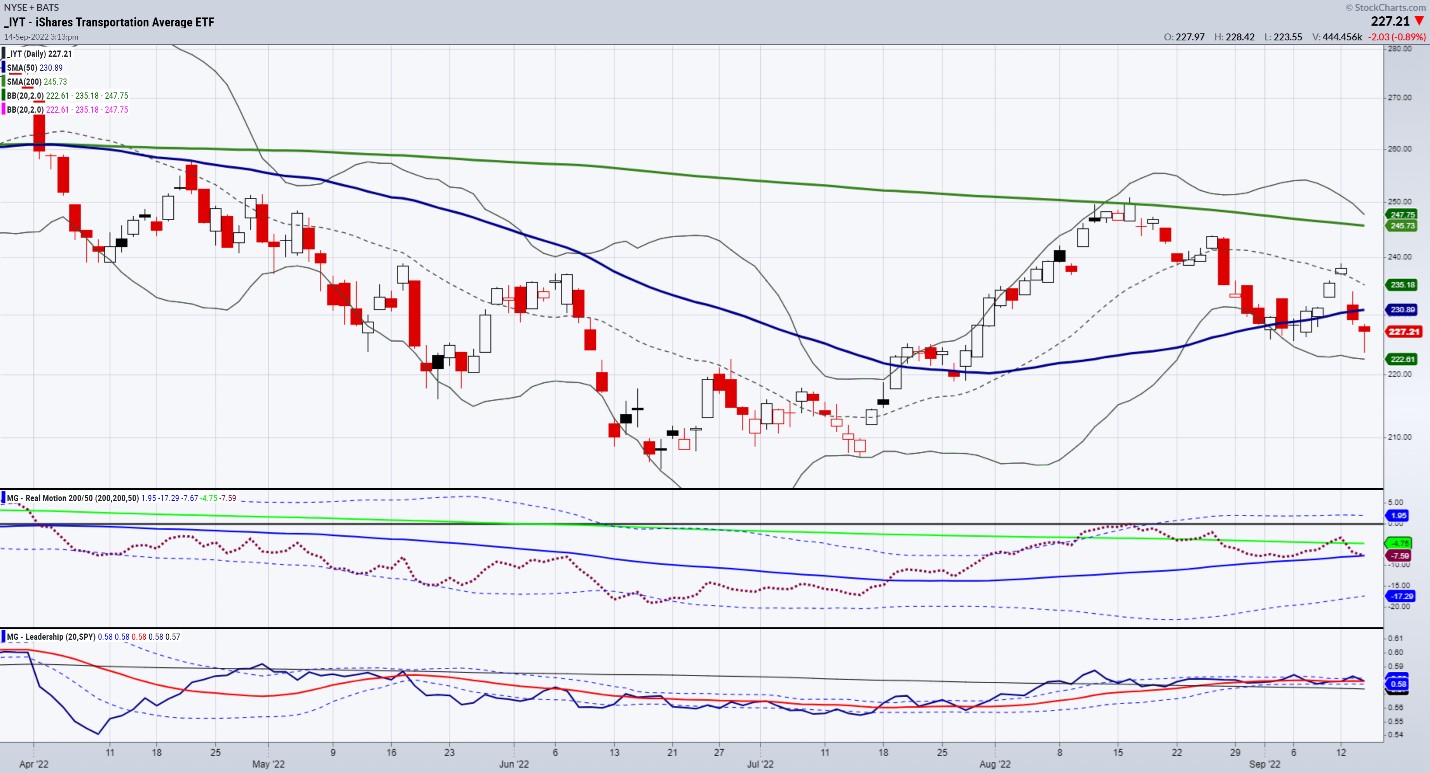

Mish's Daily: What is the Impact of the Fed Hike?

The FedEx news has caused many analysts to worry about the transportation sector and the potential ripple effects this could have on the rest of the market. As we have written before, transportation sector is seen as a barometer of economic activity. The Fed hikes and FedEx lowered profit revisions...

READ MORE

MEMBERS ONLY

Five Decades Of Personal Stock Market Passages, Tools, Lessons And Stories: Part 2

by Gatis Roze,

Author, "Tensile Trading"

To start, I want to make two points. Investing successfully requires that you remain engaged and motivated. Just because you choose to ignore the markets, the markets won't reciprocate and ignore you. Zig Ziglar said, "People often say that motivation doesn't last. Well, neither does...

READ MORE

MEMBERS ONLY

Your Brain on Trades, Part 3

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave continues his "Next 100 Trades" series with a new mystery chart for the next trade. He reviews the existing trades and shows you the results. So far, it's not so good! Is he concerned? What'...

READ MORE

MEMBERS ONLY

Mish's Daily: Is Silver About to Outshine Gold?

With the Fed about to announce its next interest rate change, it's a good time to check out the condition of gold (GLD). After all, gold is a tried-and-true safe haven asset, and has historically been used as a hedge during times of uncertainty to protect against inflation...

READ MORE

MEMBERS ONLY

Gold Discounts are Historically High

by Erin Swenlin,

Vice President, DecisionPoint.com

As we looked at yesterday's Discount for the Sprott Physical Gold Trust (PHYS) we realized it was one of the lowest readings on record since data started being collected in 2010.

Closed-end funds like PHYS can sell at a premium or discount to their net asset value (NAV)...

READ MORE

MEMBERS ONLY

Sector Spotlight: This is Still a Bear Market, Right?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, at asset class level, I highlight the strength of the USD, which also plays a role in the weakness of BTC. Stocks and bonds did not move much last week, while commodities seem to be turning. Sector...

READ MORE

MEMBERS ONLY

Mish's Daily: High Interest Rates, Your Portfolio and Next Steps

On Wednesday, the Federal Reserve is anticipated to raise interest rates by 75 basis points. How will the rate increase affect your portfolio? Depending on your investment holdings, the interest rate increase could have a significant impact.

Higher interest rates could also lead to a decrease in the stock market....

READ MORE

MEMBERS ONLY

DP Trading Room: Home Affordability Down 50%!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl takes an in-depth look at the damaging mortgage rates and their effect on home buyers. He gives his unique perspective on overall market conditions and discusses the "Golden Cross" Index and "Silver Cross" Index...

READ MORE

MEMBERS ONLY

This Chart Says the June Lows Will Not Hold

by Martin Pring,

President, Pring Research

The relationship between the stock market and money market interest rates is as old as the hills. The "hills," in this case, go back to 1900 and before.

The concept rests on the idea that, at the beginning of the cycle, when the economy is falling like a...

READ MORE

MEMBERS ONLY

Weekend Daily: Thinking Ahead for Trading Next Week

The market took another turn for the worse this past week, with four weeks in a row in the red and the DOW futures dropping, testing significant support from the summer. With the upcoming Fed meeting and higher rates coming to control inflation, we are watching a few themes.

Here...

READ MORE

MEMBERS ONLY

Do Earnings Warnings Really Matter?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Of course they do. One of the key metrics in any business valuation is earnings/earnings growth. When a company cuts its forecast, Wall Street must decide whether it's a "one-off" type of earnings miss or if it's more indicative of a longer-term trend....

READ MORE

MEMBERS ONLY

Week Ahead: Fed Fears Keep Market on Tenterhooks; Staying Selective Holds the Key

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While continuing to stay resilient as they outperformed the global markets, the Indian equities delayed their breakout, continuing to resist the important pattern resistance on the charts. While a strong attempt to break above the crucial resistance zones was underway, the inflation figures again played a spoilsport; US markets reacted...

READ MORE

MEMBERS ONLY

Coming Up Aces in Clean Energy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The broad market environment remains bearish, but one group stood out in early August and continues to stand out. The Solar Energy ETF (TAN) was featured on August 1st as the Trend Composite turned bullish and clean energy was featured as an emerging theme on August 5th. Clean energy ETFs...

READ MORE

MEMBERS ONLY

It's Not a Stock Market, It's a Market of Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I was taught early on that "a rising tide lifts all boats" and that the real game as an equity investor was to get the market call right. Forget about the individual stocks and instead focus your attention on the macro call.

Because most stocks just follow the...

READ MORE

MEMBERS ONLY

Next Week's Sector and Industry Group to Watch

by Erin Swenlin,

Vice President, DecisionPoint.com

Every Friday during the DecisionPoint Diamond Mine trading room for DP Diamonds subscribers only, we do an in-depth look at all of the sectors and choose a "Sector to Watch" that could see positive results the following week. We then dive into that sector and find an "...

READ MORE

MEMBERS ONLY

MEM TV: Next Area of Support for the Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

On this week's edition of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what to be on the lookout for after the recent break below near-term support. She also highlights areas that are holding up against the selloff and why they may remain strong.

This video was...

READ MORE

MEMBERS ONLY

Two Things I Don't Expect to See in a Bear Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I seriously hope that I was able to make clear in last Tuesday's Sector Spotlight that the market ($SPX) is still on shaky grounds and certainly not (back) in an uptrend. Sure, I mentioned the short-term improvement, which was undeniably there. But also that the upside was littered...

READ MORE

MEMBERS ONLY

Markets Continue to Break Support

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG explains that the markets have remained weak since the CPI report, despite the Put/Call ratio being high. It looks like traders are correct with their positioning. Some of the news is coming from ADBE earnings, then FDX earnings...

READ MORE

MEMBERS ONLY

TEST OF SUMMER LOW LOOKS LIKELY -- LONG-TERM STOCK INDICATORS REMAIN BEARISH

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES NEAR TEST OF SUMMR LOW... Hotter than expected inflation numbers this week pushed interest rates sharply higher and stock prices sharply lower. The daily bars in Chart 1 show the S&P 500 falling to the lowest level in two months and nearing a likely test of...

READ MORE

MEMBERS ONLY

GNG TV: Inflation Interpretation Weighs Heavily on Stocks

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler are reminded of a core tenet of technical analysis: prediction, presumption, forecasting and estimation are fertile ground for behavioral bias and emotional baggage. The scientific money manager simply reacts responsibly to market moves looking at the...

READ MORE

MEMBERS ONLY

Take Advantage of Volatility

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how the ATR(20) can be used to improve your odds when attempting swing trades. By following the trend of the Volatility, you can take advantage of counter moves to increase long or short trades. He...

READ MORE

MEMBERS ONLY

Mish's Daily: Market Stabilizes While Transports Hold Their Breath

After Tuesday's stock market rout, the outperforming sector transportation (IYT) struggled on Wednesday. Although our other indicator we have been writing about, junk bonds (JNK), led the rally in the indices, IYT did not follow.

Why?

A Western-style showdown between 60,000 rail workers, their unions and some...

READ MORE

MEMBERS ONLY

Your Brain on Trades, Part 2

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave continues with his "Next 100 Trade" series by examining recent mystery charts, with lessons on how to avoid putting capital into harm's way. For the "Mind The Trade" segment, he discusses why it'...

READ MORE

MEMBERS ONLY

Do You Believe In Equal-Weighted ETFs? Really?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of my favorite intermarket relationships exist between consumer discretionary (XLY) and consumer staples (XLP). It's a very quick way to see whether the stock market favors offense or defense. If the XLY:XLP ratio is rising, it's a signal to me that Wall Street believes...

READ MORE