MEMBERS ONLY

We're Heading For New All-Time Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I turned bearish at the end of 2021, I made it quite clear that I expected this stock market downturn to be fairly brief - at least in historical bearish terms. At our MarketVision 2022 event on Saturday, January 8th, I suggested that the S&P 500 would...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Opens Up More Room on the Upside; Sustaining Above This Level Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we mentioned that the markets have formed a strong base for themselves; the most logical move that the markets can make is to move towards their 50-Week MA, which was then placed at 17073. The beginning of the previous week was a bit jittery, as...

READ MORE

MEMBERS ONLY

July Ends With a Bang as Rotation into New Areas Takes Shape

by Mary Ellen McGonagle,

President, MEM Investment Research

The S&P 500 recorded its strongest monthly gain since November 2020, rallying 9.1% during a volatile period that ended with a bang. Growth stocks outperformed, with Consumer Discretionary (XLY) and Technology (XLK) stocks leading the way. It was not a particularly easy period to navigate, however, as...

READ MORE

MEMBERS ONLY

Weekend Daily: Big Tech Stock Earnings and Market Implications

The stock market rally continued to show strength into Friday, moving decisively higher on the week.

Big tech and many other sectors shrugged off a post-Fed pullback and more earlier in the week; bad earnings and poor guidance from Wal-Mart, Meta, and Qualcomm, to mention a few. With Amazon, Apple,...

READ MORE

MEMBERS ONLY

MEM TV: Base Breakouts and New Highs!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this special presentation courtesy of StockCharts TV'sThe MEM Edge, Mary Ellen explains why the markets are poised to trade higher and how you can participate. She also shares the rotation into newer areas that have higher upside from here.

This video was originally broadcast on July 29,...

READ MORE

MEMBERS ONLY

Market Stayed Strong During Difficult Week

by TG Watkins,

Director of Stocks, Simpler Trading

The market had the kitchen sink thrown at it this week, but it's closing on a high. On this week's edition of Moxie Indicator Minutes, TG discusses how he believes this is a strong test, for now, and how we could see SPY eventually reach its...

READ MORE

MEMBERS ONLY

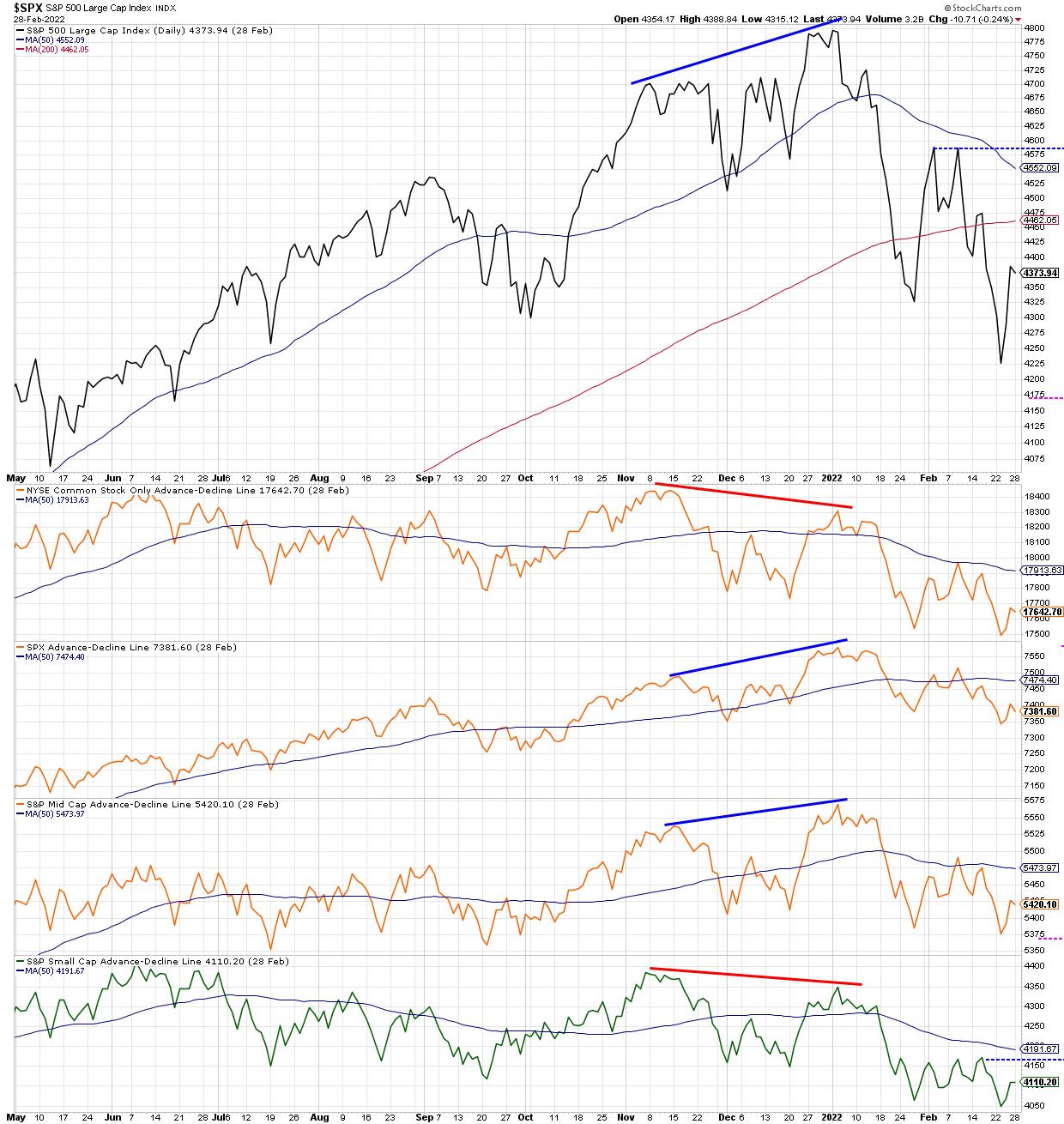

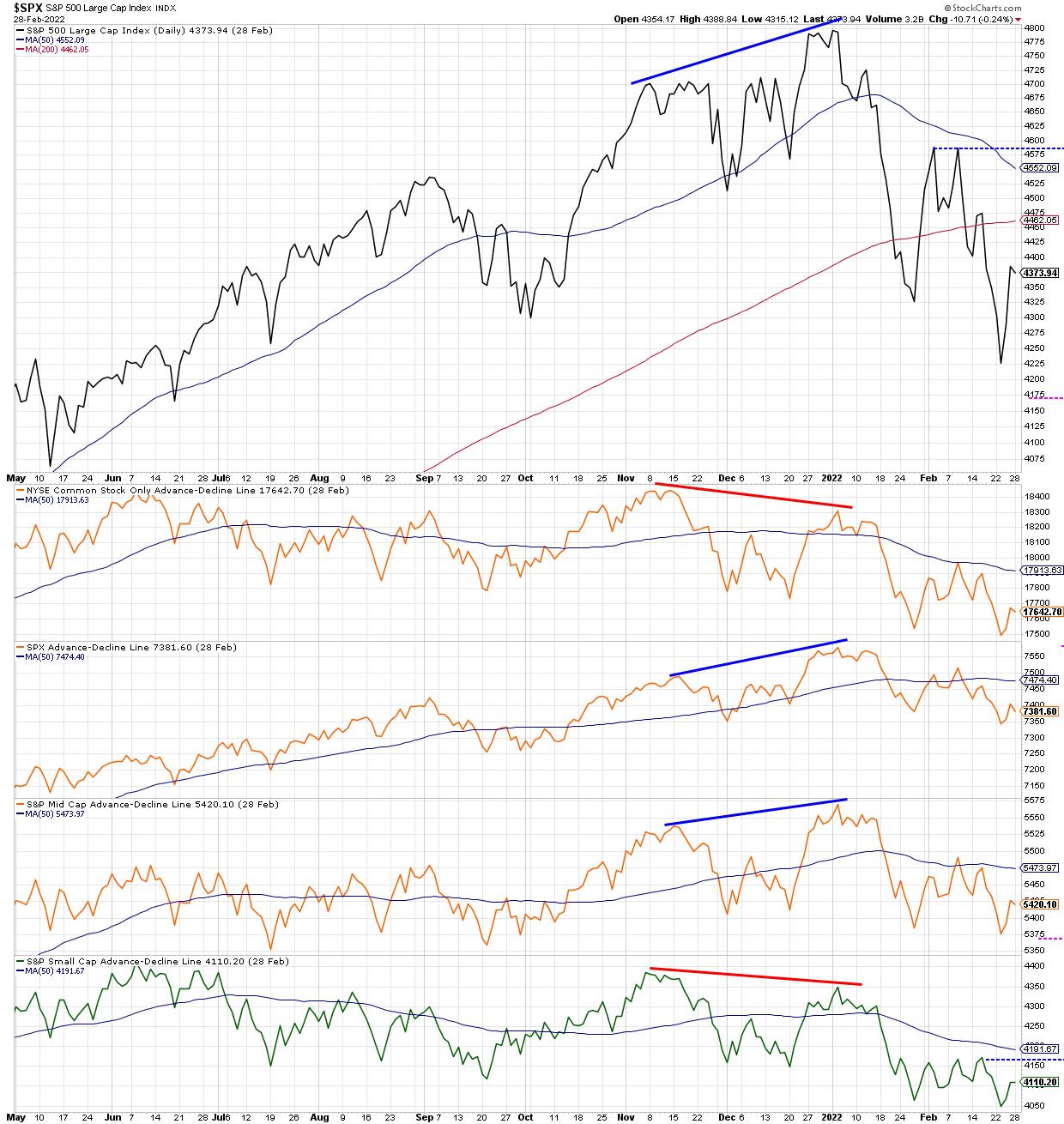

Why Breadth is Bullish... For Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

If you found this article through the Saturday, August 6 ChartWatchers newsletter, please click on this link to read this week's article instead.

If I had just one thing to use to understand the markets and predict what was coming next, it would be a daily chart of...

READ MORE

MEMBERS ONLY

STOCK INDEXES TEST MOVING AVERAGE RESISTANCE -- ENERGY AND UTILITIES ARE WEEKLY LEADERS -- DROP IN BOND YIELDS MAY BE HELPING STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAIN MORE GROUND... Despite a .75% rate hike by the Fed on Wednesday, and a second quarter of negative GDP growth on Thursday, stock indexes continued to gain ground. And they're in the process of testing some overhead resistance lines. Chart 1 shows the Dow Industrials...

READ MORE

MEMBERS ONLY

GNG TV: Retest and Resume for New "Go" Trends

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler see the rotation continue into the growth sectors and risky assets this week. With the start of a shift to risky assets being visualized by the GoNoGo Asset map and GoNoGo Sector Relmap, they look at...

READ MORE

MEMBERS ONLY

My 2 Favorite ADX Setups

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the 2 patterns that he hunts for using ADX. These setups develop in all time frames but he uses a few long-term examples to explain the overall condition and preferred pattern. He discusses the higher time...

READ MORE

MEMBERS ONLY

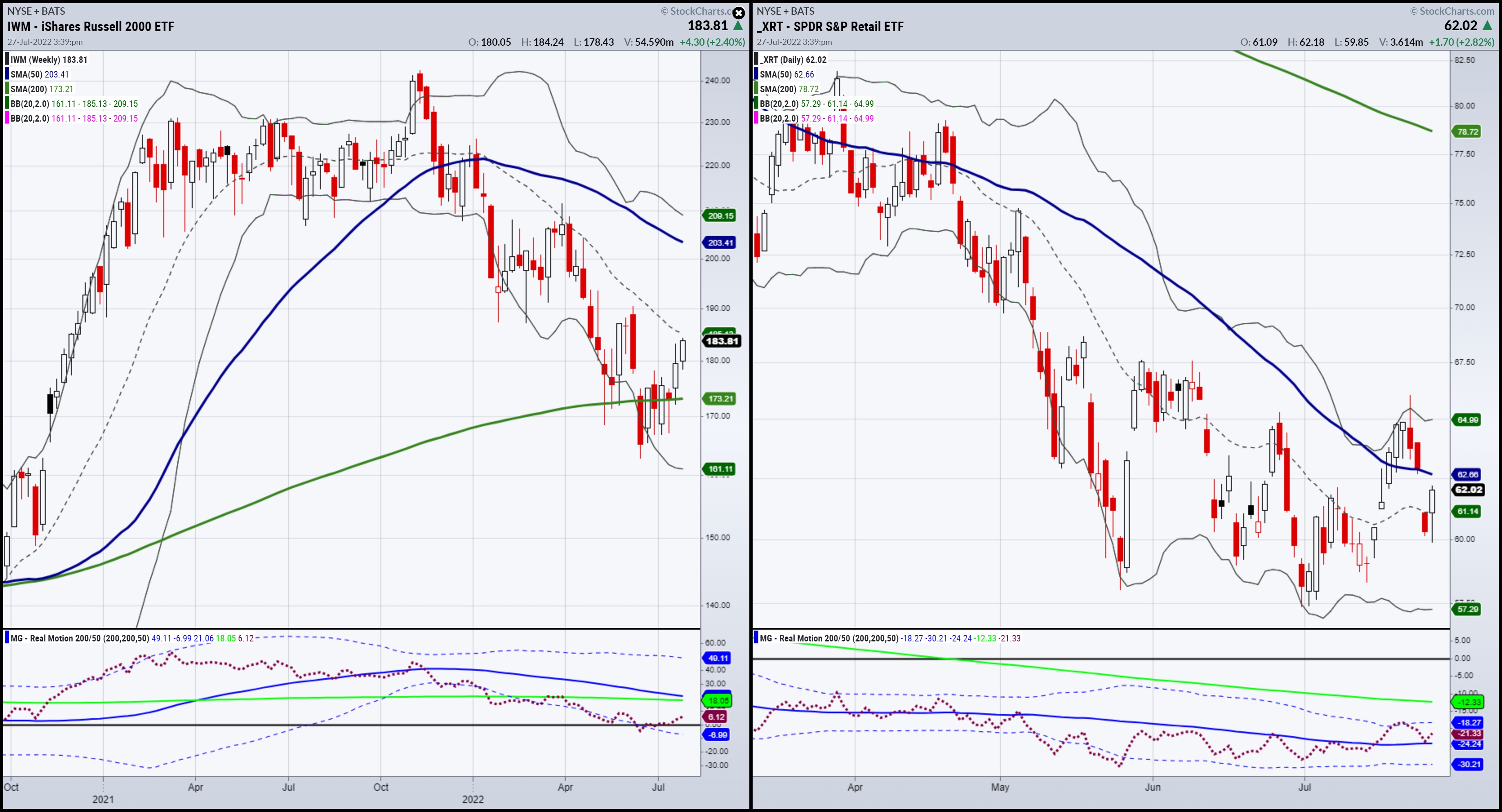

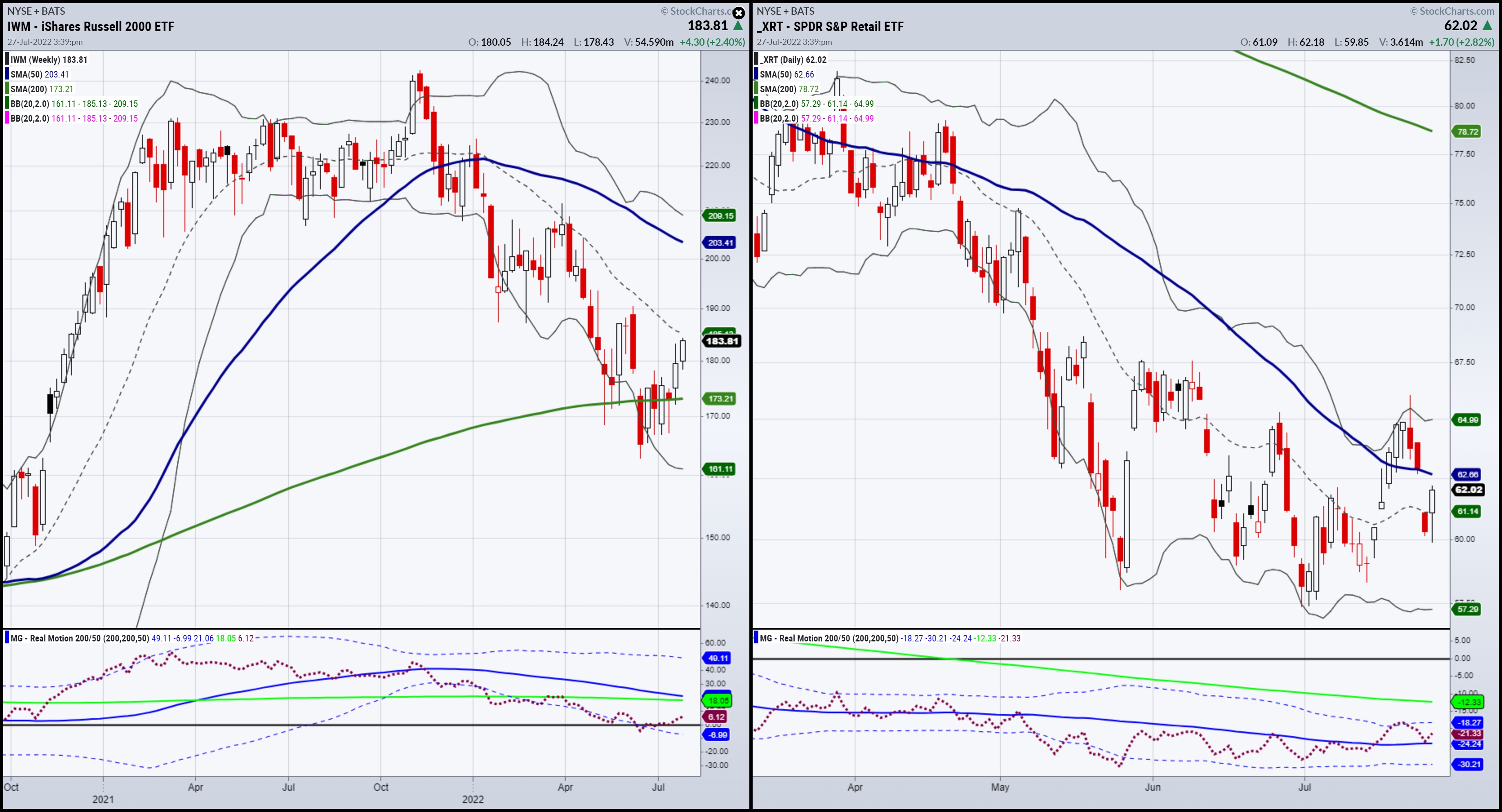

Mish's Daily: Granny Retail and Granddad Russell Dish Post-FOMC

Powell and crew raised the rates by .75 BPS in an attempt to continue the fight against inflation. He even said, "Another unusually large increase in rates could be appropriate, it depends on data." However, the market heard something different.

Sure, we rallied pre-FOMC and continued to rally...

READ MORE

MEMBERS ONLY

Technical Analysis Apologetics

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave introduces the concept of Technical Analysis Apologetics -- logical and valid reasoning for using technical analysis (and ONLY technical analysis). He begins building his case by showing how his Landry Light concept can keep you on the right side of...

READ MORE

MEMBERS ONLY

Are You a Short-Term Trader? Watch This!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

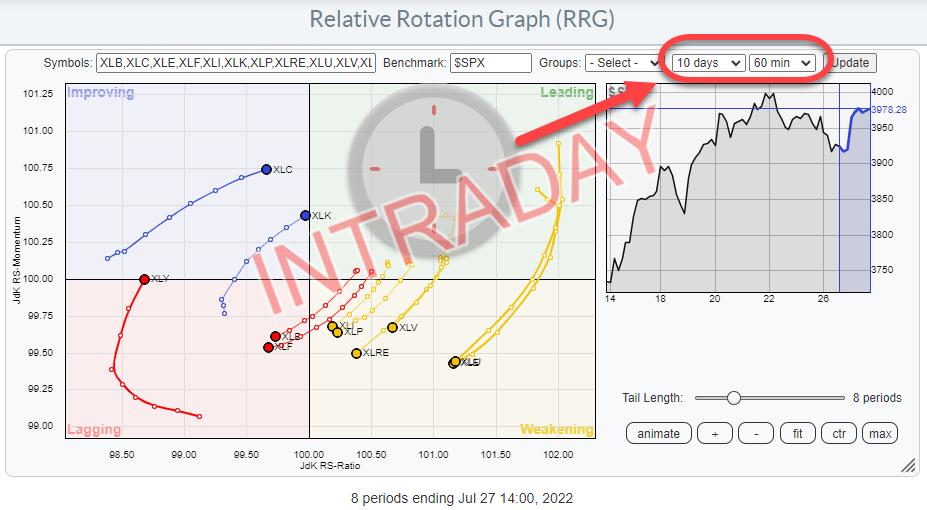

Relative Rotation Graphs (RRG) were introduced on StockCharts.com in July 2014. Since then, we have had the possibility to render the charts using weekly or daily data. Primarily, I think, because those were the time frames I was, and am, using most of the time for myself and in...

READ MORE

MEMBERS ONLY

The Enemy in the Mirror

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I first published this article in March, 2019 and believe the message then is the same as for today. As a retired money manager I want to share some thoughts on that profession and investors in general. Portfolio management is as much about managing emotions as it is about correlations,...

READ MORE

MEMBERS ONLY

The Truth About Recessions

by Martin Pring,

President, Pring Research

This week, we diverge from our normal chart talk to focus on the economy, as the word "recession" is now on virtually every one's lips, provoked by a lot of misinformation.

First, there seems to be a general understanding in the media that the definition of...

READ MORE

MEMBERS ONLY

Mish's Daily: S&P 500 Futures Fail 4,000 as Market Downtrend Looms

The Fed has already hiked rates three times this year and is expected to hike again on Wednesday, July 27th. But with the economy showing signs of significant slowdown, there are rumors that the Fed might not hike rates as much as anticipated.

The current downtrend, which began in April,...

READ MORE

MEMBERS ONLY

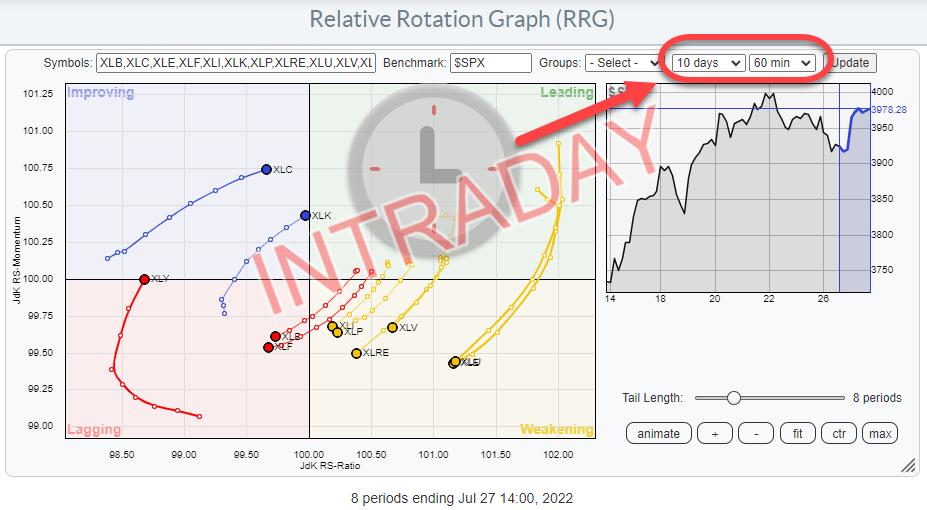

Sector Spotlight: Bouncing Bonds and Intraday RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This edition of StockCharts TV's Sector Spotlight marks an important milestone in the life of RRG on StockCharts.com. Following many user requests, the latest release of new functionalities and improvements (Bainbridge) of the website includes the support for intraday time frames on Relative Rotation Graphs. This addition...

READ MORE

MEMBERS ONLY

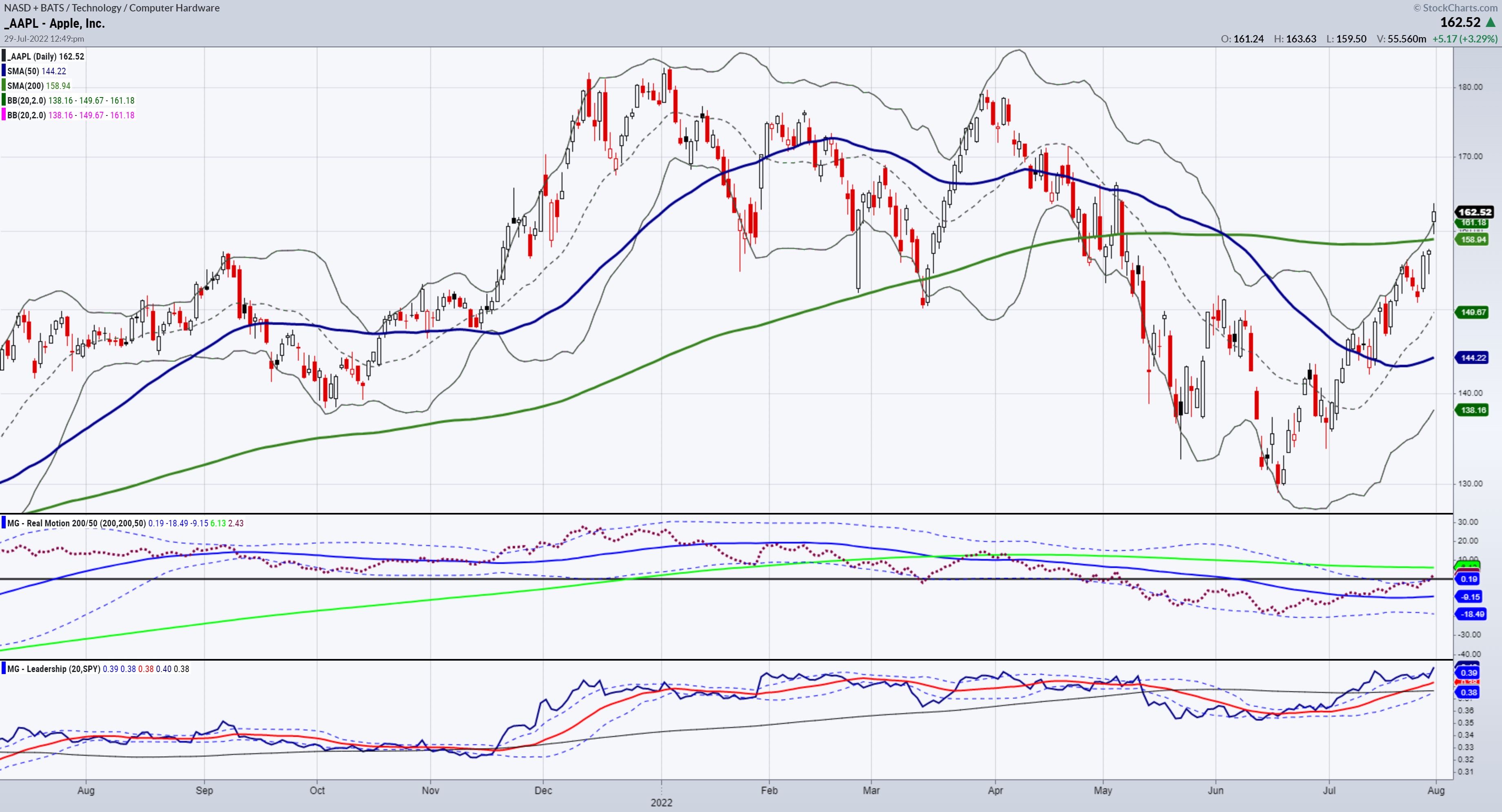

DP Trading Room: Energy Ready to Heat Up?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

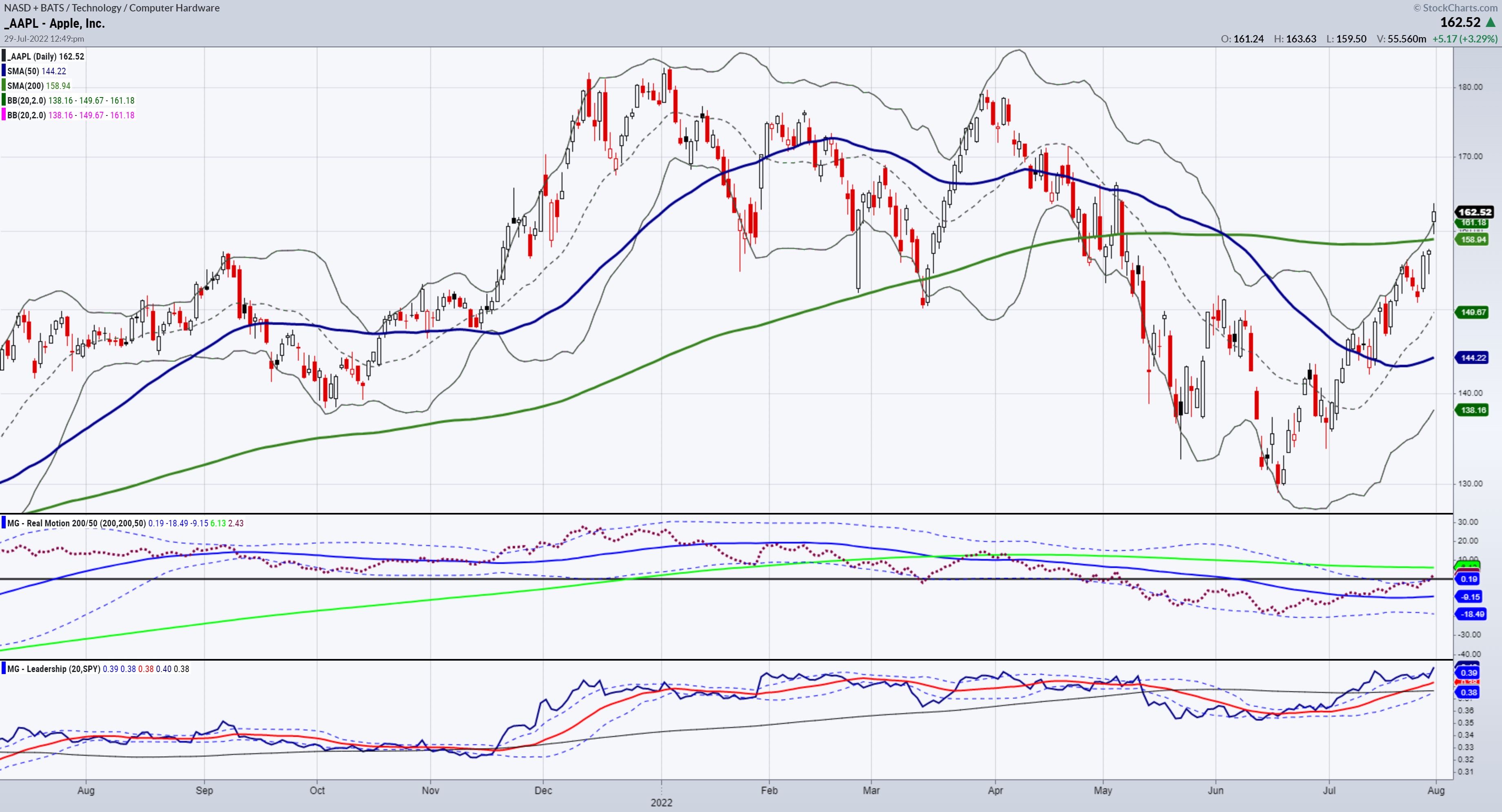

On this week's edition of The DecisionPoint Trading Room, Carl and Erin cover the indicators and live market action. Erin takes a deep dive into the Energy sector, among others that appear promising. Stocks reviewed include PayPal (PYPL), Carl's take on Amazon (AMZN) and Apple (AAPL)...

READ MORE

MEMBERS ONLY

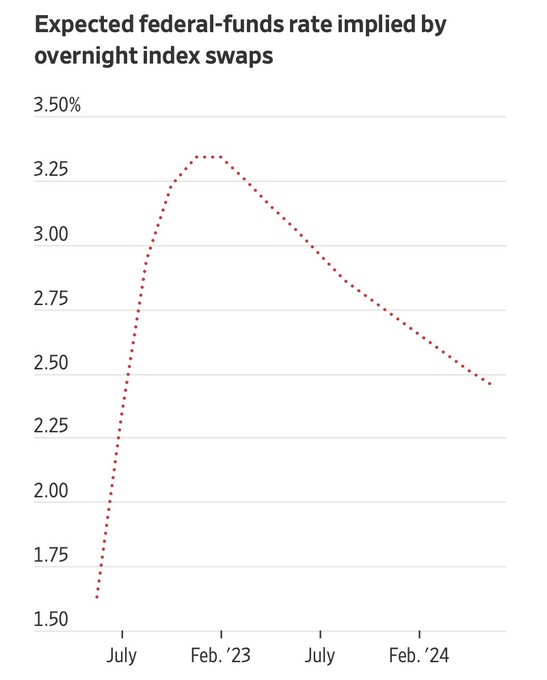

Expectations, Implications and Possible Impacts on the Market

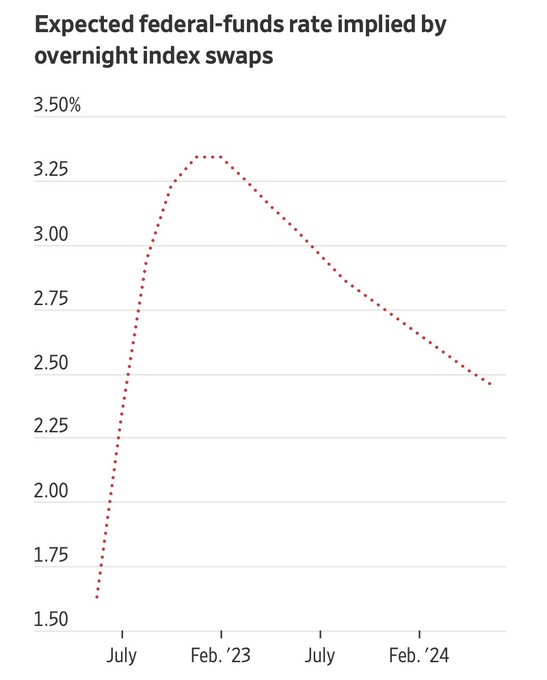

The chart posted is all about expectations.

Regardless of the talk on the new and stretched definition of recession, departing from the textbook definition, investors believe that the Fed Funds rate is close to peaking and will begin to decline into 2023 and 2024. Incidentally, I wrote a dailyon June...

READ MORE

MEMBERS ONLY

STOCKS SHOW MODEST WEEKLY GAINS -- BUT DOWNTREND STILL IN EFFECT -- PULLBACK IN BOND YIELDS MAY BE HELPING STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MODEST WEEKLY GAINS... Stock indexes gained some ground this week, but not enough to reverse major downtrends. And they remain below overhead resistance levels. The daily bars in Chart 1 show the Dow Industrials rising to the highest level in six weeks and clearing their 50-day moving average. While that...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Consolidation at Higher Levels; RRG Chart Shows This Sector Ending Relative Underperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had a strong week that was much on the expected lines. In the previous weekly note, it was categorically mentioned that the markets might resume their up move after a brief period of consolidation. Over the past five sessions, the markets continued to inch higher as they got...

READ MORE

MEMBERS ONLY

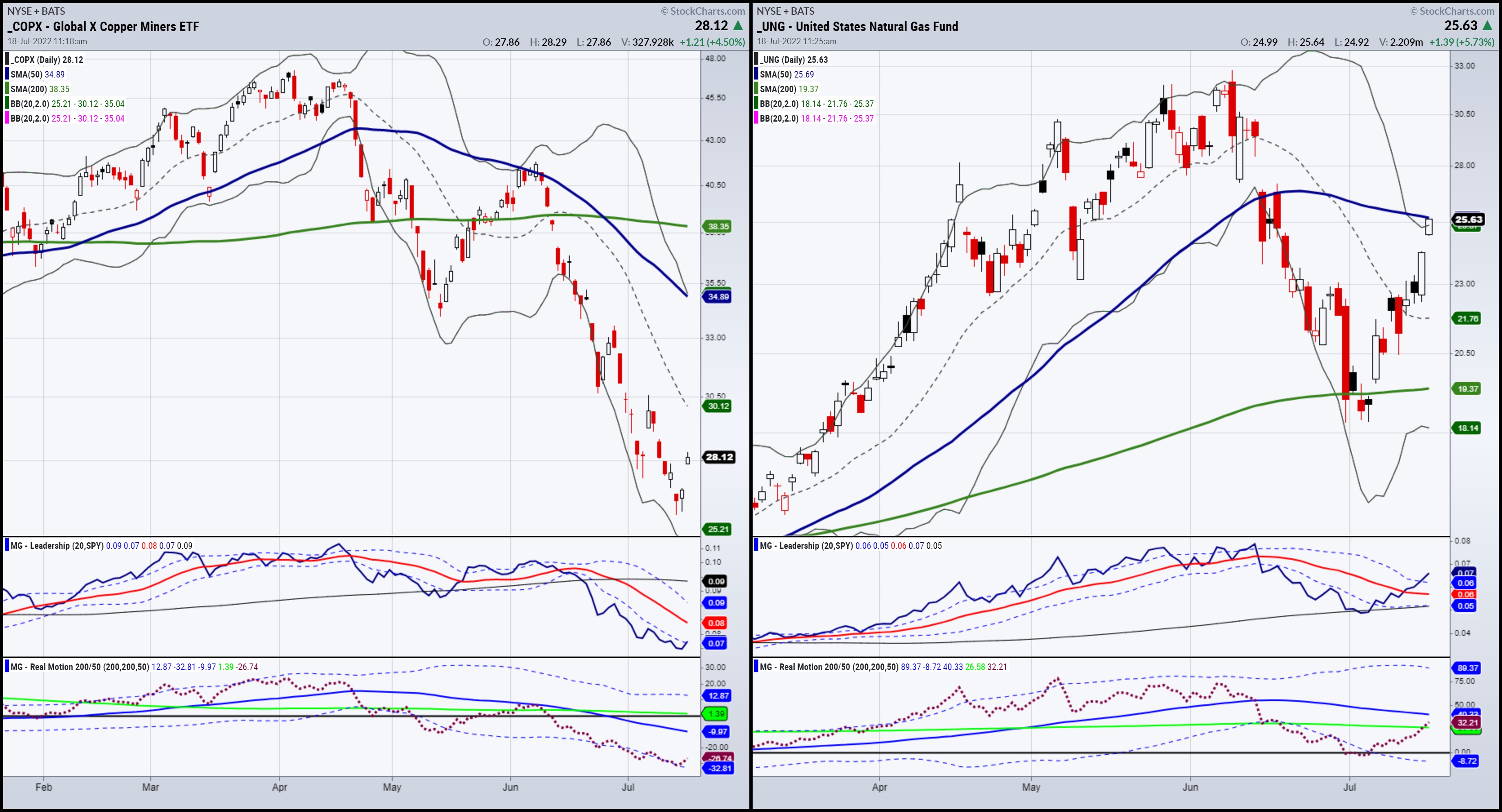

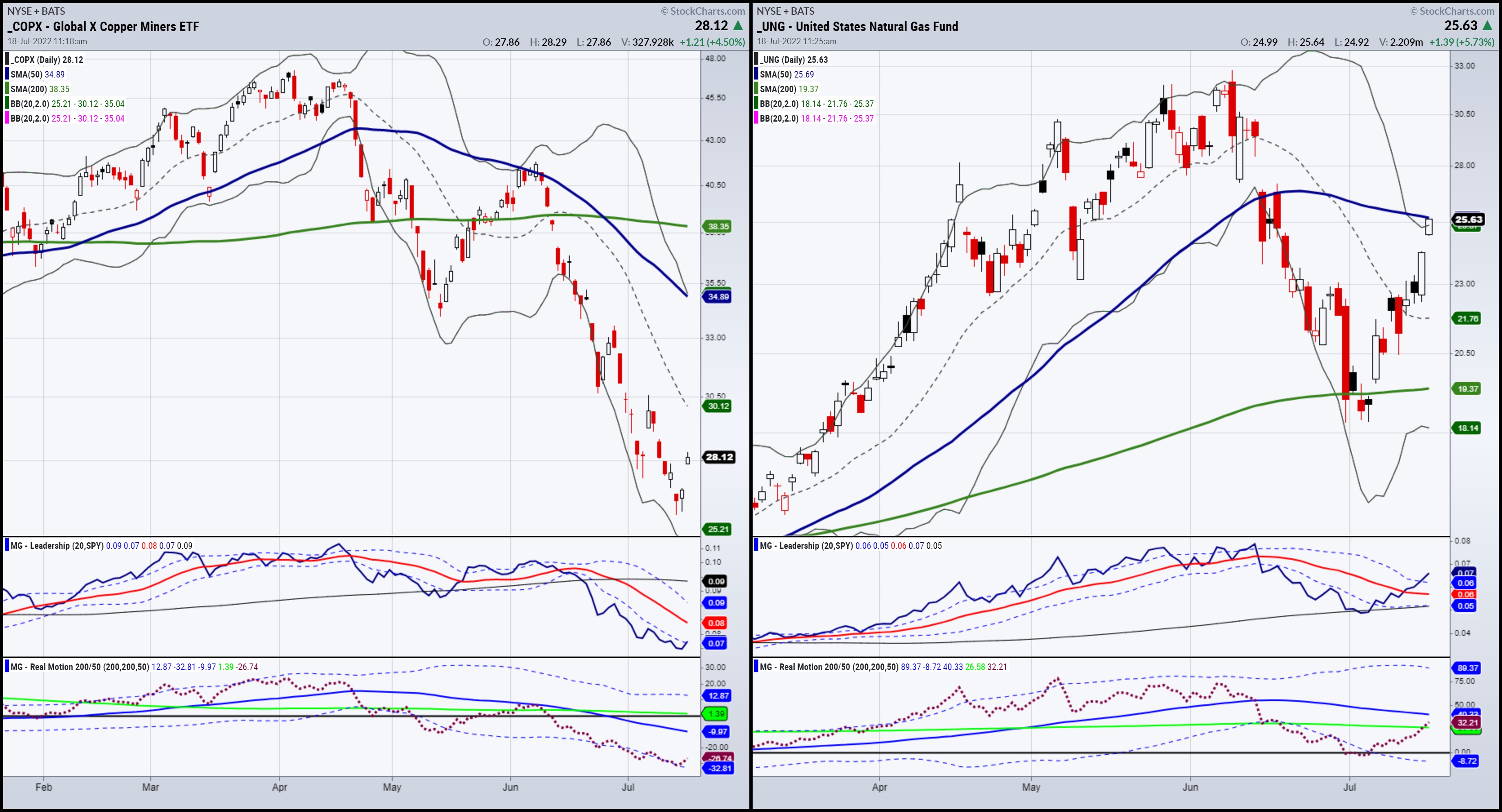

Weekend Daily: What Will Drive the Commodities Market?

Commodities across the board rallied after the Russian invasion of Ukraine and have since declined significantly.

Before the War though, commodities were already enjoying a rally due to results of the pandemic such as supply chain, low production, rising demand, high government debt and labor shortages.

The other significant factor...

READ MORE

MEMBERS ONLY

MEM TV: The Key Traits of a True Market Bottom

by Mary Ellen McGonagle,

President, MEM Investment Research

In this special presentation courtesy of StockCharts TV'sThe MEM Edge, Mary Ellen shares a rules based system to help you identify when a new bull cycle has come in to play. This proven system, "A Follow-Through Day", has identified every market bottom going back over 100...

READ MORE

MEMBERS ONLY

It's All About That 50-Day Moving Average

by David Keller,

President and Chief Strategist, Sierra Alpha Research

For the last couple months, when someone would bring up some bullish argument, my response would usually be something like, "Sure, but we're still below the 50-day moving average."

I've learned that this game is all about identifying a key level, price, signal, or...

READ MORE

MEMBERS ONLY

The First Part of the Rally

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG discusses how the market and many names have done well over the last week or two, but are now reaching areas of resistance. If things setup the way TG expects them to, then the drop would be buyable and...

READ MORE

MEMBERS ONLY

These 3 Earnings Massacres Last Night Had 1 Thing in Common

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trying to predict how Wall Street might react to an earnings report is no simple task. Sometimes, a stock has a big run into its earnings report, but then sells off after delivering solid results. It's the old adage, "buy on rumor, sell on news." In...

READ MORE

MEMBERS ONLY

GNG TV: Constructive Evidence for Risk-On Markets

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler explain some risk-on behavior this week as U.S. domestic equities paint a first aqua "Go" bar. An analysis of the GoNoGo Sector Relmap shows rotation into growth sectors like technology and discretionary and...

READ MORE

MEMBERS ONLY

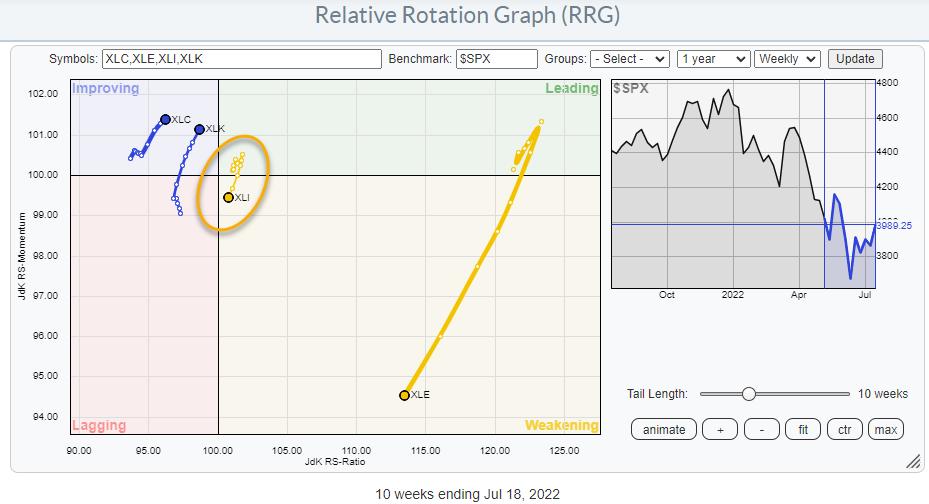

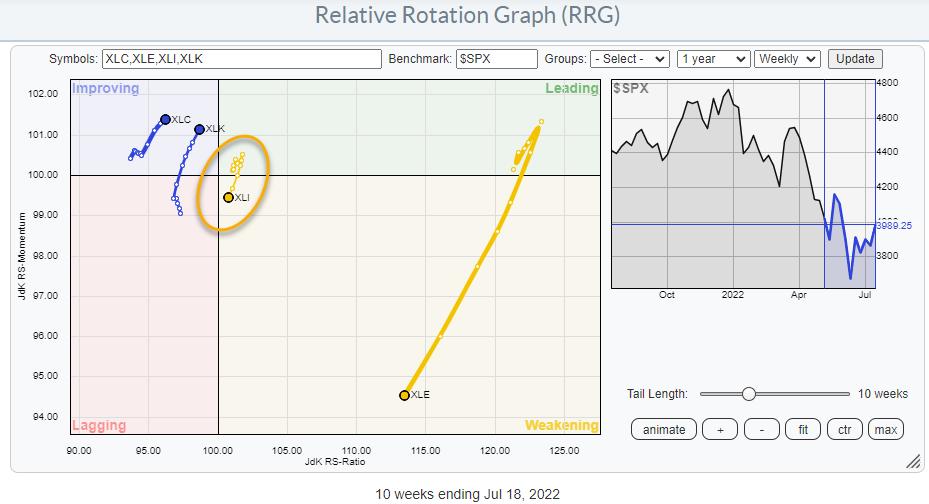

5 Interesting Industries In Industrials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this article, I'd like to dig a bit deeper into the Industrial sector.

Starting at the sector level, we find the tail for XLI inside the weakening quadrant and moving towards lagging. So definitely not one of the better sectors. As a matter of fact, it'...

READ MORE

MEMBERS ONLY

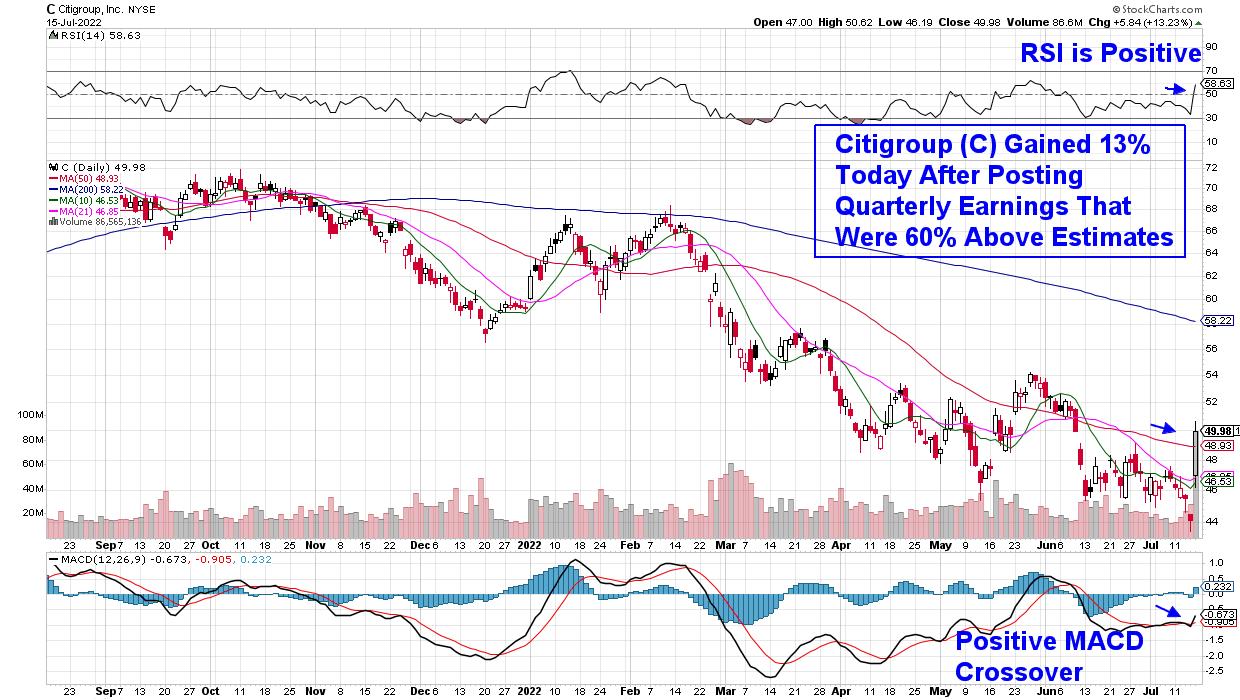

Why I Love MACD

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how he uses MACD in conjunction with ADX to improve confidence on your entry points. He explains how this indicator can be used in multiple timeframes and how it confirms price pattern reversals quicker than the...

READ MORE

MEMBERS ONLY

Mish's Daily: The Modern Family Will Not Let You Down

The disconnect between Fed tightening and the rebound in the tech sector leaves many investors wondering what will happen next.

The Fed is raising interest rates, which is frequently a precursor to a stock market decline, but growth stocks are rallying. The S&P 500 has regained some of...

READ MORE

MEMBERS ONLY

Housing Data Disappoints, But Housing ETFs Rally

by Martin Pring,

President, Pring Research

Due to its sensitivity to interest rates, housing has the greatest average lead time going into recessions than any other economic (as opposed to financial) indicator. For that reason alone, it is worth examining amid the constant talk of recession.

The HMI vs. Housing Starts

Earlier this week, two important...

READ MORE

MEMBERS ONLY

What You Must Know in a Bear Market

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave discusses the things that you must know during a bear market. He then goes on to discuss simple ways to determine market trends and signs to watch for when the market is turning. Finally, he continued his "crash course&...

READ MORE

MEMBERS ONLY

Mish's Daily: All About Netflix

As investors are looking at the earnings and guidance closely for the individual leading companies reporting, I thought I would highlight the leader in the multi-billion-dollar TV streaming industry.

First off, Netflix (NFLX) reported:

* Revenue: $7.97 billion, est: $8.04 billion

* EPS: $3.2, est: $2.91

The stock&...

READ MORE

MEMBERS ONLY

Sector Spotlight: Growth Takes Over (for Now)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I assess the current rotation in asset classes and sectors, highlighting the rotation for commodities, which are going through a setback but are likely to come back as the leading asset class. In equity sectors, I'm seeing an...

READ MORE

MEMBERS ONLY

The DP Trading Room: Bear Market Special!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the session with his market overview, spending extra time on Crude Oil. He answers quite a few viewer questions, including a discussion of his famous P/E chart, and elaborates on questions regarding Energy. He and Erin...

READ MORE

MEMBERS ONLY

Mish's Daily: Things Over Paper - Why Real Assets are Best

In today's economy, investing in assets that will hold their value to or near the rate of inflation is more important than ever. These types of investments offer protection from inflation and can provide a hedge against other economic downturns.

You don't have to be a...

READ MORE

MEMBERS ONLY

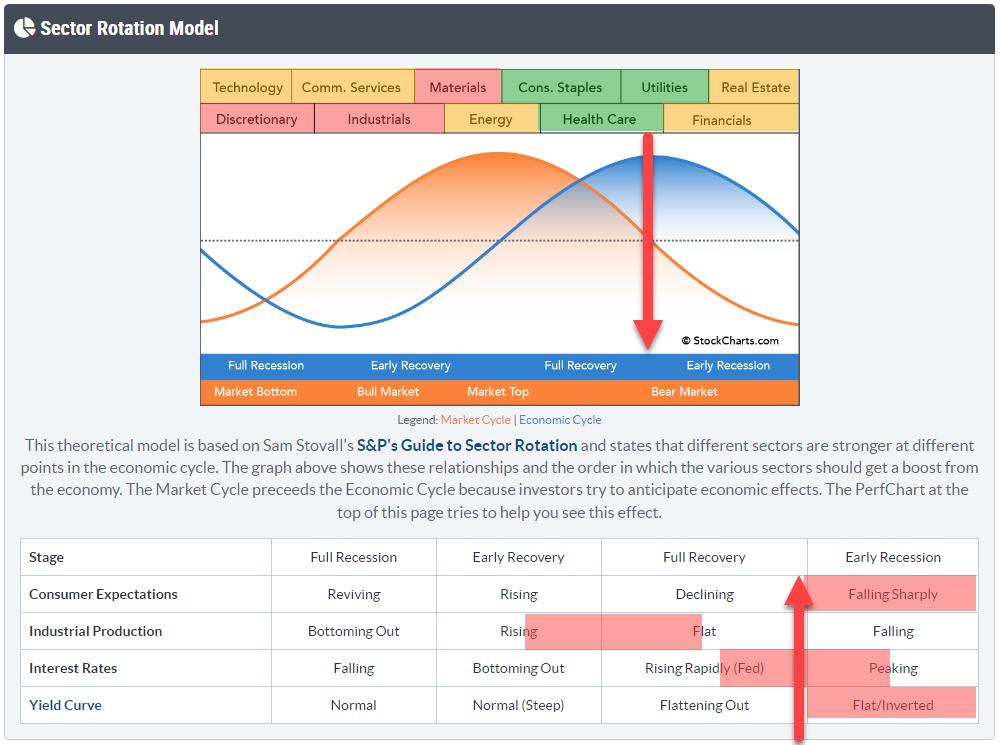

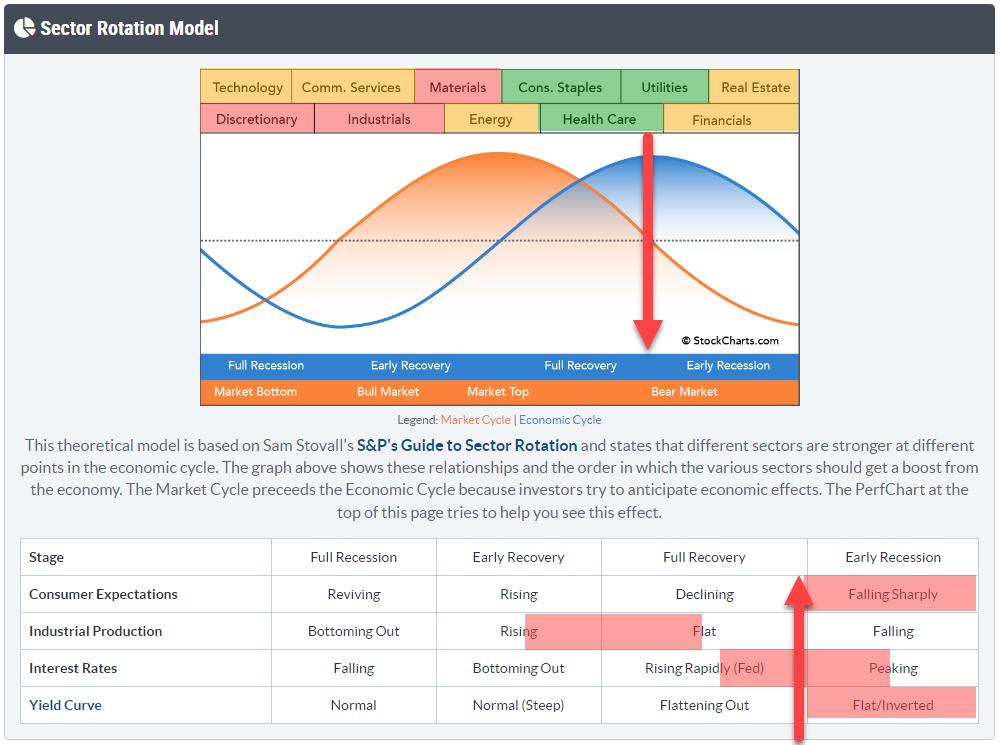

Sector Rotation (Model) vs Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Those of you who regularly watch Sector Spotlight on StockchartsTV will know that I have a few segments that come back on a regular basis.

Every last Tuesday of the month I discuss the seasonality for sectors going into the new month to see if the historical seasonal pattern aligns...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Regain Directional Momentum; RRG Chart Shows High Beta and Defensives Doing Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, it was categorically mentioned that the Indian equities were due to consolidate; any move that leads to a minor correction or consolidation should not surprise anyone. The past five sessions remained much on the expected lines, as the headline index saw some corrective moves, took...

READ MORE

MEMBERS ONLY

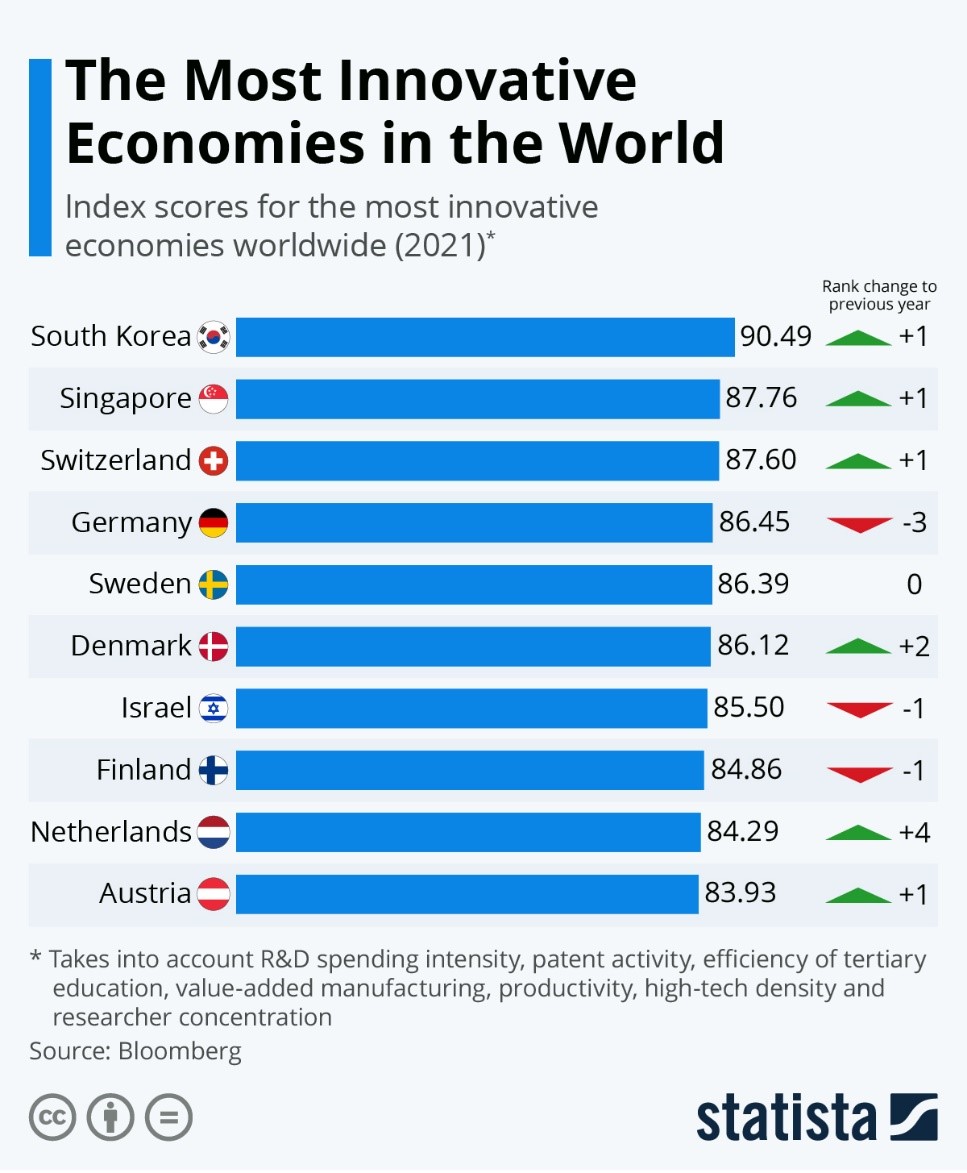

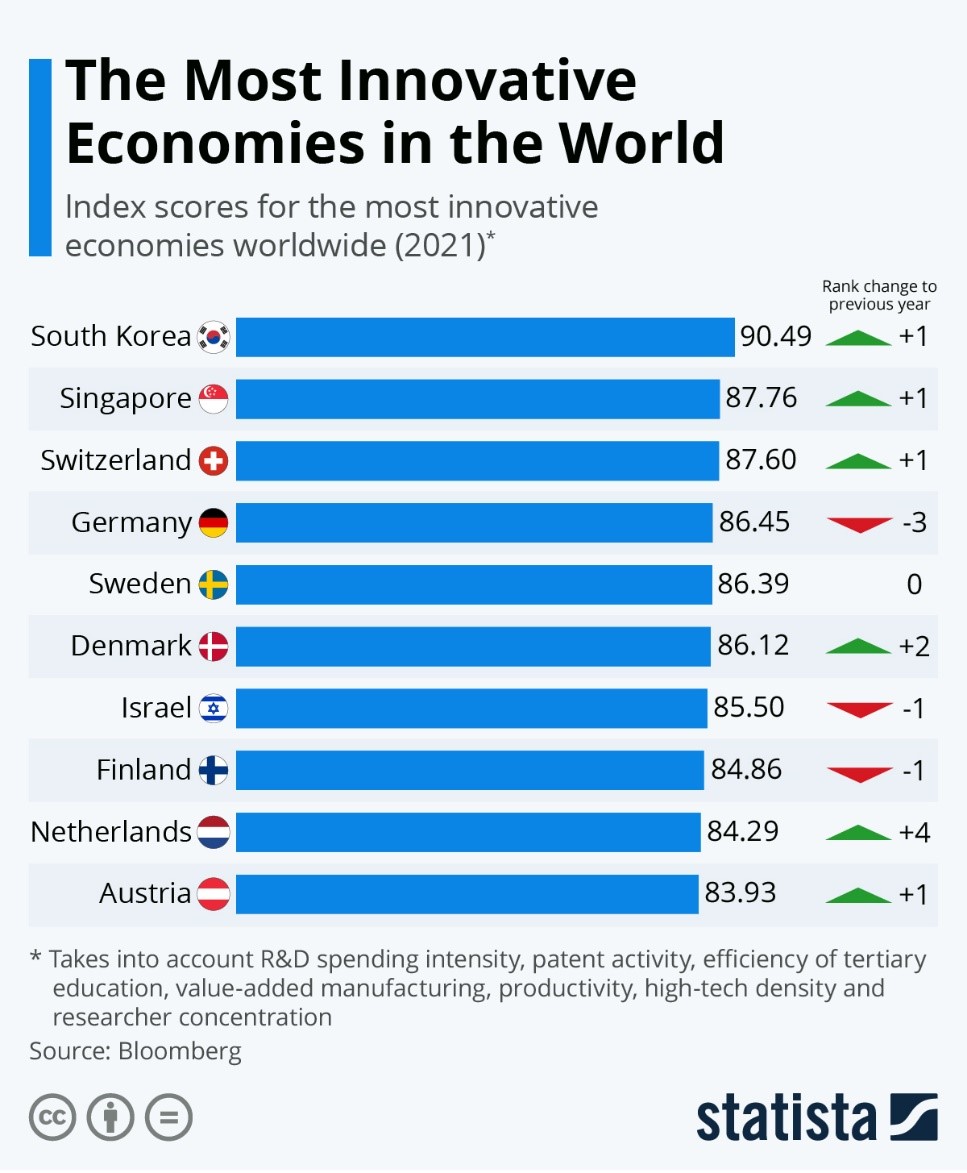

The Most Underpriced Country Fund: South Korea

Some of the most significant advancements of our day are cancer research, meat substitutes and innovative home technology.

So, which nation tops the globe in R&D, patent activity, high-tech density and all other aspects of supporting innovation? The most inventive nations are listed above from a Bloomberg report...

READ MORE

MEMBERS ONLY

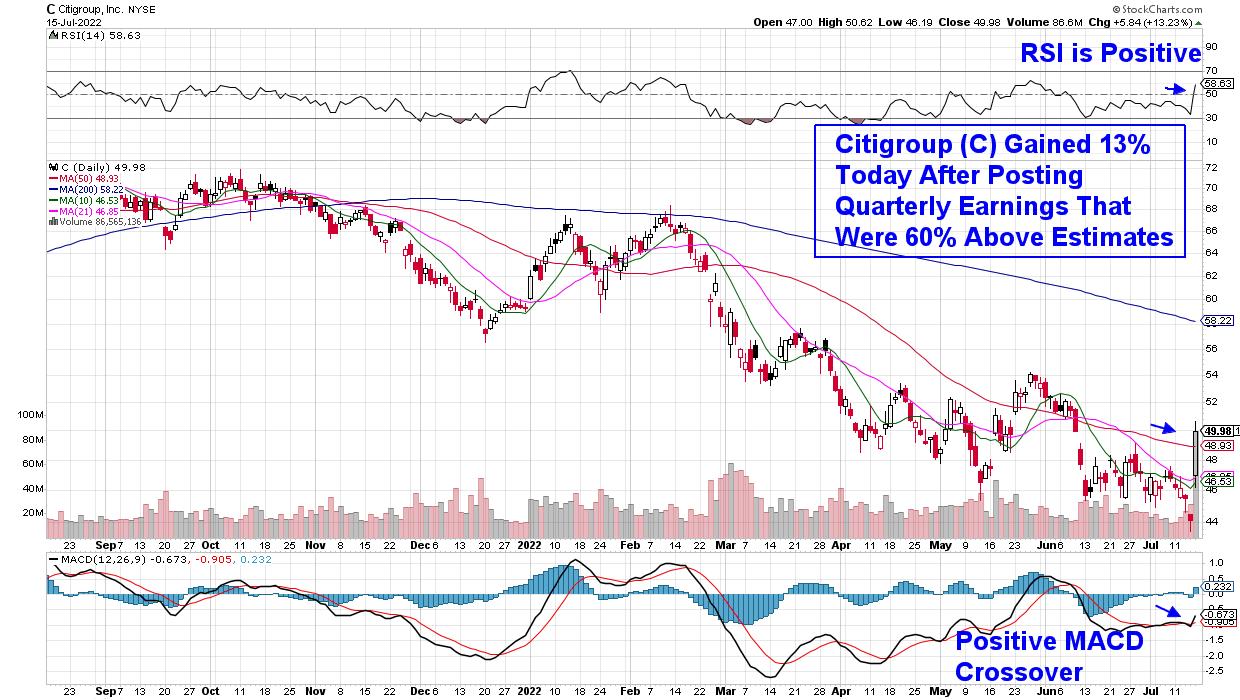

Markets End Week on High Note -- Here's Why They Could Stay There

by Mary Ellen McGonagle,

President, MEM Investment Research

It was another volatile week amid mixed economic and corporate earnings reports, as investors continue to digest news in an effort to gain long-term insights into U.S. inflation and growth prospects. While the markets traded down for most of the week, the S&P 500 gapped up in...

READ MORE