MEMBERS ONLY

Stocks Look Better… Until You See This Breakdown!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stocks are trying to stabilize, but the charts tell a more complicated story. Julius de Kempenaer explains why recent technical damage could still limit upside, along with where strength is quietly building instead....

READ MORE

MEMBERS ONLY

Market Rotation: Is "Sell America 2.0" Just Another Leadership Shift?

Rising interest rates and weakening tech are reshaping stock market leadership. Learn how market rotation works and what "Sell America 2.0" means for investors. ...

READ MORE

MEMBERS ONLY

Markets Look Past DC Drama as Bank Earnings and Charts Take Center Stage

Earnings season kicks off this week with big banks reporting. Follow the price action and market-based indicators in these charts to get clear clues rather than media headlines....

READ MORE

MEMBERS ONLY

Peace on Earth, Stability in Bonds? Watch These 3 Charts for Fixed Income in 2026

What does next year have in store for the bond market? Treasury yields, the yen, and credit spreads are expected to shape fixed-income returns in 2026. Which charts should you be watching? Find out here....

READ MORE

MEMBERS ONLY

The Silent Warning in Stocks — And the One Group Breaking Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The market might look steady at first glance, but there's a subtle warning sign developing underneath.

In this week's update, Julius de Kempenaer, the creator of RRG Charts, walks through the quiet deterioration happening across stock rotations and highlights the one group that's finally...

READ MORE

MEMBERS ONLY

The Year-End Macro Marathon: Why Every Data Point Matters & Where to Look

The StockCharts Sample Gallery contains charts of economic data, such as unemployment rate, inflation, and mortgage rates. Calm bond and mortgage markets could offer a potential tailwind as we head into 2026....

READ MORE

MEMBERS ONLY

The Santa Setup: What December Intermarket Price Action Might Look Like

Historical stock market patterns point to strength heading into Christmas. Keep an eye on the US dollar, Treasury yields, retail stocks, and volatility as we close out the year....

READ MORE

MEMBERS ONLY

Cracks within Tech; Bonds Outperform, Bitcoin; Insurance Names Catch a Strong Bid

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When technology ETFs are breaking down, insurance stocks and bonds are showing strength, and Bitcoin is triggering a downtrend, it means the stock market is showing signs of risk aversion. Arthur Hill analyzes charts of these asset groups and identifies the signals they are sending....

READ MORE

MEMBERS ONLY

Market Rotation Update: Revealing the Strongest Areas Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius builds on his new portfolio framework to reveal where market strength is shifting across asset classes and sectors. While stocks and commodities continue to lead, Julius breaks down the changes happening beneath the surface....

READ MORE

MEMBERS ONLY

Fed Chair Says, “It’s Cloudy”; These Benchmarks Could Blow the Clouds Away

by Martin Pring,

President, Pring Research

Martin Pring analyzes charts of US Treasury yields, which suggest there may be some disagreement between the market and the Fed....

READ MORE

MEMBERS ONLY

Year-End Rally Watch: How Sector Rotation Is Fueling the Bull Case

It's a market-moving week with the FOMC meeting, mega-cap earnings, and global trade headlines taking place. These tools will help you keep track of sector rotation, yield trends, and the next potential leg of the rally....

READ MORE

MEMBERS ONLY

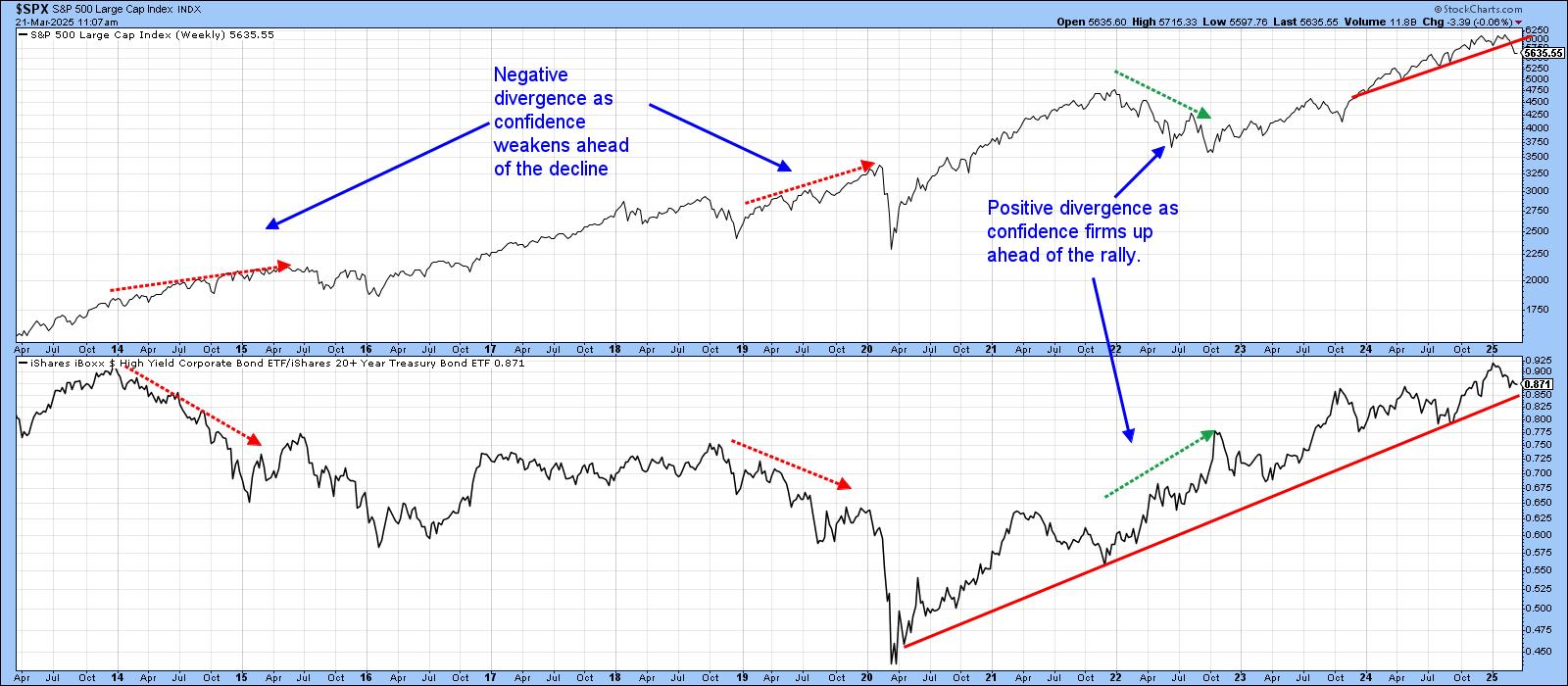

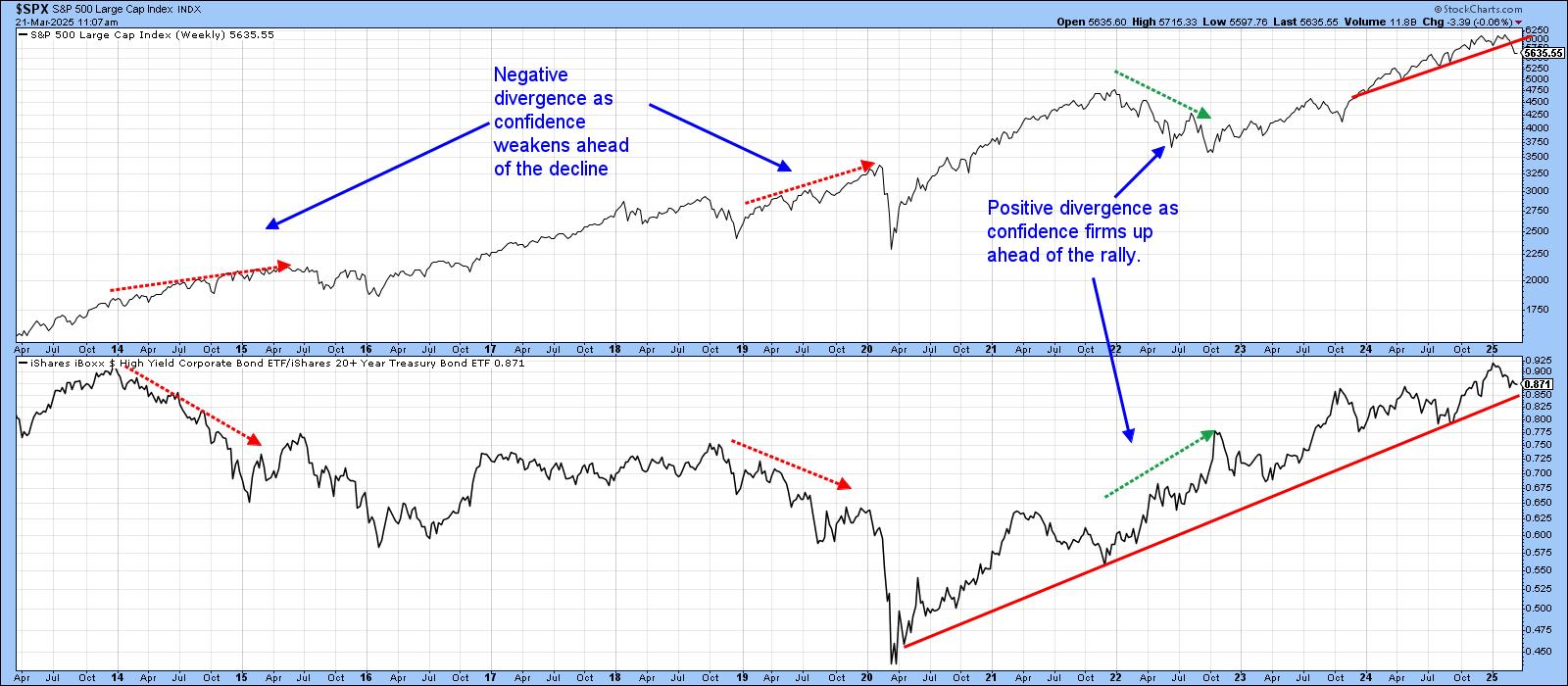

Confidence Ratios are Breaking Out in One Direction

by Martin Pring,

President, Pring Research

Martin Pring analyzes the relationship between sectors and various asset classes to confirm trend continuations....

READ MORE

MEMBERS ONLY

Intermarket Crosscurrents: What Quarter-End Trends Signal for Q4

Stocks rally as Q3 ends, yields creep higher, metals shine, and the dollar moves sideways. Explore key trends in equities, bonds, commodities, and currencies....

READ MORE

MEMBERS ONLY

Sector Rotation Points to Large-Cap Growth Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius takes a look at the current sector rotation, in combination with growth-value and size rotation. Combining these Relative Rotation Graphs shows strength concentrating in large-cap growth and the Tech, Discretionary, and Communication Services sectors. From this vantage point, we can see continued strength for the S&P 500...

READ MORE

MEMBERS ONLY

Fed Day Signals: Noise or the Start of Something Bigger?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The Fed delivered a rate cut and markets wobbled. Discover how stocks, bonds, and the dollar reacted and what investors should watch next. ...

READ MORE

MEMBERS ONLY

Wednesday May Have Been Turnaround Day for Some Markets

by Martin Pring,

President, Pring Research

Following the Fed's rate cut, the price action in several markets indicated a short-term reversal. Martin suggests monitoring these charts and their technical signals in the coming weeks....

READ MORE

MEMBERS ONLY

These Asset Relationships Could Be About to Signal Some Important Changes Ahead

by Martin Pring,

President, Pring Research

Martin explains how analyzing inter-asset relationships can give important insights into the market -- and what those relationships are telling us right now....

READ MORE

MEMBERS ONLY

Will the Fed “Go Big”? Real Estate Stocks Quiet Amid Major Macro Shifts

The Fed is set to cut rates again as Treasury yields slide and stocks rally. But why are real estate stocks still lagging? And could a breakout above a key resistance level shape the 2026 cycle?...

READ MORE

MEMBERS ONLY

Before CPI and PPI: 5 Things to Watch This Week

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Rate cuts on deck? Look for these signals in small caps, TLT, gold, and more to help you position your portfolio ahead of this week's data....

READ MORE

MEMBERS ONLY

Jackson Hole 2025: Investors Stay Calm as Bond Volatility Hits Lows

Despite rising inflation pressures and fresh Fed minutes, Treasury volatility and credit spreads remain near multi-year lows ahead of Powell’s speech....

READ MORE

MEMBERS ONLY

The Battle Between Fed Chairman and the President Will Ultimately Be Won by the Market!

by Martin Pring,

President, Pring Research

The President and the Fed Chair have been in a battle over lower rates for some time. One has been pressuring for easy money to boost the economy, the other prefers to hold off for a while to see what effects the tariffs and other factors might have on inflation....

READ MORE

MEMBERS ONLY

The Dollar Index Just Gave a Major Sell Signal - Does That Mean It's About to Implode?

by Martin Pring,

President, Pring Research

Last month, the Dollar Index triggered a number of sell signals confirming that it is in a bear market. Chart 1, for instance, shows that the red up trendline emanating in 2011 has been decisively ruptured, thereby pushing the Index further below its moving average. The Coppock Curve, seen in...

READ MORE

MEMBERS ONLY

RRG Update: Is Tech Ready to Break Out?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius shows how the Technology sector is edging toward leadership, alongside Industrials and soon-to-follow Communication Services. He highlights breakout lines for SPY, XLK, and XLC, noting that conviction climbs when daily and weekly RRG tails align to point northeast together. Bitcoin is sprinting into the leading quadrant next...

READ MORE

MEMBERS ONLY

S&P 500 on the Verge of 6,000: What's at Stake?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

A lot has happened in the stock market since Liberation Day, keeping us on our toes. Volatility has declined significantly, stocks have bounced back from their April 7 low, and the economy has remained resilient.

If you're still feeling uncertain, though, you're not alone. The stock...

READ MORE

MEMBERS ONLY

S&P 500 Slide Explained: What Past Price Action Reveals About Market Dips

by Frank Cappelleri,

Founder & President, CappThesis, LLC

On Wednesday, only 4% of the S&P 500's holdings logged gains — a pretty rare occurrence. Since the start of 2024, this has only happened three other times:

* August 5, 2024: The last day of the summer correction

* December 18, 2024: The Fed's hawkish cut...

READ MORE

MEMBERS ONLY

Unlock the Power of StockCharts' NEW Market Summary Dashboard | Walkthrough & Tips

by Grayson Roze,

Chief Strategist, StockCharts.com

In this in-depth walkthrough, Grayson introduces the brand-new Market Summary Dashboard, an all-in-one resource designed to help you analyze the market with ease, speed, and depth. Follow along as Grayson shows how to take advantage of panels, mini-charts, and quick scroll menus to maximize your StockCharts experience.

This video originally...

READ MORE

MEMBERS ONLY

Bonds Down, But Are They Out?

by Martin Pring,

President, Pring Research

Something didn't seem to ring true a couple of weeks ago when the whole world, by which I mean from the Treasury Secretary to your favorite cable news host, seized on the recent sell-off in bonds and why they would no longer be a safe haven and therefore...

READ MORE

MEMBERS ONLY

Stay Ahead of the Stock Market: Key Bond Market Signals Explained with Charts

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The bond market has been as volatile as the equity market, as indicated by the Move Index.

* The price action in bonds will alert you to stability returning to equities.

* Investors should not rush to add positions until stability returns to the stock market.

It was another erratic...

READ MORE

MEMBERS ONLY

Breadth Maps Are A Bloodbath, BUT Has The Bounce Begun?

by Grayson Roze,

Chief Strategist, StockCharts.com

In this video, Grayson unveils StockCharts' new Market Summary ChartPack—an incredibly valuable new ChartPack packed full of pre-built charts covering breadth, sentiment, volatility data and MUCH MORE!

From there, Grayson then breaks down what he's seeing on the current Market Summary dashboard, illustrating how he'...

READ MORE

MEMBERS ONLY

Investors on the Move: A Visual Guide to the Stock Market

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Declining equities, bonds, and the US dollar is making Wall Street nervous.

* Investors will need to look at market price action through the lens of macro factors.

* View longer-term charts, keep an eye on bond prices, and watch the US dollar's price action.

Another interesting week...

READ MORE

MEMBERS ONLY

Master the Market: A Guide to StockCharts' New Market Summary Page

by Grayson Roze,

Chief Strategist, StockCharts.com

Stock market analysis, technical indicators, and market trends are crucial for informed investing. StockCharts is making those things easier, and Grayson Roze is here to show you how.

In this video, Grayson provides an in-depth walk-through of the all-new Market Summary Page. This comprehensive tool offers a top-down overview of...

READ MORE

MEMBERS ONLY

This Report Might Self Destruct in 5 Days

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* With fast-moving markets, this report is vulnerable to self-destruction within 5 days.

* The bond vigilantes sent a message as long-term yields surged and bonds plunged.

* Unless reversed, these developments are negative for stocks, especially rate sensitive stocks.

In the opening scene of Mission Impossible 2, Ethan Hunt receives...

READ MORE

MEMBERS ONLY

Mastering Stock Market Turbulence: Essential Insights for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indexes bounced back with the largest one-day gains.

* Technology and Consumer Discretionary stocks were the best-performing S&P sectors.

* Bonds had the most interesting price in Wednesday's trading.

Tariff turmoil continues sending the stock market into a turbulent spin. Tariffs went into...

READ MORE

MEMBERS ONLY

Volatility Ahead: What Investors Need to Know Right Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes are showing weakness as more tariff news looms.

* The automobile sector continues to get hammered.

* Bond and precious metals prices are rising, indicating risk-off investor sentiment.

It was an ugly close to another roller-coaster trading week as the stock market struggled with several...

READ MORE

MEMBERS ONLY

Stock Market Momentum Slows Down: What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tuesday's stock market action was lackluster with not much movement in either direction.

* Lack of followthrough from the previous trading day's upside action shows uncertainty is still in the air.

* Keep an eye on the health of the overall U.S. economy by monitoring...

READ MORE

MEMBERS ONLY

Confidence Ratios are in an Uptrend, But Looking Vulnerable

by Martin Pring,

President, Pring Research

At this week's news conference, Jerome Powell mentioned that the Fed is cautious about making significant changes to interest rates due to unclear economic conditions, citing factors like trade policies and inflation, which have contributed to this uncertainty. If the "experts" don't know, it&...

READ MORE