MEMBERS ONLY

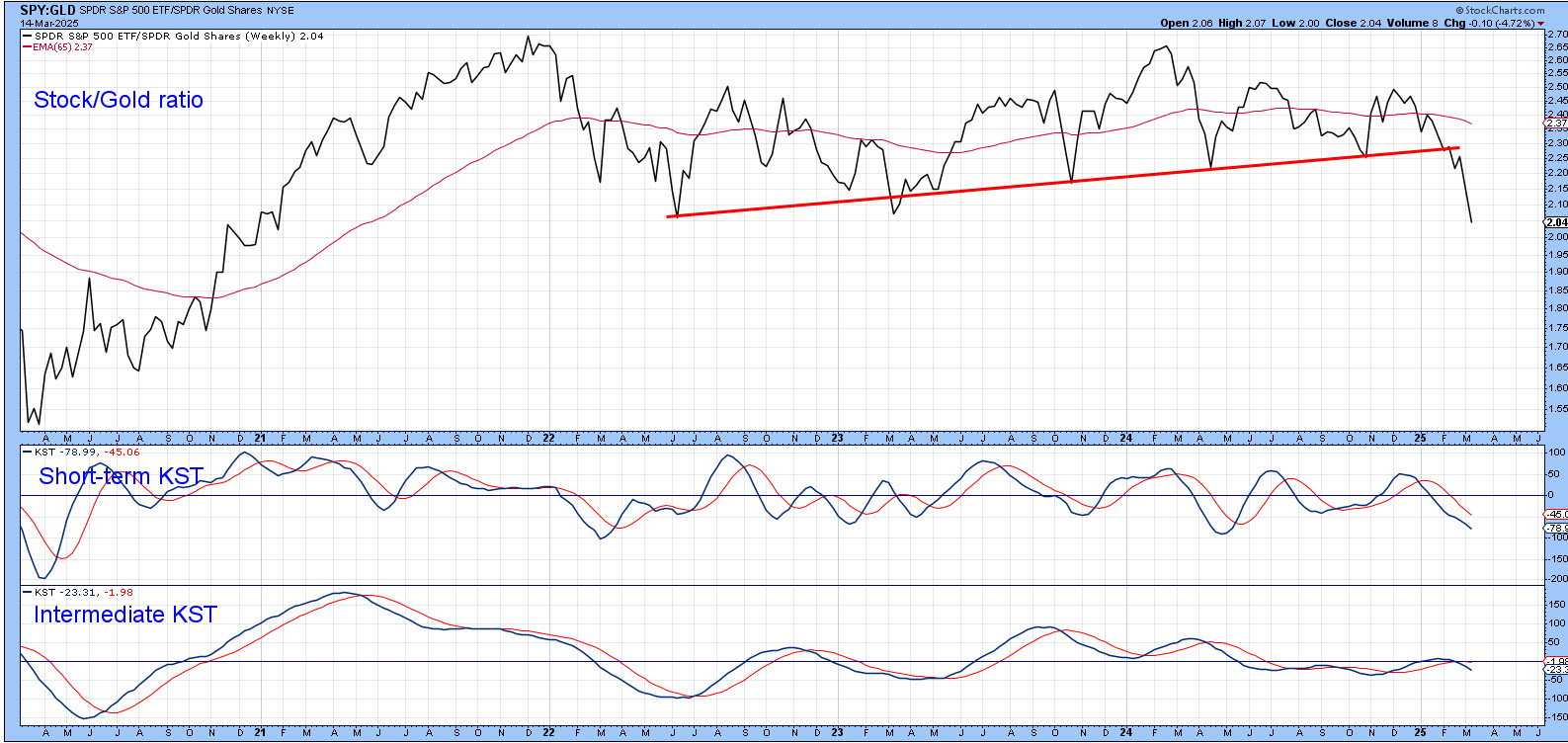

Stocks May No Longer Be the Preferred Asset Class

by Martin Pring,

President, Pring Research

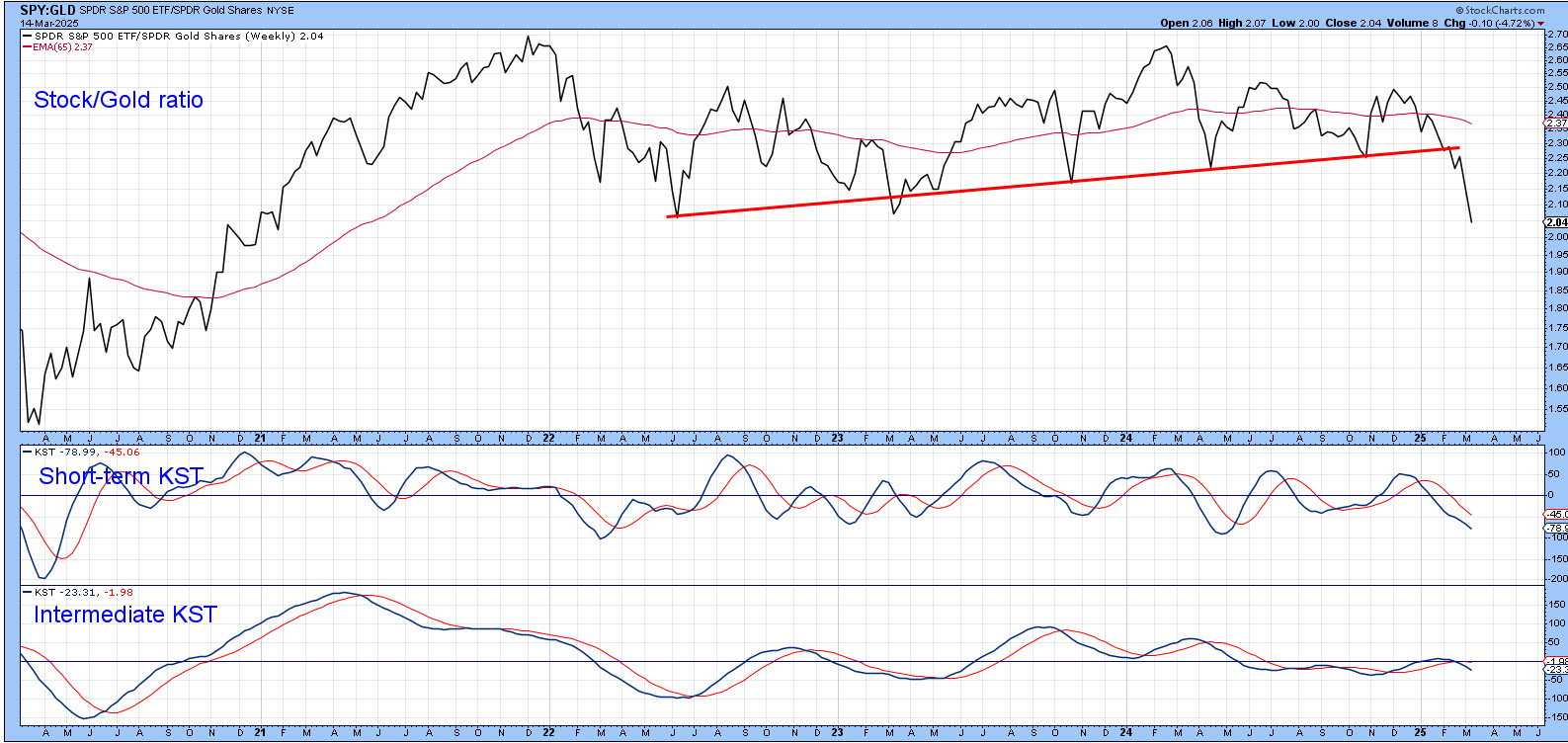

A couple of weeks ago, I wrote that stocks were beginning to slip against the gold price. Chart 1 shows that the ratio has now decisively broken below an important uptrend line, marking the lower region of a three-year top. The short-term KST is currently oversold, so some kind of...

READ MORE

MEMBERS ONLY

Get The BEST Options Trade Ideas for This Week with Tony Zhang

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony breaks down the big-picture market trends before diving deep into bullish and bearish setups for META, BIDU, AMGN, NVDA, DAL, and more! Get expert insights and key analysis you won't want to miss!

This video premiered on February 24, 2025....

READ MORE

MEMBERS ONLY

Stay on TOP of the AI Revolution!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony highlights important moves in equities, then shares the OptionsPlay research report for bull/bear plays. Tony then spends time on NVDA, highlighting the importance of staying on top of the AI revolution. He also looks at key stocks like V, BA, META, and more.

This video...

READ MORE

MEMBERS ONLY

BULLISH on These Options Trade Ideas

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony shares his weekly market review, discussing growth vs. value, volatility, commodities, and more. From there, he shares his list of bearish and bullish options trade ideas, including META, AMGN, GOOGL, NVDA, DIS, and more.

This video premiered on February 3, 2025....

READ MORE

MEMBERS ONLY

Five Key Market Ratios Every Investor Should Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares five charts from his ChartList of market ratios that investors can use to track changing market conditions through 2025. If you want to better track shifts in market leadership, identify where funds are flowing, and stay on top of evolving market trends, make sure to...

READ MORE

MEMBERS ONLY

Bullish AND Bearish Options Trade Ideas

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony starts the week with a very different tone as he looks at how markets are currently playing out. He then shares individual trade ideas, pointing out which ones they continue to have a bullish or bearish outlooks on. He looks at some key stocks including META,...

READ MORE

MEMBERS ONLY

Stocks UNDER PRESSURE! Which Sector is Leading Now?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius takes a look at asset class rotation on Relative Rotation Graphs. He then addresses the 6 sectors that are NOT in the "best five sectors" for this week. To conclude, he dives into the Technology sector to find some of the best...

READ MORE

MEMBERS ONLY

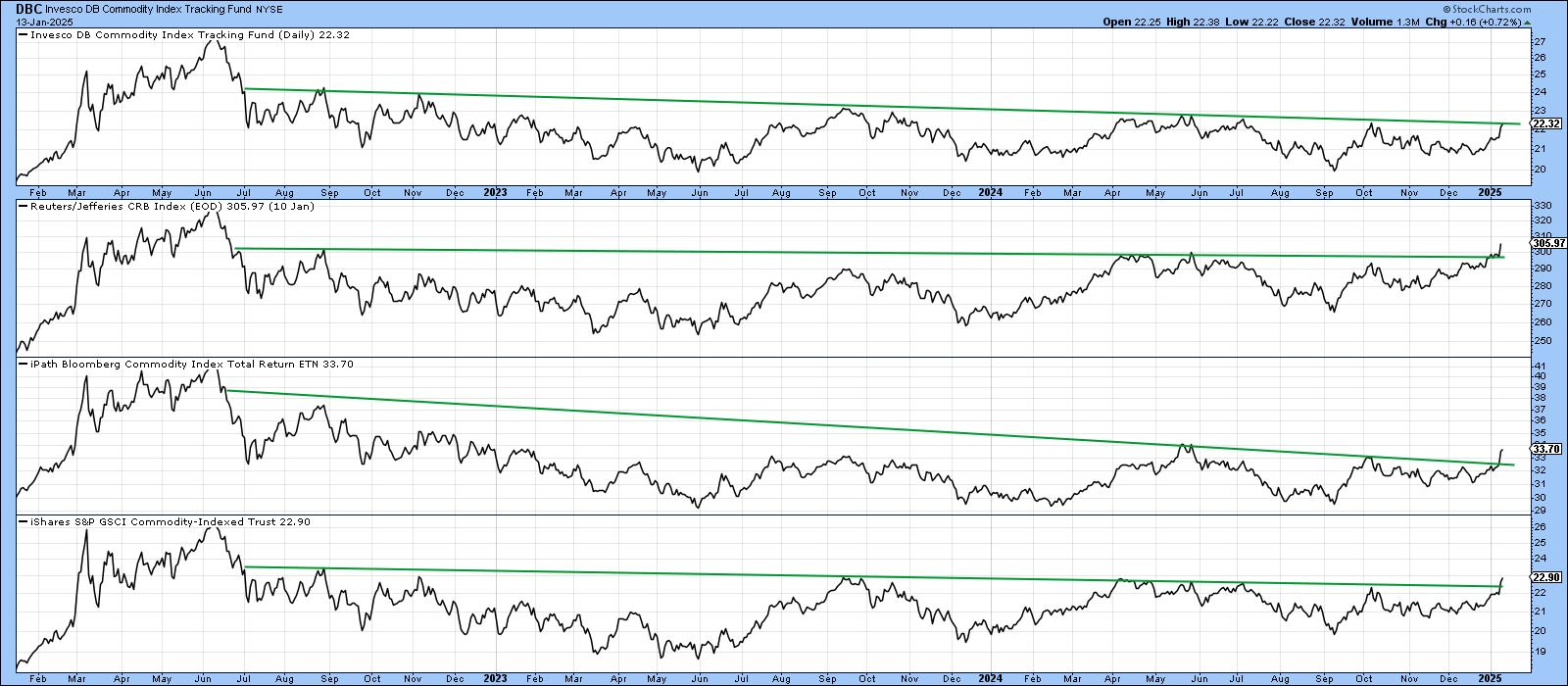

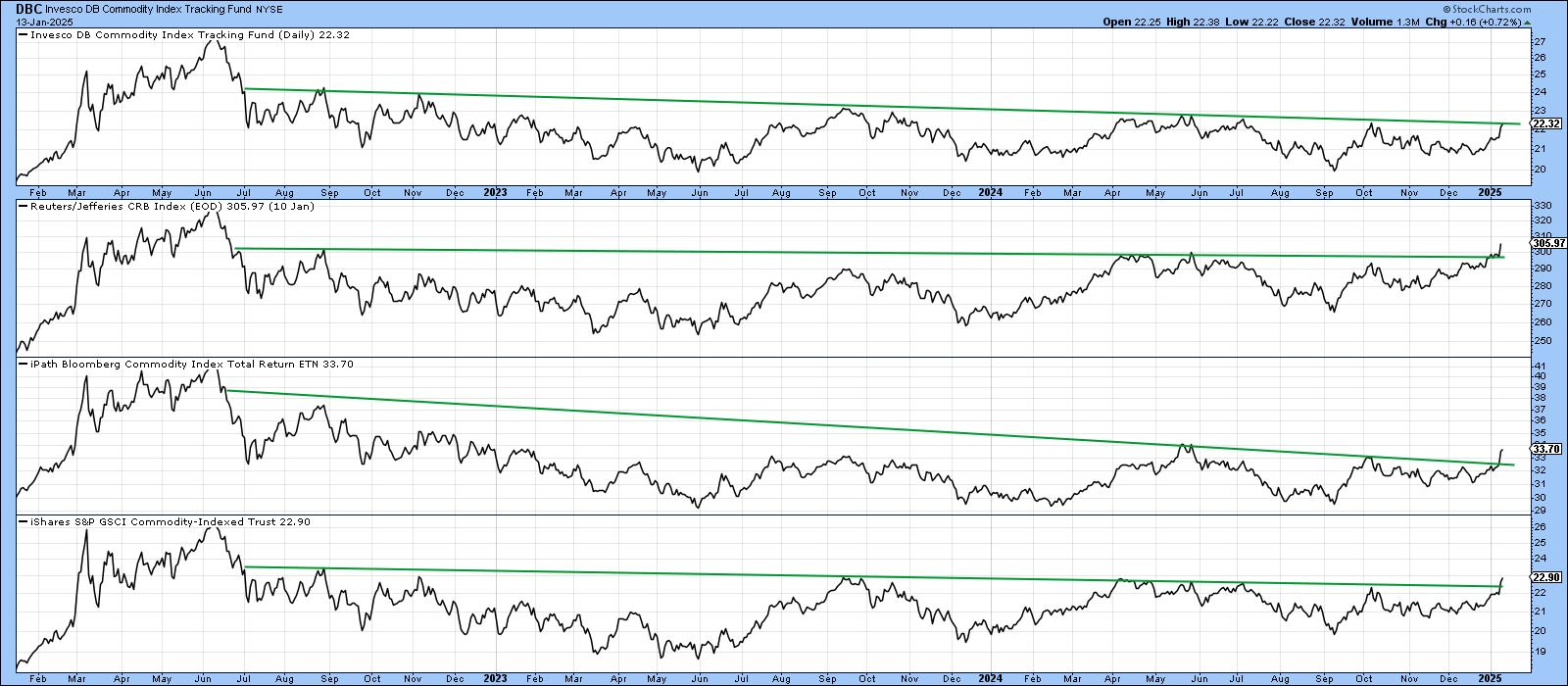

One Small Push by Commodities Could Lead to a Giant Leap for Commoditykind

by Martin Pring,

President, Pring Research

That may seem like a strange title, but it is intended to make the point that commodities look as though they are in the process of breaking out. Furthermore, this breakout, if successful, would jump-start a finely balanced long-term technical position into a primary bull market, all courtesy of our...

READ MORE

MEMBERS ONLY

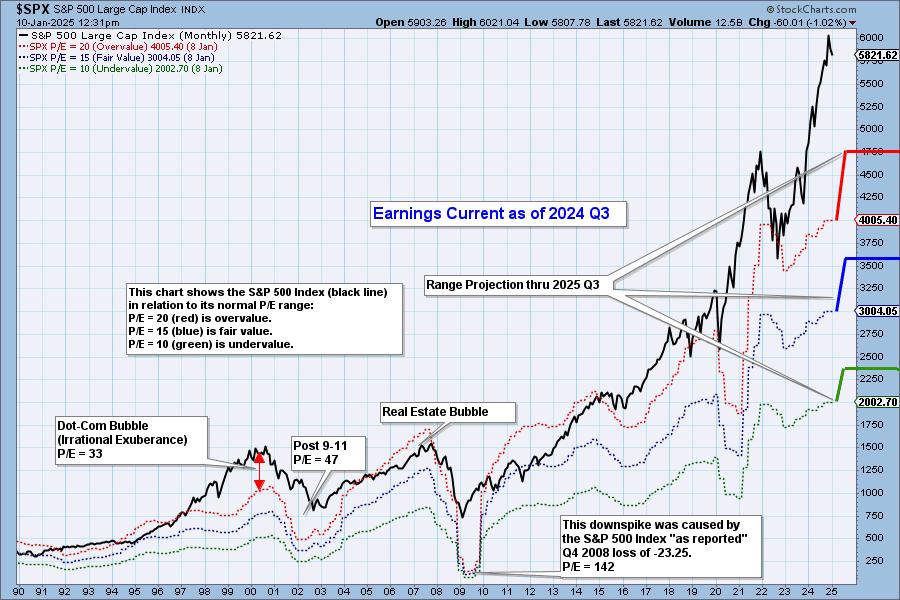

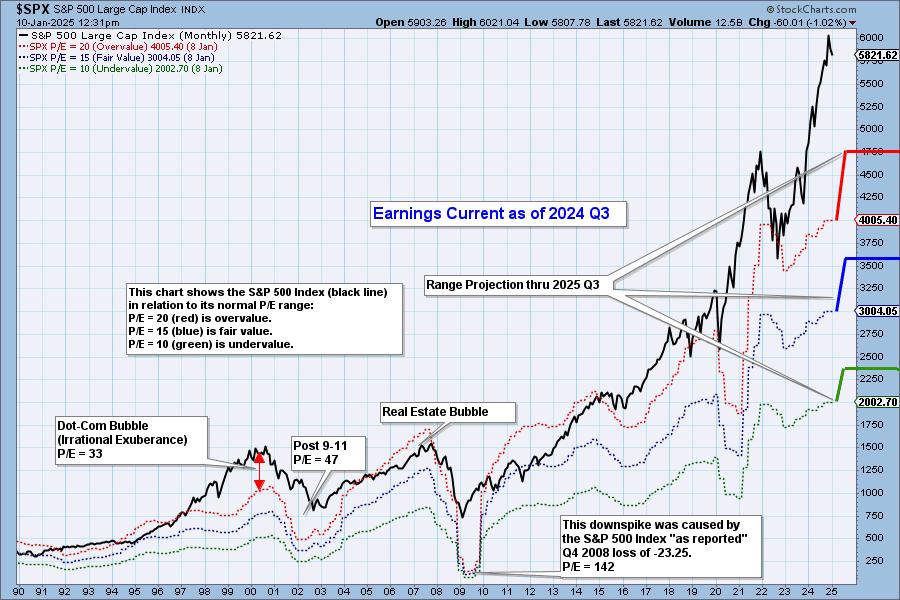

S&P 500 Earnings 2024 Q3: Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2024 Q3, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

What Higher Rates Could Mean for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Higher interest rates can directly impact industry groups like homebuilders, which are driven by consumers borrowing money.

* While a normal shaped yield curve suggests optimism for economic growth, the transition from an inverted yield curve usually results in weaker stock prices.

* The market trend remains the most important...

READ MORE

MEMBERS ONLY

Stock Market Ends the Week Strong: Could It Spark a Bullish January?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* No Santa Claus Rally this year, but the stock market's optimistic price action on Friday lifted investors' moods.

* Stocks like TSLA and NVDA had big gains while X, CVNA, and alcoholic beverages had big declines.

* Treasury yields and the US dollar remain high, and oil...

READ MORE

MEMBERS ONLY

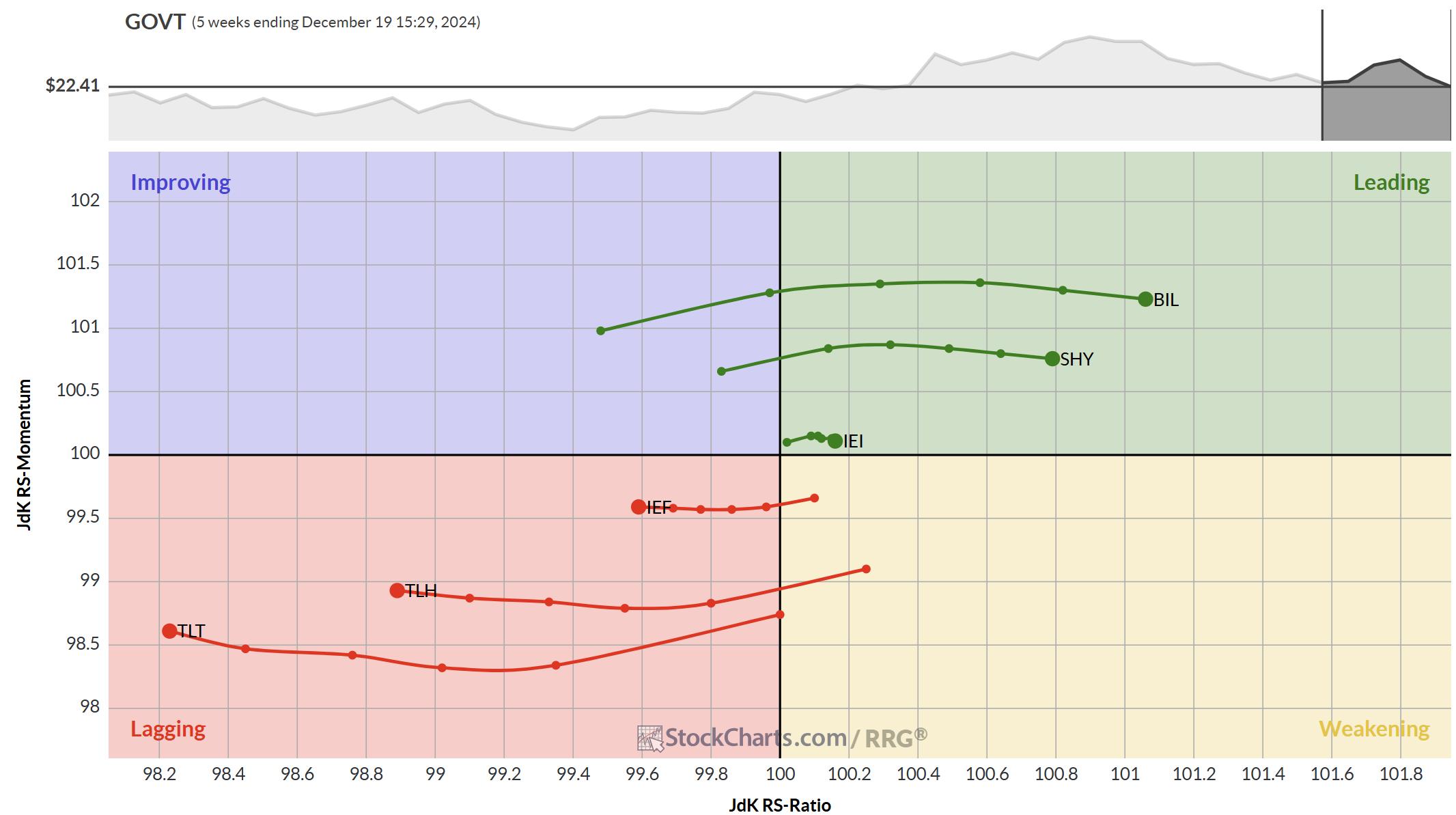

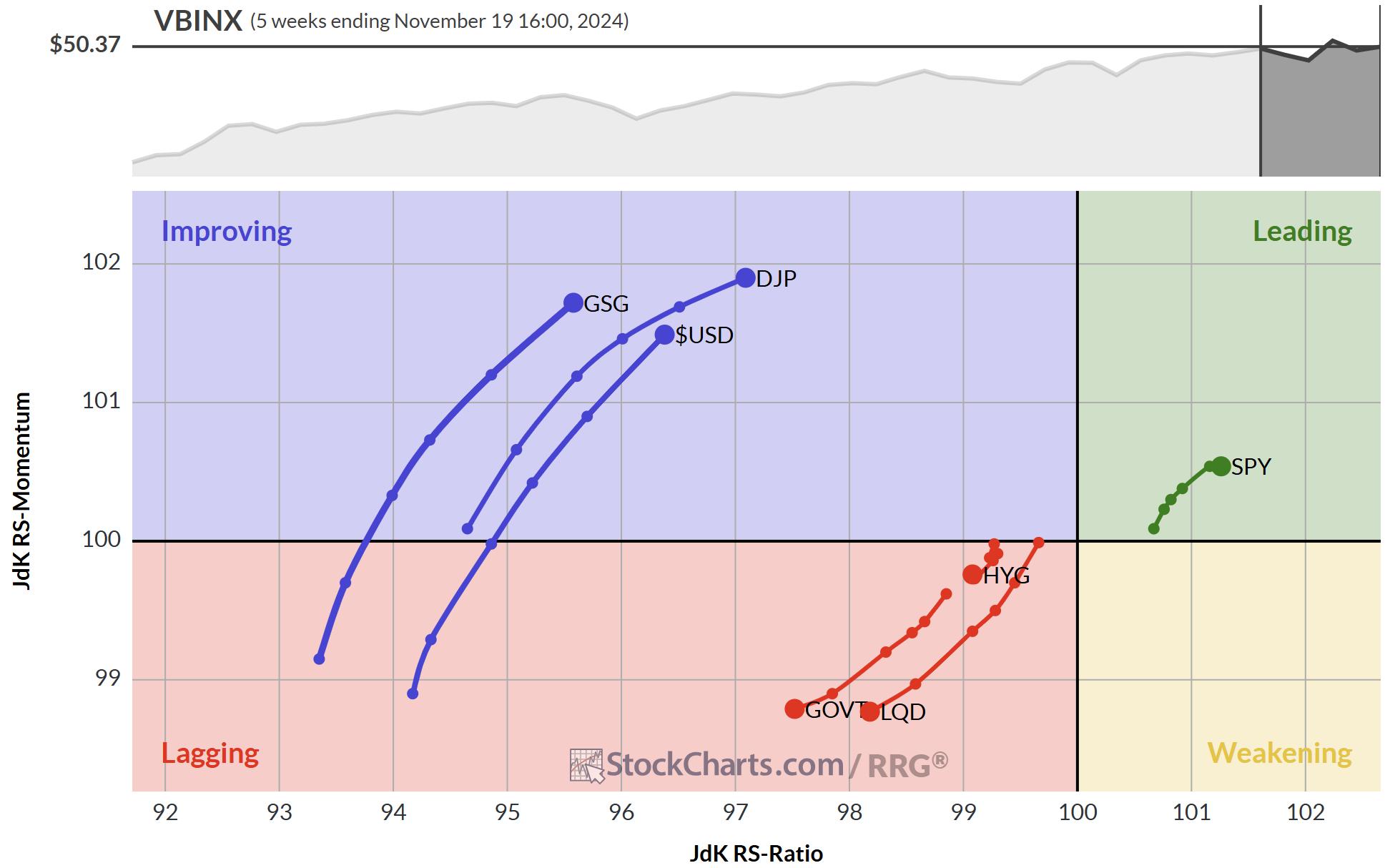

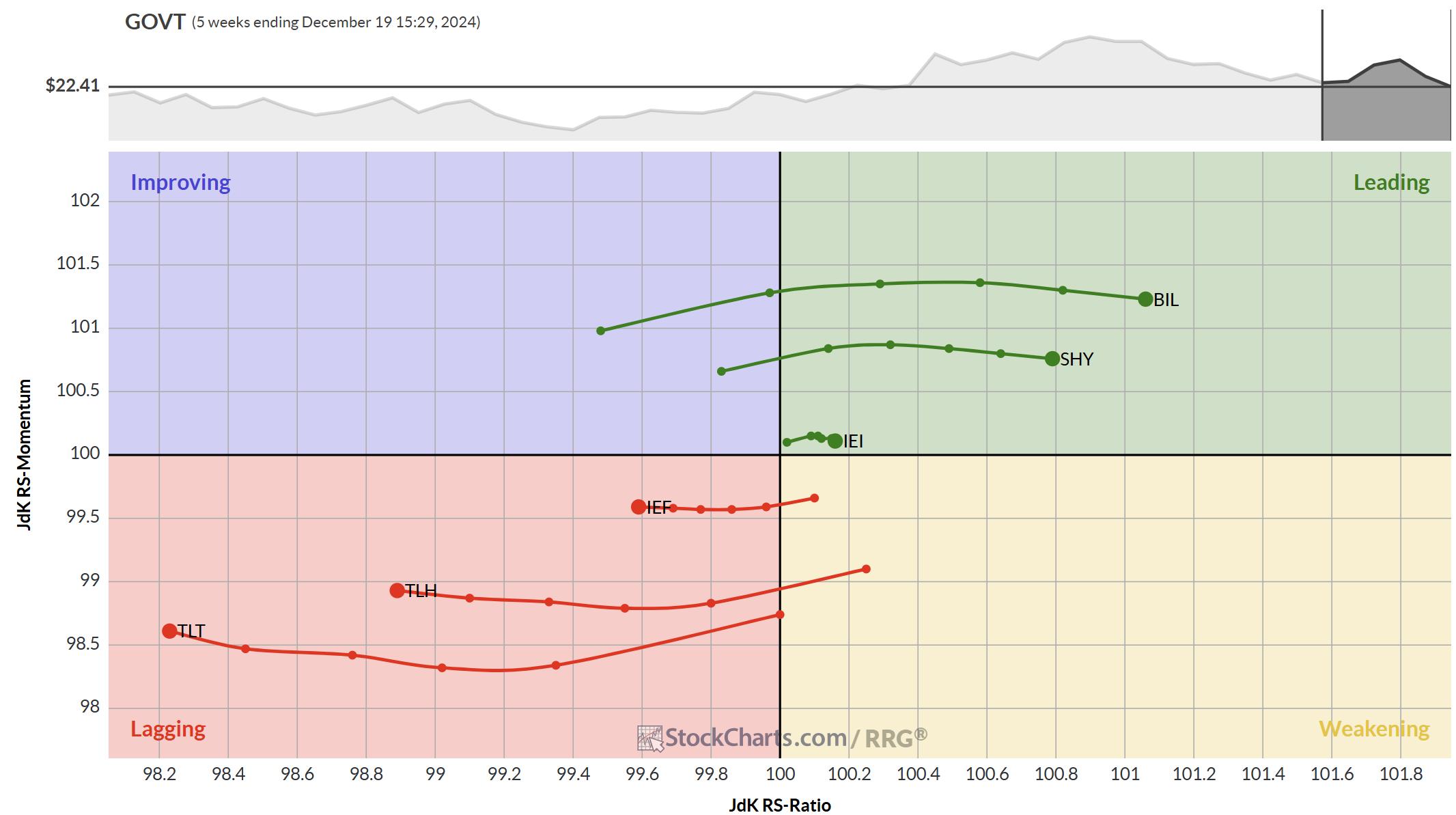

Three RRGs to Keep You on Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Track the Yield curve moving back to normal on RRG

* USD showing massive strength against all currencies

* Stock market drop not affecting sector rotation (yet)

The Yield Curve

The RRG above shows the rotations of the various maturities on the US-Yield Curve.

What we see at the moment...

READ MORE

MEMBERS ONLY

Stock Market Sell-Off: Is the Bull Market Over?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes got a bearish jolt on Wednesday.

* Gold, silver, and cryptocurrencies joined the equity selloff.

* Treasury yields and the US dollar jump higher.

Uncertainty in the stock market makes it difficult to make investment decisions. When investors sell off stocks, everyone follows without giving it...

READ MORE

MEMBERS ONLY

Bearish Formation Threatens Gold's Advance

by Carl Swenlin,

President and Founder, DecisionPoint.com

After the November pullback, GLD began to rally again. This week, on Wednesday, price exceeded the nearest November top, which made official the new rising trend from the November low. Brief celebration ends the following day as GLD tops, setting the top boundary for a bearish rising wedge formation. Rising...

READ MORE

MEMBERS ONLY

Options Trade Ideas YOU NEED to SEE!

by Tony Zhang,

Chief Strategist, OptionsPlay

Looking for options trade ideas? In this video, Tony presents some of the best options trading strategies! After discussing special 0DTE strategies, the big picture, and individual sectors and industries, Tony covers bullish and bearish ideas for stocks including NVDA, SHOP, GOOGL, META, CAT and many more.

This video premiered...

READ MORE

MEMBERS ONLY

The Stock Market's Simmering Rally: Indexes Keep Setting New Highs

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes continue to notch new record highs.

* Risk appetite is strong as Bitcoin rises while Treasury yields and volatility retreat.

* Earnings from Oracle, Adobe, Broadcom, and Costco may move the stock market next week.

The first trading week in December started on a positive...

READ MORE

MEMBERS ONLY

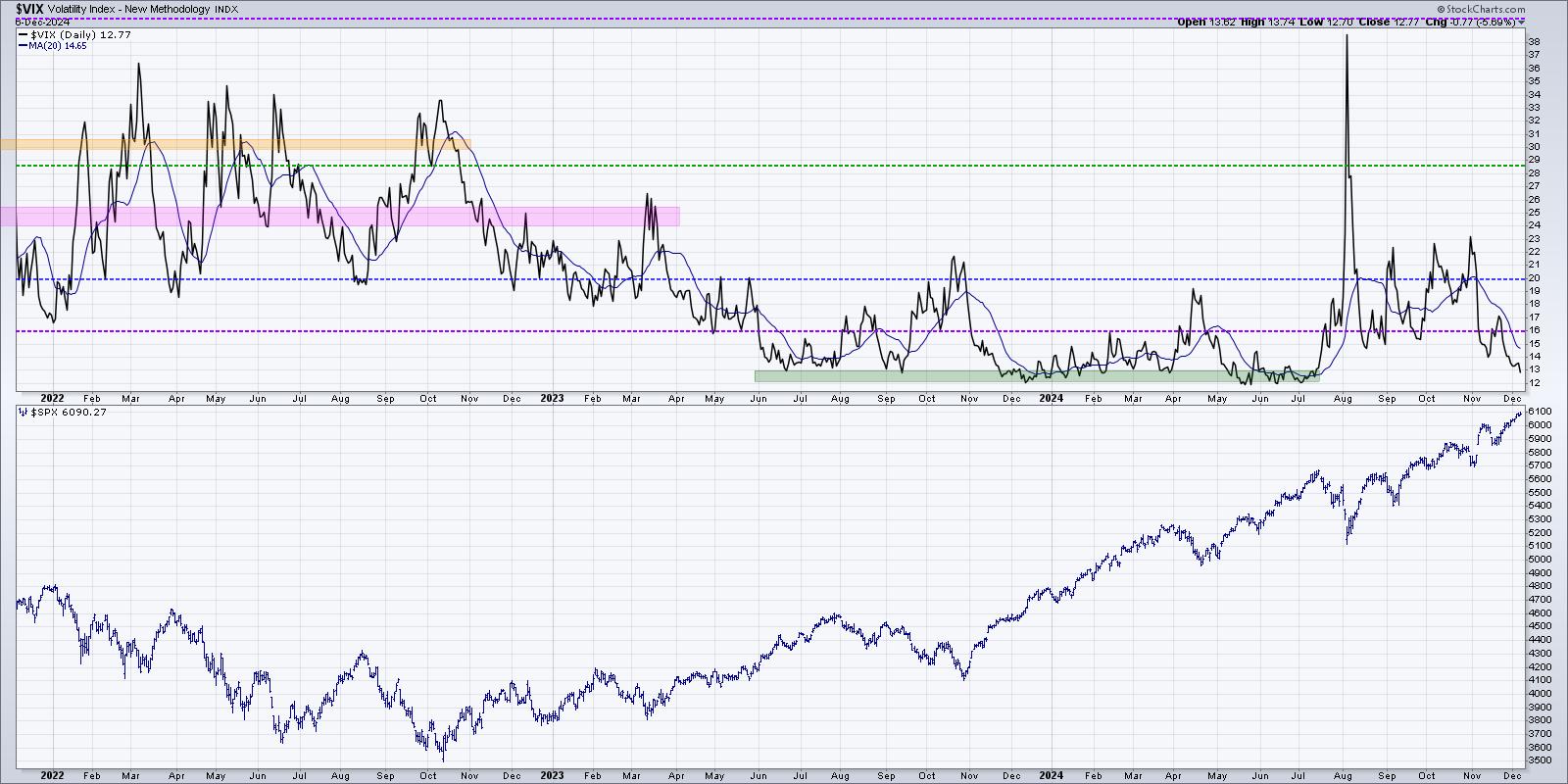

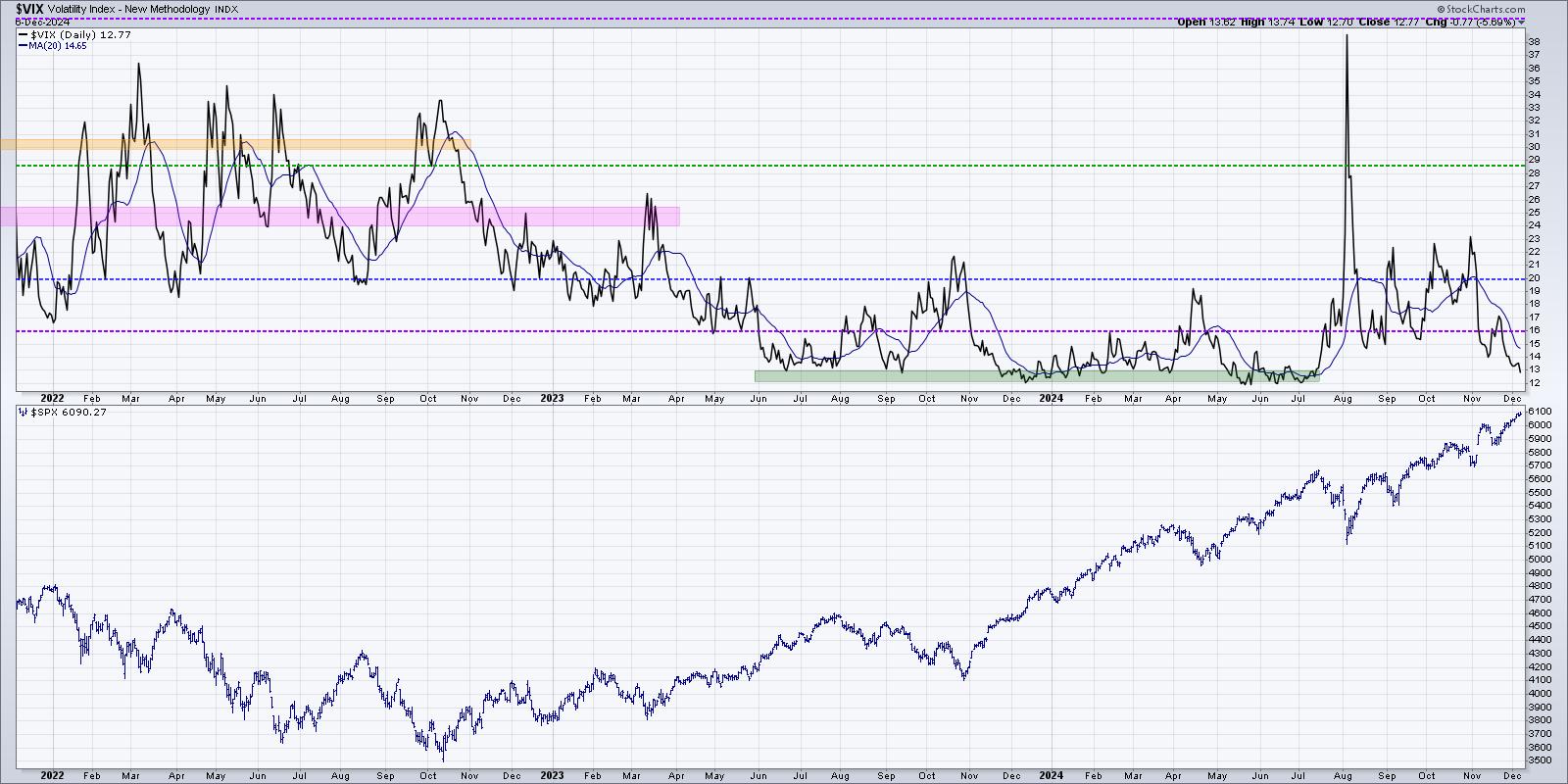

The Most Important Chart to Watch Into Year-End 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Low VIX reading implies that conditions are favorable for stocks.

* The MOVE index is basically a VIX for bonds, and can help to corroborate volatility readings across asset classes.

* High yield spreads remain quite narrow, implying bond investors perceive a low risk environment.

"The market goes up...

READ MORE

MEMBERS ONLY

Two ETFs That Could Thrive Based on a Normal Yield Curve

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My recent discussions on the Market Misbehavior podcasthave often included some comments on the interest rate environment, particularly the shape of the yield curve. We've had an inverted yield curve since late 2022, and so the yield curve taking on a more normal shape could mean a huge...

READ MORE

MEMBERS ONLY

Best Bullish and Bearish OptionsPlay Ideas for the Week!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony shows how he starts his week with a clear technical and fundamental perspective of the stocks he's likely going to enter, and of options positions throughout the week, and how you can apply that yourself. Tony shares bullish (NVDA, DIS, SHOP) and bearish (AAPL,...

READ MORE

MEMBERS ONLY

Navigating Holiday Stock Market Changes: Turn Sentiment Shifts into Successes

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes take a breather.

The day before Thanksgiving, the stock market took a little breather. But the weekly performance was still impressive.

The Dow Jones Industrial Average ($INDU) remains the broader index leader, rising 0.96% for the week. The S&P 500...

READ MORE

MEMBERS ONLY

OptionsPlay: Macro Market Outlook and Options Strategies

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, and shares his top bearish and bullish options trading ideas. He talks growth vs. value, commodities, bonds, the Dollar Index, sectors like homebuilders and semiconductors, and stocks like NVDA, DIS, INTC, and more.

This video premiered on November 26,...

READ MORE

MEMBERS ONLY

Market Movements Today: Investors Rejoice as Stocks Rally, Bitcoin and Gold Backslide

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks and bond prices rallied on Monday in response to President-elect Trump's pick for Treasury Secretary.

* Gold and oil prices fell steeply as concerns of geopolitical risks ease.

* Small and mid-cap stocks were the leaders in today's equity rally.

It's a short...

READ MORE

MEMBERS ONLY

An All-Around Rally: Navigating Stocks, US Dollar, Gold, and Bitcoin Price Action

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader equity indexes ended the week on a positive note, with small- and mid-caps gaining momentum.

* Gold regained its bullish momentum, and the US dollar surged.

* Bitcoin skyrocketed and crossed the 10K level, but closed lower.

The last full trading week before the Thanksgiving holiday has ended on...

READ MORE

MEMBERS ONLY

Bonds Get Death Cross SELL Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today, the 20-Year Bond ETF (TLT) 50-day EMA crossed down through the 200-day EMA (Death Cross), generating an LT Trend Model SELL Signal. This was the result of a downtrend lasting over two months. We note that the PMO has been running flat below the zero line for a month,...

READ MORE

MEMBERS ONLY

Financial Upswing: Understanding the Stock Market Rally and Yield Rise

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market indexes resumed their bullish trend.

* Small- and mid-cap stocks rose the most showing strong upside movement.

* Treasury yields rose higher on concerns of reinflation.

The afternoon turnaround seems to be more the norm than the exception. Thursday's stock market action followed the trend. What...

READ MORE

MEMBERS ONLY

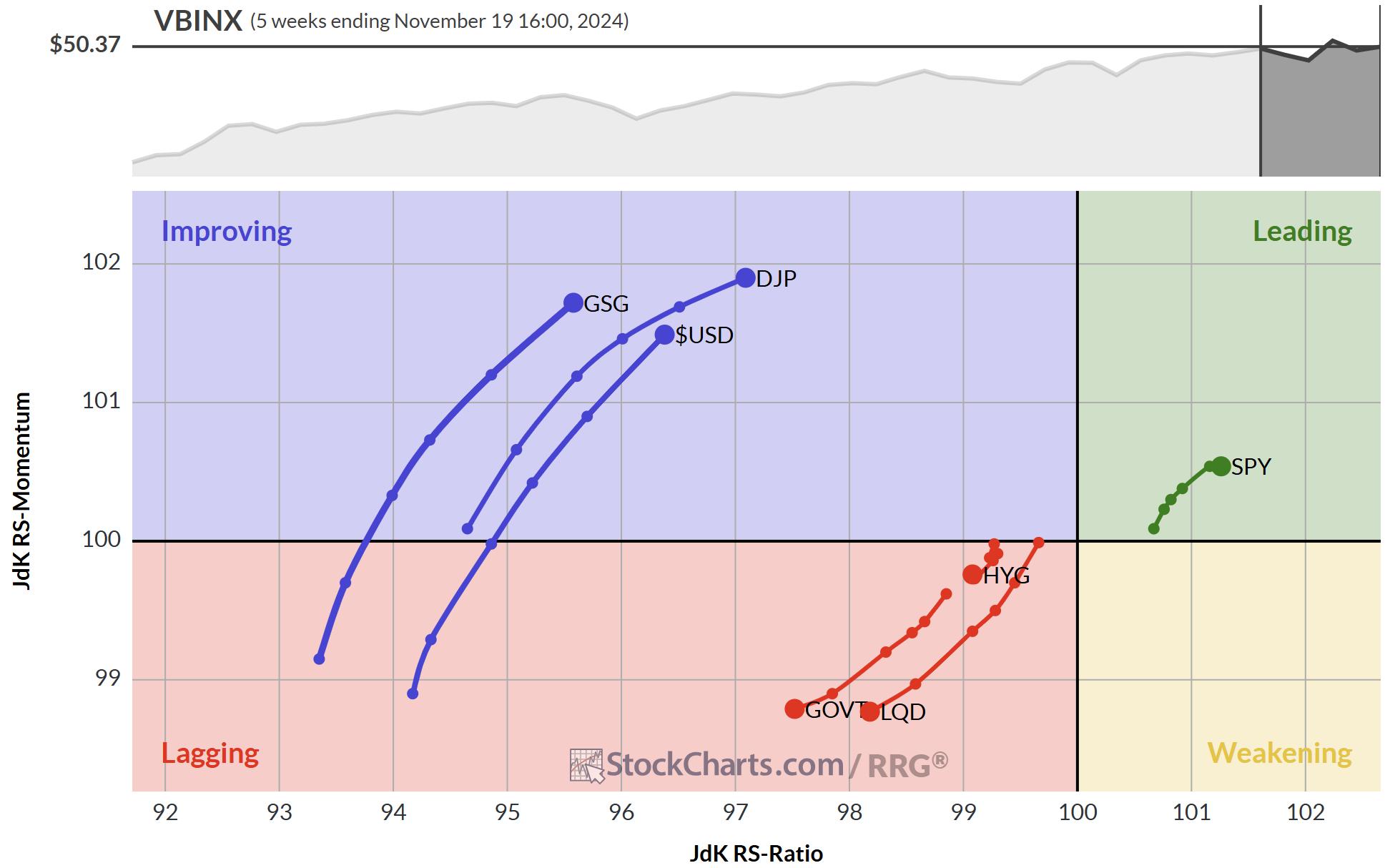

Is the USD Setting Up for a Perfect Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Despite a lot of turmoil, SPY continues to show strong rotations on both weekly and daily RRGs.

* Rising yields have not damaged the stock rally yet.

* Stock/Bond ratio remains strongly in favor of stocks.

After the election, things have hardly settled in the world. New developments in...

READ MORE

MEMBERS ONLY

Macro Market Outlook and Best Options Trade Ideas!

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, where he shares his top bearish and bullish options trading ideas, These include Disney (DIS), Shopify (SHOP), Intel (INTC), Adobe (ADBE), and Apple (AAPL). He explores growth vs. value, current sector rotation, key earnings, and more.

This video premiered...

READ MORE

MEMBERS ONLY

Tech Stocks Plunge: What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks, especially semiconductors, get hammered.

* Treasury yields continue to rally higher in response to Fed comments and strong economy.

* The US dollar rally confirms the strength of the US economy.

"The economy is not sending any signals that we need to be in a hurry to...

READ MORE

MEMBERS ONLY

Stock Market Hits Record Levels: Prepare for What Inflation Can Bring Next

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes hit milestone levels this week.

* Monitoring volatility in bonds could be a leading indicator in market action shifts.

* The US dollar can provide clues about future stock market action.

Another packed week for the stock market has come to a close. The broader...

READ MORE

MEMBERS ONLY

Election-Related Market Swings: How to Stay Ahead

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Markets bounced back after Thursday's selloff.

* Small-cap stocks are struggling to gain steam even though interest rates are likely to decline.

* Treasury yields continue to rise.

After yesterday's "trick," investors received a "treat" at the end of the trading week,...

READ MORE

MEMBERS ONLY

Election Season: Keep Calm and Optimize Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks gained some ground this week after better-than-expected earnings from Tesla.

* US Treasury yields continue to rise.

* Bullish momentum keeps gold prices rising higher.

Although earnings season is in full swing, trading volume has been relatively light this week. Perhaps investors are waiting for the stock market...

READ MORE

MEMBERS ONLY

Stocks Regain Some Ground Amid Rising Yields, Gold Prices, US Dollar

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market is treading softly as uncertainties loom on the horizon.

* Consumer Staples is the best-performing sector.

* Nasdaq breaks out above a consolidation pattern ahead of Tech earnings.

The overall trend in the stock market's broader indexes remains bullish. While the indexes were trading lower on...

READ MORE

MEMBERS ONLY

Sector Rotation is Giving Conflicting Stories!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius dives in to the sector rotation model, trying to find any alignment between theoretical and real-life rotations of sectors in combination with the economic cycle. The positions of the various sectors and the economic indicators that are part of this model are not...

READ MORE

MEMBERS ONLY

The Next Big Move in Yields May Be Different Than You Think

by Martin Pring,

President, Pring Research

Below, Chart 1 shows a weekly plot for the 30-year yield, where we can see a perfectly formed top whose completion was followed by a negative 65-week EMA crossover. At the time of the breakdown, there were few grounds for suspecting a false break. However, in the last couple of...

READ MORE

MEMBERS ONLY

Stealth AI Stocks Are Taking Off in a Flat Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights the continuation rally in AI-related stocks while also reviewing broader market conditions. The move higher in yields as well as volatility were discussed heading into next week's FOMC notes and inflation data.

This video originally premiered October 4, 2024. You...

READ MORE

MEMBERS ONLY

Stocks Soar, Energy Prices Spike: Are Geopolitical Tensions to Blame?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The macro picture of the US economy remains strong with the broader equity indexes in an uptrend.

* There has been some rotation in the sectors with Energy taking the lead as a result of rising crude oil prices.

* Use the StockCharts MarketCarpet to select stocks for your ChartLists....

READ MORE

MEMBERS ONLY

With 2024 Q2 Earnings In, Market Remains Very Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2024 Q2, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

How to Use the ADX Indicator (Trend Strength Explained)

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe presents an introduction to the Average Directional Index (ADX), sharing how it is calculated and how to use it. He highlights some of the strengths, and weaknesses, of this powerful indicator. He then analyzes Bitcoin, NVDA, and AVGO, and finishes up the show...

READ MORE

MEMBERS ONLY

Why the Stock Market is SO Confusing Right Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses current rotations in asset classes and US sectors using Relative Rotation Graphs, finding a lot of contradictory behavior. Taking a step back, he focuses on the weekly timeframe to find some more meaningful trends and shy away from day-to-day noise. He then...

READ MORE

MEMBERS ONLY

Dow Jones in the Spotlight, Bonds Stabilize, Tech Plays Catch-Up

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average closed at a new all-time high.

* Stock market indexes still have bullish momentum in spite of up and down movement.

* Bond prices could stabilize after digesting the interest rate cut.

The Federal Reserve's interest rate cut decision on Wednesdaywas like receiving...

READ MORE