MEMBERS ONLY

Trade Pullbacks Like a Pro: Simple Moving Average Strategy That Works

by Joe Rabil,

President, Rabil Stock Research

Moving average strategy, trend trading, and multi-timeframe analysis are essential tools for traders. In this video, Joe demonstrates how to use two key moving averages to determine if a stock is in an uptrend, downtrend, or sideways phase. He then expands on applying this concept across multiple timeframes to gain...

READ MORE

MEMBERS ONLY

Gold is at a Record High -- Is There a Message?

by Martin Pring,

President, Pring Research

The recent rally in the gold price has not yet attracted the kind of gold fever associated with the 1980 peak. At that time, there were numerous reports of unusual action, such as customers forming huge lines to buy the stuff at Canadian banks, an event that to my knowledge...

READ MORE

MEMBERS ONLY

Volatility Ahead: What Investors Need to Know Right Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes are showing weakness as more tariff news looms.

* The automobile sector continues to get hammered.

* Bond and precious metals prices are rising, indicating risk-off investor sentiment.

It was an ugly close to another roller-coaster trading week as the stock market struggled with several...

READ MORE

MEMBERS ONLY

This Precious Metal is On the Verge of a Massive Breakout. Here's How to Catch It!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Silver and gold have been rallying due to macroeconomic uncertainty, central bank purchases, and industrial demand.

* Precious metals have risen considerably and many analysts are projecting even higher target prices, especially for silver.

* Gold and silver are approaching key levels of entry and support.

Gold at $3,100...

READ MORE

MEMBERS ONLY

Master Multi-Timeframe Analysis to Find Winning Trades!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shares how to use multi-timeframe analysis — Monthly, Weekly, and Daily charts — to find the best stock market opportunities. See how Joe uses StockCharts tools to create confluence across timeframes and spot key levels. Joe then identifies strength in commodities, QQQ, and finishes up by...

READ MORE

MEMBERS ONLY

Uncover the Week's Key Stock Market Movements

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Price action was sideways this week, with a lot of up and down movement.

* FedEx's weak guidance sent the stock price sliding 6.45%.

* Precious metals rally with gold prices hitting an all time high this week.

If one word could characterize this week's...

READ MORE

MEMBERS ONLY

Stock Market Shifts Gears: Indexes Plunge After Climb

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes break their two day winning streak.

* Gold prices hit a new all-time high.

* European stocks are in a solid uptrend.

Tuesday's stock market action marked a reversal in investor sentiment, with the broader indexes closing lower. The S&P 500...

READ MORE

MEMBERS ONLY

Why the Market is Ready to Rally!

by Larry Williams,

Veteran Investor and Author

In this exclusive video, legendary trader Larry Williams breaks down why the stock market is primed for a rally, using technical analysis, fundamental signals, and seasonal trends. He explains how tariffs, crude oil, and cyclical patterns could fuel the next big market surge, plus stocks to watch during this potential...

READ MORE

MEMBERS ONLY

Three Reasons to Consider Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Gold has dramatically outperformed the S&P 500 and Nasdaq in 2025.

* Gold prices remain in a primary uptrend, with our Market Trend Model reading bullish on all time frames.

* Gold stocks are outperforming physical gold, and could represent a "catch up" trade going into...

READ MORE

MEMBERS ONLY

Is a New Market Uptrend Starting? Key Signals & Trading Strategies

by Mary Ellen McGonagle,

President, MEM Investment Research

Is a new market uptrend on the horizon? In this video, Mary Ellen breaks down the latest stock market outlook, revealing key signals that could confirm a trend reversal. She dives into sector rotation, explains why defensive stocks are losing ground, and shares actionable short-term trading strategies for oversold stocks....

READ MORE

MEMBERS ONLY

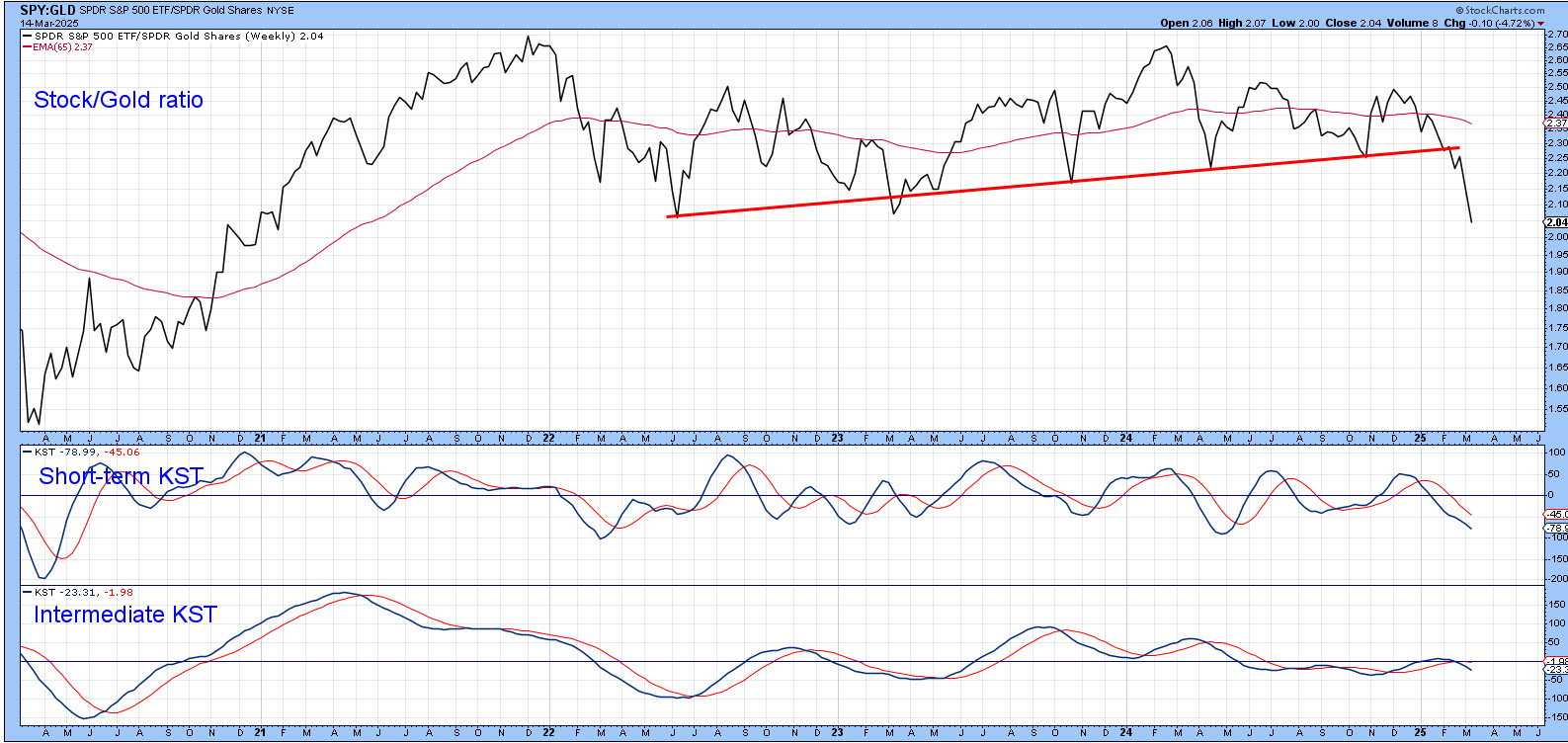

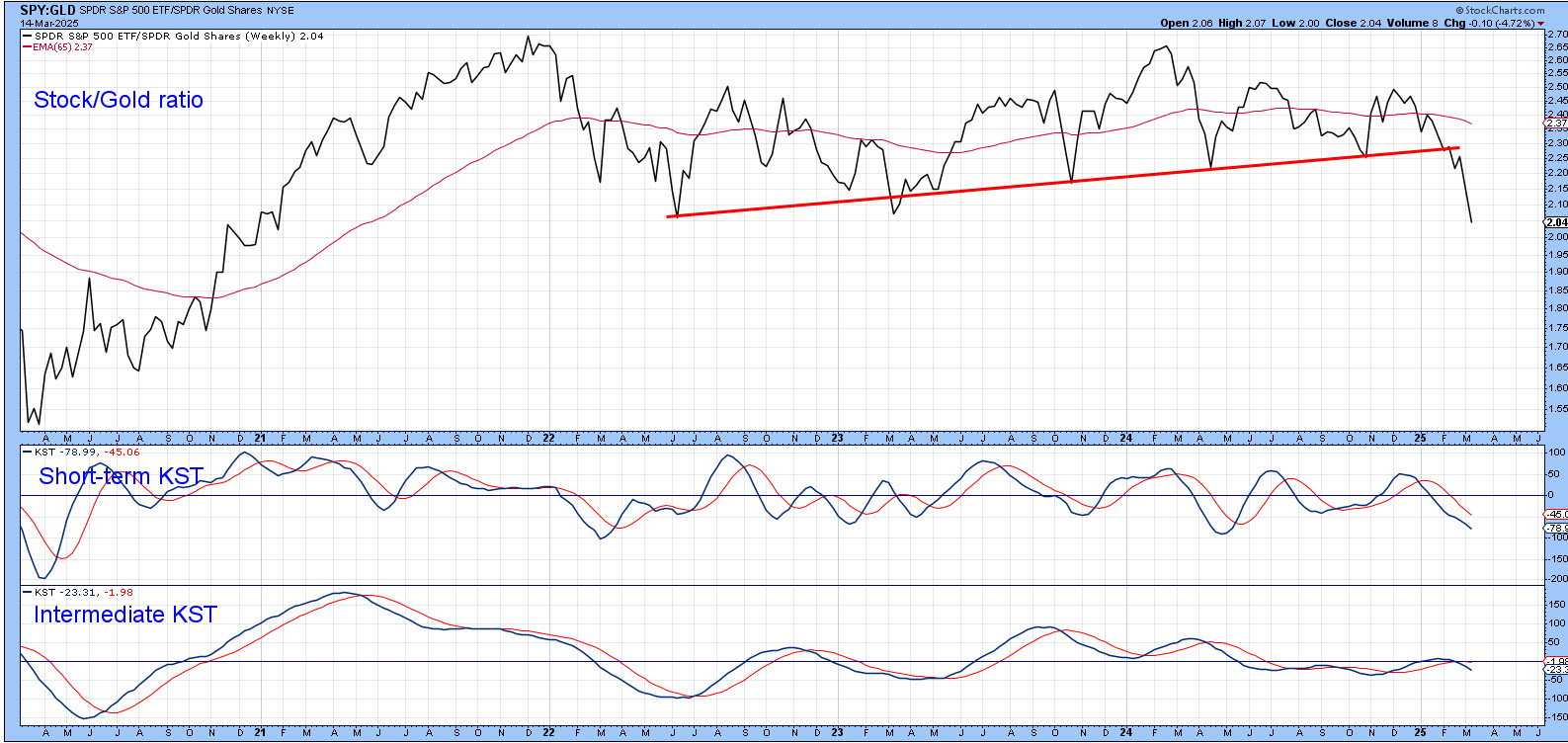

Stocks May No Longer Be the Preferred Asset Class

by Martin Pring,

President, Pring Research

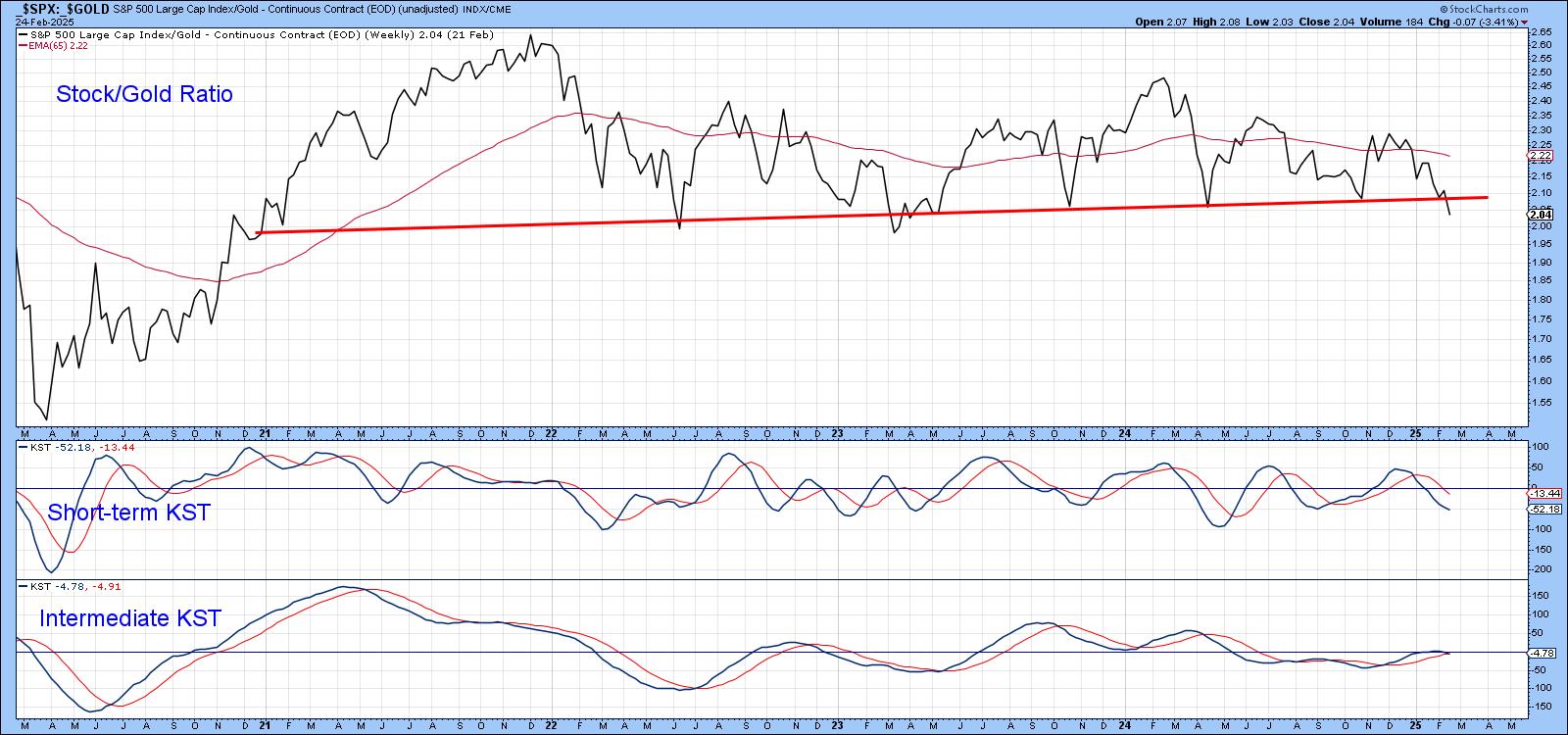

A couple of weeks ago, I wrote that stocks were beginning to slip against the gold price. Chart 1 shows that the ratio has now decisively broken below an important uptrend line, marking the lower region of a three-year top. The short-term KST is currently oversold, so some kind of...

READ MORE

MEMBERS ONLY

Bearish ADX Signal on S&P Plays Out - Now What?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe revisits a critical ADX signal that gave a major market warning, explaining the pattern and a new low ADX setup to watch. He breaks down SPY and QQQ support zones, sector rotation, and reviews viewer symbol requests including T, WBD, and more. Don'...

READ MORE

MEMBERS ONLY

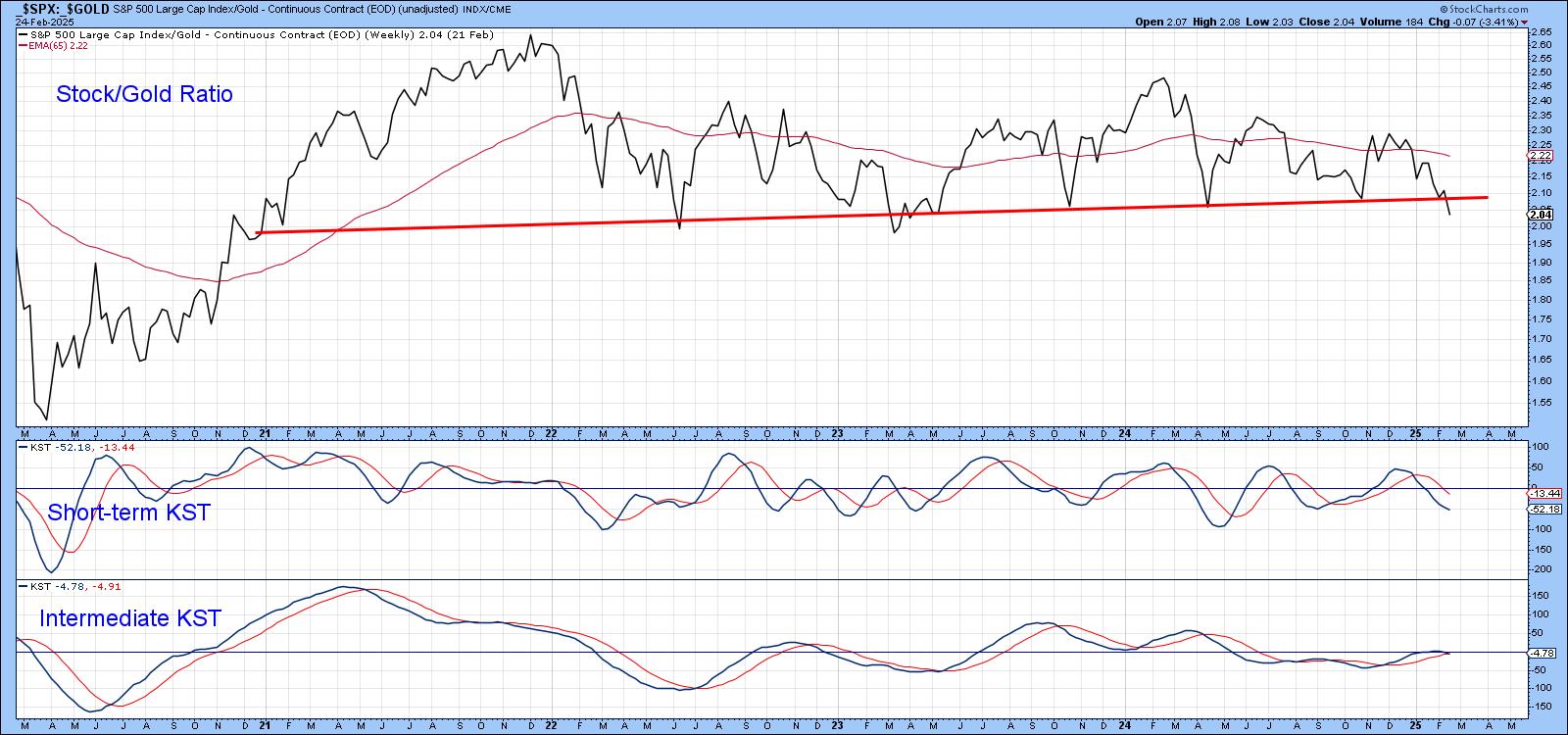

Stocks Starting to Break Down Against This Key Asset

by Martin Pring,

President, Pring Research

The S&P Composite ($SPX) briefly touched a new all-time high last week, which sounds encouraging. However, that kind of action was limited, as neither the Dow Industrials nor the NASDAQ Composite reached record territory. Such discrepancies can always be cleared up, of course, but more troubling is the...

READ MORE

MEMBERS ONLY

Gold and Silver Are Crushing the S&P 500! Here's What You Need To Know Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold and silver are crushing the commodities markets and the S&P 500.

* Gold is hitting record highs, fueled by sentiment and speculation.

* Consider the key levels to watch for investment opportunities in gold and silver.

There's been a lot of wild speculation surrounding gold&...

READ MORE

MEMBERS ONLY

Master Trades in Volatile Markets With This 4MA Strategy

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how the 4-day moving average can be useful especially in volatile markets. He explains the advantages of using it in conjunction with the 18-day MA to prevent buying at the wrong time and highlighting when good opportunities appear. He then goes through the...

READ MORE

MEMBERS ONLY

Dr Copper Could Be Close to a Major Breakout. What That Could Mean for the CPI

by Martin Pring,

President, Pring Research

The nickname "Dr. Copper" comes from its reputation as a reliable economic indicator. That's because it is used worldwide in a wide range of industries, including construction, electronics, and manufacturing. When demand for the red metal is high, it often signals that these industries are booming,...

READ MORE

MEMBERS ONLY

Three Behavioral Biases Impacting Your Portfolio Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reveals three common behavioral biases, shows how they can negatively impact your portfolio returns, and describes how to use the StockCharts platform to minimize these biases in your investment process. He also shares specific examples, from gold to Pfizer to the S&P 500, and...

READ MORE

MEMBERS ONLY

BULLISH on These Options Trade Ideas

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony shares his weekly market review, discussing growth vs. value, volatility, commodities, and more. From there, he shares his list of bearish and bullish options trade ideas, including META, AMGN, GOOGL, NVDA, DIS, and more.

This video premiered on February 3, 2025....

READ MORE

MEMBERS ONLY

An Enticing Gold Mining Stock with a Strong SCTR Score

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Gold stocks have been rising, which has helped gold mining stocks.

* This gold mining stock is close to its all-time high.

* In this article, we will present an analysis of the monthly and daily charts.

Gold stocks have risen, even after the Federal Reserve decided to keep interest...

READ MORE

MEMBERS ONLY

Investors are Pouring Into Gold Miners—Here's What You Need to Know!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* There's a renewed interest in gold mining stocks.

* Does gold outperforming miners signal an increase in mining activity and profitability?

* Miners are at a critical turning point, and the key levels discussed can help you assess whether the trend will turn bullish or bearish.

Gold mining...

READ MORE

MEMBERS ONLY

Five Key Market Ratios Every Investor Should Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares five charts from his ChartList of market ratios that investors can use to track changing market conditions through 2025. If you want to better track shifts in market leadership, identify where funds are flowing, and stay on top of evolving market trends, make sure to...

READ MORE

MEMBERS ONLY

How to Find a BUY Signal Using The 1-2-3 Reversal Pattern

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe demonstrates how to use the 1-2-3 reversal pattern as a buy signal on the weekly chart. This approach can be used when the monthly chart is in a strong position. Joe shares how to use MACD and ADX to help when the trendline pattern...

READ MORE

MEMBERS ONLY

Gold Prices: De-Dollarization, Inflation, and $3,000 Gold—What You Need to Know Now

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Central banks are accumulating gold at an increased pace which could increase the price of gold.

* While retail sentiment for gold may decline slightly, institutional accumulation remains steady.

* Compare gold futures with the ETF and look at the key levels, as a buying opportunity may be near.

Gold...

READ MORE

MEMBERS ONLY

Bullish AND Bearish Options Trade Ideas

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony starts the week with a very different tone as he looks at how markets are currently playing out. He then shares individual trade ideas, pointing out which ones they continue to have a bullish or bearish outlooks on. He looks at some key stocks including META,...

READ MORE

MEMBERS ONLY

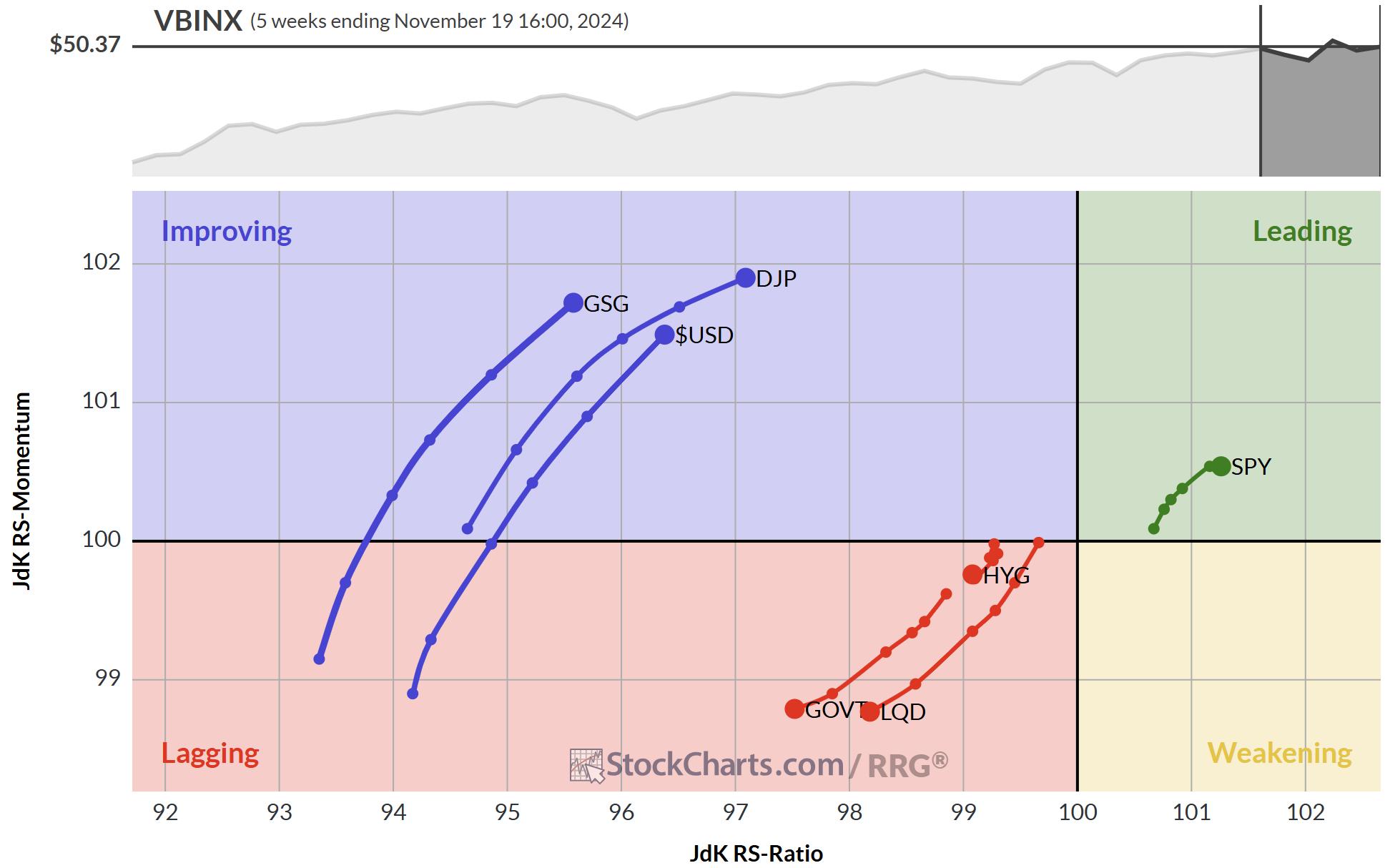

Stocks UNDER PRESSURE! Which Sector is Leading Now?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius takes a look at asset class rotation on Relative Rotation Graphs. He then addresses the 6 sectors that are NOT in the "best five sectors" for this week. To conclude, he dives into the Technology sector to find some of the best...

READ MORE

MEMBERS ONLY

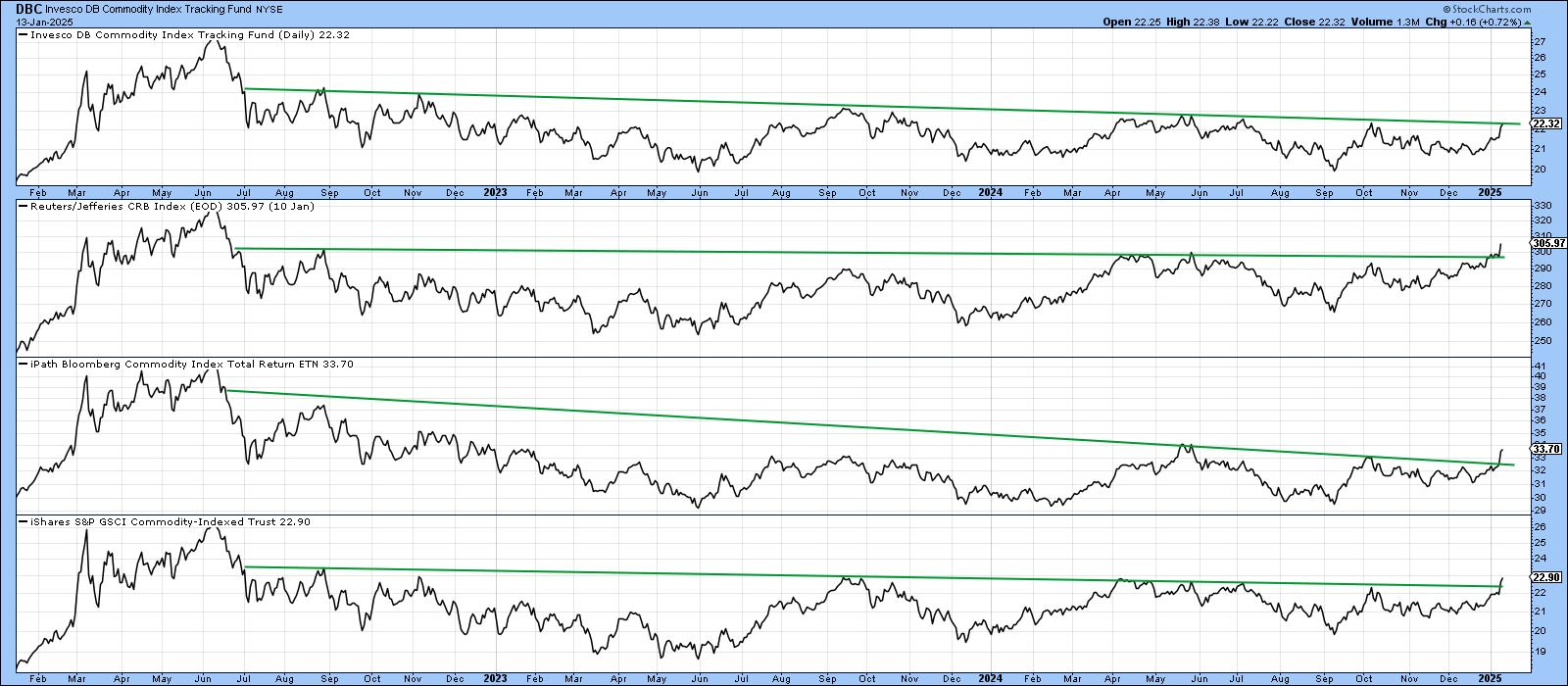

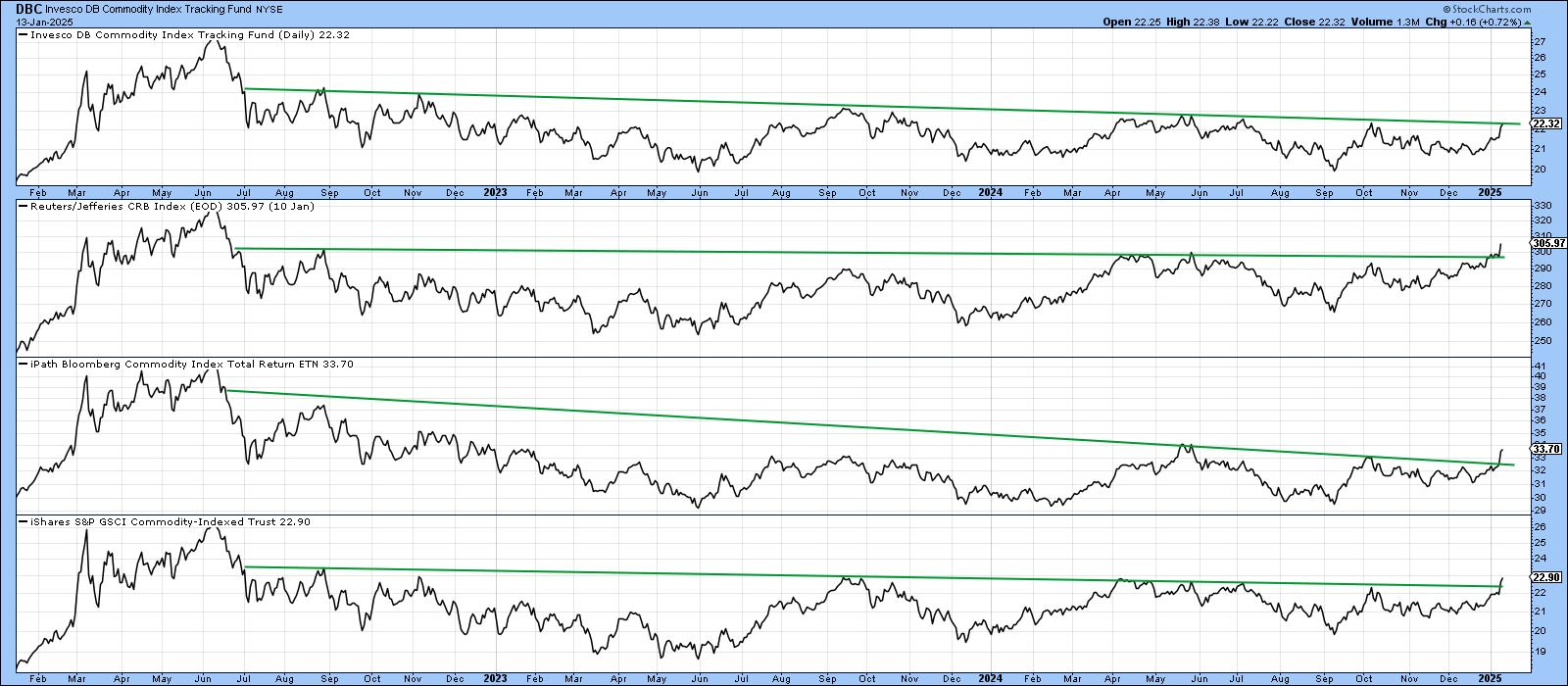

One Small Push by Commodities Could Lead to a Giant Leap for Commoditykind

by Martin Pring,

President, Pring Research

That may seem like a strange title, but it is intended to make the point that commodities look as though they are in the process of breaking out. Furthermore, this breakout, if successful, would jump-start a finely balanced long-term technical position into a primary bull market, all courtesy of our...

READ MORE

MEMBERS ONLY

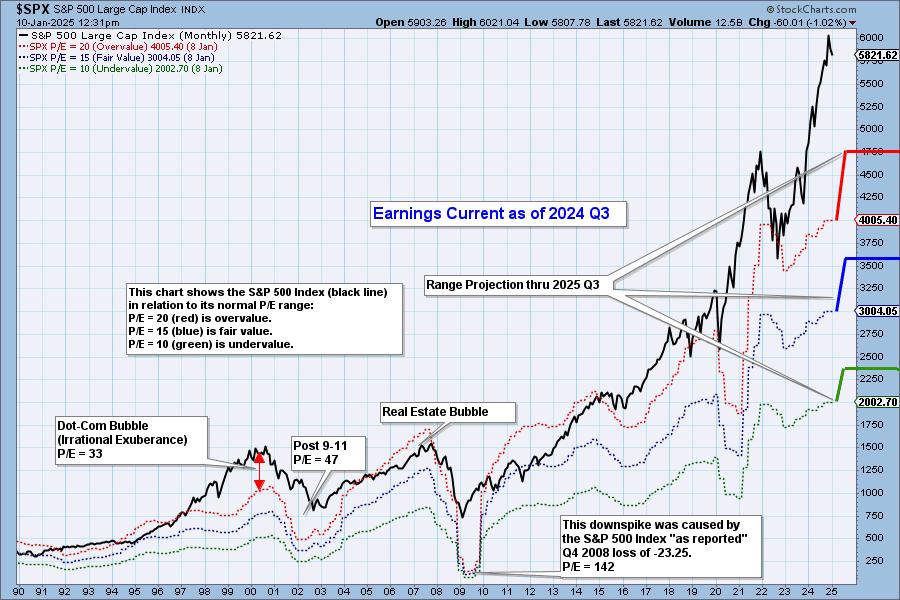

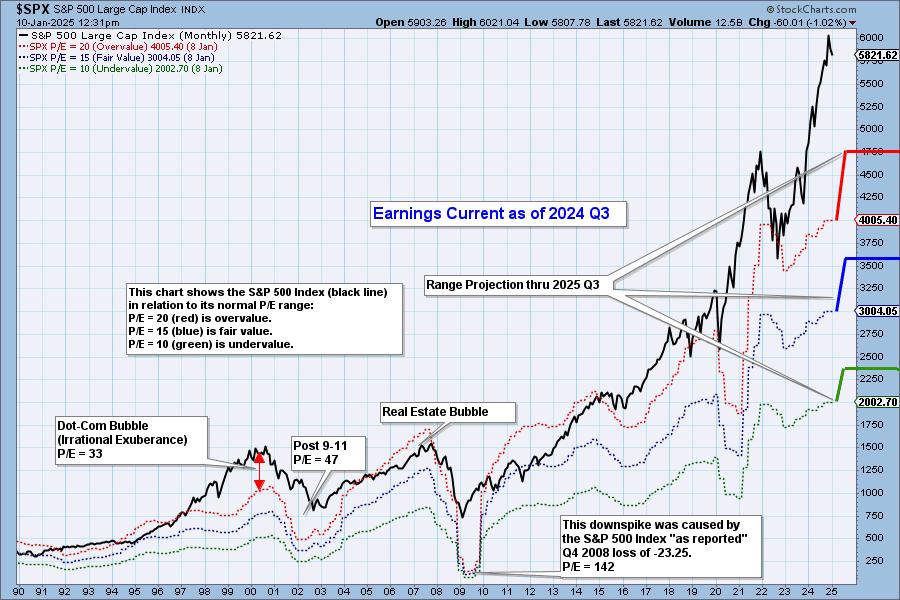

S&P 500 Earnings 2024 Q3: Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2024 Q3, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

When to Pull the Trigger: Identifying the BEST Entry Point

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shares how to identify the best entry point by using two timeframes, Moving Averages, MACD and ADX. He shows two different examples of when to pull the trigger. Joe highlights weakness in the Large Cap universe, and finally goes through the symbol requests that...

READ MORE

MEMBERS ONLY

Stock Market Sell-Off: Is the Bull Market Over?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes got a bearish jolt on Wednesday.

* Gold, silver, and cryptocurrencies joined the equity selloff.

* Treasury yields and the US dollar jump higher.

Uncertainty in the stock market makes it difficult to make investment decisions. When investors sell off stocks, everyone follows without giving it...

READ MORE

MEMBERS ONLY

Bearish Formation Threatens Gold's Advance

by Carl Swenlin,

President and Founder, DecisionPoint.com

After the November pullback, GLD began to rally again. This week, on Wednesday, price exceeded the nearest November top, which made official the new rising trend from the November low. Brief celebration ends the following day as GLD tops, setting the top boundary for a bearish rising wedge formation. Rising...

READ MORE

MEMBERS ONLY

Stock Market Sells Off Ahead of CPI: Charts You Should Be Watching

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 and Nasdaq Composite are inching toward key support levels.

* Gold prices have risen on news of China's central bank's decision to buy gold.

* NVDA is under investigation for antitrust activities, and its stock price is declining.

The Tuesday afternoon...

READ MORE

MEMBERS ONLY

Options Trade Ideas YOU NEED to SEE!

by Tony Zhang,

Chief Strategist, OptionsPlay

Looking for options trade ideas? In this video, Tony presents some of the best options trading strategies! After discussing special 0DTE strategies, the big picture, and individual sectors and industries, Tony covers bullish and bearish ideas for stocks including NVDA, SHOP, GOOGL, META, CAT and many more.

This video premiered...

READ MORE

MEMBERS ONLY

Best Bullish and Bearish OptionsPlay Ideas for the Week!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony shows how he starts his week with a clear technical and fundamental perspective of the stocks he's likely going to enter, and of options positions throughout the week, and how you can apply that yourself. Tony shares bullish (NVDA, DIS, SHOP) and bearish (AAPL,...

READ MORE

MEMBERS ONLY

OptionsPlay: Macro Market Outlook and Options Strategies

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, and shares his top bearish and bullish options trading ideas. He talks growth vs. value, commodities, bonds, the Dollar Index, sectors like homebuilders and semiconductors, and stocks like NVDA, DIS, INTC, and more.

This video premiered on November 26,...

READ MORE

MEMBERS ONLY

Market Movements Today: Investors Rejoice as Stocks Rally, Bitcoin and Gold Backslide

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks and bond prices rallied on Monday in response to President-elect Trump's pick for Treasury Secretary.

* Gold and oil prices fell steeply as concerns of geopolitical risks ease.

* Small and mid-cap stocks were the leaders in today's equity rally.

It's a short...

READ MORE

MEMBERS ONLY

An All-Around Rally: Navigating Stocks, US Dollar, Gold, and Bitcoin Price Action

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader equity indexes ended the week on a positive note, with small- and mid-caps gaining momentum.

* Gold regained its bullish momentum, and the US dollar surged.

* Bitcoin skyrocketed and crossed the 10K level, but closed lower.

The last full trading week before the Thanksgiving holiday has ended on...

READ MORE

MEMBERS ONLY

Bonds Get Death Cross SELL Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today, the 20-Year Bond ETF (TLT) 50-day EMA crossed down through the 200-day EMA (Death Cross), generating an LT Trend Model SELL Signal. This was the result of a downtrend lasting over two months. We note that the PMO has been running flat below the zero line for a month,...

READ MORE

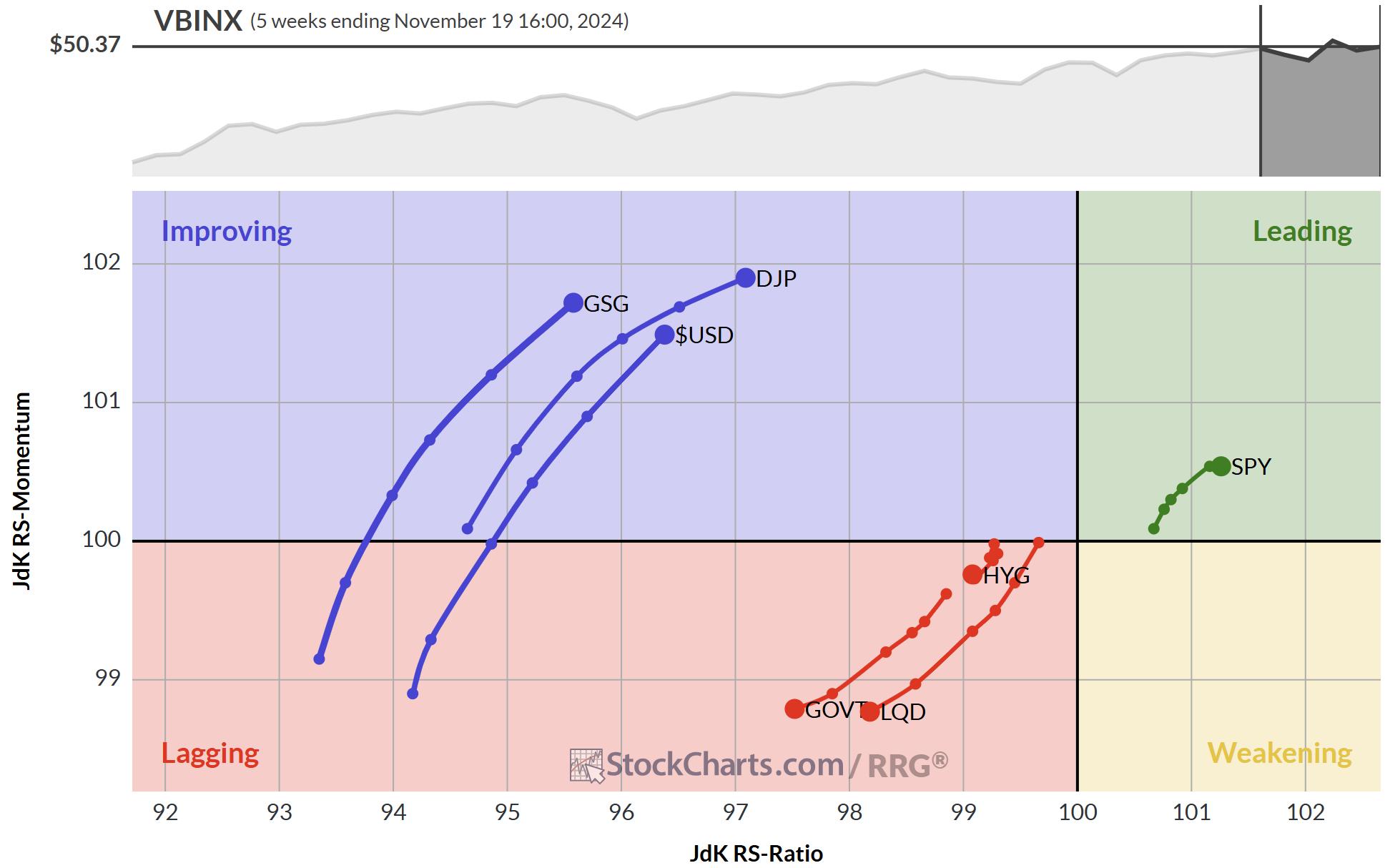

MEMBERS ONLY

Is the USD Setting Up for a Perfect Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Despite a lot of turmoil, SPY continues to show strong rotations on both weekly and daily RRGs.

* Rising yields have not damaged the stock rally yet.

* Stock/Bond ratio remains strongly in favor of stocks.

After the election, things have hardly settled in the world. New developments in...

READ MORE

MEMBERS ONLY

Macro Market Outlook and Best Options Trade Ideas!

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, where he shares his top bearish and bullish options trading ideas, These include Disney (DIS), Shopify (SHOP), Intel (INTC), Adobe (ADBE), and Apple (AAPL). He explores growth vs. value, current sector rotation, key earnings, and more.

This video premiered...

READ MORE

MEMBERS ONLY

It's GAME ON for These Stocks

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows a specific trade setup in multiple timeframes that identifies the start of an important trend. He explains the 4 keys to this setup and shows 5 examples of stocks meeting the criteria right now. Joe then covers numerous indices, commodities, 10-year Rates, and...

READ MORE