MEMBERS ONLY

A Simple Candle With BIG Meaning

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows a specific candlestick pattern that, when it develops at the right time, can signal the start of a new upleg. He uses NVDA, MSFT and GLD to explain how this can setup at different times and can give a timely signal to look...

READ MORE

MEMBERS ONLY

How to Trade Gaps Up (and Down) After Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen shares how the markets trade right before the elections, and also reviews the move in Tesla (TSLA) after reporting earnings. She shares examples of what to watch for if your stock is due to report earnings - and what to do if it...

READ MORE

MEMBERS ONLY

Election Season: Keep Calm and Optimize Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks gained some ground this week after better-than-expected earnings from Tesla.

* US Treasury yields continue to rise.

* Bullish momentum keeps gold prices rising higher.

Although earnings season is in full swing, trading volume has been relatively light this week. Perhaps investors are waiting for the stock market...

READ MORE

MEMBERS ONLY

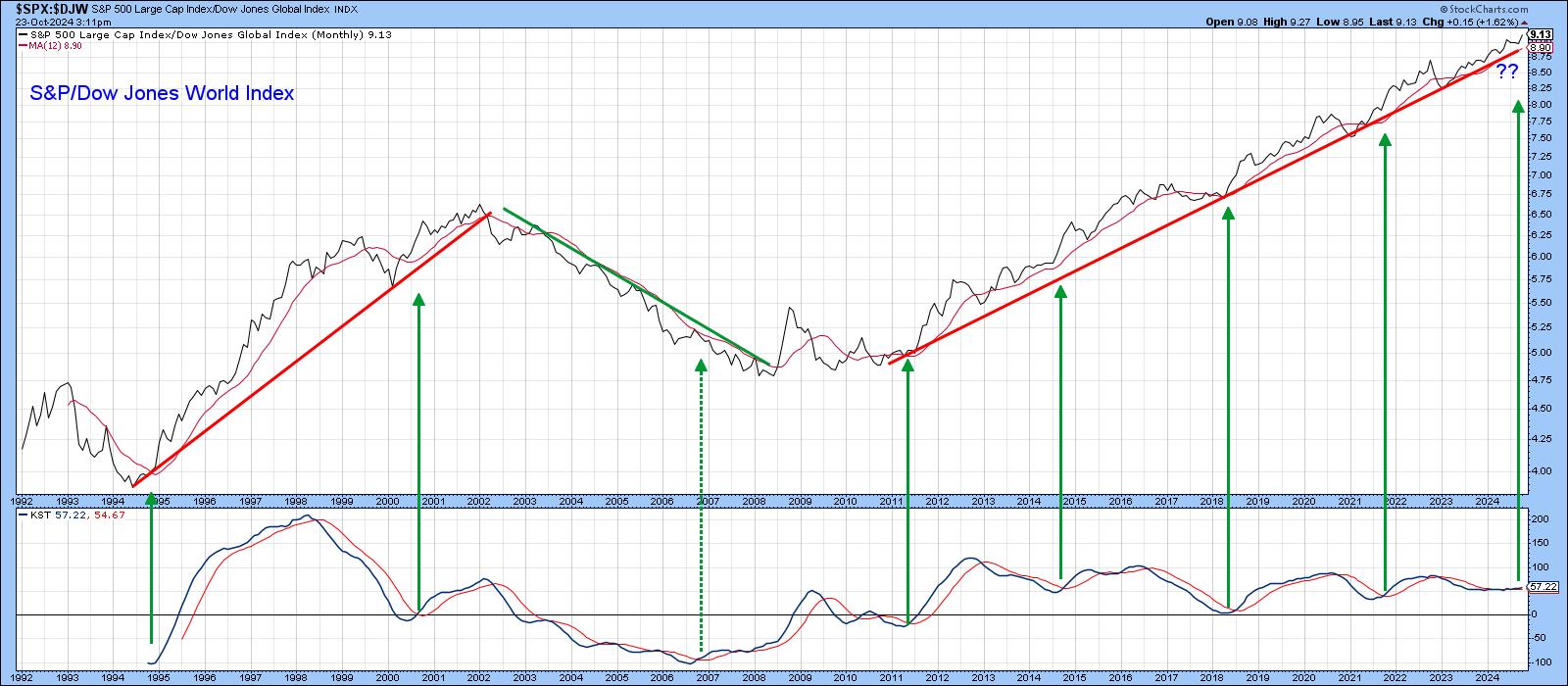

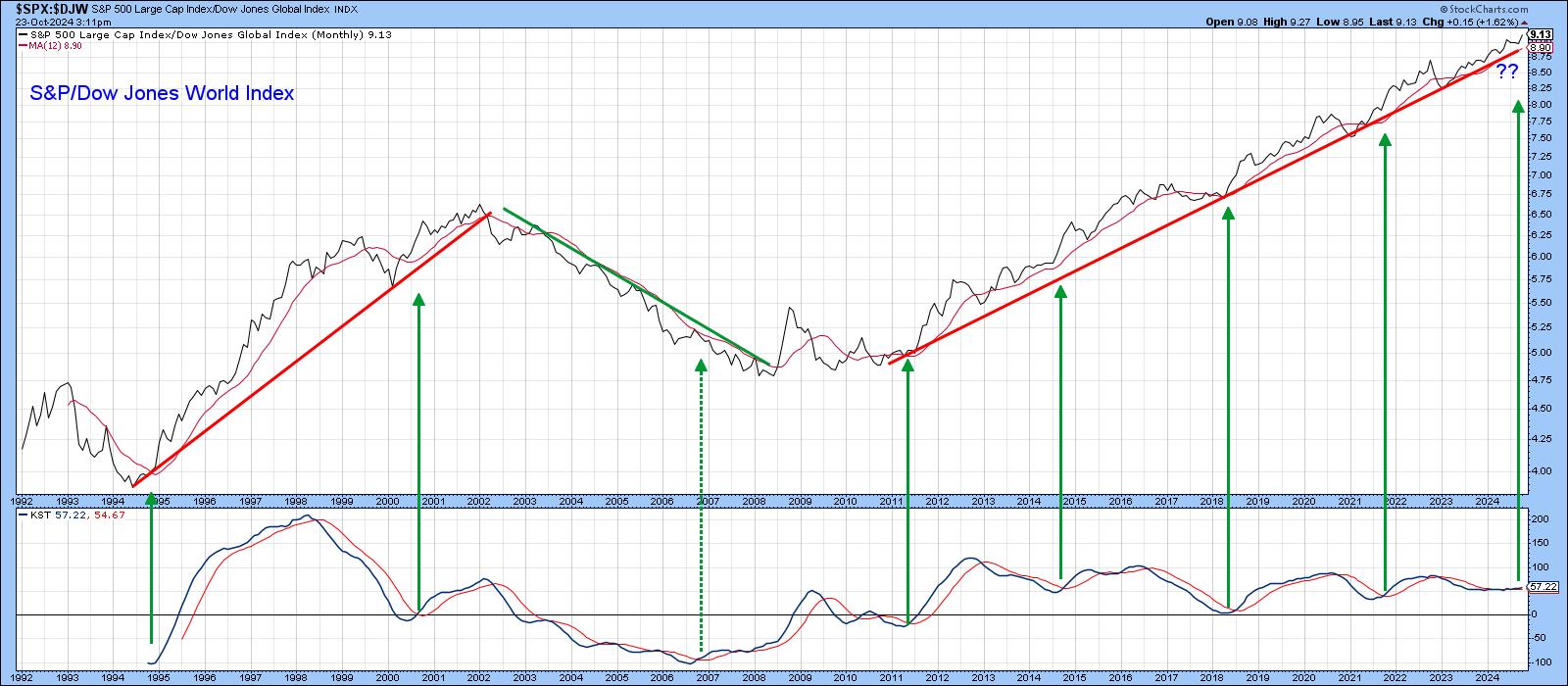

This Stock Market Will Likely Outperform the World Index, But Could Be Outshone by Something Completely Different

by Martin Pring,

President, Pring Research

Since 2011, the US stock market, represented by the S&P Composite, has outperformed the world. In the last couple of weeks or so, it has managed to break out from a trading range in its relationship with the rest of the world and looks headed even higher on...

READ MORE

MEMBERS ONLY

A Strong Week: Stocks, Gold, and Crypto's Robust Performance

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 and Dow Jones Industrial Average closed at record highs.

* Gold prices are on fire, closing at a record high.

* Bitcoin breaks out of a consolidation pattern.

Despite a light economic data week, the stock market continued its rally, with the S&P...

READ MORE

MEMBERS ONLY

Is This Still a Bull Market? | Larry's "Family Gathering" October 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Are we still in a bull market? That's a key question Larry considers in his final "Family Gathering" video, examining all the information available and what kind of conclusions about the state of the market we can draw from it.

Larry begins with a careful market...

READ MORE

MEMBERS ONLY

Signal Scoreboard As Good As It Gets

by Carl Swenlin,

President and Founder, DecisionPoint.com

At DecisionPoint, we track intermediate-term and long-term BUY/SELL signals on twenty-six market, sector, and industry group indexes. The long-term BUY signals are based upon the famous Golden Cross, which is when the 50-day moving average crosses up through the 200-day moving average. (We use exponential moving averages -- EMAs....

READ MORE

MEMBERS ONLY

The Next Big Move in Yields May Be Different Than You Think

by Martin Pring,

President, Pring Research

Below, Chart 1 shows a weekly plot for the 30-year yield, where we can see a perfectly formed top whose completion was followed by a negative 65-week EMA crossover. At the time of the breakdown, there were few grounds for suspecting a false break. However, in the last couple of...

READ MORE

MEMBERS ONLY

What's Wrong With This SPX Breakout?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe presents the price pattern to follow the recent breakout in the S&P 500. He discusses narrow range bars, wide range bars and when they are important. Joe then explains what needs to take place now to either confirm a breakout or...

READ MORE

MEMBERS ONLY

Oil Prices Soar Amid Middle East Tensions – What's Next for Gas Prices?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Crude oil prices spiked, largely due to tensions in the Middle East.

* Gasoline prices are following crude oil prices.

* An analysis of the charts of crude oil and gasoline prices show potential trading opportunities.

Monday saw something of a bloodbath on Wall Street, with the Dow ($INDU) plunging...

READ MORE

MEMBERS ONLY

Did We Just See a False Breakdown in Crude Oil?

by Martin Pring,

President, Pring Research

Using West Texas Crude, Chart 1 features one of my favorite techniques for identifying changes in long-term trends, which is simply a PPO using the 6- and 15-month parameters. When it is above zero, it's bullish, and when below, bearish. The pink shading indicates bearish periods, and the...

READ MORE

MEMBERS ONLY

Stocks Soar, Energy Prices Spike: Are Geopolitical Tensions to Blame?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The macro picture of the US economy remains strong with the broader equity indexes in an uptrend.

* There has been some rotation in the sectors with Energy taking the lead as a result of rising crude oil prices.

* Use the StockCharts MarketCarpet to select stocks for your ChartLists....

READ MORE

MEMBERS ONLY

Gold Price Surge: What Goldman Sachs' $2,900 Forecast Means for Investors

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Goldman Sachs just raised their price target for gold to $2,900 an ounce.

* Goldman Sachs' price target roughly equals $280 in SPDR Gold Shares ETF (GLD).

* GLD could have more room to run.

Here's the issue with gold: it's difficult to find...

READ MORE

MEMBERS ONLY

These 4 Chinese Stocks are Worth a Look

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe explains how to use two timeframes to identify 2 important characteristics of a great setup. For examples, he shares a few Chinese stocks that are showing great strength to the upside and what levels to watch for a pullback. Joe also covers the...

READ MORE

MEMBERS ONLY

With 2024 Q2 Earnings In, Market Remains Very Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2024 Q2, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

Traders are Eyeing These Metals After China's Big Economic Shift: Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Metals appear to be reacting bullishly after China injected more stimulus into its economy.

* Gold, silver, and copper are displaying unique patterns and structures.

* Keep an eye on momentum for clues as to each metal's likely move within the context of its current pattern.

China'...

READ MORE

MEMBERS ONLY

Are Lower Interest Rates Bad For Workers? | Focus on Stocks: October 2024

by Larry Williams,

Veteran Investor and Author

The common economic perception is that lower interest rates are good for business, which, in turn, means good for job growth. The following charts will turn that idea upside down and inside out. Keep in mind there is no chart fancy-dancing going on here; I am just presenting the last...

READ MORE

MEMBERS ONLY

Stock Market Regains Bullish Edge: Can Geopolitical Tensions Change Its Direction?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market got an influx of positive news, bringing bullish momentum.

* The Dow Jones Industrial Average closed at a record high on Friday.

* Investors are rotating out of mega-cap tech stocks and into other areas such as precious metals, as well as China-related stocks and ETFs.

There&...

READ MORE

MEMBERS ONLY

China Stimulus Energizes Stocks, Commodities; Will The Energy Sink?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks, commodities, and crypto prices soared after China announced its stimulus package, but pulled back slightly after the news.

* Metal prices are still holding strong while oil prices pulled back.

* Escalating geopolitical tensions don't seem to be impacting the stock market much at the moment.

Tuesday&...

READ MORE

MEMBERS ONLY

Why the Stock Market is SO Confusing Right Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses current rotations in asset classes and US sectors using Relative Rotation Graphs, finding a lot of contradictory behavior. Taking a step back, he focuses on the weekly timeframe to find some more meaningful trends and shy away from day-to-day noise. He then...

READ MORE

MEMBERS ONLY

Analyzing Investor Sentiment for Gold

by Carl Swenlin,

President and Founder, DecisionPoint.com

Sentiment indicators are contrarian, meaning that when the majority of investors are bullish on a market, it is bearish for that market. Most investors are aware of several sentiment indicators that relate to the stock market, but they may not be aware that there is a sentiment indicator for gold...

READ MORE

MEMBERS ONLY

How High Can Gold Prices Go? The Tools You Need to Spot the Next Big Breakout!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold prices are soaring and are at an all-time high.

* Anticipated Fed rate cuts can send gold prices higher.

* There are two tools you can use to project gold price action in bullish and bearish scenarios.

As of Tuesday, the CME's FedWatch Tool gave a 67%...

READ MORE

MEMBERS ONLY

Four Intermarket Confidence Relationships that Aren't Confident

by Martin Pring,

President, Pring Research

Most of the primary trend indicators I follow are in a bullish mode and show few signs of flagging. That said, some intermarket relationships, which help to indicate whether the environment is risk-off or risk-on, have started to move in a risk-off direction. That's usually a bearish omen...

READ MORE

MEMBERS ONLY

Is It Time to Buy Intel?

by Carl Swenlin,

President and Founder, DecisionPoint.com

I've been around long enough to remember when Intel (INTC) was the NVIDIA of the day. Now, INTC is under severe pressure, having suspended its dividend, and is currently being considered for removal from the Dow 30 Industrial Average. Oh, how the mighty have fallen!

With INTC having...

READ MORE

MEMBERS ONLY

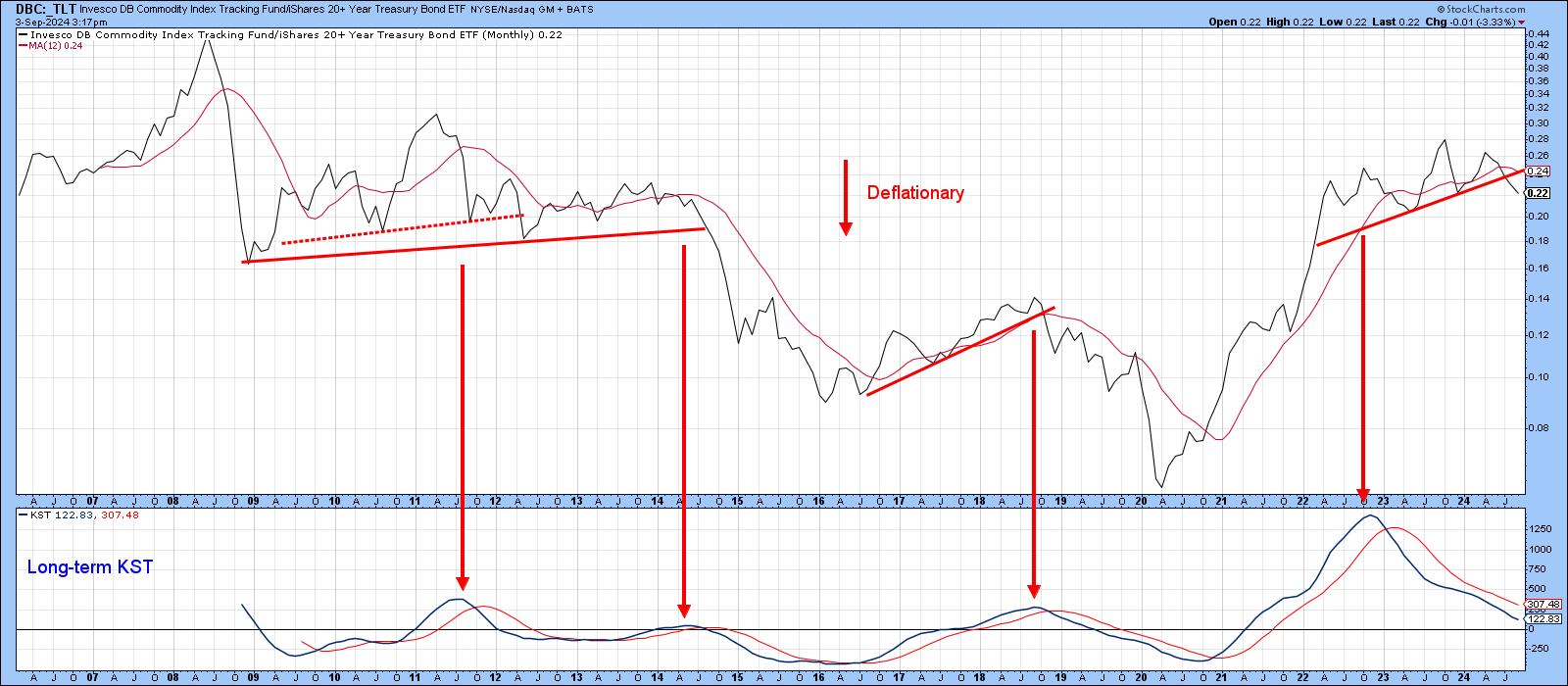

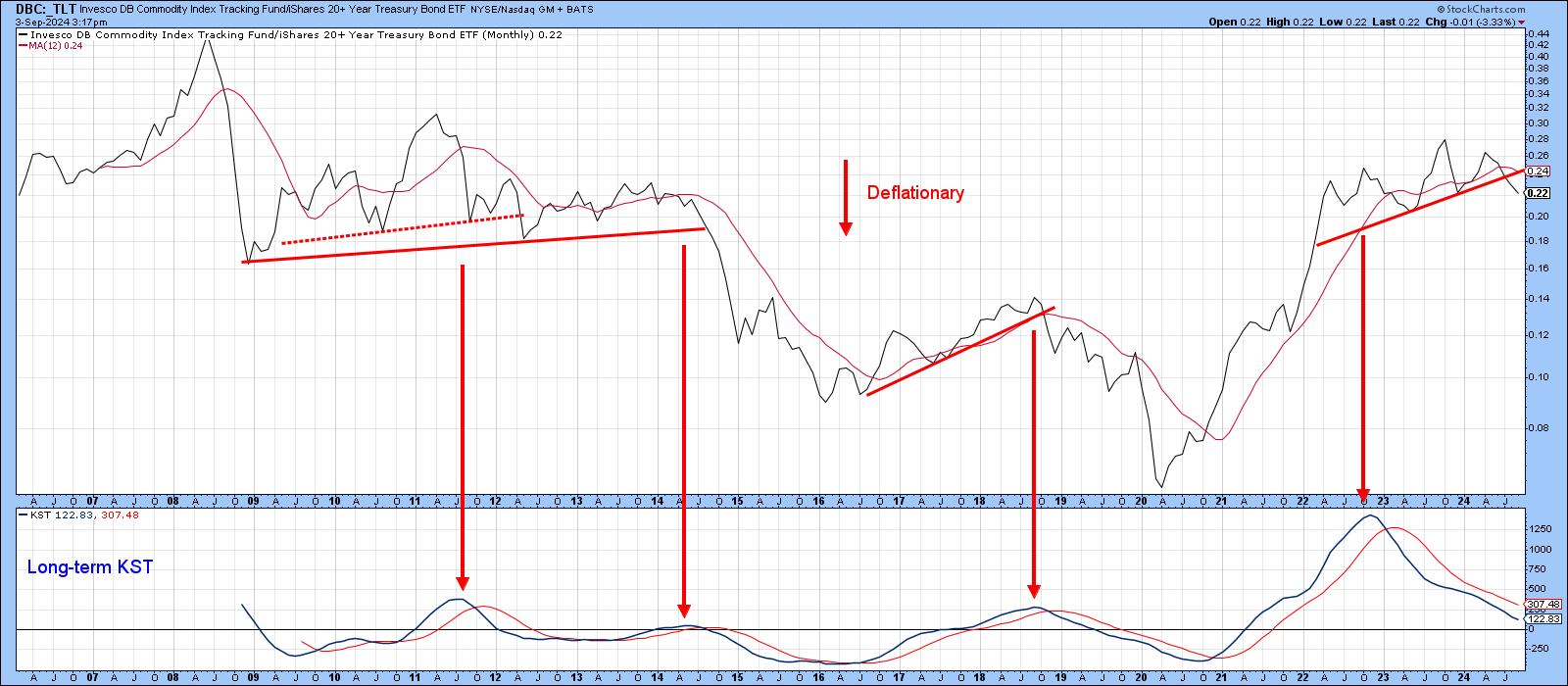

Is It Inflation or Deflation? What's in Your Wallet?

by Martin Pring,

President, Pring Research

Every business cycle has an inflationary and deflationary part, and it's very important for both traders and investors at least to try to have some understanding which has the upper hand at any particular point in time.

For example, when the economy is in a slowdown or recessionary...

READ MORE

MEMBERS ONLY

A Deeper Dive into the Dollar | Focus on Stocks: September 2024

by Larry Williams,

Veteran Investor and Author

Let's get this out of the way...

In our last Family Gathering, I announced I am doing my best to retire. That means we will have our September Family Gathering, the October newsletter and mid-month Family Gathering. After that, "Focus on Stocks" is all over.

I...

READ MORE

MEMBERS ONLY

A New Way of Forecasting Crude Oil | Larry's "Family Gathering" August 22, 2024 Recording

by Larry Williams,

Veteran Investor and Author

What to make of the market as we near the end of August? Larry presents his thoughts in this edition of the Family Gathering video.

In this month's Family Gathering video, Larry begins by presenting a new way of forecasting for Crude Oil. After that, he follows up...

READ MORE

MEMBERS ONLY

Gold Miners' Performance vs. Gold -- Does It Say Sell Gold?

by Carl Swenlin,

President and Founder, DecisionPoint.com

In Monday's DecisionPoint Trading Room video, we were asked why we cover Gold Miners (GDX) as well as Gold (GLD). There are two reasons:

1. Some people prefer to own the commodity, Gold, and others prefer to own an operating company that benefits from the price of Gold,...

READ MORE

MEMBERS ONLY

This Market is On Track for a 45-Year Breakout

by Martin Pring,

President, Pring Research

It's not very often that any market experiences a 10-year breakout, let alone a 45-year one. That, however, is what Chart 1 says is about to materialize for the inflation-adjusted gold price.

Since the chart is based on monthly data, we will not know for sure until the...

READ MORE

MEMBERS ONLY

How ADX Stage Analysis Can Make You a BETTER Trader!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows the four stages a stock or market can be in at any time. He explains each stage and how ADX & Volatility can help define each stage. He then shows what stage the SPY is right and why the bias is still...

READ MORE

MEMBERS ONLY

The Growth Trade is Back!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps an epic rally in mega cap growth stocks, with NVDA up over 6% and META threatening a new 52-week high. Dave highlights how gold and bond prices continue to rise in the face of stronger stocks, and breaks...

READ MORE

MEMBERS ONLY

CRITICAL Week Ahead for S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses various rotations using Relative Rotation Graphs, starting at asset class level and then moving to sectors. Julius zooms in on the industries of two sectors to get an idea of where pockets of out-performance may exist in the current market. He then...

READ MORE

MEMBERS ONLY

Why Bonds and Gold Are Outperforming Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy Monday for the equity markets, as gold tests new all-time highs and interest rates continue to plummet. He highlights the stock to bond ratio, revisits the classic 60:40 ratio favored by investors, and breaks down...

READ MORE

MEMBERS ONLY

Time for a Pause That Refreshes Stocks and Gold?

by Martin Pring,

President, Pring Research

Most weekends, I run through a chart list featuring weekly bars and candlesticks of bonds, stocks and commodities to see if any one or two bar patterns or candlestick formations have developed. Last week produced a crop of bearish messages from the major averages and some sectors. Before you rush...

READ MORE

MEMBERS ONLY

CrowdStrike: Did On-Balance Volume See the "Largest IT Outage In History" Coming?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Friday's CrowdStrike software disaster has been described as "the largest IT outage in history," and it brought home just how vulnerable the planet is to itty-bitty coding errors. We were busy publishing the DecisionPoint ALERT Weekly Wrap, so I didn't have a chance to...

READ MORE

MEMBERS ONLY

Election Year Patterns | Larry's "Family Gathering" July 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

What stocks right now does Larry have his eye on? Which ones is he saying "see you later... for now"? And which ones does he not like very much at all?

In this month's Family Gathering video, Larry presents an in-depth discussion on the patterns we...

READ MORE

MEMBERS ONLY

Dow Theory Bull Confirmed! What Happens Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave comments on the Newer Dow Theory signal, improving market breadth conditions, impact of lower interest rates, and key levels to watch for GLD, UNH, CAT, and BAC. He also breaks down today's rally driven by small caps...

READ MORE

MEMBERS ONLY

Citi Predicts $3,000 Gold by 2025 — What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* What the Fed does in the coming months could dramatically affect the direction of gold prices

* While seasonality suggests a shift from slump to strong performance for gold, it will likely coincide with the Fed's rate decisions in the coming months

* Goldman Sachs projects gold to...

READ MORE

MEMBERS ONLY

They Say Three Steps and Stumble; This Market is Taking a Fourth

by Martin Pring,

President, Pring Research

The legendary technician Edson Gould had a rule that, after three discount rate hikes, the stock market would be likely to stumble. That doesn't apply to emerging markets, but it did make a catchy headline. What is relevant to the iShares MSCI Emerging Market ETF (EEM) is that,...

READ MORE

MEMBERS ONLY

Silver's AI Boom: The Next Big Trade You Need to Know About

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Silver may be the next big "AI trade"

* While silver ETFs are seeing large outflows, silver futures are telling a different story

* Understanding silver's seasonal pattern and identifying the key levels to watch are critical

Over the last few years, the "AI trade&...

READ MORE