MEMBERS ONLY

S&P 500 Earnings Results Are In for 2024 Q1 and Market Is Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2024 Q1, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

Why Technical Analysis Does NOT Work for Leveraged ETFs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on using technical indicators on leveraged and inverse ETFs like SOXL and SOXS, buying breakouts below the 200-day moving average, upside targets for gold, and whether the $USD is in a primary uptrend.

See Dave'...

READ MORE

MEMBERS ONLY

June & Gloom | Larry's "Family Gathering" June 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

June is here! Will it be bloom or gloom for the stock market?

In this month's Family Gathering video, Larry examines the current averages in the market and what the advance-decline line is telling us. He explains the Trading Day of the Month (TDOM) concept and how you...

READ MORE

MEMBERS ONLY

Bearish Divergences in 2 KEY Growth Stocks: BEWARE!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a fresh new all-time high for the S&P 500, a concerning "hanging man" candle for the SPY, and troubling bearish divergences on the charts of AMZN and GOOGL. He also breaks down short-term and...

READ MORE

MEMBERS ONLY

The Next Direction for Interest Rates Is...?

by Martin Pring,

President, Pring Research

In most cycles, central banks around the world raise and lower short-term interest rates in a rough synchronization. Last week, the European and Canadian central banks began lowering their rates, and the British are expected to follow suit this week. Most observers of the US expect the Federal Reserve to...

READ MORE

MEMBERS ONLY

S&P 500 Still Bullish: This Is What You Should Watch For

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market unfazed by today's jobs data

* Yields rise, US dollar rises, and equities close the week relatively flat

* Market breadth continues to be strong, indicating the stock market is still chugging along

It was a bit of a seesaw week in the stock market, but,...

READ MORE

MEMBERS ONLY

Technology Sector Participation Is Fading

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Technology Sector (XLK) continues to dominate and drive the rally, but fewer and fewer stocks within the sector are participating in the rally. We know this because our Silver Cross Index (SCI), which shows the percent of stocks in the Technology Sector with Silver Cross BUY Signals (20-day EMA...

READ MORE

MEMBERS ONLY

3 Keys to Finding the Strongest Trends

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the three keys he hunts for when identifying reversals and strong trends, giving a few examples and then showing one that is developing now. He then highlights similar techniques he uses while reviewing the Sectors. In...

READ MORE

MEMBERS ONLY

Textbook Double Top on Silver (SLV)

by Erin Swenlin,

Vice President, DecisionPoint.com

Gold is struggling, moving mostly sideways. Silver has technically been moving sideways as well, only it has formed a textbook double top chart pattern. Textbook double tops show even tops and a clear confirmation line delineated at the middle of the "M" formation. What is good about these...

READ MORE

MEMBERS ONLY

The Sky is Not Falling | Focus on Stocks: June 2024

by Larry Williams,

Veteran Investor and Author

A note to the Cassandras who are now out in full force...

Led by "Rich Dad, Poor Dad" Robert Kiyosaki's warning of "Be careful, it's the biggest crash in world history," the bears have come out of their winter caves. "We...

READ MORE

MEMBERS ONLY

From Summer Doldrums to Year-End Surge: How to Profit from Seasonal Trends in Precious Metals and Bitcoin

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Bitcoin, gold, and silver exhibit similar seasonality patterns.

* Bitcoin, gold, and silver prices largely reflect economic expectations.

* If you're bullish on bitcoin, gold, or silver, there are critical levels to watch.

Safe-haven investments like gold, silver, and now Bitcoin have had a bumpy and uncertain rise,...

READ MORE

MEMBERS ONLY

Three Stock Ideas as S&P 500 Treads Water

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Tony Zhang of OptionsPlay. Tony shares three stock ideas showing favorable risk/reward characteristics as the S&P 500 index treads water above support at 5250. David describes the deteriorating market breadth conditions and reviews charts of...

READ MORE

MEMBERS ONLY

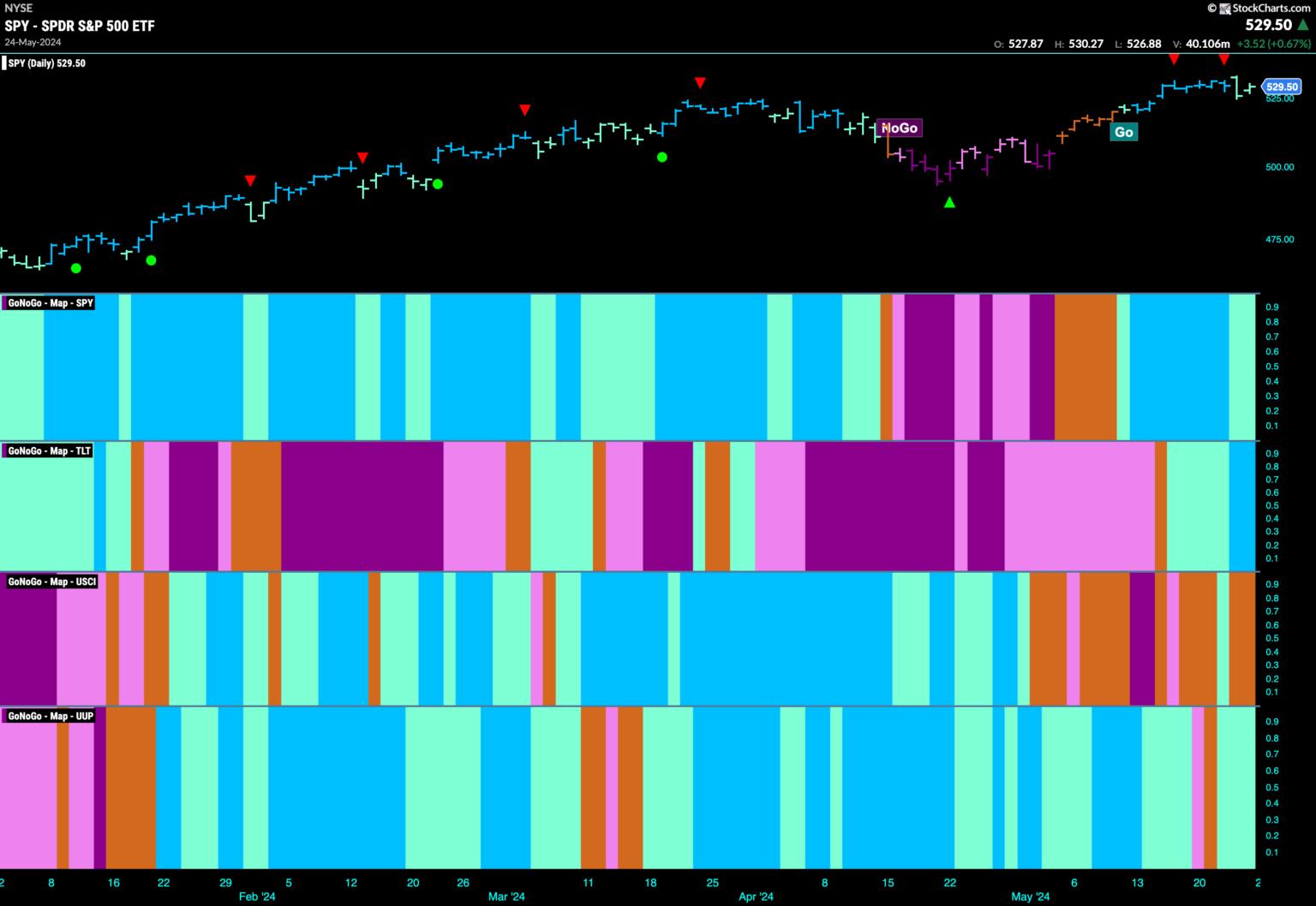

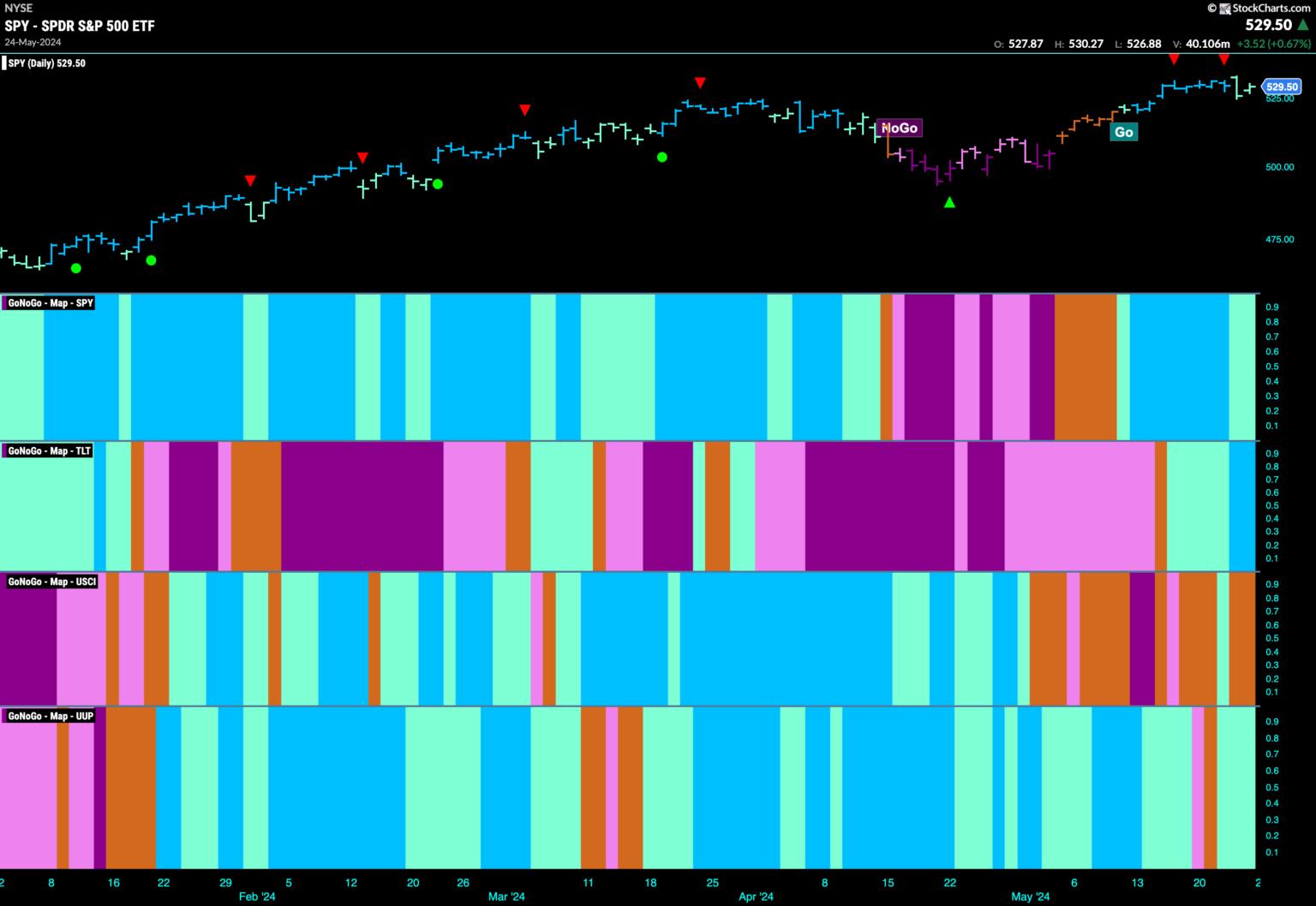

EQUITIES REMAIN IN "GO" TREND WITH SPARSE LEADERSHIP FROM TECH AND UTILITIES

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Relative Strength

* Market Trend

* Narrow Breadth

Good morning and welcome to this week's Flight Path. We saw some weakness this week as price pulled back a little from all time highs. Momentum cooled, we saw this in the form of Go Countertrend Correction Icons (red arrows)...

READ MORE

MEMBERS ONLY

These Commodities are On Track for Mega Breakouts in May

by Martin Pring,

President, Pring Research

It's rare when you see a multi-year breakout take place, but, when several materialize more or less at the same time, that should really get our attention. That's not simply because of the opportunities being presented, but also because several simultaneous breakouts indicate a broader participation...

READ MORE

MEMBERS ONLY

Market Looks Toppy

by Carl Swenlin,

President and Founder, DecisionPoint.com

In spite of the massive celebration of Nvidia's earnings report, we are seeing troublesome signs that the market is in the process of putting in a top. There are double top formations on six of the nine major indexes we follow, but the three indexes that haven'...

READ MORE

MEMBERS ONLY

Thrilling Week for the Stock Market: Dow Jones Makes Strong Close Above 40,000 for the First Time

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dow Jones Industrial Average closes above 40,000 for the first time

* Commodities such as silver, copper, and gold are moving higher

* Volatility remains low, indicating investors are complacent

It made it! The Dow Jones Industrial Average ($INDU) closed above 40,000 for the first time, another record...

READ MORE

MEMBERS ONLY

Gold Is Doing Great!

by Carl Swenlin,

President and Founder, DecisionPoint.com

While we don't typically begin with a monthly chart, it seems like a good place to start, as most of the good news is present there.

Beginning on the left side, we can see how gold made a parabolic advance into an all-time high in 2011. Parabolic advances...

READ MORE

MEMBERS ONLY

Gold and Silver Set to Smash Records: Could 2024 Be Their Biggest Year Yet?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold and silver are on the verge of breaking out toward record highs

* Gold and silver have reached most analyst price targets, but they could rise further

* From a technical perspective, gold and silver prices could smash above resistance levels

Gold is on the verge of breaking into...

READ MORE

MEMBERS ONLY

Larry Williams: Dow 40k, Cycle Analysis, and Lessons Learned

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, legendary trader and author Larry Williams joins Dave in the StockCharts TV studio. Larry shares his latest thoughts on Dow 40K, the resilient rise of gold and precious metals, cycle analysis on the S&P 500 and crude oil,...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" May 16, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Certainty is needed for a trader's actions. Good judgment comes from experience, and experience is gained from poor judgment. The key to improving your trading is to really, truly study the losing trades.

In this month's Family Gathering video, Larry presents PPI numbers for historical buy...

READ MORE

MEMBERS ONLY

A Grand Slam: Broader Stock Market Indexes Soar to New Highs

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Dow Jones Industrial Average, and the Nasdaq Composite close at all-time highs

* Bond prices also moved higher, as did gold and silver

* The VIX remains low, indicating investors are complacent

The bull market hasn't gone anywhere. Despite of worrying about the...

READ MORE

MEMBERS ONLY

Watch for Higher Lows in These Three Tech Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

35 Years of Crude Oil Forecasting the Future | Focus on Stocks: May 2024

by Larry Williams,

Veteran Investor and Author

All You Need to Know About Crude Oil and the Future

Gold, black gold, is what Crude Oil has become. The entire world runs on energy. 98% of our cars and transportation, our lights, the device you are using to read this... virtually everything we can do is thanks to...

READ MORE

MEMBERS ONLY

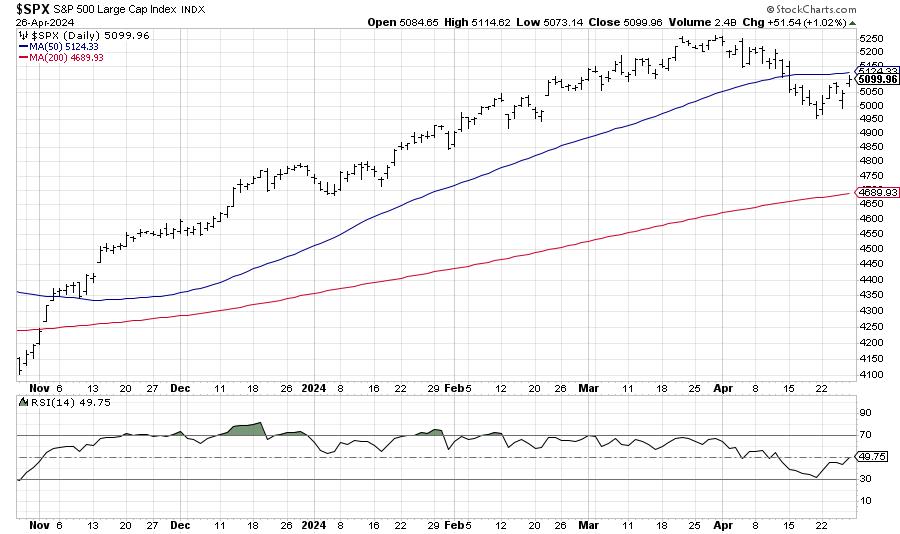

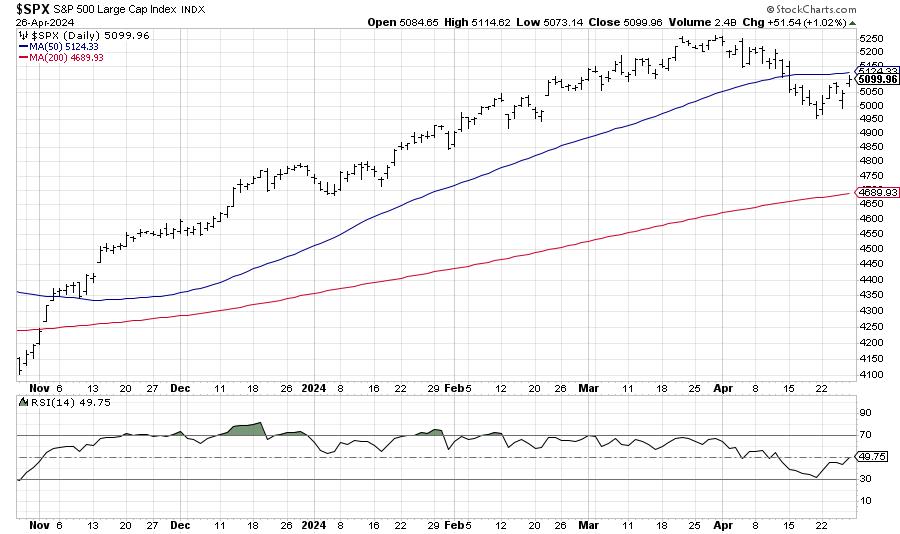

S&P 500 Makes a New All-Time High By End of June?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We've been covering the signs of weakness for stocks, from the bearish divergences in March, to the mega-cap growth stocksbreaking through their 50-day moving averages, to even thedramatic increase in volatilityoften associated with major market tops. While Q1 was marked by broad market strength and plenty of new...

READ MORE

MEMBERS ONLY

Netflix Gets Island Reversal On Earnings

by Carl Swenlin,

President and Founder, DecisionPoint.com

Netflix (NFLX) earnings were released today, and the news was good. . . except for one little thing. They also suspiciously announced that, starting next year, they would no longer be reporting subscriber metrics. That's like General Motors saying that they will no longer report how many cars and trucks...

READ MORE

MEMBERS ONLY

Charts Flashing "No Go" for S&P 500!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Tyler Wood, CMT of GoNoGo Charts. Tyler walks through their proprietary momentum model which confirms a bearish rotation for the major equity benchmarks yet a bullish rotation for the commodity space. David walks through key earnings names...

READ MORE

MEMBERS ONLY

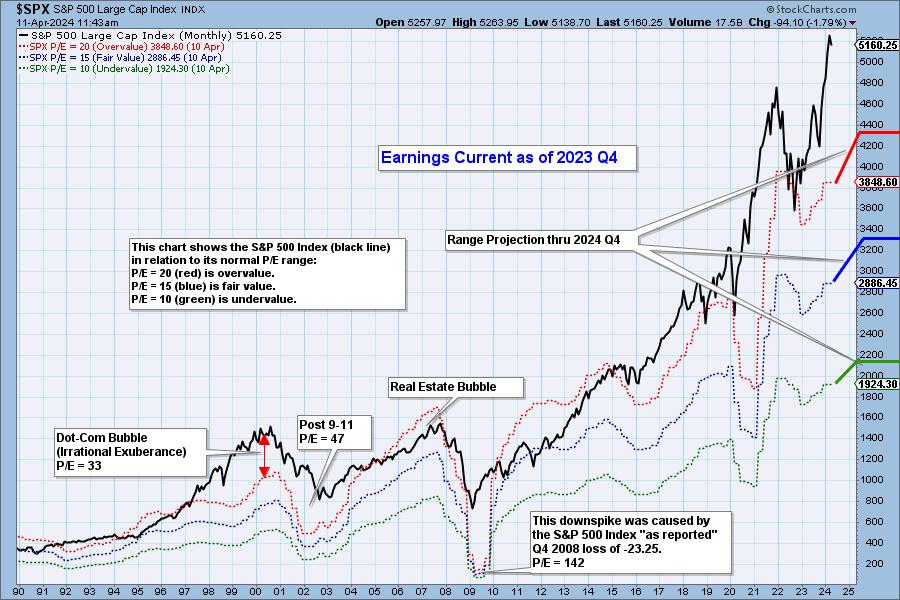

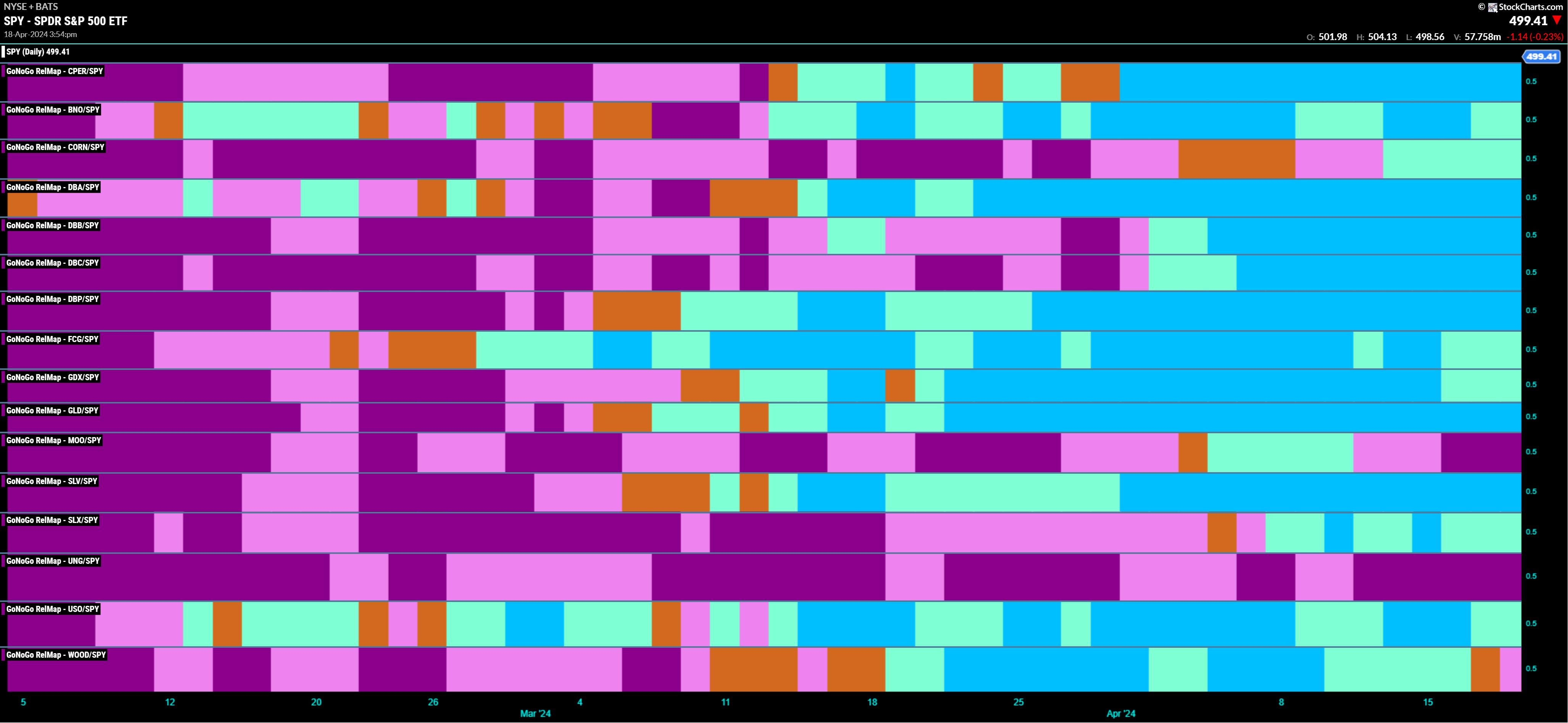

Rocks over Stocks | GoNoGo Show 041824

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* New Risk Off Environment for Equities

* Commodities Leading

The S&P500 trend conditions have reversed into "NoGo" and strengthened to purple bars. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" April 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Right now, there's lots of room for a downside in the market. Do we really want a rate cut?

In this video, Larry talks about past interest rate cuts from the Fed, and what happens to stock prices as a result. Historically, we've seen these cuts...

READ MORE

MEMBERS ONLY

Precious Metals Reach Exhaustion

by Martin Pring,

President, Pring Research

In the last couple of weeks, I have been reading stories about shoppers picking up gold bars in, of all places, Costco. According to Gemini, the AI branch of Google, "Reports indicate they may be selling up to $200 million worth of gold bars every month."

Normally, thin...

READ MORE

MEMBERS ONLY

MEM TV: Time To SELL EVERYTHING?!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares key signals that it's time to sell a stock, using INTC as an example. She also reviews a key area of support for the markets, and new sectors that have entered a downtrend. She finishes...

READ MORE

MEMBERS ONLY

Stock Market Indexes Plunge After Hitting Resistance -- Support Levels You Need to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dow Jones Industrial Average, S&P 500, and Nasdaq Composite dropped

* Gold keeps hitting new highs

* The VIX spiked above 18 but closed at 17.31

Now that earnings season has begun, what can you expect the stock market to do, especially after its stellar Q1 run?...

READ MORE

MEMBERS ONLY

From Relic To Reckoning: Can Gold Surge To $3,000?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold is at record highs with retail investors buying despite sky-high valuations

* Fiscal, monetary, and geopolitical uncertainties are driving this "relic" turned "alternative currency"

* The technical context reveals a few strategic insights for anyone bullish on the yellow metal

The strange thing about gold...

READ MORE

MEMBERS ONLY

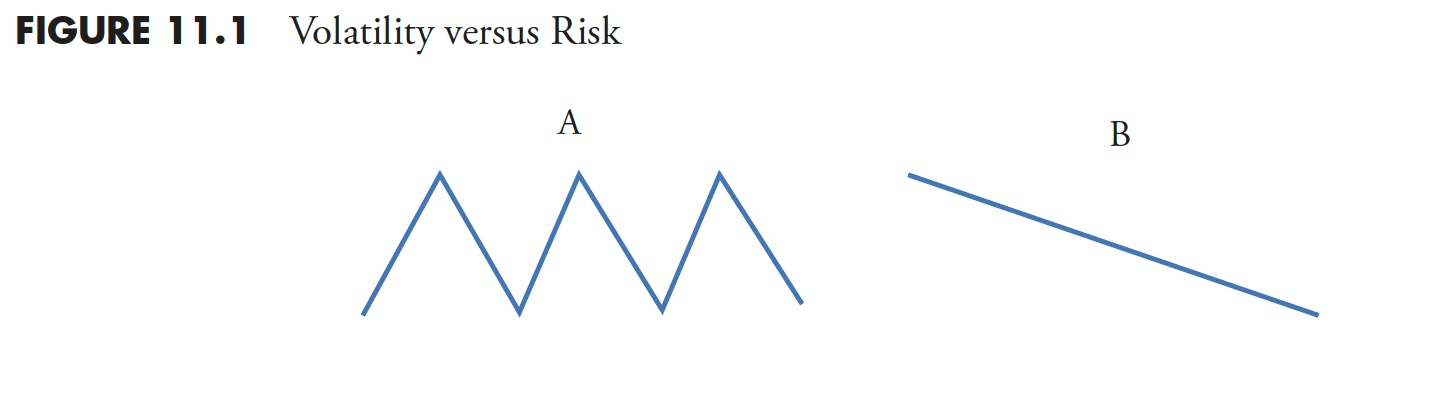

Market Research and Analysis - Part 5: Drawdown Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the sixteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

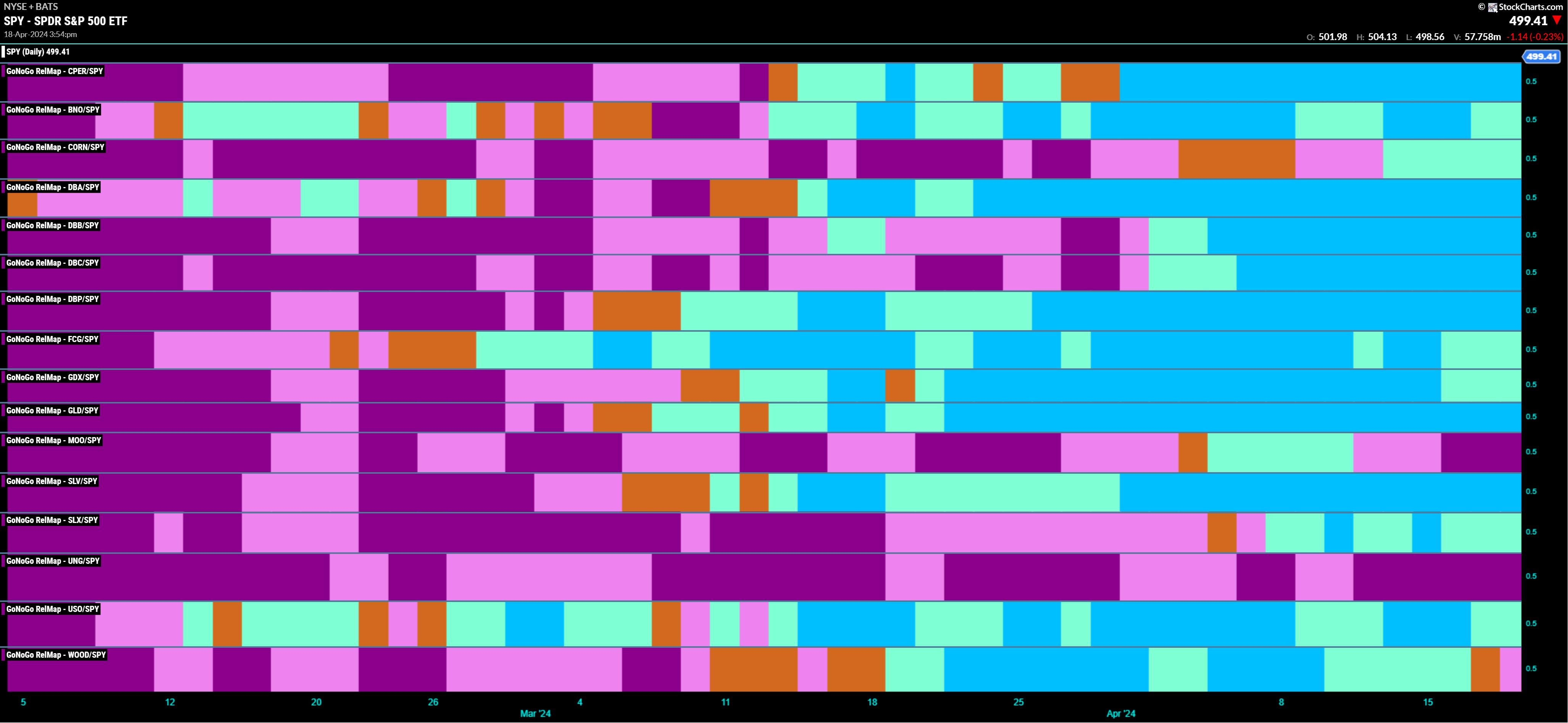

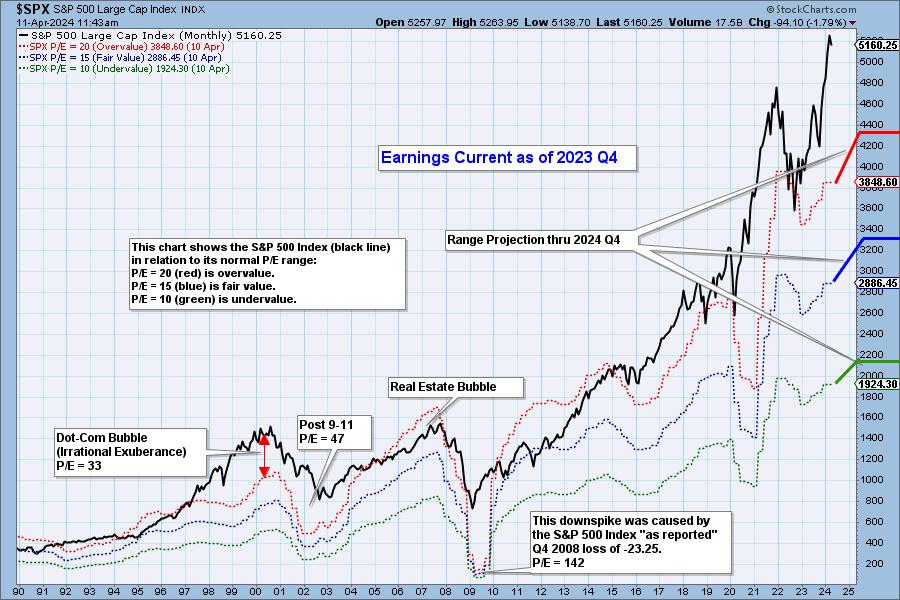

2023 Q4 Earnings Analysis and Projections Through 2024 Q4

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2023 Q4, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

Jobs In the Spotlight: Stock Market Reverses Course After Massive Selloff

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* A stronger-than-expected jobs report sent the stock market higher

* Several stocks and ETFs hit new all-time highs today

* Commodity prices continue to rise

One day doesn't make a trend—that's one lesson we learned from this week's stock market action.

The March...

READ MORE

MEMBERS ONLY

Silver's Surge: Can It Reach $50 an Ounce This Year?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Several analysts have grown exceedingly bullish on silver which has been undervalued for some time

* Price targets are now at the range of $35 to $50 an ounce

* The technical outlook presents a mixed picture, but there are a few key levels to watch if you're...

READ MORE

MEMBERS ONLY

The Stock Market's Tremendous Resilience: What This Means For Q2

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite remains unfazed about interest rates remaining higher for longer.

* Commodity prices such as oil, gold, and cocoa are rising, even though inflation seems to be cooling.

* The top S&P 500 sector performers indicate the...

READ MORE

MEMBERS ONLY

Top Two Sectors to Watch in April 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Joe Rabil of Rabil Stock Research, who shares two sectors, Energy and Materials, where he sees upside potential given the recent upswing in commodity prices. Dave speaks to the developing pullback in growth leadership names and why...

READ MORE

MEMBERS ONLY

How to Analyze Volume Trends on Multiple Time Frames

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights charts breaking above resistance levels, including Gold Shares (GLD), Phillips 66 (PSX), Capital One Fence Corp (COF), Freeport-McMoRan (FCX), and DraftKings (DKNG). Dave also interviews Buff Dormeier of Kingsview Investment Management, who shows how he uses RSI, the...

READ MORE

MEMBERS ONLY

Return of the Meme Stock Frenzy: Is Now the Time to Shift Your Investment Focus?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Wednesday's broad stock market rally shows that investors are still willing to take chances in the stock market

* Even though the stock market rallied, Communication Services and Technology were the worst performing S&P 500 sectors on Wednesday

* Gold prices have been on a tear...

READ MORE