MEMBERS ONLY

What Inflation Fear? Strong Retail Sales Fuel Growth

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps another strong up day for growth leadership names, with ULTA and NVDA powering higher after retail sales numbers pushed aside inflation fears. He notes the cautious positioning in the NAAIM Exposure Index, Bitcoin's failed attempt to...

READ MORE

MEMBERS ONLY

CRITICAL Week Ahead for S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses various rotations using Relative Rotation Graphs, starting at asset class level and then moving to sectors. Julius zooms in on the industries of two sectors to get an idea of where pockets of out-performance may exist in the current market. He then...

READ MORE

MEMBERS ONLY

1-2-3 Reversal Pattern: What It Is and How to Use It

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe explains the 1-2-3 reversal pattern, its criteria, and what it will take for QQQ to complete the pattern. He also discusses how the pattern is not always as clean as we would like. Joe then shares a few Crypto markets which are starting...

READ MORE

MEMBERS ONLY

CrowdStrike: Did On-Balance Volume See the "Largest IT Outage In History" Coming?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Friday's CrowdStrike software disaster has been described as "the largest IT outage in history," and it brought home just how vulnerable the planet is to itty-bitty coding errors. We were busy publishing the DecisionPoint ALERT Weekly Wrap, so I didn't have a chance to...

READ MORE

MEMBERS ONLY

Important Market Breadth Indicators to Watch: Making Sense of Three Consecutive Down Days

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Three consecutive declining days in the stock market increases risk appetite

* Semiconductors were the catalyst for the selloff and trading below two support levels

* Keep an eye on market breadth indicators to get indications of whether the stock market is correcting or if the selloff will be longer-term...

READ MORE

MEMBERS ONLY

Why Stocks are STILL the BEST Investment

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the markets from an asset allocation perspective using various RRGs. Stocks are (still) beating bonds, while commodities are rotating out of favor and the USD is losing steam. BTC is jumping higher off support, and the Yield Curve is steepening against...

READ MORE

MEMBERS ONLY

An Awesome Breakthrough in S&P 500 and Nasdaq: Will the Momentum Continue?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* S&P 500 and Nasdaq Composite close at record highs

* Equities, precious metals, and bonds all rise, but Bitcoin shows weakness

* Keep an eye on the Equal Weighted S&P 500 and Nasdaq breadth to get early insight into stock market direction.

If you were taking...

READ MORE

MEMBERS ONLY

One Rule to Drastically Improve Your Trading

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe uses a chart of AAPL to demonstrate how properly using a MACD and ADX indicator combo increases your chances of success. He analyzes 10-Year Yields, Bitcoin, Tesla, Datadog, and ServiceNow. Going through all the sectors, Joe explains...

READ MORE

MEMBERS ONLY

June & Gloom | Larry's "Family Gathering" June 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

June is here! Will it be bloom or gloom for the stock market?

In this month's Family Gathering video, Larry examines the current averages in the market and what the advance-decline line is telling us. He explains the Trading Day of the Month (TDOM) concept and how you...

READ MORE

MEMBERS ONLY

Bearish Divergences in 2 KEY Growth Stocks: BEWARE!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a fresh new all-time high for the S&P 500, a concerning "hanging man" candle for the SPY, and troubling bearish divergences on the charts of AMZN and GOOGL. He also breaks down short-term and...

READ MORE

MEMBERS ONLY

Bitcoin, Politics, and Profits: What You Need to Know About CleanSpark and Riot Platforms

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A presidential contender expressed a desire to mine all remaining Bitcoin in the U.S.

* 90% of Bitcoin's total supply of 21 million has been mined

* If the remaining Bitcoin gets mined, it presents an unprecedented opportunity for two of the largest Bitcoin miners in the...

READ MORE

MEMBERS ONLY

5 Simple and Powerful Uses for Moving Averages

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the five ways to use the Moving Average lines to help with decision making. He discusses how these lines can help to define trend reversals and confirmed trends, when to be on the alert for a...

READ MORE

MEMBERS ONLY

Technology Sector Participation Is Fading

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Technology Sector (XLK) continues to dominate and drive the rally, but fewer and fewer stocks within the sector are participating in the rally. We know this because our Silver Cross Index (SCI), which shows the percent of stocks in the Technology Sector with Silver Cross BUY Signals (20-day EMA...

READ MORE

MEMBERS ONLY

From Summer Doldrums to Year-End Surge: How to Profit from Seasonal Trends in Precious Metals and Bitcoin

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Bitcoin, gold, and silver exhibit similar seasonality patterns.

* Bitcoin, gold, and silver prices largely reflect economic expectations.

* If you're bullish on bitcoin, gold, or silver, there are critical levels to watch.

Safe-haven investments like gold, silver, and now Bitcoin have had a bumpy and uncertain rise,...

READ MORE

MEMBERS ONLY

Market Looks Toppy

by Carl Swenlin,

President and Founder, DecisionPoint.com

In spite of the massive celebration of Nvidia's earnings report, we are seeing troublesome signs that the market is in the process of putting in a top. There are double top formations on six of the nine major indexes we follow, but the three indexes that haven'...

READ MORE

MEMBERS ONLY

This Semi is a ROCKET With MORE UPSIDE

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows a specific semiconductor stock that meets all the criteria that he looks for. He starts with the monthly chart and then works down to the daily explaining all the key aspects to the setup. He then...

READ MORE

MEMBERS ONLY

Bitcoin Blasts ABOVE 70K!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights strong market breadth as the S&P 500 digests last week's break above 5300 and Bitcoin powers above the crucial 70K level. He also breaks down key technical levels for CCL, HD, ZM, MSTR, NFLX,...

READ MORE

MEMBERS ONLY

Bitcoin Sets Up with Classic Continuation Signal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Corrections within bigger uptrends are opportunities.

* Chartists can identify corrections using retracements and patterns.

* The pattern provides a clear resistance level to watch for a breakout.

There is a certain ebb and flow in uptrends. Often we see some sort of stair step higher with big advances and...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" May 16, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Certainty is needed for a trader's actions. Good judgment comes from experience, and experience is gained from poor judgment. The key to improving your trading is to really, truly study the losing trades.

In this month's Family Gathering video, Larry presents PPI numbers for historical buy...

READ MORE

MEMBERS ONLY

The Top Performing Sector is Utilities?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy day for equities, with utilities remaining atop the leaderboard for a second straight session. He lays out a potential reversal in interest rates, what that could mean for growth stocks, and recaps earnings plays including WYNN,...

READ MORE

MEMBERS ONLY

The BULL Case for BITCOIN

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Adrian Zduńczyk, CMT of The ₿irb Nest. David recaps a busy earnings week, breaking down the charts of PTON, AAPL, and more. Adrian tracks the recent pullback for Bitcoin and why the long-term uptrend still remains the prevailing...

READ MORE

MEMBERS ONLY

35 Years of Crude Oil Forecasting the Future | Focus on Stocks: May 2024

by Larry Williams,

Veteran Investor and Author

All You Need to Know About Crude Oil and the Future

Gold, black gold, is what Crude Oil has become. The entire world runs on energy. 98% of our cars and transportation, our lights, the device you are using to read this... virtually everything we can do is thanks to...

READ MORE

MEMBERS ONLY

Three Sectors are Showing Strength, Three are Not

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC CMT of Shadowridge Asset Management. David highlights companies reporting earnings this week, including TSLA, V, ENPH, STLD, STX, ODLF, and GD. Ryan shares key levels to watch on the S&P 500, along with...

READ MORE

MEMBERS ONLY

Netflix Gets Island Reversal On Earnings

by Carl Swenlin,

President and Founder, DecisionPoint.com

Netflix (NFLX) earnings were released today, and the news was good. . . except for one little thing. They also suspiciously announced that, starting next year, they would no longer be reporting subscriber metrics. That's like General Motors saying that they will no longer report how many cars and trucks...

READ MORE

MEMBERS ONLY

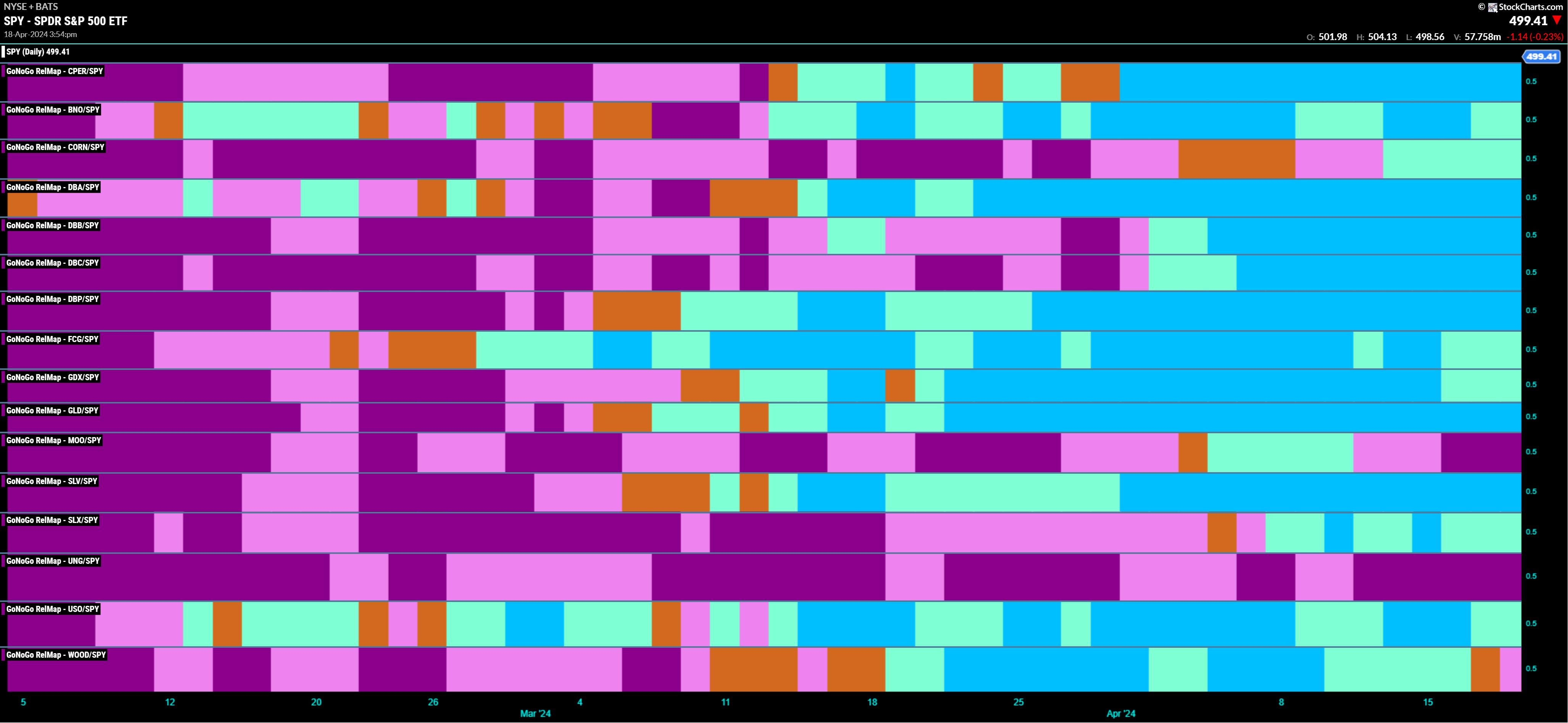

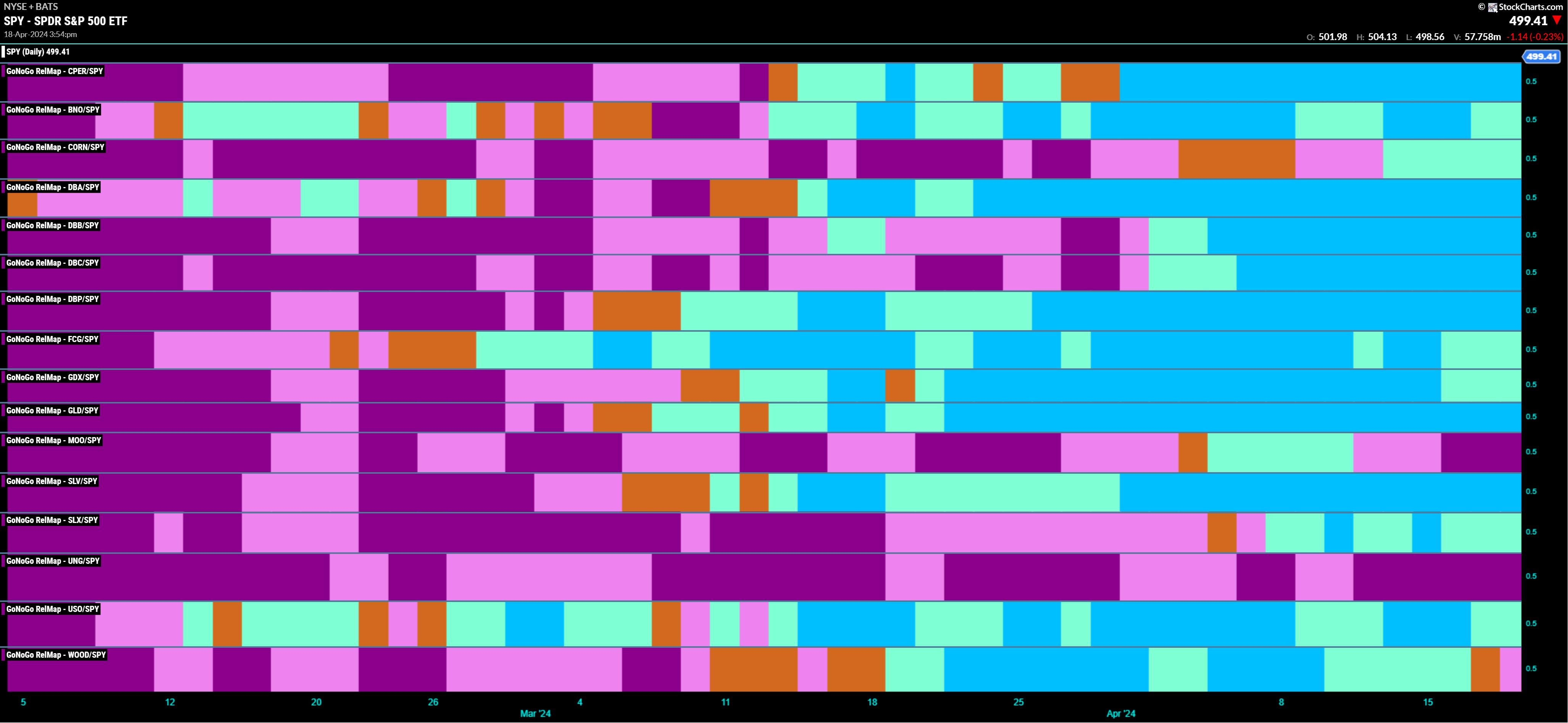

Rocks over Stocks | GoNoGo Show 041824

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* New Risk Off Environment for Equities

* Commodities Leading

The S&P500 trend conditions have reversed into "NoGo" and strengthened to purple bars. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds...

READ MORE

MEMBERS ONLY

Semiconductors are at CRITICAL Level!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Danielle Shay of Simpler Trading. Danielle speaks to the downside rotation for the QQQ, SMH, and leading growth stocks, including why the $210 level is so crucial for the SMH. Dave highlights the recent downswing for Bitcoin,...

READ MORE

MEMBERS ONLY

Bitcoin Halving Could Bring Massive Upside!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares a brief history of Bitcoin halving and relates it to the short-term and long-term technical outlook on this significant development for cryptocurrencies. He also focuses on stocks testing their 50-day moving averages, including NFLX, SMCI, and MSTR.

This...

READ MORE

MEMBERS ONLY

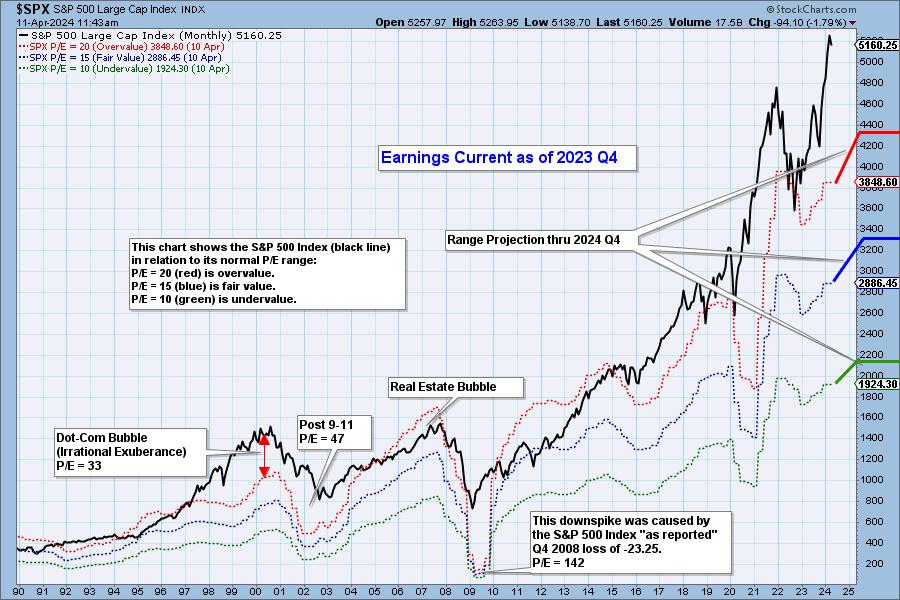

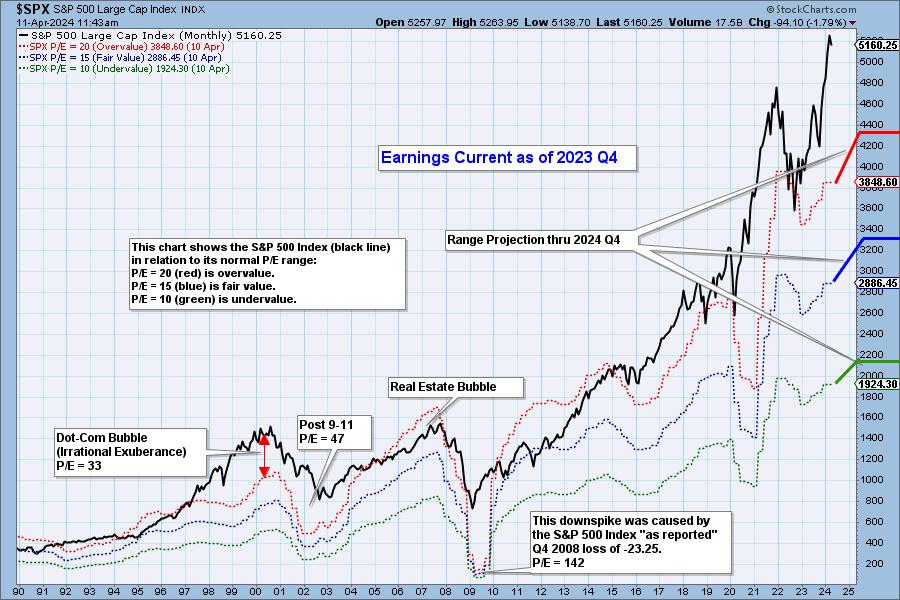

2023 Q4 Earnings Analysis and Projections Through 2024 Q4

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2023 Q4, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

Despite Stable Markets, Breadth Says Danger

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave drops a market update, with a focus on Bitcoin's rebound above 70K, deteriorating short-term breadth conditions, and stocks still making new highs despite the market consolidation phase.

This video originally premiered on April 8, 2024. Watch on...

READ MORE

MEMBERS ONLY

The Fourth Bitcoin Halving Is Upon Us: Is Now the Time to Go Long?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Bitcoin halving are often considered pivotal events for the cryptocurrency

* Bitcoin prices are rising, but momentum appears to be dwindling

* If Bitcoin stalls and reverse, there are a few potential support levels to watch

Bitcoin is about to undergo its fourth halving on April 19. For crypto enthusiasts,...

READ MORE

MEMBERS ONLY

S&P 7000 By End of 2024?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest David Hunter of Contrarian Macro Advisors shares his updated target for the S&P 500, and makes the case for a bullish melt-up phase for stocks, bonds, and gold. Dave Keller focuses in on the relative performance of...

READ MORE

MEMBERS ONLY

Market Rips Higher After Fed Announcement

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the S&P 500's first close above the 5200 level as risk assets pop higher following Fed Chair Powell's comments this afternoon. He digs into market breadth indicators, which remain bullish on short-term,...

READ MORE

MEMBERS ONLY

Downside Risk in a Bullish Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Chris Ciovacco of Ciovacco Capital Management. David focuses on downside risk for GOOGL and AMZN, and shares one utility name that should be on your radar! Chris updates a weekly S&P 500 chart he first...

READ MORE

MEMBERS ONLY

MEM TV: Risk-Off Signals Possible Downside Ahead

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews investors' responses to the rise in interest rates after inflation numbers come in higher than expected. She also shares how riskier areas of the market sold off while cyclicals came into favor. Earnings reports continue to...

READ MORE

MEMBERS ONLY

Is Coinbase Stock About to Crater? Here's One Way to Exploit It

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Coinbase's (COIN) stock is blasting off, hitting a jaw-dropping 99.6 SCTR score.

* The pin bar (most current bar) seems like a desperate attempt for the bulls to advance the stock amidst being potentially outnumbered by sellers.

* Ready to go on the offensive? Here's...

READ MORE

MEMBERS ONLY

What Loss?! NVIDIA and ORACLE Rip Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down today's market action direct from New York, tracking technology shares including NVDA and ORCL regaining lost ground after last Friday's losses. In a segment called Crypto Corner, he outlines two ways to apply...

READ MORE

MEMBERS ONLY

GNG TV: Materials, Industrials, Financials, Oh My...!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

On this week's edition of the GoNoGo Charts show from StockCharts TV, as the S&P 500 continues the rally at all time highs, Alex and Tyler take a look at GoNoGo Trend® conditions of several areas of the market. The recent breakout in Gold has much...

READ MORE

MEMBERS ONLY

Bitcoin Tests All-Time Highs While Growth Stocks Sag

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the hourly chart of Bitcoin and highlights recent breakouts for regional banks. Guest Julius de Kempenaer of RRG Research focuses in on the Communication Services sector, including META, DIS, and GOOG, and shows how defensive sectors have...

READ MORE

MEMBERS ONLY

Would You Rather Own AMZN or AAPL Stock?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how the Magnificent 7 has become much less of a comparable group of stocks, with TSLA, AAPL, and GOOGL all breaking down in recent weeks. He also tracks Bitcoin's retest of all-time highs and why high...

READ MORE

MEMBERS ONLY

Magnificent 7 Not All Magnificent!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave speaks to the diversifying patterns within the Magnificent 7, with GOOGL and AAPL showing clear signs of short-term distribution. He also tracks Bitcoin reaching the 64K level and shares some initial thoughts from the CMT Dubai Summit.

This video...

READ MORE