MEMBERS ONLY

A “Change of Character” for Stocks: Key Breakdown Levels to Watch

by David Keller,

President and Chief Strategist, Sierra Alpha Research

A “change of character” is emerging as major indexes weaken in November. Equal-weight indexes confirm a bearish turn, Bitcoin’s collapse highlights fading speculation, and the S&P 500’s key support near 6550 may be the final line before a deeper market correction....

READ MORE

MEMBERS ONLY

Discretionary Lags; Speculative Names Thrown Out; Trend Signals within MAG7 & Utilities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Healthcare, consumer staples, and gold stocks continue to hold steady while speculative tech names are flashing bearish signals. Get a closer look at the different sectors and one stock that looks like it's ready to trend higher....

READ MORE

MEMBERS ONLY

MACD Warning for S&P 500! Momentum Shift Underway

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil breaks down the MACD warning and weakening momentum in the S&P 500 as the index tests support near its 18-week moving average. Additionally, he reviews Bitcoin’s reversal setup and highlights stocks with improving relative strength and trend structure....

READ MORE

MEMBERS ONLY

S&P 500 Shows Topping Signs! Financials and Semis at Key Levels

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Frank Cappelleri breaks down a major market inflection point as the S&P 500 tests a topping pattern and several key levels. He also reviews financials and semiconductors where structure shifts and breakdown risks may determine the next move....

READ MORE

MEMBERS ONLY

Fed Jitters Shake the Market – Where are Investors Finding Shelter?

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down how hawkish Fed comments and rising yields rattled the markets this week. See where investors are finding opportunity — and which sectors are offering shelter as volatility returns....

READ MORE

MEMBERS ONLY

Small Caps Break Down, VIX Surges. What's Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Small-cap stocks have broken below a key support level. Volatility is also creeping higher. Tom Bowley shares his views by breaking down several charts....

READ MORE

MEMBERS ONLY

The Sneaky Bull Market Nobody’s Talking About: Commodities

Commodities are making a bullish run in a seasonally weak period. Keep an eye on this potentially leggy asset class and find out how you can take advantage of the commodity run....

READ MORE

MEMBERS ONLY

Retail Stocks to Watch as Consumer Sentiment Collapses: Walmart, Target, and Home Depot

Key Q3 retail earnings reports are set to begin rolling in this week. Here's a look at charts of the consumer-related stocks that will give you a hint at how it will all shake out....

READ MORE

MEMBERS ONLY

After a Volatile Week in the Markets, Here's Where I Found Strength!

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s volatile market action, highlighting areas where selective strength is showing up. Discover setups in energy, healthcare, and AI-linked names that are holding up as other areas weaken....

READ MORE

MEMBERS ONLY

Change of Character: Why the S&P 500’s Uptrend May Be Breaking Down

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 has broken below its 21-day EMA and key trend channel support, testing its 50-day moving average as market breadth weakens. With tech leaders like NVDA and AVGO tumbling, investors should watch for a possible rotation toward defensive sectors....

READ MORE

MEMBERS ONLY

Technology Selling is Creating Huge Opportunities Elsewhere

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technology stocks may be selling off, but money is rotating into other areas. Check out the charts of the industry groups that are indicating upside breakouts....

READ MORE

MEMBERS ONLY

One Sector Stands Strong as the Most Economically Sensitive Sector Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Arthur Hill analyzes the performance of the Health Care sector relative to other S&P 500 sectors. Find out why Health Care shows promise as we head into the end of the year. ...

READ MORE

MEMBERS ONLY

Market Breadth Weakens — Is the S&P 500 in Trouble??

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Follow along as Frank Cappelleri breaks down the S&P 500’s pullback, small-cap growth momentum, biotech leadership, and Bitcoin’s key support test. See what patterns and sector shifts could define the next market move!...

READ MORE

MEMBERS ONLY

Breakouts, Pullbacks & Setups: 10 Must-Watch Charts for November

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Grayson Roze and David Keller share ten charts to watch for November, including setups in Celsius, Regeneron, Caterpillar, Eli Lilly, and Shopify. Learn how they use StockCharts tools and trend analysis to locate strength and manage risk in a stretched bull market....

READ MORE

MEMBERS ONLY

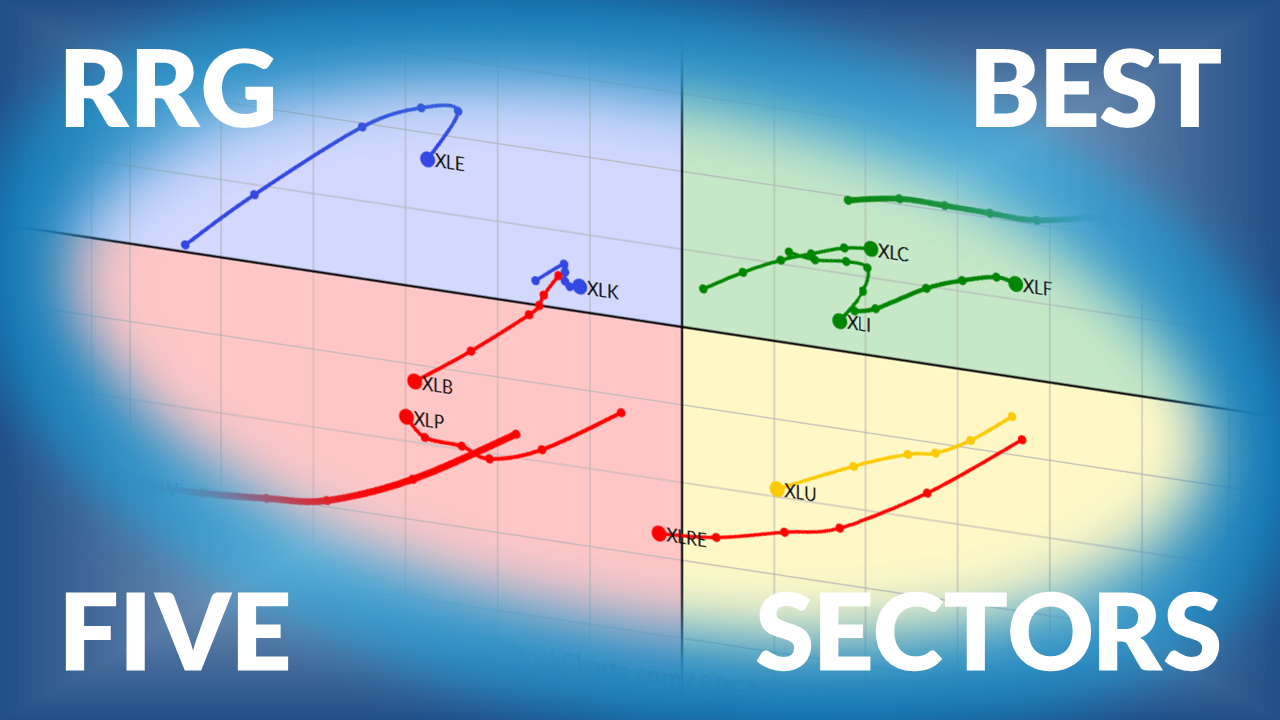

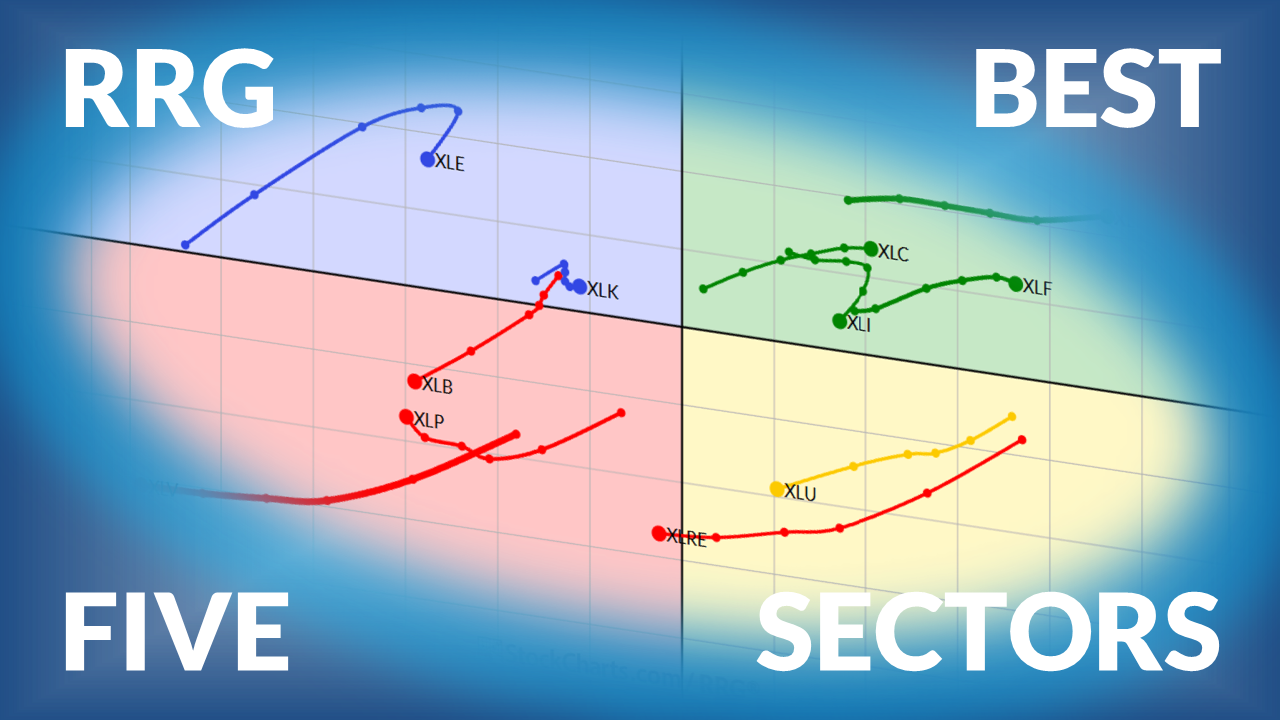

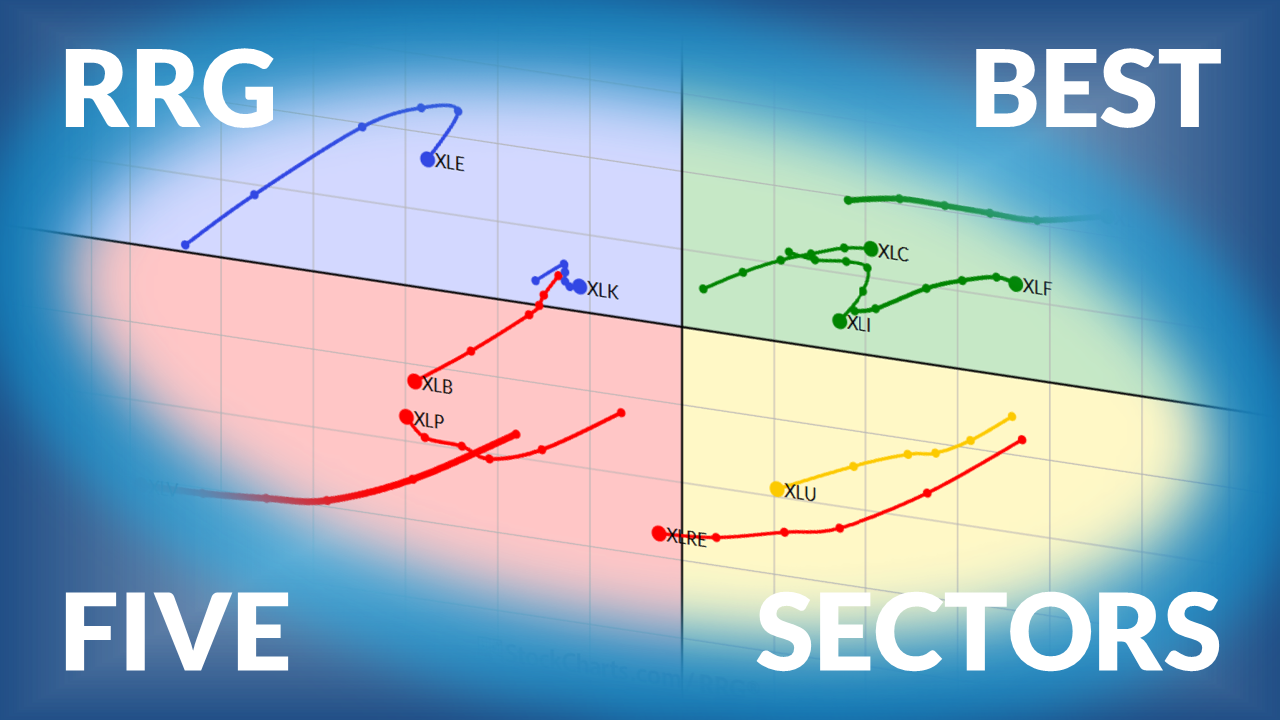

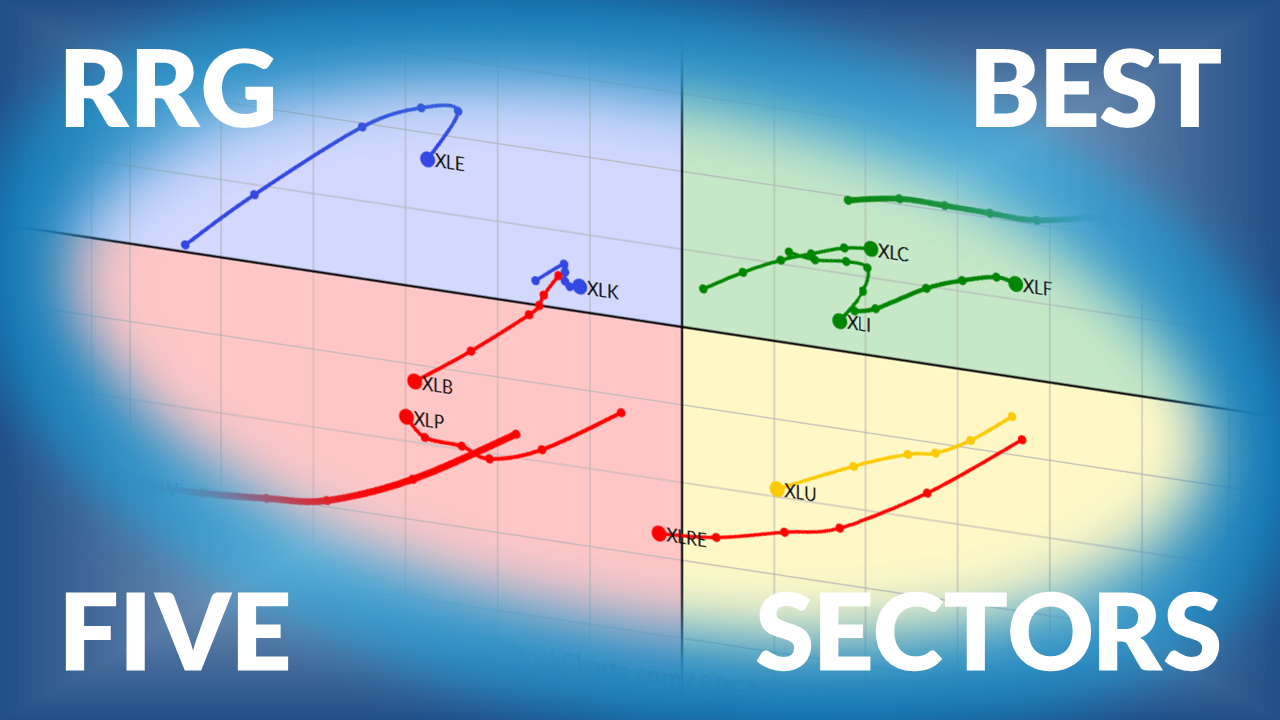

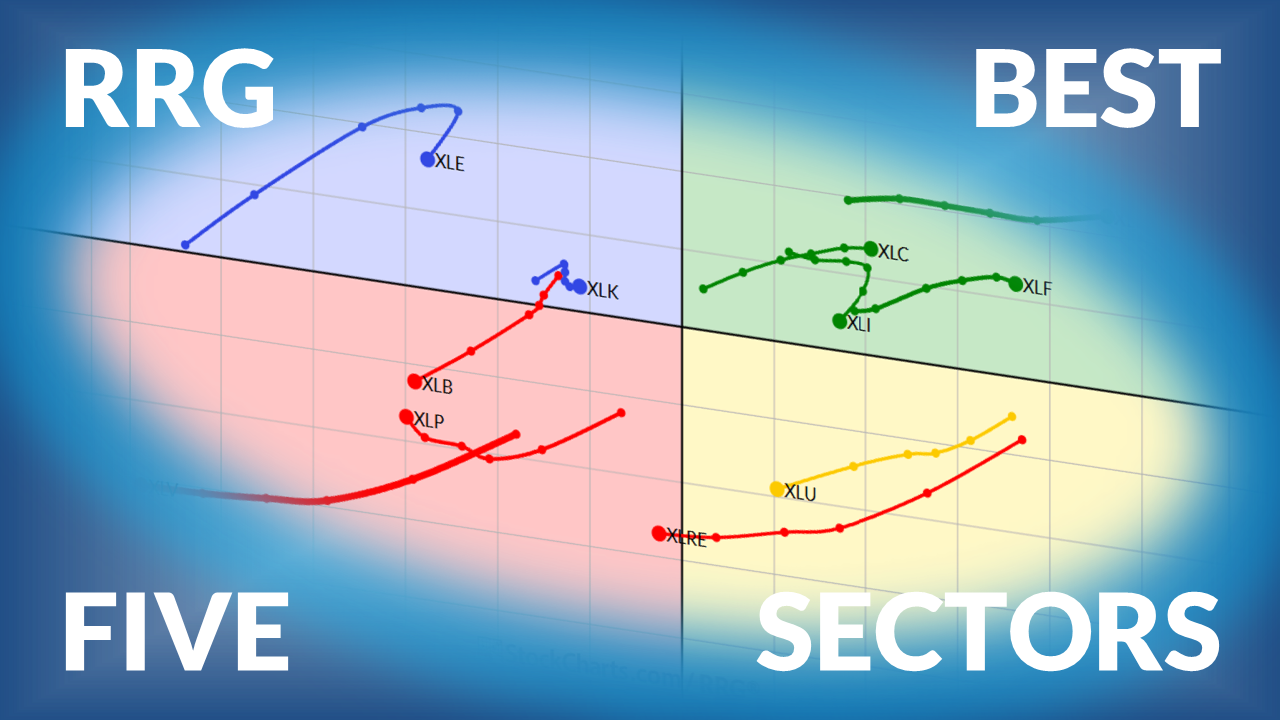

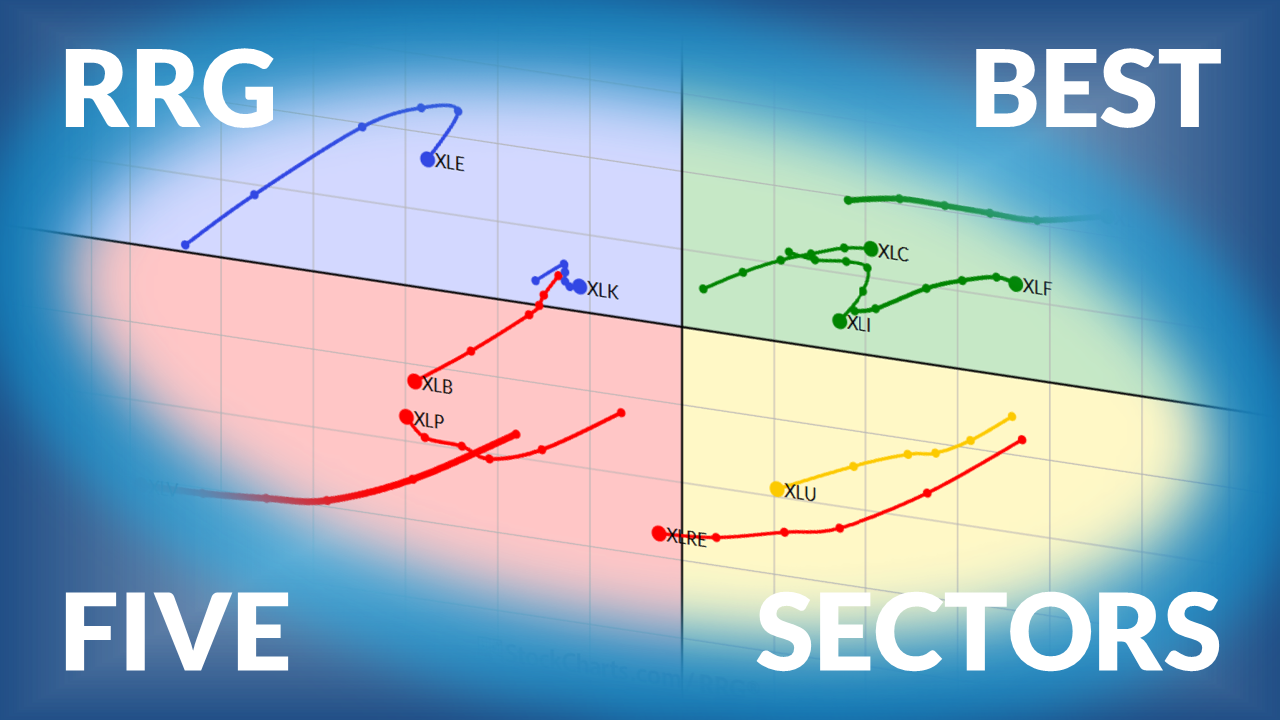

The Best Five Sectors This Week, #43

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on ranking of US sectors based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Retail Lags, Restaurants Sink: A Technical Check on the U.S. Consumer Story

November's focus will be on consumer-related company earnings, such as retail and restaurants. These will shed light on consumer confidence, an important data point as we head into the holiday season. Here's a technical deep dive into the health of the U.S. consumer....

READ MORE

MEMBERS ONLY

Earnings Shake Up the Market! Where Leadership Is Shifting Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down how recent earnings results are shaking up market leadership and where new strength is emerging. Learn which sectors and stock setups are holding up as investors navigate mixed results and rising volatility....

READ MORE

MEMBERS ONLY

MAG7 Powers Market; Breadth Wanes, But Still Bullish; QQQ Two Standard Deviation Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The primary driving forces in the stock market are the QQQ and key mega-cap companies. In this article, Arthur Hill shares his insights and observations on the technical price action in the Mag7 ETF and QQQ. ...

READ MORE

MEMBERS ONLY

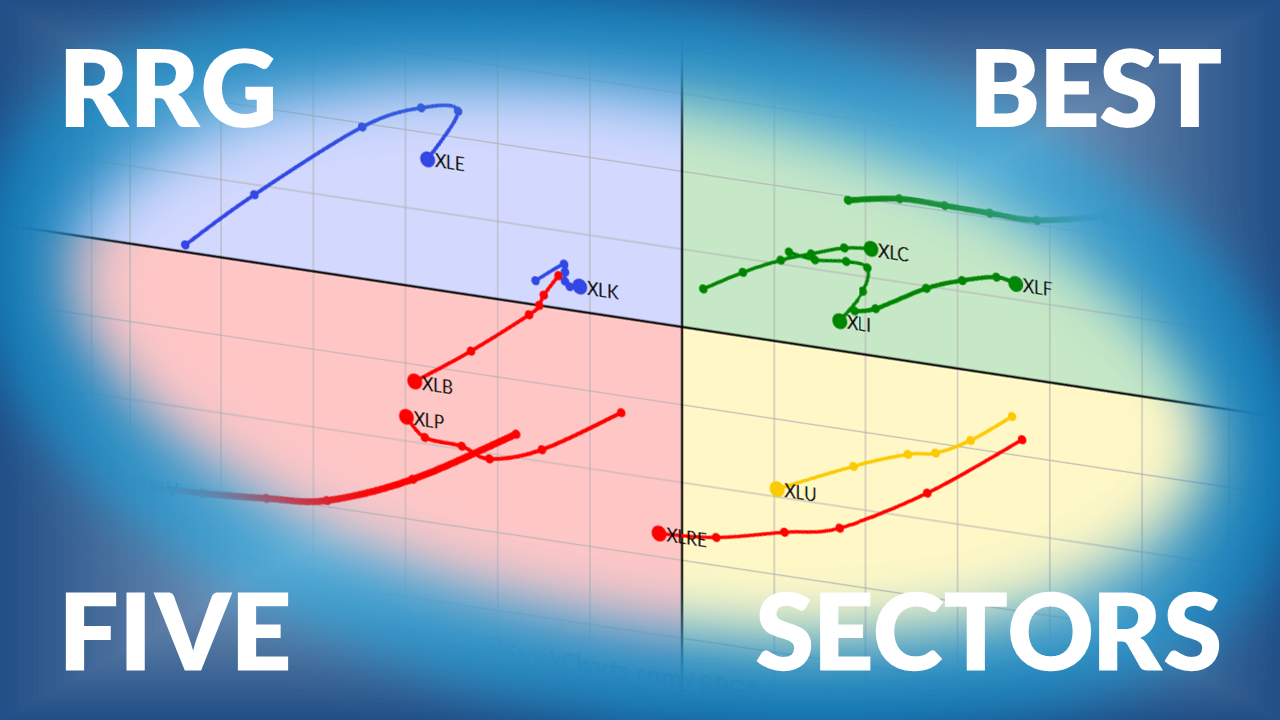

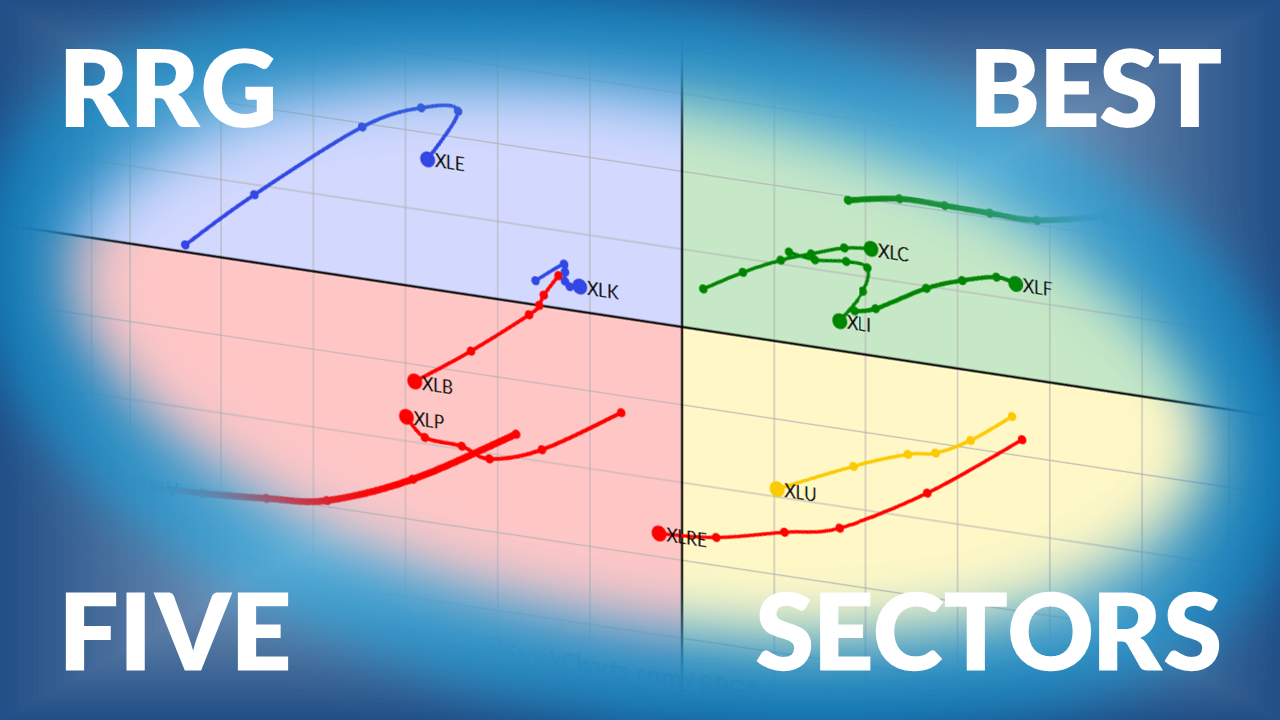

The Best Five Sectors This Week, #42

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector rotation based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Earnings Season Heats Up! New Leaders Emerging

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle highlights the new market leaders emerging as earnings season intensifies. Find out which setups and sectors are showing strength as the rally broadens beyond the mega-caps....

READ MORE

MEMBERS ONLY

Make Room, AI: This Sector Is Quietly Taking the Lead

by Mary Ellen McGonagle,

President, MEM Investment Research

The Health Care sector is emerging as the next area of strength. Mary Ellen presents a deep dive into the sector and a stock that could break out....

READ MORE

MEMBERS ONLY

3 Key Influences on Stock Performance; Bullish Continuation Patterns for Two Cybersecurity Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

In a bullish market environment, with the technology sector leading the way and cybersecurity stocks in an uptrend, Arthur presents a couple of stocks that may be poised to break out....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #41

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on Sector Rotation based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

From Trash to Treasure: Micro-Caps Lead the Market’s Risk-On Rebound

Micro-cap returns have outperformed those of the S&P 500 since the April low. Discover how you can capitalize on the micro-cap success if they continue their upward trajectory....

READ MORE

MEMBERS ONLY

The Market’s Middle Child Problem: Mid-Caps Flash a Warning

Mid-cap stocks have lagged the market of late, market breadth is weakening, and quality stocks may be out of favor. Here are the macro factors that could provide a boost to mid-cap stocks....

READ MORE

MEMBERS ONLY

StockCharts Insider: Reading Offense vs. Defense with Key Ratios

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Ever wish you had a dashboard that flickers between “caution” and “go”? That’s what these Key Ratios are. Wall Street’s caution vs. go signal. They don’t offer trade signals, but they do give you a vibe check, helping you figure out if investors...

READ MORE

MEMBERS ONLY

Should You Sell Now? Here's What the Charts Are Saying

by Mary Ellen McGonagle,

President, MEM Investment Research

ary Ellen reviews the week’s market action, highlighting leadership shifts in semiconductors, health care, utilities, and alternative energy. As sector rotation continues, she also shares how biotechs, small caps, and select quantum and crypto names are setting up with new opportunities.

New videos from Mary Ellen premiere weekly on...

READ MORE

MEMBERS ONLY

After the Stock Market Drop: Is This the Wake-Up Call?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market pulled back sharply this week as volatility spiked. Learn what key support levels, sentiment shifts, and charts are telling investors....

READ MORE

MEMBERS ONLY

QQQ Channels Higher, 5 Healthcare Leaders, How to Trade Pullbacks: Case Study and Current Signal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Arthur Hill takes a deep dive into charts of QQQ, healthcare stocks, and tech stocks. ...

READ MORE

MEMBERS ONLY

How to Trade the Q3 Earnings Wave: Delta, Pepsi, and the Banks

Earnings season is here with Delta Air Lines and PepsiCo on deck. Next week, the focus will be on big banks, which set the stage for the rest of the season....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #39

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Your weekly update and ranking of US sectors based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

A Deep Dive into the Health Care Sector

by Martin Pring,

President, Pring Research

Martin Pring analyzes the Health Care sector, which is breaking out of a key resistance level. On a relative basis, the sector's performance may not be stellar....

READ MORE

MEMBERS ONLY

The Market’s Next Leaders Are Taking Shape – Are You Ready?

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen reviews the week’s market action, highlighting leadership shifts in semiconductors, health care, utilities, and alternative energy. As sector rotation continues, she also shares how biotechs, small caps, and select quantum and crypto names are setting up with new opportunities.

New videos from Mary Ellen premiere weekly on...

READ MORE