MEMBERS ONLY

Trend Signals in Healthcare and Healthcare Stocks, 5 New Signals, 12 Leading Uptrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Health Care sector is making a comeback, with stocks within the sector generating new bullish signals. Here's a deep dive into the sector....

READ MORE

MEMBERS ONLY

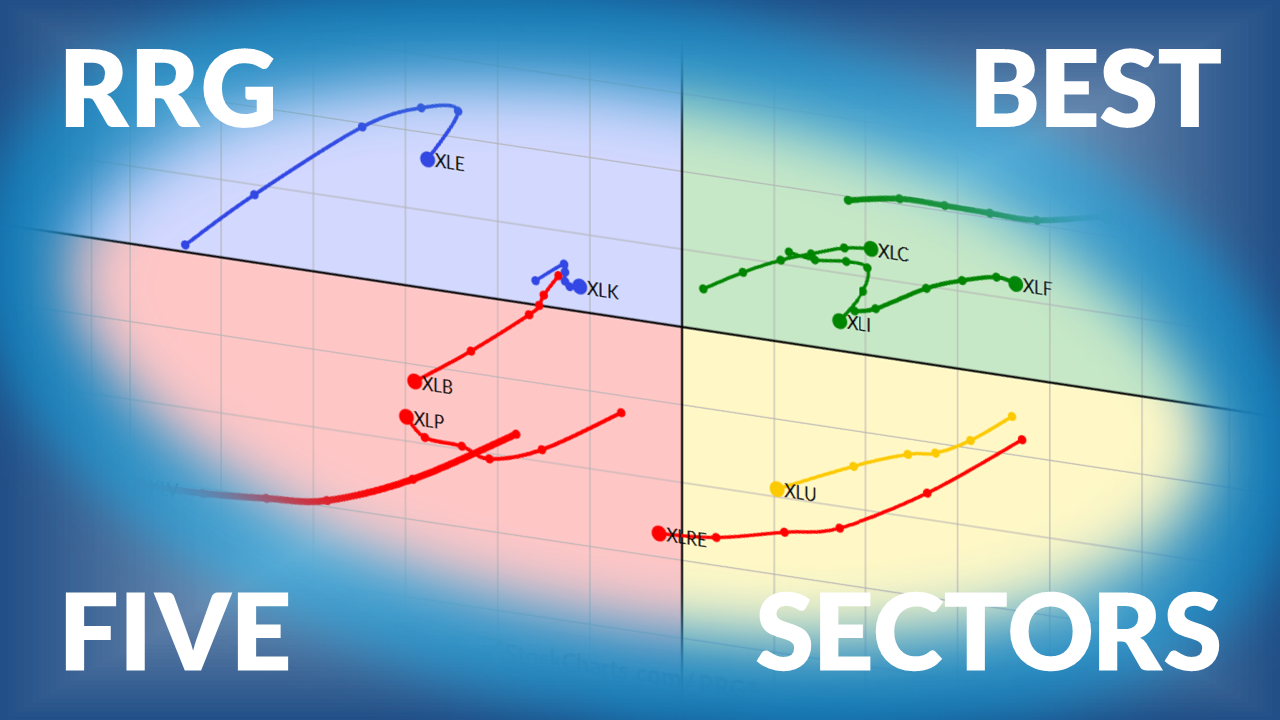

It’s All Relative: What the RRG View Tells Us About Q4

Soft jobs data raises Fed cut odds as stocks enter Q4 strong. Discover which sectors lead on RRG, Health Care's rebound, and Energy's outlook....

READ MORE

MEMBERS ONLY

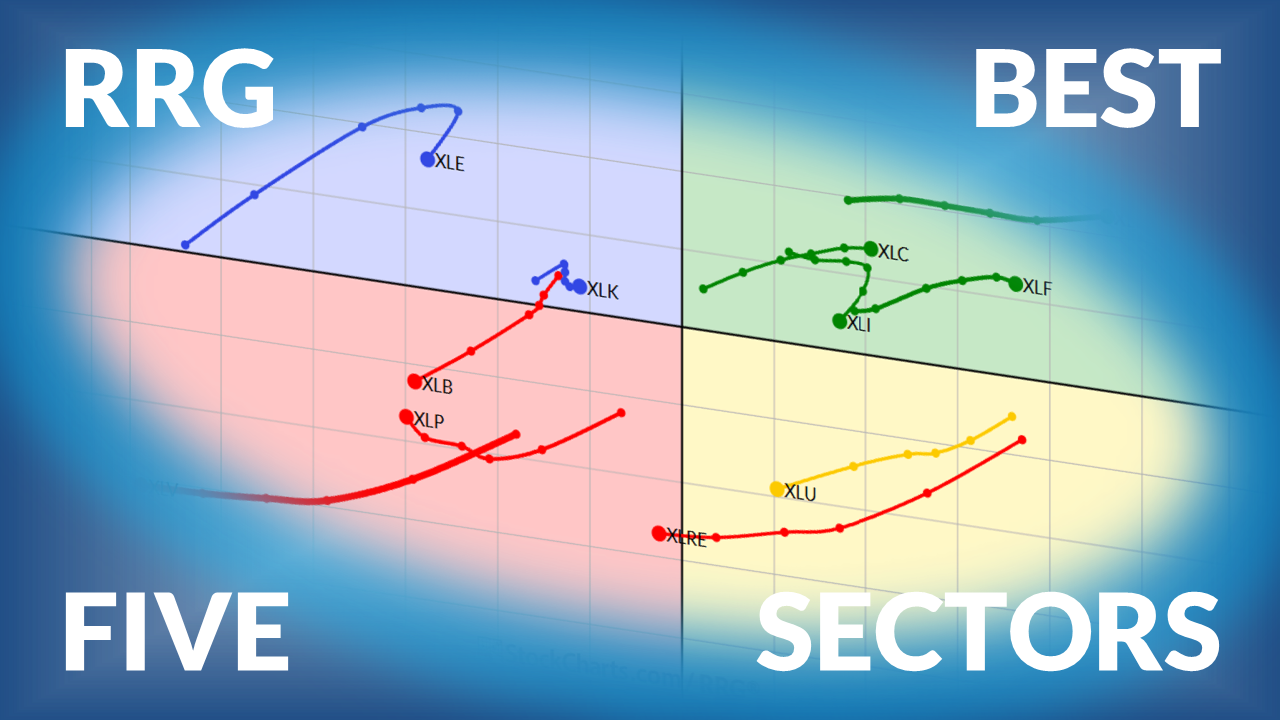

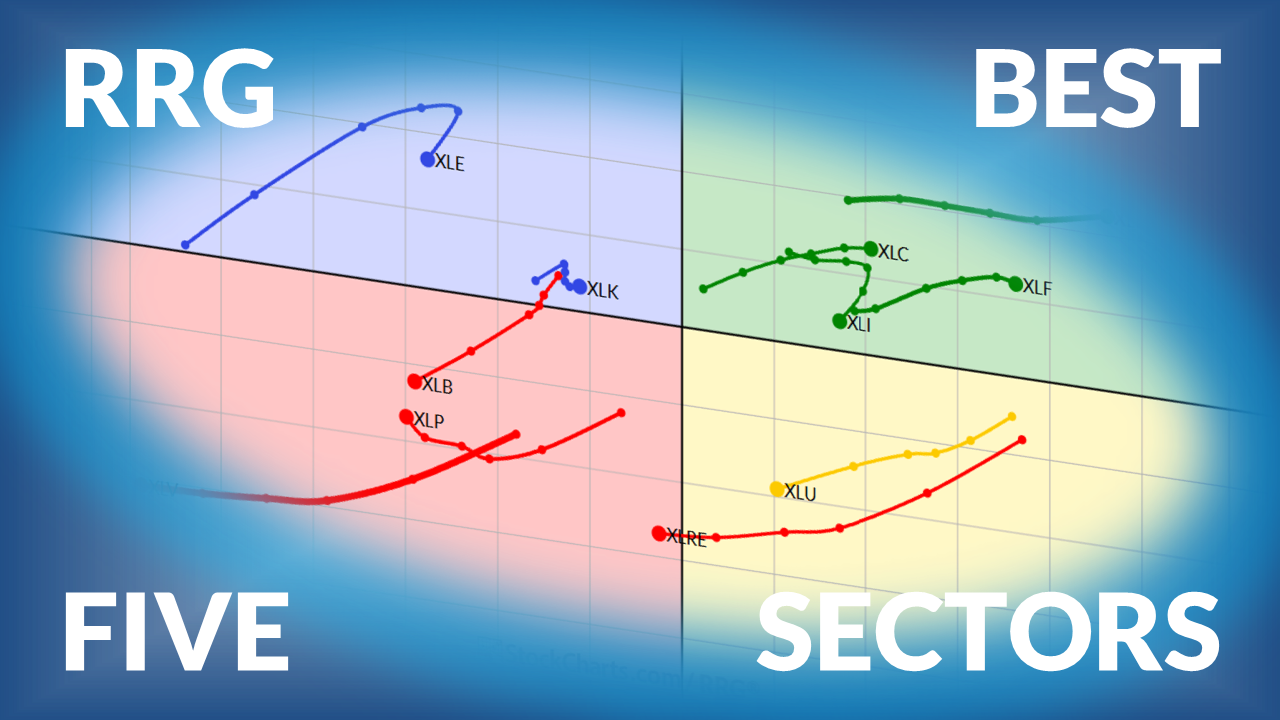

The Best Five Sectors This Week, #38

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector ranking based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

New Market Leaders Are Emerging – Don’t Miss This Rotation!

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen breaks down where strength is emerging beneath the surface of the markets, highlighting leadership in energy stocks, utilities, and industrials. She then shares setups in coal, natural gas, and electricity names, along with constructive moves in DOW components like INTC, IBM, AAPL, and CAT. In addition, she takes...

READ MORE

MEMBERS ONLY

China Tech Breakout: Alibaba Sparks a FXI Rally Despite Powell's Warning

BABA stock is rebounding with AI-driven momentum. Learn how the stock price of Alibaba impacts FXI and what the technicals signal for traders in 2025....

READ MORE

MEMBERS ONLY

Taking Stock of the Small-Cap Record High: Here's How High IWM Could Go

The Russell 2000 ETF (IWM) logged a record weekly close, triggering a bullish breakout target of $322. Explore why small-caps may thrive with Fed rate cuts, supportive seasonality, and strong relative strength versus large caps....

READ MORE

MEMBERS ONLY

Tech & Small Caps Surge After Rate Cut – Who Leads Next?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this week’s show, Mary Ellen highlights the stocks and groups showing the most promise following the Fed’s rate cut. She spotlights leadership in technology, software, and semiconductors, while also pointing out opportunities in small-cap AI names, robotics, crypto, and biotechs. Mary Ellen shares how industrials, uranium, and...

READ MORE

MEMBERS ONLY

AI Stocks Pop...These Areas Not!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this week’s video, Mary Ellen breaks down what drove AI-related stocks higher, while also revealing non-tech names that are poised to benefit. She highlights specific Crypto ETFs that are in a bullish positions, plus discusses the move into Gold and other metals.

This video originally premiered on September...

READ MORE

MEMBERS ONLY

Before CPI and PPI: 5 Things to Watch This Week

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Rate cuts on deck? Look for these signals in small caps, TLT, gold, and more to help you position your portfolio ahead of this week's data....

READ MORE

MEMBERS ONLY

Tech Stocks Regain Their Uptrend!

by Mary Ellen McGonagle,

President, MEM Investment Research

This week, Mary Ellen digs into some of the impactful news that drove price action and what to be on the lookout for going forward. She also highlights the Technology sector’s move back into an uptrend and discusses the best ways to participate. In addition, Mary Ellen gives her...

READ MORE

MEMBERS ONLY

The Market's Tug-of-War: How to Read the S&P 500's Hammer Signals

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Back-to-back hammer candlesticks in the S&P 500 are sending a message. Here's what these signals mean, why the market feels stuck, and what investors should watch for next....

READ MORE

MEMBERS ONLY

The World is Breaking Out All Over

by Martin Pring,

President, Pring Research

A plethora of breakouts suggests that international markets have much further to run on the upside. Martin reviews where the principal regions of the world currently stand....

READ MORE

MEMBERS ONLY

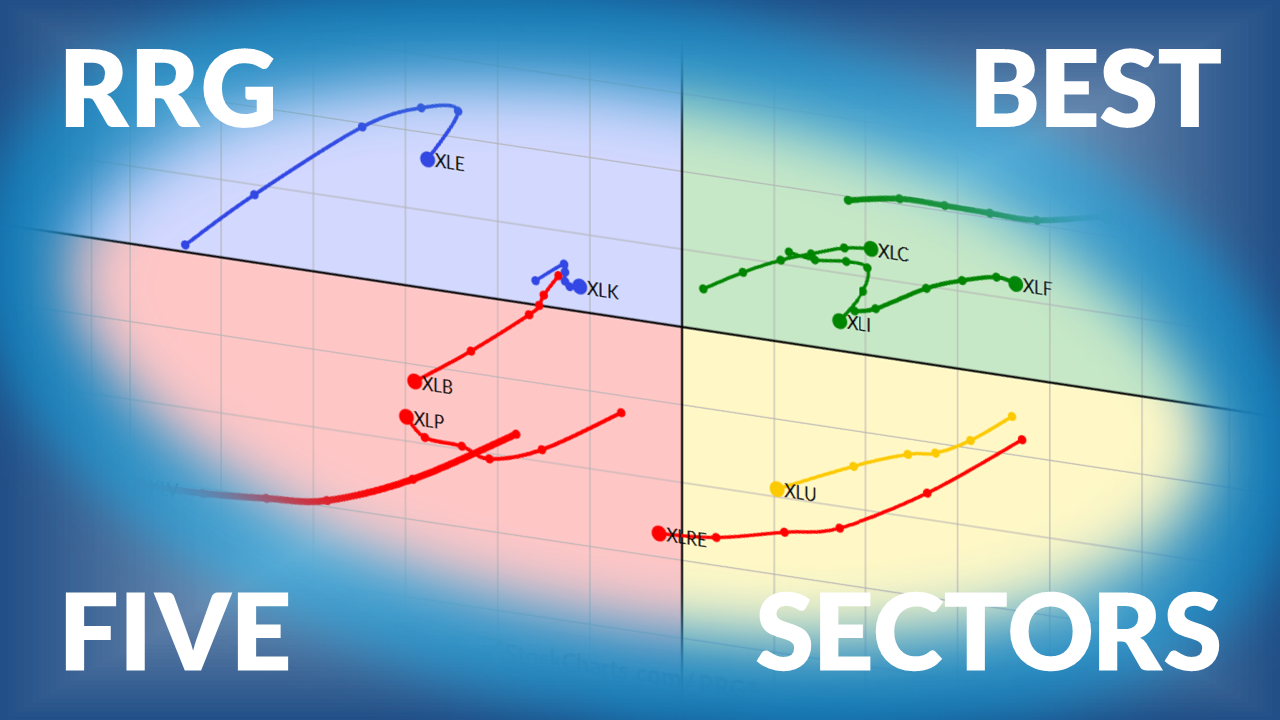

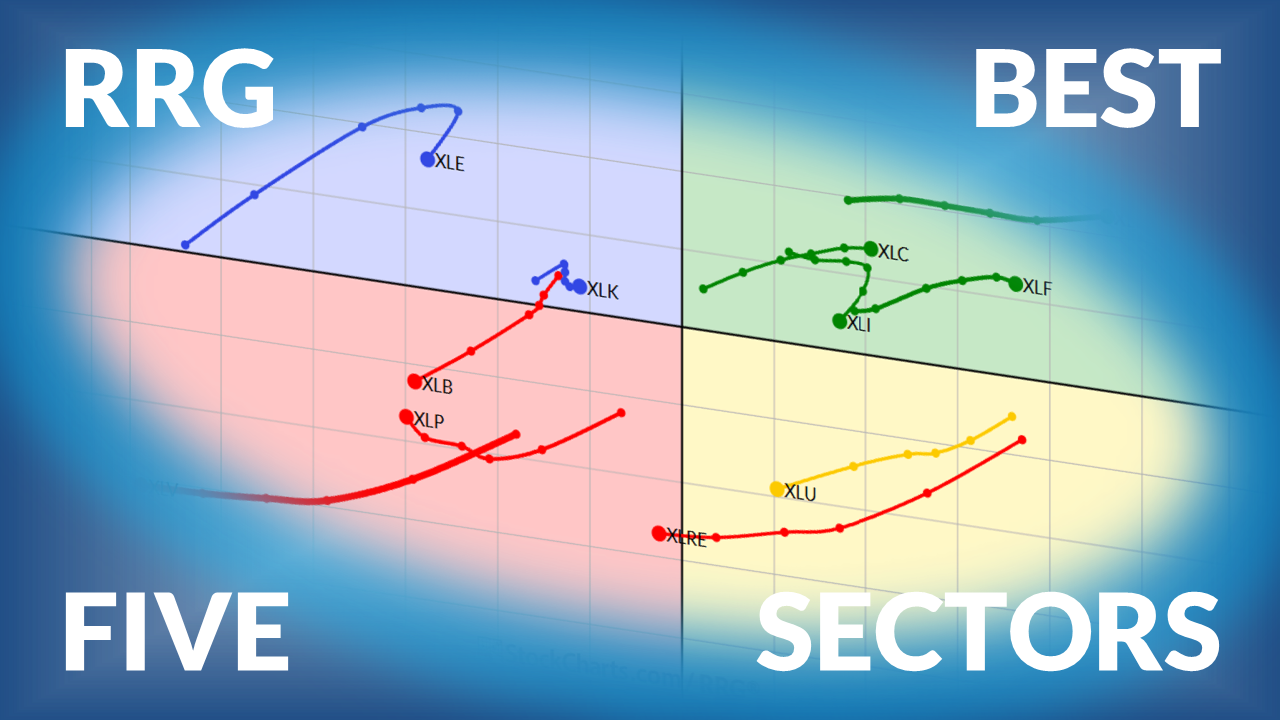

The Best Five Sectors This Week, #34

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Explore this week's sector rotation insights. See which sectors gained strength, which lost momentum, and what the RRG signals mean for investors....

READ MORE

MEMBERS ONLY

AI Stocks Struggle as Nvidia Disappoints – What’s Filling the Void?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this week’s show, Mary Ellen dives beneath the surface of the market as AI and semiconductor stocks lose momentum. New areas are beginning to take the lead, and Mary Ellen highlights strength in energy, gold, and select international markets, while pointing out where former leadership is breaking down....

READ MORE

MEMBERS ONLY

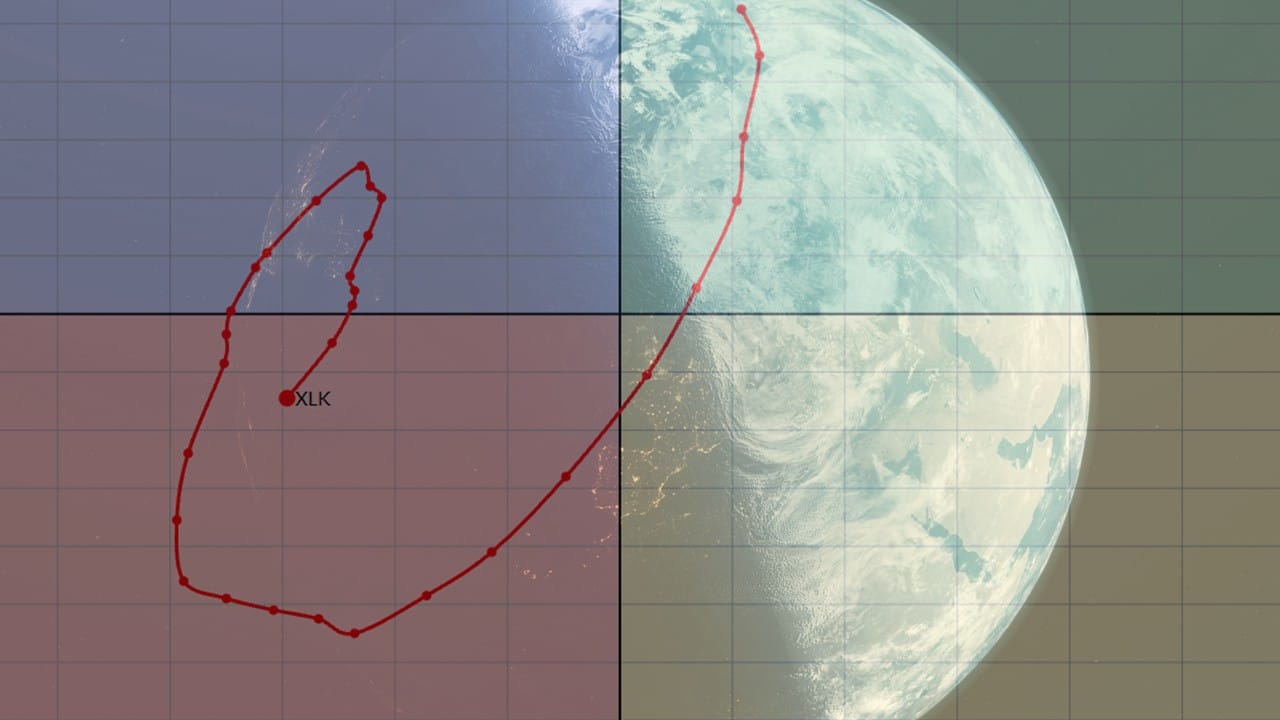

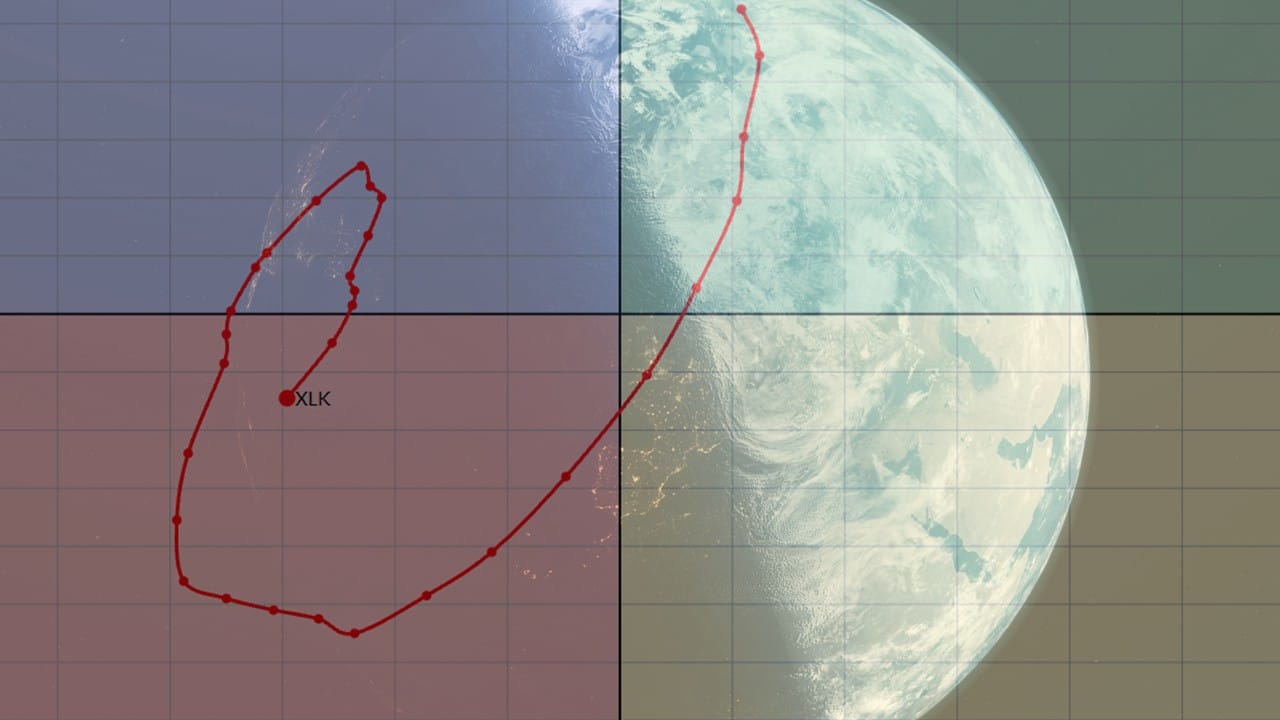

Full Rotations on One Side of an RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What does it mean when a rotation on a Relative Rotation Graph fully completes on the right-hand side or the left-hand side of the graph...

READ MORE

MEMBERS ONLY

Uptrends Expand; Tech Consolidates, Cybersecurity Breaks Out; A Classic Trading Setup; Big Banks Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Market breadth is strengthening as more stocks move into long-term uptrends. The percentage of S&P 500 stocks above their 200-day moving average hit 70%. small and mid-caps are driving this expansion, signaling broad market strength....

READ MORE

MEMBERS ONLY

Dow Jones 53k?! Why Small Caps Surge on Powell’s Rate Cut Hints

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom Bowley, EarningsBeats.com, as he recaps a week where major indices posted gains, the Dow Jones confirmed a bullish breakout above 45,000, and small-caps surged on Powell’s rate cut comments. Tom highlights the relative strength of the Russell 2000, leadership from regional banks, and strong moves...

READ MORE

MEMBERS ONLY

Is It Time to Think Small in a Big Way?

by Martin Pring,

President, Pring Research

The NYSE/S&P ratio has been in a downtrend for seventeen years, but is a reversal finally underway? What does the picture look like for small-caps going forward?...

READ MORE

MEMBERS ONLY

Unlock Explosive Breakouts with NR7 Bars!

by Joe Rabil,

President, Rabil Stock Research

Joe explains the NR7 compression bar pattern, showing how it builds energy for explosive breakout trading opportunities and how to apply it in swing trading and longer-term setups. He reviews the S&P (SPY) market conditions, covering sentiment, volatility, overbought/oversold signals, trend, and momentum. From there, he analyzes...

READ MORE

MEMBERS ONLY

Mapping the Road Ahead: Four Scenarios for the Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While August and September are traditionally a weak period for stocks, the Nasdaq 100 has continued to drive higher. We lay out four potential scenarios for the QQQ over the next six weeks, from the very bullish to the super bearish....

READ MORE

MEMBERS ONLY

Discretionary vs. Staples: Why ETFs are Flashing a Bullish Signal for 2025

Consumer Discretionary ETFs are outperforming Staples across large-cap, small-cap, and global markets. See why XLY, RSPD, PSCD, and RXI signal a bullish risk-on trend in 2025....

READ MORE

MEMBERS ONLY

Stocks Look Stalled: These Charts Point to Where the Market Could Head Next

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

From NVIDIA earnings to small-cap momentum, here's what could drive the market's next move. Here are the charts that tell the story....

READ MORE

MEMBERS ONLY

China Stocks Step Back Into the Spotlight: Here's What Investors Need to Know

China stocks are surging, with FXI up 55% year-on-year. Learn what’s driving the rally, key technical levels, and what it means for retail investors....

READ MORE

MEMBERS ONLY

Sectors Shift After Powell’s Speech: Where to Focus Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen reviews the market’s latest moves following Fed Chair Powell’s Jackson Hole comments, inflation concerns, and key earnings reports. Discover which areas are gaining strength as interest rate expectations shift, with energy, banks, homebuilders, and regional names all showing leadership. In addition, Mary Ellen highlights constructive setups...

READ MORE

MEMBERS ONLY

From Slump to Surge: Why Investors Are Smiling Again

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Stocks surged as Powell's rate-cut hints lifted markets. Dow hit a record, Nasdaq rebounded, and small caps rallied. Here's what it means for investors....

READ MORE

MEMBERS ONLY

QQQ/SPY Targets, IWM Best Hold, NDX Dominance Quantified, Bitcoin/QQQ Relationship, Costco Holds Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Signs of correction and rotation emerged this week as money moved out of tech-related groups and into defensive groups. Here's a perspective on this week's rotation with some year-to-date performance metrics....

READ MORE

MEMBERS ONLY

How to Use the 4 MA for Better Timing in Trading & Investing

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe demonstrates how to apply the 4 simple moving average (4 MA) as both a short-term trading tool and a longer-term timing guide. He explains how this moving average can help identify opportunities, manage pullbacks, and improve decision-making across multiple time frames. Joe then reviews the current...

READ MORE

MEMBERS ONLY

S&P 500 Breakouts, Bitcoin Risks & Uber’s Next Move

by Frank Cappelleri,

Founder & President, CappThesis, LLC

In this market update, Frank takes a close look at the S&P 500, key indices, ETFs, crypto, and a recent trade idea. Frank compares the 2025 market to 2020 patterns, reviewing corrections and highlighting bullish and bearish setups. He focuses on weekly Bollinger Bands, GoNoGo charts, sector performance...

READ MORE

MEMBERS ONLY

Tech Stumbles, Market Widens: What Savvy Investors Should Watch Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Tech stocks wobble while other sectors firm up. Learn how breadth, equal-weight trends, and small/mid-cap strength can guide your investment decisions....

READ MORE

MEMBERS ONLY

Surprise Sector Surge as Market Leaders Stall!

by Mary Ellen McGonagle,

President, MEM Investment Research

On this week’s show, Mary Ellen McGonagle analyzes a notable shift in market leadership as former top sectors slow and new areas step up. She covers the latest sector performance — from healthcare and biotech to home builders, retail, and small caps — and shows you how to navigate the changing...

READ MORE

MEMBERS ONLY

Friday Chart Fix: QQQ Overtakes QQEW, GOOGL Near New High, Groups with Most Highs, Verizon Gaps Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Which charts stand out this week? Arthur Hill analyzes the market and does a deep dive into the charts with price action that's not to be ignored....

READ MORE

MEMBERS ONLY

What to Make of the Small-Cap Rally: A Closer Look at IJR and IWM

Small-cap stocks are showing signs of strength. Investors should keep an eye on the performance of IWM and IJR, two small-cap ETFs, to determine if the small-cap rally has legs....

READ MORE

MEMBERS ONLY

This Week’s Stock Market Winners — And What’s Driving Them

by Mary Ellen McGonagle,

President, MEM Investment Research

Join Mary Ellen as she breaks down the latest market trends! The highlight of the show is a deep dive into the consumer discretionary sector, where Mary Ellen analyzes leading industry groups like homebuilders, apparel, and specialty retail, and explains why this sector continues to show relative strength. She shares...

READ MORE

MEMBERS ONLY

Apple's Strongest 2-Day ROC Since April: Breakout or Bull Trap?

Apple (AAPL) jumps on tariff relief headlines. See the ROC thrust, 200-day moving average test, gap levels at $213/$203, and targets to $237-$250....

READ MORE

MEMBERS ONLY

Markets Drop! But These Stocks Are Still Leading

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s market volatility and what it means for investors. She explains how inflation and employment data triggered technical breakdowns in key indexes, and discusses why volatility, relative strength, and leadership stocks (including MPWR, TER, and Cadence Design) should remain on your radar. Mary...

READ MORE

MEMBERS ONLY

Last Week’s Market Action Showed Signs of Exhaustion, Especially In This One Key Stock

by Martin Pring,

President, Pring Research

Explore how recent bearish weekly patterns in the S&P 500, Nasdaq, and Microsoft could signal an intermediate-term trend reversal. Learn why confirmation is key in technical analysis....

READ MORE

MEMBERS ONLY

What Happens to Bitcoin Should QQQ Correct?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stock market correction risks are rising as key indicators flash warnings. Discover sector correlations with SPY, potential safe havens, and how Bitcoin's surge aligns with QQQ in this data-driven analysis....

READ MORE