MEMBERS ONLY

Simple Way to Find Confluence FAST Using Moving Averages

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe explains how to use an 18 simple moving average in multiple timeframes to identify when a stock has confluence amongst 2-3 timeframes. He shows how to start with the higher timeframes first, before working down to the lower ones. Joe then covers the shifts...

READ MORE

MEMBERS ONLY

Best Way to Capitalize on Election Rally!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen presents a deep dive into last week's sharp rally in the markets. She highlights what areas could perform best under a Trump administration and how to spot a pullback. She takes a close look at the "New Economy" and...

READ MORE

MEMBERS ONLY

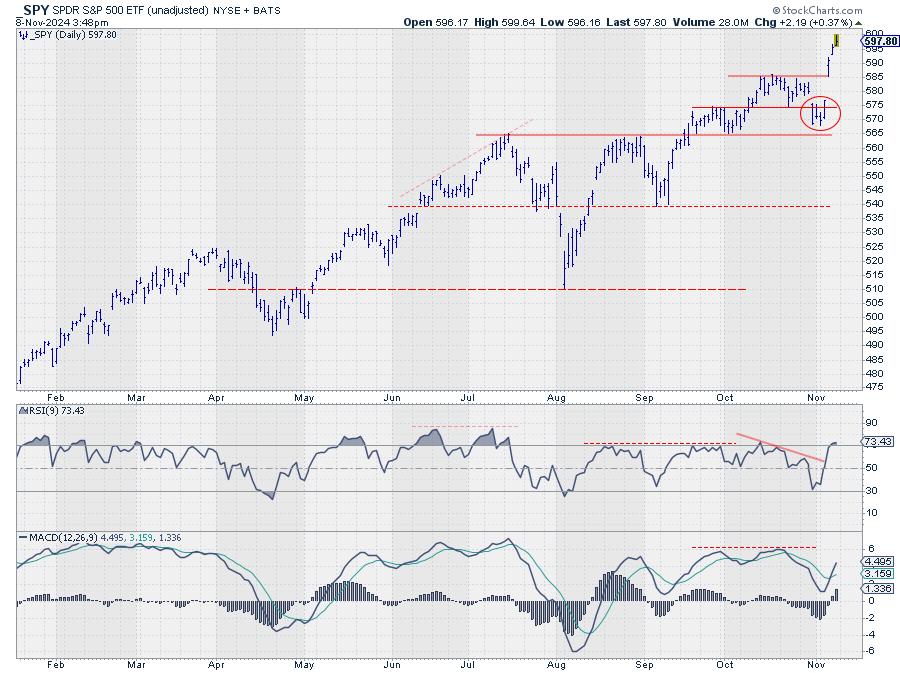

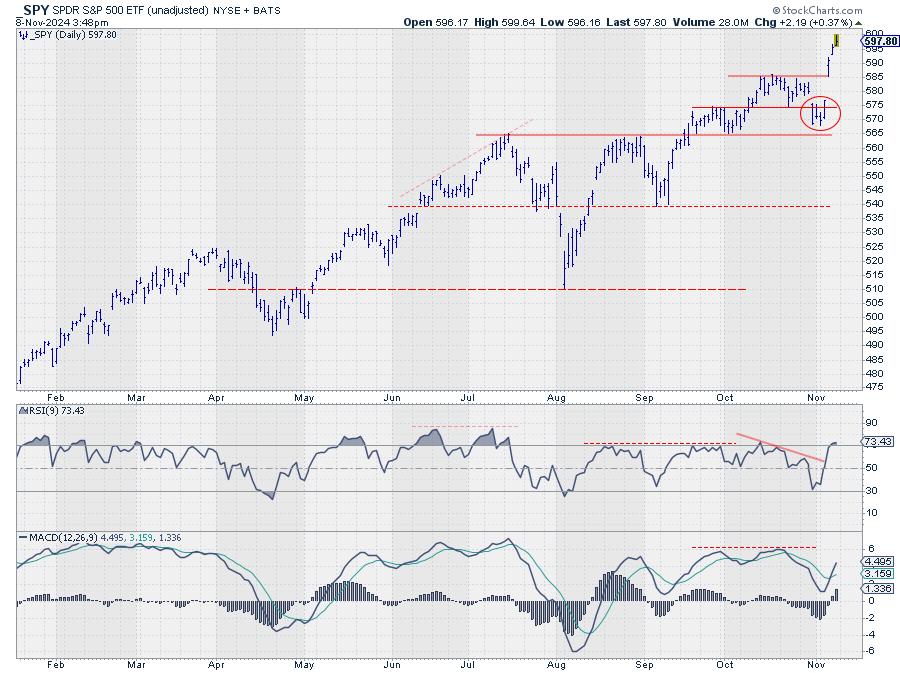

Three Sectors Leading SPY Back to Offense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The market came out of defensive mode after the election.

* Old resistance at 585 is now support for SPY.

* XLC, XLY, and XLF are all showing strength.

First of all, for those of you looking for a new video this week, I have intentionally skipped it because I...

READ MORE

MEMBERS ONLY

These S&P 500 Stocks Are Poised To Outperform!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the negative price action in the broader markets while highlighting pockets of strength. She shares how the rise in interest rates is impacting the markets ahead of next week's FOMC meeting. Last up is a segment on how to use...

READ MORE

MEMBERS ONLY

Halloween Scare: The Stock Market Ends October on a Wicked Tone

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tepid earnings and negative news sends Tech stocks plunging.

* Economic data supports the narrative that the Fed will cut interest rates by 25 basis points in November.

* The long-term trend of the broader indexes are still bullish.

The Halloween effect caught up with the stock market! October 31...

READ MORE

MEMBERS ONLY

A Simple Candle With BIG Meaning

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows a specific candlestick pattern that, when it develops at the right time, can signal the start of a new upleg. He uses NVDA, MSFT and GLD to explain how this can setup at different times and can give a timely signal to look...

READ MORE

MEMBERS ONLY

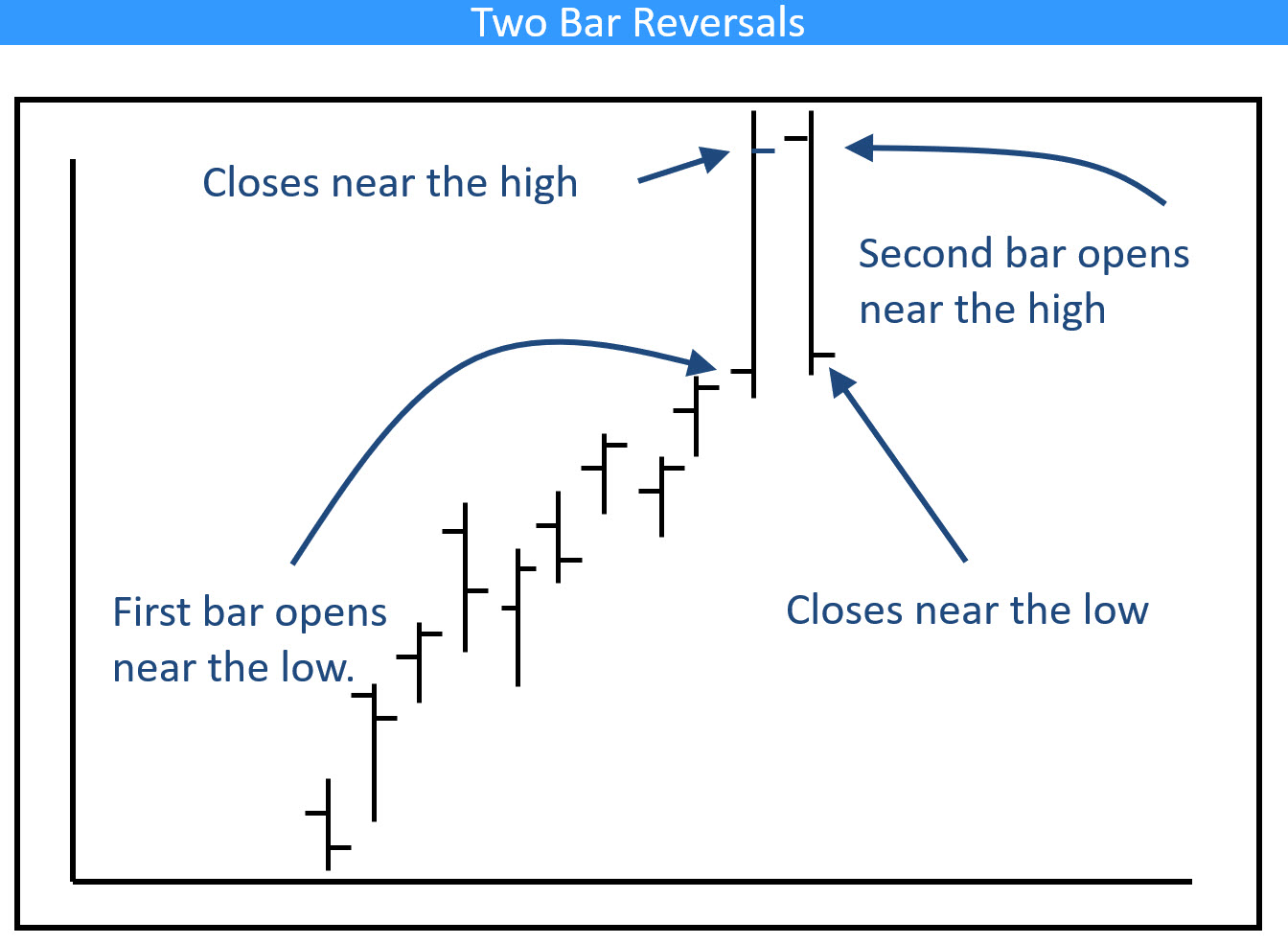

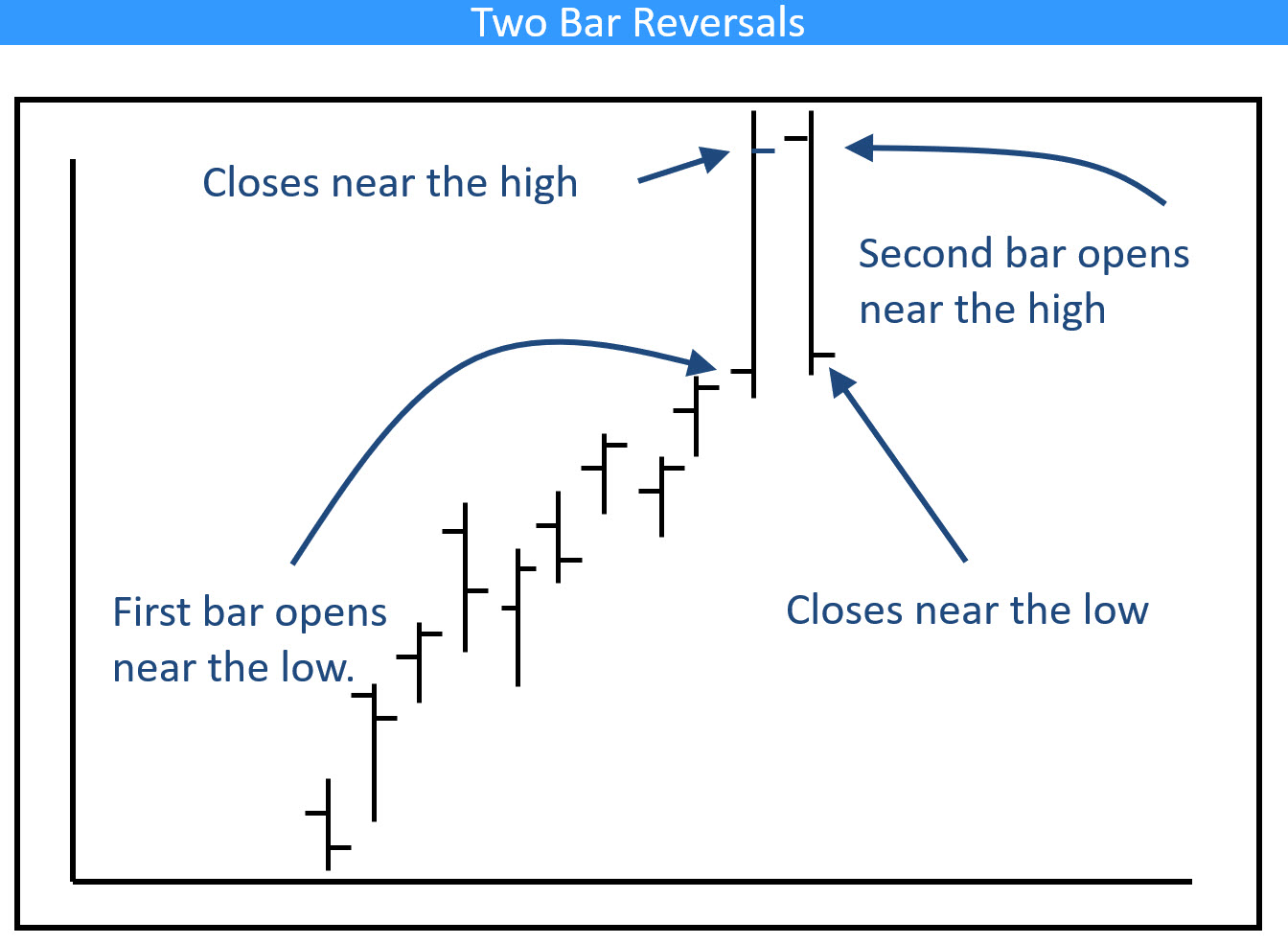

Four Sectors That Have Just Experienced Bearish Weekly Action

by Martin Pring,

President, Pring Research

Most weekends, I flip through a chartlist featuring weekly bars and candles for sectors, country ETFs, currencies, bonds and some commodities. The idea is to see whether any of these entities are showing signs of bullish or bearish reversals. Most of the time, this fishing exercise does not uncover a...

READ MORE

MEMBERS ONLY

How to Trade Gaps Up (and Down) After Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen shares how the markets trade right before the elections, and also reviews the move in Tesla (TSLA) after reporting earnings. She shares examples of what to watch for if your stock is due to report earnings - and what to do if it...

READ MORE

MEMBERS ONLY

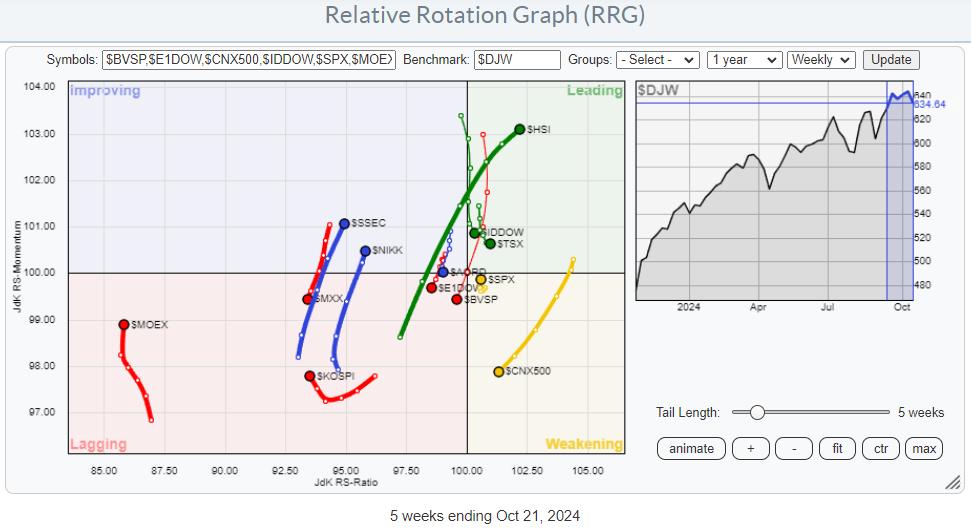

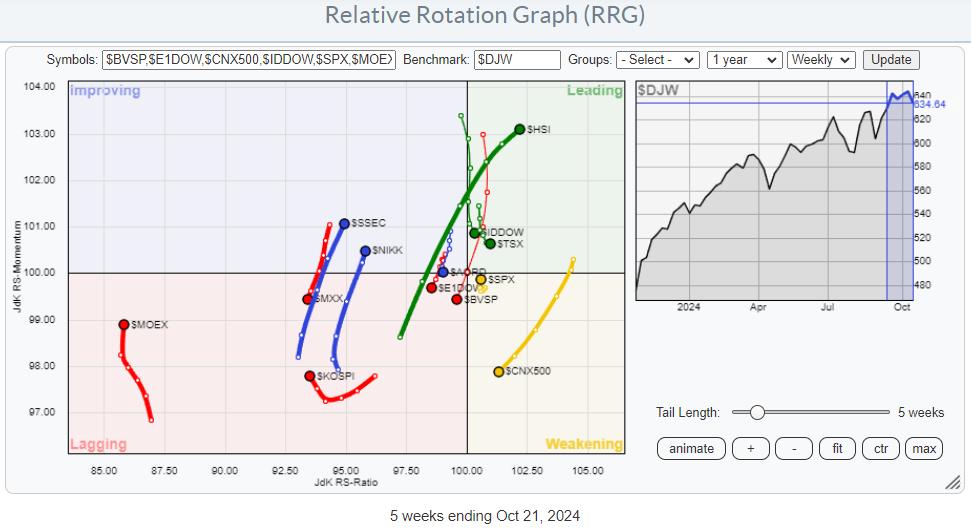

The US is Not the Only Stock Market in the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Asian stock markets showing strong relative trends.

* Meanwhile, India, Mexico, and Brazil are nosediving.

* Overall, the US is stull beating Europe.

The global stock market is a big place, and it extends far beyond the borders of the United States. While the US market is undeniably the largest...

READ MORE

MEMBERS ONLY

This Stock Market Will Likely Outperform the World Index, But Could Be Outshone by Something Completely Different

by Martin Pring,

President, Pring Research

Since 2011, the US stock market, represented by the S&P Composite, has outperformed the world. In the last couple of weeks or so, it has managed to break out from a trading range in its relationship with the rest of the world and looks headed even higher on...

READ MORE

MEMBERS ONLY

My Favorite RSI Signal

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how he sets up the RSI 20 and 5 in ACP to save space and improve analysis. He explains how he uses RSI for both reading the trend and for fine-tuning entry in a strong trend. He gives examples using weekly, daily, and...

READ MORE

MEMBERS ONLY

Be On the Lookout for THIS During Earnings Season!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews what's driving the markets higher and how you can capitalize. Moves in TSLA, NVDA, and NFLX are highlighted. She also reviews price action greatly impacted by earnings, many driven by analyst upgrades and downgrades.

This video originally premiered October 18,...

READ MORE

MEMBERS ONLY

Why the MACD Crossover Signal is SO Important

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shares the MACD downside crossover signal and explains the different ways it can play out when it takes place above the MACD zero line. These downside crossovers can lead to opportunities depending on other criteria, including the ADX action. He then shows how...

READ MORE

MEMBERS ONLY

The Next Big Move in Yields May Be Different Than You Think

by Martin Pring,

President, Pring Research

Below, Chart 1 shows a weekly plot for the 30-year yield, where we can see a perfectly formed top whose completion was followed by a negative 65-week EMA crossover. At the time of the breakdown, there were few grounds for suspecting a false break. However, in the last couple of...

READ MORE

MEMBERS ONLY

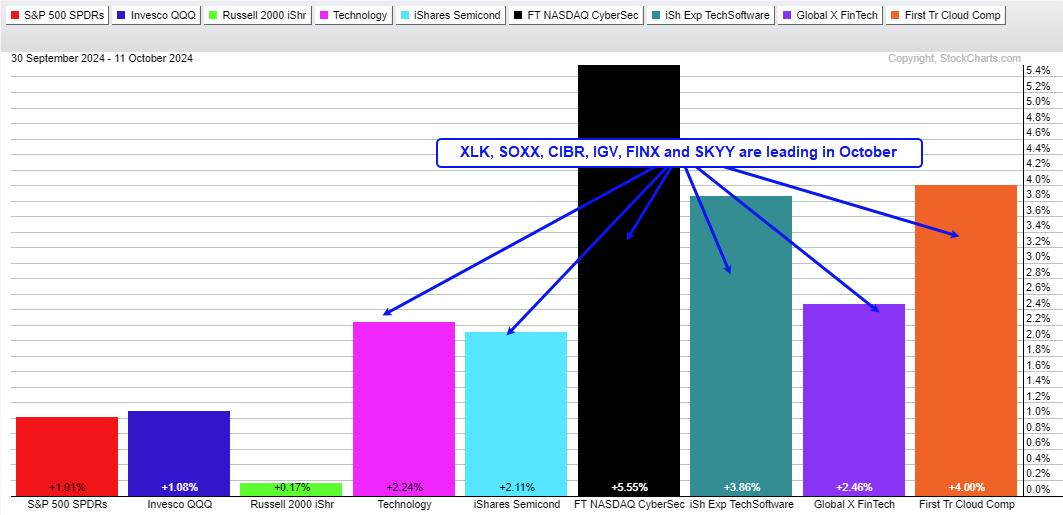

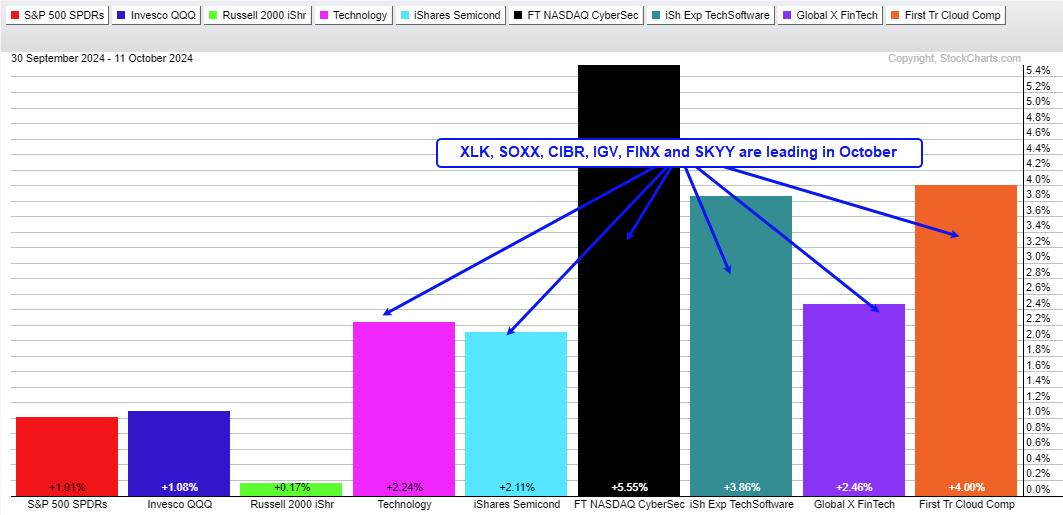

Cybersecurity ETF Comes to Life with New Trending Phase

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Stocks go through trending and non-trending phases.

* Non-trending phases often last longer than trending phases.

* CIBR recently broke out and started a new trending phase.

The Cybersecurity ETF (CIBR) is resuming the lead as it surged to new highs this past week. It is important to note that...

READ MORE

MEMBERS ONLY

Last Week's Pullback is a Buying Opportunity!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights what's driving these markets higher despite a rise in interest rates. She also focuses on the leadership area in Technology and shares several stocks from this group. Last up, she reviews how to quickly uncover top stock candidates when a...

READ MORE

MEMBERS ONLY

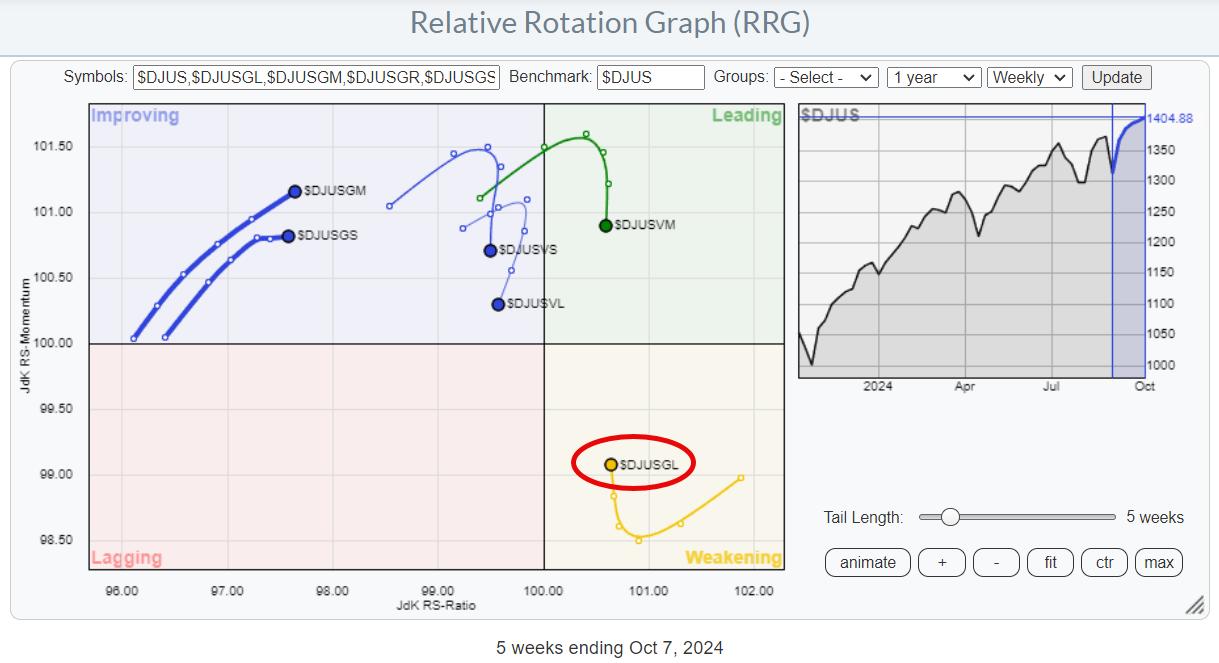

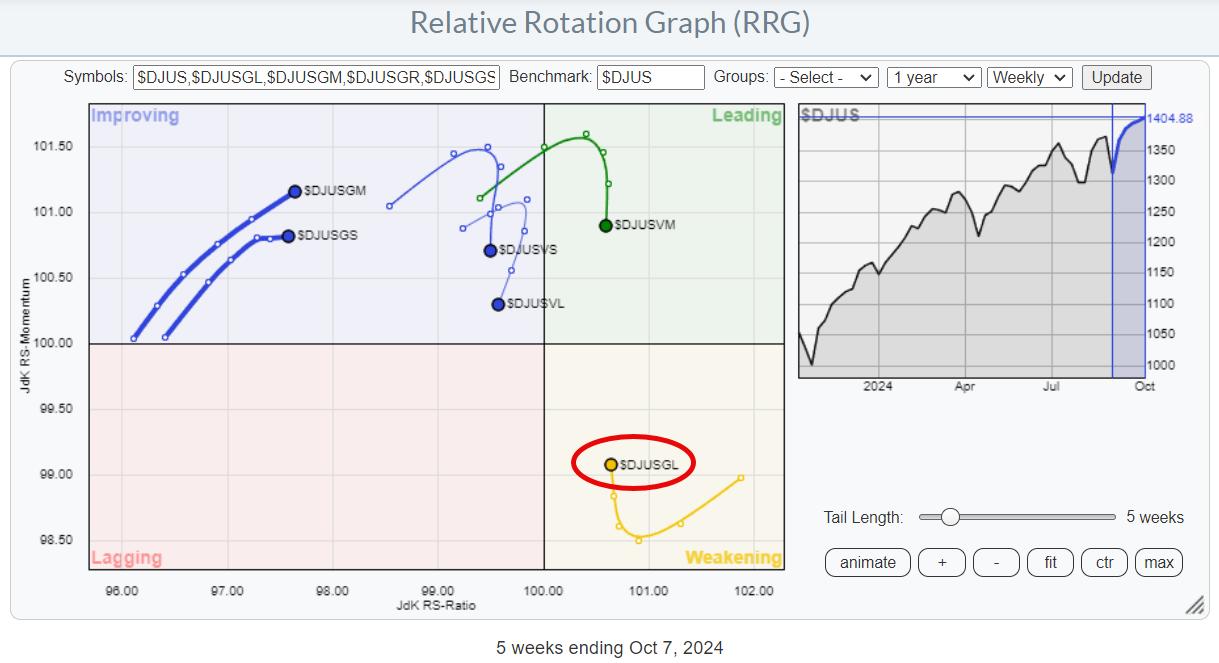

It's Large-Cap Growth Stocks (Mag 7) Once Again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is starting to resolve its negative divergence with RSI.

* Large-cap growth is coming back into favor.

* Magnificent 7 stocks provided 2.9% of the S&P 50's 6.8% performance over the past five weeks.

Where is the Recent Performance in the S&...

READ MORE

MEMBERS ONLY

Tech vs Semiconductors: Which One Should You Be Trading?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Doing a top-down sector-to-industry analysis can be an effective way to find tradable opportunities.

* It makes sense to compare charts to see which ones are outperforming and which are underperforming.

* Get a bigger picture, drill down using relative performance indicators, and then examine specific key levels of each...

READ MORE

MEMBERS ONLY

What's Wrong With This SPX Breakout?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe presents the price pattern to follow the recent breakout in the S&P 500. He discusses narrow range bars, wide range bars and when they are important. Joe then explains what needs to take place now to either confirm a breakout or...

READ MORE

MEMBERS ONLY

Oil Prices Soar Amid Middle East Tensions – What's Next for Gas Prices?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Crude oil prices spiked, largely due to tensions in the Middle East.

* Gasoline prices are following crude oil prices.

* An analysis of the charts of crude oil and gasoline prices show potential trading opportunities.

Monday saw something of a bloodbath on Wall Street, with the Dow ($INDU) plunging...

READ MORE

MEMBERS ONLY

Will Technology Drive S&P Higher in October?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius explores the October seasonal outlook for the S&P 500 and various sectors. Seasonality suggests a potential rise in the S&P 500, fueled by strength in technology, but there are still concerns about the ongoing negative divergence between price and...

READ MORE

MEMBERS ONLY

Gold Price Surge: What Goldman Sachs' $2,900 Forecast Means for Investors

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Goldman Sachs just raised their price target for gold to $2,900 an ounce.

* Goldman Sachs' price target roughly equals $280 in SPDR Gold Shares ETF (GLD).

* GLD could have more room to run.

Here's the issue with gold: it's difficult to find...

READ MORE

MEMBERS ONLY

Traders are Eyeing These Metals After China's Big Economic Shift: Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Metals appear to be reacting bullishly after China injected more stimulus into its economy.

* Gold, silver, and copper are displaying unique patterns and structures.

* Keep an eye on momentum for clues as to each metal's likely move within the context of its current pattern.

China'...

READ MORE

MEMBERS ONLY

Are Lower Interest Rates Bad For Workers? | Focus on Stocks: October 2024

by Larry Williams,

Veteran Investor and Author

The common economic perception is that lower interest rates are good for business, which, in turn, means good for job growth. The following charts will turn that idea upside down and inside out. Keep in mind there is no chart fancy-dancing going on here; I am just presenting the last...

READ MORE

MEMBERS ONLY

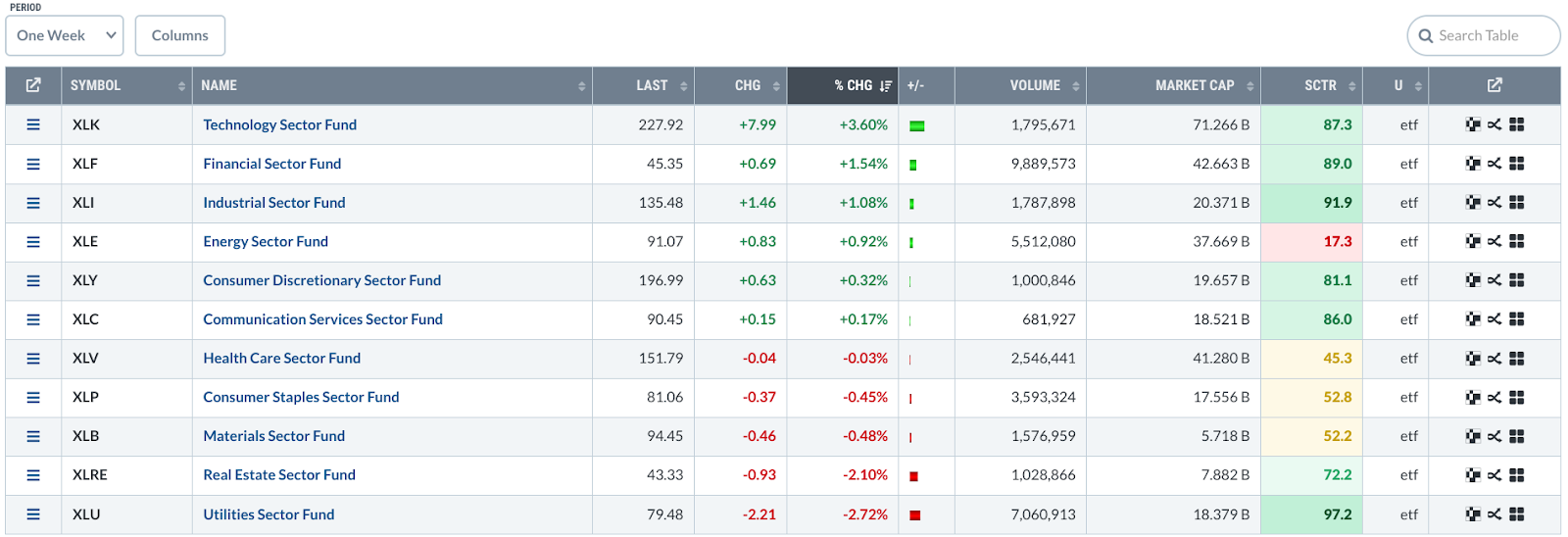

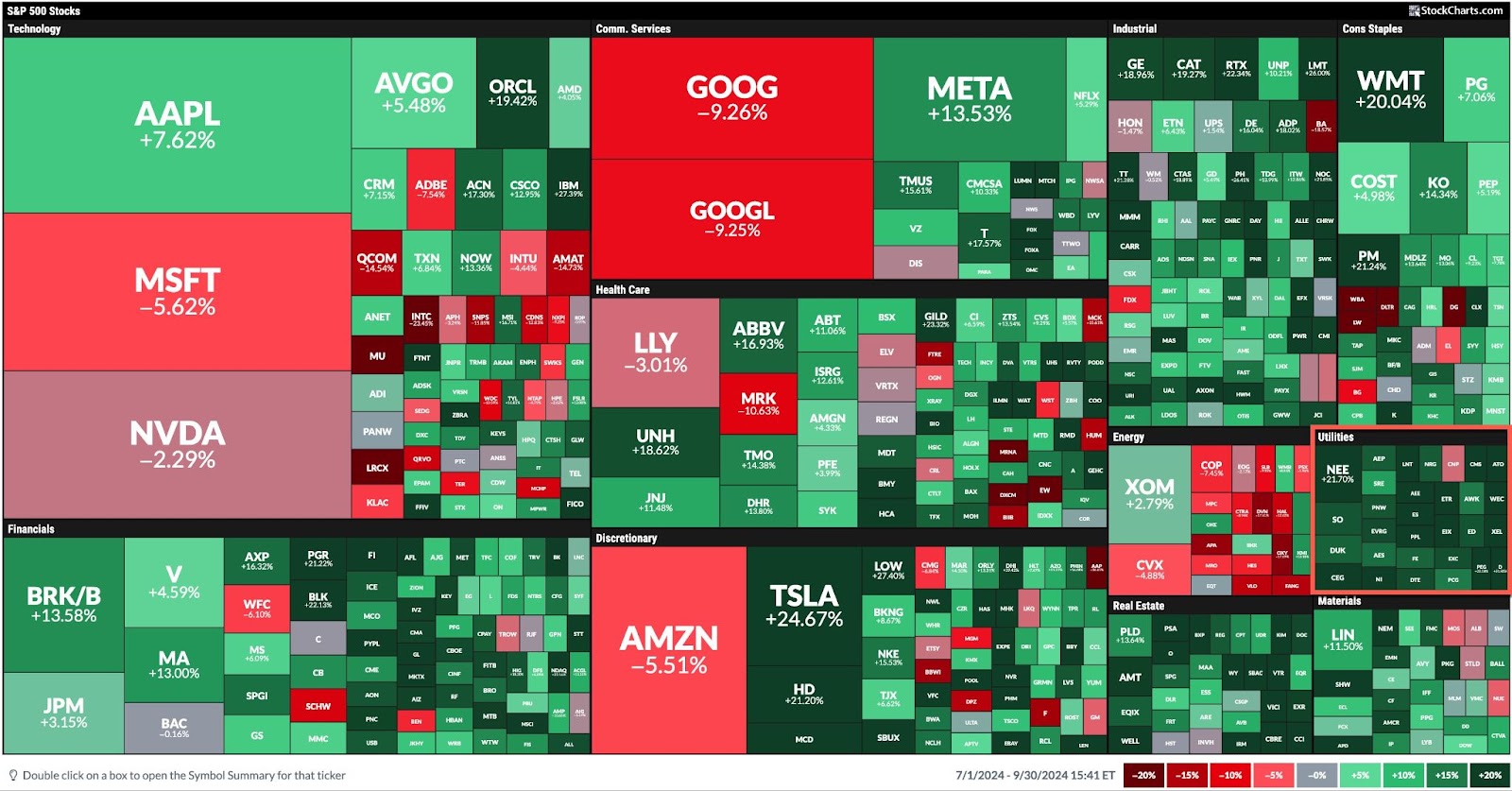

Stock Market's Spectacular Q3: Highest Sector Performer is Utilities

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The leading sector performer in Q3 was Utilities, up by 19.35%.

* Utility stocks are gaining attention because of their ability to power up AI companies.

* Many utility stocks provide dividends, which could add some extra cash to your portfolio.

September, typically considered to be the weakest month...

READ MORE

MEMBERS ONLY

Why Were Chinese Stocks Up 20% Last Week?!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets, including sector and industry group rotation, before highlighting the sharp move into Chinese stocks. She shares her thoughts on whether it's too late to participate. In addition, she looks at the key traits that signal your stock...

READ MORE

MEMBERS ONLY

Unlocking GDX's Short-Term Potential: How to Nail the Measured Move Strategy

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* VanEck Vectors Gold Miners ETF (GDX) broke above its recent highs, confirming a continued uptrend.

* GDX displayed a short-term trading setup that was apparent in its price chart.

* The "measured move" rule can exploit an obvious short-term trading opportunity in GDX.

A few weeks back, two...

READ MORE

MEMBERS ONLY

SCTR Report: China Adds More Stimulus, FXI in Second Position

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* iShares China Large-Cap ETF (FXI) gains technical strength and has made it to second position in the StockCharts Technical Rank (SCTR).

* FXI could be in the early stages of a bull rally, so keep an eye on this ETF.

* Set your price target levels for entry and exit...

READ MORE

MEMBERS ONLY

Strategy After Rate Cuts: Best Areas to BUY!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets after last week's rate-cut induced rally. She also shares stocks that are breaking out of bases and poised to trade higher. The "nuclear renaissance" is also discussed, as well as stocks that will benefit the...

READ MORE

MEMBERS ONLY

A Sector Rotation Dilemma ...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector Rotation remains defensive

* S&P chart showing resemblence to late 2021

* Negative divergences still in play

First of all, I apologize for my absence this week. I caught something that looked like Covid, and felt like Covid, but it did not identify (pun intended) as Covid....

READ MORE

MEMBERS ONLY

Analyzing Investor Sentiment for Gold

by Carl Swenlin,

President and Founder, DecisionPoint.com

Sentiment indicators are contrarian, meaning that when the majority of investors are bullish on a market, it is bearish for that market. Most investors are aware of several sentiment indicators that relate to the stock market, but they may not be aware that there is a sentiment indicator for gold...

READ MORE

MEMBERS ONLY

The Secret to Perfecting SPY Entry Points? RSI!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows how to use RSI in multiple timeframes to identify the next buying opportunity in the SPY. Joe thinks this rally is important; he uses the ADX to distinguish between the strength in different indices. Joe demonstrates how he moves quickly around ACP,...

READ MORE

MEMBERS ONLY

Investors Hesitant Ahead of Fed Meeting: How to Prepare

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes went above resistance levels, but retreated by the close.

* Small-cap stocks took the lead in Tuesday's trading.

* The Fed's decision on interest rates could make for a volatile trading day.

The broader stock market indexes are still in a holding...

READ MORE

MEMBERS ONLY

How High Can Gold Prices Go? The Tools You Need to Spot the Next Big Breakout!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold prices are soaring and are at an all-time high.

* Anticipated Fed rate cuts can send gold prices higher.

* There are two tools you can use to project gold price action in bullish and bearish scenarios.

As of Tuesday, the CME's FedWatch Tool gave a 67%...

READ MORE

MEMBERS ONLY

An Indicator to Reduce Whipsaws and Ride Trends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Whipsaws and losing trades are part of the process for trend-following strategies.

* These strategies are profitable because average profits far exceed average losses.

* Chartists can reduce whipsaws by adding signal thresholds to the 5/200 day SMA cross.

Whipsaws and losing trades are part of the process for...

READ MORE

MEMBERS ONLY

These Stocks are Just Beginning Their Move Higher!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets and highlights pockets of strength that are starting to trend higher. She also shares add-on plays to the move into home construction stocks, and shows key characteristics needed to confirm a downtrend reversal in select stocks.

This video originally...

READ MORE

MEMBERS ONLY

A Half Point Fed Rate Cut? The Stock Market Thinks So

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks make a strong recovery after last week's selloff.

* Large-, mid-, and small-cap stocks closed higher, with small caps the clear leader.

* Gold and silver prices surged on interest rate cut expectations.

This week's stock market action may have caught many investors by surprise....

READ MORE

MEMBERS ONLY

A Déjà Vu in The Consumer Staples Sector Sends a Strong Warning Signal

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Tech bounce is judged as recovery within downtrend.

* XLP, XLF, and XLV are positioned for outperformance in coming weeks.

* The XLP chart is showing interesting characteristics which we have seen before

Tech Rallies, But Remains Inside the Lagging Quadrant

A quick look at the Relative Rotation Graph for...

READ MORE

MEMBERS ONLY

Stock Market Today: Are Big Tech Growth Stocks Back in the Spotlight?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks rebounded on Wednesday with wide trading ranges.

* Investors are rotating back into large-cap growth and momentum stocks.

* The Financial sector was hit hard by negative news from banks but made some recovery.

It was a massive turnaround day in the market on Wednesday—stocks sold off after...

READ MORE

MEMBERS ONLY

Pinpoint Strong Sectors BEFORE The Masses Notice

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe discusses why he is a bottom-up technical analyst. He explains the difference between top-down and bottom-up analysis and uses this to show the strongest sectors rotating to the upside right now; this approach will help give advance notice of which areas to focus...

READ MORE