MEMBERS ONLY

Stock Market Today: Real Estate and Tech Lead, Energy Down

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The real estate sector gains ground as interest rate cuts loom.

* Technology stocks are showing slight gains, but not enough to shift momentum.

* Energy prices slide lower on weakened demand.

The Real Estate sector took the lead in Tuesday's trading, probably because interest rate cuts are...

READ MORE

MEMBERS ONLY

Biotech's Big Comeback: Why Investors are Eyeing This Beaten-Down Sector

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* With Fed rate cuts now widely anticipated, investors are looking to the biotech industry for potential investment opportunities.

* Biotech, a highly-speculative industry, has declined sharply since 2020 as inflation, along with higher interest rates, set in.

* You can spot green shoots of capital flowing into biotech; watch the...

READ MORE

MEMBERS ONLY

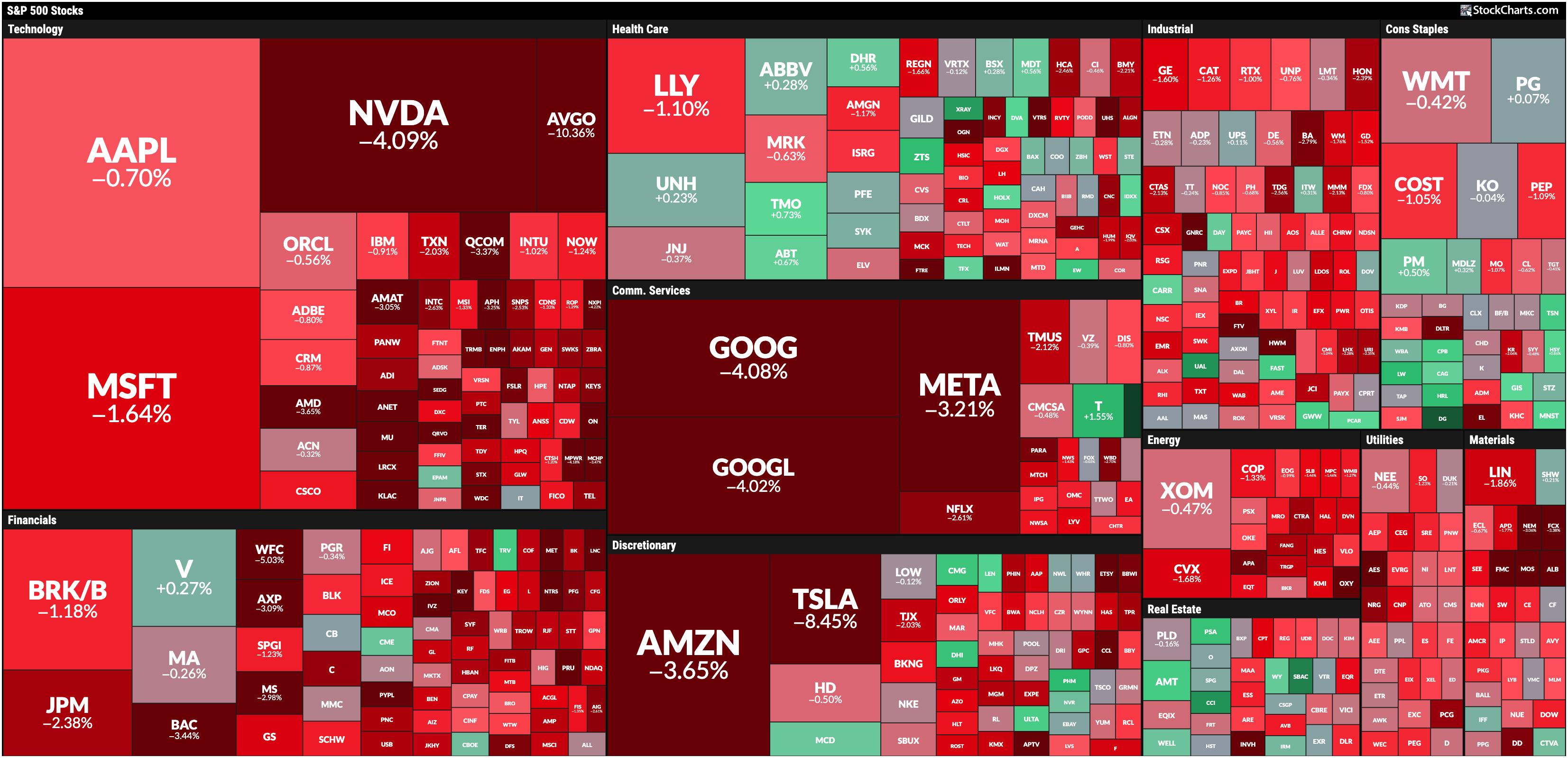

Broad-Based Stock Market Selloff: How to Position Your Portfolio?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

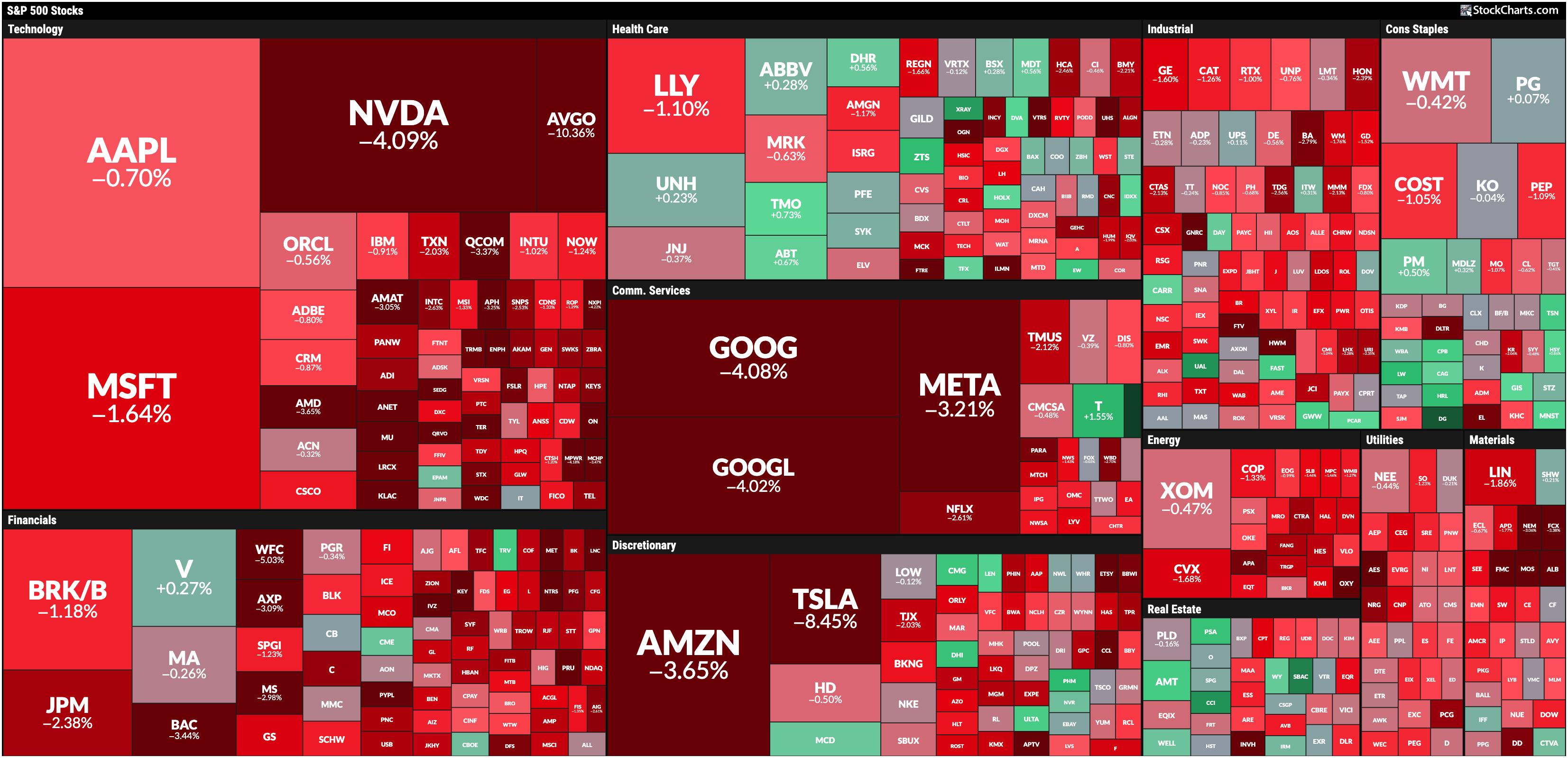

* Broader stock market indexes sell off as investors fear rate cuts may be too late.

* Treasury yields fell to their lowest yearly levels.

* Big Tech stocks got hammered, with semiconductor stocks getting hit the hardest.

After a week of wavering action, the stock market made a directional move—...

READ MORE

MEMBERS ONLY

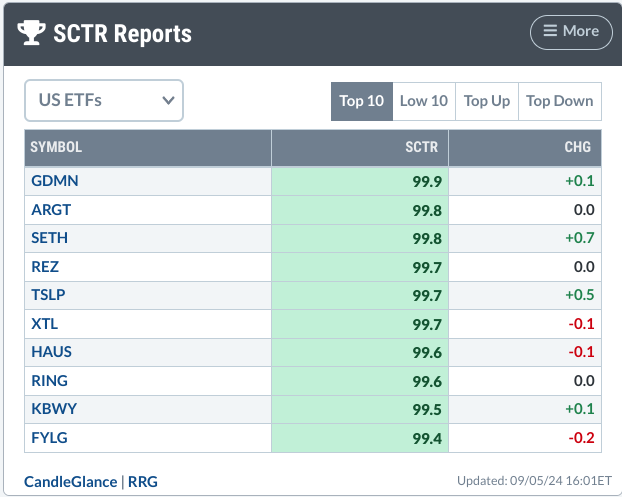

How to Spot a Golden Mining Opportunity Using SCTR Reports

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The SCTR Report highlighted two gold miner ETFs, indicating that the industry is seeing positive movement.

* A deeper dive into gold miner ETFs uncovers problems and opportunities.

* The ZigZag line applied to the chart of GDX helps identify entry and exit levels.

On Thursday afternoon, I dove into...

READ MORE

MEMBERS ONLY

It all Started with a Big Bang!

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Extended uptrends often start with a bang, a big bang.

* Chartists can find big bangs by measuring price moves in ATR terms.

* Paypal broke a major resistance level with a 5+ ATR advance in August.

Extended trends often start with big bangs and major breakouts. Chartists can identify...

READ MORE

MEMBERS ONLY

Should You Buy the Dip in NVDA?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets, including NASDAQ weakness, and the outperformance in the equal-weighted S&P 500. She examines NVDA and shares how you should trade the stock depending on your investment horizon. Last up, Mary Ellen reveals top stocks in leadership areas....

READ MORE

MEMBERS ONLY

What Would a Top in Semiconductors Mean for the S&P 500?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A head-and-shoulders top pattern has to complete three phases before it can be considered valid.

* Even if semiconductors would complete this bearish price pattern, strength in other sectors suggests limited impact on the broader equity space.

After Nvidia (NVDA) dropped after earnings this week, investors are once again...

READ MORE

MEMBERS ONLY

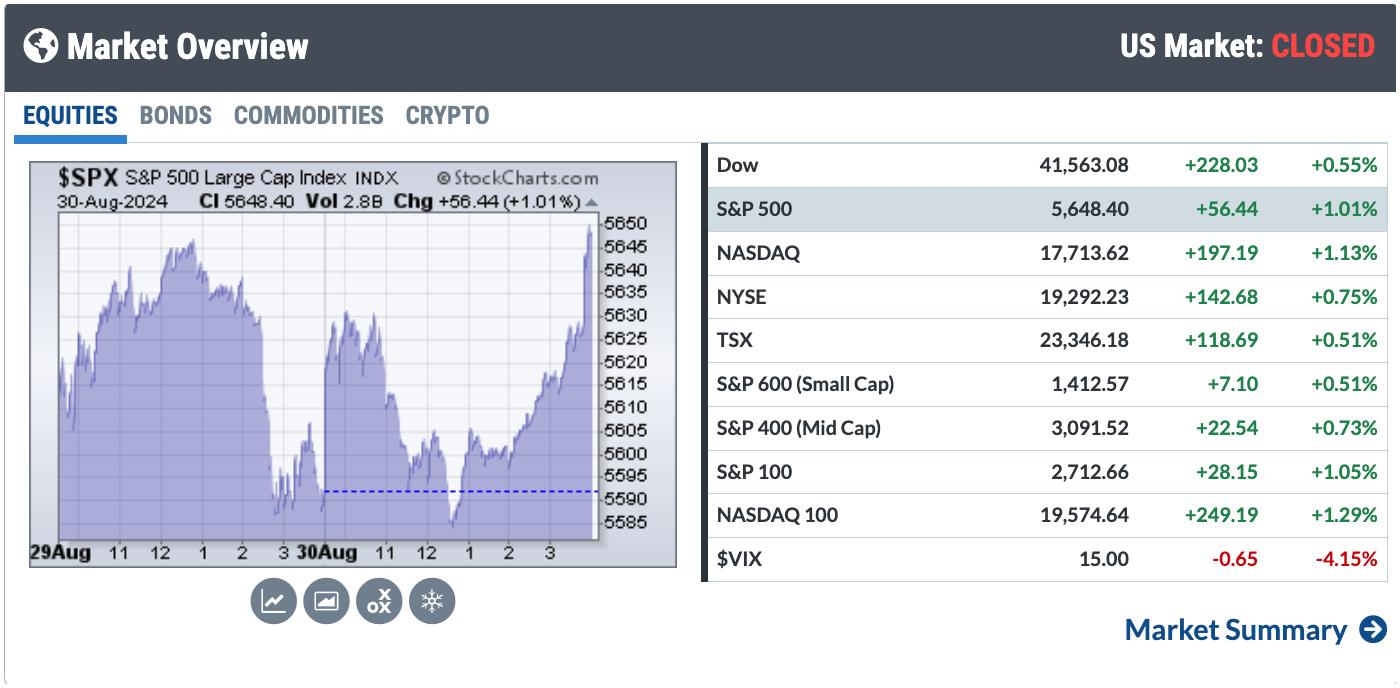

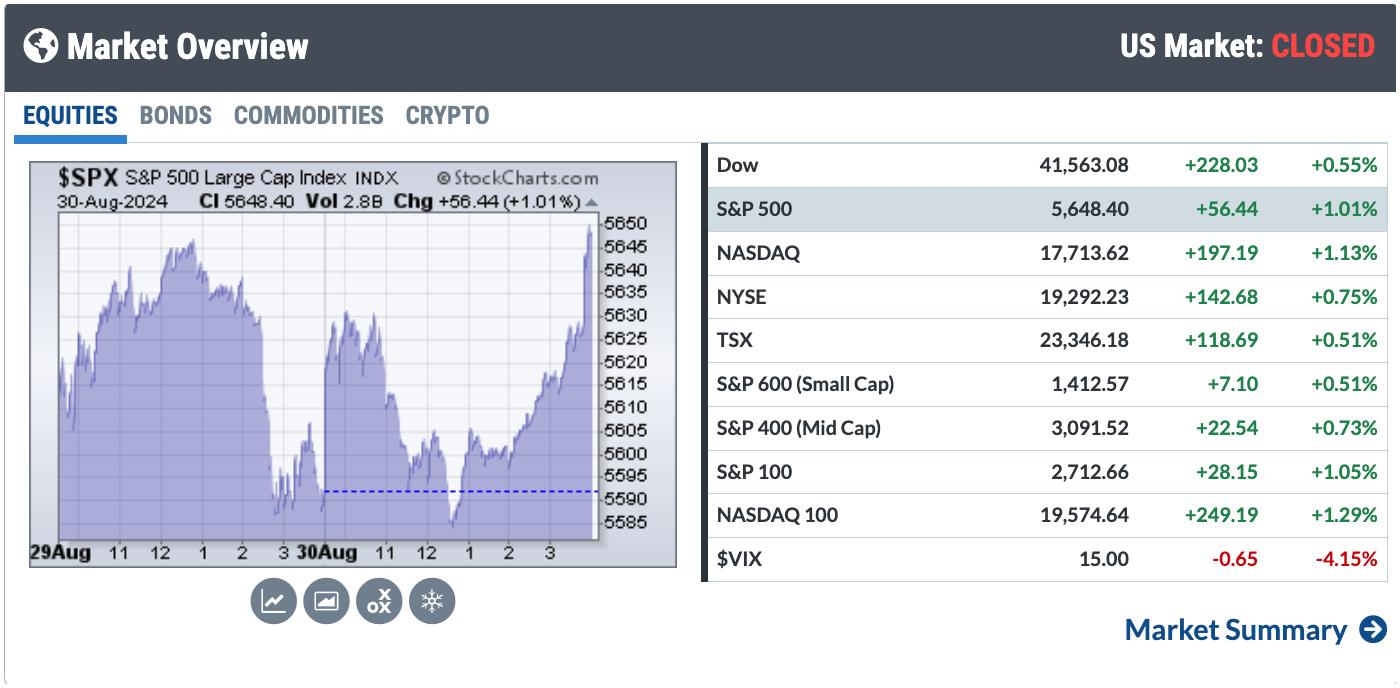

Charting Forward: Opportunities You Can Seize in September

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks close higher on Friday with volatility remaining low.

* September is typically a weak month for equities.

* Energy and Utilities tend to perform better in September.

It's a quiet end to August, with the broader stock market indexes wavering higher and lower. The Market Overview panel...

READ MORE

MEMBERS ONLY

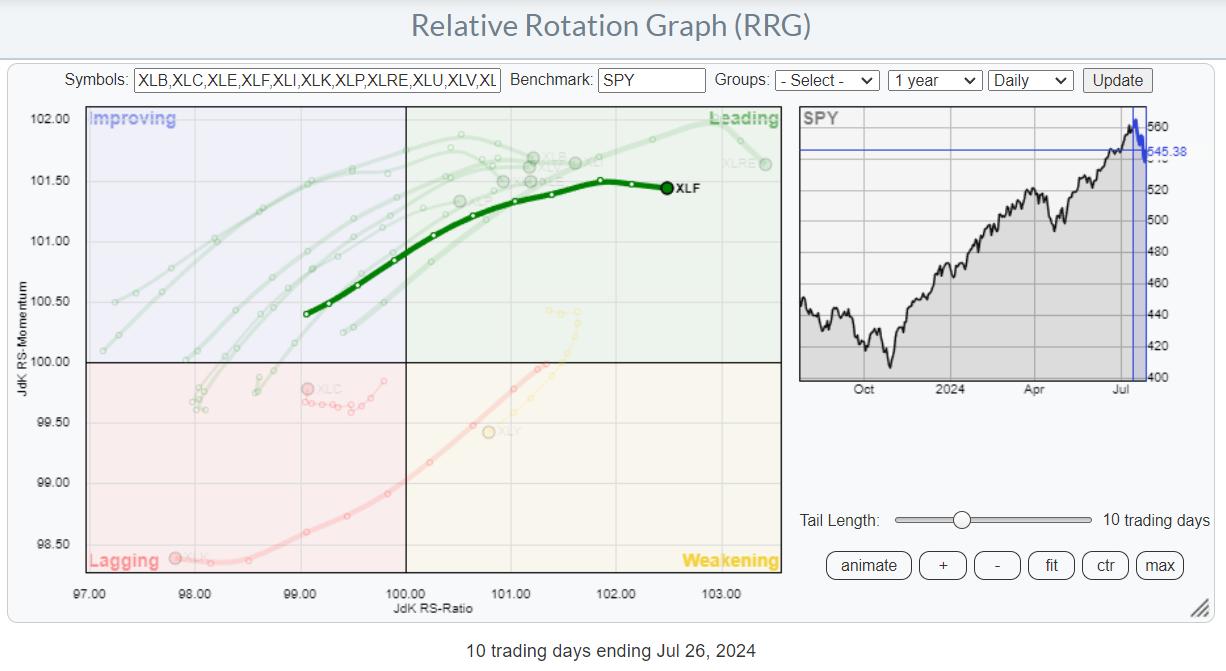

New Highs, But Danger Looms—Is XLF Heading for a Big Fall?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

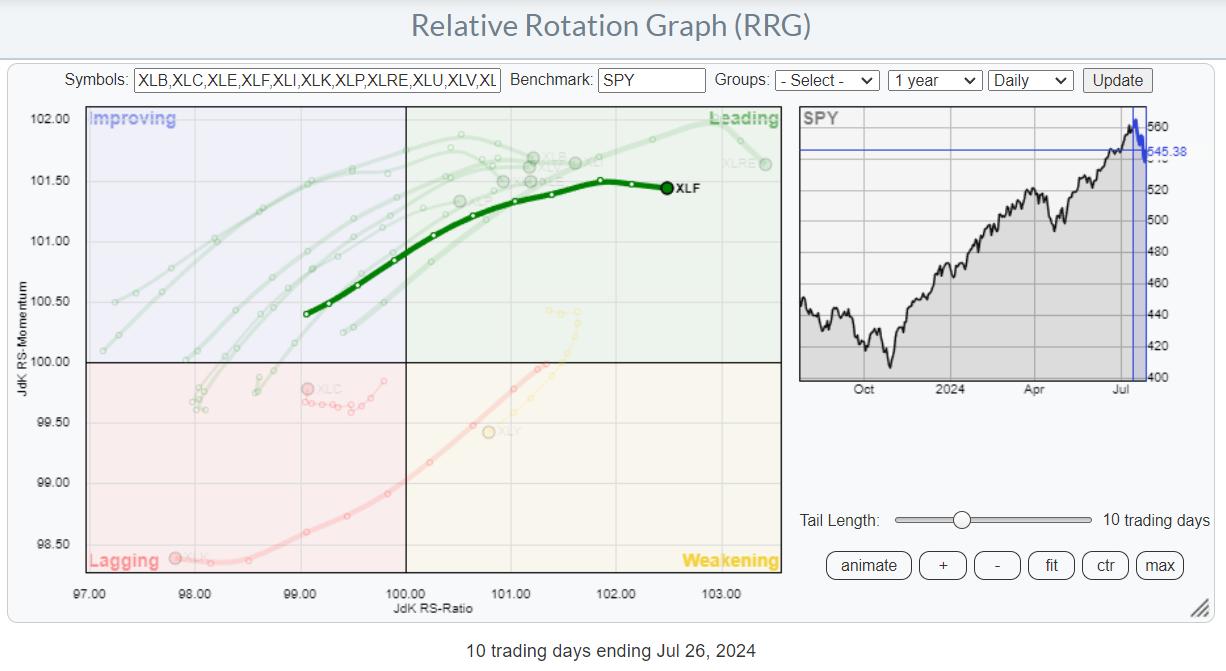

* Financials typically struggle in September, but tend to rally in Q4.

* XLF has broken into all-time high territory, but its momentum is fading.

* If XLF dips in September, it could present a buying opportunity.

Financial sector stocks are at an all-time high, fueled partly by earnings beats, a...

READ MORE

MEMBERS ONLY

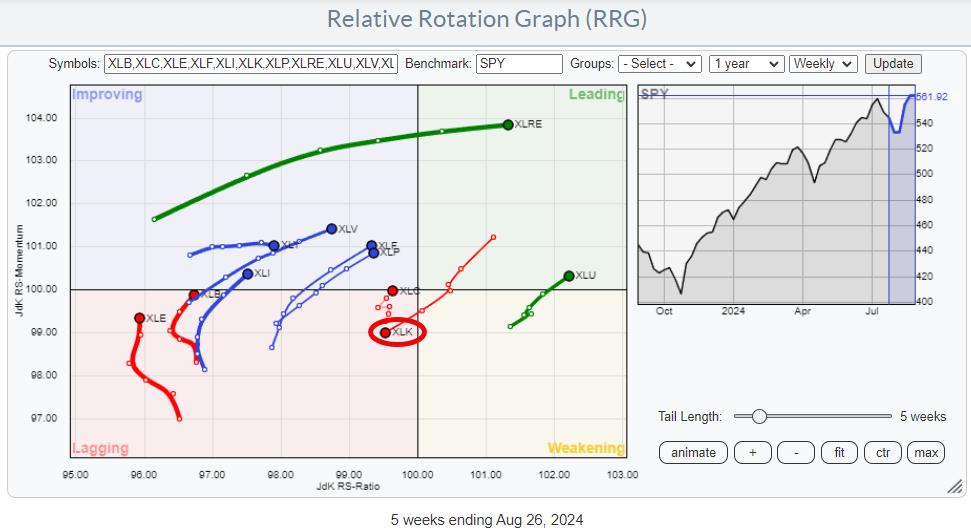

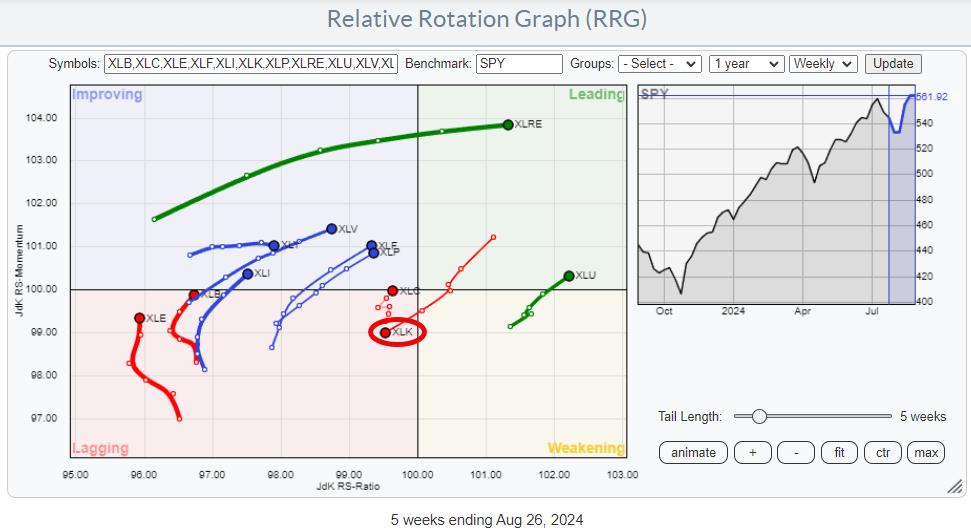

NVDA is Not the Only Semiconductor Stock Out There

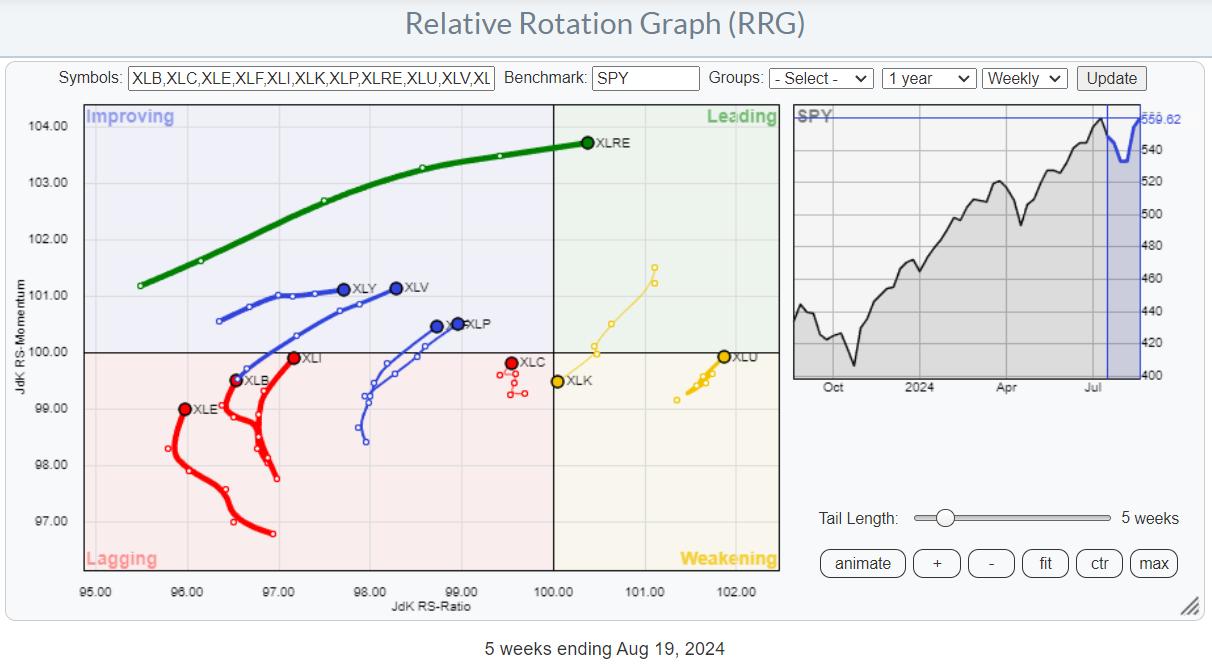

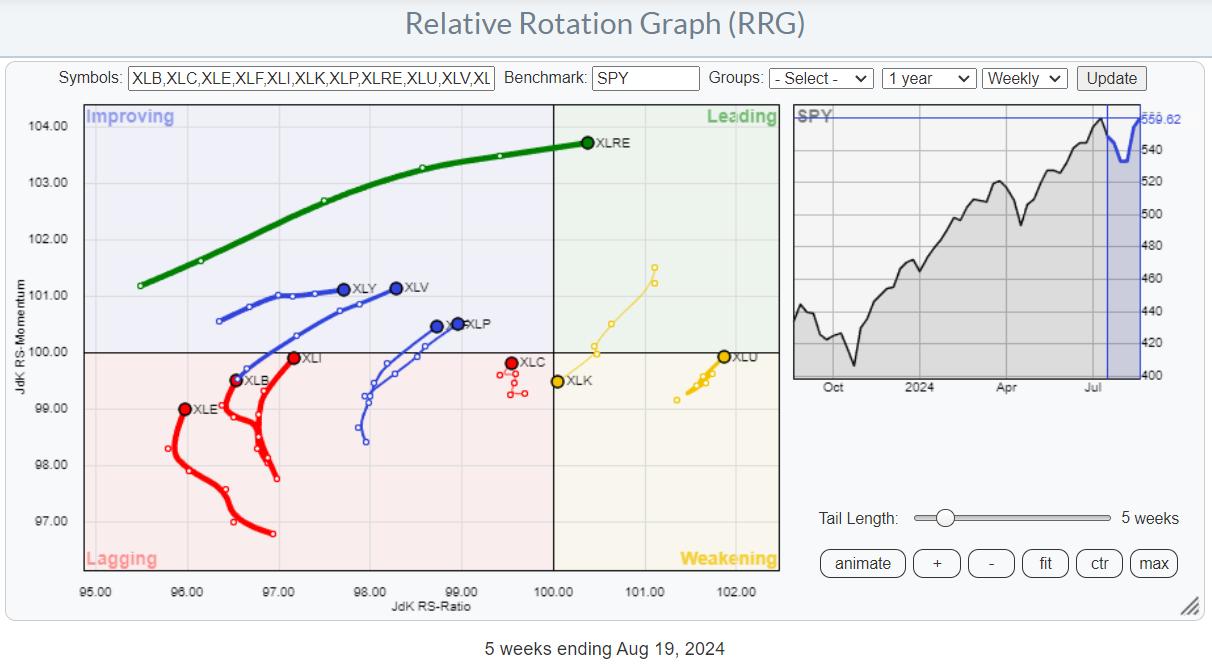

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is pushing against resistance.

* The technology sector is out of favor, and semiconductors are a drag for it.

* NVDA is big, but it is not the only semiconductor stock.

It's All Still Relative

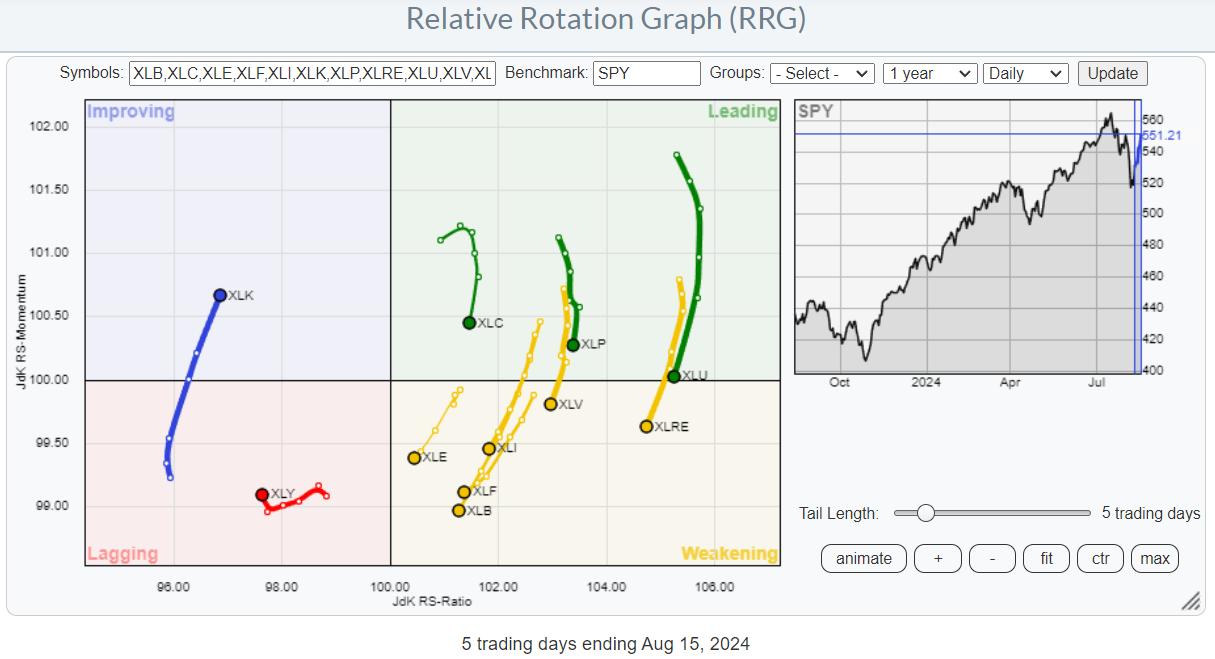

The weekly Relative Rotation Graph, as it looks toward the close of...

READ MORE

MEMBERS ONLY

NVDA Earnings Miss, Yet Dow Powers Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down key sector leadership themes and why growth stocks like Nvidia continue to take a back seat to value-oriented sectors. He speaks to the inverted yield curve, performance of the equal-weighted S&P 500 vs. the Magnificent...

READ MORE

MEMBERS ONLY

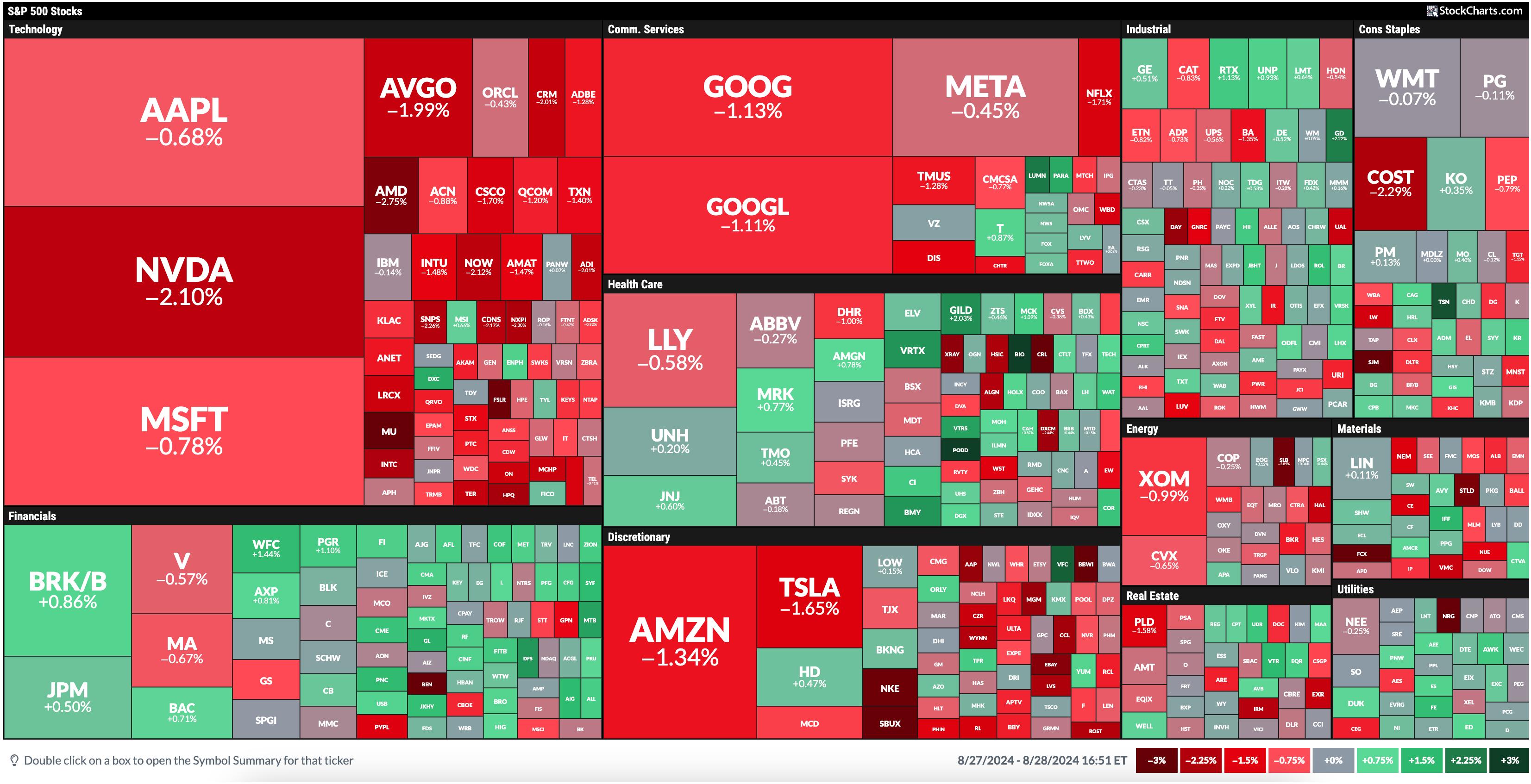

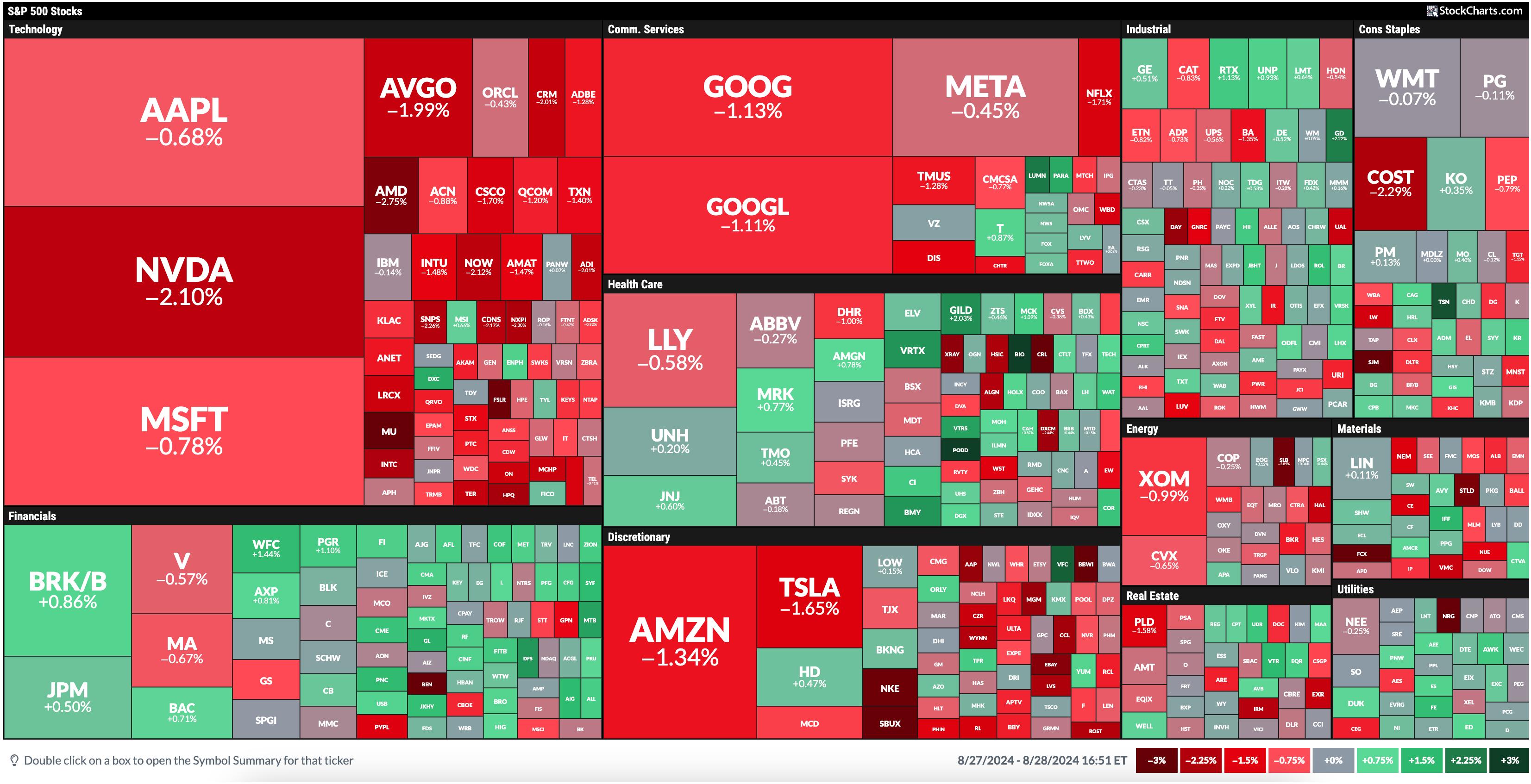

Stock Market Today: NVDA Reports, Tech Lags, Financials Take the Lead

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The leading sector today was the Financials, followed by Health Care and Utilities.

* Technology stocks sold off significantly and was the worst sector performer.

* With interest rate cuts expected in the next FOMC meeting, financial stocks have the potential to rise further.

Today's MarketCarpet was a...

READ MORE

MEMBERS ONLY

Earnings Provide Another Nail in the Retail Coffin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a brutal day for retailers as ANF, FL, and BBWI drop on earnings misses. He also highlights the bullish primary trend for hold, shares two breakout names in the consumer staples sector, and breaks down key names in...

READ MORE

MEMBERS ONLY

Three Technology Stocks in Make or Break Scenarios

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave focuses in on three key charts to watch in the technology sector as investors anxiously await NVDA earnings and Friday's inflation data. He also shares two important charts for tracking improving market breadth conditions and highlights the...

READ MORE

MEMBERS ONLY

Stock Market Today: Two Sectors That Can Make Sizable Moves

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Financial and Technology sectors were the leaders.

* With NVDA reporting earnings, tech stocks, especially semiconductors, could steal the spotlight again.

* With interest rate cuts on the horizon, financial stocks could see increased momentum.

Have you ever been in a plane that keeps circling around, waiting to land? That&...

READ MORE

MEMBERS ONLY

Major Market Shift As Week Ends Strong!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader market's health while highlighting big shifts into newer areas, including banks, retail, and autos. Sharing one of the reasons Tech stocks were weak, she highlights which areas as seeing renewed strength. She also looked at individual stocks that...

READ MORE

MEMBERS ONLY

RRG-Velocity Jumping on XLF Tail

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector rotation out of technology

* All other sectors are picking up relative strength

* Real-Estate, Utilities, and Financials showing strong rotations

On the weekly Relative Rotation Graph, the rotation still favors almost every sector over Technology. I discussed the opposite rotations between weekly and daily RRGs in last week&...

READ MORE

MEMBERS ONLY

Gold Miners' Performance vs. Gold -- Does It Say Sell Gold?

by Carl Swenlin,

President and Founder, DecisionPoint.com

In Monday's DecisionPoint Trading Room video, we were asked why we cover Gold Miners (GDX) as well as Gold (GLD). There are two reasons:

1. Some people prefer to own the commodity, Gold, and others prefer to own an operating company that benefits from the price of Gold,...

READ MORE

MEMBERS ONLY

Looking for the Next Entry Point in SPY? USE RSI!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows how to use RSI in multiple timeframes to identify the next buying opportunity in the SPY. He explains why he thinks this rally is important and uses the ADX on the daily to distinguish between the strength in different indices. Joe also...

READ MORE

MEMBERS ONLY

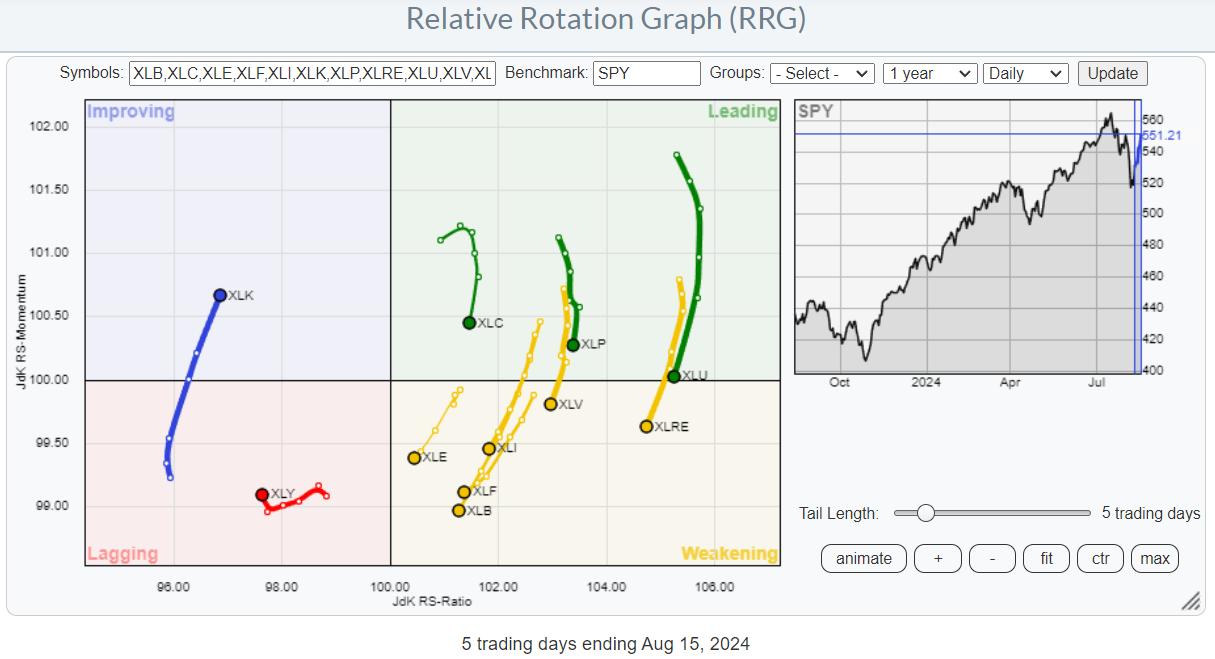

What Does This Mean for the S&P 500 Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the conflicting rotations in both asset classes and equity sectors. The weekly rotations differ significantly from their daily counterparts. What does it mean for the current rally in the S&P 500, and what does it mean for the relationship...

READ MORE

MEMBERS ONLY

This Market is On Track for a 45-Year Breakout

by Martin Pring,

President, Pring Research

It's not very often that any market experiences a 10-year breakout, let alone a 45-year one. That, however, is what Chart 1 says is about to materialize for the inflation-adjusted gold price.

Since the chart is based on monthly data, we will not know for sure until the...

READ MORE

MEMBERS ONLY

These Groups Just Turned BULLISH!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights what drove last week's sharp rally in the markets - posting their largest weekly gains for the year! She takes a close look at retail and cybersecurity stocks setting up for gains, and shares some of the best ways to...

READ MORE

MEMBERS ONLY

Will XRT (Retail) Sink or Soar? Here's What the Charts Say

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Retail stocks jumped on Thursday as the retail sales report came out higher than expected

* The SPDR S&P Retail ETF, XRT, gapped higher, but it's stuck in the middle of a wide rectangle formation

* Whether XRT breaks out or breaks down, there are key...

READ MORE

MEMBERS ONLY

Strength Off the Lows, But Concerns Remain

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Rotation to large-cap growth is back

* And so is the narrow foundation/breadth supporting this rally

* Weekly and daily $SPX charts need to get in line

Stronger than Expected

The recent rally out of the August 5th low is definitely stronger than I had anticipated. I was watching...

READ MORE

MEMBERS ONLY

Head and Shoulders Top for Semiconductors?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how breadth conditions have evolved so far in August, highlights the renewed strength in the financial sector with a focus on insurance stocks, and describes how the action so far in Q3 could be forming a potential head-and-shoulders...

READ MORE

MEMBERS ONLY

How ADX Stage Analysis Can Make You a BETTER Trader!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows the four stages a stock or market can be in at any time. He explains each stage and how ADX & Volatility can help define each stage. He then shows what stage the SPY is right and why the bias is still...

READ MORE

MEMBERS ONLY

S&P 500 Teetering On 100-Day Moving Average Support

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indexes end the week on a positive note after a scary Monday

* Volatility steps back slightly after a brief spike over 65

* Next week's consumer and producer inflation data could help set direction

A sigh of relief? The US stock market started the...

READ MORE

MEMBERS ONLY

Will USO Soar to $83? Here Are the Key Levels to Watch!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Fundamental, technical, and seasonality factors suggest an upside move in WTI crude oil.

* Seasonality and other indicators suggest a swing trading opportunity in the United States Oil Fund (USO).

* Supply and geopolitical factors can quickly change the conditions of the market and the trade.

Oil prices are climbing...

READ MORE

MEMBERS ONLY

The Great Rotation: Not What You Think

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Small-cap stocks look like they have lost momentum.

* Market breadth in small-cap stocks appears to be weakening.

* The Utilities sector seems to be gaining momentum.

Just so we are on the same page, I looked up "Great Rotation" on Microsoft's Copilot and came away...

READ MORE

MEMBERS ONLY

QQQ: Critical Levels to Watch as Nasdaq Teeters on the Edge

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* QQQ has bounced off its 200-day moving average.

* An optimal entry point for QQQ would be the 50% to 61.8% Fibonacci retracement range.

* If QQQ drops below $350, it can mean further downside.

Just Another Manic Monday? On Monday, the Nasdaq plunged over 3%. With the S&...

READ MORE

MEMBERS ONLY

It's Been a Long Time Mr Bear, Where Have You Been?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Some real damage for the markets

* Equal weight sector rotation paints a more realistic picture

* The BIG ROTATION into small caps has come to a halt

And then ..... all of a sudden..... things are heating up. Lots of (downside) market action in the past week.

Let's...

READ MORE

MEMBERS ONLY

Small Caps Poised to Soar: Is Now the Time To Buy IWM?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Small caps saw an impressive surge in July, outpacing the S&P 500 in that month alone.

* IWM, a Russelll 2000 proxy, is only 8% away from its all-time highs, potentially signaling the start of a new bull market.

* As IWM pulls back (along with the rest...

READ MORE

MEMBERS ONLY

Semiconductors Are Down: Is Now the Time to Buy SMH?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SMH has completed 100% of a measured move from the bottom of a double-top reversal.

* SMH has broken below several key levels based on various indicators.

* There are actionable levels in the SMH chart that traders can take advantage of if they materialize.

Nvidia (NVDA) was perhaps the...

READ MORE

MEMBERS ONLY

S&P 500 Equal Weight ETF Gains Strength

by Bruce Fraser,

Industry-leading "Wyckoffian"

The S&P 500 index ($SPX) is a capitalization-weighted stock index. Many lesser capitalization blue-chip stocks that compose these 500 companies have been performance laggards. Though smaller companies in the index, these corporations are among the bluest of the blue-chip stocks. These prestigious corporations have been overshadowed by the...

READ MORE

MEMBERS ONLY

Flying Financials. Will It Be Enough?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Strong Sector Rotation Out Of Technology

* Financials and Real Estate Lead

* Stock/Bond Ratio Triggers Sell Signal

Flying Financials

In the recent sector rotation, basically OUT of technology and INTO anything else, Financials and Real-Estate led the relative move.

On the RRG above, I have highlighted the (daily)...

READ MORE

MEMBERS ONLY

After the Tech Bloodbath: Ways to Strategize Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks took a dive on Wednesday but look like they are making up some of those losses prior to hitting the next support level.

* Expect volatility in the stock market in the coming weeks since it's earnings season and there's a Fed meeting...

READ MORE

MEMBERS ONLY

1-2-3 Reversal Pattern: What It Is and How to Use It

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe explains the 1-2-3 reversal pattern, its criteria, and what it will take for QQQ to complete the pattern. He also discusses how the pattern is not always as clean as we would like. Joe then shares a few Crypto markets which are starting...

READ MORE

MEMBERS ONLY

Can Small and Mid-Caps Save the Market?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at the markets through the lens of the "market factors" panel you can find on your StockCharts dashboard. Starting from the RRG, he then moves to the individual charts for these factors and notes a low correlation for...

READ MORE

MEMBERS ONLY

Is It Game Over for Growth Stocks?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen examines which areas of the market have moved into favor amid the S&P 500 pullback. She compares value vs. growth stocks and the merits of both, and highlights the move away from technology stocks. Which areas are poised for more downside?...

READ MORE

MEMBERS ONLY

Hindenburg Omen: The Truth, Effects, and Duration

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on the best time frames for viewing charts, insights on using Vanguard ETFs for sector rotation, the duration and effect of the Hindenburg Omen indicator, how stocks are indexed in Dow Jones Groups on StockCharts, and...

READ MORE