MEMBERS ONLY

Dave's September 2025 Stock Picks: 3 Charts That Worked… and 2 That Didn’t

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dave revisits five stocks from the September Top Ten Charts episode to see how they’ve evolved. He reviews NVDA, AXP, MSI, MRK, and the SIL, explaining which setups worked, which failed, and the lessons to carry forward. From short ideas that didn’t pan out to breakout patterns and...

READ MORE

MEMBERS ONLY

Taking Stock of the Small-Cap Record High: Here's How High IWM Could Go

The Russell 2000 ETF (IWM) logged a record weekly close, triggering a bullish breakout target of $322. Explore why small-caps may thrive with Fed rate cuts, supportive seasonality, and strong relative strength versus large caps....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Faces Resistance at These Levels; RRG Indicates Weakening Outpacing Shifts Within Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The price action in the Nifty reflects a potential breakout buildup. But will it be able to break out of the resistance? Here's what you need to look for in the charts....

READ MORE

MEMBERS ONLY

Sector Rotation Points to Large-Cap Growth Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius takes a look at the current sector rotation, in combination with growth-value and size rotation. Combining these Relative Rotation Graphs shows strength concentrating in large-cap growth and the Tech, Discretionary, and Communication Services sectors. From this vantage point, we can see continued strength for the S&P 500...

READ MORE

MEMBERS ONLY

Simple Yet Powerful RSI Pullback Signal

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe shows viewers how to use a deep pullback in RSI as a buying opportunity. He uses two different settings for RSI in order to identify when a stock is a getting a great setup during an uptrend, and presents several examples on weekly and daily charts....

READ MORE

MEMBERS ONLY

Offense Still Crushing Defense

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While technology stocks have stalled out over the last six weeks, other growth sectors have stepped into a leadership role. Here are the charts Dave uses regularly to track leadership themes, and identify when new sectors are improving in relative strength terms....

READ MORE

MEMBERS ONLY

Pre-FOMC Setup: S&P 500 Calm Before the Fed

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Frank Cappelleri analyzes the S&P 500’s unusual calm ahead of the Fed, highlighting trend signals, failed bearish patterns, and key GoNoGo charts....

READ MORE

MEMBERS ONLY

These Asset Relationships Could Be About to Signal Some Important Changes Ahead

by Martin Pring,

President, Pring Research

Martin explains how analyzing inter-asset relationships can give important insights into the market -- and what those relationships are telling us right now....

READ MORE

MEMBERS ONLY

RSI Overbought? Why That Could Signal Big Gains Ahead

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he explains how traders often get into trouble by thinking of “overbought” stocks as being bearish setups. While an RSI over 70 can often lead to short-term pullbacks, Dave explains that they can also signal the strength of a long-term uptrend phase. He uses Motorola Solutions (MSI)...

READ MORE

MEMBERS ONLY

Bonds Still Underperforming, Best Sectors for Hunting, IWM Starts to Leads SPY, Healthcare and Biogen Perk Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

TLT broke out, but is still underperforming SPY; meanwhile, IWM has begun outperforming SPY. Arthur explains how to find the ideal "hunting grounds" for sectors....

READ MORE

MEMBERS ONLY

6,555 Target Hit!

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Despite skepticism, the S&P reached Frank's upside target of 6,555. Frank breaks down how we got here and what it means for ongoing market patterns....

READ MORE

MEMBERS ONLY

Is the SPX Exhausted?

by Joe Rabil,

President, Rabil Stock Research

This week, Joe breaks down the importance of focusing on Price and using indicators as supporting tools. He shows how the daily SPX chart has continued to make higher highs and higher lows, explaining that, as the ADX shows weakness, we need price to confirm this signal. Joe then covers...

READ MORE

MEMBERS ONLY

Where Has Industrials Leadership Gone? A Sector Drill Down

With Industrials now in consolidation mode, Mike highlights underperforming single-stock culprits and explains why the groundwork is in place for a late-year rally....

READ MORE

MEMBERS ONLY

The CPI is Coming Out Wednesday: Here is Something to Be Aware of

by Martin Pring,

President, Pring Research

As August CPI data looms, Martin looks at the chart and analyzes whether an upside reversal could be in the cards....

READ MORE

MEMBERS ONLY

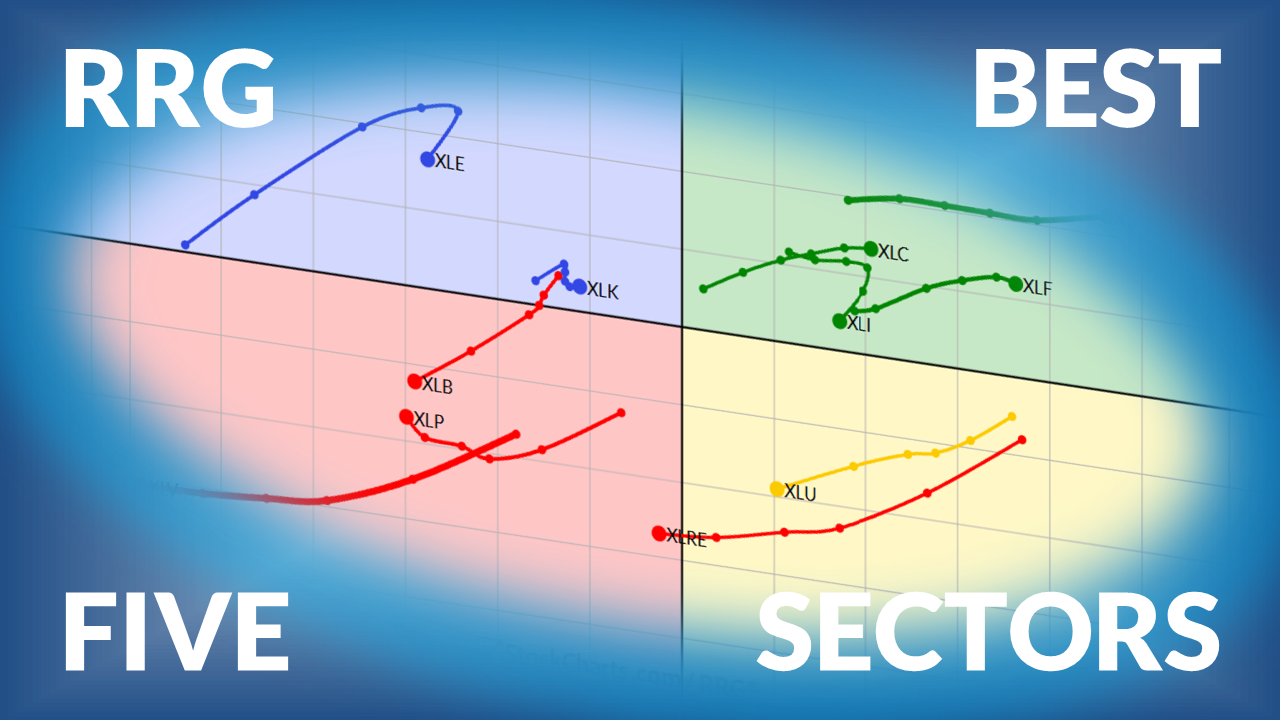

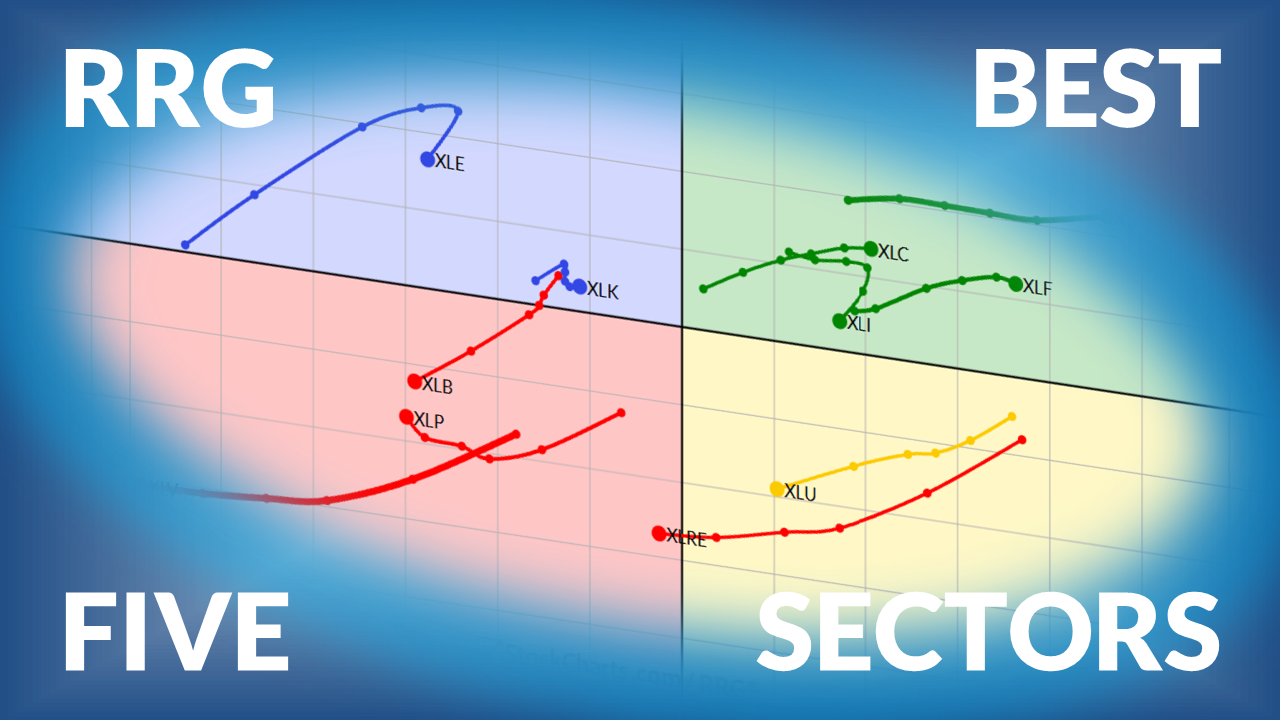

The Best Five Sectors This Week, #35

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius de Kempenaer presents his weekly update on the top five sectors on the leaderboard, and the movement under the surface....

READ MORE

MEMBERS ONLY

Pullback or Pitfall? Let the 21-Day EMA Be Your Guide

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dave explains how the 21-day exponential moving average can help confirm trend phases, validate signals from other moving averages, and serve as an essential risk management tool for traders....

READ MORE

MEMBERS ONLY

Before CPI and PPI: 5 Things to Watch This Week

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Rate cuts on deck? Look for these signals in small caps, TLT, gold, and more to help you position your portfolio ahead of this week's data....

READ MORE

MEMBERS ONLY

Major AI Announcement Sparks Repricing Across Tech Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

As Broadcom surges following the announcement of a $10 billion AI chip deal, Mary Ellen breaks down AVGO's technicals and what makes it a market leader....

READ MORE

MEMBERS ONLY

New Highs vs New Lows; XLC Goes Beast Mode; Risk is On; Dissecting Gold; A Cyber Setup

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This week, new highs are consistently outpacing new lows. The Communication Services sector is leading the pack, gold is surging, and there's a cybersecurity stock setting up for a big move. Read all about the stock market's price action here....

READ MORE

MEMBERS ONLY

The World is Breaking Out All Over

by Martin Pring,

President, Pring Research

A plethora of breakouts suggests that international markets have much further to run on the upside. Martin reviews where the principal regions of the world currently stand....

READ MORE

MEMBERS ONLY

Is a Bear Market Starting? History Says Watch These Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom recaps the week as September trading begins with weakness across major indices. He reviews market performance, sector trends, and key stock action. From there, he turns his attention to the history of bear markets, pointing out when they historically start, and explains why current conditions, including strong accumulation trends...

READ MORE

MEMBERS ONLY

MACD Reverse Divergence: Hidden Power in the Charts

by Joe Rabil,

President, Rabil Stock Research

Joe shares a lesson on the MACD reverse divergence pattern—also known as hidden divergence—and explains why it can be a powerful signal in combination with low ADX or strong ADX conditions. He highlights multiple stock examples showing this setup, then reviews the S&P market conditions, discussing...

READ MORE

MEMBERS ONLY

Mortgage Rates Hit 11-Month Low as Homebuilder Stocks Surge

With mortgage rates trending lower, homebuilder ETFs have been rising. Here's what traders and investors should watch next. ...

READ MORE

MEMBERS ONLY

Week Ahead: Cautious Start Likely as Nifty Moves Towards This Crucial Support Zone

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty is at a critical support level. A break below this level could mean a deeper correction....

READ MORE

MEMBERS ONLY

Is Consumer Discretionary About to Take Over the Market?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius breaks down the latest asset class and sector rotations in order to show where real market strength is building. Stocks continue to outperform bonds, but the spotlight is on sectors: technology remains strong, financials and industrials are gaining, and consumer discretionary is accelerating with broad participation. Meanwhile, defensive groups...

READ MORE

MEMBERS ONLY

Is It Time to Think Small in a Big Way?

by Martin Pring,

President, Pring Research

The NYSE/S&P ratio has been in a downtrend for seventeen years, but is a reversal finally underway? What does the picture look like for small-caps going forward?...

READ MORE

MEMBERS ONLY

Two Volume Indicators Every Investor Should Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dave explains why volume indicators, including the Accumulation/Distribution Line and Chaikin Money Flow, still matter in today’s markets. Using NVDA’s earnings, the S&P 500, WMT, and EAT as examples, he shows how volume trends can reveal accumulation or distribution beneath the surface, even when price...

READ MORE

MEMBERS ONLY

From Slump to Surge: Why Investors Are Smiling Again

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Stocks surged as Powell's rate-cut hints lifted markets. Dow hit a record, Nasdaq rebounded, and small caps rallied. Here's what it means for investors....

READ MORE

MEMBERS ONLY

How to Use the 4 MA for Better Timing in Trading & Investing

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe demonstrates how to apply the 4 simple moving average (4 MA) as both a short-term trading tool and a longer-term timing guide. He explains how this moving average can help identify opportunities, manage pullbacks, and improve decision-making across multiple time frames. Joe then reviews the current...

READ MORE

MEMBERS ONLY

S&P 500 Breakouts, Bitcoin Risks & Uber’s Next Move

by Frank Cappelleri,

Founder & President, CappThesis, LLC

In this market update, Frank takes a close look at the S&P 500, key indices, ETFs, crypto, and a recent trade idea. Frank compares the 2025 market to 2020 patterns, reviewing corrections and highlighting bullish and bearish setups. He focuses on weekly Bollinger Bands, GoNoGo charts, sector performance...

READ MORE

MEMBERS ONLY

Financials and Industrials Are Key to the Rally as Tech Takes a Breather

What to watch ahead of Powell: S&P 500 RSI divergence, NVDA under 20-day MA, key levels at 6212/6025/5852; can Financials and Industrials lead?...

READ MORE

MEMBERS ONLY

Short-Term Market Swings: A Gentle Rhythm of Short-Term Bounces

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Get the latest S&P 500 analysis with a focus on RSI negative divergence, short-term swing setups, and market breadth trends. Learn what current patterns mean and how to spot the next move....

READ MORE

MEMBERS ONLY

Can Gold Defy Gravity and Break to the Upside?

by Martin Pring,

President, Pring Research

Why does gold look ready to "defy gravity"? Martin Pring explains the technical signs....

READ MORE

MEMBERS ONLY

Is the S&P 500 About to Surge?

by Joe Rabil,

President, Rabil Stock Research

Joe analyzes the S&P 500’s current sequential wave pattern and, from there, explains how to spot a shift into a surging market phase. He breaks down key support and resistance levels on the SPY daily chart, evaluates the QQQ and IWM for signs of market strength, and...

READ MORE

MEMBERS ONLY

What to Make of the Small-Cap Rally: A Closer Look at IJR and IWM

Small-cap stocks are showing signs of strength. Investors should keep an eye on the performance of IWM and IJR, two small-cap ETFs, to determine if the small-cap rally has legs....

READ MORE

MEMBERS ONLY

This Week’s Stock Market Winners — And What’s Driving Them

by Mary Ellen McGonagle,

President, MEM Investment Research

Join Mary Ellen as she breaks down the latest market trends! The highlight of the show is a deep dive into the consumer discretionary sector, where Mary Ellen analyzes leading industry groups like homebuilders, apparel, and specialty retail, and explains why this sector continues to show relative strength. She shares...

READ MORE

MEMBERS ONLY

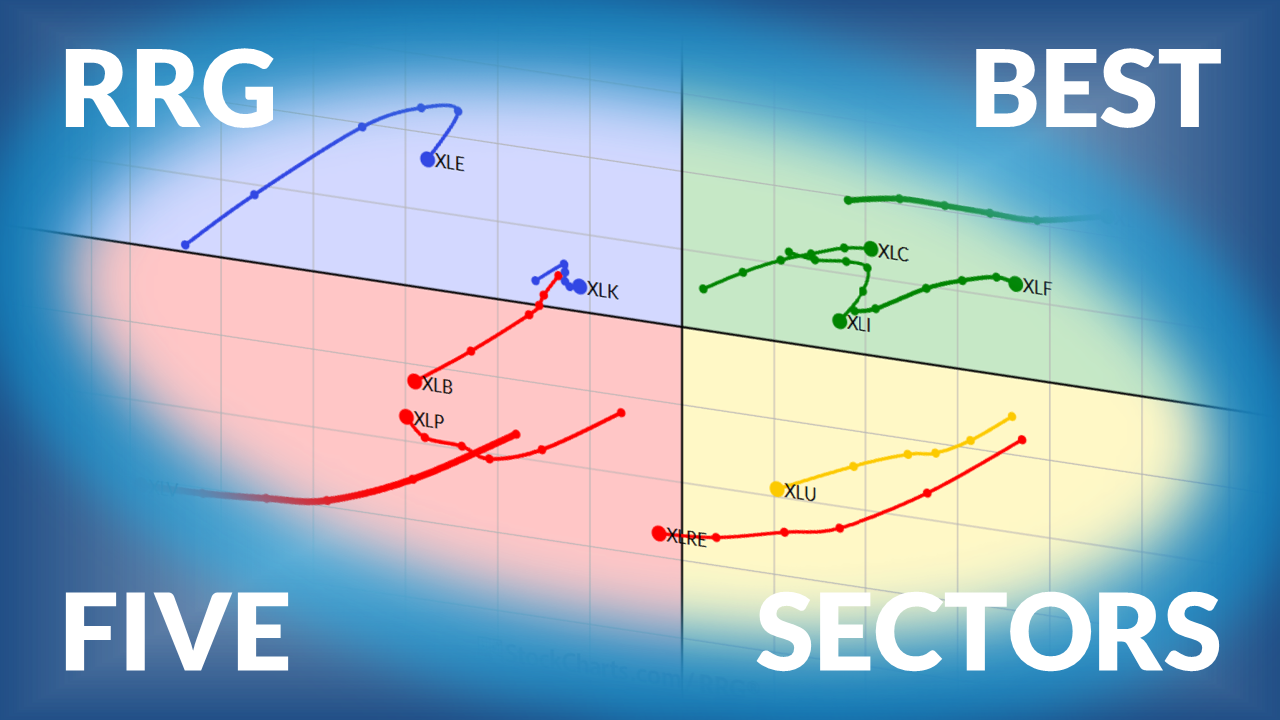

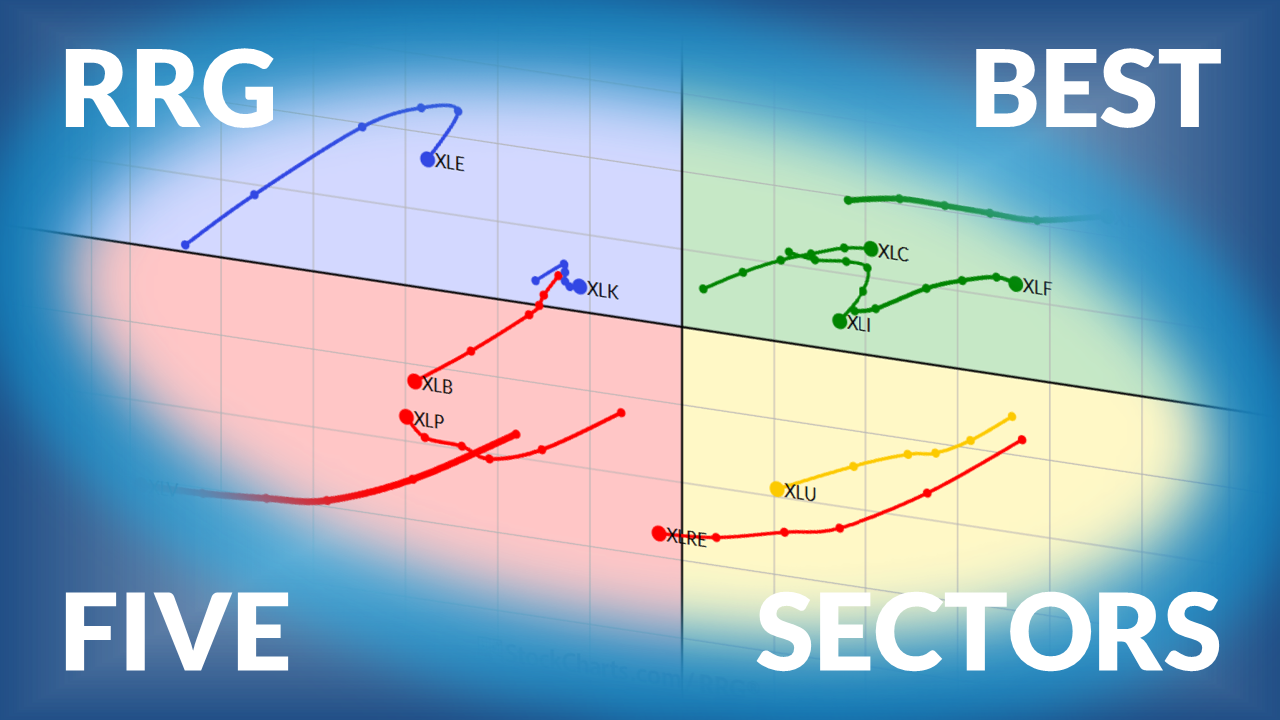

The Best Five Sectors, #31

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector rotation based on Relative Rotation Graphs....

READ MORE