MEMBERS ONLY

Three Key Macro Charts I’m Watching on Vacation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Here are the key levels to watch in the S&P 500 as well as META, MSFT, and AAPL. As long as the index and stocks hold above key support levels, the uptrend in stocks is in good shape. ...

READ MORE

MEMBERS ONLY

Smart Investors are Watching These Chart Signals: Here's Why

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Discover what Bollinger Bands and RSI are signaling for the S&P 500. Learn how low volatility and key momentum indicators could point to the next market breakout....

READ MORE

MEMBERS ONLY

The Good, the Bad, and the Sideways

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As U.S. equity indexes hit new highs, not all stocks are keeping pace. Explore these three stocks that are at key technical junctures with charts that highlight trend shifts, risk levels, and actionable signals....

READ MORE

MEMBERS ONLY

My Go-To ADX Scan for Finding Breakout Stocks

by Joe Rabil,

President, Rabil Stock Research

Joe shares his go-to ADX stock scan! Follow along as Joe uses the StockCharts platform to uncover strong long-term uptrends paired with low short-term momentum — the kind of setup that often precedes powerful breakouts. He walks through his “Strong Monthly / Low Weekly” scan criteria, explains how to apply it across...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch August 2025!

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson Roze as he reveals his top 10 stock charts to watch this month including SFM, BSX, AFRM and SYF. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. Viewers will also gain insight into key market trends...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts for August 2025 You Need to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he shares ten actionable stock charts for August 2025 that he’s watching closely. From breakout setups to key reversals, David highlights tickers like Tesla, Meta, Caterpillar, Motorola, and Newmont Mining that show compelling technical patterns. He also walks through how to manage the full trading process...

READ MORE

MEMBERS ONLY

Markets Drop! But These Stocks Are Still Leading

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s market volatility and what it means for investors. She explains how inflation and employment data triggered technical breakdowns in key indexes, and discusses why volatility, relative strength, and leadership stocks (including MPWR, TER, and Cadence Design) should remain on your radar. Mary...

READ MORE

MEMBERS ONLY

Warning Signs in the Charts: How to Survive a Late-Summer Shakeout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market rally may be hitting a wall as volatility spikes and bearish signals emerge. Discover key technical warnings, seasonal trends, and how traders and investors should prepare for a choppy August–September....

READ MORE

MEMBERS ONLY

Week Ahead: Nifty Tests Key Support Levels—May Weaken If Levels Violated

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty closed the week lower, trading within a narrow range. Volatility also rose. Monitor short-term support levels as we head into next week. Discover which sectors are leading and which are lagging....

READ MORE

MEMBERS ONLY

Why Daily vs. Weekly RRGs Matter in Portfolio Construction

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can be rendered in similar intervals as regular bar- or candlestick charts. This article explains the differences between weekly and daily RRGs....

READ MORE

MEMBERS ONLY

What Happens to Bitcoin Should QQQ Correct?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stock market correction risks are rising as key indicators flash warnings. Discover sector correlations with SPY, potential safe havens, and how Bitcoin's surge aligns with QQQ in this data-driven analysis....

READ MORE

MEMBERS ONLY

RRG Reveals the Next Big Sector Moves!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video, Julius breaks down current market trends using Relative Rotation Graphs (RRG). He examines weekly and daily asset class rotations, highlighting key developments in stocks, commodities, bonds, the U.S. dollar, and crypto. From there, Julius analyzes sector momentum shifts, including technology, energy, and real estate, and explains...

READ MORE

MEMBERS ONLY

Is It Time to Take Another Look at China?

by Martin Pring,

President, Pring Research

Here's an analysis of the recent bullish developments in the Shanghai Stock Exchange Composite Index and liquid Chinese ETFs. ...

READ MORE

MEMBERS ONLY

Is It Time For a Comeback? 3 Stocks That Might Be Turning a Corner

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

Explore technical turnaround setups for UPS stock, UNH stock price trends, and why MRK stock may offer the best risk/reward for investors this earnings season....

READ MORE

MEMBERS ONLY

The Week Ahead: NIFTY Will Have a Lot Of Reactions To Offer; Stares At Important Supports

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty ended the week slightly lower after trading within a narrow range. With key levels in focus and technical indicators showing mixed signals, markets may remain sideways for a while....

READ MORE

MEMBERS ONLY

Will SMCI Stock Soar in 2025? Here's What the Charts Say

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Discover why SMCI stock's steady breakout, key support levels, and AI-driven upside could reward patient investors....

READ MORE

MEMBERS ONLY

Chart Mania - 23 ATR Move in QQQ - Metals Lead 2025 - XLV Oversold - XLU Breakout - ITB Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tech stocks are heating up, utilities break out, metals lead, and homebuilders hit a moment of truth....

READ MORE

MEMBERS ONLY

S&P 500 Breaking Out Again: What This Means for Your Portfolio

by Frank Cappelleri,

Founder & President, CappThesis, LLC

The S&P 500 ($SPX) just logged its fifth straight trading box breakout, which means that, of the five trading ranges the index has experienced since the April lows, all have been resolved to the upside.

How much longer can this last? That's been the biggest question...

READ MORE

MEMBERS ONLY

Is META Breaking Out or Breaking Down?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The chart of Meta Platforms, Inc. (META) has completed a roundtrip from the February high around $740 to the April low at $480 – and all the way back again. Over the last couple weeks, META has pulled back from its retest of all-time highs, leaving investors to wonder what may...

READ MORE

MEMBERS ONLY

Emerging Markets May Be on the Cusp of a Major Breakout

by Martin Pring,

President, Pring Research

Emerging markets, in the form of the iShares MSCI Emerging Markets ETF (EEM), have been underperforming the DJ World Index since 2010 -- but that may be about to change.

After all, Chart 1 shows that the RS line has crossed above a three-year down trendline and experienced a long-term...

READ MORE

MEMBERS ONLY

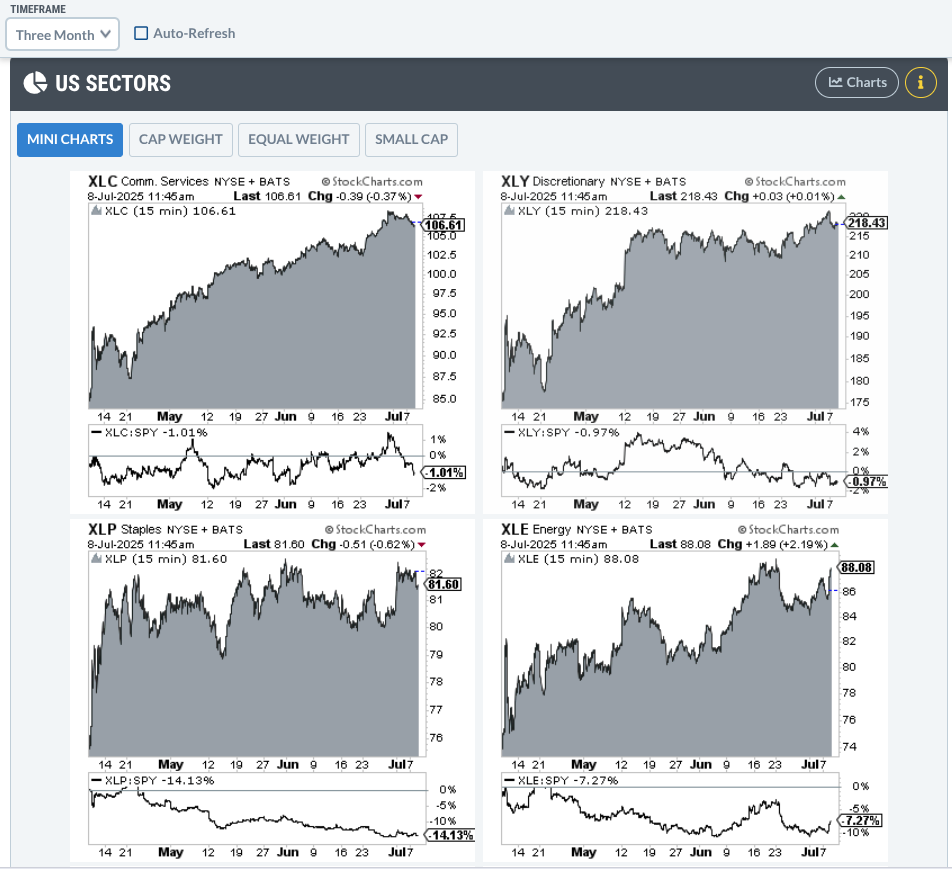

Tech Taps the Brakes, Homebuilders Hit the Gas: See the Rotation on StockCharts Today

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Technology stocks cool before earnings, but the Nasdaq holds above a key moving average. See rotation, support, and key charts on StockCharts to stay ready....

READ MORE

MEMBERS ONLY

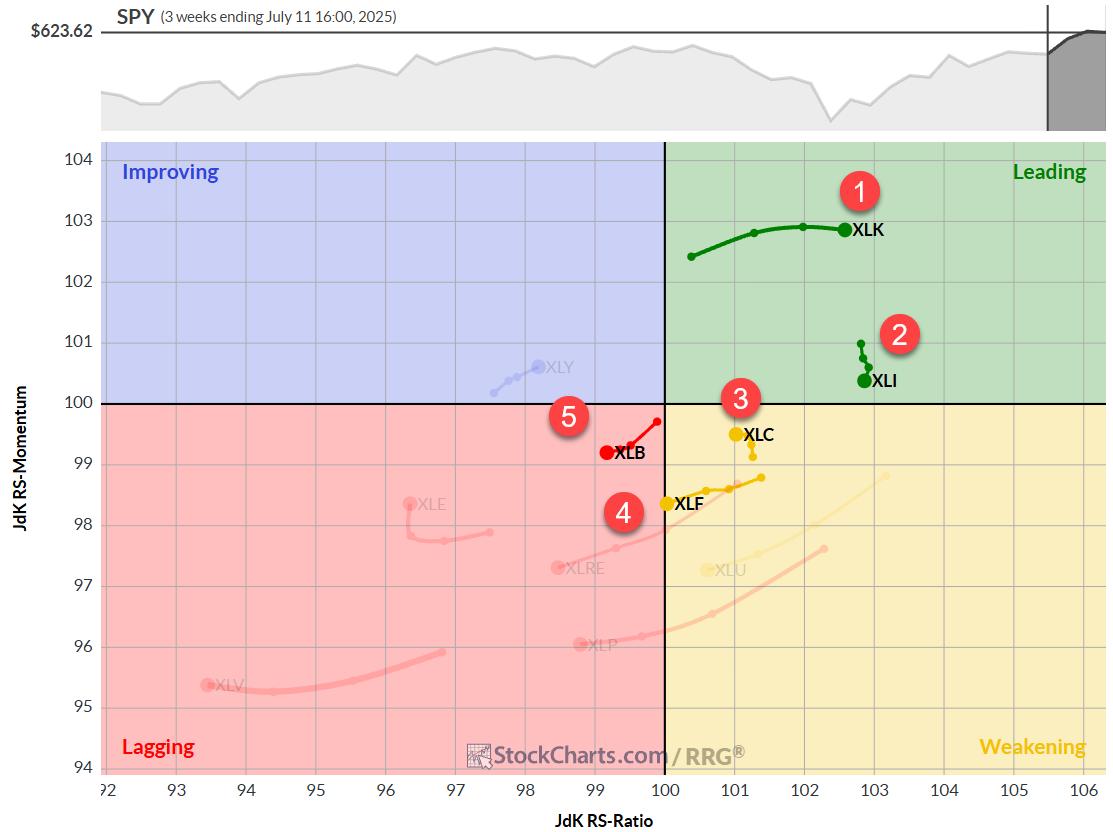

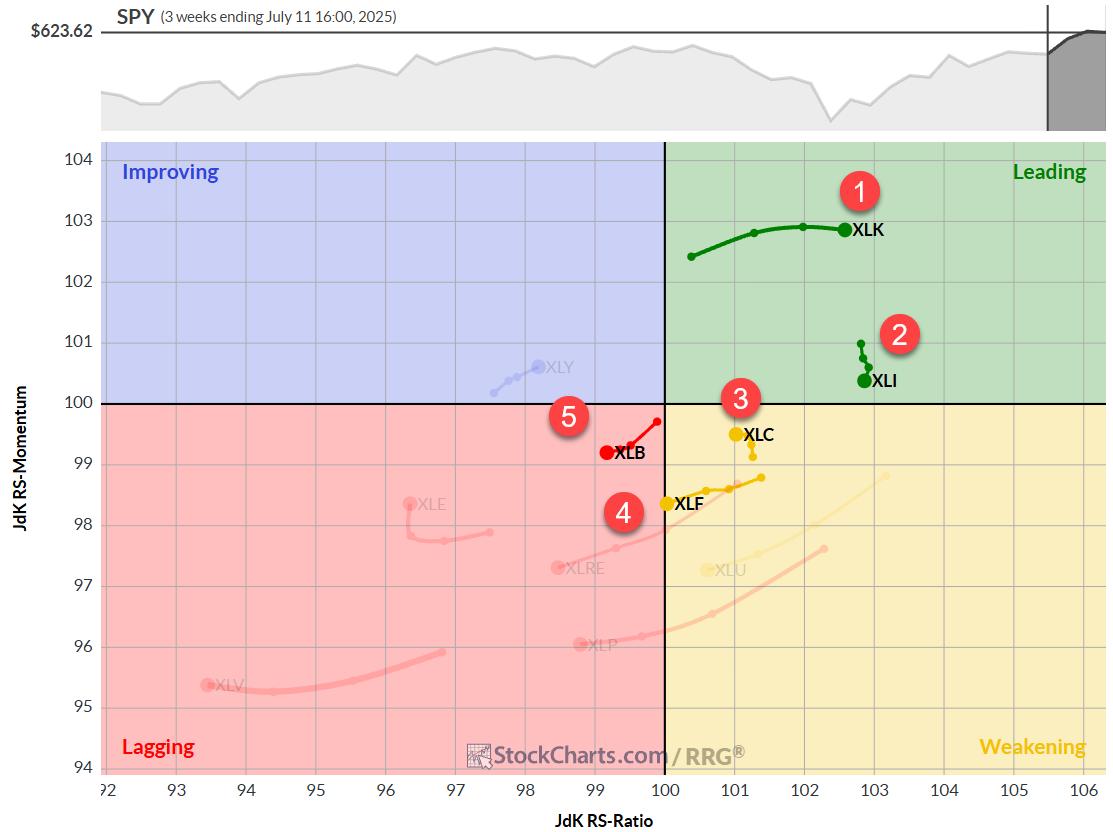

The Best Five Sectors, #28

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Technology sector continues to dominate, while Industrials are rotating out of the leading quadrant....

READ MORE

MEMBERS ONLY

Three Stocks in Focus: One Old Favorite, One Mag Name, and a Dow Comeback Story

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week, let's dive into three interesting stocks: a well-known Dow stalwart, a tech giant in a tug of war, and a former Dow member showing signs of revival. Whether you're looking for opportunity, caution, or something worth watching, there's a little something here...

READ MORE

MEMBERS ONLY

This Market Sector is Starting to Emerge as a Leader; Can it Complete the Job?

by Martin Pring,

President, Pring Research

Many years ago, I developed a couple of indexes that were designed to give me a sense of whether industry groups benefiting from inflationary conditions were outperforming those who performed better under deflationary ones. It was my way of recognizing the fact that, in a broad sense, the business cycle...

READ MORE

MEMBERS ONLY

Three Bearish Candle Patterns Every Investor Should Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The shooting star pattern indicates a short-term rotation from accumulation to distribution.

* The bearish engulfing pattern suggests sellers have taken control, suggesting further weakness.

* The evening star pattern is a three-candle formation that illustrates an exhaustion of buying power.

There is no denying that the broad markets remain...

READ MORE

MEMBERS ONLY

RGTI Stock Surged 30% — Is This the Start of a Quantum Comeback?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

RGTI stock surged 30% in a breakout move. See why RGTI and other quantum computing stocks are back on traders' radar and what to watch next. ...

READ MORE

MEMBERS ONLY

Simpler Charts, Better Results? Use This Trick to Trade Smarter With Less

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson as he shares how to streamline your analysis using custom ChartStyles. He demonstrates how to create one-click ChartStyles tailored to your favorite indicators, use style buttons to quickly switch between clean, focused views, and build a chart-leveling system that reduces noise and helps you stay locked in on...

READ MORE

MEMBERS ONLY

30 Dow Stocks in 20 Minutes: Joe Rabil's Mid-Year Technical Check

by Joe Rabil,

President, Rabil Stock Research

This week, Joe analyzes all 30 Dow Jones Industrial Average stocks in a rapid-fire format, offering key technical takeaways and highlighting potential setups in the process. Using his multi-timeframe momentum and trend approach, Joe shows how institutional investors assess relative strength, chart structure, ADX signals, and support zones. From Boeing&...

READ MORE

MEMBERS ONLY

Four Symbols, One Big Message: What the Charts are Telling Us

by Frank Cappelleri,

Founder & President, CappThesis, LLC

From the S&P 500's pause within a bullish trend, to critical support levels in semiconductors, plus bullish breakouts in Ethereum and Bitcoin, Frank highlights how the market's recent consolidation may lead to major upside. In this video, Frank explores how to use StockCharts to...

READ MORE

MEMBERS ONLY

This Tool Could Change Your Options Trading Forever

by Tony Zhang,

Chief Strategist, OptionsPlay

Unlock the power of automated options trading with Tony Zhang, Chief Strategist at OptionsPlay. In this exclusive training, Tony reveals how the OptionsPlay Strategy Center, integrated with StockCharts.com, transforms the way traders find, analyze, and execute options strategies.

Follow along as Tony illustrates how to use OptionsPlay and StockCharts...

READ MORE

MEMBERS ONLY

Bitcoin Breaks to an All-Time High; Should We Uncork the Champagne?

by Martin Pring,

President, Pring Research

Bitcoin broke out to a new all-time high last week, so it seemed to me that it would be a good time to come out with a bullish article. After all, Chart 1 shows that a solid breakout came from a one-year reverse head-and-shoulders pattern, which was also accompanied by...

READ MORE

MEMBERS ONLY

From Hammer to Harami: Using StockCharts to Crack the Candlestick Code

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he reviews three common candle patterns traders can use to identify potential turning points. From bullish engulfing patterns to evening star patterns, Dave gives insights on how to leverage these powerful candle signals to anticipate market shifts. He also shows combining candle patterns with conventional technical analysis...

READ MORE

MEMBERS ONLY

Bitcoin Just Smashed $112K—Is a Surge to 124K Next?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* $BTCUSD recently broke above critical resistance at $112k.

* Historically, the crypto has made significant moves after clearing a prolonged period of sideways trading.

* It's time to set upside and downside targets—key levels we discuss below.

Bitcoin ($BTCUSD) is riding a wave of surging optimism, smashing...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #27

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Materials sector climbs to #5 in rankings, displacing Utilities

* Technology maintains leadership, but Communication Services and Financials show weakness

* Daily RRG reveals potential for Materials, caution needed for Comm Services and Financials

* Portfolio drawdown continues, currently 8% behind S&P 500 YTD

After a relatively quiet week...

READ MORE

MEMBERS ONLY

3 Stocks Seasoned Investors Should Watch

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* The Financial sector shows strong technical momentum potentially signifying continued growth.

* Goldman Sachs (GS) presents strong upside and potential entry opportunities on pullbacks.

* Johnson & Johnson (JNJ) is a stable, long-term holding with limited short-term excitement.

As we navigate the evolving stock market landscape, understanding key sectors and...

READ MORE

MEMBERS ONLY

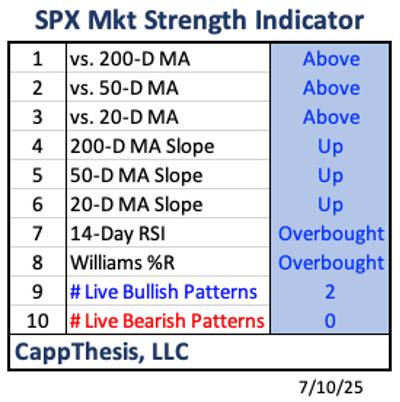

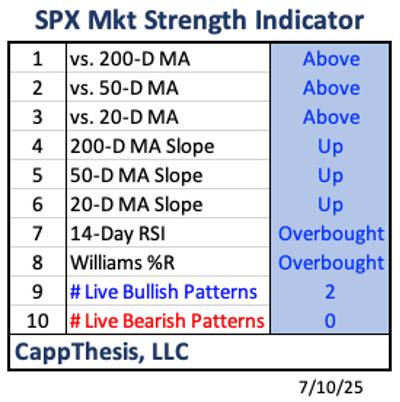

The CappThesis Market Strength Indicator: What It's Telling Us Now

by Frank Cappelleri,

Founder & President, CappThesis, LLC

KEY TAKEAWAYS

* The S&P 500 has been holdign above 6.200 for a week and hte Market Strength Indicator (MSI) is showing strong bullish momentum.

* While the MSI is highly bullish, history tells us that extreme readings often precede a pause or short-term pullback.

* Even with the potential...

READ MORE

MEMBERS ONLY

How to Find Compelling Charts in Every Sector

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Over a number of years working for a large money manager with a rich history of stock picking, I became more and more enamored with the benefits of scanning for constructive price charts regardless of the broad market conditions. Earlier in my career, as I was first learning technical analysis,...

READ MORE

MEMBERS ONLY

The Seasonality Trend Driving XLK and XLI to New Highs

by Karl Montevirgen,

The StockCharts Insider

For those who focus on sector rotation, whether to adjust portfolio weightings or invest directly in sector indexes, you're probably wondering: Amid the current "risk-on" sentiment, even with ongoing economic and geopolitical uncertainties, can seasonality help you better anticipate shifts in sector performance?

Current Sector Performance...

READ MORE

MEMBERS ONLY

Breakout Watch: One Stock in Each Sector to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When sector performance shifts gears from one day to the next, it's best to be prepared with a handful of stocks from the each of the sectors.

In this hands-on video, David Keller, CMT, highlights his criteria for picking the top stocks in 10 of the 11 S&...

READ MORE

MEMBERS ONLY

The Battle Between Fed Chairman and the President Will Ultimately Be Won by the Market!

by Martin Pring,

President, Pring Research

The President and the Fed Chair have been in a battle over lower rates for some time. One has been pressuring for easy money to boost the economy, the other prefers to hold off for a while to see what effects the tariffs and other factors might have on inflation....

READ MORE