MEMBERS ONLY

Investing with the Trend: Conclusions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-fifth and final in a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete...

READ MORE

MEMBERS ONLY

Analyze This: Will the Dow Soar or Crash in 2024?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Analyst opinions of Dow Jones Industrial Average are mixed, with both bullish and bearish forecasts

* While some analysts expect the Dow to hit 40,000 this year, some say it can fall to 34,000

* Basic tools like trend lines and support-and-resistance, paired with Fibonacci Retracements, can help...

READ MORE

MEMBERS ONLY

Is the Eighteen-Month Dollar Index Trading Range About to be Resolved?

by Martin Pring,

President, Pring Research

Chart 1 shows that the Dollar Index has been in a trading range since the start of 2023. Its sheer size indicates the ultimate breakout could be followed by a sizeable move in either direction. It is also likely to have important implications for many different markets and asset classes....

READ MORE

MEMBERS ONLY

June & Gloom | Larry's "Family Gathering" June 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

June is here! Will it be bloom or gloom for the stock market?

In this month's Family Gathering video, Larry examines the current averages in the market and what the advance-decline line is telling us. He explains the Trading Day of the Month (TDOM) concept and how you...

READ MORE

MEMBERS ONLY

NVDA Wreaks Havoc on Technology Benchmark

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave celebrates Nvidia's rise to overtake Microsoft (MSFT) as the largest company by market cap, creating chaos in the Technology Sector ETF (XLK) with implications for Apple (AAPL). He points out that 10% of the S&P...

READ MORE

MEMBERS ONLY

Seasonality Suggests a Massive Energy Market Shift This Summer—Are You Ready?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Crude, Brent, gasoline, and natural gas tend to dip and peak in the summer months

* Although seasonality plays are attractive, they're not always reliable

* If you're looking to take advantage of seasonality trends, here are some technical levels to watch

We're heading...

READ MORE

MEMBERS ONLY

Market Stumbles Near The Edge of a CLIFF

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius shares a rare RRG rotational pattern that he's never seen before! He then follows up with a breakdown of the current sector rotation into offensive, defensive, and sensitive, and finds that only one sector is on a positive relative trajectory... which...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

It's TOO EARLY to Be Bullish on Tesla

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down an upside follow-through day for the S&P 500 and Nasdaq, and highlights the continued weakness in market breadth indicators. Dave identifies key levels to watch for GLD, FSLR, ENPH, TSLA, AVGO, and BIO. Focusing in...

READ MORE

MEMBERS ONLY

DP Trading Room: Natural Gas (UNG) Bearish Again?

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and Erin return to the trading room showing you the charts you need to see to start your week!

Carl covered the market trends and condition to start the program. He also covers Bitcoin, Dollar, Gold, Silver, Gold Miners, Bonds, Yields and Crude Oil.

Carl also gave us a...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Tentative; Look For Stocks With Strong Relative Strength

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was in stark contrast to the week before that, as the markets remained in an extremely narrow range before closing with modest gains. The markets demonstrated a peculiar feature over the past five sessions; on four out of five trading days, the Nifty 50 came...

READ MORE

MEMBERS ONLY

GET IN EARLY! These Tech Stocks Are Just Taking Off

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the overbought condition in the markets after last week's move to a new high in price. She highlights select areas that pushed the markets higher and covers NVDA, AAPL, and more. She also discusses the anatomy of a true downtrend...

READ MORE

MEMBERS ONLY

Could the QQQ Turn Dramatically Lower?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There is no denying the strength of the bullish primary trend for stocks off the April low. The Nasdaq 100 index continues to make new all-time highs, closing just under $480 on Friday after gaining about 3.5% over the last week. But will this incredible uptrend continue into July...

READ MORE

MEMBERS ONLY

Breadth Thrust Can Validate a New Bull Phase for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave describes how the "breadth thrust", popularized by legendary market strategist Martin Zweig, can help to validate a new bull phase for stocks. He answers viewer questions on pairs trades, running technical indicators like RSI on price ratios,...

READ MORE

MEMBERS ONLY

Stock Market Pushes Higher, But Is There a Bond Market Surprise Brewing?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooler inflation data sees Treasury yields fall and bond prices rise

* The S&P 500 and Nasdaq Composite hit new highs as interest rate cuts could be on the horizon

* AAPL overcomes headwinds and is playing catchup while TSLA awaits results of a shareholder vote to approve...

READ MORE

MEMBERS ONLY

Bearish Divergences in 2 KEY Growth Stocks: BEWARE!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a fresh new all-time high for the S&P 500, a concerning "hanging man" candle for the SPY, and troubling bearish divergences on the charts of AMZN and GOOGL. He also breaks down short-term and...

READ MORE

MEMBERS ONLY

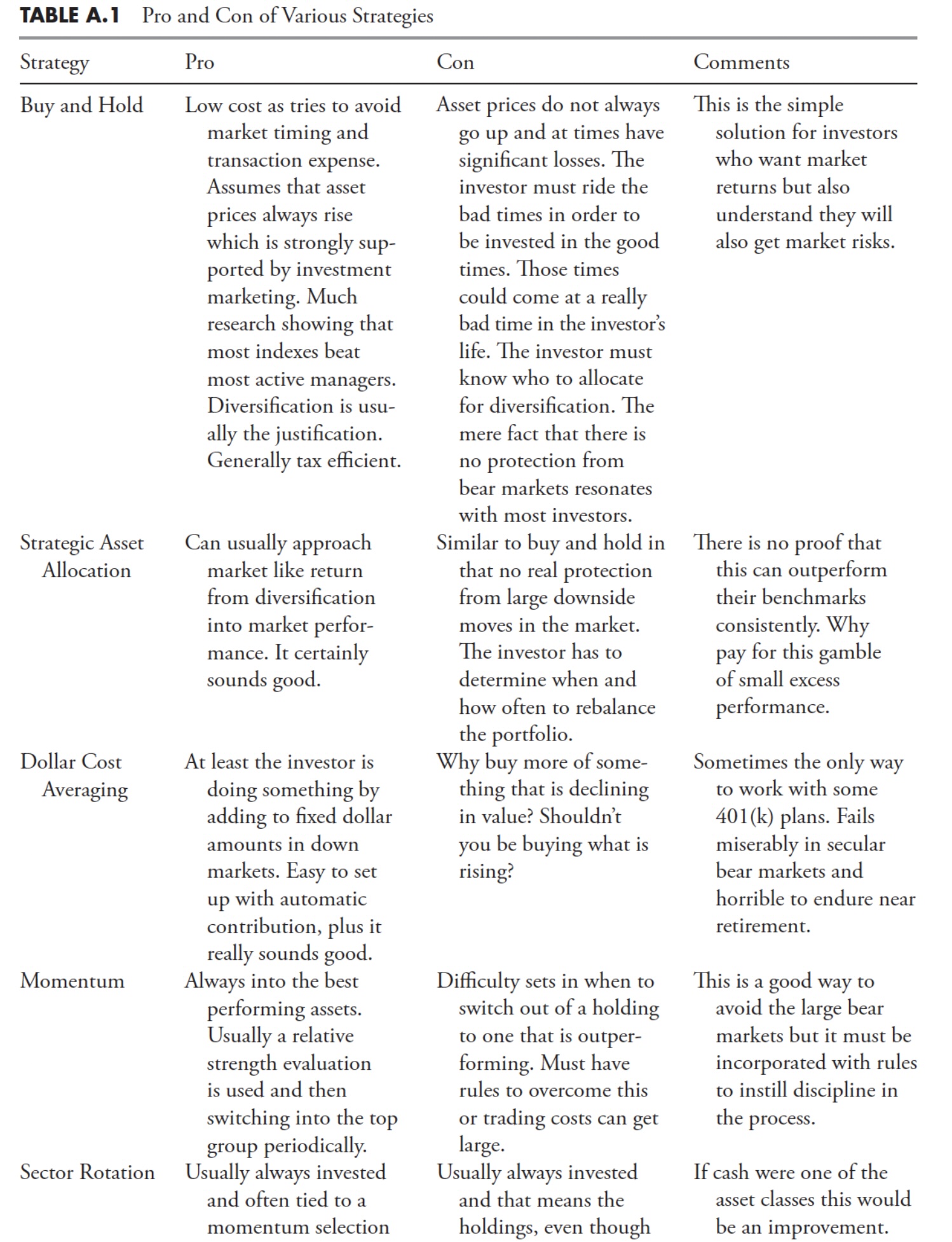

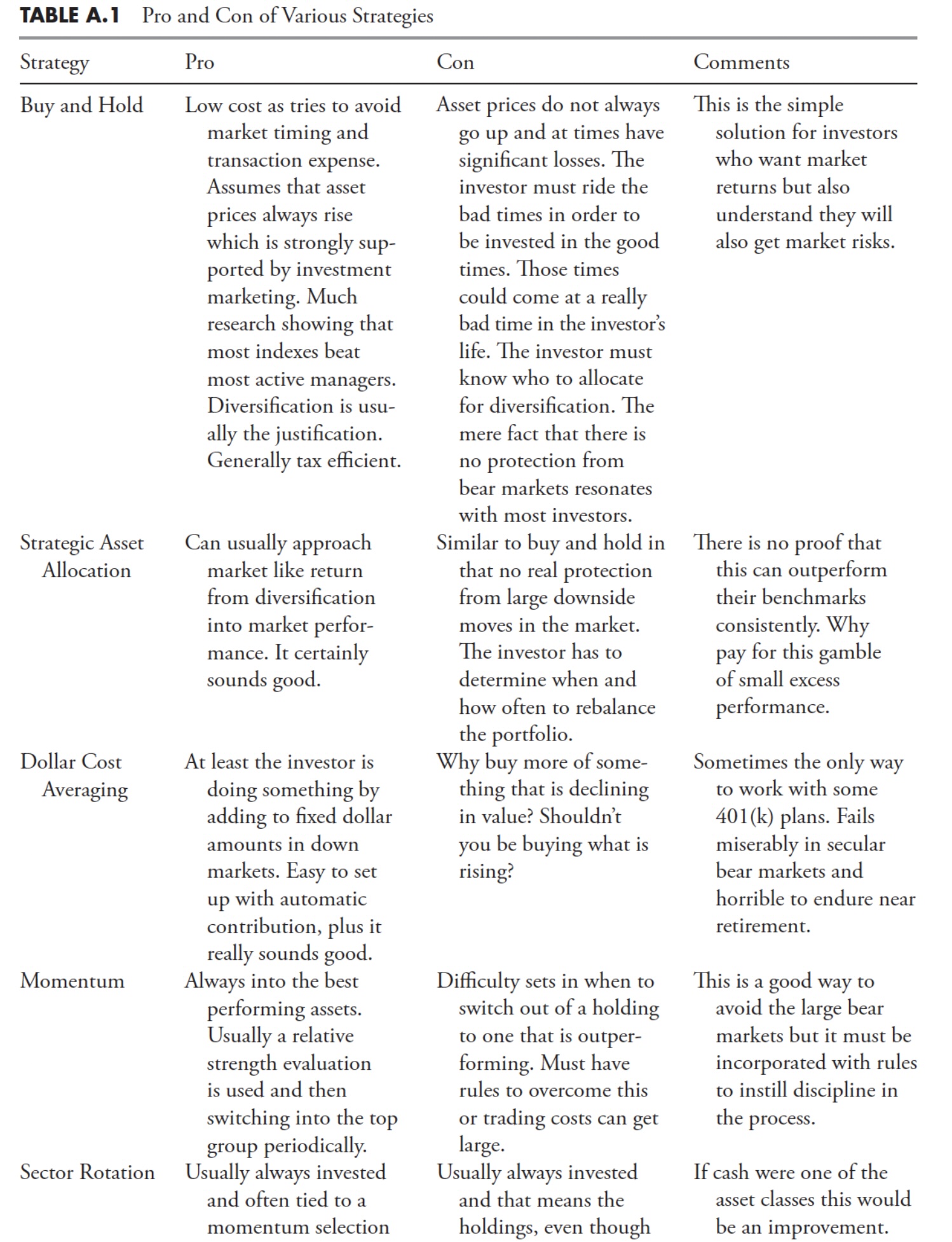

Investing with the Trend: Appendix

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is a set of appendices for a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Tuesday, June 18 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Tuesday, June 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

S&P 500 Above 5400: Economic Optimism or Irrational Exuberance?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the continued optimism for technology shares following this morning's bullish CPI data and the Fed's statements suggesting a Goldilocks scenario for risk assets. He also breaks down key technical signals and levels for AAPL,...

READ MORE

MEMBERS ONLY

5 Simple and Powerful Uses for Moving Averages

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the five ways to use the Moving Average lines to help with decision making. He discusses how these lines can help to define trend reversals and confirmed trends, when to be on the alert for a...

READ MORE

MEMBERS ONLY

Sector Rotation Model Flashes WARNING Signals

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius examines the theoretical sector rotation model and aligns it with current state of sector rotation on Relative Rotation Graphs, and the phase of the economy. He makes some interesting observations and highlights some flashing warning signals.

Check out Julius' Macroeconomic Variables/Metrics...

READ MORE

MEMBERS ONLY

Apple Blasts Through $200 On AI Optimism

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave reviews key charts from a technical analysis perspective, including AAPL, FSLR, MSTR, and STT. He also addresses the potential bearish momentum divergence for the S&P 500 index and reviews the negative breadth conditions, with new 52-week lows...

READ MORE

MEMBERS ONLY

The Next Direction for Interest Rates Is...?

by Martin Pring,

President, Pring Research

In most cycles, central banks around the world raise and lower short-term interest rates in a rough synchronization. Last week, the European and Canadian central banks began lowering their rates, and the British are expected to follow suit this week. Most observers of the US expect the Federal Reserve to...

READ MORE

MEMBERS ONLY

NVDA Stock Split Launches S&P 500 Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a bullish day for stocks, with 8 out of 11 S&P 500 sectors finishing higher. He breaks down the charts of NVDA, ENPH, FSLR, and AMD, and reviews a potential upside reversal in gold.

See Dave&...

READ MORE

MEMBERS ONLY

DP Trading Room: Equal-Weight Losing Against Cap-Weight SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

Did you know that the equally-weighted RSP is seriously underperforming the cap-weighted SPY? It is losing considerable ground against the SPY and that suggests that if mega-caps fail, so will go the market. Carl shows us charts to prove his point.

Next up Carl covers the market in general followed...

READ MORE

MEMBERS ONLY

Week Ahead: Despite Pullback, Breadth Remains a Concern; Nifty Still Prone to Retracement

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had an incredibly eventful week as they reacted to the exit polls and general election results. All happened in the same week; the Nifty saw itself forming a fresh lifetime high, and also came off close to 8% from its peak. A remarkable recovery also followed, which led...

READ MORE

MEMBERS ONLY

Tracking the Three Signs of the Bear

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There is no denying that the primary trend for the S&P 500 remains bullish as we push to the end of Q2 2024. But what about the conditions "under the hood" of the major benchmarks? Today, we'll highlight three "signs of the bear&...

READ MORE

MEMBERS ONLY

META, AMZN and MSFT On The Move! Here's How to Pinpoint Entry

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews what drove the markets to new highs. She highlights S&P 500 sectors, plus stocks that have reversed their downtrends, pointing out good entry points. Mary Ellen also takes a close look at why stocks did not respond to today'...

READ MORE

MEMBERS ONLY

S&P 500 Still Bullish: This Is What You Should Watch For

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market unfazed by today's jobs data

* Yields rise, US dollar rises, and equities close the week relatively flat

* Market breadth continues to be strong, indicating the stock market is still chugging along

It was a bit of a seesaw week in the stock market, but,...

READ MORE

MEMBERS ONLY

Only One Pocket of Strength Left in US Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Only Large-Cap Growth is on a positive RRG-Heading

* No segment, except LC Growth, has managed to take out its late March high

* $DJUSGL setting up for negative divergences

Breaking Down Into Growth / Value

Using Relative Rotation Graphs to help break down the US stock market into various segments...

READ MORE

MEMBERS ONLY

Technology Sector Participation Is Fading

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Technology Sector (XLK) continues to dominate and drive the rally, but fewer and fewer stocks within the sector are participating in the rally. We know this because our Silver Cross Index (SCI), which shows the percent of stocks in the Technology Sector with Silver Cross BUY Signals (20-day EMA...

READ MORE

MEMBERS ONLY

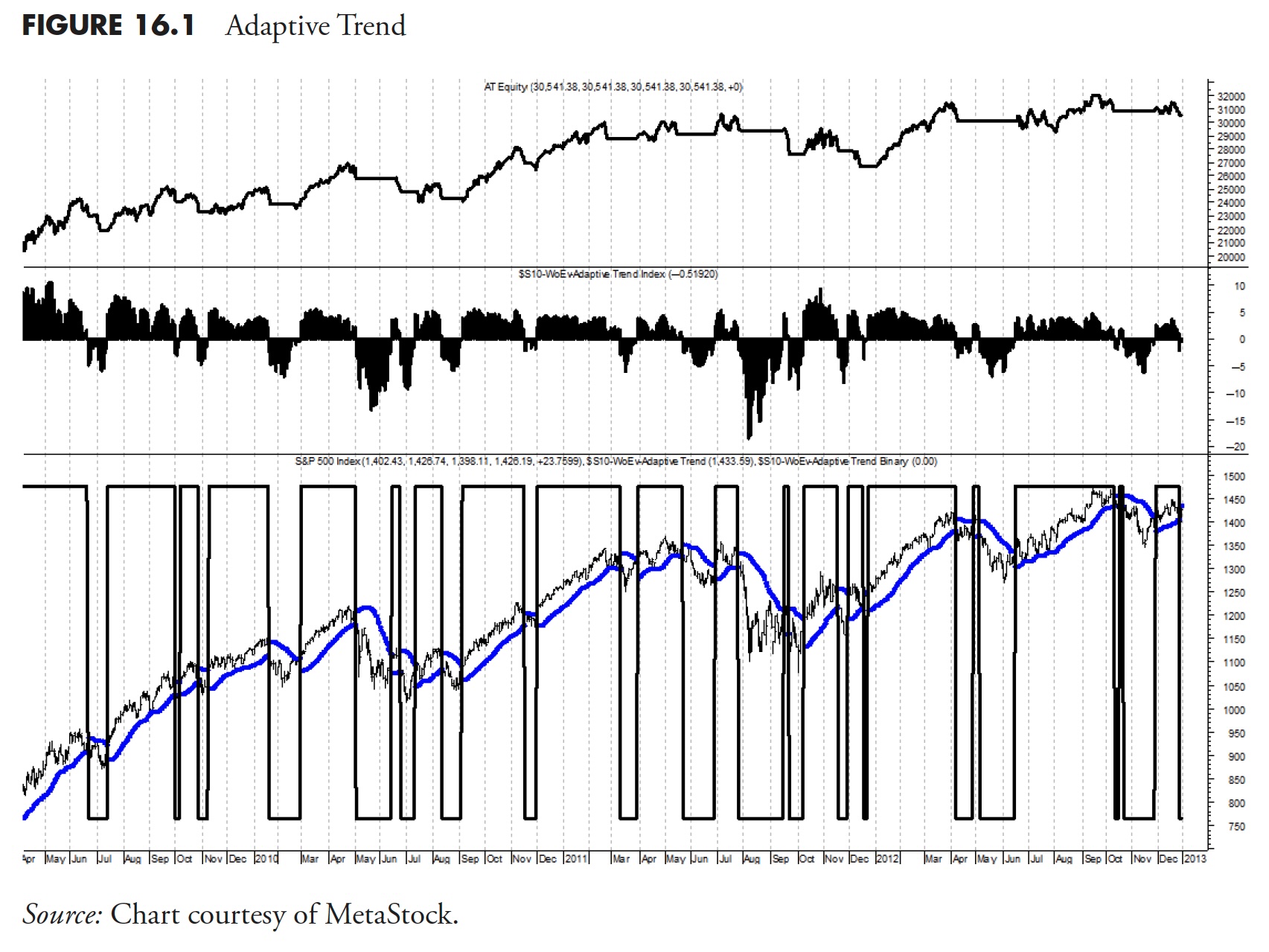

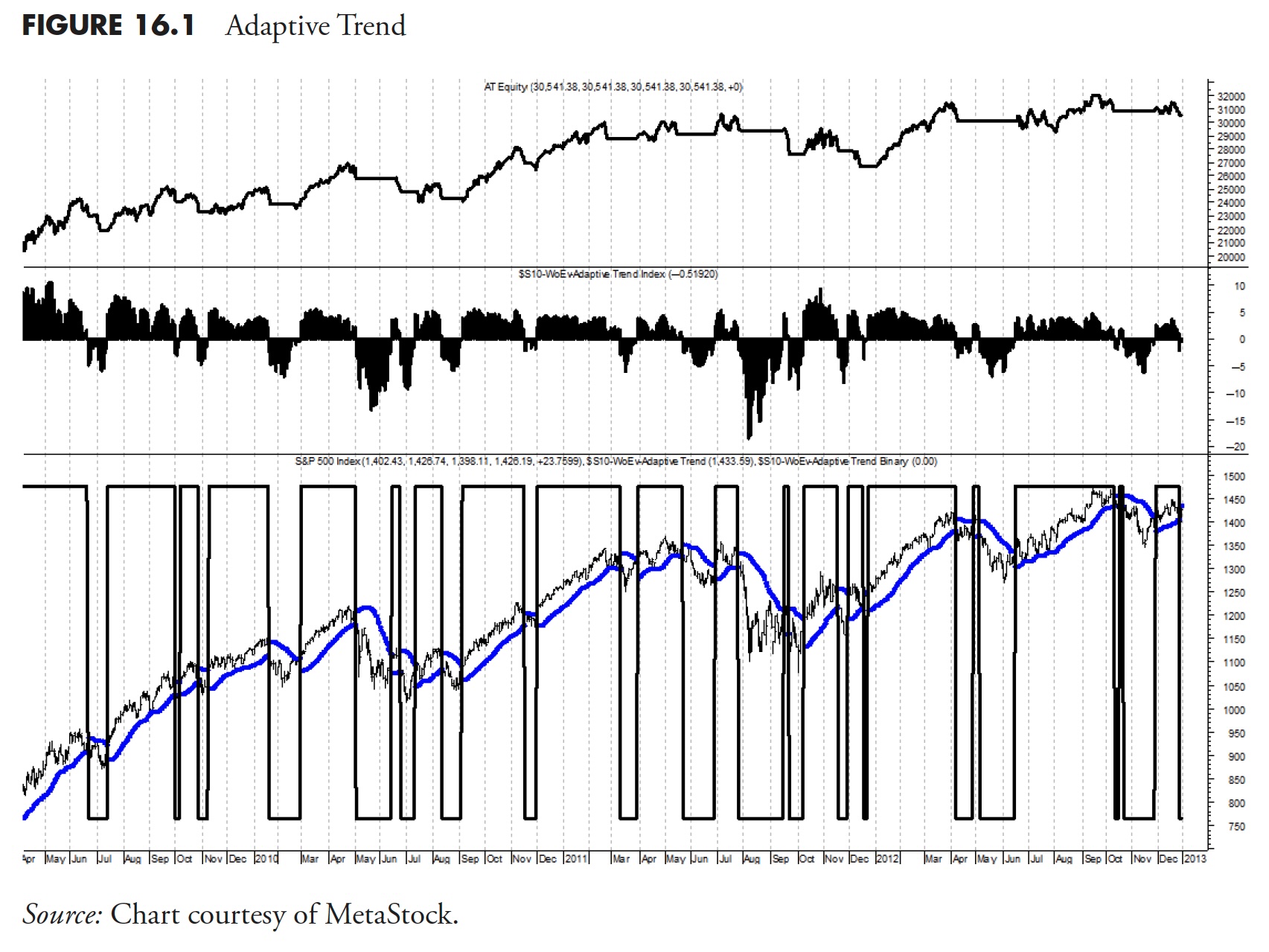

Rules-Based Money Management - Part 8: Putting Trend-Following to Work

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-fourth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

3 Keys to Finding the Strongest Trends

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the three keys he hunts for when identifying reversals and strong trends, giving a few examples and then showing one that is developing now. He then highlights similar techniques he uses while reviewing the Sectors. In...

READ MORE

MEMBERS ONLY

These SURPRISING Sectors are Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius uses the S&P 500 Sector Indexes to assess the long term price trends on the completed monthly charts for May, then discusses the long-term relative trends on a monthly RRG. Julius highlights the continued relative strength for Technology, Communication Services and...

READ MORE

MEMBERS ONLY

It's Time to Take a Look at the Canadian and Australian Dollars and What They Imply for Inflation

by Martin Pring,

President, Pring Research

The Canadian and Aussie dollars have been confined between two converging trendlines since the beginning of the century, as we can see from Chart 1. The moment of truth appears to be close at hand, as both are approaching the apex of a giant potential symmetrical triangle.

One usually consistent...

READ MORE

MEMBERS ONLY

Wyckoff at Work in the Intraday Timeframe

by Bruce Fraser,

Industry-leading "Wyckoffian"

It is well known that stock market indexes are fractal. Demonstrating repeatable price structures in all timeframes. In the intraday timeframe these price structures repeat frequently. The Wyckoff characteristics of Accumulation, Markup, Distribution and Markdown are constantly at work in smaller periods of time. Wyckoff students will study such structures...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax (Should We Trust It?)

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode Carl and Erin discuss Friday's "Upside Initiation Climax" and whether it can be trusted. With market follow through tepid, they discuss the implications of this very bullish signal.

Carl reveals his sentiment of the overall market and covers...

READ MORE

MEMBERS ONLY

Week Ahead: Markets' Reaction to Exit Poll and General Election Results

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities experienced a notably eventful previous week, marked by a fresh lifetime high and a subsequent decline of over 400 points within the same week. Over the past five sessions, the Nifty 50 index fluctuated within a 693.80-point range before closing with a net weekly loss of...

READ MORE

MEMBERS ONLY

Hindenburg Omen Flashes Initial Sell Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 did manage to finish the week above tactical support at 5250, one of the most widely-followed macro technical indicators recently registered an initial sell signal for the second time in 2024. Today we'll explain the three components of the Hindenburg Omen, show...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends | Fri May 31, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Momentum Confirmation

* Bull Flags

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE