MEMBERS ONLY

The Hoax of Modern Finance - Part 9: Market Facts — Bull and Bear Markets

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the ninth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Markets Bracing for NVDA Earnings

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the latest market breadth indicators, ranging from bullish (S&P 500 advance-decline line) to bearish (Bullish Percent Indexes breaking down) to everything in between. He also analyzes key growth names including SMCI, PANW, AMZN, and NVDA....

READ MORE

MEMBERS ONLY

Emerging Markets Getting Closer to a Breakout

by Martin Pring,

President, Pring Research

Last November I asked the question "Are emerging markets about to emerge?"Using the iShares MSCI Emerging Markets ETF (EEM) as our benchmark, I concluded that more strength was needed in order to push the indicators into a bullish mode. In the intervening period, things have improved, but...

READ MORE

MEMBERS ONLY

The Halftime Show: Don't Box the Invisible Man -- EPS Reports

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition ofStockCharts TV'sHalftime, Pete takes a look at long-term trends. Semiconductors taking it on the chin. Inflation is still a problem. Bonds are selling off, and the Fed isn't cutting rates until, in Pete's opinion, the unemployment rate falls....

READ MORE

MEMBERS ONLY

The Titanic Syndrome Indicator Issues a WARNING!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave focuses on AAPL which closed below its 200-day moving average as it tests key price support. Guest Jesse Felder of The Felder Report reports on the Titanic Syndrome, a market breadth indicator similar to the Hindenburg Omen that suggests...

READ MORE

MEMBERS ONLY

Sector Spotlight: Dominant Trend for Stocks Still UP

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I separate the 11 sectors in the S&P 500 into Offensive, Defensive, and Sensitive, assessing their group rotational patterns to see if there is any alignment with the current technical condition of the S&P 500. After...

READ MORE

MEMBERS ONLY

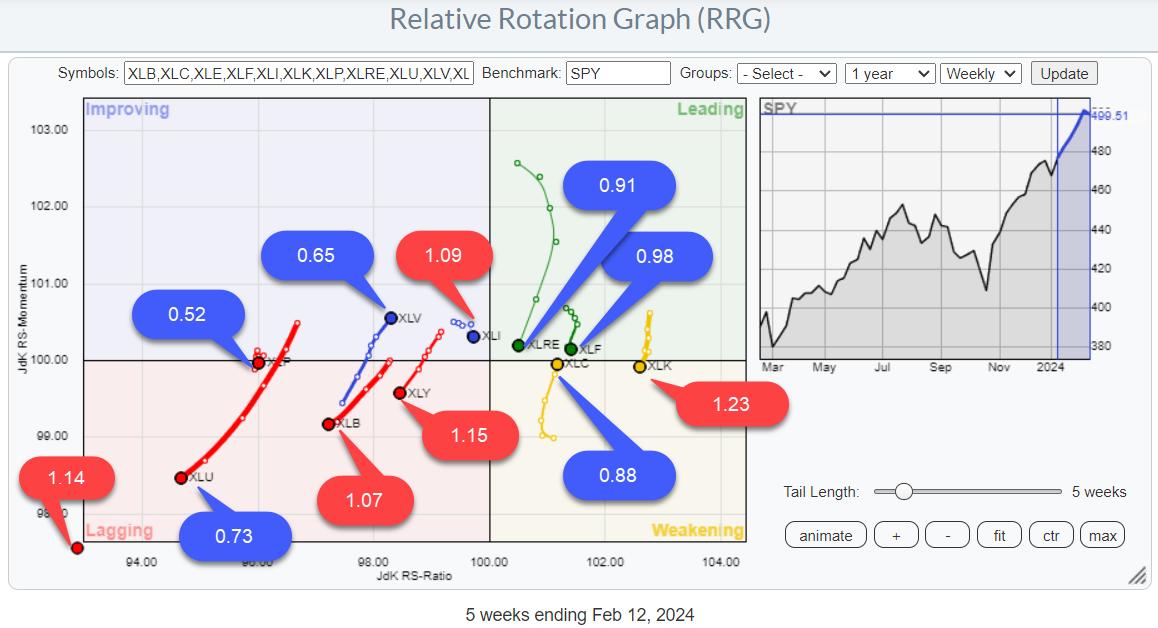

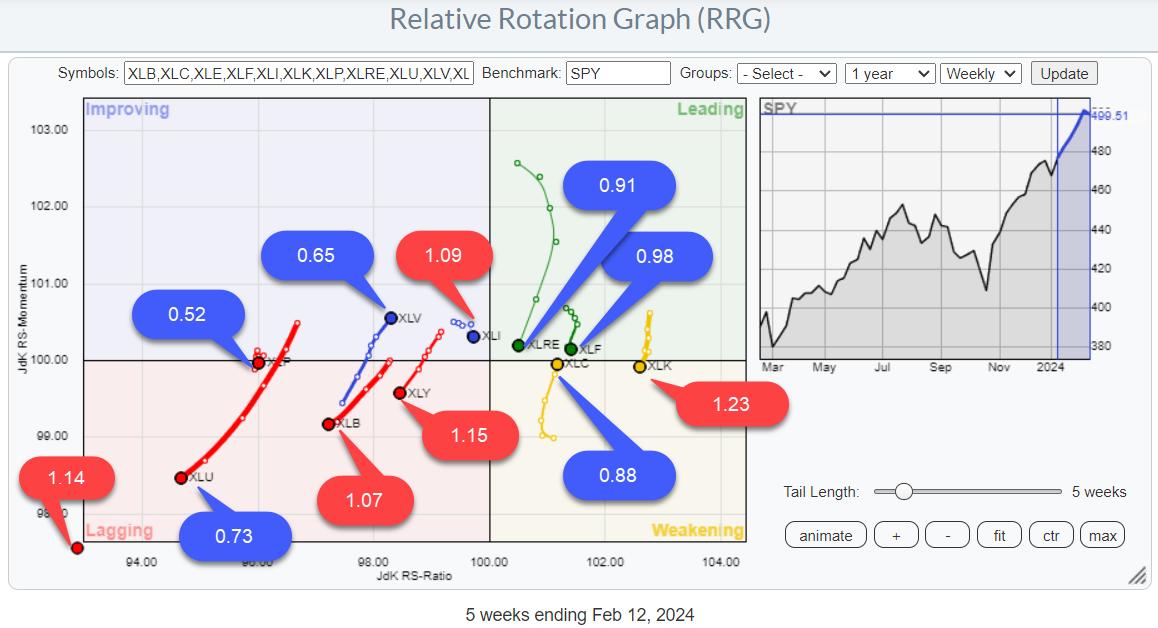

SPY Uptrend Intact, But Mixed Sector Rotation Signals Hesitation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Looking at Risk ON / OFF through BETA

* RRG shows mixed rotations

* SPY Uptrend intact with limited downside risk

BETA

One of the Risk ON/OFF metrics I like to keep an eye on is BETA.

From Investopedia:

—systematic risk—

I have updated my spreadsheet with last year'...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays In A Defined Range; Expect Directional Moves Only Outside These Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Some serious consolidation continued in the markets as the Nifty oscillated in a defined range before closing the week with modest gains. Examination of daily charts shows that the Nifty tested its 50-DMA again and rebounded from that level while defending that point as important support. The trading range widened...

READ MORE

MEMBERS ONLY

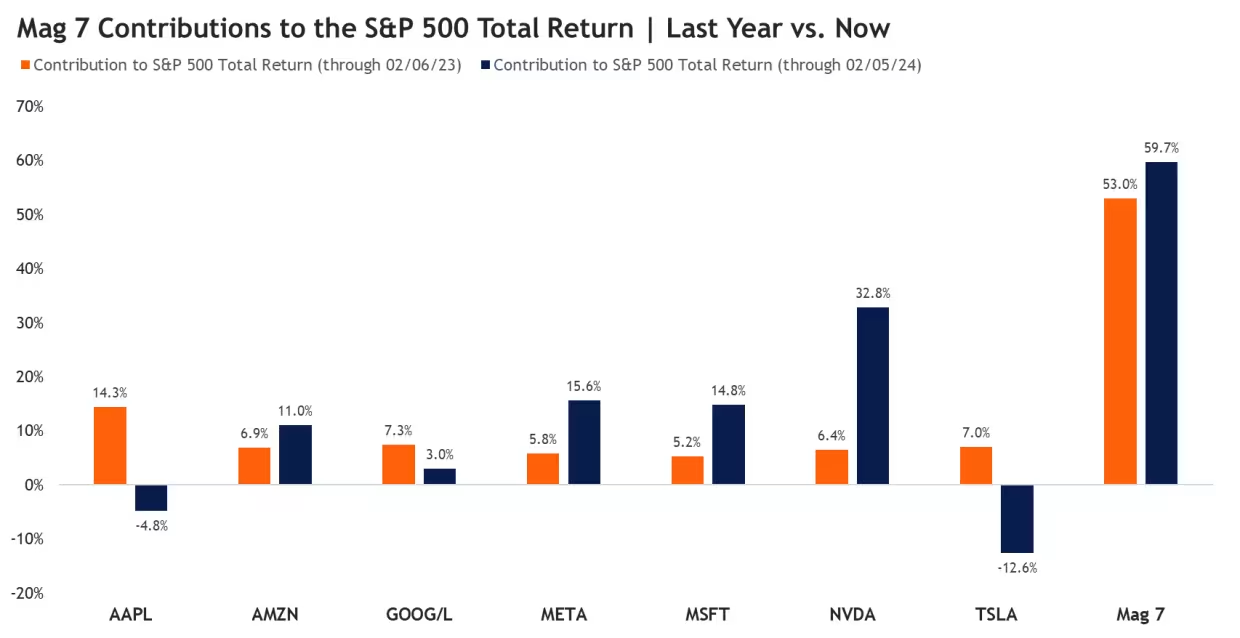

This Beaten-Down Magnificent Seven Stock is Poised to Regain Its Leadership Status

by Mary Ellen McGonagle,

President, MEM Investment Research

Going into last week, the Magnificent Seven stocks were looking more like the Magnificent Four. Leadership within the group became more concentrated, with Amazon, Meta, Microsoft and Nvidia having done most of the heavy lifting.

This is far different from the first 6 weeks of 2023, when gains among these...

READ MORE

MEMBERS ONLY

Three Leading Growth Stocks Testing Gap Support

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The NYFANG+ index of leading growth stocks is up about 12% year-to-date, while the S&P 500 and Nasdaq 100 have gained only 5%.

* All three of these growth stocks show similar patterns, with a recent gap higher. But they have now all stalled out.

* If these...

READ MORE

MEMBERS ONLY

MEM TV: Risk-On Trades Emerge Amid Big Tech Selloff

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the sloppy week for the markets, driven by the key economic data that was released. We saw interest rates rise, which had some other carry-on impact. While the S&P 500 saw a bit of a...

READ MORE

MEMBERS ONLY

What to Do With NVDA (And Others Like It)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on the Money Flow Index, using RSP vs. SPY for relative strength analysis, strategies for names in extended uptrends like NVDA, applying Fibonacci retracements to charts like KRE, and more.

This video originally premiered on February...

READ MORE

MEMBERS ONLY

Discover the Power of These 2 Cutting-Edge Tools!

by Grayson Roze,

Chief Strategist, StockCharts.com

It's all about groups on this week's edition of StockCharts TV'sStockCharts in Focus! In this video, Grayson shows you how to take your market analysis to the next with level with some of the latest enhancements on the StockCharts platform -- new features added...

READ MORE

MEMBERS ONLY

BUY Signals Continue to Diminish

by Carl Swenlin,

President and Founder, DecisionPoint.com

A Golden Cross BUY Signal is generated when the 50-day EMA of a price index crosses up through its 200-day EMA. DecisionPoint's Golden Cross Index (GCI) shows the percentage of stocks in a price index that have a Golden Cross BUY Signal, and is an expression of long-term...

READ MORE

MEMBERS ONLY

SMCI Breaks $1,000 Level - What's Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Bob Lang of Explosive Options shares three charts he's following as the S&P 500 continues to hold the crucial 5,000 level. Host David Keller, CMT highlights key stocks on the earnings list, including DKNG, COIN,...

READ MORE

MEMBERS ONLY

Identifying Powerful Trends with This Game-Changing ADX Setup

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shares the criteria for his favorite ADX setup. He explains what he needs to see on 2 different timeframes to put a stock into position for a powerful trend that can last a long time. Joe closes...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" February 15, 2024 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry begins by presenting two trade recommendations, then digs into AI stocks, Bitcoin, and what you should be doing right now. Is it time to go long? Go short? Or wait for a decline? He explains the difference between FOMO and actually losing money, and how pain...

READ MORE

MEMBERS ONLY

Gold is at the Crossroad

by Martin Pring,

President, Pring Research

Last November and December, it looked as if gold had broken out from a multi-year inverse head-and-shoulders. Since then, the price has dropped below the breakout area, and the long-term KST has begun to roll over.

Just like takeoff and landing are the critical points for an aircraft, breakouts are...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Market Pullback? Follow These Charts!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the S&P 500 back above 5K, Bitcoin back above 50K, and why NFLX, META, & AMZN may be the most important names to follow in the coming weeks. Guest Mish Schneider of MarketGauge breaks down the...

READ MORE

MEMBERS ONLY

The Halftime Show: Inflation Back in the Driver's Seat

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Yesterday, the market saw a massive selloff of over 2% at market lows for the SPY and the NDX. However, the rebound at the end of the day was promising, though not enough to change sentiment. What this means is that the selloff came from the hot CPI print, so...

READ MORE

MEMBERS ONLY

Sector Spotlight: EASY SCAN! Find Growth Names in Small-Caps

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I start with an assessment of the daily and weekly charts for SPY, trying to put recent developments into perspective. Then, I go over various Relative Rotation Graphs slicing the market down into various-size segments, as well as growth and...

READ MORE

MEMBERS ONLY

S&P 500 Plunges Below 5K!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how the S&P 500 is just barely holding trendline support as his short-term Market Trend Model threatens to turn bearish this week. Guest Sean McLaughlin of All Star Charts talks through how he's playing...

READ MORE

MEMBERS ONLY

Catch BIGGER GAINS by Fishing for Alpha

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights breakouts in home builders and Bitcoin and reviews key names reporting earnings including ABNB, SHOP, and MAR. He also shares an equity scan he uses every week to identify the next potential breakout candidates. Stay tuned until the...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, February 15th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this coming Thursday, February 15 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

DP Trading Room: Avoid These "Magnificent 7" Stocks!

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode, Carl reviews the Magnificent 7 and gives you his opinion on their current and possible future states. He warns against two in particular and gives his stamp of approval on three others. Negative divergences are still a problem and Carl explains why....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set to Consolidate in a Broad Range; Runaway Moves Unlikely Below These Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Two weeks of decline, one week of advance, and a week of consolidation. This is what sums up the market activity over the past month. The markets consolidated over the past week and stayed largely within a defined trading range, and the past five sessions remained choppy, with the NIFTY...

READ MORE

MEMBERS ONLY

Beware the Hindenburg Omen!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Jim Miekka created the Hindenburg Omen after studying the conditions present at previous market peaks.

* The Hindenburg Omen triggered an initial signal this week, just as the S&P 500 finally closed above 5000 for the first time.

* If we see a second signal in the next...

READ MORE

MEMBERS ONLY

MEM TV: Best Way To Participate in Stronger Areas of The Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews why the markets continue to hit new highs while also highlighting which areas are driving this strength. She then shares a low-risk, simple way to participate in the uptrend among these stronger areas.

This video originally premiered...

READ MORE

MEMBERS ONLY

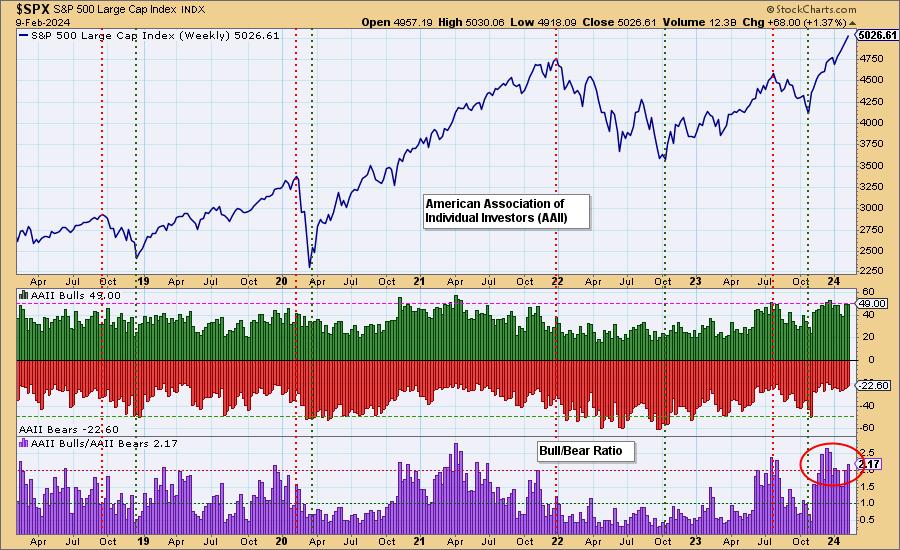

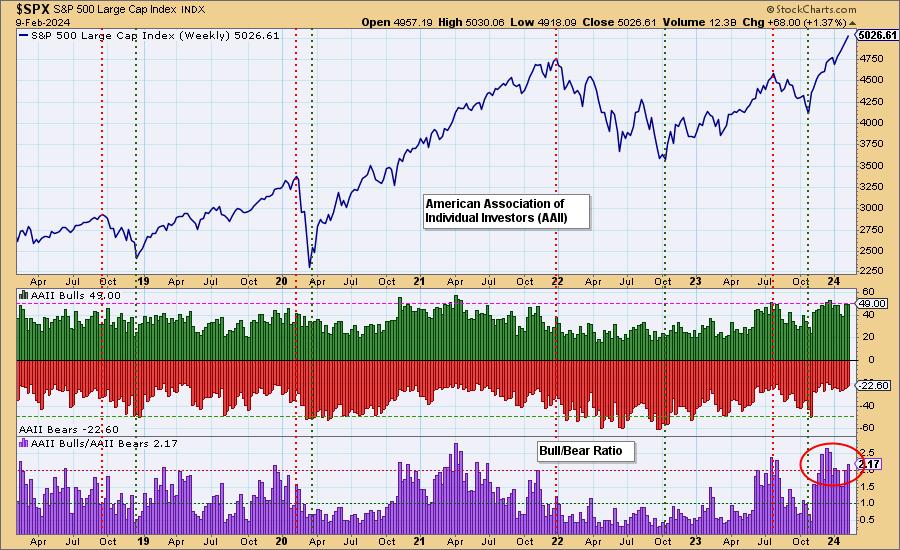

Sentiment Lopsided - Is It a Problem?

by Erin Swenlin,

Vice President, DecisionPoint.com

Periodically, we like to review sentiment charts, and today we have two for you. One is the poll results from the American Association of Individual Investors (AAII) and the other is the National Association of Active Investment Managers (NAAIM) Exposure level.

In both cases, we are starting to see sentiment...

READ MORE

MEMBERS ONLY

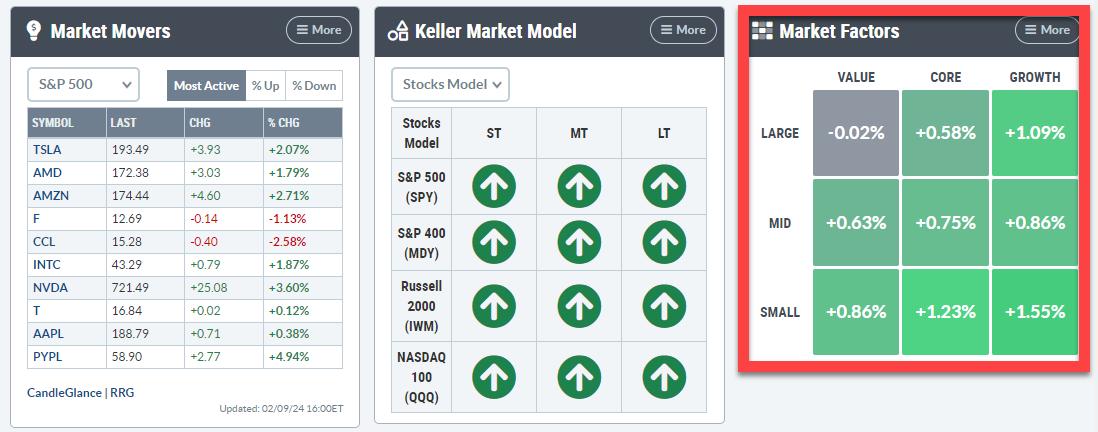

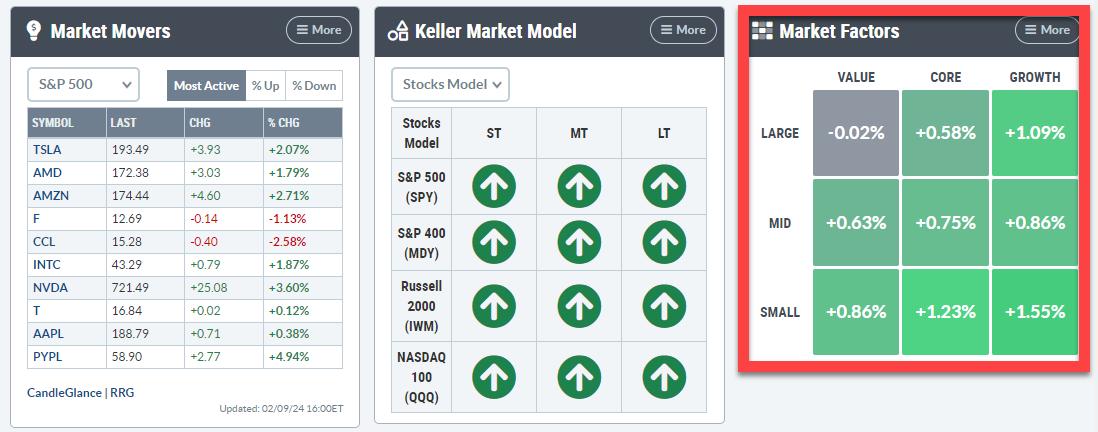

Visualizing the Market Factors Panel on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Bring the New Market Factors Panel to a Relative Rotation Graph

* Same approach using different index family shows a different image

With the release of the new Panels feature on the StockCharts dashboard, there are a lot of ways that users of RRG charts can take advantage! Let&...

READ MORE

MEMBERS ONLY

Your Questions, Answered! Price Gaps, Bull Flags, Inverse Patterns, and MORE

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave digs into The Final Bar Mailbag and answers questions on price patterns like bull flags, what price gaps actually represent on the chart, and why analyzing earnings trends could help you anticipate subsequent moves for stocks like META.

This...

READ MORE

MEMBERS ONLY

3 Expert Earnings Plays: Maximizing Reward, Minimizing Risk

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Danielle Shay of Simpler Trading. Danielle highlights three earnings plays she's focused on this week, and shares how she combines multiple time frames in her trading to better define risk vs. reward. Dave laments the weakening...

READ MORE

MEMBERS ONLY

Master Momentum Using Price Swings and Fibonacci Grids

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses how he uses the price swings and Fibonacci grid to determine the momentum of a trend without the use of indicators. He explains how indicators can lag at reversal points and why we need to lean...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 7: The Illusion of Forecasting

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the seventh in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Why the NAAIM Exposure Index Matters to Your Investments

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC, CMT of Shadowridge Asset Management and President of NAAIM. Ryan provides a primer on the NAAIM Exposure Index, including what it is, how it's calculated, and how it can be used to measure...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks vs. Bonds -- Monthly Trends Revealed!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I review the monthly charts for January 2024, in combination with the Relative Rotation on the Monthly RRGs for asset classes and sectors. At asset class level, the preference for stocks over bonds remains clearly visible. Looking at the monthly...

READ MORE

MEMBERS ONLY

Three Things I WISH I'd Known About Trading

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave speaks to weakening short-term breadth conditions as the McClellan Oscillator rotates to a bearish level this week. Guest Dave Landry of DaveLandry.com drops some serious trader wisdom and also shares what he does first thing every morning to...

READ MORE

MEMBERS ONLY

Only a Fool Would Try to Call a Correction in a Bull Market, So Here Goes!

by Martin Pring,

President, Pring Research

The vast majority of the primary trend indicators are pointing to a bull market and have been doing so for the better part of a year. Chart 1, for instance, shows that NYSE Margin Debt, or rather its long-term KST, has only recently gone bullish. The vertical lines point out...

READ MORE

MEMBERS ONLY

DecisionPoint Trading Room: Narrow Advance a Big Problem!

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rally last week was very narrow, driven mainly by large gains in communication services stocks like Meta. Many technical indicators are showing negative divergences. The broader market struggled. Erin reviews all of the sectors under the hood and then takes your symbol requests.

Key Takeaways:

- Communication services...

READ MORE