MEMBERS ONLY

The Halftime Show: Watch the Unemployment Rate - It Could Change Everything!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, Pete explains how his TLT call from 10/10 was spot-on! But that could all change based on the unemployment rate. Pete believes that rates will fallifthe unemployment rate spikes higher, likely to the 4.25-4.5% level. Until...

READ MORE

MEMBERS ONLY

Is the Bear Back?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 (SPY) has fallen about 10 percent from the July top, and the last two weeks has been pretty rough, so should we be looking for the Bear to take charge again?

First, looking at a weekly chart, it is not clear that the Bear actually...

READ MORE

MEMBERS ONLY

Late-Hour Selloff Confirms Downtrend Phase!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Tom Bowley of EarningsBeats shares his chart of key ratios illustrating how growth still has held its ground relative to value stocks. Host David Keller, CMT focuses in on distribution in the last hour of trading and highlights one...

READ MORE

MEMBERS ONLY

Market's At RISK in The Mega Cap Bloodbath!

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG discusses how breadth continues to be abysmal, and now that some of the mega caps are reporting earnings, they are getting whacked hard. If they can't hold up, most of the market is at risk of moving...

READ MORE

MEMBERS ONLY

This Powerful MACD/ADX Screener Generates Valuable Ideas

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows an intraday trade setup in the SPY that took place this week. He uses the MACD and ADX in multiple timeframes to explain in detail how they can help with our entry and timing. He discusses...

READ MORE

MEMBERS ONLY

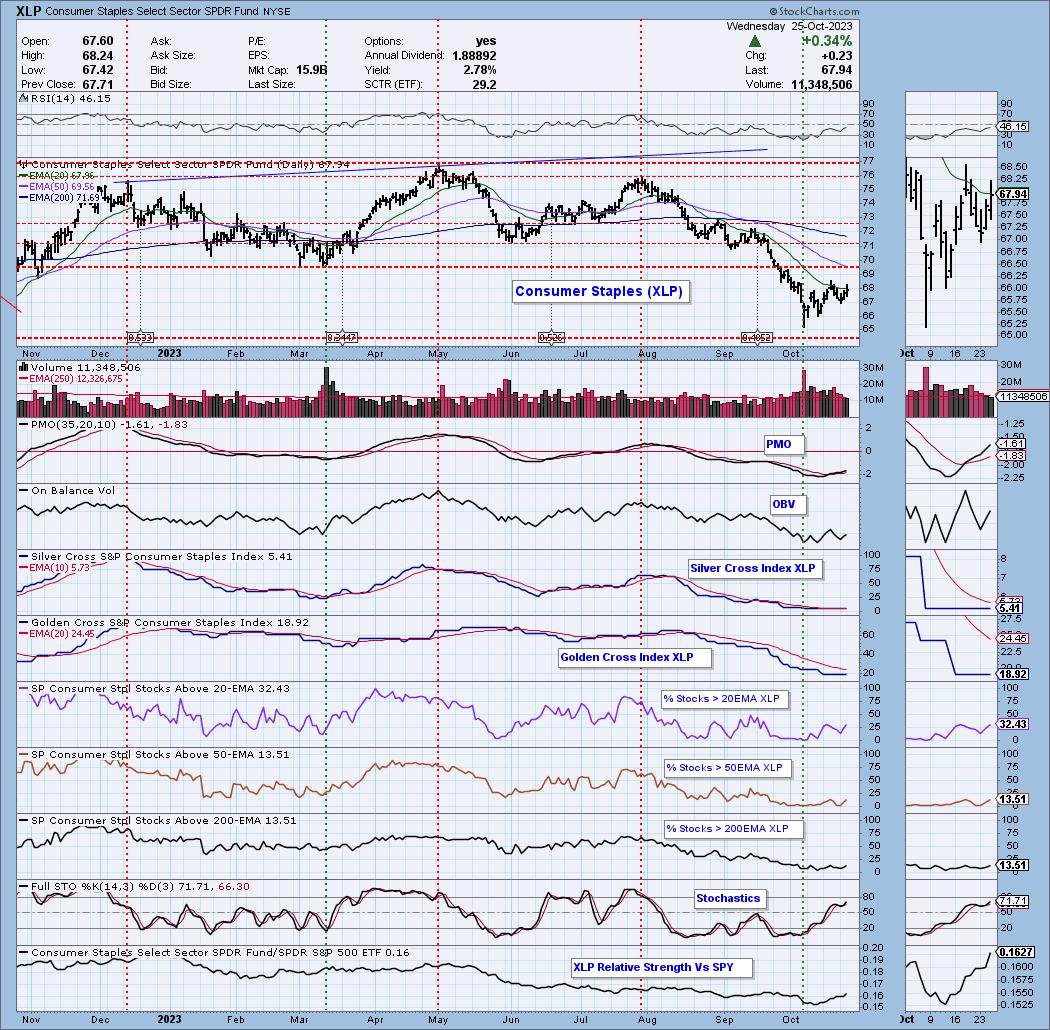

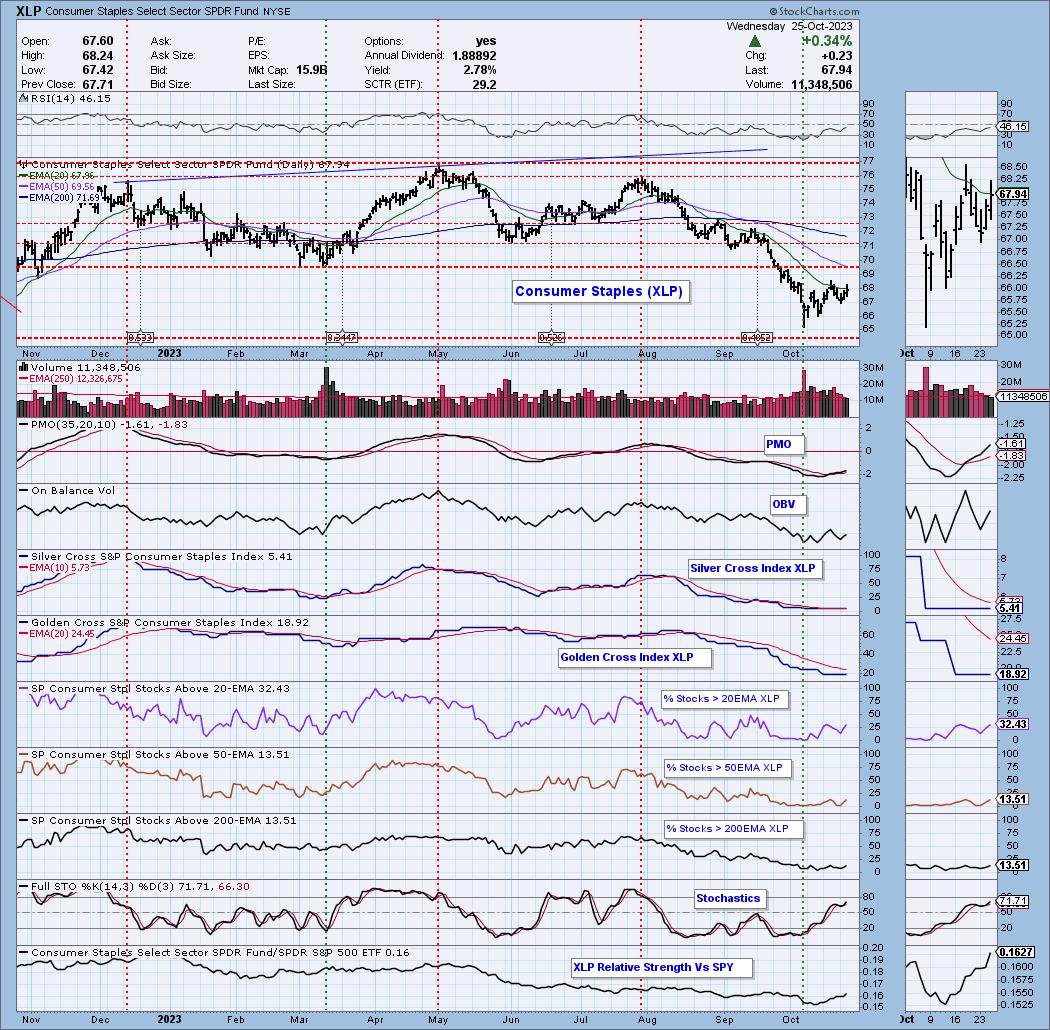

Two Defensive Sectors are Outperforming - What Does This Mean?

by Erin Swenlin,

Vice President, DecisionPoint.com

The only two sectors to close higher on Wednesday were in the defensive category, Consumer Staples (XLP) and Utilities (XLU).

We were already watching XLP as it established a short-term rising trend. What we aren't seeing is healthy participation...yet. We are seeing some expansion in stocks above...

READ MORE

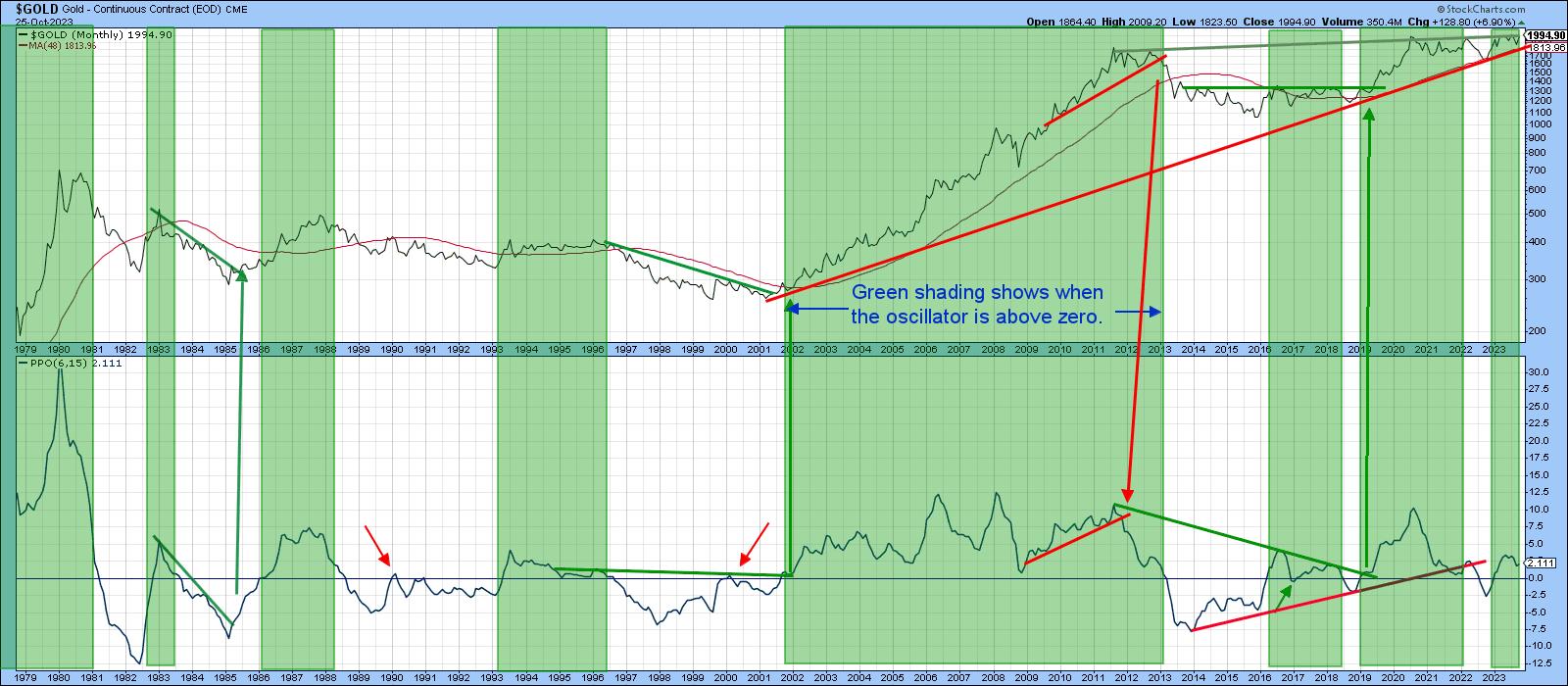

MEMBERS ONLY

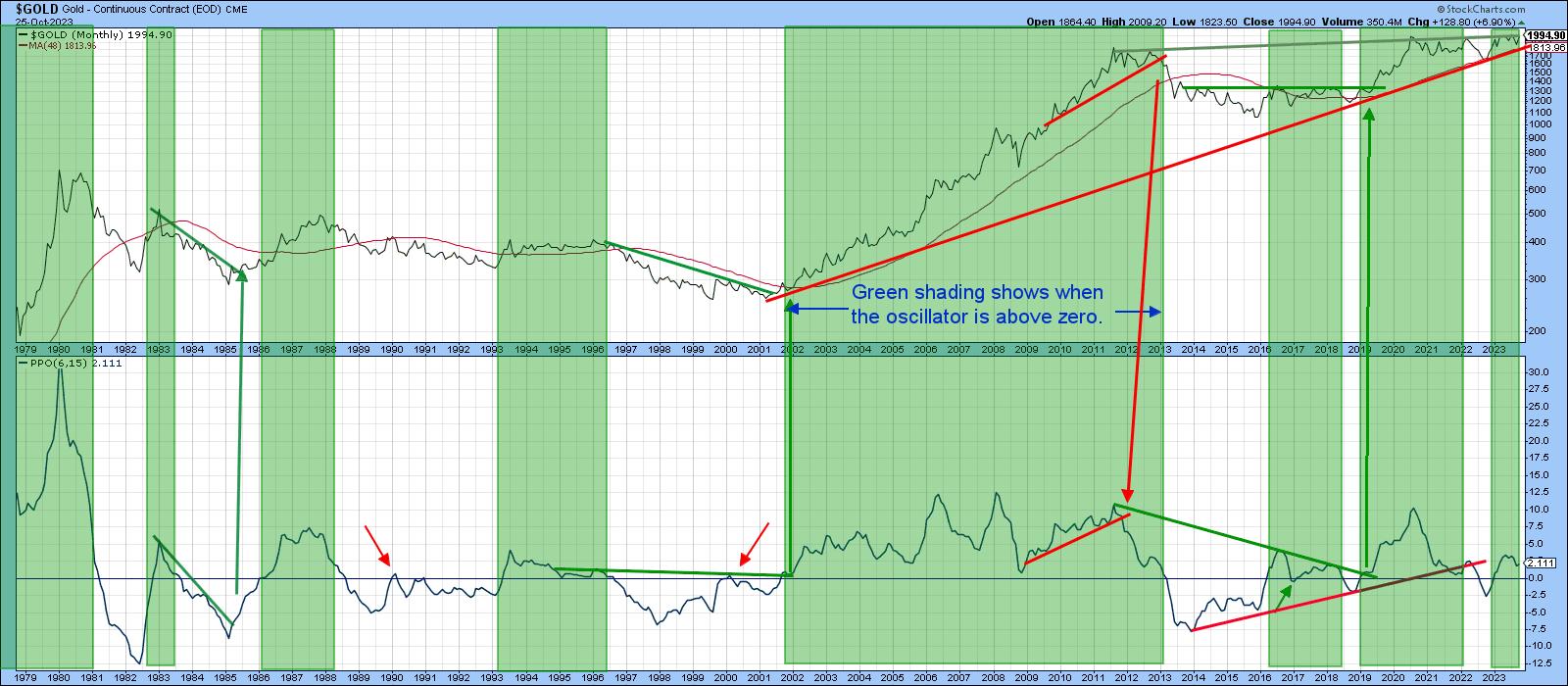

Some Gold Indicators Approach Critical Chart Points

by Martin Pring,

President, Pring Research

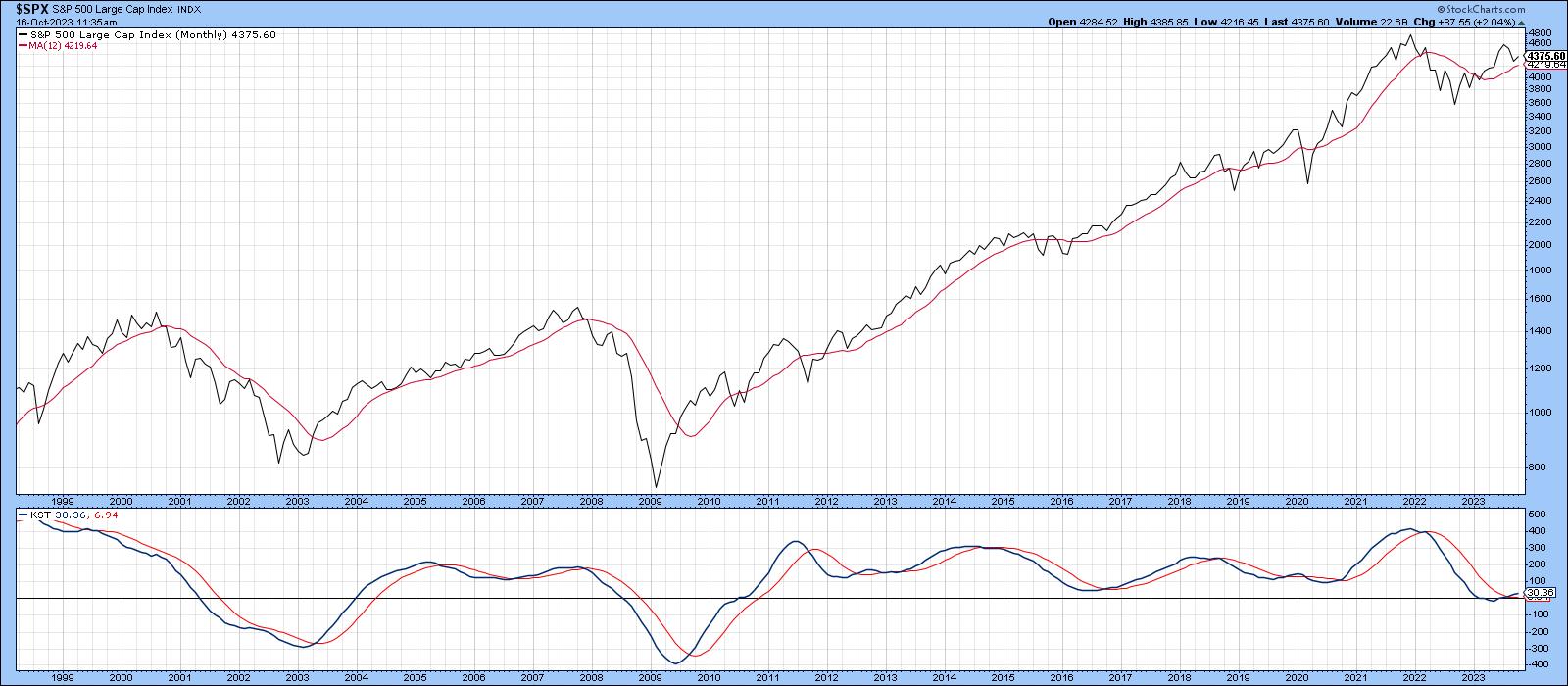

When Anwar Sadat, President of Egypt was assassinated in 1981, gold rallied sharply over the near-term, but the advance soon petered out. The reason was that gold was in a primary bear market, so the advance merely represented a counter-cyclical move. Gold has rallied sharply since the Middle East crisis...

READ MORE

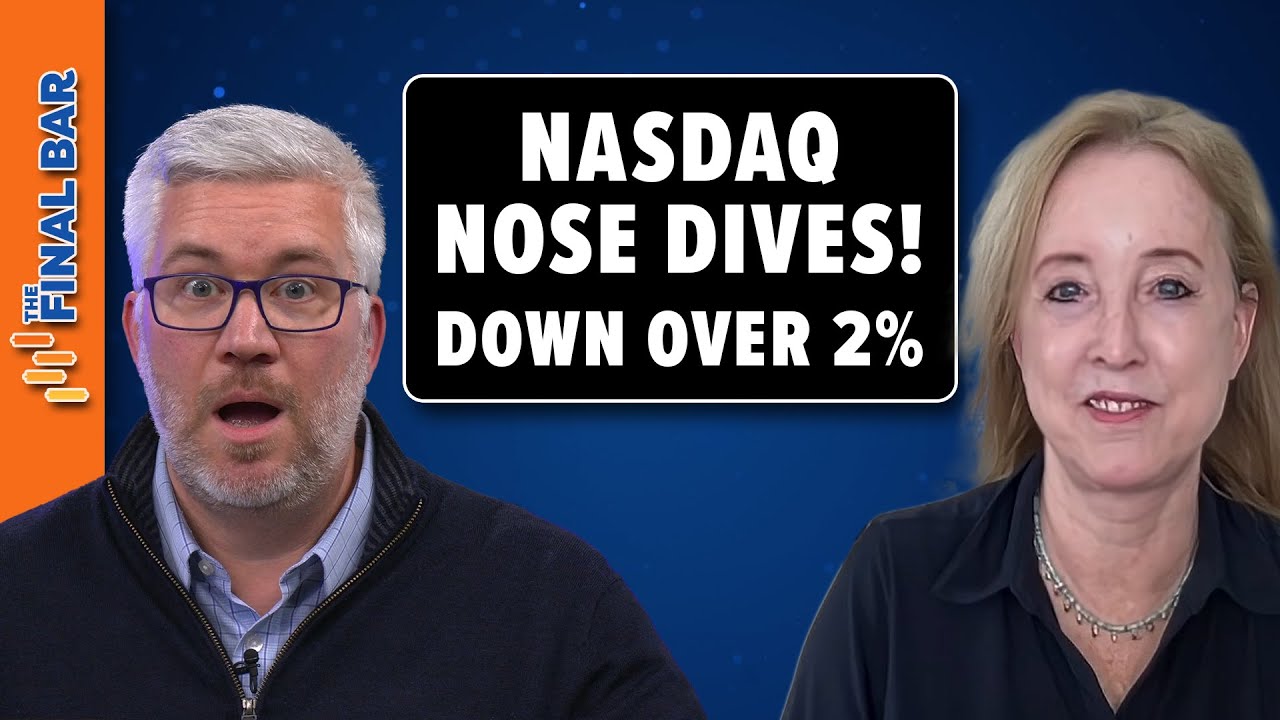

MEMBERS ONLY

NASDAQ NOSEDIVES, Down Over 2% At The Close!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mary Ellen McGonagle of MEM Investment Research shares three stocks showing promise during a period of severe market distribution. Dave focuses in on the S&P 500 testing Fibonacci support and breaks down earnings for Microsoft, Alphabet, Spotify,...

READ MORE

MEMBERS ONLY

Key Market Relationships for the Next Big Move

First off, we are heading out of town to New York where I will be visiting in studio several media channels and hosts.

Then, we are off to Orlando for the MoneyShow.

On November 1st, Keith and I go on vacation until the middle of the month.

This is the...

READ MORE

MEMBERS ONLY

It's All About Risk and the Long Bonds

Monday, after a lot of spooky headlines, the SPDR S&P 500 ETF (SPY) touched its 23-month moving average (MA) or the two-year biz cycle breakout point right around 417.

Plus, the iShares 20+ Year Treasury Bond ETF (TLT)flashed green as didIWM,the small caps.

The big question...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Have Limited Upsides In The Truncated Monthly Expiry Week; Watch These Key Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets wore a largely corrective undertone throughout the past five sessions; it oscillated within a similar range as the previous week and closed on a negative note. The volatility remained on the lower side; as the volatility has been low, the bands contracted as well. As compared to the...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" October 20, 2023 Recording

by Larry Williams,

Veteran Investor and Author

October is a significant month in the stock market, and in this pre-election year, there's a lot of uncertainty among investors, which makes the stock market more volatile. In this video, Larry discusses the October Seasonality and talks about stocks that generally perform well during the month. You&...

READ MORE

MEMBERS ONLY

Complimentary Edition of the DecisionPoint "Weekly Wrap"

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* Golden Cross BUY Signal for Gold

* Death Cross SELL Signal for NYSE Composite

* Death Cross SELL Signal for Materials (XLB)

Gold (GLD) has been strong this month and today its 50-day EMA crossed up through its 200-day EMA (Golden Cross), generating an LT Trend Model BUY Signal. You...

READ MORE

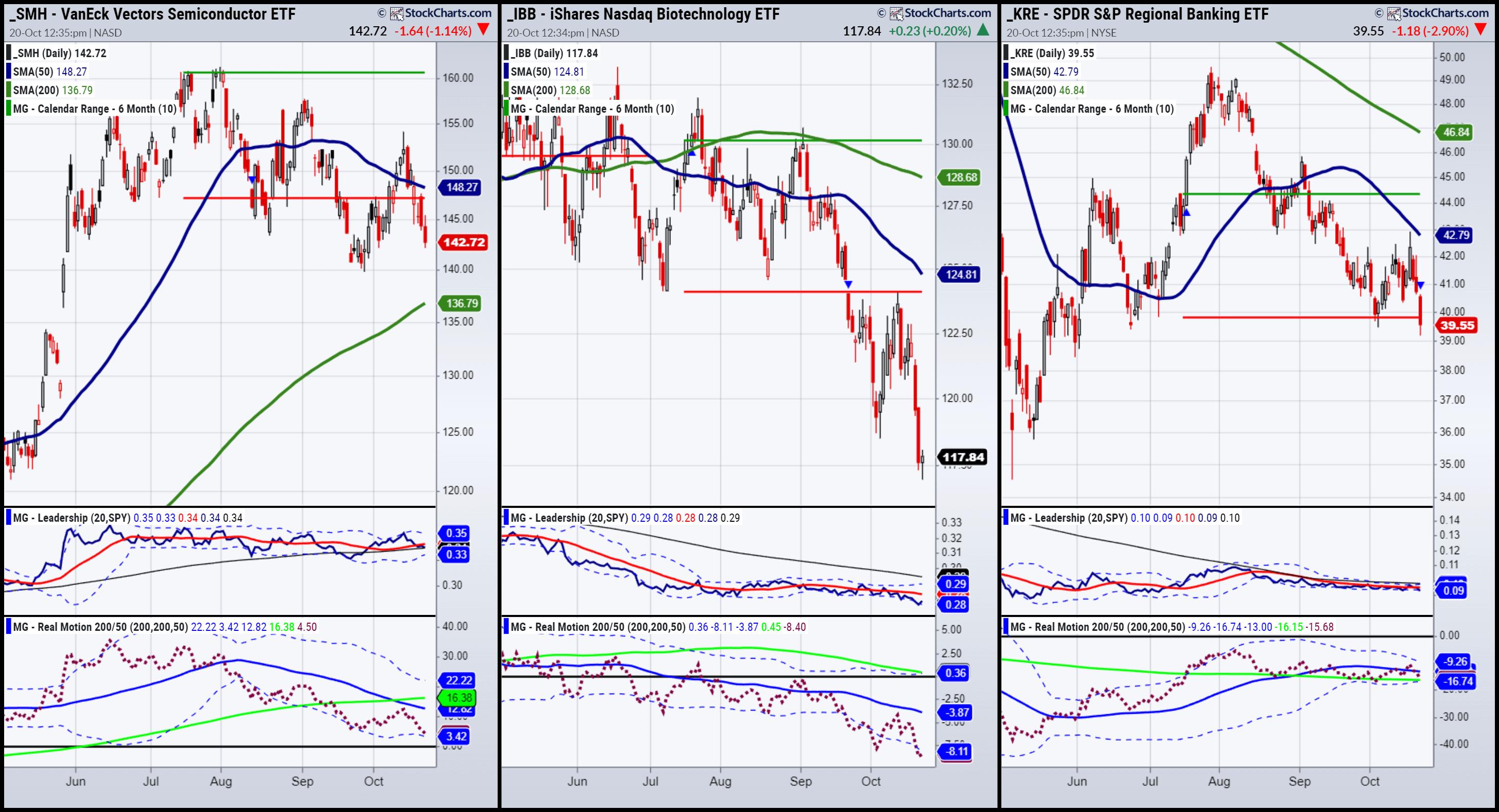

MEMBERS ONLY

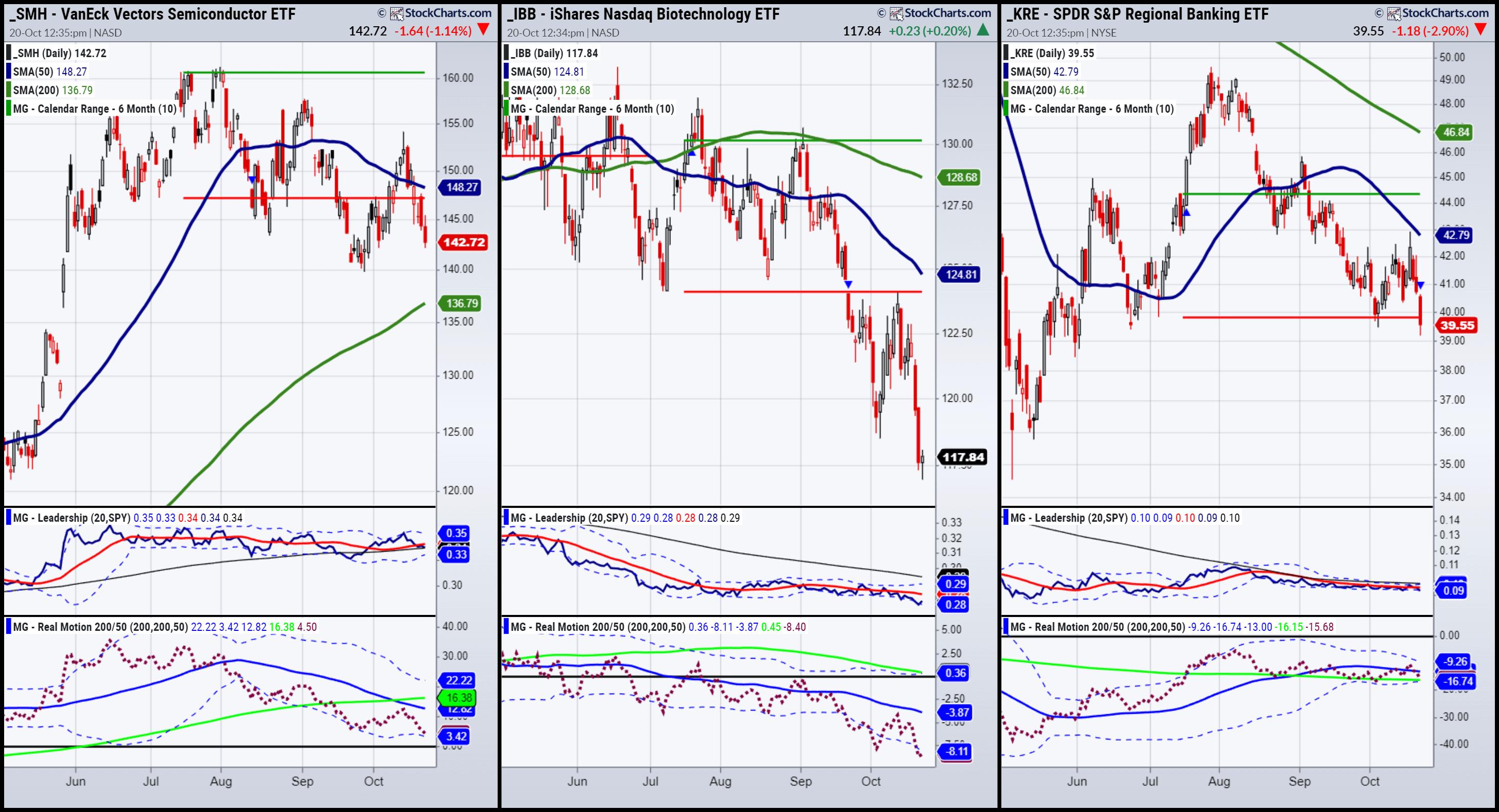

The Kids: Semiconductors, Biotechnology, Regional Banks

Most of you know our Big Viewproduct since I often discuss our risk gauges.

I can report to you that our risk gauges show three out of the five with risk off.

Most interestingly, the SPY continues to outperform the long bonds, risk-on.

And junk bonds continue to outperform long...

READ MORE

MEMBERS ONLY

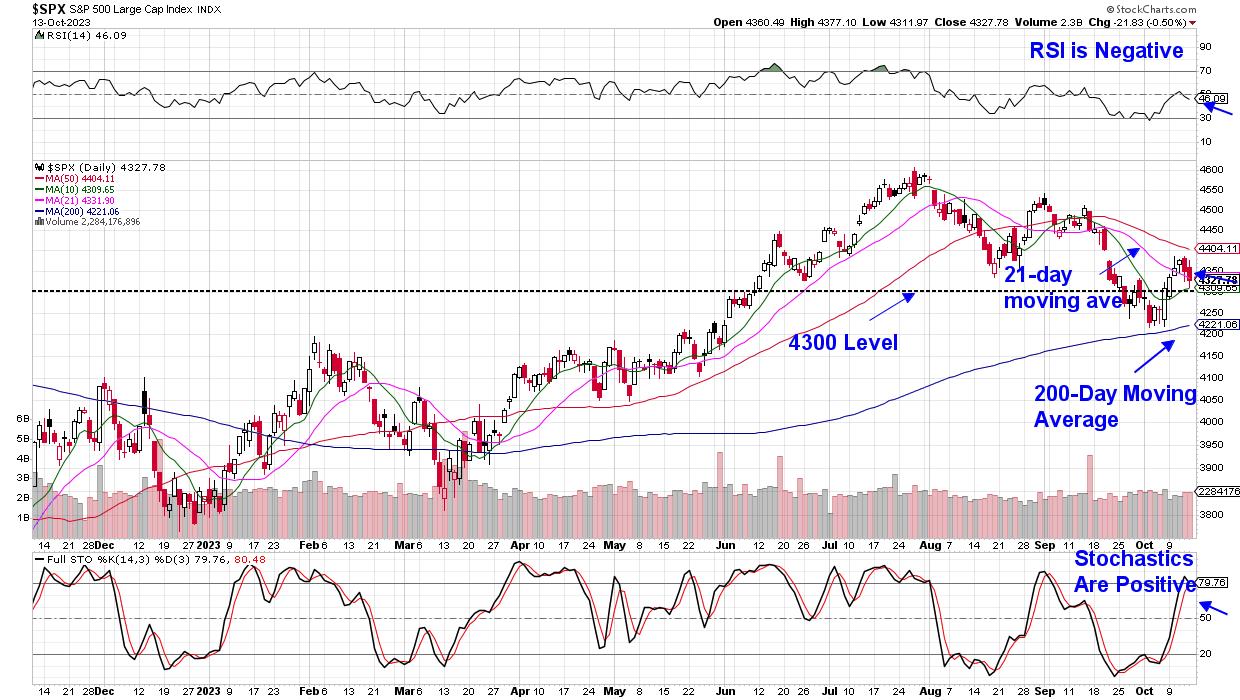

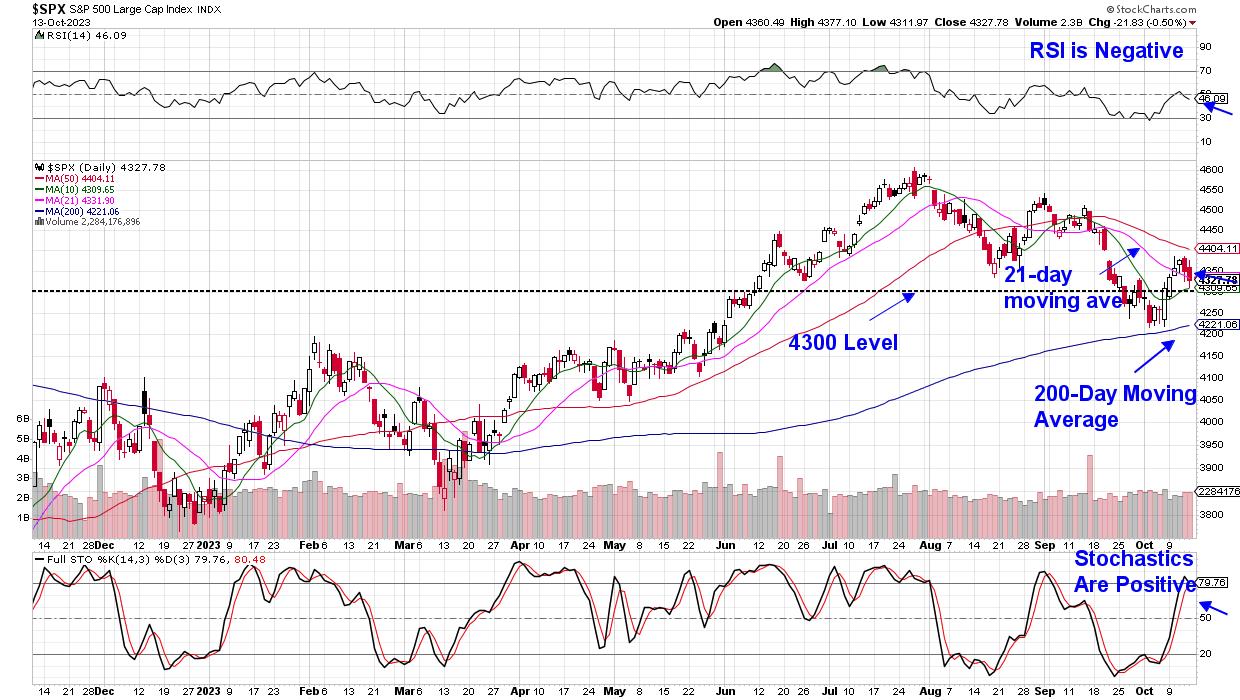

S&P Breaks Below 200-Day Moving Average: It's Going to be a Big Volatile Ride

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 index closed lower for the week and below its 200-day moving average

* Long-dated Treasury yields continue to move higher as investors digest the higher-for-longer narrative

* VIX has been trending higher which indicates a rise in investor uncertainty

Stock market action in the last...

READ MORE

MEMBERS ONLY

RRG is Sending a Clear Message And Finds Two Stocks With Good Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG is sending a strong message to prefer Growth over Value

* Putting the growth stocks from IVW through a scan and some thorough RRG analyses finds a handful of interesting names

* Two unexpected stocks are showing up as having good upside potential

* Especially growth stocks from Defensive sectors...

READ MORE

MEMBERS ONLY

Market Has Stress Fractures but No Clear Breaks

Considering everything:

1. Yields and mortgage rates

2. War

3. Inflation and rising commodity prices

4. Bank stocks falling

5. Risk Gauges: 2 out of 6 now risk-off

To name a few, why, then is the S&P 500 so strong?

Here are a few reasons:

1. Fed members...

READ MORE

MEMBERS ONLY

An Award Announcement With a Dash of Market Commentary

KEY TAKEAWAYS

* Small cap and retail stocks are rising and need to hold support to clear overhead resistance.

* iShares Nasdaq Biotechnology ETF (IBB) should stay within the 120 to 125 range.

* Watch the range in regional banks, a potential uptrend in Bitcoin, and a bullish move in commodities.

With words...

READ MORE

MEMBERS ONLY

How Mega-Cap Names Dominate Through Market Cap

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares how growth over value is less about the types of companies and more about the market cap represented in the largest benchmark names. He breaks down today's pop-and-drop for Bitcoin and answers questions from the newly-added...

READ MORE

MEMBERS ONLY

When News Moves So Fast, Stocks Can Stand Still

Waking up to a new week of geopolitical stress, fake news (Blackrock spot ETF), higher yields, softer dollar, equities rally, I thought to myself: As far as the market goes, it feels like time is standing still.

Why would I think that? After all, it may not last and certainly...

READ MORE

MEMBERS ONLY

GNG TV: Looking at a Relief Rally or a Return to Go Trends?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, with US Equities delivering a streak of daily gains this week, Alex and Tyler examine the daily weak NoGo trend conditions against the weak Go trend conditions on the weekly timeframe. The model is calculated the exact same way, but longer timeframe...

READ MORE

MEMBERS ONLY

DP Trading Room: Mortgage Rates Hit Multiyear High -- Who Goes Bankrupt First?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl discusses the war's effect on the market and looks closer at the effects of high mortgage rates, which have hit multiyear highs. These are pinching not only buyers, but sellers and homebuilders. Afterwards, he goes deeper...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sensitive Sectors Continue to Prop Up the S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, after two weeks of absence, Julius de Kempenaer is back with an in-depth look at the current state of asset class rotation and sector rotation. By slicing sectors into Offensive, Defensive, and Sensitive groups, he paints a picture with an...

READ MORE

MEMBERS ONLY

If War in the Middle East Won't Push this Market Down, What Will?

by Martin Pring,

President, Pring Research

I must say, I was surprised that the outbreak of war in the Middle East and a 4% rise in oil sent the market higher, not lower by the close of business last Monday. Typically, a market that does not respond to bad news in a negative way is one...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Friday, October 20th at 2:00pm EDT!

by Larry Williams,

Veteran Investor and Author

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Friday, October 20th at 2:00pm EDT.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Consolidates While Defending Key Levels; Vigilant Protection of Profits Advised

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was mentioned that the volatility gauge INDIAVIX had stayed at its lowest levels, and this setup was keeping the markets vulnerable to profit-taking bouts from the current levels.

Over the past five days, the markets showed some signs of profit-taking, but at the same...

READ MORE

MEMBERS ONLY

Stock Market Rally Fizzles – What to Do Now

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets started the week on a strong note with a rally, which was boosted by the release of dovish remarks from the Federal Reserve's last meeting. A stronger-than-expected CPI report sparked an increase in interest rates, however, which pushed the markets lower. The selling picked up on...

READ MORE

MEMBERS ONLY

Lagging Indicators Confirm Bearish Phase For Growth

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Leading indicators help anticipate price reversals, while lagging indicators validate trend changes you've already observed.

* RSI combines the qualities of leading and lagging indicators, helping investors to prepare for and react to trend reversals.

* AAPL recently showed a bullish momentum divergence, meaning the leading indicator has...

READ MORE

MEMBERS ONLY

MEM TV: Markets Stall As Week Progresses - Here's Why

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares where the market stands, after last week's price action had select areas far outpacing the markets while others were weak. She also reviews the start of earnings season following reports from several high profile companies....

READ MORE

MEMBERS ONLY

Growth Sectors Tumble as Defensive Plays Post a Strong Finish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the rapid decline in growth sectors including Technology and Communication Services as defensive plays like utilities and gold post a strong finish to the week. Dave answers questions from The Final Bar Mailbag on the McClellan Summation Index...

READ MORE

MEMBERS ONLY

Looking At a Perfect Pullback Opportunity

by TG Watkins,

Director of Stocks, Simpler Trading

The market followed the Moxie rules perfectly this week. The setup was there for our traders, and so we took advantage of the choppy down move over the last three days which were spurred on by some economic reports and worldly events. In this week's edition of Moxie...

READ MORE

MEMBERS ONLY

Stock Market Weekly Update: 3 Valuable Points You Need To Know About the Selloff

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indices are still holding support despite the selloff

* The VIX closed higher but it's still tame relative to past readings

* Gold futures closed above $1900 per ounce indicating that investors may have fled to gold in case geopolitical tensions escalated over the weekend...

READ MORE

MEMBERS ONLY

Will Bitcoin Go the Way of a Commodity or an Equity?

I went back to my Outlook 2023 written in December 2022, where I begin with:

You Can't Run with the Hare and Hunt with the Hounds.

This expression will ultimately summarize the upcoming year.

As the Year of the Tiger loses its roar, the Year of the Rabbit...

READ MORE

MEMBERS ONLY

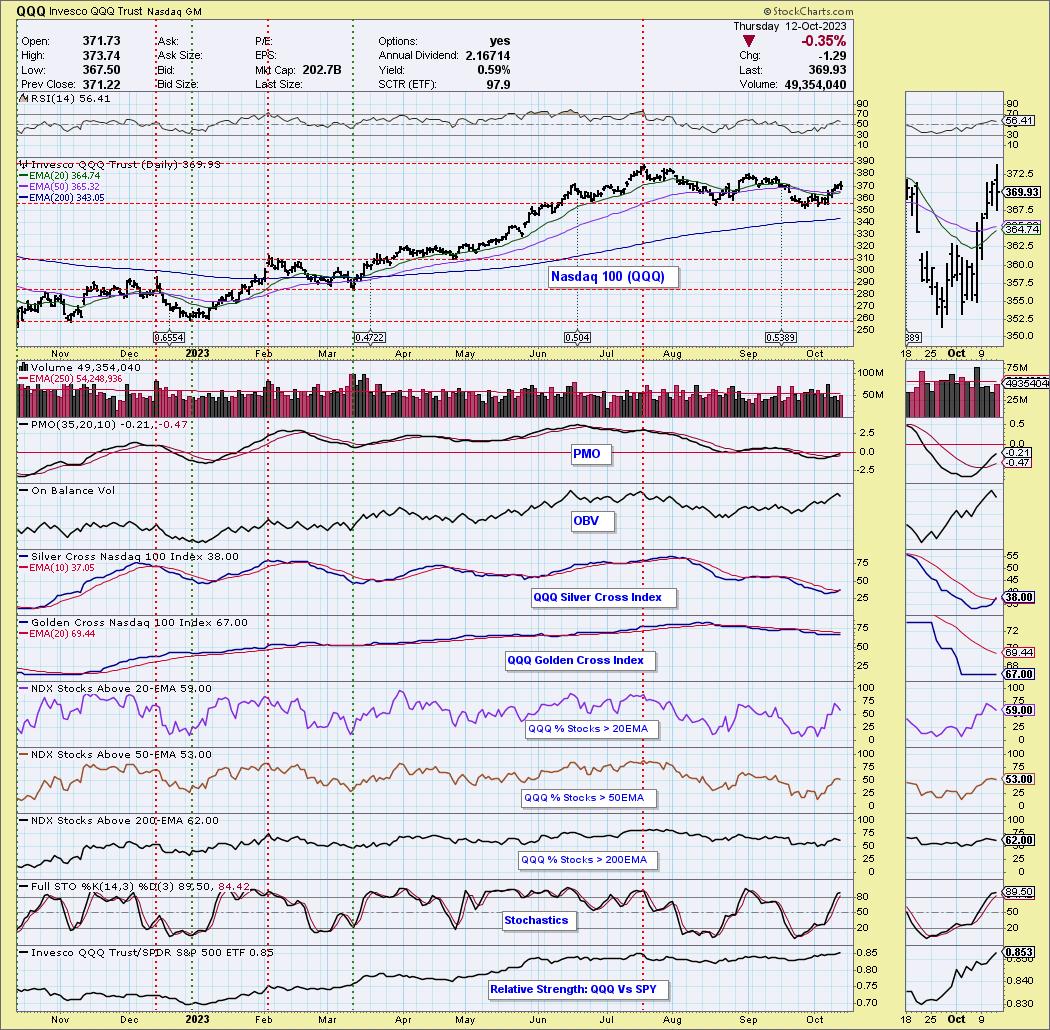

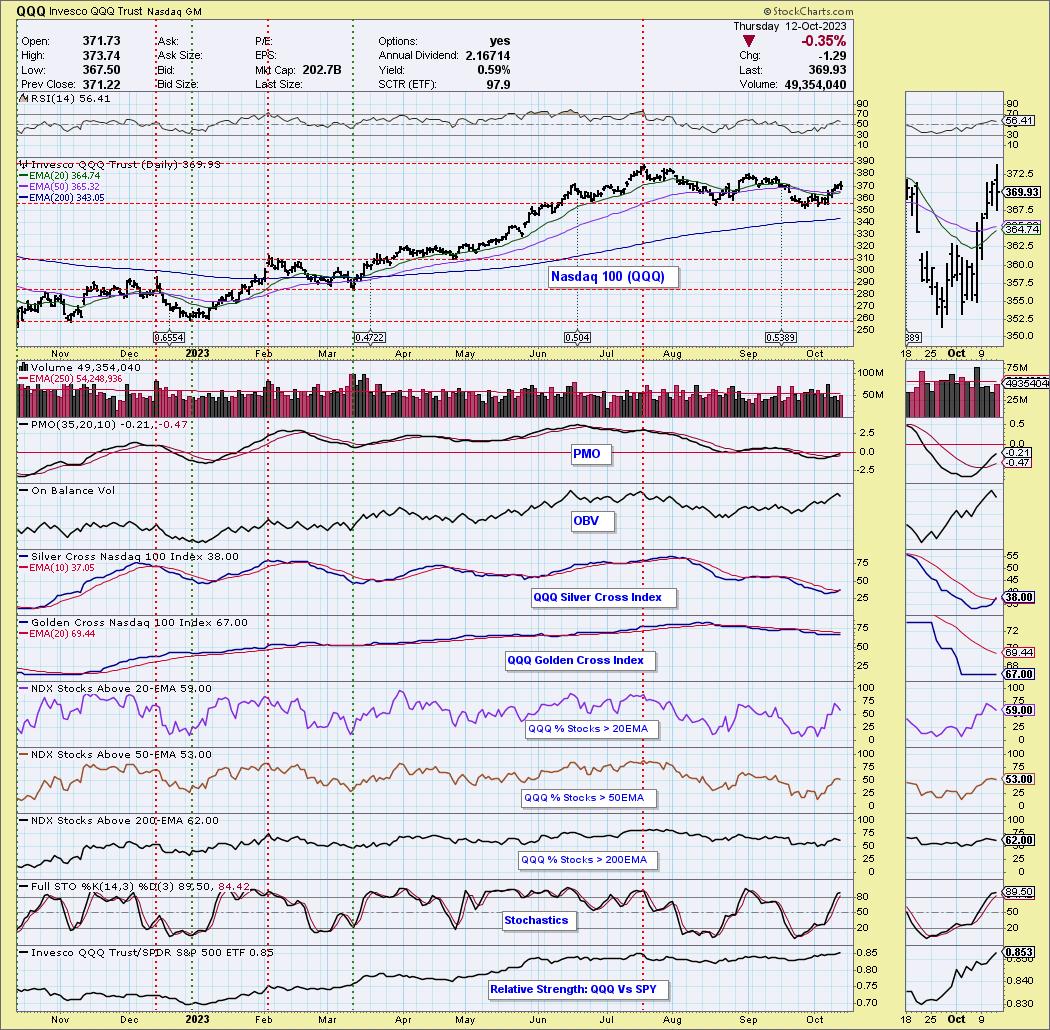

Nasdaq 100 (QQQ), Communication Services (XLC), and Transports (IYT) New Bullish Bias in IT

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* Silver Cross Index Has Bullish "Shift" Above Signal Line for QQQ, XLC and IYT

* QQQ Should Continue Higher

* XLC Struggles Today, But Has Bullish Outlook

* IYT Neutral Outlook Based on Relative Strength

The Silver Cross Index is another way for us to measure participation within an...

READ MORE

MEMBERS ONLY

Comfort in the Stock Charts (Video Interview)

Some notes this week:

Growth stocks are acting as a defense move again, especially given that the Fed remains on the fence about interest rate. Small caps and retail though, could still act as an anchor. For now, they both held a key area -- 6-7-year business cycle lows --...

READ MORE

MEMBERS ONLY

Stocks Continue Feeling The Pressure From Higher Rates

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Chris Verrone of Strategas Research Partners discusses how small-caps may emerge from the quagmire, along with why it's important to focus on relative strength. Host David Keller, CMT points out the continued strength of offense over defense...

READ MORE

MEMBERS ONLY

2 Clear Strategies When Using the ADX

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses keys to using the ADX indicator. He focuses on the 2 clear strategies for ADX and how to handle them. In addition, he describes the slope of this line and how that affects the strategy. Joe...

READ MORE

MEMBERS ONLY

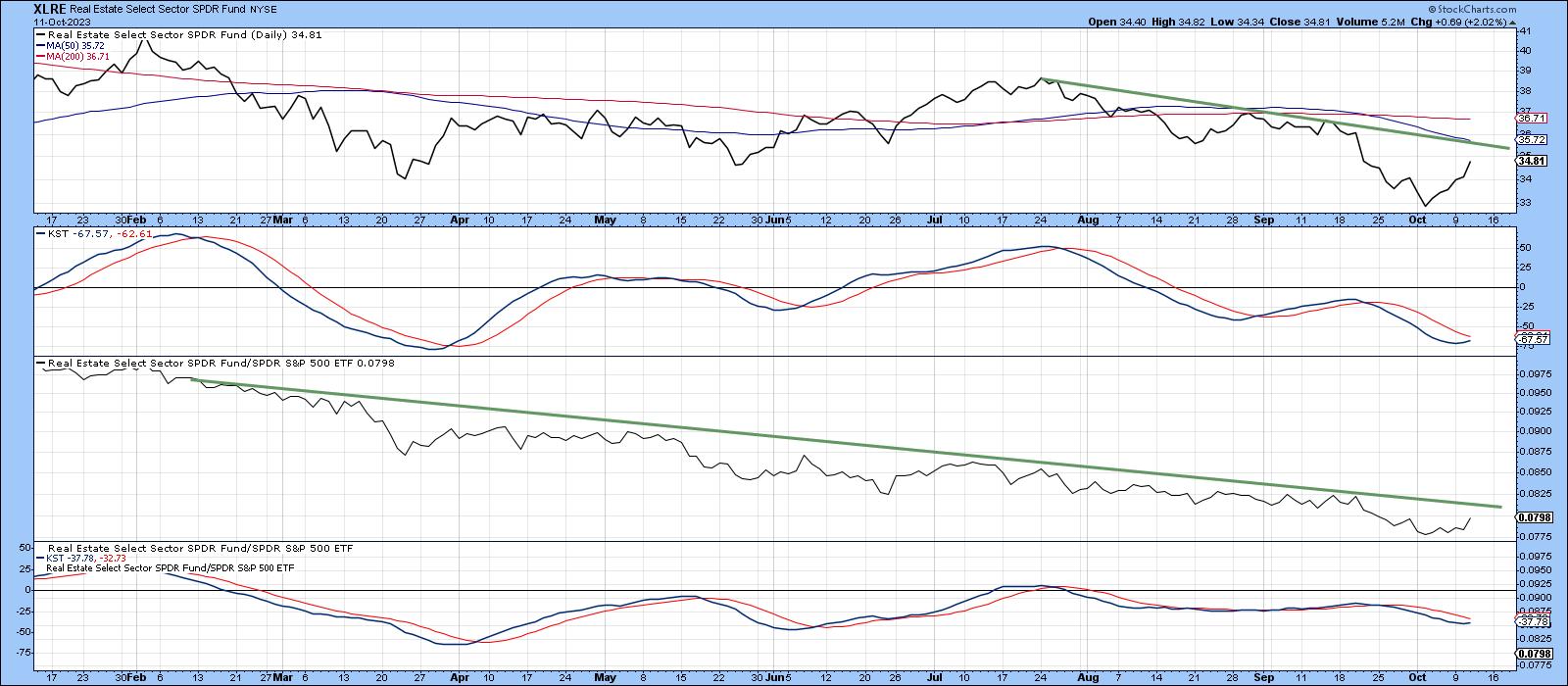

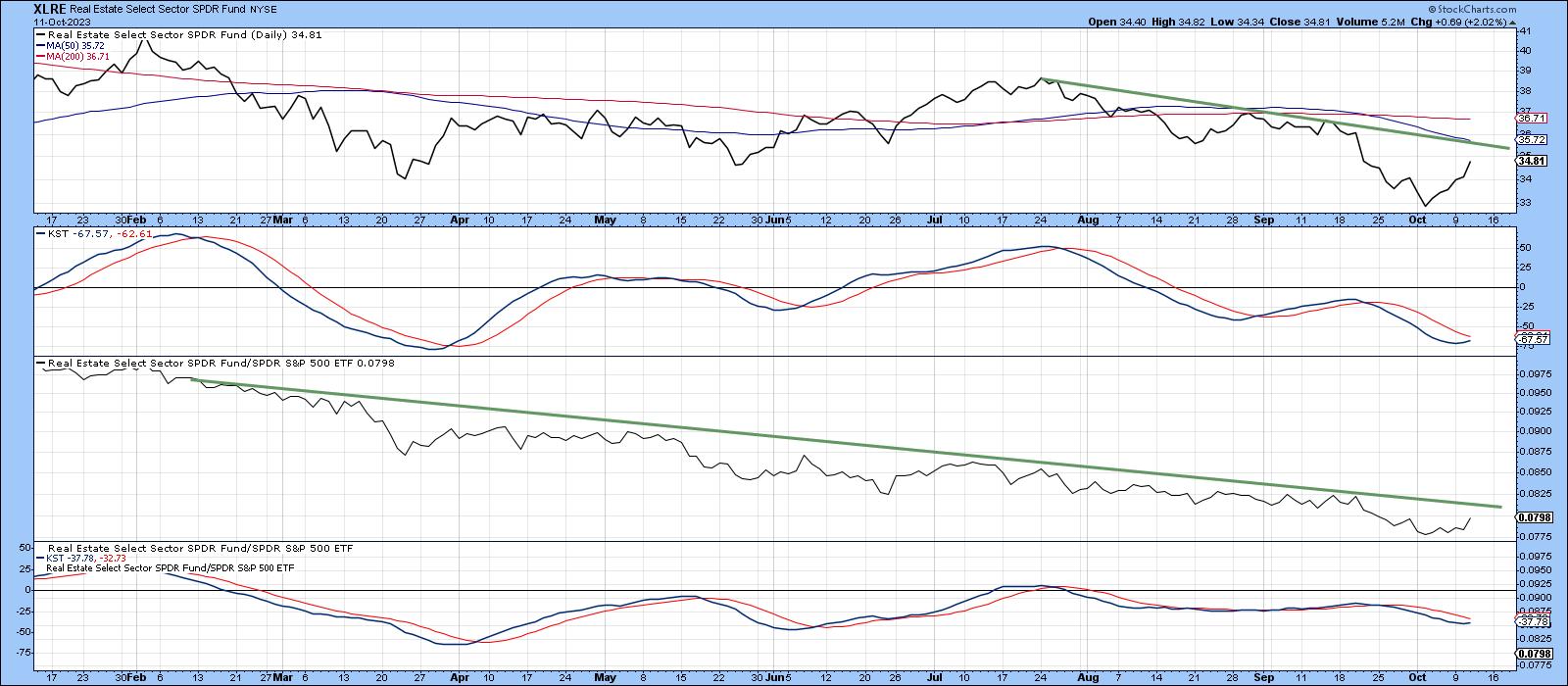

REITS Getting Ready to Rally, But What Happens After That?

by Martin Pring,

President, Pring Research

Several short-term charts suggest the SPDR Real Estate ETF (XLRE) is getting ready to rock and roll, thereby indicating an extension to this week's rebound is in the cards. It's possible that the expected rally could result in shifting some of the longer-term indicators towards a...

READ MORE

MEMBERS ONLY

The Most Important Chart to Watch During Earnings Season

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Adam Turnquist, CMT of LPL Financial shares his chart of the Ten Year Treasury Yield and explains why the US Dollar may be the most important chart to watch as earnings season begins. Dave highlights stocks making new swing...

READ MORE

MEMBERS ONLY

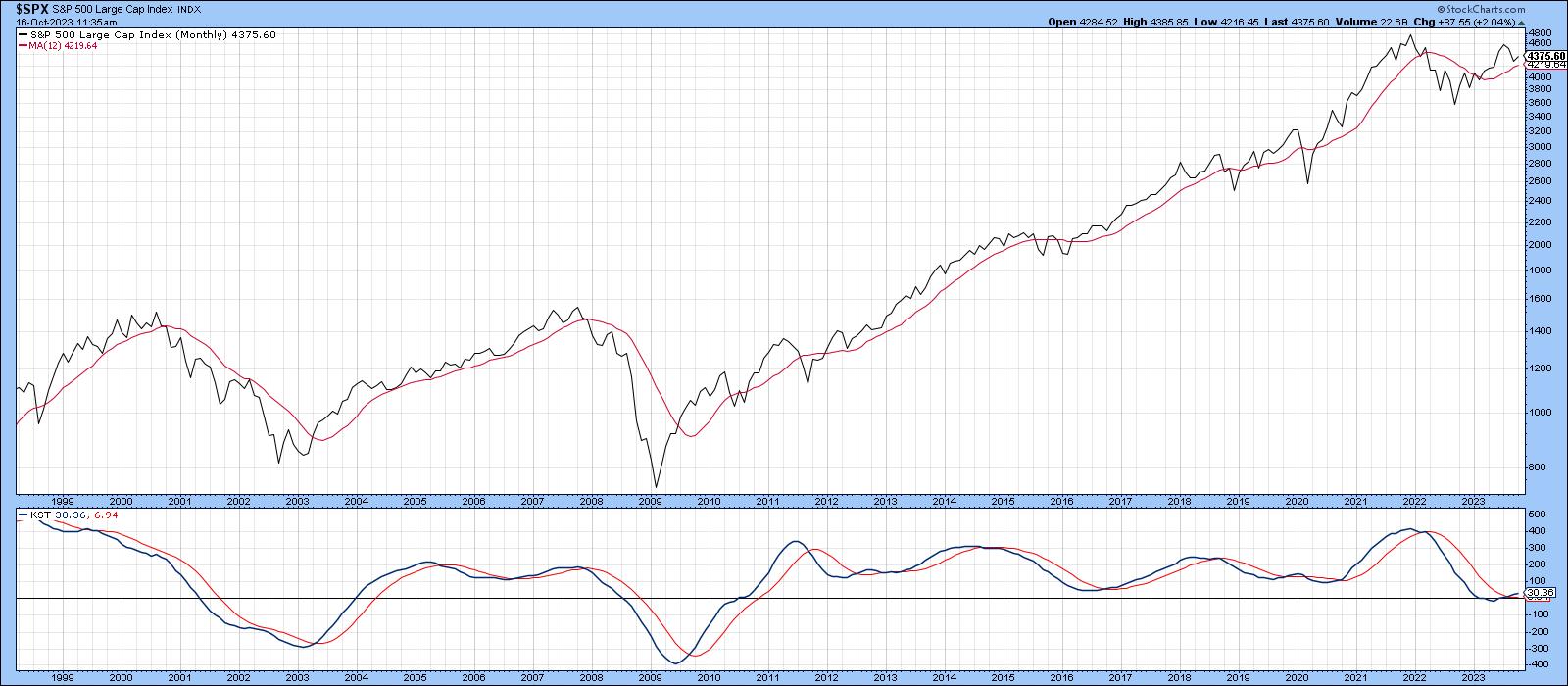

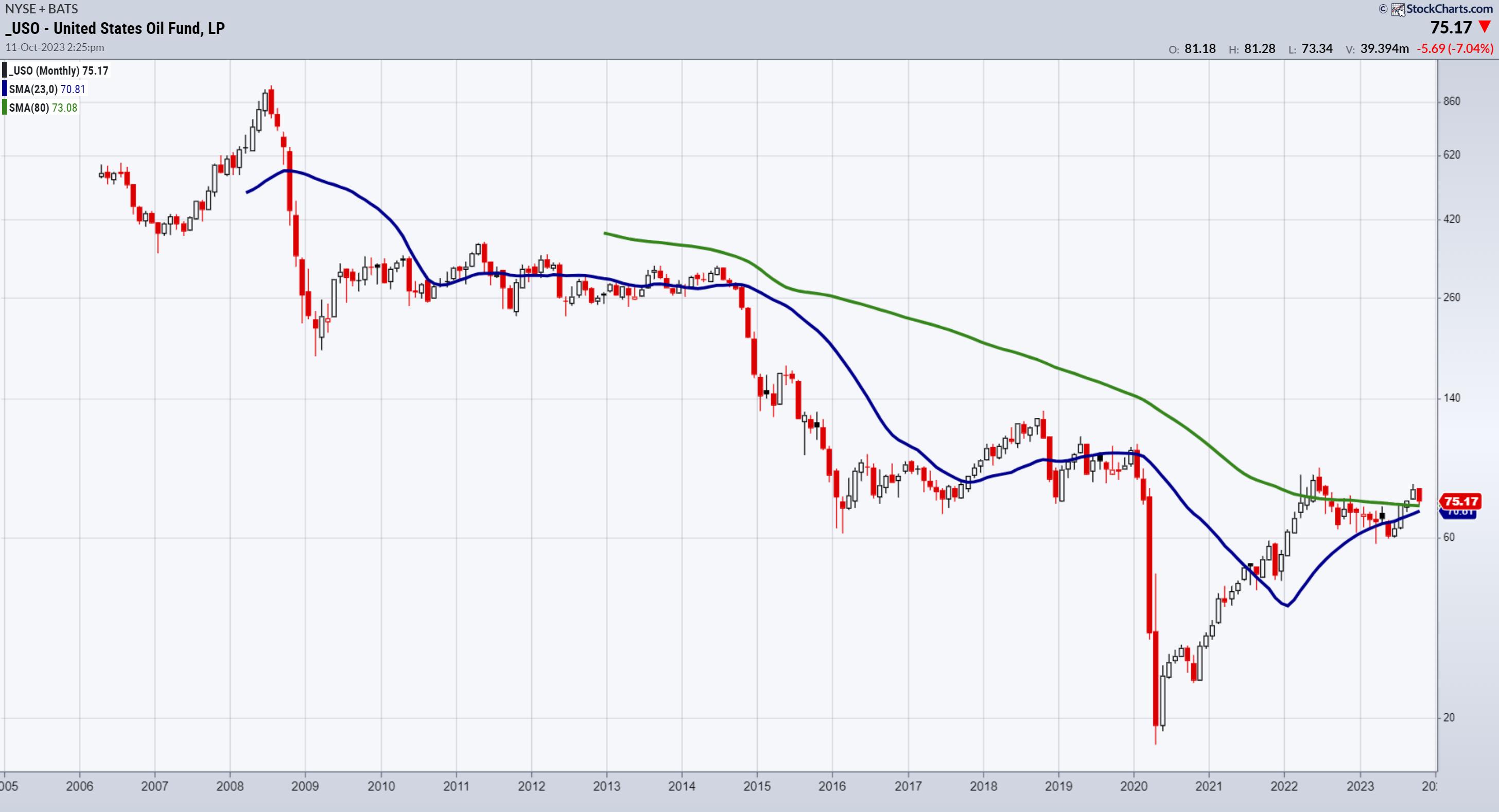

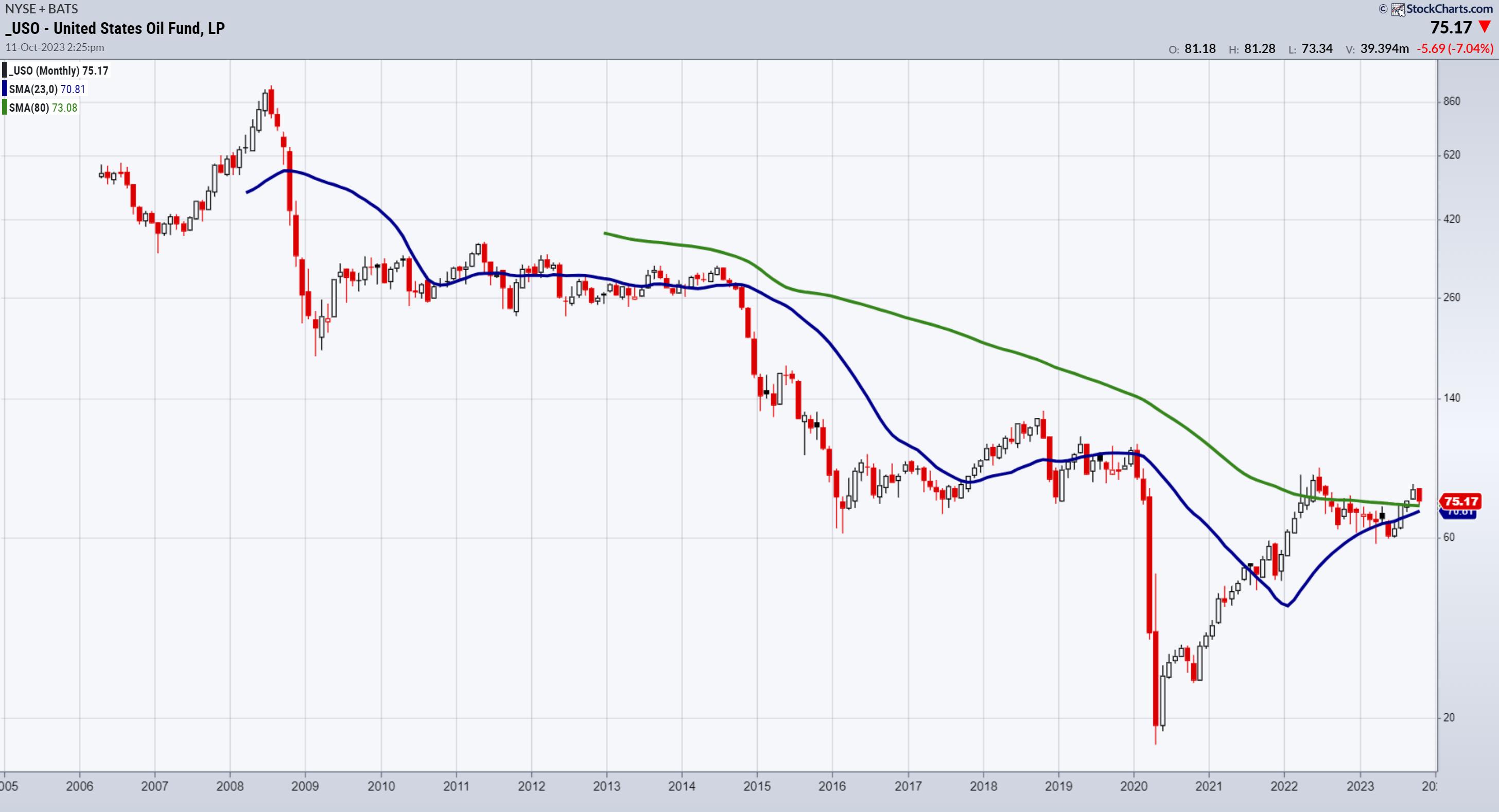

Monthly Chart Points to Much Higher Oil Prices Coming

Before we begin, just a note to mention that TLT took out the fast MA featured in the October 10th daily, while SPY underperformed. If that is a trend, it behooves you to review that daily.

Loyal readers of the Daily know that we often focus on zooming out to...

READ MORE