MEMBERS ONLY

Ranking Long-Term Breadth; Healthcare Improves; Finance Breaks Down; Technology Holds Up; MAG7 Sets Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Arthur Hill analyzes breadth in the Health Care, Financials, and Technology sectors. Which sectors are still in a long-term trend, and which are ready to break down? Find out here....

READ MORE

MEMBERS ONLY

Reading Between the Lines: What RSI and Breadth Are Saying About Stocks

by Frank Cappelleri,

Founder & President, CappThesis, LLC

RSI readings, market breadth, and price patterns can provide directional signals for the stock market. Here's what you should monitor as the market goes through a relatively volatile period....

READ MORE

MEMBERS ONLY

10 Small-Cap Stocks Set to Break Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Volatility spiked this week, with Tom Bowley breaking down the renewed trade tensions and what they mean for traders. He highlights the breakout in small-caps and reveals ten fast-moving stocks leading the next market rally....

READ MORE

MEMBERS ONLY

The Stock Market’s Sending Mixed Signals: Here’s How to Decode Them

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Get the latest stock market insights: S&P 500 support, small-cap resilience, and sector strength in semiconductors and AI energy stocks....

READ MORE

MEMBERS ONLY

From Trash to Treasure: Micro-Caps Lead the Market’s Risk-On Rebound

Micro-cap returns have outperformed those of the S&P 500 since the April low. Discover how you can capitalize on the micro-cap success if they continue their upward trajectory....

READ MORE

MEMBERS ONLY

5 Overlooked AI Stocks with BIG Upside Potential

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil highlights five overlooked AI trading stocks showing strong trend and momentum setups. He also reviews the S&P market conditions and top stock market charts, including Apple, Nvidia, Oracle, and Teva....

READ MORE

MEMBERS ONLY

The Secret to Better Investing: Watch Fewer Stocks

by Grayson Roze,

Chief Strategist, StockCharts.com

Grayson Roze reveals how narrowing your invest able universe can make you a better trader. See how to use StockCharts tools to focus your strategy, simplify analysis, and make smarter trading decisions....

READ MORE

MEMBERS ONLY

StockCharts Insider: How an “Overbought” RSI Can Be Your Best Buy Signal

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Think “overbought” means it’s time to bail? Not always. Sometimes that 70+ RSI reading doesn’t signal weakness, but strength. In this Insider post, we’ll flip the script on RSI, show you why overbought often means “stay on board,” and give you the tools...

READ MORE

MEMBERS ONLY

Four Roads Diverge in the Market: Which Will the S&P 500 Take?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We outline four potential scenarios for the S&P 500 index through the end of November 2025, along with our probabilities for each of the scenarios. Which one do you feel is most likely to occur?...

READ MORE

MEMBERS ONLY

StockCharts Insider: How to Use PerfCharts to Decode Investor Sentiment in One Minute or Less

by Karl Montevirgen,

The StockCharts Insider

There are countless tools and strategies for gauging market sentiment. When combined, sure, they give you a full picture. But they also take time.

But what if you just need a quick vibe check? You plan to dig deeper later, but right now, you need a fast read to keep...

READ MORE

MEMBERS ONLY

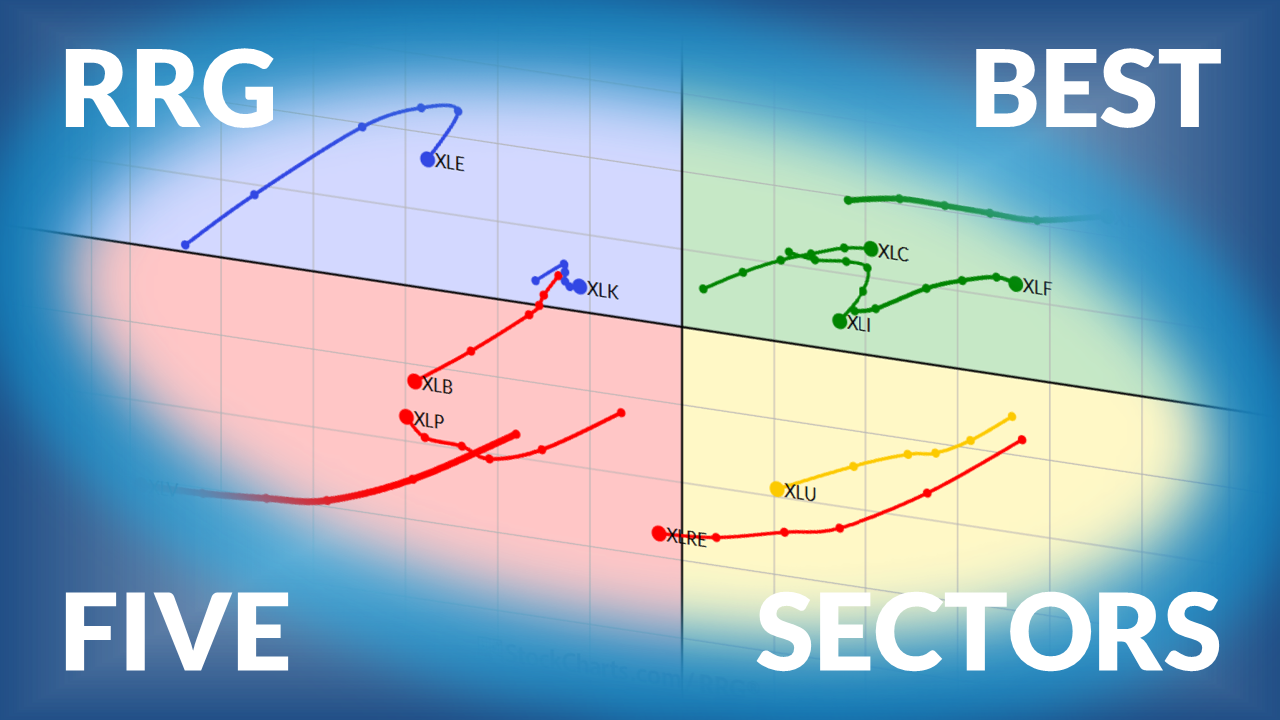

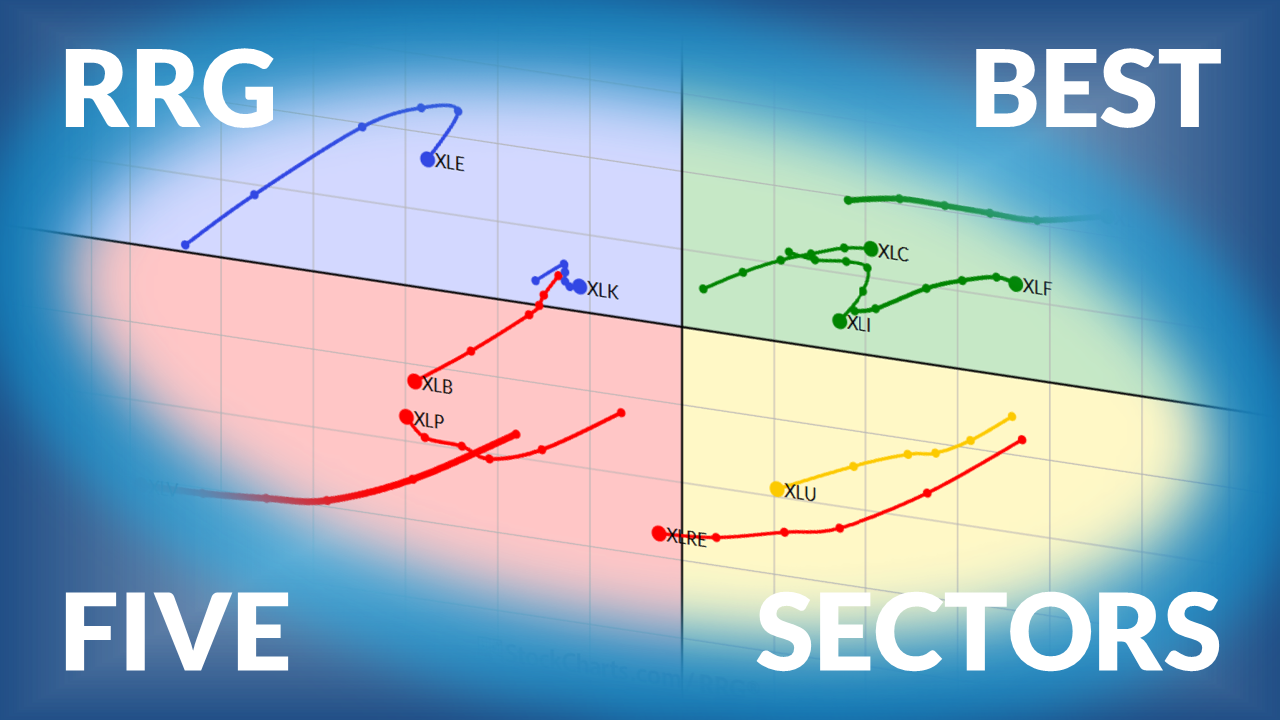

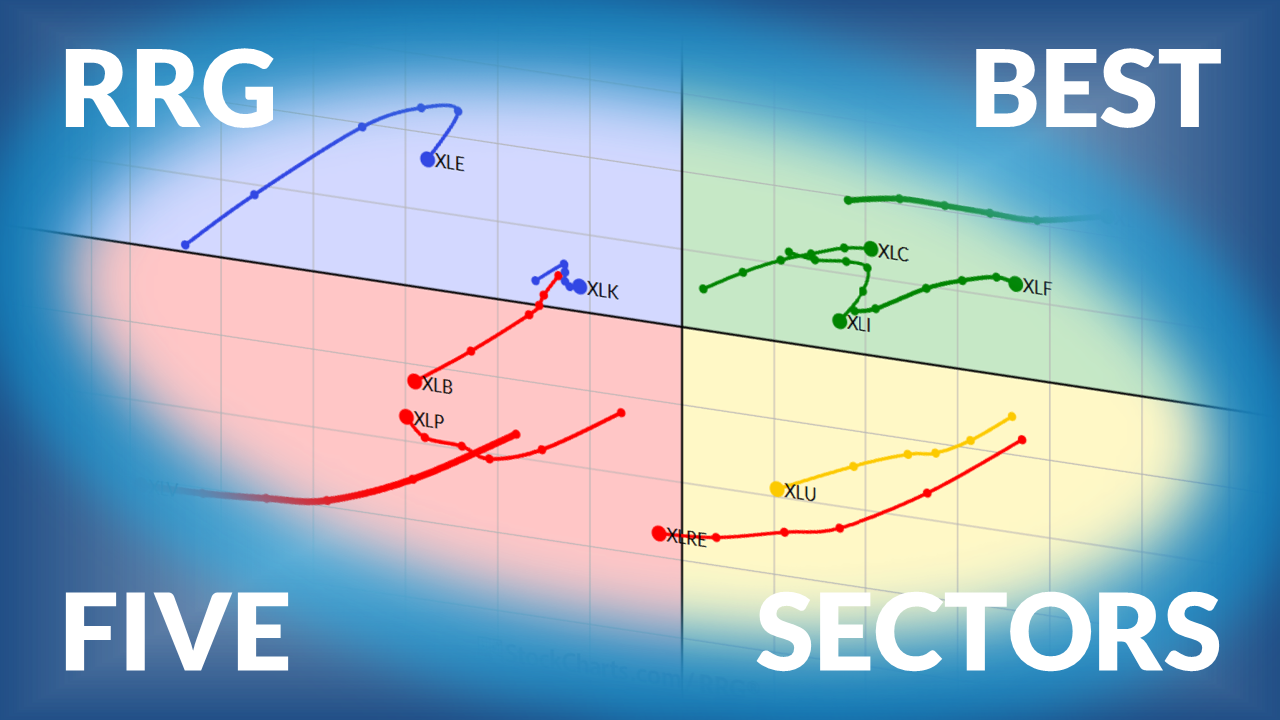

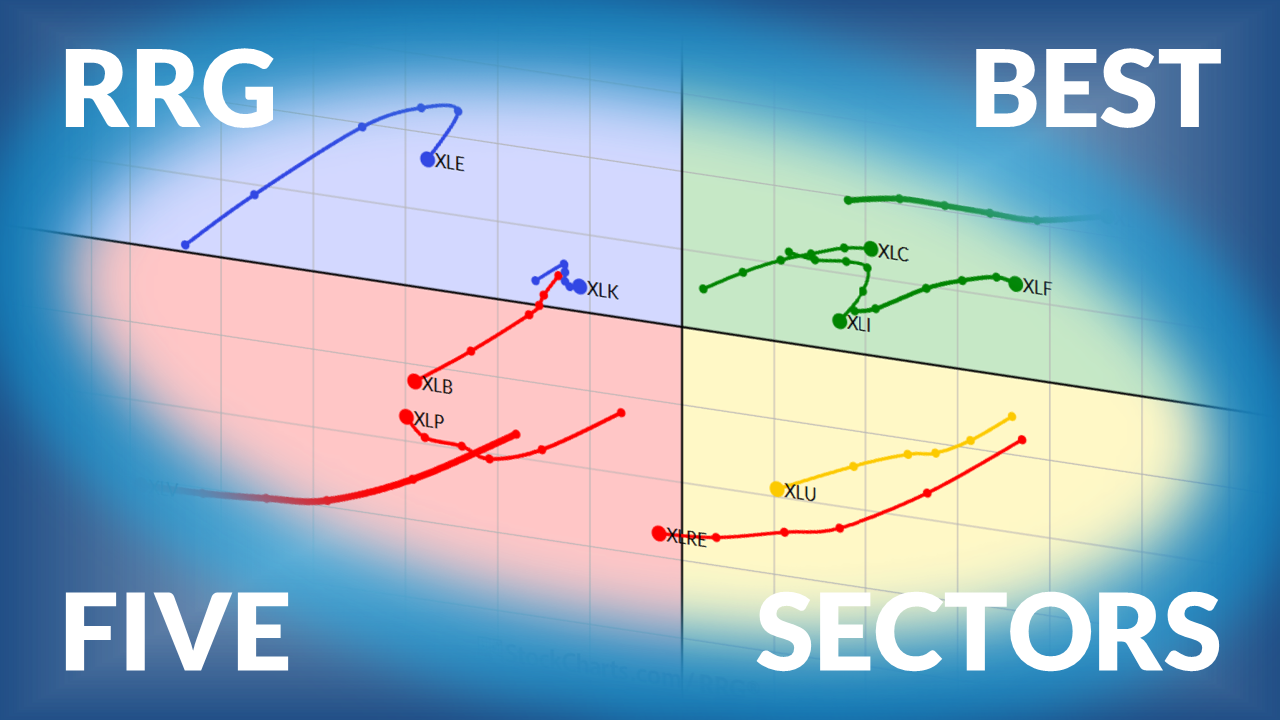

The Best Five Sectors This Week, #40

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius provides his weekly update on US Sector Rotation based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

The Market’s Middle Child Problem: Mid-Caps Flash a Warning

Mid-cap stocks have lagged the market of late, market breadth is weakening, and quality stocks may be out of favor. Here are the macro factors that could provide a boost to mid-cap stocks....

READ MORE

MEMBERS ONLY

StockCharts Insider: Reading Offense vs. Defense with Key Ratios

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Ever wish you had a dashboard that flickers between “caution” and “go”? That’s what these Key Ratios are. Wall Street’s caution vs. go signal. They don’t offer trade signals, but they do give you a vibe check, helping you figure out if investors...

READ MORE

MEMBERS ONLY

Week Ahead: Nifty Has Key Resistance in Sight — Time to Guard Gains or Chase Momentum?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The NIFTY's current technical setup reflects a market in the process of challenging a key resistance zone. But what does the next week hold?...

READ MORE

MEMBERS ONLY

Should You Sell Now? Here's What the Charts Are Saying

by Mary Ellen McGonagle,

President, MEM Investment Research

ary Ellen reviews the week’s market action, highlighting leadership shifts in semiconductors, health care, utilities, and alternative energy. As sector rotation continues, she also shares how biotechs, small caps, and select quantum and crypto names are setting up with new opportunities.

New videos from Mary Ellen premiere weekly on...

READ MORE

MEMBERS ONLY

After the Stock Market Drop: Is This the Wake-Up Call?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market pulled back sharply this week as volatility spiked. Learn what key support levels, sentiment shifts, and charts are telling investors....

READ MORE

MEMBERS ONLY

QQQ Channels Higher, 5 Healthcare Leaders, How to Trade Pullbacks: Case Study and Current Signal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Arthur Hill takes a deep dive into charts of QQQ, healthcare stocks, and tech stocks. ...

READ MORE

MEMBERS ONLY

Sector Rotation Favors Technology — But for How Long?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius de Kempenaer, creator of RRG Charts, reveals why XLK & XLC remain the key market drivers while defensive sectors struggle. He also examines how asset class rotation still favors stocks over bonds—and what that means for investors watching sector leadership....

READ MORE

MEMBERS ONLY

Will These Three Promising Charts Hold Key Support?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We highlight three stocks that have experienced strong gains since August, but are now testing key support levels. Will support hold, or will the bull market be brought into question?...

READ MORE

MEMBERS ONLY

StockCharts Insider: How to Use MarketCarpets for an Ultra-Fast Market Overview

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

You can do a lot with MarketCarpets—analyze sectors, spot outliers, gauge technical strength, the whole deal. But let’s cut the fat. You just want a fast, visual read on what’s happening now. So, let’s get to it. I’ll show you how....

READ MORE

MEMBERS ONLY

Is QQQ Losing Steam? These Chart Clues Say Maybe

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Tech stocks stumbled after a strong run. See what QQQ's chart says about the next market move and how to prepare your portfolio....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #39

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Your weekly update and ranking of US sectors based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Above Crucial Supports; Prolonged Complacency in the Markets Remains a Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty is consolidating with a slightly positive bias. Here's an analysis of the index and a look at sector performance....

READ MORE

MEMBERS ONLY

10 Stocks Set to Soar in October 2025

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 500 has broken above 6700! Tom recaps another week of all-time highs and sector strength, with healthcare leading the surge; he spotlights 10 top stocks, including Tesla, Johnson & Johnson, and more that are showing fresh upside momentum.

This video premiered on October 2, 2025. Click...

READ MORE

MEMBERS ONLY

S&P 500 Earnings for 2025 Q2: Is This the Most Overvalued Market Ever?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Discover why the S&P 500 is at its most overvalued level in history. See earnings trends, valuation ranges, and what rising P/E ratios mean for investors heading into 2026....

READ MORE

MEMBERS ONLY

It’s All Relative: What the RRG View Tells Us About Q4

Soft jobs data raises Fed cut odds as stocks enter Q4 strong. Discover which sectors lead on RRG, Health Care's rebound, and Energy's outlook....

READ MORE

MEMBERS ONLY

10 Must-See Charts for October 2025

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Grayson and Dave as they reveal their top 10 stock charts to watch this October....

READ MORE

MEMBERS ONLY

18-MA Trading Strategy: How to Spot Trends & Signals

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil of Rabil Stock Research shows how to use the 18-MA to identify trend, momentum, and support/resistance, before then reviewing the latest S&P market conditions. He also covers the IWM and stock requests such as ACT, EQNR, FLNG, SAP, FCX, OSK, and VNT, pointing out setups...

READ MORE

MEMBERS ONLY

Intermarket Crosscurrents: What Quarter-End Trends Signal for Q4

Stocks rally as Q3 ends, yields creep higher, metals shine, and the dollar moves sideways. Explore key trends in equities, bonds, commodities, and currencies....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Sits at Important Supports; Scarcity of Leadership Remains a Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The NIFTY is facing consistent resistance, failing to break out of a trading range; where does it go from here? Meanwhile, sectors are facing a lack of leadership....

READ MORE

MEMBERS ONLY

StockCharts Insider: Your Chart Might Be Lying to You — Here’s How to Fix It

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

If you’ve never checked whether your chart is set to log scale or arithmetic scale, you might be looking at a distorted picture without even knowing it. Not a great way to start your analysis. One small setting, one HUGE impact. Let’s make sure...

READ MORE

MEMBERS ONLY

New Market Leaders Are Emerging – Don’t Miss This Rotation!

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen breaks down where strength is emerging beneath the surface of the markets, highlighting leadership in energy stocks, utilities, and industrials. She then shares setups in coal, natural gas, and electricity names, along with constructive moves in DOW components like INTC, IBM, AAPL, and CAT. In addition, she takes...

READ MORE

MEMBERS ONLY

Sentiment Issues Short-Term Warning For U.S. Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Discover why September often brings stock market weakness, how sentiment indicators like CPCE & VIX signal caution, and what investors should watch next....

READ MORE

MEMBERS ONLY

102 Days Above 50-Day; New Lows Expand; Tech Power; Commodity Bull Market; Oil Gets Interesting

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The SPY has traded above its 50-day simple moving average for 102 days, commodities are in a bull market, and crude oil is starting to turn up. Explore what Arthur Hill's analysis uncovers some of the activity taking place below the surface....

READ MORE

MEMBERS ONLY

Old Dogs, New Tricks: Bitcoin & Gold and What's Next

by Larry Williams,

Veteran Investor and Author

Larry compares Bitcoin and gold, looking at their shared appeal; he notes caution signals for Bitcoin and similar risks for gold. He also revisits past forecasts and updates his market outlook....

READ MORE