MEMBERS ONLY

STRONGER DOLLAR HURTS PRECIOUS METALS -- STOCK INDEXES BACK OFF FROM 50-DAY AVERAGES AND BROKEN SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING DOLLAR PUSHES PRECIOUS METALS LOWER... With global stocks on the defensive over the last week, some money has flowed into the relative safety of the U.S. dollar. Chart 1 shows the Invesco Dollar Index (UUP) climbing to the highest level in two months. As usually happens when the...

READ MORE

MEMBERS ONLY

S&P Performance Relative to the World Reaches a Crucial Juncture

by Martin Pring,

President, Pring Research

For many years, the S&P Composite (SPY) has outperformed the MSCI World Stock ETF (ACWI). The benefit of the doubt continues to move in favor of the US, but this relationship has reached a crucial juncture point and needs to bounce; otherwise, some serious technical damage will transpire....

READ MORE

MEMBERS ONLY

GLOBAL STOCKS SELL OFF -- DOW AND S&P 500 APPEAR HEADED TOWARD THEIR 200-DAY MOVING AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 HEADING TOWARD 200-DAY LINES... Stocks are selling off all over the world today. With 50-day moving averages having already been broken, 200-day averages are now in play. Chart 1 shows the Dow Industrials approaching their 200-day line (red arrow) which isn't that...

READ MORE

MEMBERS ONLY

NASDAQ 100 BREAKS SHORT-TERM SUPPORT AS 50-DAY AVERAGES GIVE WAY -- S&P 500 ALSO TURNS DOWN

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 TURNS DOWN... The daily bars in Chart 1 show the QQQ breaking last week's short-term support and falling further below its 50-day moving average today. The two upper boxes in Chart 1 also show its RSI and MACD lines continuing to decline. That suggests more selling...

READ MORE

MEMBERS ONLY

Some Sectors Starting to Rotate from their Post-March Pattern

by Martin Pring,

President, Pring Research

From time to time, I like to review the various sectors to see which ones are in a positive or negative relative trend and which might be in a position to change. To do this, I use what I call my Nirvana Template or, in StockCharts-speak, Nirvana Chart Style. It...

READ MORE

MEMBERS ONLY

NASDAQ LEADS TODAY'S RETREAT -- LAST WEEK'S LOWS ARE BEING RETESTED -- SO ARE 50-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES RETEST LAST WEEK'S LOW... Stocks are under pressure and are retesting lows formed late last week. And are putting 50-day moving averages in jeopardy on daily charts. The tech-driven Nasdaq is leading today's retreat. The hourly bars in Chart 1 show the Invesco...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS NEAR NEW RECORD -- FEDEX IS THE DAY'S BIGGEST WINNER -- AIRLINES ARE STARTING TO HELP -- SOUTHWEST AIRLINES TESTING JUNE HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS NEAR RECORD TERRITORY...The weekly bars in Chart 1 show the Dow Transports rising above their late 2019 peak and challenging their 2018 intra-day peak at 11623. A close above that level would put the Dow Transports in record territory. Their relative strength ratio in the upper box...

READ MORE

MEMBERS ONLY

MATERIALS SPDR HITS NEW RECORD -- AVERY DENNISON AND WESTROCK ACHIEVE BULLISH BREAKOUTS -- DOW HOLDINGS HEADING TOWARD 2019 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS SPDR HITS NEW RECORD... Stocks are trading higher today with ten of eleven sectors in the green. The only one to hit a new record is shown below. Chart 1 shows the Materials SPDR (XLB) trading at a new record high. Its relative strength line in the upper box...

READ MORE

MEMBERS ONLY

VALUE STOCKS CONTINUE TO LAG BEHIND GROWTH STOCKS -- FINANCIALS ARE HOLDING VALUE BACK -- RATIOS SHOW GROWTH STILL IN THE LEAD

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 GROWTH ISHARES HOLD 50-DAY LINE... A lot has been written about the relationship between growth and value shares. During last week's pullback in technology shares, cheaper value stocks held up better which raised questions about whether a rotation was starting from growth into value...

READ MORE

MEMBERS ONLY

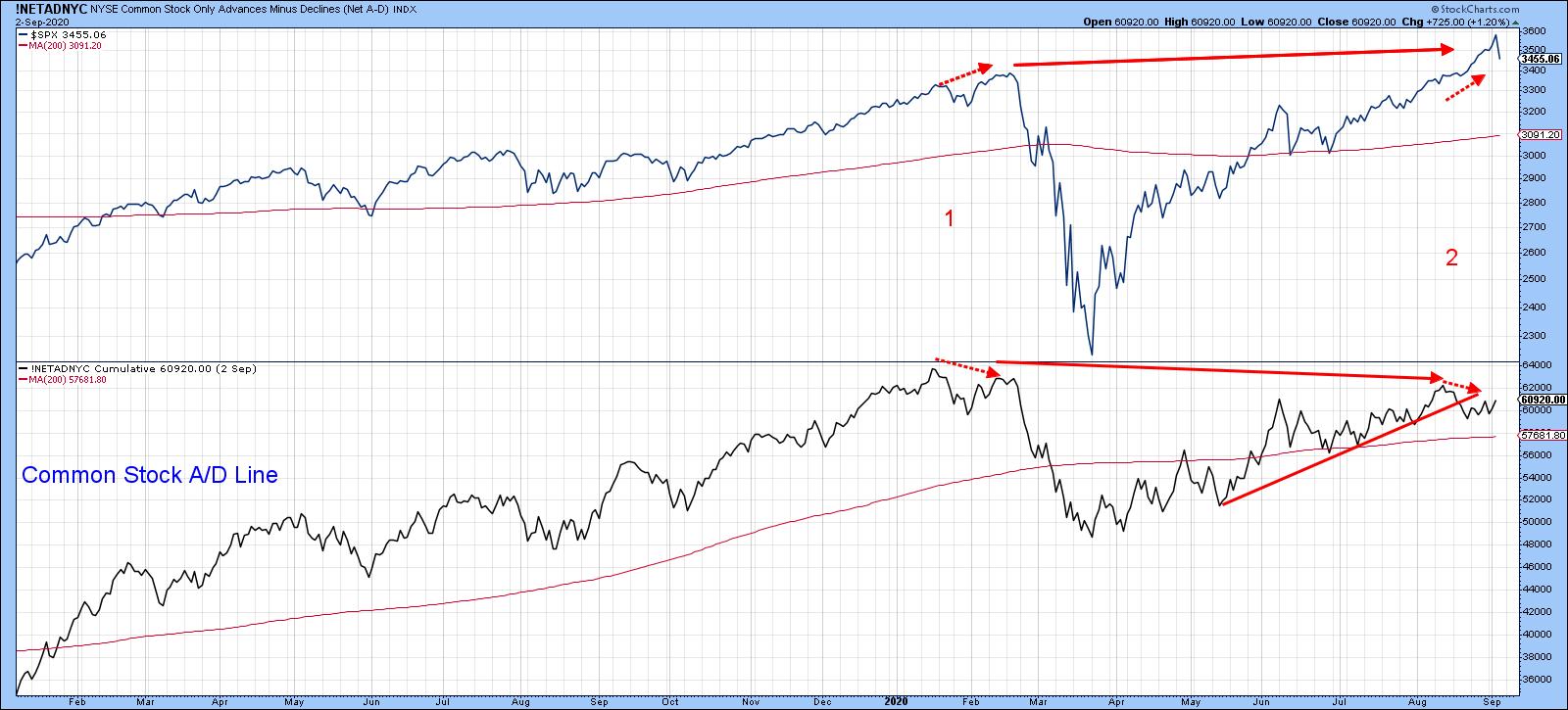

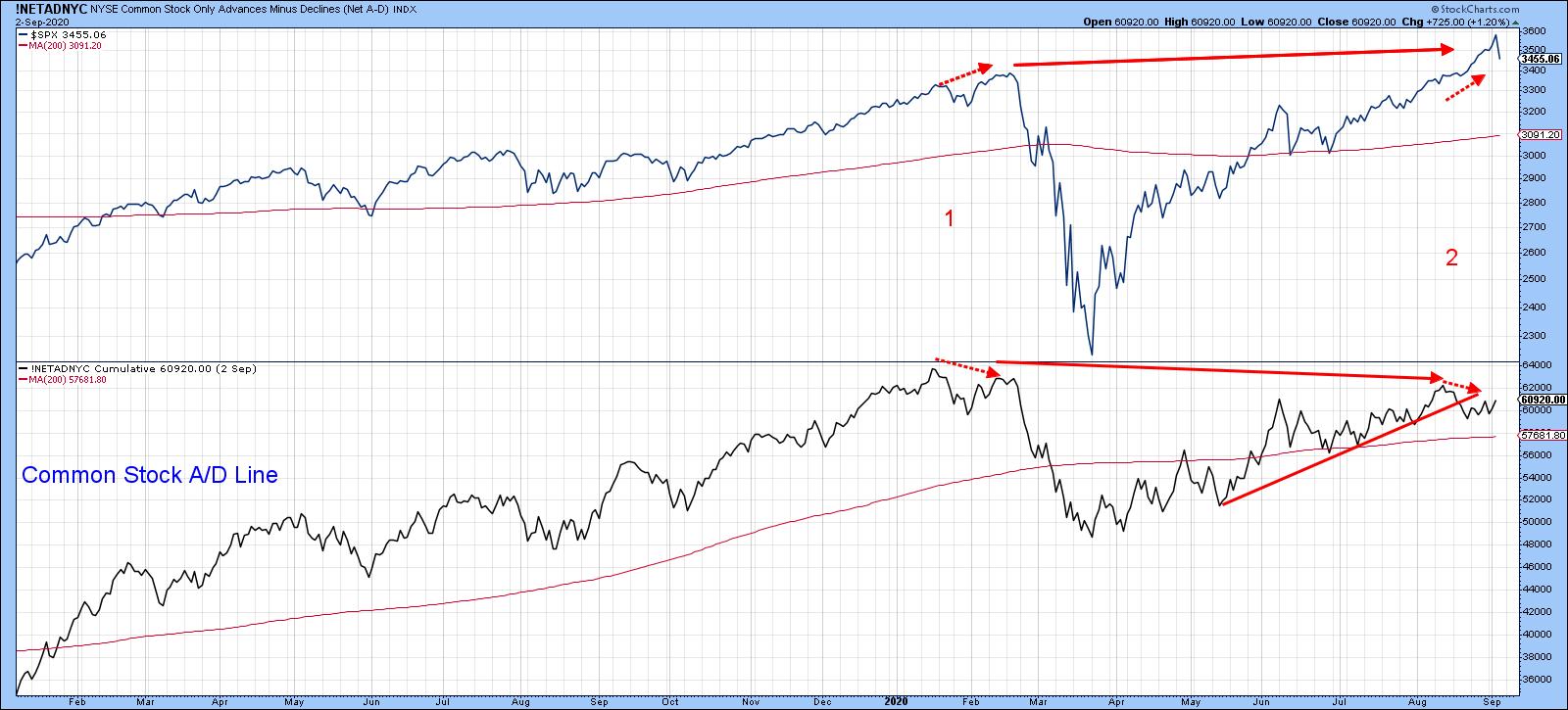

A NUMBER OF NEGATIVE DIVERGENCES SUGGEST MORE VOLATILITY AHEAD

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNICAL DIVERGENCES WARN OF MORE VOLATILITY... We're all focused on the meaning and severity of the recent selloff in stocks and trying to determine if this is a short-term pullback or something more serious. A number of technical divergences that have appeared on price charts suggest that the...

READ MORE

MEMBERS ONLY

If it's a Bull Market Correction, What Should We Look for to Signal the All-Clear?

by Martin Pring,

President, Pring Research

* Some Indicators Have Moved to Levels Consistent with a Low

* Others Suggest the Likelihood of More Corrective Activity

* Indicators that Should Be Monitored for a Possible Upside Reversal

Some Indicators Have Moved to Levels Consistent with a Low

Most corrections in a bull market fall in the 5-10% range. So...

READ MORE

MEMBERS ONLY

AN HOURLY LOOK AT QQQ REBOUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOURLY CHART SHOWS OVERHEAD RESISTANCE... The hourly price bars in Chart 1 show the Invesco QQQ Trust which measures the Nasdaq 100 Index trying to build on yesterday's bounce off its 50-day moving average. The big question is whether a bottom has been seen, or whether more testing...

READ MORE

MEMBERS ONLY

NASDAQ CONTINUES TO LEAD STOCKS LOWER -- AND IS TESTING ITS 50-DAY MOVING AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ COMPOSITE IS TESTING ITS 50-DAY AVERAGE.. The tech-driven Nasdaq market continues to lead the market lower. Chart 1 shows the Nasdaq Composite Index in the process of testing its 50-day average. That's an important test for it and the rest of the market. Chart 2 shows the...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT BOOSTS BOND YIELDS -- THAT'S HELPING LIFT FINANCIALS -- SOME MONEY MAY ALSO BE ROTATING OUT OF TECH STOCKS INTO CHEAPER FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STRONG JOBS REPORT BOOSTS BOND YIELDS...This morning's strong jobs report saw a bigger than expected jump in nonfarm payrolls during August and a bigger than expected drop in the unemployment report to 8.4%. That strong combination helped contribute to today's rebound in bond yields....

READ MORE

MEMBERS ONLY

September 3, 1929 was the Peak; September 3, 2020 sees the NASDAQ Lose Almost 5%

by Martin Pring,

President, Pring Research

I don't think there is a connection between 1929 and 2020, but the headline seemed too good to pass up. Late last week, I mentioned that September is the weakest month of the year for stocks while October is prone to crashes. "Welcome to the bearish season,...

READ MORE

MEMBERS ONLY

STOCKS HAVE WORST DAY SINCE JUNE 11 -- QQQ IS LEADING IT LOWER ON RISING VOLUME

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 LEADS MARKET LOWER... The tech-dominated Nasdaq is leading the market lower today for the worst drop since June 11. Today's negative combination of falling prices and rising volume suggests that there's more selling to come. The Candlevolume bars in Chart 1 show the Invesco...

READ MORE

MEMBERS ONLY

OVERBOUGHT TECHNOLOGY SECTOR STARTS TO WEAKEN -- TODAY'S TECH SELLING IS HAVING A NEGATIVE IMPACT ON THE REST OF THE MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ PULLS BACK FROM OVERBOUGHT TERRITORY... It shouldn't come as surprise to read that the Nasdaq has been in overbought territory. So is the technology sector. And both are leading the market lower today. The top box in Chart 1 shows the 14-day RSI line for the Technology...

READ MORE

MEMBERS ONLY

TWITTER MAY BE BREAKING OUT -- VERIZON NEARS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

TWITTER CLEARS RESISTANCE... My August 26 message showed our first chart today with the caption that Twitter might be breaking out. Today's action suggests that upside breakout may finally be taking place. Chart 1 shows Twitter (TWTR) climbing more than 2% and trading at the highest level in...

READ MORE

MEMBERS ONLY

CHEMICALS HELP LEAD MATERIALS HIGHER -- ALBEMARLE AND DOW HOLDINGS HIT SIX MONTH HIGHS -- ALCOA AND NUCOR GAIN MORE GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS LEAD MARKET HIGHER... On a strong market day, six sectors are in the black with materials in the lead. Chart 1 shows the Materials Sector SPDR (XLB) gaining 2% today to hit a new record. Its relative strength line in the upper box is bouncing as well after declining...

READ MORE

MEMBERS ONLY

AGRICULURAL COMMODITIES JOIN COMMODITY RALLY -- COFFEE AND SOYBEANS NEAR UPSIDE BREAKOUTS -- LUMBER SETS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITY RALLY CONTINUES... Previous messages have pointed out that a two-year low in the U.S. Dollar Index was helping to lift commodity prices. And that's still the case. Chart 1 shows the Invesco Commodity Index (DBC) moving further above its 200-day moving average. Most of those messages,...

READ MORE

MEMBERS ONLY

PRECIOUS METALS BOUNCE BACK FROM YESTERDAY'S SELLING -- AND REMAIN ABOVE SUPPORT LEVELS -- THE FED'S NEW PATIENCE ON INFLATION SHOULD BE GOOD FOR GOLD AND SILVER

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD SPDR HOLDS SUPPORT... My Wednesday message showed precious metals and their miners pulling back to underlying support levels within major uptrends. That's still the case. My message from yesterday described profit-taking in those same precious metals following an upside spike in bond yields after the head of...

READ MORE

MEMBERS ONLY

Eight Charts I Am Watching Closely Right Now

by Martin Pring,

President, Pring Research

* Strong Bull Market Indications

* Short-Term Vulnerability?

Strong Bull Market Indications

We are all aware of the Shakespearian saying "Beware of the Ides of March," which didn't go so well for Julius Caesar. In market folklore, October is the season for crashes and September is the worst-performing...

READ MORE

MEMBERS ONLY

10-YEAR YIELD AT TWO-MONTH HIGH -- RISE IN YIELDS BOOSTS FINANCIALS -- BUT MAY BE WEIGHING ON PRECIOUS METALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD REACHES TWO-MONTH HIGH...Bond yields are climbing today. That may be a reaction to Mr. Powell's speech suggesting that the Fed was relaxing its attitude toward the possibility of rising inflation. Treasury bonds are being sold as a result which is boosting bond yields. The...

READ MORE

MEMBERS ONLY

GOLD AND SILVER ETFS TEST UNDERLYING SUPPORTS WITHIN MAJOR UPTRENDS -- SO DO THEIR MINERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD ETF AND ITS MINERS TEST UNDERLYING SUPPORT... Precious metals have spend most of August pulling back from their recent strong advances which has enabled them to work off some short-term overbought conditions. And they're testing underlying support levels. Chart 1 shows the Gold SPDR (GLD) testing a...

READ MORE

MEMBERS ONLY

FACEBOOK AND NETFLIX LEAD COMMUNICATIONS HIGHER -- TWITTER MAY BE BREAKING OUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMUNICATION SERVICES LEAD MARKET HIGHER... Chart 1 shows the Communication Services SPDR (XLC) climbing nearly 2% today to a new record. It's relative strength line in the upper box is breaking out as well. It's two biggest percentage gainers are Netflix and Facebook. Chart 2 shows...

READ MORE

MEMBERS ONLY

GAP AND GENERAL MOTORS HELP LEAD XLY HIGHER TODAY -- REBOUND IN TRAVEL & TOURISM STOCKS BOOSTS EXPEDIA

by John Murphy,

Chief Technical Analyst, StockCharts.com

GAP AND GENERAL MOTORS HELP LEAD CYCLICALS HIGHER... My weekend message showed the Consumer Discretionary SPDR (XLY) setting new records. It's hitting another one today led higher by cruise lines, clothing, travel & tourism, gambling, and apparel retailers. Two stocks in particular show up on today's...

READ MORE

MEMBERS ONLY

S&P 500 ENDS WEEK AT NEW RECORD -- TECHNOLOGY STOCKS CONTINUE TO LEAD -- SO DO CONSUMER DISCRETIONARY STOCKS -- ESPECIALLY STOCKS TIED TO HOUSING

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 HITS NEW RECORD ON FRIDAY... The S&P 500 hit a record close on Tuesday and on Friday exceeded its February intra-day peak at 3393 to confirm a new all-time high as shown by the weekly bars in Chart 1. The Nasdaq hit another record...

READ MORE

MEMBERS ONLY

TESTING PROCESS CONTINUES FOR S&P 500 -- ANOTHER LOOK AT BOLLINGER BANDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 STILL HASN'T CLEARED FEBRUARY INTRA-DAY HIGH... The news media has been quick to declare a new record high in the S&P 500. However, we may not be there just yet. The SPX did hit a new closing high. The February intra-day high,...

READ MORE

MEMBERS ONLY

Dollar Bear to Take a Breather?

by Martin Pring,

President, Pring Research

* The Bear Market Case

* Time for a Counter-Cyclical Rally?

The Bear Market Case

By most methods and approaches, the Dollar Index is in a bear market. Take Chart 1, for instance, which compares the Index to its long-term KST. The pink-shaded areas tell us when it is below its 12-month...

READ MORE

MEMBERS ONLY

FALLING DOLLAR BOOSTS COMMODITIES -- PRECIOUS METALS REBOUND -- COPPER CONTINUES TO GAIN -- COMMODITY INDEX CLEARS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX HITS ANOTHER LOW... The greenback continues its decline to the lowest level in nearly two years. Chart 1 shows the Invesco US Dollar Bullish Fund (UUP) falling to another multi-year low today. And it's falling against all of its major trading partners. As is normally the...

READ MORE

MEMBERS ONLY

S&P 500 TESTING ITS FEBRUARY HIGH -- USING BOLLINGER BANDS FOR GUIDANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS TESTING ITS FEBRUARY HIGH... The most important test going on at the moment is the S&P 500 challenging its February high. Its highest intra-day value shown in Chart 1 is 3393.52. The SPX closing high for February was 3386.15. Although the...

READ MORE

MEMBERS ONLY

WEAK DOLLAR ALSO BOOSTS EMERGING MARKET ETFS -- SOUTH KOREA ETF IS BREAKING OUT -- TAIWAN IS ALREADY IN RECORD TERRITORY

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKET ETFS ALSO BENEFIT FROM WEAKER DOLLAR... My earlier message today made the point that a weaker dollar is benefiting foreign stock ETFs that are quoted in dollars. The message showed the rising euro benefiting eurozone ETFs with Germany on the verge of a bullish breakout. The same principle...

READ MORE

MEMBERS ONLY

WEAK DOLLAR CONTINUES TO BOOST FOREIGN STOCK ETFS QUOTED IN DOLLARS -- EUROZONE ETF REACHES SIX-MONTH HIGH -- GERMANY ISHARES MAY BE BREAKING OUT -- THE NETHERLANDS ETF HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

EAFE ISHARES REACH SIX-MONTH HIGH... I wrote a message three weeks ago on Wednesday, July 22 to the effect that a weaker U.S. dollar was boosting foreign stocks ETFs that are quoted in dollars. When American investors buy foreign stocks, they're also indirectly buying local currencies. So...

READ MORE

MEMBERS ONLY

Time for a Little Firmness in Bond Yields?

by Martin Pring,

President, Pring Research

Chart 1 shows that the basic trend for bond yields around the world is still negative, as all series are in a clear-cut downtrend. The only exception is Japan, where the secular down trendline was violated earlier in the year. So far, though, the yield has only managed a sideways...

READ MORE

MEMBERS ONLY

BOUNCING BOND YIELDS BOOST BANKS AND FINANCIALS -- AND CONTRIBUTE TO PROFIT-TAKING IN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL YIELDS REBOUND... Bond yields are rebounding today. That may be partially due to an uptick in producer price inflation. Or the fact that global stocks are also rebounding which is driving some money out of bonds and into stocks. Global yields are rebounding along with stocks. Chart 1 shows...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS EXCEED JUNE HIGH -- CATERPILLAR AND NIKE BREAK OUT -- AIRLINES LEAD TRANSPORTS HIGHER -- FEDEX HAS ANOTHER BIG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW EXCEEDS JUNE HIGH... The Dow Industrials continue to gain ground on the rest of the stock market. And is the strongest of the three major stock indexes today. Chart 1 shows the Dow Industrials trading above their June intra-day peak at 27,600. The Dow is the last of...

READ MORE

MEMBERS ONLY

ALUMINUM AND STEEL STOCKS LEAD MATERIALS HIGHER -- ALCOA AND CENTURY ALUMINUM HAVE STRONGER CHART PATTERNS -- SO DO NUCOR AND STEEL DYNAMICS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALCOA CLEARS 200-DAY LINE...CENTURY ALUMINUM LEADS... Material stocks continue to act as market leaders. Strong gold miners are a big part of that. So are copper miners. Last Wednesday' message showed the Dow Jones Nonferrous Metals Index scoring a bullish breakout along with Freeport McMoran (FCX); and Southern...

READ MORE

MEMBERS ONLY

TECHS RETREAT AS OTHER GROUPS GAIN -- INDUSTRIALS ARE WEEK'S TOP SECTOR -- SMALL CAPS AND TRANSPORTS ALSO GAIN -- FEDEX DELIVERS 52-WEEK HIGH WHILE UPS REACHES NEW RECORD--

by John Murphy,

Chief Technical Analyst, StockCharts.com

MODEST ROTATION TAKES PLACE... Big tech has been the main story in the market since the start of the pandemic with most of the rest of the market largely left behind. Over the past couple of weeks, however, we've started to see some money moving into weaker parts...

READ MORE

MEMBERS ONLY

Evidence of a Commodity Bull Market Continues to Grow

by Martin Pring,

President, Pring Research

I have written about commodities several times in the last four months or so as evidence of a major reversal had begun to appear. Now, more indicators are starting to turn. Near-term, things look overdone, but if this is really is a bull market, that will not matter, as short-term...

READ MORE

MEMBERS ONLY

SMALL CAPS AND DOW TRANSPORTS EXCEED THEIR JUNE PEAKS -- DOW EXCEEDS JULY PEAK -- XLI CLEARS 200-DAY LINE -- DEERE BREAKS OUT -- S&P 500 NEARS TEST OF FEBRUARY PEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES AND DOW TRANSPORTS PASS JUNE HIGH...DOW GAINS...The rally in stocks continues to broaden out. Market groups that had lagged behind the stock recovery are starting to catch up. Small caps and transports are two examples. Chart 1 shows the Russell 2000 iShares (IWM) trading above...

READ MORE