MEMBERS ONLY

Five Charts I Am Watching Closely

by Martin Pring,

President, Pring Research

Each week, I monitor numerous charts to see if they have the potential for an important breakout. I tend to look at longer-term ones, because they set the scene as to whether the primary trend is bullish or bearish. That's important information to have, as the magnitude and...

READ MORE

MEMBERS ONLY

Why the May 31 Close is Pivotal To Determine Primary Trend's Direction

by Martin Pring,

President, Pring Research

Way back in 1988, Robert W. Colby and Thomas A. Meyers authored a classic technical analysis book entitled Encyclopedia of Technical Market Indicators, in which they back-tested the performance of hundreds of market indicators. What caught my eye was their work on 12-month moving average (MA) crossovers, which offered the...

READ MORE

MEMBERS ONLY

Is It Time for Emerging Markets to Emerge?

by Martin Pring,

President, Pring Research

The US market has been recovering nicely since the April low, but it has actually been outperformed by the rest of the world this year so far. In that respect, Chart 1 shows that a major shift away from the US could well be in the cards.

It is evident...

READ MORE

MEMBERS ONLY

Gold Is Showing Signs of Exhaustion, But Is It Enough to Call a Top?

by Martin Pring,

President, Pring Research

Chart 1 shows that inflation-adjusted gold recently broke above a 45-year line of resistance. Since the third leg of the secular bull market began in 2023, the price of the yellow metal has been moving up sharply, thereby propelling the long-term KST to the edge of its overbought zone. It...

READ MORE

MEMBERS ONLY

If Non-US Equities Continue to Outperform the S&P, Will Europe or Asia Benefit Most?

by Martin Pring,

President, Pring Research

Since the tariff war first broke out, there have been widespread reports in the financial press telling us that investors have decided to cash in on their U.S. profits and move their capital abroad. The U.S., they tell us, is no longer regarded as a safe haven. Indeed,...

READ MORE

MEMBERS ONLY

Bonds Down, But Are They Out?

by Martin Pring,

President, Pring Research

Something didn't seem to ring true a couple of weeks ago when the whole world, by which I mean from the Treasury Secretary to your favorite cable news host, seized on the recent sell-off in bonds and why they would no longer be a safe haven and therefore...

READ MORE

MEMBERS ONLY

How to Time Your Trades For Faster Gains

by Tony Zhang,

Chief Strategist, OptionsPlay

When working with probabilities, you want to place trades that maximize your returns while minimizing your risks.

In this OptionsPlay members-only video, Tony Zhang walks you through the techniques professional traders use to identify optimal entry points. Explore how you can apply those same strategies in the StockCharts.com OptionsPlay...

READ MORE

MEMBERS ONLY

Gold is at a Record High -- Is There a Message?

by Martin Pring,

President, Pring Research

The recent rally in the gold price has not yet attracted the kind of gold fever associated with the 1980 peak. At that time, there were numerous reports of unusual action, such as customers forming huge lines to buy the stuff at Canadian banks, an event that to my knowledge...

READ MORE

MEMBERS ONLY

Are the Tariffs Bullish or Bearish for the US Dollar?

by Martin Pring,

President, Pring Research

Tariffs have been front and center of market attention, but one asset class that has been relatively subdued in its response has been the US Dollar Index. It has declined in recent weeks, but a review of the technical picture suggests that the sell-off is part of an overall corrective...

READ MORE

MEMBERS ONLY

Sentiment Is Near-Perfect for a Rally: One Thing Could Stand In the Way

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Several sentiment indicators have reached levels that usually fuel a worthwhile rally or jump-started a new bull market.

* Sentiment indicators could be at levels that are ripe for a rally but keep an eye on them.

* The absence of a rally could increase the odds of a bull...

READ MORE

MEMBERS ONLY

Is It Time to Buy Tesla?

by Martin Pring,

President, Pring Research

Recently, there have been horror stories about individual Tesla owners being harassed and dealers being vandalized, all because people have decided they don't like Elon Musk or his recent DOGE actions. In Europe, sales are reported down 49% in the first two months of the year, and, to...

READ MORE

MEMBERS ONLY

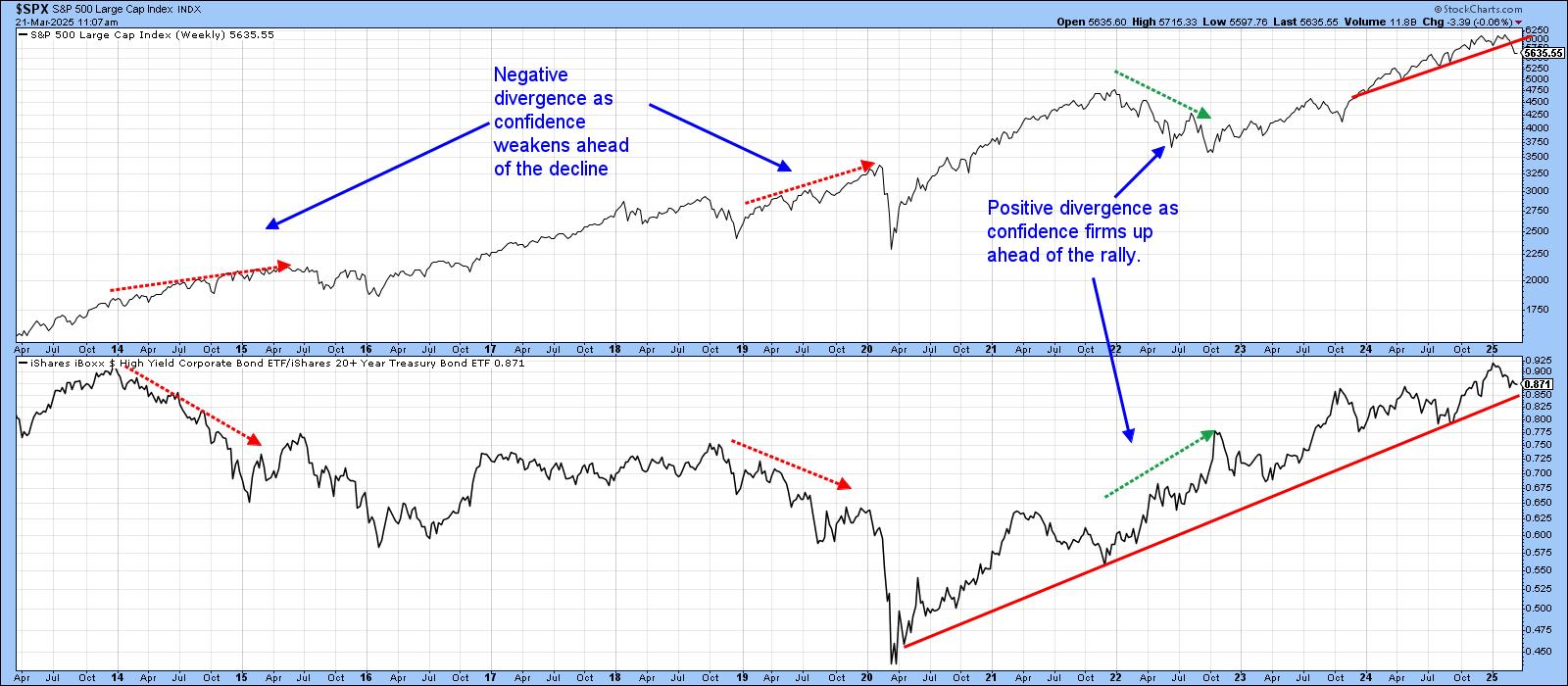

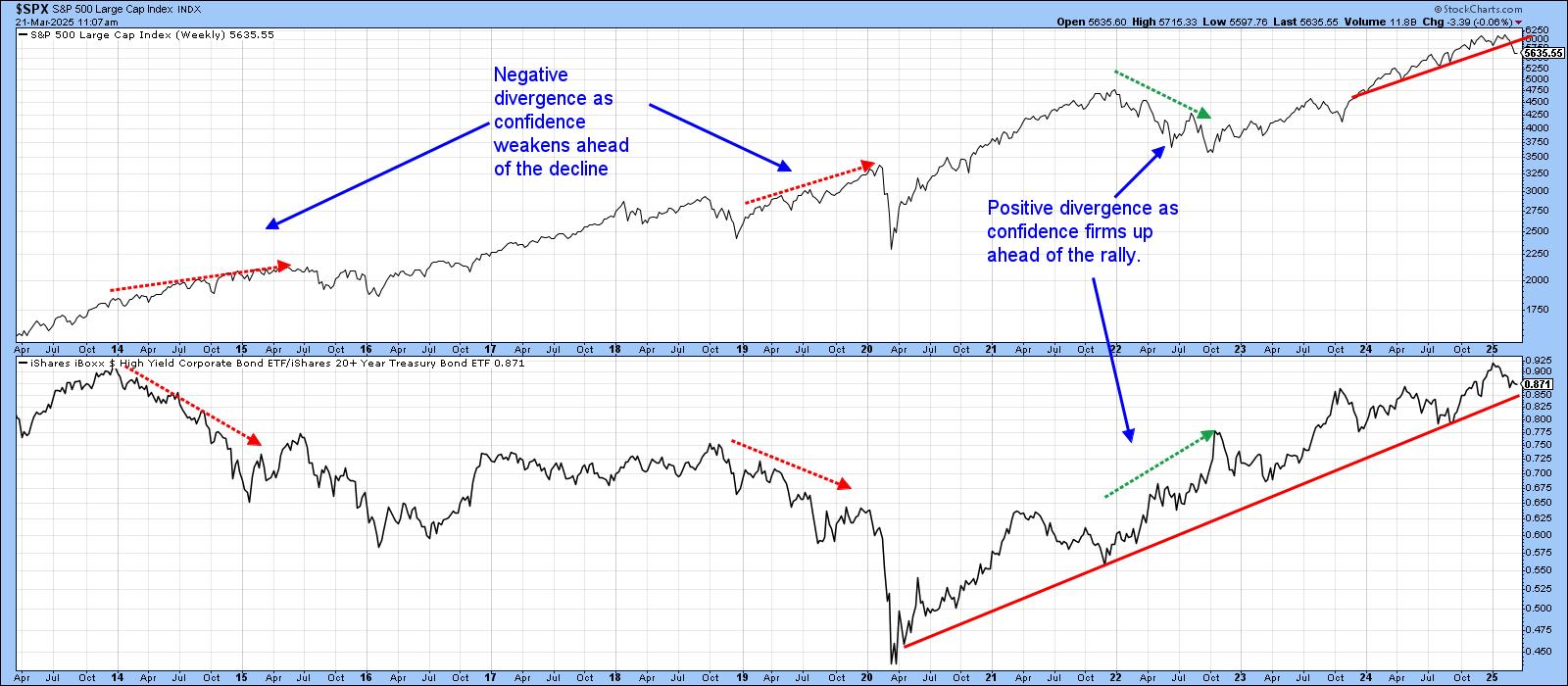

Confidence Ratios are in an Uptrend, But Looking Vulnerable

by Martin Pring,

President, Pring Research

At this week's news conference, Jerome Powell mentioned that the Fed is cautious about making significant changes to interest rates due to unclear economic conditions, citing factors like trade policies and inflation, which have contributed to this uncertainty. If the "experts" don't know, it&...

READ MORE

MEMBERS ONLY

The Top Options Strategy Hedge Funds Use

by Tony Zhang,

Chief Strategist, OptionsPlay

In a volatile stock market, hedging your portfolio can go a long way in reducing your drawdowns. In this video, follow along with Tony as he uncovers one of the top options trading strategies used by hedge funds. Learn how you can identify optimal put selling trading opportunities and apply...

READ MORE

MEMBERS ONLY

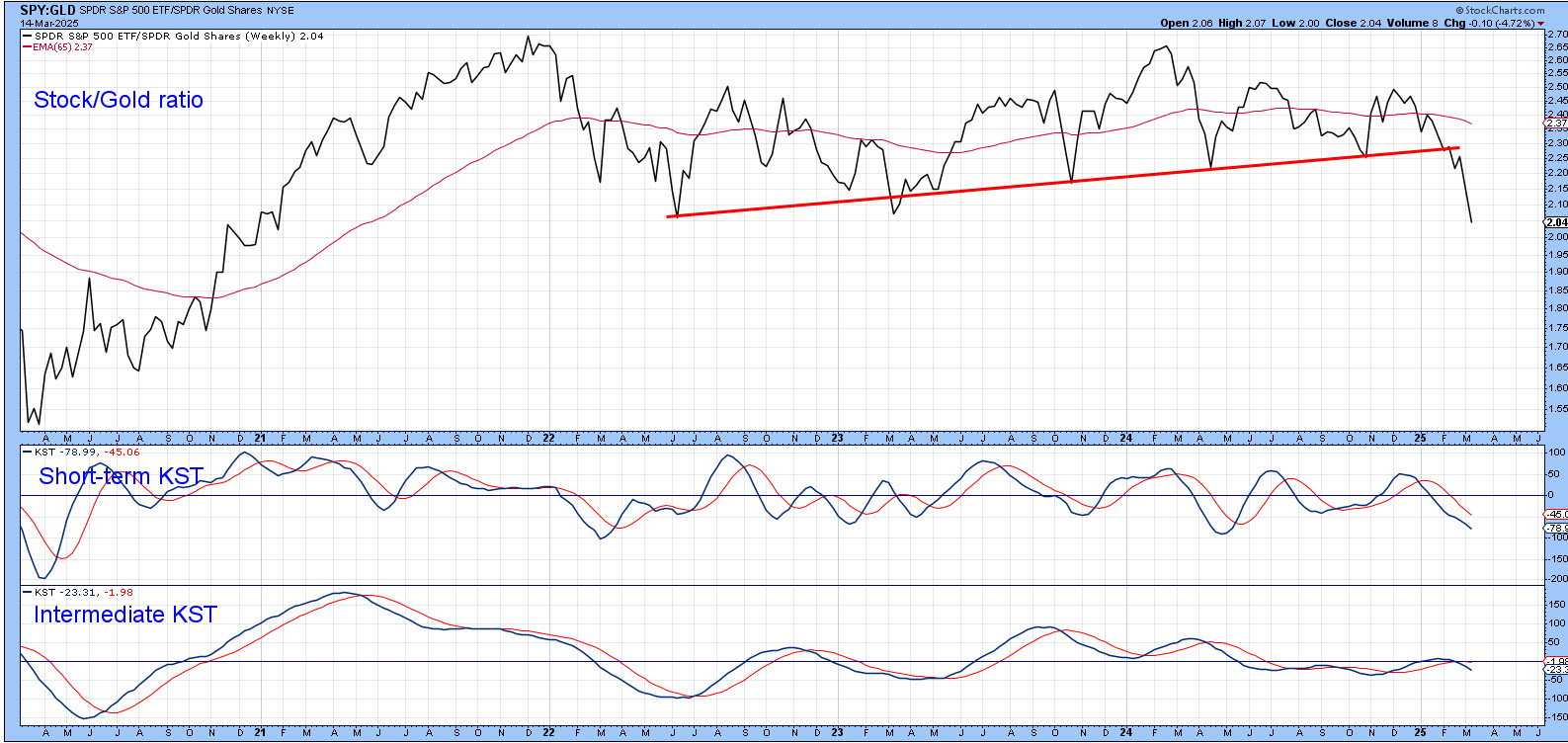

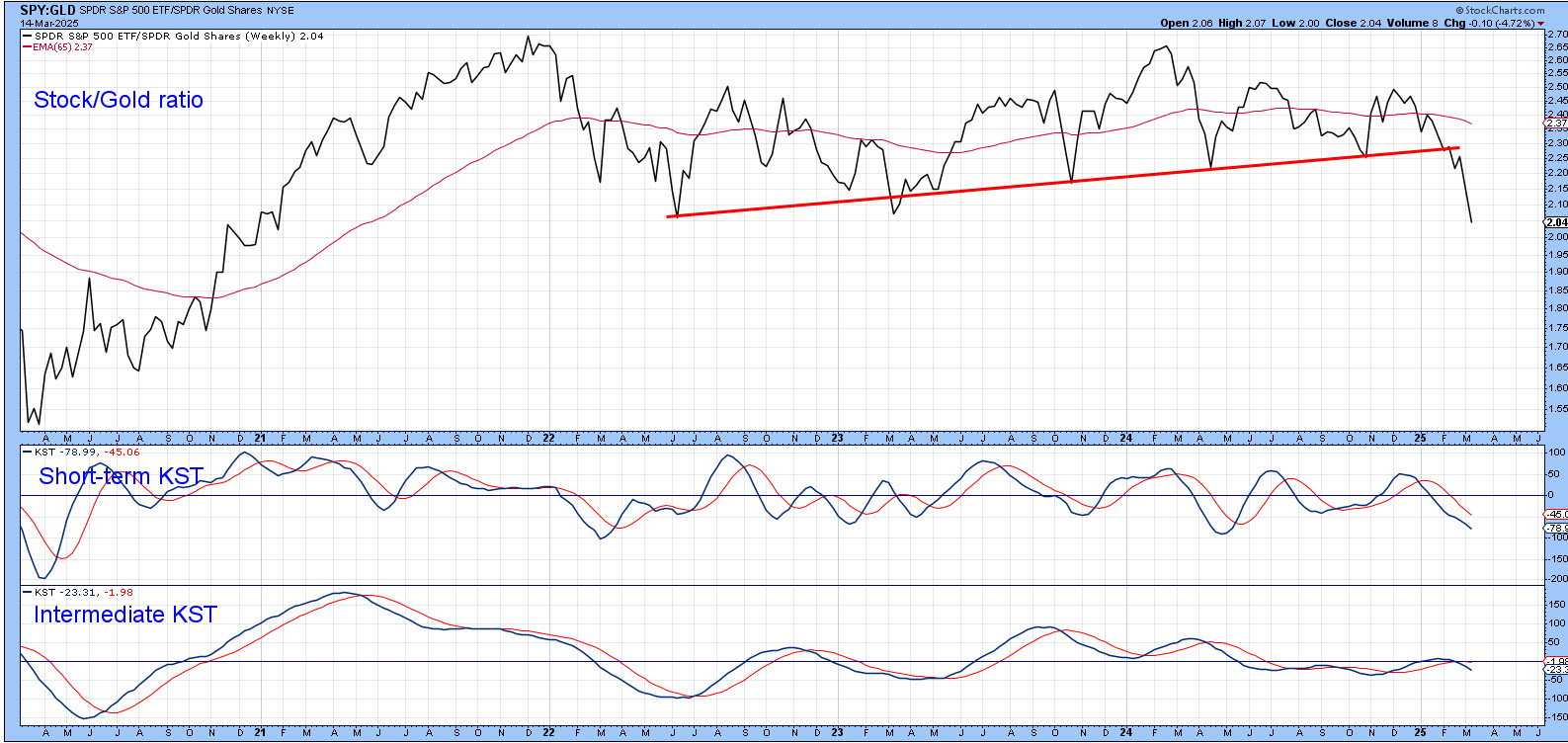

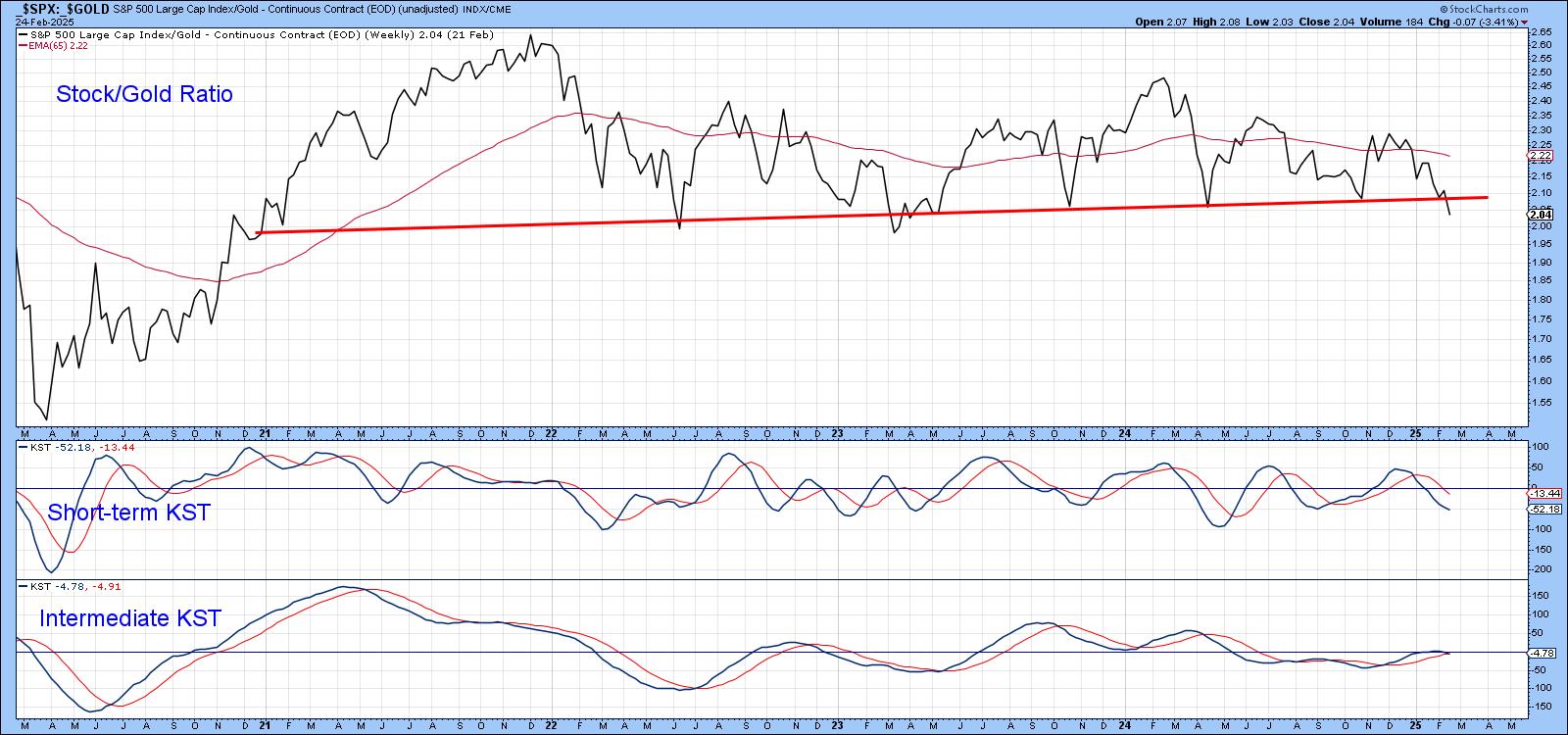

Stocks May No Longer Be the Preferred Asset Class

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote that stocks were beginning to slip against the gold price. Chart 1 shows that the ratio has now decisively broken below an important uptrend line, marking the lower region of a three-year top. The short-term KST is currently oversold, so some kind of...

READ MORE

MEMBERS ONLY

Up Now, Down Later?

by Martin Pring,

President, Pring Research

The Hysteria

Last week I saw more references to the stock market and its sharp drop on cable TV than I can ever recall.

Normally, as Humphrey Neil, the father of contrarian thinking put it, "When everyone thinks the same, everyone is usually wrong." That's because...

READ MORE

MEMBERS ONLY

How to Apply Top Options Strategies with the OptionsPlay Add-On

by Tony Zhang,

Chief Strategist, OptionsPlay

In this must-see video, Tony explains the top options strategies and shares the best practices for trade entries, exits, and optimal deployment conditions. As you watch along, you'll get a clear roadmap for confidently utilizing each option strategy. Check it out below!

Note: This video premiered on January...

READ MORE

MEMBERS ONLY

Bitcoin Faces Important Technical Test

by Martin Pring,

President, Pring Research

Over the weekend, Donald Trump declared the creation of a U.S. strategic crypto reserve, which will include Bitcoin and four other cryptocurrencies. The price immediately responded with a substantial rally over the weekend, but, by the close of business on Monday, had given up all of those gains. That...

READ MORE

MEMBERS ONLY

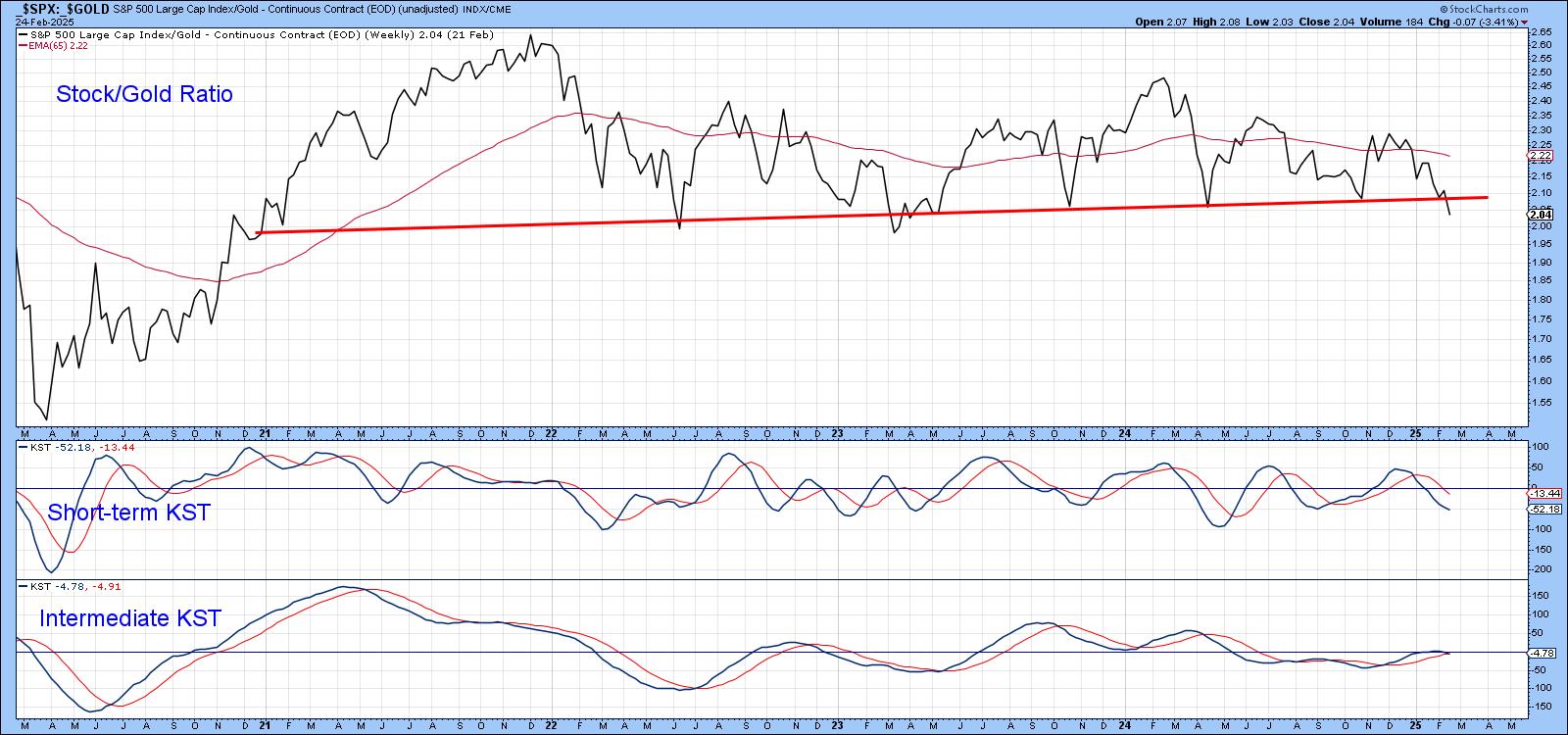

Stocks Starting to Break Down Against This Key Asset

by Martin Pring,

President, Pring Research

The S&P Composite ($SPX) briefly touched a new all-time high last week, which sounds encouraging. However, that kind of action was limited, as neither the Dow Industrials nor the NASDAQ Composite reached record territory. Such discrepancies can always be cleared up, of course, but more troubling is the...

READ MORE

MEMBERS ONLY

Get The BEST Options Trade Ideas for This Week with Tony Zhang

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony breaks down the big-picture market trends before diving deep into bullish and bearish setups for META, BIDU, AMGN, NVDA, DAL, and more! Get expert insights and key analysis you won't want to miss!

This video premiered on February 24, 2025....

READ MORE

MEMBERS ONLY

If a Rising Tide Lifts All Boats, What Does It Mean for the Dollar?

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* The US dollar is still in a bullish trend.

* An analysis of a secular trend, primary trend, and short-term trend support the dollar's bullish case.

* The Pring Dollar Diffusion indicator tends to lead the action of the US dollar and is indicating a bullish move ahead....

READ MORE

MEMBERS ONLY

How To Grow Your Options Trading Account

by Tony Zhang,

Chief Strategist, OptionsPlay

Learn how to build your confidence in the markets with this high probability of success strategy and how to find the best opportunities every day to earn consistent income with the tools available at StockCharts.com.

This video premiered on February 18, 2025....

READ MORE

MEMBERS ONLY

Dr Copper Could Be Close to a Major Breakout. What That Could Mean for the CPI

by Martin Pring,

President, Pring Research

The nickname "Dr. Copper" comes from its reputation as a reliable economic indicator. That's because it is used worldwide in a wide range of industries, including construction, electronics, and manufacturing. When demand for the red metal is high, it often signals that these industries are booming,...

READ MORE

MEMBERS ONLY

Stay on TOP of the AI Revolution!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony highlights important moves in equities, then shares the OptionsPlay research report for bull/bear plays. Tony then spends time on NVDA, highlighting the importance of staying on top of the AI revolution. He also looks at key stocks like V, BA, META, and more.

This video...

READ MORE

MEMBERS ONLY

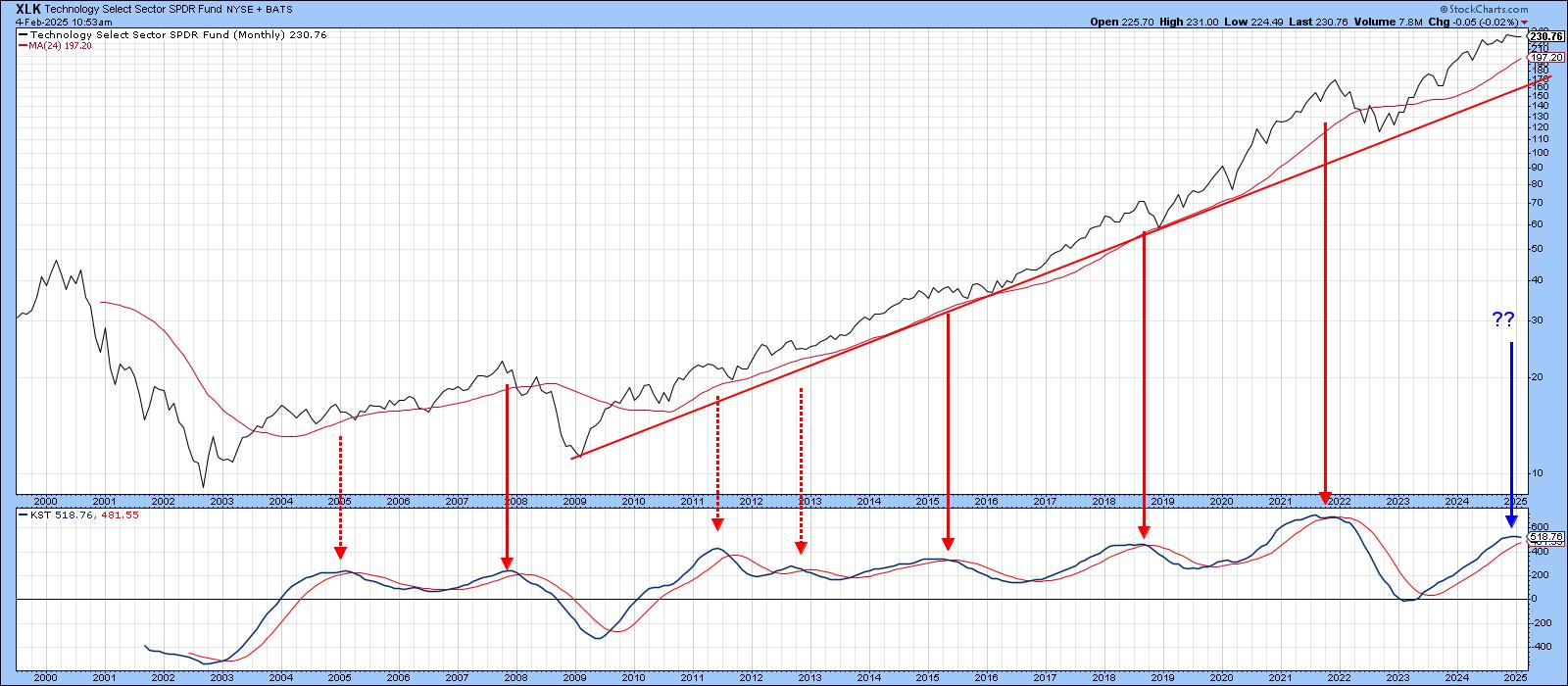

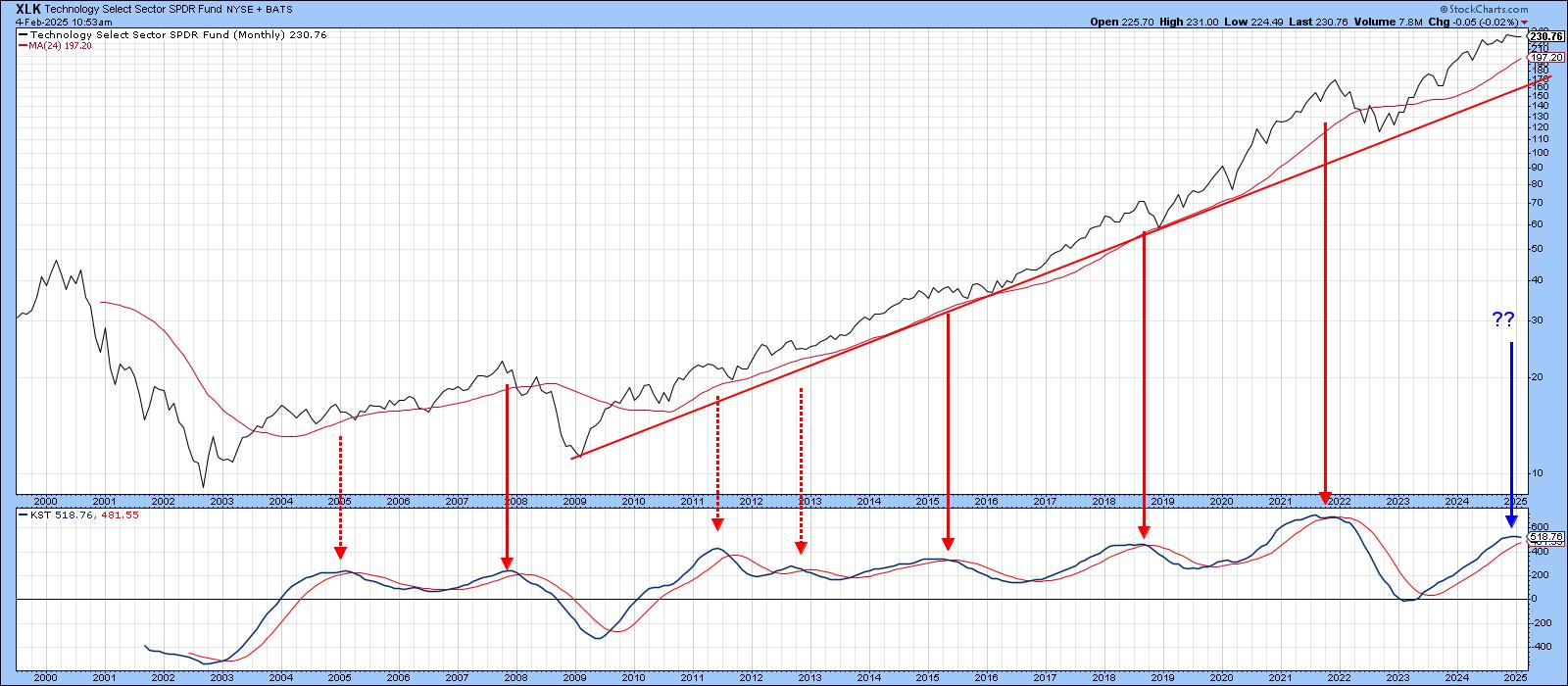

Forget Technology and Take a Look at This Sector

by Martin Pring,

President, Pring Research

Technology stocks, in the form of the SPDR Technology ETF (XLK), have been on a tear since their secular low in 2009. That strength has not only resulted in higher absolute prices, but also striking relative action.

Chart 1 compares the XLK to its long-term KST. Reversals in this indicator...

READ MORE

MEMBERS ONLY

Some Silver Linings Following a Day of AI Panic

by Martin Pring,

President, Pring Research

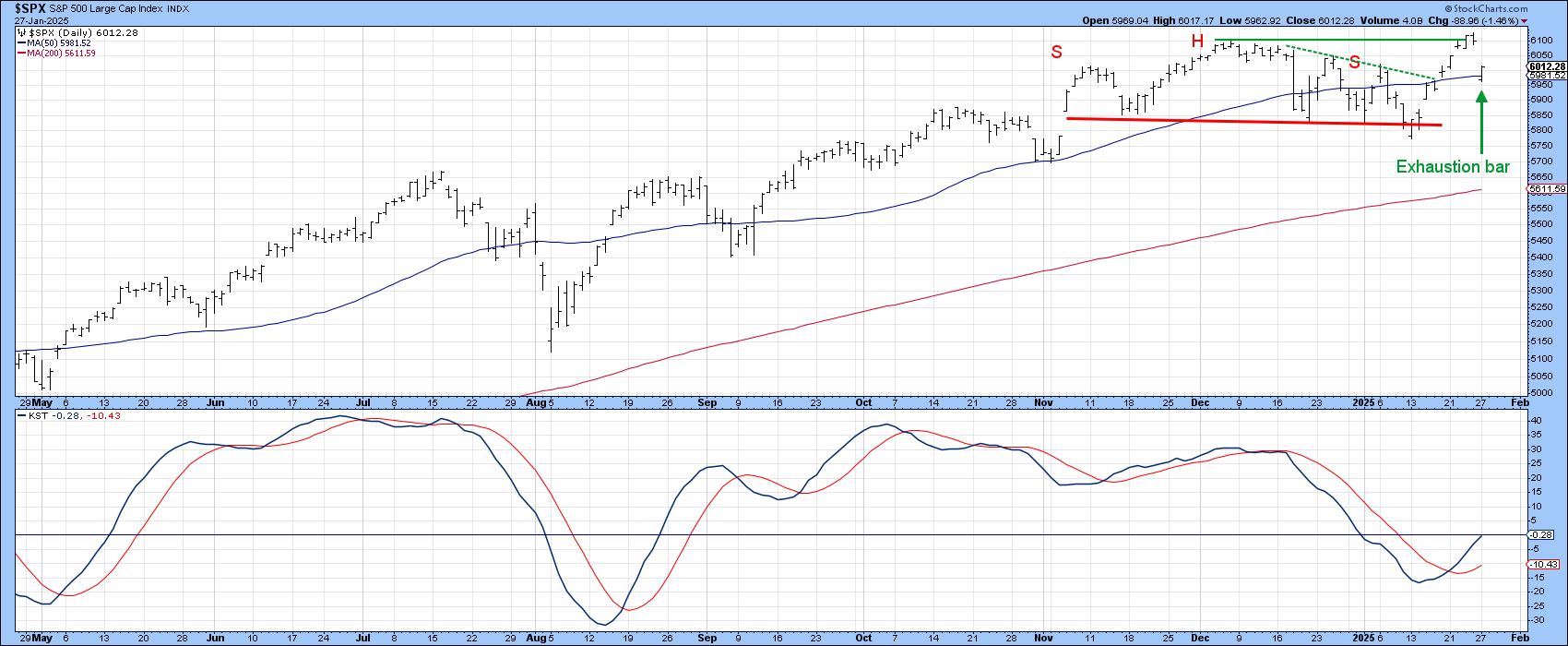

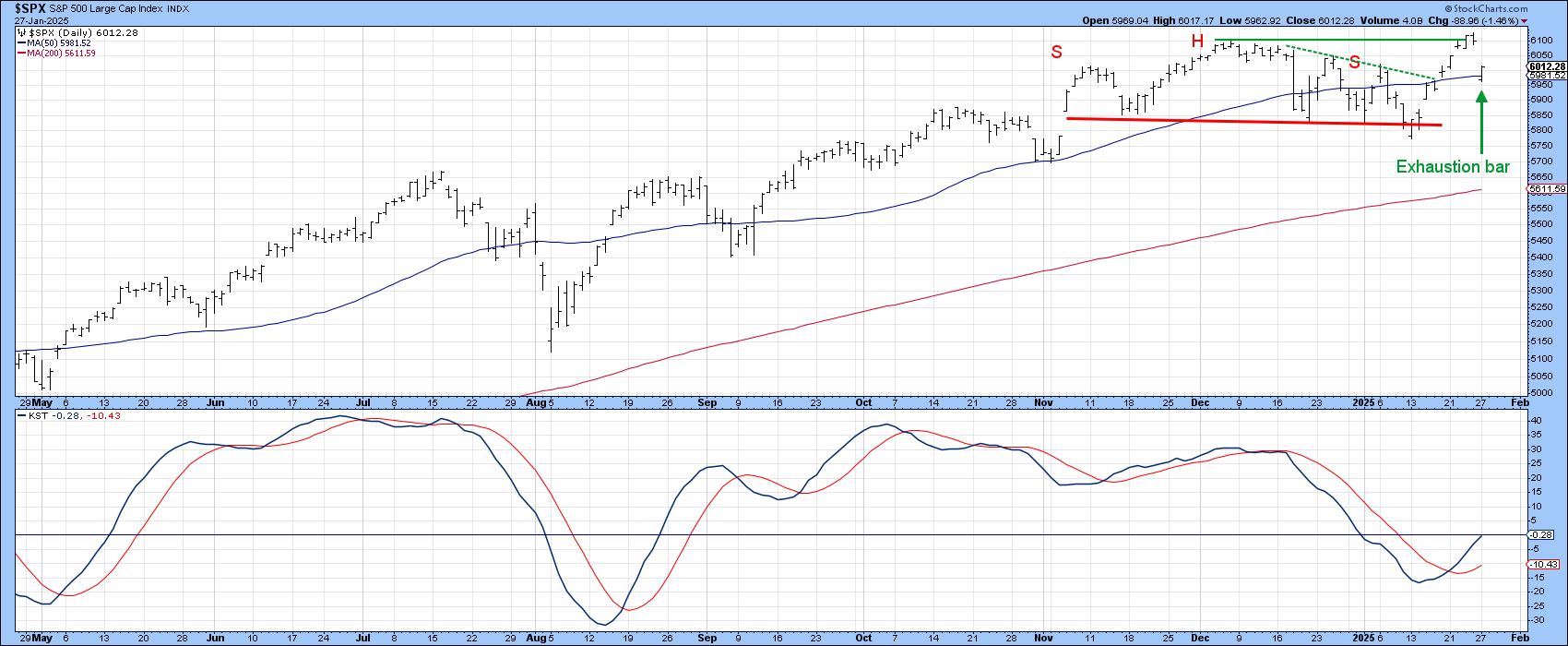

I woke up this morning noting that NASDAQ futures had been down nearly 1,000 points at their overnight intraday low. Later, I tuned into a couple of general purpose, as opposed to financial, cable news channels. They, too, were talking about the sell-off and its rationale. I began to...

READ MORE

MEMBERS ONLY

Stocks are Facing an Important Test

by Martin Pring,

President, Pring Research

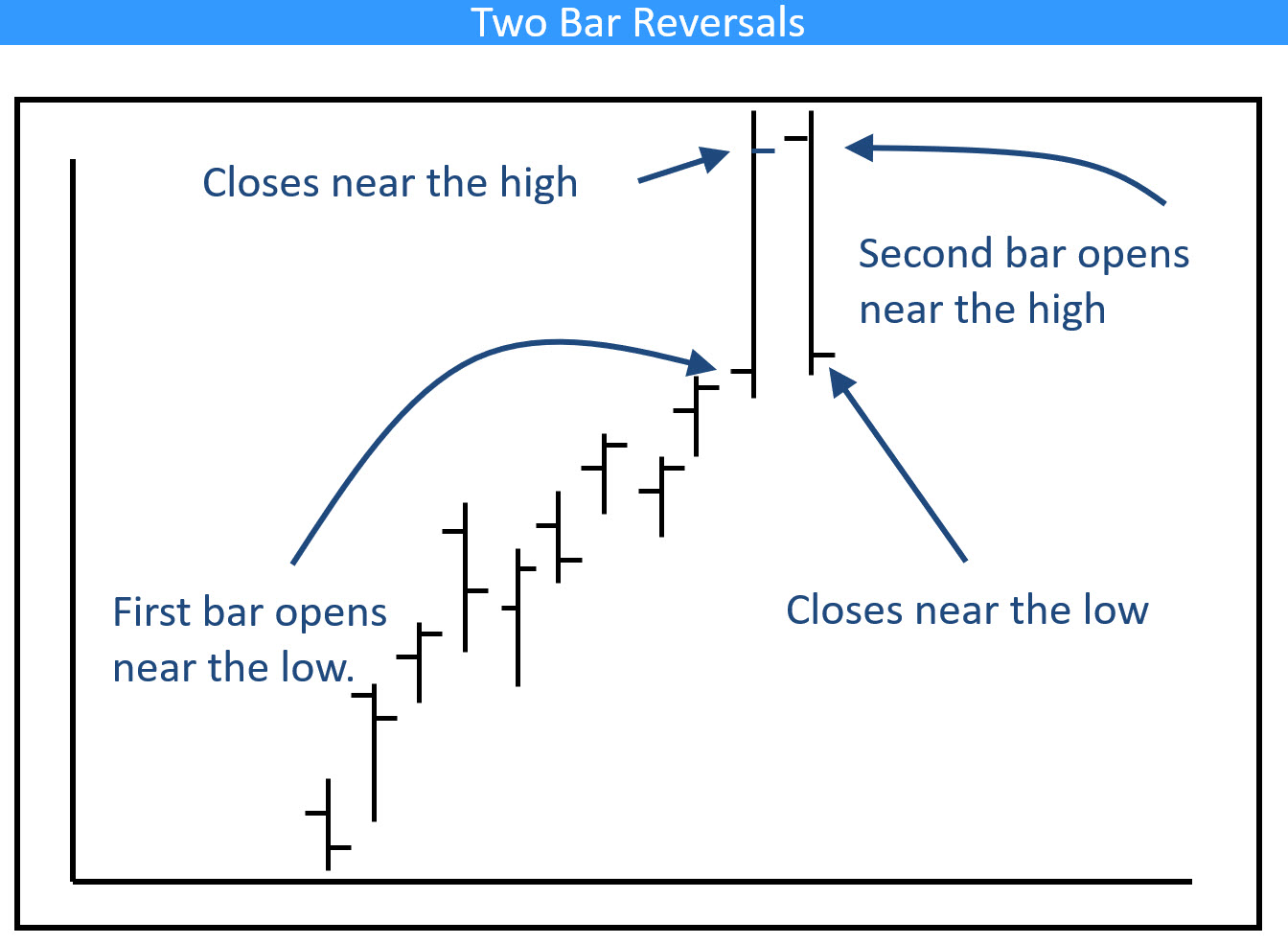

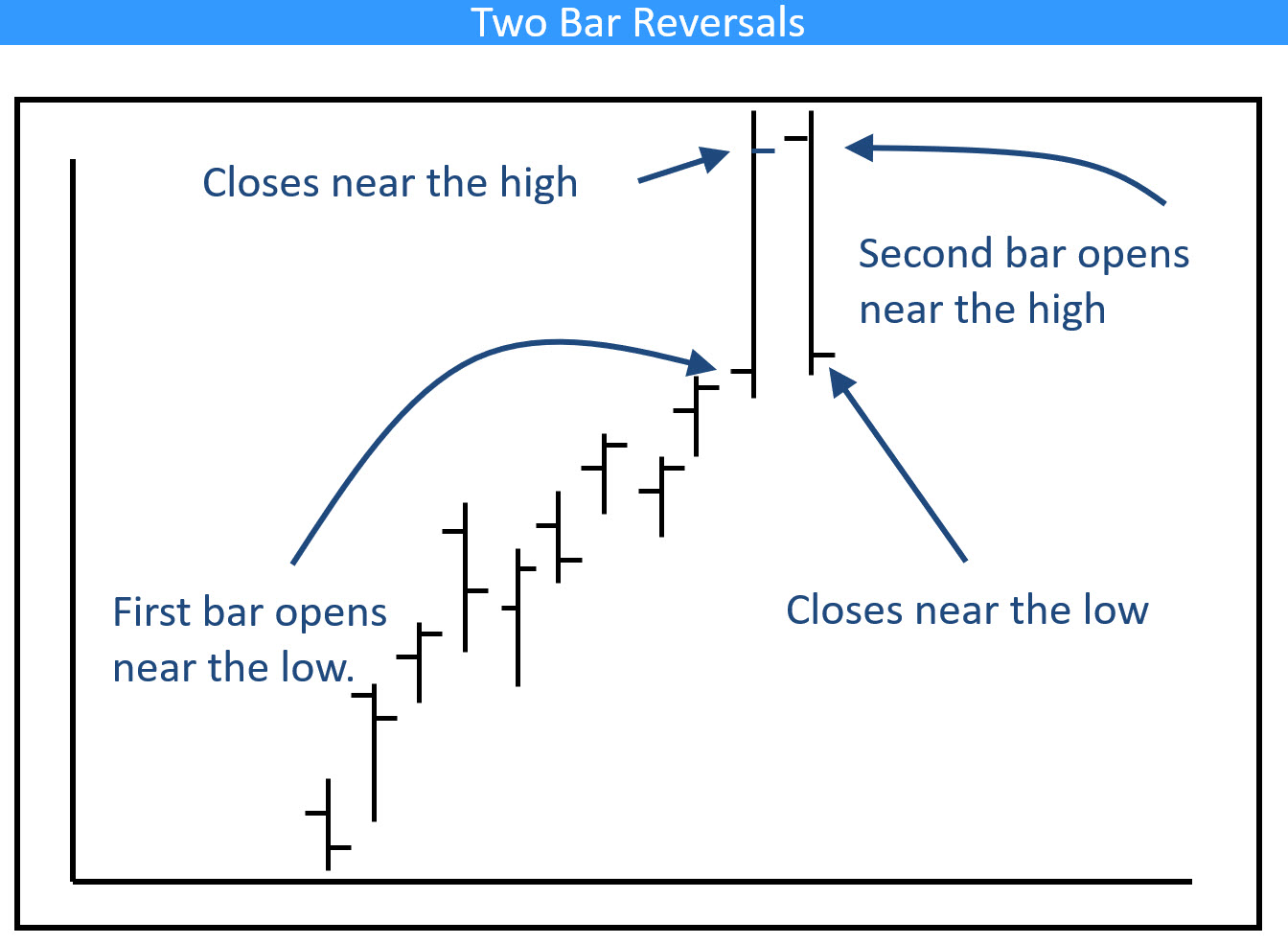

I have been expecting a bull market correction for about a month, but it's not been as deep as I expected. Now, however, several indexes have completed small bullish two-bar reversal patterns on the weekly charts. If they work, that would be a characteristic of a bull market,...

READ MORE

MEMBERS ONLY

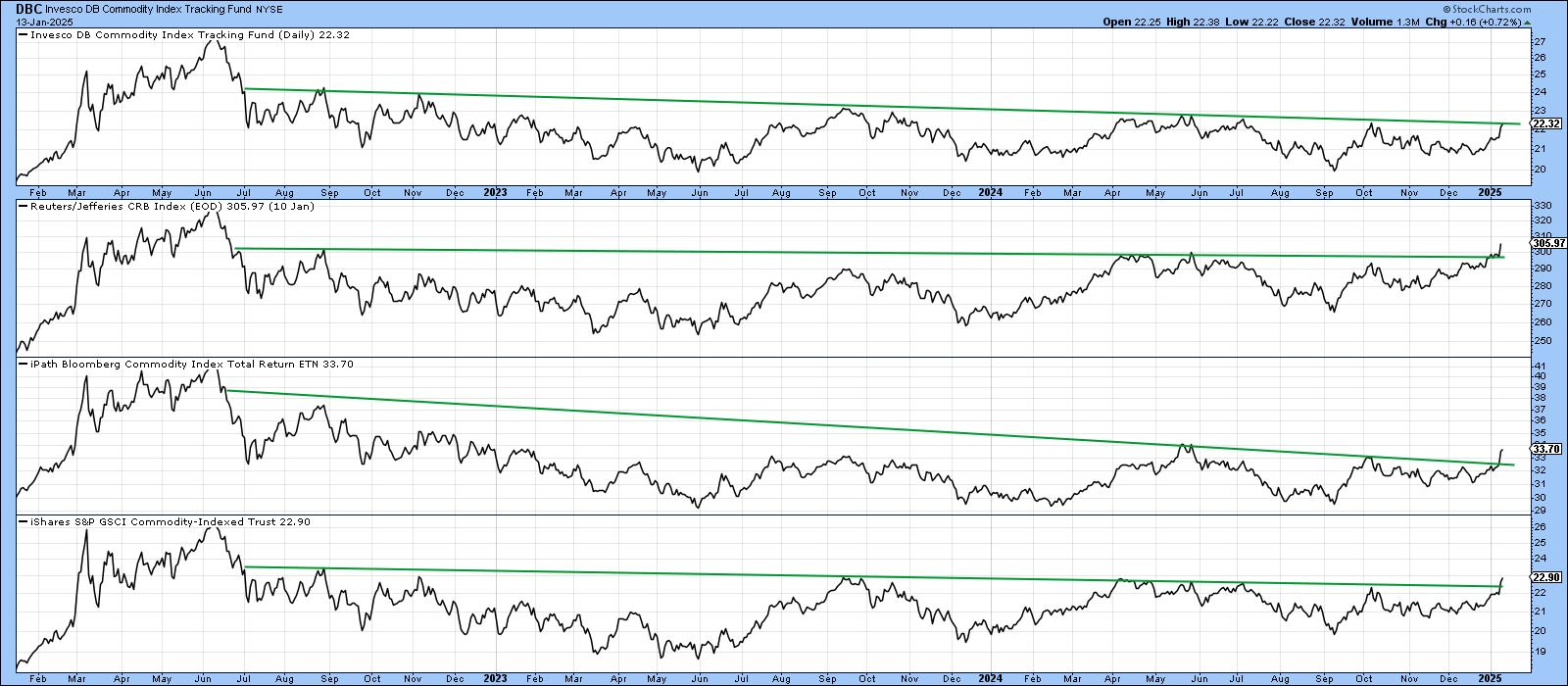

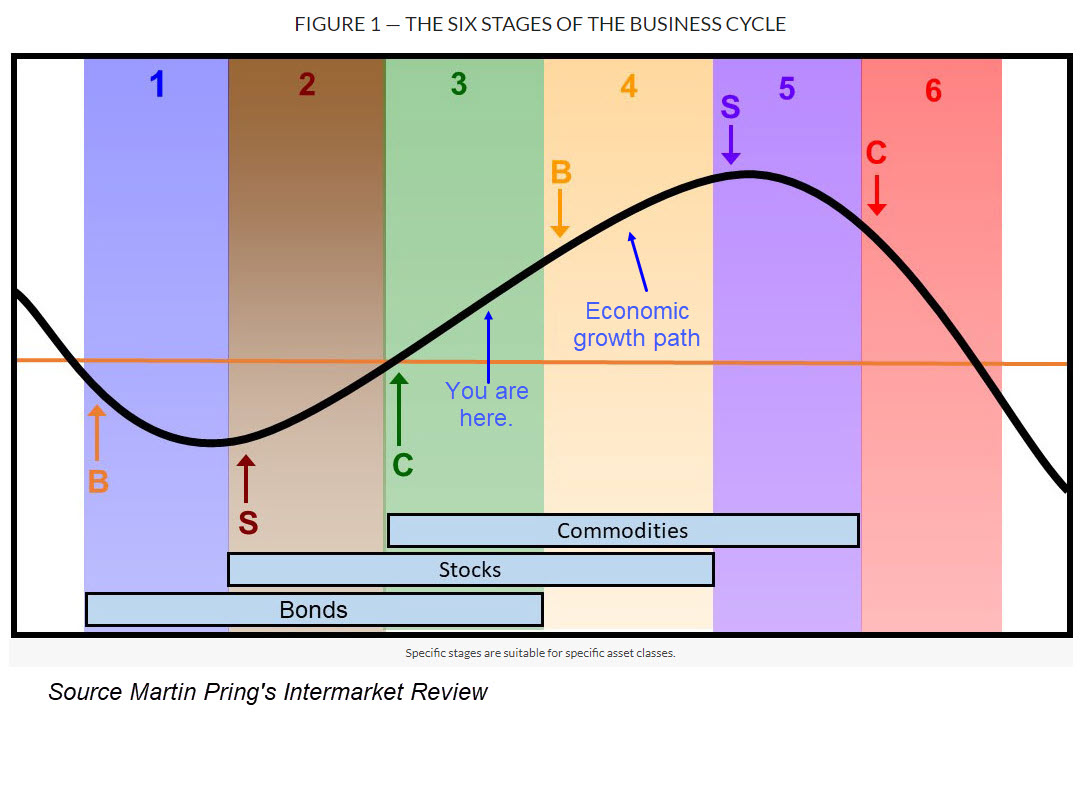

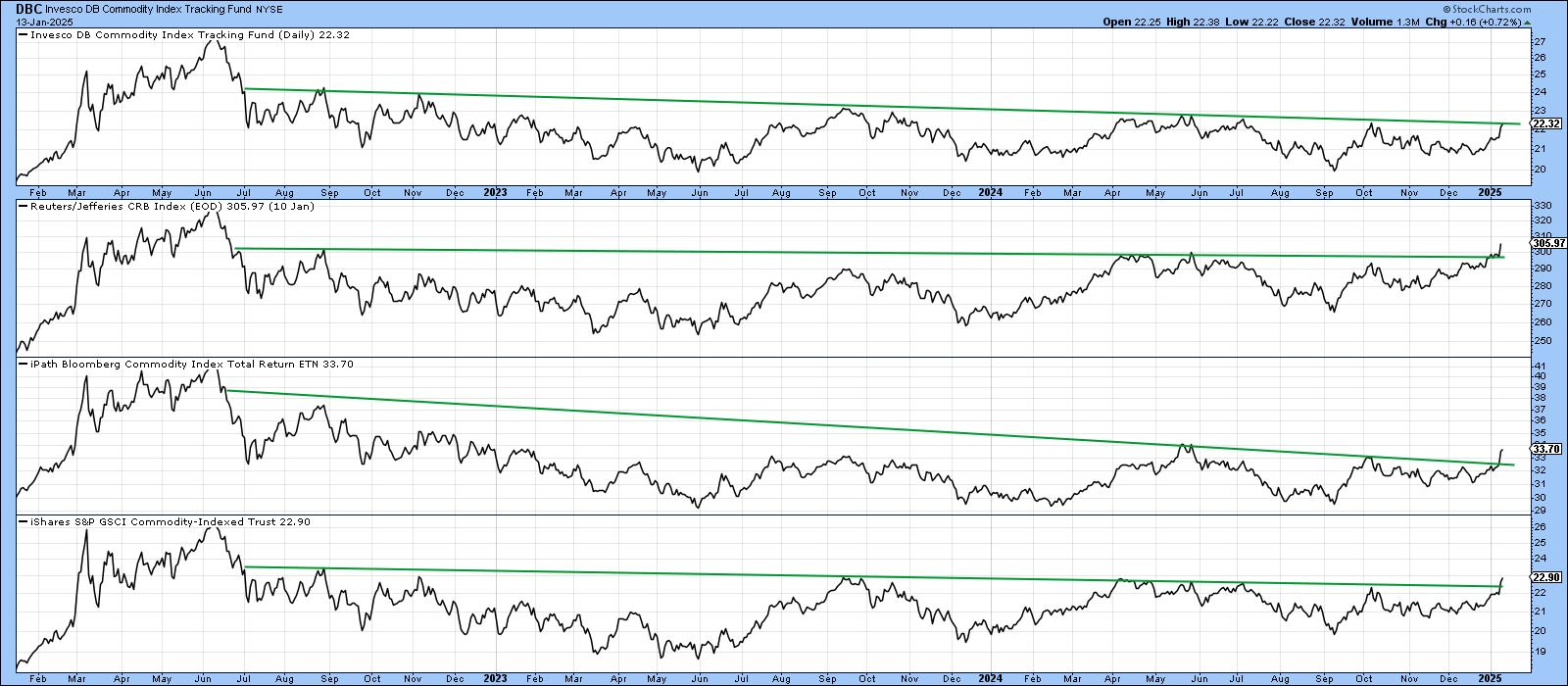

One Small Push by Commodities Could Lead to a Giant Leap for Commoditykind

by Martin Pring,

President, Pring Research

That may seem like a strange title, but it is intended to make the point that commodities look as though they are in the process of breaking out. Furthermore, this breakout, if successful, would jump-start a finely balanced long-term technical position into a primary bull market, all courtesy of our...

READ MORE

MEMBERS ONLY

Is The First Domino About to Fall for the Bitcoin Bull Market?

by Martin Pring,

President, Pring Research

The Long-Term Picture

No market goes up forever and, at some point, Bitcoin will top out. It's currently down about 12% from its peak, set on December 17 less than 4 weeks ago, so there is scant evidence at this point indicating a primary bear market. For example,...

READ MORE

MEMBERS ONLY

These Bars and Candles May Hold the Key for 2025

by Martin Pring,

President, Pring Research

Most of the time, when we study bars or candlesticks, our attention is focused on daily and intraday charts, since they give early warnings of a possible change in the short-term trend. Nonetheless, it occasionally makes sense to step back and take a look at monthly bars and candlesticks. Not...

READ MORE

MEMBERS ONLY

The Trump Trade? Not All as MAGA as You Might Think

by Martin Pring,

President, Pring Research

The "Trump Trade" refers to the market reaction and investment strategies that emerged following Donald Trump's election victories and his economic policies. It describes the shift in market sentiment driven by anticipated pro-business policies, tax cuts, and deregulation under his administration.

Investors initially rushed into sectors...

READ MORE

MEMBERS ONLY

Don't Be Surprised by an Early 2025 Pullback

by Martin Pring,

President, Pring Research

This year has been a very good one for stockholders. Come to think of it, 2023 wasn't so bad either. After an extended period of gains, it's natural for investors to become complacent, especially as they head home for the holidays.

This is the kind of...

READ MORE

MEMBERS ONLY

Several Intermarket Relationships Precariously Positioned for Stocks

by Martin Pring,

President, Pring Research

Chart 1 compares the S&P Composite with the NYSE A/D Line and its Common Stock counterpart. These, of course, are not intermarket relationships, but the chart does show that some near-term weakness would violate their bull market trendlines. Violating a trendline is not necessarily the end of...

READ MORE

MEMBERS ONLY

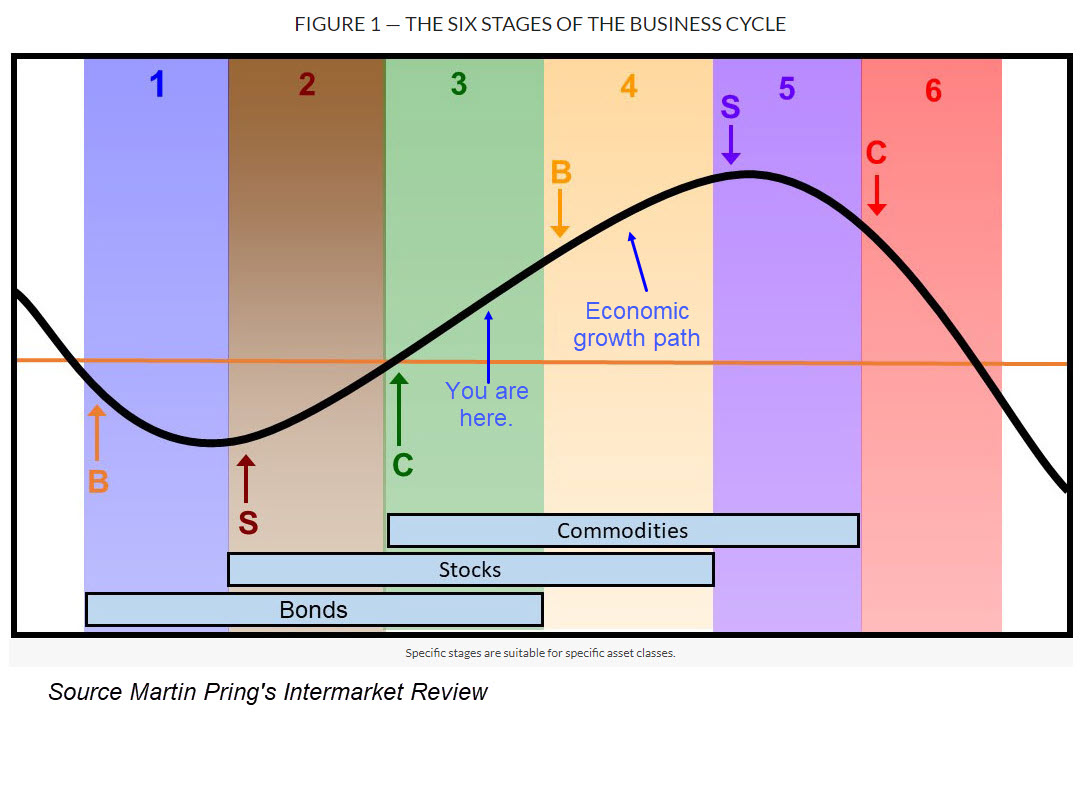

What the Economic Indicators are Saying About Stocks and Commodities

by Martin Pring,

President, Pring Research

You may not know it, but StockCharts' library of economic indicators has recently been enlarged. It's not as extensive as, say, the stock coverage, but it does include a lot of indicators that actually work, in the sense of helping identify major reversals in stock, bond, and...

READ MORE

MEMBERS ONLY

Three Charts That Could Be About to Break in a Big Way

by Martin Pring,

President, Pring Research

This article is not centered around a specific theme; rather, it focuses on some charts which look as if they are about to signal an important change in trend. In this case, "important" is defined as a forthcoming move lasting at least 3-months.

My indicator of choice for...

READ MORE

MEMBERS ONLY

These Country ETFs are Looking Particularly Vulnerable

by Martin Pring,

President, Pring Research

Chart 1, below, compares the S&P Composite to the Europe Australia Far East ETF (EFA), which is effectively the rest of the world. It shows that US equities have been on a tear against its rivals since the financial crisis. More to the point, there are very few...

READ MORE

MEMBERS ONLY

The Dollar's Technical Position is Crucial from a Short, Intermediate, Primary, and Secular Standpoint

by Martin Pring,

President, Pring Research

Chart 1 shows the Dollar Index has been in a trading range for the last couple of years and is now at resistance in the form of its upper part. The big question relates as to whether it can break to the upside, or if the resistance will once again...

READ MORE

MEMBERS ONLY

This Sector is Worth Watching, Not Just For Itself But as a Market Bellwether

by Martin Pring,

President, Pring Research

Last week, I drew your attention to the fact that out that three US market sectors had experienced bearish two-bar reversals on the weekly charts and were likely to retrace some of their previous advances. I also pointed out that this was only one piece of negative evidence and that...

READ MORE

MEMBERS ONLY

Four Sectors That Have Just Experienced Bearish Weekly Action

by Martin Pring,

President, Pring Research

Most weekends, I flip through a chartlist featuring weekly bars and candles for sectors, country ETFs, currencies, bonds and some commodities. The idea is to see whether any of these entities are showing signs of bullish or bearish reversals. Most of the time, this fishing exercise does not uncover a...

READ MORE

MEMBERS ONLY

This Stock Market Will Likely Outperform the World Index, But Could Be Outshone by Something Completely Different

by Martin Pring,

President, Pring Research

Since 2011, the US stock market, represented by the S&P Composite, has outperformed the world. In the last couple of weeks or so, it has managed to break out from a trading range in its relationship with the rest of the world and looks headed even higher on...

READ MORE

MEMBERS ONLY

Is This Still a Bull Market? | Larry's "Family Gathering" October 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Are we still in a bull market? That's a key question Larry considers in his final "Family Gathering" video, examining all the information available and what kind of conclusions about the state of the market we can draw from it.

Larry begins with a careful market...

READ MORE