MEMBERS ONLY

PREVIOUS INSTANCES OF FED TIGHTENING ACCOMPANIED RISING COMMODITY PRICES -- THE FED IS RAISING RATES NOW WHILE COMMODITIES ARE PLUNGING -- WEAK CHINESE MARKET IS PULLING COMMODITIES LOWER -- AND REFLECTS A SLOWING GLOBAL ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

LAST TWO YIELD CURVE INVERSION RESULTED FROM RISING COMMODITY PRICES ... My Wednesday morning message suggested that a sharp drop in the price of oil and other commodities argued for a more dovish tone from the Fed. That message also explained that previous Fed tightening cycles were usually done to combat...

READ MORE

MEMBERS ONLY

The Fed Unnerves Gold Market

by Martin Pring,

President, Pring Research

In my December Market Roundup webinar, I touched on the idea that the economy had begun to seriously slow down. Wednesday’s Fed action, actual and potential for next year, will amplify that process. The equity markets are obviously paying attention, but the increased probability of higher rates and a...

READ MORE

MEMBERS ONLY

THE FED CAN'T AFFORD TO MAKE A MISTAKE TODAY -- HIGHER SHORT-TERM RATES RISK AN INVERTED YIELD CURVE -- WHILE PLUNGING OIL PRICE SHOWS WEAKER INFLATION -- AND U.S. STOCKS ARE UNDERGOING A MAJOR TEST OF THEIR EARLY 2018 LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TODAY IS A BIG DAY FOR THE FED -- AND FOR THE MARKETS ... Today is one of the most important Fed days in recent memory. That's because there's a lot riding on what it does this afternoon; or doesn't do. It's widely...

READ MORE

MEMBERS ONLY

Catch A Falling Knife?

by Martin Pring,

President, Pring Research

* The Market Remains Oversold

* More Trend Damage Triggered

* Key Ratios Have Just Broken to New Lows

As a kid, I used to love building sand castles and defending them against the ensuing wave action. If the tide was coming in, however, it always proved to be a fool’s errand...

READ MORE

MEMBERS ONLY

LONGER-RANGE INDICATORS REMAIN BEARISH FOR U.S. STOCKS -- RETEST OF EARLY 2018 LOWS SHOULD DETERMINE IF STOCKS ARE IN A BEAR MARKET -- STOCKS OFF TO BAD DECEMBER START -- FAILURE OF SANTA CLAUS RALLY TO SHOW WOULD BE A BAD SIGN FOR THE NEW YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEEKLY S&P 500 CHART CONTINUES TO LOOK TOPPY... There's a reason why every short-term rally attempt over the past couple of months has failed. That's because longer-range indicators have turned bearish and remain so. It's more difficult for bounces on daily charts...

READ MORE

MEMBERS ONLY

HEAVY SELLING PUSHES U.S. STOCK INDEXES NEAR DECEMBER LOWS -- EARLY 2018 LOWS ARE NEXT -- RUSSELL 2000 SMALL CAP INDEX AND THE DOW TRANSPORTS FALL TO 52-WEEK LOWS -- SO DOES THE S&P RETAIL SPDR -- THAT'S A BAD SIGN FOR THE STOCK MARKET AND THE ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEADING BACK TO EARLY 2018 LOWS... After a unimpressive bounce this week, stock prices are ending week under heavy selling pressure. The first three charts show the Dow Industrials, the S&P 500, and the Nasdaq Composite nearing new lows for the month of December, which puts them on...

READ MORE

MEMBERS ONLY

STOCKS ARE GOING BACK ON THE DEFENSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM BOUNCE HAS RUN ITS COURSE ... This week's modest rebound in stocks has been unimpressive and appears to have run its course. Lack of upside volume and weak breadth also show that investors have stayed on the sidelines, or have sold into this week's rebound. Sector...

READ MORE

MEMBERS ONLY

MONDAY'S UPSIDE REVERSAL DAY MAY HAVE SIGNALLED SHORT-TERM BOTTOM -- THAT COULD LEAD TO DECEMBER REBOUND TO OVERHEAD RESISTANCE -- A STUDY OF SMALLER OR EQUAL WEIGHTED INDEXES SUGGESTS A RETEST OF EARLY 2018 LOWS MAY HAVE ALREADY TAKEN PLACE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 MAY BE FORMING SHORT-TERM BOTTOM... My message from last Friday suggested that the S&P 500 was likely to drop below its October low, which could lead to a retest of its early 2018 lows (more on that last point shortly). Chart 1 shows Monday&...

READ MORE

MEMBERS ONLY

Year-End Rally Here We Come?

by Martin Pring,

President, Pring Research

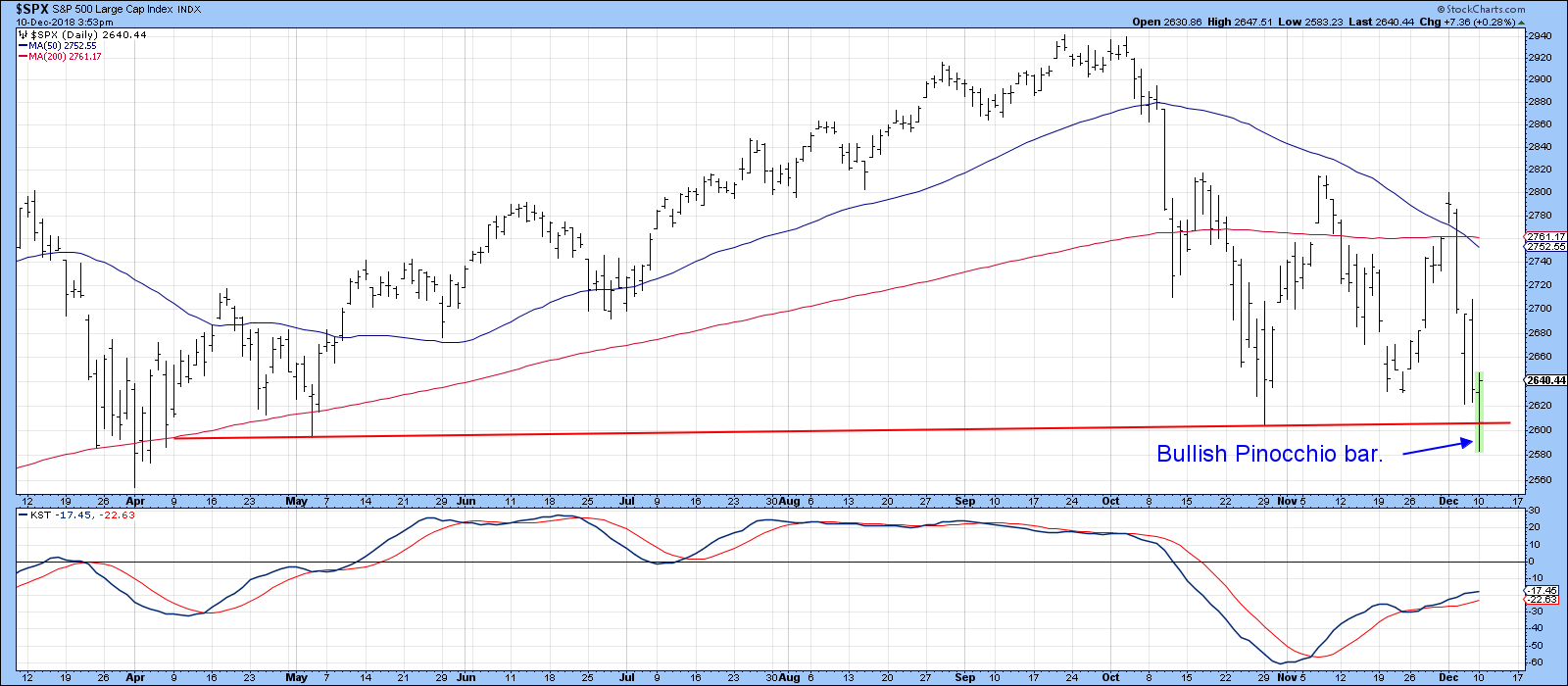

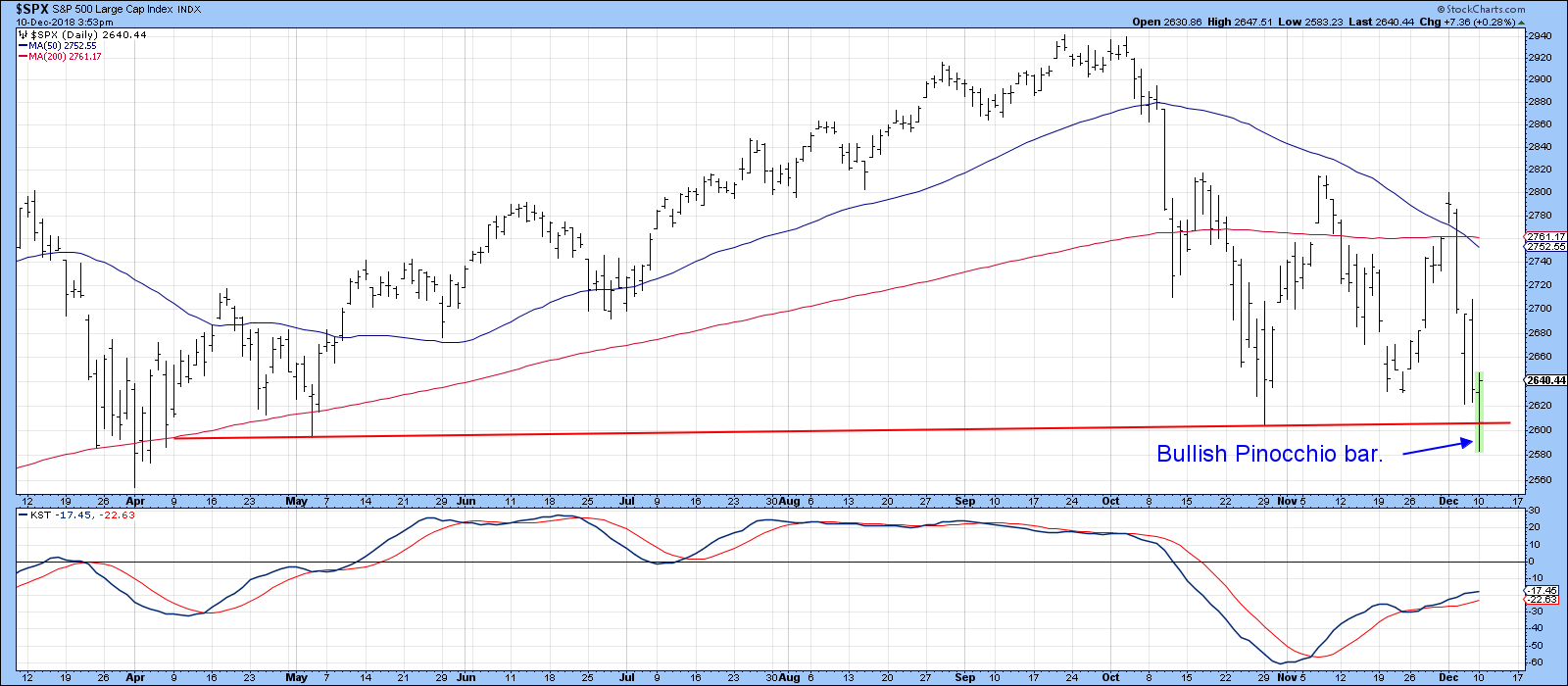

* Pinocchio Lies

* Oversold Sentiment Indicators

* Oversold Oscillators

Pinocchio Lies

Monday’s action was what I call “scary bullish.” First, we saw prices sell-off sharply, only to then rebound as if nothing had happened. Well, something did happen - the formation of a bullish Pinocchio bar on several Indexes. Chart 1...

READ MORE

MEMBERS ONLY

OIL JUMPS ON OPEC CUTS -- THAT'S GIVING ENERGY SECTOR A BOOST -- FALLING OIL HAS WEIGHED ON BOND YIELDS -- WEAK ENERGY PATCH AND FALLING STOCK PRICES HAVE ALSO WEAKENED HIGH-YIELD BONDS -- S&P 500 APPEARS TO BE TRIANGULATING WHICH FAVORS LOWER PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

LARGER THAN EXPECTED OPEC CUTS BOOST CRUDE OIL ... OPEC and Russia finally agreed to a larger-than-expected production cut of 1.2 million barrels a day of crude oil which is lifting the price of that commodity today. It remains to be seen, however, if that's enough to reverse...

READ MORE

MEMBERS ONLY

REVIEWING THE PHILOSOPHY OF TECHNICAL ANALYSIS -- CHARTS ACT AS LEADING INDICATORS OF FUNDAMENTAL INFORMATION -- THIS WEEK'S PLUNGE IN BOND YIELDS SUGGESTS ECONOMY WEAKENING -- FALLING STOCKS TOLD US THE SAME THING A MONTH AGO

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHY WE LOOK AT CHARTS ... I've written several messages since the start of October about why the sharp stock market drop that month was most likely the start of a major topping process. Previous messages used Elliott Waves, the unusually old age of the current bull market (and...

READ MORE

MEMBERS ONLY

PLUNGING BOND YIELDS SEND SIGNAL OF ECONOMIC WEAKNESS -- S&P 500 FALLS BELOW 200-DAY AVERAGE AFTER FAILING TEST OF NOVEMBER HIGH -- BIGGEST LOSERS ARE BANKS, SMALL CAPS, SEMIS, AND TRANSPORTS -- UTILITIES HIT NEW HIGHS AND ARE THE ONLY WINNERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD PLUNGES BELOW ITS 200-DAY AVERAGE ... Chart 1 shows the 10-Year Treasury yield plunging to the lowest level in three months and falling below its 200-day average for the first time in more than a year. That means that investors are putting a lot of money into Treasury...

READ MORE

MEMBERS ONLY

A Funny Thing May Have Happened To The Secular Reversal In Rates

by Martin Pring,

President, Pring Research

* The Secular Bear Market in Yields

* Near-Term Indications of a Decline in Bond Yields

* Watch That Stock/Bond Relationship for an Important Signal

The Secular Bear Market in Yields

Please note that the comments in this article relate to bond yields with maturities of 3-years or longer. They do not...

READ MORE

MEMBERS ONLY

December 2018 Market Roundup with Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For December is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

DAILY BOLLINGER BANDS SHOW SHORT-TERM STOCK TREND IMPROVING AND A POSSIBLE RETEST OF NOVEMBER HIGH -- WEEKLY AND MONTHLY BANDS ALSO SHOW SUPPORT -- BOLLINGER BAND WIDTH, HOWEVER, SHOWS THAT VOLATILITY REMAINS ELEVATED

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM TREND IS IMPROVING ... There are lots of ways to determine the trend of the stock market. The placement of moving average lines is one of them. Bollinger bands (invented by John Bollinger) are another. Chart 1 applies both techniques to a daily chart of the S&P 500....

READ MORE

MEMBERS ONLY

STOCKS REBOUND ON DOVISH FED SPEECH -- RISKIER STOCKS LEAD WHILE SAFE HAVENS LAG -- DOW REGAINS 200-DAY LINE -- LOWER BOND YIELDS WEAKEN THE DOLLAR WHICH BOOSTS GOLD AND EMERGING MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW REGAINS 200-DAY AVERAGE ... U.S. stock indexes reacted positively to today's noon speech by Fed chief Jerome Powell that was perceived to be more dovish than comments made at the start of October. Stocks all over the world are rallying as a result. Chart 1 shows the...

READ MORE

MEMBERS ONLY

The Trend Of Housing And NYSE Margin Debt Both Reverse To The Downside

by Martin Pring,

President, Pring Research

* Housing Starts are Rolling Over

* The Trend of Margin Debt is Bearish

The NYSE Margin and the housing sector do not have much in common beyond the fact that both gave sell signals in October. Neither development bodes well for the recovery of the stock market. Let’s take a...

READ MORE

MEMBERS ONLY

STOCKS BOUNCE OFF LATE OCTOBER LOW -- THIS WOULD BE A LOGICAL SPOT FOR A SEASONAL RALLY ATTEMPT -- HOW FAR IT CARRIES WILL BE VERY IMPORTANT -- NASDAQ 100 QQQ IS ALSO OVERSOLD ON ITS DAILY CHART -- ITS WEEKLY CHART, HOWEVER, SHOWS LONGER RANGE DAMAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 REBOUNDS OFF LATE OCTOBER LOW... Stocks are off to a good start to the post Thanksgiving trading week. And they have at least three things working in their favor. One is the proximity to their late October low. The other is a short-term oversold condition. The...

READ MORE

MEMBERS ONLY

AN EVENTUAL RETEST OF FIRST HALF LOWS STILL LOOKS LIKELY -- IN ORDER TO PREVENT THAT, OCTOBER LOWS HAVE TO HOLD -- FOR THAT TO HAPPEN, SOME SHORT-TERM CHART BARRIERS NEED TO BE OVERCOME --

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS RETESTING ITS OCTOBER LOW ... Since the nearly nearly three year uptrend that started in stocks in early 2016 appears to have peaked, an eventual retest of early 2018 lows appears likely. That would mean an eventual retest of February/April lows on the S&...

READ MORE

MEMBERS ONLY

Confidence Is Eroding Just When It's Needed

by Martin Pring,

President, Pring Research

* Indexes on the Brink

* Confidence Relationships Starting to Break Down

* Watch the Stock/Bond Ratio

Indexes on the Brink

More than once a week, I make sure to check several ratios that tell me whether investors and traders are getting more or less confident. These relationships, which we will get...

READ MORE

MEMBERS ONLY

HEADLINE FROM OCTOBER 13: WEEKLY AND MONTHLY CHARTS ARE SENDING MORE SERIOUS WARNING SIGNS -- ELLIOTT WAVE ANALYSIS ALSO SUGGESTS THAT THE MARKET MAY HAVE COMPLETED ITS NINE-YEAR RUN

by John Murphy,

Chief Technical Analyst, StockCharts.com

CORRECTION: ... My message from last Wednesday showed negative readings on weekly and monthly stock charts, and referred back to an earlier message on that same topic. However, I incorrectly gave a date of May 13. The correct date of that earlier article is October 13, 2018. I also mentioned that...

READ MORE

MEMBERS ONLY

STOCK INDEXES STABILIZE BUT LOSE MORE GROUND -- DROP IN RETAILERS AND HOME IMPROVEMENT STOCKS MAKE CONSUMER CYCLICALS MARKET'S WEAKEST SECTOR -- WALMART, MACY'S AND HOME DEPOT FALL ON STRONG EARNINGS -- CONSUMER STAPLES CONTINUE TO OUTPERFORM

by John Murphy,

Chief Technical Analyst, StockCharts.com

DESPITE LATE REBOUND, STOCK INDEXES LOSE GROUND... Despite a rebound on Thursday and Friday, all major U.S. stock indexes lost ground this week. But very little changed on their respective chart patterns. Chart 1 shows an upside reversal on Thursday keeping the Dow Industrials above its 200-day average. But...

READ MORE

MEMBERS ONLY

STOCKS CONTINUE THEIR NOVEMBER SLIDE -- THE S&P 500 MAY RETEST ITS LATE OCTOBER LOW -- THE REASON SHORT-TERM RALLIES ARE FAILING IS BECAUSE WEEKLY CHARTS LOOK EVEN MORE NEGATIVE -- THE S&P 500 MONTHLY CHART ALSO SHOWS SIGNS OF WEAKENING

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM STOCK TREND CONTINUES TO WEAKEN ... Today's higher open is giving way to more afternoon selling. We've seen that same pattern over the past week as stock prices have started to slide again. The daily bars in Chart 1 show the S&P 500 Index...

READ MORE

MEMBERS ONLY

Has Oil Hit A Temporary Bottom?

by Martin Pring,

President, Pring Research

* Commodities in General Remain in a Bear Market

* Oil is Also in a Primary Bear Market

* The Chart That Says That Some Kind of Bottom is at Hand

I last wrote about oil back in early August, in an article entitled More Evidence Of A Commodity Bear Market. Back then,...

READ MORE

MEMBERS ONLY

TECH STOCKS CONTINUE TO LEAD MARKET LOWER -- TECHNOLOGY SPDR SLIPS FURTHER BELOW ITS 200-DAY AVERAGE -- APPLE DROPS TOWARD ITS 200-DAY LINE AS MICROSOFT WEAKENS -- BROADCOM AND INTEL LEAD CHIP STOCKS SHARPLY LOWER -- S&P 500 IS BACK BELOW ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR FALLS FURTHER BELOW ITS 200-DAY AVERAGE ... Technology stocks continue to lead the stock market lower today. The Technology Sector SPDR (XLK) fell back below its 200-day average on Friday, and is falling further below it today (Chart 1). To get an idea of how much the techs have...

READ MORE

MEMBERS ONLY

ENERGY STOCKS FOLLOW CRUDE OIL LOWER -- RISING DOLLAR IS PUSHING COMMODITY PRICES LOWER -- DEFENSIVE SECTORS ARE STILL IN THE LEAD -- CYCLICALS RUN INTO RESISTANCE WHILE TECHOLOLOGY SECTOR WEAKENS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL ENTERS BEAR MARKET... Commodities as a group have been under a lot of selling pressure for several months. But the weakest part of that group over the past month has been energy. Chart 1 shows the price of WTIC Light Crude Oil (through yesterday) falling to the lowest...

READ MORE

MEMBERS ONLY

Several Indicators Point To A Test Of The October Lows

by Martin Pring,

President, Pring Research

* Indexes Reach Resistance and Retrace 61.8% of the Decline

* Hourly Charts Offer the First Domino

* Short-Term Breadth is Overstretched

* NASDAQ Sports a Series of Declining Peaks and Troughs

Indexes Reach Resistance and Retrace 61.8% of the Decline

The market has been on a tear for the last couple...

READ MORE

MEMBERS ONLY

THE DOW LEADS NOVEMBER REBOUND -- THE S&P 500 IS BACK ABOVE ITS 200-DAY LINE -- SO ARE THE QQQ AND XLK -- HEALTH CARE PROVIDERS LEAD THE XLV -- SO ARE ABBOTT LABS, JOHNSON & JOHNSON, AND MERCK

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW LEADS STOCK UPTURN ... Major stock indexes are building on their November gains on the day after the midterm elections. The Dow is leading on the upside. Chart 1 shows the Dow Industrials already trading above chart resistance at 25,800 and trying to clear its 50-day average. Chart...

READ MORE

MEMBERS ONLY

Last Chance For Gold To Rally?

by Martin Pring,

President, Pring Research

* The Long-Term Picture

* Price Action Characteristics are Bearish

* Gold Share Breadth is Negative

* The Now or Never Chart

The Long-Term Picture

Gold was in a secular bull market between 2001 and 2011. It then sold off into 2014 and has been essentially range bound ever since. Chart 1 shows that...

READ MORE

MEMBERS ONLY

November 2018 Market Roundup with Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For November is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

BIG DROP IN APPLE HURTS TECH SECTOR AND THE NASDAQ WHICH ARE LEADING TODAY'S STOCK RETREAT -- BOTH MAY BE FAILING TESTS OF THEIR 200-DAY AVERAGES -- THE S&P 500 IS ALSO STALLING AT MOVING AVERAGE LINES -- HOURLY BARS SHOW OVERHEAD RESISTANCE BARRIERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPLE FALLS ON GOOD NEWS ... It's usually not a good sign when the market's biggest stock takes a big hit. That's especially true when it happens the day after the company reported its fourth consecutive quarter of record revenue and profits. But that'...

READ MORE

MEMBERS ONLY

Comparing The Differences Between The February And October Declines

by Martin Pring,

President, Pring Research

* Key moving averages violated in October

* The world peaked in January

* What happened to sectors and breadth?

* February versus October conclusion

* Those pesky bonds

Key Moving Averages Violated in October

So far, 2018 has seen two sharp shakeouts in the market, specifically the ten-day special in early February and the...

READ MORE

MEMBERS ONLY

SHORT-TERM STOCK BOTTOM APPEARS TO BE IN PLACE -- SMALL AND MIDCAP INDEXES BOUNCE OFF FEBRUARY LOWS -- S&P 500 BOUNCES OFF SUPPORT -- AND MAY BE HEADING FOR A RETEST OF ITS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL AND MIDCAP STOCKS INDEXES BOUNCE OFF FEBRUARY LOWS... A lot of technical signs point to a short-term bottom in place for stocks. That suggests that major stock indexes will try to regain some of their October losses. The big question is how much of those losses. Before getting to...

READ MORE

MEMBERS ONLY

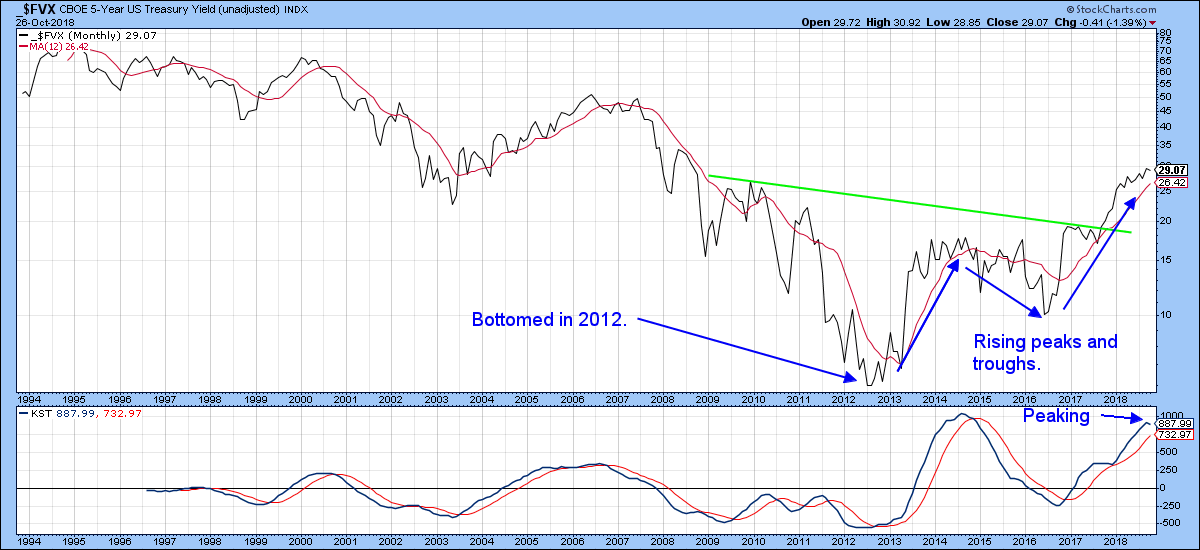

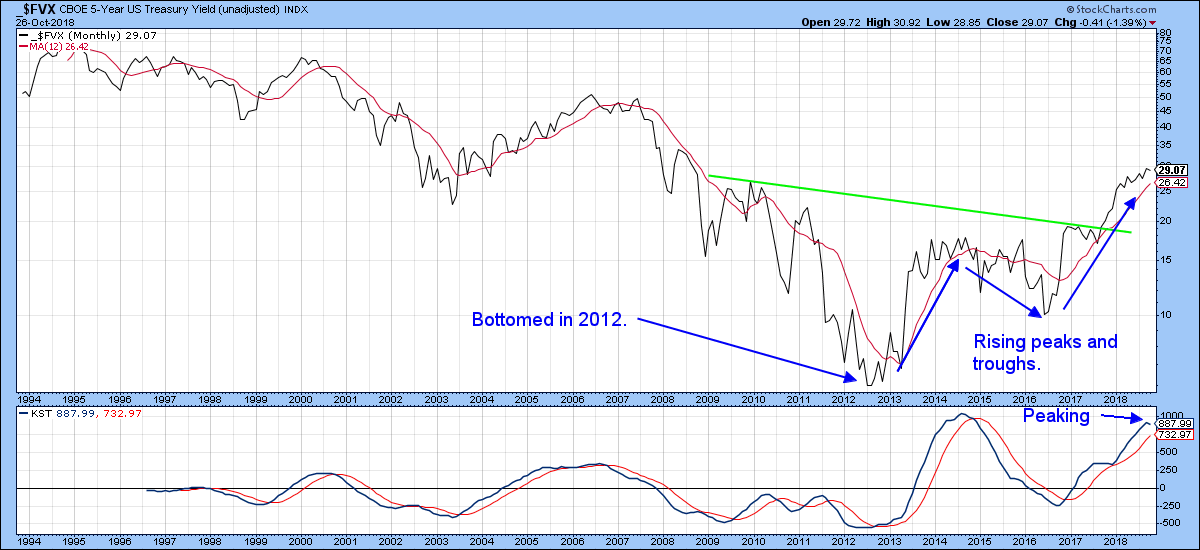

Tentative Signs That Bond Yields May Be Peaking

by Martin Pring,

President, Pring Research

* A few observations about the secular trend

* Short-term technical position

* Junk bonds peak out

* Credit spreads argue for lower government yields

A Few Observations About the Secular Trend

The 5-year yield, shown in Chart 1, has formed and broken out from a major base. It touched a low point in...

READ MORE

MEMBERS ONLY

S&P 500 APPEARS HEADED FOR TEST OF ITS EARLY 2018 LOWS -- THE BREAKING OF ITS THIRTY-MONTH SUPPORT LINE IS ANOTHER NEGATIVE SIGN -- THE LAST TWO MARKET PEAKS STARTED IN OCTOBER -- A PLUNGE IN ASSET MANAGERS MAY BE ANOTHER SIGN OF MARKET WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 HEADED FOR A RETEST OF EARLY 2018 LOWS ... I keep hearing on CNBC that stocks are down sharply but "off their lows". They never seem to mention that they're even further "off their highs". After losing nearly 4% over the...

READ MORE

MEMBERS ONLY

FOREIGN STOCKS ARE LEADING U.S. STOCKS LOWER -- EUROPE AND ASIA ARE ALREADY IN DOWNTRENDS -- THE ALL COUNTRY WORLD INDEX IS FALLING TO THE LOWEST LEVEL IN A YEAR -- THAT SUGGESTS THAT GLOBAL STOCKS ARE PEAKING -- THAT INCLUDES THE U.S.

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN STOCKS ARE LEADING THE U.S. LOWER... U.S. stocks are under pressure for a lot of reasons that have been described in previous messages. There's been the rotation over the last month out of economically-sensitive stock groups like cyclicals, industrials, energy, materials, and technology into defensive...

READ MORE

MEMBERS ONLY

S&P 500 RETESTS 200-DAY MOVING AVERAGE AND TWO-YEAR SUPPORT LINE -- VOLUME PATTERN HASN'T BEEN ENCOURAGING -- SMALL CAPS CONTINUE TO DROP FASTER THAN LARGE CAPS -- A RATIO OF SMALL CAPS VERSUS LARGE CAPS IS NOW TESTING MAJOR SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 CONTINUES TO TEST MAJOR SUPPORT LINES... After a rebound attempt on Tuesday, stocks ended the week pretty much where they started, but on the defensive. The daily bars in Chart 1 show the S&P 500 Large Cap Index closing Friday right on its 200-day...

READ MORE

MEMBERS ONLY

THE THREE DOW AVERAGES ARE GIVING BEARISH MESSAGES -- THE DOW TRANSPORTS ARE FALLING THE FASTEST -- WHILE THE UTILITIES ARE DOW LEADERS -- TRANSPORTATION/UTILITIES RATIO FALLS TO LOWEST LEVEL OF THE YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW RETESTS 200-DAY LINE... My last two messages spelled out a lot of technical reasons that are bearish for the stock market, and increase the odds that the nine-year bull run is ending. Besides the heavy selling that's taken place during October, my weekend message showed a...

READ MORE

MEMBERS ONLY

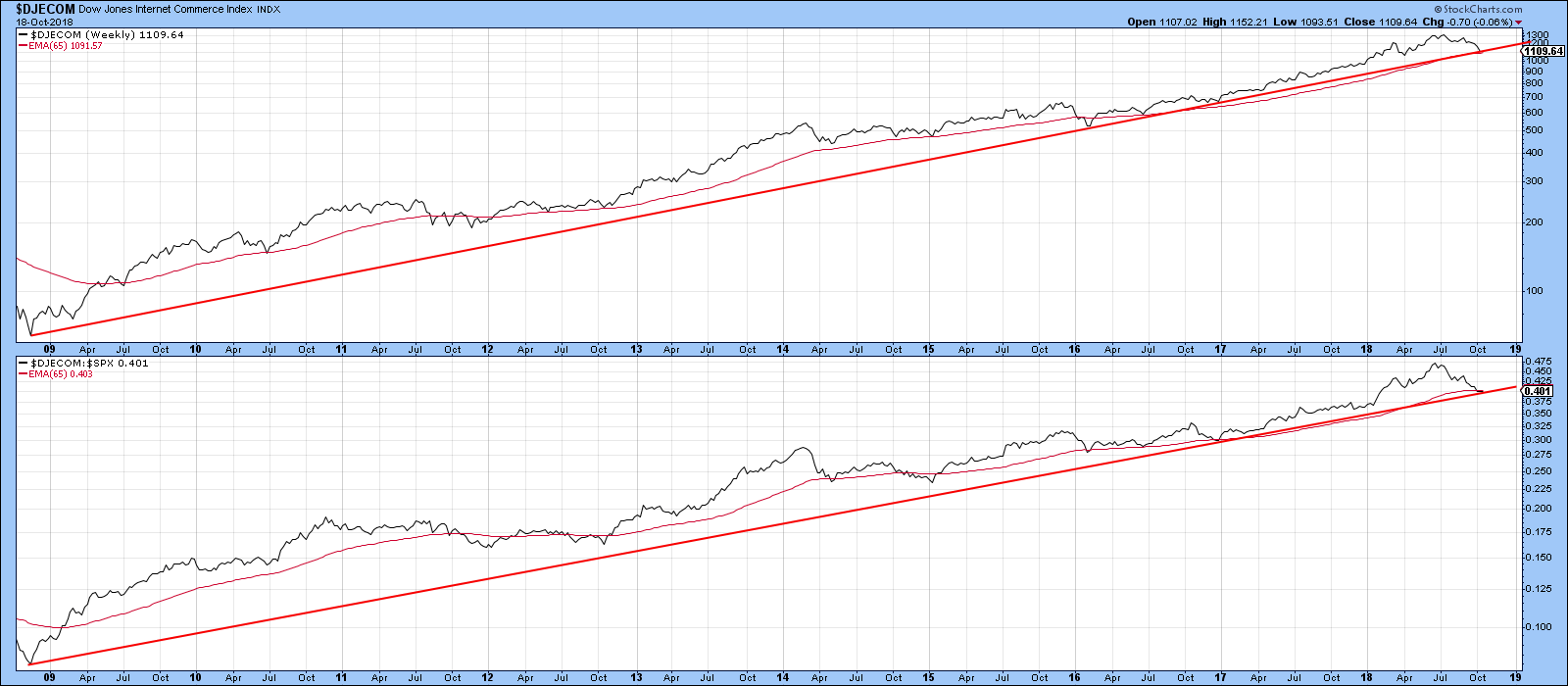

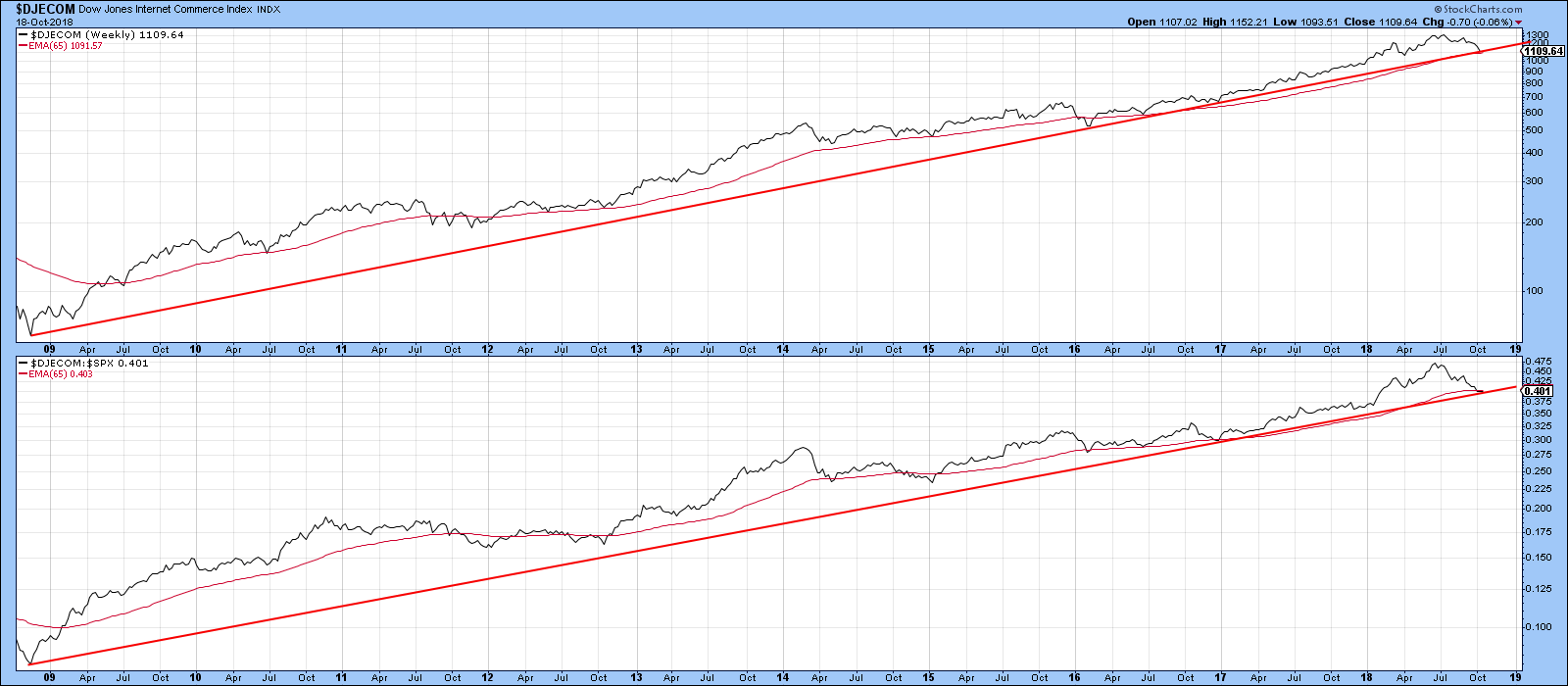

Four Areas To Watch For A Possible Bear Market Trigger

by Martin Pring,

President, Pring Research

* Internet bubble

* Credit spreads

* Rising interest rates

* Contagion from abroad

On Wednesday, I joined Tom and Erin on MarketWatchers LIVE and enjoyed a spirited discussion on what signs might foreshadow an extension to last week’s decline, or even signal a bear market. The four areas I cited were the...

READ MORE

MEMBERS ONLY

HEALTHCARE HAS BECOME THE YEAR' STRONGEST SECTOR -- AND IS BEING LED HIGHER BY DRUG STOCKS -- JOHNSON & JOHNSON IS THE DAY'S DRUG LEADER -- LILLY, MERCK, AND PFIZER NEAR NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DEFENSIVE HEALTHCARE SECTOR CONTINUES TO LEAD ... Healthcare has emerged as the market's strongest sector. Not only has healthcare been the market's strongest sector over the last month, the last three months, and the last six months. It's now the top performer for the year....

READ MORE