MEMBERS ONLY

FRIDAY'S REBOUND PREVENTS FURTHER STOCK DAMAGE -- BUT WEEKLY AND MONTHLY CHARTS ARE SENDING MORE SERIOUS WARNING SIGNS -- ELLIOTT WAVE ANALYSIS ALSO SUGGESTS THAT THE MARKET MAY HAVE COMPLETED ITS NINE-YEAR RUN -- BULL MARKETS MAY NOT DIE OF OLD AGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 HOLDS 200-DAY AVERAGE ... A stock rebound on Friday prevented a more serious market breakdown. That's because it allowed the S&P 500, and some other market gauges, to hold at or above their 200-day moving averages (Chart 1). That included the Dow and...

READ MORE

MEMBERS ONLY

GROWTH AND VALUE STOCKS ARE BOTH WEAKENING -- CONSUMER DISCRETIONARY AND TECH SPDRS HAVE FALLEN TO THEIR 200-DAY AVERAGES TO LEAD MARKET LOWER -- FINANCIALS HAVE ALSO LOST GROUND -- BANK INDEX FALLS TO NEW 2018 LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

GROWTH AND VALUE STOCKS ARE BOTH FALLING... One of the explanations for this week's big selloff is that the upside breakout in bond yields is hurting growth stocks. That's been especially true of consumer discretionary and technology stocks which suffered the biggest losses this month. Chart...

READ MORE

MEMBERS ONLY

Global And US Equities Violate Major Up Trendlines: More Downside To Come

by Martin Pring,

President, Pring Research

* The big global picture

* US equities are violating key trend lines

* Financials experience false upside breakout

* Energy triggers a false positive

* Bubble-prone e-commerce on the verge of being pricked!

Last week, I wrote about the possibility of an October “surprise.” I pointed out that such an event is completely random...

READ MORE

MEMBERS ONLY

NASDAQ CONTINUES TO LEAD MARKET LOWER -- ALONG WITH WEAK TECHNOLOGY STOCKS -- SEMICONDUCTOR ISHARES FALL TO LOWEST LEVEL IN SIX MONTHS -- SMALL AND MIDCAP INDEXES SLIP BELOW 200-DAY AVERAGES -- S&P 500 FALLS BELOW 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE NASDAQ 100 (QQQ) LEADS MARKET LOWER... Stock indexes are all under selling pressure again this morning. As has been the case of late, the technology-dominated Nasdaq market has been leading the rest of the market lower. Chart 1 shows the Invesco Nasdaq 100 QQQ Trust falling to the lowest...

READ MORE

MEMBERS ONLY

New Evidence Suggests A Change In Market Leadership Is Underway

by Martin Pring,

President, Pring Research

* The US market viewed from abroad

* Resource based sectors in general are under-performing

* Defensive sectors are generally improving

* Ratio between a late and early performing sector is at a critical juncture

Back in August I wrote an article pointing out that we might be in the early stages of a...

READ MORE

MEMBERS ONLY

HIGHER BOND YIELDS WEIGH ON STOCK PRICES -- CONSUMER CYCLICALS AND TECHNOLOGY CONTINUE TO LEAD THE MARKET LOWER -- THE QQQ FALLS BELOW ITS 50-DAY AVERAGE -- WHILE THE SOXX BREAKS ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LOT OF MOVING AVERAGE LINES ARE BEING BROKEN... Stocks continue the retreat that began after bond yields reached multiyear highs at midweek. Bond yields are hitting new highs again today. As was the case yesterday, consumer cyclicals and technology are the two worst sector performers. Chart 1 shows the...

READ MORE

MEMBERS ONLY

What Are The Odds Of An October Surprise?

by Martin Pring,

President, Pring Research

* Conditions that feed a crash

* Rising rates

* Emerging markets could be the triggering mechanism

* Market breadth not so hot

* Is the e-commerce bubble bursting?

Conditions that feed a crash

October started off as just a continuation of September’s dull price activity. However, knowing that the month of October has...

READ MORE

MEMBERS ONLY

RETAILERS CONTINUE TO WEIGH ON CYCLICALS -- CONSUMER DISCRETIONARY SPDR FALLS BELOWS 50-DAY AVERAGE -- HOMEBUILDERS ARE ALSO WEIGHING ON CYCLICALS -- HOME CONSTRUCTION ETF FALLS TO LOWEST LEVEL IN A YEAR -- RISING BOND YIELDS ARE A BIG REASON WHY

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAILERS CONTINUE TO WEAKEN... Tuesday's message showed retail stocks under selling pressure. That selling is continuing today. Chart 1 shows the S&P Retail SPDR (XRT) nearing a test of its July/August lows and maybe even its 200-day moving average (red line). The Tuesday message also...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD BREAKS OUT TO HIGHEST LEVEL SINCE 2011 ON STRONG ECONOMIC NEWS -- STOCKS RALLY WITH YIELDS AS BOND PRICES FALL -- THAT'S GIVING A LIFT TO BANKS AND OTHER FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD ACHIEVES MAJOR BULLISH BREAKOUT... Treasury yields have finally achieved the upside breakout that many of us have been warning about. And it's doing it in pretty decisive fashion. The daily bars in Chart 1 show the 10-Year Treasury yield surging above its May peak near...

READ MORE

MEMBERS ONLY

RETAIL STOCKS HAVE A BAD CHART DAY -- THAT'S STARTING TO WEIGH ON RELATIVE PERFORMANCE OF THE CONSUMER DISCRETIONARY SECTOR WHICH APPEARS TO BE LOSING UPSIDE MOMENTUM -- CYCLICAL STOCKS ARE ALSO LOSING GROUND VERSUS DEFENSIVE CONSUMER STAPLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAIL SPDR TUMBLES TO TWO-MONTH LOW... Retail stocks are having a bad chart day. The daily bars in Chart 1 show the S&P Retail SPDR (XRT) falling to the lowest level in two months, and trading below its 50-day average (blue line) by the widest margin since March....

READ MORE

MEMBERS ONLY

Evidence Of A Major Upside Dollar Breakout Is Growing

by Martin Pring,

President, Pring Research

* Dollar Index experiences a false downside breakout

* Euro encounters a false upside breakout

* Yen completes a bearish multi-year continuation formation

* Swiss franc completes a broadening wedge

Back in mid-September, I wrote an article where I pointed out that the Dollar was on a knife edge. This view was based on...

READ MORE

MEMBERS ONLY

October 2018 Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For October is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

CONSUMER CYCLICALS AND TECHNOLOGY ARE THE YEAR'S STRONGEST SECTORS -- BUT HEALTHCARE HAS BECOME THE NEW MARKET LEADER -- AND REMAINS MUCH CHEAPER THAN THE OTHER SECTOR LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE HAS BECOME NEW SECTOR LEADER... The three strongest sector leaders since the start of this year have been consumer cyclicals, technology, and healthcare (in that order). But those numbers don't reflect the fact that healthcare has become the strongest market sector over the past three and six...

READ MORE

MEMBERS ONLY

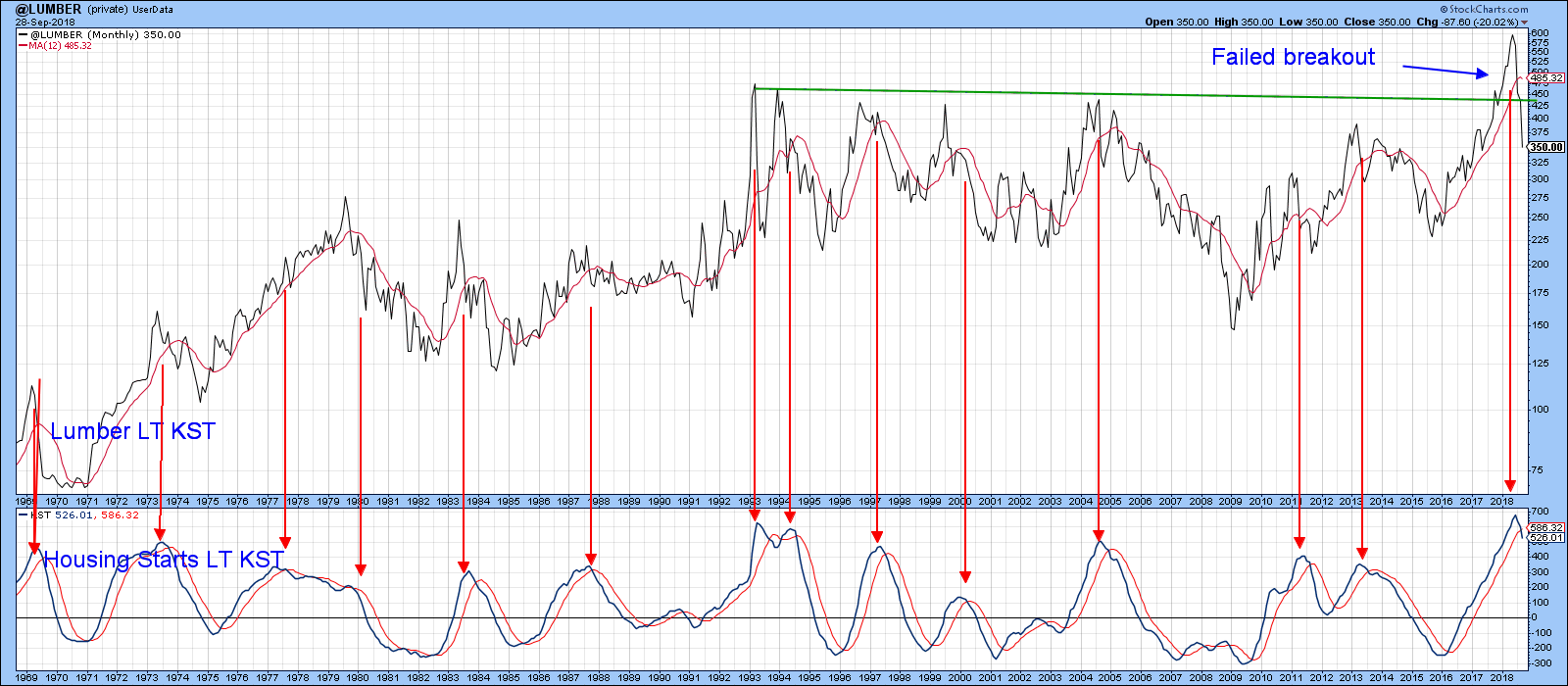

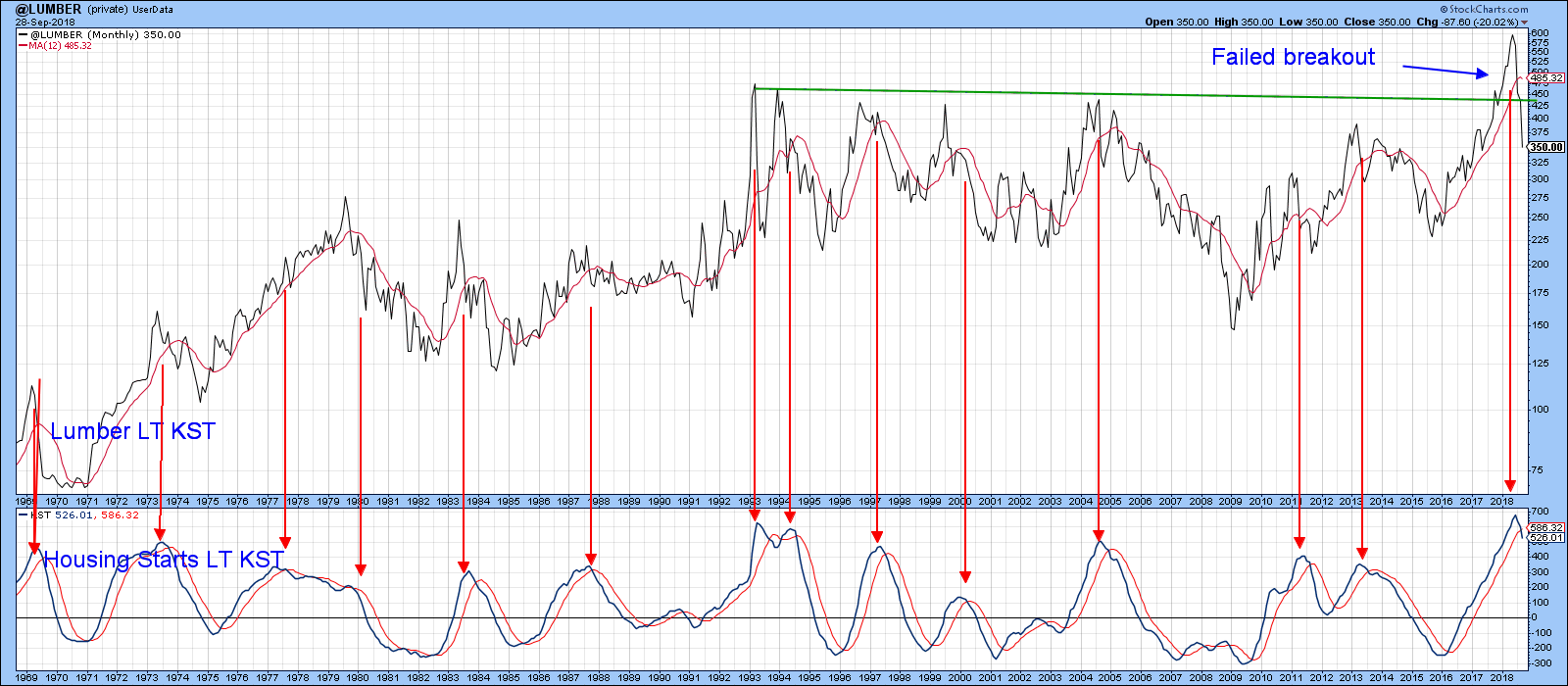

Recent Weak Lumber Prices Are Not A Good Sign For Housing Stocks

by Martin Pring,

President, Pring Research

* The connection between lumber and housing starts

* What the homebuilding ETF’s are saying

Nonfarm payrolls are an economic series that is widely followed by the investment community. However, it’s a coincident indicator, meaning it tells you what is going on now, not what might happen in the future....

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY IS TESTING ITS MAY HIGH -- A CLOSE ABOVE THAT LEVEL WOULD CONSTITUTE A MAJOR BULLISH BREAKOUT -- RISING TREASURY YIELDS ARE BEING SUPPORTED BY HIGHER FOREIGN YIELDS -- UK BOND YIELD HAS REACHED A TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD IS AT A CRUCIAL CHART POINT ... Treasury bond yields are going through an important test of overhead resistance. Chart 1 shows the 10-Year Treasury yield ($TNX) challenging its May 2018 intra high near 3.11%. After pulling back from its May high, the TNX entered a sideways...

READ MORE

MEMBERS ONLY

ENERGY PRICES RISE AS OPEC DOESN'T BOOST OUTPUT -- DB ENERGY FUND RISES TO THREE-YEAR HIGH -- ENERGY SECTOR SPDR RISES TO TWO-MONTH HIGH -- SO DOES THE S&P OIL & GAS EXPLORATION AND PRODUCTION SPDR -- MARATHON PETROLEUM HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

INVESCO DB ENERGY FUND REACHES THREE-YEAR HIGH ... This past weekend's meeting between OPEC and Russia ended with no agreement to boost output to counter rising oil price. As a result, oil and other energy prices are rising sharply today. Chart 1 shows the Invesco DB Energy Fund (DBE)...

READ MORE

MEMBERS ONLY

WEEKLY RECAP SHOWS MATERIALS AND FINANCIALS LEADING MARKET HIGHER, WHILE TECHNOLOGY AND UTILITIES LAG BEHIND -- RECORD HIGH IN THE DOW MAY BE TIED TO EASING IN GLOBAL TENSIONS AND REBOUND IN FOREIGN CURRENCIES AND STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS AND FINANCIALS LEAD, TECHS AND UTES LAG: The Dow and S&P 500 hit new records this past week, while the Nasdaq lost some ground. A rebound in chemicals and copper stocks made materials the weekly leader. Financials benefited from a jump in bond yields. That also explains...

READ MORE

MEMBERS ONLY

UNITED STATES OIL FUND IS TESTING SUMMER HIGH -- WHILE ENERGY SPDR TESTS AUGUST HIGH -- ENERGY LEADERS INCLUDE CONOCOPHILLIPS, HESS, AND MARATHON OIL -- EXXON MOBIL AT EIGHT-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

UNITED STATES OIL FUND NEARS THREE-YEAR HIGH... The price of crude oil has reached a critical chart juncture. Chart 1 shows the United States Oil Fund (USO) in the process of testing its early July peak. A close through that barrier would put the USO at the highest level in...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 HIT NEW RECORDS -- THE DOW IS THE LAST ONE TO CLEAR ITS JANUARY HIGH -- COMMODITY CHEMICALS HELP BOOST MATERIALS SPDR TO SIX MONTH HIGH -- SEMICONDUCTORS CONTINUE TO STABILIZE -- U.S. DOLLAR FALLS TO TWO-MONTH LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW IS THE LAST TO CLEAR ITS JANUARY HIGH... Another day of rising stock prices has pushed the Dow and the S&P 500 to new records. In the case of the SPX (Chart 1), today's new high is enough to push it back above its...

READ MORE

MEMBERS ONLY

Dollar Index Is On A Knife Edge

by Martin Pring,

President, Pring Research

* Long-term dollar technical position

* Short-term picture bearish outcome

* Short-term picture bullish outcome

* Euro

* Yen

* Swiss franc

Long-term dollar technical position

I have been primary trend bullish on the dollar for several months. That opinion still stands because the Dollar Index is well above its 12-month MA and its long-term KST...

READ MORE

MEMBERS ONLY

FOUR-MONTH HIGH IN THE 10-YEAR TREASURY YIELD LIFTS FINANCIAL SPDR TO SIX-MONTH HIGH AND THE DAY'S STRONGEST SECTOR -- BUT MAKES UTILITIES THE DAY'S WEAKEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING BOND YIELDS HELP FINANCIALS, BUT HURT UTILITIES... This morning's message suggested that this week's upside breakout in bond yields was helping financial stocks which were the day's strongest sector. The green bars on top of Chart 1 show the 10-Year Treasury yield surging...

READ MORE

MEMBERS ONLY

UPSIDE BREAKOUT IN BOND YIELDS IS BOOSTING FINANCIAL STOCKS -- CITIGROUP AND JP MORGAN NEAR UPSIDE BREAKOUTS -- INSURANCE ISHARES HIT SEVEN-MONTH HIGH TO LEAD XLF HIGHER -- PRUDENTIAL AND PRINCIPAL FINANCIAL GROUP ACHIEVE UPSIDE BREAKOUTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS GET A BOOST FROM RISING BOND YIELDS ... Yesterday's message showed the 10-Year Treasury yield rising to the highest level in four months. That probably explains why financials are leading the market higher today. Chart 1 shows the Financial Sector SPDR (XLF) bouncing sharply off its moving average...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD EXCEEDS 3% -- 20-YEAR T-BOND ISHARES BREAK SUPPORT -- THE DOW NEARS ITS JANUARY HIGH -- BOEING AND CATERPILLAR CLEAR RESISTANCE -- QQQ HOLDS 50-DAY LINE -- SEMICONDUCTORS CONTINUE TO STABILIZE ABOVE 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD REACHES FOUR-MONTH HIGH ... Chart 1 shows the 10-Year Treasury Yield ($TNX) rising above its twin summer peaks near 3.00% and reaching the highest level in four months. That upside move breaks the TNX out of the three-month sideways pattern that it had been trading in; and...

READ MORE

MEMBERS ONLY

STOCKS LOSE SOME UPSIDE MOMENTUM --AMAZON AND MCDONALDS PULL CYCLICALS LOWER -- INDUSTRIALS CONTINUE TO RALLY -- LED BY FEDEX, HARRIS CORP, AND PACCAR -- TEN-YEAR YIELD TESTS 3% AGAIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM SIGNS OF WEAKNESS ... The uptrend in U.S. stocks remains very much intact. However, upside momentum is weakening a bit. Chart 1, for example, shows the S&P 500 trading sideways over the past couple of weeks which is not unusual. The daily MACD lines (which are overlaid...

READ MORE

MEMBERS ONLY

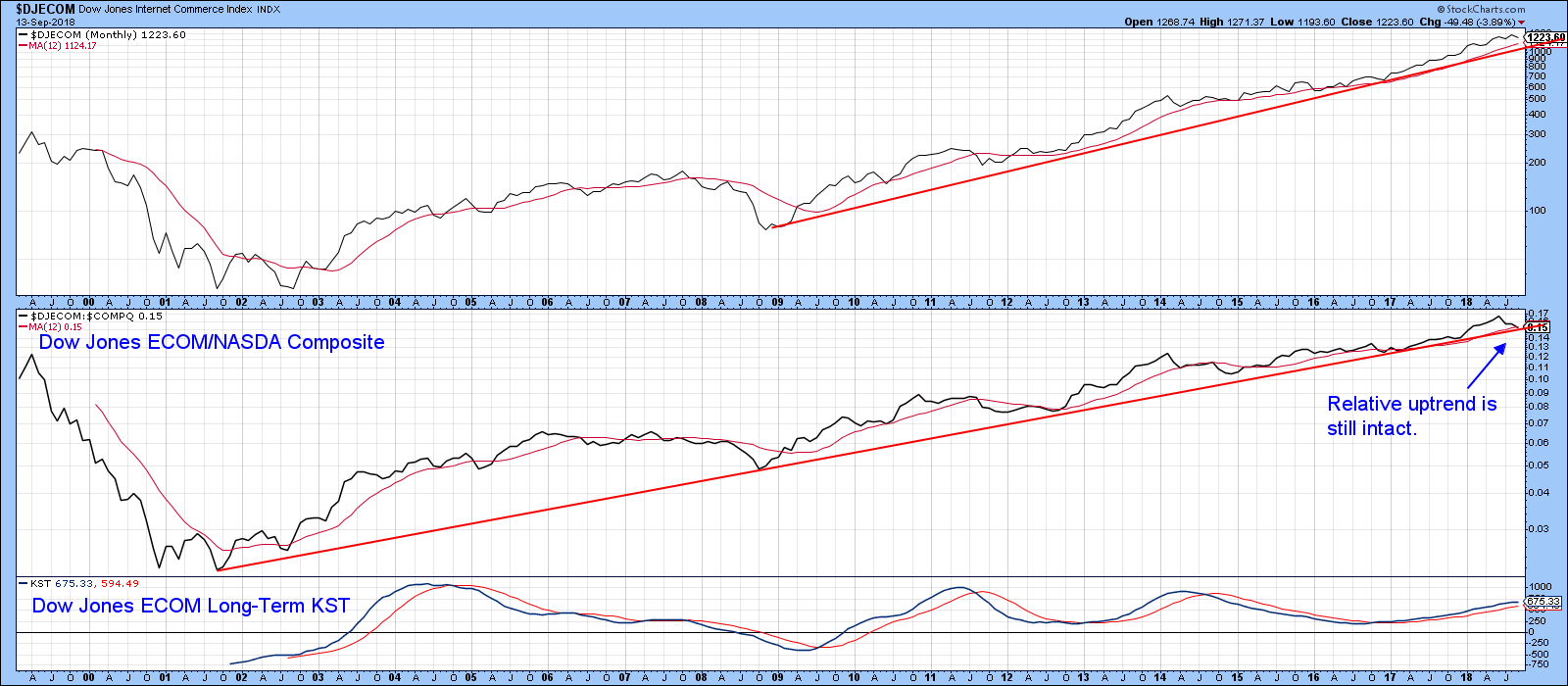

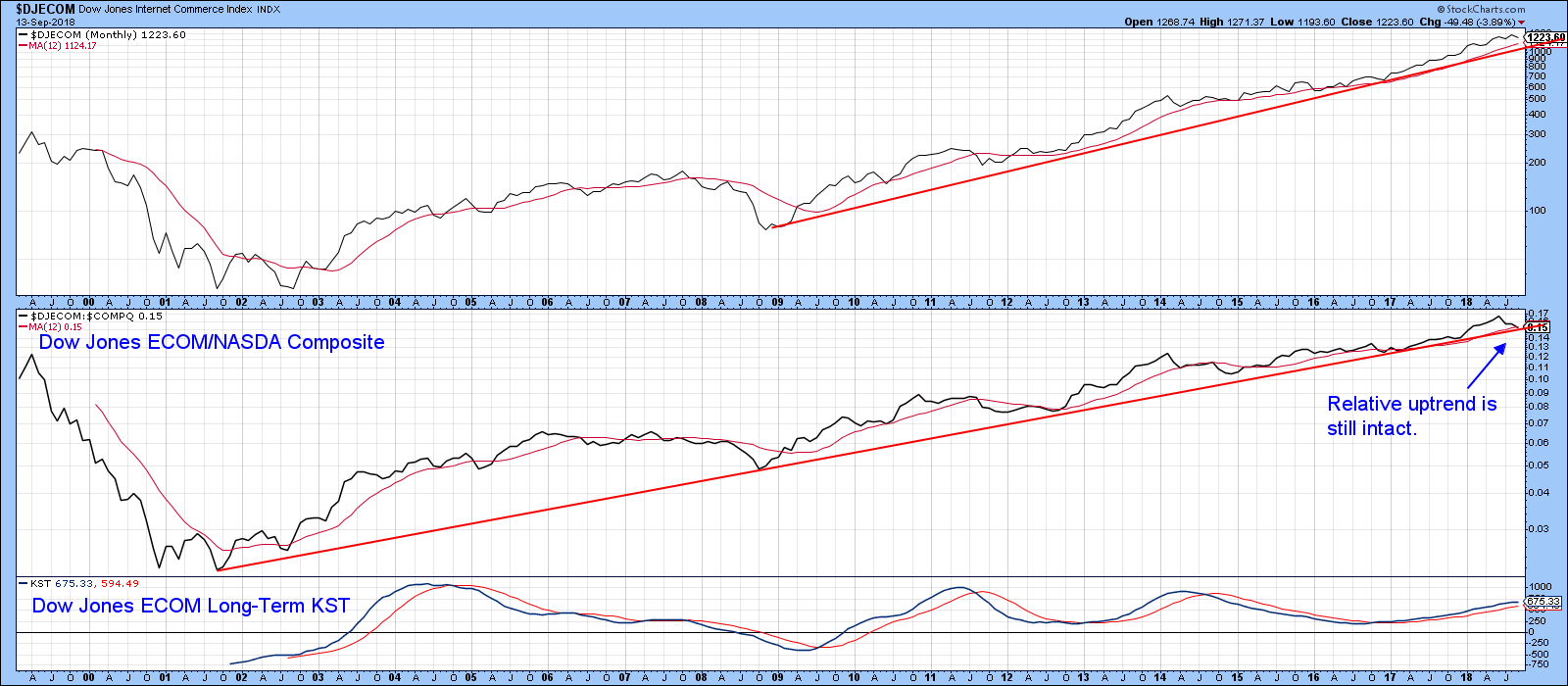

Is It A Bubble When ...

by Martin Pring,

President, Pring Research

* A few thoughts on bubbles

* Technical comments on the Dow Jones Internet Commerce Index

* China on the brink

A few thoughts on bubbles

Last week, I pointed out that most of the FAANG stocks remained in uptrends, with the possible exception of Netflix and the confirmed bear market in Facebook....

READ MORE

MEMBERS ONLY

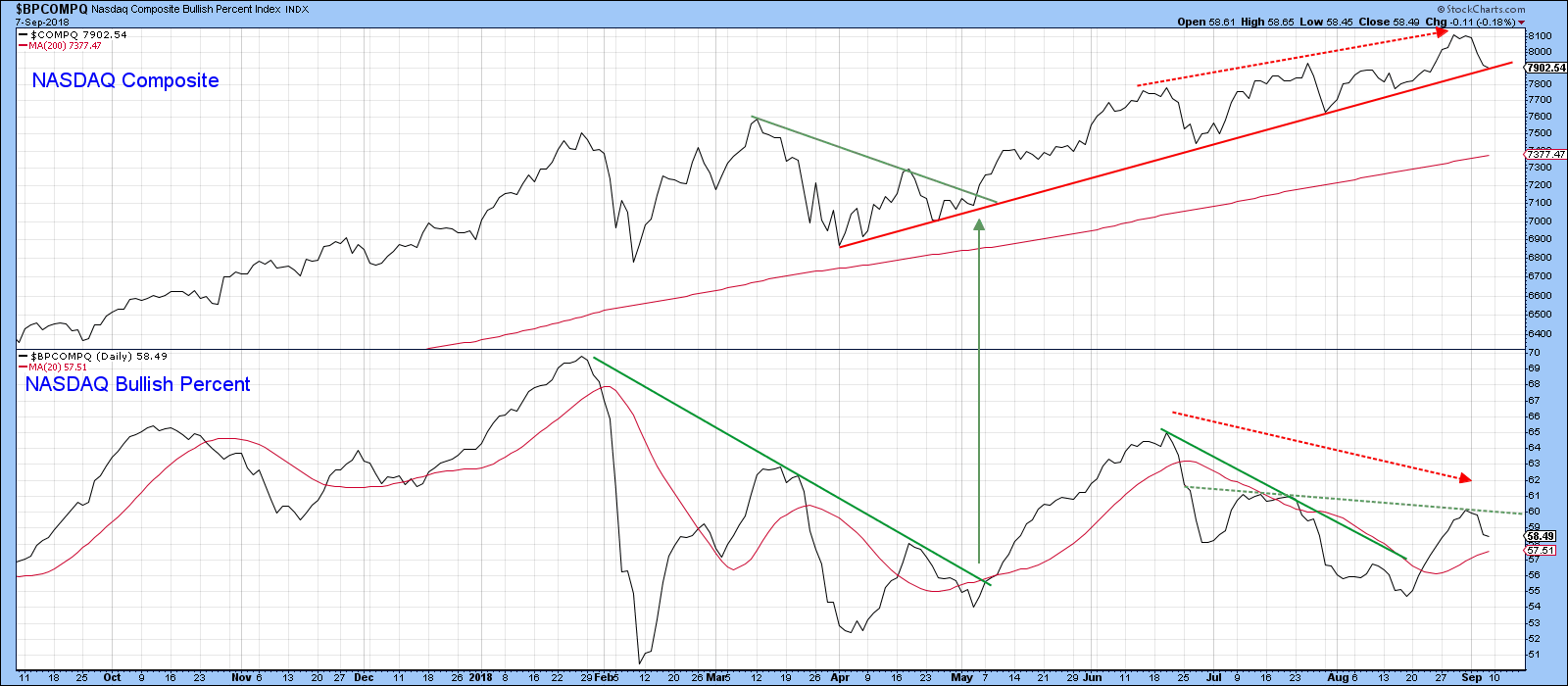

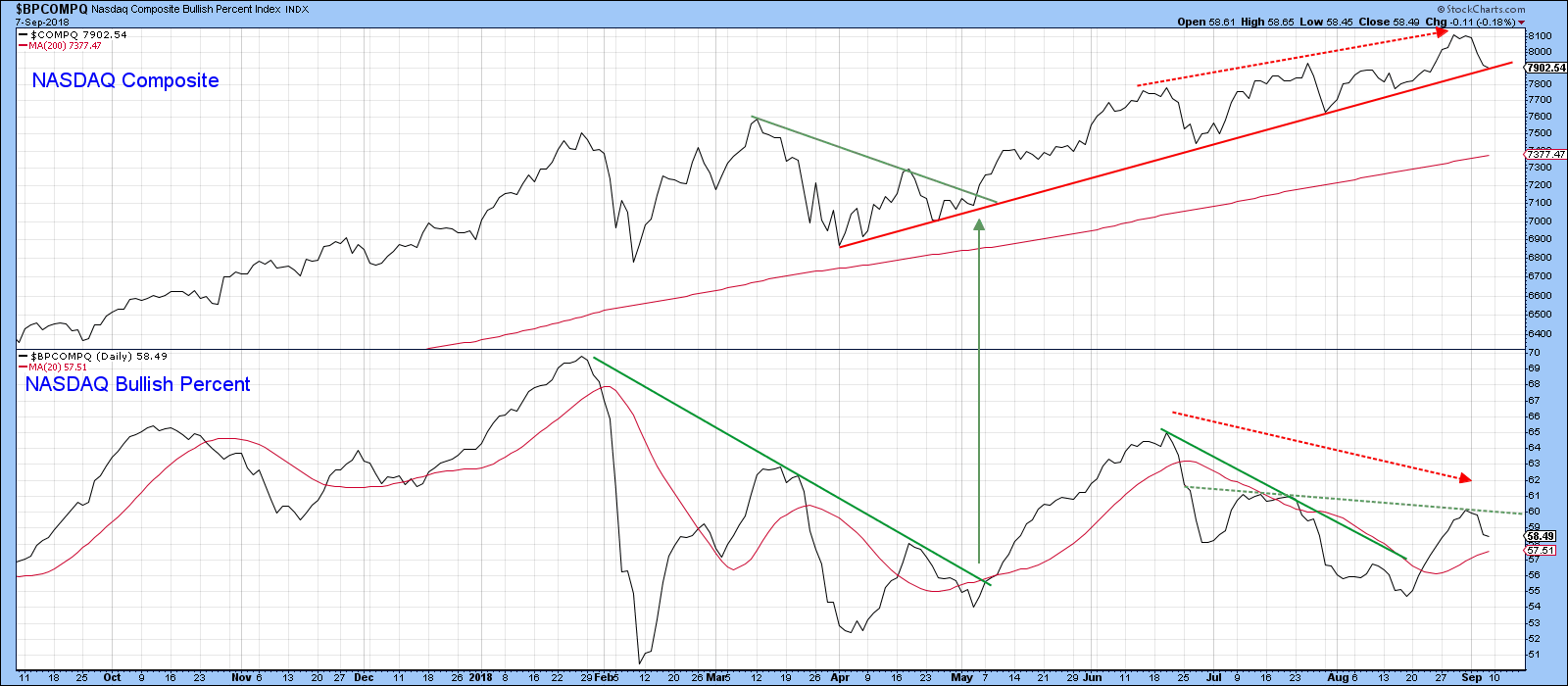

Facebook Does An About Face, But What About The Other FAANG Stocks?

by Martin Pring,

President, Pring Research

* NASDAQ breadth data offers conflicting signals

* Bullish FAANG Stocks

* De-fanged stock

NASDAQ breadth data offering conflicting signals

We have seen some attention paid to tech stocks as they have corrected in the last week or so. The so called FAANG (Facebook, Apple, Amazon, Alphabet’s Google and Netflix) have been...

READ MORE

MEMBERS ONLY

CONSUMER DISRETIONARY SPDR IS YEAR'S STRONGEST SECTOR -- BUT IT MAY BE OVERSTATING SECTOR'S STRENGTH -- ITS EQUAL WEIGHTED ETF IS LAGGING THE XLY BY AN USUALLY WIDE GAP OF 11% -- OUTSIZED GAINS IN AMAZON AND NETFLIX MAY EXAGGERATING ITS 2018 PERFORMANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR IS YEAR'S STRONGEST SECTOR ... Chart 1 shows the Consumer Discretionary SPDR (XLY) trading near a new record. Its 2018 gain of 18% makes it the year's strongest sector. That puts the XLY ahead of technology (16%) and healthcare (12%) for the year. In...

READ MORE

MEMBERS ONLY

TWITTER LEADS TECH STOCKS LOWER -- DEFENSIVE CONSUMER STAPLES, UTILITIES, AND REITS CONTINUE TO ATTRACT NEW MONEY -- NETFLIX WEIGHS ON CONSUMER DISCRETIONARY STOCKS -- AMAZON IS A QUARTER OF THE XLY AND MAY BE OVERSTATING THIS YEAR'S CYCLICAL LEADERSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

OVERBOUGHT TECH SECTOR SEES SOME PROFIT-TAKING ... Chart 1 shows the Technology Sector SPDR (XLK) losing more than 1% today to lead the market lower. Its 9-day RSI line (top chart) had reached overbought territory above 70 suggesting that the XLK was due for a pullback. It's now testing...

READ MORE

MEMBERS ONLY

September 2018 Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

The MarketRoundup Video For September is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

US Stocks Take On Global Equities, Gold, Commodities And Bonds

by Martin Pring,

President, Pring Research

* US Equities versus the world

* Stocks versus Commodities

* Stocks and bonds

* Stocks compared to gold

There are lots of seasonal reasons to be bearish on the stock market, such as September being the weakest month and mid-term election years having a downward bias. However, if you compare the S&...

READ MORE

MEMBERS ONLY

U.S. STOCKS HAVE A STRONG AUGUST -- TECHNOLOGY, CONSUMER CYCLICALS, AND HEALTHCARE ARE SECTOR LEADERS -- U.S. STOCK UPTREND IS STRETCHED BUT STILL INTACT -- MEXICAN PESO STEADIES ON TRADE DEAL -- CANADIAN DOLLAR DROPS ON FRIDAY'S LACK OF AGREEMENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS HAVE A STRONG AUGUST ... U.S. stocks had a strong August with the Nasdaq, S&P 500, Russell 2000, and Dow Transports hitting record highs. Technology, Consumer Cyclicals, and Healthcare saw the biggest percentage gains and hit record highs. The three weakest sectors were Energy, Materials, and Industrials....

READ MORE

MEMBERS ONLY

LATE AUGUST REBOUND IN FOREIGN STOCKS HELPED PUSH U.S. STOCKS TO NEW RECORD -- AND CONTRIBUTED TO UPSIDE BREAKOUTS IN GLOBAL STOCK INDEXES -- THE DOW INDUSTRIALS ARE HEADED TOWARD THEIR JANUARY PEAK -- THE DOW TRANSPORTS HIT A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN STOCK ETFS ARE FINALLY BOUNCING ... Before leaving on vacation on August 15, I expressed concern about the fact that foreign stock ETFs were lagging too far behind the U.S. which could threaten the uptrend in the S&P 500 which was nearing a test of its January...

READ MORE

MEMBERS ONLY

Bond Yields Reach A Critical Support Zone

by Martin Pring,

President, Pring Research

* The longer-term picture argues for lower yields

* Deflationary forces gain the upper hand

* Bond yields at crucial short-term support

* UK Yields in a life or death struggle

The longer-term picture argues for lower yields

Earlier in the month I wrote an article pointing out that many bond yields had reached...

READ MORE

MEMBERS ONLY

STOCKS IN STRONG REBOUND AFTER SURVIVING TEST OF 50-DAY AVERAGES YESTERDAY -- ALL SECTORS ARE IN THE BLACK -- A REBOUND IN FOREIGN MARKETS IS ALSO HELPING -- NEWS OF CHINA NEGOTIATIONS MAY ALSO BE SUPPORTING THE STOCK UPTURN

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK AVERAGES REBOUND SHARPLY... U.S. stock indexes are having an unusually strong day. Chart 1 shows the Dow Jones Industrial Average climbing more than 400 points (1.6%) in afternoon trading. The Dow tested its 50-day average yesterday and held. Chart 2 shows the S&P 500...

READ MORE

MEMBERS ONLY

More Evidence Of A Commodity Bear Market

by Martin Pring,

President, Pring Research

* Commodities starting to generate some long-term sell signals

* Internals and commodity intermarket relationships are deteriorating

* Energy has been lagging on the downside but may be ready to play catch up

Earlier in the summer I wrote a couple of articles on copper and oil suggesting some short-term vulnerability, but concluding...

READ MORE

MEMBERS ONLY

FOREIGN STOCKS LEAD U.S. LOWER -- EMERGING MARKETS AND EAFE ISHARES FALL TO LOWEST LEVEL IN A YEAR -- STRONGER DOLLAR AND WEAKNESS IN CHINA PUSH METALS LOWER AND STOCKS TIED TO THEM -- ENERGY STOCKS ARE ALSO WEAKENING WITH OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN STOCK ETFS FALL TO NEW LOWS... Last Thursday's message expressed concern that weakness in foreign stocks could start to weigh on U.S. stocks, especially with the S&P 500 testing major resistance at its January high. That dangerous situation has taken a turn for the...

READ MORE

MEMBERS ONLY

Getting Through The Old Highs Could Be A Challenge

by Martin Pring,

President, Pring Research

* Last week's test of the highs leaves a lot to be desired

* Breadth and momentum indicators fail to confirm

* Some international charts not looking so good

Last week's test of the highs leaves a lot to be desired

If the charts in this article look a...

READ MORE

MEMBERS ONLY

U.S. STOCKS MAY BE GETTING TOO FAR AHEAD OF THE REST OF THE WORLD -- U.S. STOCKS USUALLY DO BETTER WHEN FOREIGN STOCKS ARE ALSO RISING -- U.S. STOCK RECORDS IN 2012 AND 2016 WERE SUPPORTED BY RISING FOREIGN SHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS TESTING ITS JANUARY HIGH ... The black bars in Chart 1 show the S&P 500 nearing a test of its January high. That's an important test for it and the rest of the market. A test of a previous high is very...

READ MORE

MEMBERS ONLY

LONG-RANGE DOLLAR UPTREND REMAINS INTACT -- LATE CYCLE COMMODITY UPTURN IS UNLIKELY WITH A RISING DOLLAR -- STRONG DOLLAR FAVORS U.S. OVER FOREIGN STOCKS -- ESPECIALLY EMERGING MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONG-TERM TREND OF THE DOLLAR IS STILL UP... The direction of the U.S. dollar is important because it influences (or is influenced by) by a lot of other markets. That includes commodities, global interest rates, and global stocks. Dollar direction also influences the relative performance of small cap stocks...

READ MORE

MEMBERS ONLY

FINANCIAL SPDR ACHIEVES BULLISH BREAKOUT -- INDUSTRIAL SPDR MAY BE NEXT -- MATERIALS SPDR REGAINS MOVING AVERAGE LINES -- THE DOW INDUSTRIALS AND TRANSPORTS ARE BREAKING OUT TOGETHER -- THE S&P 500 NEARS TEST OF JANUARY HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS SPDR BREAKS OUT ... Global stocks are having a strong day. Rebounds in foreign developed and emerging markets set the tone for higher trading in the states. All major U.S. indexes are in the black, as are most stock sectors. The strongest sectors are energy, financials, industrials, and materials....

READ MORE