MEMBERS ONLY

REGIONAL BANK SPDR EXCEEDS 50-DAY AVERAGE -- LEADERS INCLUDE M&T BANK, BB&T CORP, AND REGIONS FINANCIAL -- JPM IS ANOTHER BANK LEADER -- TRANSPORTS BOUNCE OFF 200-DAY AVERAGE -- WEAK DOLLAR BOOSTS METALS -- STOCK REBOUND STILL HAS FURTHER TO GO

by John Murphy,

Chief Technical Analyst, StockCharts.com

REGIONAL BANK SPDR CLEARS 50-DAY AVERAGE... One of the simplest ways to determine which stock groups, or individual stocks, are leading the market higher is to look for the ones that are clearing their 50-day moving averages first (or stayed above them). Yesterday's message showed the Consumer Discretionary...

READ MORE

MEMBERS ONLY

STOCKS ARE BUILDING ON FRIDAY'S UPSIDE REVERSAL FROM 200-DAY AVERAGE -- THE NEXT TEST WILL COME AT 50-DAY AVERAGES -- SMALL AND MIDSIZE STOCK INDEXES ALSO BOUNCE OFF 200-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKETS MOVE FURTHER AWAY FROM 200-DAY LINE... Stocks continue to build on the upside reversal that took place on Friday from 200-day moving averages. The daily bars in Chart 1 show the S&P 500 gaining enough ground today to climb back over its 100-day line (green line). The...

READ MORE

MEMBERS ONLY

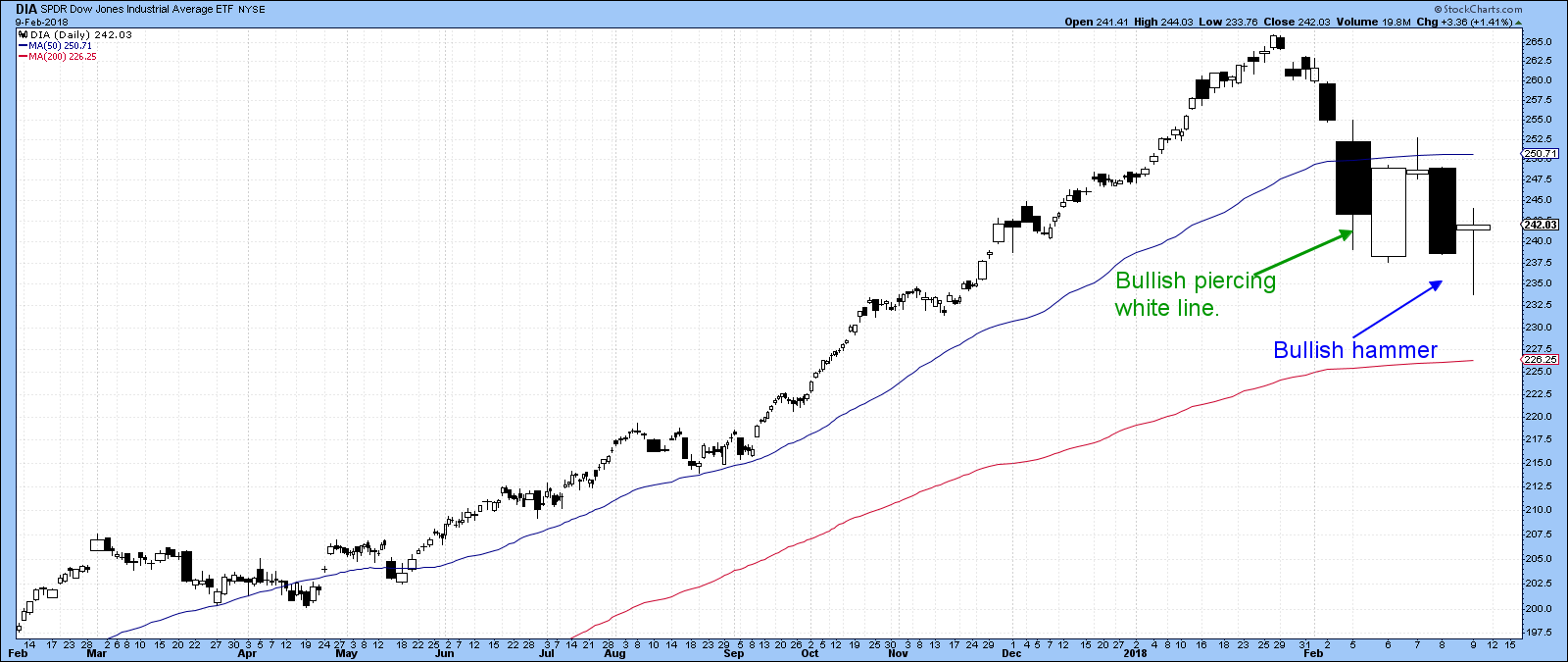

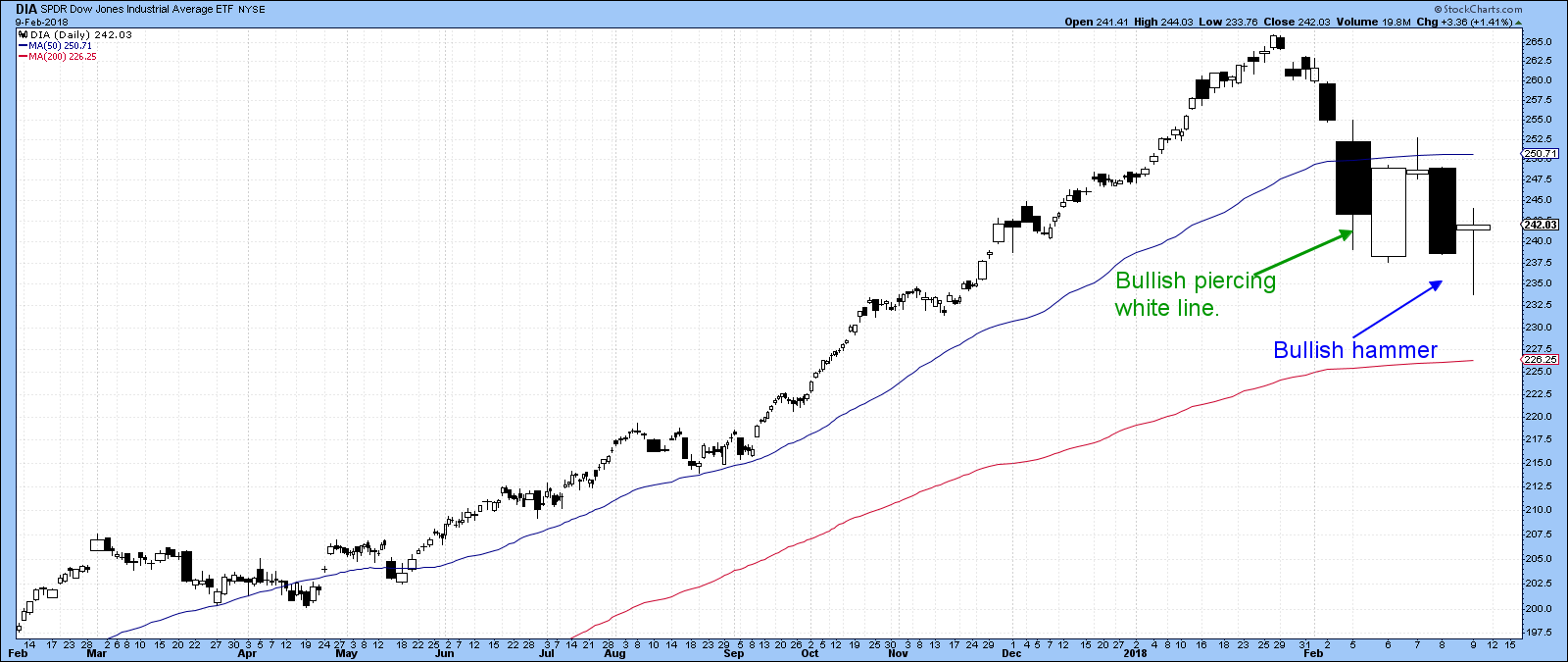

US Stock Traders Get Out Their Hammers

by Martin Pring,

President, Pring Research

* Bottoms are being “hammered” out

* VIX is quietening down

* Net new highs offer green shoots

* NASDAQ Chart is turning

Bottoms are being “hammered” out

It has certainly been a wild ride this week, but Friday saw several major indexes trace out a Japanese candlestick pattern known as a “hammer”. This...

READ MORE

MEMBERS ONLY

AN OVERSOLD S&P 500 IS TRYING TO STABILIZE AT ITS 200-DAY MOVING AVERAGE -- THE VIX INDEX IS PULLING BACK FROM RESISTANCE ABOVE THE 40 LEVEL FOR THE SECOND TIME THIS WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS TESTING ITS 200-DAY AVERAGE ... The downside correction that started a week ago pushed stock prices lower again today. But they're trying to stabilize in afternoon trading. Chart 1 shows the S&P 500 trying to find support at its 200-day moving average....

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE RETESTING INTRA-DAY SUPPORT LEVELS FORMED ON TUESDAY -- THE REBOUND IN THE VIX IS MUCH WEAKER THAN ON TUESDAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ARE RETESTING TUESDAY'S INTRA-DAY LOWS... Stocks are falling sharply again today and are in the process of retesting intra-day support levels formed on Tuesday. That's an important test. The 10-minute bars in Chart 1 shows the Dow Industrials testing lows formed Tuesday between...

READ MORE

MEMBERS ONLY

BOND YIELDS CLIMB BACK NEAR RECENT HIGH -- A BOUNCING DOLLAR IS PUSHING COMMODITIES LOWER -- THE RUSSELL 2000 SMALL CAP INDEX IS BOUNCING OFF ITS 200-DAY MOVING AVERAGE -- THE S&P 500 SLIPS INTO THE RED NEAR THE CLOSE IN HEAVIER TRADING

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD NEARS ANOTHER FOUR-YEAR HIGH ... A plunging stock market earlier in the week caused some safe-haven bond buying which caused bond yields to weaken. Chart 1, however, shows the 10-Year Treasury yield climbing 7 basis points today and very close to another four-year high. The recent upside breakout...

READ MORE

MEMBERS ONLY

Evidence of A Bottom Looking Stronger

by Martin Pring,

President, Pring Research

* Bullish piercing white line

* Bullish volume

* VIX signaling volatility retreating again

Bullish piercing white line

Tuesday’s market action suggests that the selling squall is over, at least for the time being. That’s because a couple of indexes experienced a bullish candlestick pattern known as a piercing white line....

READ MORE

MEMBERS ONLY

STOCKS ACHIEVE UPSIDE REVERSAL -- S&P 500 BOUNCES OFF TRENDLINE SUPPORT AND 100-DAY AVERAGE -- THE VIX REVERSES LOWER AFTER FAILING TO STAY OVER 40 LEVEL -- APPLE AND DOWDUPONT BOUNCE SHARPLY OFF 200-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 REBOUNDS OFF CHART SUPPORT... After opening sharply lower, stocks achieved an upside reversal on heavier volume than yesterday. And stocks bounced off a couple of important support levels. Yesterday's message showed a rising trendline extending back to late 2016 near the 2600 level. The...

READ MORE

MEMBERS ONLY

What To Look For Next

by Martin Pring,

President, Pring Research

* Primary trend indicators are still bullish

* Short-term indicators still overbought

* Very short-term indicators already at extremes

* Bonds bottoming short-term?

I have been saying for some time that the market’s primary trend is a bullish one and that we should not get hung up with short-term corrections. That theory is...

READ MORE

MEMBERS ONLY

STOCKS HAVE WORST DAY IN YEARS -- 50-DAY AVERAGES HAVE BEEN BROKEN -- S&P 500 APPEARS HEADED FOR RETEST OF RISING TRENDLINE EXTENDING BACK TO 2016 -- VIX DOUBLES TO HIGHEST LEVEL IN MORE THAN TWO YEARS -- LATE RALLY IN MAJOR STOCK INDEXES FADES

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 FALLS BELOW 50-DAY AVERAGE... Stocks had a terrible day today. Major stock indexes in the U.S. lost about 4% in one day. And some chart damage was done. The daily bars in Chart 1 show the S&P 500 falling well below its 50-day...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS ARE RATTLING STOCK HOLDERS -- TEN YEAR YIELD REACHES FOUR-YEAR HIGH -- BOND YIELDS ARE RISING FASTER THAN STOCKS FOR THE FIRST TIME SINCE THE BULL MARKET STARTED -- THE VIX INDEX SURGES TO FIFTEEN-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS ARE CLIMBING ... Bond yields are rising a lot faster than a lot of people expected. And that's starting to worry stock holders. The weekly bars in Chart 1 show the 30-Year Treasury Yield rising over 3.00% for the first time since last March and heading...

READ MORE

MEMBERS ONLY

Market Roundup With Martin Pring 2018-02-01

by Martin Pring,

President, Pring Research

* Big changes in all four areas

* Equities

* Commodities

* Currencies

* Bonds

This months market roundup has a lot of charts that are breaking out on long term relative strength breakouts.

Market Roundup With Martin Pring 2018-02-01 from StockCharts.com on Vimeo.

Chartcon 2018 registration is now open! Registration kicked off today,...

READ MORE

MEMBERS ONLY

Pause In An Ongoing Uptrend?

by Martin Pring,

President, Pring Research

* The underlying trend of improving confidence continues

* Several indicators are pointing to some kind of a correction

* Small caps are lagging

The underlying trend of improving confidence continues

The longer-term indicators monitoring the primary trend of the US stock market continue to point north. So too, do the various confidence...

READ MORE

MEMBERS ONLY

AVERAGE DIRECTIONAL INDEX SHOWS AN OVERBOUGHT MARKET IN NEED OF A BREATHER -- THE LAST 5% PULLBACK IN STOCKS WAS FIFTEEN MONTHS AGO -- CONTRACTING BOLLINGER BANDS ALSO HINT AT SOME WEAKENING IN THE MARKET'S SHORT-TERM UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS DUE FOR A PAUSE ... There are a number of ways to tell when a market is stretched too far. My January 6 message pointed out that the 14-month RSI for the S&P 500 was the most overbought since the late 1990s (twenty years...

READ MORE

MEMBERS ONLY

CRB COMMODITY INDEX ACHIEVES A BULLISH BREAKOUT BY REACHING A TWO-YEAR HIGH -- THAT HELPED PUSH THE TEN-YEAR TREASURY YIELD TO THE HIGHEST LEVEL IN THREE YEARS -- SO DID THE FACT THAT GERMAN AND AND BRITISH YIELDS TURNED UP THIS WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRB INDEX ACHIEVES BULLISH BREAKOUT ... A couple of messages during the week showed the Bloomberg Commodity Index nearing a two-year high. It broke through those highs during the week. Today's message shows the more widely-followed Reuters/Jefferies CRB Index accomplishing a bullish breakout of its own by rising...

READ MORE

MEMBERS ONLY

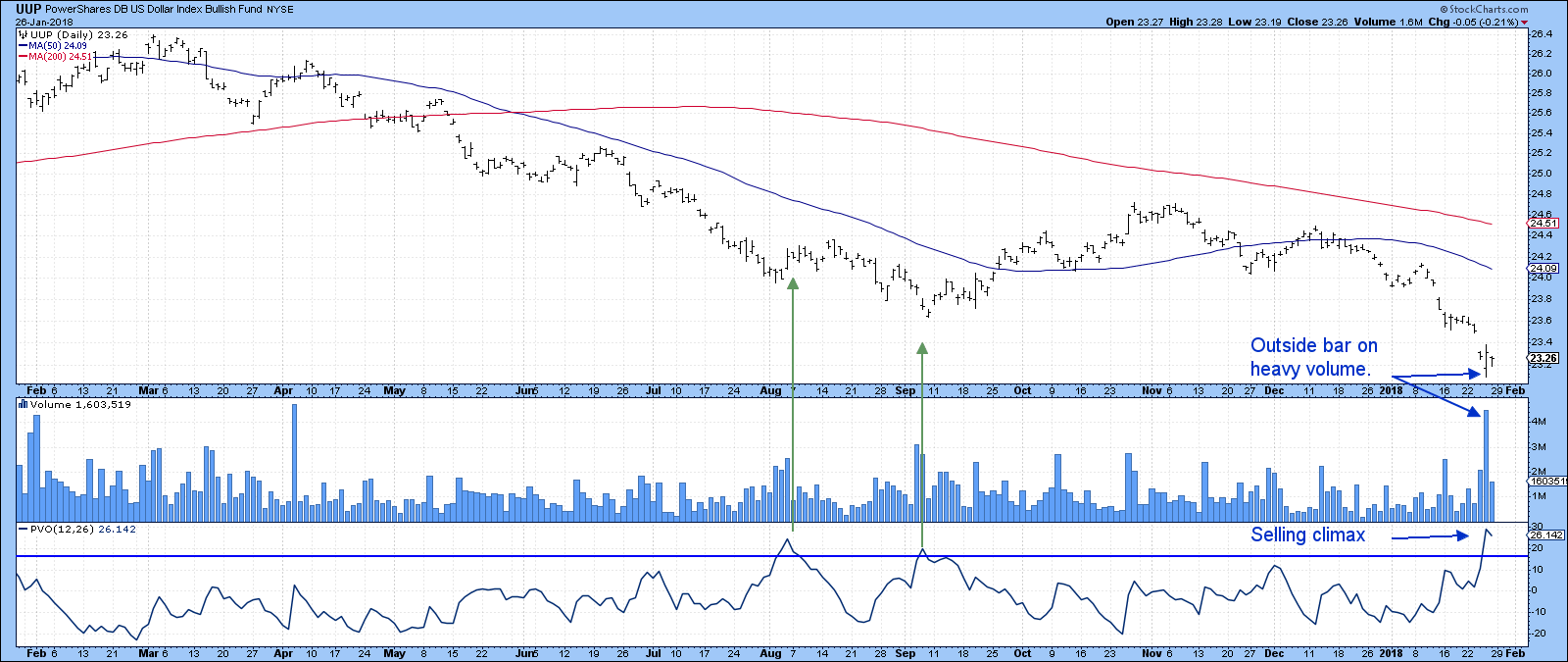

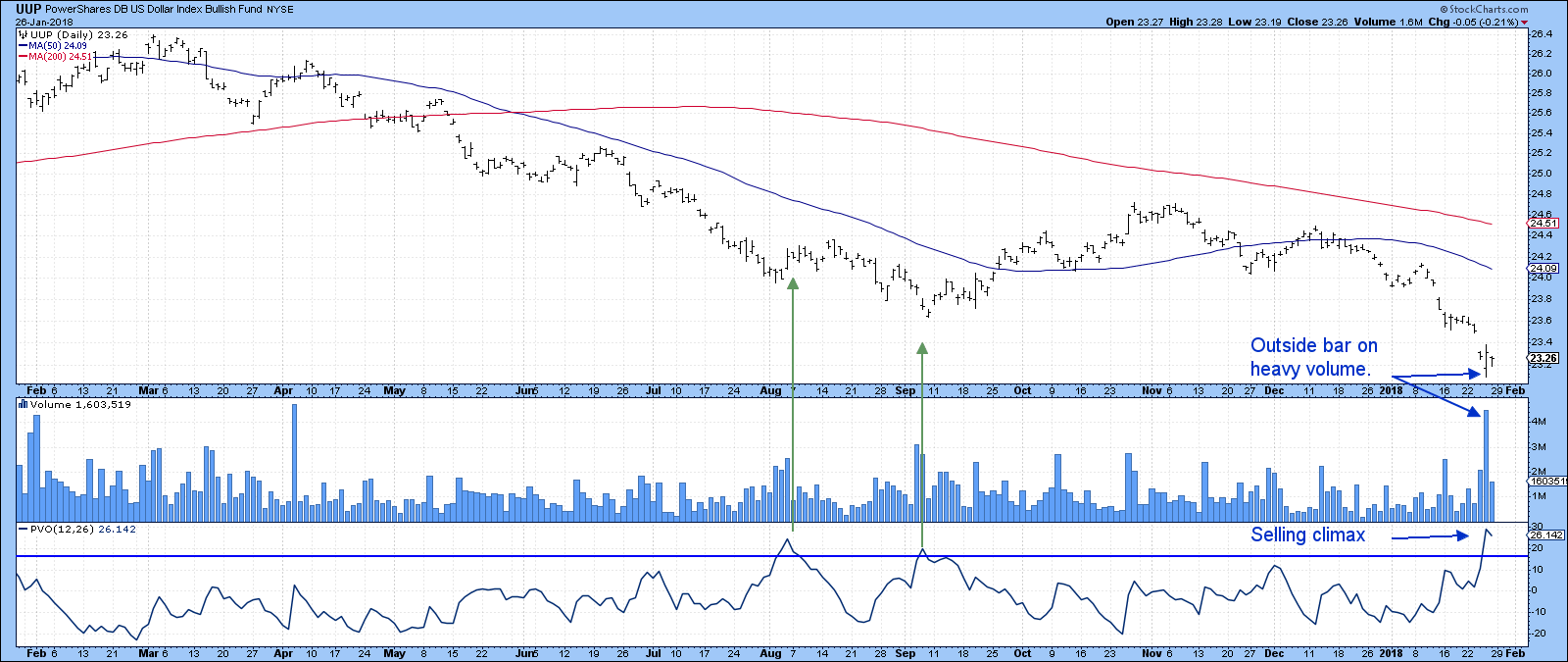

Dollar Bear Market Is Not A One Way Street

by Martin Pring,

President, Pring Research

* Dollar experiences a short-term reversal

* Commodities are in a bull market but adversely affected near-term

* Gold showing signs of tiredness but still within a base building process

Dollar experiences a short-term reversal

It’s a funny thing in markets, when you have just grown comfortable with a move, it sometimes...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR HITS NEW RECORD AND IS PLAYING CATCH-UP TO THE REST OF THE MARKET -- AMGEN AND BIOGEN LEAD BIOTECH ISHARES HIGHER -- ABBVIE EXPLODES TO NEW RECORD AND HELPS BOOST PHARMACEUTICAL ETF TO HIGHEST LEVEL IN TWO YEARS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SECTOR IS PLAYING CATCH-UP ... Healthcare stocks are off to a good start for the new year, and are one of the market's strongest sectors. That's a big change from the past three years when healthcare was one of the markets weakest laggards. That's...

READ MORE

MEMBERS ONLY

TREASURY SECRETARY TALKS DOWN THE DOLLAR WHICH DROPS SHARPLY -- BRITISH POUND SURGES AGAINST THE DOLLAR -- WHILE BRITISH BOND YIELD RISES TO HIGHEST LEVEL IN A YEAR -- BIG DROP IN DOLLAR PUSHES BLOOMBERG COMMODITY INDEX NEAR A TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BRITISH POUND RISES WITH UK BOND YIELDS ... It's now official that the U.S. government wants a weaker dollar. Speaking in Switzerland, Treasury Secretary Mnuchin stated that a weak dollar is good for the U.S. economy, and would help reduce the U.S. trade deficit. That'...

READ MORE

MEMBERS ONLY

FALLING DOLLAR PUSHES BLOOMBERG COMMODITY INDEX TO ELEVEN MONTH HIGH -- GOLD NEARS ANOTHER FOUR-MONTH HIGH -- A WEAK DOLLAR ALSO FAVORS LARGE CAPS OVER SMALLER STOCKS -- S&P BIOTECH SPDR REACHES NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR CONTINUES TO WEAKEN AS FOREIGN CURRENCIES RISE... Chart 1 shows the PowerShares Dollar Index (UUP) falling today to the lowest level in three years. The dollar is losing ground against virtually all major foreign currencies. Most of the upward movement in the UUP is coming from buying of the...

READ MORE

MEMBERS ONLY

Confidence Is Breaking Out All Over

by Martin Pring,

President, Pring Research

* Last week’s bearish dark cloud cover fails

* These confidence ratios are breaking to the upside and that’s bullish for stocks

Last week’s bearish dark cloud cover fails

Last week I pointed out that many of the principal indexes had traced out bearish dark cloud cover candlestick patterns....

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD TOUCHES THREE-YEAR HIGH -- STRONG CHINESE ECONOMY PUSHES MAINLAND STOCKS HIGHER -- HONG KONG HITS A NEW RECORD -- A WEAKER DOLLAR FAVORS FOREIGN STOCKS -- FOREIGN STOCK ETFS GET A BOOST FROM RISING LOCAL CURRENCIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR BOND YIELD TOUCHES THREE-YEAR HIGH ... The weekly bars in Chart 1 show the 10-Year Treasury Yield touching the highest level in three years today. A decisive close above its late 2016 peak (2.62%) would signal even higher rates. That's a lot better for stocks than it...

READ MORE

MEMBERS ONLY

STOCK BUYING RESUMES AFTER YESTERDAY'S PULLBACK -- DOW REGAINS 26K -- YESTERDAY'S INTRA-DAY LOW PROVIDES A SHORT-TERM SUPPORT LEVEL -- SEMICONDUCTORS LEAD TECHNOLOGY SECTOR TO NEW HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET INDEXES NEAR YESTERDAY'S INTRA-DAY HIGH ... Stocks are making a strong comeback after yesterday afternoon's pullback. The charts below show 30-minute price bars for the three major stock indexes. All three are approaching the intra-day highs reached yesterday. Chart 1 also shows the Dow Industrials back...

READ MORE

MEMBERS ONLY

Cold Weather And Dark Cloud Cover Seen Over Wall Street

by Martin Pring,

President, Pring Research

* Dark cloud cover explained

* What enhances a dark cloud signal

* How long is its bearish effect likely to last?

Dark cloud cover explained

The weather forecast this morning was for wintery weather on the East Coast. However, a more sobering non-meteorological message has been given by the stock market. Tuesday’...

READ MORE

MEMBERS ONLY

Several Intermarket Relationships Are Forecasting Higher Commodity Prices

by Martin Pring,

President, Pring Research

* CRB Composite nudging through mega resistance

* Key intermarket relationships starting to point in an inflationary direction

* Inter-asset ratios also confirm the inflationary scenario

* Euro breaks to the upside

CRB Composite nudging through mega resistance

Late last month I wrote about several charts I was watching for a possible breakout in...

READ MORE

MEMBERS ONLY

EURO REACHES THREE-YEAR HIGH AGAINST DOLLAR -- THAT'S GOOD FOR COMMODITIES -- ENERGY SPDR BREAKS OUT TO THE UPSIDE -- DECEMBER CPI ABOVE 2% SECOND MONTH IN A ROW -- CORE CPI HAS BIGGEST JUMP IN 11 MONTHS -- WHAT ENERGY DROP

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO REACHES THREE-YEAR HIGH ... Yesterday's message showed the euro on the verge of a new three-year high. The weekly bars in Chart 1 show the eurozone currency achieving that bullish breakout in today's trading. I also mentioned yesterday that a move above 1.20 would push...

READ MORE

MEMBERS ONLY

A TEN-YEAR TREASURY YIELD MOVE ABOVE 2.62% WOULD PAVE THE WAY FOR 3% YIELD LATER THIS YEAR -- THAT WOULD PUT THE THIRTY-FIVE YEAR DECLINE IN BOND YIELDS IN JEOPARDY -- GERMAN YIELD NEARS TWO-YEAR HIGH ON HAWKISH ECB HINT

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LONGER TERM LOOK AT RISING BOND YIELDS... Chart evidence of a major upturn in Treasury bond yields continues to grow. The weekly bars in Chart 1 show the 10-Year Treasury yield ($TNX) nearing a test of its late 2016 intra-day peak at 2.62%. A decisive move above that...

READ MORE

MEMBERS ONLY

Bond Yields Are Breaking Out All Over

by Martin Pring,

President, Pring Research

* Basic changes in long-term momentum

* The five-year maturity is signalling an end to the secular decline in yields

* Twenty-year yield showing signs of basing

* Ten-year attacking mega down trend line

* From a short-term aspect bond prices look vulnerable

* Utilities about to crash?

Basic changes in long-term momentum

Since the beginning...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD JUMPS TO NINE MONTH HIGH -- BANK OF JAPAN CUTS BOND PURCHASES -- THAT'S BOOSTING BANKS WHILE HURTING UTILITIES -- A DRAMATIC ROTATION OUT OF UTILITIES INTO TRANSPORTS POINTS TO A STRONGER ECONOMY AND HIGHER RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD REACHES HIGHEST LEVEL SINCE MARCH ... Chart 1 shows the 10-Year Treasury Yield ($TNX) climbing 5 basis points to 2.53% which is the highest level since last March. That leaves little doubt that the trend for Treasury yields is upward. Part of the reason for today'...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS START YEAR WITH A BANG WITH STOCKS AROUND THE WORLD HITTING NEW RECORDS -- BUT THE S&P 500 INDEX IS THE MOST OVERBOUGHT IN TWENTY YEARS -- AND IS WELL INTO A FIVE-WAVE ADVANCE -- THE CRB INDEX MAY BE NEARING AN UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS MOST OVERBOUGHT SINCE LATE 1990S... Global stock markets started off the new year with a bang. U.S. stock indexes exploded to record highs for the best start in years. Foreign stock benchmarks did the same, including the FTSE All World Stock Index which also...

READ MORE

MEMBERS ONLY

Martin Pring's Market Roundup Video January 2018-01-03

by Martin Pring,

President, Pring Research

This months Market Roundup live video has a lot of information on the bond market. The six-stage cycle is currently in Stage 3. This large overview shows some of the major macro trends that are breaking right now.

Market Roundup With Martin Pring 2018-01-03 from StockCharts.com on Vimeo.

Good...

READ MORE

MEMBERS ONLY

Dollar Index Is Just Above Make Or Break Support--- Will It Bounce Or Break?

by Martin Pring,

President, Pring Research

Dollar Index is in a confirmed bear market

* Dollar sympathy indicators are close to a major breakdown

* Canadian and Aussie dollars are driven by commodity prices

* Emerging Market ETF benefiting from a weaker dollar

Dollar Index is in a confirmed bear market

As 2018 begins to unfold the Dollar Index...

READ MORE

MEMBERS ONLY

CRUDE OIL HITS ANOTHER HIGH AND NEARS TEST OF $62 -- UNITED STATES OIL FUND NEARS TEST OF SPRING 2016 HIGH -- ENERGY SPDR MAY ON THE VERGE OF A BULLISH BREAKOUT -- ENERGY/SPX RELATIVE STRENGTH RATIO REACHES HIGHEST LEVEL IN EIGHT MONTHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

UNITED STATES OIL FUND NEARS UPSIDE BREAKOUT ... Energy prices continue to rise. WTIC Light Crude Oil is trading over $61 today for the first time more than two years and is nearing a test of its spring 2015 high just over $62. Chart 1 shows the United States Oil Fund...

READ MORE

MEMBERS ONLY

COMMODITIES ARE AT LOWEST LEVEL RELATIVE TO STOCKS IN HISTORY -- COMMODITIES HAVE A LOT OF CATCHING UP TO DO -- THAT PROCESS MAY BE BEGINNING -- CRB INDEX MAY BE NEARING UPSIDE BREAKOUT -- GLOBAL METALS AND MINING PRODUCERS ETF REACHES THREE-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITIES ARE HISTORICALLY VERY CHEAP VERSUS STOCKS... I suggested yesterday that commodity prices (and stocks tied to them) usually do better in the later stages of a business cycle as inflation pressures start to build. We may be entering that stage. One of the reasons why investors may be turning...

READ MORE

MEMBERS ONLY

Four Markets To Watch In 2018 For A Potentially Important Breakout

by Martin Pring,

President, Pring Research

* 10-year bond yields could be in the process of a secular reversal.

* What odds is the S. Korean ETF placing on the breakout of war?

* China has gone uncharacteristically quiet. Is this the quiet before the storm?

* CRB Composite just below mega resistance

As we approach 2018 I thought it...

READ MORE

MEMBERS ONLY

WEAKER DOLLAR PUSHES COMMODITY PRICES HIGHER -- GOLD AND ITS MINERS CLIMB -- RISING ALUMINUM AND COPPER PRICES PUSH THEIR SHARES TO NEW HIGHS -- SOUTHERN COPPER HITS ALL-TIME HIGH -- RISING COMMODITIES MAY GIVE A BOOST TO CANADIAN STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. DOLLAR INDEX WEAKENS ... The U.S. dollar continues to weaken. Chart 1 shows the PowerShares US Dollar Index (UUP) falling today to the lowest level in a month. The dollar is down against all foreign developed currencies except the yen which is marginally lower. The biggest influence on...

READ MORE

MEMBERS ONLY

STOCKS HAVE ANOTHER UP WEEK BUT END QUIETLY -- - SURGE IN BOND YIELDS WAS WEEK'S BIGGEST STORY -- INFLATION-SENSITIVE STOCKS SURGED WHILE RATE-SENSITIVE STOCKS TUMBLED -- THAT SUGGESTS THERE MAY BE SOME HEDGING AGAINST FUTURE INFLATION GOING ON

by John Murphy,

Chief Technical Analyst, StockCharts.com

SANTA CLAUS RALLY STILL LIES AHEAD... The stock market experienced the second slowest trading day of the year on Friday as traders headed home for Christmas. All major stock indexes, however, hit new records during the week. The Russell 2000 Small Cap Index had the week's biggest percentage...

READ MORE

MEMBERS ONLY

The Yield Curve Is Not Forecasting A Recession Right Now

by Martin Pring,

President, Pring Research

* What message is the yield curve giving?

* Secular reversal in short-term bond yields is being signalled

* Energy sector breaks to the upside

* Energy strength may breathe life into the CRB Composite

What message is the yield curve giving?

Despite what you may be reading, the yield curve is not forecasting...

READ MORE

MEMBERS ONLY

DOW JONES HOME CONSTRUCTION INDEX REACHES ELEVEN YEAR HIGH BUT STILL LOOKS CHEAP ON A RELATIVE STRENGTH BASIS -- US HOME CONSTRUCTION ISHARES ARE HAVING A STRONGER YEAR THAN THE S&P HOMEBUILDER SPDR -- ENERGY SPDR HITS ELEVEN MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES HOME CONSTRUCTION INDEX REACHES ELEVEN-YEAR HIGH... Recent reports of strong home sales and home construction have boosted stocks tied to the housing sector. The low inventory of existing homes available for sale argues for even more homebuilding in the year ahead. All of which bodes well for the...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD CLIMBS TO NINE-MONTH HIGH -- LONG-TERM TREASURY BOND CHART LOOKS BEARISH -- RELATIVE STRENGTH ANALYSIS SHOWS RISING RATES HURTING UTILITIES AND REITS -- BUT BOOSTING FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD HITS NINE-MONTH HIGH ... Chart 1 shows the 10-Year Treasury yield climbing another 3 basis points today to the highest level since March (2.49%). That's most likely tied to the impending passage of the tax bill before Congress with expectations for faster economic growth and...

READ MORE

MEMBERS ONLY

10-YEAR BOND YIELD SURGES TO TWO-MONTH HIGH AND MAY BE ON VERGE OF UPSIDE BREAKOUT -- FOREIGN YIELDS ARE ALSO JUMPING -- THAT'S PUSHING BOND PRICES SHARPLY LOWER -- UTILITIES AND REITS ARE STARTING TO SHOW SERIOUS UNDERPERMANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD SURGES... The daily bars in Chart 1 show the 10-Year Treasury yield ($TNX) jumping 7 basis points today to the highest level in two months in one of the biggest daily gains this year. That puts the yield within striking distance of its late October intra-day peak...

READ MORE