MEMBERS ONLY

Is The Pound About To Head For Parity With The Dollar?

by Martin Pring,

President, Pring Research

* Long-term perspective

* The short-term picture

* The Pound against other major currencies

* Watch that gold!

Long-term perspective

Last October, I wrote an article entitled “British Pound Headed For Par, But Not Now”. The long-term case rested on the fact that the Pound, when measured against the Dollar, had completed a 30-year...

READ MORE

MEMBERS ONLY

DOW CONTINUES TO FLIRT WITH 20K -- WHILE NASDAY CLOSES AT RECORD HIGH -- INTERNET INDEX TURNS UP WITH FANG STOCKS BACK IN FAVOR -- FACEBOOK, AMAZON, AND GOOGLE IMPROVE -- NETFLIX HITS NEW RECORD -- BIOTECHS HELP MAKE HEALTHCARE WEEK'S STRONGEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW FLIRTS WITH 20K... Let's get this out of the way first. If you've been watching business TV, all they've been talking about is the Dow nearing the 20,000 level. Much to their dismay, it came close on Friday but couldn't...

READ MORE

MEMBERS ONLY

Are Post Election Market Trends Starting To Reverse In 2017?

by Martin Pring,

President, Pring Research

* The long-term equity trend is bullish, but watch carefully

* Short-term technicals for equities

* Short-term technicals for yields and bond prices

* Short-term technicals for the Dollar Index, Gold and Commodities

The post-election trends I am referring to in the title refer but are not limited to, the five series plotted in...

READ MORE

MEMBERS ONLY

OVER-EXTENDED TREASURY YIELDS PULL BACK -- DO DOES THE DOLLAR -- THAT'S BOOSTING GOLD AND GOLD MINERS -- WEAKER DOLLAR AND STRONG YUAN ALSO BOOST EMERGING MARKETS -- UPTREND IN FINANCIALS IS STALLING -- WHILE UTILITIES STRENGTHEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD PULLS BACK ... After the steep ascent in Treasury bond yields since the November 8 election, it's not too surprising to them pulling back a bit. There are a couple of technical reasons for that. The daily bars in Chart 1 show the 10-Year Treasury Yield...

READ MORE

MEMBERS ONLY

AUTOS LEAD CYCLICALS HIGHER -- AUTO LEADERS ARE GM, FORD, AND TESLA -- GENERAL MOTORS NEARS NEW RECORD -- CARMAX COMPLETES MAJOR BASING PATTERN -- TENNECO AUTOMOTIVE LEADS AUTO PARTS STOCKS HIGHER AFTER REACHING TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES AUTO INDEX IS BREAKING OUT... For the first time in a long time, auto stocks are showing market leadership. I first wrote about the group in a December 1 message about autos leading consumer cyclicals higher. They're doing that again today. Chart 1 shows the Dow...

READ MORE

MEMBERS ONLY

Three Charts That Suggest Dow 20,000 Will Happen Later Rather Than Sooner

by Martin Pring,

President, Pring Research

* Signs of short-term exhaustion

* Watch those housing ETF’s

* Shanghai is down, but is it out?

Even bull markets need to pause for breath as profits are digested and doubts sown concerning the validity of the prevailing trend. We may have come to such a moment.

Signs of short-term exhaustion...

READ MORE

MEMBERS ONLY

Yes, 20,000 Does Matter, But Not In The Way You Might Think

by Martin Pring,

President, Pring Research

* Twenty thousand, a media point on the charts

* The real 20,000 event

* International markets that deserve a closer look

Twenty thousand, a media point on the charts

For some time, our friends in the media have been touting Dow 20,000 ($INDU) as if something magical is going to...

READ MORE

MEMBERS ONLY

STOCK RALLY REMAINS STRETCHED -- AVERAGE DIRECTIONAL INDEX FOR THE DOW SIGNALS THAT RALLY IS VULNERABLE TO A SETBACK -- THE SAME IS TRUE FOR OTHER MARKET LEADERS -- THE 20,000 MILESTONE FOR THE DOW MAY BE PROMPTING SOME PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

ADX AND RSI LINES ISSUE WARNINGS... My last couple of messages have repeated the idea that the post-election stock rally looks stretched. Last Friday's message showed the stock/bond ratio, the value/growth ratio, and the transportation/utilities ratio also in overbought territory. Momentum and seasonal factors are...

READ MORE

MEMBERS ONLY

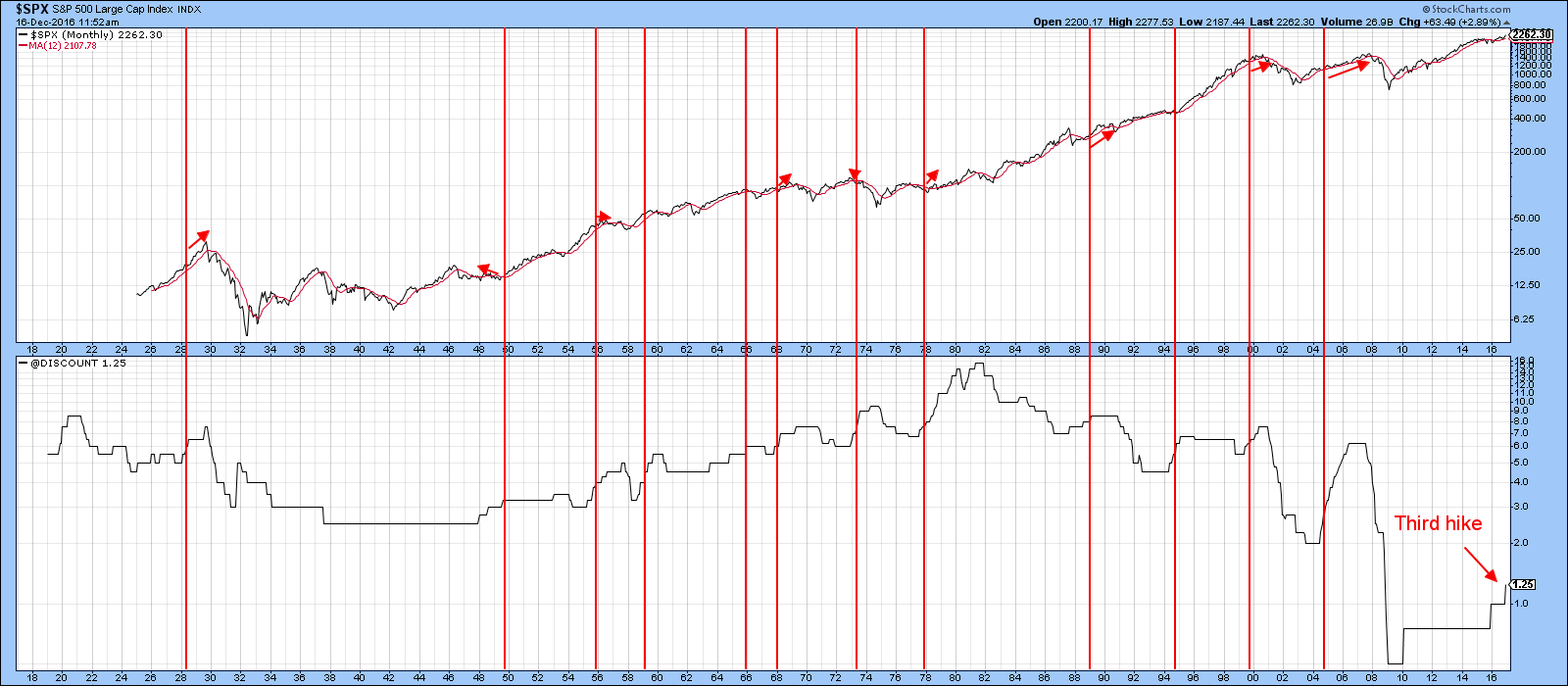

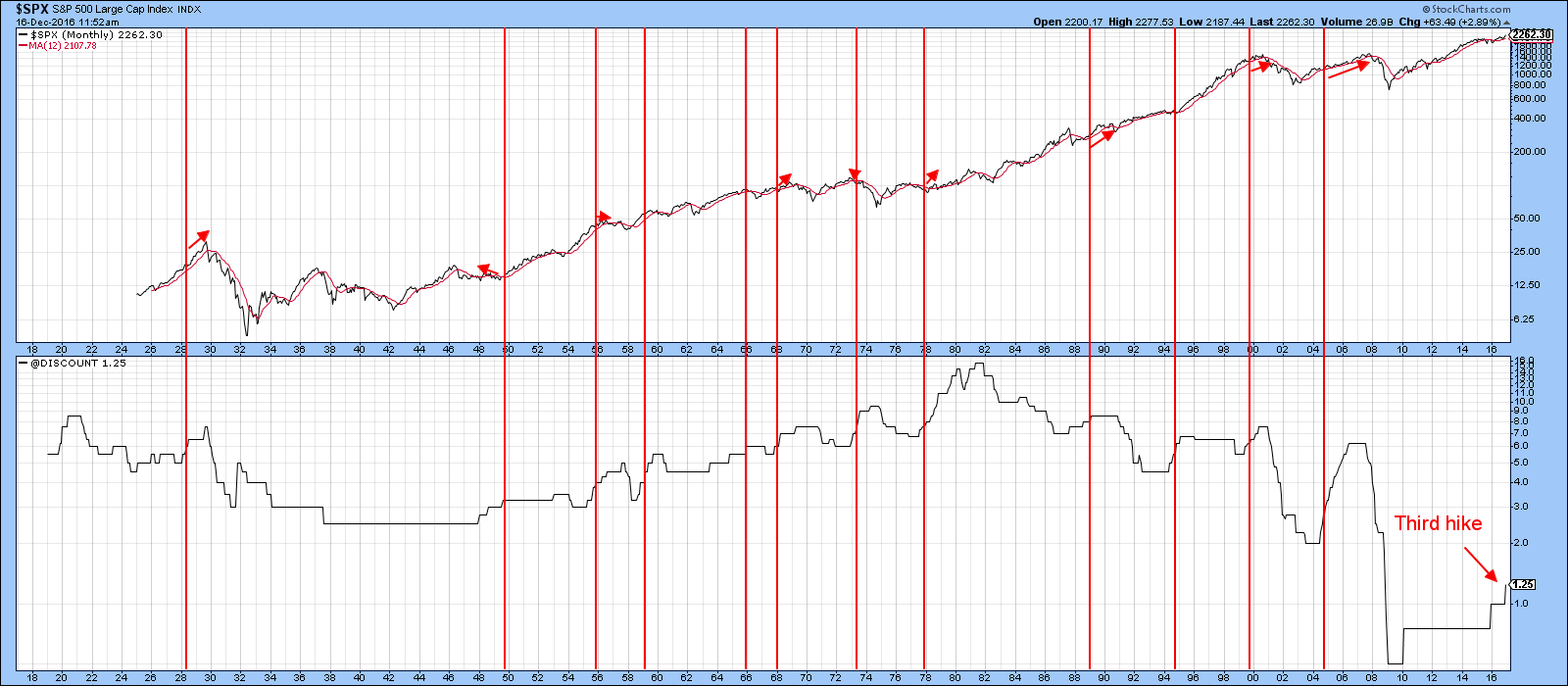

Three Steps And A Stumble?

by Martin Pring,

President, Pring Research

* Three steps and a stumble

* Interest rates are now driving the US Dollar

* Charts for the Euro, Yen and Swiss Franc continue to erode

Three steps and a stumble

The late great Edson Gould coined the term “Three Steps And A Stumble”. He was referring to his observation that when...

READ MORE

MEMBERS ONLY

STOCK/BOND RATIO STILL FAVORS STOCKS BUT HAS GOTTEN OVERBOUGHT -- SO HAS THE VALUE/GROWTH RATIO -- AND THE TRANSPORTATION/UTILITY RATIO -- ALL OF WHICH SUGGESTS THAT THE RECENT SURGE INTO STOCKS AND OUT OF BONDS MAY BE GETTING OVERDONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK/BOND RATIO IS OVERBOUGHT... Several market messages over the past couple of months used relative strength ratios to paint a more bullish picture of the stock market, and a more bearish picture for bonds. While those ratios have strengthened considerably, especially since the election, I'm a little...

READ MORE

MEMBERS ONLY

FED HIKES AS EXPECTED BUT SUGGESTS MORE TO COME IN 2017 -- BOND YIELDS CLIMB ALONG WITH THE DOLLAR -- GOLD AND RATE SENSITIVE STOCKS LOSE GROUND -- SO DO EMERGING MARKETS -- STOCK RALLY STALLS WHILE IN SHORT-TERM OVERBOUGHT CONDITION

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED OFFERS SLIGHTLY STEEPER PATH FOR 2017... The Fed surprised no one today one by raising short-term rates by a quarter of a point. It did, however, offer a steeper path for rate hikes in 2017. That may have caught more attention. Bond yields climbed which boosted bank stocks initially....

READ MORE

MEMBERS ONLY

Are They About To Take The Punch Bowl Away From The Party?

by Martin Pring,

President, Pring Research

* Some key averages showing signs of temporary exhaustion

* Energy burnt out?

* Defensives and interest sensitives looking more positive

* What about those bonds?

I have been bullish on the stock market for some time and in terms of the main trend I still am. I also council on focusing on the...

READ MORE

MEMBERS ONLY

NASDAQ 100 NEARS NEW RECORD -- IT'S BEING HELPED BY REBOUNDS IN APPLE, GOOGLE, AND INTEL -- ALL COUNTRY WORLD INDEX HITS 18-MONTH HIGH -- VANGUARD FOREIGN STOCK INDEX IS ALSO REBOUNDING -- TEN-YEAR YIELD NEARS CHALLENGE OF MID-2015 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWERSHARES QQQ NEARS NEW RECORD... A lot has been made recently about domestic-oriented American businesses leading the market rally (like small caps, retailers, and transports to name a few). And how large tech stocks have gone from market leaders to market laggards. Technology companies derive nearly two-thirds of their earnings...

READ MORE

MEMBERS ONLY

What Can We Learn From Recent Gold Price Action About Where Commodity Prices Are Headed?

by Martin Pring,

President, Pring Research

* Using Gold as a barometer for commodity prices

* Gold versus other precious metals

* Gold and the stock market

Earlier in the week I wrote an article pointing out the fact that the Gold price ($GOLD), technically speaking, had reached, what seemed to me, to be a critical technical point. That...

READ MORE

MEMBERS ONLY

EURO IS IN DANGER OF DROPPING TO 14-YEAR LOW -- THE FALLING EURO, HOWEVER, IS PUSHING EUROZONE STOCKS HIGHER -- THE WISDOMTREE EUROPE HEDGED EQUITY ETF OFFERS A WAY TO BUY EUROZONE STOCKS WITHOUT LOSING MONEY ON THE EURO

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO FALLS ON ECB... The ECB had some good and bad news for the Euro today. The ECB offered to extend its bond buying program for an additional nine months after next March. But it also announced that it was reducing the amount of bond purchases. The market interpreted the...

READ MORE

MEMBERS ONLY

AUTO PARTS LEAD CYCLICALS HIGHER -- LEADERS INCLUDE BORGWARNER, MAGNA INTL, AND TENNOCO AUTOMOTIVE -- USED CAR DEALER CARMAX ALSO COMPLETES BASING PATTERN -- IT MIGHT NOT BE A BAD IDEA TO BUY SOME AUTO STOCKS FOR CHRISTMAS

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUTO PARTS INDEX TURNS UP... My message from last Thursday was headlined: "Autos Drive Cyclicals Higher". It showed an index of auto stocks achieving a bullish breakout led by GM and Ford. Auto parts are today's cyclical leaders. That shouldn't be surprising since they&...

READ MORE

MEMBERS ONLY

The Next Two Months Will Be Critical For Gold

by Martin Pring,

President, Pring Research

* Will the current short-term oversold level in Gold trigger a rally to reverse long-term bear signals?

* Gold leads commodities

* Gold breaks down against some commodities

Will the current short-term oversold trigger a sufficient rally to reverse long-term bear signals?

Earlier in the year $GOLD proved to be one of the...

READ MORE

MEMBERS ONLY

AUTOS DRIVE CYCLICALS HIGHER -- GENERAL MOTORS HAS THE STRONGER PATTERN -- BUT FORD TURNS UP -- INDUSTRIAL LEADERS INCLUDE FLOWSERVE, DOVER, AND WW GRAINGER -- MONEY CONTINUES TO ROTATE OUT OF TECHNOLOGY INTO CHEAPER VALUE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR SHOWS RELATIVE STRENGTH ... One of the signs of growing strength behind the post-election stock market rally is that it's being led higher by economically-sensitive stocks like cyclicals and industrials. [We'll deal with industrials shortly]. Chart 1 shows the Consumer Discretionary SPDR (XLY) finding...

READ MORE

MEMBERS ONLY

Are We At The End Of The Trump Rally?

by Martin Pring,

President, Pring Research

* A different way of looking at the VIX

* What about global equities?

* Sectors are largely pointing north

* Are commodities about to break out?

The market has been rising in an uninterrupted fashion since early November, on the back of a Trump election victory. The question naturally arises as to whether...

READ MORE

MEMBERS ONLY

OPEC PRODUCTION CUT PUSHES OIL SHARPLY HIGHER -- ENERGY STOCKS LEAD MARKET HIGHER -- OIL SERVICES ETF ACHIEVES BULLISH BREAKOUT -- ENERGY LEADERS INCLUDE DEVON, MARATHON, AND MURPHY OIL -- RISING BOND YIELDS BOOST FINANCIALS WHILE UTILITIES FALL

by John Murphy,

Chief Technical Analyst, StockCharts.com

OIL SPIKES ON OPEC CUT... The agreement by OPEC to cut oil production by 1.2 million barrels a day has pushed the price of crude $3 (7%) higher in today's trading. The spike in oil is giving a huge boost to energy stocks which are leading the...

READ MORE

MEMBERS ONLY

BASE METALS INDEX HITS ANOTHER HIGH FOR THE YEAR -- SO DOES THE S&P 500 METALS & MINING SPDR -- STEEL LEADERS ARE AKSTEEL, CLIFFS NATURAL RESOURCES, AND US STEEL -- RISING DOLLAR, RISING RATES, AND A STRONG STOCK MARKET ARE PUSHING GOLD LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL METALS CONTINUE TO CLIMB... The huge rally in industrial (base) metals continues. Chart 1 shows the PowerShares DB Base Metals Fund (DBB) climbing to the highest level since mid-2015. The DBB reflects rising aluminum, copper, and zinc prices. Iron ore and steel prices are also surging in Chinese trading....

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SPDR HITS NEW RECORD -- S&P 500 RETAIL SPDR ACHIEVES BULLISH BREAKOUT-- MATERIAL SPDR NEARS UPSIDE BREAKOUT -- COPPER AND STEEL STOCKS LEAD XLB HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAILERS LEAD CYCLICALS TO NEW HIGHS... My message from last Monday wrote about apparel retailers leading retail stocks higher which were leading the cyclical sector higher. The same headline could be written again today. Chart 1 shows the Consumer Discretionary SPDR (XLY) rising above its August high to a new...

READ MORE

MEMBERS ONLY

CRUDE OIL JUMPS 4% ON HOPES FOR OPEC CUT -- ENERGY SPDR HITS NEW HIGH -- OIL SERVICES ETF MAY BE NEXT -- ENERGY AND MINERS LEAD CANADIAN STOCKS HIGHER -- HUDBAY MINERALS ACHIEVES BULLISH BREAKOUT -- SO DOES FREEPORT MCMORAN

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL CLIMBS ABOVE 50-DAY AVERAGE... Renewed optimism for an OPEC output cut has pushed crude oil 4% higher in today's trading and has given a big boost to energy shares and the rest of the stock market. Chart 1 shows WTIC Light Crude oil rising above its...

READ MORE

MEMBERS ONLY

Why Is A Strong Housing Report Is Good For The Stock Market

by Martin Pring,

President, Pring Research

* Subdued response to great housing numbers is a bullish sign

* What does this mean for housing stocks?

* Housing conclusion

* Small cap big profits?

Subdued response to great housing numbers is a bullish sign

Sometimes very important developments for the market receive widespread attention, quickly experiencing a swing in sentiment as...

READ MORE

MEMBERS ONLY

THE 2-YEAR TREASURY YIELD IS ALSO RISING, BUT NOT AS FAST AS 10-YEAR YIELD -- TREASURY YIELDS ARE ALSO RISING FASTER THAN FOREIGN YIELDS -- THAT'S HELPING PUSH THE US DOLLAR INDEX TO THE HIGHEST LEVEL IN THIRTEEN YEARS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TWO-YEAR TREASURY YIELD ALSO HITS NEW 2016 HIGH... Most recent attention has been focused on the surge in the 10-Year Treasury yield to the highest level since last December (middle line in Chart 1). That's based on expectations for stronger economic growth and higher inflation. It's...

READ MORE

MEMBERS ONLY

SOME MONEY FLOWING INTO FINANCIALS HAS COME OUT OF TECHNOLOGY -- INTERNET STOCKS MAY HAVE FOUND A BOTTOM -- TECHNOLOGY SPDR HOLDS CHART SUPPORT -- APPLE AND MICROSOFT ARE HOLDING UP -- ADVANCED MICRO DEVICES LEADS SEMICONDUCTORS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SOME TECHNOLOGY WINNINGS WENT INTO FINANCIALS... A lot is being made of the fact that technology stocks have underperformed the broader market since last Tuesday's election. I suggested last week that technology selling was most likely a rotation out of some expensive technology stocks (mainly in the Internet)...

READ MORE

MEMBERS ONLY

APPAREL RETAILERS LEAD CYCLICALS HIGHER -- RETAIL LEADERS ARE KOHLS, NORDSTOM, AND URBAN OUTFITTERS -- RAILS LEAD INDUSTRIAL SPDR HIGHER -- UNION PACIFIC AND NORTHERN SOUTHERN IN UPTRENDS -- TRANSPORTATION/INDUSTRIAL RATIO TURNS UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P RETAIL SPDR SURGES ... My last message on Thursday mentioned a rotation into discretionary sectors like retailers and out of defensive consumer staples. That rotation is looking even more impressive today as retail stocks are strong. Chart 1 shows the S&P Retail SPDR (XRT) surging nearly...

READ MORE

MEMBERS ONLY

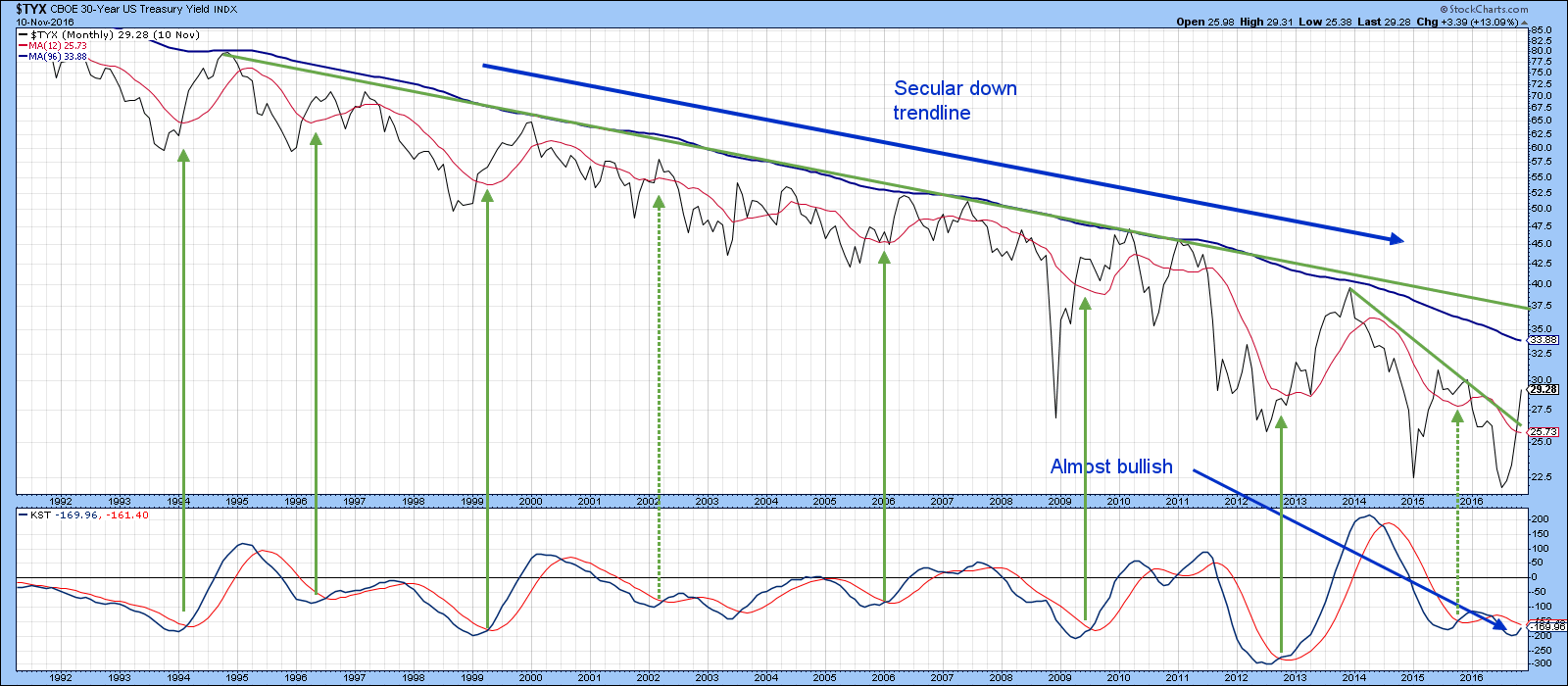

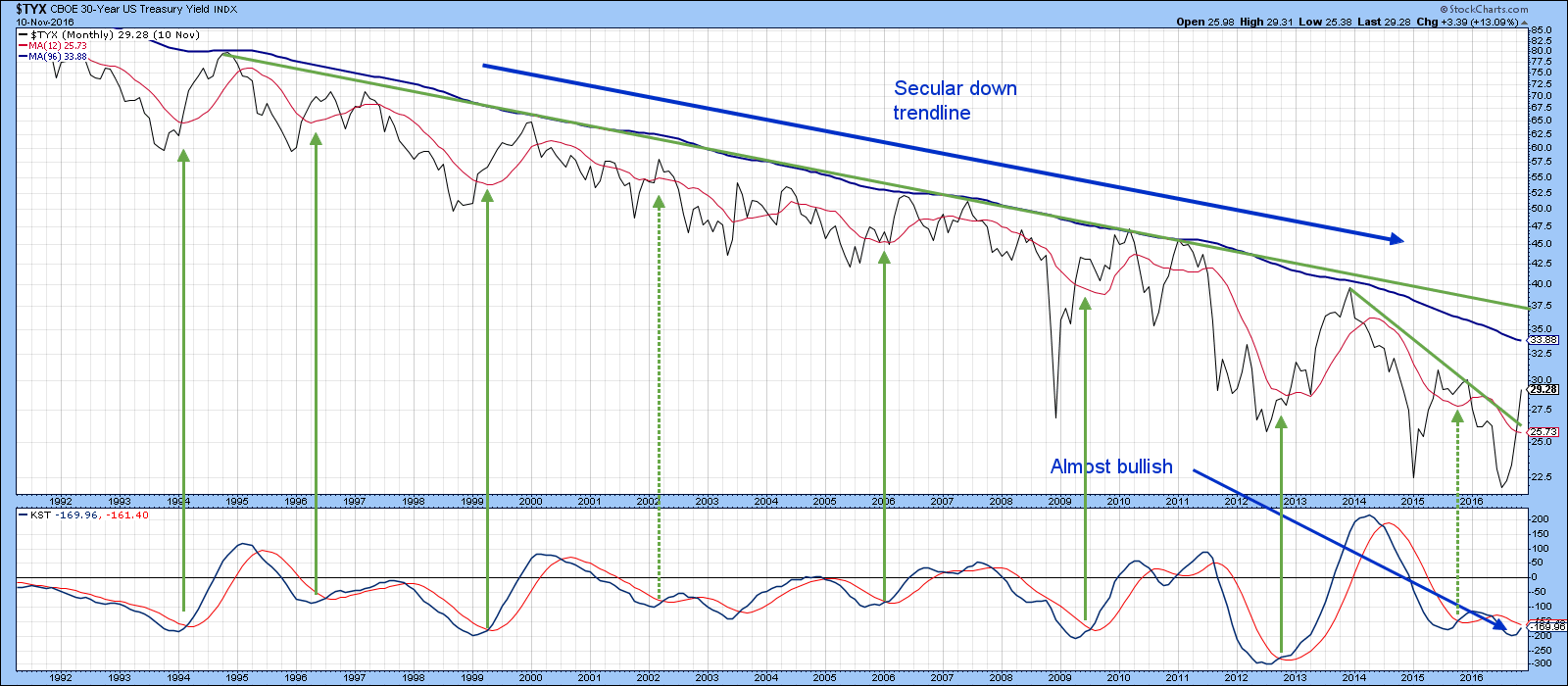

Why Is 1.75% So Critically Important?

by Martin Pring,

President, Pring Research

* What’s the direction of the primary trend of interest rates?

* What do the shorter-term maturities say?

* Appraising the short-term technicals

In early September, I wrote an article suggesting that things were beginning to fall in place for higher yields. Since then they have edged up a bit, but look...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS AND TRANSPORTS ARE FINALLY IN SYNC -- TRANSPORTATION RALLY INCLUDES AIR FREIGHT, RAILS, AND TRUCKERS -- COPPER UPTREND ACCELERATES AS FREEPORT MCMORAN NEARS BULLISH BREAKOUT -- CYCLICAL STOCKS OUTPACE STAPLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW THEORY LOOKS STRONG... Chart 1 shows the Dow Industrials trading at a new record high today. That's a positive sign. But so is the fact that the Dow Transports achieved a bullish breakout on Monday. That puts both Dow Averages in sync on the upside for the...

READ MORE

MEMBERS ONLY

STOCKS RALLY ON TRUMP VICTORY -- FINANCIALS, HEALTHCARE, INDUSTRIALS, MATERIALS, AND ENERGY HAVE BIG GAINS -- STOCKS TIED TO ALUMINUM, COPPER, STEEL, AND COAL SURGE -- 10-YEAR TREASURY YIELD SURGES ABOVE 2%

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS SURGE AFTER WEAK NIGHT... Today's strong stock market builds one surprise on top of another. The first surprise was a Trump victory. The second is today's sizable stock market gain. It was widely expected that a Trump victory would push stocks sharply lower. And it...

READ MORE

MEMBERS ONLY

Monday Triggers A Dow Theory Buy Signal

by Martin Pring,

President, Pring Research

* A brief synopsis of Dow Theory

* Transports could be explosive

* Was there anything wrong with Monday’s rally?

* Market remains short-term oversold

* Good looking ETF’s

Monday's explosion in prices sent the Dow Transports well above their previous intermediate high. This price action confirms the buy signal already...

READ MORE

MEMBERS ONLY

STOCKS SURGE ON PRE-ELECTION FBI ANNOUNCEMENT AS SAFE HAVEN ASSETS SLIDE -- RISING DOLLAR HURTS GOLD -- MEXICO LEADS EMERGING MARKETS HIGHER -- RISING BASE METALS BOOST AUSSIE DOLLAR -- AIRLINES LEAD TRANSPORTS IN BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

FBI ANNOUNCEMENT CAUSES BIG RISK-ON DAY... The Sunday afternoon FBI announcement that it was ending its Hillary Clinton email investigation with no charges caused a huge risk- on trade the day before the presidential election. Stocks have surged as much as 2% around the world. A stronger dollar, and surging...

READ MORE

MEMBERS ONLY

Is It Time To Give Up On The Stock Market?

by Martin Pring,

President, Pring Research

* What’s happening at the margin?

* Short-term technical position oversold…but

* Gold breaks out against bonds

* Dollar showing weakness

What’s happening at the margin?

Last week I wrote an upbeat article pointing out that the stock market was oversold on a near-term basis as it approached a bullish seasonal...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS BOOST INSURERS WHILE HURTING REITS AND OTHER DIVIDEND PAYERS -- LINCOLN NATIONAL, METLIFE, AND PRUDENTIAL RISE ON STRONG EARNNGS -- RISING BOND YIELDS ARE HAVING A NEGATIVE IMPACT ON STOCK INDEXES WITH MOST SECTORS IN THE RED

by John Murphy,

Chief Technical Analyst, StockCharts.com

LIFE INSURERS LEAD FINANCIALS HIGHER ... Rising bond yields continue to give a boost to financial stocks like life insurers. Bear in mind that premium income in insurance stocks is invested mostly in fixed income markets. Higher bond yields mean higher income. Life insurers are leading the financial sector higher today....

READ MORE

MEMBERS ONLY

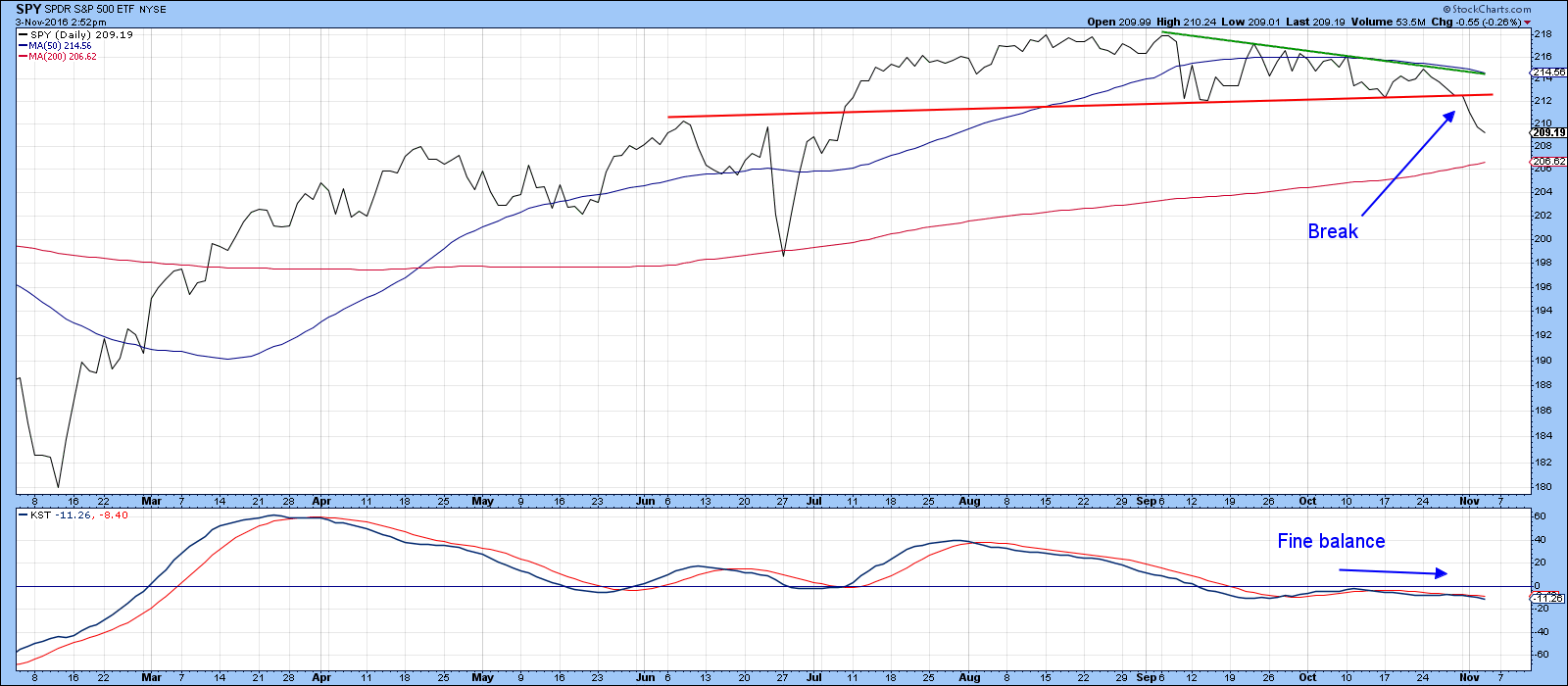

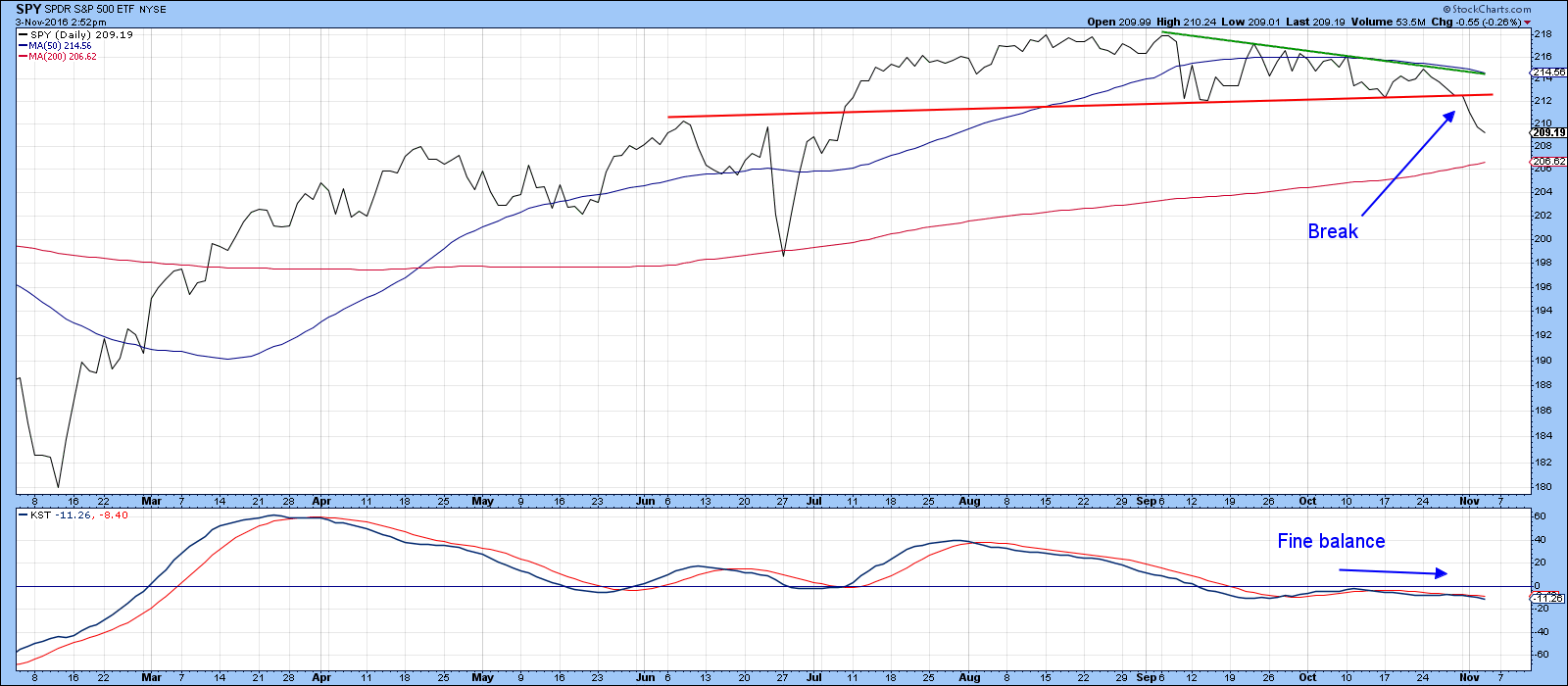

S&P 500 BREAKS CHART SUPPORT AS THE VIX SURGES -- FALLING DOLLAR PUSHES GOLD HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 BREAKS SUPPORT AS VIX SURGES... Election jitters are taking a toll on stocks. Chart 1 shows the S&P 500 falling below its September/October lows to a four month low. All other major stock indexes are falling as well. That leaves the SPX in...

READ MORE

MEMBERS ONLY

LONGER-DATED TREASURY BONDS LEAD FIXED INCOME MARKETS LOWER -- HIGH YIELD BONDS ARE MORE CLOSELY TIED TO STOCKS -- MONEY IS FLOWING INTO TIPS FOR INFLATION PROTECTION -- RISING COAL SHARES ARE ANOTHER SIGN OF A COMMODITY REVIVAL

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE BOND CHARTS ... I've been writing about how the recent upturn in bond yields has been pushing bond prices lower (primarily due to rising commodity prices). Not all bond categories are falling at the same rate however. When inflationary pressures are starting to pull bond yields higher, longer...

READ MORE

MEMBERS ONLY

RISING COMMODITY PRICES ARE PULLING BOND YIELDS HIGHER -- BASE METALS ETF HITS NEW HIGH FOR THE YEAR -- S&P METALS AND MINING ETF OUTPERFORMS -- STRONG GDP FAVORS ECONOMICALLY-SENSITIVE STOCKS OVER BONDS -- SO DOES RISING STOCK/BOND RATIO

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING COMMODITY PRICES ARE BOOSTING GLOBAL BOND YIELDS... I find it amusing listening to TV talking heads trying to explain why global bond yields have started to rise (pushing bond prices sharply lower). They don't seem to have noticed that commodity prices have risen more than 20% since...

READ MORE

MEMBERS ONLY

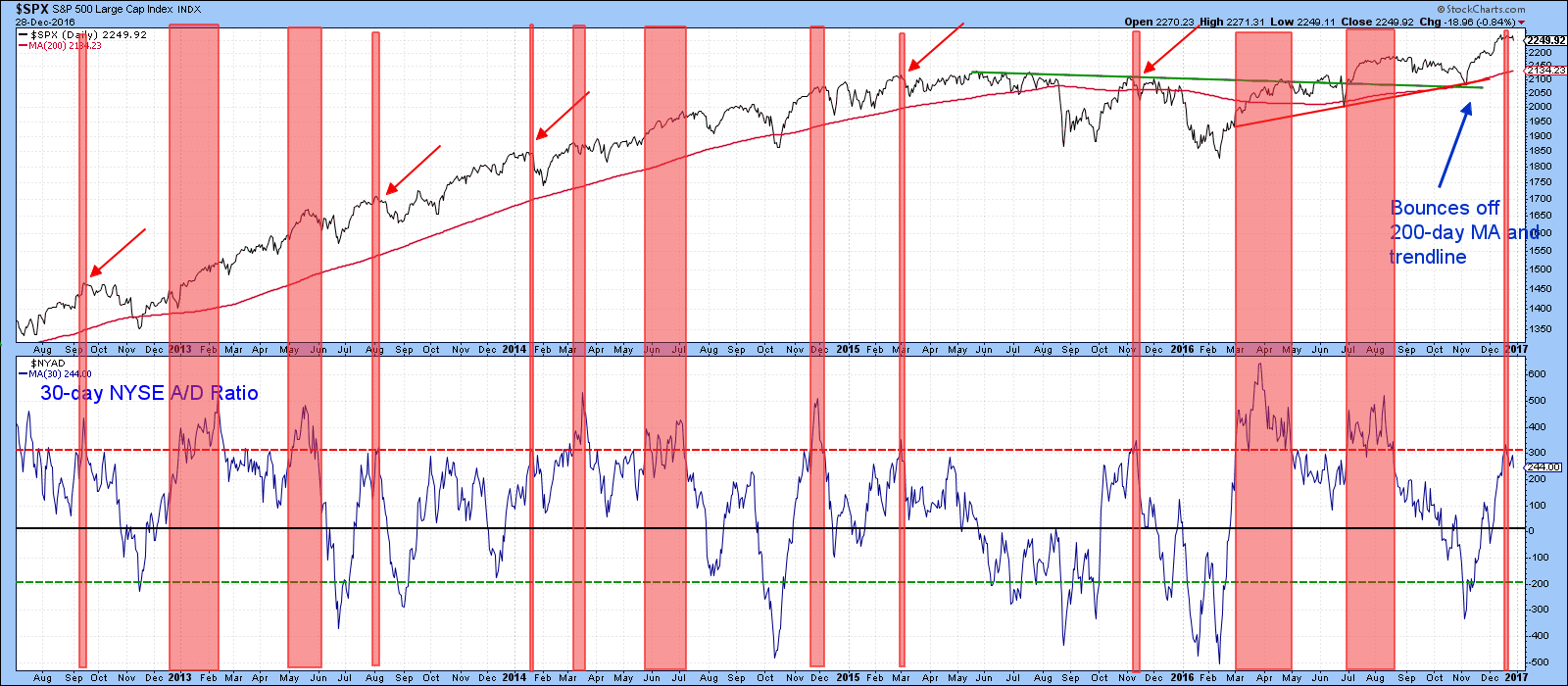

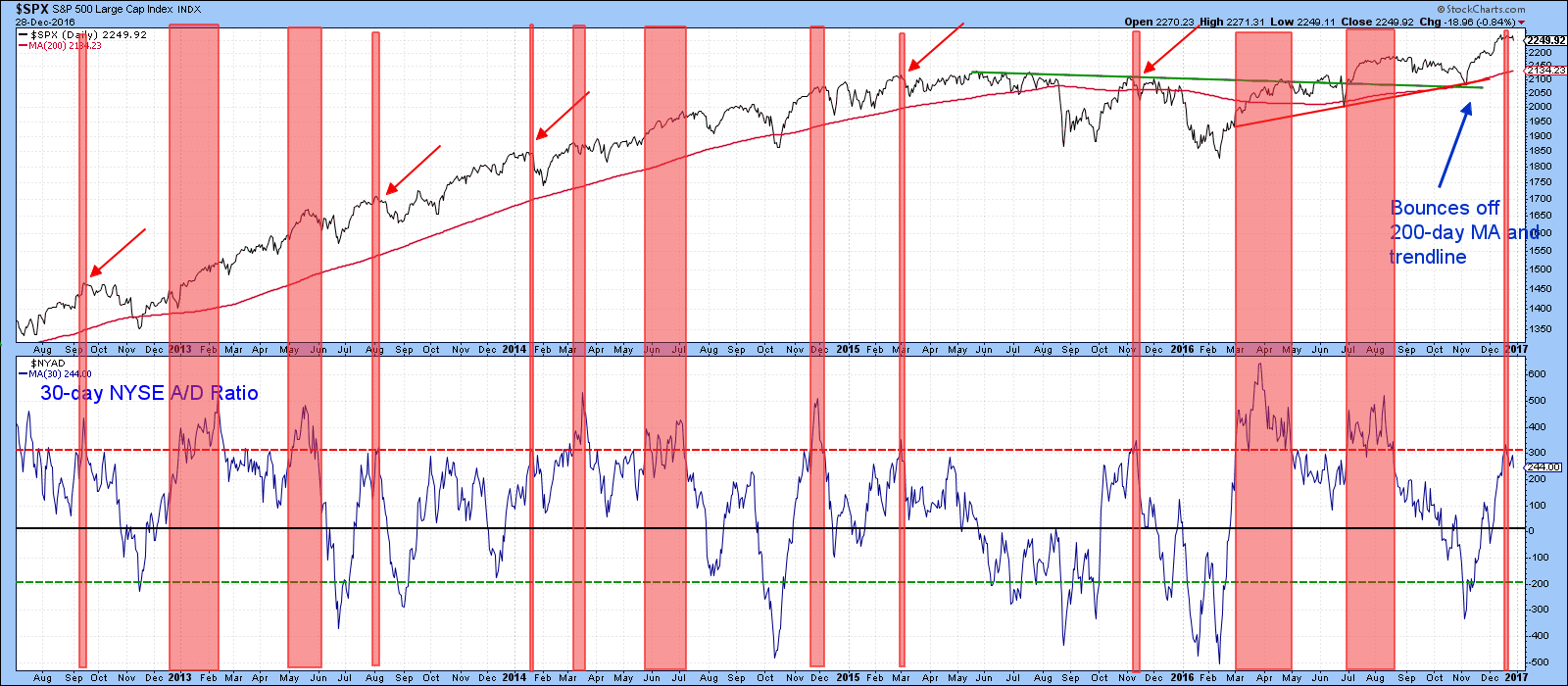

Bullish Seasonals And A Near-Term Oversold Condition Argue For An Interesting November

by Martin Pring,

President, Pring Research

* Seasonals are bullish

* Current condition of some short-term indicators

* The bullish part of the year

* Time to raise those beta glasses?

The stock market has really been in a trading range for the last two years. At my bi-weekly webinar this week, I pointed out that several long-term indicators have...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS CONTINUE TO BOOST BANKS AND INSURERS -- BANK ETF HITS NEW HIGH -- BANK LEADERS INCLUDE KEYCORP, HUNTINGTON BANKCORP, AND PNC -- INSURANCE LEADERS INCLUDE CHUBB AND HARTFORD FINANCIAL -- RISING RATES HURT REITS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CONTINUE TO CLIMB... Chart 1 shows the 10-Year Treasury Yield climbing again today after finding support along its 200-day moving average. Rising yields are giving the usual lift to financial shares, banks and insurers in particular. Chart 2 shows the S&P Bank SPDR (KBE) trading at...

READ MORE

MEMBERS ONLY

RISING BASE METALS BOOST MINERS -- COPPER AND STEEL ETFS HAVE STRONG CHART PATTERNS -- MINING LEADERS INCLUDE BHP BILLITON, RIO TINTO, AND VALE -- SHANGHAI INDEX NEARS 2016 HIGH -- EMERGING MARKETS OUTPERFORM -- RISING DOLLAR LOOKS OVERBOUGHT

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWERSHARES BASE METALS FUND JUMPS 2%... Base metal prices like iron ore and steel are seeing big gains in China. That strength is spilling over into aluminum, copper, nickel, and zinc. That's giving a big boost to global stocks tied to those commodities. Chart 1 shows the PowerShares...

READ MORE