MEMBERS ONLY

TRADERS ARE BUYING IN ANTICIPATION OF YEAREND SANTA CLAUS RALLY -- JANUARY EFFECT STARTS BOOSTING SMALL CAPS IN MID-DECEMBER -- WE'RE NOW IN THE SWEET SPOT OF THE MIDTERM ELECTION CYCLE -- AND FOREIGN STOCKS ARE REBOUNDING

by John Murphy,

Chief Technical Analyst, StockCharts.com

SANTA CLAUS RALLY IS STILL AHEAD ... The stock market is benefiting from a number of seasonal trends which should last well into the new year. For one thing, the month of November starts the "best three months" span that lasts into January, and the "best six months&...

READ MORE

MEMBERS ONLY

MARKET LIKES FED INTENTION TO STAY PATIENT -- OVERSOLD ENERGY STOCKS LEAD GLOBAL STOCK RALLY -- XLE IS ALSO IN POTENTIAL SUPPORT ZONE-- US STOCK INDEXES REGAIN 50-DAY LINE -- CANADIAN STOCKS BOUNCE SHARPLY OFF OCTOBER LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS AND BOND YIELDS JUMP... The Fed promised to remain "patient" in raising rates next year. Stocks liked the news, Treasuries didn't. Fixed income yields rose with the bigger gains in the shorter end of the yield curve. Chart 1 shows the 5-Year T-Note Yield ($FVX)...

READ MORE

MEMBERS ONLY

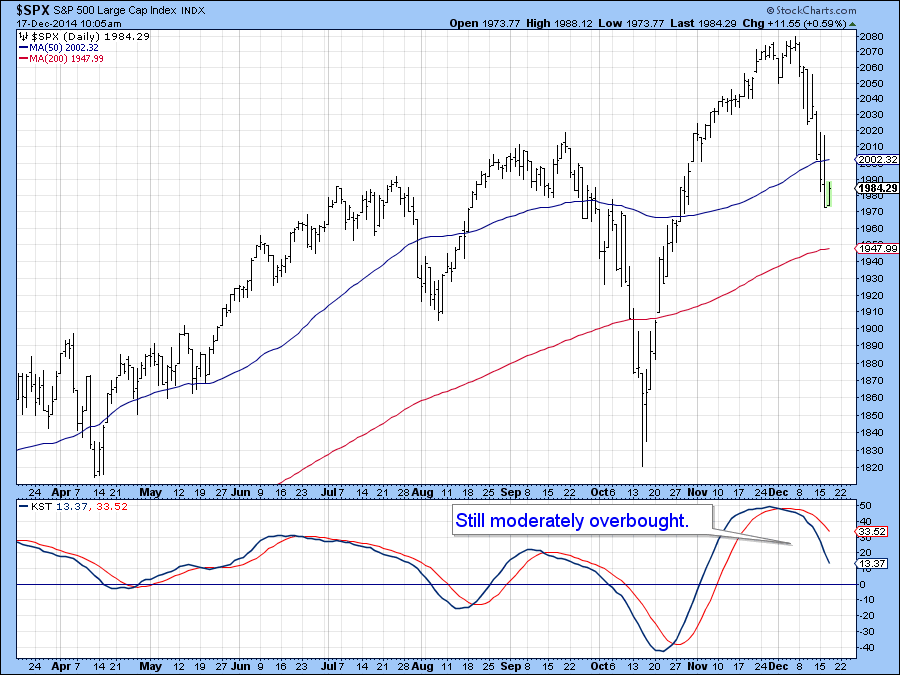

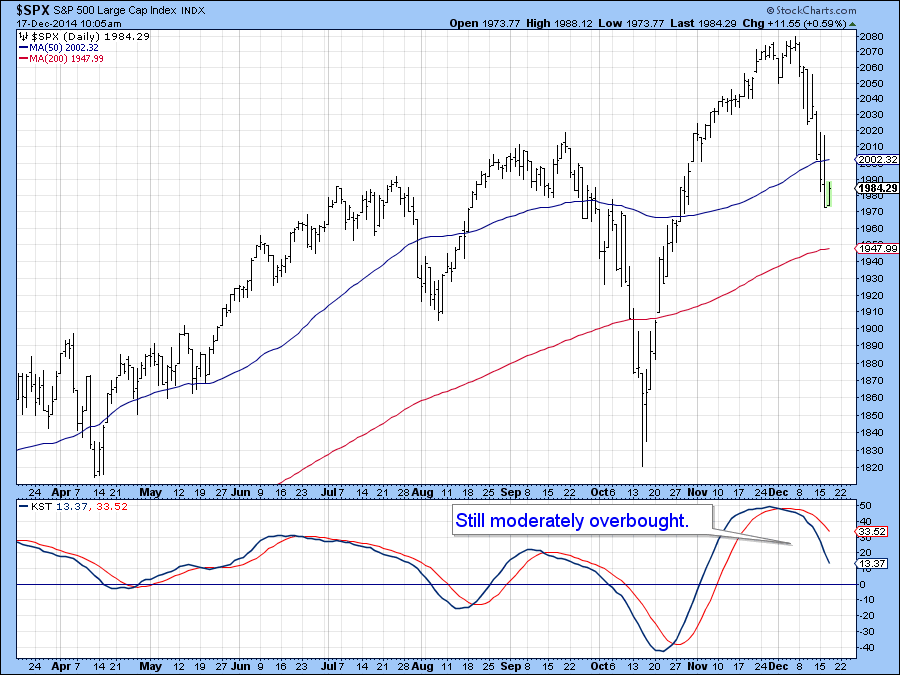

Equities still Look Vulnerable Notwithstanding a Possible Reflexive Bounce

by Martin Pring,

President, Pring Research

* Dichotomy in the credit markets is extending.

* Dim Sum bonds at a critical juncture.

* Gold asset markets weakening again.

US Equities

Statistics tell us that December is the most bullish month of the year for equities. Interestingly, the November-January period offers the best performing consecutive months of the year (S&...

READ MORE

MEMBERS ONLY

WEBINAR CHARTS -- RISK ON OR RISK OFF? -- PUTTING A 5% DECLINE INTO PERSPECTIVE -- HIGH-LOW PERCENT INDICATORS REMAIN BULLISH -- HIGH-LOW PERCENT FOR XLI TURNS BEARISH -- SHORT-TERM BREADTH REMAINS BEARISH -- GOLD, OIL, DOLLAR AND BONDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS... The charts below are from Tuesday's Webinar and include some basic commentary. See the webinar recording for more details. I also covered eleven stocks (AAPL, ORCL, CSCO, BAC, UTX, EOG, CIEN, JSDU, UPS, CHRW, JBHT). There was a demo showing the different ways to measure relative...

READ MORE

MEMBERS ONLY

RETAIL ETF'S CONTINUE TO LEAD -- APPAREL AND SPECIALTY GROUPS SHOW RELATIVE STRENGTH -- SECTOR SUMMARY DEMO -- RS LINES HIT NEW HIGHS FOR BBBY, DSW AND PLCE -- RESTAURANT INDEX PULLS BACK AFTER NEW HIGH -- TXRH AND BWLD LEAD RESTAURANT GROUP

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAIL ETF'S CONTINUE TO LEAD ... Link for today's video. John Murphy pointed out the negative correlation between retail stocks and the price of oil in early December. In short, retail stocks rose sharply as the price of oil fell sharply. This theme continues to play out...

READ MORE

MEMBERS ONLY

OIL PLUNGES BELOW $60 ON FORECAST FOR LOWER DEMAND -- OIL EXPORTERS CONTINUE TO LEAD GLOBAL STOCK DECLINE -- RUSSIAN WEAKNESS HURTS EUROPE -- LATIN AMERICA LEADS EMERGING MARKETS ISHARES TO NEW LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

IEA CUTS OIL DEMAND FORECAST AGAIN... Crude oil can't catch a break. Plunging oil prices over the past few months have been attributed mainly to increasing supplies, largely resulting in the shale revolution in the U.S. This week, however, the International Energy Agency (IEA) cut its forecast...

READ MORE

MEMBERS ONLY

USING BREADTH INDICATORS FOR SHORT-TERM SIGNALS -- QQQ CORRECTION TARGET -- AROONS GO PARALLEL ON IWM CHART -- BOND MARKET SHOWS RISK AVERSION -- MATERIALS SECTOR BREAKS DOWN -- GOLD MINERS ETF STALLS AFTER BOUNCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

USING BREADTH INDICATORS FOR SHORT-TERM SIGNALS... Link for today's video. The economic news has been pretty good lately, but stocks came under selling pressure and did not act very well. First, I should note that I am not that interested in the news per se. Instead, I am...

READ MORE

MEMBERS ONLY

Two Benchmarks that will Likely Signal the Direction of the Next Major Equity Move

by Martin Pring,

President, Pring Research

* Stocks likely to resume their downtrend vis a vis bonds.

* Emerging Markets ETF resting on a key trend line.

* Different bond maturities moving in different directions.

US Equities

The battle lines are being drawn for the next major move in the equity market. For the NYSE Composite ($NYA) those lines...

READ MORE

MEMBERS ONLY

CANADA TUMBLES ON FALLING OIL ALONG WITH MEXICO -- EMERGING MARKETS ISHARES HIT NINE-MONTH LOW -- ENERGY SECTOR TUMBLES AGAIN -- ENERGY SELLING HERE AND ABROAD SPILLS OVER TO BROADER MARKET -- S&P 500 SUFFERS SHORT-TERM DOWNTURN--

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGNS SHARES ARE FALLING ... Foreign shares are falling today, especially those that export oil. Chart 1 shows the Toronto $TSX Composite Index tumbling nearly -2.4% and nearing a test of its October low. The Canada/SPX ratio (solid line) is falling even faster. Emerging markets tied to oil are...

READ MORE

MEMBERS ONLY

SMALL-CAPS SURGE TO KEEP THE FLAG ALIVE -- S&P 500 AND NASDAQ 100 LEAD HIGH-LOW INDICATORS -- HINDENBURG OMEN TRIGGERS -- FINANCE, HEALTHCARE AND UTILITIES LEAD SECTOR HIGH-LOW PERCENT -- THREE KEY INDUSTRY GROUP ETFS MAKING NEW HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAPS SURGE TO KEEP THE FLAG ALIVE... Link for today's Webinar video. The brief commentary and charts are from today's webinar. Chart 1 shows the S&P 500 bouncing off its first support zone today. Chart 2 shows the S&P MidCap 400 consolidating...

READ MORE

MEMBERS ONLY

IWM AND IJR FLY THE FLAG AT HALF MAST -- SMALL-CAP SECTORS TAKE THE LEAD -- SMALLCAP FINANCIALS ETF BREAKS FLAG TREND LINE -- INTERNET LEADERS AND LAGGARDS -- INTERNET ETF STALLS OUT -- FACEBOOK FORMS A BIG CONSOLIDATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

IWM AND IJR FLY THE FLAG AT HALF MAST ... Programming Note: I will be doing a Webinar tomorrow at 1PM ET in place of the Market Message and video. You can register here. With a little help from financial services, the Russell 2000 iShares (IWM) had its best week since...

READ MORE

MEMBERS ONLY

Global Equity Market Roundup

by Martin Pring,

President, Pring Research

* USA still leading the way on the upside.

* Russian and Mexican ETF’s break to the downside.

* EEM components offering a mixed picture.

* The two sides of Japan.

International Equities

With the US, German, Japanese, Indian, New Zealand, Pakistani and several other markets joining the US in new all-time high...

READ MORE

MEMBERS ONLY

GERMAN DAX HITS RECORD HIGH AS EUROPE STRENGTHENS -- U.S. DOLLAR INDEX RECORDS EIGHT-YEAR HIGH -- SPREAD BETWEEN US AND GERMAN BOND YIELD WIDENS -- U.S. TWO-YEAR YIELD HITS THREE-YEAR HIGH ON STONG JOBS REPORT -- FINANCIALS SHOW MARKET LEADERSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

GERMAN DAX CLOSES AT RECORD HIGH ... German stocks sold off Thursday after the ECB delayed further monetary easing until the first quarter. Later reports that more monetary stimulus might come as early as January helped boost European stocks which rallied sharply on Friday. Chart 1 shows the German DAX Composite...

READ MORE

MEMBERS ONLY

SECTOR WEIGHTINGS IN THE S&P 500 -- KEY SECTORS LEAD WITH STRONG BREADTH -- REGIONAL BANK SPDR GETS BIG REBOUND -- FOUR BANKS WITH BREAKOUT MOVES -- STRONG JOBS NUMBER HITS EURO, BONDS AND GOLD -- ISM INDICES, AUTO SALES AND NON-FARM PAYROLLS COME IN BIG

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR WEIGHTINGS IN THE S&P 500 ... Link for today's video. The four most important sector SPDRs are strong and this supports the long-term uptrend in the large-cap indices ($SPX, $NDX, $INDU). The consumer discretionary sector is the most economically sensitive sector with lots of retail oriented...

READ MORE

MEMBERS ONLY

ECB INACTION CAUSES SELLING IN EUROPE -- OIL PRODUCERS LIKE CANADA SUFFER BIGGER LOSSES -- CANADIAN DOLLAR WEAKENS WITH OIL -- CHINA RALLY MAY FUELED BY FALLING OIL -- S&P 500 SUFFERS MINOR SETBACK FROM OVERBOUGHT CONDITION

by John Murphy,

Chief Technical Analyst, StockCharts.com

ECB PUSHES MORE EASING INTO NEXT YEAR ... Mario Draghi announced today that the ECB would wait until the first quarter to consider additional monetary easing. That decision disappointed those who were hoping for quicker action. At the same time, he downgraded prospects for eurozone growth and inflation. Bond prices sold...

READ MORE

MEMBERS ONLY

Bullish Seasonals and Cycles Should Push Stocks to Significant Highs in 2015..but will they?

by Martin Pring,

President, Pring Research

* Bullish NYSE percent has likely peaked out. Indicates market will become more selective.

* You can’t keep a good dollar down!

* Emerging market currency fund breaks down. EM are likely to follow.

US Equities

I have always said that trend trumps everything. By that I mean that however bad the...

READ MORE

MEMBERS ONLY

HEALTHCARE SECTOR CONTINUES TO LEAD -- NOVO NORDISK AND BIOGEN BOUNCE OFF SUPPORT -- MATERIALS SPDR TESTS ITS BREAKOUT -- PALLADIUM OUTSHINES OTHER METALS -- PALLADIUM ETF HITS KEY JUNCTURE -- ENERGY ISSUES WEIGH ON HIGH YIELD BOND ETF

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SECTOR CONTINUES TO LEAD... Link for today's video. Healthcare remains one of the strongest sectors in the stock market as the HealthCare SPDR (XLV) hit a new high again on Tuesday. Chart 1 shows XLV surging some 18% from its October low and hitting a series of...

READ MORE

MEMBERS ONLY

LARGE-CAP ETF'S LEAD UPSWING WITH NEW HIGHS -- SMALL-CAPS LAG, BUT TREND IS STILL UP -- TWO RISK INDICATORS REMAIN BULLISH FOR STOCKS -- ONE AD LINE DIVERGES FROM THE PACK -- BANK ETFS BREAK DOWN -- A BIG WEEK FOR ECONOMIC AND LABOR INDICATORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

LARGE-CAP ETF'S LEAD UPSWING WITH NEW HIGHS... Link for today's video. The S&P 500 SPDR (SPY) and the Nasdaq 100 ETF (QQQ) remain the strongest of the major index ETFs. SPY represents a broad basket of large-cap stocks, while QQQ represents a basket of...

READ MORE

MEMBERS ONLY

PLUNGING OIL HURTS COMMODITY-RELATED ASSETS AND COUNTRIES -- AND BOOSTS US BONDS AND STOCKS -- DAY'S WINNERS INCLUDE RETAILERS AND AIRLINES -- FALLING BOND YIELDS BOOST STAPLES AND UTILITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

OPEC FAILURE TO CUT CAUSES OIL TO PLUNGE... Thursday's decision by OPEC not to cut oil output has caused that commodity to plunge in value, and has brought other commodities down with it. The weekly bars in Chart 1 show the United States Oil Fund (USO) plunging to...

READ MORE

MEMBERS ONLY

A couple of Chinese Equity Sector ETF's break to the Upside

by Martin Pring,

President, Pring Research

* Stock/bond ratio challenges overhead resistance.

* Watch $120 on the GLD.

* Commodities may be set for short-term rally.

US Equities

For some time I have been pointing to several discrepancies in the market that have been troubling. My conclusion was that as long as the uptrend since mid-October was intact...

READ MORE

MEMBERS ONLY

WITH CHINA AND JAPANESE STOCKS DOING SO WELL, DON'T FORGET ABOUT EUROPE -- GERMAN STOCKS HIT FIVE-MONTH HIGHS -- BUT BE SURE TO HEDGE OUT CURRENCY RISK -- RECORD LOW GERMAN YIELD PULLS TREASURY YIELD LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE AND JAPAN STOCKS HAVE BECOME WORLD LEADERS... The two largest Asian stock markets have become two of the world's best gainers this year. The red bars in Chart 1 show the Shanghai Stock Exchange Composite Index ($SSEC) rising to the highest level in more than three years....

READ MORE

MEMBERS ONLY

SMALL-CAPS REFUSE TO BUCKLE -- REGIONAL BANK SPDR STALLS -- BIOTECH ETFS BREAK TO NEW HIGHS -- SEMICONDUCTOR SPDR HOLDS SHORT-TERM BREAK -- 20+ YR T-BOND ETF EDGES TOWARDS BREAKOUT -- SHANGHAI COMPOSITE HITS ANOTHER MILESTONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAPS REFUSE TO BUCKLE... Programming Note: There is no video today because I am working on the road. Also note that I will be taking the rest of the week off to be with family and friends. I will post a Market Message and video next Monday, December 1st. In...

READ MORE

MEMBERS ONLY

S&P MIDCAP 400 IS KNOCKING ON THE DOOR -- MICRO-CAP ETF HITS MOMENT-OF-TRUTH -- S&P 500 AND NASDAQ 100 AD LINES SCORE NEW HIGHS -- HIGH-LOW INDICATORS SURGE -- MATERIALS SECTOR GETS A BREADTH SURGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P MIDCAP 400 IS KNOCKING ON THE DOOR... Programming note: I am on the road today and there is no video. Getting the trend right is more than half the battle when it comes to trading and investing. Moreover, once we define the trend, it is important to...

READ MORE

MEMBERS ONLY

S&P RETAIL SPDR HITS NEW RECORD -- LEADERS INCLUDE BEST BUY, DOLLAR TREE, AND WILLIAMS SONOMA -- MACY'S BREAKS OUT -- HOMEBUILDING ETF HITS EIGHT-MONTH HIGH -- LED BY LENNAR, DR HORTON, AND PULTEGROUP -- CONSUMER DISCRETIONARY SPDR SHOWS NEW LEADERSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P RETAIL SPDR HITS NEW HIGH ... Strong buying of retail stocks continues. I've been showing record highs in the Market Vectors Retail ETF (RTH). Chart 1, however, shows the S&P Retail SPDR (XRT) hitting a record high as well. Its relative strength line (above...

READ MORE

MEMBERS ONLY

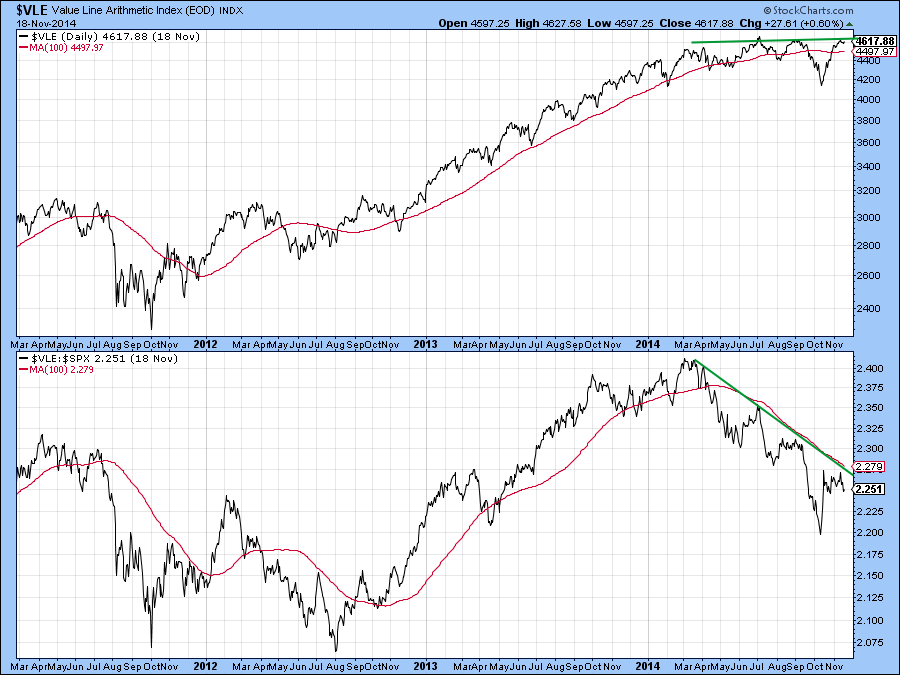

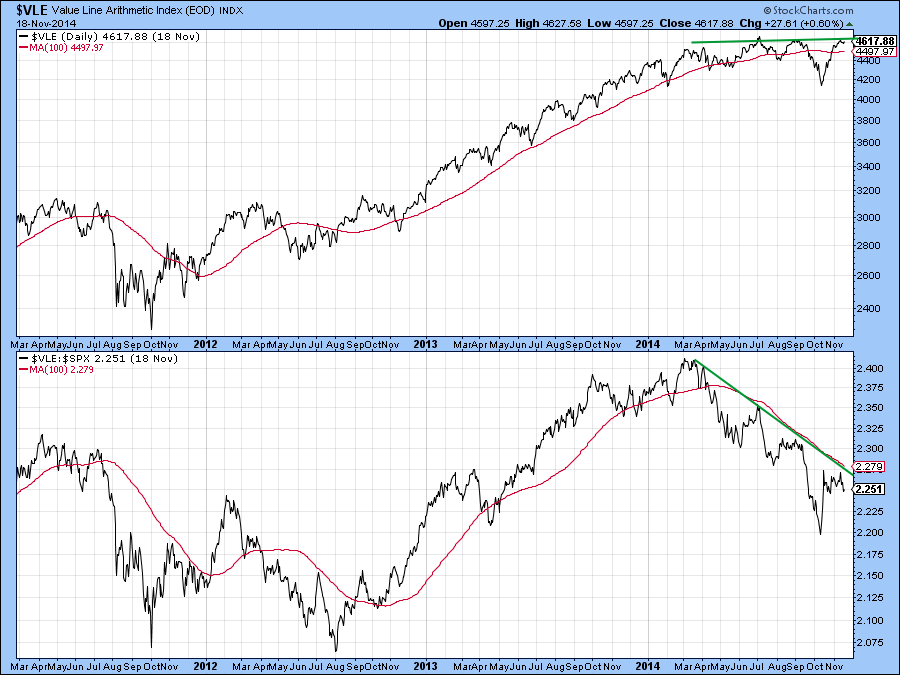

Tuesday's NASDAQ High Was Accompanied By A Paltry 50 Net New Highs

by Martin Pring,

President, Pring Research

* Value Line Arithmetic is just below important resistance.

* 10-year bond price reacts to its recent breakout point.

* The GLD fails at resistance.

US Equities

The Value Line Arithmetic($VLE) monitors the price of the average stock. It has been one of the weakest areas of the market as demonstrated by...

READ MORE

MEMBERS ONLY

CONSUMER STAPLES AND RETAIL ETFS HIT RECORD HIGHS -- RETAILERS ARE BENEFTING FROM FALLING OIL -- DIVIDEND PAYING STAPLES MAY BE BENEFITING FROM LOWER BONDS YIELDS -- A STRONGER DOLLAR IS ALSO KEEPING INFLATION AND GLOBAL BOND YIELDS DOWN

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHY ARE STAPLES AND RETAILERS LEADING ... We generally look at the relative performance of market sectors to get clues about stock market direction. It's normally a good sign, for example, when retailers are doing better than the general market. It's normally a bad sign when consumer...

READ MORE

MEMBERS ONLY

MARKET TURNS MIXED AS SMALL-CAPS LAG -- IS RELATIVE WEAKNESS IN THE RUSSELL 2000 REALLY A PROBLEM? -- MARKING SUPPORT FOR THREE MAJOR INDEX ETFS -- AIR PRODUCTS LEADS MATERIALS SECTOR -- XLV HITS NEW HIGH AS PFIZER CHALLENGES RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET TURNS MIXED AS SMALL-CAPS LAG... Link for today's video. As of Mondays close, November has been a mixed month for the stock market. The S&P 500 SPDR, the Dow Diamonds and the Nasdaq 100 ETF are up, while the S&P SmallCap iShares, Russell...

READ MORE

MEMBERS ONLY

ENERGY ETFS CONTINUE TO STRUGGLE -- GOOGLE FAILS AT BROKEN SUPPORT AND LAGS -- FACEBOOK FIRMS AFTER GAP -- INTERNET ETF MAINTAINS UPTREND -- GLOBAL SOCIAL MEDIA ETF REVERSES AT KEY RETRACEMENT -- SEMICONDUCTORS COULD HOLD THE NEXT KEY

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY ETFS CONTINUE TO STRUGGLE... Link for today's video. Energy stocks are in the news today because Baker Hughes is attempting to takeover Halliburton. This seemingly positive news did not, however, boost the sector or other energy related ETFs. Perhaps the sector is more focused on oil, which...

READ MORE

MEMBERS ONLY

Gold in Yen Breaks to the Upside. Is this the Start of a Broader Trend Feeding Back to the US Dollar Gold Price?

by Martin Pring,

President, Pring Research

* IWM continues to rally but Relative Strength action still lags.

* Dollar diffusion indicator starting to turn down.

* The Gold (GLD) experiences a strong outside bar on heavy volume.

US Equities

Chart 1 shows the Coppock Curve for the S&P 500 ($SPX) . This indicator was designed to identify major...

READ MORE

MEMBERS ONLY

EQUAL-WEIGHT TECH AND CONSUMER DISCRETIONARY ETFS LEAD -- S&P 500 NOTCHES ANOTHER NEW HIGH -- SMALL AND MID CAPS CONTINUE TO LAG -- BUT NEW HIGHS SURGE FOR SMALL AND MID CAPS -- HIGH-LOW PERCENT HITS A MILESTONE FOR 2014

by John Murphy,

Chief Technical Analyst, StockCharts.com

EQUAL-WEIGHT TECH AND CONSUMER DISCRETIONARY ETFS LEAD... Link for today's video. There are certainly pockets of weakness in the stock market, but the stock market as a whole shows enough strength to keep the bull going and there were some notable new highs this week. John Murphy wrote...

READ MORE

MEMBERS ONLY

WAL-MART JUMPS TO RECORD HIGH -- RETAIL ETFS HAVE BENEFITED FROM PLUNGE IN CRUDE OIL -- LOWER END RETAILERS LIKE COSTCO, TJX, AND TARGET HAVE LED RALLY -- HIGHER END RETAILERS LIKE TIFFANY HAVE LAGGED BEHIND -- MACY'S HAS STRONG WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

WAL-MART SHARES EXPLODE... Chart 1 shows Wal Mart surging 4% today to break out to a record high. That's a pleasant change for the world's largest retailer which has hardly been a market leaders. The WMT/SPX relative strength ratio (above chart) is just starting to...

READ MORE

MEMBERS ONLY

SHANGHAI-HONG KONG STOCK CONNECT PROGRAM IS SET TO START NEXT MONDAY -- ITS APRIL ANNOUNCEMENT IS THE MAIN REASON SHANGHAI STOCKS HAVE BEEN GAINING ON HONG KONG -- SHANGHAI STOCK INDEX TOUCHES THREE-YEAR HIGH AND IS STARTING TO GAIN ON REST OF THE WORLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGNERS WILL BE ABLE TO BUY SHANGHAI STOCKS ... Starting next Monday, foreign investors will be able for the first time to buy and sell stocks listed on the Shanghai Stock Exchange via the Hong Kong Stock Exchange. More than 500 mainland stocks (previously unavailable to foreign investors) will be traded...

READ MORE

MEMBERS ONLY

IJR AND QQQ WORK THEIR WAY HIGHER -- BREADTH INDICATORS IMPROVE FOR THE MATERIALS SECTOR -- RETAIL SPDR HITS NEW HIGH AHEAD OF KEY REPORT -- MARKETVECTORS RETAIL ETF SHOWS RELATIVE STRENGTH -- A MIXED BAG FOR APPAREL RETAILERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

IJR AND QQQ WORK THEIR WAY HIGHER... Link for today's video. Last week I featured the S&P SmallCap iShares (IJR) and the Nasdaq 100 ETF (QQQ) because both were holding their gaps and consolidating. After strong buying pressure and a big surge, buying pressure and selling...

READ MORE

MEMBERS ONLY

HOME CONSTRUCTION ISHARES MAKES A BREAK -- SHANGHAI COMP SURGES TO NEW HIGH -- CHINA AND JAPAN SHOW RELATIVE STRENGTH -- CHINA INDUSTRIALS LEADS ETF GROUP -- CHINA CONSUMER ETF FIRMS AT KEY LEVEL -- COPPER HITS SUPPORT ZONE AGAIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOME CONSTRUCTION ISHARES MAKES A BREAK... Link for today's video. Chart 1 shows the Home Construction iShares (ITB) reversing an eight month downtrend with a surge above its August-September highs. This is the first higher high of 2014. Notice that this is a weekly chart extending back two...

READ MORE

MEMBERS ONLY

IJR AND QQQ CONSOLIDATE AFTER GAPS -- THE NEW HIGH PARADE -- LARGE-CAPS LEAD MARKET WITH NEW HIGHS -- SPX AND NDX BREADTH HELD UP THE BEST IN OCTOBER -- SPX AND NDX LEAD EXPANSION OF NEW HIGHS -- THE FIVE STRONGEST SMALL-CAP SECTORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

IJR AND QQQ CONSOLIDATE AFTER GAPS... Link for today's video. The S&P SmallCap iShares (IJR) and the Nasdaq 100 ETF (QQQ) gapped up on Friday and held these gaps all week. Even though these ETFs stalled and did not continue higher, the gaps are holding and...

READ MORE

MEMBERS ONLY

POWERSHARES DOLLAR BULLISH ETF BREAKS OUT TO THE UPSIDE -- DOLLAR RALLY IS SUPPORTED BY WIDE PREMIUM OF U.S. BOND YIELDS OVER FOREIGN YIELDS -- STRONGER DOLLAR FAVORS U.S. OVER FOREIGN STOCKS -- EMERGING CURRENCIES TEST MAJOR SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWERSHARES U.S. DOLLAR BULLISH ETF BREAKS OUT TO THE UPSIDE ... The U.S. dollar rally continues. The line on top of Chart 1 shows the U.S. Dollar Cash Index (USD) trading at the highest level in four years. The main chart shows the PowerShares US Dollar Bullish ETF...

READ MORE

MEMBERS ONLY

Gold Price in Yen Offers a Thumbs Down on the BOJ's latest Inflationary Moves

by Martin Pring,

President, Pring Research

* Short-term market indicators are still bullish.

* Stock/bond ratio reaches a critical point.

* Yen completes a 28-year top against the dollar.

US Equities

Throughout 2013 and for most of 2014 every peak in the S&P was confirmed by the NYSE Composite ($NYA) . You can see that from the...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SECTOR WEIGHS ON STOCKS -- WATCHING THE UPSWINGS IN XRT AND ITB -- SMALL-CAP TECH ETF HITS NEW HIGH -- LIGHT CRUDE, BRENT AND GASOLINE BREAK DOWN -- CONSOLIDATIONS END FOR ENERGY-RELATED ETFS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SECTOR WEIGHS ON STOCKS... Link for today's video. The consumer discretionary led the market in 2013, but has lagged the market this year and the price relative just broke to a new low. Chart 1 shows the Consumer Discretionary SPDR (XLY) peaking just below the early...

READ MORE

MEMBERS ONLY

HIGH-LOW PERCENT SURGES ACROSS THE BOARD -- FINANCE SECTOR LEADS OFFENSIVE SECTOR BREADTH -- MATERIALS AND ENERGY SHOW WEAKEST BREADTH -- CRUDE OIL CONSOLIDATION EVOLVES -- GASOLINE SLIGHTLY OUTPERFORMS CRUDE -- PALLADIUM HOLDS UP BETTER THAN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

HIGH-LOW PERCENT SURGES ACROSS THE BOARD... Link for today's video. Chartists can use High-Low Percent to measure participation in a market move and compare the degree of participation. High-Low Percent equals the difference between 52-week highs and new 52-week lows divided by the total number of stocks in...

READ MORE

MEMBERS ONLY

BIG MOVE BY JAPAN PUSHES GLOBAL STOCKS SHARPLY HIGHER -- THE PLUNGING YEN PUSHES JAPANESE STOCKS TO SEVEN-YEAR HIGH -- DOW RECORD HIGH CONFIRMS TRANSPORTATION BREAKOUT -- S&P 500 HITS RECORD CLOSE AS SMALL CAPS JUMP

by John Murphy,

Chief Technical Analyst, StockCharts.com

JAPAN ANNOUNCES BIG JUMP IN ASSET BUYING... Japanese authorities surprised everyone on Friday by increasing their already aggressive bond purchases (QE) by a third. In addition, it will expand those purchases to include stocks and real estate investments. The Japanese pension fund also announced that it will increase its allocation...

READ MORE