MEMBERS ONLY

S&P 500 RECLAIMS 2K -- SMALL-CAPS RIP HIGHER -- SEASONALITY FAVORS SMALL-CAPS (LIVE DEMO) -- SHORT-TERM TREASURY YIELDS SURGE -- FINANCE SECTOR LEADS WITH NEW HIGH -- PUTTING RECENTLY VOLATILITY INTO PERSPECTIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 RECLAIMS 2K... Link for today's video. Stocks may be short-term overbought and some of the indices may be near their prior highs, but the trends are up and the breadth indicators are bullish. These short-term overbought conditions could give way to a pullback or...

READ MORE

MEMBERS ONLY

Inflation Hedge Assets Continue to Break to the Downside (Video)

by Martin Pring,

President, Pring Research

* Outside day hints that the short-term downtrend for bonds may be over.

* Dollar Index may be completing an inverse head and shoulders.

* Stronger dollar forces gold to test its lows.

* Stronger dollar causes gold to break down from a 2-year trading range.

Here is a link to the the text...

READ MORE

MEMBERS ONLY

Inflation Hedge Assets Continue to Break to the Downside

by Martin Pring,

President, Pring Research

* Outside day hints that the short-term downtrend for bonds may be over.

* Dollar Index may be completing an inverse head and shoulders.

* Stronger dollar forces gold to test its lows.

* Stronger dollar causes gold to break down from a 2-year trading range.

Here is a link to the video version...

READ MORE

MEMBERS ONLY

MARKET INDEXES BREAK MORE RESISTANCE BARRIERS -- SMALLER STOCKS SHOW RELATIVE STRENGTH -- BREADTH FIGURES ALSO SHOW IMPROVEMENT -- BUT DEFENSIVE STOCKS STILL SHOW MARKET LEADERSHIP -- TREASURIES SLIDE AS HIGH YIELD BONDS JUMP

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 HITS NEW OCTOBER HIGH ... The S&P 500 reflects continued improvement in the stock market's short-term trend. The daily bars in Chart 1 show the SPX climbing above its 50-day moving average (blue line) and chart resistance at its early October intra-day peak...

READ MORE

MEMBERS ONLY

VIX TRIGGERS THIRD SIGNAL OF 2014 -- KRE AND IWM CHALLENGE ANOTHER SUPPORT BREAK -- SOME REFINERS SHOW RELATIVE STRENGTH WITHIN ENERGY SECTOR -- TESORO AND PHILLIPS BOUNCE OFF KEY RETRACEMENTS -- REFINERS ON THE RELATIVE ROTATION GRAPH

by John Murphy,

Chief Technical Analyst, StockCharts.com

VIX TRIGGERS THIRD SIGNAL OF 2014... Link for today's video. The S&P 500 Volatility Index ($VIX) is largely a coincident indicator that rises when the S&P 500 falls and falls when the S&P 500 rises. As with the S&P 500,...

READ MORE

MEMBERS ONLY

CONSUMER STAPLES AND UTILITIES SPDRS SURGE TO NEW HIGHS -- OIL ETFS BREAK PENNANT LINES -- XOP AND XES FOLLOW OIL LOWER -- INITIAL CLAIMS AND INDUSTRIAL PRODUCTION FAVOR LESS QE -- TIP SHOWS INFLATIONARY PRESSURES DECREASING

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER STAPLES AND UTILITIES SPDRS SURGE TO NEW HIGHS... Link for today's video. The defensive sectors took the lead on Monday with the Consumer Staples SPDR (XLP) and the Utilities SPDR (XLU) hitting fresh 52-week highs. Relative strength and upside leadership in these two sectors shows a preference...

READ MORE

MEMBERS ONLY

THE KEY TO THE UPSWING IN IWM -- RAFF REGRESSION CHANNEL DEMO -- BREADTH THRUST IS BULLISH UNTIL IT ISN'T -- ELEMENTS OF RISK AVERSION REMAIN -- MEDICAL DEVICES ETF CHALLENGES PRIOR HIGHS -- OIL AND GASOLINE CONSOLIDATE WITHIN DOWNTRENDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE KEY TO THE UPSWING IN IWM (RAFF REGRESSION CHANNEL DEMO)... Link for today's video. Chart 1 shows the Russell 2000 iShares (IWM) with Raff Regression Channels marking the swings over the last six months. The overall trend is down because the ETF formed a lower high in...

READ MORE

MEMBERS ONLY

MARKET RALLY CONTINUES -- RAILS LEAD TRANSPORTS HIGHER -- MMM LEADS INDUSTRIAL SPDR ABOVE 50-DAY LINE -- SMALL CAPS ALSO IMPROVE -- DIVIDEND PAYERS ATTRACT BUYERS ON FALLING BOND YIELDS -- VIX PLUNGES BACK BELOW 20 -- OVERSOLD FOREIGN SHARES REBOUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

RAILS LEAD TRANSPORTS HIGHER ... Not only are stocks extending their recent rally with a strong day, they're being led higher by economically-sensitive groups like transports. The daily bars in Chart 1 show the Dow Jones Transportation Average trading 2% higher today and trading above its 50-day moving average....

READ MORE

MEMBERS ONLY

Bearish Candle Patterns Indicate a Test of Last Week's Lows are Likely

by Martin Pring,

President, Pring Research

* Short-term momentum is still oversold, so a rally is probable once the expected test is over.

* Any rally likely to be part of an overall topping out process.

* Europe experiences primary trend sell signal.

* Japanese and Asian Ex Japan ETF’s look vulnerable from a long-term aspect.

This week we...

READ MORE

MEMBERS ONLY

MEASURING RISK APPETITE WITH MICRO-CAPS -- RUSSELL 2000 ISHARES RE-CAPTURES ONE BREAK -- CONSUMER DISCRETIONARY AND INDUSTRIALS SECTORS LEAD THE REBOUND -- ITB FORMS A BIG REVERSAL ON BIG VOLUME -- OIL SERVICE ETF FIRMS AFTER SELLING CLIMAX

by John Murphy,

Chief Technical Analyst, StockCharts.com

MEASURING MICRO-CAPS FOR RISK APPETITE... Link for today's video. The Russell Micro-Cap iShares (IWC) is an important ETF to watch because it represents the appetite for the riskiest stocks in the market. Small-cap stocks are deemed riskier than large-caps and micro-cap stocks are deemed riskier than small-caps. Micro-caps...

READ MORE

MEMBERS ONLY

SPY GETS STUCK BETWEEN A GAP AND A HARD PLACE -- FALLING YIELD CURVE WEIGHS ON REGIONAL BANKS -- RETAILER SPDR STRUGGLES TO STAY POSITIVE -- TWO DISCOUNTERS SHOW RELATIVE STRENGTH -- WATCHING MACY'S AND NORDSTROM FOR CLUES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPY GETS STUCK BETWEEN A GAP AND A HARD PLACE... Link for today's video. Chart 1 shows the S&P 500 SPDR (SPY) forging a short-term reversal last week. Notice how the ETF gapped below 187 on Wednesday, stalled for two days and then gapped above 187...

READ MORE

MEMBERS ONLY

CRB INDEX TESTS MAJOR SUPPORT -- BOND SURGE SHOWS EXHAUSTION -- JUMP IN HIGH YIELD BONDS IS ENCOURAGING -- S&P 500 BOUNCES FROM OVERSOLD CONDITION -- BUT MORE TESTING MAY BE NEEDED -- SMALL CAP RALLY FADES ON FRIDAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRB INDEX IS TESTING MAJOR SUPPORT... I'm starting today's message with a look at commodity prices because they've been the focus of a lot of attention of late. That's because falling commodity prices are deflationary in nature, which is something central bankers...

READ MORE

MEMBERS ONLY

S&P 500 HITS LONG VOLUME-BY-PRICE BAR -- S&P MIDCAP 400 FULFILLS DOUBLE TOP TARGET -- SMALL-CAP PRICE RELATIVE BOUNCES -- SECTOR ROTATIONS FAVOR DEFENSIVE SECTORS -- TWO SMALL-CAP SECTORS TO WATCH -- PLUNGE IN SHORT-TERM RATES SHOWS FLIGHT TO SAFETY

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 HITS LONG VOLUME-BY-PRICE BAR... On an intraday basis, the S&P 500 fell around 10% from its summer high to the mid October low. Even though a 10% decline may seem drastic, it still pales relative to the 50% advance from the November 2012 low...

READ MORE

MEMBERS ONLY

That Was Probably It....For The Time Being

by Martin Pring,

President, Pring Research

* Short-term indicators continue to decline, but Wednesday’s price action may cause them to go bullish.

* Small caps starting to emerge as leaders on the upside (At least for the short-term).

* Quality bonds experience probable upside blow-off and high yield exhaustion on the downside .

Earlier in the week I pointed...

READ MORE

MEMBERS ONLY

FOREIGN WEAKNESS FINALLY HITS U.S. STOCKS -- RISING VIX IS AT THREE-YEAR HIGH AND MAY HAVE FURTHER TO GO -- S&P 500 MAY RETEST ITS FEBRUARY LOW -- FOUR YEAR LOW IN BRENT CRUDE PULLS GERMAN BOND YIELD TO NEW RECORD LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN WEAKNESS FINALLY HITS THE U.S.... It took awhile for it to happen, but tumbling foreign markets have finally pulled the U.S. market into a downside correction. The three lines in Chart 1 tell the story. The blue line shows EAFE iShares (EFA) peaking at the start of...

READ MORE

MEMBERS ONLY

Shanghai Reverses Four -year Bear Market in Relative Action

by Martin Pring,

President, Pring Research

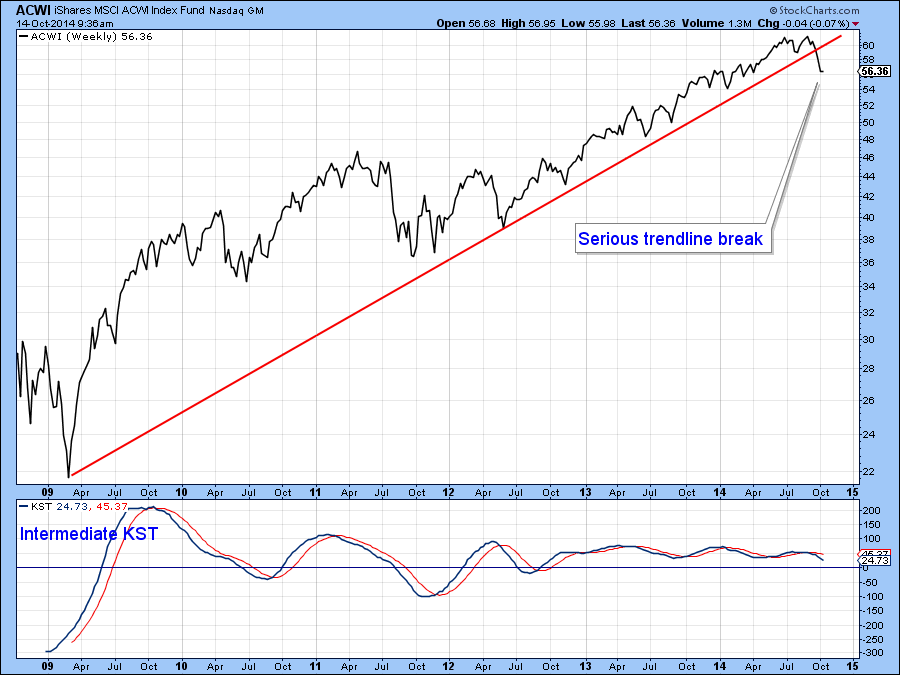

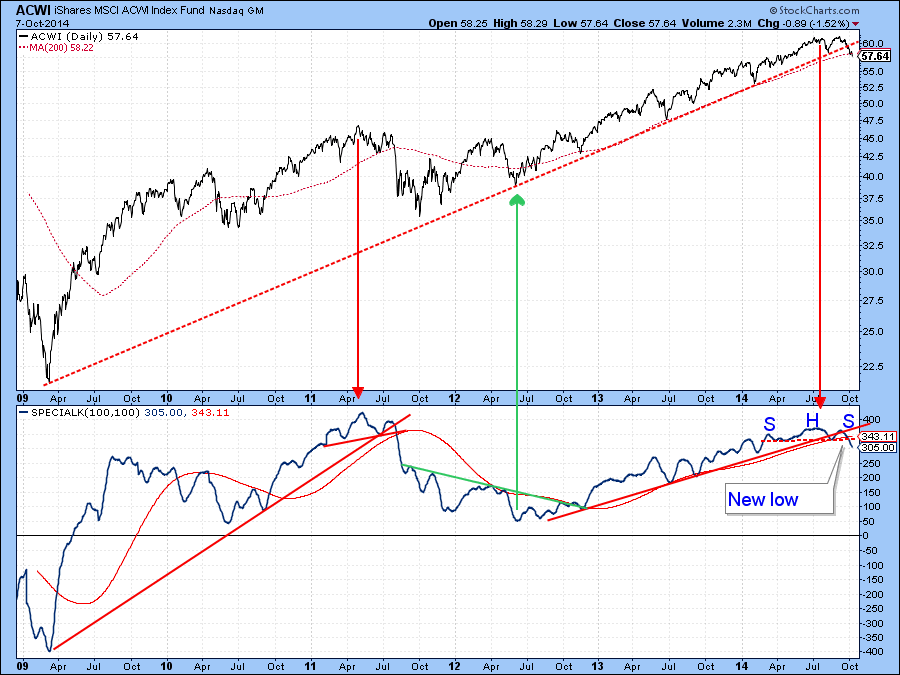

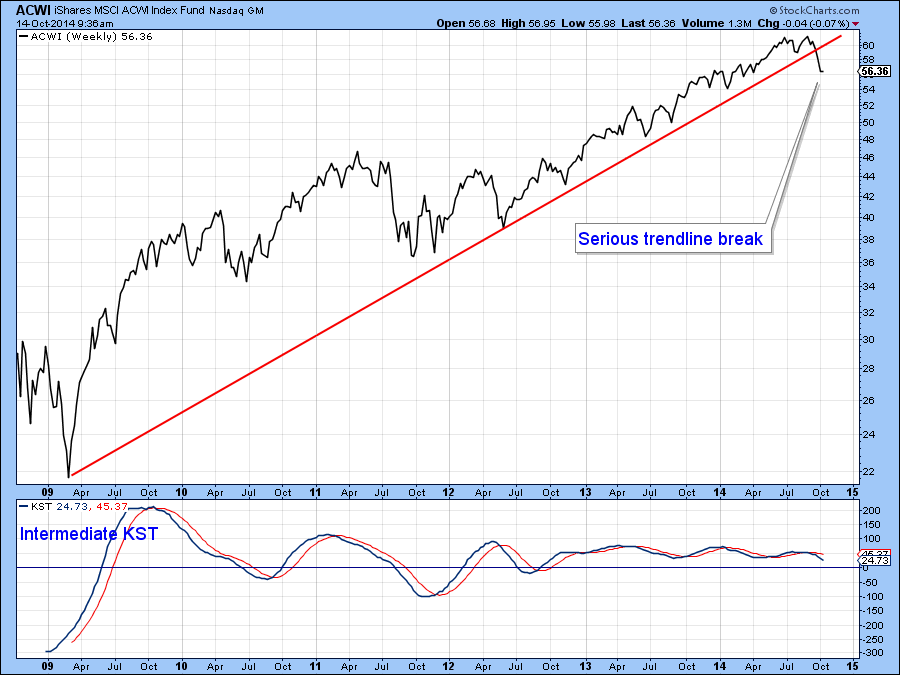

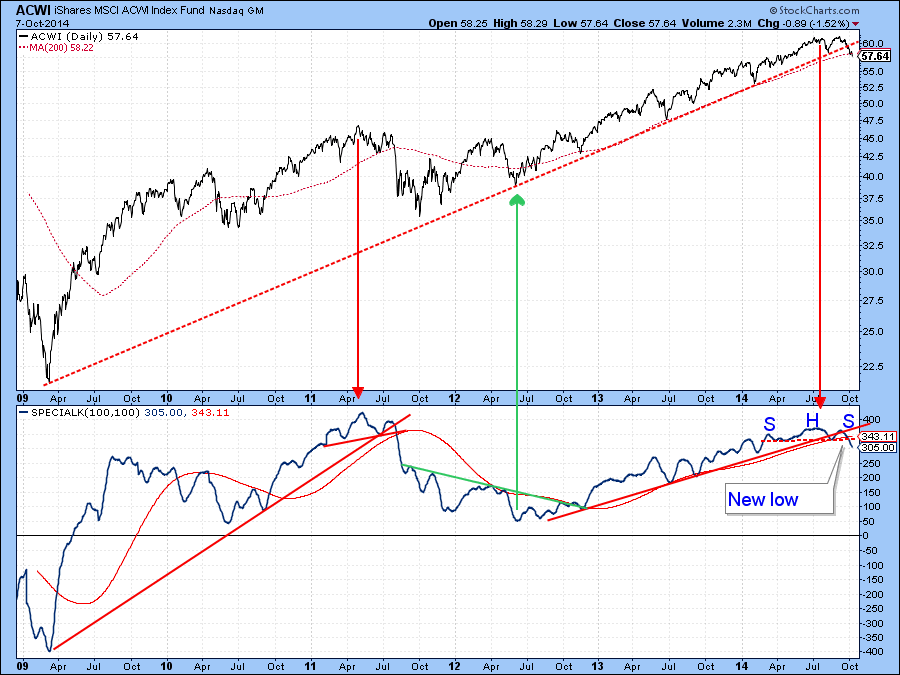

* Global equities experience long term technical damage.

* But short-term indicators are close to signaling a tradable rally.

* Bond market still looks strong.

* Gold experiences marginal upside breakout against stocks.

US Equities

Last week I described how some serious long-term technical damage had been done to global equities but that a...

READ MORE

MEMBERS ONLY

S&P 500 BREAKS KEY MOVING AVERAGE -- GOOGLE BREAKS DOWN AS APPLE HOLDS STRONG -- PLAYING THE SWINGS IN KRE AND IWC -- DECEMBER NATURAL GAS TESTS KEY LEVEL -- ENERGY-RELATED ETFS ARE THE MOST OVERSOLD -- COFFEE ETF CHALLENGES PRIOR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 BREAKS KEY MOVING AVERAGE ... Link for today's video. The S&P 500 is not in uncharted territory, but it is in territory we have not seen in some time. Chart 1 shows the index breaking below its 200-day moving average, breaking its prior...

READ MORE

MEMBERS ONLY

FOUR WAYS TO MEASURE RELATIVE PERFORMANCE -- UTILITIES SECTOR MAINTAINS WEDGE BREAKOUT -- SMALL FINANCIALS SHOW RELATIVE STRENGTH -- FINDING SECTORS THAT POINT NORTHEAST -- AVOIDING SECTORS THAT POINT SOUTHWEST

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPX TESTS A KEY MOVING AVERAGE... Link for today's video. Selling pressure and volatility have dominated October, but some sectors and industry groups are holding up better than others. How can we find the strong groups and avoid the weak? The next few charts will show four methods...

READ MORE

MEMBERS ONLY

MARKETS REMAIN IN RISK-OFF MODE -- S&P 500 MOVES TOWARDS SUPPORT -- MID-CAPS BREAK SUPPORT -- SMALL-CAPS CONTINUE TO LAG -- INDUSTRIALS SPDR BREAKS KEY LEVEL -- CONSUMER DISCRETIONARY SPDR TESTS KEY LEVEL -- TECH AND FINANCE SPDRS ARE HOLDING UP THE BEST

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKETS REMAIN IN RISK-OFF MODE... Link for today's video. The markets continue to shun risk and embrace safety, which means the markets are in risk-off mode. There are several metrics to we can use for this assessment. First, small-caps have broken down and are underperforming large-caps. The S&...

READ MORE

MEMBERS ONLY

Stocks Break Down Against Bonds In A Major Way

by Martin Pring,

President, Pring Research

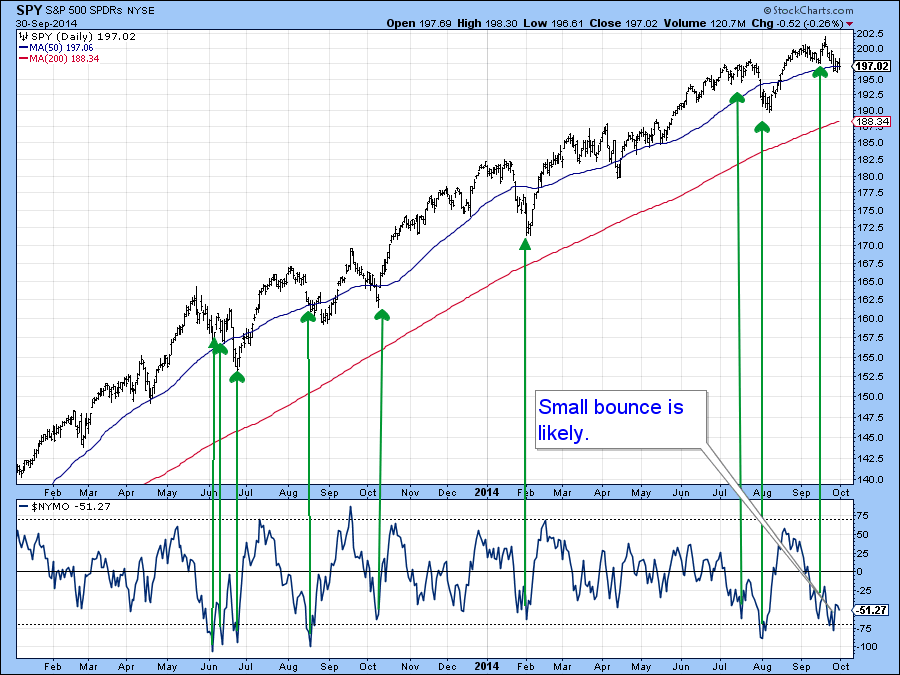

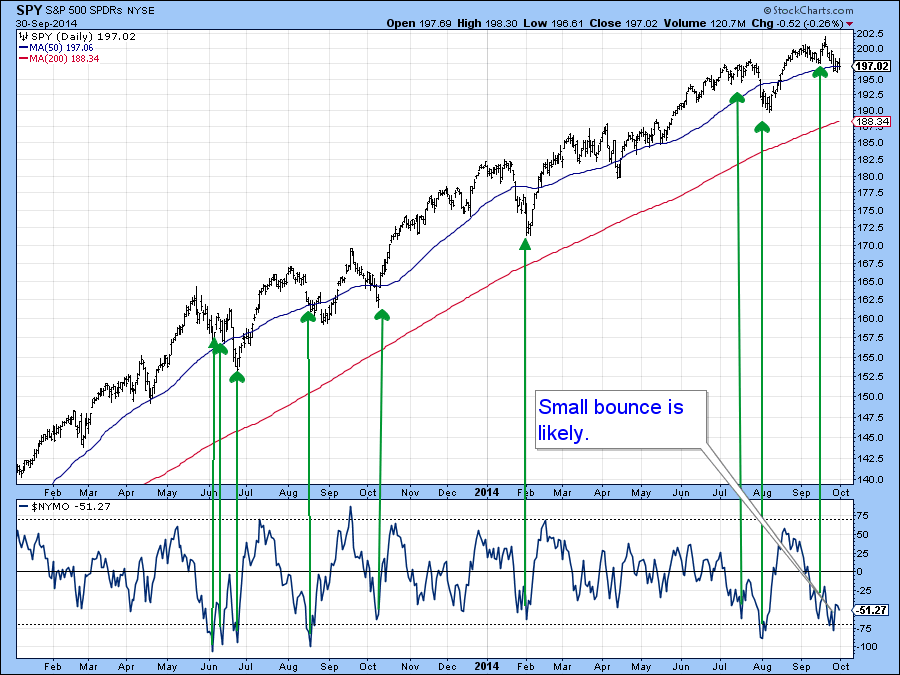

* Oversold short term condition could trigger a bounce... but remember this is October!

* Five year yield experiences false upside breakout. That signals lower yields

* Gold bounces from a must hold support level.

(Click here for the Video Version of this article.)

US Equities

In the last week some serious long-term...

READ MORE

MEMBERS ONLY

Stocks Break down Against Bonds in a Major Way - Video Version

by Martin Pring,

President, Pring Research

* Oversold short term condition could trigger a bounce... but remember this is October!

* Five year yield experiences false upside breakout. That signals lower yields.

* Gold bounces from a must hold support level.

Click here for the Print Version

Good luck and good charting,

Martin Pring...

READ MORE

MEMBERS ONLY

QQQ AND SPY TEST THEIR GAPS -- SMALL AND MICRO CAP ETFS FILL THEIR GAPS -- SECTOR PERFORMANCE REFLECTS DEFENSIVE MARKET -- DOLLAR AND TREASURIES ARE IN RISK OFF MODE -- 20+ YR T-BOND ETF CHALLENGES AUGUST HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ AND SPY TEST THEIR GAPS ... Link for today's video. The S&P 500 SPDR (SPY) and Nasdaq 100 ETF (QQQ) forged intraday reversals last Thursday and followed up with gaps on Friday, but the bulls are getting cold feet already because both fell back into their...

READ MORE

MEMBERS ONLY

SEASONAL PATTERNS START TO GET INTERESTING -- LOOKING AT SMALL-CAP PERFORMANCE FOR YEAREND -- SEASONAL PATTERNS STAND OUT FOR THREE SECTORS -- NATURAL GAS TESTS SUPPORT AGAIN -- AIRLINE INDEX BOUNCES OFF SUPPORT -- DELTA AND UNITED LEAD AIRLINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEASONAL PATTERNS START TO GET INTERESTING... Link for today's video. StockCharts users can analyze seasonal patterns using the Seasonality Tool. This tool creates a histogram chart showing the percentage of times a security gained and the average gain/loss overall. Before getting into the current seasonal patterns, note...

READ MORE

MEMBERS ONLY

S&P 500 MAINTAINS ITS LONG-TERM UPTREND -- CONSUMER DISCRETIONARY SECTOR ETFS TESTS KEY LEVEL -- MACY'S, NORDSTROM AND TJX LEAD RETAILERS HIGHER -- WHEN IS OVERSOLD REALLY OVERSOLD? -- USING PPO AND RSI FOR TO DEFINE OVERSOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 MAINTAINS ITS LONG-TERM UPTREND... Link for today's video. Even though the S&P Small-Cap 600 and S&P MidCap 400 are underperforming and have stalled for several months, the S&P 500 remains in a clear uptrend and over 50 points...

READ MORE

MEMBERS ONLY

SMALL CAPS TEST NECKLINE OF POSSIBLE H&S TOP -- MIDCAP INDEX IS IN DANGER OF BREAKING AUGUST LOW -- SO IS THE NYSE COMPOSITE INDEX -- THE U.S. IS BEING LED LOWER BY FOREIGN SHARES -- THE DOLLAR RALLY MAY BE JUST STARTING

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAP HEAD AND SHOULDERS TOP?... A debate is going on within the technical community as to whether or not the Russell 2000 Small Cap Index is in danger of completing a "head and shoulders top". A case can certainly made for it, although it would be an...

READ MORE

MEMBERS ONLY

SMALL CAPS BREAK SUPPORT -- MIDCAPS MAY BE NEXT -- DOW AND S&P 500 BREAK 50-DAY AVERAGES -- AIRLINES LEAD TRANSPORTS LOWER AS UTILITIES RALLY WITH BONDS -- EMERGING BONDS FALL ON RISING DOLLAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS FALL BELOW AUGUST LOW -- MIDCAPS MAY BE NEXT... Arthur Hill and myself have been warning of a potential breakdown in smaller stocks, and the potential damage that could do to the rest of the stock market. That situation has gotten even worse. Chart 1 shows the Russell...

READ MORE

MEMBERS ONLY

Silver Breaks to the Downside in a Big Way

by Martin Pring,

President, Pring Research

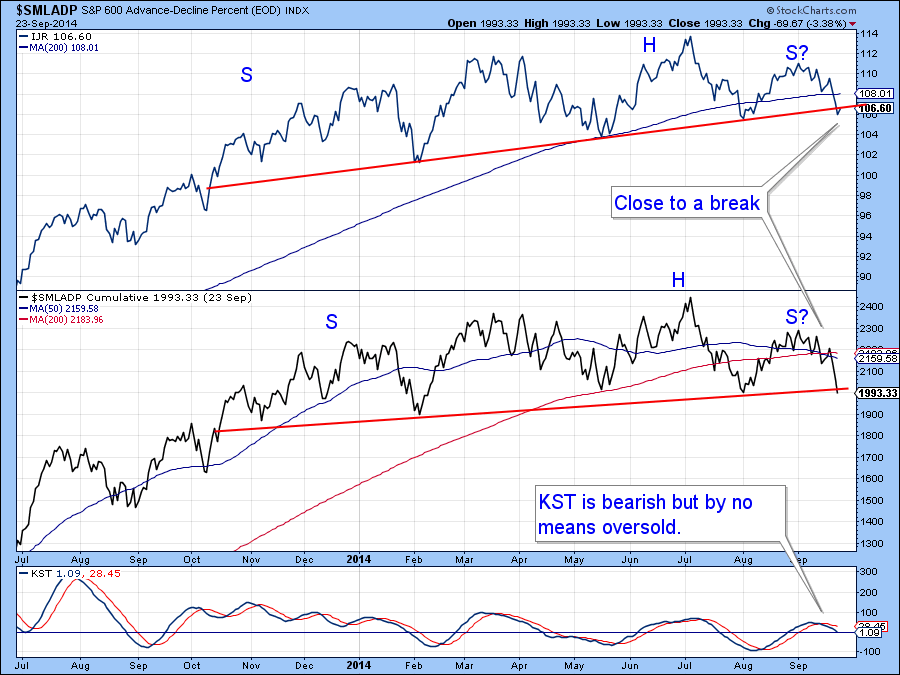

* Negative divergences in the equity market continue to build.

* The rest of the world (EFA) completes a head and shoulders top.

* Credit spreads continue to deteriorate.

* Some commodity indexes break down in a major way, others hold fast.

US Equities

In our last issue my basic conclusion on equities was...

READ MORE

MEMBERS ONLY

UTILITIES SECTOR RETURNS TO THE LEADERBOARD -- APPLE, AT&T AND VERIZON HOLD STRONG -- SCANNING FOR RELATIVE STRENGTH -- BOEING, BERRY, CALLIDUS AND VEECO MAKE THE CUT -- WHEN TO SELL OR EXIT A POSITION

by John Murphy,

Chief Technical Analyst, StockCharts.com

UTILITIES SECTOR RETURNS TO THE LEADERBOARD... Link for today's video. The Utilities SPDR (XLU) is leading the market over the last two days and its StockCharts Technical Rank (SCTR) is improving. Chart 1 shows XLU trading flat since April as it oscillated around the 42 level for several...

READ MORE

MEMBERS ONLY

DIA AND QQQ HOLD UP THE BEST -- RUSSELL 2000 VALUE UNDERPERFORMS GROWTH -- BIG BANKS LEAD, BUT REGIONAL BANKS LAG -- BIOTECHS REFUSE TO BUCKLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DIA AND QQQ HOLD UP THE BEST... Link for today's video. Most of the major index ETFs broke below their mid September lows with sharp declines last week, but the Dow Diamonds (DIA) and the Nasdaq 100 ETF (QQQ) held these lows and show relative strength. The Dow...

READ MORE

MEMBERS ONLY

HOW FAR CAN THE S&P 500 CORRECT? -- NOTHING BULLISH ON SMALL-CAP CHART -- MID-CAPS REMAIN IN THE MIDDLE -- 20+ YR T-BOND ETF BOUNCES OF KEY RETRACEMENT -- COMPARING THE 2011 DOLLAR SHOCK WITH 2014 (PERFCHART DEMO) -- OIL FIRMS WITHIN DOWNTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOW FAR CAN THE S&P 500 CORRECT?... Link for today's video. The S&P 500 is down less than 3% from its all time high and still in a long-term uptrend. Even though this week's decline could extend, it would take a lot...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS SELL OFF IN RISING VOLUME -- A LOT OF MOVING AVERAGES HAVE BEEN BROKEN -- HIGH YIELD BOND ETF BREAKS 200-DAY LINE -- FOREIGN STOCKS FALL AS WELL -- A RISING DOLLAR IS HURTING EMERGING MARKET CURRENCIES AND STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ AND S&P 500 BREAK 50-DAY LINES... Chart 1 shows the S&P 500 SPDRS closing below its 50-day line today in heavy trading. That's a negative combination. Chart 2 shows the Nasdaq Composite Index doing the same. Their daily MACD lines remain decidedly negative....

READ MORE

MEMBERS ONLY

Global Equities and Some US Averages are Just Above Critical Support

by Martin Pring,

President, Pring Research

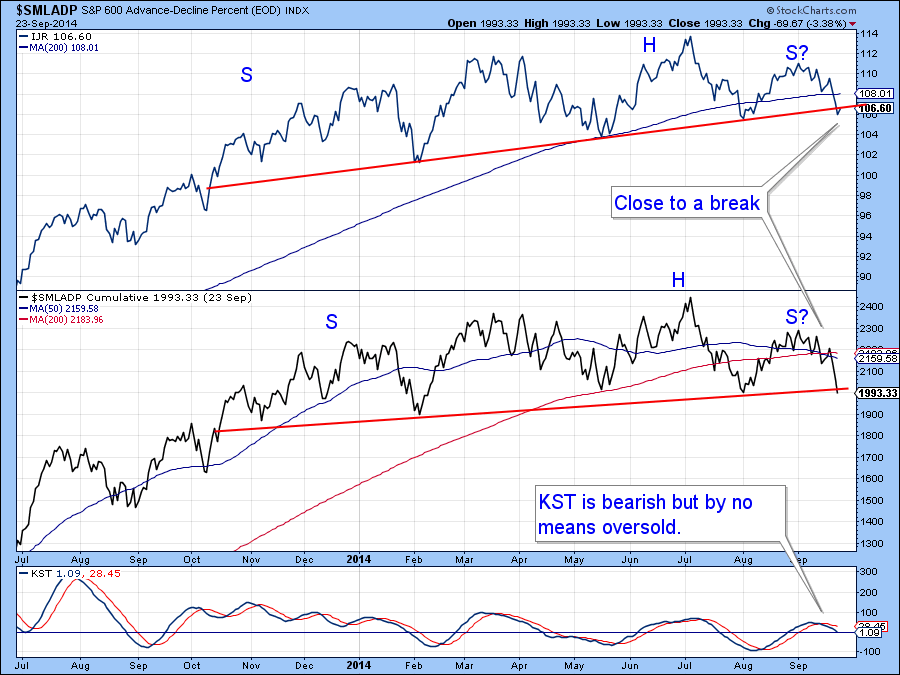

* Small cap stocks on the verge of a major breakdown.

* Gold shares violate important up trend line.

* Dollar Index due for a correction within a primary bull market.

Click here for the video version.

For the last few weeks I have been pointing out the gradually deteriorating technical position but...

READ MORE

MEMBERS ONLY

Global Equities and Some US Averages are Just Above Critical Support - Video Version

by Martin Pring,

President, Pring Research

This is the video version of the Market Roundup.

* Small cap stocks on the verge of a major breakdown.

* Gold shares violate important up trend line.

* Dollar Index due for a correction within a primary bull market.

Click here for the print version.

Good Luck and good charting,

Martin Pring...

READ MORE

MEMBERS ONLY

FOREIGN STOCK ETFS ARE TESTING MAJOR OVERHEAD RESISTANCE BARRIERS WHICH COULD THREATEN GLOBAL RALLY -- THE % NYSE STOCKS ABOVE 200-DAY AVERAGE HAS FALLEN TO 2014 LOW -- SMALL CAP RELATIVE WEAKNESS IS WORST IN THREE YEARS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE STOCK RALLY IS GETTING NARROWER... Arthur Hill wrote about the negative divergence between small and micap stocks relative to large cap stocks. Let's put that in some perspective. Chart 1 shows that the three stock categories have been rising together since the 2009 bottom (as they usually...

READ MORE

MEMBERS ONLY

SCANNING FOR PULLBACKS WITHIN AN UPTREND (LIVE DEMO) -- BIOGEN IDEC BOUNCES OFF SUPPORT -- CVR REFINING FIRMS IN FIBONACCI CLUSTER ZONE -- QLYS AND MON ALSO MAKE THE SCAN CUT -- FRENCH, GERMAN AND UK STOCKS MOVE SHARPLY LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SCANNING FOR PULLBACKS WITHIN AN UPTREND... Link for today's video. As noted on Monday, stocks have weakened this month with small-caps leading the way lower. However, with most of the major indices hitting new highs recently, I still classify these declines as corrections within a bigger uptrend. I...

READ MORE

MEMBERS ONLY

SMALL-CAPS CONTINUE TO UNDERPERFORM -- MID-CAPS AND MICRO-CAPS ALSO LAG LARGE-CAPS -- THREE MOMENTUM ETFS BREAK LOWER BOLLINGER BANDS -- WATCHING THE BREAKOUTS IN FINANCE AND INDUSTRIALS -- STEEL STOCKS LEAD METALS AND MINING ETF LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAPS CONTINUE TO UNDERPERFORM... Link for today's video. September continues to be a rough month for mid-caps, small-caps, micro-caps and some of the high-beta groups. Overall, we have a bifurcated market with relative strength in large-caps and relative weakness in the other caps. Don't forget that...

READ MORE

MEMBERS ONLY

SETTING A YEAREND TARGET FOR THE S&P 500 -- SMALL AND MID-CAP INDICES HOLD THEIR CHANNELS -- SEASONAL EVIDENCE FOR THE JANUARY EFFECT -- NAT GAS CONSOLIDATES WITHIN DOWNTREND -- FIRSTTRUST NATURAL GAS ETF HITS SUPPORT ZONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SETTING A YEAREND TARGET FOR THE S&P 500... Link for today's video. The S&P 500, S&P MidCap 400 and S&P Small-Cap 600 are all in uptrends, and the S&P 500 remains the clear leader. Even though one can...

READ MORE

MEMBERS ONLY

LIFE INSURERS AND INVESTMENT SERVICE STOCKS BENEFIT FROM RISING BOND YIELDS -- PRUDENTIAL AND GOLDMAN SACHS ACHIEVE UPSIDE BREAKOUTS -- THE WISDOM TREE JAPAN HEDGED ETF ACHIEVES NEW RECOVERY HIGH ON PLUNGING YEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING RATES HELP INSURANCE PORTFOLIOS... Financial stocks are starting to show upside leadership at the same time that bond yields are starting to rise. Banks usually benefit from rising bond yields because they can charge higher rates for their loans. Two other financial groups have actually done better than banks...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS HIT NEW HIGHS -- BANKS LEAD FINANCIALS HIGHER -- LENNAR LEADS BIG BOUNCE IN HOMEBUILDERS -- RATE BOUNCE AFTER FED MEETING PUSHES DOLLAR HIGHER AND GOLD LOWER -- RISING SHORT-TERM RATES CAN BE GOOD FOR STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW INDUSTRIALS JOIN TRANSPORTS IN NEW HIGHS... Chart 1 shows the Dow Transports hitting another record high today, and remaining the strongest of the three Dow averages. Today's rally was led by rails and delivery services. Fedex gained 3.5% to lead the latter group higher. Chart 2...

READ MORE

MEMBERS ONLY

Five Year Yield Experiences Major Upside Breakout

by Martin Pring,

President, Pring Research

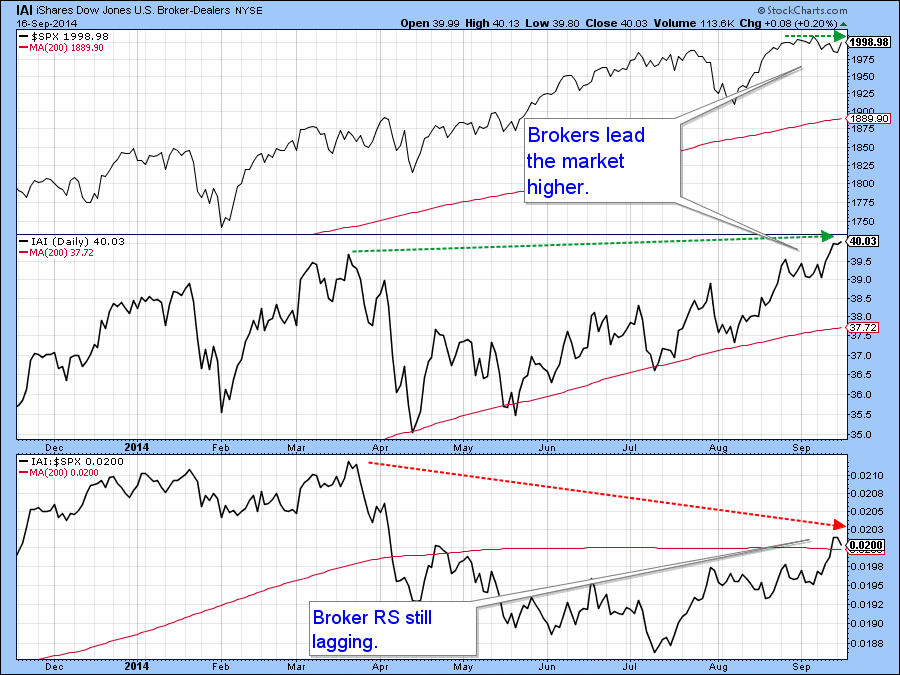

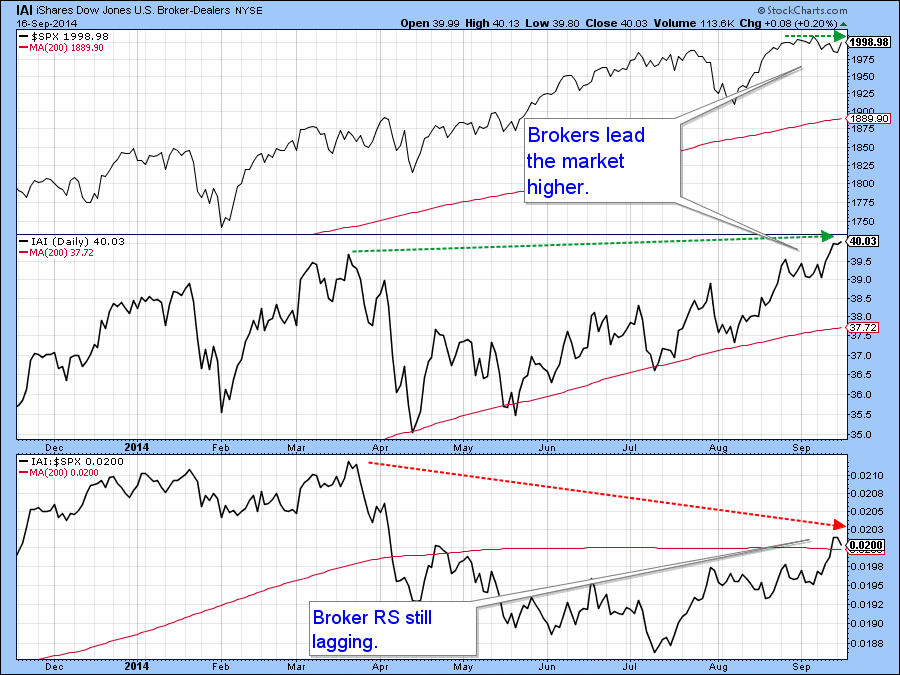

* - Brokers experience new bull market closing high.

* - NYSE stocks above their 200-day MA’s continue to shrink.

* - Canadian dollar experiences false break to the downside.

* - Commodities break to the downside. Could it be a whipsaw?

US Equities

Tuesday’s strong equity action could well be a...

READ MORE