MEMBERS ONLY

Two Charts I'm Watching Closely for Potential Breakouts

by Martin Pring,

President, Pring Research

The title of this article should really be more in the vein of two technical situations I am watching, because the long-term forces look as if they may be converging with short-term ones to form a kind of potential bullish reverse domino effect. Let's consider our first candidate,...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" Full September Webinar -- AVAILABLE NOW!

by Larry Williams,

Veteran Investor and Author

Larry's "Family Gathering" webinar is now available! Whether you missed it and need to catch up, or just want to review the information Larry presented, you can now see the full recording below.

In this special presentation, Larry coaches viewers for success and explains his strategies...

READ MORE

MEMBERS ONLY

RISING CRUDE OIL IS PUNISHING TRANSPORTS -- RISING BOND YIELDS MAY THREATEN TECH STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING OIL PRICES HURT TRANSPORTS... Transportation stocks are one of the groups most sensitive to the direction of energy prices. That makes sense since fuel is so important to their bottom line. And not surprisingly, they've been one of the market's weakest groups over the last...

READ MORE

MEMBERS ONLY

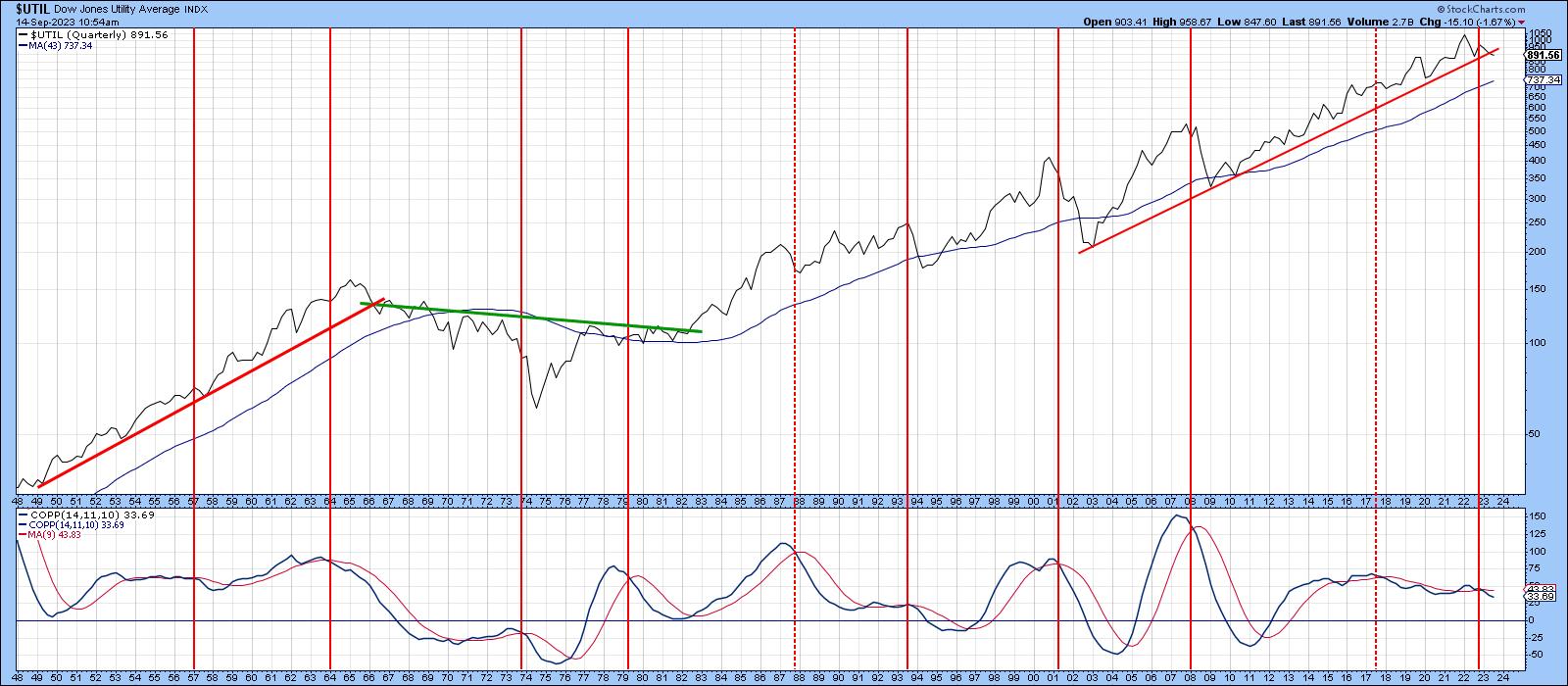

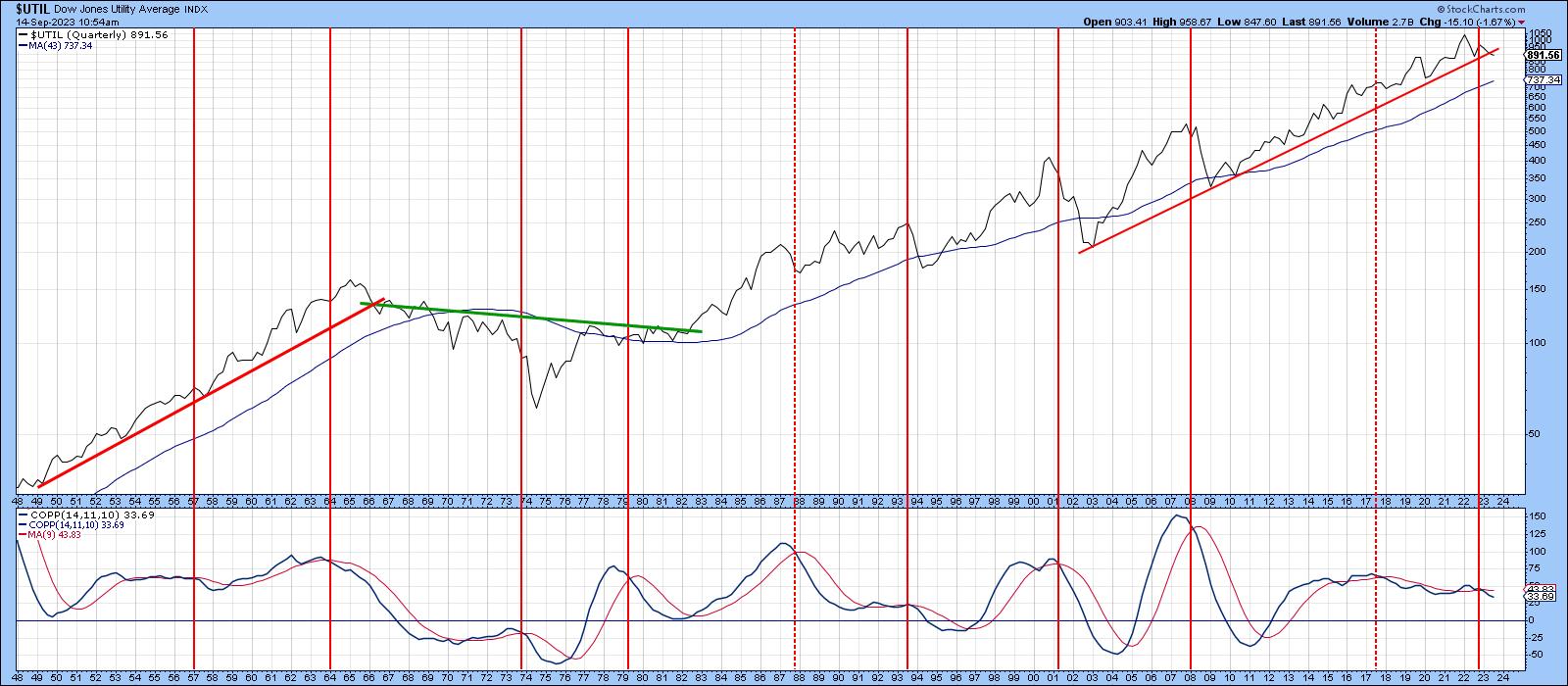

This Sector Looks Really Sick Long-Term

by Martin Pring,

President, Pring Research

The overall market has been rallying since registering its low last October. However, there is one sector which, in August, fell below its October low on a monthly closing basis. More serious is the fact that it recently violated a 23-year secular up trendline. Can you guess which sector I...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, September 14th at 3:00pm EDT!

by Larry Williams,

Veteran Investor and Author

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, September 14th at 3:00pm EDT.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

ENERGY SPDR HITS RECORD HIGH AS OIL BREAKS OUT -- THAT COULD BE BAD FOR BONDS AND STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY BREAKOUTS... Several previous messages have talked about upside breakouts taking place in energy stocks. And that trend has only gotten stronger both in the stocks and the commodity. The upper box in Chart 1 shows the price of WTIC crude oil rising to the highest level since last November....

READ MORE

MEMBERS ONLY

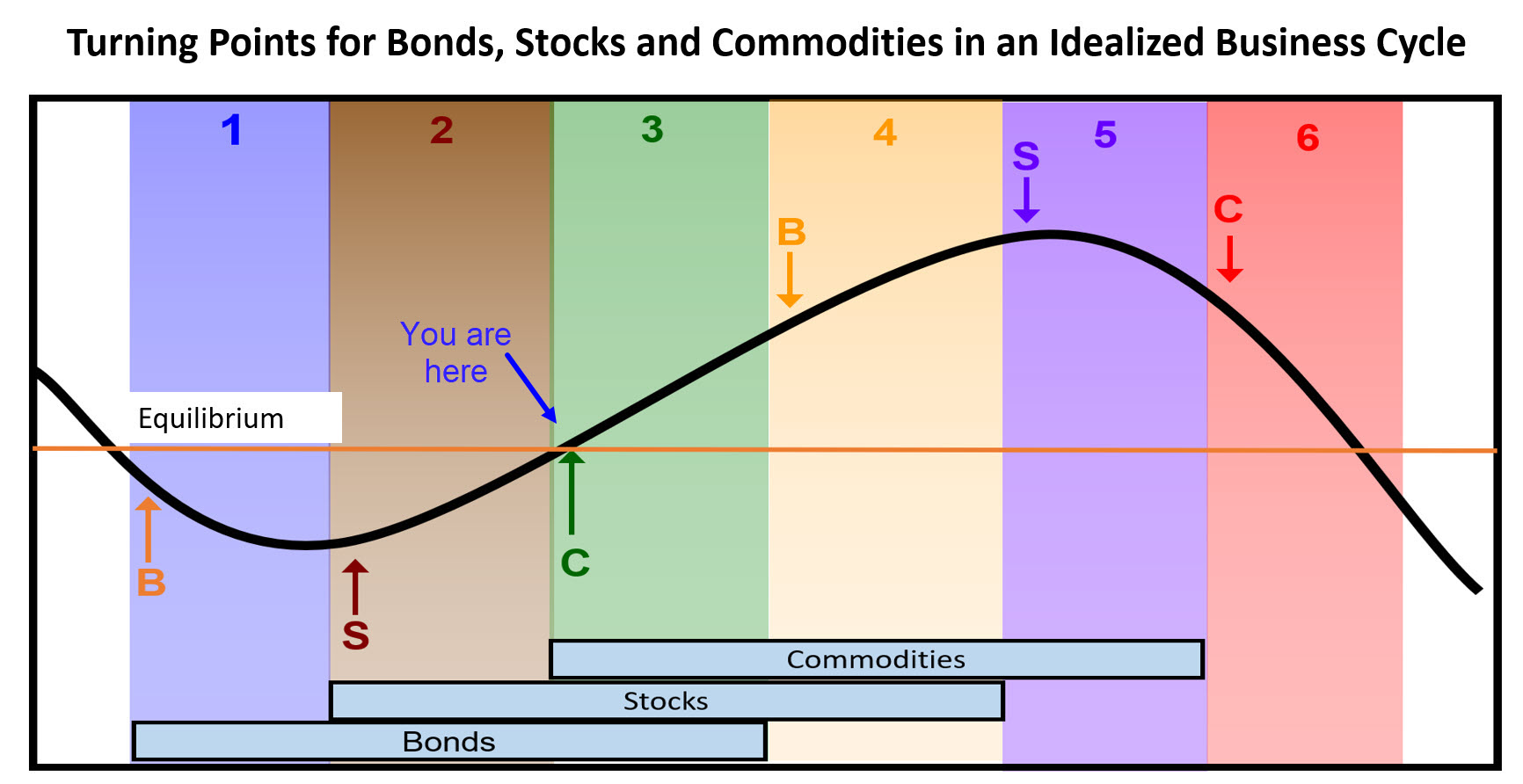

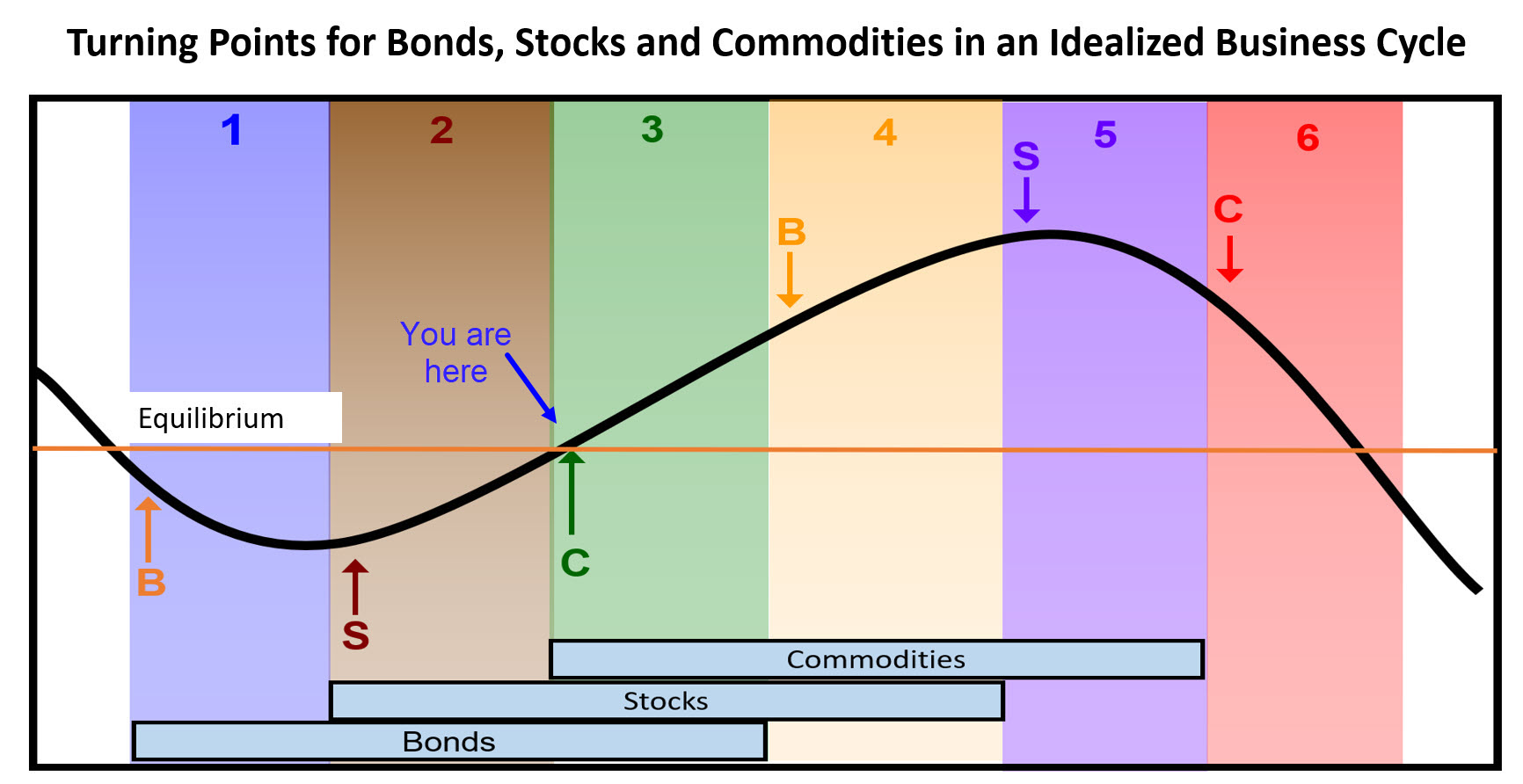

Some Investment Implications for Stage 3 of the Business Cycle

by Martin Pring,

President, Pring Research

The business cycle has been with us for as long as reliable financial records have been available, and that's at least 200 years. It may seem to be a mysterious force, but it is nothing more than a set sequence of chronological events that just keeps repeating. The...

READ MORE

MEMBERS ONLY

Focus on Stocks: September 2023

by Larry Williams,

Veteran Investor and Author

Cycle Deep Dive

At times, it seems there are as many cycles as there are traders. I have been focusing on the shorter-term ones, those ranging from 2 to 5 years.

Recently, I pondered on the clear fact that cycle forecasts work far better to spot market bottoms than tops....

READ MORE

MEMBERS ONLY

Positive Confidence Ratios Argue for Higher Stocks

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Comparing risky asskets with more conservative ones can reflect investor confidence

* Negative divergences offer subtle indications of a deterioration of a stock market rally

* An upward trend indicates that investor confidence is positive

Traders and investors pay a lot of attention to surveys to assess swings in sentiment,...

READ MORE

MEMBERS ONLY

ANOTHER LOOK AT MARKET BREADTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

ADVANCE-DECLINE LINE BOUNCING... A glance at various measures of market breadth offers good and bad news. All of them are lagging behind the S&P 500 which is a caution sign. The good news is that they're bouncing off potential support lines. Chart 1 compares the S&...

READ MORE

MEMBERS ONLY

The Dollar Index Goes to Missouri

by Martin Pring,

President, Pring Research

The Dollar Index has experienced a nice rally since mid-July and now reached important resistance. It's time to show us whether it can push through, thereby signaling an important extension to the recent advance. Before we examine that possibility, however, let's briefly take a step backwards...

READ MORE

MEMBERS ONLY

TEN-YEAR BOND YIELD NEARS UPSIDE BREAKOUT -- NEXT UPSIDE TARGET COULD BE 2007 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR YIELD TESTING OCTOBER HIGH... Last week's message suggested that rising bond yields (along with rising energy prices) was one of the factors that could push an overbought stock market into a downside pullback. More on that shortly. The big story of the week, however, was how much...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" Full Webinar -- AVAILABLE NOW!

by Larry Williams,

Veteran Investor and Author

Larry's "Family Gathering" webinar is now available! Whether you missed it and need to catch up, or just want to review the information Larry presented, you can now see the full recording below.

In this special presentation, Larry discusses market cycles in detail, outlines his proprietary...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, August 17th at 4:00pm EDT!

by Larry Williams,

Veteran Investor and Author

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, August 17th at 4:00pm EDT.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

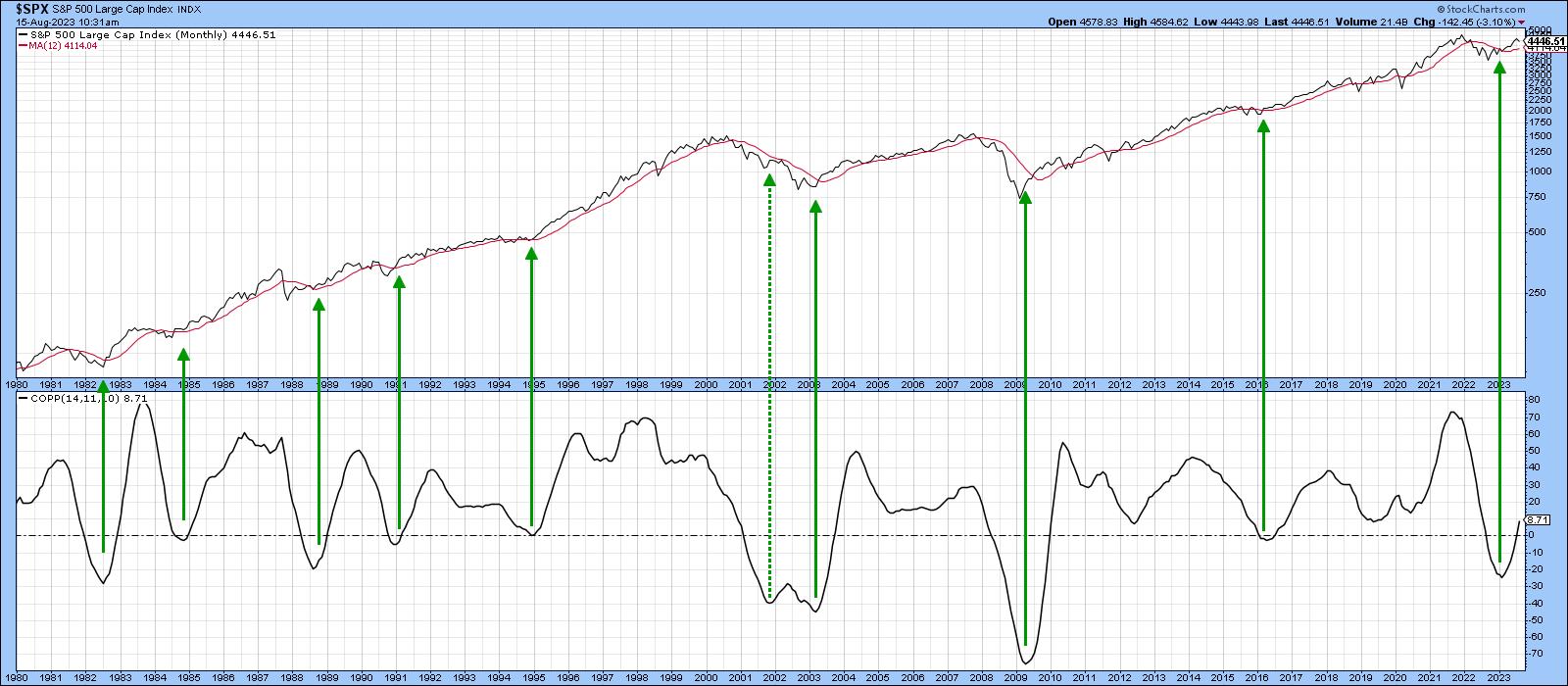

Is this a Normal Correction? Or Could It Be the Start of Something Much Bigger?

by Martin Pring,

President, Pring Research

The recent rise in interest rates and energy prices is certainly a cause for concern should these trends extend in any meaningful way over the next few months. After all, we are just about to enter September, which is seasonally the worst month of the year for stocks. Following that,...

READ MORE

MEMBERS ONLY

RISING ENERGY PRICES AND RISING BOND YIELDS MAY THREATEN OVERBOUGHT STOCK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING ENERGY PRICES MAY BOOST YIELDS... This week's inflation reports sent a mixed message. July's CPI came in lower while July's PPI came in higher. Bond yields, however, gained more ground. The green bars in the upper box in Chart 1 show the 10-Year...

READ MORE

MEMBERS ONLY

Will the Test of Last October's High for Bond Yields be Successful?

by Martin Pring,

President, Pring Research

The 30-year yield reached its high point last October and has been rangebound since December. Chart 1 shows that it began to break out of that trading range in late July, but has yet to succeed in taking out the October high. The 14-day RSI is currently correcting from an...

READ MORE

MEMBERS ONLY

ENERGY SECTOR IS BREAKING OUT TO THE UPSIDE -- RISING PRICES CARRY GOOD AND BAD NEWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

UPSIDE ENERGY BREAKOUTS...Last week's message listed energy as the strongest market sector over the last week and month. That positive trend continued this past week with some upside breakouts taking place. Chart 1 shows the United States Oil Fund (USO) trading above its April high. WTIC hasn&...

READ MORE

MEMBERS ONLY

Focus on Stocks: August 2023

by Larry Williams,

Veteran Investor and Author

Hi Gang.

Larry Williams here. Welcome to my new stock market service called "Focus On Stocks," which I'm creating in conjunction with my friends at StockCharts.com.

As a "Focus On Stocks" subscriber, you now have access to my latest market analysis. Be sure...

READ MORE

MEMBERS ONLY

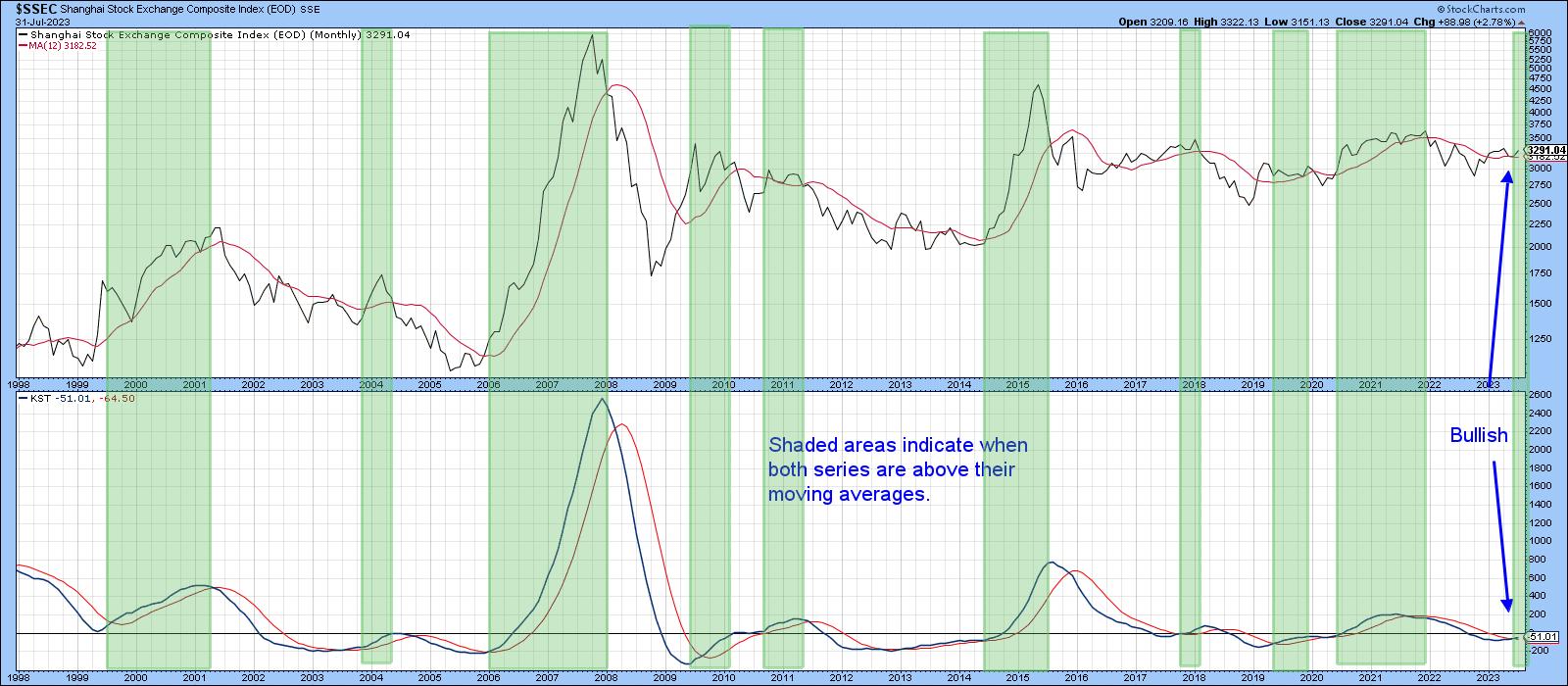

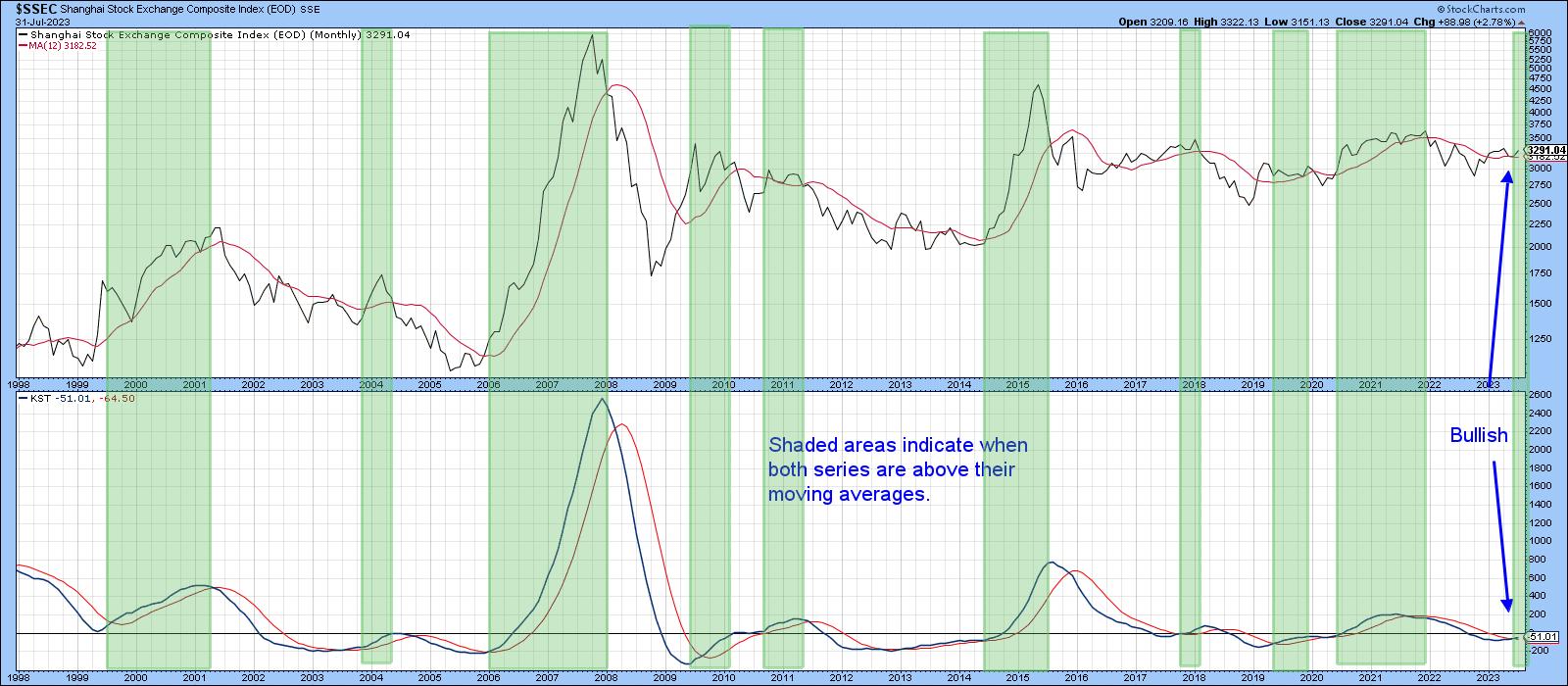

It's Time for These Chinese ETFs to Play Catch-Up

by Martin Pring,

President, Pring Research

There have recently been a lot of depressing stories concerning the state of the Chinese economy. Here are a spattering of headlines that appeared just today:

* China's Economic Recovery Weakens as Growth Concerns Linger (WSJ)

* China Manufacturing Keeps Shrinking, Weighing on Economic Recovery (Bloomberg)

* More Stimulus "Desperately...

READ MORE

MEMBERS ONLY

MARKET BREADTH IMPROVES -- SMALL CAPS TEST RESISTANCE -- ENERGY AND MATERIALS HAVE STRONG MONTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

NYSE ADVANCE-DECLINE LINE BREAKS OUT... Stocks gained more ground this week to continue their uptrend. What's helping keep the rally going is the fact that more individual stocks are joining the uptrend. Chart 1 shows the NYSE Advance-Decline line rising above several previous peaks to the reach the...

READ MORE

MEMBERS ONLY

The Banking Crisis is Over... Or Is It?

by Martin Pring,

President, Pring Research

Last April, I wrote about the SVB (SVIB) banking crisis, using the KBW Regional Banking Index ($KRX) as a proxy, and suggested the price action in the right hand part of Chart 1 had the potential to be a double bottom formation. Double bottoms are characterized by heavy activity on...

READ MORE

MEMBERS ONLY

HEALTHCARE SECTOR NEARS UPSIDE BREAKOUT-- LED BY UNITEDHEALTH, JNJ, AND ABBOTT LABS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MONEY ROTATES INTO HEALTHCARE... One of the most encouraging developments over the last month has been the rotation into formerly lagging sectors like industrials, financials, and materials. That rotation also includes this week's upside breakout in the Dow Industrials to the highest level in more than a year....

READ MORE

MEMBERS ONLY

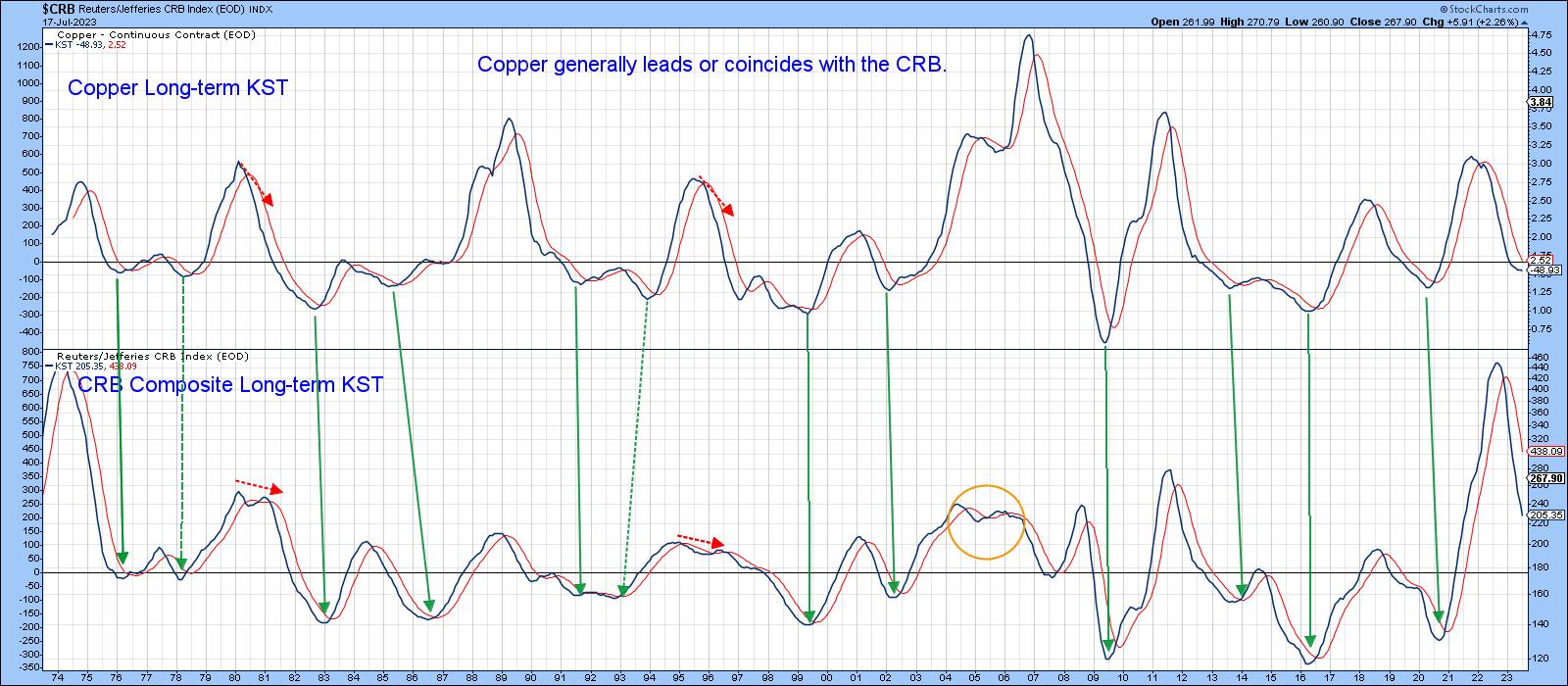

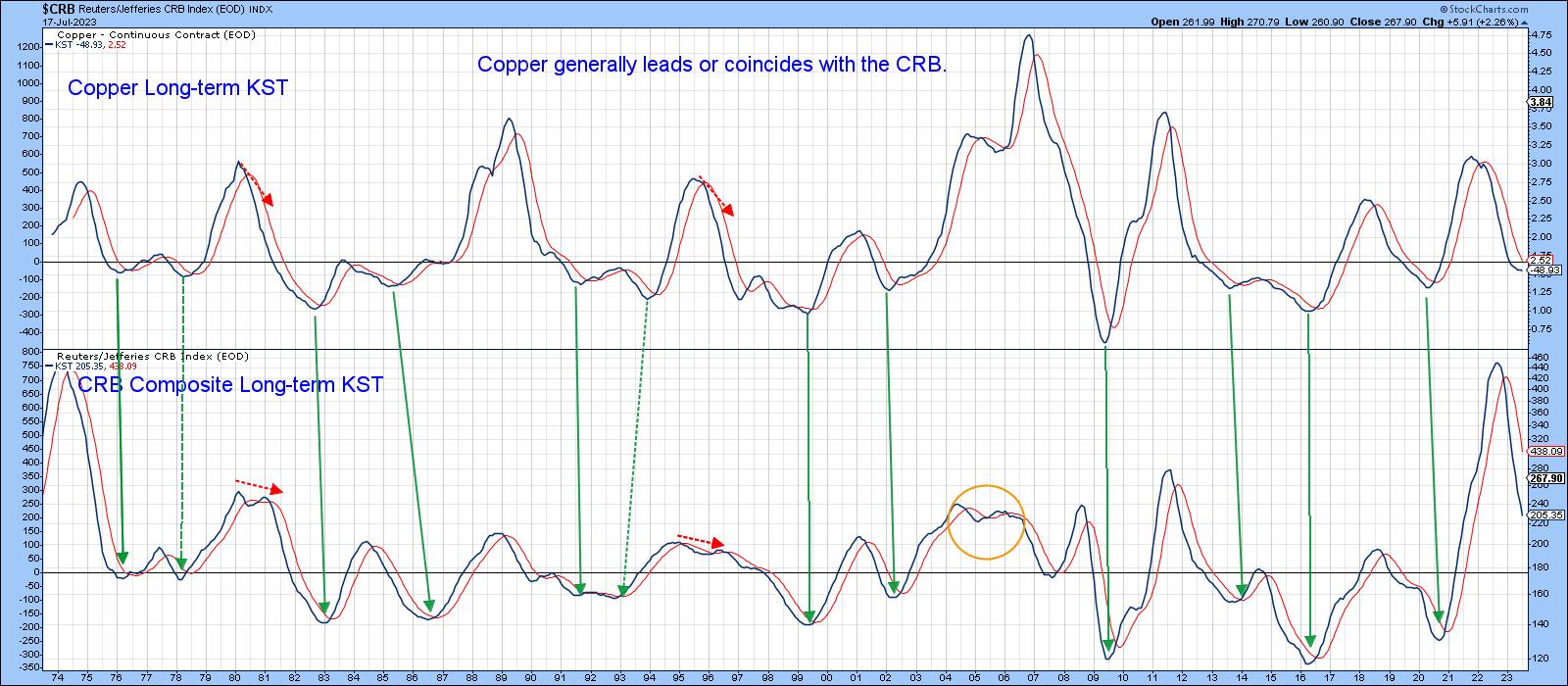

Taking a Deep Dive Into Dr. Copper and What it Means

by Martin Pring,

President, Pring Research

Last week, I pointed out that several indicators were close to triggering a bull market for commodities. Some of those benchmarks have since been met, but none have yet moved decisively in that direction. Now, it's time to take a deep dive into the copper price, as this...

READ MORE

MEMBERS ONLY

Commodities are in a Bear Market, But These Indicators Say That Could Soon Change

by Martin Pring,

President, Pring Research

I have been bearish on the primary trend of commodities for some time whilst still maintaining a bullish stance on their secular or very long-term trend. In other words, negative over a 9-month-to-2-year outlook, but constructive on a 10-to-20-year one. The secular aspect is important, because history shows primary bear...

READ MORE

MEMBERS ONLY

OIL SERVICE STOCKS LEAD ENERGY SECTOR HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY SECTOR LOOKS OVERSOLD... Energy stocks have been one of the year's weakest sectors. The daily bars in Chart 1 show the Energy SPDR (XLE) trading sideways since March and looking oversold. The XLE would need to clear its red 200-day average and falling trendline to signal a...

READ MORE

MEMBERS ONLY

Why Rising Short Rates Could be Bullish for Stocks

by Martin Pring,

President, Pring Research

There has been a notable shift in expectations concerning rate hikes going forward, as several Fed spokesmen have floated the idea of additional hikes later in the year. Rising interest rates are generally seen as a negative factor for stocks, as they increase borrowing costs for companies, lowering their profitability...

READ MORE

MEMBERS ONLY

ECONOMICALLY-SENSITIVE STOCKS OUTPERFORM -- MATERIALS ON VERGE OF UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS GAIN, UTILITIES LOSE... Chart 1 shows transportation stocks rising while utilities are falling. The significance of the chart is that it suggests that investors are turning more positive. That's because stronger transports suggest a stronger economy while falling utilities show that investors are turning less defensive. Airlines...

READ MORE

MEMBERS ONLY

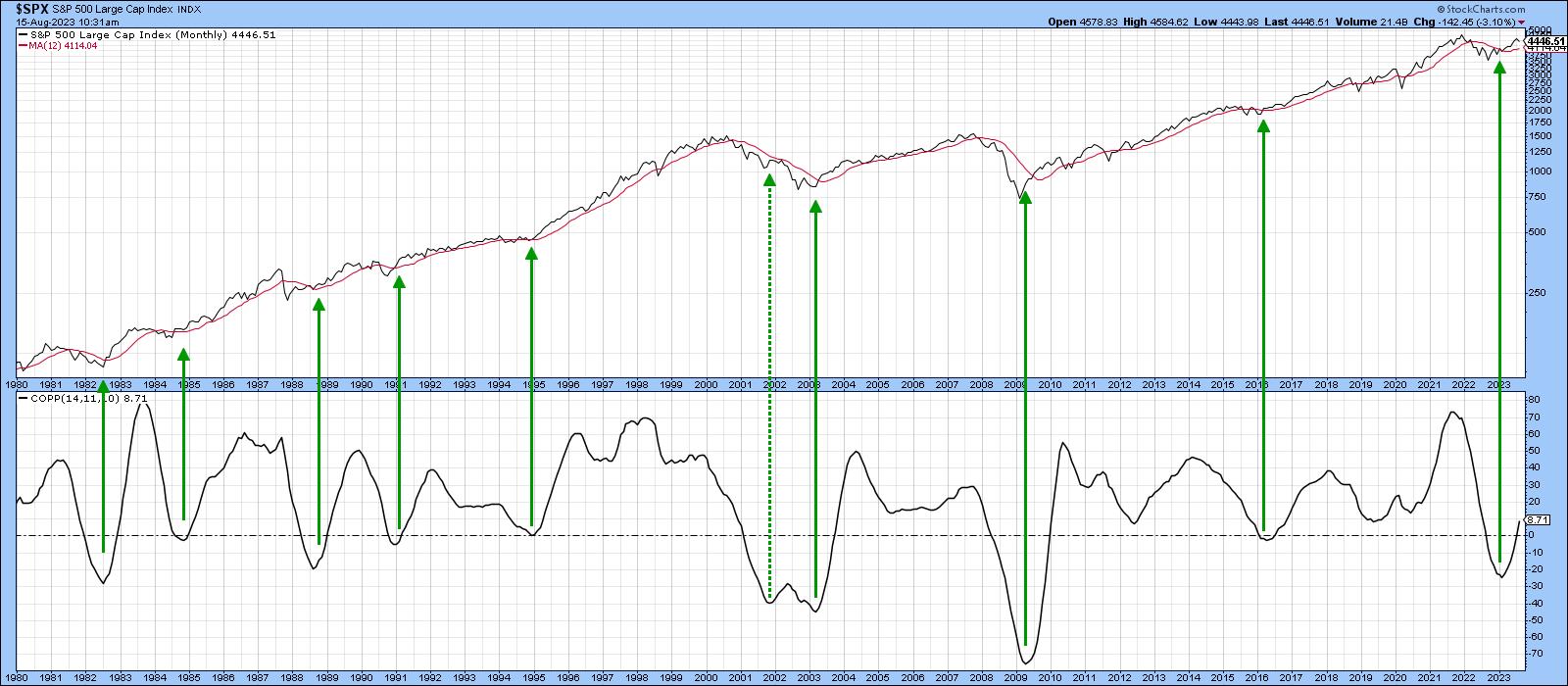

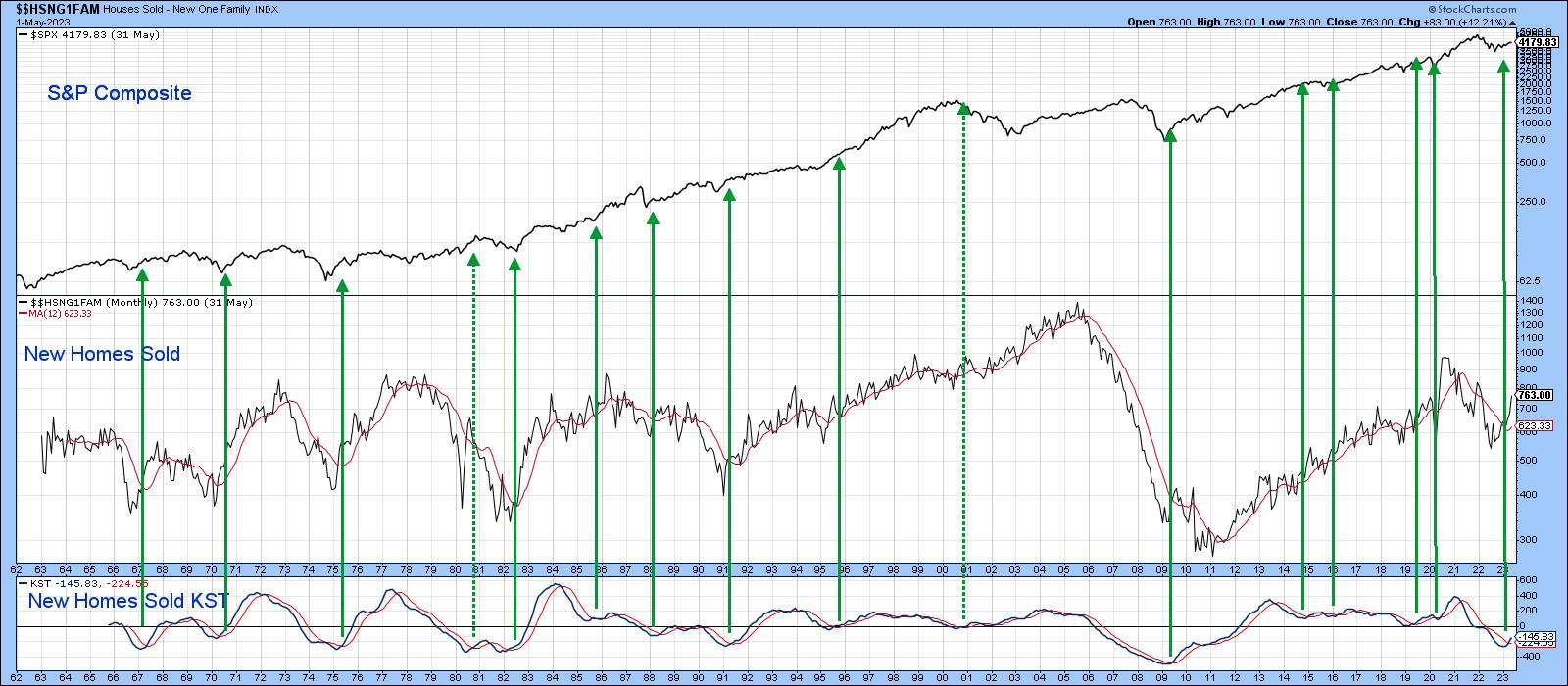

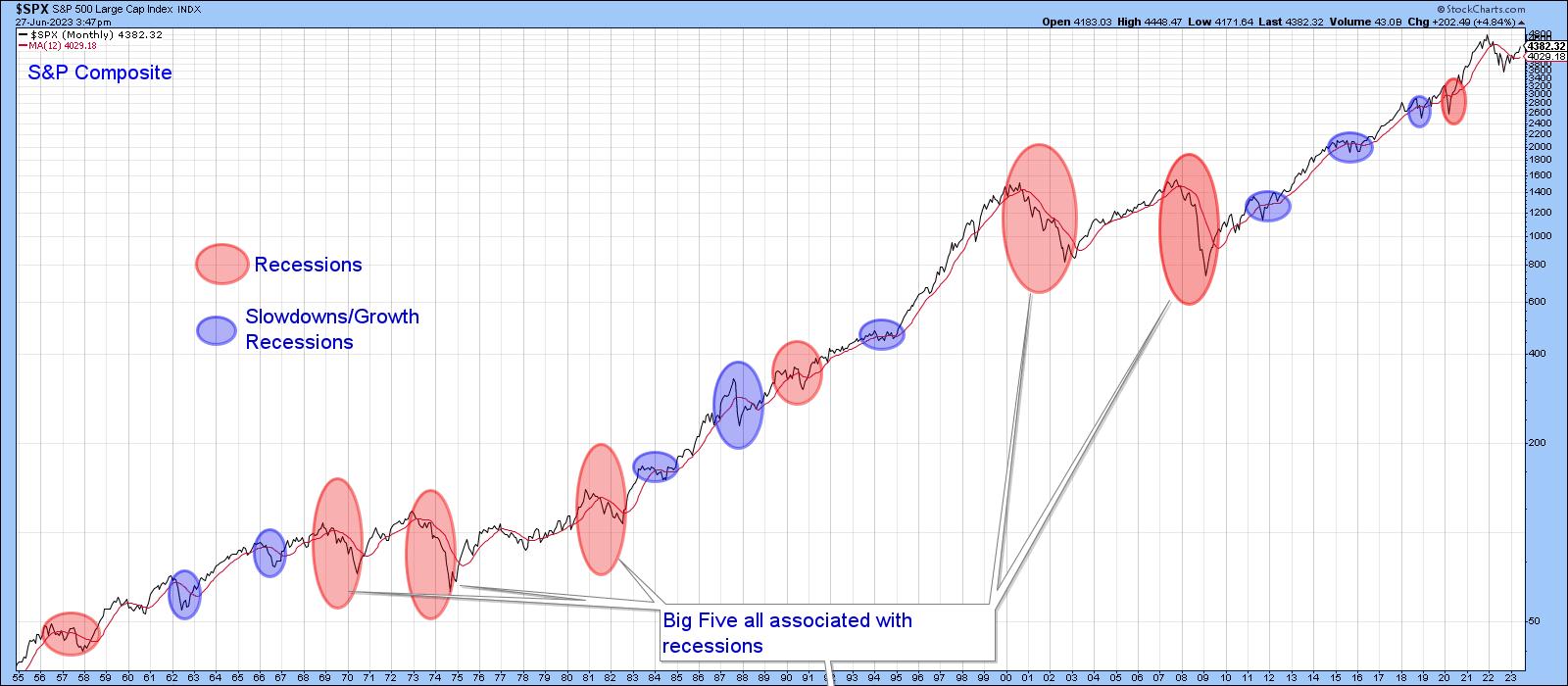

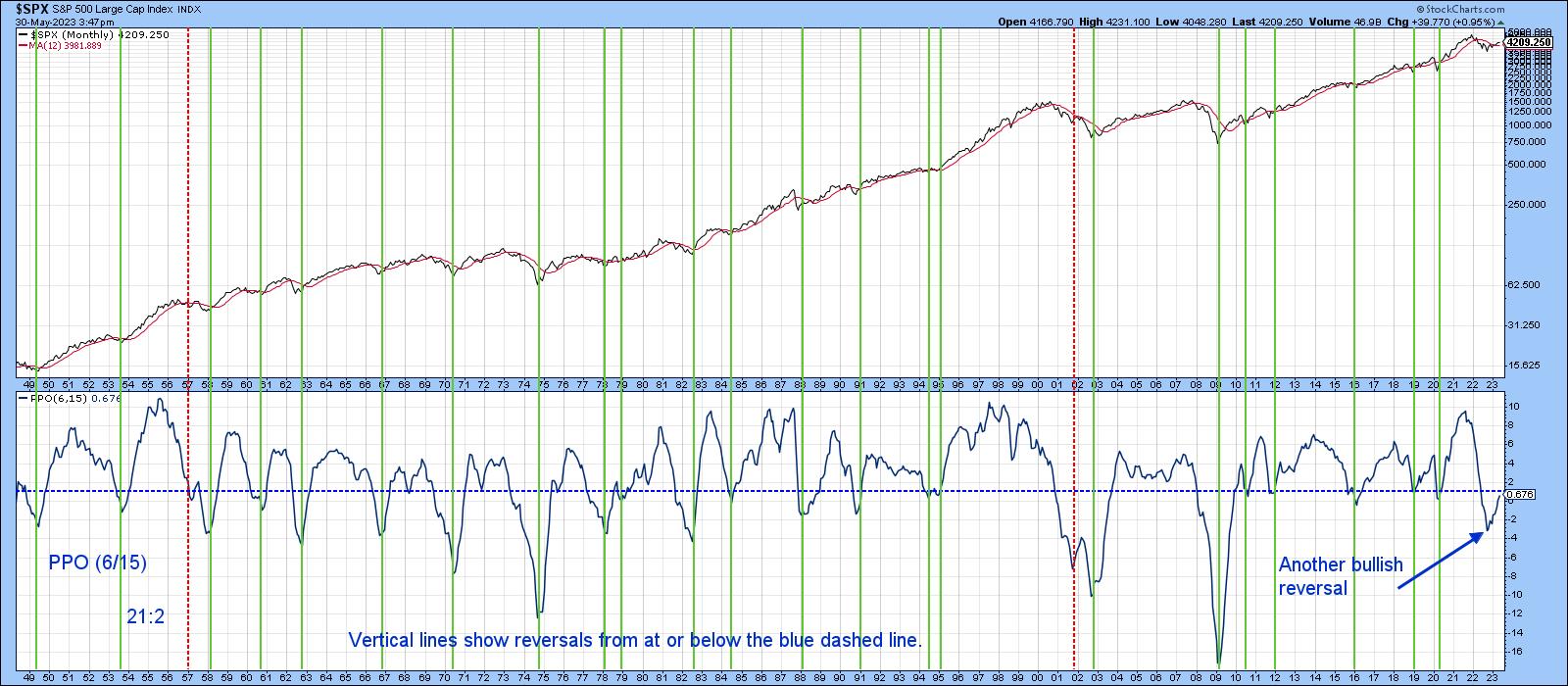

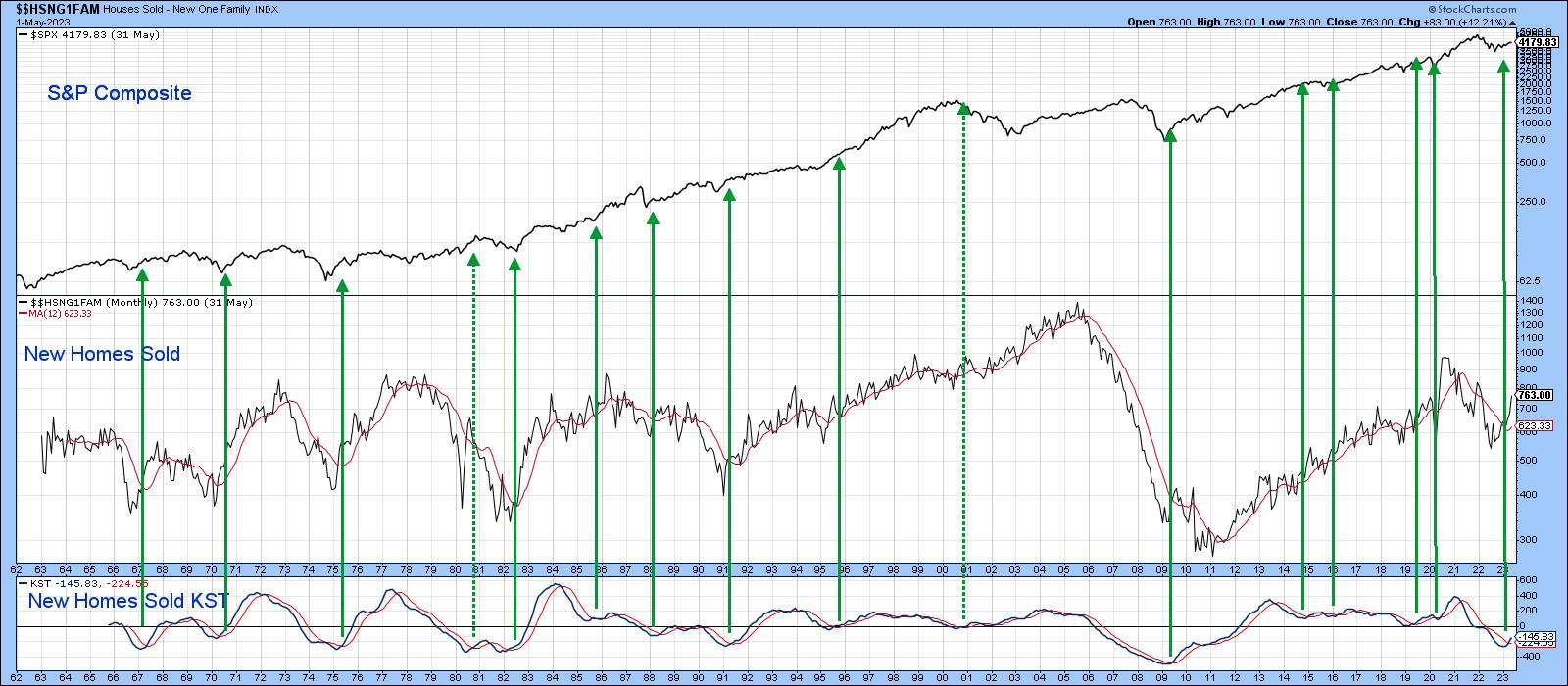

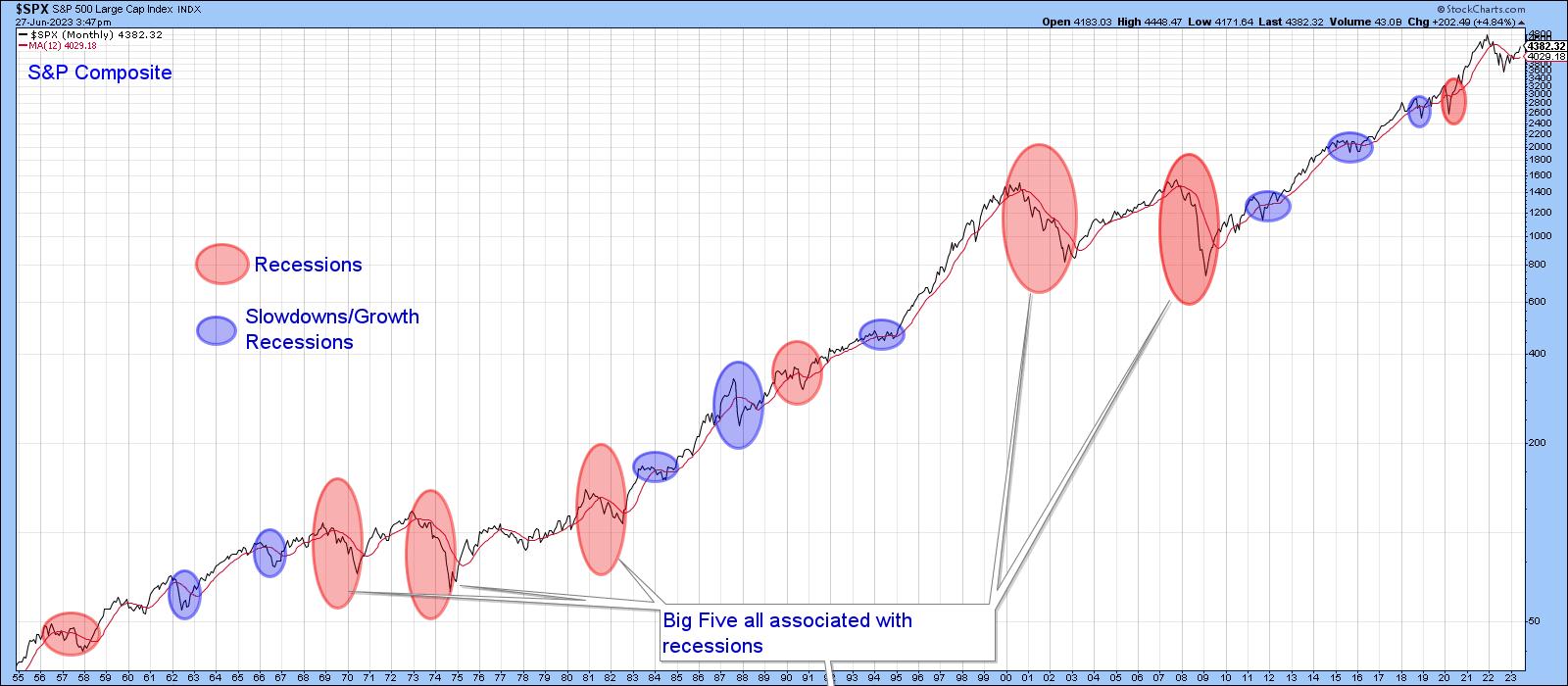

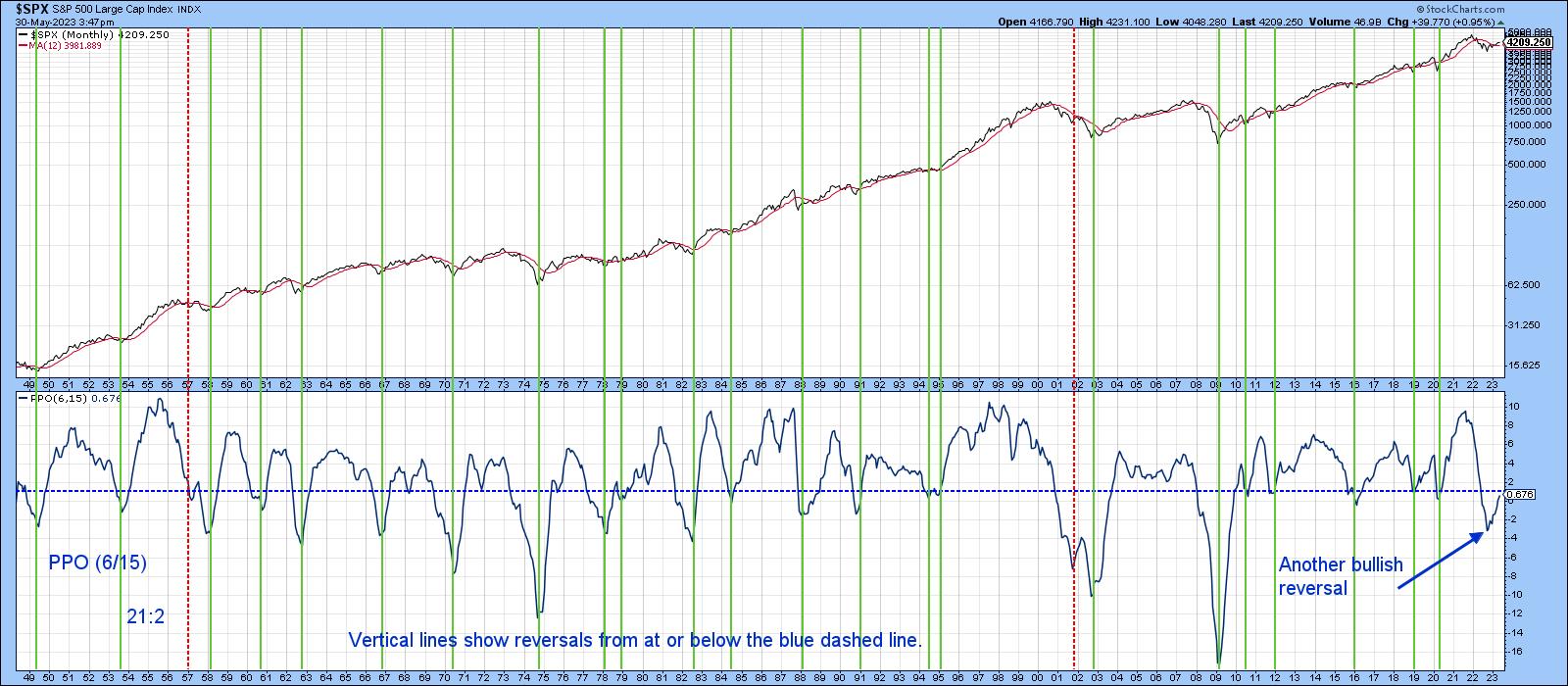

These Charts Explain Why Stocks Have Been Rallying Since October

by Martin Pring,

President, Pring Research

The ellipses in Chart 1 reflect economic events that have adversely affected the stock market since the 1950s. The pink ones reflect recessions, and those colored in blue indicate setbacks that anticipated economic slowdowns. Slowdowns develop when some economic sectors slip into recession, but that weakness is insufficient to push...

READ MORE

MEMBERS ONLY

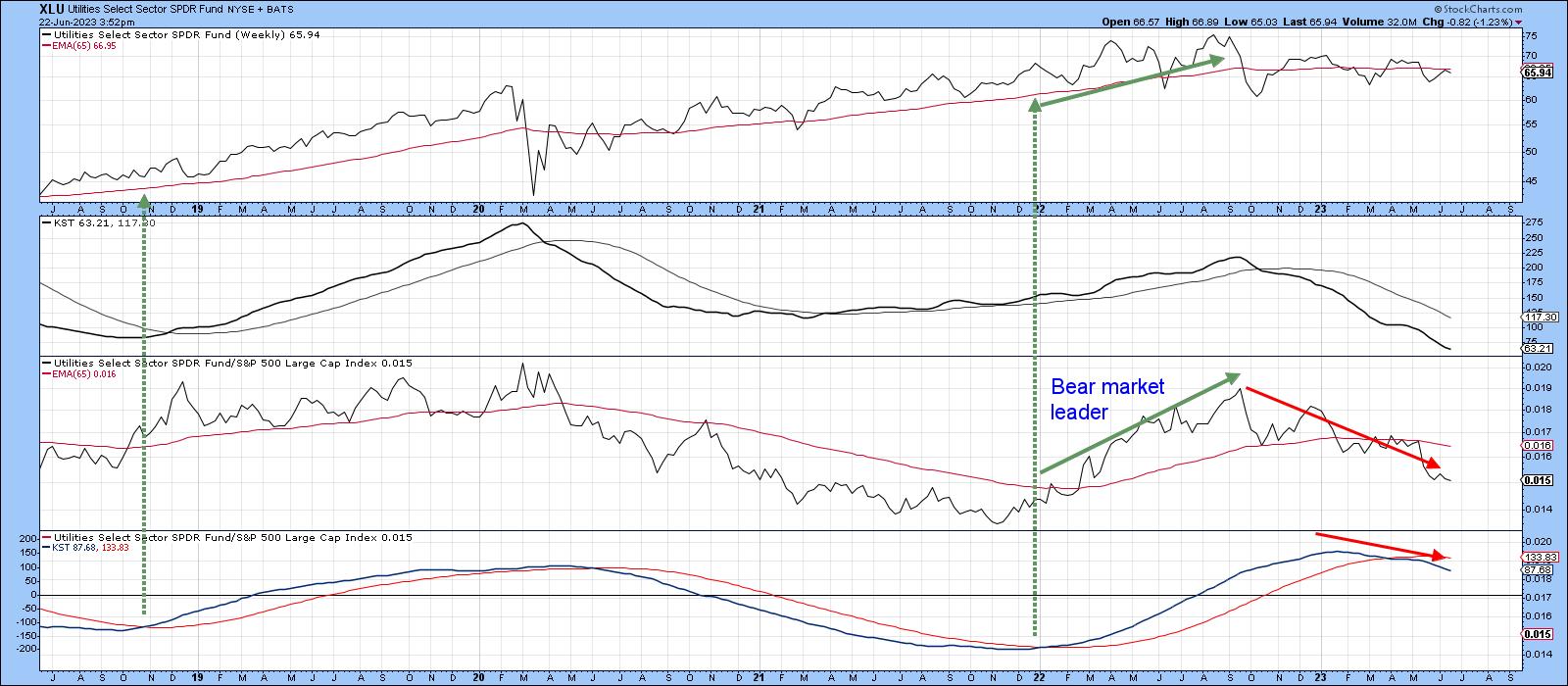

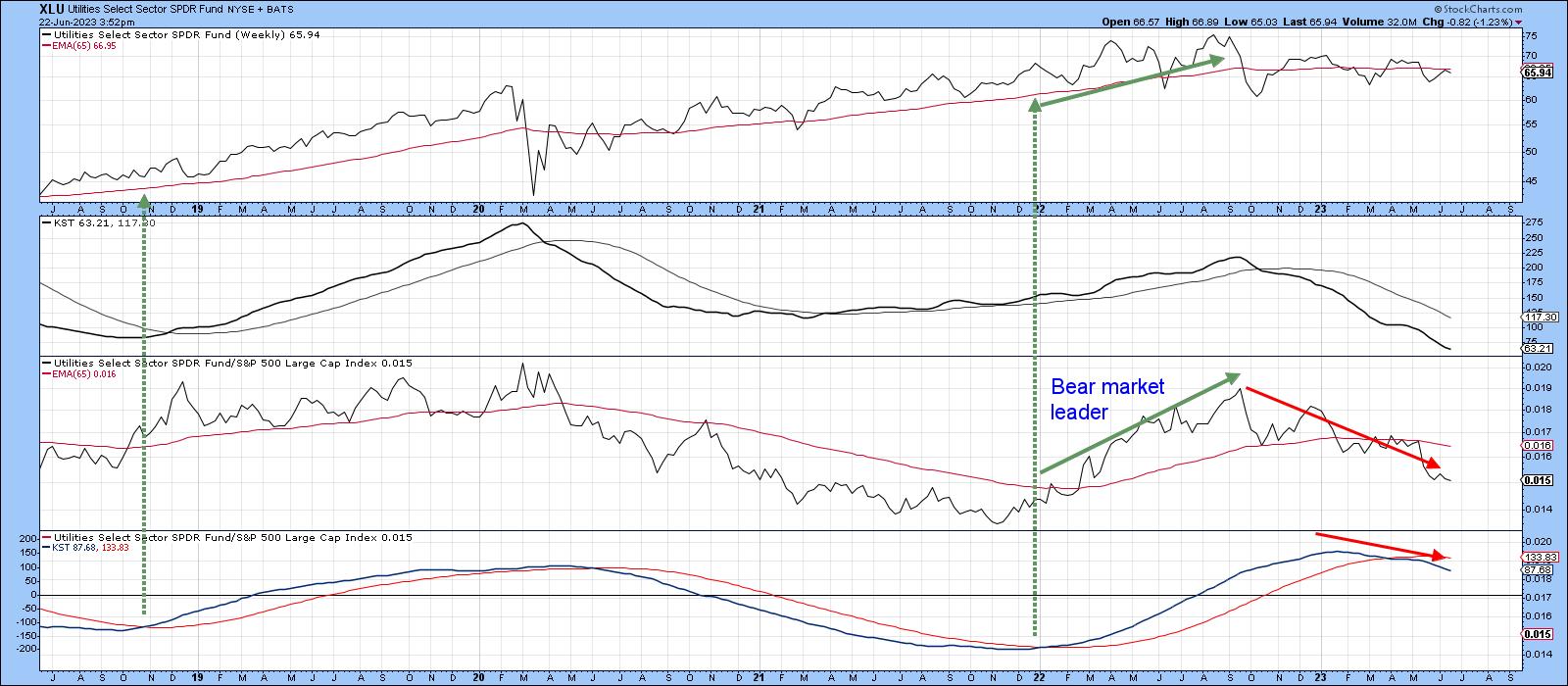

Is the Tech Rally Overdone?

by Martin Pring,

President, Pring Research

When the direction of the primary trend changes, it's usually because the business cycle is transitioning from a slowdown or recession to a recovery. That process usually results in a change in sector rotation, as defensive ones, such as utilities and consumer staples, come to the fore and...

READ MORE

MEMBERS ONLY

MARKET BREADTH CONTINUES TO IMPROVE--AIRLINES LEAD INDUSTRIAL SECTOR HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE BROADENING OUT...Various measure of market breadth continue to improve. That includes the number of stocks moving back above their moving average lines. Chart 1 shows the Percent of S&P 500 stocks trading above their 200-day averages rising to the highest level in four months. As a...

READ MORE

MEMBERS ONLY

Can We Use Golf to Forecast Oil Prices?

by Martin Pring,

President, Pring Research

There used to be a rule of thumb on Wall Street that, whenever brokers upgraded to a new office after years of making do with smaller premises, it was the sign of market peak. Such behavior typically followed years of a bull market in which the investment houses had grown...

READ MORE

MEMBERS ONLY

S&P 500 TESTING AUGUST HIGH -- SMALL CAPS TURN UP -- XLY ACHIEVES UPSIDE BREAKOUT -- SO DO TESLA AND FORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TESTS AUGUST HIGH...Chart 1 shows the S&P 500 Index in the process of testing important overhead resistance at its August high (flat line). A close above that barrier would be a positive sign. The SPX has now gained 20% from its October low....

READ MORE

MEMBERS ONLY

Is Gold About to Explode or Crash?

by Martin Pring,

President, Pring Research

The price of gold was recently trading at an all-time monthly closing high. Since then, it has backed off, raising the question of whether that was "the" top or whether the subsequent short-term price decline represents a healthy digestion of previous price gains, which will serve as a...

READ MORE

MEMBERS ONLY

Market Correction is Coming

by Larry Williams,

Veteran Investor and Author

"The farther backward you can look, the farther forward you can see." - Winston Churchill

In this exclusive StockCharts TV special, Larry is back to talk about a stock market correction ahead. There have not been any long term selling opportunities recently. However, right here & now, Larry...

READ MORE

MEMBERS ONLY

MARKET RALLY BROADENS OUT -- DOW LEADS FRIDAY RALLY -- CYCLICALS HAVE A STRONG WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW PLAYS CATCH-UP... A strong May jobs report and the passing of the debt ceiling bill have combined to give a big boost to stocks at week's end. The rally has been enough to push the Nasdaq to a new 52-week high and a ten-month high in the...

READ MORE

MEMBERS ONLY

Perhaps It's Time for the Laggards to Catch Up?

by Martin Pring,

President, Pring Research

The recent strong performance by a few tech stocks has gained widespread attention, as has the disappointing market breadth. The result has been a soaring NASDAQ and a lagging NYSE Composite and Dow. Small cap stocks have also left a lot to be desired. The question is whether this divergence,...

READ MORE

MEMBERS ONLY

CHIP STOCKS LEAD MARKET HIGHER -- SPX STILL LAGS BEHIND -- AUTOS HAVE A STRONG WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

TALE OF TWO MARKETS... Previous messages have pointed out the growing gap between rising technology stocks and the rest of the market. That gap widened even further this week. Technology was once again the week's strongest sector thanks to surging chip stocks. The weekly bars in Chart 1...

READ MORE

MEMBERS ONLY

TECH STOCKS CONTINUE TO LEAD MARKET HIGHER -- MOST OTHER SECTORS, HOWEVER, CONTINUE TO LAG BEHIND THE S&P 500 FOR THE YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIG TECH STOCKS LEAD MARKET HIGHER... The largest stocks in the technology sector saw big gains during the week. That pushed the Invesco QQQ Trust to the highest level in more than a year as shown by the weekly bars in Chart 1. Technology and Communication Services SPDRS were the...

READ MORE

MEMBERS ONLY

Does this Technology Rally Have Legs?

by Martin Pring,

President, Pring Research

In the last couple of months, we have seen a number of analysts and commentators point out that the current rally has been led by a handful of large-cap tech stocks and is therefore suspect. That observation suggests this week's extension to the advance is doomed. It'...

READ MORE