MEMBERS ONLY

AI Boom Meets Tariff Doom: How to Time Semiconductor Stocks

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Semiconductors are caught in a tug-of-war with AI demand on one side and tariff fears on the other.

* The industry's technical performance shows a narrow standstill that can break either way.

* Watch SMH and its top three holdings—NVDA, TSM, and AVGO—for insights into timing...

READ MORE

MEMBERS ONLY

The Trump Trade? Not All as MAGA as You Might Think

by Martin Pring,

President, Pring Research

The "Trump Trade" refers to the market reaction and investment strategies that emerged following Donald Trump's election victories and his economic policies. It describes the shift in market sentiment driven by anticipated pro-business policies, tax cuts, and deregulation under his administration.

Investors initially rushed into sectors...

READ MORE

MEMBERS ONLY

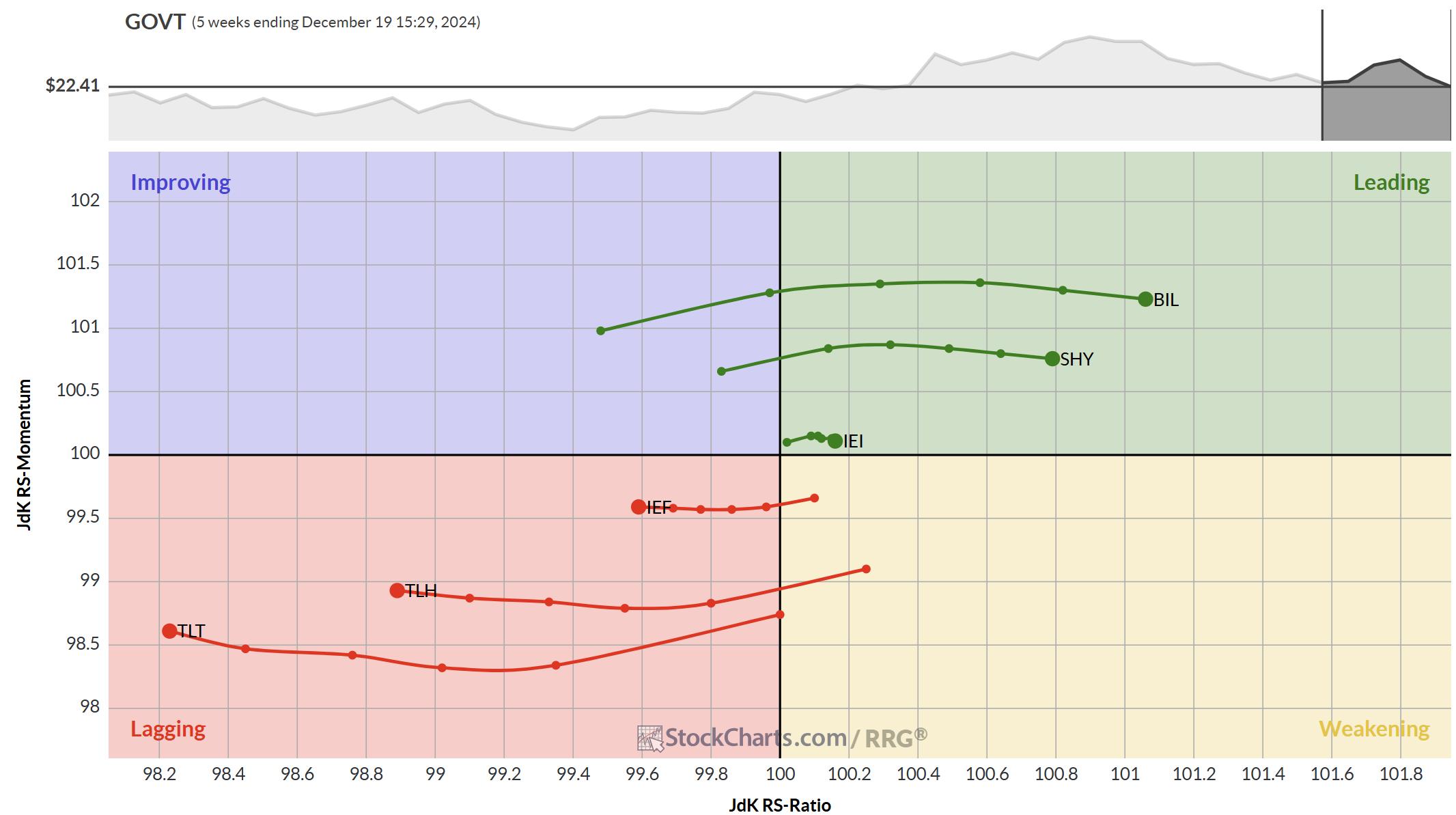

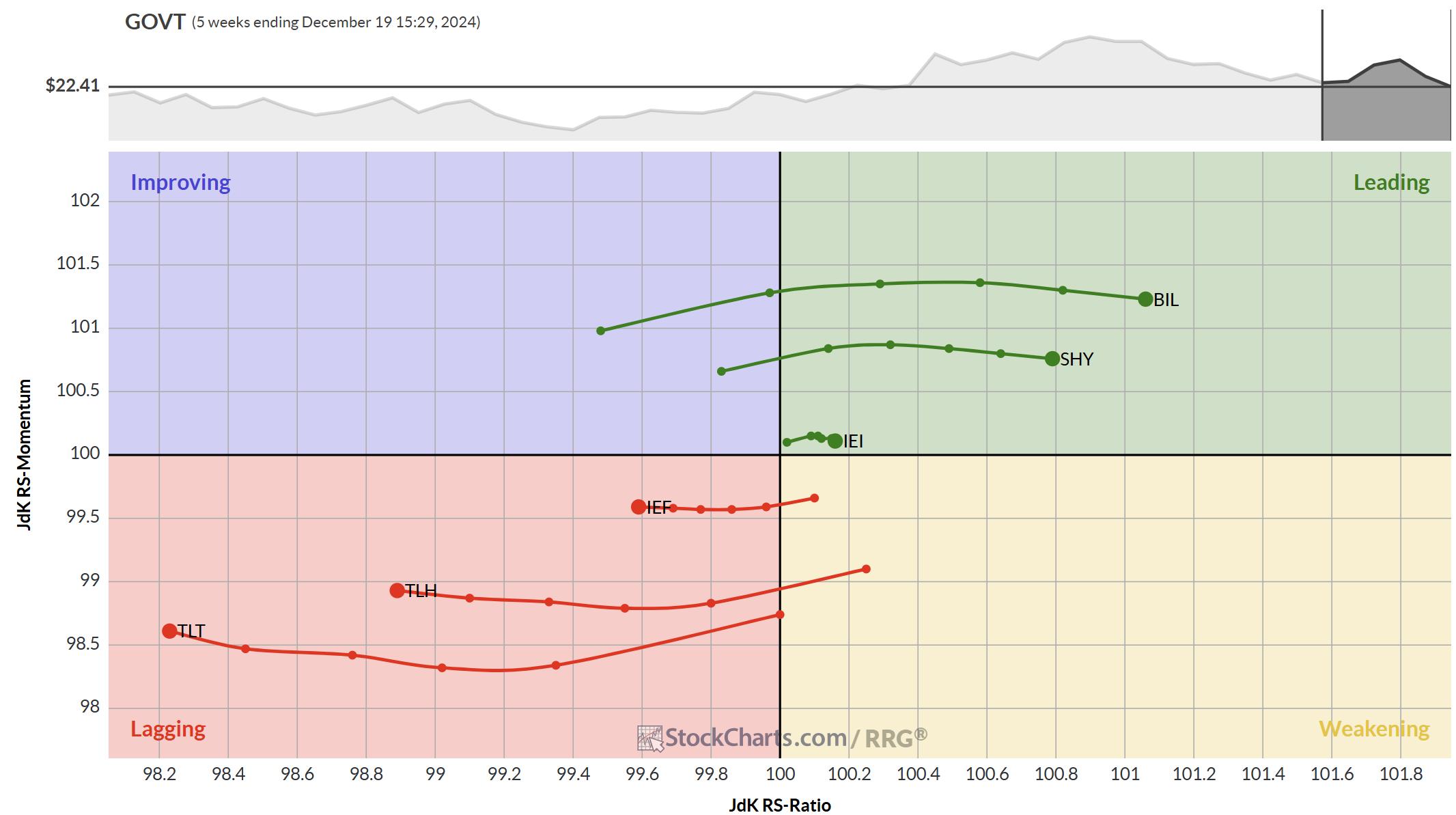

Three RRGs to Keep You on Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Track the Yield curve moving back to normal on RRG

* USD showing massive strength against all currencies

* Stock market drop not affecting sector rotation (yet)

The Yield Curve

The RRG above shows the rotations of the various maturities on the US-Yield Curve.

What we see at the moment...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Broadcom (AVGO) the New NVIDA (NVDA)?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin looks at the Broadcom (AVGO) chart and compares it to the NVIDIA (NVDA) chart. She shows us the differences between the two and tells you whether she believes AVGO will be the new NVDA, meaning it will perform as NVDA used to perform with a concerted move up...

READ MORE

MEMBERS ONLY

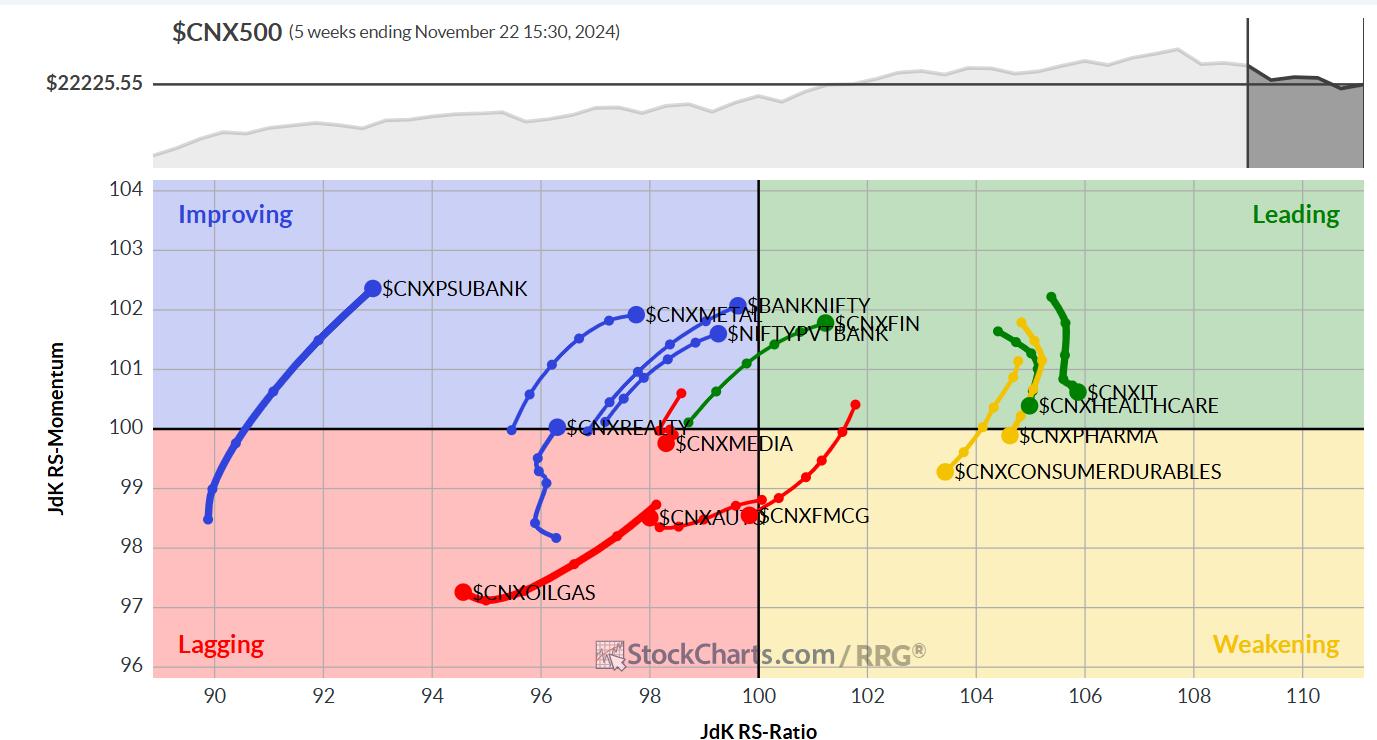

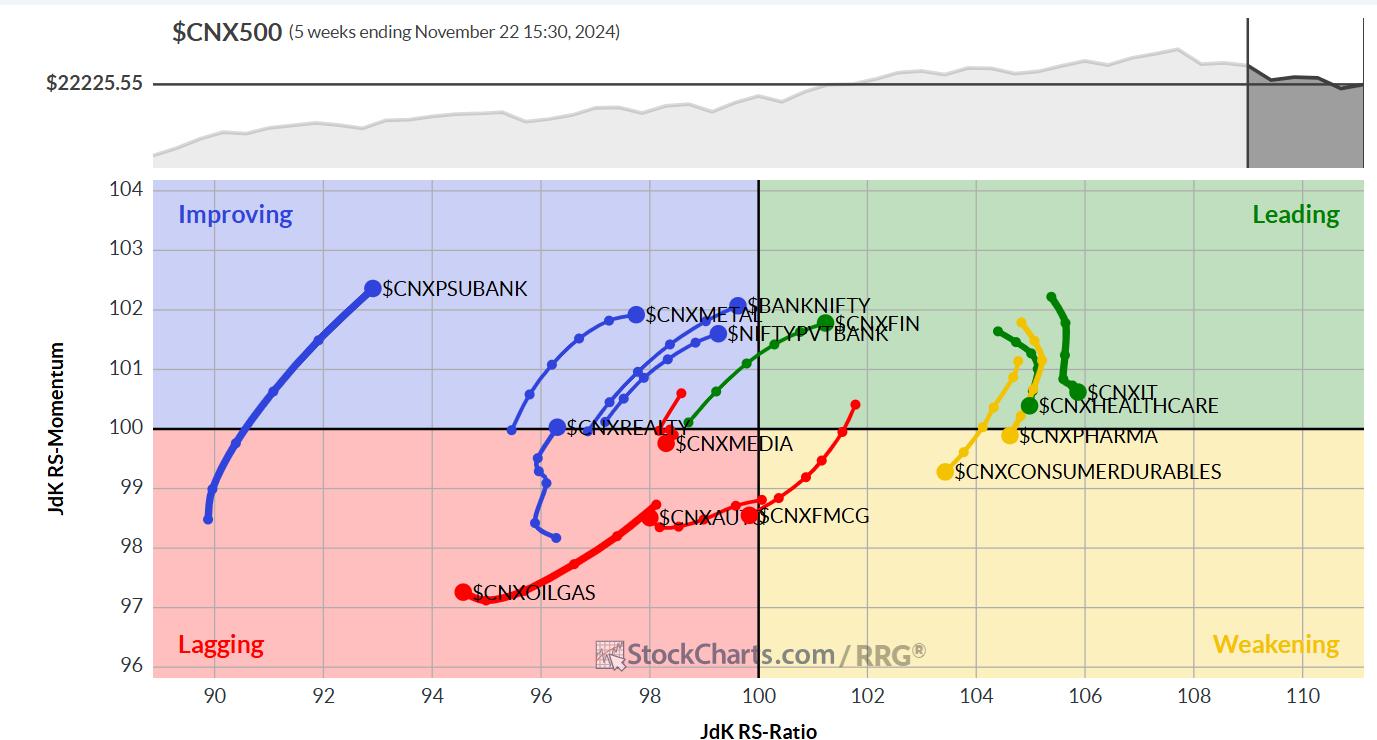

Week Ahead: NIFTY Halts at Crucial Levels; Staying Above This Point Necessary to Extend The Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had a wide-ranging week once again; however, they ended near its high point this time. The Nifty had ranged sessions for four out of five days; the last trading day of the week saw the Nifty swinging wildly before closing near its high point. The trading range also...

READ MORE

MEMBERS ONLY

How to Buy WINNERS When They Pull Back!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights how select M7 stocks, mostly TSLA, propped the markets up while some sectors continued to trend lower. She reviews how to find entry points in winning stocks, and also discusses why Small Caps are falling.

This video originally premiered December 13, 2024. You can...

READ MORE

MEMBERS ONLY

Master the MACD Zero Line for a Trading Edge!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how to use the MACD zero line as a bias for a stock. As opposed to offering a buy signal, this Zero line level can provide insight into a market or stock's underlying condition; Joe shows how to refine that information...

READ MORE

MEMBERS ONLY

Top Techniques for Finding Strength in Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius gives a quick update on sector rotation, then examines the strength uncovered in Consumer Discretionary. He analyzes names like TSLA, AMZN, and LULU; some are in full swing uptrends, but there are also a few names that are on the verge of turning around...

READ MORE

MEMBERS ONLY

Several Intermarket Relationships Precariously Positioned for Stocks

by Martin Pring,

President, Pring Research

Chart 1 compares the S&P Composite with the NYSE A/D Line and its Common Stock counterpart. These, of course, are not intermarket relationships, but the chart does show that some near-term weakness would violate their bull market trendlines. Violating a trendline is not necessarily the end of...

READ MORE

MEMBERS ONLY

How to Spot Low-Volatility Stocks That are Ready to Explode

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* If you want to reposition your portfolio for 2025, consider the potential policy changes that can significantly affect the market.

* Focusing on financials and using MarketCarpets Bollinger BandWidth setting identifies stocks with low volatility setups, among other qualities.

* Identify stocks that meet your investing criteria and add them...

READ MORE

MEMBERS ONLY

Options Trade Ideas YOU NEED to SEE!

by Tony Zhang,

Chief Strategist, OptionsPlay

Looking for options trade ideas? In this video, Tony presents some of the best options trading strategies! After discussing special 0DTE strategies, the big picture, and individual sectors and industries, Tony covers bullish and bearish ideas for stocks including NVDA, SHOP, GOOGL, META, CAT and many more.

This video premiered...

READ MORE

MEMBERS ONLY

Market As Good As It Gets

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the 26 indexes, sectors and groups in a CandleGlance to see how the indexes stack up. It is clear that all of the indexes are as good as they can get. Carl warns that when things are as good as they can get, the only place...

READ MORE

MEMBERS ONLY

Week Ahead: Consolidation Likely as NIFTY Tests Crucial Levels; Guard Profits Mindfully

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets closed with gains for the third week in a row, as key indices posting gains while extending their technical rebound. The Nifty trended higher most of the week. The volatility was largely absent, but the Indices stayed quite choppy on most days except the last, where it remained...

READ MORE

MEMBERS ONLY

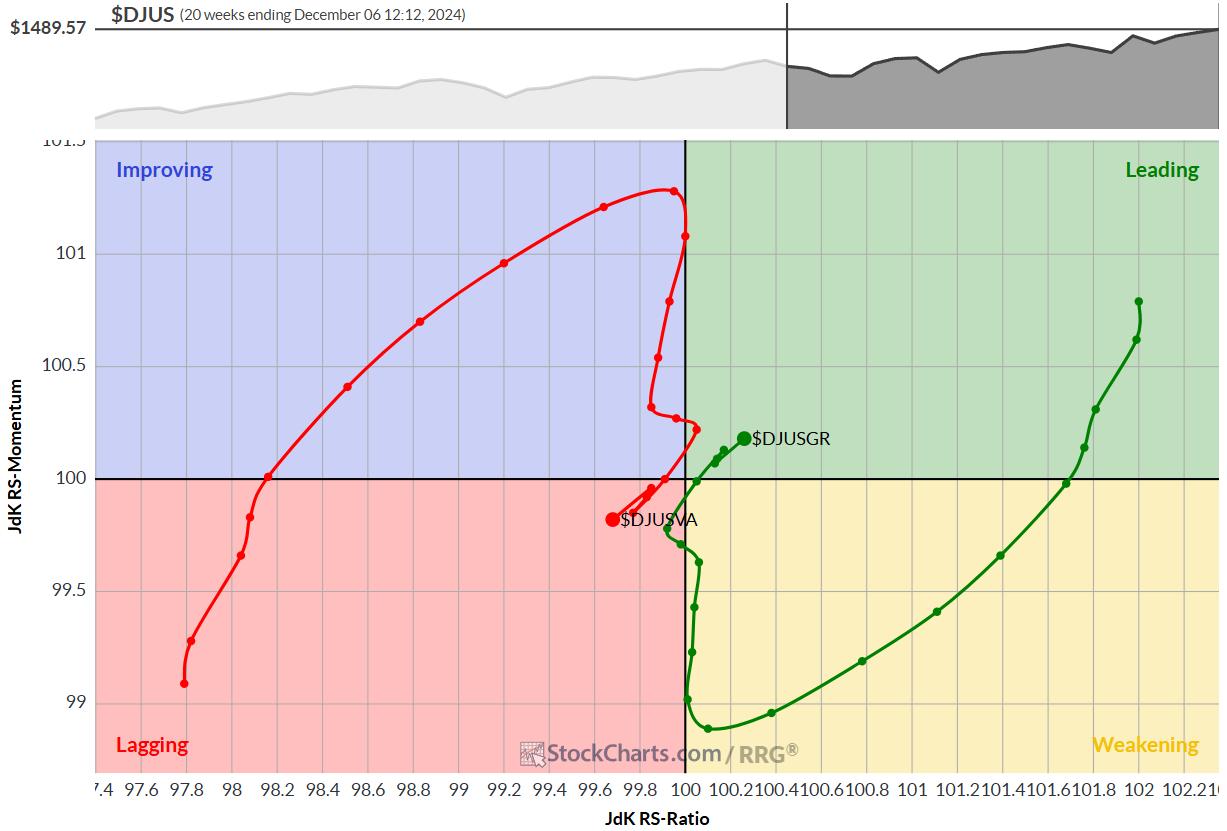

Stay Away from Large-Cap Value Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

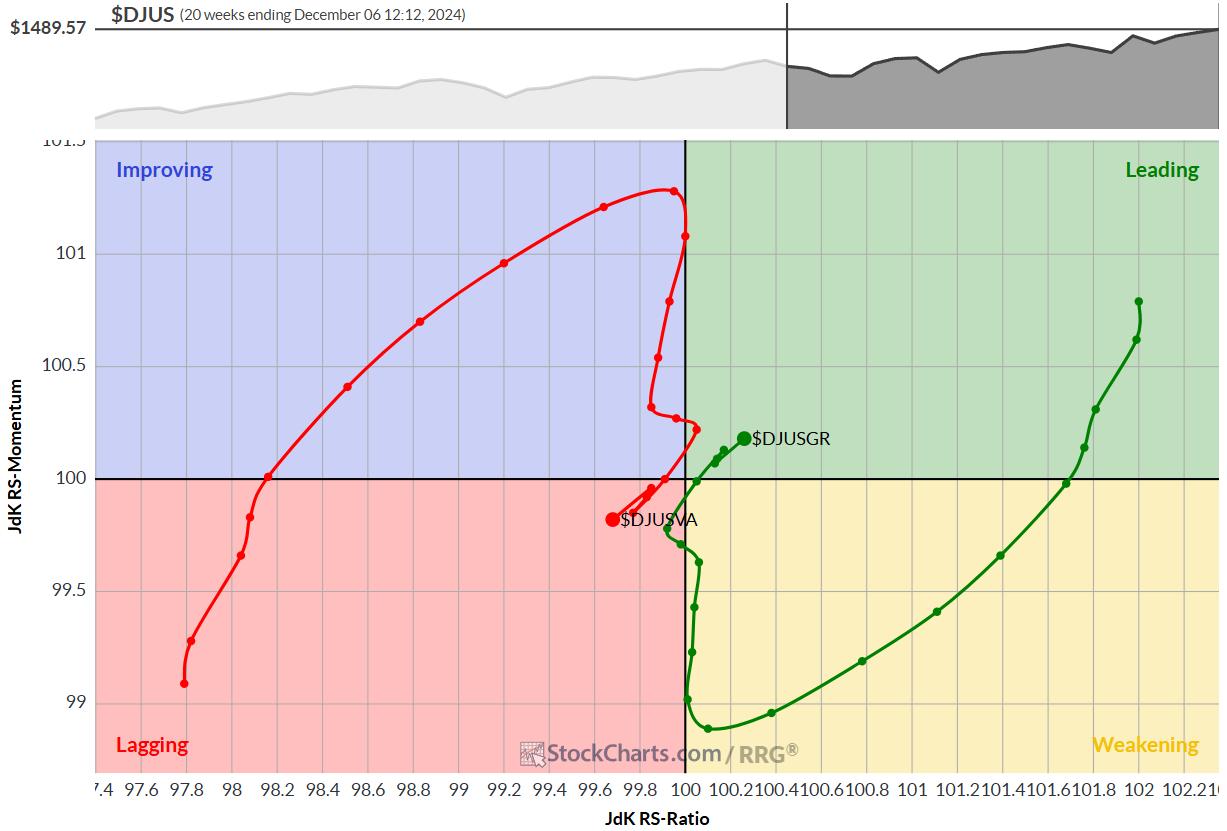

KEY TAKEAWAYS

* Growth stocks are regaining leadership over value.

* Small and mid-cap growth sectors are leading the charge.

* Large-cap value is currently the weakest market segment.

Growth vs. Value Rotation: The Pendulum Swings Again

Relative Rotation Graphs (RRG) are not just good tools to use in analyzing sector rotation; they&...

READ MORE

MEMBERS ONLY

Double Top on Industrials (XLI)

by Erin Swenlin,

Vice President, DecisionPoint.com

Industrials (XLI) benefited greatly from the "Trump Trade", but fell back to digest the gap up rally. It rallied again, but failed after overcoming overhead resistance at the prior November top. Now it is pulling back once again, which that has formed a bearish double top formation. The...

READ MORE

MEMBERS ONLY

Master the Market: Navigating Up Days and Down Days

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Assess the cumulative strength or weakness of a stock's up and down days to help decide on a prospective trade or investment.

* MarketCarpets can comprehensively display the cumulative strength or weakness of stocks in a specific group, such as the S&P 500.

* Discover how...

READ MORE

MEMBERS ONLY

Financials Primed to Beat Tech in December!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive video,Julius analyzes the completed monthly charts for November and assesses the long-term trends for all sectors. What we can expect for the coming month of December based on seasonality? With the technology sector under pressure, an interesting opportunity appears to be arising in Financials.

This video...

READ MORE

MEMBERS ONLY

DP Trading Room: Swenlin Trading Oscillators Top!

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday our short-term Swenlin Trading Oscillators (STOs) turned down even after a rally. This is an attention flag that we shouldn't ignore, but what do the intermediate-term indicators tell us? Are they confirming these short-term tops?

Carl goes through the DP Signal tables to start the program...

READ MORE

MEMBERS ONLY

Can the S&P 500 Rally Without Tech?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a deep dive into US sector rotation, breaking it down into offensive, defensive and cyclical sectors. He first looks at the relative rotations that are shaping up inside the group, assessing each sector's price chart in combination with the rotation...

READ MORE

MEMBERS ONLY

OptionsPlay: Macro Market Outlook and Options Strategies

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, and shares his top bearish and bullish options trading ideas. He talks growth vs. value, commodities, bonds, the Dollar Index, sectors like homebuilders and semiconductors, and stocks like NVDA, DIS, INTC, and more.

This video premiered on November 26,...

READ MORE

MEMBERS ONLY

Market Rally Broadens - New All-Time Highs?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the small-caps and mid-caps that have now begun to outperform the market. Clearly the rally is broadening, the question now is can we continue to make new all-time highs. It does seem very likely especially given the positive outlook on the Secretary of Treasury nomination.

Carl...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Defends This Crucial Support; Chase Rebounds Mindfully

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a truncated trading week, the Indian equities closed the week with gains thanks to a robust technical rebound that it witnessed on Friday. The Nifty continued to wear a corrective look for three days; on the last trading day of the week, the Index managed to get itself into...

READ MORE

MEMBERS ONLY

These Old-School Stocks Have Joined The AI Rally!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broad-based rally that pushed the Equal-Weighted SPX to new highs. She also shared base breakouts and downtrend reversal candidates in the now hot Retail space, and takes a close look at 3 old school stocks that are seeing AI-related growth.

This...

READ MORE

MEMBERS ONLY

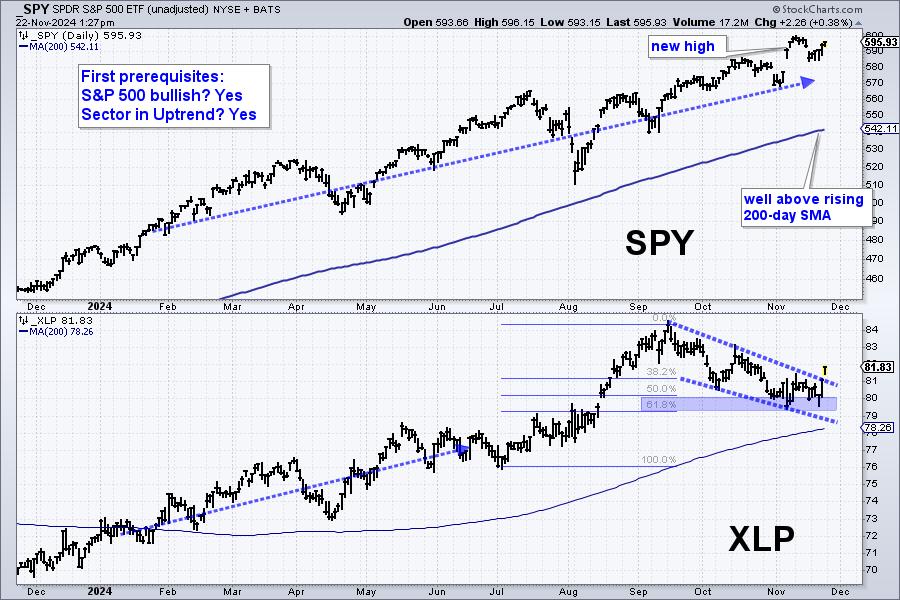

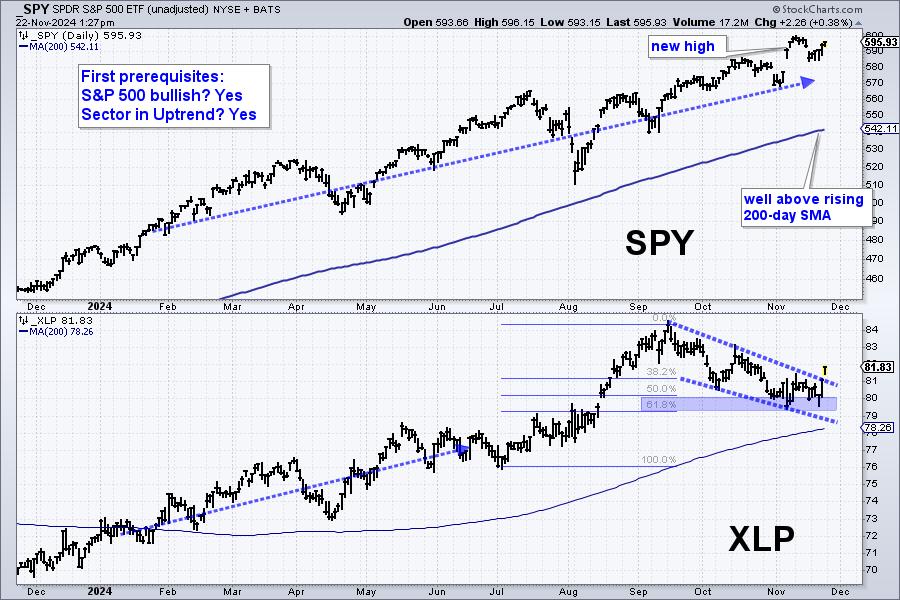

Four Prerequisites to Improve Your Odds - A Live Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Traders can improve their odds with market, sector and stock filters.

* We should be in a bull market and the sector should be in an uptrend.

* The stock should be in a long-term uptrend and leading.

Even though trading based on chart analysis involves some discretionary decisions, chartists...

READ MORE

MEMBERS ONLY

Sector Rotation Suggests Offense Over Defense

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Relative strength trends show a recent rotation into Consumer Discretionary, Communication Services, Financials, and Energy.

* The offense to defense ratio still favors "things you want" over "things you need."

* RRG charts give a fairly clear roadmap of what to look for rotation-wise into early...

READ MORE

MEMBERS ONLY

Three Ways Top Investors Track Sector Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave outlines three tools he uses on the StockCharts platform to analyze sector rotation, from sector relative strength ratios to the powerful Relative Rotation Graphs (RRG). Dave shares how institutional investors think about sector rotation strategies, evaluating the current evidence to determine how money managers are allocating...

READ MORE

MEMBERS ONLY

Macro Market Outlook and Best Options Trade Ideas!

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, where he shares his top bearish and bullish options trading ideas, These include Disney (DIS), Shopify (SHOP), Intel (INTC), Adobe (ADBE), and Apple (AAPL). He explores growth vs. value, current sector rotation, key earnings, and more.

This video premiered...

READ MORE

MEMBERS ONLY

MarketCarpets Secrets: How to Spot Winning Stocks in Minutes!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* StockCharts' MarketCarpets can be customized to find stocks to invest in using specific criteria.

* The MarketCarpets tool helps users drill down from a big-picture view to individual stocks.

* Getting an at-a-glance view of strong stocks poised to bounce can be done immediately and efficiently with MarketCarpets.

When...

READ MORE

MEMBERS ONLY

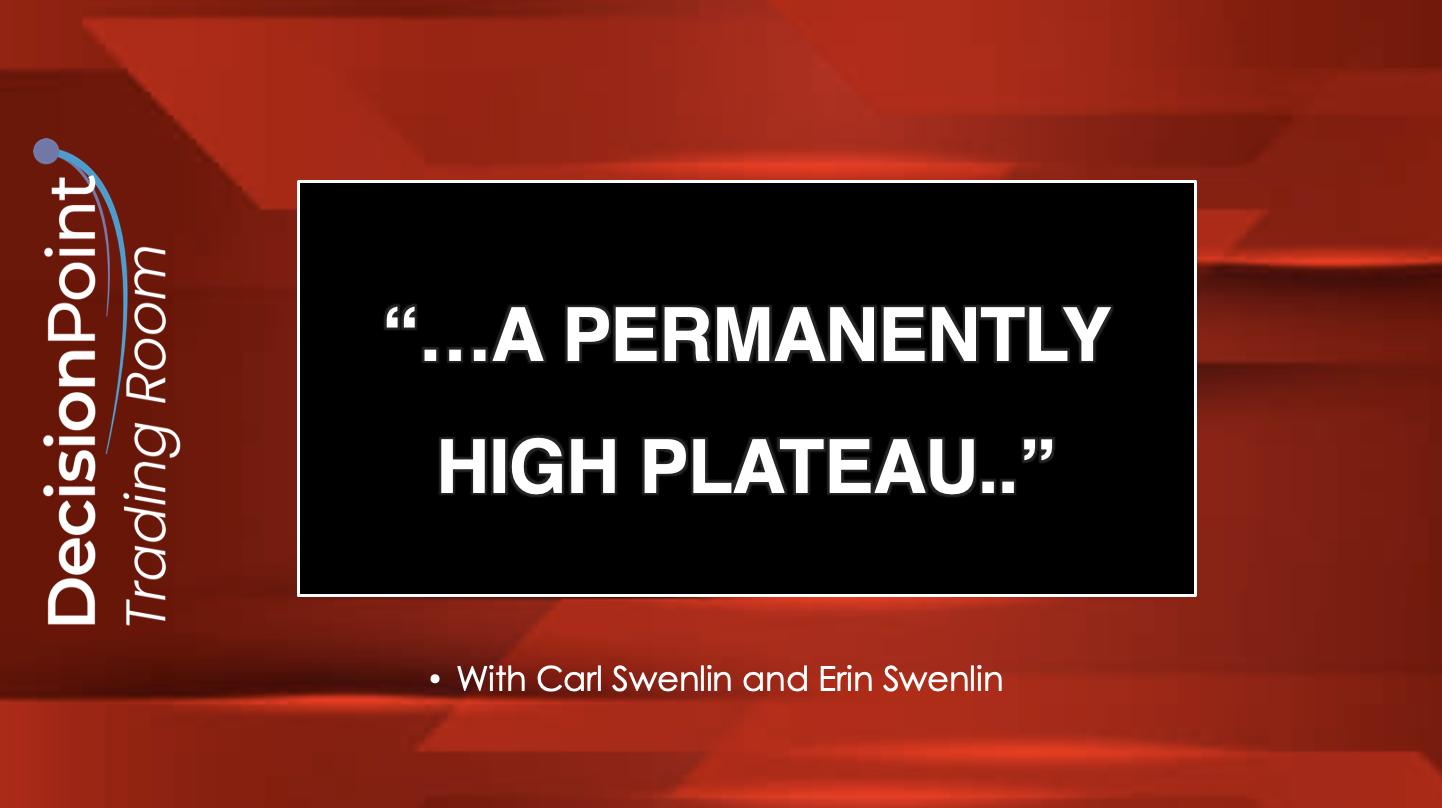

Stocks: "...a PERMANENTLY high plateau"?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today we explore the bullish sentiment that has taken SPX valuations to the moon. There are many out there that believe we have hit a plateau on prices that will continue permanently. We talk about the quote: "Stock prices have reached 'what looks like a permanently high plateau,...

READ MORE

MEMBERS ONLY

Don't Miss These Breakouts Poised to Trade Higher!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reveals what took place last week and how the markets closed. She also revealed what drove price action, and what to be on the lookout for next week. In addition, she shares several stocks that broke out of powerful bases on bullish news....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Mild Rebounds; Painful Mean Reversion May Continue

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian benchmark Nifty 50 extended its corrective decline. Over the past four sessions of a truncated week, the Nifty 50 index remained largely under selling pressure, and the markets continued with their process of mean-reversion. The volatility, though, did not show any major surge. The volatility gauge, IndiaVIX rose...

READ MORE

MEMBERS ONLY

Simple Way to Find Confluence FAST Using Moving Averages

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe explains how to use an 18 simple moving average in multiple timeframes to identify when a stock has confluence amongst 2-3 timeframes. He shows how to start with the higher timeframes first, before working down to the lower ones. Joe then covers the shifts...

READ MORE

MEMBERS ONLY

Riding the Stock Market's Wave: How to Maximize Your Gains

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader US stock market indexes took a breather on Tuesday.

* Mega-cap Mag 7 stocks are back in the limelight.

* Investors are rotating into Technology and Communication Services sectors.

The post-election euphoria may have taken a breather on Tuesday, as the US stock market indexes closed lower. The...

READ MORE

MEMBERS ONLY

What Seasonality Charts Reveal About the Top Sectors to Watch Right Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Seasonality provides a unique historical technical context, as long as you remember that it's more of a traffic flow map than a crystal ball.

* Seasonality charts can be useful for drilling down from market to sector or sector to stocks.

* Checking the daily chart is crucial...

READ MORE

MEMBERS ONLY

MUST SEE Updates to RRG Charts on StockCharts!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius pulls the curtain back on the updated Relative Rotation Graphs that are now available on the StockCharts website. He demonstrates a myriad of new features, including alignment of the intraday time frames with SharpCharts/ACP, zoom and position control with your mouse, and...

READ MORE

MEMBERS ONLY

Is the Trump Rally Like the Reagan Rally?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl compares this week's Trump Rally with the rally we saw after Reagan was elected in 1980. There are similarities and differences. The Trump rally has lifted certain sectors of the market as well as Cryptocurrencies. While the Reagan rally had different catalysts.

The market continues to...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Stay Sluggish; Multiple Resistances Nestled in This Zone

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets remained tentative over the past five days while continuing to trade with a weak undertone, while the Nifty digested the reaction to the US election outcome. There were two days of a strong technical rebound; this was subsequently sold into, which kept Nifty in a broadly-defined range. The...

READ MORE

MEMBERS ONLY

Best Way to Capitalize on Election Rally!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen presents a deep dive into last week's sharp rally in the markets. She highlights what areas could perform best under a Trump administration and how to spot a pullback. She takes a close look at the "New Economy" and...

READ MORE

MEMBERS ONLY

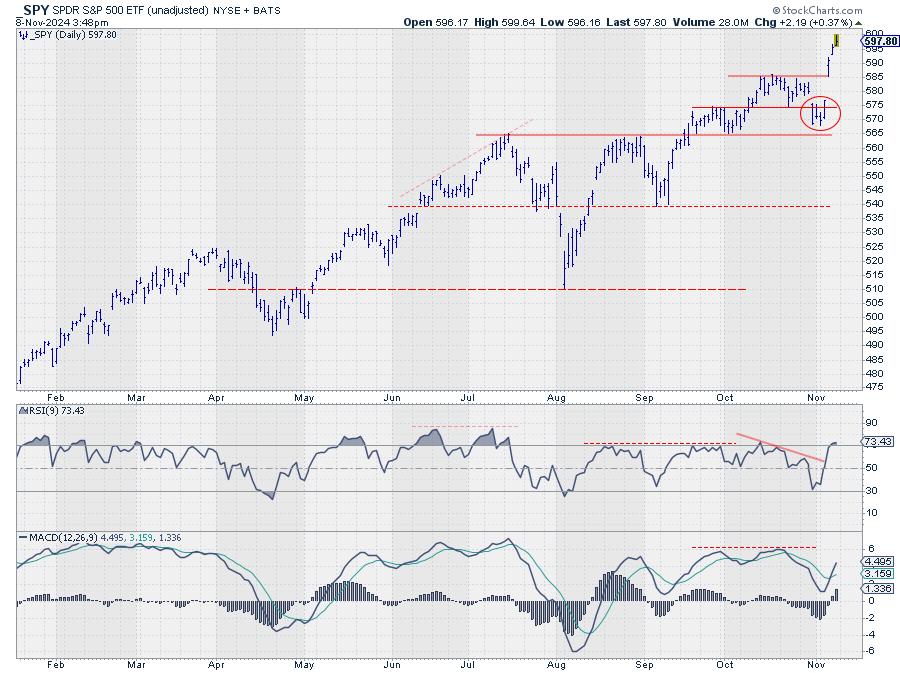

Three Sectors Leading SPY Back to Offense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

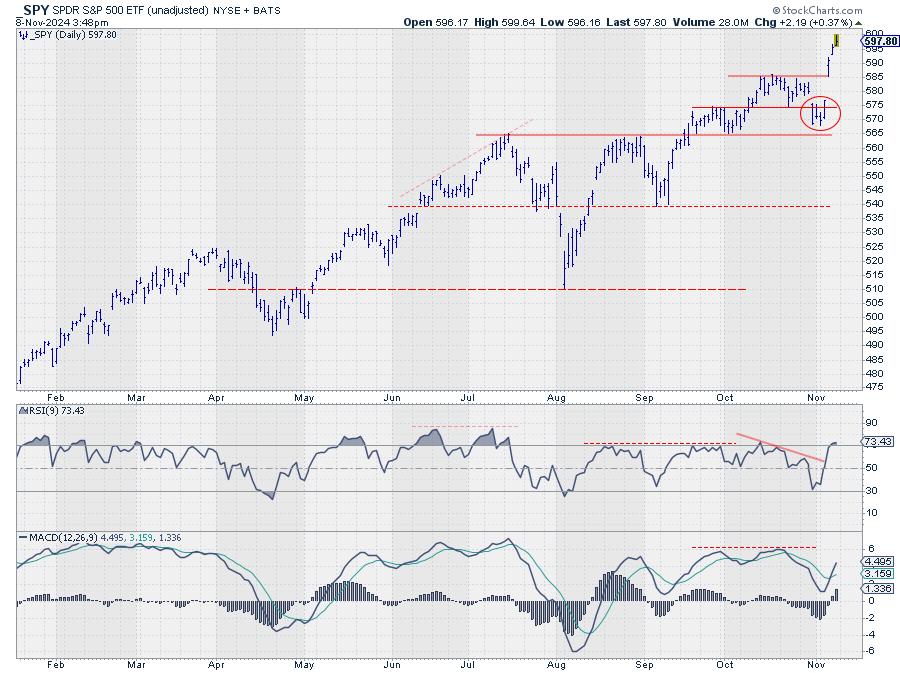

KEY TAKEAWAYS

* The market came out of defensive mode after the election.

* Old resistance at 585 is now support for SPY.

* XLC, XLY, and XLF are all showing strength.

First of all, for those of you looking for a new video this week, I have intentionally skipped it because I...

READ MORE

MEMBERS ONLY

This Sector is Worth Watching, Not Just For Itself But as a Market Bellwether

by Martin Pring,

President, Pring Research

Last week, I drew your attention to the fact that out that three US market sectors had experienced bearish two-bar reversals on the weekly charts and were likely to retrace some of their previous advances. I also pointed out that this was only one piece of negative evidence and that...

READ MORE