MEMBERS ONLY

Stock Market Today: How to Scan for Post-Election Profit Opportunities

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Pre- and post-election jitters can cause market reactions and overreactions.

* The best thing you can do is get a bird's-eye view of opportunities that may unfold as the political fog clears.

* MarketCarpets is an effective tool to help you gauge market activity and spot high-probability trades....

READ MORE

MEMBERS ONLY

DP Trading Room: Six-Month Period of Favorable Seasonality Begins Now!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's here! The SPY starts a period of favorable seasonality for the next six months. Carl takes us through his charts and explains favorable versus unfavorable periods of seasonality.

Carl covers our signal tables showing new weakness seeping in despite this period of favorable seasonality. The market looks...

READ MORE

MEMBERS ONLY

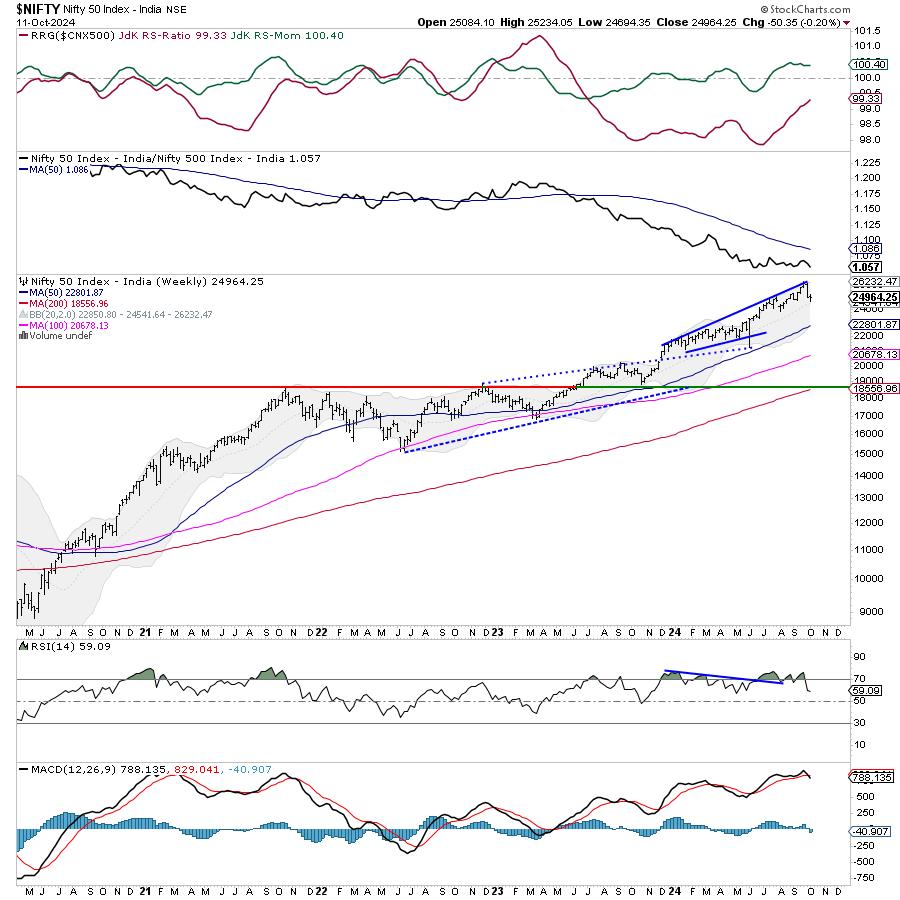

Week Ahead: NIFTY May See Stable Start; Likely to Remain Under Selling Pressure at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty largely consolidated over the past five sessions, but did so with a bearish undertone. The Nifty traded in a defined range and closed the week with a modest gain. Importantly, the index also stayed below its crucial resistance points. The volatility also expanded; the IndiaVIX surged higher by...

READ MORE

MEMBERS ONLY

S&P 500 Under Pressure, Can Strong Seasonality Save It?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius begins by looking back at the completed monthly bars for October to assess the long term trends in the 11 S&P sectors. He follows that up with an updated view for SPY in coming weeks. After that, Julius looks forward using...

READ MORE

MEMBERS ONLY

These S&P 500 Stocks Are Poised To Outperform!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the negative price action in the broader markets while highlighting pockets of strength. She shares how the rise in interest rates is impacting the markets ahead of next week's FOMC meeting. Last up is a segment on how to use...

READ MORE

MEMBERS ONLY

Market Rotation Fueled by Large-Cap Growth (Again)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Large-cap stocks are pushing the market higher.

* Large-cap growth is the only segment driving the market.

* AAPL, TSLA, NVDA, and AMD are having trouble pushing higher.

Following the recent market fluctuations, with a sharp decline and a subsequent rally, it's crucial to examine these movements'...

READ MORE

MEMBERS ONLY

Homebuilding Rebound: How to Catch the Trend Early On

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Homebuilders are getting ready for a potential comeback in 2025.

* Many homebuilder stocks are exhibiting tepid-to-poor technical strength.

* When the homebuilding industry flips to the upside, there are undervalued names that could offer early investment opportunities.

Homebuyers are still on the sidelines, waiting for better mortgage rates, while...

READ MORE

MEMBERS ONLY

Cruise Or Soar? Carnival, Delta, and United Hit New Highs—Which One's Your Best Bet?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Carnival Corp occupies the top spot for new highs across different timeframes.

* Delta Air Lines and United Airlines, two other transportation companies, have also gained new highs.

* Compare Carnival Corp, Delta, and United stock price action and determine which might present a strong opportunity in the coming weeks....

READ MORE

MEMBERS ONLY

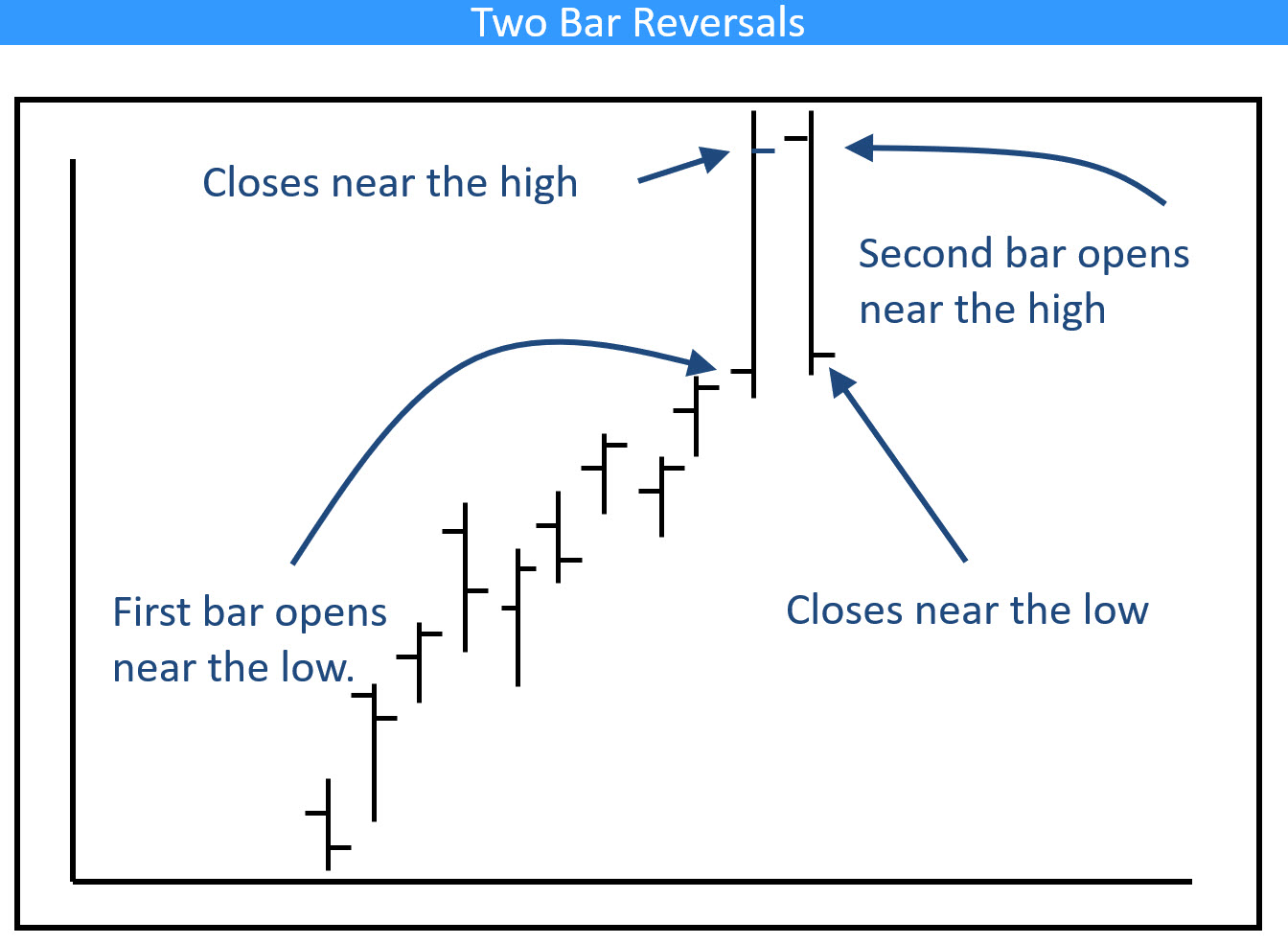

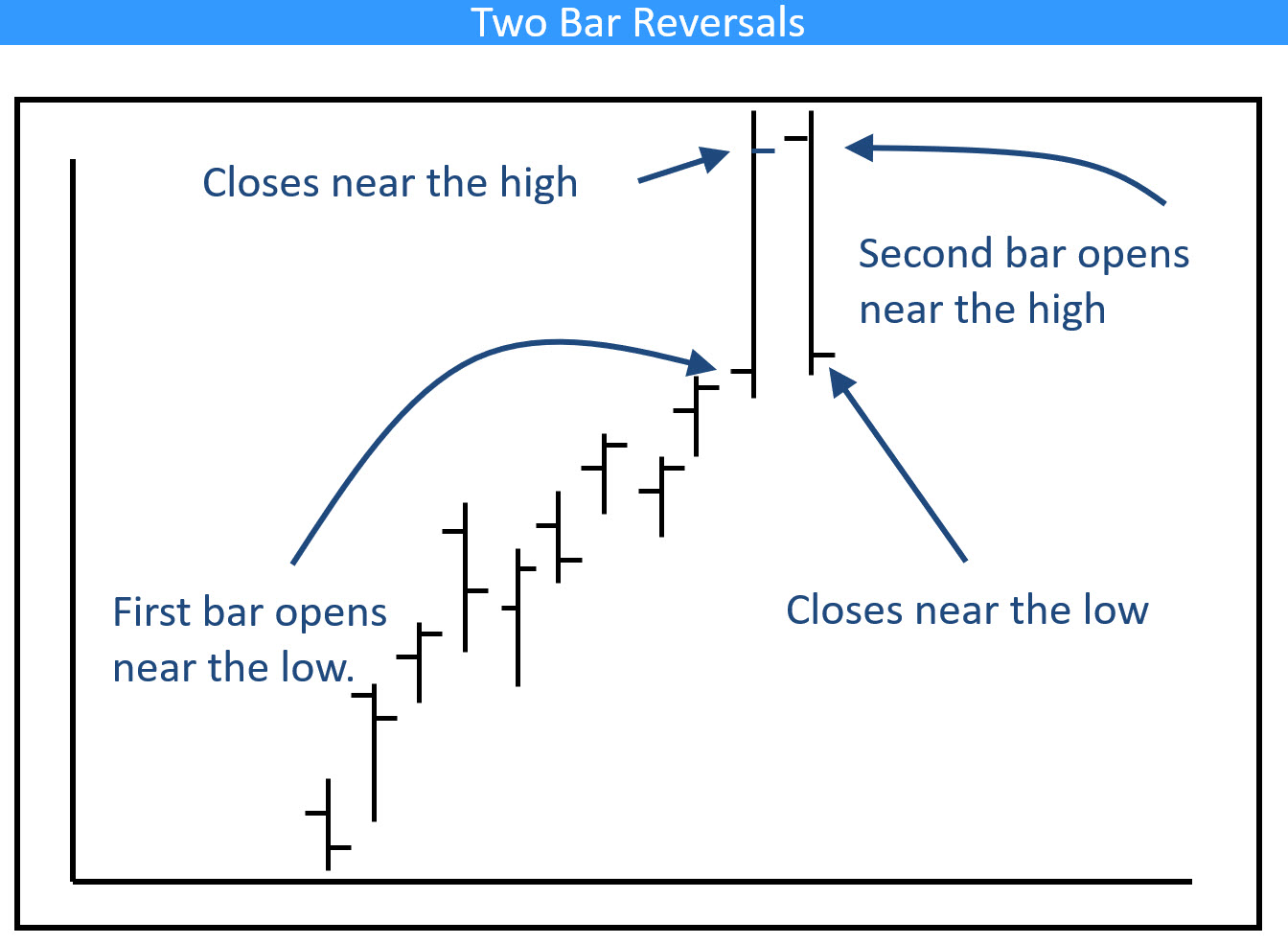

Four Sectors That Have Just Experienced Bearish Weekly Action

by Martin Pring,

President, Pring Research

Most weekends, I flip through a chartlist featuring weekly bars and candles for sectors, country ETFs, currencies, bonds and some commodities. The idea is to see whether any of these entities are showing signs of bullish or bearish reversals. Most of the time, this fishing exercise does not uncover a...

READ MORE

MEMBERS ONLY

DP Trading Room: Magnificent Seven Earnings Preview

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of today's coverage of the Magnificent Seven we remind you when the big mega-caps are reporting and give you are current perspective of each. We also cover all of the Magnificent Seven in the short and intermediate terms with daily and weekly charts.

Carl gives us...

READ MORE

MEMBERS ONLY

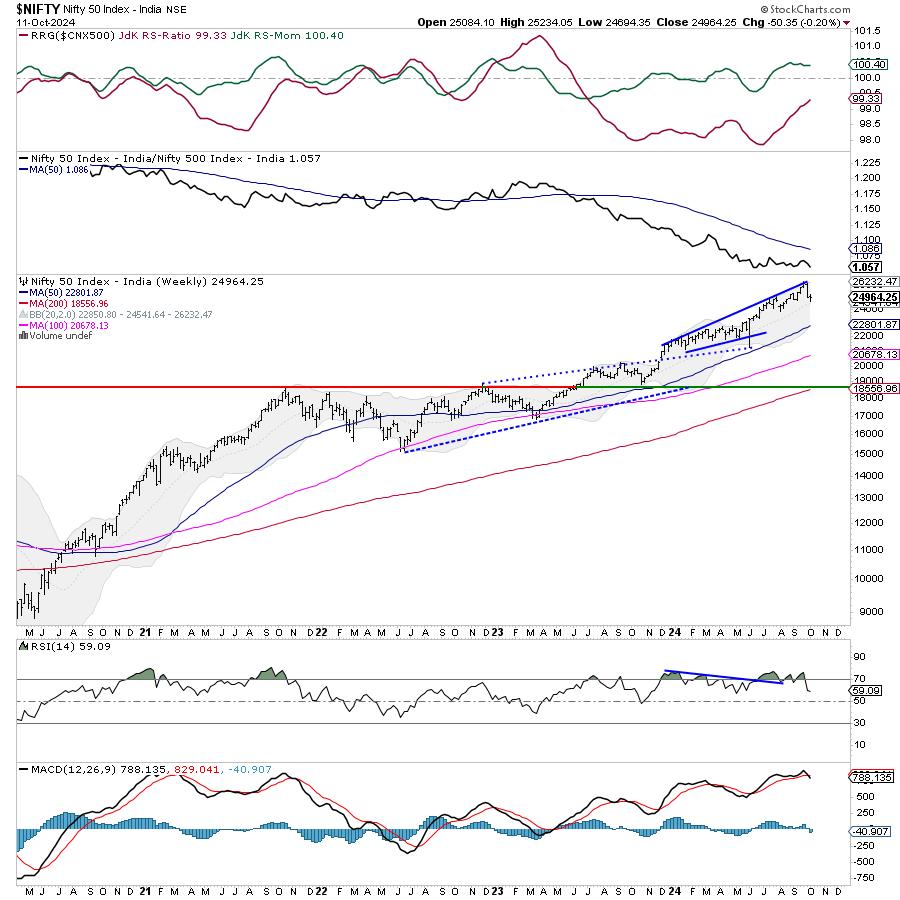

Week Ahead: NIFTY Violates Key Support Levels; Drags Resistance Lower

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The over-deviated markets continued to extend their losses for the fourth week in a row. The Nifty remained largely under sustained selling pressure over the past five days, barring a few feeble attempts to stage a technical rebound. The markets extended their downsides while giving up key supports on the...

READ MORE

MEMBERS ONLY

How to Trade Gaps Up (and Down) After Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen shares how the markets trade right before the elections, and also reviews the move in Tesla (TSLA) after reporting earnings. She shares examples of what to watch for if your stock is due to report earnings - and what to do if it...

READ MORE

MEMBERS ONLY

My Favorite RSI Signal

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how he sets up the RSI 20 and 5 in ACP to save space and improve analysis. He explains how he uses RSI for both reading the trend and for fine-tuning entry in a strong trend. He gives examples using weekly, daily, and...

READ MORE

MEMBERS ONLY

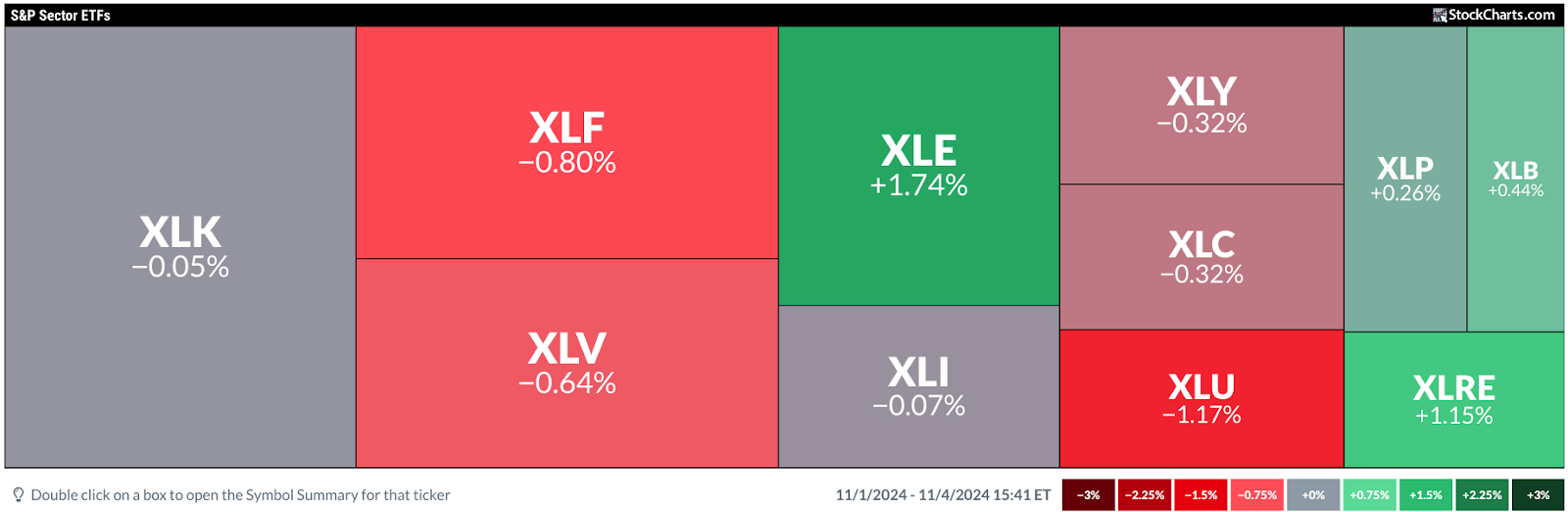

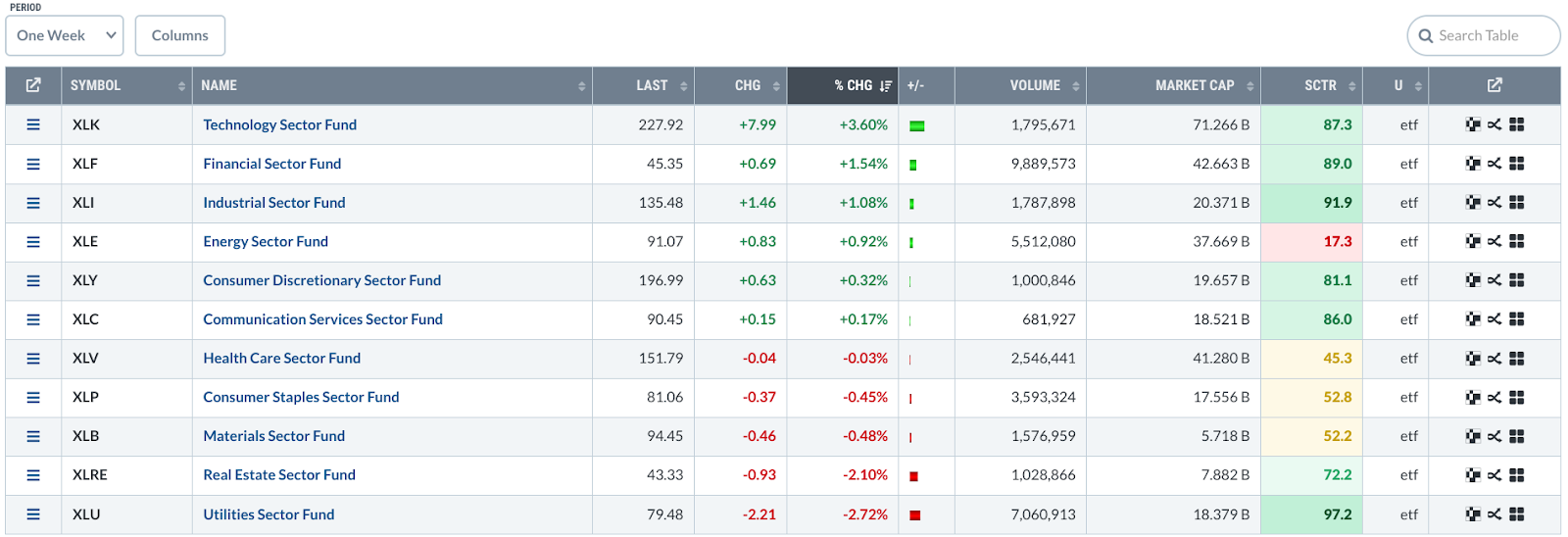

Stocks Regain Some Ground Amid Rising Yields, Gold Prices, US Dollar

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market is treading softly as uncertainties loom on the horizon.

* Consumer Staples is the best-performing sector.

* Nasdaq breaks out above a consolidation pattern ahead of Tech earnings.

The overall trend in the stock market's broader indexes remains bullish. While the indexes were trading lower on...

READ MORE

MEMBERS ONLY

DISCOVER the Top Consumer Discretionary Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius begins by looking back at the completed monthly bars for October to assess the long term trends in the 11 S&P sectors. He follows that up with an updated view for SPY in coming weeks. After that, Julius looks forward using...

READ MORE

MEMBERS ONLY

DP Trading Room: Which is Better? SP600 (IJR) or Russell 2000 (IWM)

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl explores which index is best...the SP600 (IJR) or Russell 2000 (IWM). He makes a comparison over time and reveals which tends to be the better performer. Which one should you use to analyze what is happening in small-caps?

Carl gives us his market outlook as prices pullback today....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Ranged; Trending Moves to Occur Only If These Edges are Breached

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets closed on a negative note for the third week in a row; over the past five sessions, the Nifty remained largely on a declining trajectory, except for the last trading day where it saw some relief rally from the lower levels. Following a strong weekly decline of 1167...

READ MORE

MEMBERS ONLY

Be On the Lookout for THIS During Earnings Season!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews what's driving the markets higher and how you can capitalize. Moves in TSLA, NVDA, and NFLX are highlighted. She also reviews price action greatly impacted by earnings, many driven by analyst upgrades and downgrades.

This video originally premiered October 18,...

READ MORE

MEMBERS ONLY

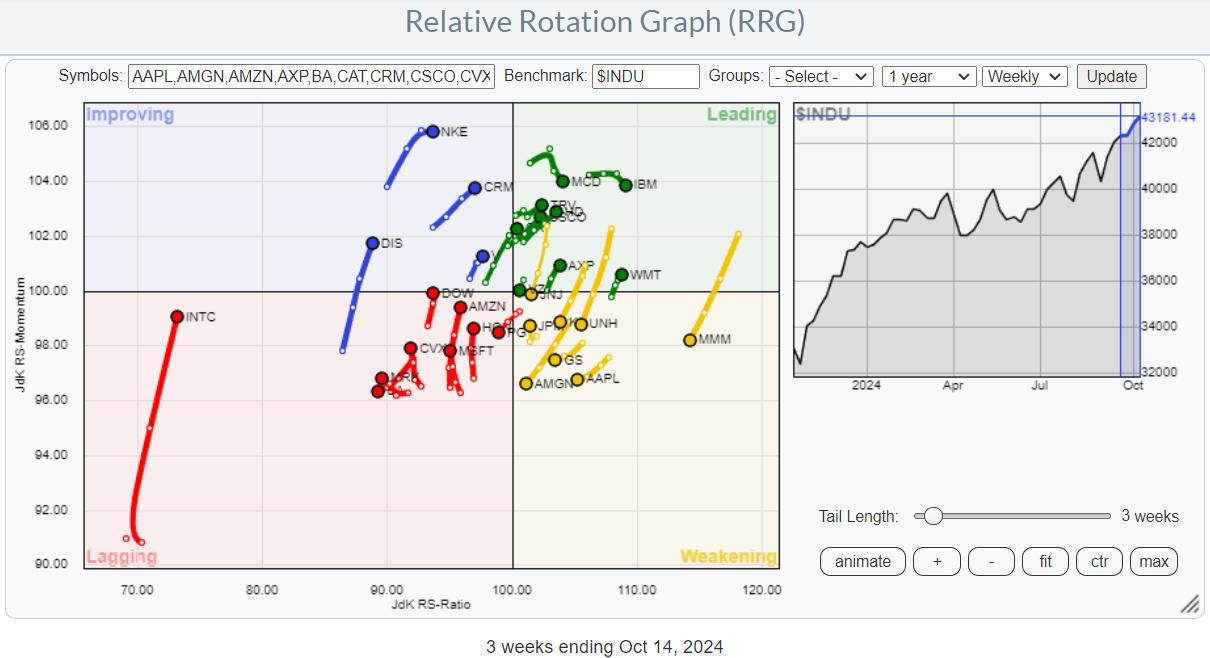

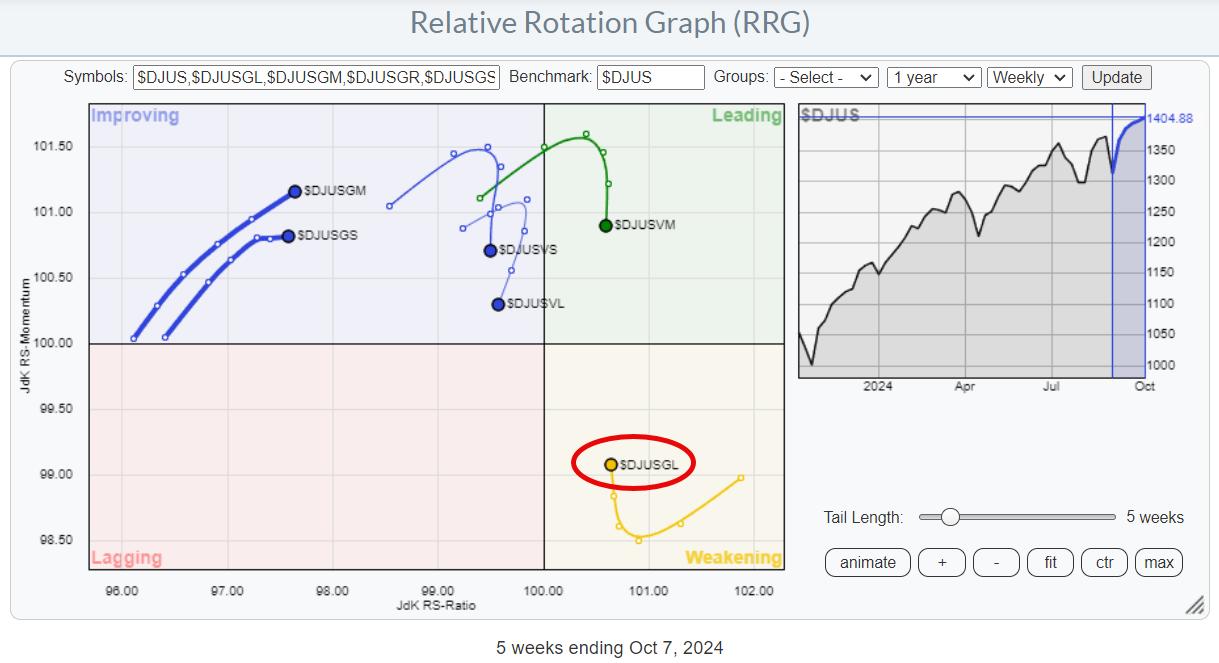

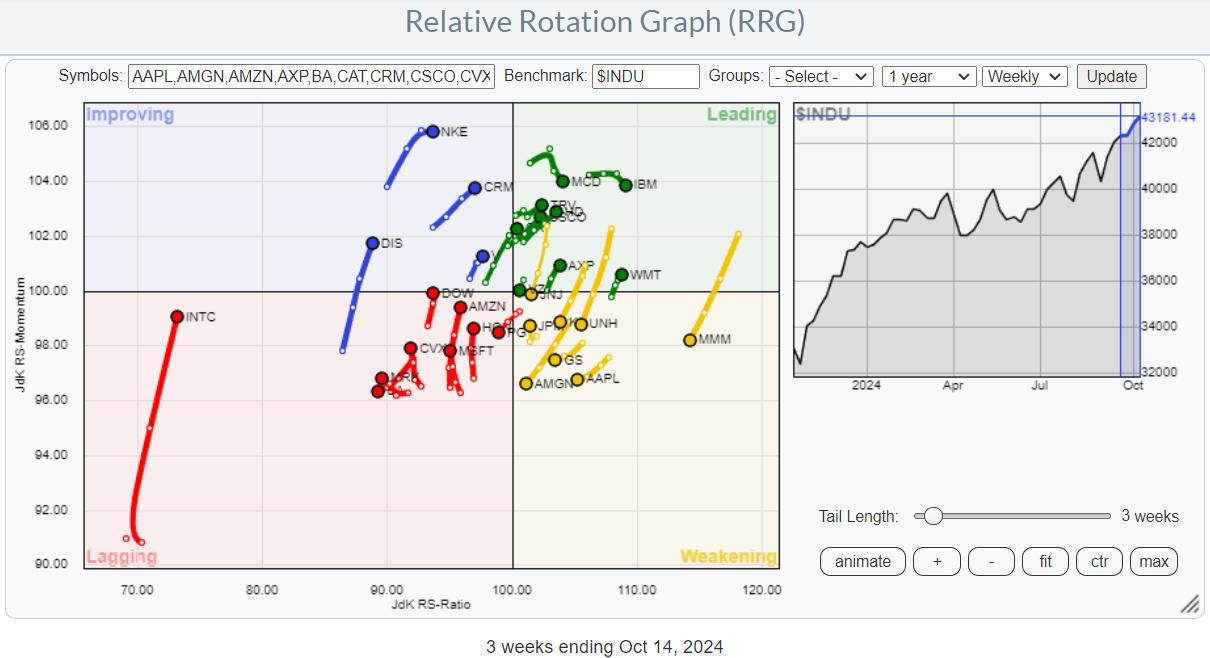

Using RRG To Find Best Three Stocks inside the DJ Industrials Index

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector Rotation Model and current sector rotation are not supporting broad market strength.

* Plotting the members of $INDU on a Relative Rotation Graph helps find the best names in that universe.

* TRV, WMT, and AXP are still strong, but now have too much risk for new positions.

* CAT,...

READ MORE

MEMBERS ONLY

United Airlines Stock Soars: Watch For a Promising Buying Opportunity

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* United Airlines stock took off on solid earnings.

* UAL has broken above a consolidation pattern and is ascending to a higher altitude.

* Look for a pullback before entering a long position in UAL.

Airline stocks had a strong day, with United Airlines (UAL), American Airlines (AAL), and Delta...

READ MORE

MEMBERS ONLY

Sector Rotation is Giving Conflicting Stories!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius dives in to the sector rotation model, trying to find any alignment between theoretical and real-life rotations of sectors in combination with the economic cycle. The positions of the various sectors and the economic indicators that are part of this model are not...

READ MORE

MEMBERS ONLY

MarketCarpets: The Fastest Way to Scan for Hidden Market Opportunities

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Use the StockCharts MarketCarpets to get a fast snapshot of market trends without sifting through endless news.

* Toggle between performance and technical rankings like SCTR to find hidden opportunities.

* Make MarketCarpets part of your daily routine to catch opportunities faster than traditional methods.

When Wall Street rings its...

READ MORE

MEMBERS ONLY

Week Ahead: While Nifty Consolidates, Keeping Above These Levels Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was in complete contrast to the week before, as the markets heavily consolidated in a tight range. In the previous week, the Nifty had seen a significant retracement of over 1167 points; however, over the past five trading days, the index stayed totally devoid of...

READ MORE

MEMBERS ONLY

Last Week's Pullback is a Buying Opportunity!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights what's driving these markets higher despite a rise in interest rates. She also focuses on the leadership area in Technology and shares several stocks from this group. Last up, she reviews how to quickly uncover top stock candidates when a...

READ MORE

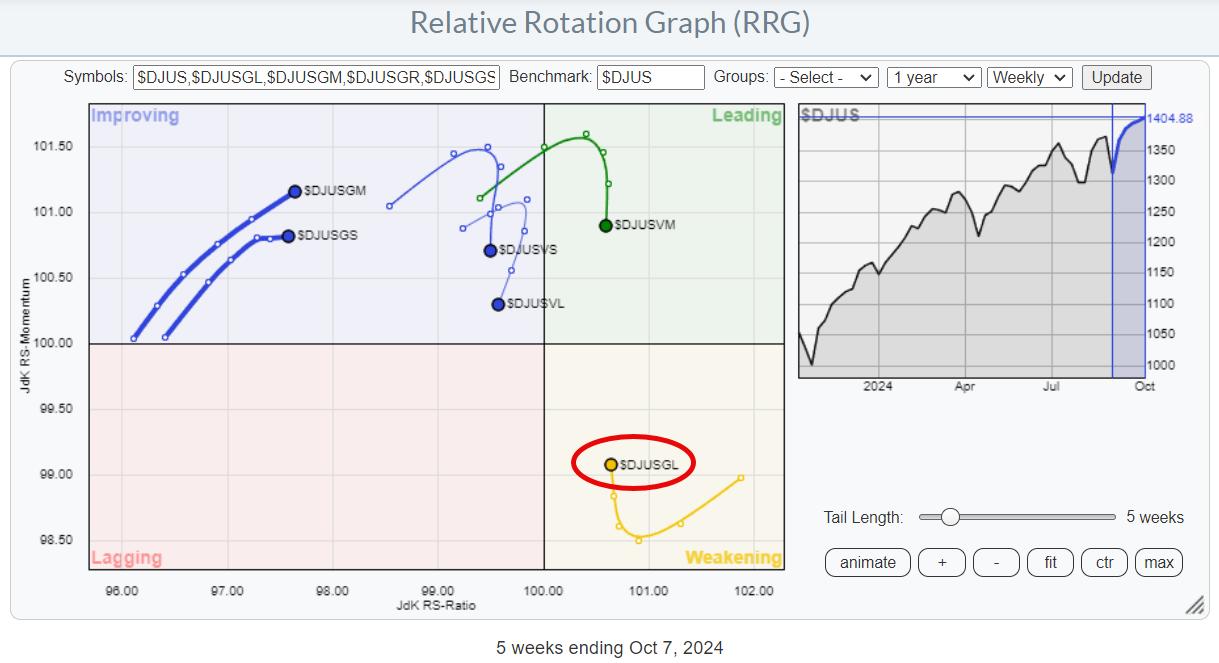

MEMBERS ONLY

It's Large-Cap Growth Stocks (Mag 7) Once Again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is starting to resolve its negative divergence with RSI.

* Large-cap growth is coming back into favor.

* Magnificent 7 stocks provided 2.9% of the S&P 50's 6.8% performance over the past five weeks.

Where is the Recent Performance in the S&...

READ MORE

MEMBERS ONLY

Tech vs Semiconductors: Which One Should You Be Trading?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Doing a top-down sector-to-industry analysis can be an effective way to find tradable opportunities.

* It makes sense to compare charts to see which ones are outperforming and which are underperforming.

* Get a bigger picture, drill down using relative performance indicators, and then examine specific key levels of each...

READ MORE

MEMBERS ONLY

Why This S&P Support Level is SO IMPORTANT

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius presents a few conflicting rotations and signals that continue to warrant caution while the S&P 500 keeps hovering just above support. With the negative divergences between price and MACD/RSI remaining intact, SPY should not break 565. Julius looks at rotations...

READ MORE

MEMBERS ONLY

DP Trading Room: A Case for a Market Top

by Erin Swenlin,

Vice President, DecisionPoint.com

During today's market analysis Carl laid out his reasons why we believe we are at a market top. He discusses the current market price action combined with exclusive DecisionPoint indicators to substantiate his position. Don't miss his analysis.

Carl also goes though the Magnificent Seven by...

READ MORE

MEMBERS ONLY

Week Ahead: Putting Market Moves in Perspective; Watch Nifty From This Angle

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

On the back of one of the major FII selloffs seen in recent times, the markets succumbed to strong corrective pressure through the week and ended on a very weak note. The Nifty 50 remained under selling pressure; at no point in time did it show any intention to stage...

READ MORE

MEMBERS ONLY

Stealth AI Stocks Are Taking Off in a Flat Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights the continuation rally in AI-related stocks while also reviewing broader market conditions. The move higher in yields as well as volatility were discussed heading into next week's FOMC notes and inflation data.

This video originally premiered October 4, 2024. You...

READ MORE

MEMBERS ONLY

Will Technology Drive S&P Higher in October?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius explores the October seasonal outlook for the S&P 500 and various sectors. Seasonality suggests a potential rise in the S&P 500, fueled by strength in technology, but there are still concerns about the ongoing negative divergence between price and...

READ MORE

MEMBERS ONLY

SCTR Report: Vistra Energy Soars, Reaches New All-Time High

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Vistra Energy can be a big player in providing nuclear power to AI companies.

* Vistra Energy's stock price has hit an all-time high.

* There are support levels on the daily price chart that could present buying opportunities in VST.

Utility stocks are now becoming cool. Going...

READ MORE

MEMBERS ONLY

These 4 Chinese Stocks are Worth a Look

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe explains how to use two timeframes to identify 2 important characteristics of a great setup. For examples, he shares a few Chinese stocks that are showing great strength to the upside and what levels to watch for a pullback. Joe also covers the...

READ MORE

MEMBERS ONLY

US Sectors Soar to New Highs!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a detailed look at the monthly charts for all US sectors and the S&P 500. With many sectors breaking to new highs, he highlights how the long-term uptrend for the S&P 500 remains intact. Julius also examines the...

READ MORE

MEMBERS ONLY

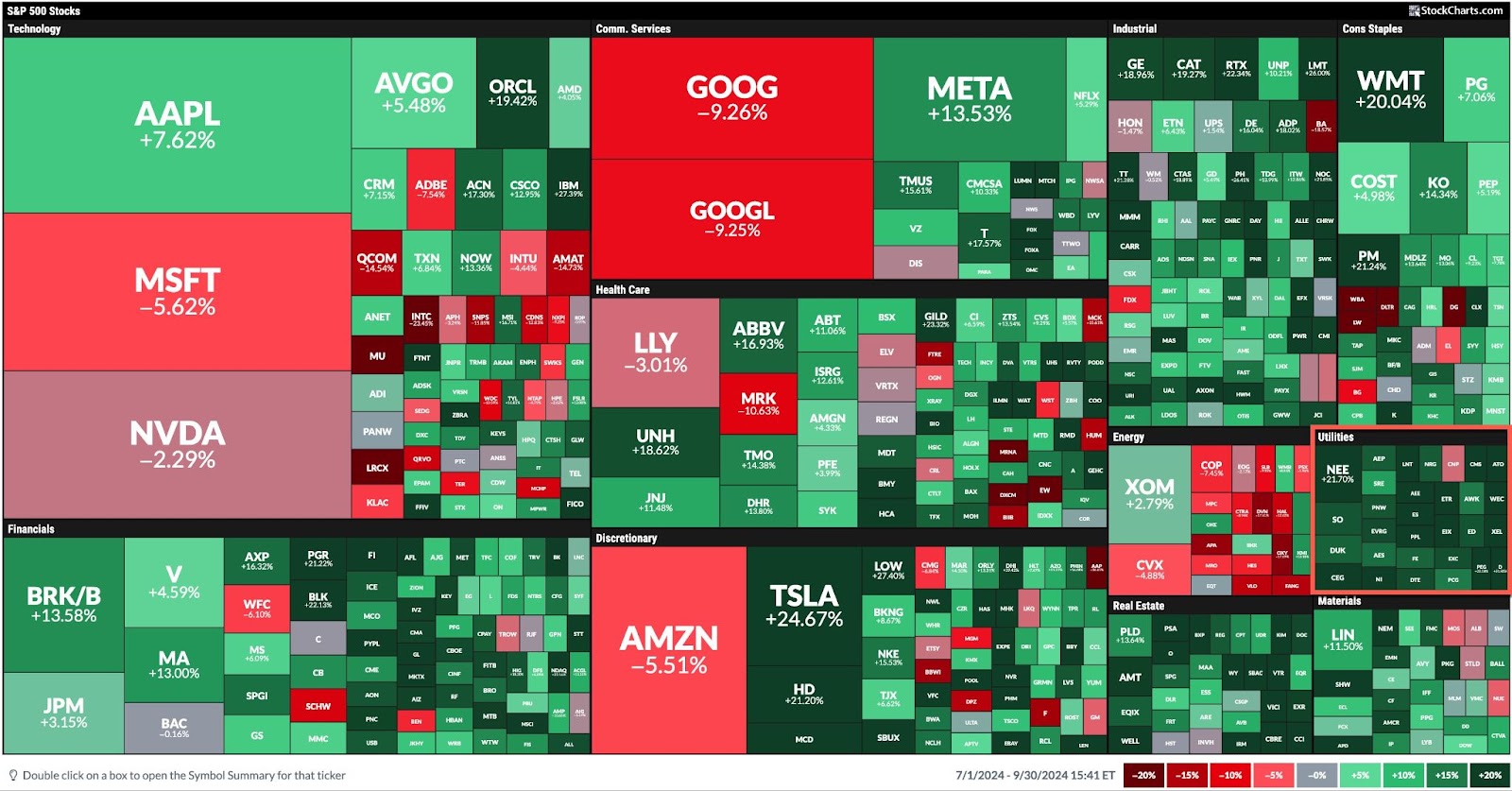

Stock Market's Spectacular Q3: Highest Sector Performer is Utilities

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The leading sector performer in Q3 was Utilities, up by 19.35%.

* Utility stocks are gaining attention because of their ability to power up AI companies.

* Many utility stocks provide dividends, which could add some extra cash to your portfolio.

September, typically considered to be the weakest month...

READ MORE

MEMBERS ONLY

DP Trading Room: Uncovering Stocks from DP Scan Alerts

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DecisionPoint Trading Room, Erin pulls out her exclusive DecisionPoint Diamond Scans and finds us some new and interesting stock symbols to explore further. These scans are very powerful and bring the best charts to your attention. DecisionPoint has a new Scan Alert System for purchase...

READ MORE

MEMBERS ONLY

Why Were Chinese Stocks Up 20% Last Week?!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets, including sector and industry group rotation, before highlighting the sharp move into Chinese stocks. She shares her thoughts on whether it's too late to participate. In addition, she looks at the key traits that signal your stock...

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch for October 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As we near the end of what has been a fairly solid Q3 for the equity markets, we are left with the eternal question for investors: "What's next?"

We now have the Fed's first rate cut in the rearview mirror, with multiple rate cuts...

READ MORE

MEMBERS ONLY

This Week's "Sector to Watch" and "Industry Group to Watch"

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday mornings in our DP Diamonds subscriber-only trading room, the DecisionPoint Diamond Mine, I like to look for a "Sector to Watch" and an "Industry Group to Watch" within. These are for your watchlist and not necessarily ready for immediate investment. In the case of...

READ MORE

MEMBERS ONLY

Opportunities in Industrials and Materials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Negative divergence remains a distracting factor

* Defensive rotation still present

* Industrials and Materials on positive track toward leading RRG quadrant

Despite a backdrop of conflicting market signals, there are still sectors within the S&P 500 that are showing promising movements and potential opportunities for investors. Today,...

READ MORE