MEMBERS ONLY

EB Weekly Market Report - Monday, November 20, 2023

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sample Report

Below is our latest Weekly Market Report (WMR), which is published on Sunday/Monday of every trading week. It's unlike our Daily Market Report (DMR) as the WMR focuses almost exclusively on the Big Picture and is more designed for those with longer-term investing/trading horizons....

READ MORE

MEMBERS ONLY

MEM TV: Easy Way To Uncover Best Candidates for These Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reveals areas of the market that are reversing lengthy downtrends and the best way to participate. She also highlights where the strength is in the markets as the uptrend remains firmly in place.

This video originally premiered November...

READ MORE

MEMBERS ONLY

Stock Market Welcomes Us Home in a Big Way

The Economic Modern Family has opened its loving arms to the bulls and to us after our 2 weeks away.

Beginning with Granddad Russell 2000 (IWM), Monday began with a gap up over the 50-DMA (blue). We will watch for a phase change confirmation. Furthermore, the monthly chart shows IWM...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation and Macro Insights for the Economic Cycle!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I update the current rotation in sectors and the positioning of macroeconomic variables to make an assessment of the positioning of the stock market within the economic cycle.

This video was originally broadcast on November 14, 2023. Click anywhere on...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Your Portfolio OUTDATED? The Truth About The 60/40 Mix

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a discussion about the typical 60/40 Portfolio (60% US Stocks/40% US Bonds) and whether it will continue to serve you well given the decline in Bonds. Is this portfolio blend obsolete? Both...

READ MORE

MEMBERS ONLY

Focused Market Leadership Ahead Of Core Inflation Data - Here's What Investors Need To Look Out For

by Mary Ellen McGonagle,

President, MEM Investment Research

On Friday, the Nasdaq Composite posted its best day in more than five months, with a 2% rally that pushed this Index further into an uptrend. The S&P 500 had a good day as well, with all eleven sectors advancing higher. The sharp gain in the Nasdaq was...

READ MORE

MEMBERS ONLY

MEM TV: Will The Markets to Continue Trading Higher? This Needs to Happen First

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets higher last week. She also shares what needs to take place in order for a sustained uptrend to materialize. Last up, she presents a review of the weaker areas as defensive stocks pull...

READ MORE

MEMBERS ONLY

Sector Spotlight: Unleash The Power of Sector Analysis by Plotting Ratio Symbols on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I take a look at current sector rotation while comparing cap-weighted sectors with equal weight sectors, trying to find areas of the market where either one of these is dominating. I then demonstrate how to use ratio symbols on Relative...

READ MORE

MEMBERS ONLY

DP Trading Room: This Powerful Scan Finds Stocks Showing NEW Momentum

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl covers the major markets as well as the Dollar, Gold, yields, and Bitcoin. Erin runs her "Momentum Sleepers Scan" to find stocks that are showing new momentum under the surface. She uncovers a few stocks for...

READ MORE

MEMBERS ONLY

GNG TV: S&P Rallies Back to 4300 - Is It a Go?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, as equities rally right on seasonal cue, Alex and Tyler take a look across asset classes, sectors and review a few of the magnificent 7 that are holding up the broad cap-weighted indices. All that can be determined from this week'...

READ MORE

MEMBERS ONLY

MEM TV: New BULLISH THRUST in the S&P 500

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the new uptrend in the markets and the areas that are best positioned to benefit. She also highlights how to use different timeframe charts to tell if a stock will continue to trend higher after gapping up...

READ MORE

MEMBERS ONLY

An Incredible Stock Market Rally Closes the Week on a Strong Note: The Best Week This Year, So Far

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite rally into the close

* Fed Chairman Jerome Powell's comments eased investor fears of further interest rate hikes

* Lower Treasury yields helped the banks, including regional banks

Five up days in a row for the...

READ MORE

MEMBERS ONLY

Holiday Shopping Bonanza: Retail Stocks You Need to Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Since holiday shopping season is here it could be a good time to add some retail stocks to your portfolio

* AMZN, WMT, COST, and TGT could be potential stocks to add to your portfolio as holiday shopping begins

* Set alerts for these stocks so you can enter at...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Charts Suggest Downside Risk is Limited

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the completed monthly charts for October and assess the condition of the long term trends, along with whether they are still in play or have shifted. As usual, I start with the long-term rotation and trends in asset...

READ MORE

MEMBERS ONLY

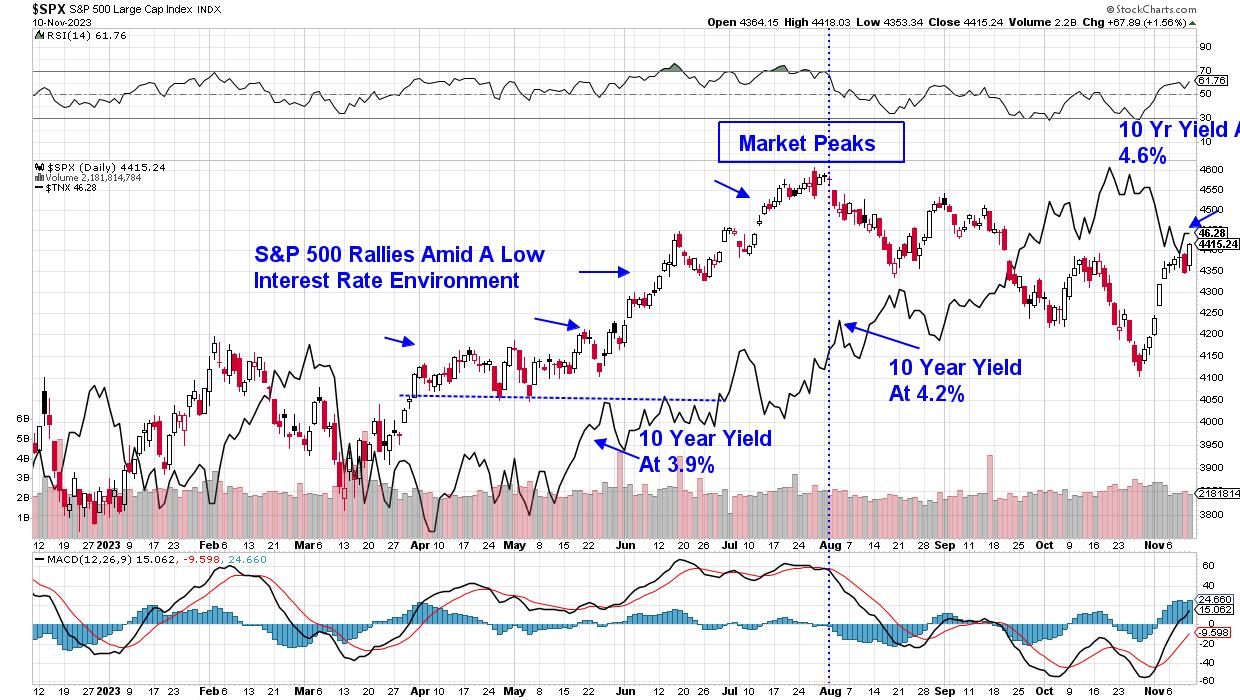

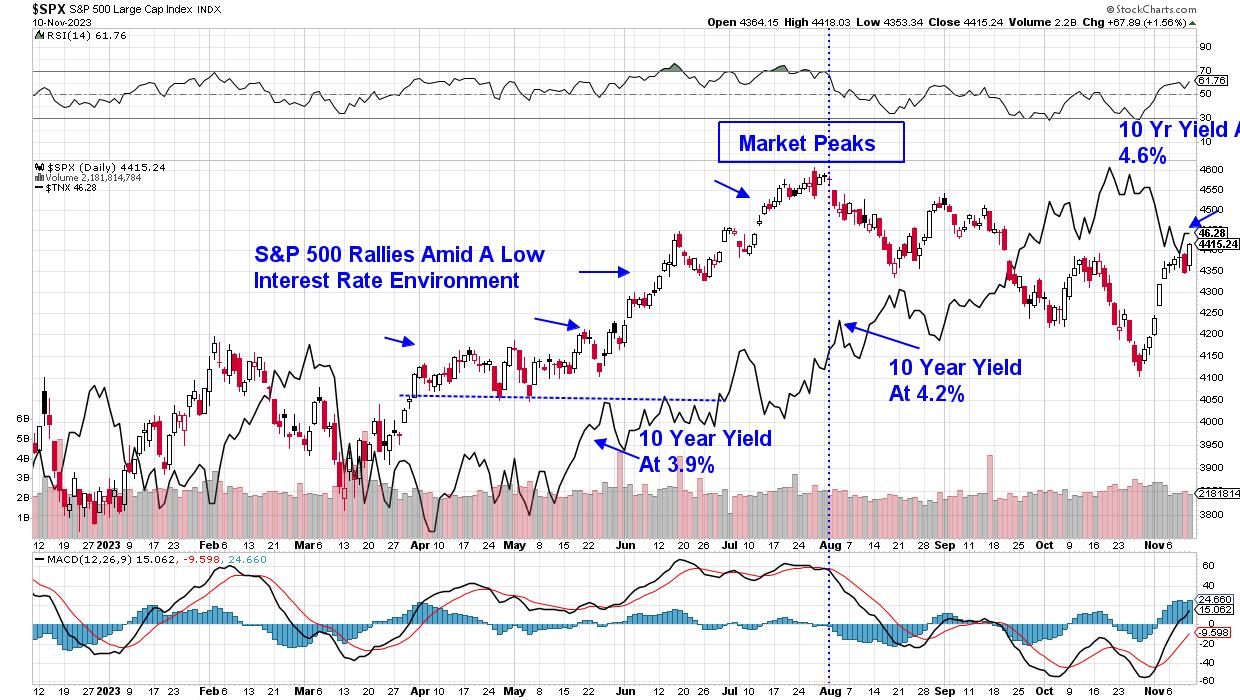

Stock Market Hinges on the Ten Year Interest Rate

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tony Dwyer of Canaccord Genuity breaks down four charts that speak to a potential tactical rally for the S&P 500, and explains why this market is still all about interest rates. Meanwhile, Dave charts the downtrend channel for...

READ MORE

MEMBERS ONLY

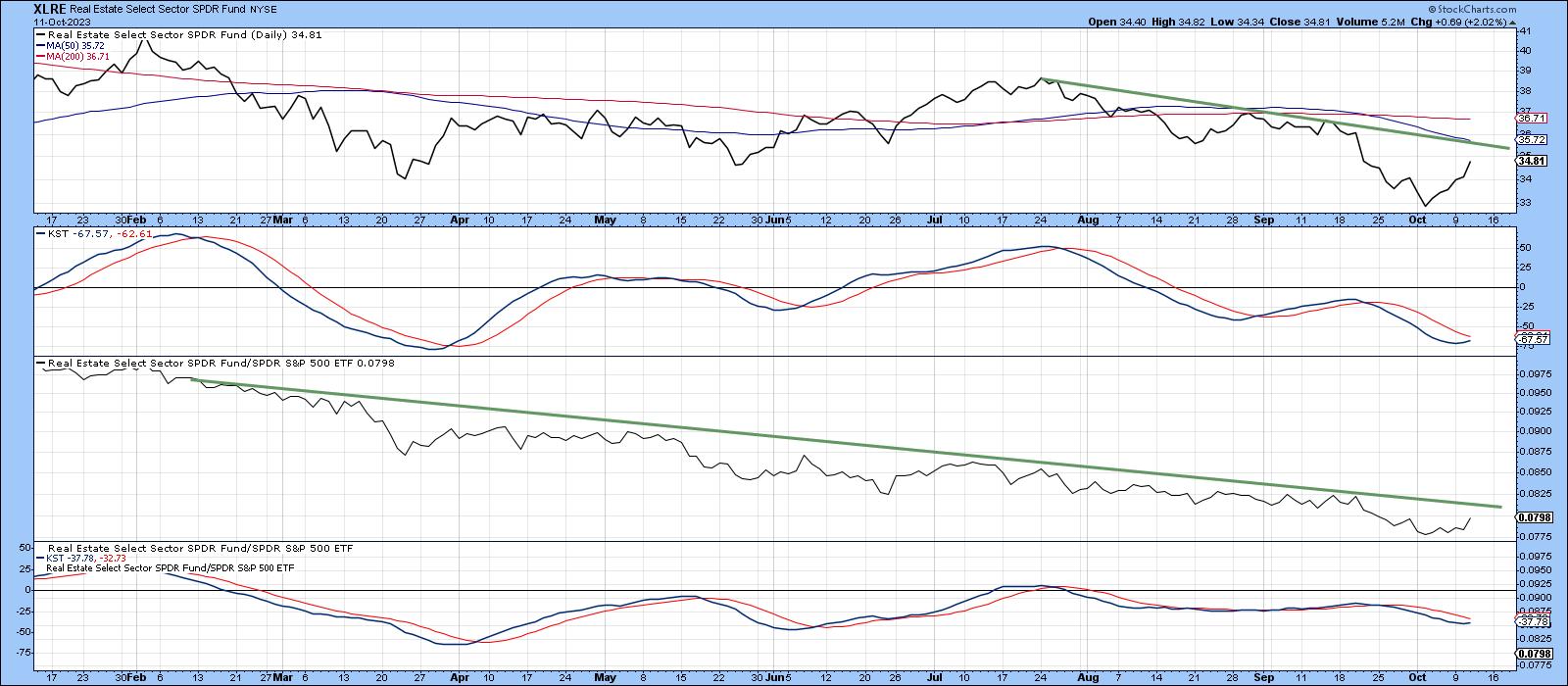

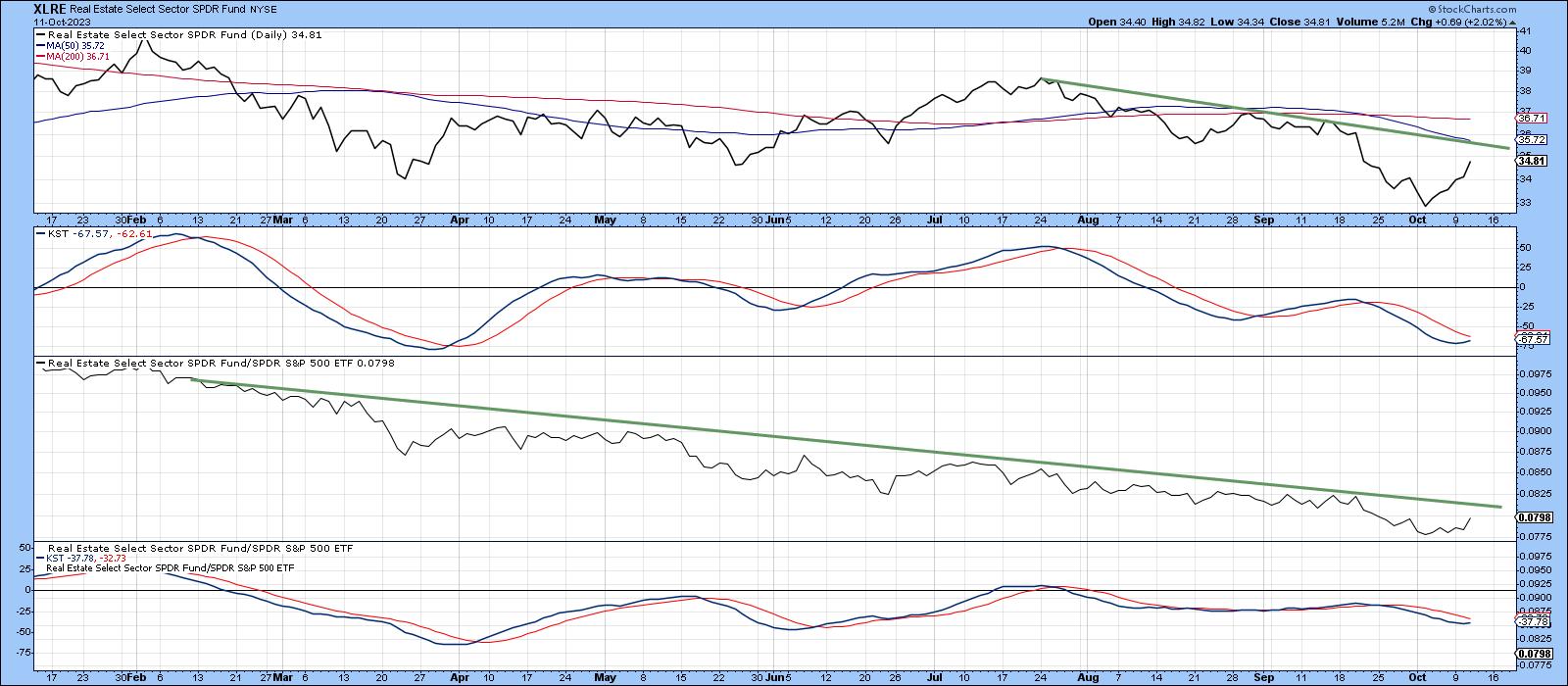

Sector Spotlight: Seasonality is Dropping Big Bomb on Real Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the seasonality patterns that are likely to affect stock market and sector performance in the coming month. November is one of the strongest months in the year based on seasonality, but the Real Estate Sector looks to be...

READ MORE

MEMBERS ONLY

DP Trading Room: Bad News for Buyers Weighing Hefty Mortgage Rates

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a look at a very bearish market BIAS Table. He examines how the latest mortgage rates are squeezing buyers and sellers alike by comparing today's mortgage payments versus payments at the lows;...

READ MORE

MEMBERS ONLY

Bonds Now Beating Stocks While NVDA Goes into Tailspin

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The Stock/Bond ratio is changing course

* SPY:IEF complets top formation

* NVDA completes large H&S formation unlocking 20% downside risk

SPY:IEF completes top formation

One of the metrics I keep a close eye on is the ratio between stocks and bonds. Most of the...

READ MORE

MEMBERS ONLY

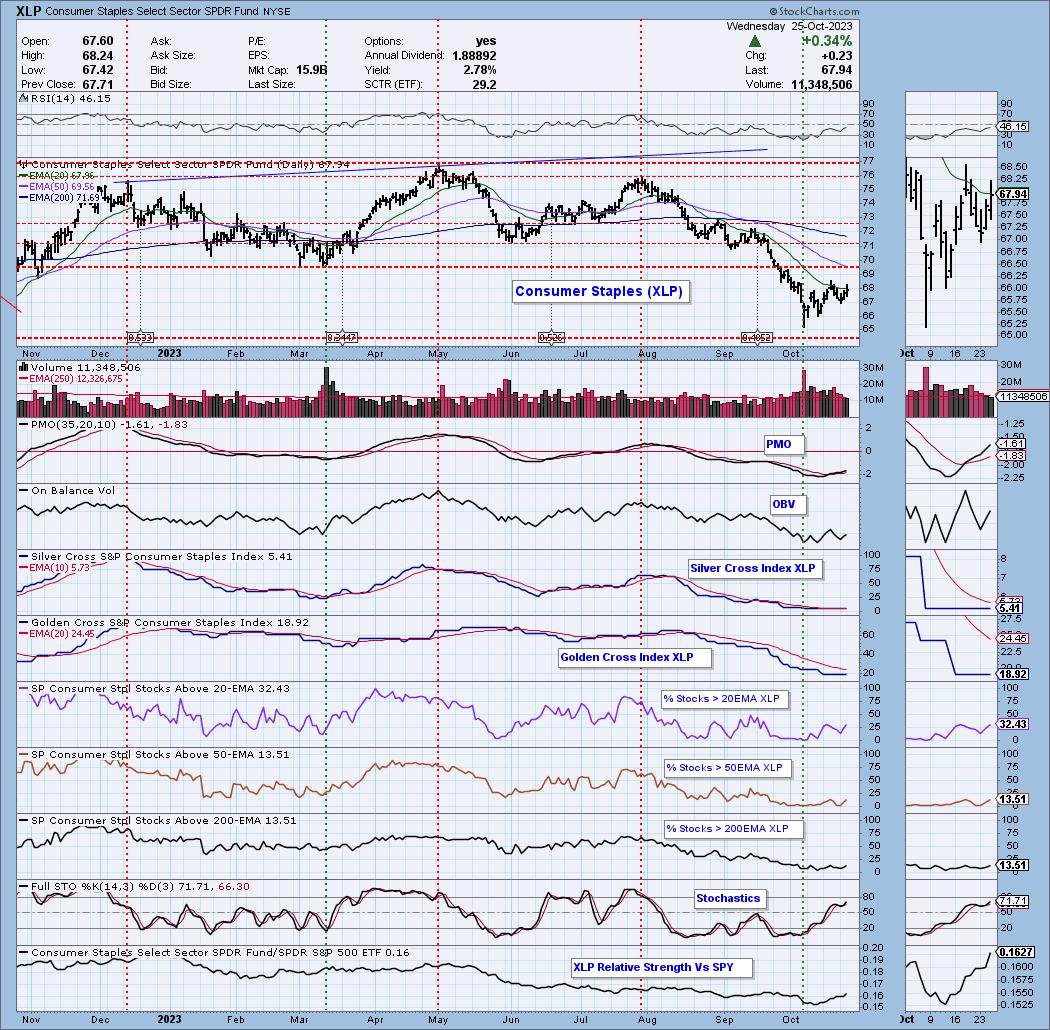

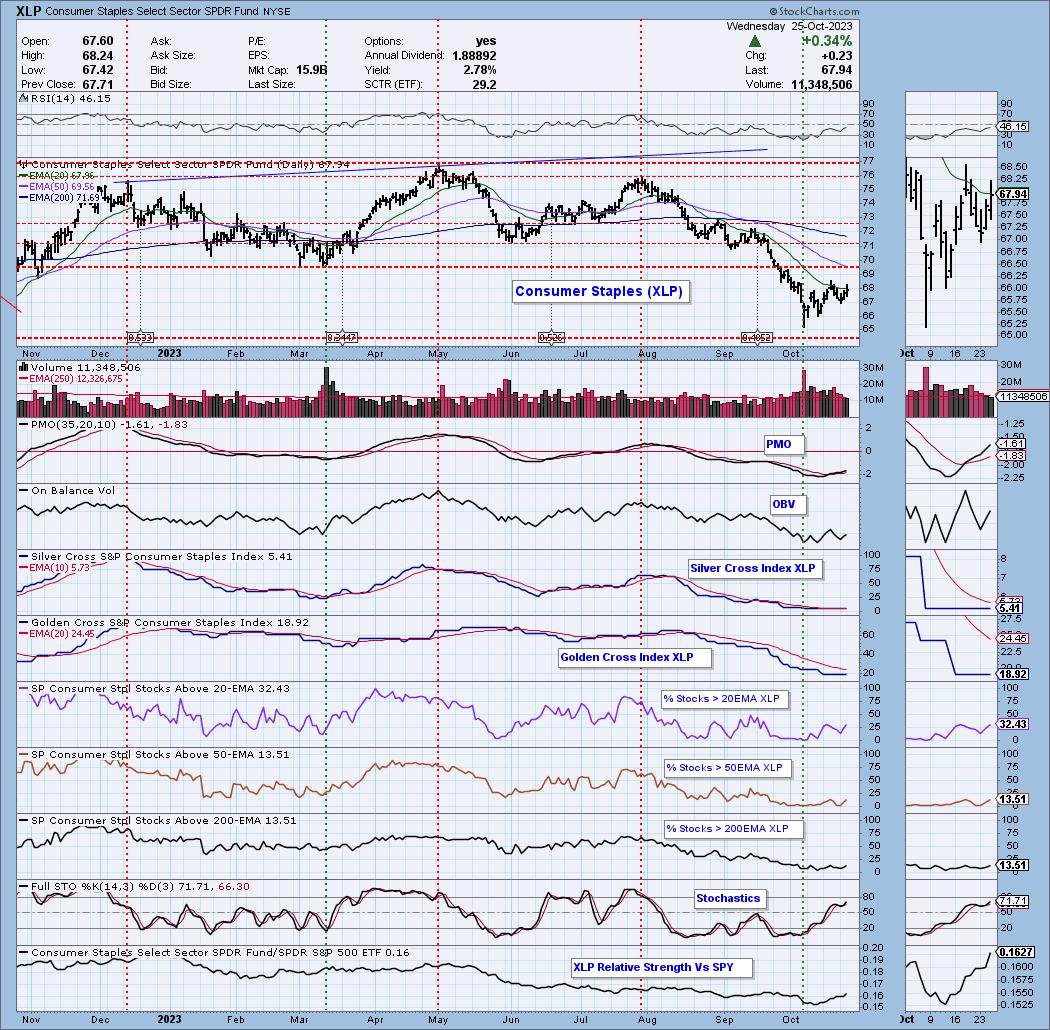

Two Defensive Sectors are Outperforming - What Does This Mean?

by Erin Swenlin,

Vice President, DecisionPoint.com

The only two sectors to close higher on Wednesday were in the defensive category, Consumer Staples (XLP) and Utilities (XLU).

We were already watching XLP as it established a short-term rising trend. What we aren't seeing is healthy participation...yet. We are seeing some expansion in stocks above...

READ MORE

MEMBERS ONLY

NASDAQ NOSEDIVES, Down Over 2% At The Close!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mary Ellen McGonagle of MEM Investment Research shares three stocks showing promise during a period of severe market distribution. Dave focuses in on the S&P 500 testing Fibonacci support and breaks down earnings for Microsoft, Alphabet, Spotify,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Have Limited Upsides In The Truncated Monthly Expiry Week; Watch These Key Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets wore a largely corrective undertone throughout the past five sessions; it oscillated within a similar range as the previous week and closed on a negative note. The volatility remained on the lower side; as the volatility has been low, the bands contracted as well. As compared to the...

READ MORE

MEMBERS ONLY

Complimentary Edition of the DecisionPoint "Weekly Wrap"

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* Golden Cross BUY Signal for Gold

* Death Cross SELL Signal for NYSE Composite

* Death Cross SELL Signal for Materials (XLB)

Gold (GLD) has been strong this month and today its 50-day EMA crossed up through its 200-day EMA (Golden Cross), generating an LT Trend Model BUY Signal. You...

READ MORE

MEMBERS ONLY

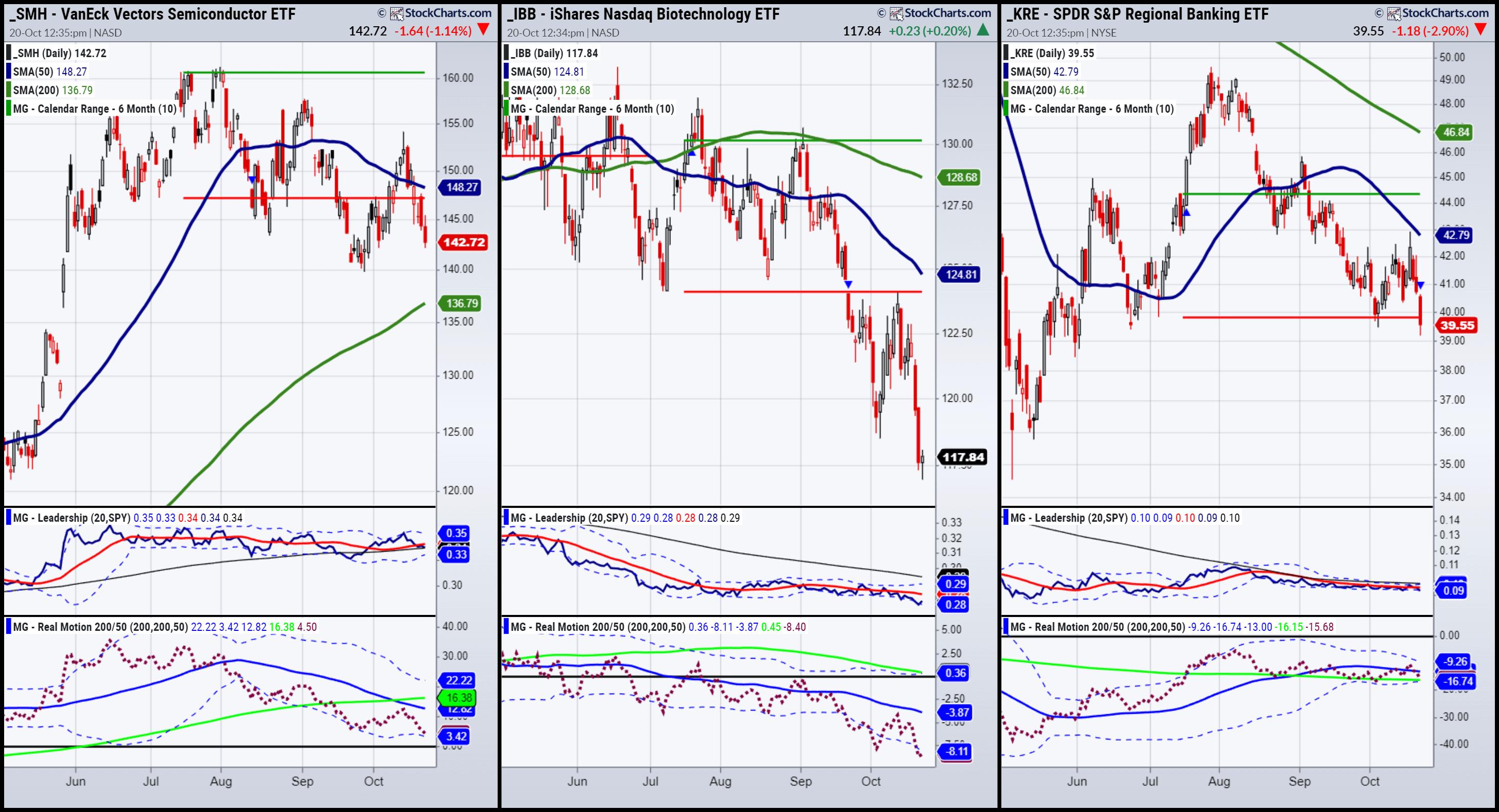

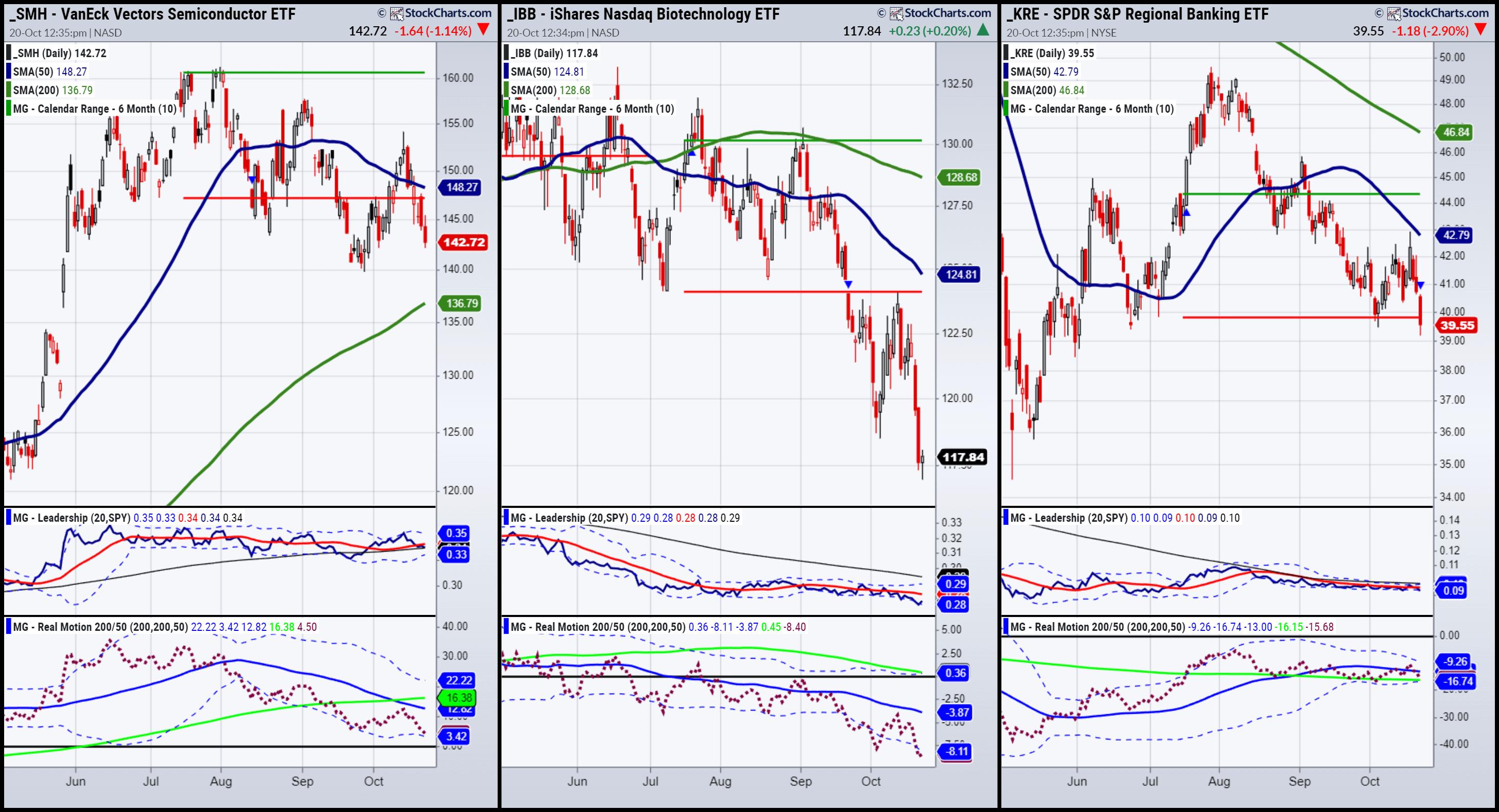

The Kids: Semiconductors, Biotechnology, Regional Banks

Most of you know our Big Viewproduct since I often discuss our risk gauges.

I can report to you that our risk gauges show three out of the five with risk off.

Most interestingly, the SPY continues to outperform the long bonds, risk-on.

And junk bonds continue to outperform long...

READ MORE

MEMBERS ONLY

RRG is Sending a Clear Message And Finds Two Stocks With Good Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG is sending a strong message to prefer Growth over Value

* Putting the growth stocks from IVW through a scan and some thorough RRG analyses finds a handful of interesting names

* Two unexpected stocks are showing up as having good upside potential

* Especially growth stocks from Defensive sectors...

READ MORE

MEMBERS ONLY

Market Has Stress Fractures but No Clear Breaks

Considering everything:

1. Yields and mortgage rates

2. War

3. Inflation and rising commodity prices

4. Bank stocks falling

5. Risk Gauges: 2 out of 6 now risk-off

To name a few, why, then is the S&P 500 so strong?

Here are a few reasons:

1. Fed members...

READ MORE

MEMBERS ONLY

An Award Announcement With a Dash of Market Commentary

KEY TAKEAWAYS

* Small cap and retail stocks are rising and need to hold support to clear overhead resistance.

* iShares Nasdaq Biotechnology ETF (IBB) should stay within the 120 to 125 range.

* Watch the range in regional banks, a potential uptrend in Bitcoin, and a bullish move in commodities.

With words...

READ MORE

MEMBERS ONLY

How Mega-Cap Names Dominate Through Market Cap

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares how growth over value is less about the types of companies and more about the market cap represented in the largest benchmark names. He breaks down today's pop-and-drop for Bitcoin and answers questions from the newly-added...

READ MORE

MEMBERS ONLY

DP Trading Room: Mortgage Rates Hit Multiyear High -- Who Goes Bankrupt First?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl discusses the war's effect on the market and looks closer at the effects of high mortgage rates, which have hit multiyear highs. These are pinching not only buyers, but sellers and homebuilders. Afterwards, he goes deeper...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sensitive Sectors Continue to Prop Up the S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, after two weeks of absence, Julius de Kempenaer is back with an in-depth look at the current state of asset class rotation and sector rotation. By slicing sectors into Offensive, Defensive, and Sensitive groups, he paints a picture with an...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Consolidates While Defending Key Levels; Vigilant Protection of Profits Advised

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was mentioned that the volatility gauge INDIAVIX had stayed at its lowest levels, and this setup was keeping the markets vulnerable to profit-taking bouts from the current levels.

Over the past five days, the markets showed some signs of profit-taking, but at the same...

READ MORE

MEMBERS ONLY

Stock Market Rally Fizzles – What to Do Now

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets started the week on a strong note with a rally, which was boosted by the release of dovish remarks from the Federal Reserve's last meeting. A stronger-than-expected CPI report sparked an increase in interest rates, however, which pushed the markets lower. The selling picked up on...

READ MORE

MEMBERS ONLY

MEM TV: Markets Stall As Week Progresses - Here's Why

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares where the market stands, after last week's price action had select areas far outpacing the markets while others were weak. She also reviews the start of earnings season following reports from several high profile companies....

READ MORE

MEMBERS ONLY

Growth Sectors Tumble as Defensive Plays Post a Strong Finish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the rapid decline in growth sectors including Technology and Communication Services as defensive plays like utilities and gold post a strong finish to the week. Dave answers questions from The Final Bar Mailbag on the McClellan Summation Index...

READ MORE

MEMBERS ONLY

Stocks Continue Feeling The Pressure From Higher Rates

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Chris Verrone of Strategas Research Partners discusses how small-caps may emerge from the quagmire, along with why it's important to focus on relative strength. Host David Keller, CMT points out the continued strength of offense over defense...

READ MORE

MEMBERS ONLY

REITS Getting Ready to Rally, But What Happens After That?

by Martin Pring,

President, Pring Research

Several short-term charts suggest the SPDR Real Estate ETF (XLRE) is getting ready to rock and roll, thereby indicating an extension to this week's rebound is in the cards. It's possible that the expected rally could result in shifting some of the longer-term indicators towards a...

READ MORE

MEMBERS ONLY

The Most Important Chart to Watch During Earnings Season

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Adam Turnquist, CMT of LPL Financial shares his chart of the Ten Year Treasury Yield and explains why the US Dollar may be the most important chart to watch as earnings season begins. Dave highlights stocks making new swing...

READ MORE

MEMBERS ONLY

DP Trading Room: Exponential vs. Simple -- This is the Moving Average We Use

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a discussion of the yield curve, followed by his coverage of the Magnificent 7+ and the market in general. Erin looks at the effect of war on the Energy sector, as well as a...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Vulnerable At Higher Levels; This Sectors Rolls Inside The Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Despite the volatile moves during the four sessions of this week's shortened frame, we ended on a very flat note for the second time in a row. The trading range remained slightly wider compared to the previous week. Compared to the 274.55-point range in the week before,...

READ MORE

MEMBERS ONLY

MEM TV: Here's What To Do With Base Breakouts and Other Bullish Signals

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish bias that's shaping up in the markets as high-growth areas begin to turn positive. She also provides insights into what's driving this price action, as well as what to be on...

READ MORE

MEMBERS ONLY

10 Crucial Charts Shaping The Markets in October 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special edition of StockCharts TV'sThe Final Bar, Dave breaks down the crucial charts shaping October 2023's financial landscape.

This video originally premiered on October 6, 2023. Watch on our dedicated Final Bar pageon StockCharts TV, or clickthis linkto watch on YouTube.

New episodes of...

READ MORE