MEMBERS ONLY

Everyone’s Bullish on 2026 - That’s the Problem!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The market ended 2025 on shaky footing despite a strong overall year, raising questions about what lies ahead. Tom Bowley explains why rising complacency, fading leadership, and a weak year-end pattern may matter more in 2026 than most investors realize....

READ MORE

MEMBERS ONLY

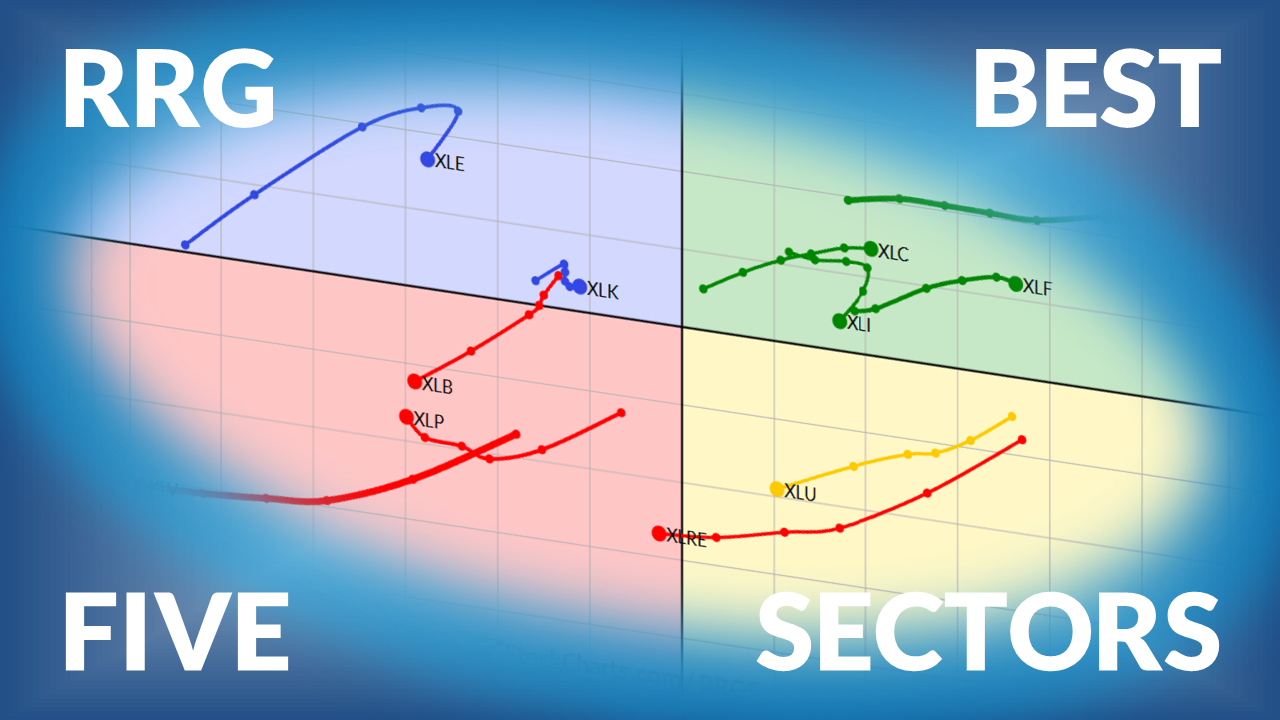

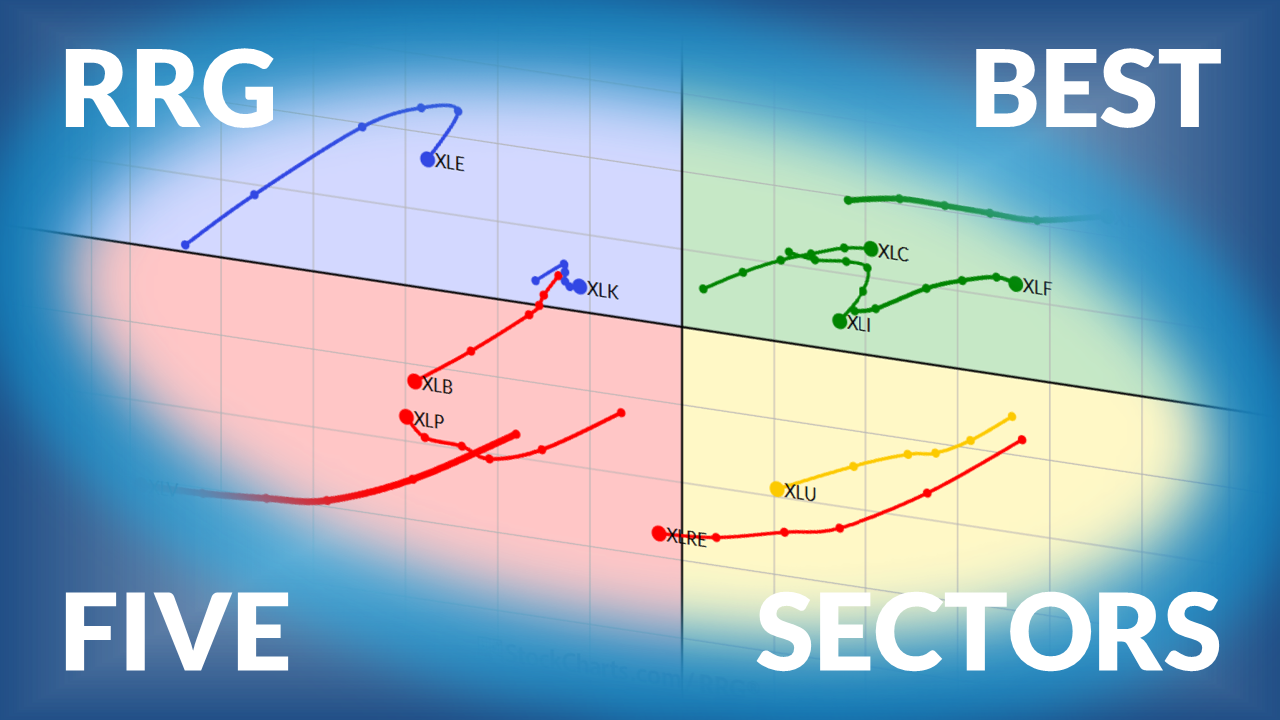

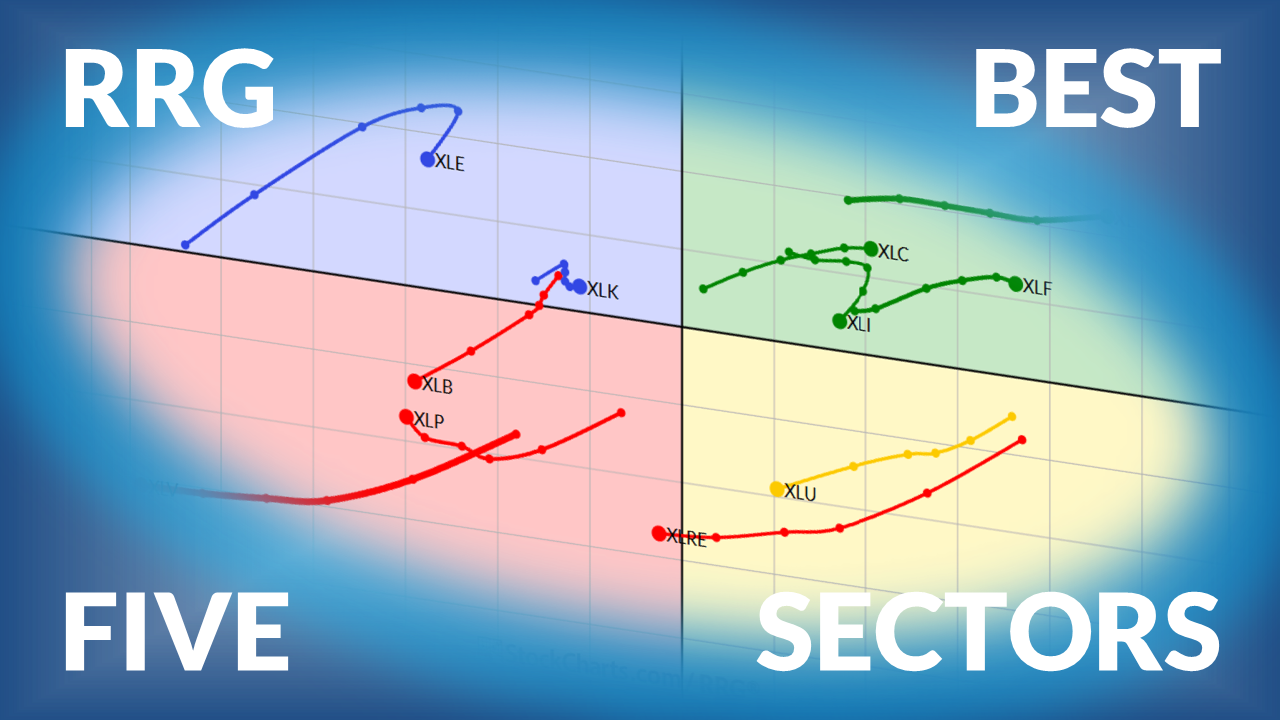

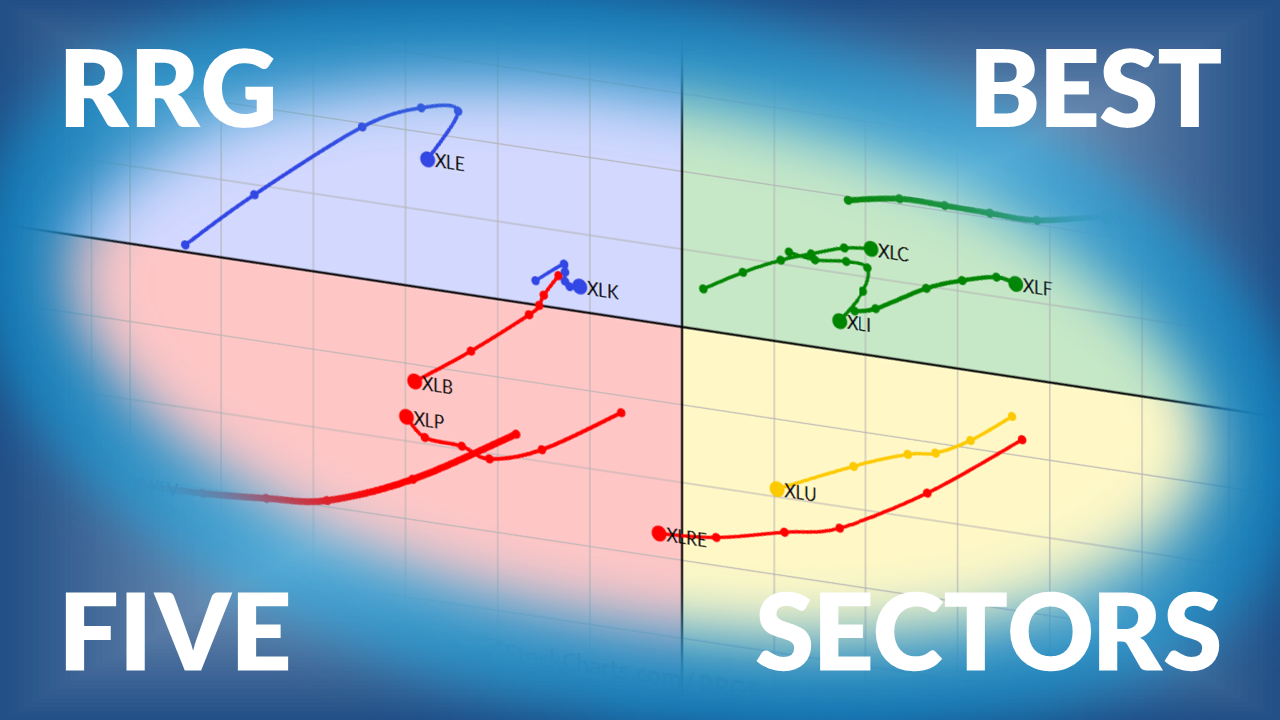

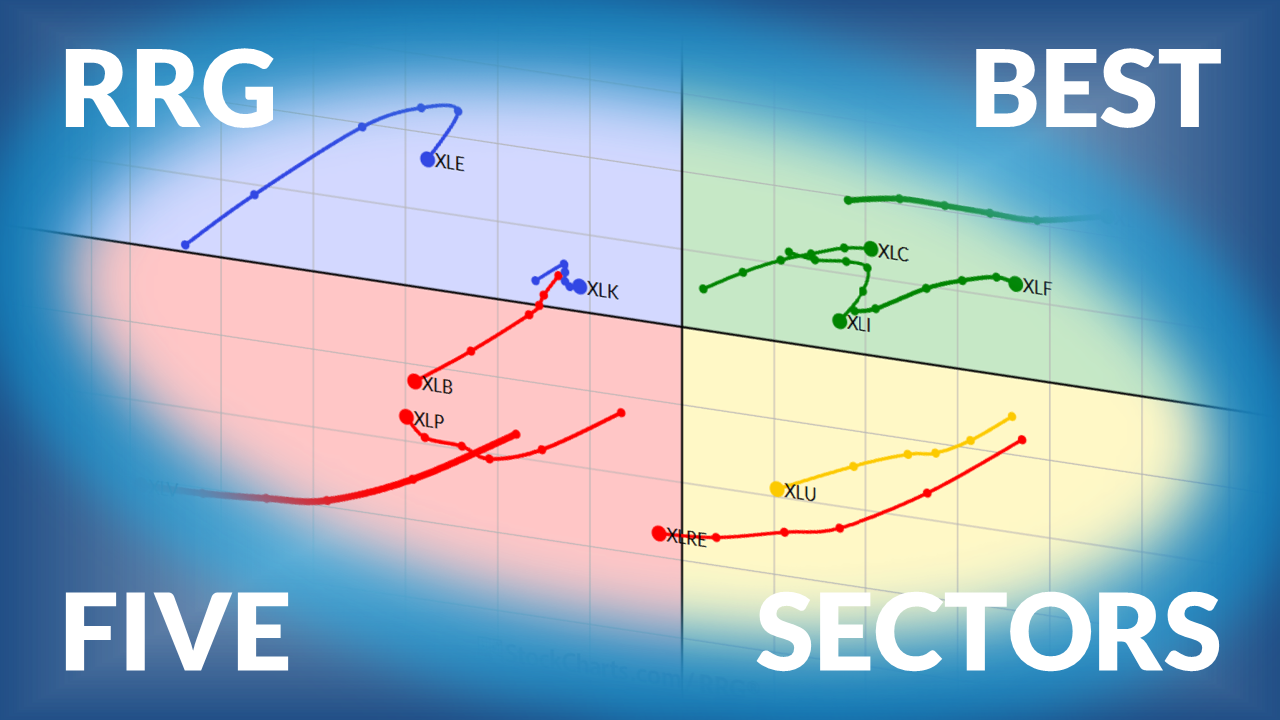

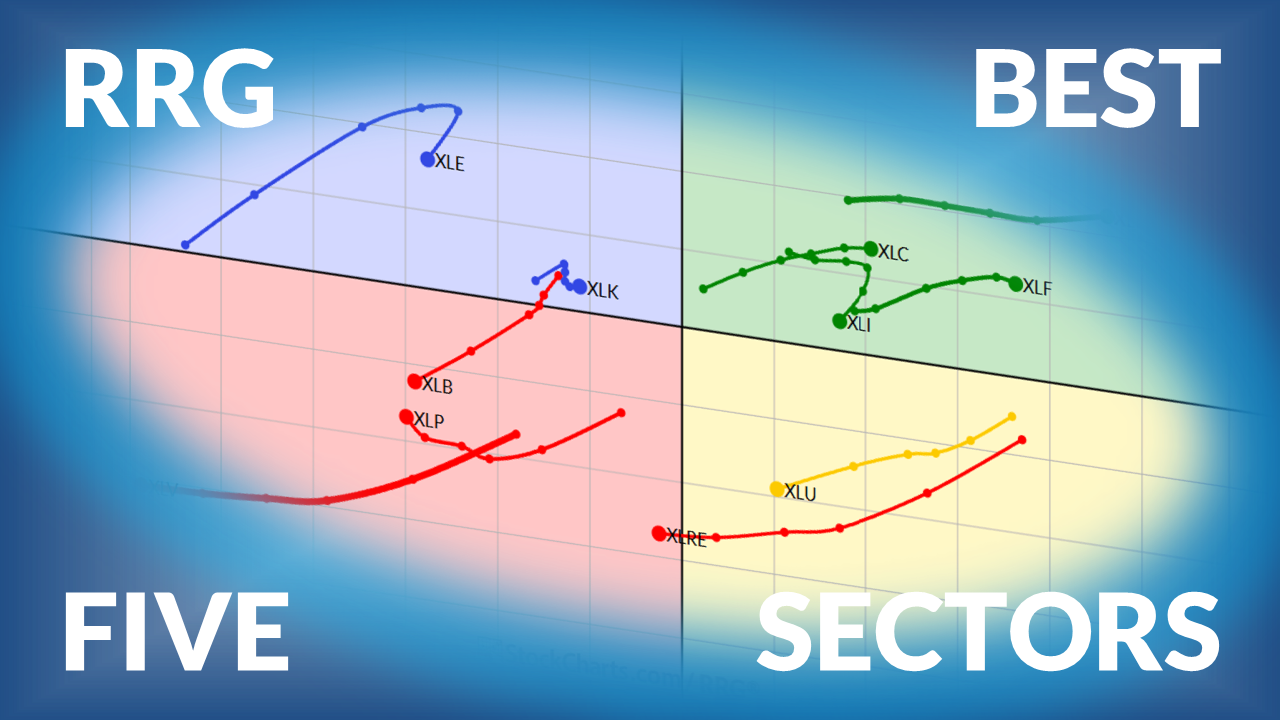

The Best Five Sectors This Week, #51

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector ranking based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Volatility Hits Rock Bottom, What It Means for the Week Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Though the NIFTY is trading just below lifetime highs, it appears to be in a zone of indecision. What's the best strategy in a setting where any adverse trigger could make the market vulnerable?...

READ MORE

MEMBERS ONLY

Stocks are Improving - So Why Am I Still Cautious?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stocks may be improving again, but the signals aren’t lining up cleanly just yet. Julius de Kempenaer explains what’s getting better, what’s still holding the market back, and why caution might be warranted here....

READ MORE

MEMBERS ONLY

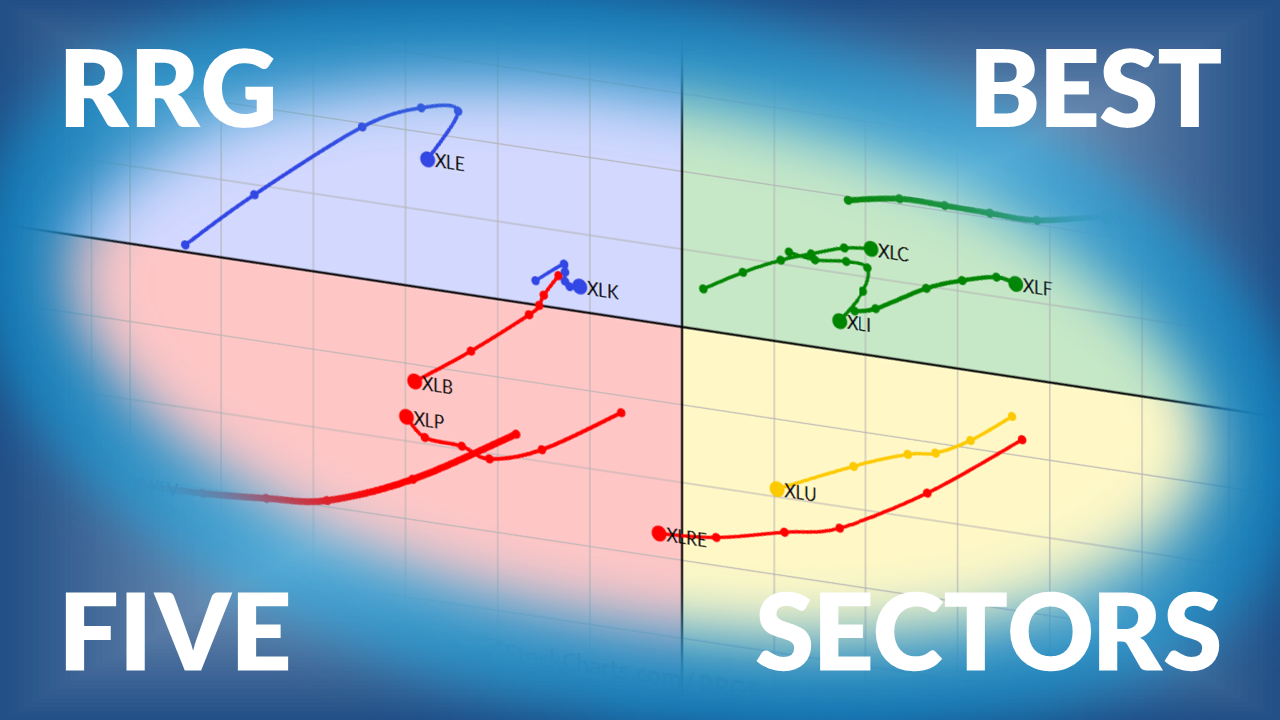

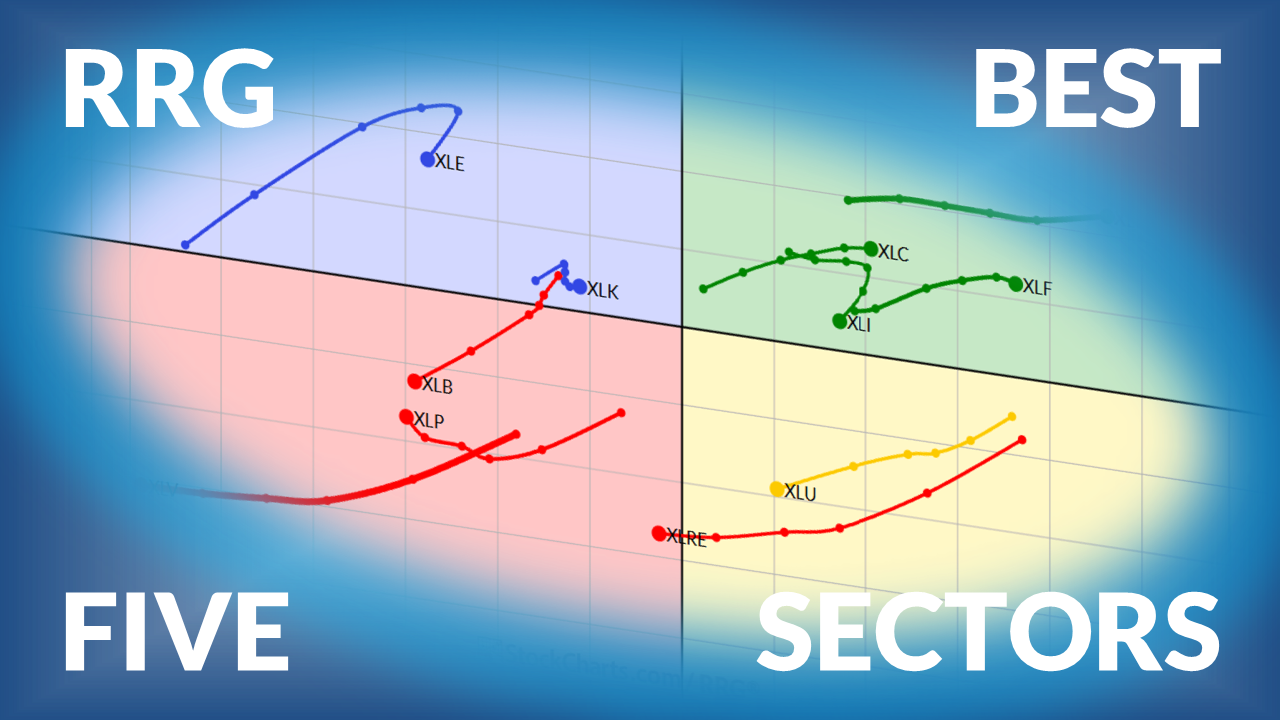

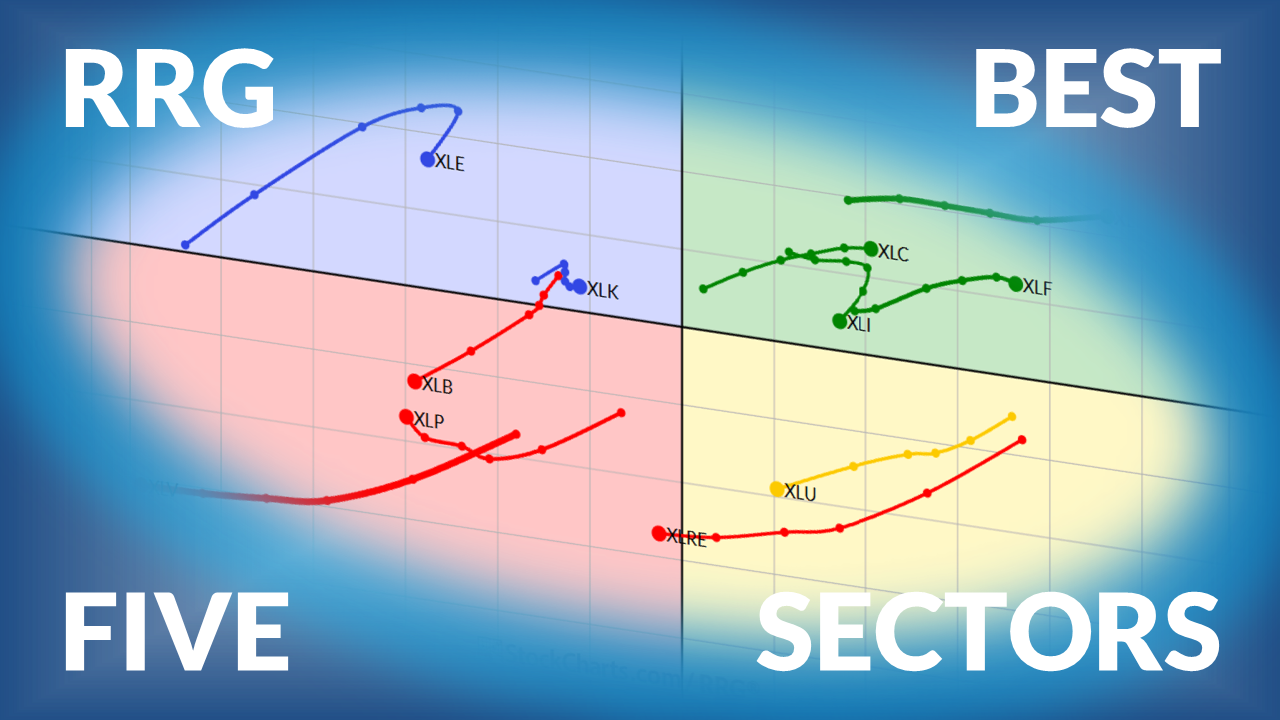

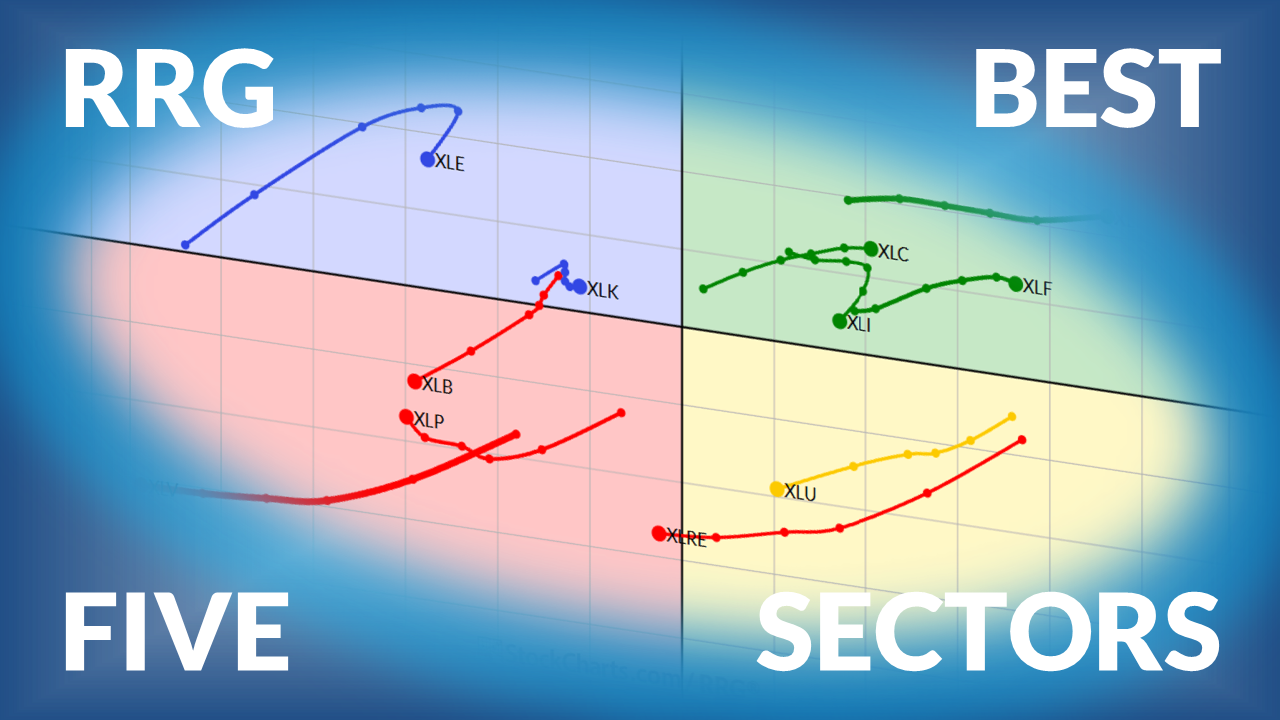

The Best Five Sectors This Week, #50

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly Sector Rotation Update for US Sectors based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

Consolidation Continues: Nifty Awaits Trigger for Directional Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With the Nifty now in a sideways consolidation, what will it take to reignite upward momentum? And what does the truncated week ahead look like for the Indian market?...

READ MORE

MEMBERS ONLY

J.P. Morgan's Top Picks for 2026: A Closer Look at the Charts

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle takes a close look at some seminconductor and networking names that J.P. Morgan has ranked as top picks for the new year. What are her thoughts?...

READ MORE

MEMBERS ONLY

Three Investing Lessons from a Challenging 2025 Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

After a challenging and highly rotational 2025, Dave Keller, CMT, shares three key investing lessons, from focusing on process over prediction to recognizing leadership shifts beneath the surface. Learn how investors can better prepare for market opportunities in 2026....

READ MORE

MEMBERS ONLY

Is a Santa Claus Rally Starting to Take Shape?

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen analyzes a notable shift in the markets, how to capitalize, and what it might mean for the fabled Santa Claus Rally....

READ MORE

MEMBERS ONLY

2025 Market Recap & 2026 Outlook: Trends, Psychology, and What Comes Next

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Grayson and Dave give their year-end thoughts about the wild market action of 2025, what worked (or not) for traders over the course of the year, and what lessons to take for 2026. ...

READ MORE

MEMBERS ONLY

Semiconductors Crumble; Big Warning Signs Flashing!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom looks at the last week's market action and what it means for bulls....

READ MORE

MEMBERS ONLY

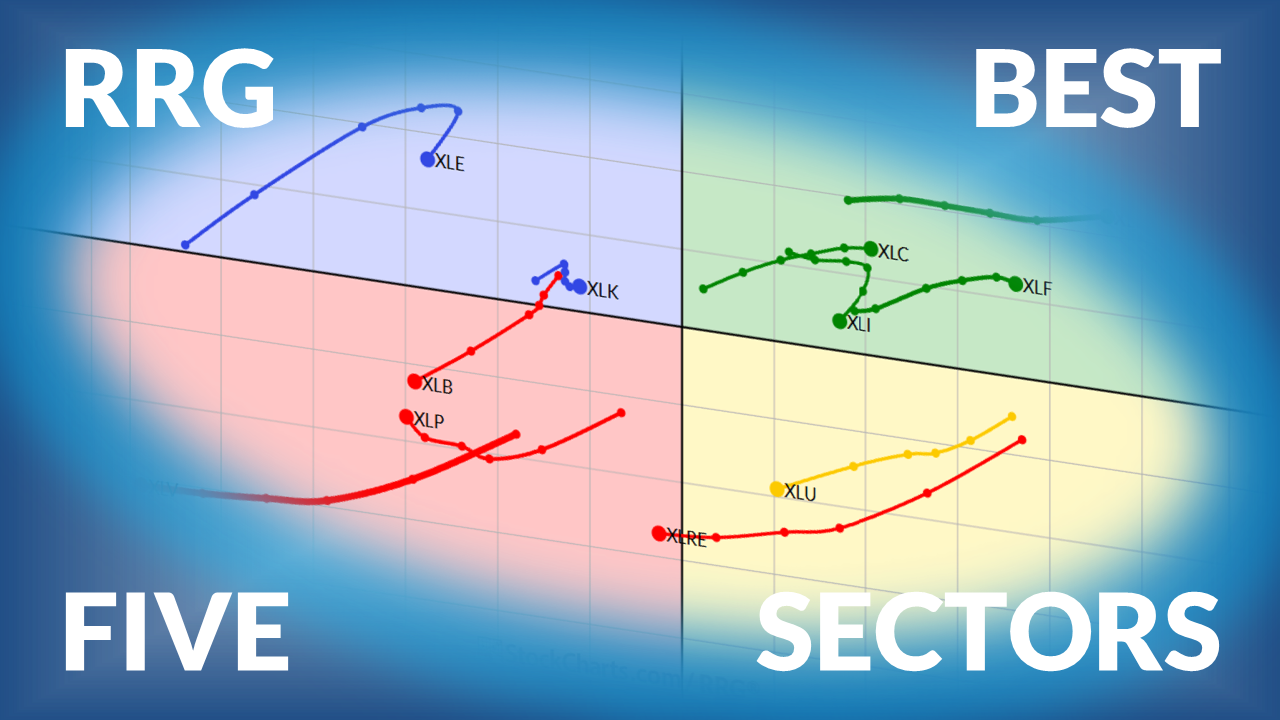

The Best Five Sectors This Week, #49

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on U.S. sector rotation using Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Critical Week Ahead: Can Nifty Push Past Resistance?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The broader structure of the Nifty remains bullish, but the index is navigating a key inflection zone. Will the next week extend the trend?...

READ MORE

MEMBERS ONLY

Is This Rally for Real? Here's What the Charts Are Saying

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down the current market rally and examines whether expanding participation and sector movement are confirming the move. Discover what market breadth, equal-weight indexes, and sector charts are revealing beneath the surface....

READ MORE

MEMBERS ONLY

Will Semiconductors Be A Problem in 2026?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Are semiconductors due for a correction? Tom Bowley analyzes the longer-term chart of the Dow Jones US Semiconductors Index. Find out what his analysis reveals....

READ MORE

MEMBERS ONLY

The Rotation No One Wants to Talk About — And Why It’s a Warning

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Money is rotating sharply out of large-cap growth and into areas like small caps, transports, and regional banks. Tom Bowley of EarningsBeats explains why that shift matters, breaking down the signals raising caution and the five stocks showing standout strength as the market resets....

READ MORE

MEMBERS ONLY

Momentum Shift Starting — These Sectors Are Waking Up

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil of Rabil Stock Research highlights a momentum shift taking shape across sectors, showing which ones are beginning to wake up as 2026 begins. He also reviews the S&P 500, market conditions, and individual stock setups showing improving structure and momentum....

READ MORE

MEMBERS ONLY

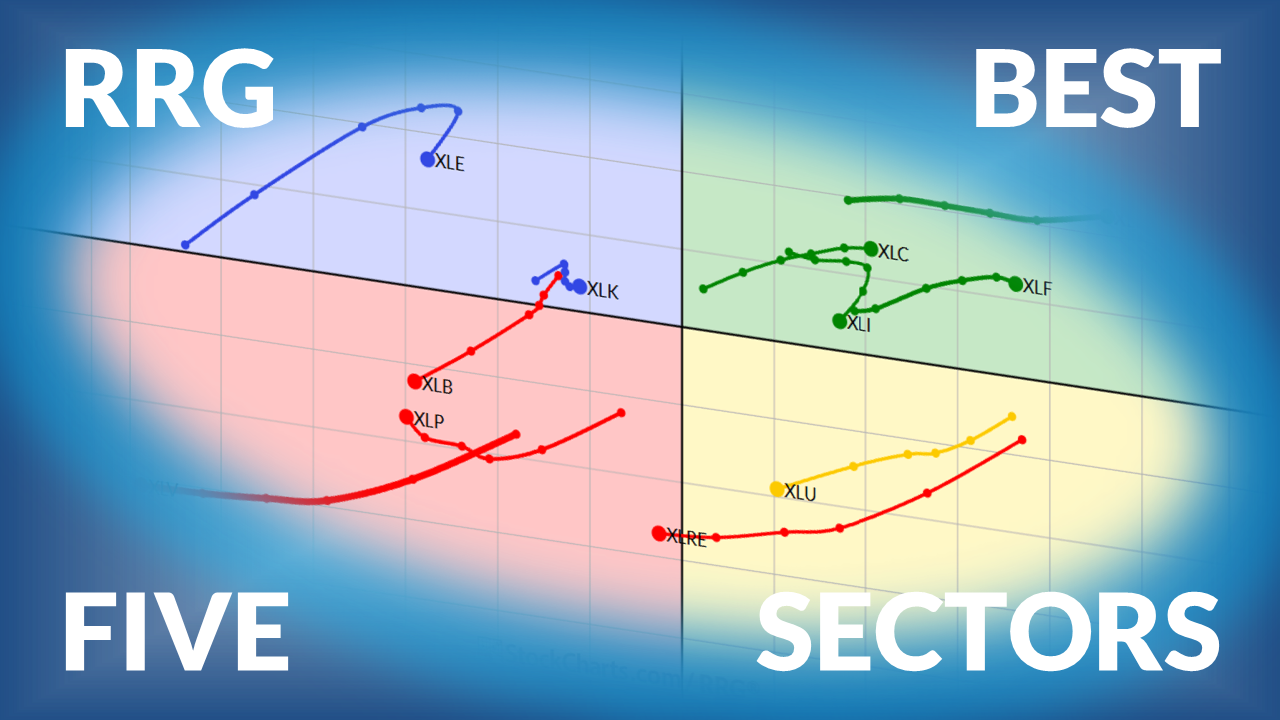

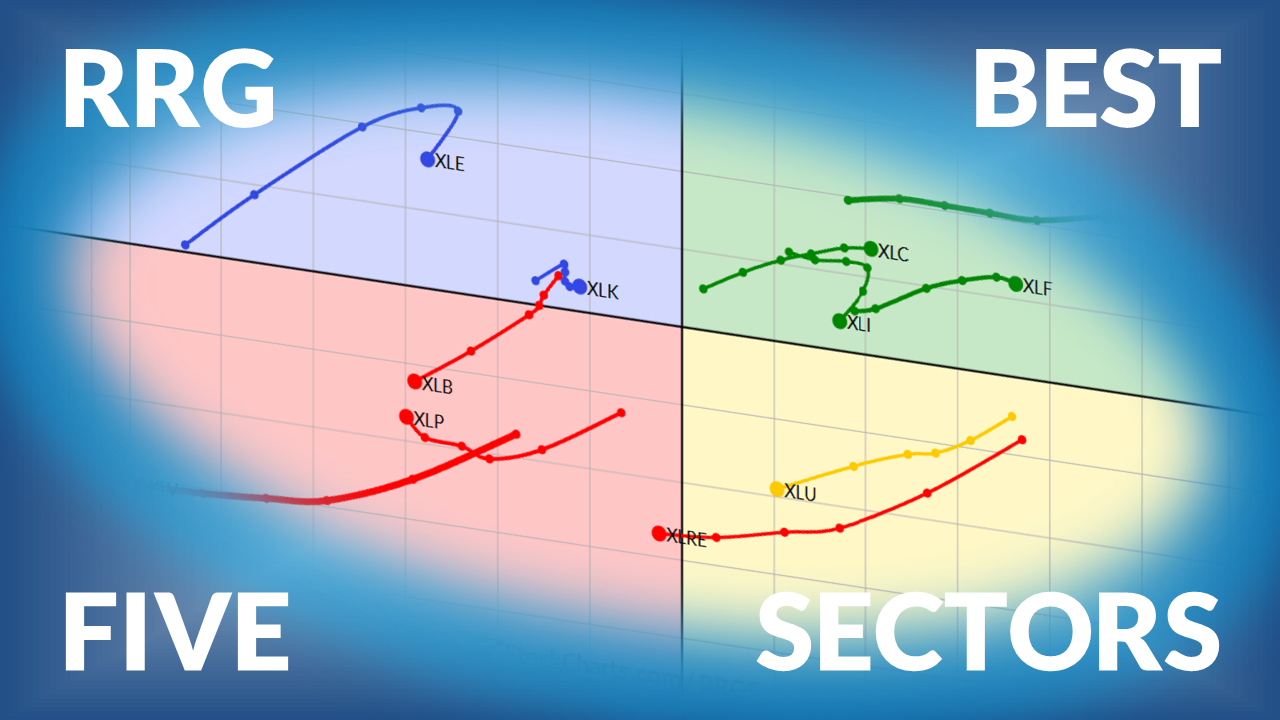

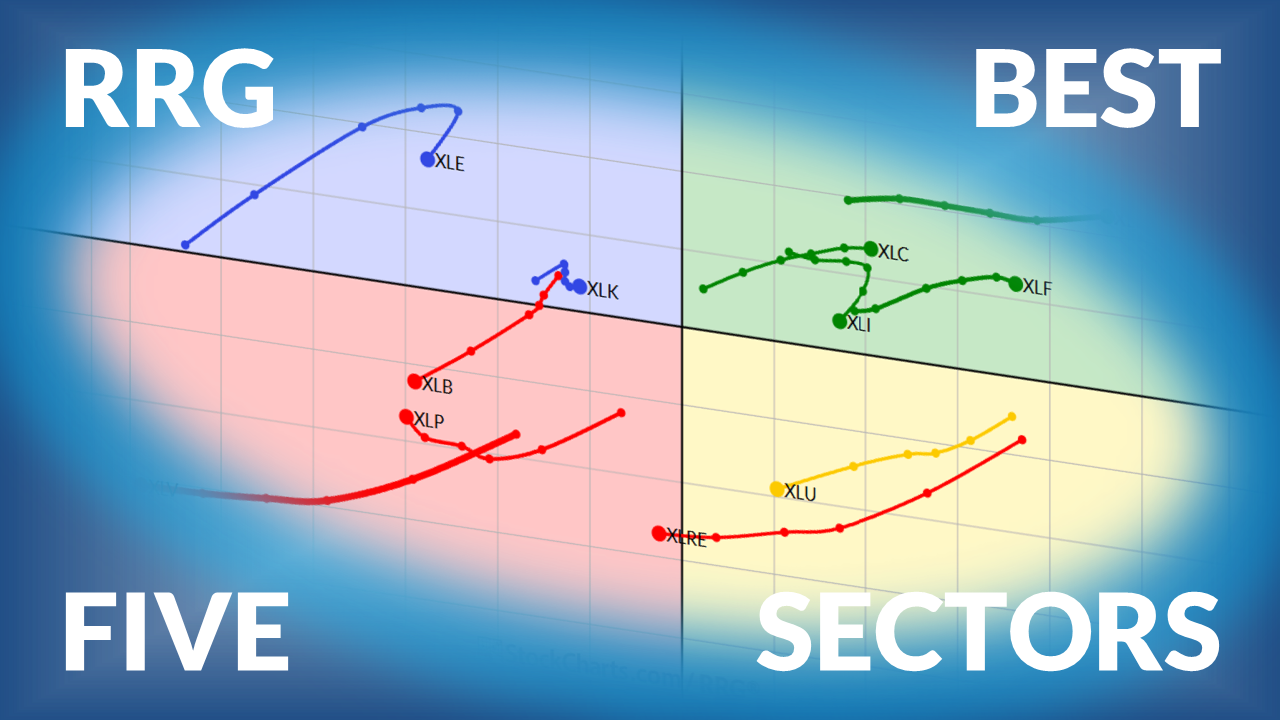

The Best Five Sectors This Week, #48

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on sector rotation ranking based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

Nifty Stays Cautious Near Highs Amid Soft Breadth

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty ended the week flat to mildly negative. The lack of participation from the broader market and weakening market breadth indicate that investors should be cautious. Here's a deep dive into the analytics....

READ MORE

MEMBERS ONLY

Broad Market Rally Continues — New Strength Across Key Sectors!

by Mary Ellen McGonagle,

President, MEM Investment Research

This week, Mary Ellen breaks down the continuation of the market's rally as optimism around a potential Fed rate cut lifts sentiment. She highlights the sectors showing fresh strength, i.e., financials, semiconductors, retail, software, and biotechs, and explains how improving market breadth and strong ETF momentum are...

READ MORE

MEMBERS ONLY

As Technology Loses Its Luster, What Stocks Should You Consider?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technology has lost its momentum. Until it shows more leadership, it makes sense to focus on other areas of the market for potential investment opportunities. ...

READ MORE

MEMBERS ONLY

The Silent Warning in Stocks — And the One Group Breaking Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The market might look steady at first glance, but there's a subtle warning sign developing underneath.

In this week's update, Julius de Kempenaer, the creator of RRG Charts, walks through the quiet deterioration happening across stock rotations and highlights the one group that's finally...

READ MORE

MEMBERS ONLY

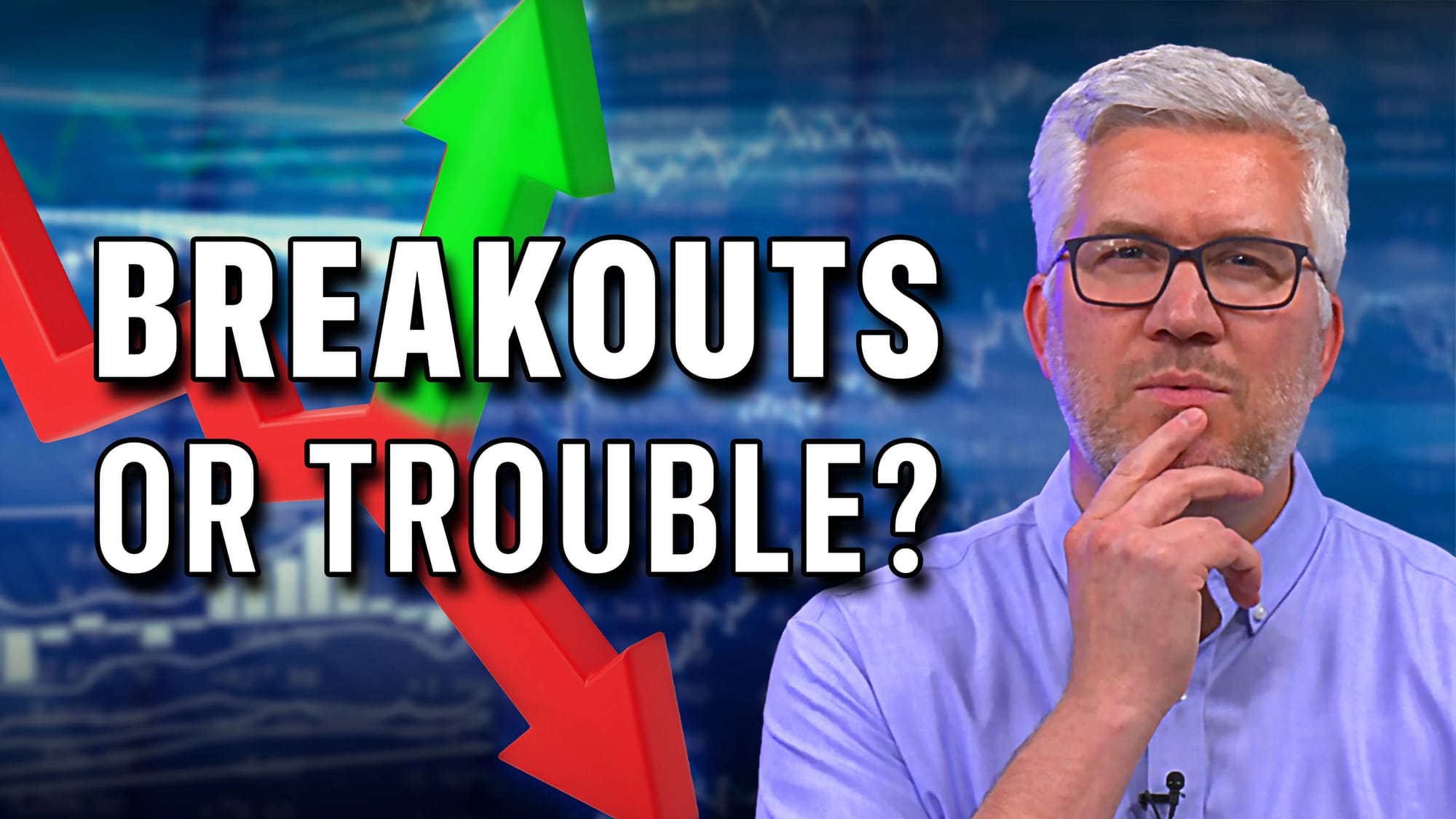

David Keller's December Playbook: 10 Charts You Should See

by David Keller,

President and Chief Strategist, Sierra Alpha Research

If you're looking for a quick pulse of the stock market heading into the last month of the year, David Keller, CMT, just dropped a video breaking down the 10 charts he's watching, and there's a lot to unpack.

Some stocks are powering higher...

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #47

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Your weekly update on US sector rotation based on relative rotation graphs....

READ MORE

MEMBERS ONLY

Nifty Breaks Out, Breadth Lags: Cautious Optimism Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty is in an uptrend and continues to scale new heights, but the market remains somewhat narrow. Are we approaching a zone of resistance?...

READ MORE

MEMBERS ONLY

Market Strength Broadens — What’s Powering This Rally?

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s market pullback and the key chart signals emerging after the break below support. She highlights the areas still showing strength and where potential opportunities may be forming beneath the surface....

READ MORE

MEMBERS ONLY

Stocks Bounce Back: Is This the Start of Something Bigger?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Market breadth is turning bullish while sentiment lags. Get a clear breakdown of what's driving this week's market action....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #46

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly Update on Sector Ranking for US stocks based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

Nifty Near Highs as Sector Leadership Rotates on RRG

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty is at a crucial inflection zone, trading just below its all-time high; could it see a breakout?...

READ MORE

MEMBERS ONLY

Breakdown or Opportunity? What the Charts Reveal Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s market pullback and the key chart signals emerging after the break below support. She highlights the areas still showing strength and where potential opportunities may be forming beneath the surface....

READ MORE

MEMBERS ONLY

History Is Repeating: Why Today’s AI Pullback Looks Familiar

by Mary Ellen McGonagle,

President, MEM Investment Research

Are we seeing a repeat of the late 2023 stock market pullback? Compare today's price action to that of 2023 and identify the similarities....

READ MORE

MEMBERS ONLY

Discretionary Lags; Speculative Names Thrown Out; Trend Signals within MAG7 & Utilities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Healthcare, consumer staples, and gold stocks continue to hold steady while speculative tech names are flashing bearish signals. Get a closer look at the different sectors and one stock that looks like it's ready to trend higher....

READ MORE

MEMBERS ONLY

Market Leadership Is Shifting — Are You Positioned for It?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With a massive shift in market leadership underway, Julius de Kempenaer looks at sector rotation to see where leadership is moving now—and what that could mean for portfolio positioning ahead....

READ MORE

MEMBERS ONLY

3 Major Breakdown Signals - Is a Market Top Forming?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

David Keller, CMT uses the modern Dow Theory, sector rotation, and Bitcoin’s decline to illustrate what might be a developing market top. With StockCharts’ tools, Dave tracks weakening momentum, defensive shifts, and the S&P 500’s crucial 6550 support level....

READ MORE

MEMBERS ONLY

Consumer Watch: A Costco Breakdown Could Be the Market’s Biggest Warning Yet

Consumer Discretionary and Consumer Staples are lagging the most in sector performance. Costco's chart could send an early warning signal in consumer sentiment....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #45

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Your weekly update on the ranking of U.S. sectors based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Charting the Week Ahead: Where Is Nifty Headed Next?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty's current technical setup reflects a strong market, steadily grinding higher. What does the coming week have in store?...

READ MORE

MEMBERS ONLY

Fed Jitters Shake the Market – Where are Investors Finding Shelter?

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down how hawkish Fed comments and rising yields rattled the markets this week. See where investors are finding opportunity — and which sectors are offering shelter as volatility returns....

READ MORE

MEMBERS ONLY

Market Rotation: What’s Really Happening Beneath the Surface

by Mary Ellen McGonagle,

President, MEM Investment Research

While the stock market indexes are looking range-bound, there's a shift in what's driving the market's performance. Find out what's going on beneath the surface....

READ MORE