MEMBERS ONLY

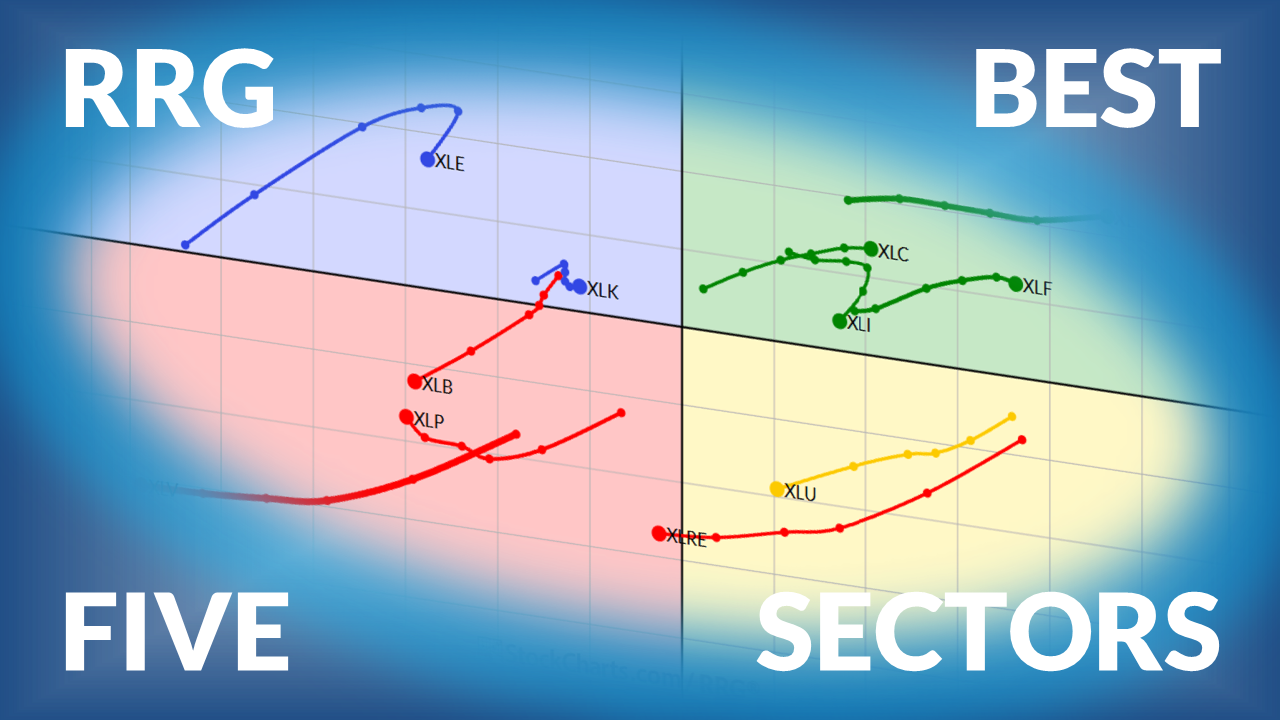

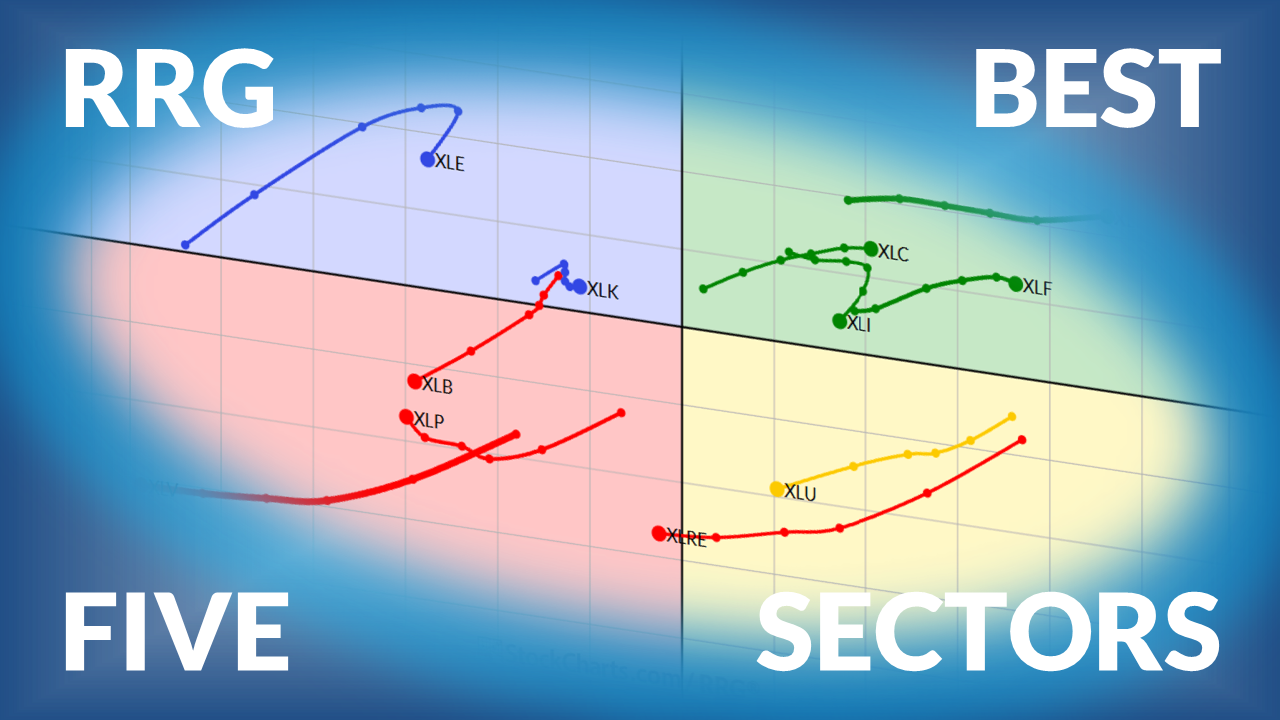

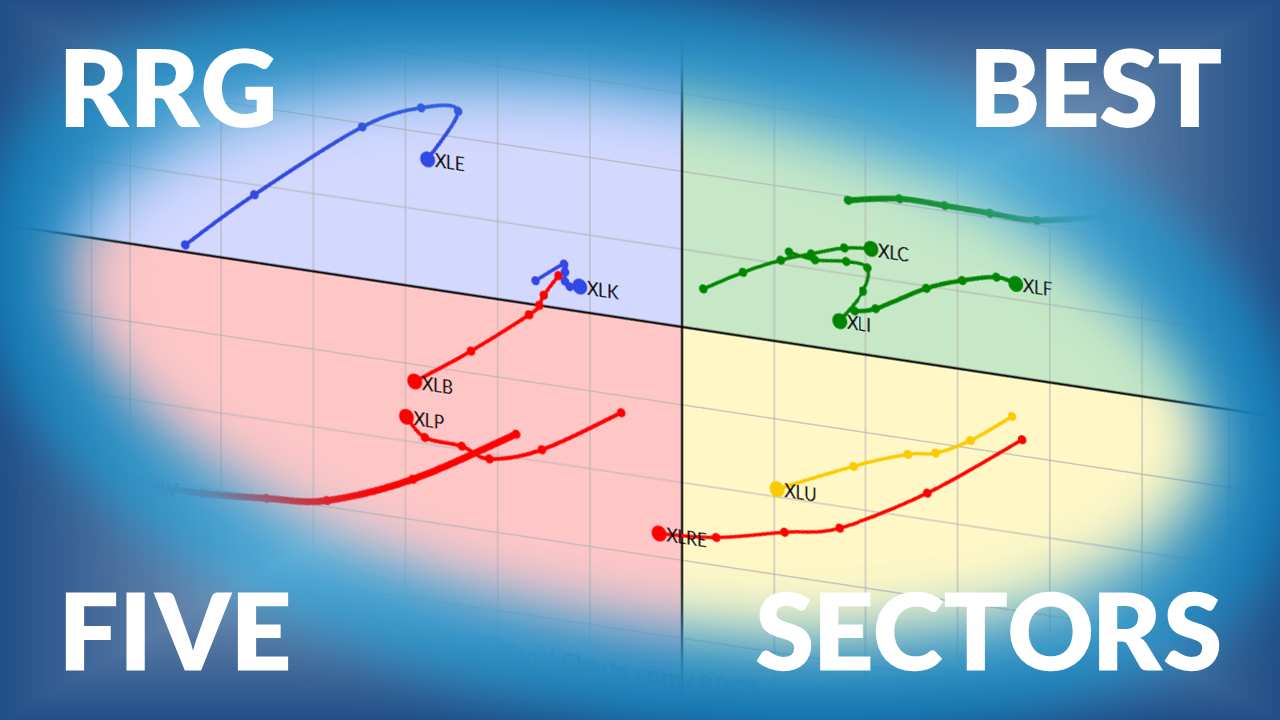

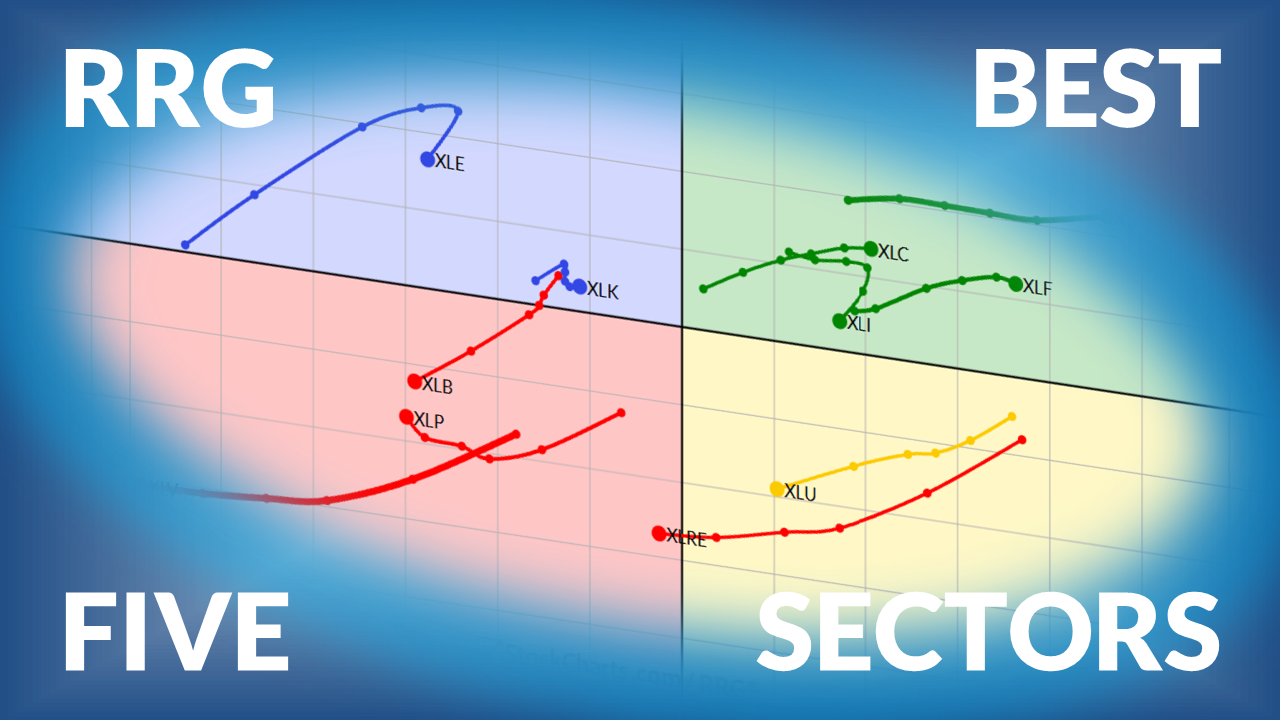

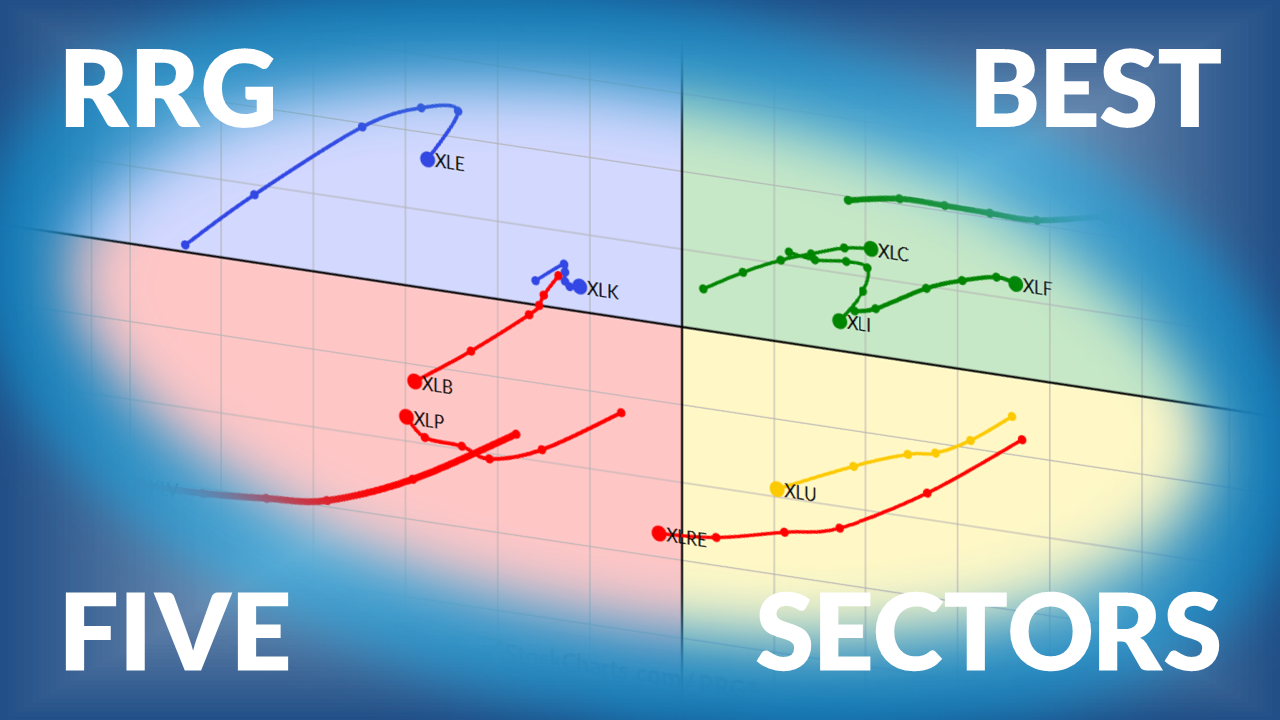

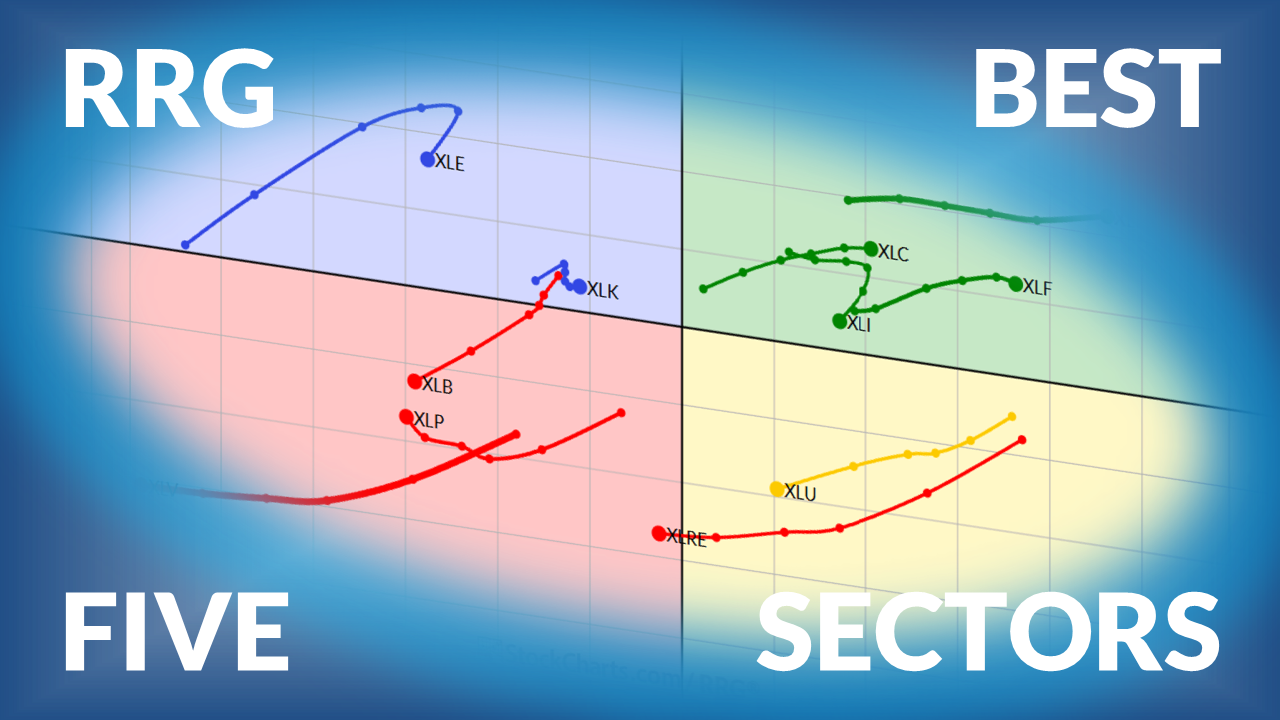

The Best Five Sectors This Week, #38

Julius presents his weekly update on US sector ranking based on Relative Rotation Graphs.... READ MORE

Julius presents his weekly update on US sector ranking based on Relative Rotation Graphs.... READ MORE

The NIFTY is facing consistent resistance, failing to break out of a trading range; where does it go from here? Meanwhile, sectors are facing a lack of leadership.... READ MORE

Mary Ellen breaks down where strength is emerging beneath the surface of the markets, highlighting leadership in energy stocks, utilities, and industrials. She then shares setups in coal, natural gas, and electricity names, along with constructive moves in DOW components like INTC, IBM, AAPL, and CAT. In addition, she takes... READ MORE

Joe highlights key setups in the energy sector, reviewing stocks such as XOM, CVX, VLO, and SU while explaining patterns like reverse divergence, zero line reversals, and low ADX conditions. He then analyzes the S&P market conditions, covering sentiment, volatility, trend, and momentum across multiple time frames, noting... READ MORE

Tom recaps the week, then turns his attention to the Mag 7 stocks after short-term sentiment warnings appeared in the market. He reviews key charts showing bearish engulfing patterns, resistance tests, and potential pullbacks in AAPL, MSFT, NVDA, META, GOOGL, TSLA, and AMZN, noting that six of the seven may... READ MORE

Weekly update on US sector rotation ranking based on Relative Rotation Graphs... READ MORE

The price action in the Nifty reflects a potential breakout buildup. But will it be able to break out of the resistance? Here's what you need to look for in the charts.... READ MORE

Dow Theory has flashed a bearish non-confirmation signal. Dave breaks down the implications of this ominous pattern and analyzes some of the key transportation stocks that have caused this macro divergence.... READ MORE

In this week’s show, Mary Ellen highlights the stocks and groups showing the most promise following the Fed’s rate cut. She spotlights leadership in technology, software, and semiconductors, while also pointing out opportunities in small-cap AI names, robotics, crypto, and biotechs. Mary Ellen shares how industrials, uranium, and... READ MORE

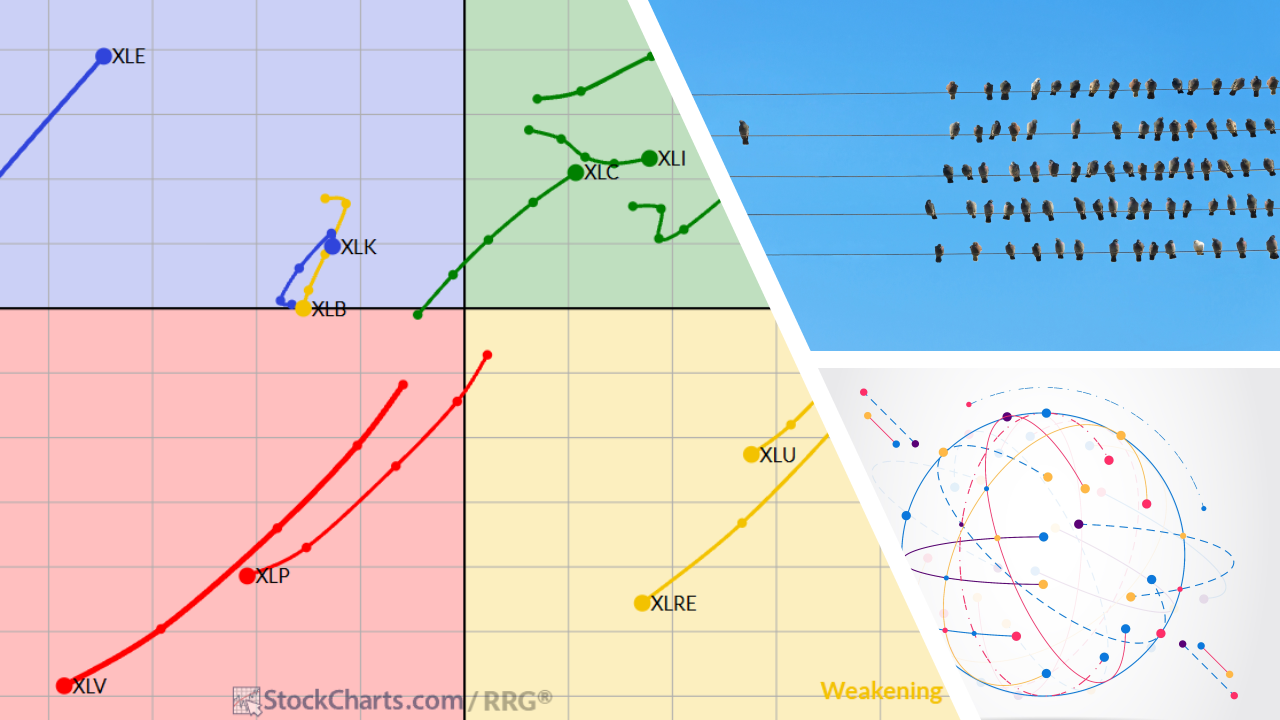

Julius takes a look at the current sector rotation, in combination with growth-value and size rotation. Combining these Relative Rotation Graphs shows strength concentrating in large-cap growth and the Tech, Discretionary, and Communication Services sectors. From this vantage point, we can see continued strength for the S&P 500... READ MORE

The Fed delivered a rate cut and markets wobbled. Discover how stocks, bonds, and the dollar reacted and what investors should watch next. ... READ MORE

While technology stocks have stalled out over the last six weeks, other growth sectors have stepped into a leadership role. Here are the charts Dave uses regularly to track leadership themes, and identify when new sectors are improving in relative strength terms.... READ MORE

Late September is historically tough for stocks. Mike explores why the S&P 500, Materials (XLB), and low-volatility put options could define the weeks ahead.... READ MORE

Martin explains how analyzing inter-asset relationships can give important insights into the market -- and what those relationships are telling us right now.... READ MORE

The Fed is set to cut rates again as Treasury yields slide and stocks rally. But why are real estate stocks still lagging? And could a breakout above a key resistance level shape the 2026 cycle?... READ MORE

Julius presents his weekly update on sector rotation using Relative Rotation Graphs.... READ MORE

Growth and Value segments are widely used in the investment world, as investors shift from one to another based on market conditions and risk-appetite. Julius shows how to use Relative Rotation Graphs to help monitor these shifts.... READ MORE

In this week’s video, Mary Ellen breaks down what drove AI-related stocks higher, while also revealing non-tech names that are poised to benefit. She highlights specific Crypto ETFs that are in a bullish positions, plus discusses the move into Gold and other metals. This video originally premiered on September... READ MORE

Join Tom as he recaps the stock market action of the past week! Tom breaks down the current technical outlook on the major indices, before highlighting key sector rotation using RRG charts. He then dives into large AI stocks like ORCL, NVDA, MSFT, META, PLTR, and others, followed by a... READ MORE

TLT broke out, but is still underperforming SPY; meanwhile, IWM has begun outperforming SPY. Arthur explains how to find the ideal "hunting grounds" for sectors.... READ MORE

With Industrials now in consolidation mode, Mike highlights underperforming single-stock culprits and explains why the groundwork is in place for a late-year rally.... READ MORE

Julius de Kempenaer presents his weekly update on the top five sectors on the leaderboard, and the movement under the surface.... READ MORE

This week, Mary Ellen digs into some of the impactful news that drove price action and what to be on the lookout for going forward. She also highlights the Technology sector’s move back into an uptrend and discusses the best ways to participate. In addition, Mary Ellen gives her... READ MORE

Tom recaps the week as September trading begins with weakness across major indices. He reviews market performance, sector trends, and key stock action. From there, he turns his attention to the history of bear markets, pointing out when they historically start, and explains why current conditions, including strong accumulation trends... READ MORE

Explore this week's sector rotation insights. See which sectors gained strength, which lost momentum, and what the RRG signals mean for investors.... READ MORE

With mortgage rates trending lower, homebuilder ETFs have been rising. Here's what traders and investors should watch next. ... READ MORE

In this week’s show, Mary Ellen dives beneath the surface of the market as AI and semiconductor stocks lose momentum. New areas are beginning to take the lead, and Mary Ellen highlights strength in energy, gold, and select international markets, while pointing out where former leadership is breaking down.... READ MORE

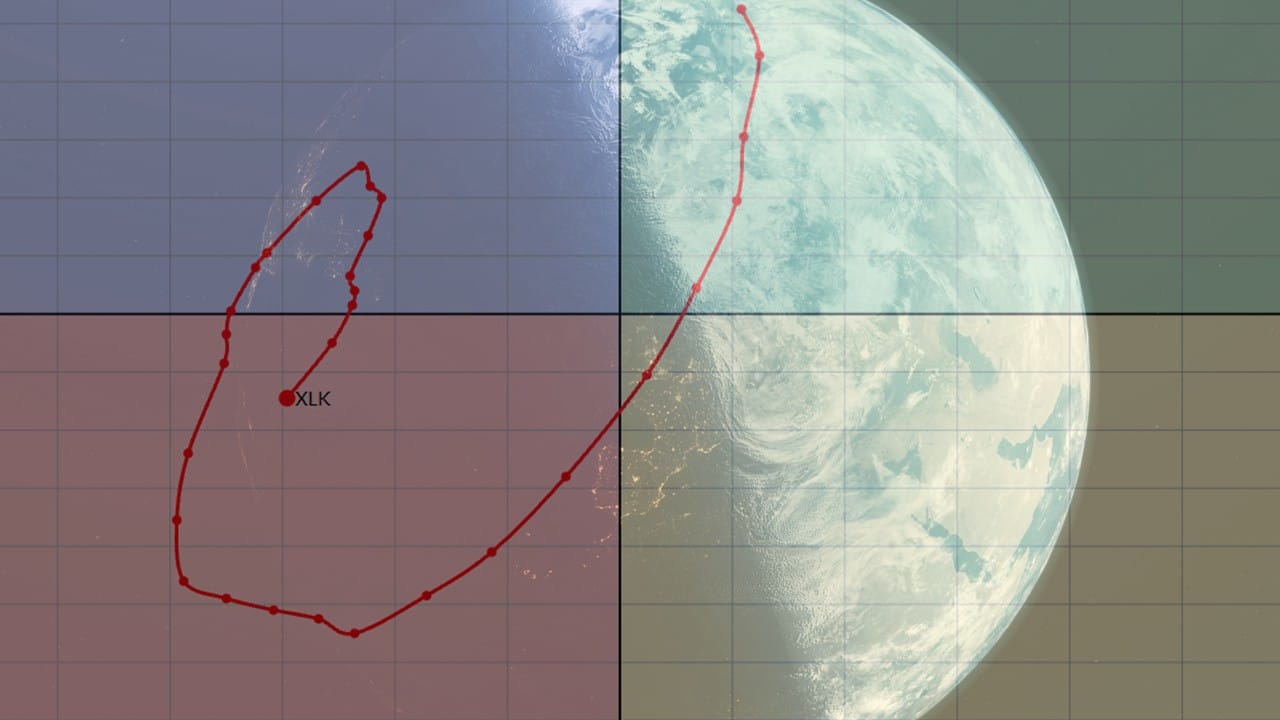

What does it mean when a rotation on a Relative Rotation Graph fully completes on the right-hand side or the left-hand side of the graph... READ MORE

The Nifty is at a critical support level. A break below this level could mean a deeper correction.... READ MORE

Julius breaks down the latest asset class and sector rotations in order to show where real market strength is building. Stocks continue to outperform bonds, but the spotlight is on sectors: technology remains strong, financials and industrials are gaining, and consumer discretionary is accelerating with broad participation. Meanwhile, defensive groups... READ MORE

Join Tom Bowley, EarningsBeats.com, as he recaps a week where major indices posted gains, the Dow Jones confirmed a bullish breakout above 45,000, and small-caps surged on Powell’s rate cut comments. Tom highlights the relative strength of the Russell 2000, leadership from regional banks, and strong moves... READ MORE

Consumer Discretionary ETFs are outperforming Staples across large-cap, small-cap, and global markets. See why XLY, RSPD, PSCD, and RXI signal a bullish risk-on trend in 2025.... READ MORE

Weekly update on US sector rotation using Relative Rotation Graphs... READ MORE

The Nifty is trading within a narrow band and testing the 25,100–25,150 resistance zone. Investors should look for a break above this resistance zone before considering long positions.... READ MORE

Mary Ellen reviews the market’s latest moves following Fed Chair Powell’s Jackson Hole comments, inflation concerns, and key earnings reports. Discover which areas are gaining strength as interest rate expectations shift, with energy, banks, homebuilders, and regional names all showing leadership. In addition, Mary Ellen highlights constructive setups... READ MORE

Join Tom as he recaps the last week’s stock market action in this new video. Tom reviews the performance of the major indices, points out the relative strength in the Dow Jones last week, and comments on the high-growth NASDAQ 100 taking a well-deserved breather. From there, he breaks... READ MORE

In this market update, Frank takes a close look at the S&P 500, key indices, ETFs, crypto, and a recent trade idea. Frank compares the 2025 market to 2020 patterns, reviewing corrections and highlighting bullish and bearish setups. He focuses on weekly Bollinger Bands, GoNoGo charts, sector performance... READ MORE

What to watch ahead of Powell: S&P 500 RSI divergence, NVDA under 20-day MA, key levels at 6212/6025/5852; can Financials and Industrials lead?... READ MORE

When it comes to understanding what’s really going on beneath the surface of the market, two key concepts come to mind: breadth and rotation. Breadth helps us gauge the participation behind a trend, while rotation reveals where the strength is moving within the universe we’re analyzing. Combine both,... READ MORE

On this week’s show, Mary Ellen McGonagle analyzes a notable shift in market leadership as former top sectors slow and new areas step up. She covers the latest sector performance — from healthcare and biotech to home builders, retail, and small caps — and shows you how to navigate the changing... READ MORE