MEMBERS ONLY

Surprise Sector Surge as Market Leaders Stall!

by Mary Ellen McGonagle,

President, MEM Investment Research

On this week’s show, Mary Ellen McGonagle analyzes a notable shift in market leadership as former top sectors slow and new areas step up. She covers the latest sector performance — from healthcare and biotech to home builders, retail, and small caps — and shows you how to navigate the changing...

READ MORE

MEMBERS ONLY

Rate Cut Rally: Stocks & Sectors Poised to Surge!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom as he reviews the explosive gains in small-cap stocks following the July CPI report. He also looks at the breakout in the Russell 2000, along with strength across key sectors like transports, biotechs, regional banks, and home construction. From there, he covers major index performance, key technical breakout...

READ MORE

MEMBERS ONLY

Consumer Discretionary Breakouts — 3 Stocks to Watch Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Discover which sectors are leading — and which to avoid — with Julius' latest RRG analysis. Follow along as he breaks down weekly and daily sector rotations, revealing technology’s dominance, potential in consumer discretionary, and why some defensive sectors are showing unexpected strength. Julius then dives deeper into the consumer...

READ MORE

MEMBERS ONLY

This Week’s Stock Market Winners — And What’s Driving Them

by Mary Ellen McGonagle,

President, MEM Investment Research

Join Mary Ellen as she breaks down the latest market trends! The highlight of the show is a deep dive into the consumer discretionary sector, where Mary Ellen analyzes leading industry groups like homebuilders, apparel, and specialty retail, and explains why this sector continues to show relative strength. She shares...

READ MORE

MEMBERS ONLY

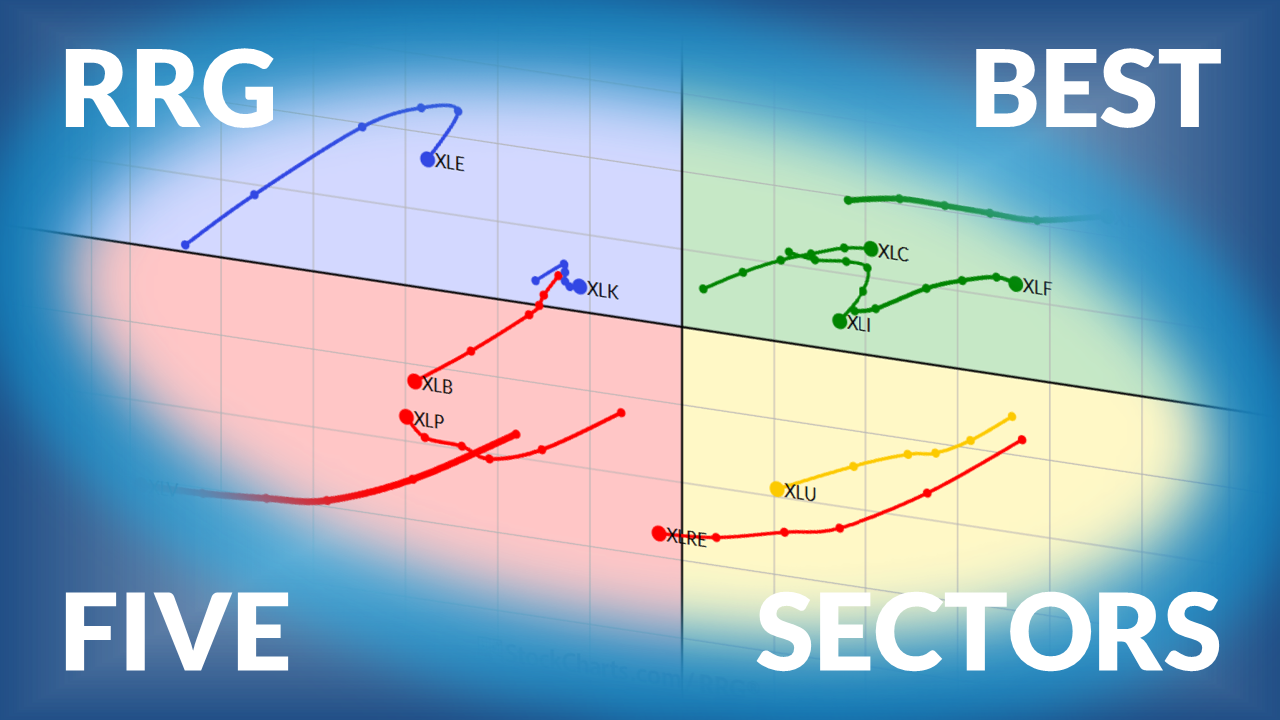

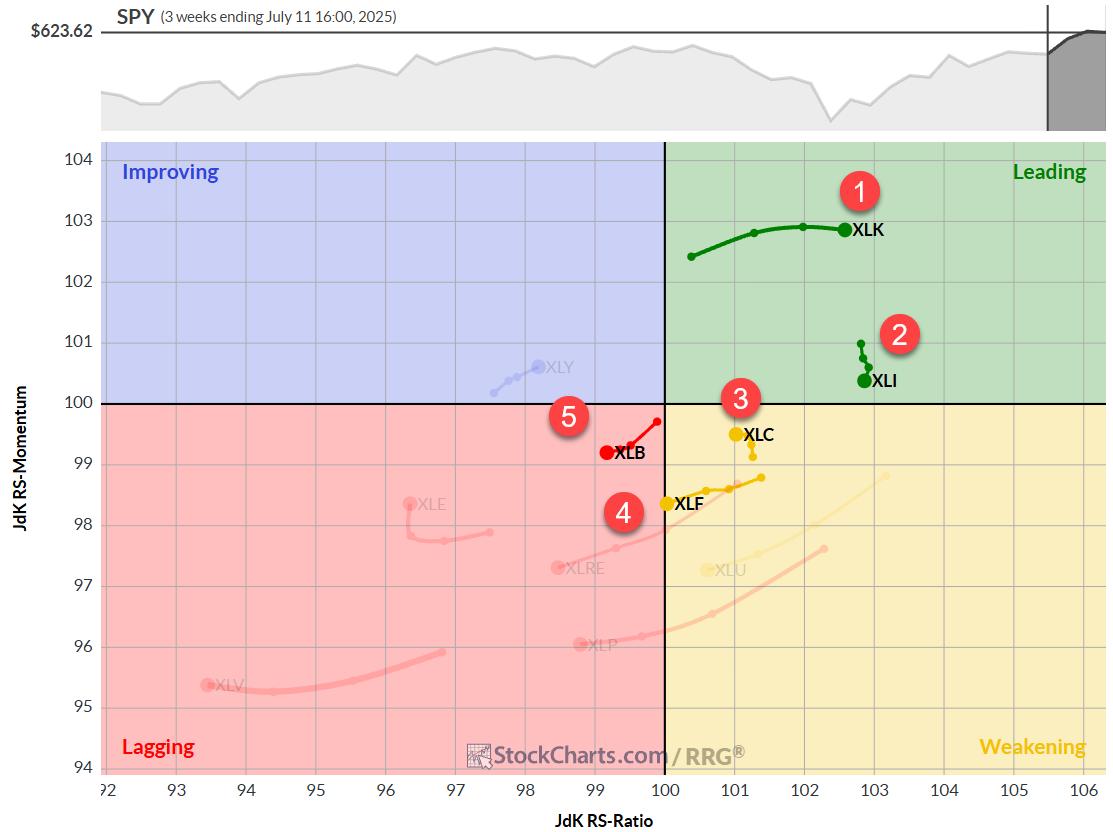

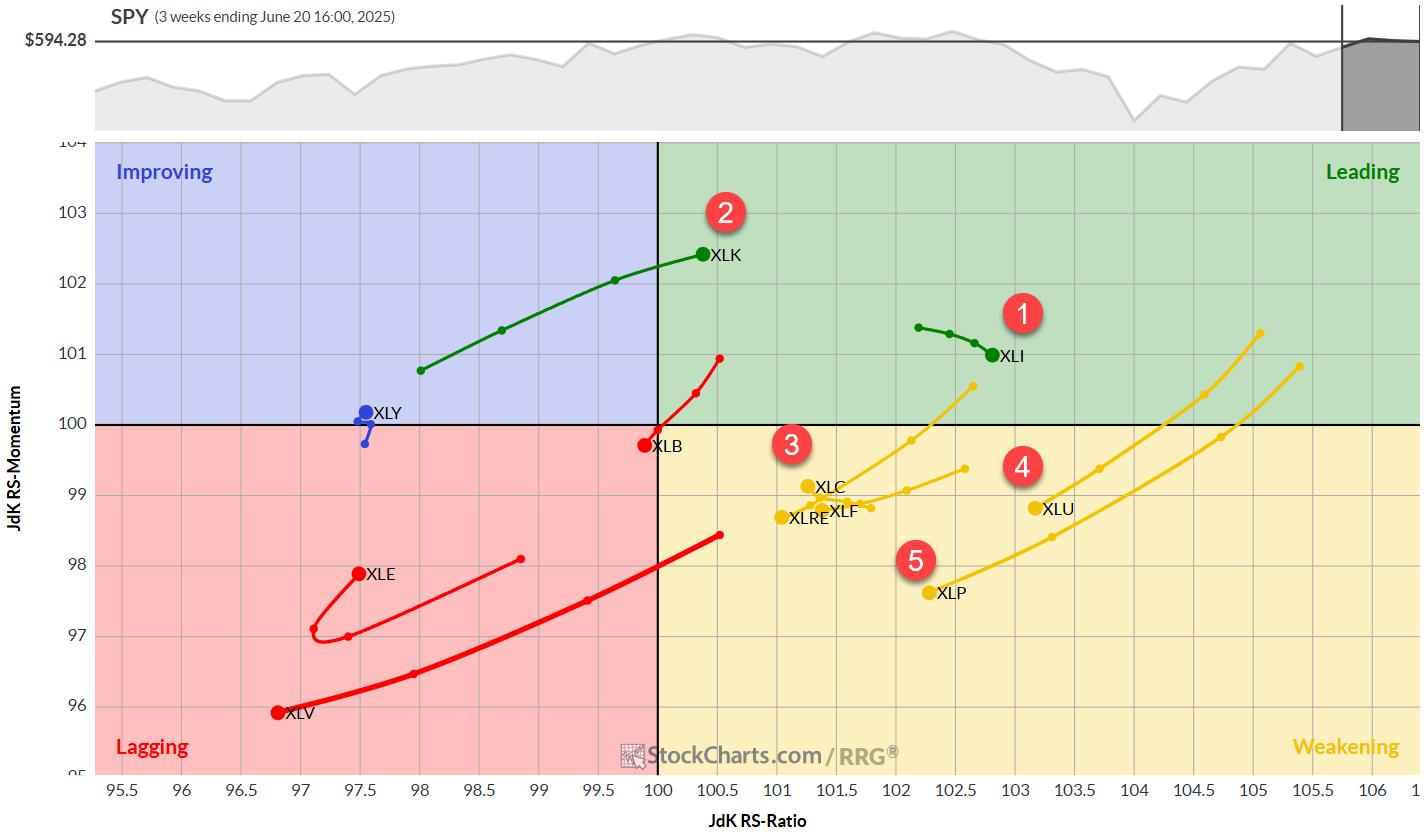

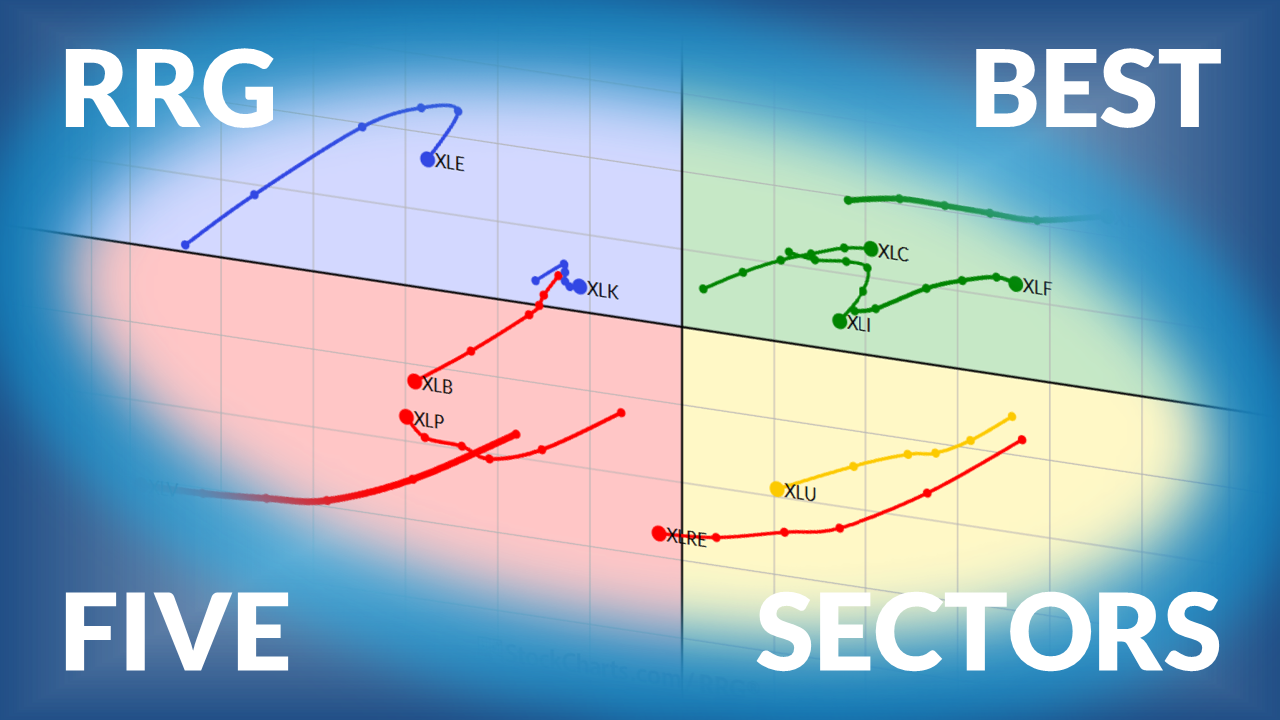

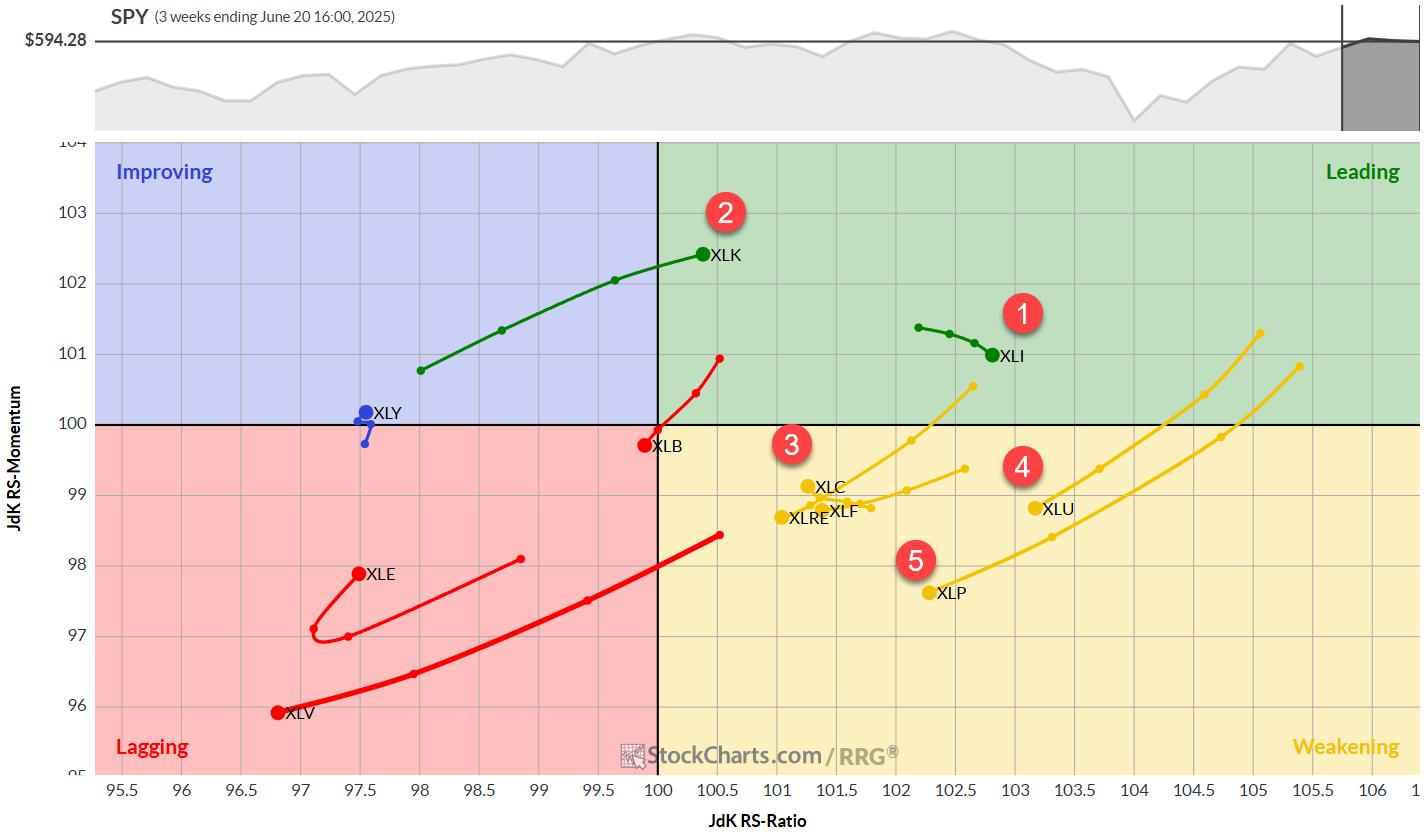

The Best Five Sectors, #31

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector rotation based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Week Ahead: Keeping Head Above This Level Crucial for Nifty To Avoid Slipping Into Prolonged Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty logs its sixth week of losses, hovering below key resistance. Traders remain cautious amid potential downside risks. ...

READ MORE

MEMBERS ONLY

How We Beat the S&P 500 by 20% This Quarter!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom breaks down how his model portfolios have consistently outperformed the S&P 500 — including a 24.5% return for the aggressive portfolio over the past quarter, against the S&P 500’s 5%. He covers market signals following the Fed’s recent rate decision, explains why Wall...

READ MORE

MEMBERS ONLY

Markets Drop! But These Stocks Are Still Leading

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s market volatility and what it means for investors. She explains how inflation and employment data triggered technical breakdowns in key indexes, and discusses why volatility, relative strength, and leadership stocks (including MPWR, TER, and Cadence Design) should remain on your radar. Mary...

READ MORE

MEMBERS ONLY

Week Ahead: Nifty Tests Key Support Levels—May Weaken If Levels Violated

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty closed the week lower, trading within a narrow range. Volatility also rose. Monitor short-term support levels as we head into next week. Discover which sectors are leading and which are lagging....

READ MORE

MEMBERS ONLY

Why Daily vs. Weekly RRGs Matter in Portfolio Construction

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can be rendered in similar intervals as regular bar- or candlestick charts. This article explains the differences between weekly and daily RRGs....

READ MORE

MEMBERS ONLY

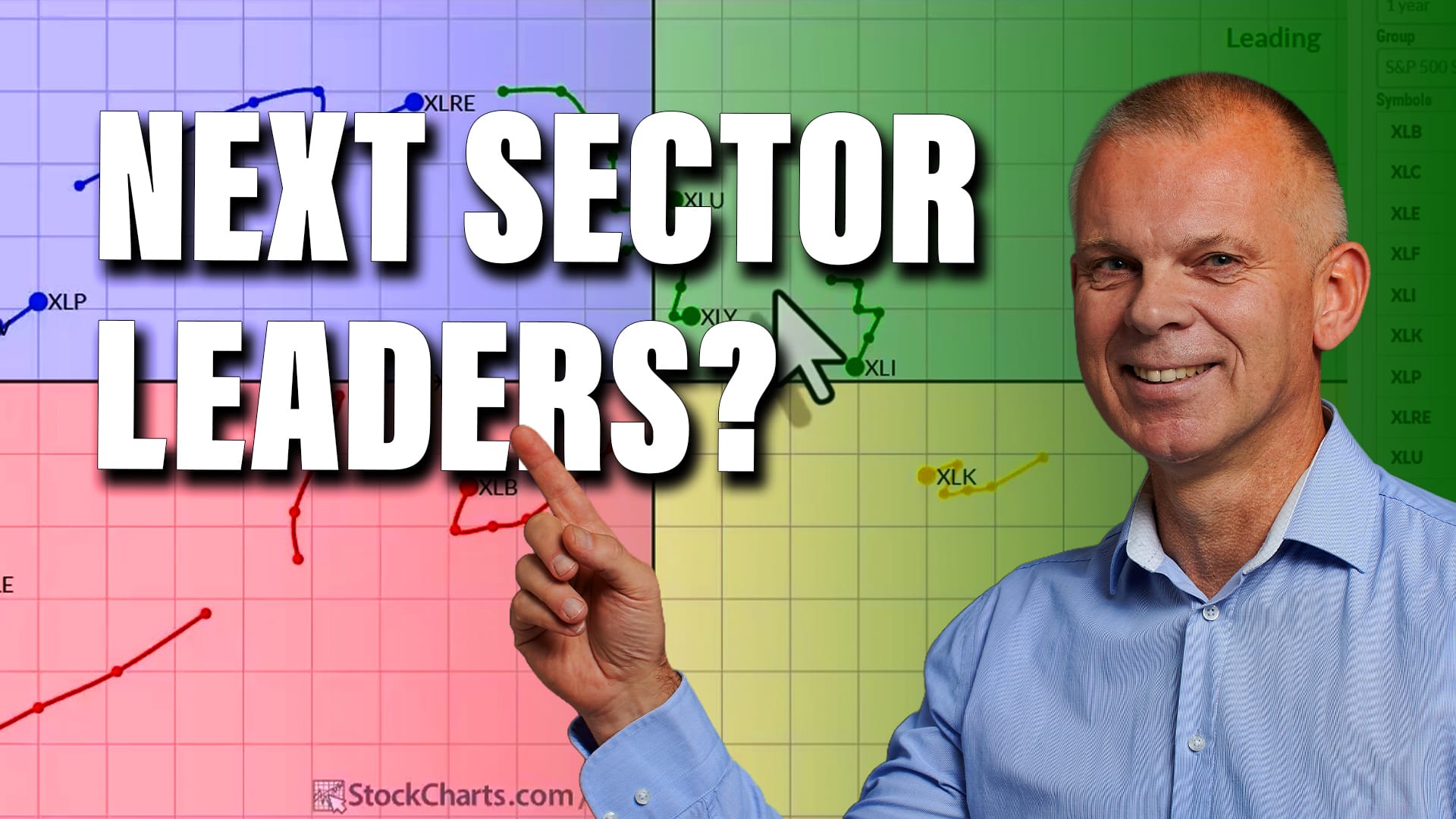

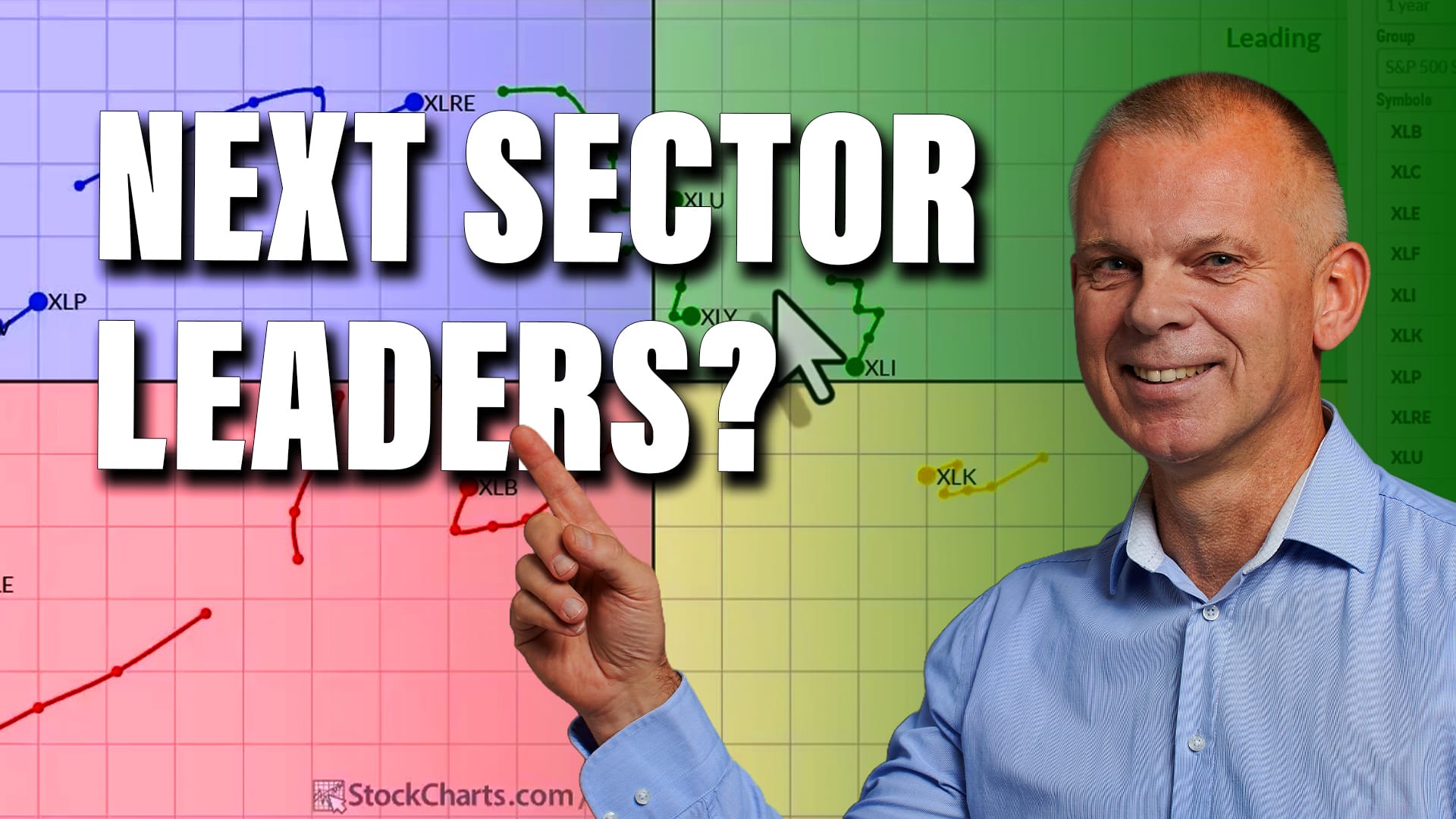

RRG Reveals the Next Big Sector Moves!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video, Julius breaks down current market trends using Relative Rotation Graphs (RRG). He examines weekly and daily asset class rotations, highlighting key developments in stocks, commodities, bonds, the U.S. dollar, and crypto. From there, Julius analyzes sector momentum shifts, including technology, energy, and real estate, and explains...

READ MORE

MEMBERS ONLY

These Breakout Stocks Are Leading the Market Right Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Markets hit another all-time high as rotation accelerates into biotech, software, and alt-energy names. Follow along as Mary Ellen breaks down the top-performing sectors and ETFs, including key breakouts in Bloom Energy, DoorDash, and Deckers. She also highlights meme stocks' action, examines what international leadership in countries like Spain...

READ MORE

MEMBERS ONLY

The Week Ahead: NIFTY Will Have a Lot Of Reactions To Offer; Stares At Important Supports

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty ended the week slightly lower after trading within a narrow range. With key levels in focus and technical indicators showing mixed signals, markets may remain sideways for a while....

READ MORE

MEMBERS ONLY

Using Relative Rotation Graphs to Visualize Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs or RRGs will help investors to keep an eye on relative trends that unfold within a universe. Among other things this will help to visualize sector rotation...

READ MORE

MEMBERS ONLY

Chart Mania - 23 ATR Move in QQQ - Metals Lead 2025 - XLV Oversold - XLU Breakout - ITB Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tech stocks are heating up, utilities break out, metals lead, and homebuilders hit a moment of truth....

READ MORE

MEMBERS ONLY

Momentum Leaders Are Rotating — Here's How to Find Them

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Is the market's next surge already underway? Find out with Tom Bowley's breakdown of where the money is flowing now and how you can get in front of it.

In this video, Tom covers key moves in the major indexes, revealing strength in transports, small caps,...

READ MORE

MEMBERS ONLY

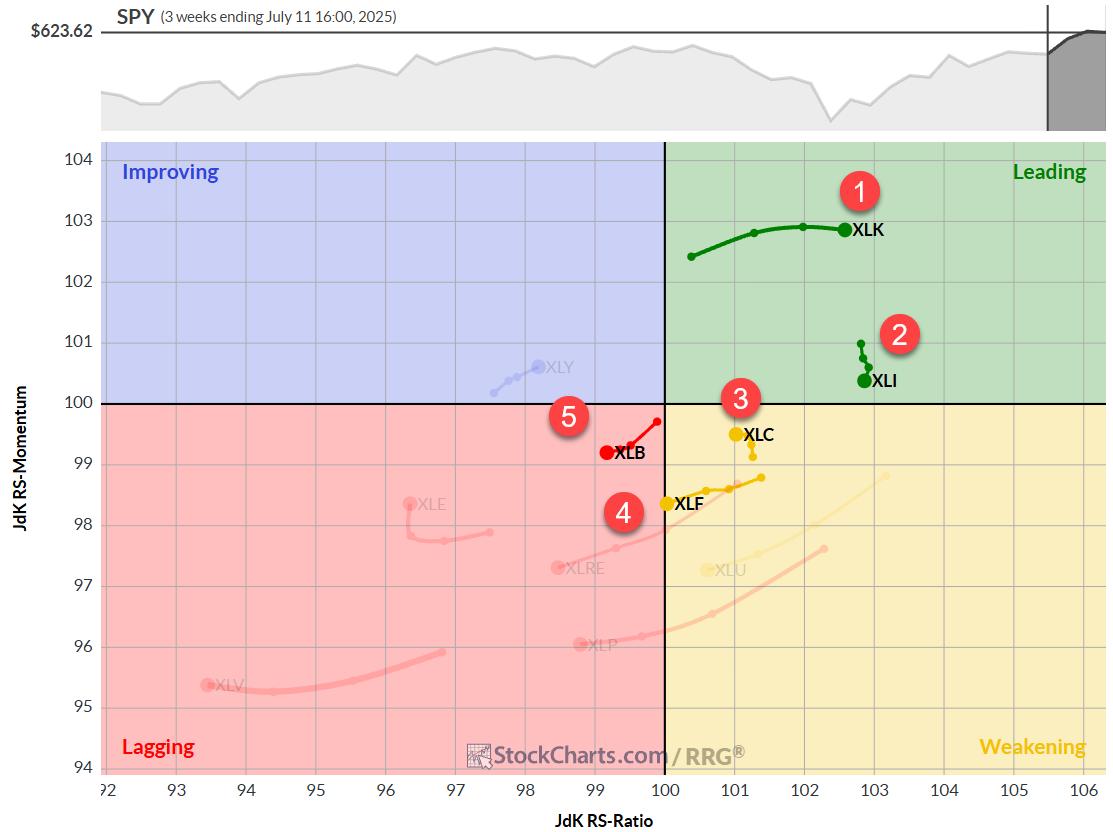

The Best Five Sectors, #28

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Technology sector continues to dominate, while Industrials are rotating out of the leading quadrant....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Violates Short-Term Supports; Still Tentatively Devoid of Any Major Triggers

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty traded in a broadly sideways and range-bound manner throughout the week, ending it with a modest decline. The Index oscillated within a narrow 276-point range, between 25144.60 on the higher end and 24918.65 on the lower end, before settling mildly lower. The India VIX declined by...

READ MORE

MEMBERS ONLY

The Real Drivers of This Market: AI, Semis & Robotics

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen spotlights the areas driving market momentum following Taiwan Semiconductor's record-breaking earnings report. She analyzes continued strength in semiconductors, utilities, industrials, and AI-driven sectors, plus highlights new leadership in robotics and innovation-focused ETFs like ARK. From there, Mary Ellen breaks down weakness in health...

READ MORE

MEMBERS ONLY

This Market Sector is Starting to Emerge as a Leader; Can it Complete the Job?

by Martin Pring,

President, Pring Research

Many years ago, I developed a couple of indexes that were designed to give me a sense of whether industry groups benefiting from inflationary conditions were outperforming those who performed better under deflationary ones. It was my way of recognizing the fact that, in a broad sense, the business cycle...

READ MORE

MEMBERS ONLY

These HOT Industry Groups are Fueling This Secular Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom as he covers key inflation data, earnings season highlights, and sector rotation trends. He breaks down recent price action in major indexes like the S&P 500 and Nasdaq, with a close look at the 20-day moving average as a support gauge. Tom spotlights standout industry groups...

READ MORE

MEMBERS ONLY

Tech Takes the Spotlight Again—Are You Watching These Stocks?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Tech stocks led by semiconductors pushed the Nasdaq to a record high. Learn why this sector is gaining momentum and how to track top stocks....

READ MORE

MEMBERS ONLY

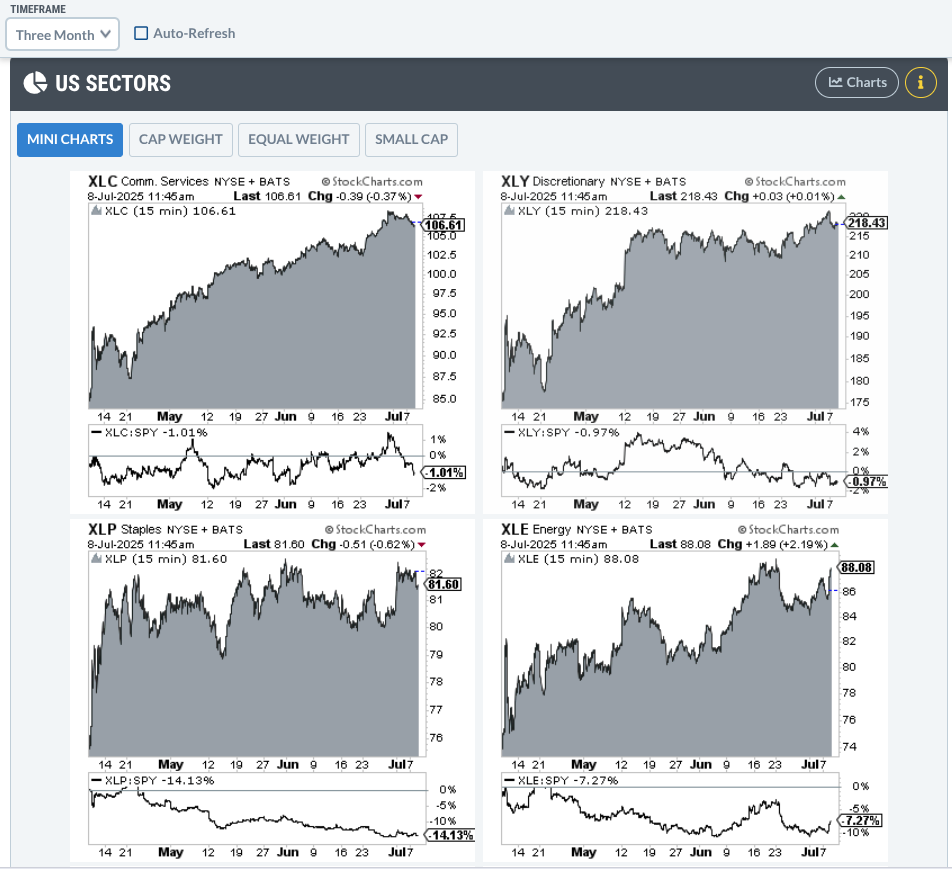

The Best Five Sectors, #27

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Materials sector climbs to #5 in rankings, displacing Utilities

* Technology maintains leadership, but Communication Services and Financials show weakness

* Daily RRG reveals potential for Materials, caution needed for Comm Services and Financials

* Portfolio drawdown continues, currently 8% behind S&P 500 YTD

After a relatively quiet week...

READ MORE

MEMBERS ONLY

Here's What's Fueling the Moves in Bitcoin, Gaming, and Metals

by Mary Ellen McGonagle,

President, MEM Investment Research

Is the market flashing early signs of a shift?

In this week's video, Mary Ellen McGonagle breaks down the subtle but telling moves happening under the surface. From strength in semiconductors, home builders, and energy to surging momentum in Bitcoin and silver, Mary Ellen highlights the sectors gaining...

READ MORE

MEMBERS ONLY

How I Triple My Returns With 3x Leveraged ETFs!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Investing in triple-leveraged ETFs may not be on your radar. But that may change after you watch this video.

Tom Bowley of EarningsBeats shares how he uses the 3x leveraged ETFs to take advantage of high probability upside moves. Tom shows charts of 3x leveraged ETFs that mirror their benchmark...

READ MORE

MEMBERS ONLY

The Seasonality Trend Driving XLK and XLI to New Highs

by Karl Montevirgen,

The StockCharts Insider

For those who focus on sector rotation, whether to adjust portfolio weightings or invest directly in sector indexes, you're probably wondering: Amid the current "risk-on" sentiment, even with ongoing economic and geopolitical uncertainties, can seasonality help you better anticipate shifts in sector performance?

Current Sector Performance...

READ MORE

MEMBERS ONLY

Small Caps Are Rotating In — Here's Why It Matters

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After months of whiplash sector swings, the market may finally be showing signs of settling down.

In this video, Julius de Kempenaer uses Relative Rotation Graphs (RRG) to analyze asset class rotation at a high level and then dives into sectors and factors. Julius highlights the rotation into cryptocurrencies and...

READ MORE

MEMBERS ONLY

Breakout Watch: One Stock in Each Sector to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When sector performance shifts gears from one day to the next, it's best to be prepared with a handful of stocks from the each of the sectors.

In this hands-on video, David Keller, CMT, highlights his criteria for picking the top stocks in 10 of the 11 S&...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #26

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we're seeing some interesting shifts within the rankings that warrant closer examination. Let's dive into the details and see what the Relative Rotation...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set To Stay In A Defined Range Unless These Levels Are Taken Out; Drags Support Higher

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a strong move in the week before this one, the Nifty spent the last five sessions largely consolidating in a very defined range. The markets traded with a weak underlying bias and lost ground gradually over the past few days; however, the drawdown remained quite measured and within the...

READ MORE

MEMBERS ONLY

From Oversold to Opportunity: Small Caps on the Move

by Mary Ellen McGonagle,

President, MEM Investment Research

This holiday-shortened week was anything but short on action! The S&P 500 and Nasdaq Composite closed at record highs, but what is really driving the market?

In this essential recap, expert Mary Ellen McGonagle dives into the sectors and stocks making big moves. She'll reveal why...

READ MORE

MEMBERS ONLY

Money's Not Leaving the Market - It's Rotating!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn't fleeing the market; it's simply moving around, creating fresh opportunities.

In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #25

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A Greek Odyssey

First of all, I apologize for any potential delays or inconsistencies this week. I'm currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then...

READ MORE

MEMBERS ONLY

Week Ahead: As NIFTY Breaks Out, Change of Leadership Likely to Keep the Index Moving

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After six weeks of consolidation and trading in a defined range, the markets finally broke out from this formation and ended the week with gains. Over the past five sessions, the markets have largely traded with a positive undercurrent, continuing to edge higher. The trading range was wider than anticipated;...

READ MORE

MEMBERS ONLY

Shifting Tides in the Stock Market: A New Era for Bulls?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market has been on quite the rollercoaster of late, thanks to news headlines. But investors seem to have shrugged off the past weekend's geopolitical tensions, at least for now.

On Tuesday, we saw a surge of enthusiasm. Investors were diving back into stocks and selling off...

READ MORE

MEMBERS ONLY

Offense vs. Defense: How Geopolitical Tensions Shape Market Trends

by Karl Montevirgen,

The StockCharts Insider

As the cycle of uncertainty continues to yield confusion than clarity, investors are again caught having to decide between taking an offensive and defensive posture in the market. The tough part in today's market environment is how fast situations can shift. With headlines driving the action, sentiment can...

READ MORE

MEMBERS ONLY

AI Stocks Ignite Again—Where Smart Money is Heading Next

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen opens with a look at the S&P 500, noting that the index remains above its 10-day average despite a brief pullback—a sign of healthy market breadth. She points to ongoing sector leadership in technology, while observing that energy and defense stocks are...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #24

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Some Sector Reshuffling, But No New Entries/Exits

Despite a backdrop of significant geopolitical events over the weekend, the market's reaction appears muted -- at least, in European trading. As we assess the RRG best five sectors model based on last Friday's close, we're...

READ MORE

MEMBERS ONLY

RRG Alert Tech Vaults to ‘Leading'—Is XLK Signaling a New Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius breaks down the current sector rotation using his signature Relative Rotation Graphs, with XLK vaulting into the leading quadrant while utilities and staples fade. He spotlights strength in the technology sector, led by semiconductors and electronic groups that are outpacing the S&P 500. Microchip heavyweights...

READ MORE

MEMBERS ONLY

Diving into Energy Investments: Uncover Hidden Gems Today!

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

With oil prices surging and geopolitical unrest stirring in the Middle East, it's no surprise that energy stocks are drawing renewed attention. And, quite frankly, this week didn't have many market-moving earnings. So this week, we skate to where the puck is, or, in this case,...

READ MORE