MEMBERS ONLY

The Best Five Sectors, #23

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

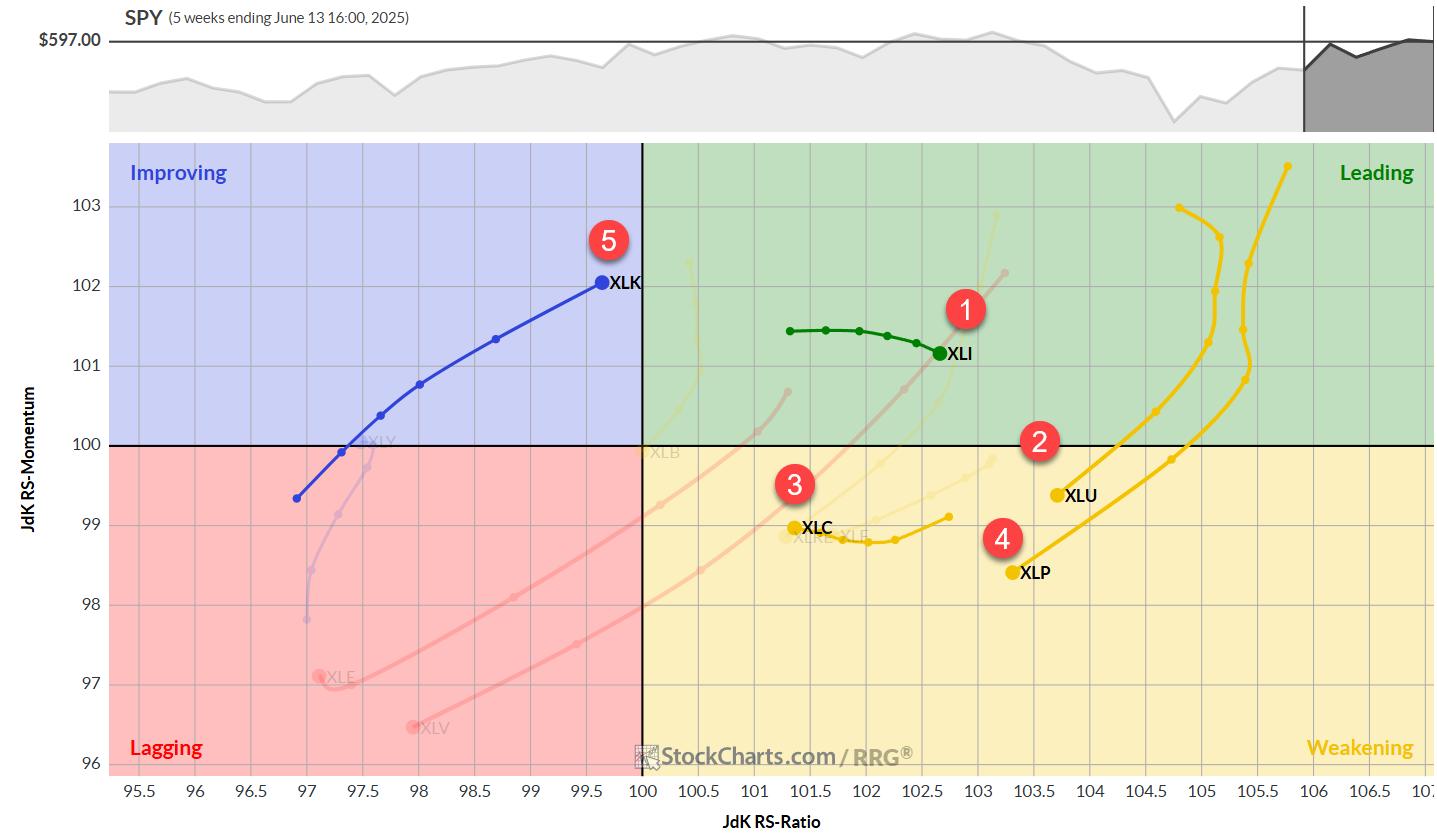

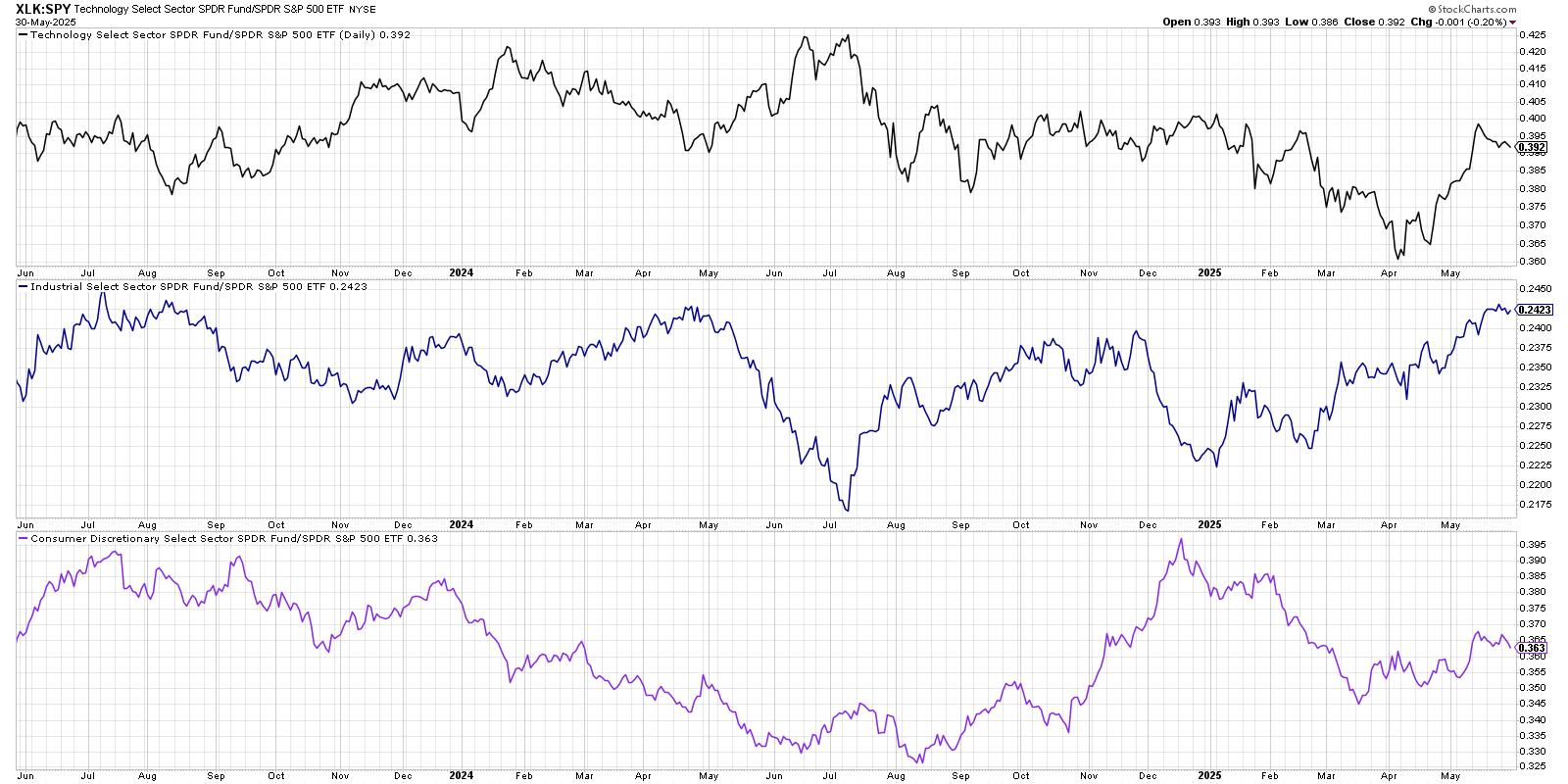

This Time Technology Beats Financials

After a week of no changes, we're back with renewed sector movements, and it's another round of leapfrogging.

This week, technology has muscled its way back into the top five sectors at the expense of financials, highlighting the ongoing volatility in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Continue Showing Resilience; Broader Markets May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

An attempt to break out of a month-long consolidation fizzled out as the Nifty declined and returned inside the trading zone it had created for itself. Over the past five sessions, the markets consolidated just above the upper edge of the trading zone; however, this failed to result in a...

READ MORE

MEMBERS ONLY

Is a Bold Rotation Brewing in Healthcare and Biotech? Here's What to Watch Now

by Karl Montevirgen,

The StockCharts Insider

Catching a sector early as it rotates out of a slump is one of the more reliable ways to get ahead of an emerging trend. You just have to make sure the rotation has enough strength to follow through.

On Thursday morning, as the markets maintained a cautiously bullish tone,...

READ MORE

MEMBERS ONLY

Three Sectors Stand Out and One Sports a Bullish Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Three sectors stand out, with one sporting a recent breakout that argues for higher prices. Today's report will highlight three criteria to define a leading uptrend. First, price should be above the rising 200-day SMA. Second, the price-relative should be above its rising 200-day SMA. And finally, leaders...

READ MORE

MEMBERS ONLY

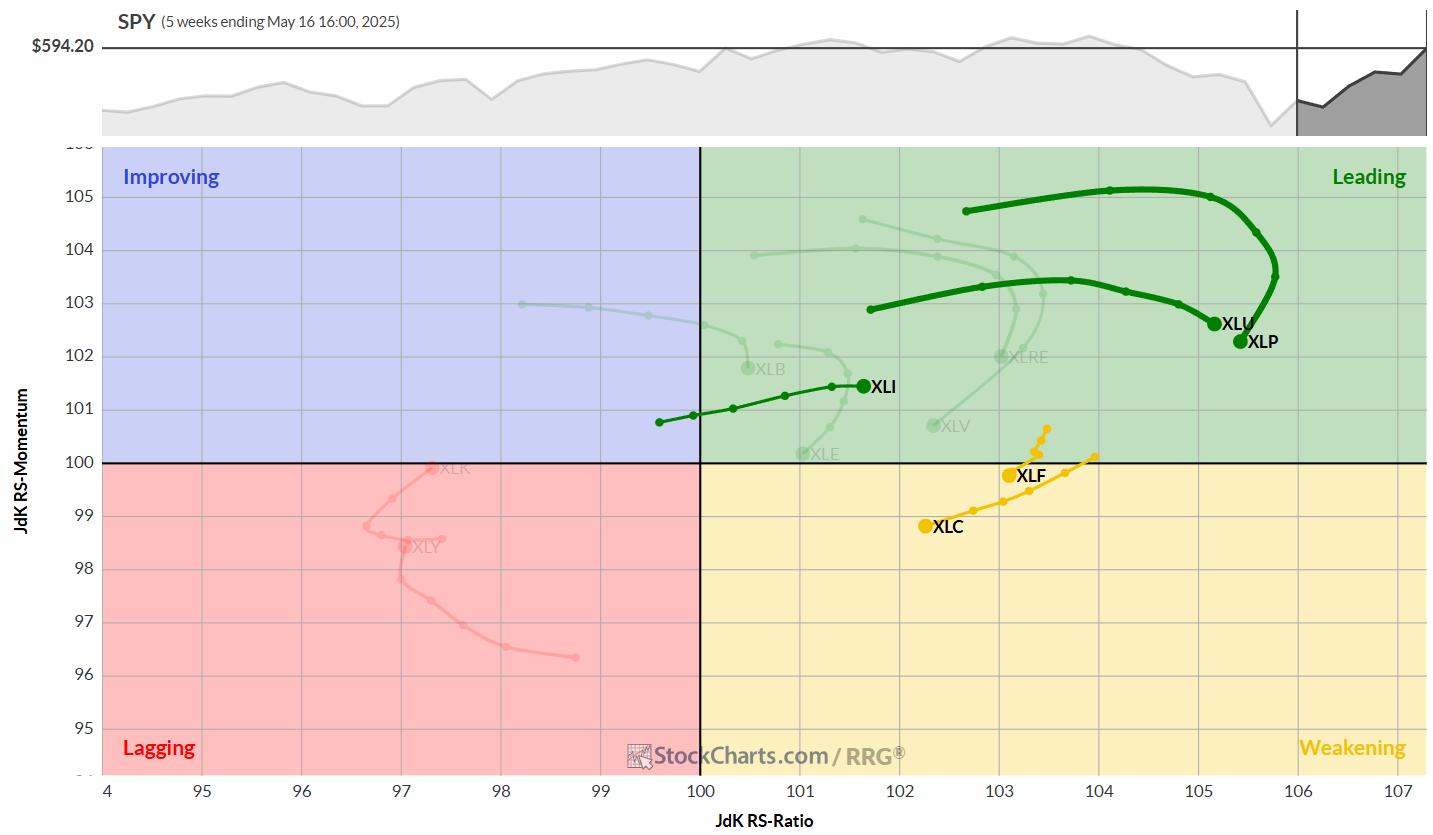

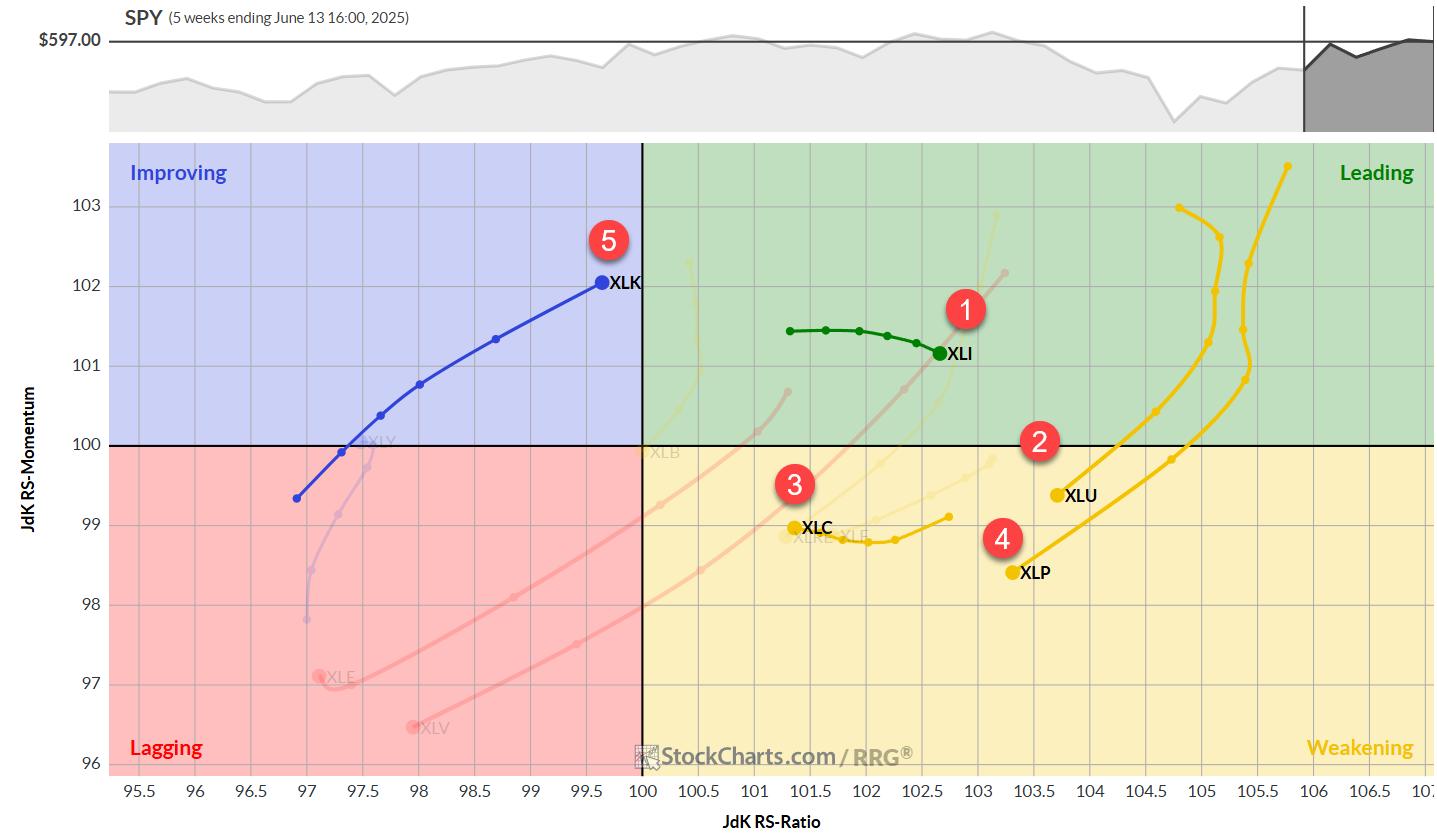

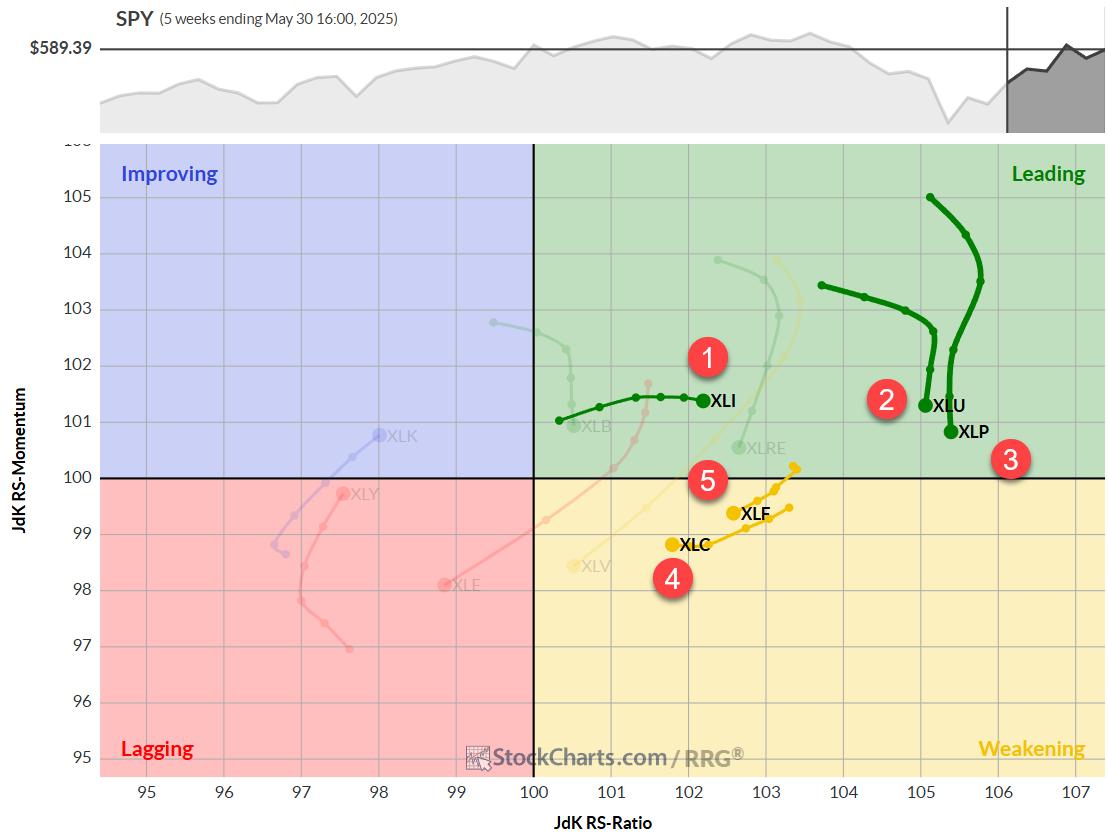

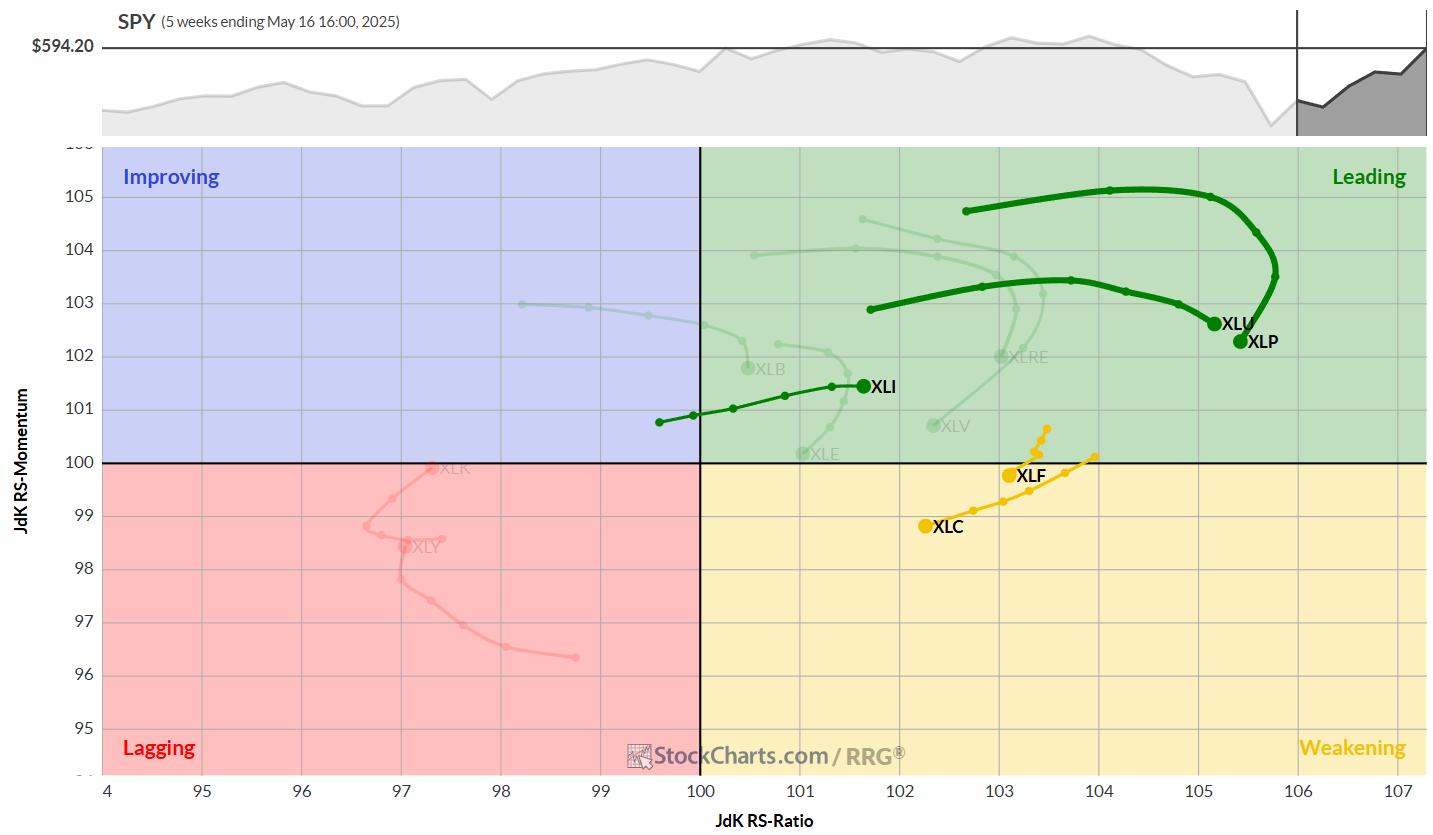

RRG Update: Is Tech Ready to Break Out?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius shows how the Technology sector is edging toward leadership, alongside Industrials and soon-to-follow Communication Services. He highlights breakout lines for SPY, XLK, and XLC, noting that conviction climbs when daily and weekly RRG tails align to point northeast together. Bitcoin is sprinting into the leading quadrant next...

READ MORE

MEMBERS ONLY

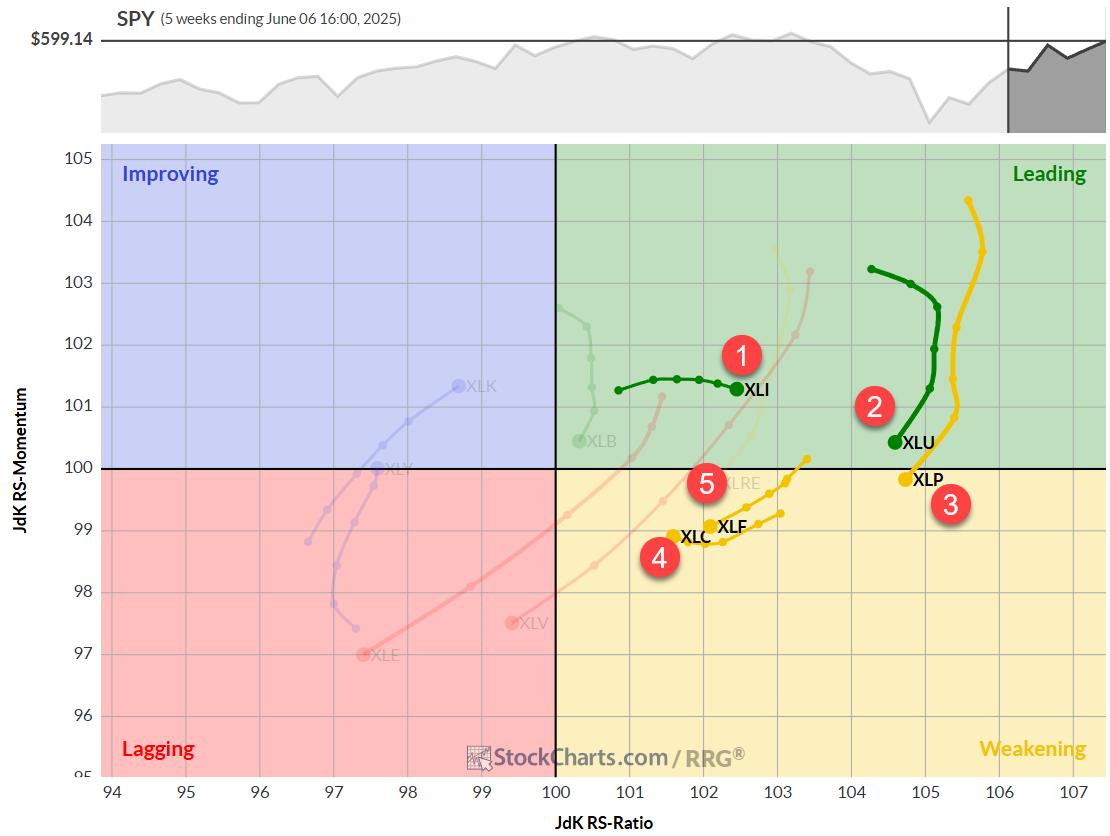

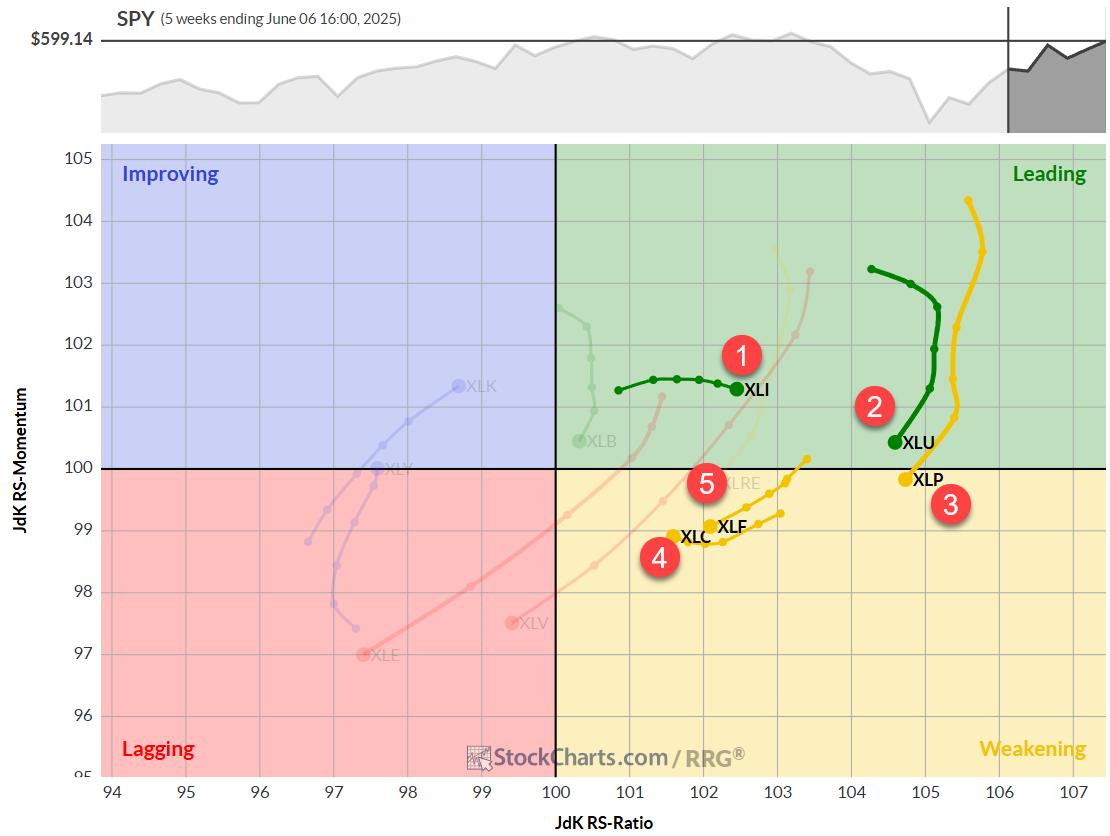

The Best Five Sectors, #22

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sector Rotation: A Week of Stability Amidst Market Dynamics

Last week presented an intriguing scenario in our sector rotation portfolio.

For the first time in recent memory, we witnessed complete stability across all sector positions -- no changes whatsoever in the rankings.

1. (1) Industrials - (XLI)

2. (2) Utilities...

READ MORE

MEMBERS ONLY

Tech ETFs are Leading Since April, but Another Group is Leading YTD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

QQQ and tech ETFs are leading the surge off the April low, but there is another group leading year-to-date. Year-to-date performance is important because it includes two big events: the stock market decline from mid February to early April and the steep surge into early June. We need to combine...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY's Behavior Against This Level Crucial as Index Looks at Potential Resumption of Up Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After consolidating for two weeks, the Nifty finally appeared to be flexing its muscles for a potential move higher. Over the past five sessions, the Nifty traded with an underlying positive bias and ended near the week's high point while also attempting to move past a crucial pattern...

READ MORE

MEMBERS ONLY

From Tariffs to Tech: Where Smart Money's Moving Right Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which sectors are truly leading (industrials, technology & materials), and what next week's inflation data could mean for your portfolio.

This video originally...

READ MORE

MEMBERS ONLY

Your Weekly Stock Market Snapshot: What It Means for Your Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

This week, we got a smorgasbord of jobs data — JOLTS, ADP, weekly jobless claims, and the nonfarm payrolls (NFP). Friday's NFP, the big one the market was waiting for, showed that 139,000 jobs were added in May, which was better than the expected 130,000. Unemployment rate...

READ MORE

MEMBERS ONLY

S&P 500 on the Verge of 6,000: What's at Stake?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

A lot has happened in the stock market since Liberation Day, keeping us on our toes. Volatility has declined significantly, stocks have bounced back from their April 7 low, and the economy has remained resilient.

If you're still feeling uncertain, though, you're not alone. The stock...

READ MORE

MEMBERS ONLY

Hedge Market Volatility with These Dividend Aristocrats & Sector Leaders

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights key areas of the stock market that gained strength last week, including Staples and Aerospace stocks. She also shares several Dividend Aristocrat stocks that can help stabilize your portfolio in times of market volatility.Whether you're seeking defensive plays or looking to...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #21

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Staples and Tech Swap Positions Again

The weekly sector rotation continues to paint a picture of a market in flux, with defensive sectors gaining ground while cyclicals take a step back. This week's shifts underscore the ongoing volatility and lack of clear directional trade that's been...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays in Defined Range; Moving Past This Level Crucial for Resumption of Upmove

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past five sessions, the Indian equity markets headed nowhere and continued consolidating in a defined range.

In the previous weekly note, it was categorically expected that the markets might stay devoid of any directional bias unless they either took out the upper edge or violated the lower edge...

READ MORE

MEMBERS ONLY

Leadership Rotation Could Confirm Corrective Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There's no denying that the equity markets have taken on a decisively different look and feel in recent weeks.

We've compared the charts of the S&P 500 and Nasdaq 100, as well as leading growth stocks like Nvidia, to an airplane experiencing a "...

READ MORE

MEMBERS ONLY

Nuclear Power Trio: OKLO, SMR, and CCJ in Focus

by Karl Montevirgen,

The StockCharts Insider

Nuclear energy stocks are on a tear, and Oklo Inc. (OKLO), Cameco Corp. (CCJ), and NuScale Power Corporation (SMR) are leading the charge, fueled by presidential executive orders, investor hype, and hopes for a nuclear-powered future.

Is It Time to Go Nuclear?

These names bucked the trend on Wednesday, rising...

READ MORE

MEMBERS ONLY

Top Sectors to Watch + The 18 SMA Setup Every Trader Should Know

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe analyzes which sectors to focus on when selecting new stocks. He demonstrates how to use the 18-period simple moving average (SMA) on monthly, weekly, and daily charts to identify the strongest stock patterns and the best timeframes to trade. He then provides chart analysis on the...

READ MORE

MEMBERS ONLY

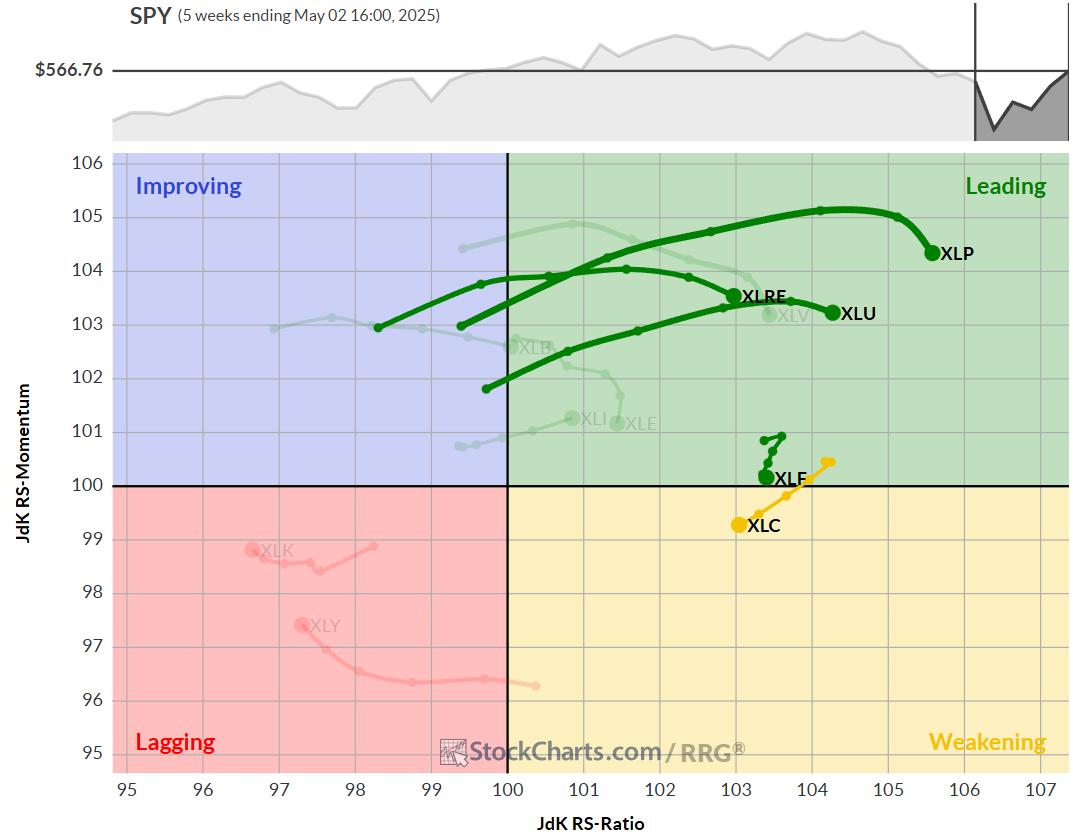

Mixed Signals on the Charts? RRG Reveals Market Rotation Tension

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Confused by mixed market signals? Follow along as Julius analyzes sector rotation, asset rotation, and global market trends using daily and weekly Relative Rotation Graphs (RRGs).

In this video, Julius puts the current sector rotation in perspective on both weekly and daily Relative Rotation Graphs (RRGs). He also examines asset...

READ MORE

MEMBERS ONLY

Is It A Pullback? Or is More Downside Ahead?

by Mary Ellen McGonagle,

President, MEM Investment Research

Get the latest stock market update with Mary Ellen McGonagle. Learn key downside signals, how to manage pullbacks, and which earnings reports could impact the market next week.

In this week's episode, Mary Ellen reviews where the markets currently stand and what to watch for to signal further...

READ MORE

MEMBERS ONLY

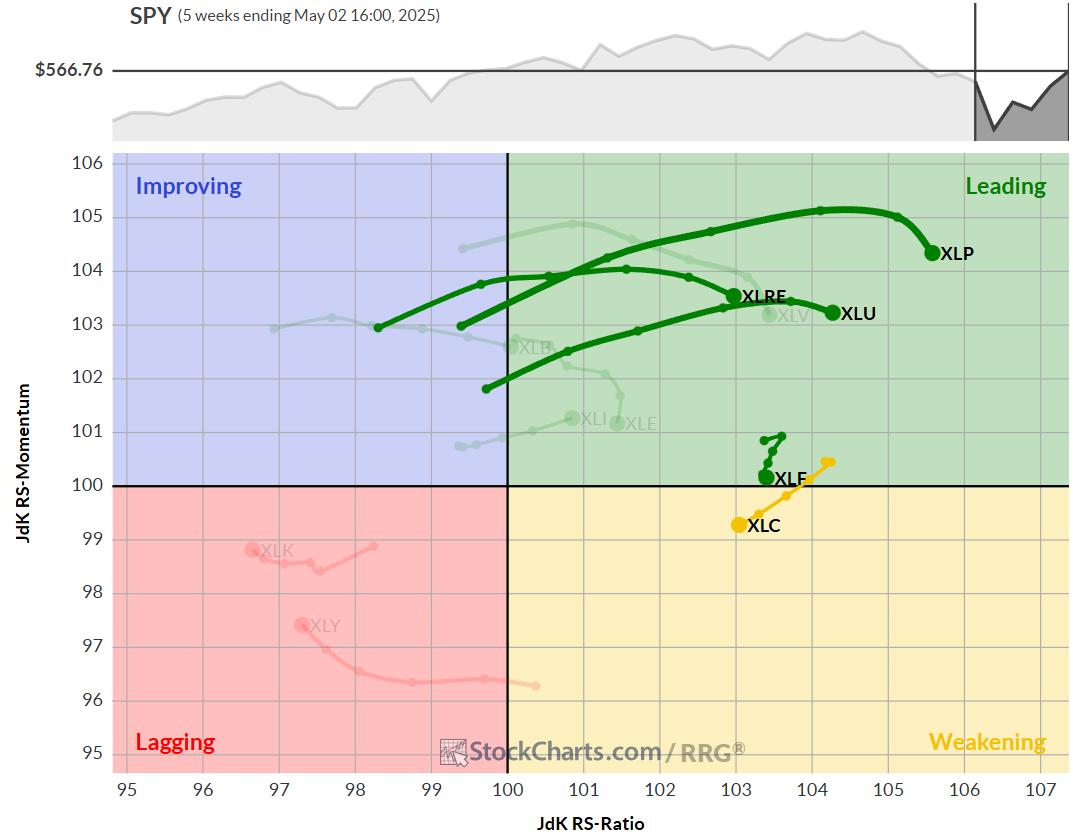

The Best Five Sectors, #20

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Technology Back in Top-5

Last week's market decline of 2-2.5% (depending on the index) has led to some notable shifts in sector performance and rankings.

This pullback, coming after a strong rally, is changing the order of highs and lows on the weekly chart -- a particularly...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays in Technically Challanging Situation; Sector Rotation Shows Likely Change In Leadership

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a very strong move in the week before this one, the markets chose to take a breather. Although they moved in a wide range, they ended the week on a mildly negative note after rebounding from their low point of the week. While defending the key levels, the markets...

READ MORE

MEMBERS ONLY

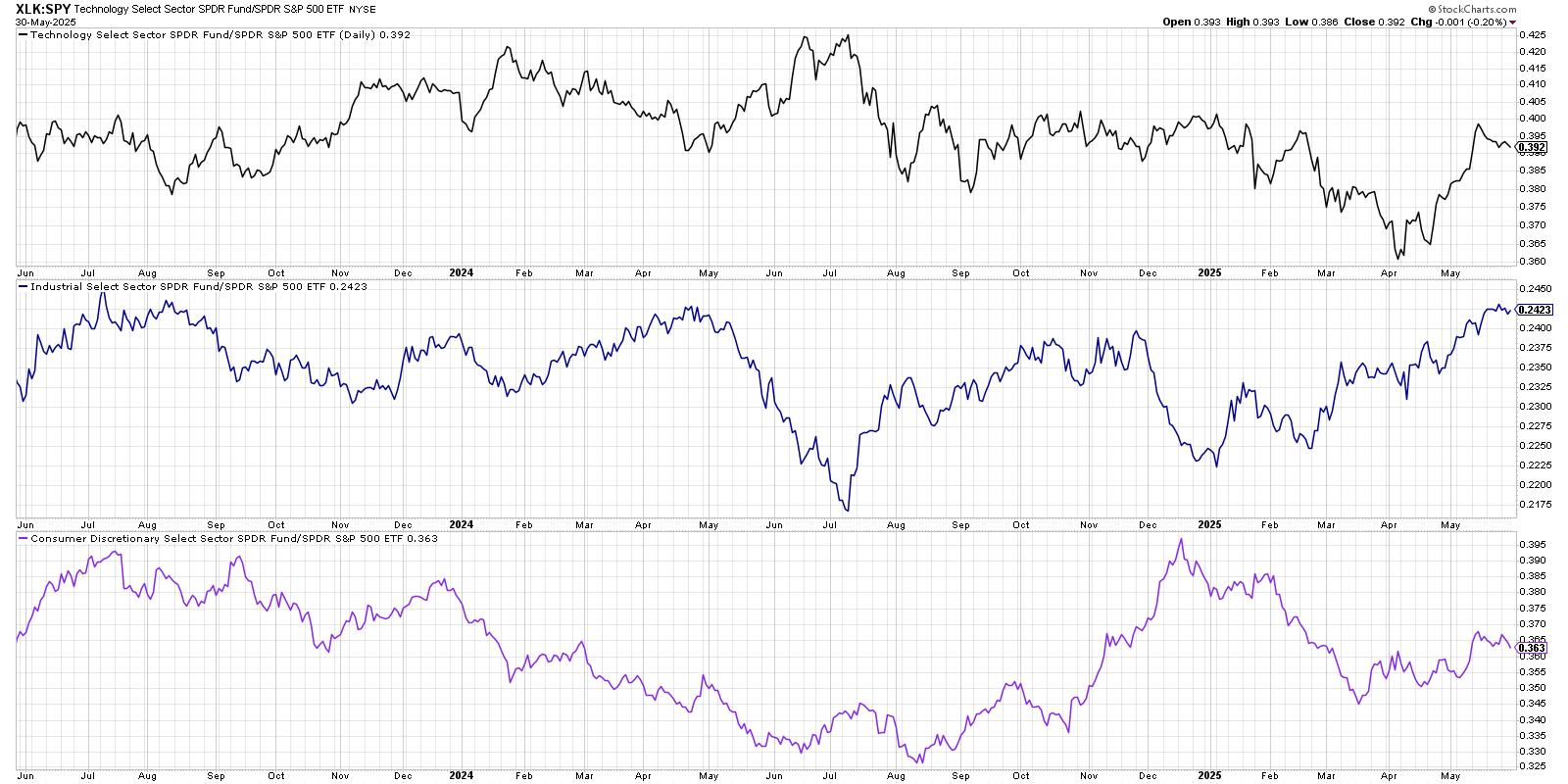

Applying Key Ratios to the Broader Market Surge: Are We at the Threshold of a New Trend?

by Karl Montevirgen,

The StockCharts Insider

The financial media is flooded with commentary questioning whether the current rise in stock indexes is sustainable enough to mark the beginning of a new bull market. In short, have we gotten out of the woods, or are we in a clearing with more uncertainty to come?

There are many...

READ MORE

MEMBERS ONLY

Quantum Stocks Explode: Why Traders are Obsessed with QBTS and RGTI Right Now

by Karl Montevirgen,

The StockCharts Insider

If you regularly follow the SCTR Reports (StockCharts Technical Rank), you'll notice that some top-ranked stocks aren't just individual standouts, but groupings that call attention to particular sectors, industries, or subgroups within the two.

That's exactly what happened Tuesday morning. A couple of high-ranking...

READ MORE

MEMBERS ONLY

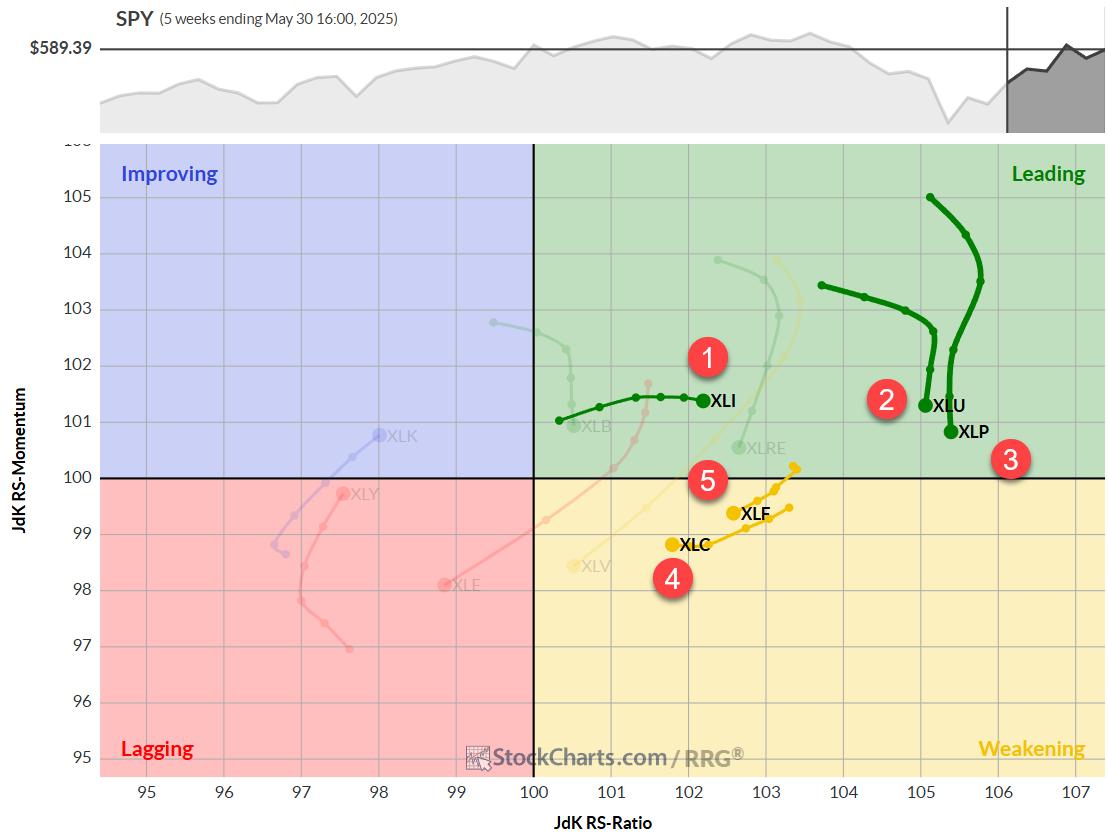

The Best Five Sectors, #19

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Industrials surge to #1 in sector ranking, replacing Real Estate in top 5

* Communication Services showing vulnerability, moving into weakening quadrant

* Utilities and Consumer Staples losing momentum but maintaining leading positions

* Portfolio maintains defensive positioning despite underperformance vs SPY

Sector Rotation Shakeup: Industrials Take the Lead

Another week...

READ MORE

MEMBERS ONLY

Emerging Stocks to Watch – Breakouts, Momentum & Upgrades!

by Mary Ellen McGonagle,

President, MEM Investment Research

Looking for breakout stocks and top market leaders? Follow along as Mary Ellen shares stock breakouts, analyst upgrades, and sector leadership trends to help you trade strong stocks in today's market.

In this week's episode, Mary Ellen reveals the stocks leading the market higher and explains...

READ MORE

MEMBERS ONLY

The Stock Market's Comeback: Key Takeaways for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Nasdaq, and Dow Jones all broke above their 200-day moving averages and signaled renewed strength.

* AI stocks like NVDA and PLTR posted double-digit gains, highlighting continued momentum in AI-driven investing opportunities.

* Investors are rotating into offensive sectors like Technology and Consumer Discretionary.

If...

READ MORE

MEMBERS ONLY

What Sector Rotation Says About the Market Cycle Right Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Where are we in the market cycle? In this video, Julius reviews the sector rotation and asset class performance from the past 2-3 weeks to provide an objective take on where we stand in the current market cycle. Using his signature Relative Rotation Graphs (RRG), he uncovers shifts in momentum...

READ MORE

MEMBERS ONLY

The S&P 500 Snapped Back Hard: Now What?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

KEY TAKEAWAYS

* The S&P 500's 14-week RSI hit its lowest point since the 2008 financial crisis.

* Sector ETFs like XLK (Technology) and XLI (Industrials) are showing bullish patterns.

* While the stock market's rapid reversal is encouraging, historical trends show that pullbacks often follow oversold...

READ MORE

MEMBERS ONLY

How to Use Relative Strength in a Volatile Market

by Joe Rabil,

President, Rabil Stock Research

Want to know how to find strong stocks in a volatile market? In this video, Joe uses Relative Strength (RS), Fibonacci retracements, and technical analysis to spot top sectors and manage downside risk.

Follow along as Joe breaks down how to use the Relative Strength indicator to separate outperforming stocks...

READ MORE

MEMBERS ONLY

Tariff Tensions Ease, Nasdaq Soars — But is SMH the Emerging Leader?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Nasdaq 100 leads with a strong show of breadth.

* Semiconductors are showing signs of recovery, despite lagging major indices.

* SMH's price action may be reaching a turning point.

For months, investors have been on edge over U.S.-China tariff tensions, bracing for everything from...

READ MORE

MEMBERS ONLY

Unlock the Power of StockCharts' NEW Market Summary Dashboard | Walkthrough & Tips

by Grayson Roze,

Chief Strategist, StockCharts.com

In this in-depth walkthrough, Grayson introduces the brand-new Market Summary Dashboard, an all-in-one resource designed to help you analyze the market with ease, speed, and depth. Follow along as Grayson shows how to take advantage of panels, mini-charts, and quick scroll menus to maximize your StockCharts experience.

This video originally...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* All 11 sectors changed positions, but the top-5 / bottom-6 composition remained the same.

* Utilities now strongest sector, despite overall market strength.

* Communication Services jumped from 5th to 2nd place.

* Portfolio still 3% behind the S&P 500 YTD, unchanged from last week.

Sector Shuffle: Same Players, New...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays in Technically Challanging Environment; Price Action Against These Levels Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Amid ever-increasing uncertainties on the global front and similarly rising geopolitical tensions between India and Pakistan, the Indian equity markets demonstrated strong resilience, consolidating before ending the week on just a modestly negative note. The trading range remained modest; the Nifty oscillated in a 590-point range. While the markets defended...

READ MORE

MEMBERS ONLY

Recession Ahead? Sector Rotation Model Warns of Rising Risk

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Is a recession coming? In this video, Julius breaks down the latest updates to his powerful Sector Rotation Model, analyzing four key macroeconomic indicators and their impact on sector performance.

This video was originally published on May 9, 2025. Click on the icon above to view on our dedicated page...

READ MORE

MEMBERS ONLY

Where the Market Goes Next: Key Resistance Levels + Top Bullish Stocks to Watch Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Want to know where the stock market is headed next? In this week's market update, Mary Ellen McGonagle analyzes key resistance levels and reveals what's fueling the current uptrend. She highlights top bullish setups among U.S. leadership stocks, plus global names showing strength.

This video...

READ MORE

MEMBERS ONLY

Investment Portfolio Feeling Stagnant? Transform Your Path Today

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tariffs and trade talks add to investor uncertainty with short-lived rallies.

* Frequent shifts between offensive and defensive sectors indicate ongoing stock market volatility.

* Mid-cap and small-cap stocks are gaining momentum and worth monitoring.

When your investment portfolio isn't gaining ground, it's natural to feel...

READ MORE

MEMBERS ONLY

The Unpredictable Stock Market: How to Make Sense of It

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 is struggling to break above key resistance levels.

* It's a headline-driven market out there, with stocks reacting quickly to geopolitical and policy changes.

* The Cboe Volatility Index (VIX) indicates investors are still uncertain.

The stock market's action on Wednesday...

READ MORE

MEMBERS ONLY

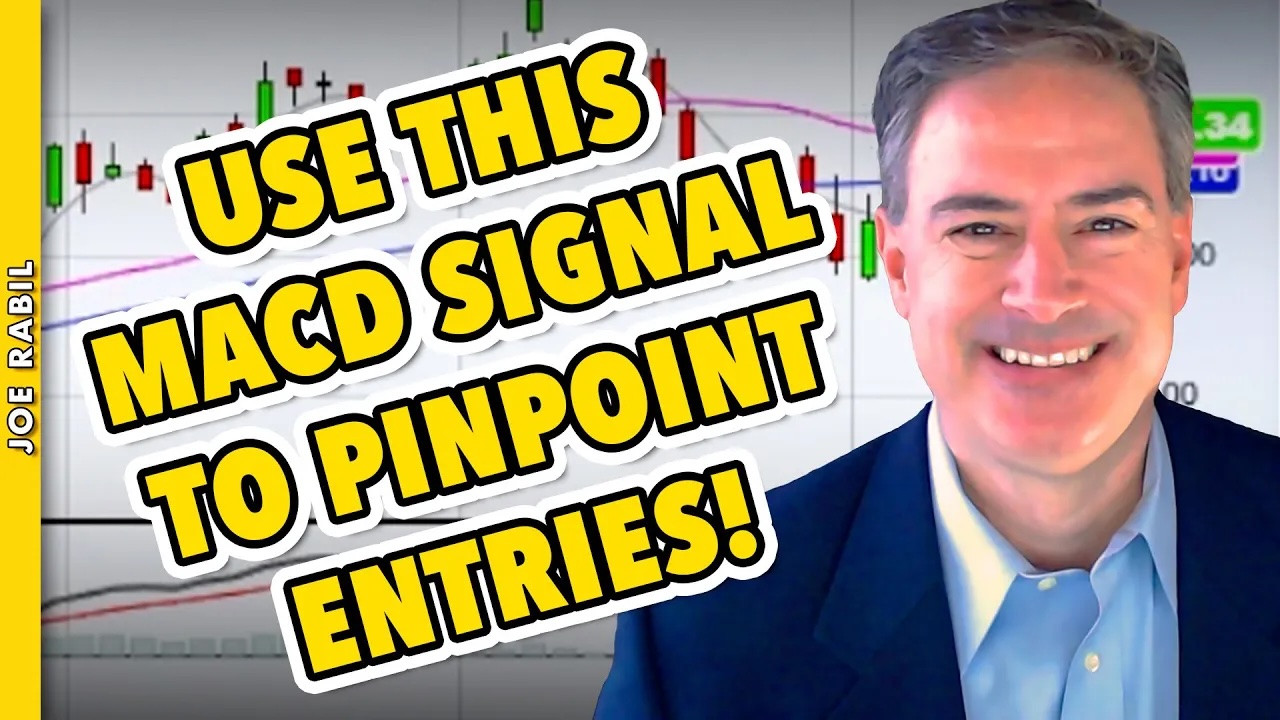

Use This Multi-Timeframe MACD Signal for Precision Trades

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe shares how to trade MACD signals using multiple timeframes, and how to spot stock market pullback setups that can help to pinpoint a great entry off a low. He then reviews sector performance to identify market leadership, covers key chart patterns, and discusses a looming bearish...

READ MORE

MEMBERS ONLY

Fed Watch: Key Bullish Patterns in the S&P 500, Utilities, and Crypto

by Frank Cappelleri,

Founder & President, CappThesis, LLC

KEY TAKEAWAYS

* Bullish chart patterns, such as the inverse head-and-shoulders and cup with handle, are in play in the S&P 500.

* Utilities are breaking to new 50-day highs.

* Bitcoin and Ethereum continue to signal rising risk appetite.

The S&P 500 ($SPX) wrapped up Tuesday just below...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Top 5 sectors remain unchanged, with minor position shifts

* Leading sectors showing signs of losing momentum

* Daily RRG reveals top sectors in weakening quadrant

* Communication services at risk of dropping out of top 5

Communication Services Drops to #5

The composition of the top five sectors remains largely...

READ MORE