MEMBERS ONLY

Did We Just See a False Breakdown in Crude Oil?

by Martin Pring,

President, Pring Research

Using West Texas Crude, Chart 1 features one of my favorite techniques for identifying changes in long-term trends, which is simply a PPO using the 6- and 15-month parameters. When it is above zero, it's bullish, and when below, bearish. The pink shading indicates bearish periods, and the...

READ MORE

MEMBERS ONLY

DP Trading Room: A Case for a Market Top

by Erin Swenlin,

Vice President, DecisionPoint.com

During today's market analysis Carl laid out his reasons why we believe we are at a market top. He discusses the current market price action combined with exclusive DecisionPoint indicators to substantiate his position. Don't miss his analysis.

Carl also goes though the Magnificent Seven by...

READ MORE

MEMBERS ONLY

Does the Market Have Bad Breadth?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* There have been less new 52-week highs since mid-September, suggesting leaders are falling off.

* The percent of S&P 500 members above their 50-day moving average is below 75%, which often serves as a threshold for a downturn.

* The S&P 500 Bullish Percent Index remains...

READ MORE

MEMBERS ONLY

Coming Soon: A New Era of Options Trading With OptionsPlay

by Tony Zhang,

Chief Strategist, OptionsPlay

We know that successful options trading requires precise analysis and actionable options strategies. That's why we're excited to introduce a groundbreaking partnership between OptionsPlay and StockCharts.com—bringing you the world's first integration of technical analysis and options screening in one powerful tool.

No...

READ MORE

MEMBERS ONLY

China Stocks May Be On to Something

by Martin Pring,

President, Pring Research

China's stock market exploded last week in an amazing rally, so formidable that it raises the question of whether it could be the start of a new bull market, or just a short-covering rally which will quickly fizzle out. In that respect, it's important to note...

READ MORE

MEMBERS ONLY

These 4 Chinese Stocks are Worth a Look

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe explains how to use two timeframes to identify 2 important characteristics of a great setup. For examples, he shares a few Chinese stocks that are showing great strength to the upside and what levels to watch for a pullback. Joe also covers the...

READ MORE

MEMBERS ONLY

Are Lower Interest Rates Bad For Workers? | Focus on Stocks: October 2024

by Larry Williams,

Veteran Investor and Author

The common economic perception is that lower interest rates are good for business, which, in turn, means good for job growth. The following charts will turn that idea upside down and inside out. Keep in mind there is no chart fancy-dancing going on here; I am just presenting the last...

READ MORE

MEMBERS ONLY

DP Trading Room: Uncovering Stocks from DP Scan Alerts

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DecisionPoint Trading Room, Erin pulls out her exclusive DecisionPoint Diamond Scans and finds us some new and interesting stock symbols to explore further. These scans are very powerful and bring the best charts to your attention. DecisionPoint has a new Scan Alert System for purchase...

READ MORE

MEMBERS ONLY

Why Were Chinese Stocks Up 20% Last Week?!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets, including sector and industry group rotation, before highlighting the sharp move into Chinese stocks. She shares her thoughts on whether it's too late to participate. In addition, she looks at the key traits that signal your stock...

READ MORE

MEMBERS ONLY

Unlocking GDX's Short-Term Potential: How to Nail the Measured Move Strategy

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* VanEck Vectors Gold Miners ETF (GDX) broke above its recent highs, confirming a continued uptrend.

* GDX displayed a short-term trading setup that was apparent in its price chart.

* The "measured move" rule can exploit an obvious short-term trading opportunity in GDX.

A few weeks back, two...

READ MORE

MEMBERS ONLY

SCTR Report: China Adds More Stimulus, FXI in Second Position

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* iShares China Large-Cap ETF (FXI) gains technical strength and has made it to second position in the StockCharts Technical Rank (SCTR).

* FXI could be in the early stages of a bull rally, so keep an eye on this ETF.

* Set your price target levels for entry and exit...

READ MORE

MEMBERS ONLY

How to Spot the Perfect Buying Opportunity in XLRE

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Investors began piling into real estate stocks over the last three months.

* XLRE is now just under 1% from its 52-week high, as indicated by the Distance From Highs indicator.

* With a potential dip on the horizon in XLRE, watch these levels to spot zones of opportunity from...

READ MORE

MEMBERS ONLY

DP Trading Room: Analyzing Two New Stocks in SP500 (DELL, PLTR)

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DP Trading Room Carl reviews the charts of two new members to the SP500, Dell (DELL) and Palantir (PLTR). Are they poised to break out on this news?

Carl also discussed the inflation on housing prices to open the show. Before going over the signal...

READ MORE

MEMBERS ONLY

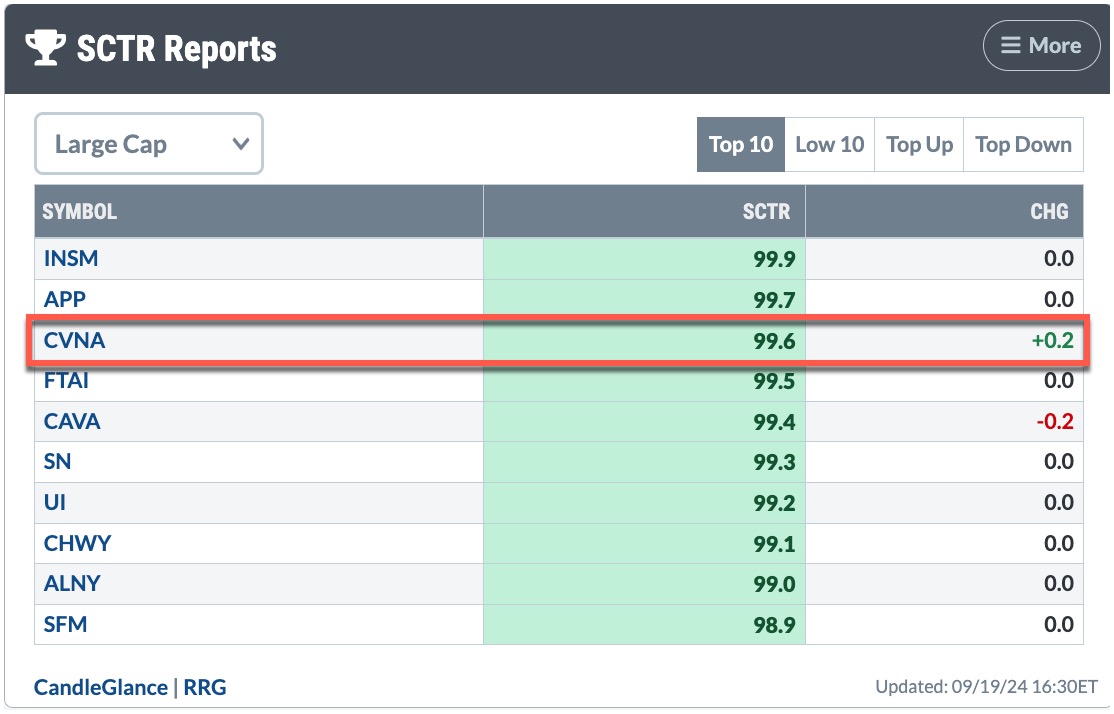

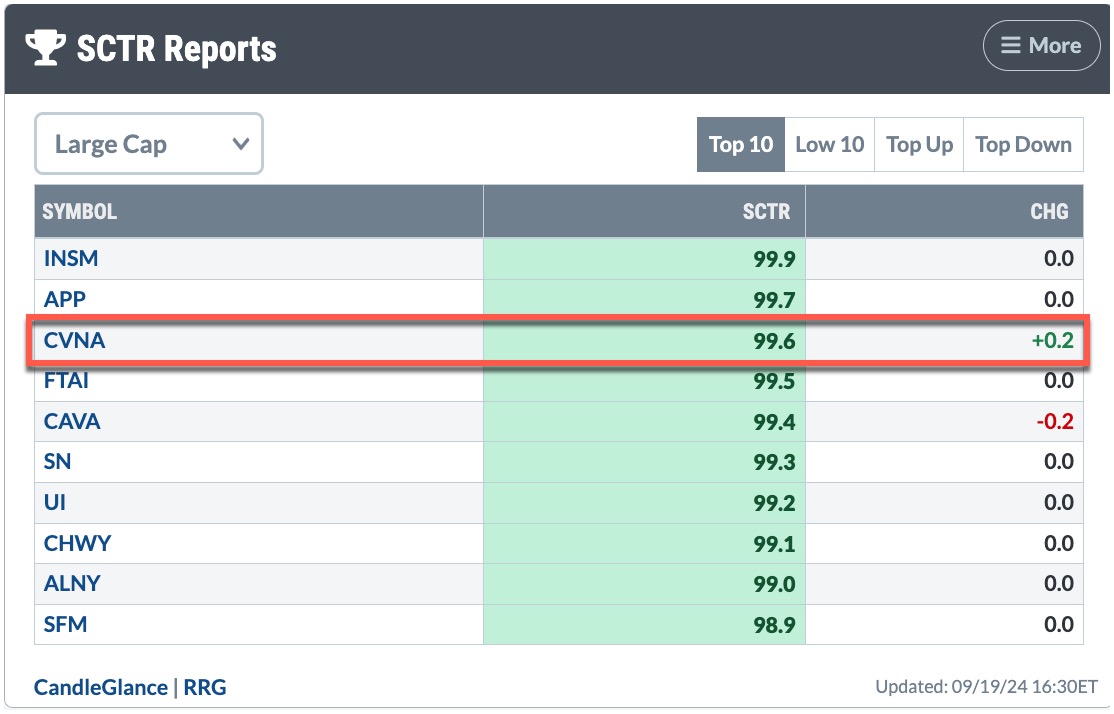

The SCTR Report: Carvana's Gain Makes It Worth a Revisit

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Carvana stock fell behind in its ranking during its August–September pullback, but it's now gaining momentum.

* From a weekly perspective, the uptrend in Carvana looks solid.

* Watch the Fibonacci retracement levels on the weekly chart to identify your entry and exit points.

On August 5,...

READ MORE

MEMBERS ONLY

This S&P 500 Rally is Defying the Experts – Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Wells Fargo analysts issued a warning about the current rally.

* Their last warning in November 2023 may have caused many investors to have missed out on a huge move.

* Analysts can be right or wrong, so it's important to watch key technical levels.

If you logged...

READ MORE

MEMBERS ONLY

The Fed Cut Discount Rate | Larry's "Family Gathering" September 19, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Interest rates have been cut -- what now? Larry presents his thoughts in this edition of the Family Gathering video.

In this month's Family Gathering video, Larry begins with what he calls the "Fed Cut Discount Rate" and what it means. What does history make of...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

The Secret to Perfecting SPY Entry Points? RSI!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows how to use RSI in multiple timeframes to identify the next buying opportunity in the SPY. Joe thinks this rally is important; he uses the ADX to distinguish between the strength in different indices. Joe demonstrates how he moves quickly around ACP,...

READ MORE

MEMBERS ONLY

SHOP Stock Ready to Surge: An Options Strategy to Take Advantage of the Big Move

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* SHOP stock pulled back to a support level and is showing a strong signal for an up move.

* SHOP's stock price has the potential to rise to $85.

* This call vertical spread options strategy could potentially result in a 238% return on investment.

Shopify (SHOP) continues...

READ MORE

MEMBERS ONLY

Investors Hesitant Ahead of Fed Meeting: How to Prepare

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes went above resistance levels, but retreated by the close.

* Small-cap stocks took the lead in Tuesday's trading.

* The Fed's decision on interest rates could make for a volatile trading day.

The broader stock market indexes are still in a holding...

READ MORE

MEMBERS ONLY

How High Can Gold Prices Go? The Tools You Need to Spot the Next Big Breakout!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold prices are soaring and are at an all-time high.

* Anticipated Fed rate cuts can send gold prices higher.

* There are two tools you can use to project gold price action in bullish and bearish scenarios.

As of Tuesday, the CME's FedWatch Tool gave a 67%...

READ MORE

MEMBERS ONLY

DP Trading Room: Tracking Gold Sentiment

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of Carl's review of Gold charts, he explained how we use the close-ended fund, Sprott Physical Gold Trust (PHYS) to measure sentiment for Gold. Depending on how PHYS trades, it trades at a discount or premium based on the physical Gold that it holds. These discounts...

READ MORE

MEMBERS ONLY

Here's My Most-Likely Scenario for QQQ

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 finished the week once again testing new all-time highs around 5650, the Nasdaq 100 remains rangebound in a symmetrical triangle or "coil" pattern. While this pattern does not necessarily suggest a potential next move for the QQQ, it did lead me to...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Thursday, September 19 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, September 19 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

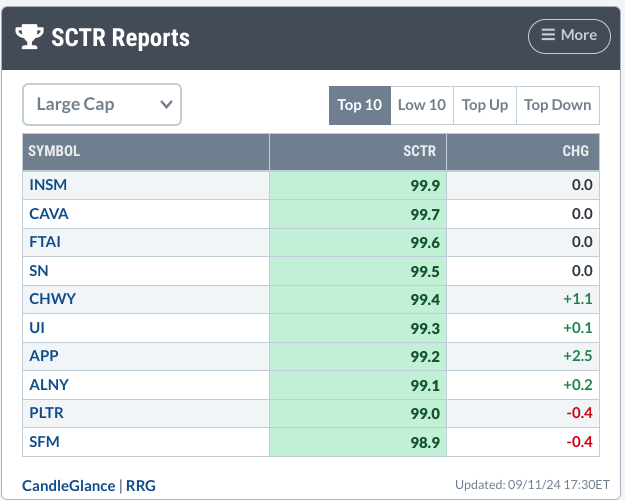

The SCTR Report: Insmed's Stock Hangs in the Balance—Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Insmed (INSM) has been near the top of the StockCharts SCTR report for weeks.

* Insmed's stock price has pulled back, but maintained its high SCTR score.

* Insmed could be posed for an upside move.

Numerous companies are making strides within their respective sectors, but, unless you...

READ MORE

MEMBERS ONLY

Biotech's Big Comeback: Why Investors are Eyeing This Beaten-Down Sector

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* With Fed rate cuts now widely anticipated, investors are looking to the biotech industry for potential investment opportunities.

* Biotech, a highly-speculative industry, has declined sharply since 2020 as inflation, along with higher interest rates, set in.

* You can spot green shoots of capital flowing into biotech; watch the...

READ MORE

MEMBERS ONLY

DP Trading Room: AI Bubble Deflating

by Erin Swenlin,

Vice President, DecisionPoint.com

The recent decline last week revealed that the artificial intelligence bubble is deflating. Magnificent Seven stocks are unwinding in response to investors losing confidence in the AI trade in general. Carl gives us a complete picture of the Magnificent Seven in the short and intermediate terms. It doesn't...

READ MORE

MEMBERS ONLY

Market Timing for a Rules-Based Strategy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Chartists need a market timing mechanism to assess risk

* Risk is above average during bear markets (preserve capital)

* Risk levels are acceptable during bull markets (invest capital)

Any strategy that trades stocks needs some sort of market timing mechanism to identify bull and bear markets. Typically, stock strategies...

READ MORE

MEMBERS ONLY

Four Intermarket Confidence Relationships that Aren't Confident

by Martin Pring,

President, Pring Research

Most of the primary trend indicators I follow are in a bullish mode and show few signs of flagging. That said, some intermarket relationships, which help to indicate whether the environment is risk-off or risk-on, have started to move in a risk-off direction. That's usually a bearish omen...

READ MORE

MEMBERS ONLY

Markets Nosedive Amid Recession Fears

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the current downtrend taking place in the S&P 500 and Nasdaq, and highlights the "uninverting" yield curve. She finishes with a deep dive into Nvidia, sharing how to handle the stock depending on your investment horizon.

This video...

READ MORE

MEMBERS ONLY

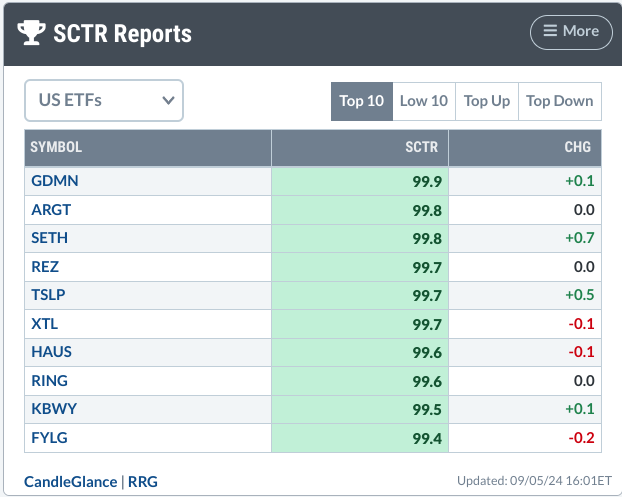

How to Spot a Golden Mining Opportunity Using SCTR Reports

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The SCTR Report highlighted two gold miner ETFs, indicating that the industry is seeing positive movement.

* A deeper dive into gold miner ETFs uncovers problems and opportunities.

* The ZigZag line applied to the chart of GDX helps identify entry and exit levels.

On Thursday afternoon, I dove into...

READ MORE

MEMBERS ONLY

The SCTR Report: Why TSLA Stock Sees Tremendous Strength

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tesla's stock price has been gaining technical strength, evident from its daily and weekly price charts.

* An analysis of Tesla's stock price shows a potential intermediate-term trading opportunity.

* Before entering a buy position, be sure to identify your entry and exit positions.

When the...

READ MORE

MEMBERS ONLY

How to Spot a Hedge Fund Trap: MicroStrategy's Dramatic Plunge

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* In March 2024, certain hedge funds began heavily shorting MicroStrategy stock.

* Microstrategy was a meme stock that surged 300% from February to March.

* While many investors got burned when Microstrategy's price tanked, there were clues that short sellers were taking over the stock.

In early 2024,...

READ MORE

MEMBERS ONLY

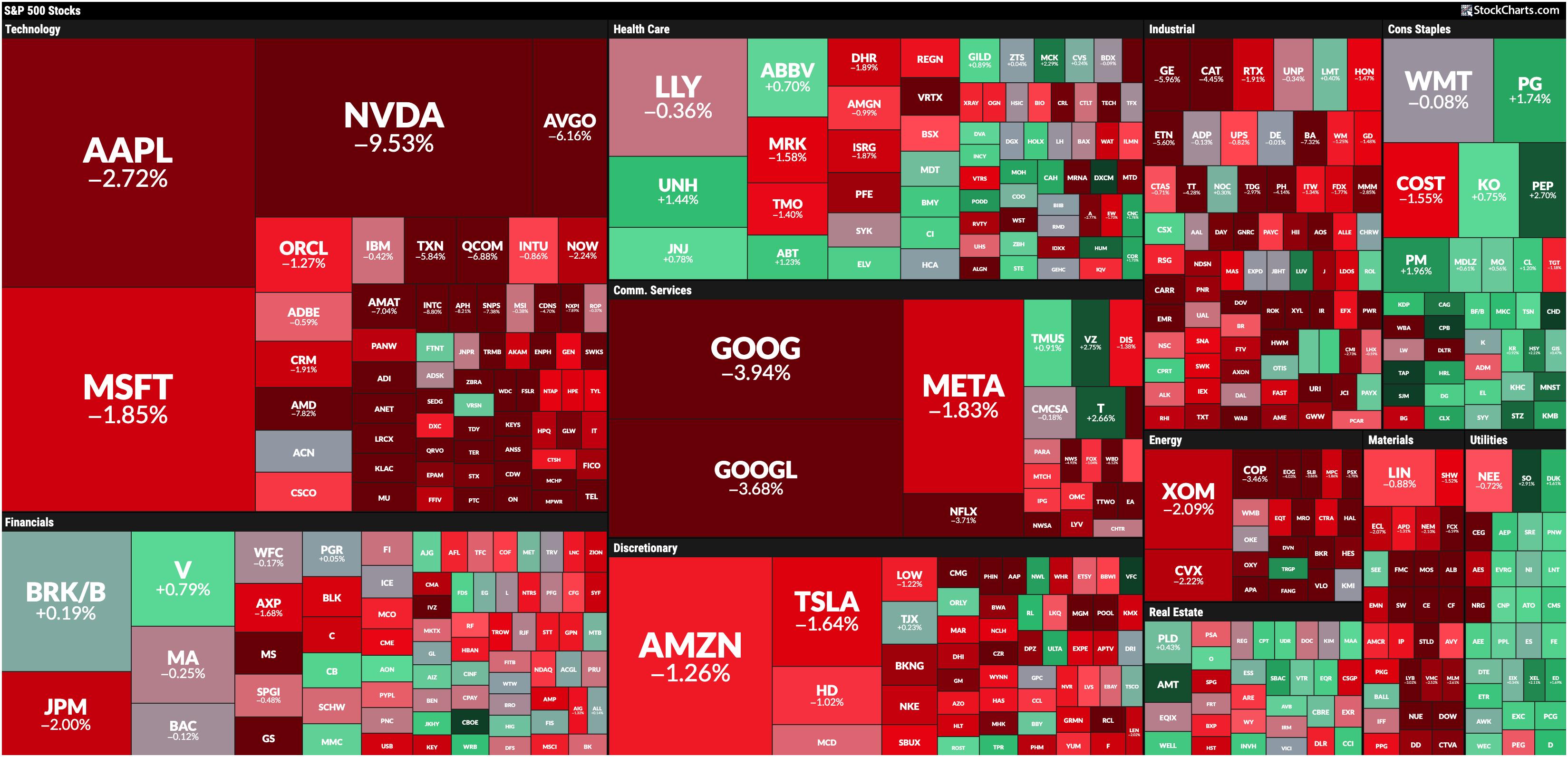

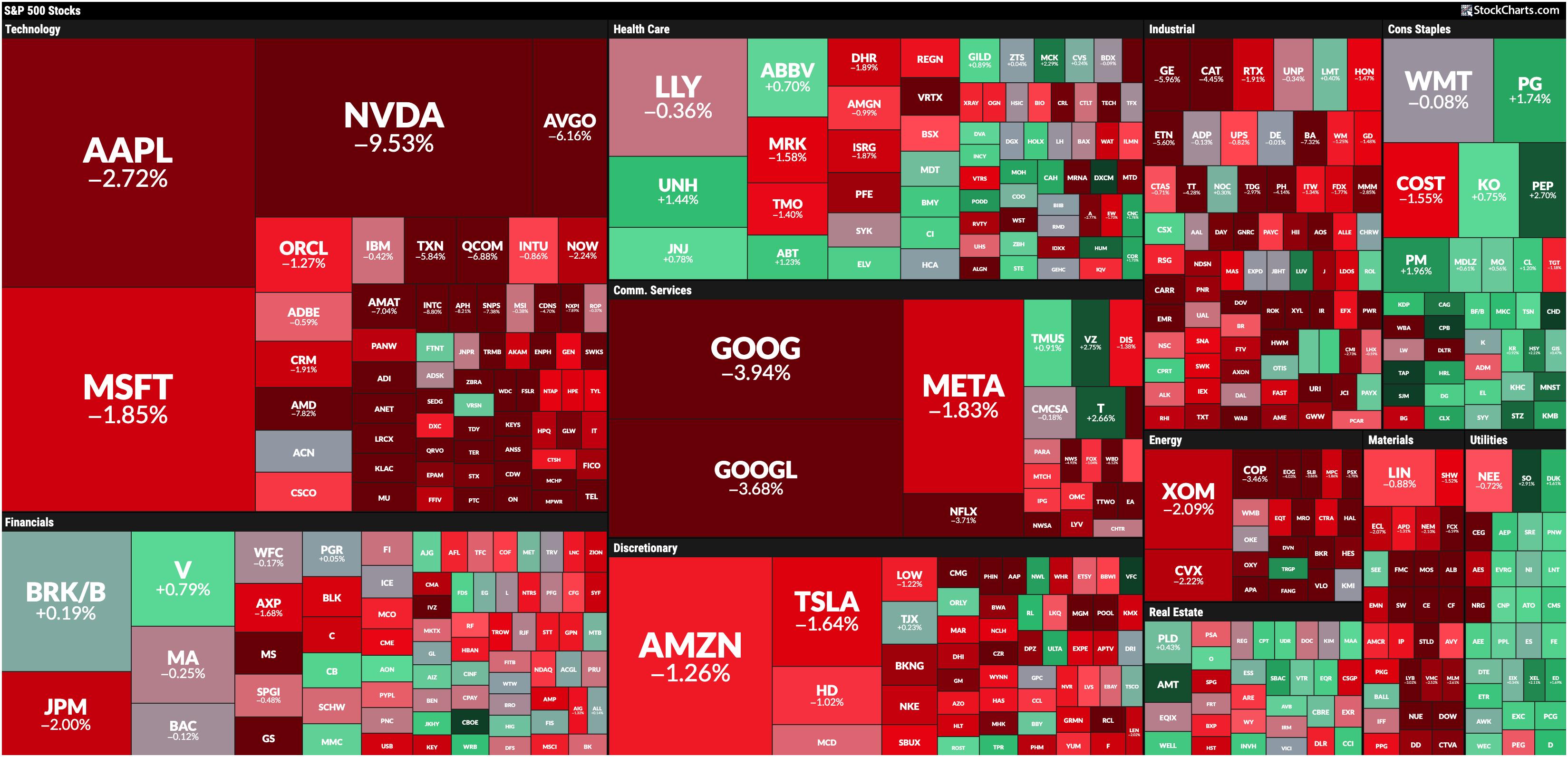

Stock Market Today: Tech Tumbles as Mega-Cap Stocks Get Hit by Major Profit-Taking

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Semiconductor stocks get slammed

* Volatility rises as investors become more fearful of more selling pressure ahead

* Investors should be extremely cautious as Broadcom earnings and Non-Farm Payrolls could impact the stock market

I hope you had a relaxing, restful long weekend, and welcome to September.

It was a...

READ MORE

MEMBERS ONLY

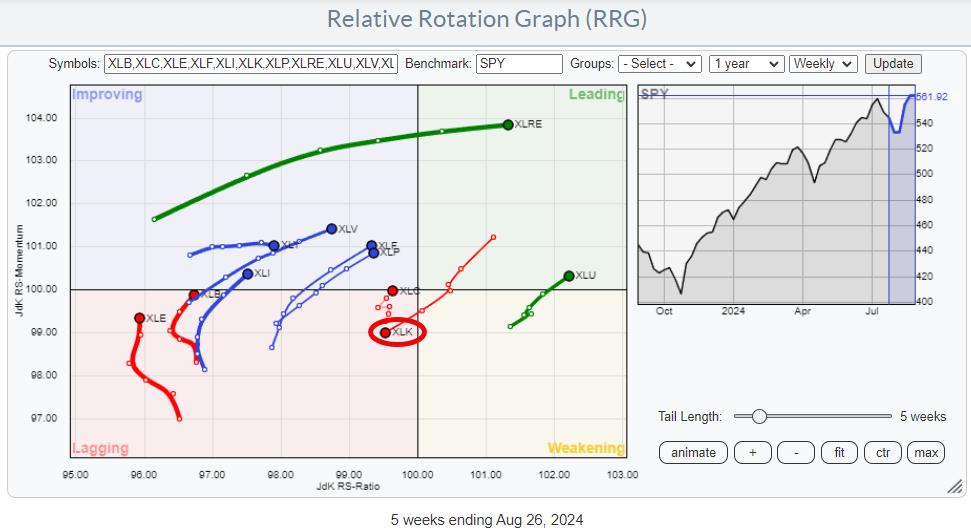

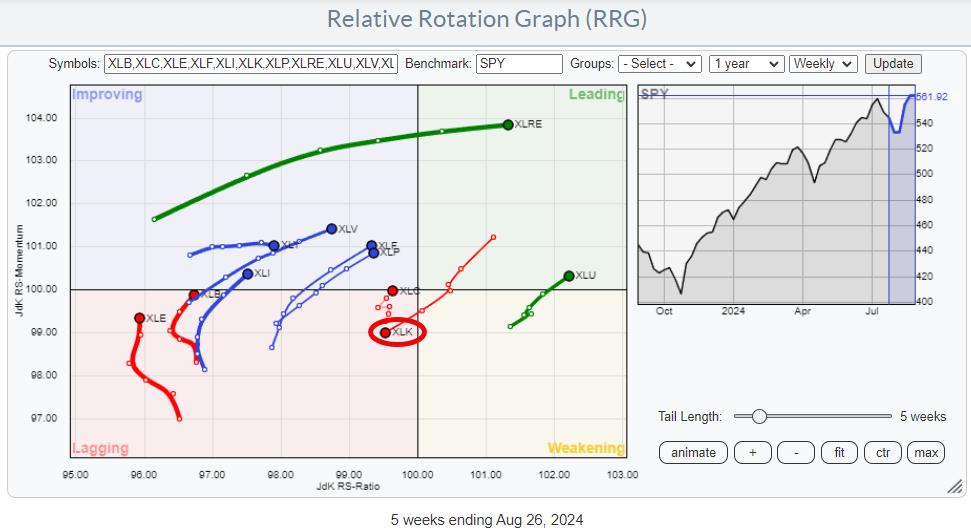

Why the S&P 500 Going Sideways is the Best Case Scenario

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius evaluates the completed monthly charts for August, noting the strength of defensive sectors. He then analyzes a monthly RRG and seeks alignment for the observations from the price charts. Could "sideways" be the most positive scenario for the S&P...

READ MORE

MEMBERS ONLY

Signing Off

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Signing Off

I want to thank the owner/President of StockCharts.com, Chip Anderson, and his son, Eric, for 25 years of friendship, over 10 years of writing 200+ articles in my "Dancing with the Trend" blog on StockCharts.com. StockCharts.com offers a giant selection of tools...

READ MORE

MEMBERS ONLY

Should You Buy the Dip in NVDA?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets, including NASDAQ weakness, and the outperformance in the equal-weighted S&P 500. She examines NVDA and shares how you should trade the stock depending on your investment horizon. Last up, Mary Ellen reveals top stocks in leadership areas....

READ MORE

MEMBERS ONLY

What Would a Top in Semiconductors Mean for the S&P 500?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A head-and-shoulders top pattern has to complete three phases before it can be considered valid.

* Even if semiconductors would complete this bearish price pattern, strength in other sectors suggests limited impact on the broader equity space.

After Nvidia (NVDA) dropped after earnings this week, investors are once again...

READ MORE

MEMBERS ONLY

NVDA is Not the Only Semiconductor Stock Out There

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is pushing against resistance.

* The technology sector is out of favor, and semiconductors are a drag for it.

* NVDA is big, but it is not the only semiconductor stock.

It's All Still Relative

The weekly Relative Rotation Graph, as it looks toward the close of...

READ MORE

MEMBERS ONLY

A Deeper Dive into the Dollar | Focus on Stocks: September 2024

by Larry Williams,

Veteran Investor and Author

Let's get this out of the way...

In our last Family Gathering, I announced I am doing my best to retire. That means we will have our September Family Gathering, the October newsletter and mid-month Family Gathering. After that, "Focus on Stocks" is all over.

I...

READ MORE