MEMBERS ONLY

The One Chart to Watch as S&P 500 Makes New All-Time Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As the S&P 500 and Nasdaq 100 have once again made new all-time highs, and the Dow Jones Industrial Average has briefly broken above the 40,000 level for the first time, how should we think about further upside for our equity benchmarks?

There are two general ways...

READ MORE

MEMBERS ONLY

Thrilling Week for the Stock Market: Dow Jones Makes Strong Close Above 40,000 for the First Time

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dow Jones Industrial Average closes above 40,000 for the first time

* Commodities such as silver, copper, and gold are moving higher

* Volatility remains low, indicating investors are complacent

It made it! The Dow Jones Industrial Average ($INDU) closed above 40,000 for the first time, another record...

READ MORE

MEMBERS ONLY

TOP 10 Stock Picks for May 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they run through the top 10 charts to watch in May 2024! They'll cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights...

READ MORE

MEMBERS ONLY

Gold and Silver Set to Smash Records: Could 2024 Be Their Biggest Year Yet?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold and silver are on the verge of breaking out toward record highs

* Gold and silver have reached most analyst price targets, but they could rise further

* From a technical perspective, gold and silver prices could smash above resistance levels

Gold is on the verge of breaking into...

READ MORE

MEMBERS ONLY

Bitcoin Sets Up with Classic Continuation Signal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Corrections within bigger uptrends are opportunities.

* Chartists can identify corrections using retracements and patterns.

* The pattern provides a clear resistance level to watch for a breakout.

There is a certain ebb and flow in uptrends. Often we see some sort of stair step higher with big advances and...

READ MORE

MEMBERS ONLY

Larry Williams: Dow 40k, Cycle Analysis, and Lessons Learned

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, legendary trader and author Larry Williams joins Dave in the StockCharts TV studio. Larry shares his latest thoughts on Dow 40K, the resilient rise of gold and precious metals, cycle analysis on the S&P 500 and crude oil,...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" May 16, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Certainty is needed for a trader's actions. Good judgment comes from experience, and experience is gained from poor judgment. The key to improving your trading is to really, truly study the losing trades.

In this month's Family Gathering video, Larry presents PPI numbers for historical buy...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 5: Security Selection, Rules, and Guidelines

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-first in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

Powerful Entry Strategy Using One Moving Average

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use one SMA to pinpoint great entries in pullback plays, demonstrating how it can develop in slightly different ways. He shows 3 different types of setups in the price action and its relationship to...

READ MORE

MEMBERS ONLY

Salesforce Falls Out of Favor: Trade the Bear Put Spread Options Strategy

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Salesforce stock will likely trade within the $210 to $220 area.

* A bear put spread is a strategy to consider if you want to take advantage of the stock trading between $210 and $220.

* With CRM's earnings about three weeks away, a bear put spread could...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, May 16 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, May 16 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

This is the #1 Options Income Strategy You Should Master

by Tony Zhang,

Chief Strategist, OptionsPlay

In this exclusive interview, StockCharts' Grayson Roze sits down with Tony Zhang, Chief Strategist at OptionsPlay. Tony shares an informative overview of the Covered Call Strategy, explains how it can be used to generate reliable income for your portfolio, and explores best practices for the strategy including expiration and...

READ MORE

MEMBERS ONLY

DP Trading Room: Bonds & Yields At An Inflection Point

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's focus was on the current and long-term conditions of Bonds and Yields which are at an inflection point. Yields are attempting to hold onto a rising trend and Bonds are plodding along to the upside for now. One reader asked if it is time to start dollar...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Bullish Flags

* Momentum Confirmation

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

Relative Strength Screams Bullish for This Tech Stock

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

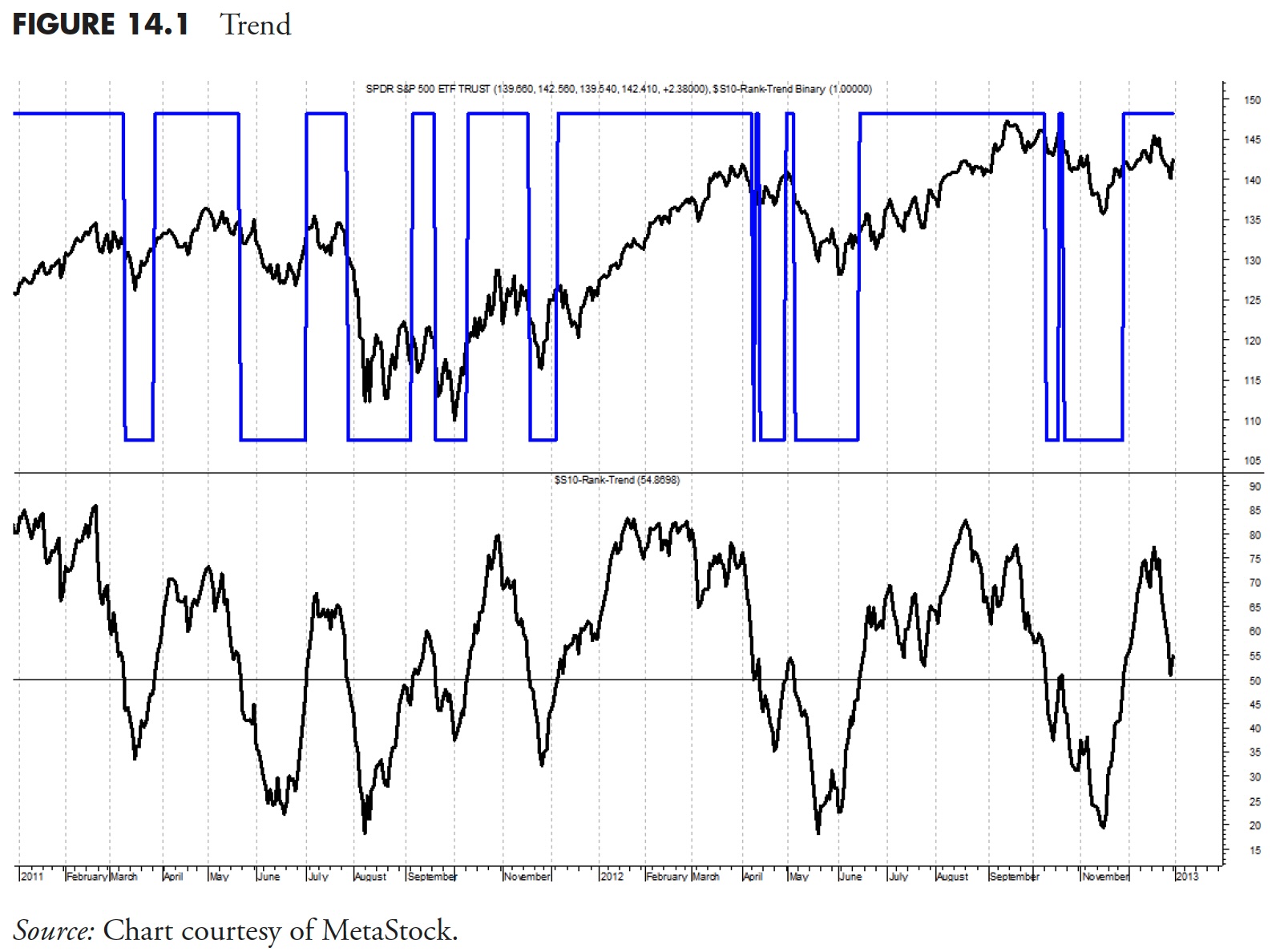

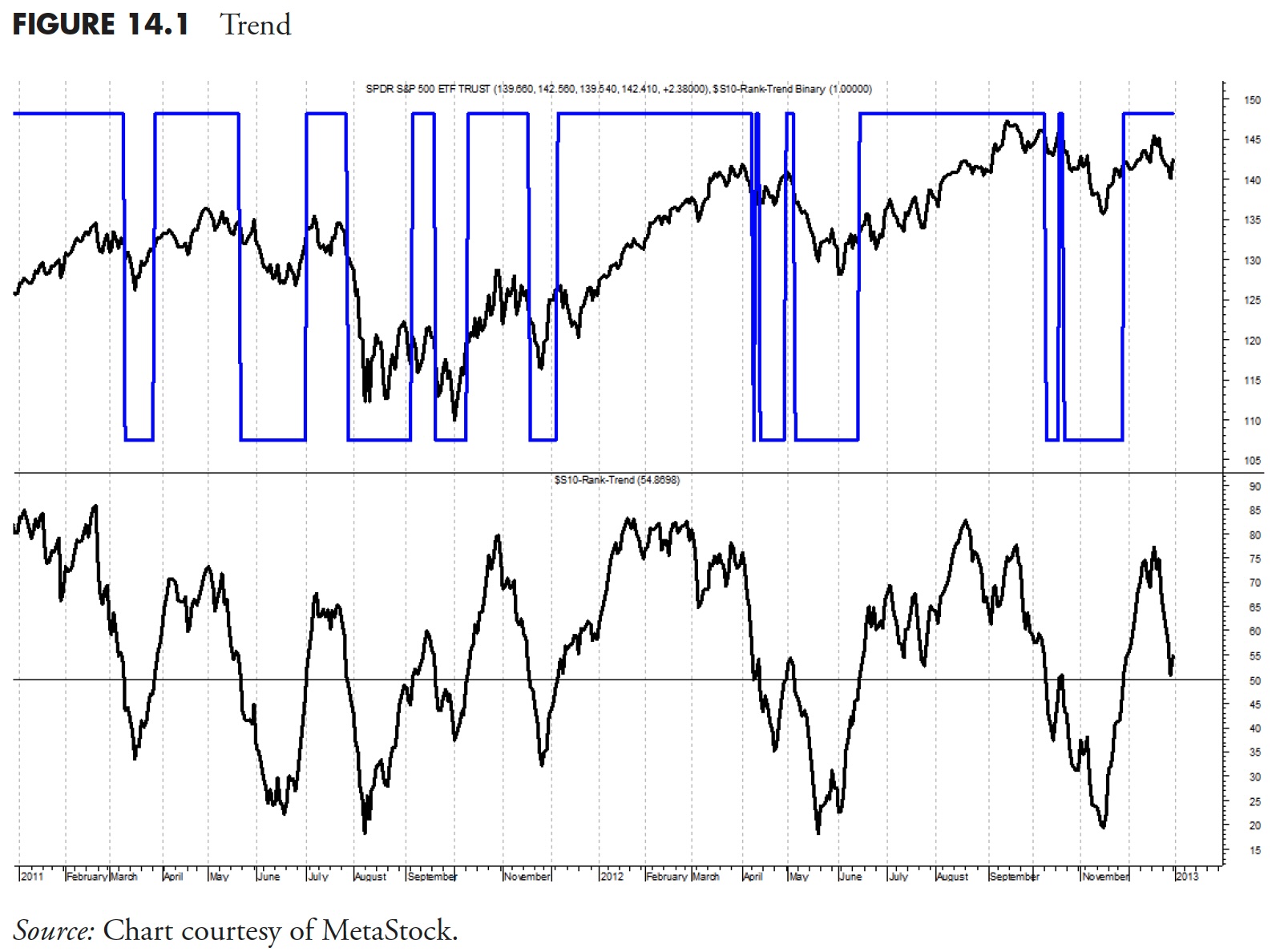

Rules-Based Money Management - Part 4: Security Ranking Measures

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twentieth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

What Rising Volatility Means to the Current Market

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how he uses a rising volatility condition to signal increased risk. He then discusses what needs to take place to offer a nice trading opportunity, and shows how to adjust your approach when volatility is increasing....

READ MORE

MEMBERS ONLY

Why Novo Nordisk's Stock Price Recovery Makes It a Promising Buy

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Novo Nordisk's stock price fell after its Q1 earnings report, but pivoted and reversed

* NVO stock could break above its all-time highs

* A couple of technical indicators can help confirm your buy decision

Novo Nordisk (NVO) reported Q1 earnings on May 2. Even though it was...

READ MORE

MEMBERS ONLY

DP Trading Room: Two Industry Groups To Watch!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin uncovers two industry groups that are showing strength and potential in the short term. She takes a look "Under the Hood" to reveal participation and trends that are quite bullish.

Carl walks us through the market overall, covering not only the SPY, but also interest rates,...

READ MORE

MEMBERS ONLY

MEM TV: NVIDA is Setting Up To SURGE

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

Key Breadth Indicator Flashes Buy Signal for Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave opens The Final Bar mailbag to answer viewer questions on the Nasdaq Bullish Percent Index, the value of long-term technical analysis techniques, how sentiment indicators relate to the market trend, and how the CMT program helped him improve his...

READ MORE

MEMBERS ONLY

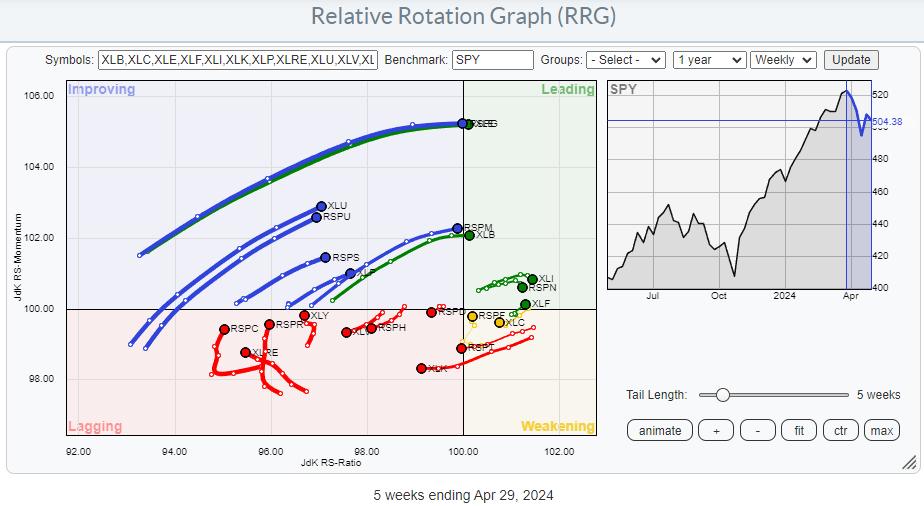

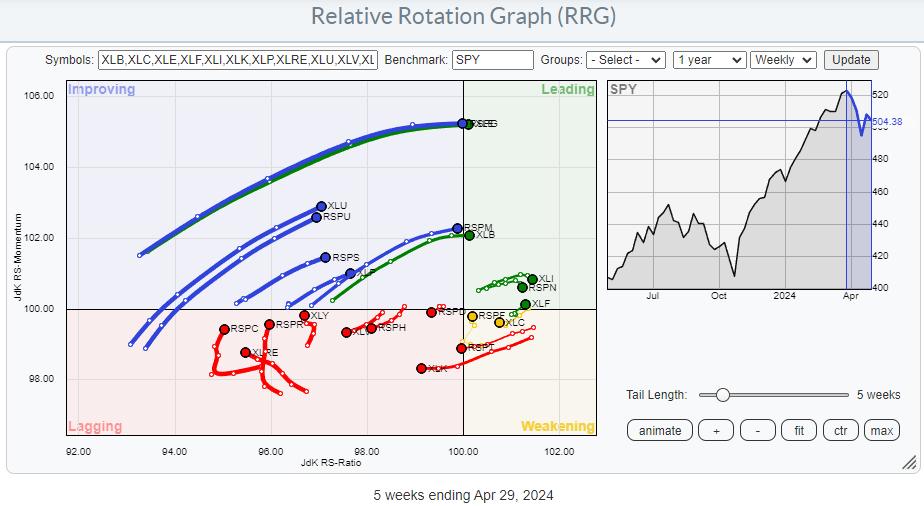

Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Comparing equal-weighted and cap-weighted sectors on a Relative Rotation Graph can offer interesting insights

* When the trajectory of the tails and their position on the chart differ significantly, further investigation is warranted

* At the moment, two sectors are showing such divergences

All on the Same Track... or?

The...

READ MORE

MEMBERS ONLY

AMD at a Crossroads: Buy Now or Brace for More Losses?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AMD stock plunged 7% after slightly topping Wall Street estimates

* There are three crucial turnaround levels to closely close monitor

* Momentum is key when deciding whether to go long, wait, or call off the trade

Advanced Micro Devices (AMD) slightly topped Wall Street's earnings and guidance...

READ MORE

MEMBERS ONLY

Time for a Pause in the Ongoing Dollar Bull Market? Or Full Steam Ahead?

by Martin Pring,

President, Pring Research

I last wrote about the dollar in December, where I came to the conclusion that a limited rally was a likely possibility in what was assumed to be a primary bull market. I am still of the view that the bull market is alive and well, but it's...

READ MORE

MEMBERS ONLY

Gain AN EDGE Over Other Traders with ADX/DI

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe breaks down the differences between buyers and sellers, and shows how the ADX/DI can be used in three different ways: The action phase, low ADX period and an expansion phase. Understanding this indicator will give you...

READ MORE

MEMBERS ONLY

35 Years of Crude Oil Forecasting the Future | Focus on Stocks: May 2024

by Larry Williams,

Veteran Investor and Author

All You Need to Know About Crude Oil and the Future

Gold, black gold, is what Crude Oil has become. The entire world runs on energy. 98% of our cars and transportation, our lights, the device you are using to read this... virtually everything we can do is thanks to...

READ MORE

MEMBERS ONLY

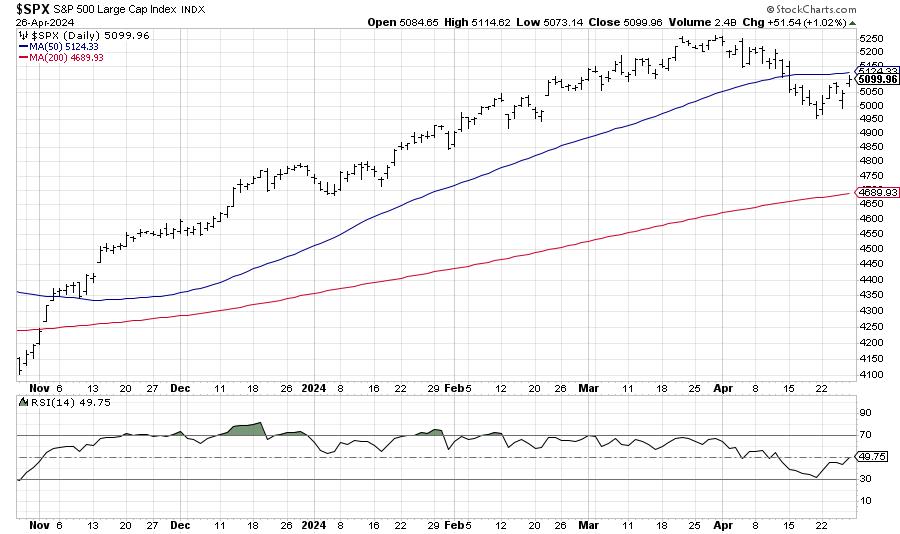

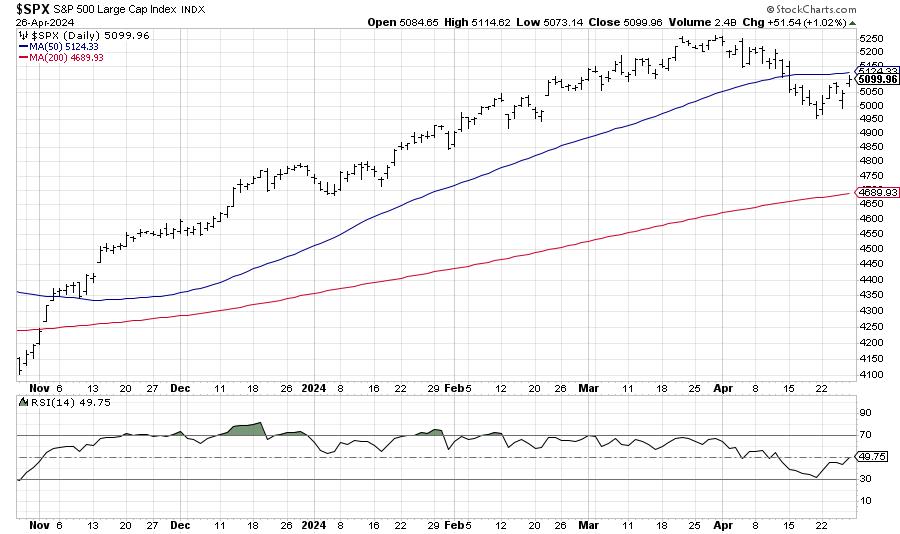

SPY's Pullback Continues: How To Know When It's Over

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The SPDR S&P 500 ETF (SPY) dipped lower after hitting resistance of its 50-day moving average

* There are three key turnaround levels to watch closely to determine if the pullback is over

* Breadth indicators can identify when the buyers are back

What's a trader...

READ MORE

MEMBERS ONLY

Stocks Plunge with Key Earnings on Tap

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Gina Martin Adams, CMT CFA of Bloomberg Intelligence. David highlights a spike higher in the VIX, and charts names for earnings including AMZN, AMD, SMCI, SBUX, MCD, PYPL, and ETN. Gina shows how rising interest rates continue to...

READ MORE

MEMBERS ONLY

DP Trading Room: Intermediate-Term View of the Magnificent 7

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl puts the spotlight on the Magnificent 7 with a look at not only the daily charts, but also a review of the intermediate term using weekly charts. See where they are headed short-term and what are our expectations are in the intermediate term.

Carl also gave us his...

READ MORE

MEMBERS ONLY

S&P 500 Makes a New All-Time High By End of June?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We've been covering the signs of weakness for stocks, from the bearish divergences in March, to the mega-cap growth stocksbreaking through their 50-day moving averages, to even thedramatic increase in volatilityoften associated with major market tops. While Q1 was marked by broad market strength and plenty of new...

READ MORE

MEMBERS ONLY

DEFENSE IS ON THE FIELD | GoNoGo Show APRIL 26, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Defensive Sector Leadership

* Risk Off Macro Environment

* Opportunities in Electricity Utilities Companies

Chart Above (XLU:SPY) highlights trending relative strength of Utilities Sector. Watch Video below for details:

The S&P500 trend conditions have continued this week in "NoGo" conditions despite relief rallies. Alex Cole...

READ MORE

MEMBERS ONLY

S&P 500 & Nasdaq Composite Approach Critical Resistance; Watch for These Important Levels!

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Nasdaq Composite is trading above its last swing high, which could a the first sign of a reversal to the upside

* The S&P 500 is up against resistance from its 50-day moving average and a downward sloping trendline

* The Dow Jones Industrial Average has reversed...

READ MORE

MEMBERS ONLY

Analyzing Alphabet's Surge — Here's How to Get In Earlier Next Time

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Alphabet shocked Wall Street on Thursday when it reported earnings, its first dividend, and a $70-billion buyback

* The stock gapped up 16%, its biggest since 2015

* Alphabet's technical "undervaluation" and quirks signaled the go-ahead to go long

Using technical indicators to identify stocks fundamentally...

READ MORE

MEMBERS ONLY

META's Reverse Island - Two More Mag Seven Islands to Monitor

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

Whenever we see price gapping up or down, as happened with META in February, we prepare for the possibility of an island reversal. After the gap up, price forms a cluster, the island, and we ponder the possibility of a gap down to complete the reversal. During the formation of...

READ MORE

MEMBERS ONLY

Analyzing the SPY: How to Know When the Pullback is Over

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* SPY is trading within a downward channel in the daily chart and has equal odds of breaking out in either direction

* The weekly chart shows the uptrend is still in play and SPY is going through a healthy correction

* Analyze different index and sector exchange-traded funds to identify...

READ MORE

MEMBERS ONLY

What's Really Driving Tesla's Surprising Stock Surge?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* TSLA has been riding a long and volatile downtrend since 2021

* Tuesday's earnings were dismal, yet the stock jumped 16% after an announcement about near-term EV production

* The big question is if the gap up in TSLA's stock price has any substance or if...

READ MORE

MEMBERS ONLY

Buy the Dip or Sell the Rip?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Bret Kenwell of eToro. Bret shares the levels he's watching for AAPL and AMD, speaks to this week's bounce higher, and points out why Energy still shows long-term strength. David breaks down earnings names...

READ MORE

MEMBERS ONLY

Weak Charts Keep Getting Weaker

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave examines names making moves in the market like Tesla (TSLA), Verizon (VZ), and Nucor (NUE). Explore the world of equity benchmarks and learn how large caps, mid caps, and small caps can offer unique opportunities based on sector rotation...

READ MORE

MEMBERS ONLY

DP TRADING ROOM: Find Shorts Using the Diamond Dog Scan

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin shared her Diamond Dog Scan that she uses to find shorting opportunities. She was able to uncover five possible shorts. She discusses each chart and let's you know what she looks for in a good short.

Carl did the market overview with special attention paid to...

READ MORE