MEMBERS ONLY

Don't Bet on Lower Rates

by Martin Pring,

President, Pring Research

To paraphrase the late great contrarian Humphrey Neil: When everyone thinks alike, it's usually time to look for a turn in the market.

It seems to me, after reviewing an unscientific survey of the financial media, that everyone and his dog (no disrespect to our canine friends) is...

READ MORE

MEMBERS ONLY

DP Trading Room: Shake Up at Boeing (BA)

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin reviewed the Boeing (BA) chart together discussing the technical ramifications of the step down of the CEO and two other board members. We do note that the CEO will finish out the year so problems could continue throughout the year. The technicals on the chart are...

READ MORE

MEMBERS ONLY

An Indicator to Define the Trend and Quantify Momentum

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 200-day SMA is perhaps the most widely used long-term moving average. As its name implies, it is a simple indicator that chartists can use for trend-following and momentum strategies. For trend-following, we just need to know where prices stand relative to the 200-day SMA. For momentum, we need to...

READ MORE

MEMBERS ONLY

Look Out Below! The Bear Case For Apple

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* While the long-term trend in Apple has been quite strong, the weekly charts shows a clear double-top pattern with declining momentum.

* Our Market Trend Model currently reads short-term bearish, medium-term bearish, and long-term bullish.

* A break below price support around $169 could open the door to further downside,...

READ MORE

MEMBERS ONLY

MEM TV: Get In EARLY! These Areas Are Seeing LIFT OFF

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's shaping up in the broader markets after the Fed announced their rate cut plans. She also shares how to use ETFs to shape your investment decisions for the longer term. In addition, Mary Ellen...

READ MORE

MEMBERS ONLY

The Best Leading Indicator for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave brings you another mailbag show! Explore the differences between RSI and Accumulation Distribution for stocks. Compare the benefits of SharpCharts or ACP on StockCharts. Understand the nuances between Keltner and Bollinger Bands. Discover why considering sector trends and using...

READ MORE

MEMBERS ONLY

Post-Fed Rally Ignites Flurry of New Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave comments on AAPL's breakdown on antitrust legislation, the breakouts occurring in the homebuilder space, and how to play names like WDC gapping into key resistance levels. Guest Chris Verrone of Strategas Research Partners compares the S&...

READ MORE

MEMBERS ONLY

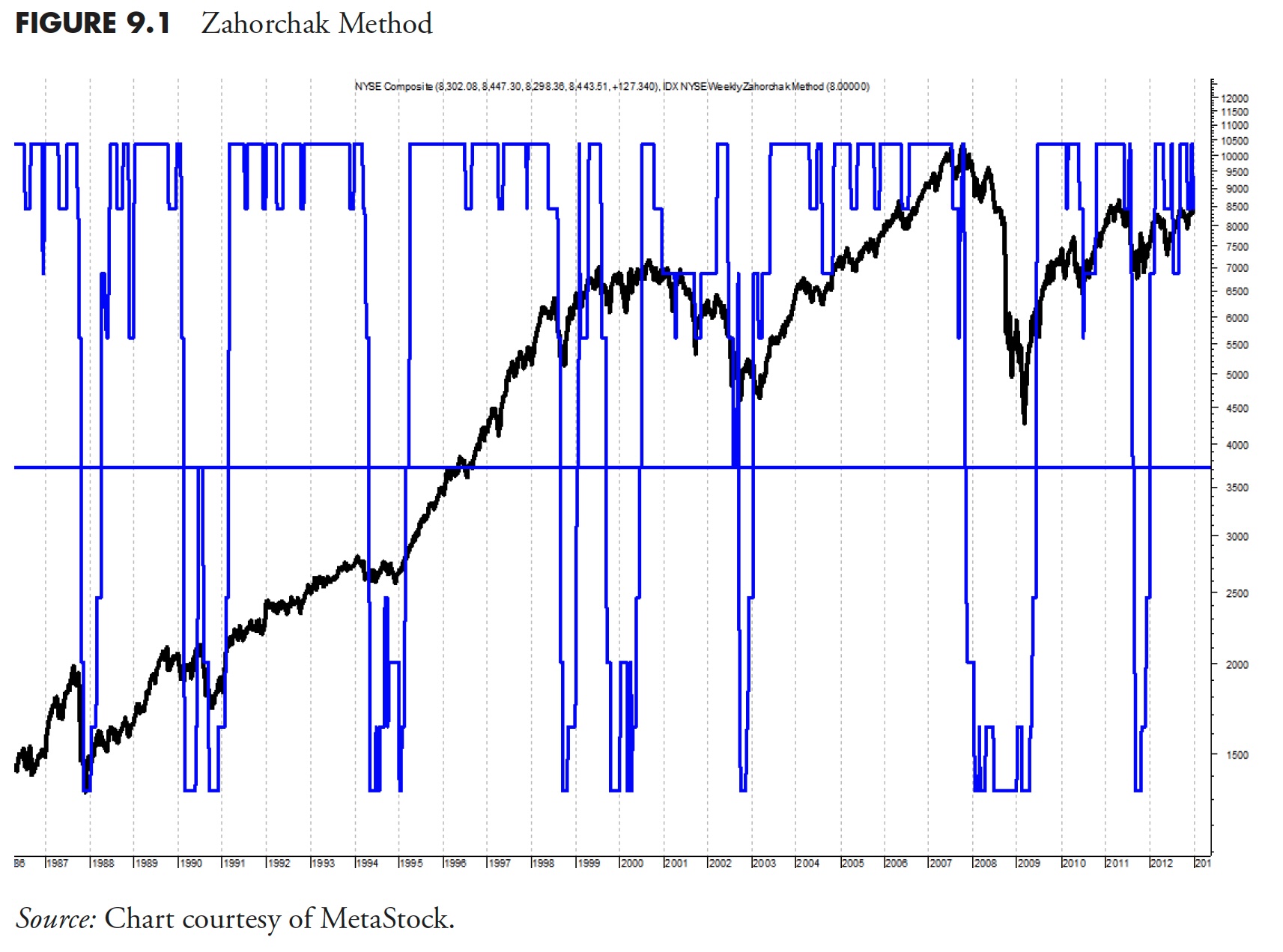

Market Research and Analysis - Part 2: Using Technical Indicators

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

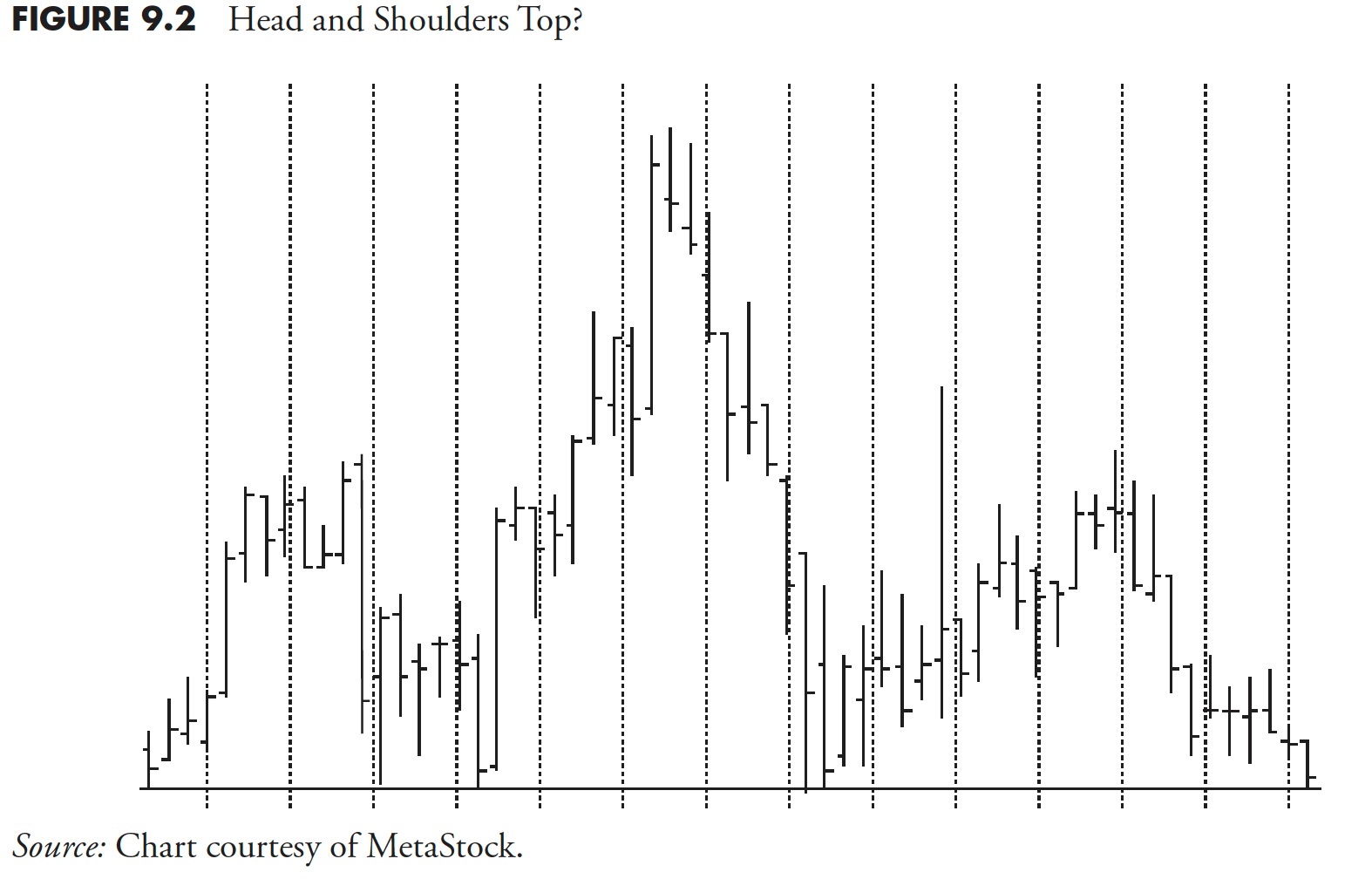

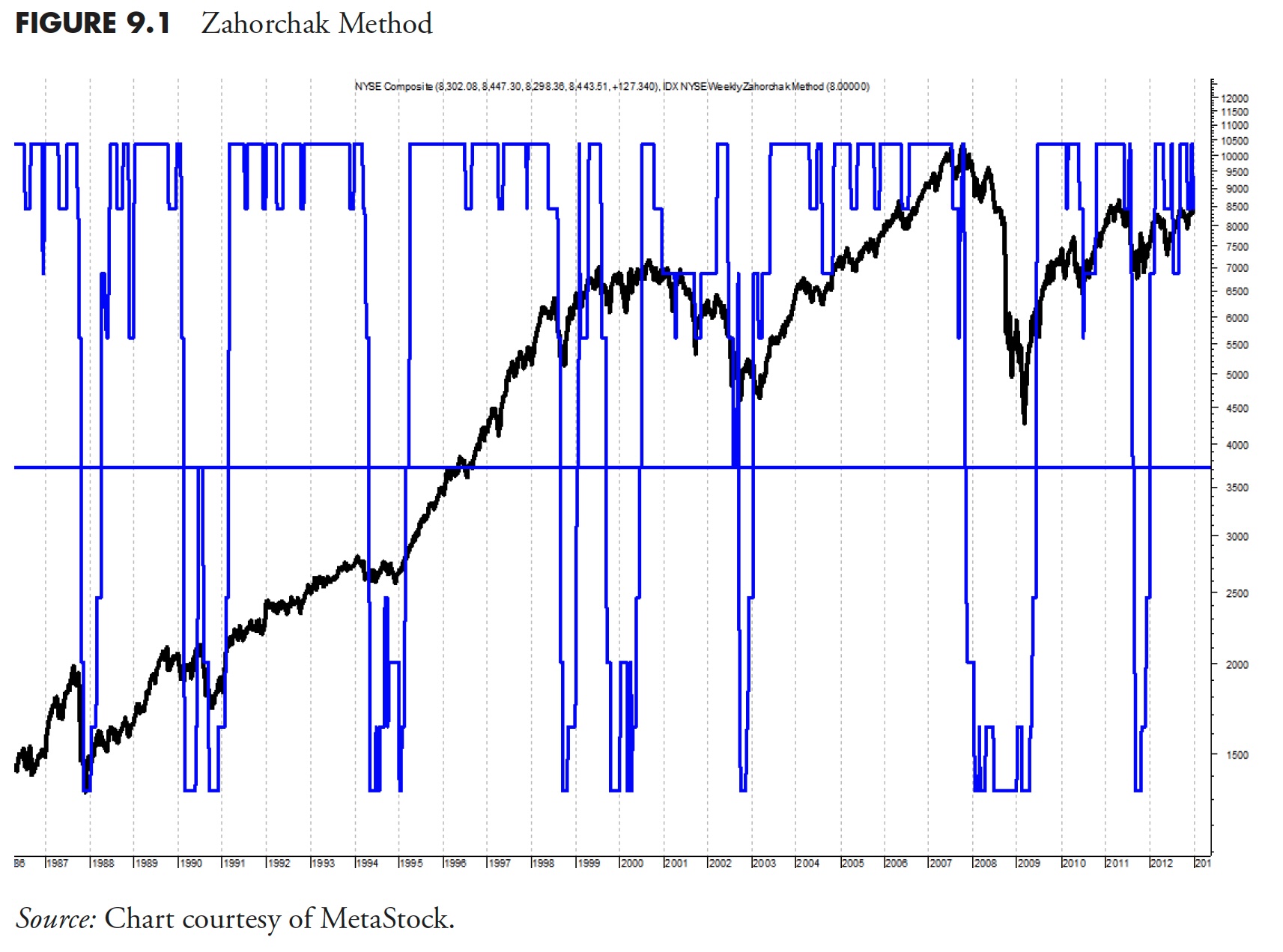

Note to the reader: This is the thirteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Top Candlestick Pattern For Entries

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe demonstrates how to use the "Big Green Bar" candlestick pattern. This candlestick provides great confirmation on certain types of entry points, and can also be helpful for exits. Joe finishes up the show covering the...

READ MORE

MEMBERS ONLY

Market Rips Higher After Fed Announcement

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the S&P 500's first close above the 5200 level as risk assets pop higher following Fed Chair Powell's comments this afternoon. He digs into market breadth indicators, which remain bullish on short-term,...

READ MORE

MEMBERS ONLY

Coinbase Stock Didn't Crash, But the Trade Still Raked in Cash

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Technical indicators suggested that Coinbase stock was due for a pullback

* The scenario identified a clear short setup with multiple price targets and stop-loss levels

* Coinbase eventually dipped but the risk may have been greater than the reward

As a trader, calling market tops (or bottoms) is a...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" March 19, 2024 Recording

by Larry Williams,

Veteran Investor and Author

It's March Madness in the stock market!

In this video, Larry begins by presenting his Trading Days of the Month (TDOM) for the rest of March, as well as the days to hold back on trading. He also presents what he dubs his "Machu Picchu" trade....

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

How Would YOU Rank the Magnificent 7 Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the continued leadership rotation from growth to value, with SMCI breaking below $1000 and GOOGL dropping a shooting star candle on Monday's session. He walks through a process to compare and contrast the Magnificent 7 stocks,...

READ MORE

MEMBERS ONLY

DP Trading Room: Use a Price Momentum Oscillator (PMO) Sort to Find Winners!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin open the show with an example of how you can find stock and ETF relative strength using a Price Momentum Oscillator (PMO) sort. Many may not know but PMO readings can be compared to one another to determine relative strength.

Carl gives us a review of...

READ MORE

MEMBERS ONLY

How To Profit From Bullish Gap-Down Reversals

by Mary Ellen McGonagle,

President, MEM Investment Research

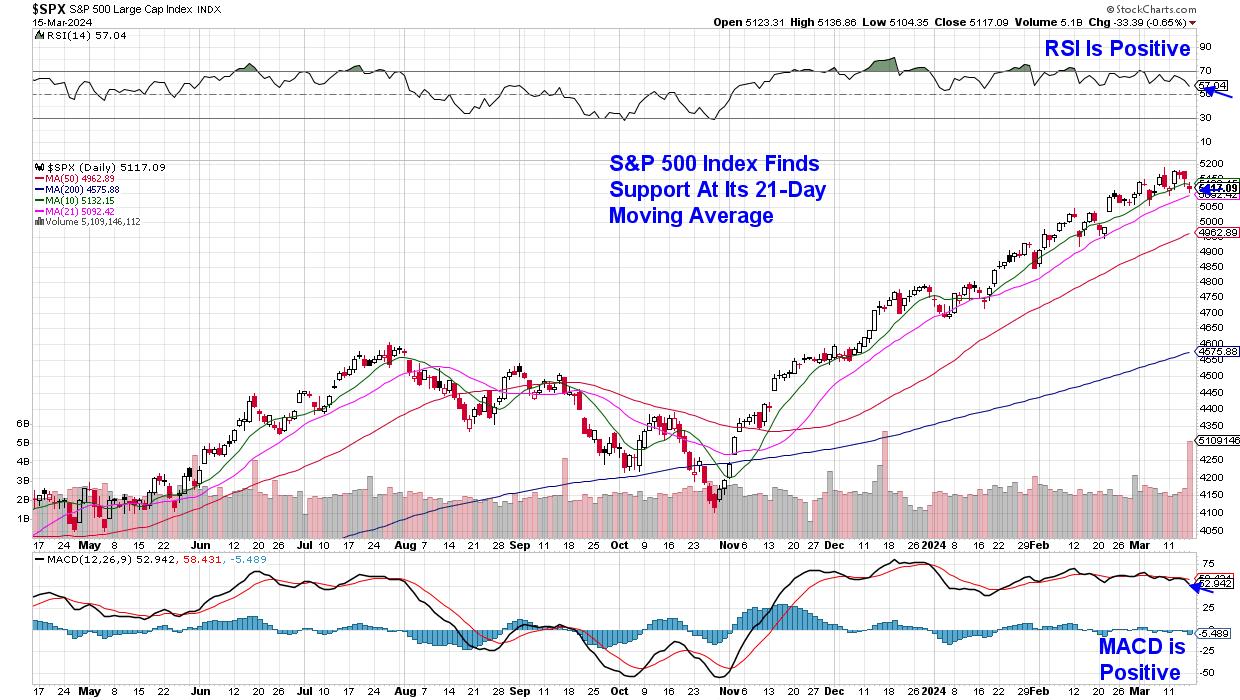

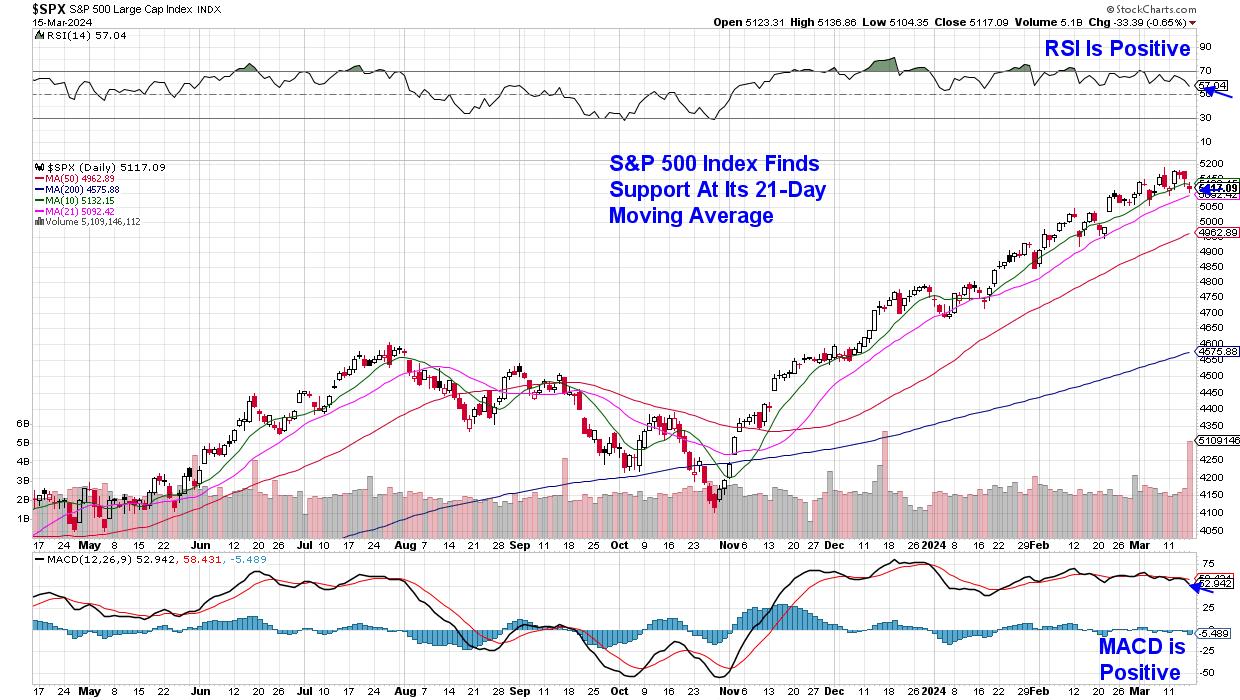

The S&P 500 ended the week with a slight pullback that has this Index closing below its key 10-day simple moving average, but above its 21-day moving average. With the RSI and MACD in positive territory, the near-term uptrend in this Index remains in place. While last week&...

READ MORE

MEMBERS ONLY

Stop Trading In The WRONG DIRECTION With This Simple Rule

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shares a little trick out of his own process to make sure he's trading in the right direction. If you find yourself buying a new stock only to watch it go down, down, down...

READ MORE

MEMBERS ONLY

What's the Downside Risk for QQQ?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A bearish momentum divergence and declining Bullish Percent Index suggests rough waters ahead for the QQQ.

* The 50-day moving average and Chandelier Exit system can serve as trailing stops to lock in gains from the recent uptrend.

* If stops are broken, we can use Fibonacci Retracements to identify...

READ MORE

MEMBERS ONLY

Spot The Warning Signs of Bankruptcy!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents an in-depth discussion on technical analysis patterns, market trends, and risk management. Explore how to spot bankruptcy risks, candlestick patterns, Dave's approach to QQQ, optimizing the Market Trend Model, RSI and MACD signals, "master risk...

READ MORE

MEMBERS ONLY

Oil & Gas Equipment & Services ETF Resumes its Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Oil & Gas Equipment & Services ETF (XES) is showing strength here in March as it breaks back above its 40-week SMA. More importantly, the long-term trend is up and this week's breakout argues for a continuation of this uptrend.

The chart below shows XES with a...

READ MORE

MEMBERS ONLY

Missed Out on Micron's 112% Surge? Here's Your Second Chance!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Micron's AI game just got started and is looking to heat up as it provides key components to both Nvidia and Advanced Micro Devices

* MU's price, however, has begun to pull back as bulls look for a favorable entry point

* Using a bearish StockCharts...

READ MORE

MEMBERS ONLY

These Signals Will Improve Your Timing!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the MACD crossover signal and the Pinch play signal. There are times when one is better than the other, and he uses several examples to show this distinction. He discusses how the low...

READ MORE

MEMBERS ONLY

Market Research and Analysis - Part 1: Why Technical Analysis?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twelfth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Tuesday, March 19th at 2:00pm EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Tuesday, March 19 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

Is Coinbase Stock About to Crater? Here's One Way to Exploit It

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Coinbase's (COIN) stock is blasting off, hitting a jaw-dropping 99.6 SCTR score.

* The pin bar (most current bar) seems like a desperate attempt for the bulls to advance the stock amidst being potentially outnumbered by sellers.

* Ready to go on the offensive? Here's...

READ MORE

MEMBERS ONLY

The Business Cycle is Edging its Way to a More Inflationary Stage

by Martin Pring,

President, Pring Research

Last week, I pointed out the inflationary consequences of the recent gold breakout, as gold market participants initially expect prices to firm up in the commodity pits and later the CPI itself. This week, we will take those thoughts a step further by relating swings in industrial commodity prices to...

READ MORE

MEMBERS ONLY

WFC Stock: A Step-By-Step Analysis to Better Time Your Entry

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Wells Fargo stock hits a new all-time high

* The Financial sector has been gaining strength with several big bank stocks displaying positive movement

* Momentum in WFC may be strong now but a slowdown could mean a big pullback since the stock is trading above its average price movement...

READ MORE

MEMBERS ONLY

DP Trading Room: Semiconductors - SOXX v. SMH, They're Not the Same

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and Erin explore the differences between two Semiconductor ETFs, SOXX and SMH. They are NOT the same. One offers far more upside potential than the other. Learn how to easily compare two ETFs or even two stocks using relative strength.

Carl covered the market in general with special attention...

READ MORE

MEMBERS ONLY

Bearish Engulfing Pattern Marks Top For NVDA?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

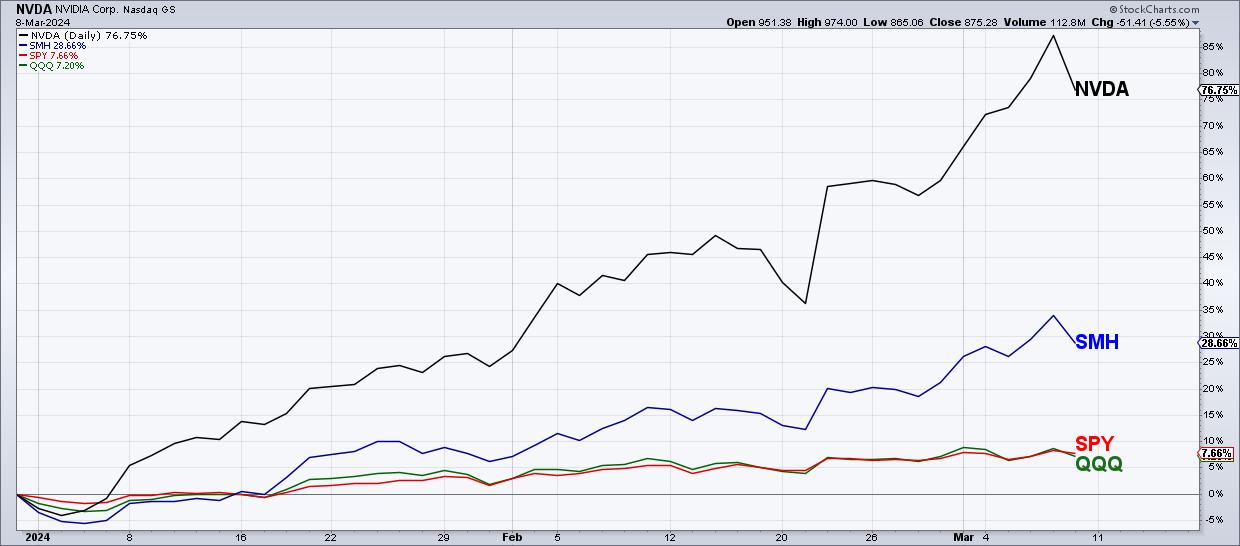

KEY TAKEAWAYS

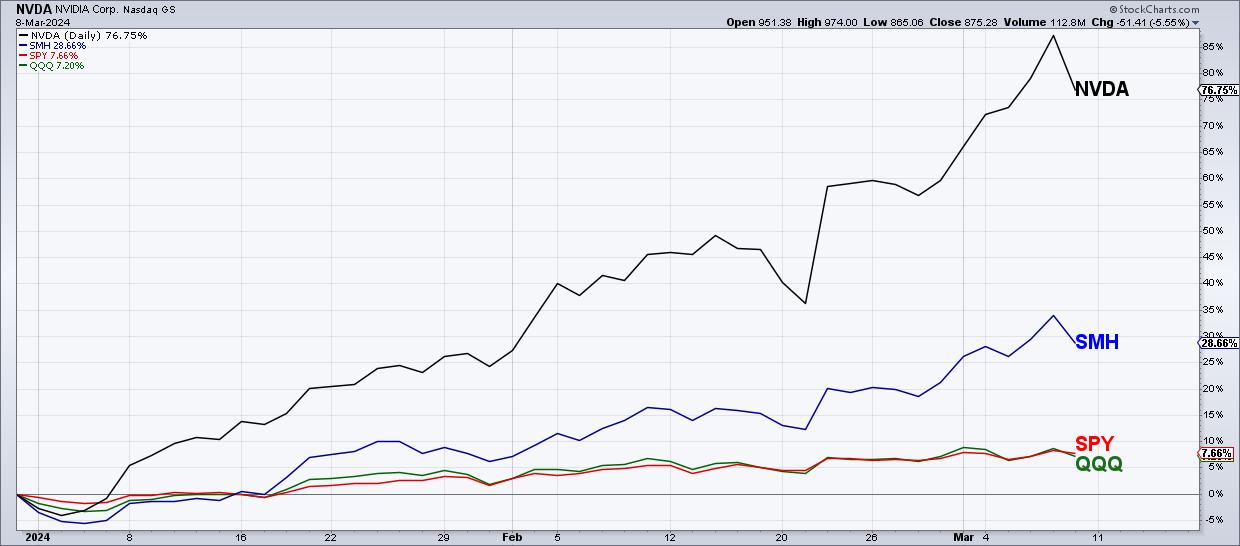

* Nvidia is up 77% year-to-date, far outpacing the S&P 500 and Nasdaq which are both up about 7-8%.

* A bearish engulfing pattern is a two-bar candle pattern indicating short-term distribution and negative sentiment.

* Downside targets for NVDA can be identified using trendlines and Fibonacci retracements.

Large-cap...

READ MORE

MEMBERS ONLY

The Halftime Show: 100th and LAST Show!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Pete presents the 100th and final edition ofStockCharts TV'sHalftime! This week, Pete shares some parting tips on what to look for when the trends change from defense, (risk off) to offense (risk on). He explains how he saw them coming and how the Chaikin Power Gauge did as...

READ MORE

MEMBERS ONLY

Find Stocks That Are BEATING The S&P 500 - In Just One Click!

by Grayson Roze,

Chief Strategist, StockCharts.com

Feel like you never find those high-flying stocks before they make their big moves? This week's edition of StockCharts TV'sStockCharts in Focus is for you! Grayson walks you through the 3 simple steps he uses to find, track and trade the market's strongest stocks...

READ MORE

MEMBERS ONLY

What Happened to NVIDIA (NVDA)?

by Erin Swenlin,

Vice President, DecisionPoint.com

NVIDIA (NVDA) was enjoying quite a rally to start the day. All seemed right with the world. Someone recently said to me, regarding another company, that it was "a victim of its own success." This is what happened to NVDA.

It appears that the ceiling was reached for...

READ MORE

MEMBERS ONLY

Top 10 Actionable Charts to Watch 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Grayson and Dave run through the 10 charts they feel present actionable opportunities based on their technical analysis setups. They'll cover breakout strategies, moving average techniques, relative strength, and much more. And you'll have ten new...

READ MORE

MEMBERS ONLY

Ozempic Set the Stage, But Could Novo's Newest Drug Be the Real Moneymaker?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Novo Nordisk A/S (NVO) has been riding a strong uptrend since 2017, fueled by its Ozempic drug.

* This last week, positive results for its new drug, amycretin, transformed the Ozempic fever into a Wall Street frenzy.

* Technical and fundamental buy points seem to be at odds if...

READ MORE

MEMBERS ONLY

Clear Split in NY FANG+ Universe Offers Pair Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* NYFANG+ Index at elevated levels in strong uptrend.

* New long positions are exposed to high risk.

* I found a pair trading opportunity within the NYFANG universe to avoid directional market risk.

It is no secret that the NYFANG+ Index is still in in incredible up-run after bottoming out...

READ MORE

MEMBERS ONLY

How To Stop Missing Trades Using Price Alerts

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how to use StockCharts price and advanced alerts to help you stop missing trades. He explains why he uses alerts of all kinds on stocks he is interested in buying, as well as current holdings. This...

READ MORE

MEMBERS ONLY

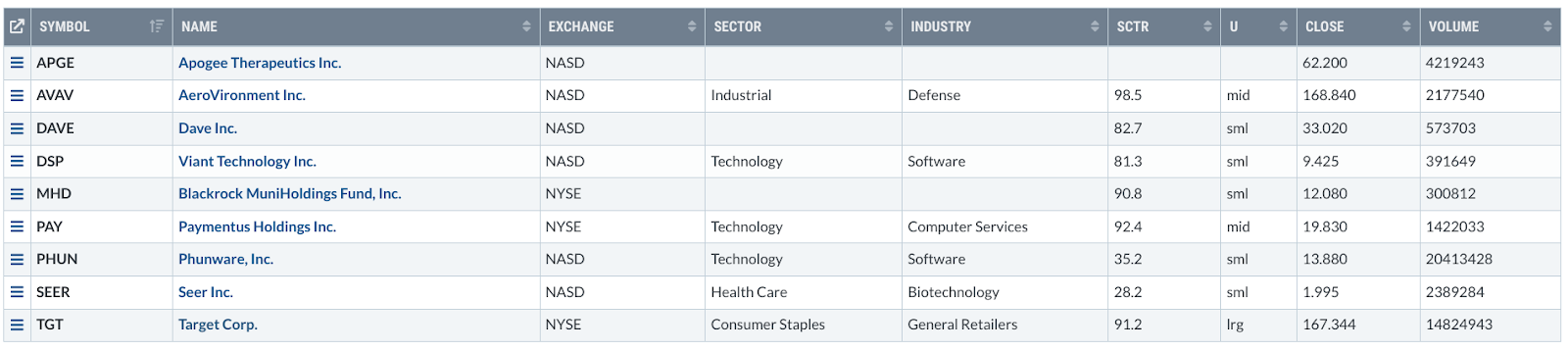

Target's Stock Defied Gravity When the Market Tanked: Timely Buy or FOMO?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Target Corp (TGT) bucked the trend on Tuesday, popping 13% despite a broader market selloff.

* Investors jumped in despite the retailer's weak 2024 guidance.

* A potentially strong entry point for TGT rests on two factors, one technical and the other fundamental.

On Tuesday, Target Corp (TGT)...

READ MORE

MEMBERS ONLY

DP Trading Room: Must See Gold Charts!

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl begins today's show with a walk through General Electric (GE) which was in the news this week. See what Carl thinks of the charts!

Carl covers the market in general and pays particular attention to Gold as it launches skyward. Can this run continue? What does this...

READ MORE

MEMBERS ONLY

How I Found SMCI BEFORE the Stock Gained Over 205% (in 3 Simple Steps!)

by Grayson Roze,

Chief Strategist, StockCharts.com

Feel like you never find those high-flying stocks before they make their big moves? This week's edition of StockCharts TV'sStockCharts in Focus is for you! Grayson walks you through the 3 simple steps he uses to find, track and trade the market's strongest stocks...

READ MORE

MEMBERS ONLY

Could This Stock Be the NEXT NVDA?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave wraps up his Dubai journey with a special Viewer's Questions Mailbag edition! Dave explores whether LABU is on the path to mimic NVIDIA and if it's still the right time to jump in. He also...

READ MORE