MEMBERS ONLY

Three Ways to Trade NVIDIA: Which One Gives You the Best Risk/Reward

Tech took a hit, but all's not lost. Here's what NVIDIA's chart is indicating and how you can use options to trade the pullback with confidence.... READ MORE

Tech took a hit, but all's not lost. Here's what NVIDIA's chart is indicating and how you can use options to trade the pullback with confidence.... READ MORE

Which stocks could benefit the most if trade tariffs are rolled back? Dave highlights ten potential winners—including CAT, NKE, and more—and shows how to use StockCharts tools to uncover trend strength and opportunities.... READ MORE

The Nifty is in a state of flux, testing its symmetrical triangle pattern. Could an uptrend be on the horizon, or will we see incremental downside?... READ MORE

Grayson Roze and David Keller share ten charts to watch for November, including setups in Celsius, Regeneron, Caterpillar, Eli Lilly, and Shopify. Learn how they use StockCharts tools and trend analysis to locate strength and manage risk in a stretched bull market.... READ MORE

Following a rangebound week, the Nifty's technical structure remains bullish, but there's signs of fatigue. Will it breakout, or see corrective moves?... READ MORE

Grayson Roze shows how to become the laziest chartist possible—without losing performance. Learn how StockCharts’ sample charts, chart packs, and scans can instantly build a pro-level setup in your account.... READ MORE

Before We Dive In… For every story a chart tells, there are stories hidden from plain view. One story tends to repeat itself almost like clockwork, though it also comes with variations. That’s what seasonality is all about: odd months where stocks tend to shine, stumble, or stall. In... READ MORE

Technical analysis is about having a consistent process of evaluating the evidence. Dave revisits three charts he highlighted at the end of September, reviews how the technical picture has changed, and updates his thesis using price and momentum techniques.... READ MORE

Catch market reversals before the crowd! Tony Zhang reveals how to scan, rank and trade high-probability options setups with the OptionsPlay Add-on for StockCharts.... READ MORE

Before We Dive In… You’re about to learn something unique: how to gauge trend strength and seize market opportunities using two sets of eyes. The GMMA splits price action into short-term and long-term views, giving you two perspectives on the same market. With one eye on fast-money moves and... READ MORE

Bearish momentum divergences can help provide a game plan for confirming potential price breakdowns. We review three charts to see how they have evolved since a bearish rotation, and focus on identifying potential entry points for the next rally phase.... READ MORE

Before We Dive In… Here’s today’s play: you’ll run the Entered Ichimoku Cloud scan to spot buy-the-dip candidates, use the SCTR to find the strongest stocks, and then you’ll flip to the charts to see which candidates may be worth pursuing. Plus, you’ll learn how... READ MORE

RSI readings, market breadth, and price patterns can provide directional signals for the stock market. Here's what you should monitor as the market goes through a relatively volatile period.... READ MORE

Grayson Roze reveals how narrowing your invest able universe can make you a better trader. See how to use StockCharts tools to focus your strategy, simplify analysis, and make smarter trading decisions.... READ MORE

Before We Dive In… Think “overbought” means it’s time to bail? Not always. Sometimes that 70+ RSI reading doesn’t signal weakness, but strength. In this Insider post, we’ll flip the script on RSI, show you why overbought often means “stay on board,” and give you the tools... READ MORE

Endowment bias can hurt your portfolio by keeping you tied to losing positions. David Keller shares how to manage risk, protect profits, and spot weakening charts using technical analysis and automated scans on StockCharts.... READ MORE

Before We Dive In… Every index wears two faces. The first is performance—what you see on the surface. The second is breadth—what lies beneath. Price tells you where the money’s moving today. But breadth tells you if that move has legs, or if it may be running... READ MORE

Gold’s 2025 rally is outpacing stocks and showing remarkable momentum. Dave breaks down the charts, RSI signals, and trend-following tools revealing strength in gold, gold stocks, and ETFs like GLD, and GDX. In addition, Dave breaks down gold’s historic run toward $4,000 per ounce, using the Historical... READ MORE

Tech stocks stumbled after a strong run. See what QQQ's chart says about the next market move and how to prepare your portfolio.... READ MORE

The Health Care sector is making a comeback, with stocks within the sector generating new bullish signals. Here's a deep dive into the sector.... READ MORE

Join Grayson and Dave as they reveal their top 10 stock charts to watch this October.... READ MORE

Learn how the TTM Squeeze indicator spots stocks ready to break out of a consolidation and see how you can apply it to stocks that have long-term investing potential.... READ MORE

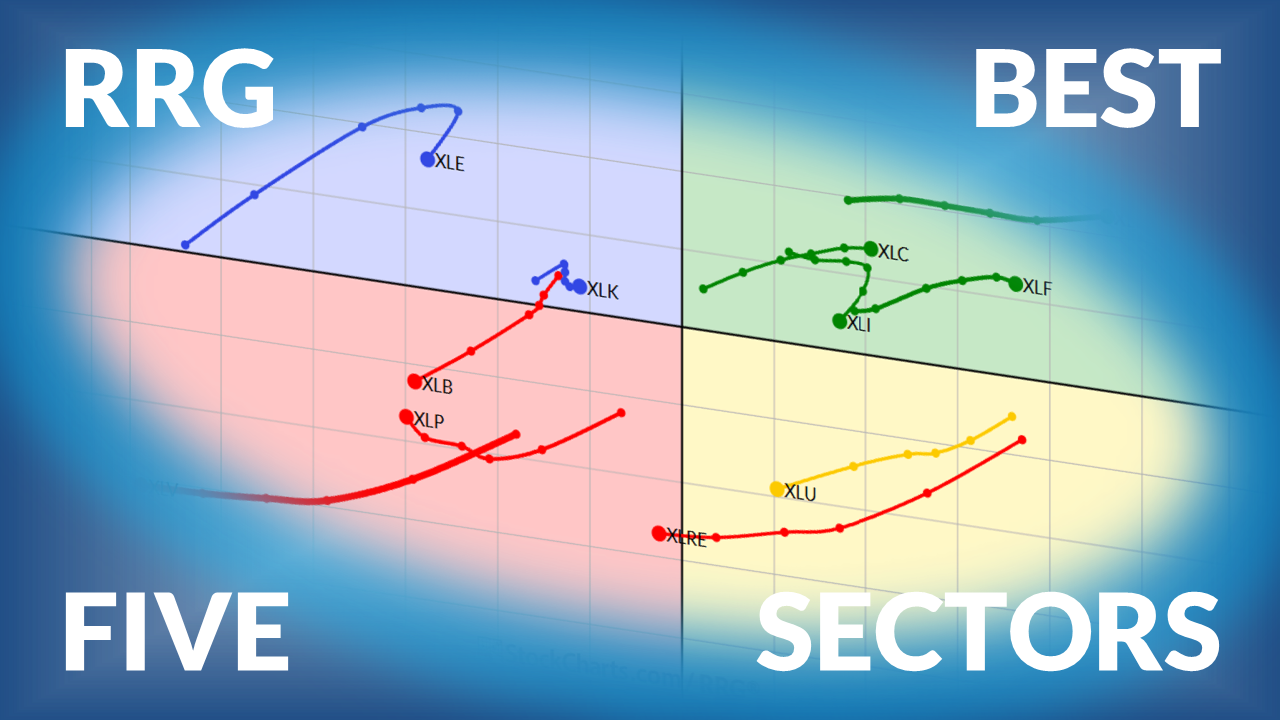

Julius presents his weekly update on US sector ranking based on Relative Rotation Graphs.... READ MORE

Learn how the StockCharts Technical Rank (SCTR) score can help you spot stocks gaining momentum.... READ MORE

Dave revisits five stocks from the September Top Ten Charts episode to see how they’ve evolved. He reviews NVDA, AXP, MSI, MRK, and the SIL, explaining which setups worked, which failed, and the lessons to carry forward. From short ideas that didn’t pan out to breakout patterns and... READ MORE

Learn how to trade credit spreads for consistent income. Tony Zhang shows simple setups, risk manage, and automation with the OptionsPlay Strategy Center from StockCharts.com... READ MORE

Join Dave as he explains how traders often get into trouble by thinking of “overbought” stocks as being bearish setups. While an RSI over 70 can often lead to short-term pullbacks, Dave explains that they can also signal the strength of a long-term uptrend phase. He uses Motorola Solutions (MSI)... READ MORE

TLT broke out, but is still underperforming SPY; meanwhile, IWM has begun outperforming SPY. Arthur explains how to find the ideal "hunting grounds" for sectors.... READ MORE

Mike spotlights a bearish NVDA options setup using StockCharts' OptionsPlay Strategy Center, and explains what could stir fresh volatility.... READ MORE

Dave explains how the 21-day exponential moving average can help confirm trend phases, validate signals from other moving averages, and serve as an essential risk management tool for traders.... READ MORE

This week, new highs are consistently outpacing new lows. The Communication Services sector is leading the pack, gold is surging, and there's a cybersecurity stock setting up for a big move. Read all about the stock market's price action here.... READ MORE

Back-to-back hammer candlesticks in the S&P 500 are sending a message. Here's what these signals mean, why the market feels stuck, and what investors should watch for next.... READ MORE

Every investor dreams of finding that next big stock before it takes off. The good news is that there’s a proven system that helps take a lot of the guesswork out of it. The system I’m talking about? None other than William O’Neil’s methodology, developed after... READ MORE

Consumer Discretionary ETFs are outperforming Staples across large-cap, small-cap, and global markets. See why XLY, RSPD, PSCD, and RXI signal a bullish risk-on trend in 2025.... READ MORE

China stocks are surging, with FXI up 55% year-on-year. Learn what’s driving the rally, key technical levels, and what it means for retail investors.... READ MORE

What to watch ahead of Powell: S&P 500 RSI divergence, NVDA under 20-day MA, key levels at 6212/6025/5852; can Financials and Industrials lead?... READ MORE

Get the latest S&P 500 analysis with a focus on RSI negative divergence, short-term swing setups, and market breadth trends. Learn what current patterns mean and how to spot the next move.... READ MORE

Discover what Bollinger Bands and RSI are signaling for the S&P 500. Learn how low volatility and key momentum indicators could point to the next market breakout.... READ MORE

Joe shares his go-to ADX stock scan! Follow along as Joe uses the StockCharts platform to uncover strong long-term uptrends paired with low short-term momentum — the kind of setup that often precedes powerful breakouts. He walks through his “Strong Monthly / Low Weekly” scan criteria, explains how to apply it across... READ MORE

Relative Rotation Graphs can be rendered in similar intervals as regular bar- or candlestick charts. This article explains the differences between weekly and daily RRGs.... READ MORE