MEMBERS ONLY

Stocks and Bonds SOAR After October CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Pete Carmasino of Chaikin Analytics puts this week's action into long-term perspective using his charts of bond prices, interest rates, unemployment, and regional banks. Dave highlights three stocks with actionable signals this week: ROST, FSLR, and MCK....

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation and Macro Insights for the Economic Cycle!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I update the current rotation in sectors and the positioning of macroeconomic variables to make an assessment of the positioning of the stock market within the economic cycle.

This video was originally broadcast on November 14, 2023. Click anywhere on...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Your Portfolio OUTDATED? The Truth About The 60/40 Mix

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a discussion about the typical 60/40 Portfolio (60% US Stocks/40% US Bonds) and whether it will continue to serve you well given the decline in Bonds. Is this portfolio blend obsolete? Both...

READ MORE

MEMBERS ONLY

Boeing Stock Takes Off: How to Profit From the Price Surge

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Boeing stock gapped on increased orders for its aircraft

* After a double bottom pattern on the weekly chart, Boeing's stock price looks to be recovering

* The stock could pull back or push through resistance and keep flying higher

After falling from August to October, Boeing stock...

READ MORE

MEMBERS ONLY

The Zweig Breadth Thrust Triggers, but the Indicator is Missing Something

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's report features the Zweig Breadth Thrust, which was developed by the late, and great, Marty Zweig. Zweig appeared regularly on Wall Street Week, contributed to Barrons, published The Zweig Forecast and wrote Winning on Wall Street in 1986. Among other things, his timeless book shows us how...

READ MORE

MEMBERS ONLY

Why is S&P 4400 So Important Right Now?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Charles Dow first popularized the concept of trends as defined by the pattern of peaks and valleys in price action.

* We can create shaded areas on a chart based on traditional support and resistance levels to create a "stoplight" effect to better define the market phase....

READ MORE

MEMBERS ONLY

Two EASY But INSANELY POWERFUL Ways to See Stocks in the S&P 500, NASDAQ & Dow

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson demonstrates two easy ways to take the individual stocks in key indexes like the S&P 500, NASDAQ 100, Dow Industrials and more, save those to a ChartList in your own account, and then review...

READ MORE

MEMBERS ONLY

Decoding Bear Markets, Divergences, & More! A Q&A with David Keller, CMT

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave dives deep into the world of market dynamics and technical analysis to answer YOUR burning questions! He talks topics like point and figure charts, moving averages, Nomura Holdings (NMR), Arthur J. Gallagher & Co. (AJG), and more!

This video...

READ MORE

MEMBERS ONLY

Moxie Indicator Alerts: Predicting Yesterday's Market Pullback!

by TG Watkins,

Director of Stocks, Simpler Trading

We had been patiently waiting for the action that happened yesterday, even though it was down. In this week's edition of Moxie Indicator Minutes, TG shows you real alerts from the Moxie Indicator Trading room that called the pullback before it happened, and presents how you too can...

READ MORE

MEMBERS ONLY

Find Great Trading Ideas By Combining SCTR Rankings and RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Combing Top SCTR rankings with Relative Rotation Graphs provides a powerful combination

* Confirmation between weekly and daily RRG tails sends strong signals

* PLTR, DKNG, COIN, ADBE, NVDA showing strong set-ups

One of the several widgets/panels I have on my dashboard is SCTR Reports. To visualize the group...

READ MORE

MEMBERS ONLY

Top Ten Hidden Features of StockCharts, Features 6-10

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave takes a closer look at some key features on StockCharts and how to use them in new and improved ways, in order to gain a deeper understanding of market dynamics and price behavior. You might even stumble upon some...

READ MORE

MEMBERS ONLY

Top Ten Hidden Features of StockCharts, Features 1-5

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave takes a closer look at some key features on StockCharts and how to use them in new and improved ways, in order to gain a deeper understanding of market dynamics and price behavior. You might even stumble upon some...

READ MORE

MEMBERS ONLY

The Best Traders ALWAYS Cherry-Pick Their Setups

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action with two open trades, explaining why you must "cherry-pick" all setups and see subsequent positions through their fruition, even during less-than-ideal conditions. He also shows the recent TFM 10% sell signal and discusses...

READ MORE

MEMBERS ONLY

Sector Spotlight: Unleash The Power of Sector Analysis by Plotting Ratio Symbols on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I take a look at current sector rotation while comparing cap-weighted sectors with equal weight sectors, trying to find areas of the market where either one of these is dominating. I then demonstrate how to use ratio symbols on Relative...

READ MORE

MEMBERS ONLY

Why are Higher Interest Rates a Big Deal?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mike Singleton of Invictus Research describes the impact of higher interest rates on consumer spending and growth stock valuations. Host David Keller, CMT charts the breakout for the QQQ and reviews stocks reporting earnings, including DKNG, UBER, and more....

READ MORE

MEMBERS ONLY

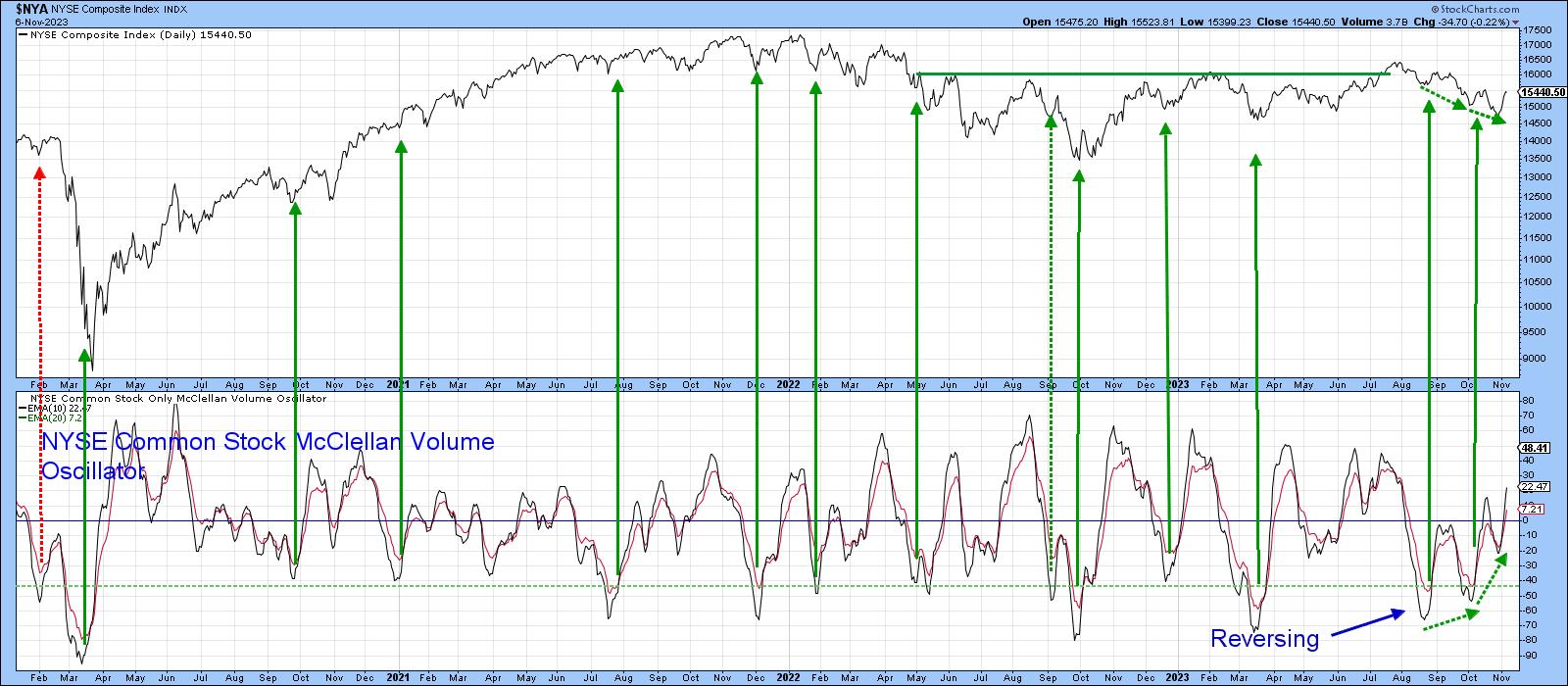

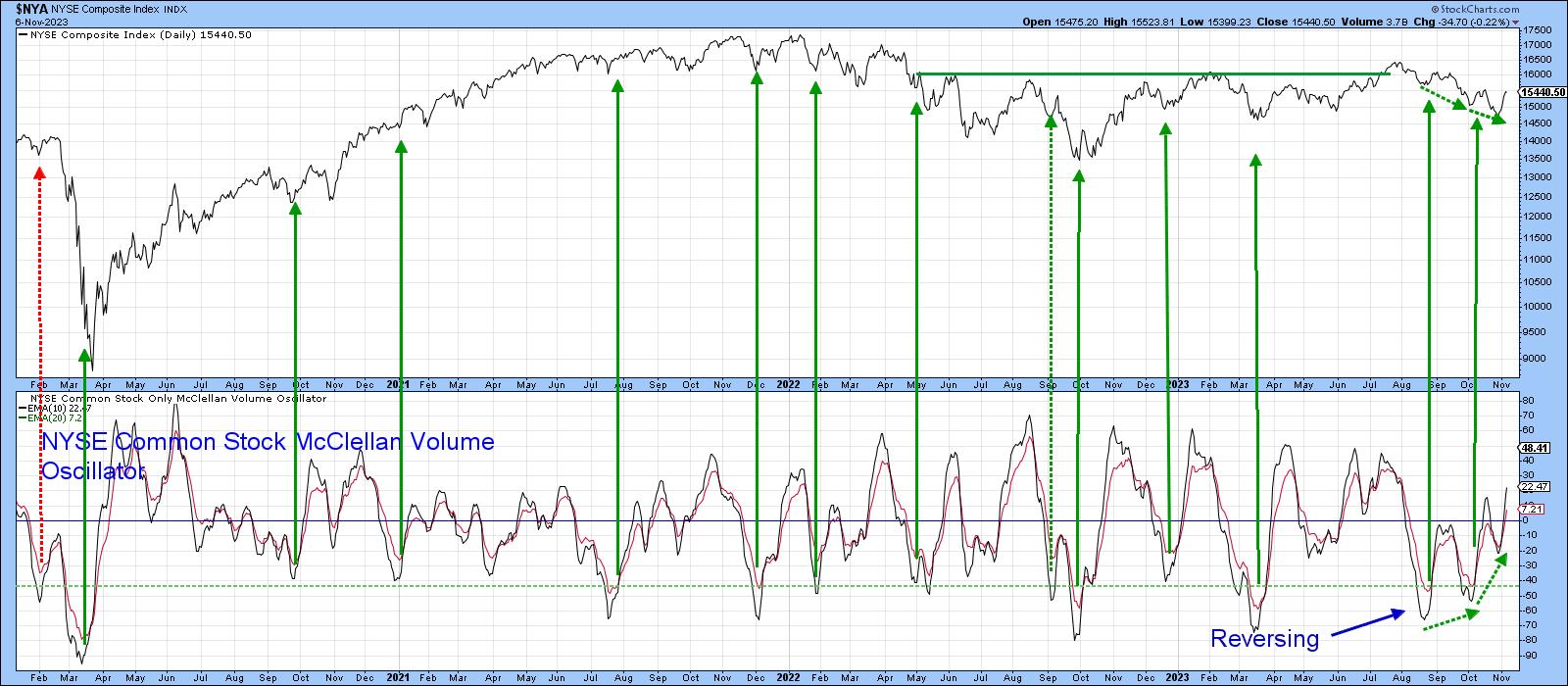

Benchmarks that Will Tell Us this Market Has Legs

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote an upbeat article on the market, pointing out the fact that many short- and intermediate-term indicators were in a potentially bullish position at a time when stocks seemed impervious to bad news. I concluded "That does not mean the market will go...

READ MORE

MEMBERS ONLY

This Key Resistance Level is Crucial for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the charts of the S&P 500 and Nasdaq 100 with a focus on the downtrend channel for the QQQ and key resistance at 4400 for the S&P 500. He answers viewer questions on...

READ MORE

MEMBERS ONLY

DP Trading Room: This Powerful Scan Finds Stocks Showing NEW Momentum

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl covers the major markets as well as the Dollar, Gold, yields, and Bitcoin. Erin runs her "Momentum Sleepers Scan" to find stocks that are showing new momentum under the surface. She uncovers a few stocks for...

READ MORE

MEMBERS ONLY

Skip the Noise and Focus on the Signal by Effectively Using the 200-day SMA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is battling the 200-day SMA with four crosses over the last eleven days. We are also seeing a rise in volatility as this market benchmark plunged 5.86% in nine days (18-27 October) and then surged 5.85% the last five days. With such conditions,...

READ MORE

MEMBERS ONLY

Week Ahead: Broader Markets Set to Relatively Underperform; Watch These Nifty Levels Closely

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, during our analysis of the patterns of the NIFTY's weekly chart, it was mentioned that the Index has achieved a full throwback. This occurs when the instrument gives up the breakout gains entirely and retests the original breakout point which acts as a...

READ MORE

MEMBERS ONLY

Trading the QQQ in Three Timeframes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The short-term trend for the QQQ is positive after this week's rally, but price is now at the upper edge of a downtrend channel.

* On the medium-term timeframe, the downtrend channel is still intact, and the momentum reading is still in line with a bearish phase....

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch in November 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they break down the trends for the top ten stocks and ETF charts for November 2023. Watch as they identify key levels and signals to keep an eye out for using the power of StockCharts&...

READ MORE

MEMBERS ONLY

Shopify Stock Shatters Expectations: What You Need to Know About Its Rise

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Shopify saw a significant surge of over 20% following a robust earnings report and guidance

* The daily price chart shows a breakaway gap from a prevailing near-term downtrend

* Breakaway gaps don't often fill, so if you are considering entering a position the stock has room to...

READ MORE

MEMBERS ONLY

Holiday Shopping Bonanza: Retail Stocks You Need to Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Since holiday shopping season is here it could be a good time to add some retail stocks to your portfolio

* AMZN, WMT, COST, and TGT could be potential stocks to add to your portfolio as holiday shopping begins

* Set alerts for these stocks so you can enter at...

READ MORE

MEMBERS ONLY

Focus on Stocks: November 2023

by Larry Williams,

Veteran Investor and Author

The Million Dollar Stock Market Bet

Warren Buffett proved his point in 2016 when he bet $1,000,000 that the S&P 500 Stock Index would outperform hedge funds. His bet was that active investment management by professionals would under-perform the returns of people who were passively investing....

READ MORE

MEMBERS ONLY

29 MUST SEE Charts You Can Start Using Today!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson gives viewers 29 of the most important charts straight out of his own personal account. He'll review his weekly "Market Evaluation" ChartList and discuss all of the advanced charts within. This entire...

READ MORE

MEMBERS ONLY

Stock Market Indexes Shatter Critical Support Levels. Watch the March Lows.

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow, S&P 500, and Nasdaq Composite are trading below their 200-day moving averages

* US Treasury yields are taking a breather now but their near-term action could impact equities, especially big tech stocks

* Investors are anxiously awaiting to hear if Fed Chairman Jerome Powell will lean...

READ MORE

MEMBERS ONLY

This Powerful MACD/ADX Screener Generates Valuable Ideas

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows an intraday trade setup in the SPY that took place this week. He uses the MACD and ADX in multiple timeframes to explain in detail how they can help with our entry and timing. He discusses...

READ MORE

MEMBERS ONLY

Many Reasons to Love and Hate AMZN Stock

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Amazon stock has been falling ahead of earnings and is close to hitting the support of its 200-day moving average

* When AMZN announce its Q3 earnings, investors will be interested in the company's e-commerce and cloud services

* Keep an eye on AMZN's price action...

READ MORE

MEMBERS ONLY

Google Stock Expectations In the Spotlight: Will Earnings Results Exceed Expectations?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Google's Q3 earnings will have an impact on which way the stock moves

* GOOGL's daily stock chart shows the stock is trading very close to its 52-week high

* GOOGL stock is trading above its 21-day exponential moving average, it has a high SCTR rank,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Have Limited Upsides In The Truncated Monthly Expiry Week; Watch These Key Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets wore a largely corrective undertone throughout the past five sessions; it oscillated within a similar range as the previous week and closed on a negative note. The volatility remained on the lower side; as the volatility has been low, the bands contracted as well. As compared to the...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" October 20, 2023 Recording

by Larry Williams,

Veteran Investor and Author

October is a significant month in the stock market, and in this pre-election year, there's a lot of uncertainty among investors, which makes the stock market more volatile. In this video, Larry discusses the October Seasonality and talks about stocks that generally perform well during the month. You&...

READ MORE

MEMBERS ONLY

RRG is Sending a Clear Message And Finds Two Stocks With Good Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG is sending a strong message to prefer Growth over Value

* Putting the growth stocks from IVW through a scan and some thorough RRG analyses finds a handful of interesting names

* Two unexpected stocks are showing up as having good upside potential

* Especially growth stocks from Defensive sectors...

READ MORE

MEMBERS ONLY

These 3 Stocks Keep Hitting New Highs and Can Still Surge: This Is the Time To Look for an Entry

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Scanning for stocks that are reaching all-time highs while the broader market is trending lower can result in ideal trading opportunities

* Look for stocks that are trending higher over the longer-term and pulling back

* FANG, PGR, and MUSA are showing signs of pullback and should be on your...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Friday, October 20th at 2:00pm EDT!

by Larry Williams,

Veteran Investor and Author

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Friday, October 20th at 2:00pm EDT.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Consolidates While Defending Key Levels; Vigilant Protection of Profits Advised

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was mentioned that the volatility gauge INDIAVIX had stayed at its lowest levels, and this setup was keeping the markets vulnerable to profit-taking bouts from the current levels.

Over the past five days, the markets showed some signs of profit-taking, but at the same...

READ MORE

MEMBERS ONLY

Lagging Indicators Confirm Bearish Phase For Growth

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Leading indicators help anticipate price reversals, while lagging indicators validate trend changes you've already observed.

* RSI combines the qualities of leading and lagging indicators, helping investors to prepare for and react to trend reversals.

* AAPL recently showed a bullish momentum divergence, meaning the leading indicator has...

READ MORE

MEMBERS ONLY

Gain GREATER CLARITY on The Market's Latest Moves With Seasonality Charts!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson explores the Seasonality tool and shares how these unique charts can help you gain a deeper, more data-driven perspective on the market's latest moves. By charting historical price moves for each month of the...

READ MORE

MEMBERS ONLY

2 Clear Strategies When Using the ADX

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses keys to using the ADX indicator. He focuses on the 2 clear strategies for ADX and how to handle them. In addition, he describes the slope of this line and how that affects the strategy. Joe...

READ MORE

MEMBERS ONLY

Trading the Swing within the Pattern: IGV Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking to get the jump on a bigger breakout can turn to the swings within a developing pattern. For example, a Symmetrical Triangle after an advance is a bullish continuation pattern. We can get the jump on a breakout by trading a downswing reversal within the pattern. Let'...

READ MORE