MEMBERS ONLY

Thursday's Stock Market Dive: Noise or a Warning? Let the Charts Decide

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Was Thursday's market dip a warning sign or just noise? Explore market trends, sentiment, and sector rotation, and learn how the StockCharts Market Summary page can help you stay one step ahead....

READ MORE

MEMBERS ONLY

Avoid This Common RSI Mistake (And What to Do Instead)

by Joe Rabil,

President, Rabil Stock Research

Master RSI strategies with Joe! Follow along as Joe shares his refined method using dual timeframes and a two-RSI approach; see how he uses RSI-20 as a trend filter and RSI-5 as an entry signal to avoid common mistakes and enhance trading precision. Joe breaks down real chart examples on...

READ MORE

MEMBERS ONLY

Catch Big Moves Early With This Breakout Scan!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Follow along as Dave shares the one stock scan he runs every week to uncover potential breakout candidates. He explains the three types of chart setups that frequently appear, each with their own trading implications, and walks through how he structures trades according to type. He also illustrates how to...

READ MORE

MEMBERS ONLY

Before You Cast Away, Hook the Market's Key Trends on StockCharts

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Check these must-see StockCharts signals before you cast off for the summer and see whether August's market currents say "stay the course" or "make adjustments."...

READ MORE

MEMBERS ONLY

Is It Time For a Comeback? 3 Stocks That Might Be Turning a Corner

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

Explore technical turnaround setups for UPS stock, UNH stock price trends, and why MRK stock may offer the best risk/reward for investors this earnings season....

READ MORE

MEMBERS ONLY

Is the Charging Bull Getting Tired?

by Bruce Fraser,

Industry-leading "Wyckoffian"

Optimism surrounds the stock market indexes with lofty price targets. Could the fulfillment of Point & Figure targets mean the end of a bull market? Find out here. ...

READ MORE

MEMBERS ONLY

Will SMCI Stock Soar in 2025? Here's What the Charts Say

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Discover why SMCI stock's steady breakout, key support levels, and AI-driven upside could reward patient investors....

READ MORE

MEMBERS ONLY

S&P 500 Breaking Out Again: What This Means for Your Portfolio

by Frank Cappelleri,

Founder & President, CappThesis, LLC

The S&P 500 ($SPX) just logged its fifth straight trading box breakout, which means that, of the five trading ranges the index has experienced since the April lows, all have been resolved to the upside.

How much longer can this last? That's been the biggest question...

READ MORE

MEMBERS ONLY

Is META Breaking Out or Breaking Down?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The chart of Meta Platforms, Inc. (META) has completed a roundtrip from the February high around $740 to the April low at $480 – and all the way back again. Over the last couple weeks, META has pulled back from its retest of all-time highs, leaving investors to wonder what may...

READ MORE

MEMBERS ONLY

A Wild Ride For the History Books: 2025 Mid-Year Recap

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Markets don't usually hit record highs, then risk falling into bearish territory, and spring back to new highs within six months. But that's what happened in 2025.

In this special mid-year recap, Grayson Roze sits down with David Keller, CMT, to show how disciplined routines, price-based...

READ MORE

MEMBERS ONLY

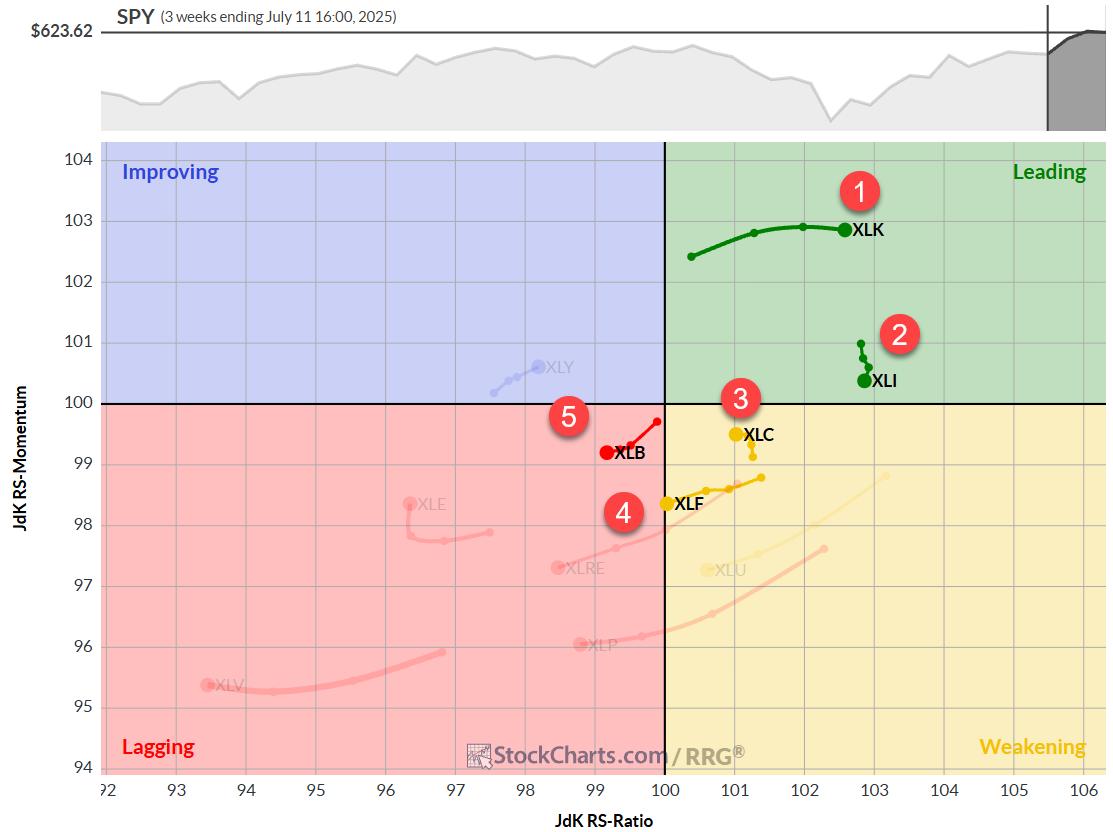

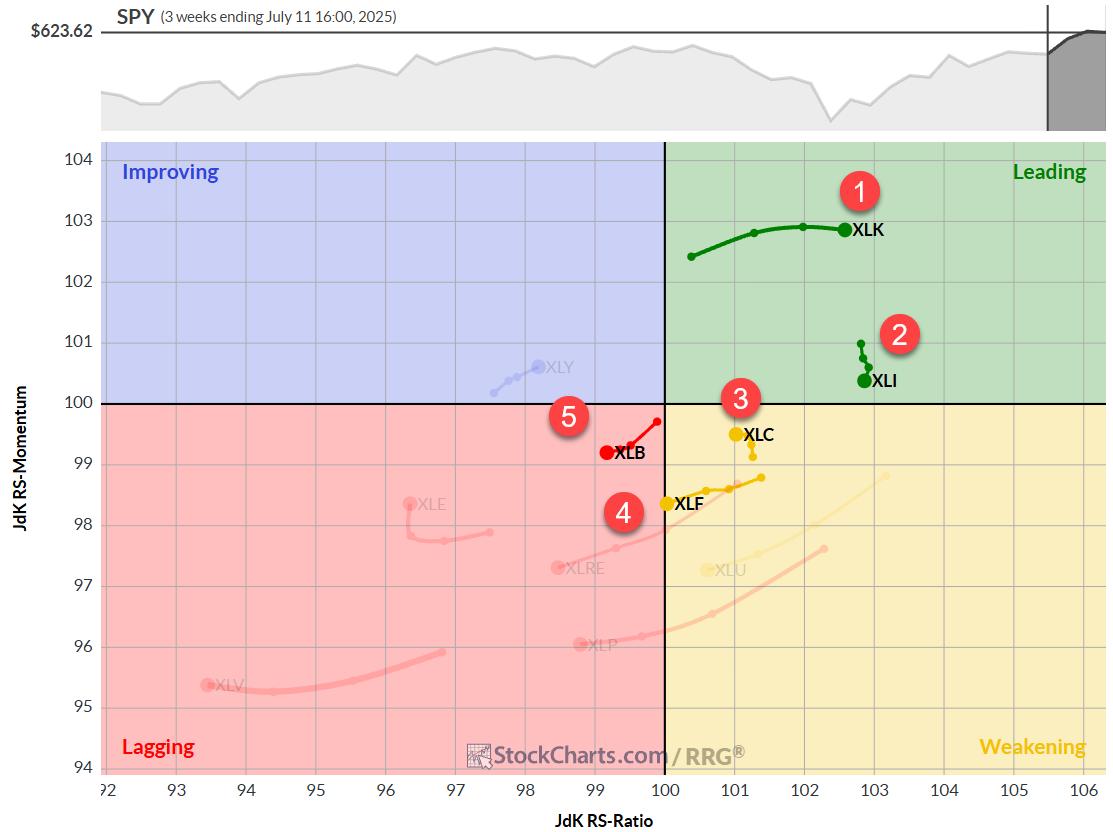

The Best Five Sectors, #28

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Technology sector continues to dominate, while Industrials are rotating out of the leading quadrant....

READ MORE

MEMBERS ONLY

July Strength, Late-Summer Caution: 3 Charts to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

July seasonality is lifting the S&P 500 as breadth and bullish sentiment hold up. Discover which charts to watch before the choppier August to October stretch. ...

READ MORE

MEMBERS ONLY

Three Stocks in Focus: One Old Favorite, One Mag Name, and a Dow Comeback Story

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week, let's dive into three interesting stocks: a well-known Dow stalwart, a tech giant in a tug of war, and a former Dow member showing signs of revival. Whether you're looking for opportunity, caution, or something worth watching, there's a little something here...

READ MORE

MEMBERS ONLY

Three Bearish Candle Patterns Every Investor Should Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The shooting star pattern indicates a short-term rotation from accumulation to distribution.

* The bearish engulfing pattern suggests sellers have taken control, suggesting further weakness.

* The evening star pattern is a three-candle formation that illustrates an exhaustion of buying power.

There is no denying that the broad markets remain...

READ MORE

MEMBERS ONLY

RGTI Stock Surged 30% — Is This the Start of a Quantum Comeback?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

RGTI stock surged 30% in a breakout move. See why RGTI and other quantum computing stocks are back on traders' radar and what to watch next. ...

READ MORE

MEMBERS ONLY

Simpler Charts, Better Results? Use This Trick to Trade Smarter With Less

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson as he shares how to streamline your analysis using custom ChartStyles. He demonstrates how to create one-click ChartStyles tailored to your favorite indicators, use style buttons to quickly switch between clean, focused views, and build a chart-leveling system that reduces noise and helps you stay locked in on...

READ MORE

MEMBERS ONLY

Four Symbols, One Big Message: What the Charts are Telling Us

by Frank Cappelleri,

Founder & President, CappThesis, LLC

From the S&P 500's pause within a bullish trend, to critical support levels in semiconductors, plus bullish breakouts in Ethereum and Bitcoin, Frank highlights how the market's recent consolidation may lead to major upside. In this video, Frank explores how to use StockCharts to...

READ MORE

MEMBERS ONLY

This Tool Could Change Your Options Trading Forever

by Tony Zhang,

Chief Strategist, OptionsPlay

Unlock the power of automated options trading with Tony Zhang, Chief Strategist at OptionsPlay. In this exclusive training, Tony reveals how the OptionsPlay Strategy Center, integrated with StockCharts.com, transforms the way traders find, analyze, and execute options strategies.

Follow along as Tony illustrates how to use OptionsPlay and StockCharts...

READ MORE

MEMBERS ONLY

From Hammer to Harami: Using StockCharts to Crack the Candlestick Code

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he reviews three common candle patterns traders can use to identify potential turning points. From bullish engulfing patterns to evening star patterns, Dave gives insights on how to leverage these powerful candle signals to anticipate market shifts. He also shows combining candle patterns with conventional technical analysis...

READ MORE

MEMBERS ONLY

Bitcoin Just Smashed $112K—Is a Surge to 124K Next?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* $BTCUSD recently broke above critical resistance at $112k.

* Historically, the crypto has made significant moves after clearing a prolonged period of sideways trading.

* It's time to set upside and downside targets—key levels we discuss below.

Bitcoin ($BTCUSD) is riding a wave of surging optimism, smashing...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #27

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Materials sector climbs to #5 in rankings, displacing Utilities

* Technology maintains leadership, but Communication Services and Financials show weakness

* Daily RRG reveals potential for Materials, caution needed for Comm Services and Financials

* Portfolio drawdown continues, currently 8% behind S&P 500 YTD

After a relatively quiet week...

READ MORE

MEMBERS ONLY

3 Stocks Seasoned Investors Should Watch

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* The Financial sector shows strong technical momentum potentially signifying continued growth.

* Goldman Sachs (GS) presents strong upside and potential entry opportunities on pullbacks.

* Johnson & Johnson (JNJ) is a stable, long-term holding with limited short-term excitement.

As we navigate the evolving stock market landscape, understanding key sectors and...

READ MORE

MEMBERS ONLY

These 25 Stocks Drive the Market: Are You Watching Them?

by Grayson Roze,

Chief Strategist, StockCharts.com

If you're serious about trading or investing, establishing a weekly market routine is a must. But where do you begin?

In this eye-opening video, Grayson Roze, Chief Strategist at StockCharts, shares the method he uses every week to stay aligned with the market's biggest drivers — the...

READ MORE

MEMBERS ONLY

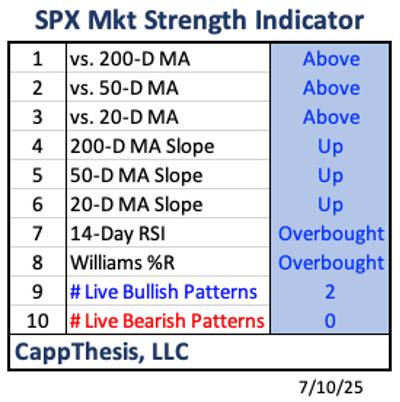

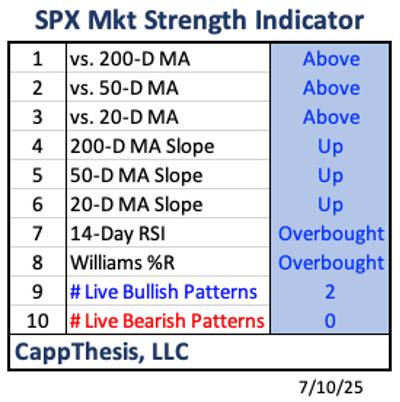

The CappThesis Market Strength Indicator: What It's Telling Us Now

by Frank Cappelleri,

Founder & President, CappThesis, LLC

KEY TAKEAWAYS

* The S&P 500 has been holdign above 6.200 for a week and hte Market Strength Indicator (MSI) is showing strong bullish momentum.

* While the MSI is highly bullish, history tells us that extreme readings often precede a pause or short-term pullback.

* Even with the potential...

READ MORE

MEMBERS ONLY

The Small Cap 'Early Warning' System: Use StockCharts to Time Pullbacks and Protect Profits

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market continued to push higher with the S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) closing at record highs on Thursday. The Dow Jones Industrial Average ($INDU) tacked on a solid 192 points (+0.43%). There was a pullback on Friday, but July is a seasonally strong...

READ MORE

MEMBERS ONLY

How to Find Compelling Charts in Every Sector

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Over a number of years working for a large money manager with a rich history of stock picking, I became more and more enamored with the benefits of scanning for constructive price charts regardless of the broad market conditions. Earlier in my career, as I was first learning technical analysis,...

READ MORE

MEMBERS ONLY

How I Triple My Returns With 3x Leveraged ETFs!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Investing in triple-leveraged ETFs may not be on your radar. But that may change after you watch this video.

Tom Bowley of EarningsBeats shares how he uses the 3x leveraged ETFs to take advantage of high probability upside moves. Tom shows charts of 3x leveraged ETFs that mirror their benchmark...

READ MORE

MEMBERS ONLY

Want Faster, Lower Risk Trades? Use This Setup

by Joe Rabil,

President, Rabil Stock Research

A good trade starts with a well-timed entry and a confident exit. But that's easier said than done.

In this video, Joe Rabil of Rabil Stock Research reveals his go-to two-timeframe setup he uses to gain an edge in his entry and exit timings and reduce his investment...

READ MORE

MEMBERS ONLY

Tariff Shock Spurs "Buy-the-Dip" Setups in Tesla and ON Semiconductor

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Just when we thought tariff talk had gone quiet, it's back on center stage. With the reciprocal tariff deadline landing this Wednesday, President Trump has mailed out notices that new duties will kick in on August 1. Countries such as Japan, South Korea, Malaysia, and Kazakhstan face a...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #26

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we're seeing some interesting shifts within the rankings that warrant closer examination. Let's dive into the details and see what the Relative Rotation...

READ MORE

MEMBERS ONLY

Missed Disney's Rally? Grab This Defined-Risk Put Spread for a Second Chance

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Stocks keep notching record highs. If you're like most investors, you're probably wondering, "Should I really chase these prices or sit tight and wait for a pullback?"

Instead of overthinking and ending up in Analysis-Paralysis land, however, it may be worth exploring other avenues...

READ MORE

MEMBERS ONLY

Should You Buy Roblox Stock Now? Key Levels to Watch

by Karl Montevirgen,

The StockCharts Insider

Roblox Corporation (RBLX), the company behind the immersive online gaming universe, has been on a strong run since April. This isn't the first time the stock demonstrated sustained technical strength: RBLX has maintained a StockCharts Technical Rank(SCTR) above 90, aside from a few dips, since last November....

READ MORE

MEMBERS ONLY

MACD Crossovers: Why Most Traders Get It Wrong

by Joe Rabil,

President, Rabil Stock Research

Joe presents a deep dive into MACD crossovers, demonstrating how to use them effectively across multiple timeframes, establish directional bias, and improve trade timing. He explains why price action should confirm indicator signals, sharing how to identify "pinch plays" and zero-line reversals for higher-quality setups. Joe then analyzes...

READ MORE

MEMBERS ONLY

Market Signals Align - Is a Bigger Move Ahead?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

This week, Frank analyzes recent technical signals from the S&P 500, including overbought RSI levels, key price target completions, and the breakout potential of long-term bullish patterns. He examines past market breakouts and trend shifts, showing how overbought conditions historically play out. Frank also walks through a compelling...

READ MORE

MEMBERS ONLY

Top 10 July 2025 Stock Picks You Shouldn't Miss

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson for a solo show as he reveals his top 10 stock charts to watch this month. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. As a viewer, you'll also gain insight into key market...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #25

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A Greek Odyssey

First of all, I apologize for any potential delays or inconsistencies this week. I'm currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then...

READ MORE

MEMBERS ONLY

3 Stock Setups for the Second Half of 2025

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

As we head into the second half of 2025, here are three stocks that present strong technical setups with favorable risk/reward profiles. One is the largest market cap stock we're familiar with, which bodes well for the market in general. The second is an old tech giant...

READ MORE

MEMBERS ONLY

How to Improve your Trading Odds and Increase Opportunities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can improve their odds and increase the number of opportunities by trading short-term bullish setups within bigger uptrends. The first order of business is to identify the long-term trend using a trend-following indicator. Second, chartist can turn to more granular analysis to find short-term bullish setups. Today's...

READ MORE

MEMBERS ONLY

NEW! 5 Significant Additions to Our Professionally-Curated Market Summary Dashboard

by Grayson Roze,

Chief Strategist, StockCharts.com

Take a tour of the FIVE latest updates and additions to our fan-favorite, professionally-curated Market Summary dashboard with Grayson!

In this video, Grayson walks viewers through the new charts and indexes that have been added to multiple panels on the page. These include mini-charts for the S&P sectors,...

READ MORE

MEMBERS ONLY

SMCI Stock Surges: How to Invest Wisely Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Over a month ago, Super Micro Computer, Inc. (SMCI) appeared on our StockCharts Technical Rank(SCTR) Top 10 list. SCTRs are an exclusive StockCharts tool that can help you quickly find stocks showing strong technical strength relative to other stocks in a similar category.

Now, the stock market is dynamic,...

READ MORE