MEMBERS ONLY

Modest Selling Pressure Hits Stocks - GLD Surges to First Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure extended on Thursday, but the losses in the major index ETFs were modest. The Russell 2000 ETF declined .61% and the S&P 500 SPDR fell .71%. This is moderate selling pressure. There were, of course, some pockets with more intense selling pressure. The consumer discretionary and...

READ MORE

MEMBERS ONLY

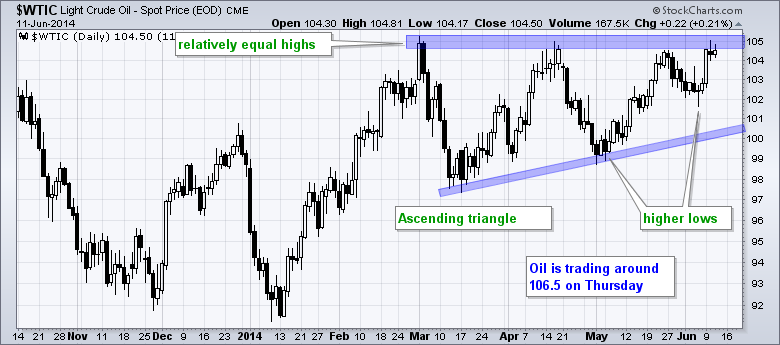

Spot Light Crude Surges Through Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tensions in Iraq put a big bid into Spot Light Crude ($WTIC) as this key commodity broke above its March-May highs. Overall, crude formed an ascending triangle over the last few months and today's breakout signals a continuation of the January-February surge. The height of the pattern (105...

READ MORE

MEMBERS ONLY

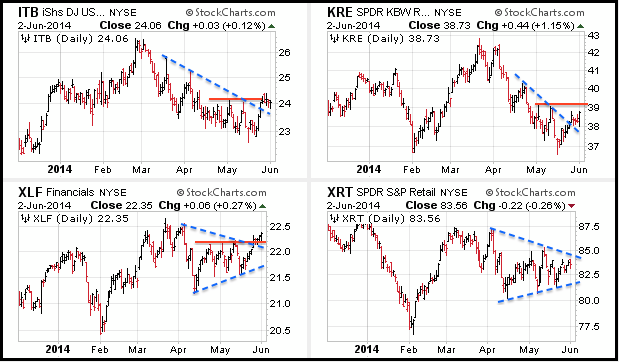

ITB Tests Breakout Zone - UUP Extends Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks came under selling pressure on Wednesday with the Russell 2000 ETF losing around .50% and the S&P 500 SPDR falling .35%. Even though today's decline was insignificant for the broader market, there are some growing concerns that could lead to a pullback or corrective period...

READ MORE

MEMBERS ONLY

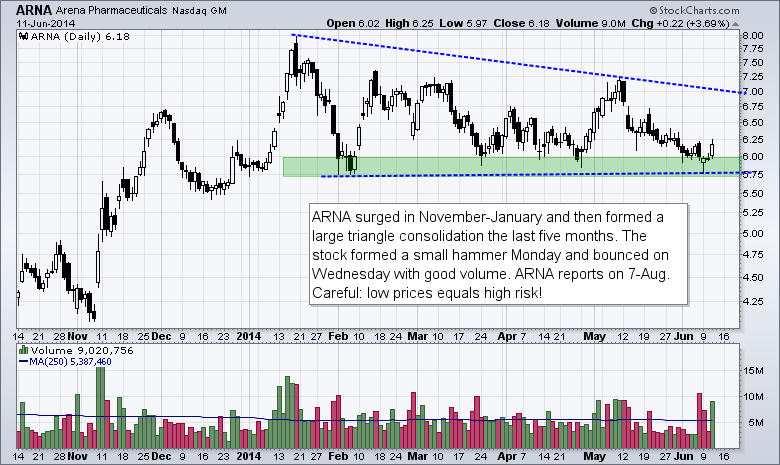

Chart Setups: ARNA, EIGI, JIVE, MYL, UTHR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's charts feature five setups. First, there is a small pharma company bouncing off support after a hammer. Second, we have a recent IPO getting a breakout with good volume. Third, there is a small software company with a double bottom taking shape. Fourth, a generic drug maker...

READ MORE

MEMBERS ONLY

The Noose Tightens on NutriSystem

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Nutrisystem (NTRI) broke out with a big gap-surge in early May and then consolidated with a triangle. The gap and breakout are largely holding as volatility contracts. Notice how the Bollinger Bands narrowed and volume dried up over the last few weeks. Chartists should watch the June range for the...

READ MORE

MEMBERS ONLY

Stocks Turned Mixed, but Short-Term Uptrend Remains

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a mixed day on Wall Street as the Nasdaq 100 ETF edged higher (.17%) and the S&P 500 SPDR edged lower (.01%). The gains and losses in the major index ETFs were insignificant and Tuesday can be called a consolidation day. The sectors were also mixed...

READ MORE

MEMBERS ONLY

New Highs Expand as Small-Caps Extend Rally

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued higher in early trading and then succumbed to some selling pressure in the afternoon. The Nasdaq 100 ETF (QQQ) closed slightly lower, the S&P 500 SPDR (SPY) edged higher and the Russell 2000 ETF (IWM) gained .88% on the day. The sectors were mixed with five...

READ MORE

MEMBERS ONLY

Chart Setups: ARMH, CERN, DWA, HTWR, WTW

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's charts feature five setups. First, we have a semiconductor stock with a bullish reversal pattern in the works. Second, we have a software company catering to the healthcare sector. Third, there is a movie producer scheduled to release a sequel this weekend. Fourth, there is a medical...

READ MORE

MEMBERS ONLY

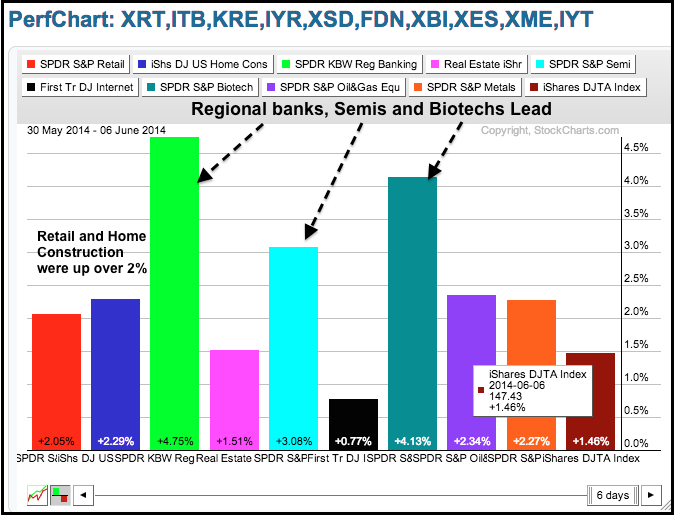

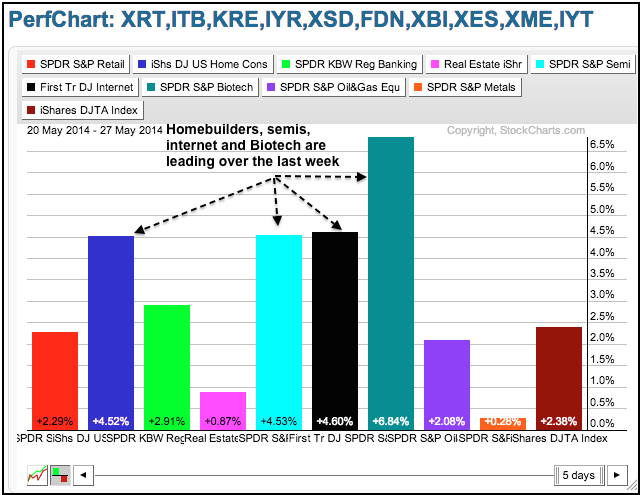

Key Industry Group ETFs Lead Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks caught a decent bid last week with small-caps, mid-caps and micro-caps leading the way. This shows strength at the high-beta end of the market and shows an increased appetite for risk. All sectors were up with finance, industrials and consumer discretionary leading the way. Relative strength in finance and...

READ MORE

MEMBERS ONLY

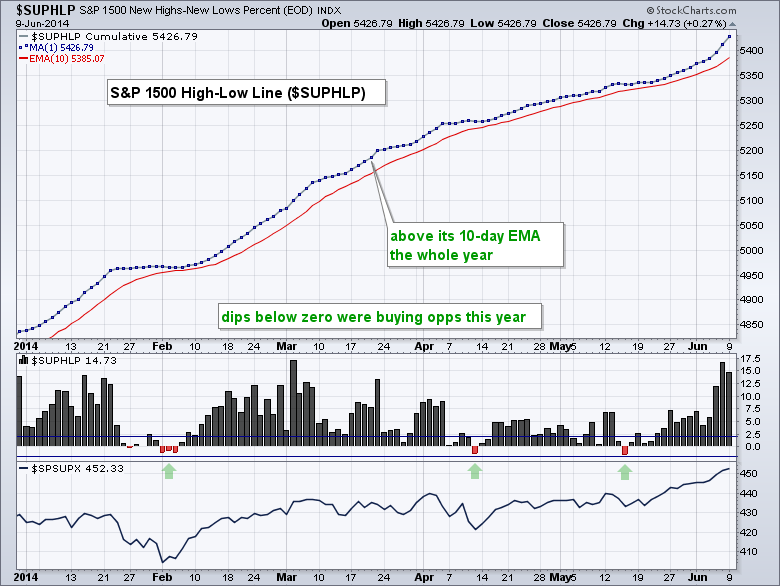

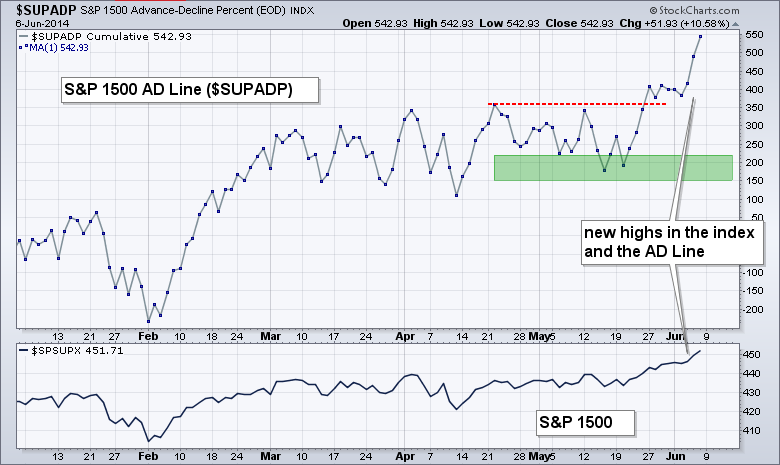

Key Breadth Indicators Confirm New Highs in the Stock Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The AD Line and AD Volume Line are aggregate measures of participation. The AD Line favors small and mid-caps because an advance equals +1 and a decline equals -1, regardless of market cap. This means an advance in Apple ($556 billion market cap) counts the same as an advance in...

READ MORE

MEMBERS ONLY

Small-Caps and Regional Banks Lead Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks caught a bid with the Russell 2000 ETF and Russell MicroCap iShares leading the charge. Both gained over 2% and easily outperformed the S&P 500 SPDR, which gained just .60% on the day. All sectors were up with industrials and finance leading. Among the key industry group...

READ MORE

MEMBERS ONLY

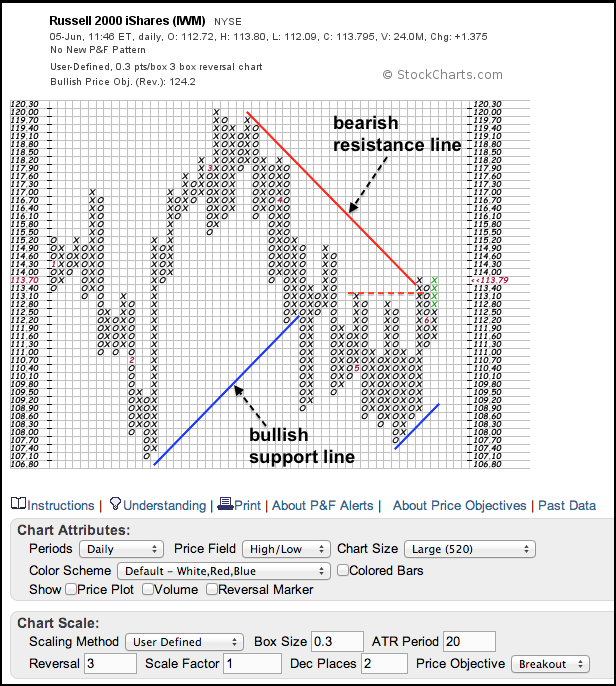

IWM Breaks Bearish Resistance Line on P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The P&F chart below shows the Russell 2000 ETF (IWM) with 30-cent boxes to capture the medium-term trend. Notice that this chart extends back to January, which is marked by the red numeral 1 in the first column. The ETF broke the bullish support line in April and...

READ MORE

MEMBERS ONLY

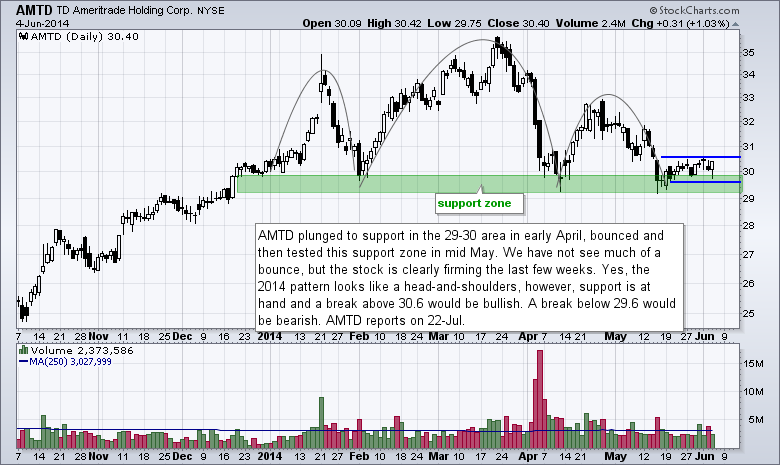

Chart Setups: AMTD, BBRY, DSX, IACI, SPWR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's charts feature five setups. First, we have a stockbroker testing a major support zone. Second, there is a cell phone maker gapping higher and holding the gap. Third, a shipper is showing signs of life with a big move. The fourth chart features an internet company with...

READ MORE

MEMBERS ONLY

CCI Breakout on IWM Chart Holds - TLT Breaks Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks edged higher on Wednesday with the major index ETFs posting modest gains. The economic reports continue to be positive with the ISM Services Index coming in well above 50 and the ADP report showing 179000 new private sector jobs. Also note that the Fed's beige book showed...

READ MORE

MEMBERS ONLY

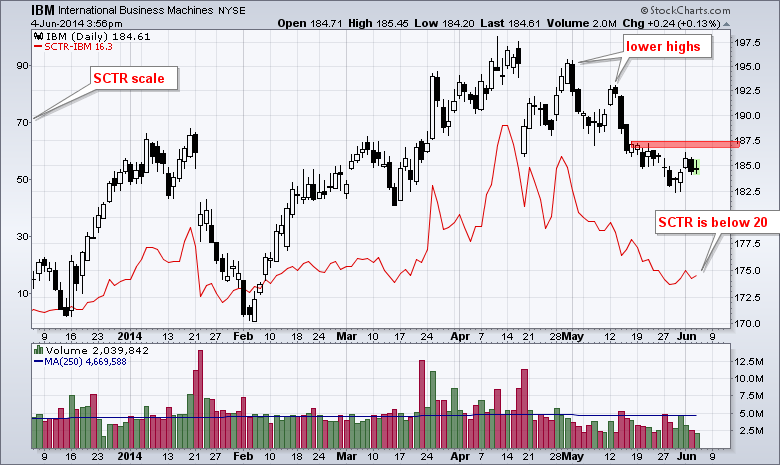

Dow Hits New High without Big Blue

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Industrials hit another new high this week, but IBM did not help the cause and remains well below its mid April high. This means IBM shows relative weakness, which is confirmed by the StockCharts Technical Rank (SCTR). The SCTR (red line) is below 20 and has spent most...

READ MORE

MEMBERS ONLY

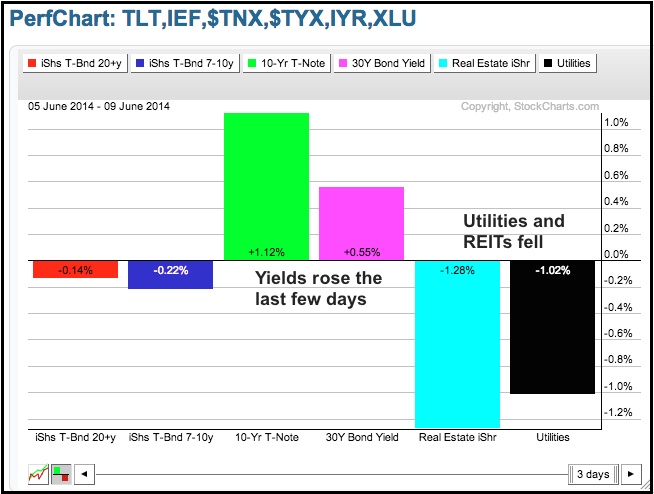

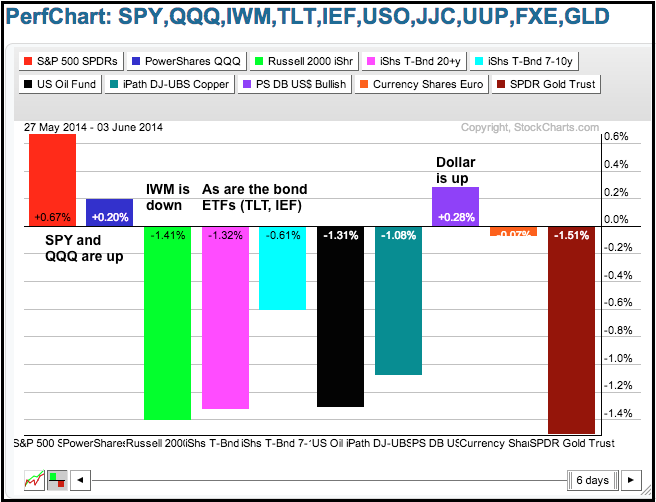

Stocks Start Outperforming Bonds as TLT Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks put in a lackluster performance as the market awaits a data deluge in the coming days. We have the ADP Employment Report, Fed Beige Book and ISM Services today. Initial Claims and the European Central Bank (ECB) meeting are Thursday. And, of course, Friday is non-farm payrolls. Automakers reported...

READ MORE

MEMBERS ONLY

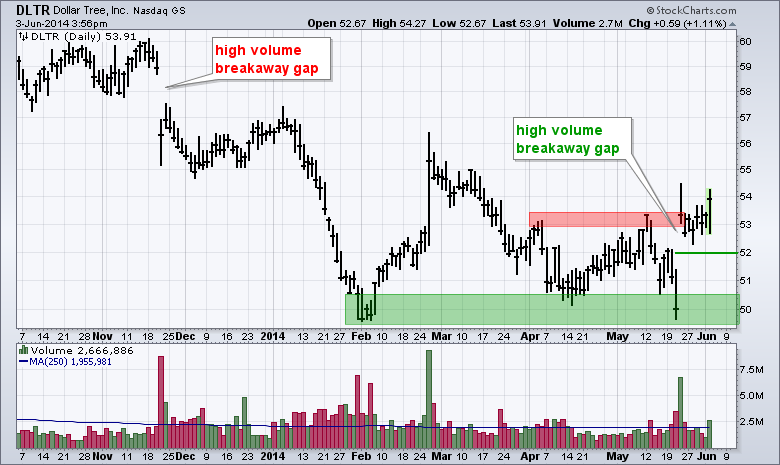

Dollar Tree Holds the Breakaway Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dollar Tree chart shows two breakaway gaps in opposite directions. The first breakaway gap occurred in November and started a downtrend. The second breakaway gap occurred in late May and held for over a week. Like the November gap, this gap occurred on high volume and could signal the...

READ MORE

MEMBERS ONLY

KRE Challenges Resistance as TLT Plunges to Trend Line Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks put in a mixed performance on Monday with large-caps and mid-caps edging higher, and small-caps moving lower. The gains and losses were contained and not enough to affect the short-term trends. Five of the nine sector SPDRs were up, but the gains and losses were inconsequential. Of note, the...

READ MORE

MEMBERS ONLY

Chart Setups: ATVI, ANF, LB, MOS, NYT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's charts feature five setups. A video game maker is consolidating within an uptrend. A teen apparel retailer triggered a bear trap after a failed support break. A women's apparel retailer is consolidating after a gap-reversal. A fertilizer company formed a big bullish continuation pattern. And,...

READ MORE

MEMBERS ONLY

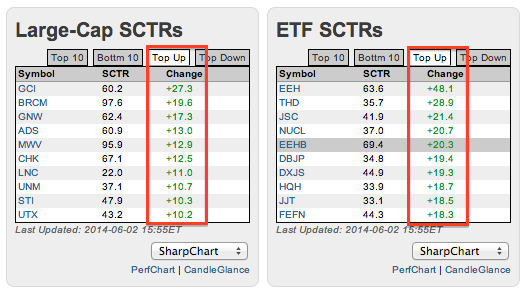

Gannet Leads Large-caps SCTR Gainers with a Big Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Looking for relative performance leaders? Look no further than the StockCharts home page and the top SCTR movers. The StockCharts Technical Rank (SCTR) tables can be found on the home page near the bottom. Click the "top up" tab to see the biggest gainers and "top down&...

READ MORE

MEMBERS ONLY

SPY and TLT Hit New Highs ahead of Big Economic Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR and 20+ YR T-Bond ETF extended their uptrends with new highs last week, but this positive correlation could get a big test with a full economic docket this week. The Dow Diamonds, Nasdaq 100 ETF, Equal-Weight S&P 500 ETF and S&...

READ MORE

MEMBERS ONLY

Regional Bank SPDR Continues to Track the Yield Spread

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While falling yields translate into lower borrowing costs for the borrower, they are not always positive for the lender. In particular, the recent decline in the 10-Year Treasury Yield ($TNX) caused the spread between the 10-year yield and the 2-year yield to narrow (red dashed line). The chart below shows...

READ MORE

MEMBERS ONLY

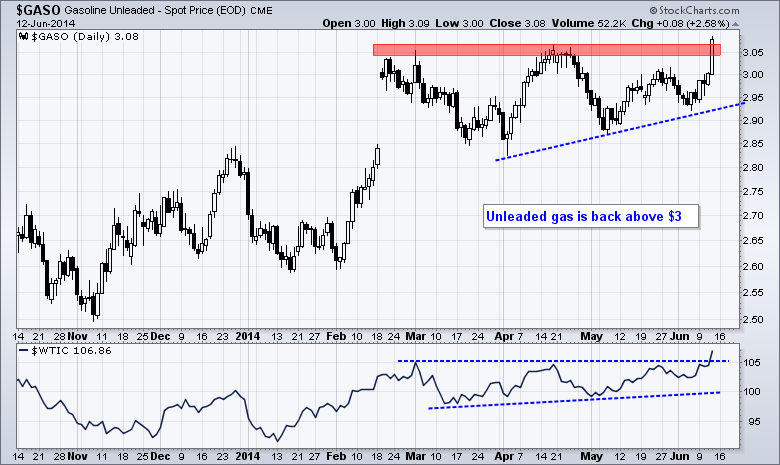

Chart Setups: COPPER, GME, NBL, $WTIC, XRT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's charts feature five setups from across the board. A key industrial metal retraced 50-62% of its prior advance and may hit resistance soon. A game retailer with high short interest gapped up. An oil services company shows signs of firming in a key retracement zone. Oil hit...

READ MORE

MEMBERS ONLY

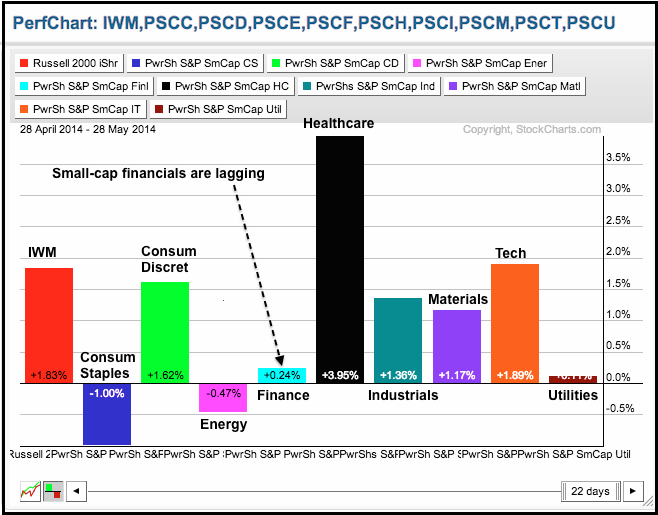

Small-Cap Financials are Still Underperforming

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Note that I will be taking a day off on Friday and Art's charts will not be updated until Monday. Stocks took a breather on Wednesday with small losses in the major index ETFs. The Russell 2000 ETF and Russell MicroCap iShares suffered the biggest losses, but the...

READ MORE

MEMBERS ONLY

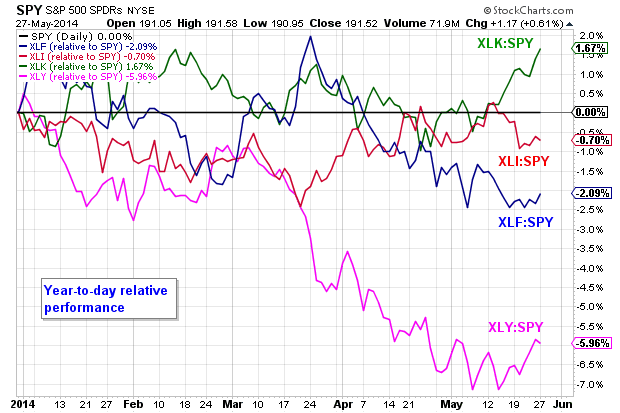

Tech SPDR Makes a Relative Strength Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows year-to-date relative performance for four sector SPDRs (XLK, XLF, XLI and XLY). Notice that the XLK:SPY ratio shot up over the last two weeks and moved to its highest level of the year (above the February peak). In fact, the XLK:SPY ratio is the...

READ MORE

MEMBERS ONLY

Techs Lead Market High - Gold Confirms Bearish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were higher again on Tuesday with small-caps leading the way. The Russell 2000 ETF and Russell MicroCap iShares gained 1.44% and 1.92%, respectively. Strength in small-caps triggered a breakout in IWM as it moved above its mid May high. The Finance SPDR and Technology SPDR led the...

READ MORE

MEMBERS ONLY

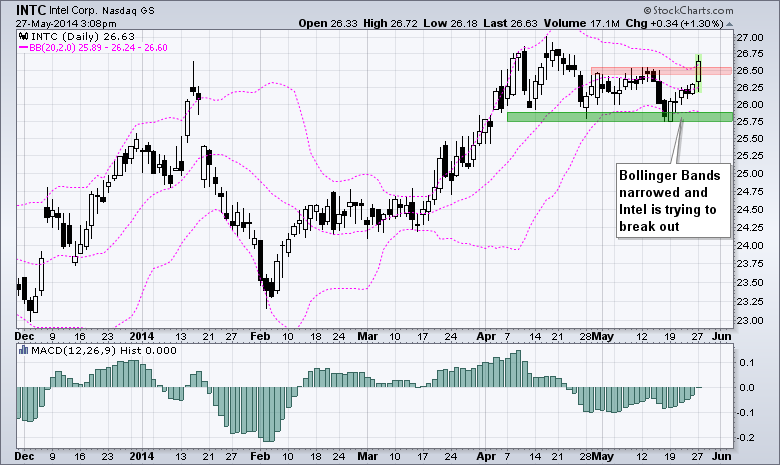

Intel Gets a Squeeze and a Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intel (INTC) is leading the semiconductor group higher with a move above its upper Bollinger Band. Notice how the bands contracted as volatility narrowed over the last few weeks. The breakout signals what could be the start of a volatility expansion and continuation higher. Chartists can use the recent lows...

READ MORE

MEMBERS ONLY

Chart Setups: CY, GPS, LB, MRVL, USG

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's charts feature five setups in various groups. We start with a semiconductor stock making a breakout on high volume. Next, there are two retailers with bullish continuation patterns forming. Both broke out with gaps and are now consolidating. Fourth, we have another semiconductor stock bouncing off support...

READ MORE

MEMBERS ONLY

IWM Moves Back above Key Moving Average - SPY Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last week was a pretty good week for stocks. First, small-caps led the market as the Russell 2000 ETF gained over 2%. Second, the Consumer Discretionary SPDR led the sectors higher with a 2.09% gain. Third, Treasuries actually fell as the 20+ YR T-Bond ETF lost .74% last week....

READ MORE

MEMBERS ONLY

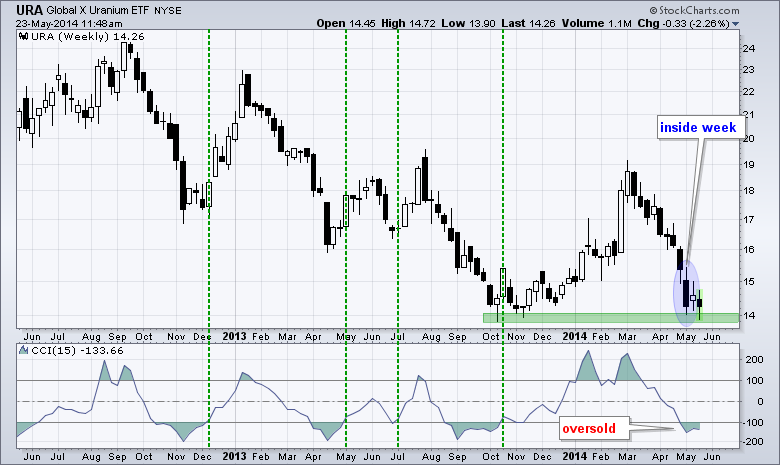

Uranium ETF Tests Support with Inside Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Global Uranium ETF (URA) has had a tough eleven weeks with a decline from 19 to 14, but support may be at hand. The October-November lows marked support in the 14 area and the ETF firmed here with an inside week last week. Also notice that CCI is oversold....

READ MORE

MEMBERS ONLY

IWM Keeps Bear Trap Alive - ITB Bounces within Downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher on Thursday with another lopsided advance. The Russell 2000 ETF gained around 1%, but the S&P 500 SPDR gained just .30%. Small-caps led and large-caps lagged. Eight of the nine sectors were higher with the consumer discretionary and finance sectors leading. Homebuilders contributed to relative...

READ MORE

MEMBERS ONLY

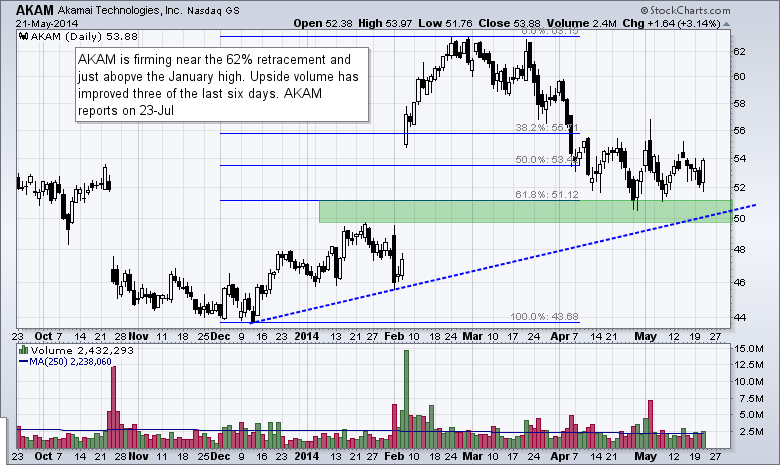

Charts: ANF, AKAM, CYH, DDD, FB

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's charts feature five setups in various groups. We start with an internet stock that is firming in a gap zone and retracement area. There is a clothing retailer with a bearish wedge. Next up is a hospital stock that appears to be healing with a gap and...

READ MORE

MEMBERS ONLY

Media Stocks Lead XLY - Small-Cap Breadth Indicator Remains Bearish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded on Wednesday with large-caps leading the way. The Dow Diamonds (DIA) and S&P 100 ETF (OEF) rose around 1%. All sectors were up with consumer discretionary and industrials leading. Note, however, that the Retail SPDR (XRT) and the Home Construction iShares (ITB) did not lead the...

READ MORE

MEMBERS ONLY

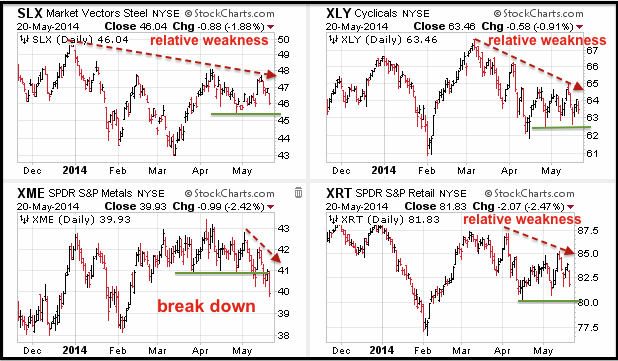

Metals & Miners SPDR Breaks Support and Shows Relative Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After stalling in March and April, the Metals & Miners SPDR (XME) turned lower in May and broke a key support zone. Notice how XME held the 41 area for two months and then broke this zone twice in May. The indicator window shows the price relative (XME:SPY ratio)...

READ MORE

MEMBERS ONLY

Retailers Weigh on Market, but SPY and QQQ Hold Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks came under selling pressure with retailers leading the way lower. The Russell 2000 ETF and Russell MicroCap iShares lost around 1.5% on Tuesday. The S&P 500 SPDR and Nasdaq 100 ETF led up relatively well with losses of .63% and .36%, respectively. Yes, the song remains...

READ MORE

MEMBERS ONLY

Charts: AMD, GLF, F, FAST, TWO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's charts feature five setups in various groups. A little chip maker found support near its prior gap with a breakout the last two days. An offshore driller shows signs of buying pressure after a breakout. An auto maker bounces off support. An industrial supply stock firms near...

READ MORE

MEMBERS ONLY

Techs and Small-Caps Lead the Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rallied on Monday with techs and small-caps leading the way. The Russell 2000 ETF gained over 1% and the Nasdaq 100 Equal-Weight ETF advanced .85% on the day. Seven of the nine sector SPDRs were higher with technology, finance and consumer discretionary leading. Their gains, however, were quite modest...

READ MORE

MEMBERS ONLY

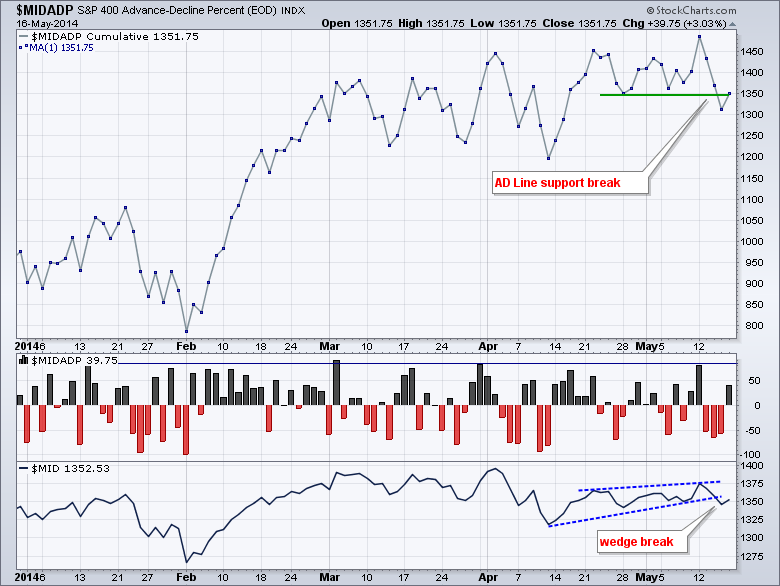

MidCap AD Line Breaks First Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

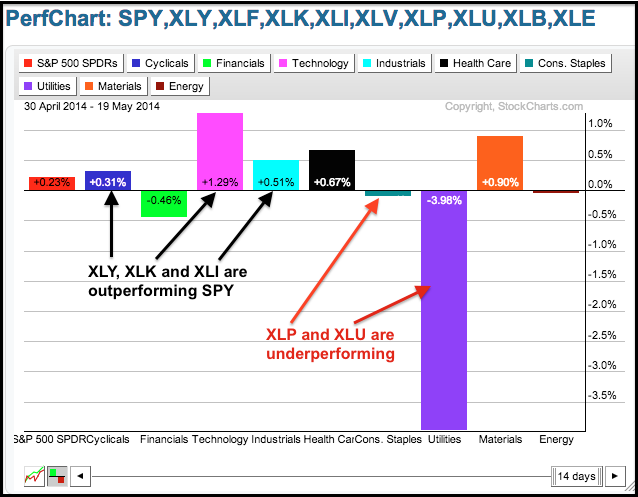

Stocks remain mixed overall, but selling pressure is quietly spreading. The S&P 500 SPDR and Nasdaq 100 ETF continue to hold up well, but the Russell 2000 ETF and small-caps remain relatively weak. The market as a whole remains vulnerable as long as small-caps under perform. Note that...

READ MORE

MEMBERS ONLY

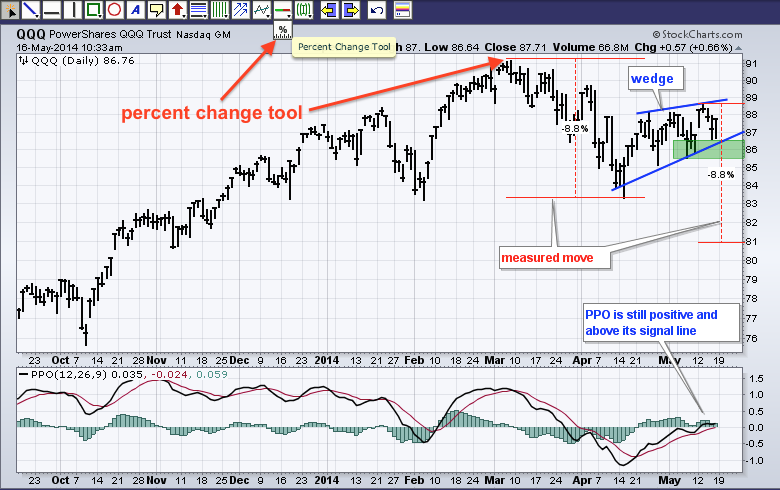

Another Wedge worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As noted in ChartWatchers two weeks ago, rising wedges are appearing on some key charts and chartists should watch these closely for directional clues. Even though the rising wedge can be a bearish continuation pattern, keep in mind that the immediate trend is up as long as the wedge rises....

READ MORE

MEMBERS ONLY

Test Looms for SPY as TLT Surges to Highest Level of 2014

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks took it on the chin Thursday with the major index ETFs falling across the board. Reading the financial media, one would have expected 2+ percent declines and blood in the street. The losses, however, where relatively modest and the Russell 2000 did not lead the way lower. The Dow...

READ MORE