MEMBERS ONLY

Charts of Interest: AKS, AMCC, CHKP, KBH, TEVA, VRTX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

$AKS Bounces with Good Volume. $KBH Forms Falling Wedge. $TEVA Traces out Bullish Engulfing Pattern.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves...

READ MORE

MEMBERS ONLY

QQQ Forms Spinning Top Candlestick with Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) broke above resistance from the July highs and remains in an uptrend, but a spinning top formed on Friday. These candlesticks show indecision and the prior two foreshadowed pullbacks within the uptrend.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

QQQ Breaks Resistance, but IWM Remains in Falling Channel

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There it is again. Stocks were pushed down early in the week, but positive news on employment and the ISM Services Index produced a very sharp rally on Friday. Small-caps led the surge as the Russell 2000 ETF (IWM) gained over 2%. All sectors were higher with the finance, industrials...

READ MORE

MEMBERS ONLY

IWM Bounces off 200-day and Tests Channel Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks turned a negative week into a positive week with a sharp advance on Friday. The S&P 500 ETF, Dow Industrials SPDR and Nasdaq 100 ETF recouped their early week losses and exceeded their July highs. The Russell 2000 ETF (IWM) and S&P MidCap 400 SPDR...

READ MORE

MEMBERS ONLY

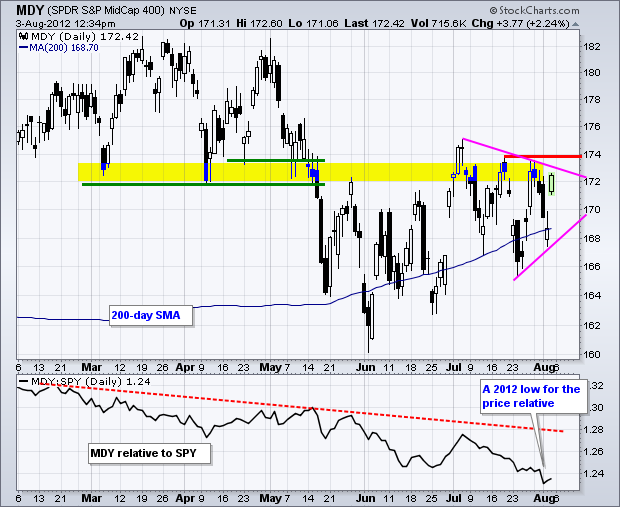

S&P MidCap 400 SPDR Battles Triangle Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P MidCap 400 SPDR (MDY) continues to underperforming the S&P 500 ETF (SPY), but the ETF is showing signs of life with a surge off back above the 200-day and a challenge to triangle resistance. A breakout would be bullish and target a move to...

READ MORE

MEMBERS ONLY

BPIs, NYSE AD Line and Net New Highs Keep Summary Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary. On the positive side, the NYSE AD Line is trading near a 52-week high, NYSE Net New Highs are positive and eight of the nine sector Bullish Percent Indices are above 50%. On the negative side, the AD Volume Lines remain weak,...

READ MORE

MEMBERS ONLY

TLT Channels Higher - GLD Hits Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved sharply lower on Thursday's open when it became clear that European Central Bank (ECB) president Mario Draghi was not quite ready to act. Nevertheless, stocks firmed at midday and then edged off their lows in the afternoon. Perhaps the market is expecting an upside surprise to...

READ MORE

MEMBERS ONLY

Fiserve Breaks Support after Island Reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Fiserve (FISV) gapped up last week, but then gapped down this week to forge an island reversal. The stock followed through with a support break at 68 and this short-term trend reversal is turning into a medium-term trend reversal.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

AD Volume Lines Falter as IWM Leads Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (-.36%) and Dow Industrials SPDR (-.19%) edged lower on Wednesday, but the Russell 2000 ETF (-1.65%) and S&P MidCap 400 SPDR (1.05%) moved decisively lower. Again, relative weakness in small-caps and mid-caps remains a major concern in the...

READ MORE

MEMBERS ONLY

Charts of Interest: ARO, ASEI, BBBY, FISV, HRB, LIFE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ARO Stalls at 61.80% Retracement.

FISV Forms Island Reversal.

HRB Breaks Flag Support with High Volume.

Plus ASEI, BBBY, LIFE

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

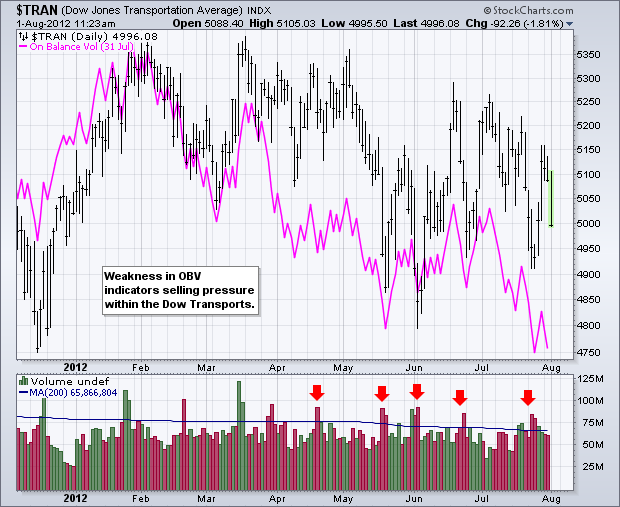

OBV Falls to New Lows for Dow Transports

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On Balance Volume (OBV) is a simple indicator that measures buying and selling pressure. Volume is added on up days and subtracted on down days. Even though the Dow Transports is holding above its June low, OBV sank to new lows and shows selling pressure.

Click this image for a...

READ MORE

MEMBERS ONLY

SPY Forms Falling Flag as USO Starts to Underperform

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued to edge lower on Tuesday with small-caps and mid-caps leading the way. The Russell 2000 ETF lost .70% and the S&P MidCap 400 SPDR declined just over 1%. Eight of the nine sectors were down with the Technology SPDR bucking the trend. However, XLK gained just...

READ MORE

MEMBERS ONLY

IWM and SPY Go Separate Ways

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ETF (IWM) and the S&P 500 ETF (SPY) parted ways over the last few weeks. IWM peaked in early July and zigzagged lower. SPY, in contrast, zigzagged higher with a move above the mid July high. This divergence means small-caps are showing relative weakness.

Click...

READ MORE

MEMBERS ONLY

SPY Stalls with Indecisive Candlestick

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks edged lower on Monday in listless trading. The Russell 2000 ETF (IWM) led the way down with a .64% loss, while the Nasdaq 100 ETF (QQQ) held most of its ground with a fractional .11% loss. Sector action was mixed with technology, energy, consumer staples and utilities slightly higher....

READ MORE

MEMBERS ONLY

Charts: ANF, CVS, DDR, DHI, KGC, MCHP, UTX, XL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

DHI Stalls above Resistance Break.

KGC Breaks Wedge Resistance.

MCHP Breaks Triangle Resistance.

Plus ANF, CVS, DDR, UTX, XL

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

Technology Stocks Lead Market Lower on Sector Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were weak on Monday with the Technology Sector (XLK) leading the market down. The average loss for a technology stock was .70 percent. Citrix (CTXS) was the big loser with a decline of 6.09%. The Consumer Discretionary SPDR (XLY) was also showing weakness.

Click this image for a...

READ MORE

MEMBERS ONLY

NYSE Breadth Remains Strong, but Nasdaq Breadth is Weak

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There was one downgrade, but the indicator summary remains net positive. Net New Highs were downgraded to neutral because Nasdaq Net New Highs are showing weakness as the cumulative line moved below its 10-day EMA. NYSE breadth remains strong overall as the AD Line trades near a 52-week high and...

READ MORE

MEMBERS ONLY

SPY Surges to Channel Trend Line - GLD Breaks Triangle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Mario Draghi said the magic words and stocks answered with a powerful surge higher. The rally started on Thursday and extended on Friday. The Russell 2000 ETF (IWM) and Nasdaq 100 ETF (QQQ) led the charge with 2+ percent gains. All sectors were higher the Technology SPDR (XLK), Industrials SPDR...

READ MORE

MEMBERS ONLY

Taking a Day off - Back on Monday

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I am taking Friday off. Art's Charts will return on Monday with the Indicator Summary and normal commentary. Have a great weekend!...

READ MORE

MEMBERS ONLY

S&P 500 Bounces off Bullish Support Line on P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a big surge above 1350 today, the S&P 500 reversed its falling O-Column and started a rising X-Column on the P&F chart. This reversal creates support from the prior two O-Columns and the rising Bullish Support Line (blue). A move below 1320 would break these...

READ MORE

MEMBERS ONLY

ITB Breaks Short-Term Support - GLD Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Wednesday. The Nasdaq 100 ETF (QQQ) and S&P 100 ETF (OEF) moving lower, but the Russell 2000 ETF (IWM) and S&P MidCap 400 SPDR (MDY) edging higher. The sectors were also moved with the Consumer Discretionary SPDR (XLY) and Technology SPDR (XLK)...

READ MORE

MEMBERS ONLY

Charts: AMZN, BBBY, CTXS, DRI, IDCC, JWN, NUE, SKUL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMZN Tests Triangle ahead of Earnings.

CTXS Gaps Down.

JWN Hits Key Retracement.

Plus BBBY, DRI, IDCC, NUE, SKUL

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

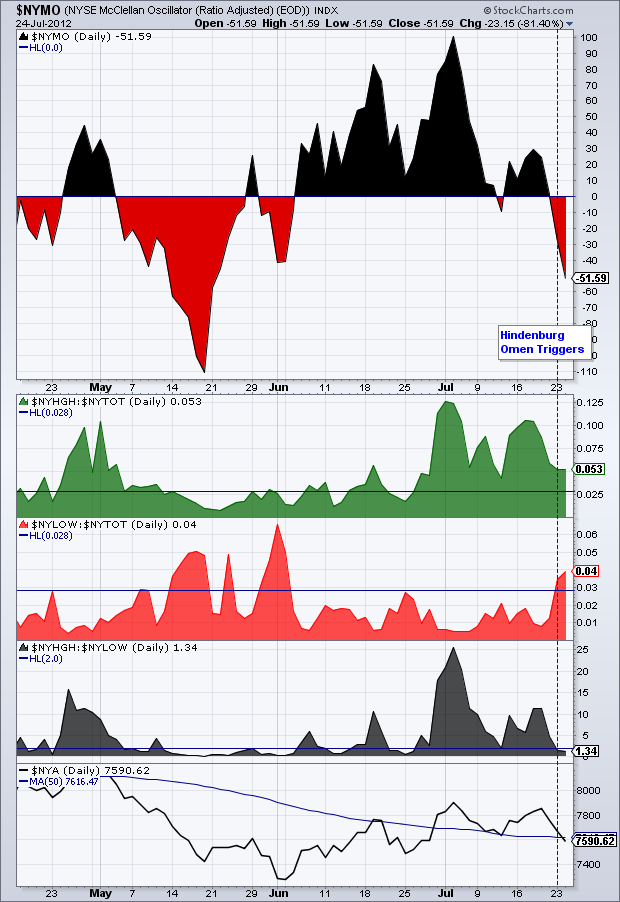

Hindenburg Omen Almost Triggers as New Lows Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This blog entry has been updated to reflect new information. The Hindenburg omen almost triggered on July 23rd. First, notice that new highs and news lows as a percentage of total issues surged above 2.8%. Second, notice that new highs were less twice the number of new lows. The...

READ MORE

MEMBERS ONLY

IWM Tests 200-day - GLD Firms within Falling Wedge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were under selling pressure again on Tuesday with the Russell 2000 ETF (IWM) and S&P MidCap 400 SPDR (MDY) leading the way lower. Small and mid-caps are less diversified than large-caps and they have less overseas exposure. In other words, they are more domestically oriented. Relative weakness...

READ MORE

MEMBERS ONLY

New Lows Expand on the Technical Indicator Scan

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The image below comes from the predefined scans page. New highs were outpacking new lows earlier this month, but the tide is shifting as new lows expand on the NYSE and Nasdaq.

Click this image for a live version....

READ MORE

MEMBERS ONLY

SPY Gaps Down Again - XLY Continues to Underperform

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs were hit with strong selling pressure on the open, but managed to bounce after gapping down. Nevertheless, the major index ETFs finished with losses and the gaps held. Small-caps led the way lower as the Russell 2000 ETF (IWM) lost 1.60%. All nine sectors were...

READ MORE

MEMBERS ONLY

Charts of Interest: CCE, ECA, FCX, FDX, JPM, NVDA, WU

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CCE Advances on Good Volume.

FDX Reverses at Key Retracement.

JPM Forms Falling Flag.

Plus ECA, FCX, NVDA, WU

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

Rising Yen Weighs on Japanese Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the market shifting to risk-off mode the last few days, the Yen ETF (FXY) broke above trend line resistance. The Yen has been moving higher since early July and the Nikkei 225 ($NIKK) has been moving lower. In fact, notice that this seesaw relationship has been quite strong in...

READ MORE

MEMBERS ONLY

IWM Gaps below Rising Wedge Trendline - XLF Underperforms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved sharply lower on Friday with the Russell 2000 ETF (IWM) and the Nasdaq 100 ETF (QQQ) leading the major index ETFs down. Seven of the nine sectors were lower with the Finance SPDR (XLF) leading this group. The Energy SPDR (XLE) and the Utilities SPDR (XLU) managed to...

READ MORE

MEMBERS ONLY

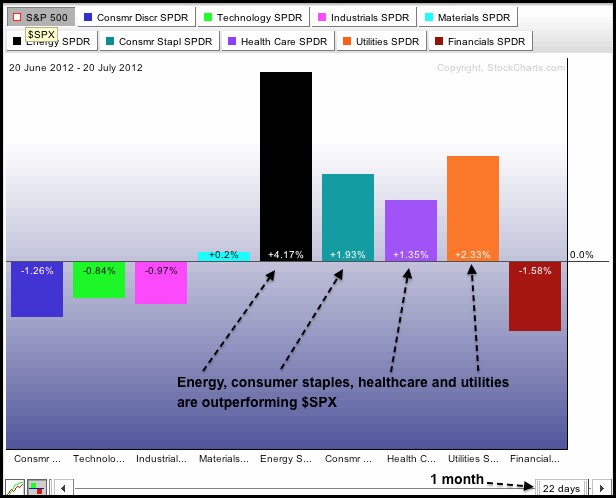

DEFENSIVE SECTORS STILL OUTPERFORMING OFFENSIVE SECTORS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The first chart shows the S&P Sector PerfChart for the one month time frame (22 trading days) and the second chart shows the three month timeframe (64 trading days). Note that these PerfCharts show relative performance, which is the amount the SPDR is outperforming or underperforming the S&...

READ MORE

MEMBERS ONLY

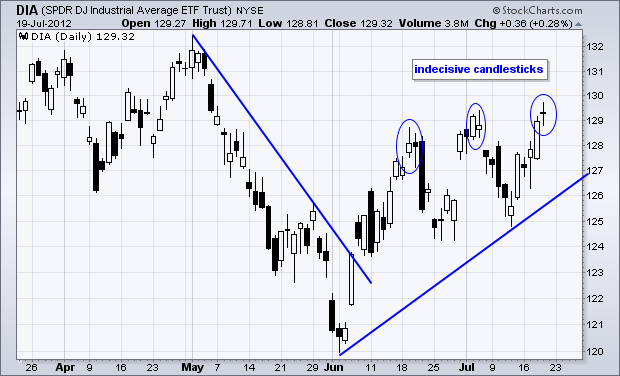

Dow Industrials SPDR Forms a Doji near Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a four day surge that carried the Dow Industrials SPDR (DIA) above 129, the ETF formed a doji to signal indecision on Thursday. Also notice that DIA formed indecisive candlesticks at the prior two peaks. A gap down and long black candlestick on Friday would form a rare evening...

READ MORE

MEMBERS ONLY

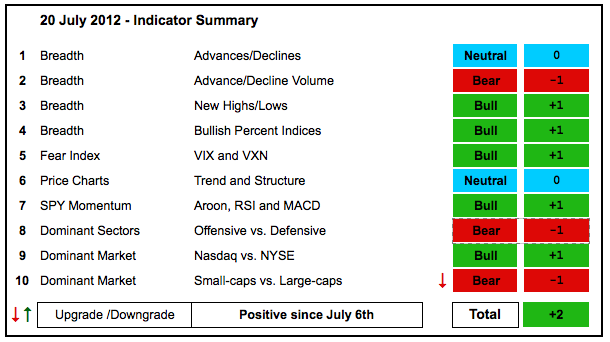

Small-caps Start Underperforming as AD Volume Lines Turn Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary remains positive overall, but I downgraded the small-cap/large-cap indicator because small-caps are seriously underperforming the last two weeks. Even though the indicators remain net positive, I remain concerned because some key indicators are still bearish. The AD Volume Lines are bearish overall and the offensive sectors...

READ MORE

MEMBERS ONLY

SPY Forms Doji as XLF and IWM Underperform

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Technology stocks led the market again on Thursday, but the finance sector weakened again and small-caps were also down on the day. Relative weakness in these two is not a good sign. At best, it points to a divided market that will trade sideways. At worst, it points to underlying...

READ MORE

MEMBERS ONLY

Finance SPDR Looks A Little Sick as the Price Relative Breaks Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Finance SPDR (XLF) led the market higher from early June to mid July, but stalled the last four days and started showing relative weakness. The indicator window shows the price relative (XLF:SPY ratio). Notice how this indicator broke support from the early July low and XLF is now...

READ MORE

MEMBERS ONLY

Charts: BDX, BX, CNX, MCD, MCO, MDT, SWKS, UNH, ZION

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SWKS Bounces off Support with Good Volume.

UNH Firms at Support Zone.

Plus BDX, BX, CNX, MCD, MCO, MDT, ZION

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all...

READ MORE

MEMBERS ONLY

IWM and XLY are Lagging, but SPY Extends Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulls simply refuse to buckle. Economic reports have been below expectations for months, earnings are less than stellar and the Fed stands ready to act. Perhaps the stock market is pricing in quantitative easing for August or September. Even though stocks advanced, the advance was not even and did...

READ MORE

MEMBERS ONLY

Technology Sector Lights up the Sector Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher with the technology sector leading the charge on Wednesday. The Sector Carpet shows lots of green in this key sector. Also notice that four of the top five performers come from technology. The finance sector was the weakest with three of the five biggest losers coming from...

READ MORE

MEMBERS ONLY

QQQ Forms Bearish Wedge and Underperforms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were edgy on Tuesday as Fed chairman Ben Bernanke testified before congress. After an initial pop on the open, the major index ETFs dipped lower for around 40 minutes and then surged back into positive territory in the early afternoon. Tuesday's dip now provides a short-term support...

READ MORE

MEMBERS ONLY

SPY and GLD Consolidate above their Breakouts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure hit the stock market after a weak retail sales report, but the major index ETFs managed to firm and finish with small losses. With another key economic report coming in below expectations, investors turned their attention to the prospects of more quantitative easing. Fed chairman Ben Bernanke testifies...

READ MORE

MEMBERS ONLY

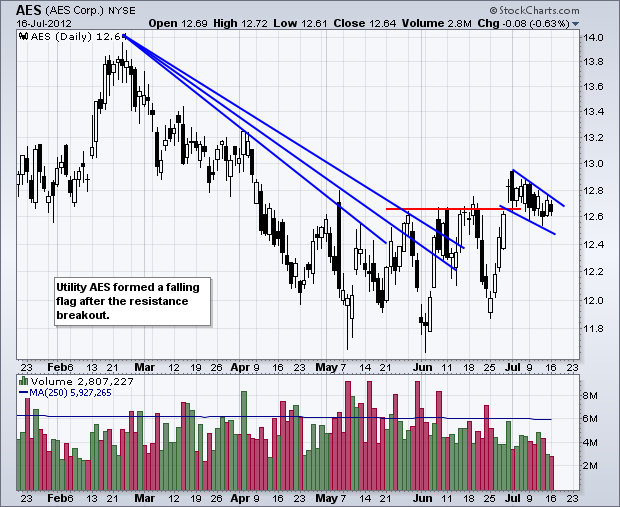

Charts: AES, ARO, ATVI, COV, DNR, GS, IACI, INTU, MRO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AES Extends Flag Consolidation.

ATVI Surges and then Forms Bull Flag.

COV Breaks Wedge Trend Line.

Plus ARO, DNR, GS, IACI, INTU, MRO

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or...

READ MORE