MEMBERS ONLY

Is the Charging Bull Getting Tired?

Optimism surrounds the stock market indexes with lofty price targets. Could the fulfillment of Point & Figure targets mean the end of a bull market? Find out here. ... READ MORE

Bruce is an industry-leading "Wyckoffian" who began teaching graduate-level courses at Golden Gate University in 1987. He has developed curriculum for and taught many courses in GGU’s Technical Market Analysis Graduate Certificate Program. Learn More

Optimism surrounds the stock market indexes with lofty price targets. Could the fulfillment of Point & Figure targets mean the end of a bull market? Find out here. ... READ MORE

There are a number of effective swing trading systems being used today. Let's explore one that is popular among Wyckoffians. It uses two inputs: Point and Figure charts and volume. Let's review this system with a case study of Charles Schwab Corp. (SCHW). As markets are... READ MORE

The secular bull market in stocks has been epic both in duration and extent. The NASDAQ 100 Index illustrates this bull run best of all. Using Wyckoff Method classic trendline construction techniques, the chart below illuminates this secular bull phenomena. The stride of the bull market run is set with... READ MORE

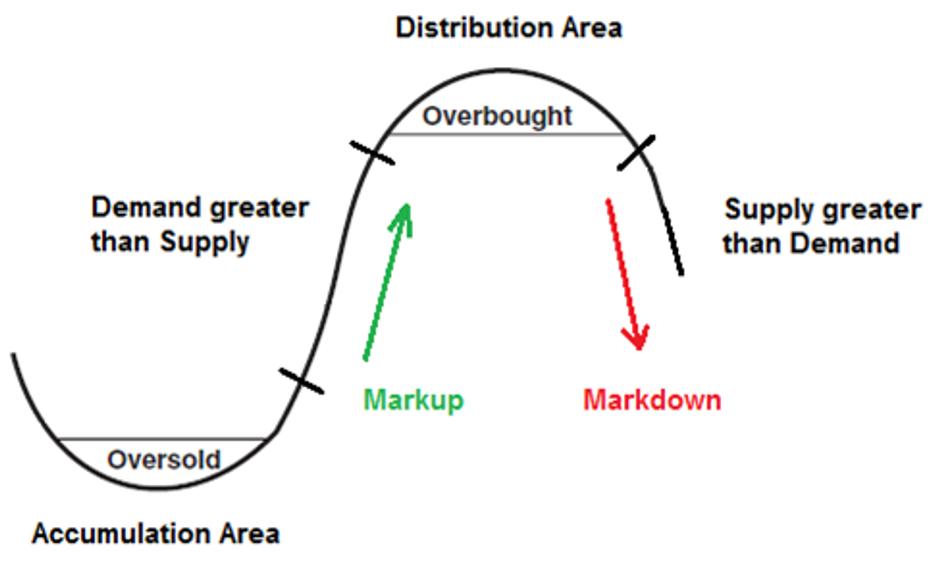

As we have discussed many times, financial markets are fractal. Different timeframes produce similar price structures. This is a very valuable phenomena for the study and practice of trading. When tracking the intraday time frame; Wyckoff structures of Accumulation, Markup, Distribution and Markdown repeat over and over. This creates a... READ MORE

In the classroom we would have students alter their view of charts they were evaluating to gain fresh perspective and possibly enhance their analysis. Students often had Ah-Ha moments after freshening their interpretation of a chart they had previously laid eyes on many times. Stock chart analysis heavily emphasizes the... READ MORE

The S&P 500 index ($SPX) is a capitalization-weighted stock index. Many lesser capitalization blue-chip stocks that compose these 500 companies have been performance laggards. Though smaller companies in the index, these corporations are among the bluest of the blue-chip stocks. These prestigious corporations have been overshadowed by the... READ MORE

The NASDAQ 100 ($NDX) has been surging higher since October 2023 with the pace of advance accelerating in the second quarter of 2024. These 100 components are among the largest market capitalization NASDAQ Composite ($COMPQ) stocks. All of the ‘Magnificent-7' mega-caps are represented in this index. Now the second... READ MORE

It is well known that stock market indexes are fractal. Demonstrating repeatable price structures in all timeframes. In the intraday timeframe these price structures repeat frequently. The Wyckoff characteristics of Accumulation, Markup, Distribution and Markdown are constantly at work in smaller periods of time. Wyckoff students will study such structures... READ MORE

The Markup Phase of a Bull Market is glorious to behold and participate in. But they do ebb and flow. The bullish run in the major stock indexes has been persistent in 2024. We often discuss the quarter-end effect for stock index trends and the upward trend has persisted into... READ MORE

Crude Oil struck an intraday low on December 13th of 2023, the same day as Fed Chair Powell's notable press conference. This concluded a decline from approximately $95 (at the end of the 3rd quarter) to under $68 (near the end of the 4th quarter). After that Fed... READ MORE

On this week's edition of Stock Talk with Joe Rabil, Joe features special guest, Bruce Fraser of Power Charting. Joe and Bruce discuss swing trading in detail, first by defining swing trading and how it is different from trend trading, and then spending time going through the SIG... READ MORE

A Buying Climax typically concludes a long term uptrend. The rally phase from the October low of 2023 has these climactic characteristics. This advance comes after a major trend that began in late 2022. The steady upward march in the 4th quarter of 2023 was broad and powerful, which created... READ MORE

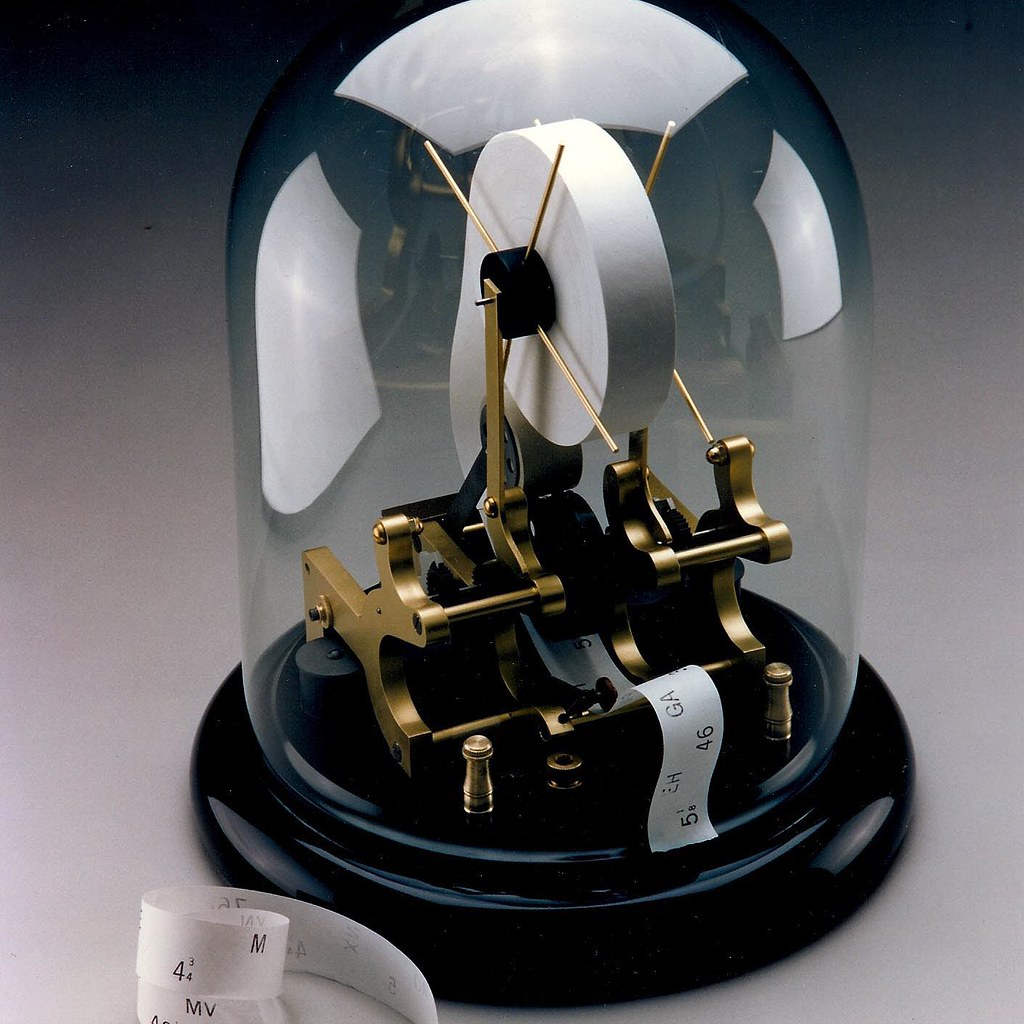

Recent Power Charting episodes have been devoted to the classic technique of chart reading innovated by Richard D. Wyckoff. He referred to the method as ‘Tape Reading' while it is actually the technique of reading charts, bar by bar to assess the likely future direction of an index, stock,... READ MORE

Last week's sharp upward reversal in the bond market followed the FOMC Interest Rate decision. A decision to not change the Fed Funds Interest Rate target. Unlike the prior meeting ‘non-action', this decision inspired robust bond and stock buying by the investment community. The downward stride of... READ MORE

A project that I have been working on in recent years is Horizontal PnF Counting using Percent Scaling. The method has generated promising results. Here we look at two case studies that illustrate the techniques value. Using the ‘Percentage Chart Scaling' Method in StockCharts.com Point & Figure charting... READ MORE

Being able to efficiently drill down from Sector to Industry Group to best Stock ideas is critical to an effective methodology. John Colucci guest hosts this episode of Power Charting to illustrate such a method and the scanning principles developed for the ‘Wyckoff Market Report'. Johni Scan (editor) does... READ MORE

Wyckoff analysis of this essential commodity is currently revealing. The trend of Crude Oil has a major influence on not only most sectors of the stock market, but it is also a key cost input for the production of almost all goods, services, and other commodities. Since March of 2022,... READ MORE

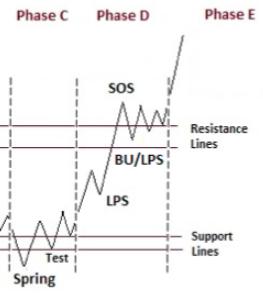

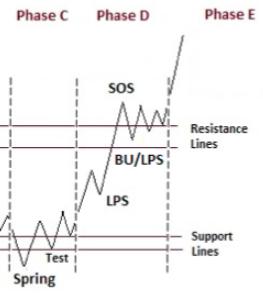

Are the major stock indexes under Accumulation? If so, we Wyckoffians would expect an important Markup (uptrend) to follow. Accumulation is the process of large interests (known as Composite Operators) stealthily Absorbing shares of stocks they expect to appreciate during the subsequent Markup Phase. Accumulation can take an indeterminant period... READ MORE

Mega-Cap Growth stocks have led the stock market weakness on the way down in 2022. They have also lagged during the 4th quarter rally. This weakness has been a drag on major stock indexes such as the S&P 500 and the NASDAQ Composite. With the recent rally phase... READ MORE

On rare occasions stock indexes become delicately balanced between two profoundly differing scenarios. This currently seems to be one of those junctures. The most recent Power Charting TV episode explores this existential moment. Stock indexes have been in a mega-bullish upward stride since 2009. The pace of this advance has... READ MORE

Richard D. Wyckoff, the Master, in his own words; and his quest to understand what propelled stock prices. He observed large interests conducting campaigns of a magnitude that resulted in trends lasting for months and years. As a young man he studied these Composite Operators (C.O.) and how they... READ MORE

Determining the stride of an uptrend or downtrend is an essential Wyckoff technique. The stride of a trend is often set early in that trend and then prices can adhere to that pace of advance or decline for the majority of the bull or bear run. Trend determination techniques have... READ MORE

In May and June oversold conditions in the major stock indexes developed. Internal breadth and sentiment measures reached notable extremes. Keeping in mind the quarter-end effect, Wyckoffians were on the lookout for an acceleration of the downtrend into a ‘Selling Climax', which arrived in mid-June (quarter-end). Following a series... READ MORE

When studying the markets chartists can tend to become myopic and close in on smaller and smaller timeframes (certainly that is the case for this Wyckoffian). Meanwhile, the tsunami of monster trends can engulf portfolios with unexpected reversals. A powerful antidote to this vulnerability is awareness of the major price... READ MORE

Trouble for the S&P 500 Index became apparent last September when an outsized decline arrived. Downward volatility with volume expansion (presence of Supply) characterized the decline into October, touching the demand trendline. Bulls were relieved by the near vertical rise into November which included a new high in... READ MORE

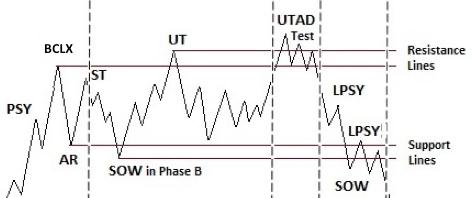

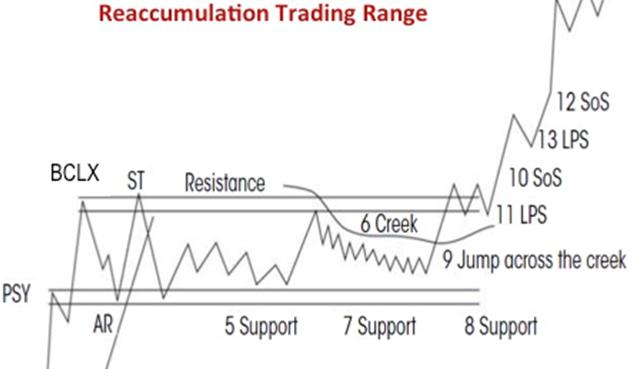

Join Johni Scan and me for Monday's (2/28/2022) "Your Daily Five" where we focus on Distribution and Re-Accumulation characteristics. Both begin in nearly the same manner but conclude very differently. A Re-accumulation is a range-bound condition that forms after an uptrend. It is a... READ MORE

Join Johni Scan and me on our quest to develop a library of Wyckoff Scans during 2022. Context is a term often used with chart analysis employing the Wyckoff Method. Understanding the chart attributes during the various phases of Accumulation, Distribution and Trend Analysis is a cornerstone of the Methodology.... READ MORE

The Point and Figure charting engine at StockCharts.com is an outstanding tool. It provides incredible flexibility to draw many varied types of PnF charts. Navigating the PnF chart controls is easy once they are understood. Wyckoffians use these charts to estimate price objectives using a horizontal counting method. There... READ MORE

Apple, Inc. (AAPL) has been one of the most analyzed stocks in the Wyckoff Power Charting pages. It is the largest company by market capitalization and has a huge influence on the major stock indexes. On March 19th of 2015 it was added to the (pre) historic Dow Jones Industrial... READ MORE

On the most recent episode of Power Charting on Stock Charts TV (link below) an analysis of the Dow Jones Industrial Average was considered. A sudden and sharp reaction occurred earlier this week. The index returned to the Oversold Trendline and found good support. Is the DJIA completing a Reaccumulation... READ MORE

Join special guest Alessio Rutigliano for a discussion of Crypto Currencies and the Wyckoff Method. Alessio has become a foremost expert on trading Crypto. He has very effectively combined vertical bar chart analysis and horizontal Point & Figure (PnF) studies (link to the Power Charting episode is below). Alessio and... READ MORE

Materials prices are screaming higher and higher and this is emphasizing to investors that inflation is surging. Eventually raw and intermediate materials price increases work their way into the Consumer Price Index (C.P.I.) trend. The Federal Reserve acknowledged as much last week, using the term ‘frothy' to... READ MORE

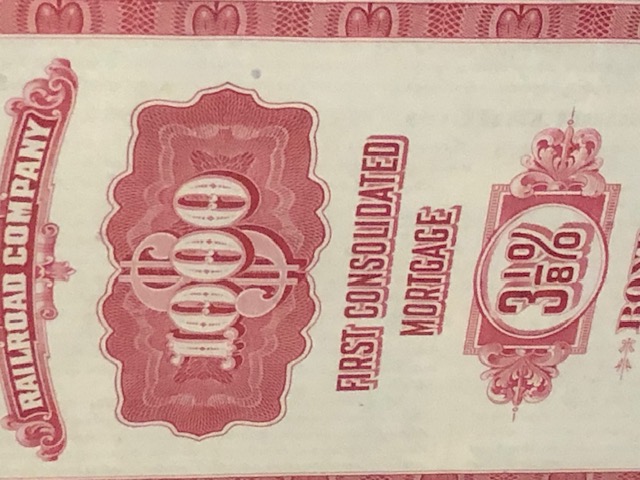

Campaign Investing is a specialized process. The tools of the Wyckoff Method are very adaptable to the practice of Campaigning. Wyckoff is fractal, working effectively in multiple timeframes. In the case of Campaigning the longer time periods are evaluated. The goal is to identify the pre-conditions to the emergence of... READ MORE

Richard D. Wyckoff was on a mission to discover the ‘Real Rules of the Game' for success on Wall Street. He understood that public investors and traders were not profitable in their speculative activities and, in fact, were being preyed upon by large stock market operators. Mr. Wyckoff devoted... READ MORE

On January 4th BOK Financial (BOKF), PacWest Bancorp (PACW) and super regional bank SVB Financial (SIVB) all received analyst upgrades. BOKF and PACW were increased to ‘Overweight' status. The Financial sector (XLF) and bank industry groups are in constructive uptrends. Using Wyckoff Methodology technique can we confirm the timeliness... READ MORE

Lockheed Martin (LMT) announced in December the acquisition of Aerojet Rocketdyne Holdings (AJRD) for $56 per share. From a Wyckoff perspective this appears to be a great deal for LMT. The Point and Figure chart indicates that Lockheed management knew they were purchasing an undervalued company. We typically think of... READ MORE

In these holiday shortened weeks volatility could be the central story of the stock market indexes. Empty trading desks and light volume make it easier for markets to get pushed around. The emergence of a potential new strain of COVID-19 in England has kicked off this weeks market excitement. The... READ MORE

Sentiment measures are environmental to the stock market. They speak to the general state of speculation in stocks, but are difficult to use for precise timing. Sentiment is considered in a contrary way for speculative markets. In the example of the Equity Put to Call ratio (plotted below), when an... READ MORE

This weeks Power Charting episode sparked interest as it covered current market conditions and also the long term stock market cycle. Roman Bogomazov and I also discussed these topics in our weekly ‘Wyckoff Market Discussion' episode, which can now be viewed on-demand. Roman and I invite you to join... READ MORE

Starting in the second quarter of 2019, Tesla Inc. (TSLA) stock has launched like a SpaceX rocket. In the Wyckoff Method a ‘Cause' will precede an ‘Effect'. A Cause is a preparation phase of Accumulation or Distribution (a trading range). The Horizontal Point and Figure (PnF) counting technique... READ MORE