MEMBERS ONLY

What Can the VIX Reveal To Us In November 2023?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tim Hayes of Ned Davis Research shares an outlook for interest rates in 2024, and explains why a VIX over 28.5 could mean disaster for risk assets. Host David Keller, CMT updates charts of stocks reporting earnings including SBUX,...

READ MORE

MEMBERS ONLY

Signs of Top in Rates As Fed Says NO CHANGE

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Katie Stockton, CMT of Fairlead Strategies shares her weekly charts of the S&P 500, VIX, and XLK and identifies three areas of opportunity through year-end 2023. Dave breaks down this week's Fed meeting from a technical...

READ MORE

MEMBERS ONLY

Stock Market Hinges on the Ten Year Interest Rate

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tony Dwyer of Canaccord Genuity breaks down four charts that speak to a potential tactical rally for the S&P 500, and explains why this market is still all about interest rates. Meanwhile, Dave charts the downtrend channel for...

READ MORE

MEMBERS ONLY

Countertrend Rally in the Works for SPX? What the Charts Reveal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave discusses implications for this week's earnings releases, the November Fed meeting, and geopolitical events. He answers live viewer questions on volume-based indicators, downside targets for the S&P 500 chart, possibilities for a countertrend rally for...

READ MORE

MEMBERS ONLY

My Downside Targets for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 has almost reached the minimum downside objective based on the head and shoulders topping pattern.

* SPX 3800 would mean represent a 38.2% retracement level of the March 2020 to January 2022 bull market phase.

If you've been fighting the mounting...

READ MORE

MEMBERS ONLY

Where to Find Stock Opportunities in Bear Territory

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, host Dave wraps a bearish week with a discussion on downtrend conditions, trendline resistance, deteriorating breadth, and finding opportunities in a bearish landscape. He answers viewer questions on inverted yield curves, recessionary periods, and leading vs. lagging technical indicators.

This...

READ MORE

MEMBERS ONLY

Late-Hour Selloff Confirms Downtrend Phase!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Tom Bowley of EarningsBeats shares his chart of key ratios illustrating how growth still has held its ground relative to value stocks. Host David Keller, CMT focuses in on distribution in the last hour of trading and highlights one...

READ MORE

MEMBERS ONLY

NASDAQ NOSEDIVES, Down Over 2% At The Close!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mary Ellen McGonagle of MEM Investment Research shares three stocks showing promise during a period of severe market distribution. Dave focuses in on the S&P 500 testing Fibonacci support and breaks down earnings for Microsoft, Alphabet, Spotify,...

READ MORE

MEMBERS ONLY

How Mega-Cap Names Dominate Through Market Cap

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares how growth over value is less about the types of companies and more about the market cap represented in the largest benchmark names. He breaks down today's pop-and-drop for Bitcoin and answers questions from the newly-added...

READ MORE

MEMBERS ONLY

Lagging Indicators Confirm Bearish Phase For Growth

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Leading indicators help anticipate price reversals, while lagging indicators validate trend changes you've already observed.

* RSI combines the qualities of leading and lagging indicators, helping investors to prepare for and react to trend reversals.

* AAPL recently showed a bullish momentum divergence, meaning the leading indicator has...

READ MORE

MEMBERS ONLY

Growth Sectors Tumble as Defensive Plays Post a Strong Finish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the rapid decline in growth sectors including Technology and Communication Services as defensive plays like utilities and gold post a strong finish to the week. Dave answers questions from The Final Bar Mailbag on the McClellan Summation Index...

READ MORE

MEMBERS ONLY

Stocks Continue Feeling The Pressure From Higher Rates

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Chris Verrone of Strategas Research Partners discusses how small-caps may emerge from the quagmire, along with why it's important to focus on relative strength. Host David Keller, CMT points out the continued strength of offense over defense...

READ MORE

MEMBERS ONLY

The Most Important Chart to Watch During Earnings Season

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Adam Turnquist, CMT of LPL Financial shares his chart of the Ten Year Treasury Yield and explains why the US Dollar may be the most important chart to watch as earnings season begins. Dave highlights stocks making new swing...

READ MORE

MEMBERS ONLY

Breadth Indicators Illustrate Recent Dire Conditions

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Doug Ramsey, CFA CMT of The Leuthold Group talks small-cap underperformance and shares two breadth indicators illustrating the recently dire conditions. Host David Keller, CMT declares the 200-day moving average "the most important line in the sand for...

READ MORE

MEMBERS ONLY

Maximizing Profits: Three Stocks in Three Phases

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The accumulation phase is marked by higher highs and higher lows, as investors push the price onward and ever upward.

* Stocks in the distribution phase are trending lower, with the price usually below two downward-sloping moving averages.

* A symmetrical triangle or "coil" pattern is a telltale...

READ MORE

MEMBERS ONLY

10 Crucial Charts Shaping The Markets in October 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special edition of StockCharts TV'sThe Final Bar, Dave breaks down the crucial charts shaping October 2023's financial landscape.

This video originally premiered on October 6, 2023. Watch on our dedicated Final Bar pageon StockCharts TV, or clickthis linkto watch on YouTube.

New episodes of...

READ MORE

MEMBERS ONLY

The Top Three Indicators Pressuring Earnings Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Jesse Felder of The Felder Report shares his long-term charts comparing price and earnings, and reveals the two charts he's watching now to navigate a potential market bottom. Dave focuses on resilient strength in the semiconductor group and...

READ MORE

MEMBERS ONLY

How Market Breadth Indicators Can Lead You Out of Market Bottoms

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave digs out his market correction playbook and shares what market breadth indicators tend to do leading into and out of market bottoms. He also reveals the charts that can serve investors well in corrective phases, using relative strength as...

READ MORE

MEMBERS ONLY

Here's a Scary Scenario for You: S&P 500 Downside to 2200?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investment Partners updates his Elliott Wave count for the S&P 500 and shares what the MOVE index can tell us about further upside potential for interest rates. Dave recaps the continued deterioration...

READ MORE

MEMBERS ONLY

Watch for These Signs of a Bottom As Market Breadth Conditions Crumble

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how market breadth conditions have continued to deteriorate to the point where signs of a bottom may emerge. He answers viewer questions on historical Fed cycles, under-performance of defensive sectors like utilities, and how to use technical analysis...

READ MORE

MEMBERS ONLY

Your Burning Questions, Answered: FATE of TESLA & Bullish Bias Solutions!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions about Tesla's potential trajectory towards the 200-day moving average and ways to normalize relative strength graphs using volatility measures. He also dives into his past trades' technical setup, shares tips for setting up...

READ MORE

MEMBERS ONLY

Is it Possible for the S&P 500 to Hold the 4300 Level?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Samantha LaDuc of LaDuc Capital breaks down the implications of higher interest rates and why semiconductors remain a crucial space to watch. Host David Keller, CMT tracks the recent rally in Bitcoin and identifies two key names testing moving average...

READ MORE

MEMBERS ONLY

Looking at Recent Market PULLBACK in a Long-Term Context & More!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Joe Rabil of Rabil Stock Research walks through his monthly, weekly, and daily S&P 500 charts to put the recent market pullback into proper long-term context. Host David Keller, CMT digs into breadth indicators that have turned quite...

READ MORE

MEMBERS ONLY

S&P 500 Head and Shoulders Top Confirmed

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The head and shoulders pattern is a classic price pattern that confirms an exhaustion of buyers.

* Investors should consider the three phases of price patterns, and make sure to confirm all three phases before taking action.

* This pattern yields a minimum downside objective of around 4080-4100 for the...

READ MORE

MEMBERS ONLY

Confirmed! Head-and-Shoulders Top Pattern for the S&P 500!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Mish Schneider of MarketGauge shares why the most important ETFs to watch are Retailers (XRT) and Small Caps (IWM) and also shares their latest plugin on the StockCharts ACP platform. Host David Keller, CMT tracks today's risk-off move...

READ MORE

MEMBERS ONLY

Fed Keeps Hands Off Rates, Leaves DOOR OPEN for More Hikes!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Danielle Shay of Simpler Trading joins Dave to discuss what's the technical take on the FAANG stocks after today's Fed announcement going into earnings season? Powell and Co. leave rates unchanged, leave the door open for...

READ MORE

MEMBERS ONLY

When to BUY, When to SELL, and When to SIT On Your Hands

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Dave Landry of DaveLandry.com shares his own approach to what he calls the "Three Whens"- when to buy, when to sell, and when to sit on your hands! Meanwhile, host Dave Keller reviews charts of...

READ MORE

MEMBERS ONLY

Analyzing Risks for Mega-Cap Growth Stocks Before Key FED Meeting

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave conducts a deep dive into current market breadth indicators, including advance-decline data, the McClellan Oscillator, and the Bullish Percent Index. He reviews key support and resistance levels for AAPL, TSLA, NVDA, and other growth stocks as the market waits...

READ MORE

MEMBERS ONLY

Three ETFs Suggest Further Downside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This past week had all the potential to see a revival of the great bull market of 2023. The September inflation data, Apple's latest product announcements, and Arm's IPO all seemed had the possibility to reignite the fire of bullishness for investors.

By Friday's...

READ MORE

MEMBERS ONLY

Deep Dive Into Stop Losses, Volatility Hacks, and Bullish Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave drops a special all-mailbag episode, including viewer questions on using Average True Range for stop losses, stocks vs. bonds, India's test of all-time highs, and best practices for price volatility.

This video originally premiered on September 15,...

READ MORE

MEMBERS ONLY

Timeless Lessons from the Godfather of Technical Analysis

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave sits down with Ralph Acampora, CMT, co-founder of the CMT Association, for a memorable conversation on all things technical analysis. They review lessons learned from the October 2022 market low, words of wisdom for traders new to technical analysis,...

READ MORE

MEMBERS ONLY

Sector Rotation Analysis Still Quite Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Julius de Kempenaer of RRG Research shows how his market visualizations still show stocks over bonds and offense over defense. Host David Keller, CMT highlights one industry sector breaking down due to higher crude oil prices.

This video originally...

READ MORE

MEMBERS ONLY

The Bull Case for Commodities

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, David Cox, CFA CMT of Raymond James reviews underperformance for defensive sectors like Utilities and describes why commodities should be an area of focus for investors. Host David Keller, CMT reviews today's drop in ORCL and AAPL as...

READ MORE

MEMBERS ONLY

When Facing a Market Pullback, RUN THESE SCANS!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a big up day for TSLA and bearish engulfing pattern for energy stocks. He answers viewer questions on growth stocks during rising rate environment and shares two scans to identify potential opportunities during corrective periods.

This video originally...

READ MORE

MEMBERS ONLY

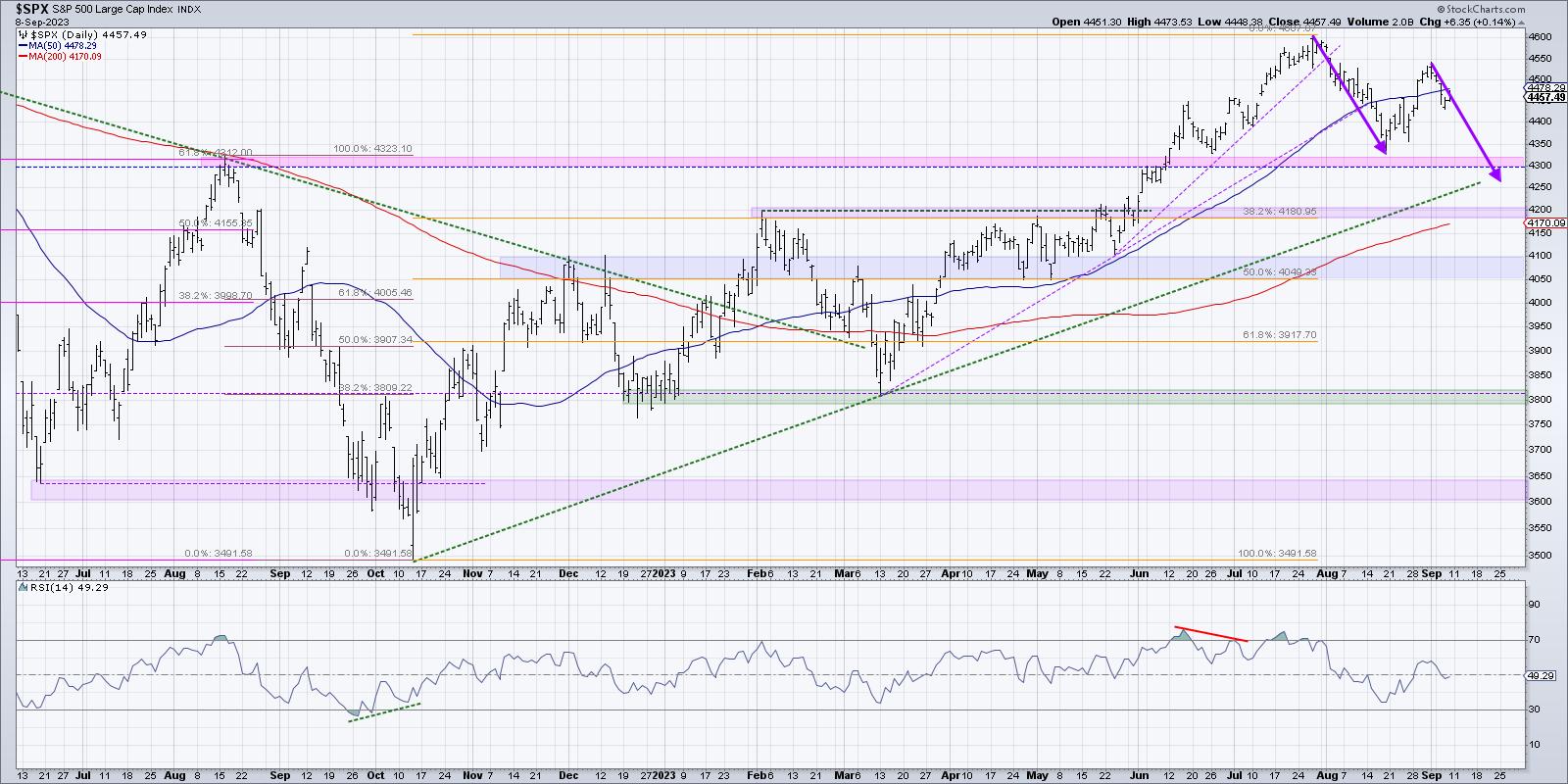

Which is More Likely -- SPX Over 4600 or Below 4200?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Top investors use probabilistic analysis to think through different scenarios to determine which appears the most likely.

* By thinking through each of four potential future paths for the S&P 500, we can be better prepared for whichever scenario actually plays out in the coming weeks.

We...

READ MORE

MEMBERS ONLY

BONDS & CASH - But Can We Find Better Income Alternatives?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave wraps the week with a focus on weakening breadth conditions, the Russell 2000 and underperformance of small caps, and strong energy stocks driven by stronger crude oil prices. He answers viewer questions on using ETFs instead of bonds or...

READ MORE

MEMBERS ONLY

Crucial Insights: How Rising Rates IMPACT You!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Willie Delwiche, CMT, CFA of Hi Mount Research outlines the long-term uptrend in interest rates and shares two sectors to focus on given the rising rate environment. Host David Keller, CMT tracks the sharp pullback for semiconductors and breaks...

READ MORE

MEMBERS ONLY

FORGET Valuations, REMEMBER the Charts!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Ari Wald, CFA, CMT of Oppenheimer & Co. shows how energy stocks are taking a leadership role, with high beta sectors still outperforming low volatility defensive stocks. Host David Keller, CMT tracks the latest downswing and describes a potential...

READ MORE

MEMBERS ONLY

Small-Caps Take BIG Plunge in Risk-Off Move

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave notes severe weakness in the small-cap space as the Russell 2000 forms a potential head-and-shoulders topping pattern. He answers viewer questions on index volume, Coppock curves and running oscillators on breadth indicators.

This video originally premiered on September 5,...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch, September 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave and Grayson co-host a special presentation, wherein they unveil the top 10 charts that are poised to shape the landscape of September 2023.

This video originally premiered on September 4, 2023. Watch on our dedicated Final Bar pageon StockCharts...

READ MORE