MEMBERS ONLY

The Benefits of a Consistent Imperfect Routine

by David Keller,

President and Chief Strategist, Sierra Alpha Research

A consistent imperfect routine is way better than an inconsistent perfect routine.

When I've worked with investors that are new to technical analysis, I often find that they spend too much time trying to perfect their analytical approach on a particular chart, and way too little time determining...

READ MORE

MEMBERS ONLY

Better Routines Lead to Better Results

by David Keller,

President and Chief Strategist, Sierra Alpha Research

A consistent imperfect routine is way better than an inconsistent perfect routine.

When I've worked with investors that are new to technical analysis, I often find that they spend too much time trying to perfect their analytical approach on a particular chart, and way too little time determining...

READ MORE

MEMBERS ONLY

Key Ratios Speak to Market Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Great chart, but it seems super short-term. When would you get out of this?"

That was the reaction I received on social media when I posted this chart showing the relative strength of semiconductors to the S&P 500.

In terms of my process, I focus my...

READ MORE

MEMBERS ONLY

The Ratios Speak to Market Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Great chart, but it seems super short-term. When would you get out of this?"

That was the reaction I received on social media when I posted this chart showing the relative strength of semiconductors to the S&P 500.

In terms of my process, I focus my...

READ MORE

MEMBERS ONLY

The Bull Market Top Checklist: What Would Change My Mind?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The last five months of market history are a blur for me. Back in mid-March, the S&P 500 was in free fall with no end in sight. Here we are in mid-August, and the S&P is retesting all-time highs. Trend-following is about defining the trend, recognizing...

READ MORE

MEMBERS ONLY

What Would Change My Mind on This Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The last five months of market history are a blur for me. Back in mid-March, the S&P 500 was in free fall with no end in sight. Here we are in mid-August, and the S&P is retesting all-time highs. Trend-following is about defining the trend, recognizing...

READ MORE

MEMBERS ONLY

Multiple Time Frames and Overextended Amazon

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Last week on The Final Bar, one of our Mailbag questions related to Amazon.com (AMZN) and how far it has reached above its 200-day moving average. This phenomenon speaks to the long-term strength of AMZN's price movements, the short-term overreaching of the price since the March market...

READ MORE

MEMBERS ONLY

Too Far, Too Fast for Amazon

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week on The Final Bar, one of our Mailbag questions related to Amazon.com (AMZN) and how far it has reached above its 200-day moving average. This phenomenon speaks to the long-term strength of AMZN's price movements, the short-term overreaching of the price since the March market...

READ MORE

MEMBERS ONLY

Overbought Names Begin Potential Topping Process

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I wrote this article for last Saturday's ChartWatchers newsletter, focusing on the overbought conditions rampant in mega cap technology and consumer names. Monday's selloff certainly changes the short-term look of most of these charts, potentially beginning the topping process I described below.

The next move higher...

READ MORE

MEMBERS ONLY

Overbought Means Up A Lot

by David Keller,

President and Chief Strategist, Sierra Alpha Research

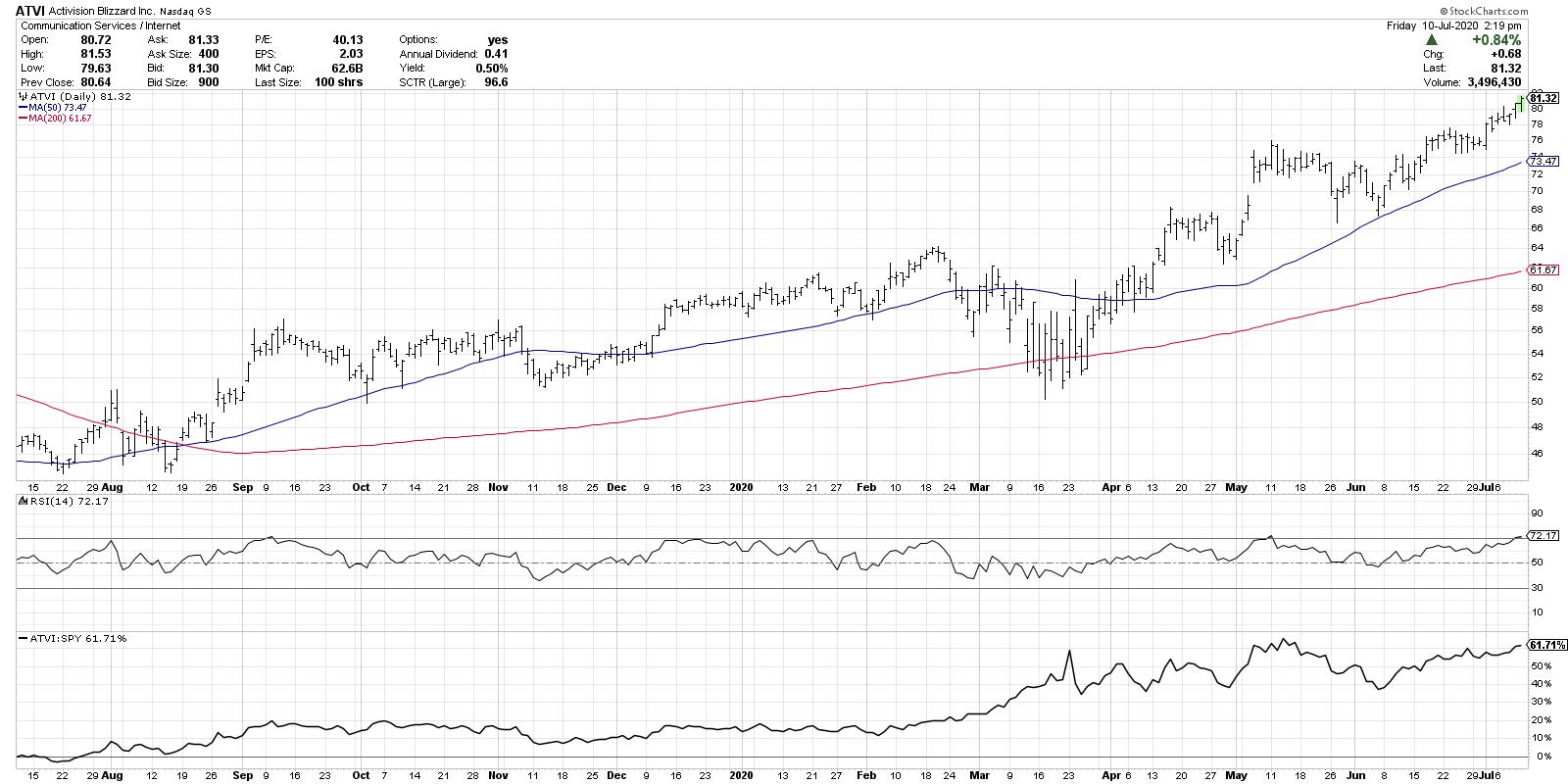

I've received many questions recently on stocks experiencing overbought conditions, from stocks like Activision Blizzard (ATVI), which recently broke above RSI 70, to Amazon (AMZN), which has an RSI that has breached 80.

What does it mean to be overbought? Is that a sell signal? What do I...

READ MORE

MEMBERS ONLY

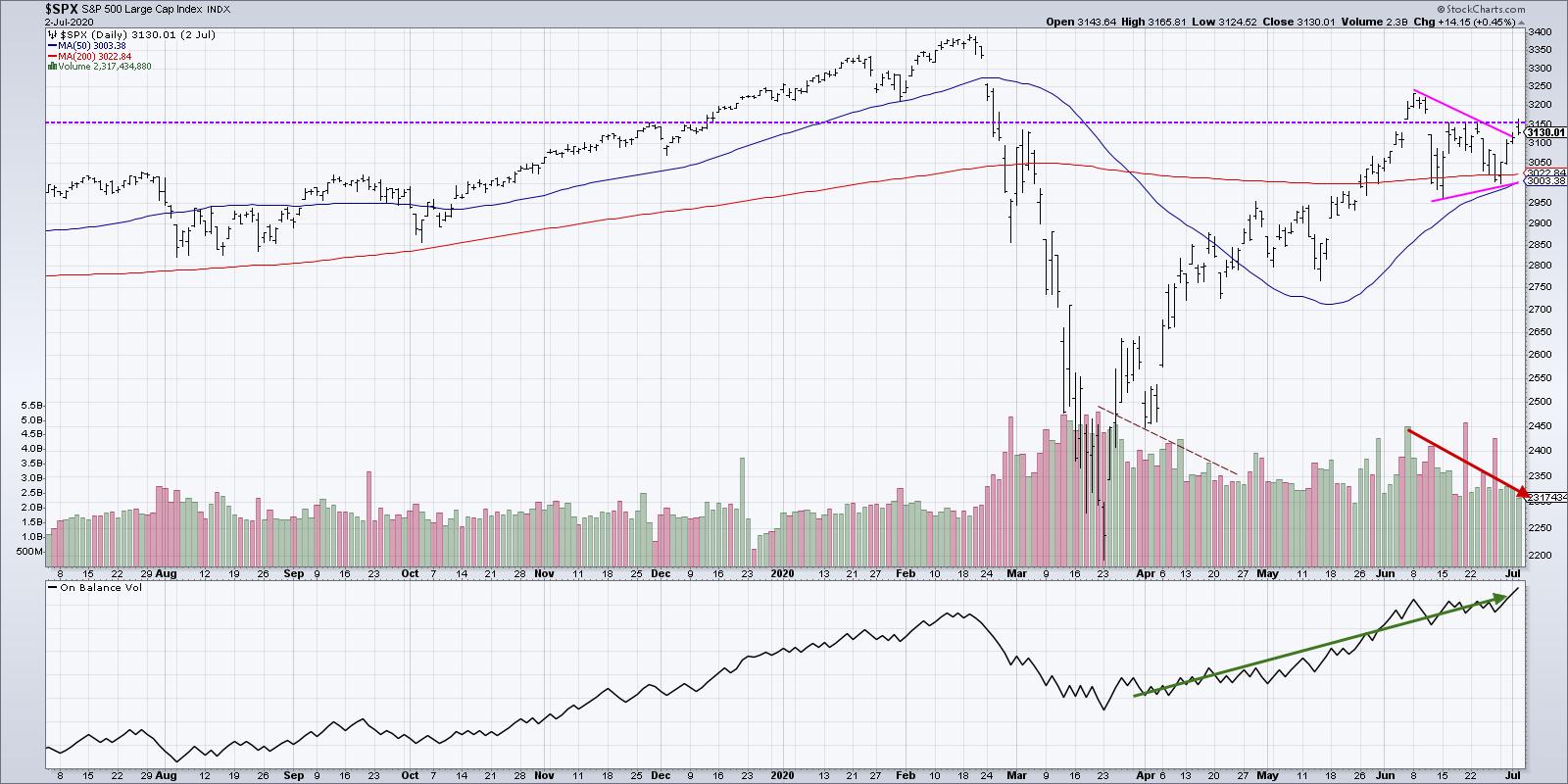

Introducing "The Mindful Six" Stocks Threatening Breakouts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 index has remained in consolidation mode, spending the shortened holiday week in a rally back to the upper end of the recent trading range. Last week on The Final Bar, I announced "The Mindful Six", a group of six stocks that I feel...

READ MORE

MEMBERS ONLY

The Mindful Six Stocks to Follow Here

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 index has remained in consolidation mode, spending the shortened holiday week in a rally back to the upper end of the recent trading range. Last week on The Final Bar,I announced "The Mindful Six", a group of six stocks that I feel...

READ MORE

MEMBERS ONLY

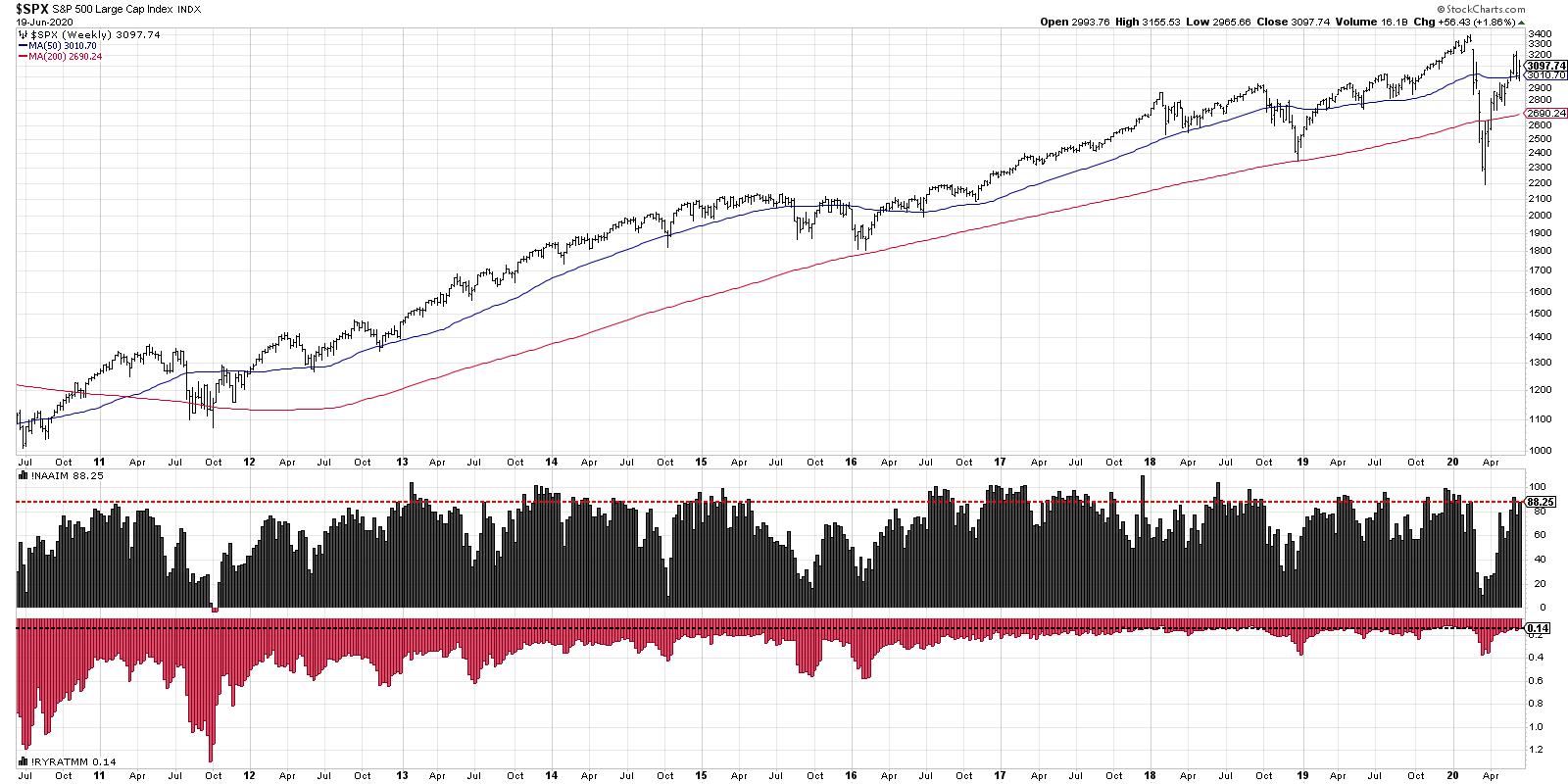

Extremes in Sentiment Mean Extreme Bullishness

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When I'm prioritizing information to help me understand the broad market environment, I tend to consider this as the order of importance:

1. Price

2. Breadth

3. Sentiment

I've found sentiment readings such as the American Association of Individual Investors (AAII) and Investors Intelligence (II) surveys...

READ MORE

MEMBERS ONLY

Extremes in Sentiment Show Bullish Tilt

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When I'm prioritizing information to help me understand the broad market environment, I tend to consider this as the order of importance:

1. Price

2. Breadth

3. Sentiment

I've found sentiment readings such as the American Association of Individual Investors (AAII) and Investors Intelligence (II) surveys...

READ MORE

MEMBERS ONLY

Three Stocks That Tell You Everything

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've often said that by looking at individual stocks, you can get a deeper level of understanding of what's moving the overall equity markets. While some investors insist that "a rising tide lifts all boats" and you're better off just following the...

READ MORE

MEMBERS ONLY

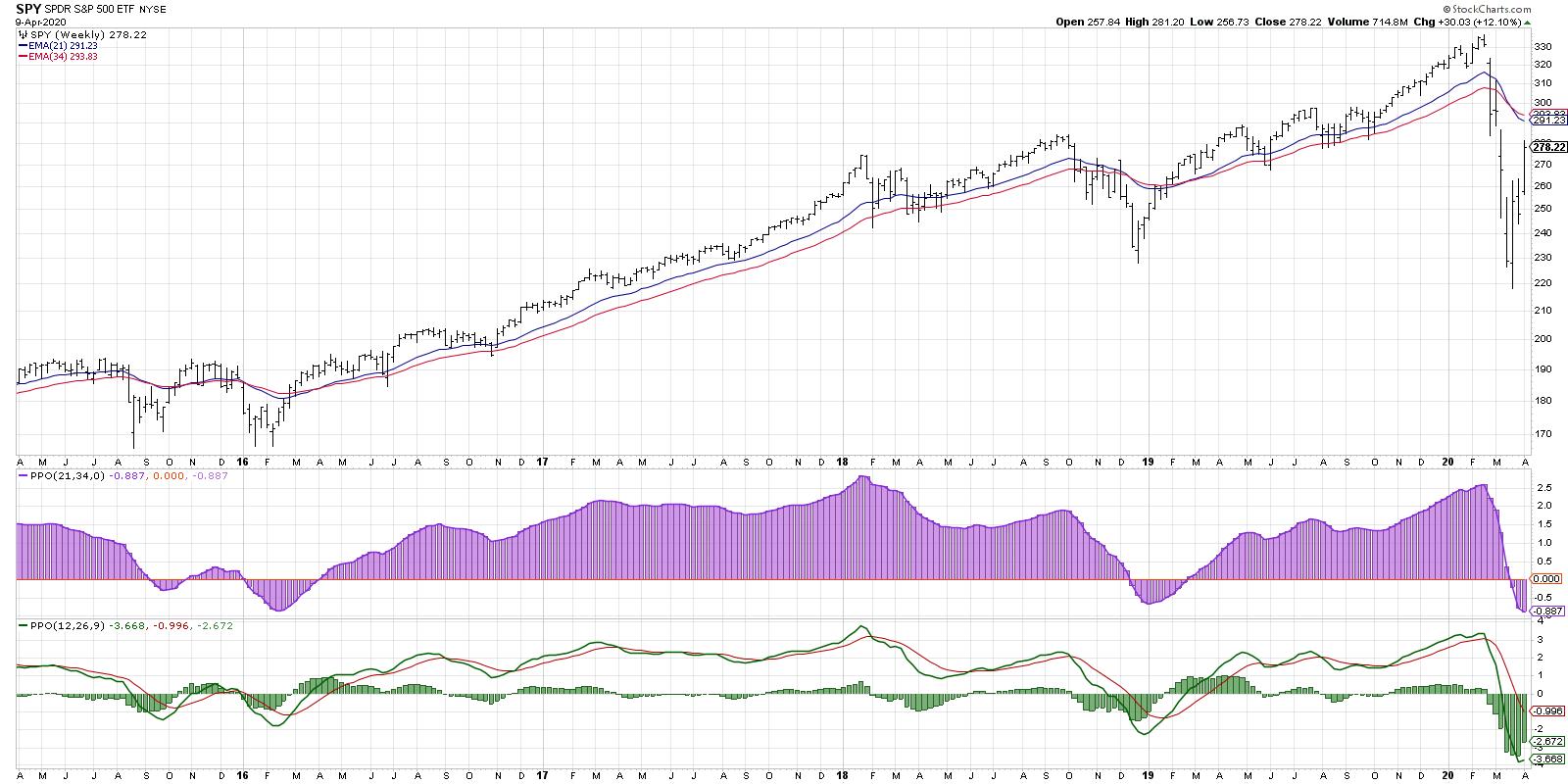

Stocks Overbought... Bonds Oversold... Impending Reversal?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Every Friday on The Final Bar, I conduct a weekly chart routine called "Wrap the Week" where we review macro charts and how they've evolved over the previous seven days. This week was focused on the unrelenting uptrend in stocks, but a deeper analysis after the...

READ MORE

MEMBERS ONLY

Stocks Overbought, Bonds Oversold (Almost)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Every Friday on The Final Bar,I conduct a weekly chart routine called "Wrap the Week" where we review macro charts and how they've evolved over the previous seven days. This week was focused on the unrelenting uptrend in stocks, but a deeper analysis after the...

READ MORE

MEMBERS ONLY

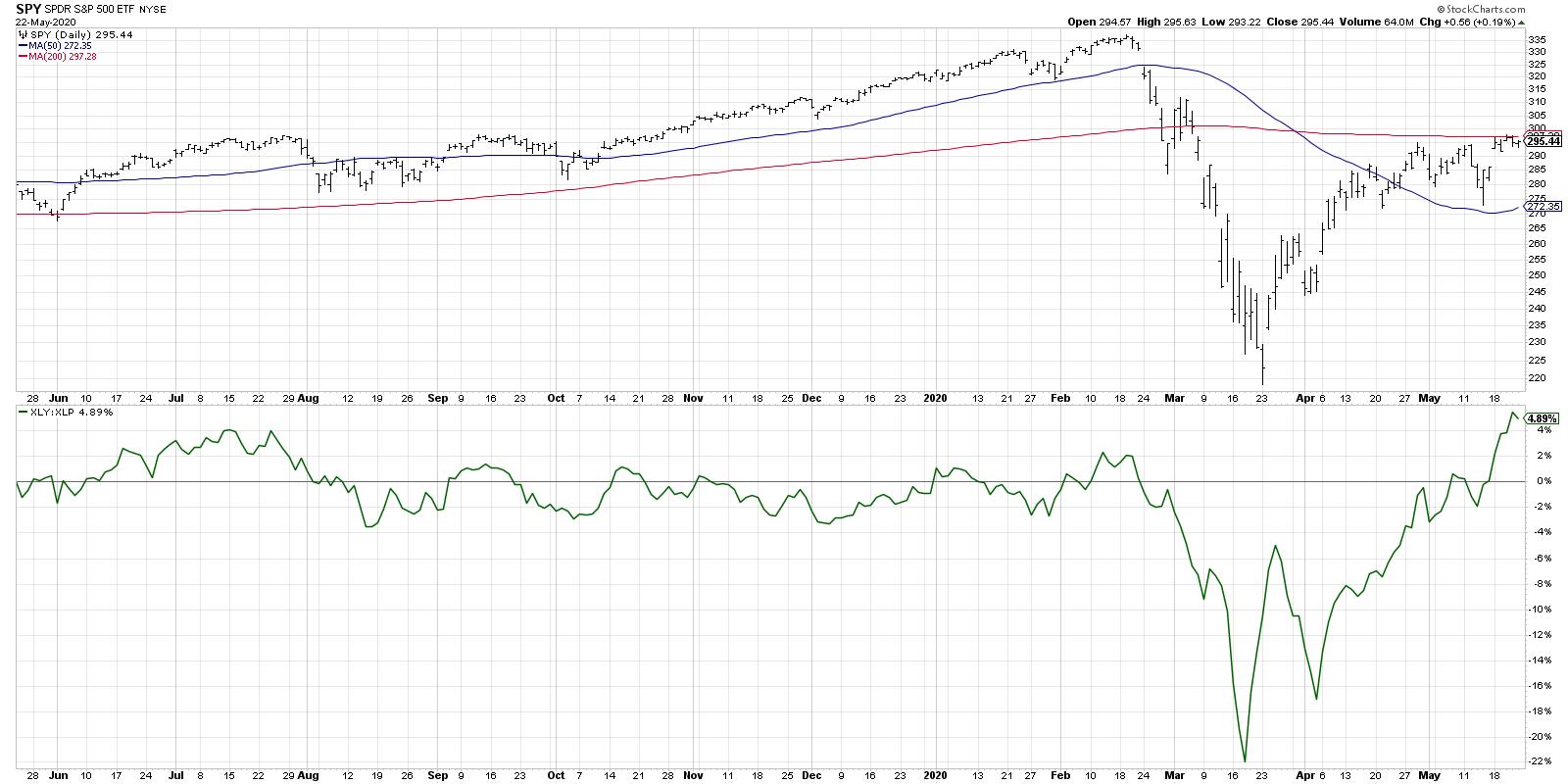

Limited Time Offer on Consumer Discretionary

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of my favorite ratios to track offense vs. defense within the equity markets is the Consumer Discretionary sector (XLY) divided by the Consumer Staples sector (XLP). But a look under the hood shares narrow leadership and questionable upside.

Below, we see the S&P 500 ETF along with...

READ MORE

MEMBERS ONLY

Limited-Time Offer on Consumer Discretionary

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of my favorite ratios to track offense vs. defense within the equity markets is the Consumer Discretionary sector (XLY) divided by the Consumer Staples sector (XLP). But a look under the hood shares narrow leadership and questionable upside.

Below, we see the S&P 500 ETF along with...

READ MORE

MEMBERS ONLY

Breadth Improves as Bear Market Rally Exhausts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Most of my guests in recent weeks on The Final Barhave embraced the "we're due for a pullback" thesis. From the very bullish (S&P 3600) to the quite bearish (S&P 2000) and everyone in between, it seems most people feel that the...

READ MORE

MEMBERS ONLY

Breadth Improves as Uptrend Persists

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Most of my guests in recent weeks on The Final Barhave embraced the "we're due for a pullback" thesis. From the very bullish (S&P 3600) to the quite bearish (S&P 2000) and everyone in between, it seems most people feel that the...

READ MORE

MEMBERS ONLY

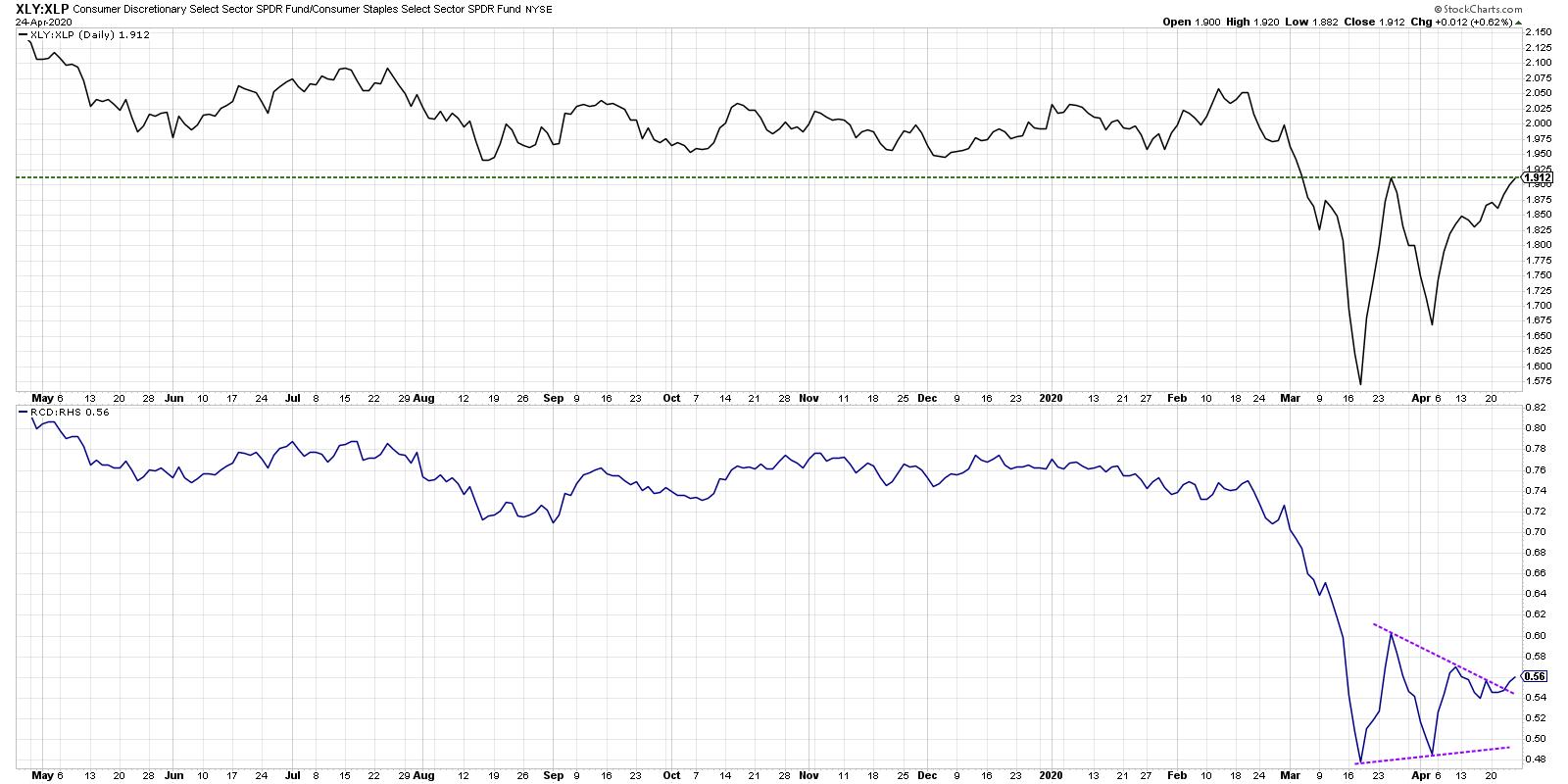

Consumer Sectors Threaten Bullish Breakout

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of the ways I like to measure offensive vs. defensive pressure in the equity market is using the ratio of Consumer Discretionary to Consumer Staples. Watching this ratio can tell you whether institutions are betting more on the "offense," like retail and travel names, or the traditional...

READ MORE

MEMBERS ONLY

Three Sector Charts Turn Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Every Monday on StockCharts TV's The Final Bar, we look at the markets from three perspectives: top-down macro, sector rotation and bottom-up stock selection. In this week's review, we identified three sector charts that are potentially turning bearish and suggest broader weakness in the equity space....

READ MORE

MEMBERS ONLY

Seven Bear Market Mistakes and How to Avoid Them

by David Keller,

President and Chief Strategist, Sierra Alpha Research

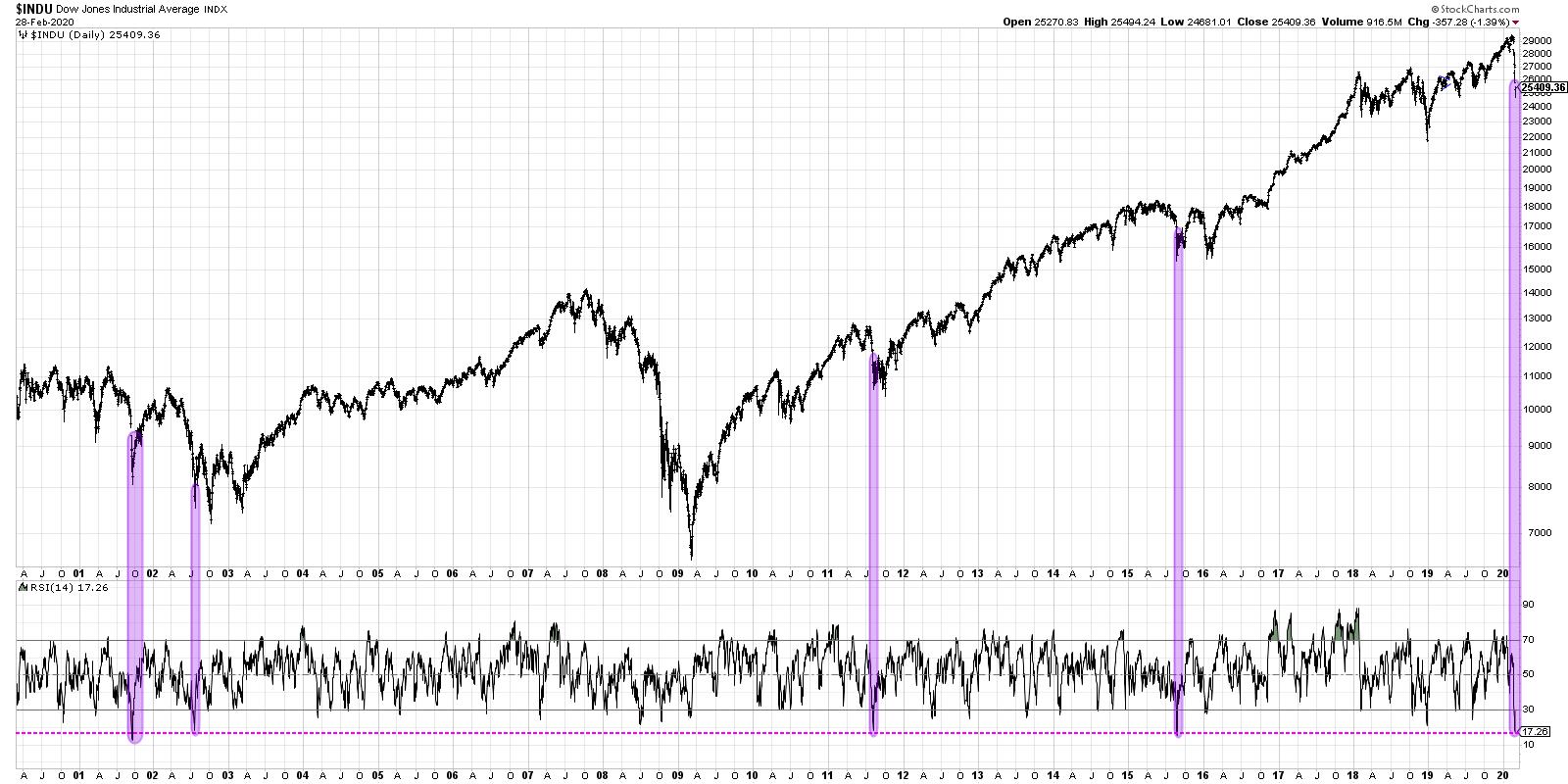

As a technical analyst who started my career just after the market top in March 2000, I've had the pleasure (I guess?) of living through a number of previous bear market cycles.

I first learned about and started to apply technical analysis during the 2001-2002 bear market, so...

READ MORE

MEMBERS ONLY

Seven Bear Market Mistakes and How to Avoid Them

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As a technical analyst who started my career just after the market top in March 2000, I've had the pleasure (I guess?) of living through a number of previous bear market cycles.

I first learned about and started to apply technical analysis during the 2001-2002 bear market, so...

READ MORE

MEMBERS ONLY

Three Surprise Charts Facing Huge Resistance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My weekly routine involves two important steps. First, in preparation for Friday's edition of The Final Bar, I go through a series of long-term macro charts for my Wrap the Week segment. Second, over the weekend I review the individual stock charts for all the S&P...

READ MORE

MEMBERS ONLY

The Charts That Speak to Further Downside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I very much enjoyed participating in our StockCharts TV special event "Navigating a Bear Market" along with many of my fellow StockCharts contributors. In this article, I'll provide my comments and charts from that special, along with some brief updates on what has changed in the...

READ MORE

MEMBERS ONLY

Bullish Divergences Can Be Hazardous to Your Portfolio

by David Keller,

President and Chief Strategist, Sierra Alpha Research

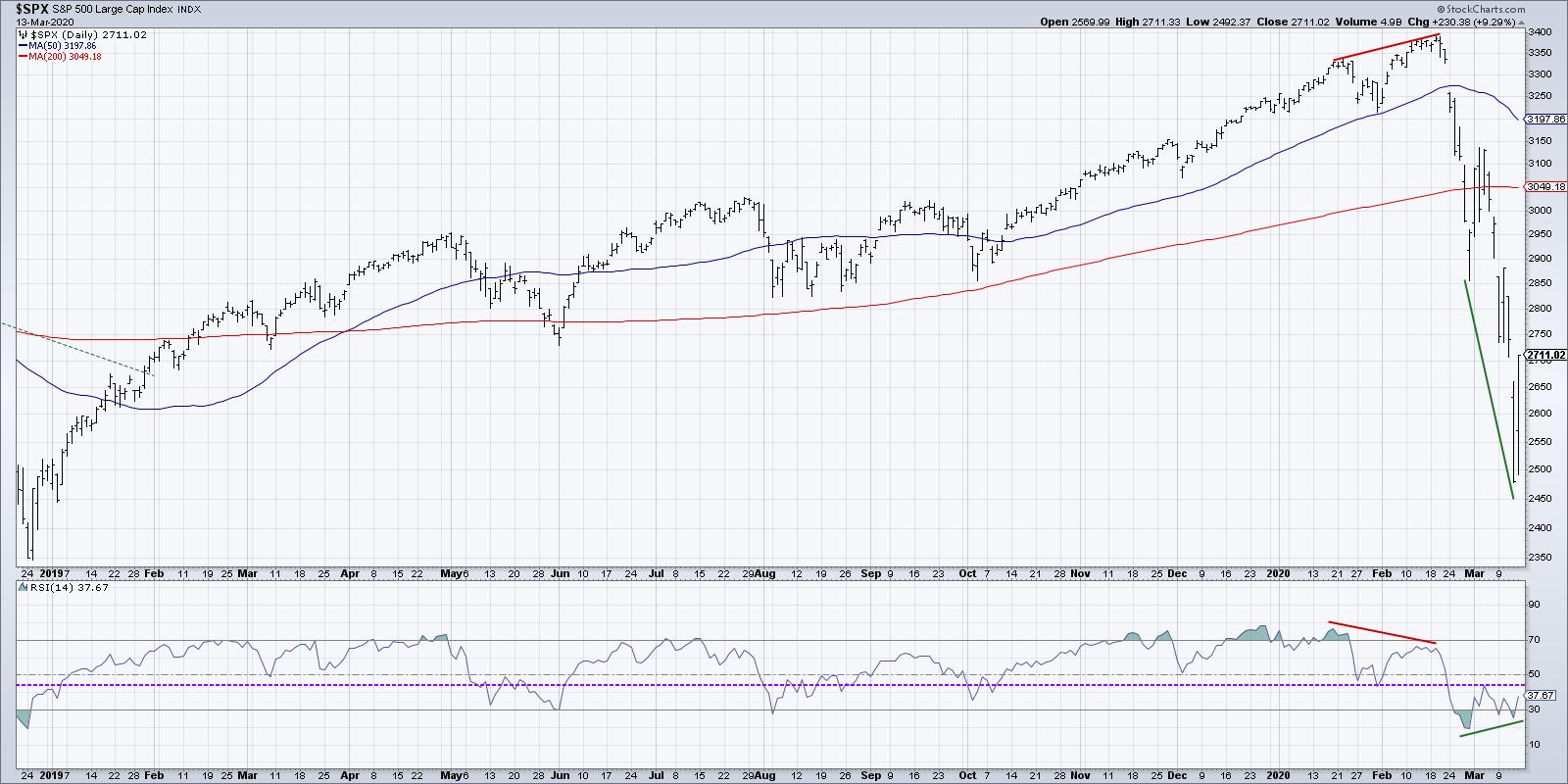

For this weekend's ChartWatchers newsletter, I shared some perspective on the bullish divergence appearing on the daily S&P 500 chart. It's worth noting that Monday's selloff pushed the S&P down to new lows, invalidating the bullish divergence.

As price continues...

READ MORE

MEMBERS ONLY

Bullish Divergence Suggests Short-Term Upside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Every Friday on my show The Final Bar, we answer viewer questions from throughout the past week. One of today's questions related to the potential bullish divergence on the S&P 500 using price and RSI. In this article, I'll share how I think about...

READ MORE

MEMBERS ONLY

Three Charts Suggesting Further Downside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Are the markets oversold? Yes.

Is it reasonable to expect that next week will see the markets recover at least a bit after this week's mayhem? Absolutely. But here are three charts suggesting that any short-term market bounce will most likely be followed by further downside for stocks....

READ MORE

MEMBERS ONLY

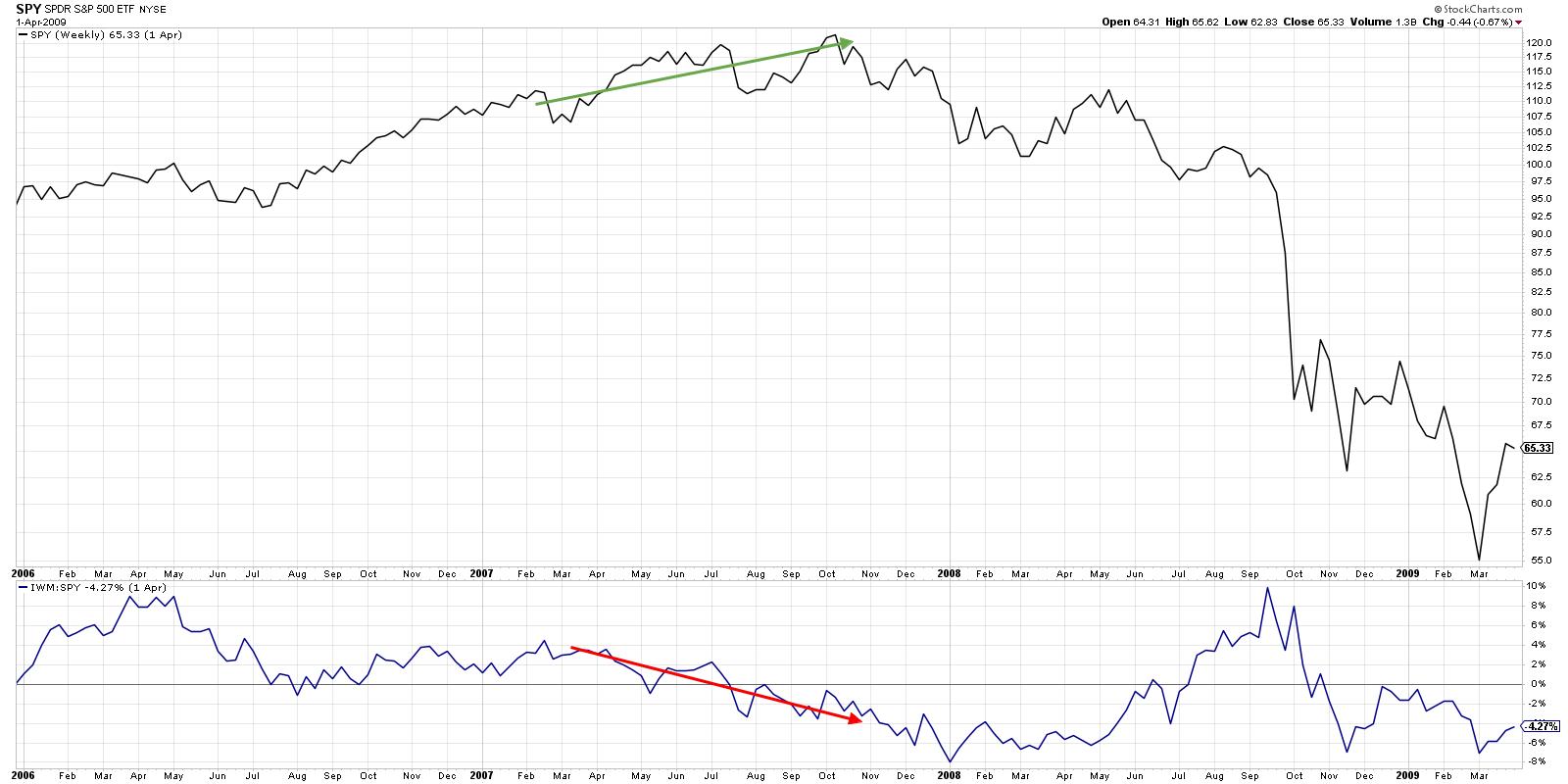

Struggling Small Caps

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"How come small-caps aren't doing better when the market's making new highs?"

I've heard some version of this question many times over the last couple years, starting with the emergence of the FAANG trade. Once that subsided and the market resumed its...

READ MORE

MEMBERS ONLY

High Returns and Low Correlations: The Case for Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With stock markets in rapid decline this week, mindful investors should be looking around for opportunities. What asset classes are thriving while others are struggling?

A quick survey of the asset allocation will indicate that, while oil has been in freefall and stocks are now testing and failing at support,...

READ MORE

MEMBERS ONLY

The Shiny (and Bullish) Yellow Metal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With stock markets in rapid decline this week, mindful investors should be looking around for opportunities. What asset classes are thriving while others are struggling?

A quick survey of the asset allocation will indicate that, while oil has been in freefall and stocks are now testing and failing at support,...

READ MORE

MEMBERS ONLY

Ten Quotes on Extended Bull Markets

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I keep reminding viewers of my daily show, The Final Bar(new episodes every weekday at 4pm ET!), that extended bull markets can actually be a little frustrating. While a consistent uptrend in prices tends to be a good thing for long-term investors, two things present quite a challenge.

The...

READ MORE

MEMBERS ONLY

Healthy Prognosis for Health Care

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While sectors like Technology of received much of the praise for leading the recent market upswing, the Health Care sector is comprised of a group of five industries that all have fairly attractive chart setups. (Earlier this week, on my daily closing bell show The Final Bar, I conducted a...

READ MORE

MEMBERS ONLY

What Gold's Pullback Means for the 2020 Outlook

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The final chart that I shared in my portion of the StockCharts 2020 Market Outlook (coming soon to our YouTube channel!) was a two-year chart of gold. After a pullback in the fall to Fibonacci support, gold appeared to be resuming its long-term uptrend.Later, gold reached an extreme overbought...

READ MORE

MEMBERS ONLY

Gold Enters Extreme Overbought Zone

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The final chart that I shared in my portion of the StockCharts 2020 Market Outlook (coming soon to our YouTube channel!) was a two-year chart of gold. After a pullback in the fall to Fibonacci support, gold appeared to be resuming its long-term uptrend. Now, gold has reached the extreme...

READ MORE

MEMBERS ONLY

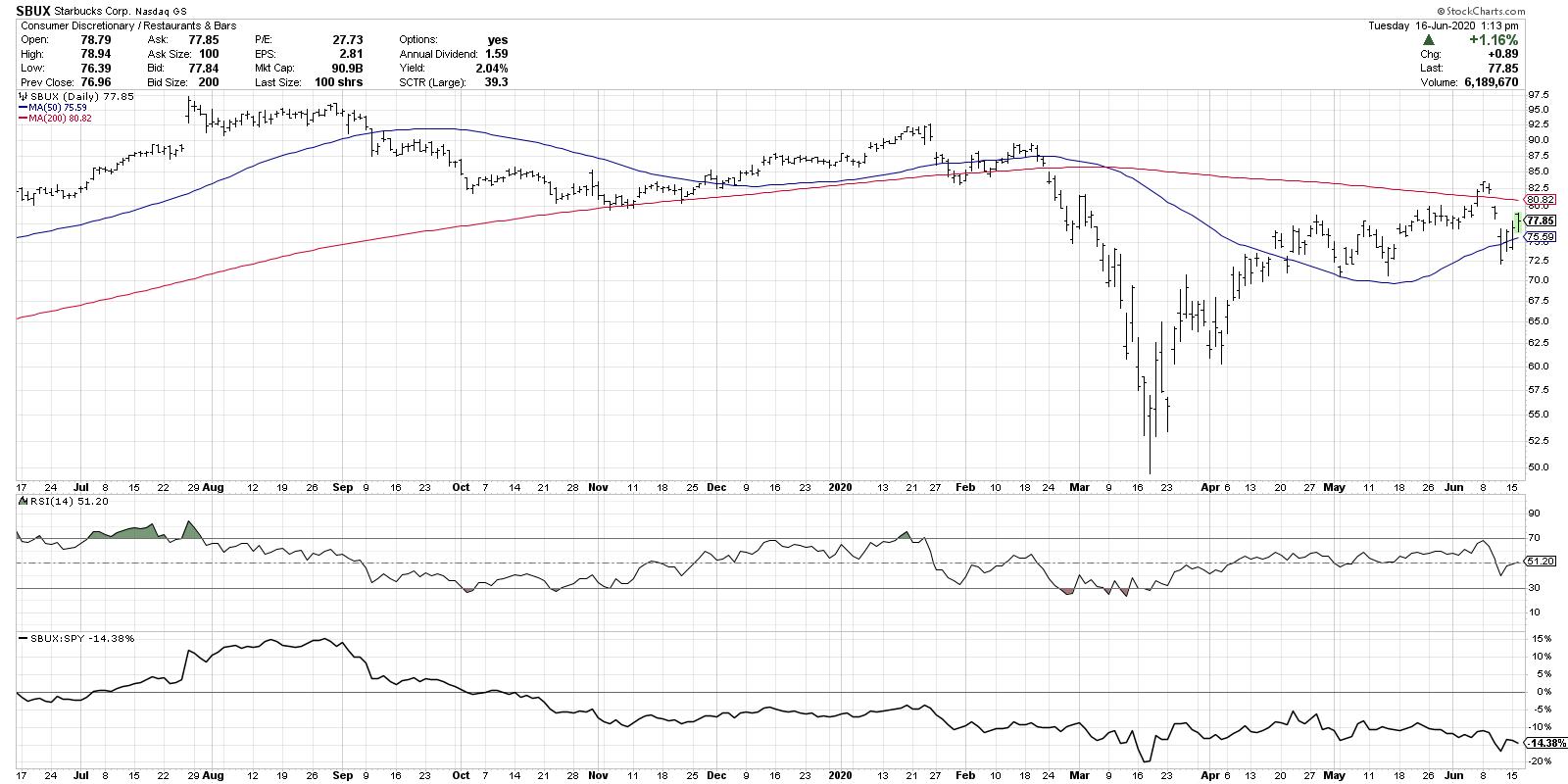

Coffee, Charts and a Proper Perspective

by David Keller,

President and Chief Strategist, Sierra Alpha Research

You pour yourself a cup and coffee, fire up the computer and begin your daily investment process. What do you look at first? What's the last thing you review before moving on to other things? Most importantly, is your daily process consistent from one day to the next?...

READ MORE

MEMBERS ONLY

Coffee, Charts and a Proper Perspective

by David Keller,

President and Chief Strategist, Sierra Alpha Research

You pour yourself a cup and coffee, fire up the computer and begin your daily investment process. What do you look at first? What's the last thing you review before moving on to other things? Most importantly, is your daily process consistent from one day to the next?...

READ MORE

MEMBERS ONLY

What's Your Second Chart of the Day?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've written before about the importance of a good morning coffee routine. These are the charts you review first thing in the morning as a way of enhancing your market awareness.

The first chart on your list, given that you're a long-term investor, should be a...

READ MORE