MEMBERS ONLY

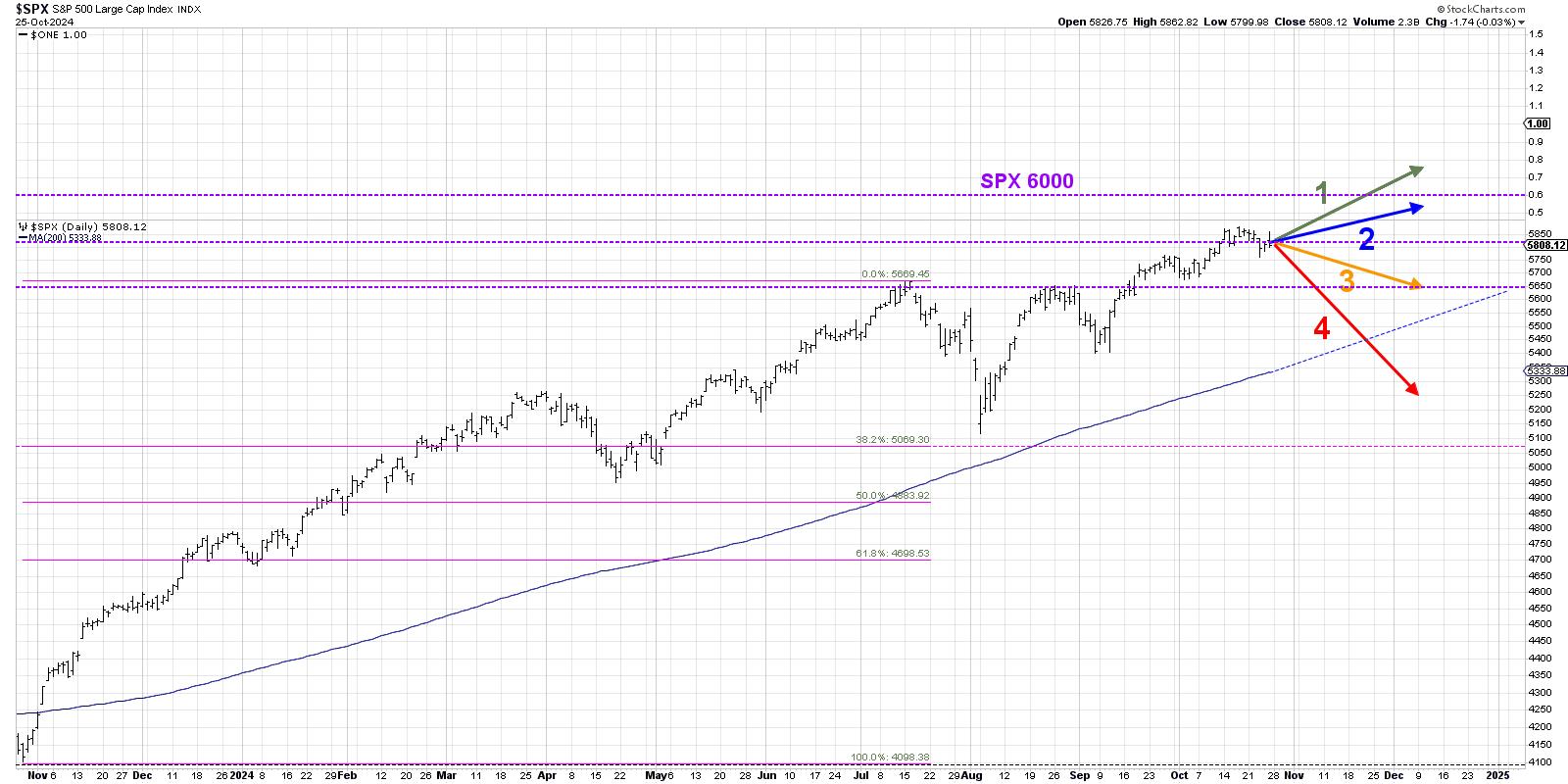

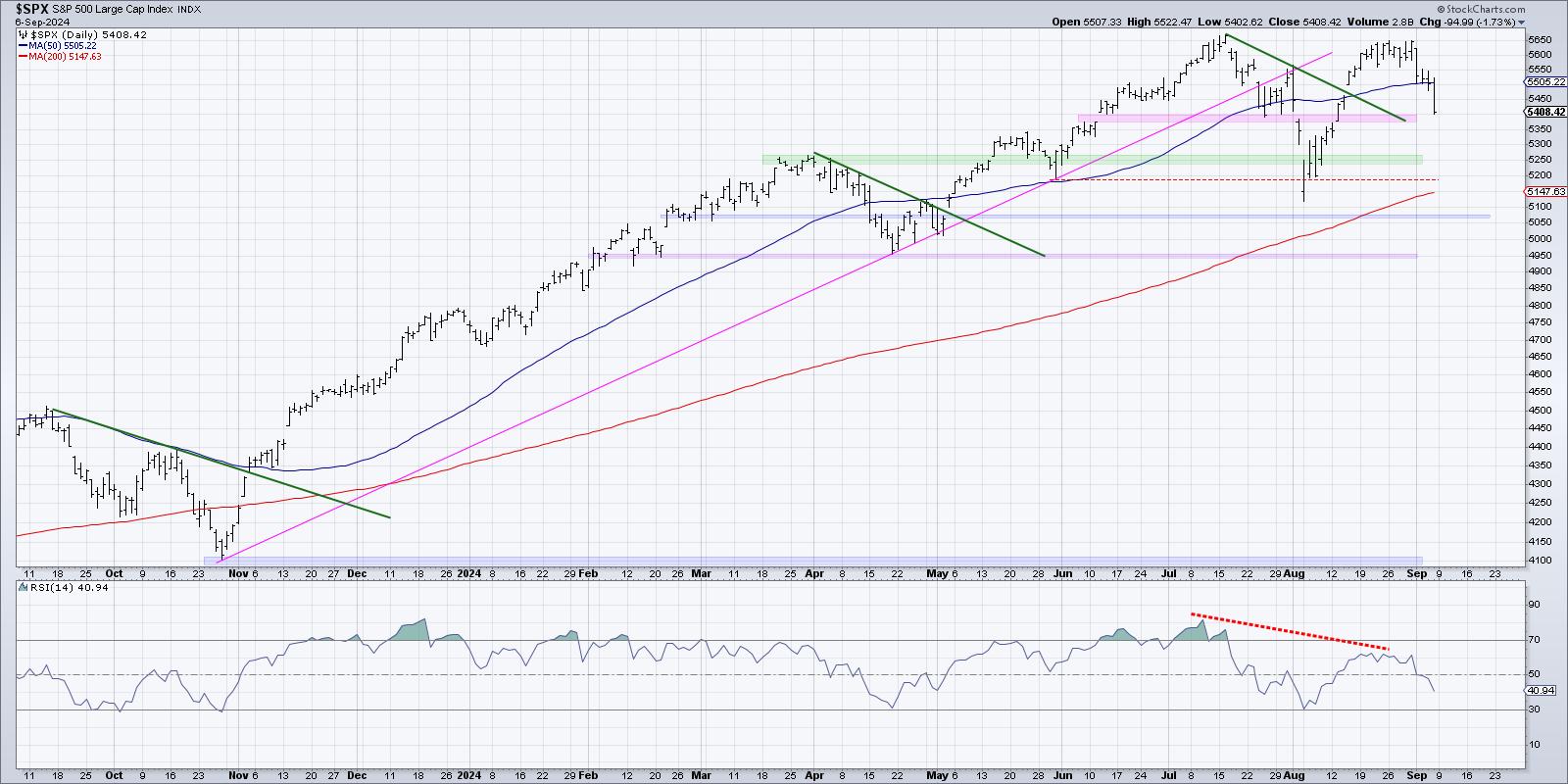

S&P 500 Breakdown Alert! Downside Targets Explained

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

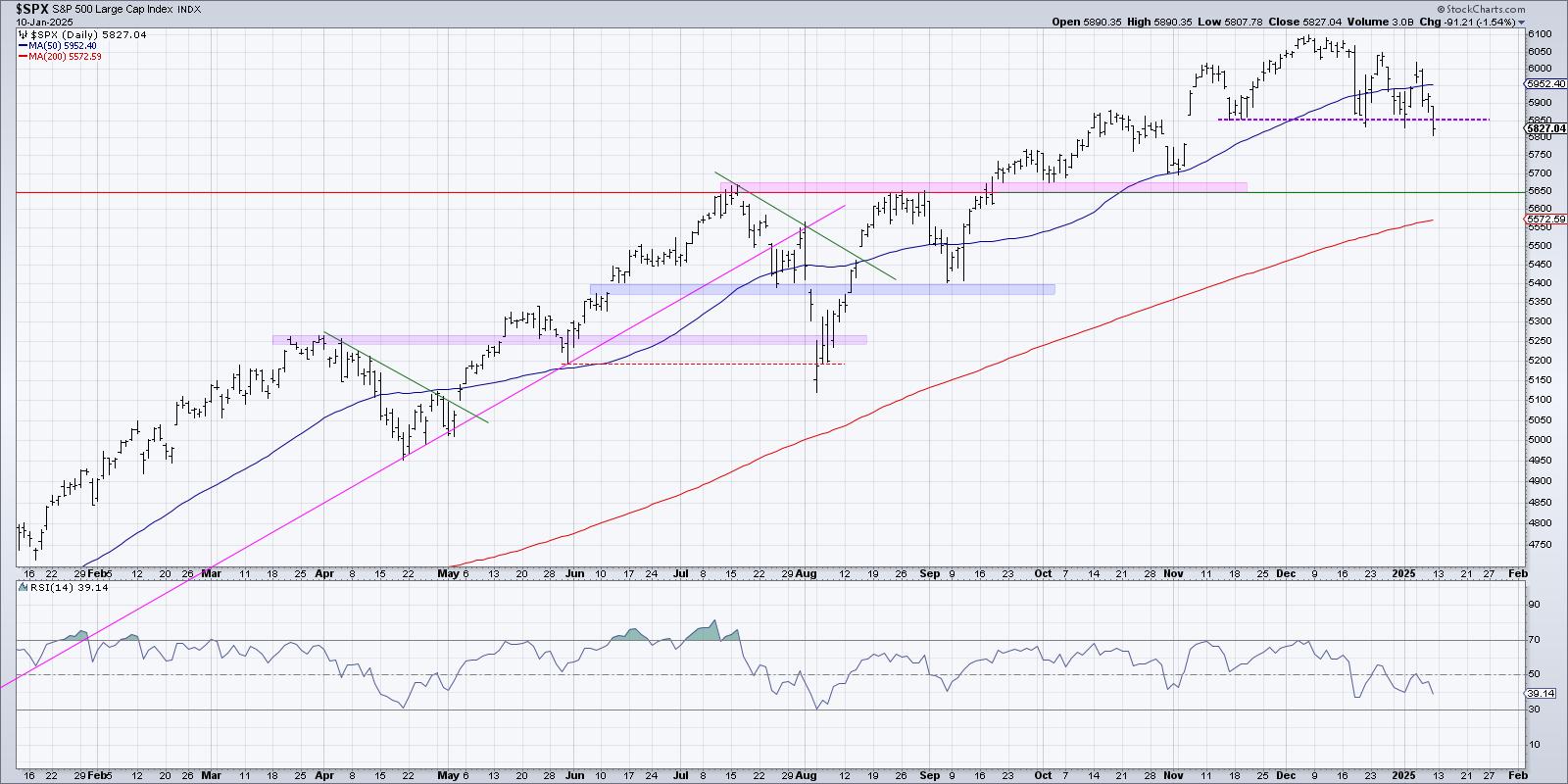

* The break of SPX 5850 suggests further downside in January for the equity benchmarks.

* Using price pattern analysis, we can use the height of the head and shoulders pattern to determine potential support around SPX 5600.

* We can further validate this downside target using Fibonacci Retracements and moving...

READ MORE

MEMBERS ONLY

What Higher Rates Could Mean for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Higher interest rates can directly impact industry groups like homebuilders, which are driven by consumers borrowing money.

* While a normal shaped yield curve suggests optimism for economic growth, the transition from an inverted yield curve usually results in weaker stock prices.

* The market trend remains the most important...

READ MORE

MEMBERS ONLY

Rising Rates Suggest Weaker Stocks - Here's What I'm Watching!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares a long-term analysis of the Ten-Year Treasury Yield, breaks down how the shape of the yield curve has been a great leading indicator of recessionary periods and weaker stock prices, and outlines the chart he's watching to determine if early 2025 will look...

READ MORE

MEMBERS ONLY

2024's Big Bang: A Deeper Dive Into the Hindenburg Omen

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

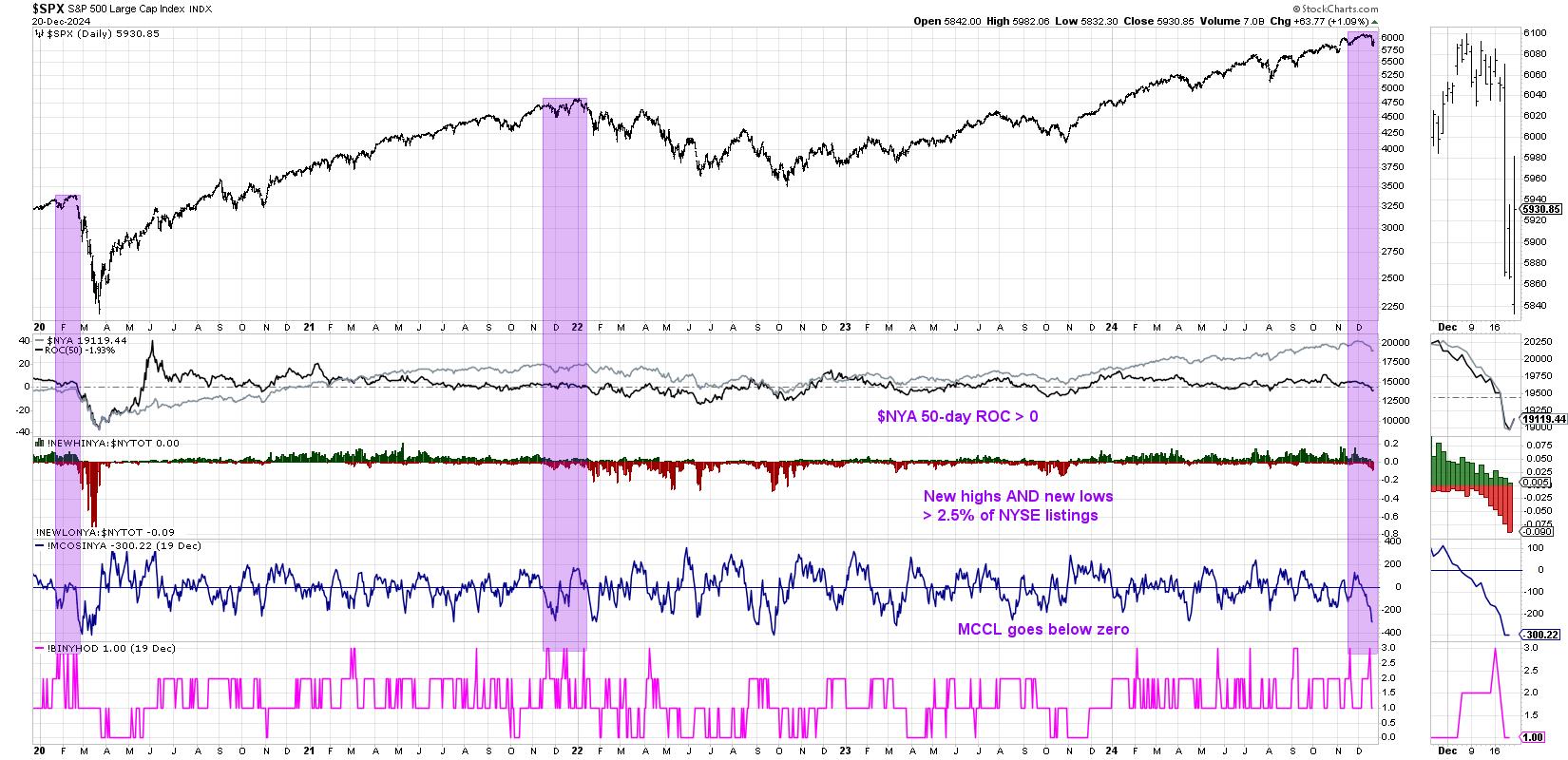

* The Hindenburg Omen looks for patterns that have consistently shown at major market tops.

* Using trend-following techniques like support and resistance levels can help to improve accuracy of macro indicators.

* S&P 5850 remains the most important level in our view going into year-end 2024.

This week...

READ MORE

MEMBERS ONLY

The Big Divergence in Bullish Percents

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 and Nasdaq 100 have been holding steady into this week's Fed meeting, warning signs under the hood have suggested one of two things is likely to happen going into Q1. Either a leadership rotation is amiss, with mega-cap growth stocks potentially taking...

READ MORE

MEMBERS ONLY

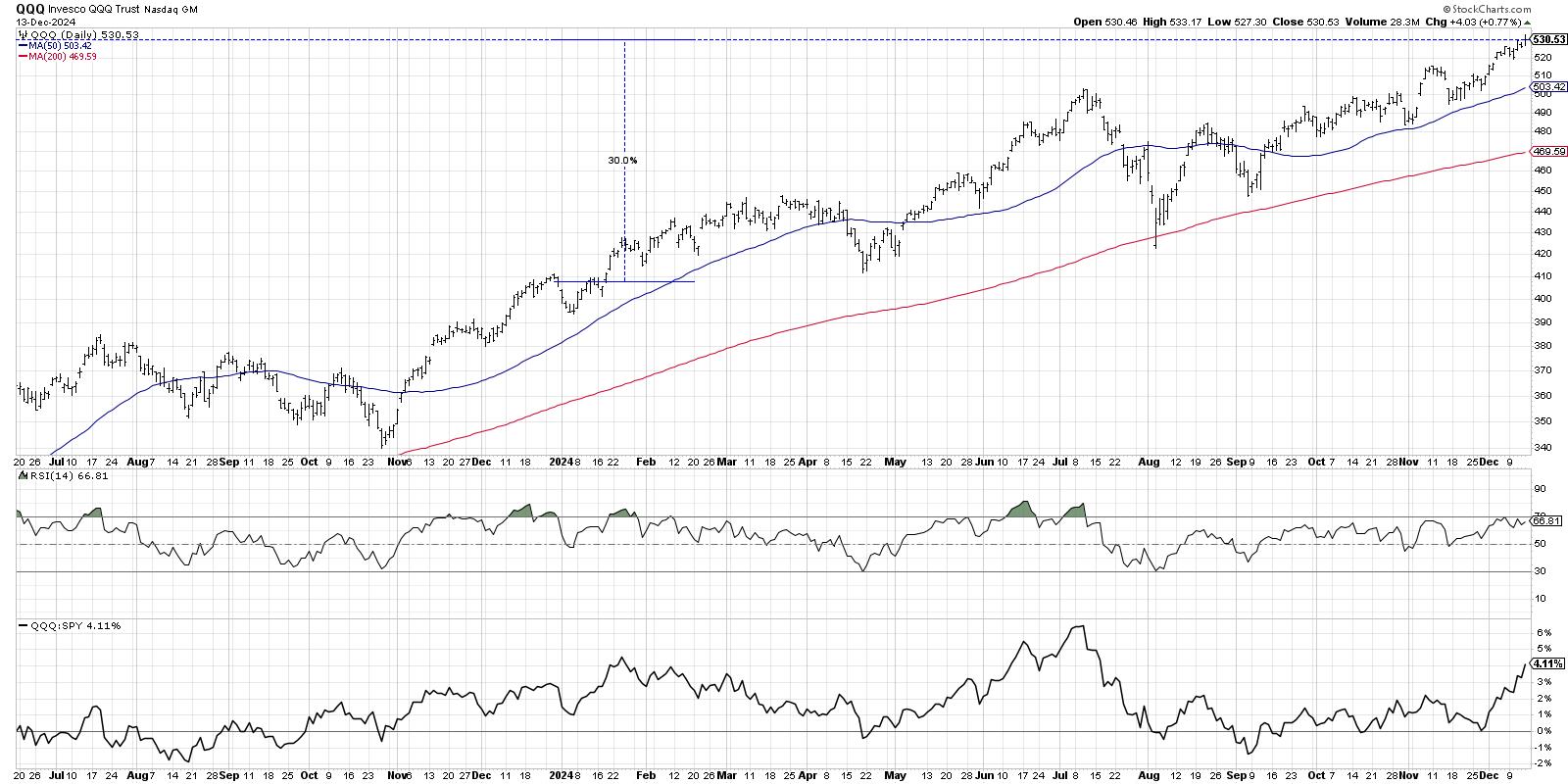

Will the QQQ Sell Off in January? Here's How It Could Happen

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In recent interviews for my Market Misbehavior podcast, I've asked technical analysts including Frank Cappelleri, TG Watkins, and Tom Bowley what they see happening as we wrap a very successful 2024. With the Nasdaq 100 logging about a 30% gain for 2024, it's hard to imagine...

READ MORE

MEMBERS ONLY

3 WAYS to Pinpoint When a Stocks Uptrend is Ending

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave unveils his "line in the sand" technique to help determine when stocks in established uptrends may be near the end of the bullish phase. He'll share specific levels he's watching for the S&P 500, AMZN, TMUS, and KR,...

READ MORE

MEMBERS ONLY

The Most Important Chart to Watch Into Year-End 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Low VIX reading implies that conditions are favorable for stocks.

* The MOVE index is basically a VIX for bonds, and can help to corroborate volatility readings across asset classes.

* High yield spreads remain quite narrow, implying bond investors perceive a low risk environment.

"The market goes up...

READ MORE

MEMBERS ONLY

Two ETFs That Could Thrive Based on a Normal Yield Curve

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My recent discussions on the Market Misbehavior podcasthave often included some comments on the interest rate environment, particularly the shape of the yield curve. We've had an inverted yield curve since late 2022, and so the yield curve taking on a more normal shape could mean a huge...

READ MORE

MEMBERS ONLY

Can You Really Predict Stock Market Success Using the Yield Curve?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reflects on the shape of the yield curve during previous bull and bear cycles with the help of StockCharts' Dynamic Yield Curve tool. He shares insights on interest rates as investors prepare for the final Fed meeting of 2024, and shares two additional charts he&...

READ MORE

MEMBERS ONLY

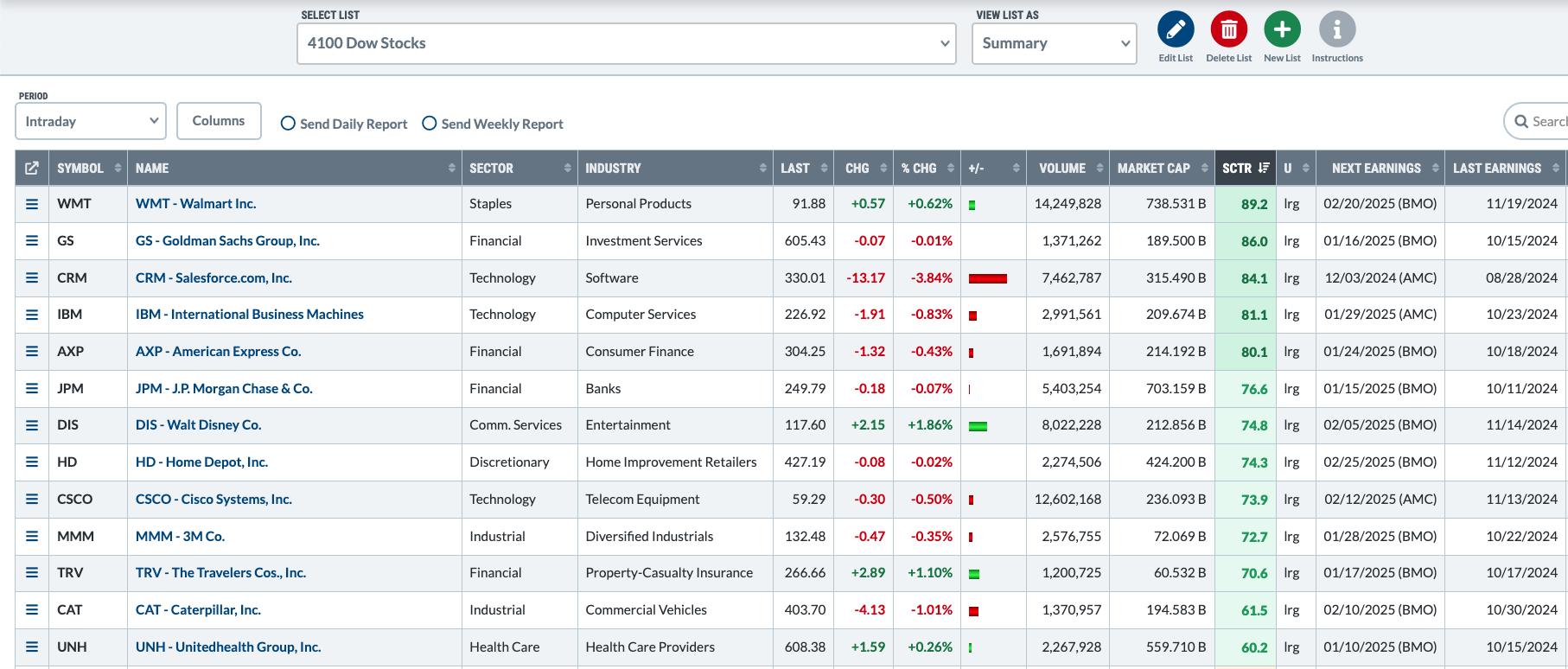

Five Ways You Should Use ChartLists Starting Today!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Having used many technical analysis platforms over my career as a technical analyst, I can tell you with a clear conscience that the ChartList feature on StockCharts provides exceptional capabilities to help you identify investment opportunities and manage risk in your portfolio. Once you get your portfolio or watch list...

READ MORE

MEMBERS ONLY

Five Must-Have Tools for Analyzing Stock Charts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares how he uses the powerful ChartLists feature on StockCharts to analyze trends and momentum shifts as part of his daily, weekly, and monthly chart routines. He shows how mindful investors can use ChartLists to identify inflection points, focus on top performers, analyze performance trends, and...

READ MORE

MEMBERS ONLY

2024 is Shaping Up Like 2021, Which Did Not End Particularly Well

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've always found technical analysis to be a fantastic history lesson for the markets. If you want to consider how the current conditions relate to previous market cycles, just compare the charts; you'll usually have a pretty good starting point for the discussion.

As we near...

READ MORE

MEMBERS ONLY

Sector Rotation Suggests Offense Over Defense

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Relative strength trends show a recent rotation into Consumer Discretionary, Communication Services, Financials, and Energy.

* The offense to defense ratio still favors "things you want" over "things you need."

* RRG charts give a fairly clear roadmap of what to look for rotation-wise into early...

READ MORE

MEMBERS ONLY

Three Ways Top Investors Track Sector Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave outlines three tools he uses on the StockCharts platform to analyze sector rotation, from sector relative strength ratios to the powerful Relative Rotation Graphs (RRG). Dave shares how institutional investors think about sector rotation strategies, evaluating the current evidence to determine how money managers are allocating...

READ MORE

MEMBERS ONLY

Are the Magnificent 7 Still the Kings of Wall Street?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Breakout Names have already broken to new all-time highs in Q4, but will they be able to hold those gains?

* The Consolidating Charts have failed to break to new highs, so it's all about watching key price support levels.

* The Wild Cards may be the...

READ MORE

MEMBERS ONLY

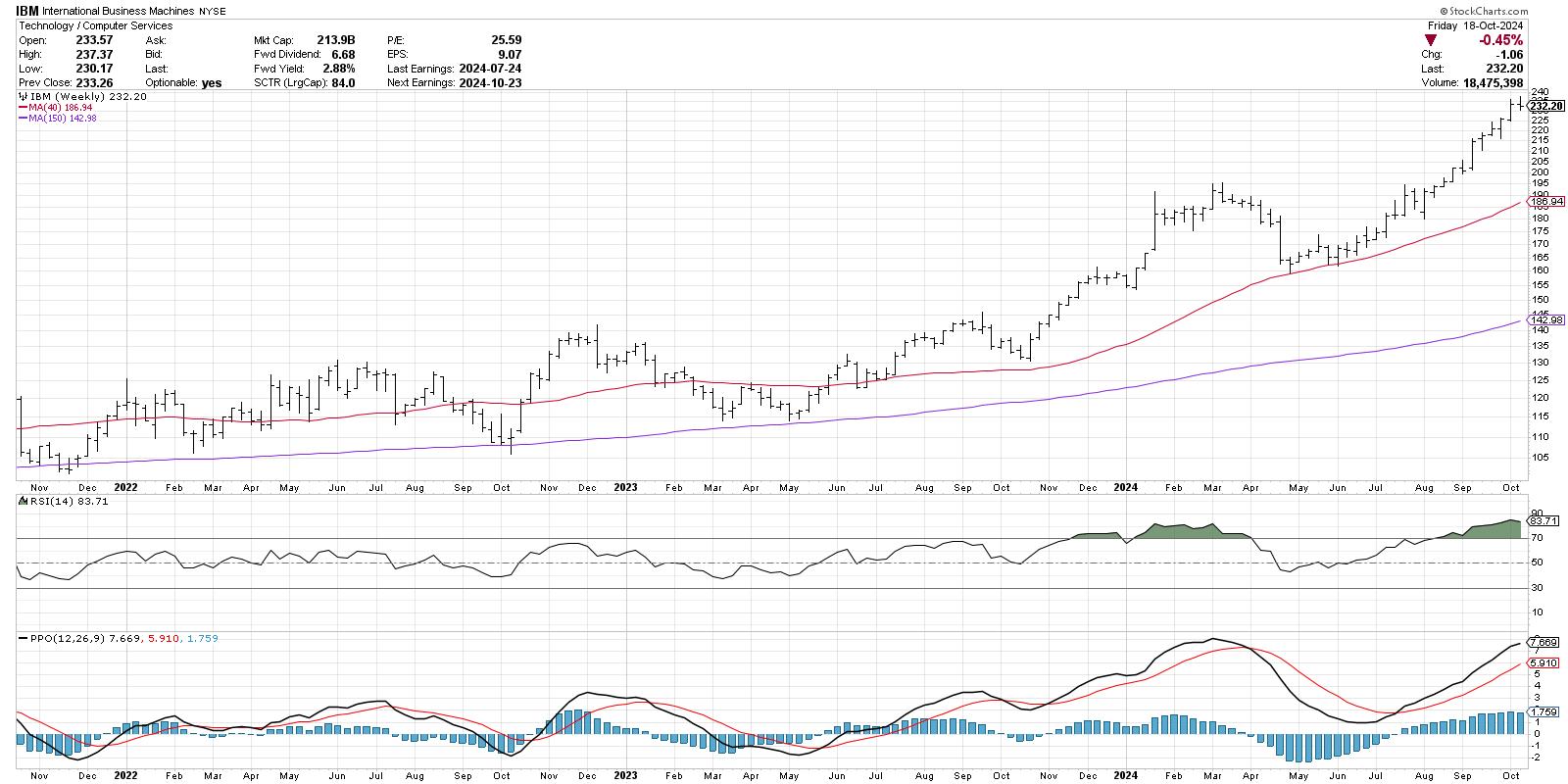

The Sign of Strong Charts Getting Stronger

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I was originally taught to use RSI as a swing trading tool, helping me to identify when the price of a particular asset was overextended to the upside and downside. And, on the swing trading time frame, that approach very much works, especially if you employ a shorter time period...

READ MORE

MEMBERS ONLY

Are Extremely Overbought Conditions Good or Bad for Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When a stock shows an RSI value above 80, is that a good thing or a bad thing? In this video, Dave reviews a series of examples showing this "extreme overbought" condition, highlights how these signals usually occur not at the end of, but often earlier in an...

READ MORE

MEMBERS ONLY

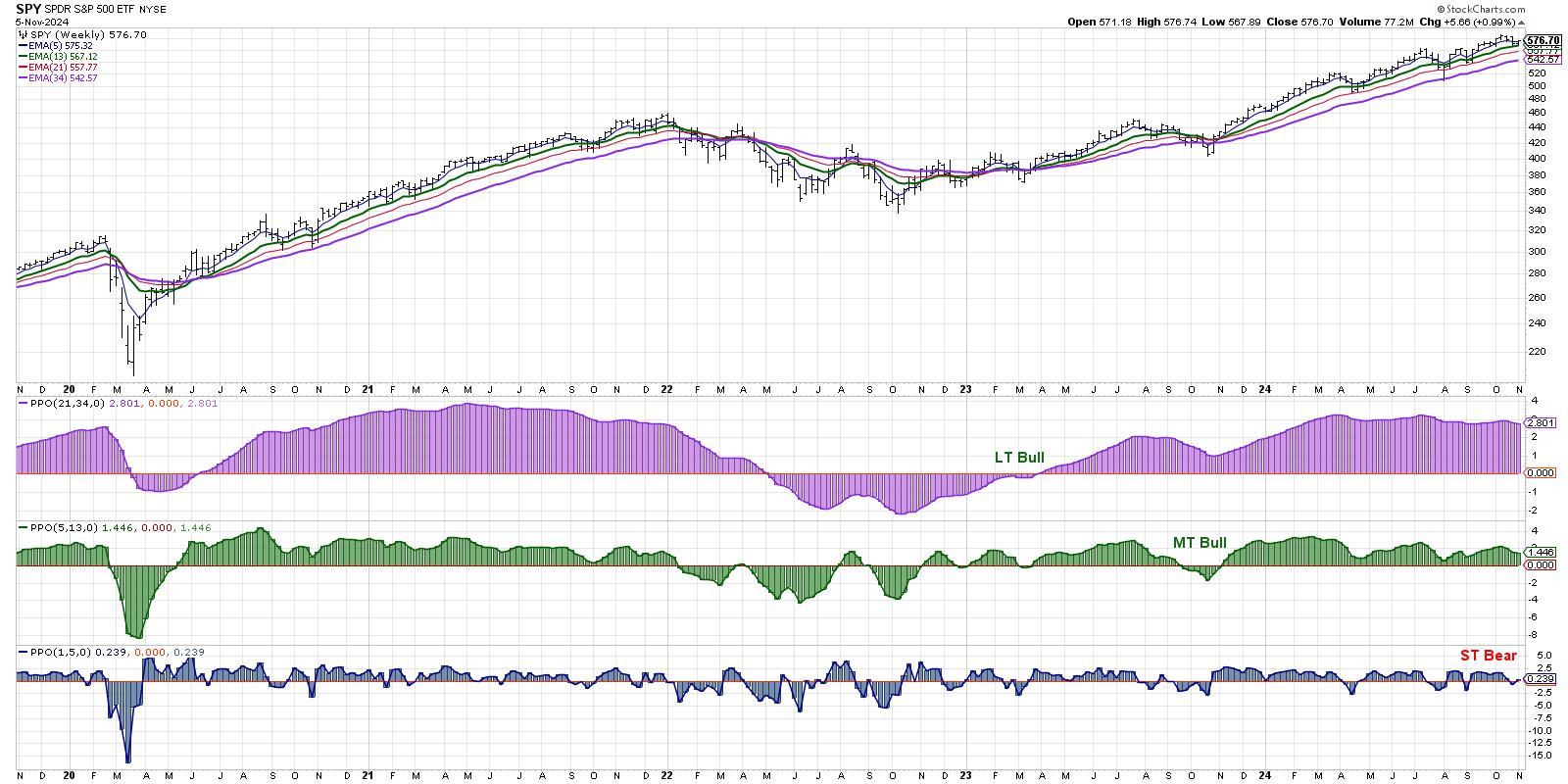

Short-Term Bearish Signal as Markets Brace for News-Heavy Week

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* We can define the market trend on multiple time frames using a series of exponential moving averages.

* While our short-term Market Trend Model turned bearish last week, the medium-term and long-term models remain bullish.

* 2021 could provide a compelling analogue to what we're experiencing so far...

READ MORE

MEMBERS ONLY

Market Trend Model Flashes Short-Term Bearish, What's Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down the three time frames in his Market Trend Model, reveals the short-term bearish signal that flashed on Friday's close, relates the current configuration to previous bull and bear market cycles, and shares how investors can best track this model to ensure they&...

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch for November 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With the Magnificent 7 stocks struggling to hold up through a tumultuous earnings season, what sort of opportunities are emerging on the charts going into November? Today, we'll break down some of the names we've included in our Top Ten Charts to Watch for November 2024....

READ MORE

MEMBERS ONLY

Will Breadth Divergences Signal the End of the Bull?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A negative McClellan Oscillator suggests short-term weakness in breadth conditions.

* About 30% of the S&P 500 members have already broken down below their 50-day moving average.

* The Bullish Percent Index has broken a key bearish threshold, indicating that many stocks have already begun bearish trends.

As...

READ MORE

MEMBERS ONLY

Top 5 Breadth Indicators You Can't Afford to Ignore!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave digs into five market breadth indicators every investor should track as we navigate a volatile period including Q3 earnings, the US elections, and the November Fed meeting. He breaks down key insights on each of the five charts, talks about why breadth indicators are equal-weighted, and...

READ MORE

MEMBERS ONLY

Why the S&P 500 Won't Break 6000 (Yet)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When I was growing up, I loved Choose Your Own Adventure books. I see the world in shades of gray instead of black-and-white, so I was immediately drawn to the seemingly endless scenarios that the main characters could experience as I made different choices for them.

As investors, we often...

READ MORE

MEMBERS ONLY

Three Ways to Visualize the Start of a Potential Distribution Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 is nearing trendline support, which could provide a crucial signal of downside rotation.

* Market breadth indicators are beginning to diverge from the index, trending lower in the month of October.

* The MarketCarpet visualization shows a concerning drop in the mega-cap growth names which...

READ MORE

MEMBERS ONLY

What's the BEST Market Visualization Tool?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

How do you track movements of all the S&P 500 stocks on any given trading day? In this video, Dave will show you how he uses the StockCharts MarketCarpet to evaluate broad equity market conditions, assess the changes in the mega-cap stocks which dominate the benchmarks, and identify...

READ MORE

MEMBERS ONLY

Does the MACD Histogram Hold the Secret to Anticipating Trend Changes?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The MACD and PPO indicators are trend-following devices designed to confirm a trend reversal has occurred.

* The histogram shows when the MACD indicator is showing signs of a potential reversal, providing more of a leading indicator.

* Investors can use other indicators, such as the Chandelier Exit system, on...

READ MORE

MEMBERS ONLY

The Master Sentiment Chart You Need to Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The put/call ratio measures volumes in the options market to compare bullish vs. bearish positioning.

* The AAII Survey is close to the 50% bullish level, which often coincides with major market tops.

* The NAAIM Exposure Index, currently just above 90%, tells us that money managers are not...

READ MORE

MEMBERS ONLY

Stay Ahead: Key Sentiment Indicators to Track in October 2024!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Which market sentiment indicators should we follow to validate the current bull market phase and anticipate a potential market top? David Keller, CMT breaks down three sentiment indicators he's watching in October 2024, explains their calculations and methodology, reviews their signals during previous bull market cycles, and describes...

READ MORE

MEMBERS ONLY

The One Volume Indicator You Should Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* While the daily volume reading can give us limited insight on the balance of buyers and sellers, Chaikin Money Flow gives a much clearer picture of trends in volume.

* Major tops in the last 12-18 months have been marked with a particular pattern in the S&P...

READ MORE

MEMBERS ONLY

Three Thoughts on Risk Management for October 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Watch the S&P 500's "line in the sand" for a signs of a breakdown in the major averages.

* Market breadth indicators could provide an early warning of a potential breakdown for the benchmarks.

* By being thoughtful about your position sizing for each...

READ MORE

MEMBERS ONLY

Market Top in October? 2007 vs. 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Will we see a major market top during the month of October? Dave breaks down three market breadth indicators and compares their current configuration to what we observed at the 2007 market top. He then goes through the charts and reviews market topping conditions from a breadth perspective using the...

READ MORE

MEMBERS ONLY

Does the Market Have Bad Breadth?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* There have been less new 52-week highs since mid-September, suggesting leaders are falling off.

* The percent of S&P 500 members above their 50-day moving average is below 75%, which often serves as a threshold for a downturn.

* The S&P 500 Bullish Percent Index remains...

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch for October 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As we near the end of what has been a fairly solid Q3 for the equity markets, we are left with the eternal question for investors: "What's next?"

We now have the Fed's first rate cut in the rearview mirror, with multiple rate cuts...

READ MORE

MEMBERS ONLY

Bullish or Bearish? The Truth About Rate Cuts and Stock Performance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

So the first Fed rate cut is behind us, and we are no longer in a "higher for longer" period, but in a new rate cut cycle which will most likely last well into 2025. So that's good news for stocks, right? Well, not necessarily.

The...

READ MORE

MEMBERS ONLY

Here's My Most-Likely Scenario for QQQ

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 finished the week once again testing new all-time highs around 5650, the Nasdaq 100 remains rangebound in a symmetrical triangle or "coil" pattern. While this pattern does not necessarily suggest a potential next move for the QQQ, it did lead me to...

READ MORE

MEMBERS ONLY

Three Charts Screaming Market Top

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Weaker price momentum suggests an exhaustion of buyers.

* The VIX pushed back above 20 this week, indicating a higher likelihood of a price correction.

* The equal-weighted S&P 500 made a new all-time high in August, but that was not echoed with a new high from the...

READ MORE

MEMBERS ONLY

What Would a Top in Semiconductors Mean for the S&P 500?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A head-and-shoulders top pattern has to complete three phases before it can be considered valid.

* Even if semiconductors would complete this bearish price pattern, strength in other sectors suggests limited impact on the broader equity space.

After Nvidia (NVDA) dropped after earnings this week, investors are once again...

READ MORE

MEMBERS ONLY

NVDA Earnings Miss, Yet Dow Powers Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down key sector leadership themes and why growth stocks like Nvidia continue to take a back seat to value-oriented sectors. He speaks to the inverted yield curve, performance of the equal-weighted S&P 500 vs. the Magnificent...

READ MORE

MEMBERS ONLY

Earnings Provide Another Nail in the Retail Coffin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a brutal day for retailers as ANF, FL, and BBWI drop on earnings misses. He also highlights the bullish primary trend for hold, shares two breakout names in the consumer staples sector, and breaks down key names in...

READ MORE